Filed Pursuant to Rule 424(b)(3)

Registration No. 333-164313

PHILLIPS EDISON – ARC SHOPPING CENTER REIT INC.

SUPPLEMENT NO. 11 DATED MAY 10, 2011

TO THE PROSPECTUS DATED SEPTEMBER 17, 2010

This document supplements, and should be read in conjunction with, our prospectus dated September 17, 2010 relating to our offering of 180,000,000 shares of common stock. Supplement No. 11 supersedes and replaces all prior supplements to the prospectus. Unless otherwise defined in this Supplement No. 11, capitalized terms used have the same meanings as set forth in the prospectus. The purpose of this supplement is to disclose, among other things, the following:

| • | operating information, including the status of the offering, portfolio data, selected financial data, distribution information, information about our share repurchase program, and compensation to our advisor, our sub-advisor, our dealer manager, and their affiliates; |

| • | the removal of the additional suitability standards applicable to Mississippi investors; |

| • | revised disclosure regarding our expected monthly distributions; |

| • | updates regarding risk factors; |

| • | the appointment of R. Mark Addy as our Chief Operating Officer; |

| • | the amendment of our advisory agreement; |

| • | revised disclosure regarding our conflicts of interest; |

| • | the adoption of best practices guidelines on affiliated transactions; |

| • | updated information regarding the prior performance of programs operated by our sponsors, including prior performance tables, as of December 31, 2010; |

| • | updates to the “Experts” section of our prospectus; and |

| • | information incorporated by reference. |

OPERATING INFORMATION

Status of the Offering

We commenced this initial public offering on August 12, 2010, pursuant to which we are offering up to 150,000,000 shares of our common stock in a primary offering at $10.00 per share, with discounts available for certain categories of purchasers, and up to 30,000,000 shares of our common stock pursuant to our dividend reinvestment plan at $9.50 per share. On September 17, 2010, we received and accepted subscriptions under this offering equal to the minimum offering amount of $2.5 million, at which point active operations commenced. As of April 8, 2011, we had raised aggregate gross offering proceeds of approximately $10.4 million from the sale of approximately 1.2 million shares in our initial public offering, including shares sold under our dividend reinvestment plan, and incurred approximately $5.4 million of related organization and offering costs. As of April 8, 2011, approximately 148.8 million shares of our common stock remain available for sale in our primary offering, and approximately 30.0 million shares of our common stock remain available for issuance under our dividend reinvestment plan.

The termination date of our primary offering of 150,000,000 shares of common stock will be August 12, 2012, unless extended for an additional year by our board of directors. If we continue our primary offering beyond August 12, 2012, we will provide that information in a prospectus supplement. We may continue to offer shares under our dividend reinvestment plan beyond the conclusion of the primary offering until we have sold 30,000,000 shares of common stock through the reinvestment of distributions. We may terminate this offering at any time.

1

Real Estate Investment Summary

Real Estate Portfolio

As of April 8, 2011, we owned fee simple interests in two real estate properties acquired from third parties unaffiliated with us or our advisor. The following is a summary of our real estate properties as of April 8, 2011:

Property Name | Location | Property Type | Date Acquired | Contract Purchase Price(1) | Approximate Rentable Square Footage | Approximate Annualized Base Rent(2) | Approximate Annualized Base Rent per Square Foot | Average Remaining Lease Term in Years | Approximate % Leased | |||||||||||||||||||||

Lakeside Plaza | Salem, Virginia | Shopping Center | 12/10/10 | $ | 8.75 million | 82,033 | $ | 800,000 | $ | 9.99 | 6.2 years | 98 | % | |||||||||||||||||

Snow View Plaza | Parma, Ohio | Shopping Center | 12/15/10 | $ | 12.30 million | 100,460 | $ | 1,121,000 | $ | 12.12 | 8.0 years | 92 | % | |||||||||||||||||

| (1) | The contract purchase price excludes closing costs and acquisition costs. |

| (2) | Annualized base rent is calculated by annualizing the current, in-place monthly base rent for leases and does not take into account any rent concessions or prospective rent increases. To the extent we are required to provide rent concessions in the future, our annualized base rent may be lower. For the year ended December 31, 2010, we did not incur any free rent. |

The average occupancy rate for Lakeside Plaza in 2008, 2009, and 2010 was 91.0%, 96.0%, and 98.9%, respectively. The average effective annual rental rate per square foot for Lakeside Plaza in 2008, 2009, and 2010 was $9.49, $9.32, and $9.96, respectively. The average occupancy rate for Snow View Plaza in 2009 and 2010 was 93.1% and 98.0%, respectively. The average effective annual rental rate per square foot for Snow View Plaza in 2009 and 2010 was $12.73 and $11.69, respectively. The previous owners of Lakeside Plaza and Snow View Plaza were unable to provide information relating to the occupancy rate and the average effective annual rental rate to us prior to 2008 and 2009, respectively.

We believe that our real estate properties are suitable for their intended purpose and adequately covered by insurance. We do not intend to make significant renovations or improvements to our properties. Our properties are located in markets where there is competition for attracting new tenants and retaining current tenants.

Significant Tenants and Lease Expirations

The following table sets forth information regarding the two tenants occupying ten percent or more of the aggregate rentable square footage at our two shopping centers, Lakeside Plaza and Snow View Plaza, as of April 8, 2011:

Tenant Name/Property | Tenant Industry | Approximate Annualized Base Rent(1) | % of Total Portfolio Annualized Base Rent | Approximate Rental Square Footage | % of Total Portfolio Square Footage | Lease Expiration | ||||||||||||||

Kroger Co./Lakeside Plaza | Retail – Grocery Store | $ | 406,659 | 21.2 | % | 52,337 sq. ft. | 28.7 | % | January 2019(2) | |||||||||||

Giant Eagle Inc./Snow View Plaza | Retail – Grocery Store | $ | 713,529 | 37.1 | % | 58,171 sq. ft. | 31.9 | % | September 2020(3) | |||||||||||

| (1) | Annualized base rent represents contractual base rental income, exclusive of tenant reimbursements, on a U.S. GAAP straight-line adjustment basis from the time of our acquisition, without consideration of tenant contraction or termination rights. Tenant reimbursements generally include payment of real estate taxes, operating expenses, and common area maintenance and utility charges. |

| (2) | Kroger has five options to extend the term of its lease by five years each. |

| (3) | Giant Eagle has five options to extend the term of its lease by five years each. |

2

No material tenant credit issues have been identified at this time. As of April 8, 2011, we had no tenants with rent balances outstanding over 90 days.

The following table lists, on an aggregate basis, all of the scheduled lease expirations after April 8, 2011 over each of the years ending December 31, 2011 and thereafter for our two shopping centers. The table shows the approximate rentable square feet and annualized base rent represented by the applicable lease expirations:

Year | Number of Expiring Leases | Approximate Annualized Base Rent(1) | % of Total Portfolio Annualized Base Rent | Leased Rentable Square Feet Expiring | % of Rentable Square Feet Expiring | |||||||||||||||

2011 | 2 | $ | 57,407 | 3.0 | % | 2,900 | 1.7 | % | ||||||||||||

2012 | 3 | $ | 56,313 | 2.9 | % | 4,005 | 2.3 | % | ||||||||||||

2013 | 4 | $ | 95,904 | 5.0 | % | 7,475 | 4.3 | % | ||||||||||||

2014 | 4 | $ | 199,207 | 10.4 | % | 17,795 | 10.3 | % | ||||||||||||

2015 | 4 | $ | 140,487 | 7.3 | % | 8,875 | 5.1 | % | ||||||||||||

2016 | 1 | $ | 48,000 | 2.5 | % | 3,313 | 1.9 | % | ||||||||||||

2017 | 1 | $ | 65,219 | 3.4 | % | 7,476 | 4.3 | % | ||||||||||||

2018 | — | — | — | — | — | |||||||||||||||

2019 | 3 | $ | 448,325 | 23.3 | % | 54,533 | 31.6 | % | ||||||||||||

2020 | 2 | $ | 809,532 | 42.2 | % | 66,171 | 38.4 | % | ||||||||||||

Thereafter | — | — | — | — | — | |||||||||||||||

| (1) | Annualized base rent represents contractual base rental income, exclusive of tenant reimbursements, on a U.S. GAAP straight-line adjustment basis from the time of our acquisition, without consideration of tenant contraction or termination rights. Tenant reimbursements generally include payment of real estate taxes, operating expenses, and common area maintenance and utility charges. |

Yield on Real Estate Investments

The weighted-average year-one yield of real estate properties we have acquired during the 12 months ending April 8, 2011, including Lakeside Plaza and Snow View Plaza, is approximately 8.1%. The year-one yield is equal to the estimated first-year net operating income of the property divided by the purchase price of the property, excluding closing costs and acquisition fees. Estimated first-year net operating income on our real estate investments is total estimated gross income (rental income, tenant reimbursements, parking income and other property-related income) derived from the terms of in-place leases at the time we acquire the property, less property and related expenses (property operating and maintenance expenses, management fees, property insurance and real estate taxes) based on the operating history of the property. Estimated first-year net operating income excludes other non-property income and expenses, interest expense from financings, depreciation and amortization and our company-level general and administrative expenses. Historical operating income for these properties is not necessarily indicative of future operating results.

Debt Obligations

The following is a summary of our debt obligations as of April 8, 2011:

Property and Related Loan | Outstanding | Interest Rate | Loan Type | Payments | Maturity Date | |||||

Lakeside Loan(1) | $6.125 million | 3.0% + the quotient of (i) one-month LIBOR divided by (ii) one minus the reserve percentage as set forth by the Federal Reserve Board(2) | First mortgage loan | Monthly interest only payments through July 1, 2012, followed by continued monthly interest payments and monthly payments of principal in the amount of $20,415(3) | December 10, 2012(4) | |||||

Snow View Loan(1) | $5.12 million | 3.0% + the quotient of (i) one-month LIBOR divided by (ii) one minus the reserve percentage as set forth by the Federal Reserve Board(5) | First mortgage loan | Monthly interest only payments through July 1, 2012 followed by continued monthly interest payments and monthly payments of principal in the amount of $28,500(6) | December 15, 2012(7) | |||||

| (1) | The Lakeside Loan and the Snow View Loan subject Lakeside Plaza and Snow View Plaza to cross-collateral and cross-default provisions under separate and corresponding provisions of each loan. Our operating partnership has guaranteed our obligations under the Lakeside Loan and the Snow View Loan. |

| (2) | If the principal amount of the Lakeside Loan is reduced by at least $675,000 and Lakeside Plaza achieves a minimum debt yield of 12.50%, then the interest rate for the Lakeside Loan will be 2.75% plus the quotient of (i) LIBOR divided by (ii) one minus the reserve percentage. If the principal amount of the Lakeside Loan is reduced by at least $675,000 and |

3

Lakeside Plaza achieves a minimum debt yield of 15.00%, then the interest rate for the Lakeside Loan will be 2.50% plus the quotient of (i) LIBOR divided by (ii) one minus the reserve percentage. |

| (3) | On or before July 1, 2012, we are required to repay principal in the amount of $675,000. We have the right to prepay any outstanding amounts at any time in whole or in part without premium or penalty. |

| (4) | We may extend the maturity date of the Lakeside Loan to December 10, 2013 upon payment of an extension fee equal to 0.25% of the amount outstanding on December 10, 2012. |

| (5) | If the principal amount of the Snow View Loan is reduced by at least $940,000 and Snow View Plaza achieves a minimum debt yield of 12.50%, then the interest rate for the Snow View Loan will be 2.75% plus the quotient of (i) LIBOR divided by (ii) one minus the reserve percentage. If the principal amount of the Snow View Loan is reduced by at least $940,000 and Snow View Plaza achieves a minimum debt yield of 15.00%, then the interest rate for the Snow View Loan will be 2.50% plus the quotient of (i) LIBOR divided by (ii) one minus the reserve percentage. |

| (6) | On or before July 1, 2012, we are required to repay principal in the amount of $940,000. We have the right to prepay any outstanding amounts at any time in whole or in part without premium or penalty. |

| (7) | We may extend the maturity date of the Snow View Loan to December 15, 2013 upon payment of an extension fee equal to 0.25% of the amount outstanding on December 15, 2012. |

Selected Financial Data

The following selected financial data should be read in conjunction with our consolidated financial statements and the notes thereto and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” contained in our Annual Report on Form 10-K for the year ended December 31, 2010, and incorporated by reference into this prospectus.

| (in thousands) | December 31, 2010 | December 31, 2009 | ||||||

Balance Sheet Data: | ||||||||

Investment in real estate assets, net | $ | 19,065 | $ | — | ||||

Acquired intangible lease assets, net | 2,328 | — | ||||||

Cash and cash equivalents | 707 | 200 | ||||||

Other assets | 604 | 943 | ||||||

Total assets | $ | 22,704 | $ | 1,143 | ||||

Mortgage loans payable | $ | 14,695 | $ | — | ||||

Notes payable—affiliates | 600 | — | ||||||

Accounts payable—affiliates | 5,542 | 943 | ||||||

Other liabilities | 710 | — | ||||||

Total liabilities | 21,547 | 943 | ||||||

Stockholders’ equity | 1,157 | 200 | ||||||

Total liabilities and stockholders’ equity | $ | 22,704 | $ | 1,143 | ||||

Operating Data: | ||||||||

Total revenues | $ | 98 | $ | — | ||||

Property operating expenses | (32 | ) | — | |||||

General and administrative | (228 | ) | — | |||||

Acquisition-related expenses | (467 | ) | — | |||||

Depreciation and amortization | (81 | ) | — | |||||

Operating loss | (710 | ) | — | |||||

Other income | 1 | |||||||

Interest expense | (38 | ) | — | |||||

Net loss | $ | (747 | ) | — | ||||

Cash Flow Data: | ||||||||

Cash flows provided by operating activities | $ | 201 | $ | — | ||||

Cash flows used in investing activities | $ | (21,249 | ) | $ | — | |||

Cash flows provided by financing activities | $ | 21,555 | $ | 200 | ||||

Per Share Data: | ||||||||

Net loss attributable to common shareholders per share—basic and diluted | $ | (4.44 | ) | $ | N/A | |||

Weighted average distributions per share declared | $ | 0.22 | $ | — | ||||

Weighted average shares outstanding—basic and diluted | 168,419 | 20,000 | ||||||

4

Distributions Declared

On October 8, 2010, our board of directors declared our first distributions for the period from December 1, 2010 through and including December 31, 2010. Distributions declared in the fourth quarter of 2010 were $37,000 We paid these distributions on January 4, 2011. On December 27, 2010, our board of directors declared distributions for the period from January 1, 2011 through and including February 28, 2011. Distributions for the month of January were paid on February 1, 2011, and distributions for the month of February were paid on March 1, 2011. On February 22, 2011, our board of directors declared distributions for the period from March 1, 2011 through and including March 31, 2011. Distributions for the month of March were paid on April 1, 2011. On March 23, 2011, our board of directors declared distributions for the period from April 1, 2011 through June 30, 2011. Distributions for the month of April will be paid on such day of May 2011 as our President may determine; distributions for the month of May will be paid on such day of June 2011 as our President may determine; and distributions for the month of June will be paid on such day of July 2011 as our President may determine. All declared distributions equal a daily amount of $0.00178082 (0.178082 cents) per share of common stock. If this rate were paid each day for a 365-day period, it would equal a 6.5% annualized rate based on a purchase price of $10.00 per share. A portion of each distribution may constitute a return of capital for tax purposes. There is no assurance that we will continue to declare daily distributions at this rate.

Net Tangible Book Value of our Shares

In connection with this ongoing offering of shares of our common stock, we are providing information about our net tangible book value per share. Our net tangible book value is a rough approximation of value calculated simply as total book value of assets (exclusive of certain intangible items including depreciation) minus total liabilities, divided by the total number of shares of common stock outstanding. It assumes that the value of real estate assets diminishes predictably over time as shown through the depreciation and amortization of real estate investments. Real estate values have historically risen or fallen with market conditions. Net tangible book value is used generally as a conservative measure of net worth that we do not believe reflects our estimated value per share. It is not intended to reflect the value of our assets upon an orderly liquidation of the company in accordance with our investment objectives. Our net tangible book value reflects dilution in the value of our common stock from the issue price as a result of (i) operating losses, which reflect accumulated depreciation and amortization of real estate investments, and (ii) fees paid in connection with our public offering, including selling commissions and marketing fees re-allowed by our dealer manager to participating broker dealers. As of December 31, 2010, our net tangible book value per share was $0.89. To the extent we are able to raise substantial proceeds in this offering, the expenses that cause dilution of the net tangible value per share are expected to decrease on a per share basis, resulting in increases in the net tangible book value per share. The offering price of shares under our primary offering (ignoring purchase price discounts for certain categories of purchasers) at December 31, 2010 was $10.00 per share.

Our offering price was not established on an independent basis and bears no relationship to the net value of our assets. Further, even without depreciation in the value of our assets, the other factors described above with respect to the dilution in the value of our common stock are likely to cause our offering price to be higher than the amount you would receive per share if we were to liquidate at this time.

Funds from Operations and Modified Funds from Operations

Funds from operations, or FFO, is a non-GAAP performance financial measure that is widely recognized as a measure of REIT operating performance. We use FFO as defined by the National Association of Real Estate Investment Trusts to be net income (loss), computed in accordance with GAAP excluding extraordinary items, as defined by GAAP, and gains (or losses) from sales of property (including deemed sales and settlements of pre-existing relationships), plus depreciation and amortization on real estate assets, and after related adjustments for unconsolidated partnerships, joint ventures and subsidiaries and noncontrolling interests. We believe that FFO is helpful to our investors and our management as a measure of operating performance because it excludes real estate-related depreciation and amortization, gains and losses from property dispositions, and extraordinary items, and as a result, when compared year to year, reflects the impact on operations from trends in occupancy rates, rental rates, operating costs, development activities, general and administrative expenses, and interest costs, which are not immediately apparent from net income. Historical cost accounting for real estate assets in accordance with GAAP

5

implicitly assumes that the value of real estate and intangibles diminishes predictably over time. Since real estate values have historically risen or fallen with market conditions, many industry investors and analysts have considered the presentation of operating results for real estate companies that use historical cost accounting alone to be insufficient. As a result, our management believes that the use of FFO, together with the required GAAP presentations, is helpful for our investors in understanding our performance. Factors that impact FFO include start-up costs, fixed costs, delay in buying assets, lower yields on cash held in accounts, income from portfolio properties and other portfolio assets, interest rates on acquisition financing and operating expenses. In addition, FFO will be affected by the types of investments in our targeted portfolio which will consist of, but is not limited to, necessity-based neighborhood and community shopping centers, first- and second-priority mortgage loans, mezzanine loans, bridge and other loans, mortgage-backed securities, collateralized debt obligations, and debt securities of real estate companies.

Since FFO was promulgated, GAAP has expanded to include several new accounting pronouncements, such that management and many investors and analysts have considered the presentation of FFO alone to be insufficient. Accordingly, in addition to FFO, we use modified funds from operations, or MFFO, as defined by the Investment Program Association (“IPA”). MFFO excludes from FFO the following items:

| (1) | acquisition fees and expenses; |

| (2) | straight-line rent amounts, both income and expense; |

| (3) | amortization of above- or below-market intangible lease assets and liabilities; |

| (4) | amortization of discounts and premiums on debt investments; |

| (5) | impairment charges; |

| (6) | gains or losses from the early extinguishment of debt; |

| (7) | gains or losses on the extinguishment or sales of hedges, foreign exchange, securities and other derivatives holdings except where the trading of such instruments is a fundamental attribute of our operations; |

| (8) | gains or losses related to fair-value adjustments for derivatives not qualifying for hedge accounting, including interest rate and foreign exchange derivatives; |

| (9) | gains or losses related to consolidation from, or deconsolidation to, equity accounting; |

| (10) | gains or losses related to contingent purchase price adjustments; and |

| (11) | adjustments related to the above items for unconsolidated entities in the application of equity accounting. |

Additionally, we make an additional adjustment to MFFO to add back amounts we receive from the Sub-advisor or an affiliate thereof in the form of additional capital contributions to us (without any corresponding issuance of equity by us to the Sub-advisor or the affiliate).

We believe that MFFO is helpful helpful in assisting management and investors assess the sustainability of operating performance in future periods and, in particular, after our offering and acquisition stages are complete, primarily because it excludes acquisition expenses that affect property operations only in the period in which the property is acquired. Thus, MFFO provides helpful information relevant to evaluating our operating performance in periods in which there is no acquisition activity.

As explained below, management’s evaluation of our operating performance excludes the items considered in the calculation based on the following economic considerations. Many of the adjustments in arriving at MFFO are not applicable to us. For example, we have not suffered any impairments. Nevertheless, we explain below the reasons for each of the adjustments made in arriving at our MFFO definition.

| • | Acquisition fees and expenses. In evaluating investments in real estate, including both business combinations and investments accounted for under the equity method of accounting, management’s investment models and analyses differentiate costs to acquire the investment from the operations derived from the investment. Prior to 2009, acquisition costs for both of these types of investments were capitalized under GAAP; however, beginning in 2009, acquisition costs related to business combinations are expensed. Both of these acquisition-related costs have been and will continue to be funded from the proceeds of our offering and generally not from operations. We believe by excluding expensed acquisition costs, MFFO provides useful supplemental information that is comparable for each type of real estate investment and is consistent with management’s analysis of the investing and operating performance of our properties. Acquisition fees and expenses include those paid to the Advisor, the Sub-advisor or third parties. |

| • | Adjustments for straight-line rents and amortization of discounts and premiums on debt investments. In the proper application of GAAP, rental receipts and discounts and premiums on debt investments |

6

are allocated to periods using various systematic methodologies. This application may result in income recognition that could be significantly different than underlying contract terms. By adjusting for these items, MFFO provides useful supplemental information on the realized economic impact of lease terms and debt investments and aligns results with management’s analysis of operating performance. |

| • | Adjustments for amortization of above or below market intangible lease assets. Similar to depreciation and amortization of other real estate related assets that are excluded from FFO, GAAP implicitly assumes that the value of intangibles diminishes ratably over time and that these charges be recognized currently in revenue. Since real estate values and market lease rates in the aggregate have historically risen or fallen with market conditions, management believes that by excluding these charges, MFFO provides useful supplemental information on the performance of the real estate. |

| • | Impairment charges, gains or losses related to fair-value adjustments for derivatives not qualifying for hedge accounting and gains or losses related to contingent purchase price adjustments. Each of these items relates to a fair value adjustment, which is based on the impact of current market fluctuations and underlying assessments of general market conditions and specific performance of the holding, which may not be directly attributable to current operating performance. As these gains or losses relate to underlying long-term assets and liabilities, management believes MFFO provides useful supplemental information by focusing on the changes in core operating fundamentals rather than changes that may reflect anticipated gains or losses. In particular, because GAAP impairment charges are not allowed to be reversed if the underlying fair values improve or because the timing of impairment charges may lag the onset of certain operating consequences, we believe MFFO provides useful supplemental information related to current consequences, benefits and sustainability related to rental rate, occupancy and other core operating fundamentals. |

| • | Adjustment for gains or losses related to early extinguishment of hedges, debt, consolidation or deconsolidation and contingent purchase price. Similar to extraordinary items excluded from FFO, these adjustments are not related to continuing operations. By excluding these items, management believes that MFFO provides supplemental information related to sustainable operations that will be more comparable between other reporting periods and to other real estate operators. |

| • | Adjustments for sponsor contributions to capital when no additional securities are issued. Our Sub-advisor has made capital contributions to us without receiving an additional issuance of equity securities. These capital contributions are meant to offset a portion of our general and administrative expenses during the early stages and portfolio ramp-up of our initial public offering when our asset and investor bases are not yet large enough to generate economies of scale. By adding back these capital contributions when arriving at MFFO, we believe that we arrive at an MFFO that is more reflective of our performance after we complete our offering stage because at that time our general and administrative expenses can be expected to be much lower in proportion to our portfolio size, reflecting both economies of scale in the servicing of a larger investor base and economies of scale with respect to operations and management of our portfolio. Moreover, we believe that this adjustment improves the comparability of our company with other real estate operatorsthat are beyond the start-up phase and at a more advanced stage of portfolio aggregation. We note that these contributions to cover general and administrative costs do not affect net income. Therefore an adjustment in arriving at MFFO is necessary for purposes of fair comparison. There is no assurance that our Sub-advisor will continue to make additional capital contributions to offset certain general and administrative expenses prior to our realization of such economies of scale |

By providing MFFO, we believe we are presenting useful information that also assists investors and analysts to better assess the sustainability of our operating performance after our offering and acquisition stages are completed. We also believe that MFFO is a recognized measure of sustainable operating performance by the non-listed REIT industry. MFFO is useful in comparing the sustainability of our operating performance after our offering and acquisition stages are completed with the sustainability of the operating performance of other real estate companies that are not as involved in acquisition activities. However, investors are cautioned that MFFO should only be used to assess the sustainability of our operating performance after our offering and acquisition stages are completed, as it excludes acquisition costs that have a negative effect on our operating performance during the periods in which properties are acquired. Acquisition costs also adversely affect our book value and stockholders’ equity.

FFO or MFFO should not be considered as an alternative to net income (loss), nor as an indication of our liquidity, nor is either indicative of funds available to fund our cash needs, including our ability to fund distributions. In particular, as we are currently in the acquisition phase of our life cycle, acquisition-related costs and other adjustments that are increases to MFFO are, and may continue to be, a significant use of cash. Accordingly, both FFO and MFFO should be reviewed in connection with other GAAP measurements. Our FFO and MFFO as presented may not be comparable to amounts calculated by other REITs.

The following section presents our calculation of FFO and MFFO and provides additional information related to our operations (in thousands, except per share amounts). As a result of the timing of the commencement of our public offering and our active real estate operations, FFO and MFFO are not relevant to a discussion comparing operations for the two periods presented. We expect revenues and expenses to increase in future periods as we raise additional offering proceeds and use them to acquire additional investments.

7

NET LOSS TO FFO/MFFO RECONCILIATION

| ($000’s) | ||||||||

| Q4 2010 | For the Period from September 17, 2010 through December 31, 2010* | |||||||

Net loss | $ | (667 | ) | $ | (747 | ) | ||

Depreciation and amortization | 81 | 81 | ||||||

FFO | $ | (586 | ) | $ | (666 | ) | ||

Amortization of above or below market leases | 17 | 17 | ||||||

Acquisition-related expenses | 467 | 467 | ||||||

Sponsor capital contribution for certain general and administrative expenses(1) | 140 | 140 | ||||||

MFFO | $ | 38 | $ | (42 | ) | |||

Distributions paid | $ | — | $ | — | ||||

| * | Date operations commenced |

| (1) | Neither the Advisor nor the Sub-Advisor have received any additional interests in the company or any other consideration in exchange for these capital contributions. |

Share Repurchase Program

Our share repurchase program generally requires you to hold your shares for at least one year prior to submitting them for repurchase by us. Our share repurchase program also contains numerous restrictions on your ability to sell your shares to us. During any calendar year, we may repurchase no more than 5.0% of the weighted-average number of shares outstanding during the prior calendar year. Further, the cash available for redemption on any particular date will generally be limited to the proceeds from the dividend reinvestment plan during the period consisting of the preceding four fiscal quarters for which financial statements are available, less any cash already used for redemptions during the same period; however, subject to the limitations described above, we may use other sources of cash at the discretion of our board of directors. We may amend, suspend or terminate the program at any time upon 30 days’ notice.

We first received and accepted subscriptions in this offering on September 17, 2010. In addition, we did not pay our first distribution until January 4, 2011. Thus, we expect to have limited ability to repurchase shares under our share repurchase program in 2011. As of April 8, 2011, we have not received any repurchase requests under our share repurchase program.

Fees Earned by and Expenses Reimbursable to Our Advisor, Our Dealer Manager and Their Affiliates

Summarized below are the fees earned by and expenses reimbursable to our advisor, our sub-advisor, our dealer manager and their affiliates for the year ended December 31, 2010 and any related amounts payable as of December 31, 2010:

| Amount | ||||||||

Form of Compensation | Incurred in the Year Ended December 31, 2010 | Payable as of December 31, 2010 | ||||||

Selling commissions(1) | $ | — | $ | — | ||||

8

Dealer manager fee(2) | — | — | ||||||

Reimbursement of organization and offering expenses | 4,790,000 | 4,610,000 | ||||||

Acquisition fees | 210,000 | 210,000 | ||||||

Debt financing fee | 110,000 | 110,000 | ||||||

Asset management fee | — | — | ||||||

Property management fee | — | — | ||||||

Reimbursement of other operating expenses | 250,000 | 160,000 | ||||||

| (1) | Our dealer manager reallows 100% of commissions earned to participating broker-dealers. |

| (2) | Our dealer manager reallows a portion of the dealer manager fee to participating broker-dealers. |

PROSPECTUS UPDATES

Suitability Standards

The ninth bullet point under the section of the prospectus entitled “Investor Suitability Standards” on page (iii) is revised to remove the requirement that Mississippi residents represent that they have a liquid net worth of at least 10 times the amount of their investment in this real estate program and other similar programs, and is amended to read, as follows:

Alabama

| • | In addition to the general suitability requirements described above, shares will only be sold to Alabama residents who represent that they have a liquid net worth of at least 10 times the amount of their investment in this real estate program and other similar programs. |

Distributions

The “Stable Dividend” bullet point on page 2 of our prospectus is revised as follows.

| • | Stable Dividend – We expect to pay monthly distributions to our stockholders at a rate that is consistent with our projected operating performance, with due regard to our modified funds from operations (MFFO) as a key measure of the sustainability of our operating performance after the completion of our offering and acquisition stage (see “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Funds from Operations”); |

The sixth bullet point under the heading “Market Opportunity” on page 75 of our prospectus is revised as follows.

| • | generating monthly distributions at a rate that is consistent with our projected operating performance, with due regard to our modified funds from operations (MFFO) as a key measure of the sustainability of our operating performance after the completion of our offering and acquisition stage (see “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Funds from Operations”); and |

The “Stable Dividend” bullet point on page 125 of our prospectus is revised as follows.

| • | Stable Dividend – We expect to pay monthly distributions to our stockholders at a rate that is consistent with our projected operating performance, with due regard to our modified funds from operations (MFFO) as a key measure of the sustainability of our operating performance after the completion of our offering and acquisition stage (see “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Funds from Operations”); |

Risk Factors

The following risk factors revise and supplement, as appropriate, the risk factors included in our prospectus under the heading “Risk Factors.”

We may change our targeted investments without stockholder consent.

We expect to allocate approximately 90.0% of our portfolio to investments in necessity-based neighborhood and community shopping centers throughout the United States with a focus on well-located grocery-anchored shopping centers that are well occupied at the time of purchase and typically cost less than $20.0 million per property. We intend to allocate approximately 10.0% of our portfolio to other real estate properties and real estate-related loans and securities such as mortgage, mezzanine, bridge and other loans; debt and derivative securities related to real estate assets, including mortgage-backed securities; and the equity securities of other REITs and real estate companies. We do not expect our non-controlling equity investments in other public companies to exceed 5.0% of the proceeds of this offering, assuming we sell the maximum offering amount. If we raise substantially less than the maximum offering amount and we acquire a real estate-related asset early in our offering stage, our investments in real estate-related loans and securities could constitute a greater percentage of our portfolio, although we do not expect those assets to represent a substantial portion of our assets at any one time. Though this is our current target portfolio, we may make adjustments to our target portfolio based on real estate market conditions and investment opportunities, and we may change our targeted investments and investment guidelines at any time without the consent of our stockholders, which could result in our making investments that are different from, and possibly riskier than, our current targeted investments. A change in our targeted investments or investment guidelines may increase our exposure to interest rate risk, default risk and real estate market fluctuations, all of which could adversely affect the value of our common stock and our ability to make distributions to our stockholders.

9

The management of multiple REITs, especially REITs in the development stage, by the officers of our advisor may significantly reduce the amount of time the officers of our advisor are able to spend on activities related to us and may cause other conflicts of interest, which may cause our operating results to suffer.

The officers of our advisor are part of the senior management or are key personnel of eight other AR Capital-sponsored REITs and their advisors. Five of the AR Capital-sponsored REITs, have registration statements that are not yet effective and are in the development phase, and three of the AR Capital-sponsored REITs have registration statements that became effective in the past six months. As a result, such REITs will have concurrent and/or overlapping fundraising, acquisition, operational and disposition and liquidation phases as us, which may cause conflicts of interest to arise throughout the life of our company with respect to, among other things, finding investors, locating and acquiring properties, entering into leases and disposing of properties. Additionally, based on our AR Capital sponsor’s experience, a significantly greater time commitment is required of senior management during the development stage when the REIT is being organized, funds are initially being raised and funds are initially being invested, and less time is required as additional funds are raised and the offering matures. The conflicts of interest each of the officers of our advisor will face may delay our fund raising and investment of our proceeds due to the competing time demands and generally cause our operating results to suffer.

We will compete for investors with other programs of our sponsor, which could adversely affect the amount of capital we have to invest.

Our AR Capital sponsor is currently the sponsor of seven other public offerings of non-traded REIT shares and a public offering of shares for a REIT that has applied for listing on The NASDAQ Capital Market, which offerings will be ongoing during a significant portion of our offering period. These programs all have filed registration statements for the offering of common stock and intend to elect to be taxed as REITs. The offerings will likely occur concurrently with our offering, and our AR Capital sponsor is likely to sponsor other offerings during our offering period. Our dealer manager is the dealer manager for these other offerings. We will compete for investors with these other programs, and the overlap of these offerings with our offering could adversely affect our ability to raise all the capital we seek in this offering, the timing of sales of our shares and the amount of proceeds we have to spend on real estate investments.

Management

Appointment of R. Mark Addy as Our Chief Operating Officer

On October 27, 2010, R. Mark Addy was appointed as our Chief Operating Officer. The professional background of Mr. Addy is described in the “Management—Our Sponsors” section of the prospectus.

10

Management Compensation

Amended Advisory Agreement

On March 28, 2011, we amended our advisory agreement to reflect a waiver of all or a portion of the asset management fees to the extent that, as of the date of payment, our operating performance during the prior quarter has not been commensurate with our distributions during such period. Specifically, our modified funds from operations (as defined in accordance with the then-current practice guidelines issued by the Investment Program Association (a trade association for direct investment programs, including non-listed REITs), with an additional adjustment to add back capital contribution amounts received from the Sub-advisor or an affiliate thereof (without any corresponding issuance of equity to the Sub-advisor or affiliate)), during the quarter must be at least equal to our declared distributions (whether or not paid) during the quarter. However, we cannot avoid payment of an asset management fee by raising our distribution rate beyond $0.65 per share on an annualized basis.

Conflicts of Interest

Our Sponsors’ Interests in Other Real Estate Programs

The portion of our prospectus under the heading “Our Sponsors’ Interests in Other Real Estate Programs – Competition for Investors” is revised as follows.

We expect that American Realty Capital Trust, Inc., American Realty Capital New York Recovery REIT, Inc., American Realty Capital Healthcare Trust, Inc., American Realty Capital – Retail Centers of America, Inc., Business Development Corporation of America, Healthcare Trust of America, Inc. and United Development Funding IV, the seven other offerings referred to above, will be raising capital in their respective public offerings concurrently with at least a portion of the duration of this offering. Our dealer manager is the dealer manager for these other offerings. We will compete for investors with these other programs, and the overlap of these offerings with our offering could adversely affect our ability to raise all the capital we seek in this offering, the timing of sales of our shares and the amount of proceeds we have to spend on real estate investments. In addition, our sponsors may decide to sponsor future programs that would seek to raise capital through public offerings conducted concurrently with our offering. As a result, we face a conflict of interest due to the potential competition among us and these other programs for investors and investment capital.

Our sponsors generally seek to reduce the conflicts that may arise among their various programs by avoiding simultaneous public offerings by programs that have a substantially similar mix of targeted investment types. Nevertheless, there are likely to be periods during which one or more programs sponsored by our sponsors will be raising capital and which will compete with us for investment capital.

The portion of our prospectus under the heading “Our Sponsors’ Interests in Other Real Estate Programs – Allocation of Our Affiliates’ Time” is revised as follows.

As a result of their interests in other programs, their obligations to other investors and the fact that they engage in and they will continue to engage in other business activities on behalf of themselves and others, our executive officers and our Phillips Edison and AR Capital sponsors face conflicts of interest in allocating their time among us and other Phillips Edison- and AR Capital-sponsored programs and other business activities in which they are involved. In addition, many of the same key professionals associated with our Phillips Edison and AR Capital sponsors have existing obligations to other programs sponsored by our sponsors. Our executive officers and the key professionals associated with our sponsors who provide services to us are not obligated to devote a fixed amount of their time to us, but our sponsors believe that our executive officers and the other key professionals have sufficient time to fully discharge their responsibilities to us and to the other business in which they are involved.

We believe that our executive officers will devote the time required to manage our business and expect that the amount of time a particular executive officer devotes to us will vary during the course of the year and depend on our business activities at a given time. For example, our executive officers may spend significantly more time focused on our activities when we are reviewing potential property acquisitions or negotiating a financing arrangement than during times when we are not. Because we have not commenced operations, it is difficult to predict specific amounts of time an executive officer will devote to our company. We believe that our President, Mr. Bessey, and our Chief Operating Officer, Mr. Addy, will devote a substantial majority of their time to us and that each of our Chief Executive Officer, Mr. Edison, and our Chief Financial Officer, Mr. Smith, may devote

11

significantly less time to us. There is no assurance that our expectations are correct and our executive officers may devote more or less time to us than described above.

The officers and key personnel of our advisor serve in the same capacity for the advisors of each of the other AR Capital-sponsored REITs referred to above. Several of these other REITs are still in the developmental stage, when the REIT is being organized, funds are initially being raised and funds are initially being invested. We refer to the “developmental stage” of a REIT as the time period from inception of the REIT until it raises a sufficient amount of funds to break escrow. Based on our AR Capital sponsor’s experience in sponsoring multiple non-traded REITs, a significantly greater time commitment is required for development stage REITs than for REITs that have transitioned to the operational stage. Thus, the officers and key personnel of our advisor are expected to spend a substantial portion of their time on activities unrelated to us, reducing the amount of time they may devote to us.

Adoption of Best Practice Guidelines

On March 23, 2011, our board of directors adopted best practices guidelines on affiliated transactions that prevent us, with certain exceptions, from entering into co-investments or any other business transaction with any other Phillips Edison- or American Realty Capital-affiliated entity. The exceptions under the guidelines do, however, allow us to enter into (i) transactions specifically contemplated by this prospectus, (ii) roll-up transactions that comply with the requirements set forth in our charter (provided that the roll-up transaction is not with programs sold through broker-dealers and sponsored by Phillips Edison or American Realty Capital), and (iii) funding transactions, including loans, with AR Capital Advisor, Phillips Edison Sub-advisor, or another Phillips Edison- or American Realty Capital-affiliated entity. Except when in connection with permitted roll-up transactions, we may not purchase any asset from, or sell any asset to, any Phillip Edison- or American Realty Capital-affiliated entity.

Prior Performance Summary

The following information supersedes the disclosure in the prospectus under the heading “Prior Performance Summary.”

The information presented in this section represents the historical experience of all real estate programs managed over the last ten years by Messrs. Phillips and Edison, our individual Phillips Edison sponsors, and Messrs. Schorsch and Kahane, our individual AR Capital sponsors. In assessing the relative importance of this information with respect to a decision to invest in this offering, you should keep in mind that we will rely primarily on affiliates of our Phillips Edison sponsor to identify acquisitions and manage our portfolio and we will rely primarily on affiliates of our AR Capital sponsor with respect to our capital-raising efforts, although both AR Capital Advisor and Phillips Edison Sub-Advisor will jointly participate in major decisions as described in this prospectus at “Management – Our Advisor and Sub-Advisor.” You should also note that only programs sponsored by Phillips Edison have invested in our targeted portfolio of grocery-anchored neighborhood shopping centers.

Unless otherwise indicated, the information presented below with respect to the historical experience of Phillips Edison and the private real estate funds sponsored by Phillips Edison and of AR Capital and the prior programs sponsored by AR Capital is as of the 10-years ending December 31, 2010. By purchasing shares in this offering, you will not acquire any ownership interest in any funds to which the information in this section relates and you should not assume that you will experience returns, if any, comparable to those experienced by the investors in the real estate funds discussed. Further, the private funds discussed in this section were conducted through privately held entities that were subject neither to the up-front commissions, fees and expenses associated with this offering nor all of the laws and regulations that will apply to us as a publicly offered REIT.

We intend to conduct this offering in conjunction with future offerings by one or more public and private real estate entities sponsored by Phillips Edison and AR Capital and their respective affiliates. To the extent that such entities have the same or similar objectives as ours or involve similar or nearby properties, such entities may be in competition with the properties acquired by us. See the section entitled “Conflicts of Interest” in this prospectus for additional information.

Appendix A includes five tables with information about the public programs and private funds discussed in this section. They present information with respect to (1) the experience of our sponsors in raising and investing in

12

funds, (2) the compensation paid by prior funds to the sponsor and its affiliates, (3) the operating results of prior funds, (4) sales or disposals of properties by prior funds, and (5) results of completed funds. Table VI located in Part II of the registration statement, which is not part of this prospectus, describes acquisitions of properties by prior programs and funds. We will provide a copy of Table VI to you upon written request and without charge. In all cases, the tables presenting information about the historical experience of programs sponsored by Phillips Edison appear first, followed by tables summarizing similar information for AR Capital.

Private Programs Sponsored by Phillips Edison

Since 1991, Michael C. Phillips and Jeffrey S. Edison, have partnered to acquire, manage and reposition necessity-driven retail properties, primarily grocery-anchored neighborhood and community shopping centers across the United States. Phillips Edison has operated with financial partners through both property-specific and multi-asset discretionary funds, and to date, Phillips Edison has sponsored five private real estate funds and raised approximately $600 million of equity from high-net-worth individuals and institutional investors.

During the 10-year period ending December 31, 2010, Phillips Edison managed five private real estate funds, all of which were multi-investor, commingled funds. All of these private funds were limited partnerships for which affiliates of Messrs. Phillips and Edison act or acted as general partner. In all cases, affiliates of Messrs. Phillips and Edison had responsibility for acquiring, investing, managing, leasing, developing and selling the real estate and real estate-related assets of each of the funds.

Two of the five private real estate funds managed by Phillips Edison raised approximately $395 million of equity capital from 12 institutional investors during the 10-year period ending December 31, 2010. The institutional investors investing in the private funds include public pension funds, sovereign wealth funds, insurance companies, financial institutions, endowments and foundations. For more information regarding the experience of our sponsors in raising funds from investors, see Table I and Table II of the Prior Performance Tables contained in Appendix A of this supplement.

During the 10-year period ending December 31, 2010, Phillips Edison acquired 249 real estate investments and invested over $1.8 billion in these assets (purchase price) on behalf of the five private funds raising capital for new investments during this period. Debt financing was used in acquiring the properties in all of these five private funds.

Four of the five private funds managed by Phillips Edison during the 10-year period ending December 31, 2010 have or had investment objectives that are similar to ours. Like ours, their primary investment objectives are to provide investors with stable returns, to preserve and return their capital contributions and to realize growth in the value of their investments. In addition, investments in real estate and real estate-related assets involve similar assessments of the risks and rewards of the operation of the underlying real estate and financing thereof as well as an understanding of the real estate and real estate-finance markets. For each of the private funds, Phillips Edison has focused on acquiring a diverse portfolio of real estate investments. Phillips Edison has typically diversified the portfolios of the private funds by geographic region, investment size, and tenant mix. In constructing the portfolios of the five private funds, Phillips Edison specialized in acquiring a mix of value-added and enhanced-return properties. Value-added and enhanced-return assets are assets that are undervalued or that could be repositioned to enhance their value.

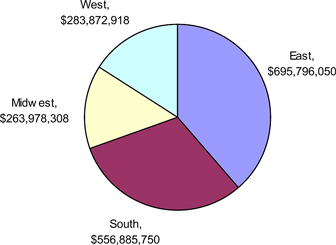

Phillips Edison has sought to diversify investments in its private funds by geographic region as illustrated by the chart below. The chart below outlines investments of the private funds by amounts invested (purchase price) during the 10-year period ending December 31, 2010. All were within the United States. The geographic dispersion of properties acquired during the 10-year period ending December 31, 2010 is as follows: 38% of the amount was invested in 97 properties located in the eastern United States, 31% of the amount was invested in 68 properties located in the southern United States, 16% of the amount was invested in 47 properties located in the western United States and 15% of the amount was invested in 37 properties located in the midwestern United States.

13

PHILLIPS EDISON - PRIVATE PROGRAMS

INVESTMENT BY REGION

In addition to diversifying the private fund portfolios by geographic region, Phillips Edison has primarily focused on necessity-driven retail investments that include the following categories: grocery, general merchandise, discount, health and beauty, and office supply retailers. Unlike industries that are routinely affected by cyclical fluctuations in the economy, shopping centers anchored by these retailers have historically been more resistant to economic downturns. In general, the consistent consumer demand for items such as food, pharmaceutical goods, postal services, general retail and hardware is present in all cycles of the economy.

In seeking to diversify the portfolios of the private funds by investment risk, Phillips Edison has purchased a mix of low-risk, high-quality properties and high-quality but under-performing properties in need of repositioning. The majority of the properties purchased by the private funds had prior owners and operators. For more detailed information regarding acquisitions by the private funds in the three years ending December 31, 2010, see Table VI located in Part II of the registration statement, which is not part of this prospectus. We will provide a copy of Table VI to you upon written request and without charge.

During the 10-year period ending December 31, 2010, Phillips Edison sold 43 properties on behalf of these five private funds. Phillips Edison continues to actively manage the remaining unsold properties of these private funds.

Though the private funds were not subject to the up-front commissions, fees and expenses associated with this offering, the private funds have fee arrangements with Phillips Edison affiliates structured similar to ours. The percentage of the fees varied based on the market factors at the time the particular fund was formed. For more information regarding the fees paid to Phillips Edison affiliates by these private funds and the operating results of these private funds, please see Tables II and III of the Prior Performance Tables in Appendix A of this supplement.

Adverse Business Developments and Conditions

Market timing is a strategy of buying or selling assets based on predictions of future market price movements. Phillips Edison has not tried to time the sponsorship of real estate programs based on its predictions of the real estate market as a whole. For most of the last 10 years, sponsored programs have been raising capital in order to acquire a desirable portfolio of real estate. As the money has been raised, sponsored programs have sought to acquire real estate at favorable prices based on then-current market conditions. In other words, such programs have generally sought to put capital to use promptly if suitable investments are available rather than hold substantial

14

amounts of cash for long periods. Although our Phillips Edison sponsor believes that this strategy has generally served the investors in Phillips Edison-sponsored programs well, some of the assets acquired by Phillips Edison-sponsored programs were acquired at times when real estate was generally more expensive than during the later stages of the life of the program. As a result, at any given time some acquired assets of a Phillips Edison-sponsored program might sell for prices that are lower than the prices paid for them if those assets had to be liquidated at that time. This can be true even if the property remains leased to creditworthy tenants with long-term leases such that the program continues to project strong income yields. This possibility is the primary reason why Phillips Edison-sponsored programs are sold as long-term investments. With a long-term investment horizon, Phillips Edison-sponsored programs have more flexibility to liquidate or list at a more favorable time during a real estate cycle. Nevertheless, we cannot make any assurances regarding our ability to liquidate or list at a time when real estate prices are attractive relative to the prices we will pay for our portfolio.

Prior Investment Programs Sponsored by AR Capital

The information presented in this section represents the historical experience of the real estate programs managed or sponsored over the last ten years by Messrs. Schorsch and Kahane. Investors should not assume that they will experience returns, if any, comparable to those experienced by investors in such prior real estate programs. The prior performance of real estate investment programs sponsored by affiliates of Messrs. Schorsch and Kahane and AR Capital advisor may not be indicative of our future results. The information summarized below is current as of December 31, 2010 and is set forth in greater detail in the Prior Performance Tables included in this prospectus. In addition, we will provide upon request to us and without charge, a copy of the most recent Annual Report on Form 10-K filed with the SEC by any public program within the last 24 months, and for a reasonable fee, a copy of the exhibits filed with such annual report.

We intend to conduct this offering in conjunction with future offerings by one or more public and private real estate entities sponsored by American Realty Capital and its affiliates. To the extent that such entities have the same or similar objectives as ours or involve similar or nearby properties, such entities may be in competition with the properties acquired by us. See the section entitled “Conflicts of Interest” in this prospectus for additional information.

Summary Information

During the period from August 2007 (inception of the first public program) to December 31, 2010, affiliates of AR Capital Advisor have sponsored nine public programs, of which three programs have raised public funds to date, and five non-public programs with similar investment objectives to our program. From August 2007 (inception of the first public program) to December 31, 2010, public programs which have raised public funds to date, including American Realty Capital Trust, Inc., or ARCT, American Realty Capital New York Recovery REIT, Inc. and the programs consolidated into ARCT, which were ARC Income Properties II and all of the Section 1031 Exchange Programs in existence as of December 31, 2010 described below, had raised $612.7 million from 15,633 investors in ARCT’s public offering and an additional $65.3 million from 205 investors in a private offering by ARC Income Properties II, LLC and 45 investors in a private offering by the Section 1031 Exchange Programs. The public programs purchased 268 properties with an aggregate purchase price of $972.7 million, including acquisition fees, in 39 states and U.S. territories.

The following table details the percentage of properties by state based on purchase price:

State/Possession | Purchase Price % | |||

Alabama | 1.3 | % | ||

Arizona | 0.8 | % | ||

Arkansas | 1.2 | % | ||

California | 10.8 | % | ||

Colorado | 0.4 | % | ||

Florida | 4.5 | % | ||

15

Georgia | 2.9 | % | ||

Illinois | 4.1 | % | ||

Indiana | 1.3 | % | ||

Iowa | 0.4 | % | ||

Kansas | 3.6 | % | ||

Kentucky | 3.1 | % | ||

Louisiana | 1.3 | % | ||

Maine | 0.4 | % | ||

Massachusetts | 3.7 | % | ||

Michigan | 1.2 | % | ||

Minnesota | 1.2 | % | ||

Mississippi | 0.8 | % | ||

Missouri | 3.8 | % | ||

Nebraska | 0.2 | % | ||

Nevada | 0.3 | % | ||

New Jersey | 3.6 | % | ||

New Mexico | 0.4 | % | ||

New York | 11.1 | % | ||

North Carolina | 1.4 | % | ||

North Dakota | 0.6 | % | ||

Ohio | 2.7 | % | ||

Oklahoma | 1.3 | % | ||

Oregon | 0.5 | % | ||

Pennsylvania | 8.7 | % | ||

Puerto Rico | 3.3 | % | ||

South Carolina | 1.2 | % | ||

South Dakota | 0.3 | % | ||

Tennessee | 0.4 | % | ||

Texas | 8.6 | % | ||

Utah | 3.5 | % | ||

Virginia | 1.1 | % | ||

Washington | 0.3 | % | ||

West Virginia | 3.7 | % | ||

| 100 | % | |||

The properties are all commercial properties comprised of 25.8% freight and distribution facilities, 23.4% retail pharmacies, 14.5% retail bank branches, 6.2% restaurants, 5.8% discount and specialty retail, 4.5% supermarkets and supermarket anchored shopping centers, 4.3% auto services, 3.6% fashion retail, 3.4% home maintenance, 3.4% office/showroom, 2.7% gas/convenience and 2.6% healthcare, based on purchase price. The purchased properties were 36.0% new and 64.0% used, based on purchase price. None of the purchased properties were construction properties. As of December 31, 2010, one property had been sold. The acquired properties were purchased with a combination of proceeds from the issuance of common stock, the issuance of convertible preferred stock, mortgage notes payable, short-term notes payable, revolving lines of credit, long-term notes payable issued in private placements and joint venture arrangements.

During the period from June 2008 (inception of the first non-public program) to December 31, 2010, our non-public programs, which were ARC Income Properties, LLC, ARC Income Properties II, LLC, ARC Income Properties III, LLC, ARC Income Properties IV, LLC and ARC Growth Fund, LLC, had raised $54.3 million from

16

694 investors. The non-public programs purchased 171 properties with an aggregate purchase price of $247.9 million, including acquisition fees, in 18 states.

The following table details the percentage of properties by state based on purchase price:

| State location | Purchase Price % | |||

Alabama | 0.1 | % | ||

Connecticut | 0.6 | % | ||

Delaware | 4.8 | % | ||

Florida | 11.0 | % | ||

Georgia | 3.5 | % | ||

Illinois | 6.6 | % | ||

Louisiana | 2.3 | % | ||

Michigan | 11.5 | % | ||

North Carolina | 0.1 | % | ||

New Hampshire | 0.5 | % | ||

New Jersey | 13.0 | % | ||

New York | 9.7 | % | ||

Ohio | 10.3 | % | ||

Pennsylvania | 9.5 | % | ||

South Carolina | 8.4 | % | ||

Texas | 5.0 | % | ||

Virginia | 1.2 | % | ||

Vermont | 2.2 | % | ||

| 100 | % | |||

The properties are all commercial single tenant facilities with 81.0% retail banking and 10.5% retail distribution facilities and 8.6% specialty retail. The purchased properties were 11.0% new and 89.0% used, based on purchase price. None of the purchased properties were construction properties. As of December 31, 2010, 53 properties had been sold. The acquired properties were purchased with a combination of equity investments, mortgage notes payable and long term notes payable issued in private placements.

The investment objectives of these programs are different from our investment objectives, which aim to acquire necessity-based neighborhood and community shopping centers.

For a more detailed description, please see Table VI in Part II of the registration statement of which this prospectus is a part. In addition, we will provide upon request to us and without charge, the more detailed information in Part II.

Programs of Our AR Capital Sponsor

American Realty Capital Trust, Inc.

American Realty Capital Trust, Inc., or ARCT, a Maryland corporation, is the first publicly offered REIT sponsored by American Realty Capital. ARCT was incorporated on August 16, 2007, and qualified as a REIT beginning with the taxable year ended December 31, 2008. ARCT commenced its initial public offering of

17

150,000,000 shares of common stock on January 25, 2008. As of March 31, 2011, ARCT had received aggregate gross offering proceeds of approximately $859.1 million from the sale of approximately 87.9 million shares in its initial public offering. On August 5, 2010, ARCT commenced a follow-on offering of $325 million in shares of common stock. The initial public offering was set to expire on January 25, 2011. However, as permitted by Rule 415 of the Securities Act, ARCT has elected to continue its initial public offering until the earlier of July 24, 2011, or the date that the SEC declares the registration statement for the follow-on offering effective. As of March 31, 2011, ARCT had acquired 318 properties, primarily comprised of freestanding, single-tenant retail and commercial properties that are net leased to investment grade and other creditworthy tenants. As of March 31, 2011, ARCT had total real estate investments, at cost, of approximately $1.3 billion. ARCT intends to liquidate each real property investment eight to ten years from the date purchased. As of December 31, 2010, ARCT had incurred, cumulatively to that date, $73.7 million in offering costs, commissions and dealer manager fees for the sale of its common stock and $18.1 million for acquisition costs related to its portfolio of properties.

American Realty Capital New York Recovery REIT, Inc.

American Realty Capital New York Recovery REIT, Inc., or ARCNYRR, a Maryland corporation, is the second publicly offered REIT sponsored by American Realty Capital. ARCNYRR was organized on October 6, 2009 and intends to elect to be taxed as a REIT beginning with its taxable year ending December 31, 2010. ARCNYRR filed its initial registration statement with the SEC on November 12, 2009 and the registration statement became effective on September 2, 2010. ARCNYRR was formed to acquire quality income-producing commercial real estate, as well as acquiring properties or making other real estate investments that relate to office, retail, multi-family residential, industrial and hotel property types, located primarily in New York City. As of March 31, 2011, ARCNYRR had received aggregate gross proceeds of approximately $8.4 million from the sale of 853,990 shares of common stock in its public offering and aggregate gross proceeds of approximately $17.0 million from the sale of approximately 2.0 million shares of its Series A convertible preferred stock from a private offering to “accredited investors” (as defined in Regulation D as promulgated under the Securities Act), which terminated on September 2, 2010, the effective date of the registration statement. As of March 31, 2011, ARCNYRR had acquired six commercial properties which are 100% leased. As of March 31, 2011, ARCNYRR had total real estate investments, at cost, of approximately $67.6 million. As of March 31, 2011, ARCNYRR had incurred, cumulatively to that date, approximately $5.0 million in offering costs for the sale of its common stock.

American Realty Capital Healthcare Trust, Inc.

American Realty Capital Healthcare Trust, Inc. or ARC HT, a Maryland corporation, is the fourth publicly offered REIT sponsored by American Realty Capital. ARC HT was organized on August 23, 2010 and intends to qualify as a REIT beginning with the taxable year ending December 31, 2011. ARC HT filed its registration statement with the SEC on August 27, 2010 and the registration statement became effective on February 18, 2011. As of March 31, 2011, the company had not raised any money in connection with the sale of its common stock nor had it acquired any properties.

American Realty Capital — Retail Centers of America, Inc.

American Realty Capital — Retail Centers of America, Inc., or ARC RCA, a Maryland corporation, is the fifth publicly offered REIT sponsored by American Realty Capital. ARC RCA was incorporated on July 29, 2010 and intends to qualify as a REIT beginning with the taxable year ending December 31, 2011. ARC RCA filed its registration statement with the SEC on September 14, 2010 and the registration statement became effective on March 17, 2011. As of March 31, 2011, ARC RCA had not raised any money in connection with the sale of its common stock nor had it acquired any properties.

American Realty Capital Trust II, Inc.

American Realty Capital Trust II, Inc. or ARCT II, a Maryland corporation, is the sixth publicly offered REIT sponsored by American Realty Capital. ARCT II was incorporated on September 10, 2010 and intends to qualify as a REIT beginning with the taxable year ending December 31, 2011. ARCT II filed its registration

18

statement with the SEC on October 8, 2010, which has not been declared effective by the SEC. As of March 31, 2011, ARCT II had not raised any money in connection with the sale of its common stock nor had it acquired any properties.

ARC —Northcliffe Income Properties, Inc.

ARC — Northcliffe Income Properties, Inc., or ARC — Northcliffe, a Maryland corporation, is the seventh publicly offered REIT sponsored by American Realty Capital. ARC — Northcliffe was incorporated on September 29, 2010 and intends to qualify as a REIT beginning with the taxable year ending December 31, 2011. ARC — Northcliffe filed its registration statement with the SEC on October 12, 2010, which has not been declared effective by the SEC. As of March 31, 2011, ARC — Northcliffe had not raised any money in connection with the sale of its common stock nor had it acquired any properties.

American Realty Capital Trust III, Inc.

American Realty Capital Trust III, Inc., or ARCT III, a Maryland corporation, is the eighth publicly offered REIT sponsored by American Realty Capital. ARCT III was incorporated on October 15, 2010 and intends to qualify as a REIT beginning with the taxable year ending December 31, 2011. ARCT III filed its registration statement with the SEC on November 2, 2010 and the registration statement became effective on March 31, 2011. As of March 31, 2011, ARCT III had not raised any money in connection with the sale of its common stock nor had it acquired any properties.

American Realty Capital Properties, Inc.

American Realty Capital Properties, Inc., or ARCP, a Maryland corporation, is the ninth publicly offered REIT sponsored by the American Realty Capital group of companies. ARCP was incorporated on December 2, 2010 and intends to qualify as a REIT beginning with the taxable year ending December 31, 2011. ARCP filed its registration statement with the SEC on February 11, 2011, which has not been declared effective by the SEC. As of March 31, 2011, ARCP had not raised any money in connection with the sale of its common stock nor had it acquired any properties.

Private Note Programs

ARC Income Properties, LLC implemented a note program that raised aggregate gross proceeds of $19.5 million. The net proceeds were used to acquire, and pay related expenses in connection with, a portfolio of 65 bank branch properties triple-net leased to RBS Citizens, N.A. and Citizens Bank of Pennsylvania. The purchase price for those bank branch properties also was funded with proceeds received from mortgage loans, as well as equity capital invested by American Realty Capital II, LLC. Such properties contain approximately 323,000 square feet and were acquired at a purchase price of approximately $98.8 million. The properties are triple-net leased for a primary term of five years and include extension provisions. The notes issued under this note program by ARC Income Properties, LLC were sold by Realty Capital Securities through participating broker-dealers.

ARC Income Properties II, LLC implemented a note program that raised aggregate gross proceeds of $13.0 million. The net proceeds were used to acquire, and pay related expenses in connection with, a portfolio of 50 bank branch properties triple-net leased to PNC Bank. The purchase price for those bank branch properties also was funded with proceeds received from a mortgage loan, as well as equity capital raised by American Realty Capital Trust, Inc. in connection with its public offering of equity securities. The properties are triple-net leased with a primary term of ten years with a 10% rent increase after five years. The notes issued under this note program by ARC Income Properties II, LLC were sold by Realty Capital Securities through participating broker-dealers.

ARC Income Properties III, LLC implemented a note program that raised aggregate gross proceeds of $11.2 million. The net proceeds were used to acquire, and pay related expenses in connection with the acquisition of a distribution facility triple-net leased to Home Depot. The purchase price for the property was also funded with proceeds received from a mortgage loan. The property has a primary lease term of twenty years which commenced on January 30, 2010 with a 2% escalation each year. The notes issued under this note program by ARC Income Properties III, LLC were sold by our dealer manager through participating broker-dealers.

19

ARC Income Properties IV, LLC implemented a note program that raised proceeds of $5.4 million. The proceeds were used to acquire and pay related expenses in connection with the acquisition of six Tractor Supply stores. An existing mortgage loan of $16.5 million was assumed in connection with the acquisition. The properties had a remaining average lease term of 11.8 years with a 6.25% rental escalation every five years. The notes issued under this program by ARC Income Properties IV, LLC were sold by Realty Capital Securities through participating broker dealers.

ARC Growth Fund, LLC