Table of Contents

As filed with the Securities and Exchange Commission on July 17, 2012

Registration No. 333-164313

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

POST-EFFECTIVE AMENDMENT NO. 10 TO

FORM S-11

REGISTRATION STATEMENT

Under

THE SECURITIES ACT OF 1933

Phillips Edison – ARC Shopping Center REIT Inc.

(Exact name of registrant as specified in its charter)

11501 Northlake Drive

Cincinnati, Ohio 45249

(513) 554-1110

(Address, including zip code, and telephone number, including area code, of the registrant’s principal executive offices)

Jeffrey S. Edison

Chief Executive Officer

11501 Northlake Drive

Cincinnati, Ohio 45249

(513) 554-1110

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

Robert H. Bergdolt, Esq. DLA Piper LLP (US) 4141 Parklake Avenue, Suite 300 Raleigh, North Carolina 27612-2350 (919) 786-2000 | Peter M. Fass, Esq. James P. Gerkis, Esq. Proskauer Rose LLP Eleven Times Square New York, New York 10036-8299 (212) 969-3000 |

Approximate date of commencement of proposed sale to public: As soon as practicable after the effectiveness of the registration statement.

If any of the securities being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act, check the following box: x

If this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration number of the earlier effective registration statement for the same offering. ¨

If this form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration number of the earlier effective registration statement for the same offering. ¨

If delivery of the prospectus is expected to be made pursuant to Rule 434, please check the following box. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act (Check One):

Large accelerated filer ¨ | Accelerated filer ¨ | |

Non-accelerated filer ¨ | Smaller Reporting Company x | |

(Do not check if smaller reporting company) | ||

This Post-Effective Amendment No. 10 consists of the following:

| 1. | The registrant’s final prospectus dated November 22, 2011. |

| 2. | Supplement No. 14 dated July 17, 2012 to the registrant’s prospectus dated November 22, 2011. Supplement No. 14 supersedes and replaces all prior supplements to the prospectus. |

| 3. | Part II, included herewith. |

| 4. | Signature, included herewith. |

Table of Contents

Maximum Offering of 180,000,000 Shares of Common Stock

Phillips Edison – ARC Shopping Center REIT Inc. is a Maryland corporation that invests primarily in grocery-anchored neighborhood and community shopping centers throughout the United States with a focus on those shopping centers occupied by top-performing grocers. In addition, we may invest in other retail properties including power and lifestyle shopping centers, multi-tenant shopping centers, free-standing single-tenant retail properties, and other real estate and real estate-related loans and securities depending on real estate market conditions and investment opportunities. We have elected to qualify and be taxed as a real estate investment trust for U.S. federal income tax purposes, or REIT, commencing with our taxable year ended December 31, 2010.

We are offering up to 150,000,000 shares of our common stock at a price of $10.00 per share on a “best efforts” basis through Realty Capital Securities, LLC, our dealer manager. “Best efforts” means that our dealer manager is not obligated to purchase any specific number or dollar amount of shares. We also are offering up to 30,000,000 shares of our common stock pursuant to our dividend reinvestment plan at $9.50 per share. We reserve the right to reallocate the shares of common stock we are offering between the primary offering and our dividend reinvestment plan.

Investing in our common stock involves a high degree of risk. See “Risk Factors” beginning on page 24 to read about risks you should consider before buying shares of our common stock. These risks include the following:

| • | As of November 11, 2011, we owned six real estate properties consisting entirely of grocery-anchored shopping centers. We are considered a “blind pool” because, except as described in a supplement to this prospectus, we have not yet identified any additional properties in which there is a reasonable probability we will invest the proceeds from this offering. |

| • | No public market currently exists for our common stock, and we have no plans to list our shares on an exchange. If you are able to sell your shares, you would likely have to sell them at a substantial discount or loss. |

| • | No one may own more than 9.8% of our aggregate outstanding stock unless exempted by our board and we may prohibit transfers of our shares to ensure our qualification as a REIT. See “Description of Shares – Restriction on Ownership of Shares” beginning on page 172. |

| • | This offering price is arbitrary and unrelated to the book or net value of our assets or to our expected operating income. |

| • | We depend on our sub-advisor (acting on behalf of our advisor) to conduct our operations. Both our advisor and our sub-advisor have limited operating histories and no prior experience operating a public company. |

| • | We have a limited operating history and we currently own six real estate properties. |

| • | We will make investments through a joint venture on a limited basis. Investments in joint ventures that own real properties involve risks not otherwise present when properties are owned directly. Our joint venture arrangement reduces our control over our assets and could give rise to disputes with our joint venture partners, which could adversely affect the value of your investment in us. |

| • | All of our executive officers and some of our directors are also officers, managers, directors or holders of a controlling interest in our advisor, sub-advisor, dealer manager or other affiliates of our sponsors. As a result, they face conflicts of interest, including significant conflicts created by our advisor’s compensation arrangements with us and other sponsor-advised programs. |

| • | If we raise substantially less than the maximum offering, we may not be able to invest in a diverse portfolio of real estate assets and the value of your investment may vary more widely with the performance of specific assets. As of November 11, 2011, we have raised $22.1 million. |

| • | We pay substantial fees and expenses to our advisor, our sub-advisor and their respective affiliates and broker-dealers. These fees increase your risk of loss. |

| • | Our organizational documents permit us to pay distributions from any source without limit, including offering proceeds. Until the proceeds from this offering are fully invested and from time to time during our operational stage, we expect to use proceeds from financings to fund distributions in anticipation of cash flow to be received in later periods. We may also fund such distributions from advances or contributions from our sponsors or from any deferral or waiver of fees by our advisor and sub-advisor. To the extent distributions exceed our net income or net capital gain, a greater proportion of your distributions will generally represent a return of capital as opposed to current income or gain, as applicable. To date, we have paid distributions from operating cash flow and contributions from our sub-advisor. |

| • | We may incur debt causing our total liabilities to exceed 75.0% of the cost of our tangible assets with the approval of the conflicts committee. Especially during the early stages of this offering, our conflicts committee may approve debt in excess of this limit. Higher debt levels increase the risk of your investment. |

Neither the U.S. Securities and Exchange Commission, or SEC, the Attorney General of the State of New York nor any other state securities regulator has approved or disapproved of our common stock, determined if this prospectus is truthful or complete or passed on or endorsed the merits of this offering. Any representation to the contrary is a criminal offense.

This investment involves a high degree of risk. You should purchase these securities only if you can afford a complete loss of your investment. The use of projections or forecasts in this offering is prohibited. No one is permitted to make any oral or written predictions about the cash benefits or tax consequences you will receive from your investment.

Price to Public | Selling Commissions | Dealer Manager Fee | Net Proceeds (Before Expenses) | |||||

Primary Offering | ||||||||

Per Share | $ 10.00* | $ 0.70* | $ 0.30* | $ 9.00 | ||||

Total Maximum | $1,500,000,000.00* | $105,000,000.00* | $45,000,000.00* | $1,350,000,000.00 | ||||

Dividend Reinvestment Plan | ||||||||

Per Share | $ 9.50 | $ 0.00 | $ 0.00 | $ 9.50 | ||||

Total Maximum | $ 285,000,000.00 | $ 0.00 | $ 0.00 | $ 285,000,000.00 | ||||

| * | Discounts are available for some categories of investors. Reductions in commissions and fees will result in corresponding reductions in the purchase price. |

We expect to sell the 150,000,000 shares offered in our primary offering by August 12, 2012. If we have not sold all of the shares by August 12, 2012, we may continue the primary offering for up to an additional year until August 12, 2013. If we decided to continue our primary offering beyond two years from the date of this prospectus, we would provide that information in a prospectus supplement. This offering must be registered in every state in which we offer or sell shares. Generally, such registrations are for a period of one year. Thus, we may have to stop selling shares in any state in which our registration is not renewed or otherwise extended annually.

We will not sell any shares to Pennsylvania investors unless we raise $75.0 million in gross offering proceeds (including sales made to residents of other jurisdictions) from persons not affiliated with us or our sponsors. If we do not raise this amount by August 12, 2012, we will promptly return all funds held in escrow for the benefit of Pennsylvania investors.

The date of this prospectus is November 22, 2011.

Table of Contents

INVESTOR SUITABILITY STANDARDS

An investment in our common stock involves significant risk and is suitable only for persons who have adequate financial means, desire a relatively long-term investment and who will not need immediate liquidity from their investment. Persons who meet this standard and seek to diversify their personal portfolios with a finite-life, real estate-based investment, which may hedge against inflation and the volatility of the stock market, seek to receive current income, seek to preserve capital, wish to obtain the benefits of potential long-term capital appreciation and who are able to hold their investment for a time period consistent with our liquidity plans are most likely to benefit from an investment in our company. On the other hand, we caution persons who require immediate liquidity or guaranteed income, or who seek a short-term investment not to consider an investment in our common stock as meeting these needs. Notwithstanding these investor suitability standards, potential investors should note that investing in shares of our common stock involves a high degree of risk and should consider all the information contained in this prospectus, including the “Risk Factors” section contained herein, in determining whether an investment in our common stock is appropriate.

In order to purchase shares in this offering, you must:

| • | meet the applicable financial suitability standards as described below; and |

| • | purchase at least the minimum number of shares as described below. |

We have established suitability standards for initial stockholders and subsequent purchasers of shares from our stockholders. These suitability standards require that a purchaser of shares have, excluding the value of a purchaser’s home, home furnishings and automobiles, either:

| • | a net worth of at least $250,000; or |

| • | an annual gross income of at least $70,000 and a net worth of at least $70,000. |

The minimum purchase is 250 shares ($2,500). You may not transfer fewer shares than the minimum purchase requirement. In addition, you may not transfer, fractionalize or subdivide your shares so as to retain less than the number of shares required for the minimum purchase. In order to satisfy the minimum purchase requirements for individual retirement accounts, or IRAs, unless otherwise prohibited by state law, a husband and wife may jointly contribute funds from their separate IRAs, provided that each such contribution is made in increments of $100. You should note that an investment in shares of our common stock will not, in itself, create a retirement plan and that, in order to create a retirement plan, you must comply with all applicable provisions of the Internal Revenue Code.

Several states have established suitability requirements that are more stringent than the standards that we have established and described above. Shares will be sold to investors in these states only if they meet the special suitability standards set forth below. In each case, these special suitability standards exclude from the calculation of net worth the value of the investor’s home, home furnishings and automobiles.

General Standards for all Investors

| • | Investors must have either (a) a net worth of at least $250,000 or (b) an annual gross income of at least $70,000 and a net worth of at least $70,000. |

Kentucky

| • | Investors must have either (a) a net worth of at least $250,000 or (b) a gross annual income of at least $70,000 and a net worth of at least $70,000, with the amount invested in this offering not to exceed 10% of the Kentucky investor’s liquid net worth. |

i

Table of Contents

Iowa, Maine, Massachusetts, Michigan, Ohio, Oregon, Pennsylvania and Washington

| • | Investors must have either (a) a net worth of at least $250,000 or (b) an annual gross income of at least $70,000 and a net worth of at least $70,000. The investor’s maximum investment in the issuer and its affiliates cannot exceed 10.0% of the investor’s net worth. |

Tennessee

| • | Investors must have either (a) a net worth of at least $500,000 (exclusive of home, home furnishings and automobiles) or (b) an annual gross income of at least $100,000 and a net worth of at least $100,000 (exclusive of home, home furnishings and automobiles). The investor’s maximum investment in our shares and our affiliates shall not exceed 10.0% of the investor’s net worth. |

Nebraska

| • | Investors must have either (a) a net worth of at least $350,000 (exclusive of home, home furnishings and automobiles) or (b) an annual gross income of at least $70,000 and a net worth of at least $100,000 (exclusive of home, home furnishings and automobiles). The investor’s total investment in our shares should not exceed 10.0% of the investor’s net worth. |

Kansas

| • | In addition to the general suitability requirements described above, it is recommended that investors should invest no more than 10.0% of their liquid net worth in our shares and securities of other real estate investment trusts. “Liquid net worth” is defined as that portion of net worth (total assets minus total liabilities) that is comprised of cash, cash equivalents and readily marketable securities. |

Missouri

| • | In addition to the general suitability requirements described above, no more than 10.0% of any one investor’s liquid net worth shall be invested in the securities registered by us for this offering with the Securities Division. |

California

| • | In addition to the general suitability requirements described above, an investor’s maximum investment in our shares will be limited to 10.0% of the investor’s net worth (exclusive of home, home furnishings and automobile). |

Alabama

| • | In addition to the general suitability requirements described above, shares will only be sold to Alabama residents who represent that they have a liquid net worth of at least 10 times the amount of their investment in this real estate investment program and other similar programs. |

In addition, because the minimum offering amount of $2.5 million was less than $100 million, Pennsylvania investors are cautioned to carefully evaluate our ability to fully accomplish our stated objectives and to inquire as to the current dollar volume of subscription proceeds. Further, the minimum aggregate closing amount for Pennsylvania investors is $75 million.

In the case of sales to fiduciary accounts (such as an IRA, Keogh Plan or pension or profit-sharing plan), these minimum suitability standards must be satisfied by the beneficiary, the fiduciary account, or by the donor

ii

Table of Contents

or grantor who directly or indirectly supplies the funds to purchase our common stock if the donor or the grantor is the fiduciary. Prospective investors with investment discretion over the assets of an individual retirement account, employee benefit plan or other retirement plan or arrangement that is covered by the Employee Retirement Income Security Act of 1974, as amended, or ERISA, or Section 4975 of the Internal Revenue Code should carefully review the information in the section of this prospectus entitled “ERISA Considerations.” Any such prospective investors are required to consult their own legal and tax advisors on these matters.

In the case of gifts to minors, the minimum suitability standards must be met by the custodian of the account or by the donor.

In order to ensure adherence to the suitability standards described above, requisite criteria must be met, as set forth in the subscription agreement in the form attached hereto as Appendix B. In addition, our sponsors, our dealer manager and the soliciting dealers, as our agents, must make every reasonable effort to determine that the purchase of our shares is a suitable and appropriate investment for an investor. In making this determination, the soliciting dealers will rely on relevant information provided by the investor in the investor’s subscription agreement, including information regarding the investor’s age, investment objectives, investment experience, income, net worth, financial situation, other investments and any other pertinent information. Executed subscription agreements will be maintained in our records for six years. See “Plan of Distribution – Suitability Standards” for a detailed discussion of the determinations regarding suitability that we require.

iii

Table of Contents

| Page | ||||

| i | ||||

| 1 | ||||

| 24 | ||||

| 24 | ||||

| 30 | ||||

| 34 | ||||

| 38 | ||||

| 47 | ||||

| 51 | ||||

| 54 | ||||

| 62 | ||||

| 64 | ||||

| 65 | ||||

| 67 | ||||

| 67 | ||||

| 71 | ||||

| 74 | ||||

| 74 | ||||

| 75 | ||||

| 76 | ||||

| 80 | ||||

| 80 | ||||

| 82 | ||||

Limited Liability and Indemnification of Directors, Officers, Employees and Other Agents | 83 | |||

| 85 | ||||

| 89 | ||||

| 90 | ||||

| 94 | ||||

| 97 | ||||

| 98 | ||||

| 104 | ||||

| 105 | ||||

| 105 | ||||

Receipt of Fees and Other Compensation by Our Sponsors and Their Respective Affiliates | 108 | |||

| 109 | ||||

| 109 | ||||

| 110 | ||||

| 110 | ||||

| 110 | ||||

| 116 | ||||

| 116 | ||||

| 117 | ||||

Other Real Estate and Real Estate-Related Loans and Securities | 117 | |||

| 118 | ||||

| 121 | ||||

| 121 | ||||

| 123 | ||||

iv

Table of Contents

| Page | ||||

| 124 | ||||

| 125 | ||||

| 125 | ||||

| 125 | ||||

| 126 | ||||

Disclosure Policies with Respect to Future Probable Acquisitions | 127 | |||

Investment Limitations to Avoid Registration as an Investment Company | 128 | |||

| 128 | ||||

| 129 | ||||

| 129 | ||||

| 131 | ||||

| 131 | ||||

| 134 | ||||

| 138 | ||||

| 139 | ||||

| 141 | ||||

| 142 | ||||

| 157 | ||||

| 162 | ||||

| 164 | ||||

| 164 | ||||

| 166 | ||||

| 167 | ||||

| 167 | ||||

| 170 | ||||

| 170 | ||||

| 171 | ||||

| 172 | ||||

| 172 | ||||

| 173 | ||||

| 173 | ||||

Advance Notice for Stockholder Nominations for Directors and Proposals of New Business | 174 | |||

| 174 | ||||

| 176 | ||||

| 177 | ||||

| 177 | ||||

| 178 | ||||

| 179 | ||||

| 179 | ||||

| 180 | ||||

| 183 | ||||

| 186 | ||||

| 186 | ||||

| 188 | ||||

| 188 | ||||

| 188 | ||||

| 188 | ||||

| 189 | ||||

| 189 | ||||

| 190 | ||||

| 190 | ||||

v

Table of Contents

| Page | ||||

| 191 | ||||

| 191 | ||||

| 192 | ||||

| 192 | ||||

Compensation of Our Dealer Manager and Participating Broker-Dealers | 193 | |||

| 197 | ||||

| 198 | ||||

| 198 | ||||

| 199 | ||||

| 199 | ||||

| 200 | ||||

| 200 | ||||

| 200 | ||||

| A-1 | ||||

Appendix B – Form of Subscription Agreement with Instructions | B-1 | |||

| C-1 | ||||

vi

Table of Contents

As used herein and unless otherwise required by context, the term “prospectus” refers to this prospectus as amended and supplemented. This prospectus summary highlights material information contained elsewhere in this prospectus. Because it is a summary, it may not contain all of the information that is important to you. To understand this offering fully, you should read the entire prospectus carefully, including the “Risk Factors” section, before making a decision to invest in our common stock. In this prospectus, references to “Phillips Edison – ARC Shopping Center REIT Inc.,” “our company,” “the company,” “we,” “us” and “our” mean Phillips Edison – ARC Shopping Center REIT Inc., a Maryland corporation, and Phillips Edison – ARC Shopping Center Operating Partnership, L.P., a Delaware limited partnership and the subsidiary through which we will conduct substantially all of our business and which we refer to as “our operating partnership,” except where it is clear from the context that the term only means the issuer of the common stock in this offering, Phillips Edison – ARC Shopping Center REIT Inc.

As described in more detail throughout this prospectus, we have entered into a contractual relationship with our advisor. In exchange for services provided to us, we will pay our advisor certain fees and reimburse certain expenses. Our advisor has entered into a contractual relationship with a sub-advisor that provides most of these services to us on behalf of the advisor. A substantial portion of any fees that we pay to our advisor has been assigned by our advisor to the sub-advisor according to the terms of the agreement between those parties. Our advisor has also assigned expense reimbursements to our sub-advisor in proportion to the expenses the parties have incurred on our behalf. Any references in this prospectus to fees or expenses that we pay or reimburse to “our sub-advisor” or its affiliates are actually fees or expenses paid or reimbursed to our advisor that are then paid or assigned in whole or in part to the sub-advisor by our advisor pursuant to the terms of the agreement between those parties.

What is Phillips Edison – ARC Shopping Center REIT Inc.?

Phillips Edison – ARC Shopping Center REIT intends to invest primarily in grocery-anchored neighborhood and community shopping centers throughout the United States with a focus on those shopping centers occupied by top-performing grocers and that typically cost less than $20.0 million per property. The shopping centers will have a mix of national, regional, and local retailers that sell essential goods and services to customers who live in the neighborhood. We expect to build a high-quality portfolio focusing on the following attributes:

| • | Necessity-Based Retail – We expect to acquire well-occupied shopping centers that focus on serving the day-to-day shopping needs of the community in the surrounding trade area (e.g., grocery stores, general merchandise stores, discount stores, drug stores, restaurants, and neighborhood service providers) and that are primarily grocery-anchored; |

| • | Double- or Triple-Net Leases – We expect that the vast majority of the leases we enter into or acquire will provide for tenant reimbursements of operating expenses, providing a level of protection against rising expenses; |

| • | Diversified Portfolio – Once we have substantially invested all of the proceeds of this offering, we expect to have acquired a well-diversified portfolio based on geography, anchor tenant diversity, tenant mix, lease expirations, and other factors; |

| • | Infill Locations – We will target properties in more densely populated locations with higher barriers to entry, which we believe limits additional competition; |

1

Table of Contents

| • | Solid Markets –Our properties will be located in established or growing markets based on trends in population density, population growth, employment, household income, employment diversification, and other key demographic factors; and |

| • | Discount To Replacement Cost – In the current acquisition environment, we expect to acquire properties at values based on current rents and at a substantial discount to replacement cost. |

Our strategy is to acquire, own and manage a high-quality, diverse, necessity-based real estate portfolio, while maintaining a focused approach to maximize stockholder value. We believe we will accomplish these goals by incorporating these key elements into our strategy:

| • | Seasoned Management – We will acquire and manage the portfolio through our sub-advisor and its affiliates, acting on behalf of our advisor, including our Phillips Edison sponsor’s seasoned team of 16 professional managers with an average of 20 years of industry experience and extensive knowledge and expertise in the retail sector; |

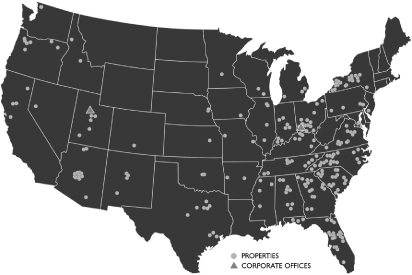

| • | National Platform – We will provide reliable execution of the investment and operating strategies through our sub-advisor and its affiliates, acting on behalf of our advisor, who have a fully-integrated, scalable, national operating and leasing platform with over 200 employees and extensive knowledge of the retail marketplace and established national tenant relationships; |

| • | Property Focus – We will utilize a property-specific operational focus that combines intensive leasing and merchandising plans with cost containment measures, delivering a more solid and stable income stream for each property; |

| • | Stable Dividend – We expect to pay monthly distributions to our stockholders at a rate that is consistent with our projected operating performance, with due regard to our modified funds from operations (MFFO) as a key measure of the sustainability of our operating performance after the completion of our offering and acquisition stage (see “Funds from Operations and Modified Funds from Operations” in a supplement to the prospectus); |

| • | Low Leverage – We will target a prudent leverage strategy with an approximate 50.0% loan-to-value ratio on our portfolio (calculated once we have invested substantially all of the offering proceeds); |

| • | Upside Potential – We expect our portfolio to have upside potential from a combination of strategic leasing, rent growth, strategic expense reduction leading to increased cash flow; and |

| • | Exit Strategy – We expect to sell our assets, sell or merge our company, or list our company within three to five years after the end of this offering. |

As of November 11, 2011, we owned six real estate properties, with each property being a grocery-anchored shopping center. Because we have a limited portfolio of real estate investments and, except as described in a supplement to this prospectus, we have not yet identified any additional properties in which there is a reasonable probability we will invest the proceeds from this offering, we are considered to be a “blind pool.”

We are externally advised by our advisor and sub-advisor, American Realty Capital II Advisors, LLC (“AR Capital Advisor” or “our advisor”) and Phillips Edison NTR LLC (the “Phillips Edison Sub-Advisor” or “our sub-advisor”), respectively. Pursuant to the agreement between our advisor and sub-advisor, our sub-advisor, acting on behalf of our advisor, conducts our operations and manages our portfolio of real estate investments. We have no paid employees.

2

Table of Contents

Our office is located at 11501 Northlake Drive, Cincinnati, Ohio 45249. Our telephone number is (513) 554-1110. Our fax number is (513) 554-1820, and our web site address iswww.phillipsedison-arc.com.

What is a REIT?

In general, a REIT is an entity that:

| • | combines the capital of many investors to acquire or provide financing for real estate investments; |

| • | allows individual investors to invest in a professionally managed, large-scale, diversified portfolio of real estate assets; |

| • | pays distributions to investors of at least 90.0% of its annual REIT taxable income (computed without regard to the dividends paid deduction and excluding net capital gain); and |

| • | avoids the “double taxation” treatment of income that normally results from investments in a corporation because a REIT is not generally subject to U.S. federal corporate income taxes on that portion of its income distributed to its stockholders, provided certain U.S. federal income tax requirements are satisfied. |

However, under the Internal Revenue Code of 1986, as amended (the “Internal Revenue Code”), REITs are subject to numerous organizational and operational requirements. If we fail to qualify for taxation as a REIT in any year, our income will be taxed at regular corporate rates, and we may be precluded from qualifying for treatment as a REIT for the four-year period following our failure to qualify. Even if we qualify as a REIT for U.S. federal income tax purposes, we may still be subject to state and local taxes on our income and property and to federal income and excise taxes on our undistributed income.

What are your investment objectives?

Our primary investment objectives are:

| • | to preserve and protect your capital contribution; |

| • | to provide you with stable cash distributions; |

| • | to realize growth in the value of our assets upon the sale of such assets; and |

| • | to provide you with the potential for future liquidity through the sale of our assets, a sale or merger of our company, a listing of our common stock on a national securities exchange, or other similar transaction. See “– What are your exit strategies?” |

We may return all or a portion of your capital contribution in connection with the sale of the company or the assets we will acquire or upon maturity or payoff of debt investments we may make. Alternatively, you may be able to obtain a return of all or a portion of your capital contribution in connection with the sale of your shares.

3

Table of Contents

Are there any risks involved in an investment in your shares?

Investing in our common stock involves a high degree of risk. You should carefully review the “Risk Factors” section of this prospectus beginning on page 24, which contains a detailed discussion of the material risks that you should consider before you invest in our common stock. Some of the more significant risks relating to an investment in our shares include:

| • | No public market currently exists for our shares of common stock, and we currently have no plans to list our shares on a national securities exchange. Our shares cannot be readily sold and, if you are able to sell your shares, you would likely have to sell them at a substantial discount from their public offering price. |

| • | Our charter prohibits the ownership of more than 9.8% in value of our aggregate outstanding stock or more than 9.8% in value or number of shares, whichever is more restrictive, of our aggregate outstanding common stock, unless exempted by our board of directors, which may inhibit large investors from purchasing your shares. |

| • | The offering price of our shares may not be indicative of the price at which our shares would trade if they were listed on an exchange or actively traded, and this price bears no relationship to the book or net value of our assets or to our expected operating income. |

| • | We are dependent on our sub-advisor, acting on behalf of our advisor, to select investments and conduct our operations. Neither our advisor nor our sub-advisor has any operating history or any experience operating a public company. This inexperience makes our future performance difficult to predict. |

| • | We have a limited operating history and we currently own six real estate properties. Except as discussed in a supplement to this prospectus, we have not identified any additional properties in which there is a reasonable probability we will invest the proceeds from this offering. Thus, you will not have an opportunity to evaluate our investments before we make them, making an investment in us more speculative. |

| • | We will make investments through a joint venture. Investments in joint ventures that own real properties involve risks not otherwise present when properties are owned directly. Our joint venture arrangement reduces our control over our assets and could give rise to disputes with our joint venture partners, which could adversely affect the value of your investment in us. A dispute with our joint venture partners may trigger buy/sell rights that could result in us selling our interest or buying the interests of our joint venture partners, either of which might not be in our best interest. We are limited in our ability to sell our interests in the joint venture, which may prevent us from selling our interests at a time that is most beneficial to us. |

| • | All of our executive officers and some of our directors and other key real estate professionals are also officers, directors, managers, key professionals or holders of a direct or indirect controlling interest in our advisor, sub-advisor, dealer manager or other sponsor-affiliated entities. As a result, our executive officers, some of our directors, some of our key real estate professionals, our advisor and sub-advisor and their respective affiliates face conflicts of interest, including significant conflicts created by our advisor’s compensation arrangements with us and other programs and investors advised by our sponsors and their respective affiliates and conflicts in allocating time among us and these other programs and investors. These conflicts could result in action or inaction that is not in the best interests of our stockholders. |

4

Table of Contents

| • | Affiliates of our sponsors receive fees in connection with transactions involving the purchase of our investments. These fees, at least initially, are based on the cost of the investment, and not based on the quality of the investment or the quality of the services rendered to us. This may influence our advisor and sub-advisor to recommend riskier transactions to us. |

| • | If we raise substantially less than the maximum offering, we may not be able to invest in a diverse portfolio of real estate properties and real estate-related assets and the value of your investment may vary more widely with the performance of specific assets. |

| • | We pay substantial fees to and expenses of our sponsors, our advisor, our sub-advisor and their respective affiliates and participating broker-dealers, which payments increase the risk that you will not earn a profit on your investment. |

| • | Our organizational documents permit us to pay distributions from any source without limit, including offering proceeds. Until the proceeds from this offering are fully invested and from time to time during our operational stage, we expect to use proceeds from financings to fund distributions in anticipation of cash flow to be received in later periods. We may also fund such distributions from advances or contributions from our sponsors or from any deferral or waiver of fees by our advisor or sub-advisor. To the extent distributions exceed our net income or net capital gain, a greater proportion of your distributions will generally represent a return of capital as opposed to current income or gain, as applicable. To date, we have paid distributions to our stockholders from operating cash flow and contributions from our sub-advisor. The sub-advisor will neither be repaid nor receive an equity issuance from us in return for these contributions. |

| • | Our policies do not limit us from incurring debt until our borrowings would cause our total liabilities to exceed 75.0% of the cost (before deducting depreciation or other non-cash reserves) of our tangible assets, and we may exceed this limit with the approval of the conflicts committee of our board of directors. During the early stages of this offering and to the extent financing in excess of this limit is available on attractive terms, our conflicts committee is more likely to approve debt in excess of this limit. High debt levels could limit the amount of cash we have available to distribute and could result in a decline in the value of your investment. |

| • | We depend on tenants for our revenue and, accordingly, our revenue is dependent upon the success and economic viability of our tenants. |

| • | Our current and future investments in real estate properties and real estate-related loans and securities may be affected by unfavorable real estate market and general economic conditions, which could decrease the value of those assets and reduce the investment return to you. |

| • | Continued disruptions in the financial markets and challenging economic conditions could adversely affect our ability to obtain financing on favorable terms, if at all. |

What is the role of the board of directors?

We operate under the direction of our board of directors, the members of which are accountable to us and our stockholders as fiduciaries. We have seven members of our board of directors, four of whom are independent of our sponsors and their respective affiliates. Our charter requires a majority of our directors to be independent of our sponsors and creates a committee of our board consisting solely of all of our independent directors. This committee, which we call the conflicts committee, is responsible for reviewing the performance of AR Capital Advisor and must approve other matters set forth in our charter. Our directors are elected annually by the stockholders.

5

Table of Contents

Who are your advisor and sub-advisor and what do they do?

American Realty Capital II Advisors, LLC, an affiliate of American Realty Capital II, LLC, one of our sponsors, is our advisor. As our advisor, AR Capital Advisor is responsible for coordinating the management of our day-to-day operations and for identifying and making investments in real estate properties on our behalf, subject to the supervision of our board of directors. Subject to the terms of the advisory agreement between AR Capital Advisor and us, AR Capital Advisor has delegated most of its duties, including managing our day-to-day operations, identifying and negotiating investments on our behalf and providing asset management services, to Phillips Edison Sub-Advisor, which is indirectly wholly owned by Phillips Edison Limited Partnership, our other sponsor, and which we generally refer to throughout this prospectus as the “sub-advisor.” Notwithstanding such delegation to the sub-advisor, AR Capital Advisor retains ultimate responsibility for the performance of all the matters entrusted to it under the advisory agreement.

Because our advisor is owned by affiliates of American Realty Capital II, LLC and because our sub-advisor is owned by affiliates of Phillips Edison Limited Partnership, we consider ourselves to be co-sponsored by the individuals who own and control those entities. Unless the context dictates otherwise, throughout this prospectus we generally refer collectively to Phillips Edison Limited Partnership and the individuals who own and control it, as our “Phillips Edison sponsors.” We generally refer collectively to American Realty Capital II, LLC and the individuals who own and control it, as our “AR Capital sponsors.” Collectively, we may refer to our Phillips Edison sponsors and our AR Capital sponsors as “our sponsors.” We also refer to AR Capital Advisor and Phillips Edison Sub-Advisor as “Advisor Entities.”

Phillips Edison Sub-Advisor has primary responsibility, acting on behalf of AR Capital Advisor, for making decisions regarding the selection and the negotiation of real estate investments. AR Capital Advisor and Phillips Edison Sub-Advisor jointly make recommendations on all investments and dispositions to our board of directors. If AR Capital Advisor and Phillips Edison Sub-Advisor disagree with respect to any such recommendation, the determination of Phillips Edison Sub-Advisor prevails. Other major decisions to be jointly approved by AR Capital Advisor and Phillips Edison Sub-Advisor, subject to the direction of our board of directors, include decisions with respect to the retention of investment banks, marketing methods with respect to this offering, the termination or extension of this offering, the initiation of a follow-on offering, mergers and other change-of-control transactions, and certain significant press releases.

What is the experience of your advisor and sub-advisor?

AR Capital Advisor is a limited liability company that was formed in the State of Delaware on December 28, 2009. Our advisor has a limited operating history and no prior experience managing a public company.

Phillips Edison Sub-Advisor is a limited liability company that was formed in the State of Delaware on December 9, 2009. Our sub-advisor has a limited operating history and no prior experience managing a public company.

What is the experience of your Phillips Edison sponsors?

Formed in 1991, Phillips Edison is a fully integrated, real estate operating company that acquires and repositions underperforming (primarily grocery-anchored) neighborhood shopping centers throughout the United States. Since its inception, Phillips Edison has operated with financial partners through both property-specific joint ventures and multi-asset discretionary private equity funds. Phillips Edison and its affiliates have acquired assets covering approximately 26 million square feet and having an aggregate value of approximately $1.8 billion, providing its investors with a vehicle through which they could invest in a carefully selected and

6

Table of Contents

professionally managed portfolio of operating assets and development opportunities, which have produced a track record of strong financial results. Phillips Edison and its affiliates have over 3,100 tenants and long-standing relationships with national and regional companies with high credit ratings.

Michael C. Phillips, Co-Chairman of the Board, has served as a principal of Phillips Edison since 1991. Jeffrey S. Edison, Co-Chairman of the Board and our Chief Executive Officer, has served as a principal of Phillips Edison since 1995. We consider Messrs. Phillips and Edison to be our individual Phillips Edison sponsors. They have significant experience in real estate acquisitions, repositionings, financings and dispositions, as well as property management, project development and leasing. Messrs. Phillips and Edison have invested in commercial real estate through all economic cycles and together have more than 50 years of experience in the real estate industry.

What is the experience of your AR Capital sponsors?

American Realty Capital II, LLC, our AR Capital sponsor, is directly or indirectly controlled by Nicholas S. Schorsch and William M. Kahane, one of our directors. Each of these individuals is an executive officer of American Realty Capital Trust, Inc. (“ARCT”) and other non-traded public REITs sponsored by our AR Capital sponsor. Mr. Schorsch and Mr. Kahane have been active in the structuring and financial management of commercial real estate investments for over 20 years and 25 years, respectively. Our AR Capital sponsor wholly owns our advisor.

How do you expect your portfolio to be allocated between real estate properties and real estate-related loans and securities?

We intend to acquire and manage a diverse portfolio of real estate properties and real estate-related loans and securities. We plan to diversify our portfolio by geographic region, anchor tenants, tenant mix, investment size and investment risk with the goal of attaining a portfolio of income-producing real estate properties and real estate-related assets that provide stable returns to our investors and the potential for growth in the value of our assets. We intend to allocate approximately 90.0% of our portfolio to investments in grocery-anchored neighborhood and community shopping centers throughout the United States with a focus on well-located shopping centers that are well occupied at the time of purchase and typically cost less than $20.0 million per property. We intend to allocate approximately 10.0% of our portfolio to other real estate properties, real estate-related loans and securities and the equity securities of other REITs and real estate companies, assuming we sell the maximum offering amount.

How do you select potential properties for acquisition?

To find properties that best meet our criteria for investment, our sub-advisor, acting on behalf of our advisor, has developed a disciplined investment approach that combines the experience of its team of real estate professionals with a structure that emphasizes thorough market research, stringent underwriting standards and an extensive down-side analysis of the risks of each investment.

What types of real estate-related debt investments do you expect to make?

Assuming that we sell the maximum offering amount, we expect that our real estate-related debt investments will not constitute more than 10.0% of our portfolio nor represent a substantial portion of our assets at any one time. With respect to our investments in such assets, we will primarily focus on investments in first mortgages. The other real estate-related debt investments in which we may invest include mortgage, mezzanine, bridge and other loans; debt and derivative securities related to real estate assets, including mortgage-backed securities; collateralized debt obligations; debt securities issued by real estate companies; and credit default swaps.

7

Table of Contents

What types of investments will you make in the equity securities of other companies?

We expect to make equity investments in REITs and other real estate companies. We may purchase the common or preferred stock of these entities or options to acquire their stock. We do not expect our non-controlling equity investments in other public companies to exceed 5.0% of the proceeds of this offering, assuming we sell the maximum offering amount, or to represent a substantial portion of our assets at any one time. In addition, we do not expect our non-controlling equity investments in other public companies combined with our investments in real estate properties outside of our target shopping center investments and other real estate-related investments to exceed 10.0% of our portfolio, assuming we sell the maximum offering amount.

Will you use leverage?

Yes. We expect that once we have fully invested the proceeds of this offering, assuming we sell the maximum amount, our debt financing will be approximately 50.0% of the value of our real estate investments (calculated after the close of this offering) plus the value of our other assets, but may be as high as 65.0%. There is no limitation on the amount we may borrow for the purchase of any single asset. Our charter limits our borrowings such that our total liabilities do not exceed 75.0% of the cost (before deducting depreciation or other non-cash reserves) of our tangible assets; however, we may exceed that limit if a majority of the conflicts committee approves each borrowing in excess of our charter limitation, and we disclose such borrowing to our stockholders in our next quarterly report with an explanation from the conflicts committee of the justification for the excess borrowing. In all events, we expect that our secured and unsecured borrowings will be reasonable in relation to the net value of our assets and will be reviewed by our board of directors at least quarterly.

We do not intend to exceed the leverage limit in our charter except in the early stages of our development when the costs of our investments are most likely to exceed our net offering proceeds. Careful use of debt will help us to achieve our diversification goals because we will have more funds available for investment. However, high levels of debt could cause us to incur higher interest charges and higher debt service payments, which would decrease the amount of cash available for distribution to our investors.

How will you structure the ownership and operation of your assets?

We plan to own substantially all of our assets and conduct our operations through Phillips Edison – ARC Shopping Center Operating Partnership, L.P., which we refer to as our operating partnership in this prospectus. Because we plan to conduct substantially all of our operations through the operating partnership, we are considered an UPREIT. UPREIT stands for “Umbrella Partnership Real Estate Investment Trust.” Using an UPREIT structure may give us an advantage in acquiring properties from persons who may not otherwise sell their properties because of certain unfavorable U.S. federal income tax consequences.

Will you acquire properties or other assets in joint ventures?

Yes. On September 20, 2011, we entered into a joint venture with a group of institutional international investors advised by CBRE Investors Global Multi Manager (each a “CBRE Global Investor”). The joint venture is in the form of PECO-ARC Institutional Joint Venture I, L.P., a Delaware limited partnership (the “Joint Venture”). We, through an indirectly wholly owned subsidiary, serve as the general partner of and own a 54% interest in the Joint Venture. Each CBRE Global Investor is a limited partner and they collectively own a 46% interest in the Joint Venture.

The Joint Venture intends to invest in necessity-based neighborhood and community shopping centers with acquisition costs of typically no more than $20 million per property. We have committed to contribute approximately $59 million to the Joint Venture and the CBRE Global Investors have committed to contribute $50

8

Table of Contents

million in cash. We intend to fund our capital commitment through the contribution of the properties we currently own and cash. We expect to contribute these properties over a period of months as funds are needed to acquire additional properties meeting the Joint Venture’s investment strategy. Until we have exhausted all of capital contributed to the Joint Venture, all of the real estate properties that fall under the investment strategy of the Joint Venture will be owned by the Joint Venture, rather than directly by us. See “Investment Objectives and Criteria – The Joint Venture.”

What conflicts of interest do your sponsors face?

Each of our Phillips Edison and AR Capital sponsors, and their respective affiliates and personnel, experience conflicts of interest in connection with the management of our business. Some of the material conflicts that our sponsors and their respective affiliates face include the following:

| • | Our Phillips Edison sponsor and its affiliates must determine which investment opportunities to recommend to us and to other operating private Phillips Edison-sponsored programs for which the offering proceeds have not been fully invested, as well as any programs Phillips Edison affiliates may sponsor in the future; |

| • | Our AR Capital sponsor and its affiliates must determine which investment opportunities to recommend to us and to other AR Capital-sponsored programs, as well as any programs AR Capital affiliates may sponsor in the future; |

| • | Because our AR Capital sponsor is a sponsor of other public offerings selling shares of capital stock concurrently with this offering, we have to compete with other programs sponsored by our AR Capital sponsor for the same investors when raising capital; |

| • | AR Capital Advisor and its affiliates may structure the terms of joint ventures between us and other Phillips Edison- or AR Capital-sponsored programs or Phillips Edison- or AR Capital-advised entities; |

| • | Our sponsors and their respective affiliates have to allocate their time between us and other real estate programs and activities in which they are involved; |

| • | Our sponsors and their respective affiliates receive fees in connection with transactions involving the purchase, origination, management and sale of our assets regardless of the quality of the asset acquired or the services provided to us; |

| • | Our dealer manager, Realty Capital Securities, LLC, is an affiliate of AR Capital Advisor and receives fees in connection with our public offerings of equity securities; and |

| • | We may only terminate our dealer manager in limited circumstances and, under certain conditions, may be obligated to use our dealer manager in future offerings. |

9

Table of Contents

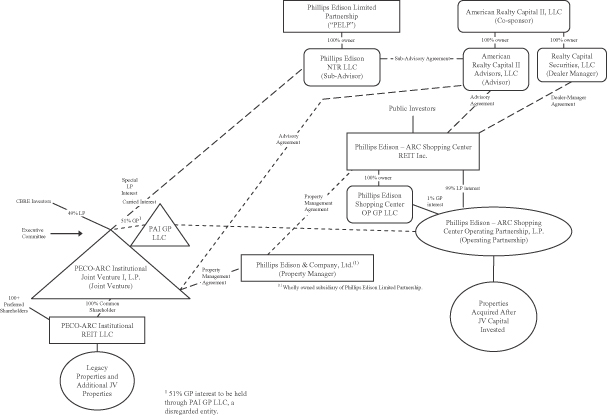

What is the ownership structure of the company and the entities that perform services for you?

The following chart shows the ownership structure of the various entities that perform or are likely to perform important services for us.

10

Table of Contents

What are the fees that you pay to the advisor, its affiliates, the dealer manager and your directors?

AR Capital Advisor and its affiliates receive compensation and reimbursement for services relating to this offering and the investment and management of our assets. We also compensate the dealer manager and our independent directors for their service to us. The most significant items of compensation are included in the table below. Unless otherwise noted, the fees to be paid and expenses to be reimbursed described below are to be paid or reimbursed to our advisor, an affiliate of our AR Capital sponsor. AR Capital Advisor has assigned 85% of such fees to our sub-advisor, an affiliate of our Phillips Edison sponsor. AR Capital Advisor has also assigned expense reimbursements to our sub-advisor in proportion to the expenses the parties have incurred on our behalf. Selling commissions and dealer manager fees may vary for different categories of purchasers. This table assumes that we sell all shares at the highest possible selling commissions and dealer manager fees (with no discounts to any categories of purchasers) and assumes a $9.50 price for each share sold through our dividend reinvestment plan. No selling commissions or dealer manager fees are payable on shares sold through our dividend reinvestment plan or the “friends and family” program.

Form of Compensation and Recipient | Determination of Amount | Estimated Amount for | ||

| Organization and Offering Stage | ||||

Selling Commissions – Dealer Manager | 7.0% of gross offering proceeds before reallowance of selling commissions earned by participating broker-dealers, except no selling commissions are payable on shares sold under the dividend reinvestment plan or our “friends and family” program. The dealer manager reallows 100% of selling commissions earned to participating broker-dealers. | $105,000,000 | ||

Dealer Manager Fee – Dealer Manager | 3.0% of gross offering proceeds, except no dealer manager fee is payable on shares sold under the dividend reinvestment plan or our “friends and family” program. The dealer manager reallows all or a portion of its dealer manager fees to participating broker-dealers. | $45,000,000 | ||

Other Organization and Offering Expenses | To date, our advisor has paid $75,000 in organization and offering expenses and our sub-advisor has paid or is responsible for the remaining organization and offering expenses. Our sub-advisor will pay future organization and offering expenses on our behalf (excluding underwriting compensation) and is obligated to reimburse our advisor and its affiliates for such organization and offering expenses that they incur (including reimbursements for third-party due diligence fees included in detailed and itemized invoices). We reimburse on a monthly basis these costs (and we may pay some of them directly) but only to the extent that the reimbursements or payments do not exceed 1.5% of gross offering proceeds over the life of the offering. | $22,927,500 | ||

11

Table of Contents

Form of Compensation and Recipient | Determination of Amount | Estimated Amount for | ||

| Acquisition and Development Stage | ||||

| Acquisition Fees | We pay to our Advisor Entities 1.0% of the contract purchase price of each property acquired (including our pro rata share of debt attributable to such property) and 1.0% of the amount advanced for a loan or other investment (including our pro rata share of debt attributable to such investment). For purposes of this prospectus, “contract purchase price” or the “amount advanced for a loan or other investment” means the amount actually paid or allocated in respect of the purchase, development, construction or improvement of a property or the amount actually paid or allocated in respect of the purchase of loans or other real-estate related assets, in each case inclusive of acquisition expenses and any indebtedness assumed or incurred in respect of such investment but exclusive of acquisition fees and financing fees. | $13,144,000 (maximum offering and no debt)/$25,716,000 (maximum offering and target leverage of 50.0% of the cost of our investments)/$49,289,000 (maximum offering, assuming leverage of 75.0% of the cost of our investments) | ||

| Acquisition Expenses | We reimburse our Advisor Entities for expenses actually incurred related to selecting, evaluating and acquiring assets on our behalf, regardless of whether we actually acquire the related assets. In addition, we also pay third parties, or reimburse the advisor or its affiliates, for any investment-related expenses due to third parties, including, but not limited to, legal fees and expenses, travel and communications expenses, costs of appraisals, accounting fees and expenses, third-party brokerage or finders fees, title insurance expenses, survey expenses, property inspection expenses and other closing costs regardless of whether we acquire the related assets. We expect these expenses to be approximately 1.0% of the purchase price of each property (including our pro rata share of debt attributable to such property) and 1.0% of the amount advanced for a loan or other investment (including our pro rata share of debt attributable to such investment). In no event will the total of all acquisition fees (including the financing fees described below) and acquisition expenses payable with respect to a particular investment exceed 4.5% of the contract purchase price of each property (including our pro rata share of debt attributable to such property) or 4.5% of the amount advanced for a loan or other investment (including our pro rata share of debt attributable to such investment). | $6,539,000 | ||

12

Table of Contents

Form of Compensation and Recipient | Determination of Amount | Estimated Amount for | ||

| Construction Management Fee | We expect to engage Phillips Edison Property Manager to provide construction management services for some of our properties. We will pay a construction management fee in an amount that is usual and customary for comparable services rendered to similar projects in the geographic market of the project. | Actual amounts cannot be determined at the present time. | ||

| Operational Stage | ||||

| Asset Management Fee | We pay our Advisor Entities a monthly fee of 0.08333% of the sum of the cost of all real estate and real estate-related investments we own and of our investments in joint ventures, including the portion of the cost paid for with borrowed funds and including expenses related to the acquisition (other than expenses that represent fees payable to the Advisor Entities or their affiliates). This fee is payable monthly in arrears on the first business day of each month based on assets held by us during the previous month, calculated by taking the average of the total costs of our assets at the end of each month. However, the Advisor Entities will reimburse us on a quarterly basis for all or a portion of the asset management fees paid to the Advisor Entities in the immediately preceding fiscal quarter to the extent that, as of the date of payment, our modified FFO (as defined in accordance with the then-current practice guidelines issued by the Investment Program Association (a trade association for direct investment programs, including non-listed REITs) with an additional adjustment to add back capital contribution amounts received from our sub-advisor or an affiliate thereof (without any corresponding issuance of equity to our sub-advisor or an affiliate)) during the quarter was not at least equal to our declared distributions (whether or not paid) during the quarter. We are not permitted to avoid payment of an asset management fee by raising our distribution rate beyond $0.65 per share on an annualized basis. | Actual amounts depend on the total equity and debt capital we raise and the results of our operations; we cannot determine these amounts at the present time. | ||

| Financing Fee | We pay our Advisor Entities a financing fee equal to 0.75% of all amounts made available under any loan or line of credit. In the case of a joint venture, we will pay our advisor a financing fee equal to 0.75% of the portion that is attributable to our investment in the joint venture. | Actual amounts depend on the amount of any debt financed and therefore cannot be determined at the present time. If we utilize leverage equal to 50.0% of the cost of the aggregate value of our assets, the fees would be $9,595,000. If we utilize leverage equal to 75.0% of the cost of the aggregate value of our assets, the fees would be $27,587,000. | ||

13

Table of Contents

Form of Compensation and Recipient | Determination of Amount | Estimated Amount for | ||

| Property Management Fees | Property management fees equal to 4.5% of the monthly gross receipts from the properties managed by Phillips Edison Property Manager, our property manager, are payable monthly to our property manager. Our property manager may subcontract the performance of its property management and leasing duties to third parties, and our property manager may pay a portion of its property management or leasing fees to the third parties with whom it subcontracts for these services. We reimburse the costs and expenses incurred by our property manager on our behalf, including legal, travel and other out-of-pocket expenses that are directly related to the management of specific properties, as well as fees and expenses of third-party service providers. We do not, however, reimburse our property manager for general overhead costs or for the wages and salaries and other employee-related expenses of employees of our property manager other than employees or subcontractors who are engaged in the on-site operation, management, maintenance or access control of our properties. | Actual amounts depend on gross revenues of specific properties and actual management fees or property management fees and customary leasing fees and therefore cannot be determined at the present time. | ||

| Leasing Fee – Property Manager | We have engaged Phillips Edison Property Manager to provide leasing services with respect to our properties. We pay a leasing fee to our property manager in an amount that is usual and customary for comparable services rendered in the geographic market of the property. | Actual amounts cannot be determined at the present time. | ||

| Other Operating Expenses | We reimburse the expenses incurred by our Advisor Entities in connection with their provision of services to us, including our allocable share of our Advisor Entities’ overhead, such as rent, personnel costs, utilities and IT costs. Such personnel costs include salaries and benefits, but do not include bonuses. Personnel costs are allocated to programs for reimbursement based generally on the percentage of time devoted by personnel to the program, except that we do not reimburse for the personnel costs of acquisition, financing or disposition personnel when such personnel attend to matters for which the Advisor Entities earn an acquisition fee, a financing fee or a disposition fee. | Actual amounts depend on the results of our operations; we cannot determine these amounts at the present time. | ||

14

Table of Contents

Form of Compensation and Recipient | Determination of Amount | Estimated Amount for | ||

Independent Director Compensation | We pay each of our independent directors an annual retainer of $30,000. We also pay our independent directors for attending meetings as follows: (1) $1,000 for each board meeting attended in person or telephonically and (2) $1,000 for each committee meeting attended in person or telephonically. The audit committee chair also receives an annual retainer of $5,000 and the conflicts committee chair receives an annual retainer of $3,000. We expect to grant our independent directors an annual award of 2,500 shares of restricted stock. All directors receive reimbursement of reasonable out-of-pocket expenses incurred in connection with attendance at meetings of the board of directors. | Actual amounts depend on the total number of board and committee meetings that each independent director attends; we cannot determine these amounts at the present time. | ||

| Liquidation/Listing Stage | ||||

| Disposition Fees | For substantial assistance in connection with the sale of properties or other investments, we will pay our Advisor Entities or their respective affiliates 2.0% of the contract sales price of each property or other investment sold; provided, however, that (i) if a third party also receives a commission on the sale, our Advisor Entities and their affiliates may receive up to one-half of the total brokerage commissions paid but in no event an amount that exceeds 3.0% of the contract sales price of such sale, and (ii) total real estate commissions paid (to our Advisor Entities and others) in connection with the sale may not exceed the lesser of a competitive real estate commission and 6% of the contract sales price. The conflicts committee will determine whether our Advisor Entities or their affiliates have provided substantial assistance to us in connection with the sale of an asset. Substantial assistance in connection with the sale of a property includes our advisor’s or sub-advisor’s preparation of an investment package for the property (including an investment analysis, rent rolls, tenant information regarding credit, a property title report, an environmental report, a structural report and exhibits) or such other substantial services performed by the advisor or sub-advisor in connection with a sale. If we were to sell an asset to an affiliate, our organizational documents prohibit us from paying our advisor or sub-advisor a disposition fee. Before we sold an asset to an affiliate, our charter would require that a majority of our board of directors, including a majority of our conflicts committee, conclude that the transaction is fair and reasonable to us and on terms and conditions no less favorable to us than those available from third parties. | Actual amounts depend on the results of our operations; we cannot determine these amounts at the present time. | ||

15

Table of Contents

Form of Compensation and Recipient | Determination of Amount | Estimated Amount for | ||

| Subordinated Share of Cash Flows | Our Advisor Entities will receive 15.0% of remaining net cash flows after return of capital contributions plus payment to investors of a 7.0% cumulative, pre-tax, non-compounded return on the capital contributed by investors. We cannot assure you that we will provide this 7.0% return, which we have disclosed solely as a measure for our Advisor Entities’ and their respective affiliates’ incentive compensation. This fee is not payable after a listing of our common stock on a national securities exchange. | Actual amounts depend on the results of our operations; we cannot determine these amounts at the present time. | ||

| Subordinated Incentive Fee | Following a listing of our common stock on a national securities exchange, our Advisor Entities will receive 15.0% of the amount by which the sum of our adjusted market value plus distributions exceeds the sum of the aggregate capital contributed by investors plus an amount equal to a 7.0% cumulative, pre-tax, non-compounded annual return to investors. We cannot assure you that we will provide this 7.0% return, which we have disclosed solely as a measure for our Advisor Entities’ and their respective affiliates’ incentive compensation. | Actual amounts depend on the results of our operations; we cannot determine these amounts at the present time. | ||

How many real estate investments do you currently own?

As of November 11, 2011, we owned six real estate properties, each of which is a grocery-anchored shopping center. Because we have a limited portfolio of real estate investments and, except as described in a supplement to this prospectus, we have not yet identified any additional properties in which there is a reasonable probability we will invest the proceeds from this offering, we are considered to be a “blind pool”. As additional property acquisitions become probable, we will supplement this prospectus to provide information regarding the likely acquisition to the extent material to an investment decision with respect to our common stock. We will also describe material changes to our portfolio, including the closing of property acquisitions, by means of a supplement to this prospectus.

If I buy shares, will I receive distributions and how often?

Since we commenced real estate operations in December 2010, we have authorized and declared distributions based on daily record dates for each day during the period commencing December 1, 2010 through March 31, 2012, and we have paid or will pay these distributions on a monthly basis. We expect to continue to pay distributions monthly unless our results of operations, our general financial condition, general economic conditions or other factors make it imprudent to do so. The timing and amount of future distributions will be determined by our board, in its sole discretion. Distributions may vary from time to time, and will be influenced in part by the board’s intention to comply with the REIT requirements of the Internal Revenue Code.

Because we may receive income from interest or rents at various times during our fiscal year and because we may need funds from operations during a particular period to fund capital expenditures and other expenses, we expect that at least during the early stages of our development, and from time to time during our operational

16

Table of Contents

stage, we will declare distributions in anticipation of funds that we expect to receive during a later period, and we will pay these distributions in advance of our actual receipt of these funds. In these instances, we expect to look to third-party borrowings to fund our distributions. We may also fund such distributions from advances or contributions from our sponsors or from any deferral or waiver of fees by our advisor or sub-advisor.

Our distribution policy is not to use the proceeds of this offering to pay distributions. However, our board has the authority under our organizational documents, to the extent permitted by Maryland law, to pay distributions from any source without limit, including proceeds from this offering or the proceeds from the issuance of securities in the future.

To maintain our qualification as a REIT, we must make aggregate annual distributions to our stockholders of at least 90.0% of our REIT taxable income (which is computed without regard to the dividends paid deduction or net capital gain and which does not necessarily equal net income as calculated in accordance with GAAP). See “Material U.S. Federal Income Tax Considerations – Taxation of Phillips Edison – ARC Shopping Center REIT Inc. – Annual Distribution Requirements.” Our board of directors may authorize distributions in excess of those required for us to maintain REIT status depending on our financial condition and such other factors as our board of directors deems relevant.

We have not established a minimum distribution level, and our charter does not require that we make distributions to our stockholders.

May I reinvest my distributions in shares of Phillips Edison – ARC Shopping Center REIT Inc.?

Yes. You may participate in our dividend reinvestment plan by checking the appropriate box on the subscription agreement or by filling out an enrollment form that we will provide to you at your request. The purchase price for shares purchased under the dividend reinvestment plan will initially be $9.50. Once we establish an estimated value per share that is not based on the price to acquire a share in our primary offering or a follow-on public offering, shares issued pursuant to our dividend reinvestment plan will be priced at the estimated value per share of our common stock, as determined by our advisor or another firm chosen for that purpose. We expect to establish an estimated value per share not based on the price to acquire a share in the primary offering or a follow-on public offering after the completion of our offering stage. We will consider our offering stage complete when we are no longer offering equity securities – whether through this offering or follow-on public offerings – and have not done so for 18 months. No selling commissions or dealer manager fees are payable on shares sold under our dividend reinvestment plan. We may amend, suspend or terminate the dividend reinvestment plan for any reason at any time upon 10 days’ notice to the participants. We may provide notice by including such information (1) in a current report on Form 8-K or in our annual or quarterly reports, all publicly filed with the SEC or (2) in a separate mailing to the participants.

Will the distributions I receive be taxable as ordinary income?

Yes and no. Distributions that you receive (not designated as capital gain dividends), including distributions reinvested pursuant to our dividend reinvestment plan, will be taxed as ordinary income to the extent they are paid from our earnings and profits (as determined for U.S. federal income tax purposes). However, distributions that we designate as capital gain dividends generally will be taxable as long-term capital gain to the extent they do not exceed our actual net capital gain for the taxable year. Some portion of your distributions may not be subject to tax in the year in which they are received because depreciation expense reduces the amount of taxable income, but does not reduce cash available for distribution. The portion of your distribution that is not designated as a capital gain dividend and is in excess of our current and accumulated earnings and profits is considered a return of capital for U.S. federal income tax purposes and will reduce the tax basis of your investment, deferring such portion of your tax until your investment is sold or our company is

17

Table of Contents

liquidated, at which time you will be taxed at capital gains rates. Please note that each investor’s tax considerations are different; therefore, you should consult with your tax advisor prior to making an investment in our shares.

How will you use the proceeds raised in this offering?