- PECO Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

424B3 Filing

Phillips Edison & Company (PECO) 424B3Prospectus supplement

Filed: 5 Feb 13, 12:00am

Filed Pursuant to Rule 424(B)(3)

Registration No. 333-164313

PHILLIPS EDISON – ARC SHOPPING CENTER REIT INC.

SUPPLEMENT NO. 8 DATED FEBRUARY 5, 2013

TO THE PROSPECTUS DATED OCTOBER 26, 2012

This document supplements, and should be read in conjunction with, our prospectus dated October 26, 2012 relating to our offering of 180 million shares of common stock, as supplemented by Supplement No. 7 dated January 28, 2013. Unless otherwise defined in this Supplement No. 8, capitalized terms used have the same meanings as set forth in the prospectus. The purpose of this supplement is to disclose, among other things, the following:

| • | the acquisition of Fairlawn Town Centre; |

| • | the year-one yield on properties acquired during the last 12 months; |

| • | information regarding our current leverage ratio; |

| • | updates to our “Prospectus Summary;” and |

| • | updates to our “Compensation Table.” |

Property Acquisition

On January 30, 2013, we, through a wholly-owned subsidiary, purchased a shopping center containing approximately 348,255 rentable square feet located in Fairlawn, Ohio (“Fairlawn Town Centre”) for approximately $42.2 million, exclusive of closing costs. We funded the purchase price with proceeds from a syndicated revolving credit facility led by KeyBank National Association and proceeds from this offering. Fairlawn Town Centre was purchased from AG/WP Fairlawn Owner, LLC, a Delaware limited liability company, which is not affiliated with us, our advisor or our sub-advisor.

Fairlawn Town Centre is currently 95.0% leased to 38 tenants, including a Giant Eagle grocery store that occupies approximately 27.3% of the total rentable square feet of Fairlawn Town Centre. Based on the current condition of Fairlawn Town Centre, we do not believe that it will be necessary to make significant renovations to the property. Our management believes that Fairlawn Town Centre is adequately insured.

Year-One Yield on Properties Acquired in the Last 12 Months

The weighted-average year-one yield of real estate properties we have acquired during the 12 months ending January 30, 2013, including Fairlawn Town Centre, is approximately 7.9%. The year-one yield is equal to the estimated first-year net operating income of the property divided by the purchase price of the property, excluding closing costs and acquisition fees. Estimated first-year net operating income on our real estate investments is total estimated gross income (rental income, tenant reimbursements, parking income and other property-related income) derived from the terms of in-place leases at the time we acquire the property on a straight-line basis, less property and related expenses (property operating and maintenance expenses, management fees, property insurance and real estate taxes) based on the operating history of the property. Estimated first-year net operating income excludes other non-property income and expenses, interest expense from financings, depreciation and amortization and company-level general and administrative expenses. Historical operating income for these properties is not necessarily indicative of future operating results.

Use of Leverage

As of January 30, 2013, our leverage ratio, or the ratio of total debt, less cash and cash equivalents, to total real estate investments, at cost, was approximately 57.1%.

1

Updates to the Prospectus Summary

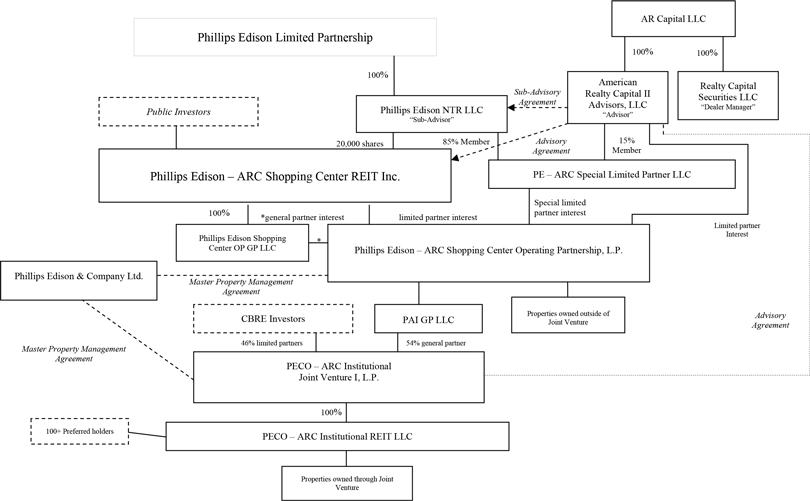

The following disclosure replaces in its entirety the disclosure in our prospectus under the heading “Prospectus Summary - What is the ownership structure of the company and the entities that perform services for you?”

The following chart shows the ownership structure of the various entities that perform or are likely to perform important services for us.

2

The following disclosure replaces in its entirety the section entitled “Asset Management Fee” in the table in our prospectus under the heading “Prospectus Summary - What are the fees that you pay to the advisor, its affiliates, the dealer manager and your directors?”

Form of Compensation and Recipient | Determination of Amount | Estimated Amount for Maximum Offering | ||

| Asset Management Subordinated Participation Interest | Within 60 days after the end of each calendar quarter (subject to the approval of the board of directors), our operating partnership will pay an asset management subordinated participation interest by issuing a number of restricted Class B Units to our Advisor Entities equal to: (i) the excess of the product of (x) the cost of our assets multiplied by (y) 0.25%; divided by (ii) the value of one share of common stock as of the last day of such calendar quarter net of the selling commissions and dealer manager fees payable on shares purchased in this offering. Class B Units are subject to forfeiture until such time as: (a) the value of the operating partnership’s assets plus all distributions made equals or exceeds the total amount of capital contributed by investors plus a 6.0% cumulative, pre-tax, non-compounded annual return thereon, or the “economic hurdle”; (b) any one of the following events occurs concurrently with or subsequently to the achievement of the economic hurdle described above: (1) the termination of the advisory agreement by an affirmative vote of a majority of the conflicts committee without cause; (2) a listing event; or (3) another liquidity event; and (z) our Advisor Entities are still providing advisory services to us (the “performance condition”). Such Class B units will be forfeited immediately if: (a) the advisory agreement is terminated other than by an affirmative vote of a majority of the conflicts committee without cause; or (b) the advisory agreement is terminated by an affirmative vote of a majority of the conflicts committee without cause before the economic hurdle has been met. | Actual amounts cannot be determined at the present time. Because the subordinated participation interests are based on a fixed percentage of aggregate asset value, there is no maximum dollar amount of these participation interests. |

The following disclosure replaces in their entirety the sections entitled “Subordinated Share of Cash Flows” and “Subordinated Incentive Fee” in the table in our prospectus under the heading “Prospectus Summary - What are the fees that you pay to the advisor, its affiliates, the dealer manager and your directors?”

Form of Compensation and Recipient | Determination of Amount | Estimated Amount for Maximum Offering | ||

| Subordinated Participation in Net Sales Proceeds (payable only if we are not listed on an exchange at the time of sale) | PE – ARC Special Limited Partner LLC, the special limited partner of our operating partnership (the “Special Limited Partner”), will receive from time to time, when available, 15.0% of remaining “net sales proceeds” (as defined in our operating partnership agreement) after return of capital contributions plus payment to investors of an annual 7.0% cumulative, pre-tax, non-compounded return on the capital contributed by investors. We cannot assure you that we will provide this 7.0% return, which we have disclosed solely as a measure for our Advisor Entities’ incentive compensation. | Actual amounts depend on the results of our operations; we cannot determine these amounts at the present time. |

3

Form of Compensation and Recipient | Determination of Amount | Estimated Amount for Maximum Offering | ||

| Subordinated Incentive Listing Fee (payable only if we are listed on an exchange, which we have no intention to do at this time) | The Special Limited Partner will receive 15.0% of the amount by which the sum of the market value of our shares of common stock plus distributions exceeds the sum of the aggregate capital contributed by investors plus an amount equal to an annual 7.0% cumulative, pre-tax, non-compounded return to investors. We cannot assure you that we will provide this 7.0% return, which we have disclosed solely as a measure for our Advisor Entities’ incentive compensation. | Actual amounts depend on the results of our operations; we cannot determine these amounts at the present time. | ||

| Subordinated Distribution Upon Termination of the Advisory Agreement | Upon termination or non-renewal of the advisory agreement, the Special Limited Partner will receive distributions from our operating partnership payable equal to 15.0% of the amount by which the value of our assets at the time of termination exceeds the amount needed to provide investors with an annual 7.0% cumulative, pre-tax, non-compounded return on the capital contributed by investors. These distributions will be paid in the form of a non-interest bearing promissory note. In addition, the Special Limited Partner may elect to defer its right to receive a subordinated distribution upon termination until either a listing on a national securities exchange or other liquidity event occurs. | Actual amounts depend on the results of our operations; we cannot determine these amounts at the present time. | ||

4

Updates to the Compensation Table

The following disclosure replaces in its entirety the section entitled “Asset Management Fee” in the table in our prospectus under the heading “Compensation Table.”

Form of Compensation and Recipient | Determination of Amount | Estimated Amount for Maximum Offering | ||

| Asset Management Subordinated Participation Interest | Within 60 days after the end of each calendar quarter (subject to the approval of the board of directors), our operating partnership will pay an asset management subordinated participation interest by issuing a number of restricted Class B Units to our Advisor Entities equal to: (i) the excess of the product of (x) the cost of our assets multiplied by (y) 0.25%; divided by (ii) the value of one share of common stock as of the last day of such calendar quarter net of the selling commissions and dealer manager fees payable on shares purchased in this offering. Class B Units are subject to forfeiture until such time as: (a) the value of the operating partnership’s assets plus all distributions made equals or exceeds the total amount of capital contributed by investors plus a 6.0% cumulative, pre-tax, non-compounded annual return thereon, or the “economic hurdle”; (b) any one of the following events occurs concurrently with or subsequently to the achievement of the economic hurdle described above: (1) the termination of the advisory agreement by an affirmative vote of a majority of the conflicts committee without cause; (2) a listing event; or (3) another liquidity event; and (z) our Advisor Entities are still providing advisory services to us (the “performance condition”). Such Class B units will be forfeited immediately if: (a) the advisory agreement is terminated other than by an affirmative vote of a majority of the conflicts committee without cause; or (b) the advisory agreement is terminated by an affirmative vote of a majority of the conflicts committee without cause before the economic hurdle has been met. | Actual amounts cannot be determined at the present time. Because the subordinated participation interests are based on a fixed percentage of aggregate asset value, there is no maximum dollar amount of these participation interests. |

The following disclosure replaces in their entirety the sections entitled “Subordinated Share of Cash Flows” and “Subordinated Incentive Fee” in the table in our prospectus under the heading “Compensation Table.”

Form of Compensation and Recipient | Determination of Amount | Estimated Amount for Maximum Offering | ||

| Subordinated Participation in Net Sales Proceeds (payable only if we are not listed on an exchange at the time of sale)(8)(9) | The Special Limited Partner will receive from time to time, when available, 15.0% of remaining “net sales proceeds” (as defined in our operating partnership agreement) after return of capital contributions plus payment to investors of an annual 7.0% cumulative, pre-tax, non-compounded return on the capital contributed by investors. We cannot assure you that we will provide this 7.0% return, which we have disclosed solely as a measure for our Advisor Entities’ incentive compensation. | Actual amounts depend on the results of our operations; we cannot determine these amounts at the present time. |

5

Form of Compensation and Recipient | Determination of Amount | Estimated Amount for Maximum Offering | ||

| Subordinated Incentive Listing Fee (payable only if we are listed on an exchange, which we have no intention to do at this time)(8)(10) | The Special Limited Partner will receive 15.0% of the amount by which the sum of the market value of our shares of common stock plus distributions exceeds the sum of the aggregate capital contributed by investors plus an amount equal to an annual 7.0% cumulative, pre-tax, non-compounded return to investors. We cannot assure you that we will provide this 7.0% return, which we have disclosed solely as a measure for our Advisor Entities’ incentive compensation. | Actual amounts depend on the results of our operations; we cannot determine these amounts at the present time. | ||

| Subordinated Distribution Upon Termination of the Advisory Agreement(11) | Upon termination or non-renewal of the advisory agreement, the Special Limited Partner will receive distributions from our operating partnership payable equal to 15% of the amount by which the value of our assets at the time of termination exceeds the amount needed to provide investors with an annual 7.0% cumulative, pre-tax, non-compounded return on the capital contributed by investors. These distributions will be paid in the form of a non-interest bearing promissory note. In addition, the Special Limited Partner may elect to defer its right to receive a subordinated distribution upon termination until either a listing on a national securities exchange or other liquidity event occurs. | Actual amounts depend on the results of our operations; we cannot determine these amounts at the present time. | ||

The following disclosure replaces in their entirety footnote 8 through footnote 10 to the table in our prospectus under the heading “Compensation Table.”

| (8) | Neither our advisor, our sub-advisor nor any of their affiliates (including the Special Limited Partner, in which our advisor has a 15.0% interest and our sub-advisor has an 85.0% interest) can earn both the subordinated participation in net sales proceeds and the subordinated incentive listing distribution. The subordinated incentive listing distribution will be paid in the form of a non-interest bearing promissory note that will be repaid from the net sales proceeds of each sale of a property, loan or other investment after the date of the listing. At the time of such sale, we may, however, at our discretion, pay all or a portion of such promissory note with shares of our common stock or cash or a combination thereof. If shares are used for payment, we do not anticipate that they will be registered under the Securities Act and, therefore, will be subject to restrictions on transferability. Any subordinated participation in net sales proceeds becoming due and payable to the Special Limited Partner or its assignees hereunder shall be reduced by the amount of any distribution made to the Special Limited Partner pursuant to the limited partnership agreement of our operating partnership. Any portion of the subordinated participation in net sales proceeds that the Special Limited Partner receives prior to our listing will offset the amount otherwise due pursuant to the subordinated incentive listing distribution. |

| (9) | Upon an investment liquidity event, which means a liquidation or the sale of all or substantially all our investments (regardless of the form in which such sale shall occur, including through a merger or sale of stock or other interests in an entity), the Special Limited Partner will be entitled to receive, payable in one or more payments solely out of net sales proceeds, an amount equal to (A) 15.0% of the amount, if any, by which (1) the sum of (w) the fair market value of the investments owned as of the date of the liquidity event and the investments acquired after the termination date of the advisory agreement for which a contract to acquire such investment had been entered into as of the termination date, or collectively the included assets, or all issued and outstanding shares of our common stock, in each case as determined in good faith by us, as the sole member of the general partner of the operating partnership, as of the date the investment liquidity event is consummated, plus (y) total distributions paid through the date the investment liquidity event is consummated, exceeds (2) the sum of the gross proceeds raised in all offerings through the date the investment liquidity event is consummated (less amounts paid on or prior to such date to purchase or redeem any shares of our common stock purchased in an offering pursuant to our share repurchase program) and the total amount of cash that, if distributed to those stockholders who purchased shares of our common stock in an offering on or prior to the date the investment liquidity event is consummated, would have provided such stockholders an annual 7.0% cumulative, non-compounded, pre-tax return on the gross proceeds raised in all offerings through the date the investment liquidity event is consummated, measured for the period from inception through the date the investment liquidity event is consummated, less (B) any prior payments to the Special Limited Partner of the subordinated participation in net sales proceeds or the subordinated incentive listing distribution. |

6

Under our charter, an interest in gain from the sale of assets may not exceed 15.0% of the balance of net sale proceeds remaining after investors have received a return of their net capital contributions and a 6.0% per year cumulative, non-compounded return. Our advisory agreement, in conjunction with our operating partnership agreement, sets a higher threshold for the payment of the subordinated participation in net sale proceeds than that required by our charter. Any lowering of the threshold set forth in the advisory agreement and operating partnership agreement would require the approval of a majority of the members of the conflicts committee.

| (10) | The subordinated incentive listing distribution will be paid in the form of a non-interest bearing promissory note that will be repaid from the net sales proceeds of each sale of a property, loan or other investment after the date of the listing. At the time of such sale, we may, however, at our discretion, pay all or a portion of such promissory note with shares of our common stock or cash or a combination thereof. The market value of our outstanding common stock will be calculated based on the average market value of the shares of common stock issued and outstanding at listing over the 30 trading days beginning 180 days after the shares are first listed or included for quotation. Any previous payments of the subordinated participation in net sales proceeds will offset the amounts due pursuant to the subordinated incentive listing distribution. If the Special Limited Partner receives the subordinated incentive listing distribution, neither it nor any of its affiliates would be entitled to receive any more of the subordinated distributions of net sales proceeds or the subordinated distribution upon termination. |

| (11) | The subordinated distribution upon termination, if any, will be payable in the form of a non-interest bearing promissory note equal to (A) 15.0% of the amount, if any, by which (1) the sum of (w) the fair market value (determined by appraisal as of the termination date) of our investments on the termination date, less (x) any loans secured by such investments, plus (y) total distributions paid through the termination date, less (z) any amounts distributable as of the termination date to limited partners who received operating partnership units in connection with the acquisition of any investments (including cash used to acquire investments) upon the liquidation or sale of such investments (assuming the liquidation or sale of such investments on the termination date), exceeds (2) the sum of the gross proceeds raised in all offerings through the termination date (less amounts paid on or prior to the termination date to purchase or redeem any shares of our common stock pursuant to our share repurchase program) and the total amount of cash that, if distributed to those stockholders who purchased shares of our common stock in an offering on or prior to the termination date, would have provided such stockholders an annual 7.0% cumulative, non-compounded, pre-tax return on the gross proceeds raised in all offerings through the termination date, measured for the period from inception through the termination date, less (B) any prior payments to the Special Limited Partner of the subordinated participation in net sales proceeds or the subordinated incentive listing distribution. In addition, at the time of termination, the Special Limited Partner may elect to defer its right to receive a subordinated distribution upon termination until either a listing or another liquidity event occurs, including a liquidation or the sale of all or substantially all our investments (regardless of the form in which such sale shall occur, including through a merger or sale of stock or other interests in an entity). If the Special Limited Partner elects to defer its right to receive a subordinated distribution upon termination and there is a subsequent listing of the shares of our common stock on a national securities exchange, then the Special Limited Partner will be entitled to receive a subordinated distribution upon termination, payable in one or more payments solely out of net sales proceeds, in an amount equal to (A) 15.0% of the amount, if any, by which (1) the sum of (w) the fair market value (determined by appraisal as of the date of listing) of the included assets, less (x) any loans secured by the included assets, plus (y) total distributions paid through the date of listing on shares of our common stock issued through the termination date, less (z) any amounts distributable as of the date of listing to limited partners who received operating partnership units in connection with the acquisition of any included assets (including cash used to acquire the included assets) upon the liquidation or sale of such included assets (assuming the liquidation or sale of such included assets on the date of listing), exceeds (2) the sum of (y) the gross proceeds raised in all offerings through the termination date (less amounts paid on or prior to the date of listing to purchase or redeem any shares of our common stock purchased in an offering on or prior to the termination date pursuant to our share repurchase program), plus (z) the total amount of cash that, if distributed to those stockholders who purchased shares of our common stock in an offering on or prior to the termination date, would have provided such stockholders an annual 7.0% cumulative, non-compounded, pre-tax return on the gross proceeds raised in all offerings through the termination date, measured for the period from inception through the date of listing, less (B) any prior payments to the Special Limited Partner of the subordinated participation in net sales proceeds or the subordinated incentive listing distribution. |

7

If the Special Limited Partner elects to defer its right to receive a subordinated distribution upon termination and there is a subsequent investment liquidity event, then the Special Limited Partner will be entitled to receive a subordinated distribution upon termination, payable in one or more payments solely out of net sales proceeds, in an amount equal to (A) 15.0% of the amount, if any, by which (1) the sum of (w) the fair market value (determined by appraisal as of the date of such other liquidity event) of the included assets, less (x) any loans secured by the included assets, plus (y) total distributions paid through the date of the other liquidity event on shares of our common stock issued in offerings through the termination date, less (z) any amounts distributable as of the date of the other liquidity event to limited partners who received operating partnership units in connection with the acquisition of any included assets (including cash used to acquire included assets) upon the liquidation or sale of such included assets (assuming the liquidation or sale of such included assets on the date of the other liquidity event), exceeds (2) the sum of (y) the gross proceeds raised in all offerings through the termination date (less amounts paid on or prior to the date of the other liquidity event to purchase or redeem any shares of our common stock purchased in an offering on or prior to the termination date pursuant to our share repurchase program), plus (z) the total amount of cash that, if distributed to those stockholders who purchased shares of our common stock in an offering on or prior to the termination date, would have provided such stockholders an annual 7.0% cumulative, non-compounded, pre-tax return on the gross proceeds raised in all offerings through the termination date, measured for the period from inception through the date of the other liquidity event, less (B) any prior payments to the Special Limited Partner of the subordinated participation in net sales proceeds or the subordinated incentive listing distribution.

If the Special Limited Partner receives the subordinated distribution upon termination, neither it nor any of its affiliates would be entitled to receive any more of the subordinated participation in net sales proceeds or the subordinated incentive listing distribution. There are many additional conditions and restrictions on the amount of compensation our advisor, our sub-advisor and their affiliates may receive.

8