- PECO Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

425 Filing

Phillips Edison & Company (PECO) 425Business combination disclosure

Filed: 18 Jul 18, 8:46am

Phillips Edison Grocery Center REIT II (“REIT II”) to Merge with Phillips Edison & Company (“PECO”) July 18, 2018 Exhibit 99.4

Forward-Looking Statement Disclosure Certain statements contained in this presentation may be considered forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), including statements regarding the transactions discussed herein and the ability to consummate the transactions and anticipated dividends. We intend for all such forward-looking statements to be covered by the safe harbor provisions for forward-looking statements contained in Section 27A of the Securities Act and Section 21E of the Exchange Act, as applicable. Such statements include, in particular, statements about Phillips Edison Grocery Center REIT II, Inc.’s (“REIT II”) plans, strategies, and prospects, and the anticipated benefits of the proposed merger between REIT II and Phillips Edison & Company, Inc. (“PECO”) and are subject to certain risks and uncertainties, as well as known and unknown risks, which could cause actual results to differ materially from those projected or anticipated. Therefore, such statements are not intended to be a guarantee of REIT II’s performance in future periods. Such forward-looking statements can generally be identified by our use of forward-looking terminology such as “may,” “will,” “would,” “could,” “should,” “expect,” “intend,” “anticipate,” “estimate,” “believe,” “continue,” or other similar words. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this release. REIT II makes no representation or warranty (express or implied) about the accuracy of any such forward-looking statements contained in this release, and does not intend, and undertakes no obligation, to publicly update or revise any forward-looking statements, whether as a result of new information, future events, or otherwise.

Information disclosure Additional Information and Where You Can Find It This communication relates to the proposed merger transaction of REIT II and PECO pursuant to the terms of the Agreement and Plan of Merger, dated as of July 17, 2018. PECO and REIT II intend to file a joint proxy statement/prospectus on Form S-4 in connection with the proposed merger. Investors are urged to read carefully the joint proxy statement/prospectus and other relevant materials because they contain important information about the merger. Investors may obtain free copies of these documents and other documents filed by PECO or REIT II with the SEC through the website maintained by the SEC at www.sec.gov. Investors may obtain free copies of the documents filed with the SEC by PECO by going to PECO’s corporate website at www.phillipsedison.com or by directing a written request to: Phillips Edison & Company, Inc., 11501 Northlake Drive, Cincinnati, OH 45249, Attention: Investor Relations. Investors may obtain free copies of documents filed with the SEC by REIT II by going to REIT II’s corporate website at www.grocerycenterREIT2.com or by directing a written request to: Phillips Edison Grocery Center REIT II, Inc., 11501 Northlake Drive, Cincinnati, OH 45249, Attention: Investor Relations. Investors are urged to read the joint proxy statement/prospectus and the other relevant materials before making any voting decision with respect to the merger. PECO and its directors and executive officers and REIT II and its directors and executive officers may be deemed to be participants in the solicitation of proxies from the stockholders of each of PECO and REIT II in connection with the merger. Information regarding the interests of these directors and executive officers in the merger will be included in the joint proxy statement/prospectus referred to above. Additional information regarding certain of these persons and their beneficial ownership of PECO common stock is also set forth in the Definitive Proxy Statement for PECO’s 2017 Annual Meeting of Stockholders, which has been filed with the SEC. Additional information regarding certain of these persons and their beneficial ownership of REIT II’s common stock is set forth in the Definitive Proxy Statement for REIT II’s 2017 Annual Meeting of Stockholders, which has been filed with the SEC.

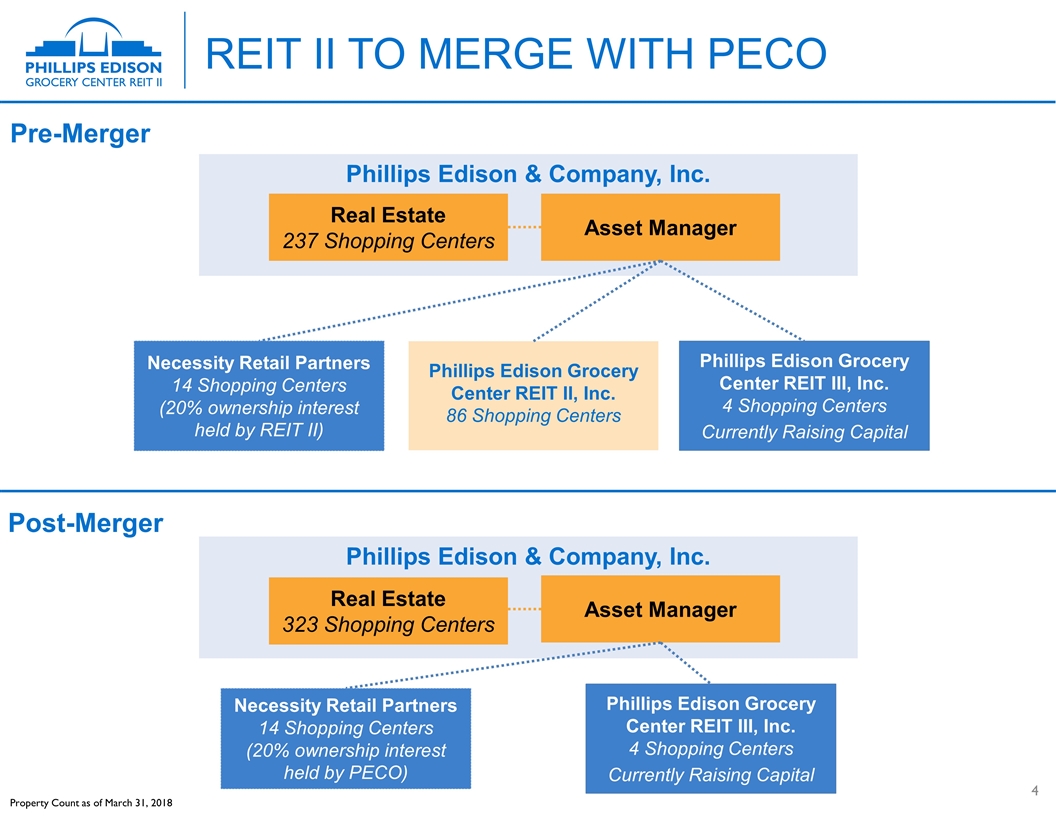

REIT II to Merge with PECO Property Count as of March 31, 2018 Phillips Edison Grocery Center REIT II, Inc. 86 Shopping Centers Phillips Edison & Company, Inc. Asset Manager Real Estate 323 Shopping Centers Phillips Edison & Company, Inc. Asset Manager Real Estate 237 Shopping Centers Phillips Edison Grocery Center REIT III, Inc. 4 Shopping Centers Currently Raising Capital Phillips Edison Grocery Center REIT III, Inc. 4 Shopping Centers Currently Raising Capital Necessity Retail Partners 14 Shopping Centers (20% ownership interest held by REIT II) Necessity Retail Partners 14 Shopping Centers (20% ownership interest held by PECO) Post-Merger Pre-Merger

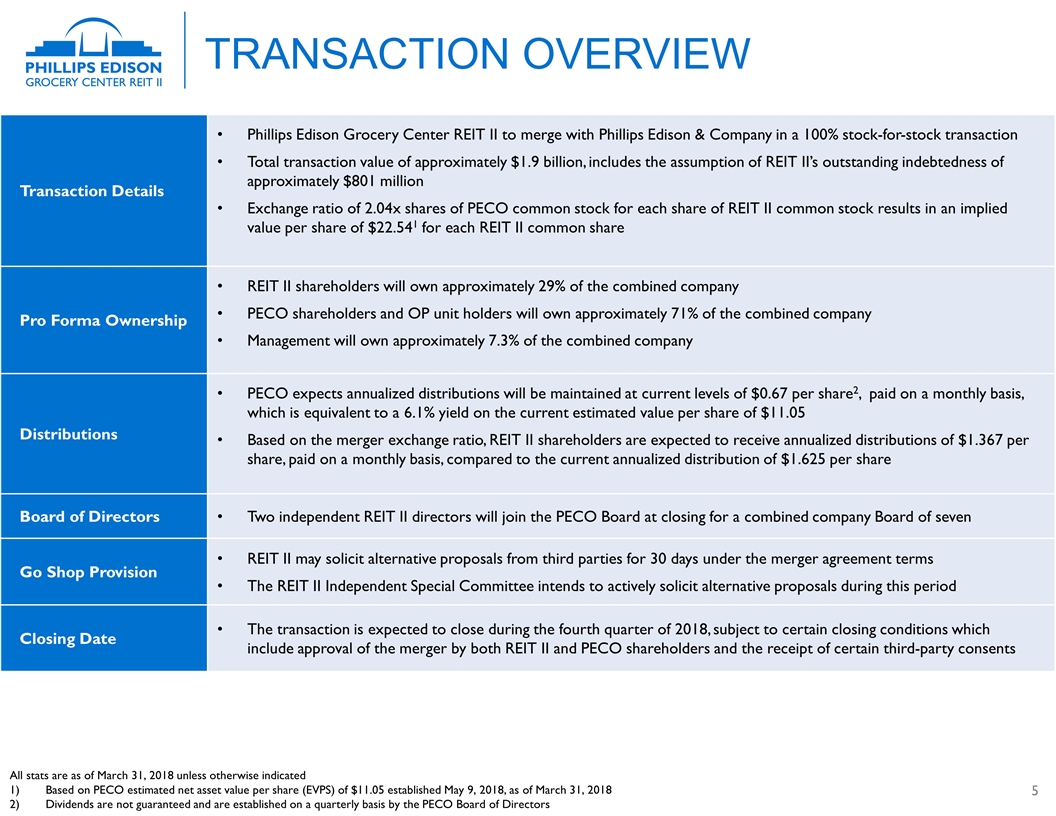

Transaction Overview Transaction Details Phillips Edison Grocery Center REIT II to merge with Phillips Edison & Company in a 100% stock-for-stock transaction Total transaction value of approximately $1.9 billion, includes the assumption of REIT II’s outstanding indebtedness of approximately $801 million Exchange ratio of 2.04x shares of PECO common stock for each share of REIT II common stock results in an implied value per share of $22.541 for each REIT II common share Pro Forma Ownership REIT II shareholders will own approximately 29% of the combined company PECO shareholders and OP unit holders will own approximately 71% of the combined company Management will own approximately 7.3% of the combined company Distributions PECO expects annualized distributions will be maintained at current levels of $0.67 per share2, paid on a monthly basis, which is equivalent to a 6.1% yield on the current estimated value per share of $11.05 Based on the merger exchange ratio, REIT II shareholders are expected to receive annualized distributions of $1.367 per share, paid on a monthly basis, compared to the current annualized distribution of $1.625 per share Board of Directors Two independent REIT II directors will join the PECO Board at closing for a combined company Board of seven Go Shop Provision REIT II may solicit alternative proposals from third parties for 30 days under the merger agreement terms The REIT II Independent Special Committee intends to actively solicit alternative proposals during this period Closing Date The transaction is expected to close during the fourth quarter of 2018, subject to certain closing conditions which include approval of the merger by both REIT II and PECO shareholders and the receipt of certain third-party consents All stats are as of March 31, 2018 unless otherwise indicated Based on PECO estimated net asset value per share (EVPS) of $11.05 established May 9, 2018, as of March 31, 2018 Dividends are not guaranteed and are established on a quarterly basis by the PECO Board of Directors

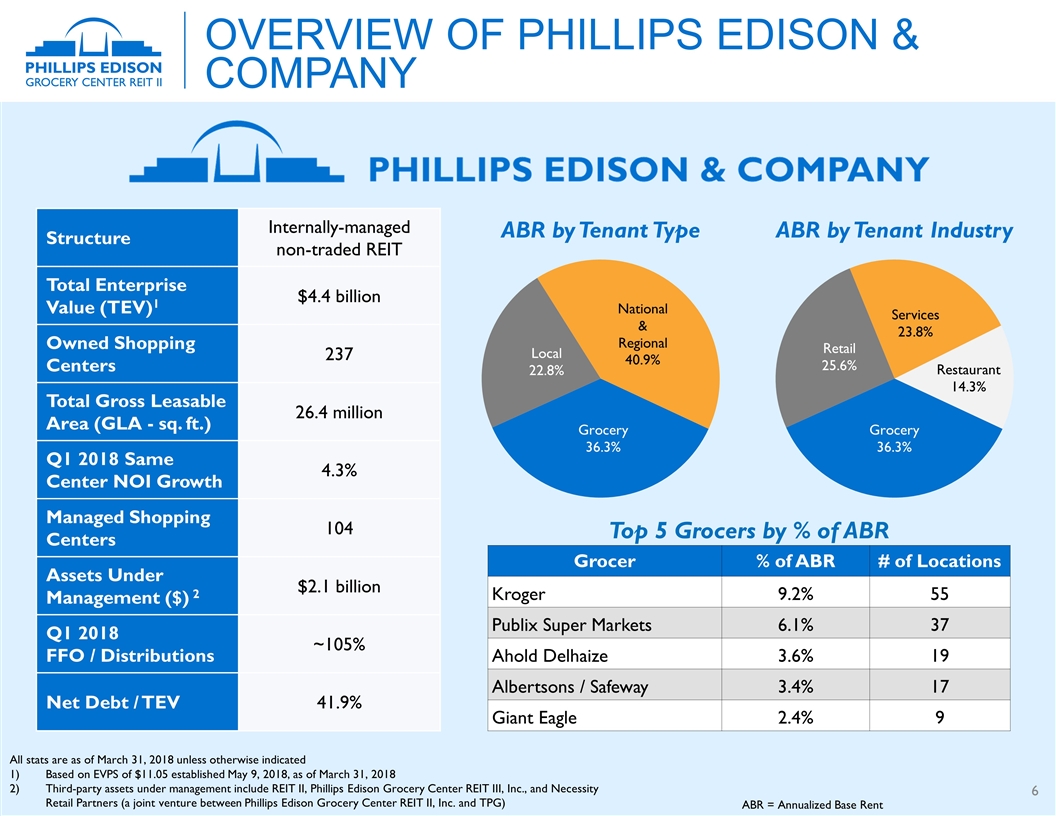

Overview OF Phillips Edison & company Structure Internally-managed non-traded REIT Total Enterprise Value (TEV)1 $4.4 billion Owned Shopping Centers 237 Total Gross Leasable Area (GLA - sq. ft.) 26.4 million Q1 2018 Same Center NOI Growth 4.3% Managed Shopping Centers 104 Assets Under Management ($) 2 $2.1 billion Q1 2018 FFO / Distributions ~105% Net Debt / TEV 41.9% All stats are as of March 31, 2018 unless otherwise indicated Based on EVPS of $11.05 established May 9, 2018, as of March 31, 2018 Third-party assets under management include REIT II, Phillips Edison Grocery Center REIT III, Inc., and Necessity Retail Partners (a joint venture between Phillips Edison Grocery Center REIT II, Inc. and TPG) Grocer % of ABR # of Locations Kroger 9.2% 55 Publix Super Markets 6.1% 37 Ahold Delhaize 3.6% 19 Albertsons / Safeway 3.4% 17 Giant Eagle 2.4% 9 Top 5 Grocers by % of ABR ABR = Annualized Base Rent

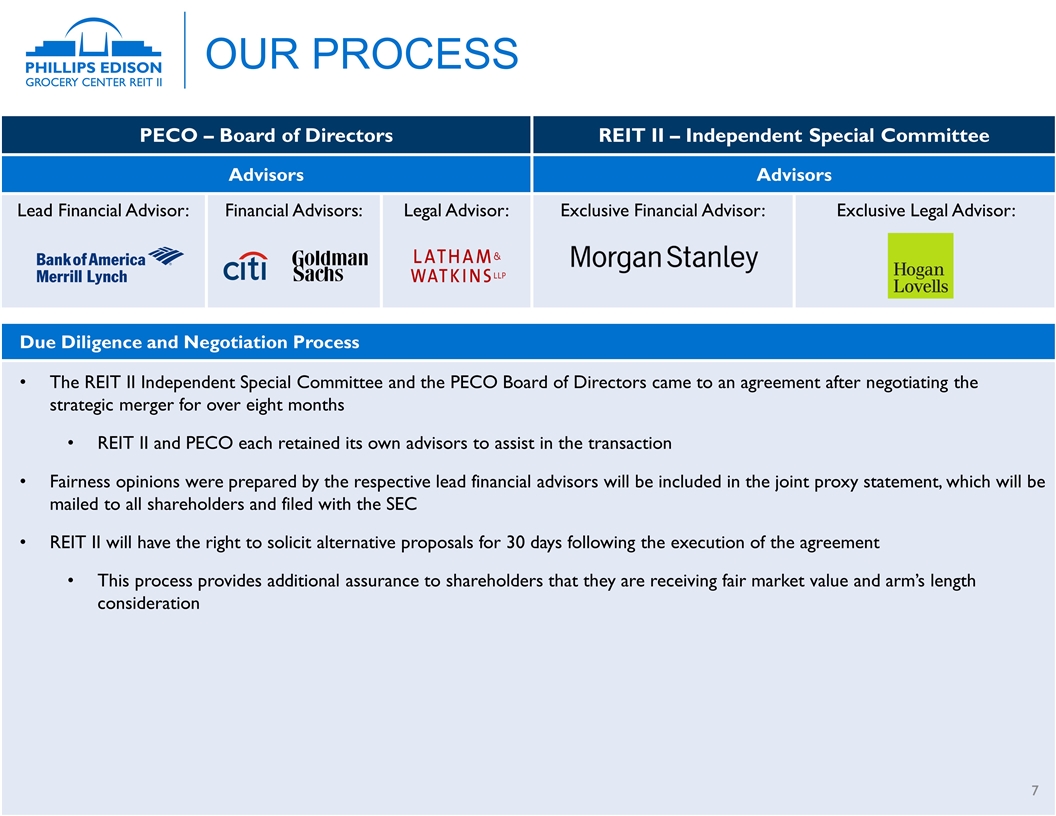

PECO – Board of Directors REIT II – Independent Special Committee Advisors Advisors Lead Financial Advisor: Financial Advisors: Legal Advisor: Exclusive Financial Advisor: Exclusive Legal Advisor: Due Diligence and Negotiation Process The REIT II Independent Special Committee and the PECO Board of Directors came to an agreement after negotiating the strategic merger for over eight months REIT II and PECO each retained its own advisors to assist in the transaction Fairness opinions were prepared by the respective lead financial advisors will be included in the joint proxy statement, which will be mailed to all shareholders and filed with the SEC REIT II will have the right to solicit alternative proposals for 30 days following the execution of the agreement This process provides additional assurance to shareholders that they are receiving fair market value and arm’s length consideration Our process

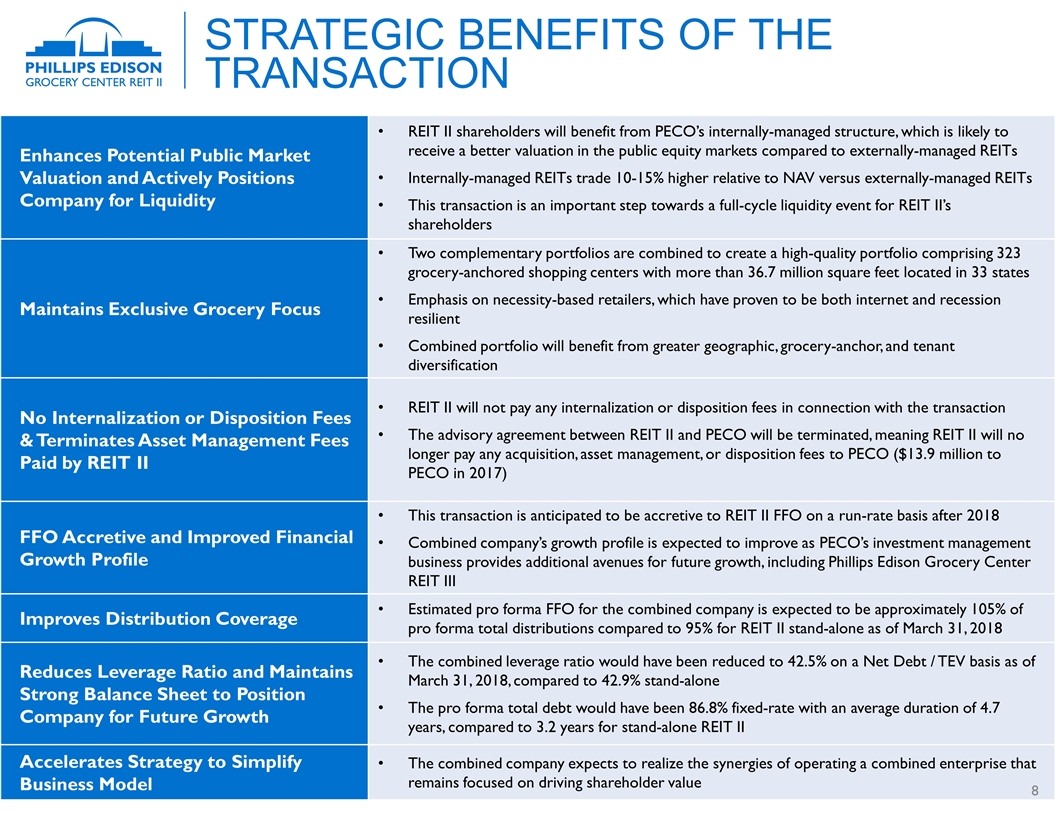

Enhances Potential Public Market Valuation and Actively Positions Company for Liquidity REIT II shareholders will benefit from PECO’s internally-managed structure, which is likely to receive a better valuation in the public equity markets compared to externally-managed REITs Internally-managed REITs trade 10-15% higher relative to NAV versus externally-managed REITs This transaction is an important step towards a full-cycle liquidity event for REIT II’s shareholders Maintains Exclusive Grocery Focus Two complementary portfolios are combined to create a high-quality portfolio comprising 323 grocery-anchored shopping centers with more than 36.7 million square feet located in 33 states Emphasis on necessity-based retailers, which have proven to be both internet and recession resilient Combined portfolio will benefit from greater geographic, grocery-anchor, and tenant diversification No Internalization or Disposition Fees & Terminates Asset Management Fees Paid by REIT II REIT II will not pay any internalization or disposition fees in connection with the transaction The advisory agreement between REIT II and PECO will be terminated, meaning REIT II will no longer pay any acquisition, asset management, or disposition fees to PECO ($13.9 million to PECO in 2017) FFO Accretive and Improved Financial Growth Profile This transaction is anticipated to be accretive to REIT II FFO on a run-rate basis after 2018 Combined company’s growth profile is expected to improve as PECO’s investment management business provides additional avenues for future growth, including Phillips Edison Grocery Center REIT III Improves Distribution Coverage Estimated pro forma FFO for the combined company is expected to be approximately 105% of pro forma total distributions compared to 95% for REIT II stand-alone as of March 31, 2018 Reduces Leverage Ratio and Maintains Strong Balance Sheet to Position Company for Future Growth The combined leverage ratio would have been reduced to 42.5% on a Net Debt / TEV basis as of March 31, 2018, compared to 42.9% stand-alone The pro forma total debt would have been 86.8% fixed-rate with an average duration of 4.7 years, compared to 3.2 years for stand-alone REIT II Accelerates Strategy to Simplify Business Model The combined company expects to realize the synergies of operating a combined enterprise that remains focused on driving shareholder value Strategic Benefits of the transaction

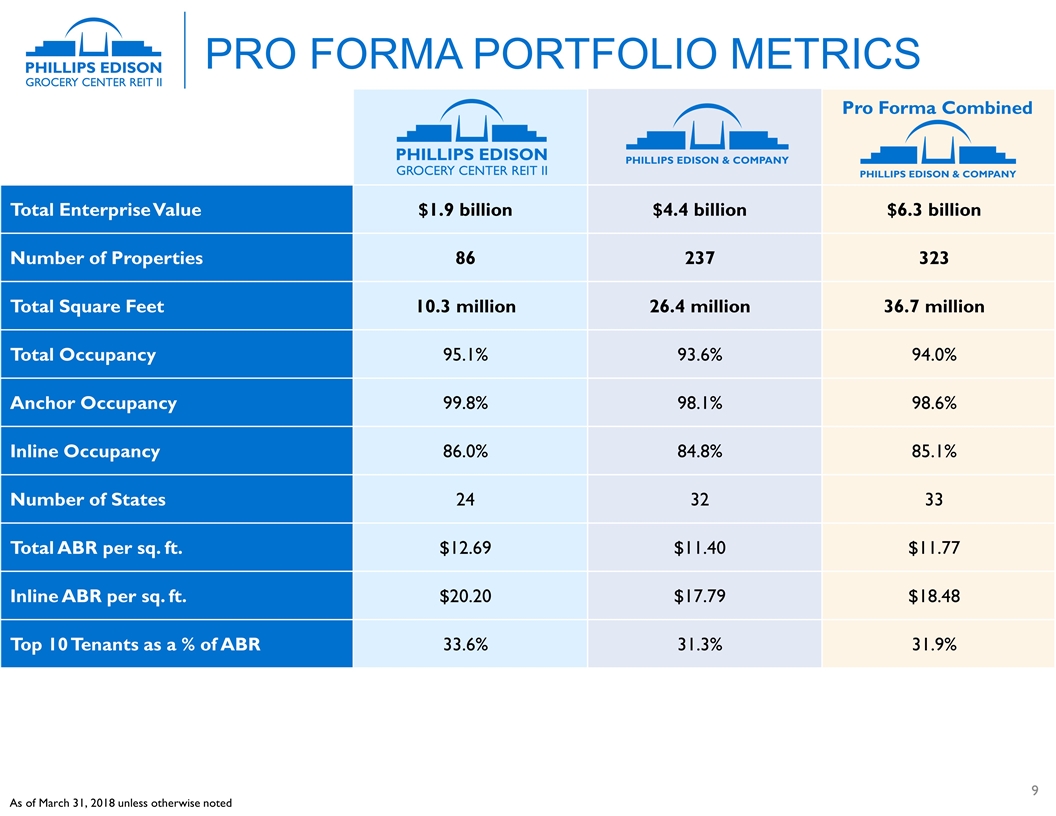

Pro forma portfolio metrics Total Enterprise Value $1.9 billion $4.4 billion $6.3 billion Number of Properties 86 237 323 Total Square Feet 10.3 million 26.4 million 36.7 million Total Occupancy 95.1% 93.6% 94.0% Anchor Occupancy 99.8% 98.1% 98.6% Inline Occupancy 86.0% 84.8% 85.1% Number of States 24 32 33 Total ABR per sq. ft. $12.69 $11.40 $11.77 Inline ABR per sq. ft. $20.20 $17.79 $18.48 Top 10 Tenants as a % of ABR 33.6% 31.3% 31.9% Pro Forma Combined As of March 31, 2018 unless otherwise noted

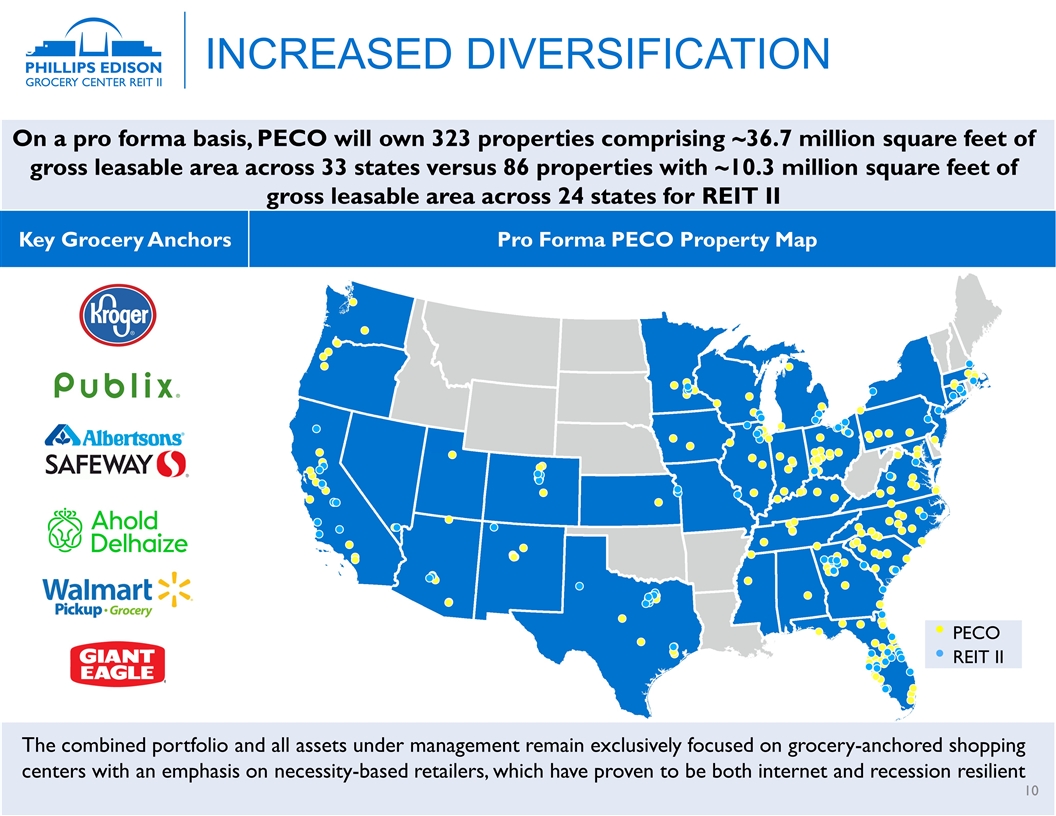

The combined portfolio and all assets under management remain exclusively focused on grocery-anchored shopping centers with an emphasis on necessity-based retailers, which have proven to be both internet and recession resilient increased diversification On a pro forma basis, PECO will own 323 properties comprising ~36.7 million square feet of gross leasable area across 33 states versus 86 properties with ~10.3 million square feet of gross leasable area across 24 states for REIT II Key Grocery Anchors Pro Forma PECO Property Map PECO REIT II

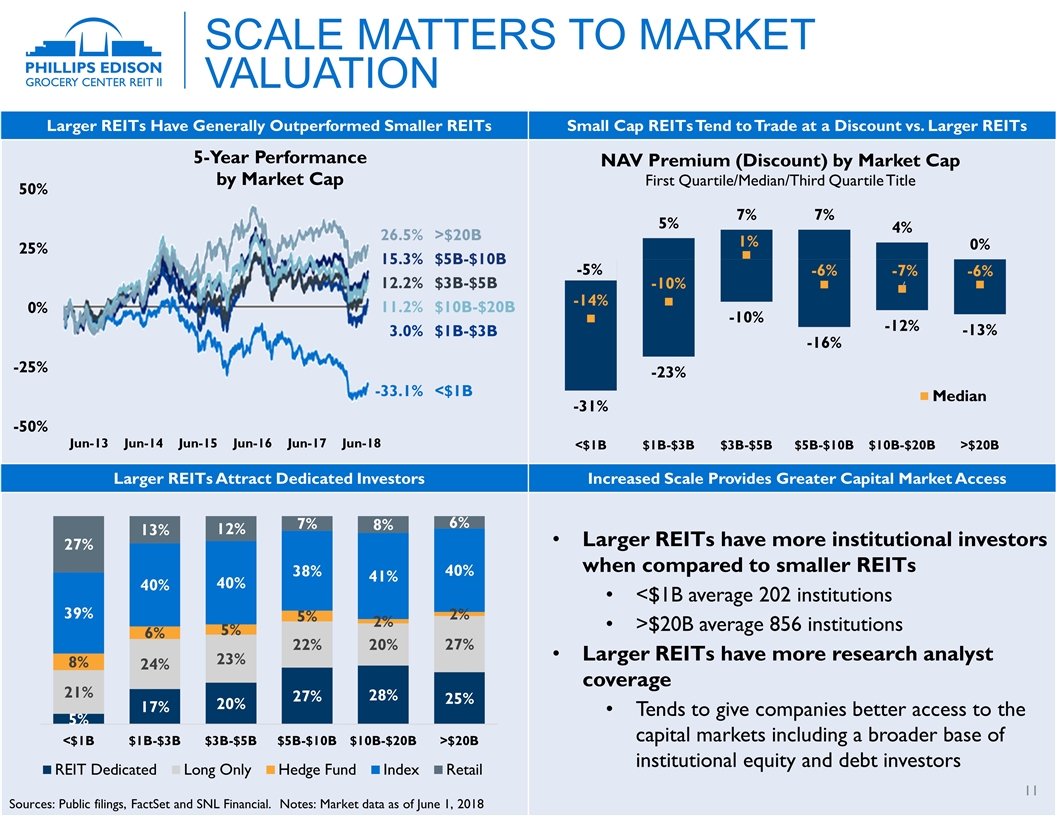

Larger REITs Have Generally Outperformed Smaller REITs Small Cap REITs Tend to Trade at a Discount vs. Larger REITs Larger REITs Attract Dedicated Investors Increased Scale Provides Greater Capital Market Access Larger REITs have more institutional investors when compared to smaller REITs <$1B average 202 institutions >$20B average 856 institutions Larger REITs have more research analyst coverage Tends to give companies better access to the capital markets including a broader base of institutional equity and debt investors Scale matters to market valuation 26.5% >$20B 15.3% $5B-$10B 12.2% $3B-$5B 11.2% $10B-$20B 3.0% $1B-$3B -33.1% <$1B Sources: Public filings, FactSet and SNL Financial. Notes: Market data as of June 1, 2018

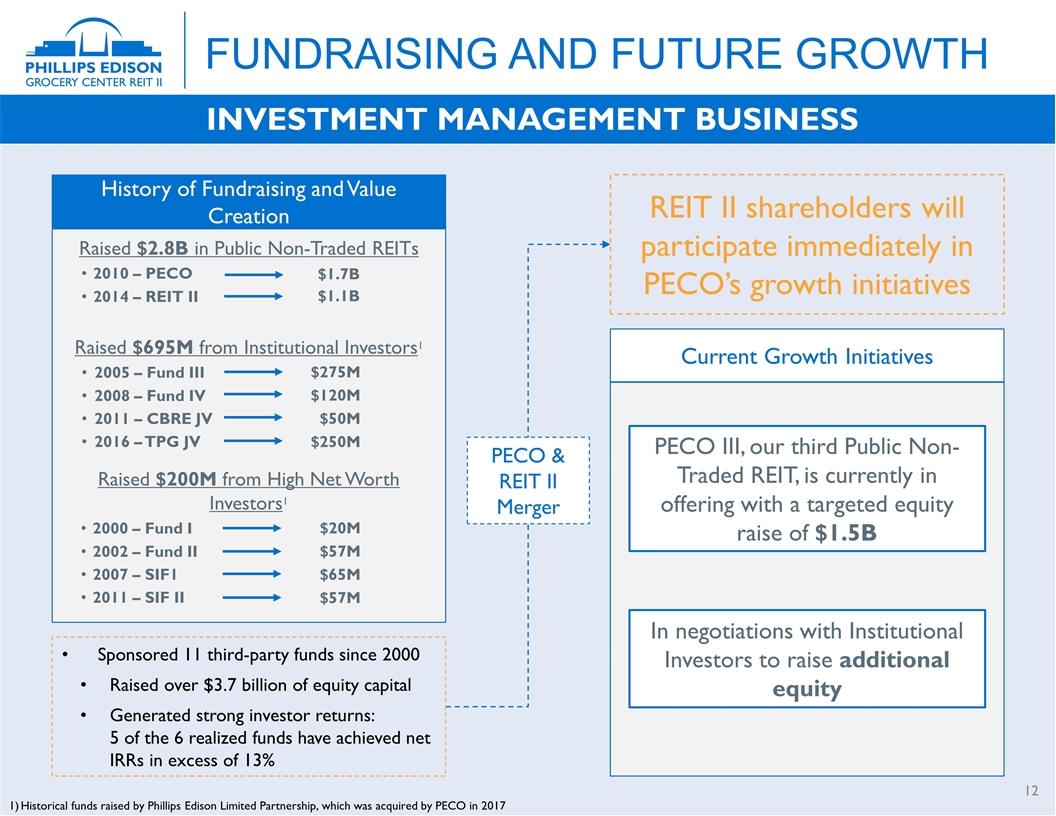

INVESTMENT MANAGEMENT BUSINESS Raised $200M from High Net Worth Investors1 2000 – Fund I 2002 – Fund II 2007 – SIF1 2011 – SIF II Raised $2.8B in Public Non-Traded REITs 2010 – PECO 2014 – REIT II History of Fundraising and Value Creation Raised $695M from Institutional Investors1 2005 – Fund III 2008 – Fund IV 2011 – CBRE JV 2016 – TPG JV Current Growth Initiatives PECO III, our third Public Non-Traded REIT, is currently in offering with a targeted equity raise of $1.5B In negotiations with Institutional Investors to raise additional equity Sponsored 11 third-party funds since 2000 Raised over $3.7 billion of equity capital Generated strong investor returns: 5 of the 6 realized funds have achieved net IRRs in excess of 13% REIT II shareholders will participate immediately in PECO’s growth initiatives $1.7B $1.1B $275M $120M $50M $250M $20M $57M $65M $57M Historical funds raised by Phillips Edison Limited Partnership, which was acquired by PECO in 2017 PECO & REIT II Merger Fundraising and future growth

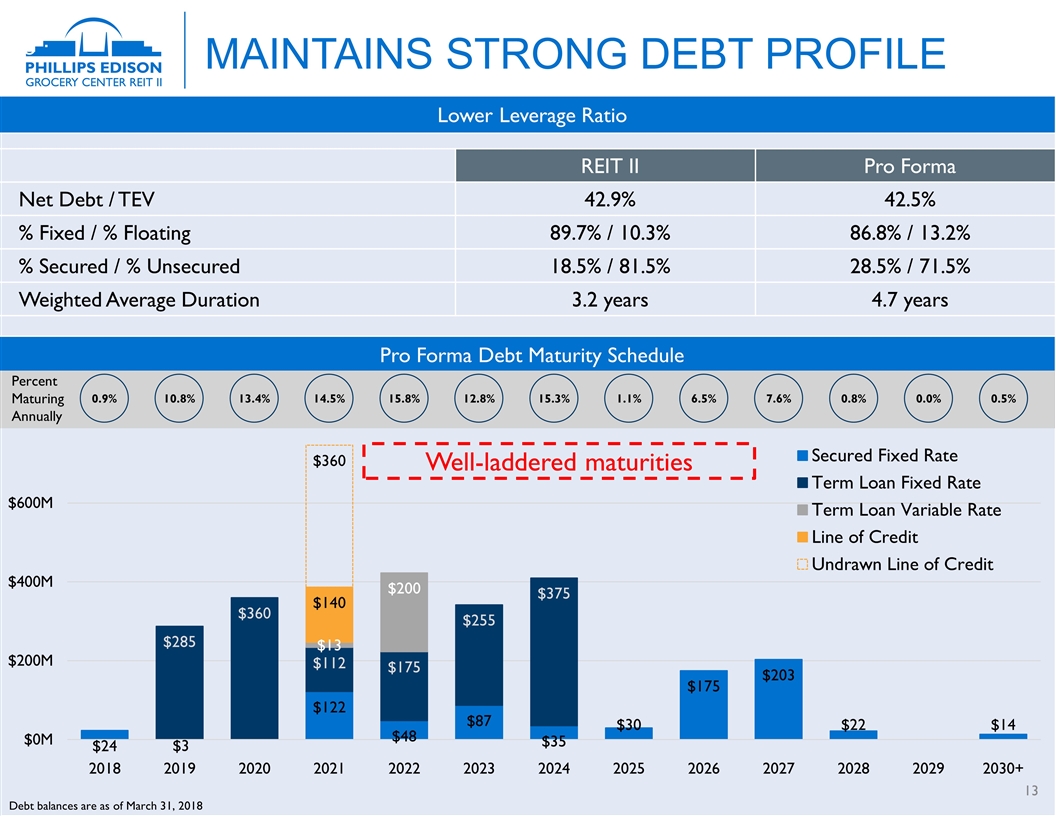

Lower Leverage Ratio Maintains strong debt profile REIT II Pro Forma Net Debt / TEV 42.9% 42.5% % Fixed / % Floating 89.7% / 10.3% 86.8% / 13.2% % Secured / % Unsecured 18.5% / 81.5% 28.5% / 71.5% Weighted Average Duration 3.2 years 4.7 years Pro Forma Debt Maturity Schedule 0.9% 10.8% 13.4% 14.5% 15.8% 12.8% 15.3% 1.1% 6.5% 7.6% 0.8% 0.0% 0.5% Percent Maturing Annually Debt balances are as of March 31, 2018 Well-laddered maturities

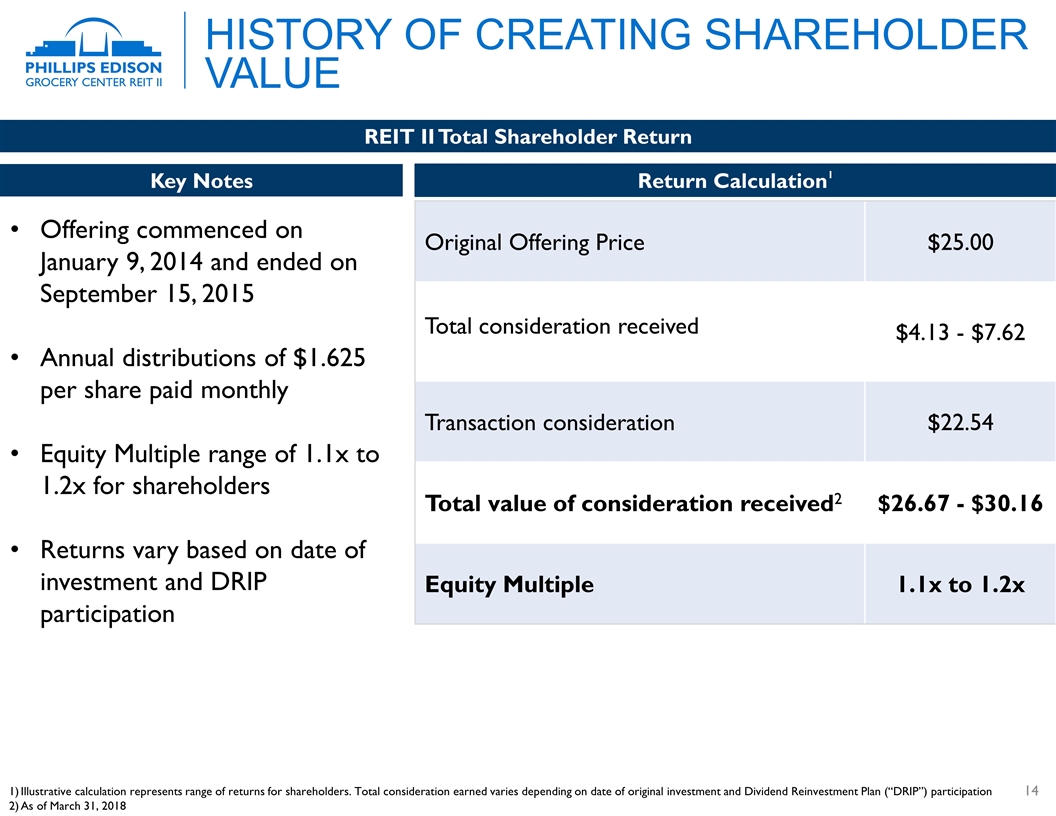

history of Creating shareholder value Offering commenced on January 9, 2014 and ended on September 15, 2015 Annual distributions of $1.625 per share paid monthly Equity Multiple range of 1.1x to 1.2x for shareholders Returns vary based on date of investment and DRIP participation Return Calculation1 Key Notes REIT II Total Shareholder Return Original Offering Price $25.00 Total consideration received $4.13 - $7.62 Transaction consideration $22.54 Total value of consideration received2 $26.67 - $30.16 Equity Multiple 1.1x to 1.2x Illustrative calculation represents range of returns for shareholders. Total consideration earned varies depending on date of original investment and Dividend Reinvestment Plan (“DRIP”) participation As of March 31, 2018

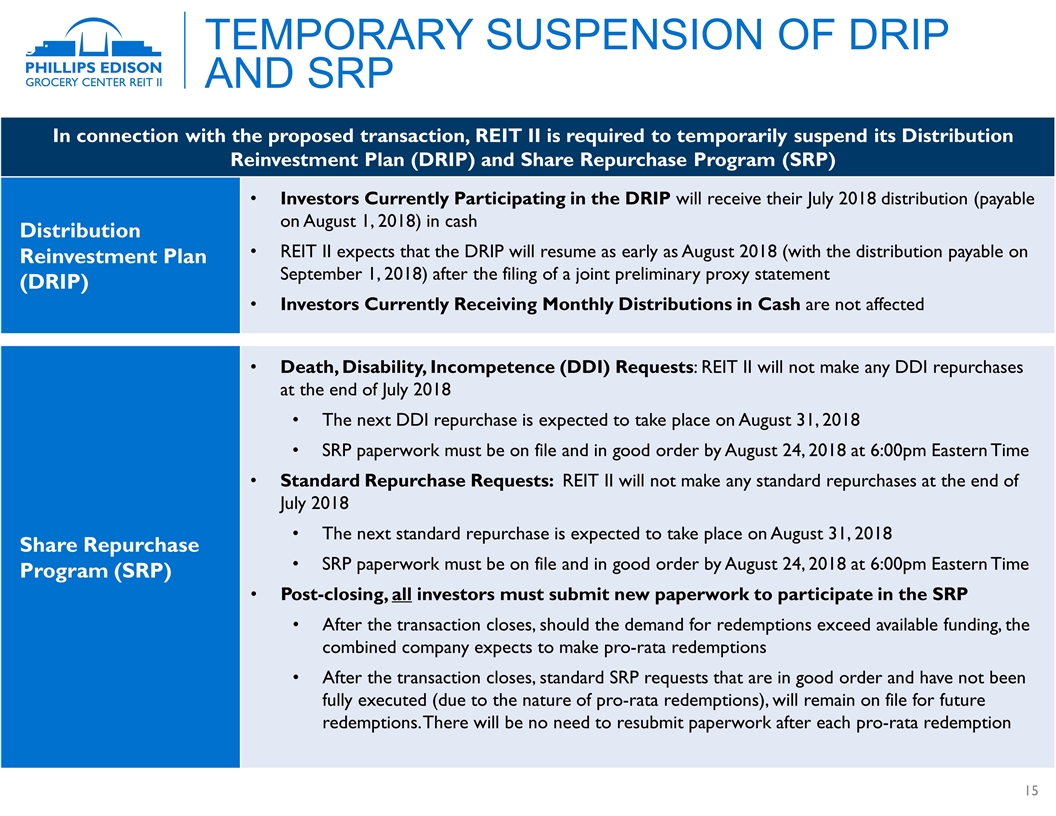

Temporary Suspension of DRIP and SRP In connection with the proposed transaction, REIT II is required to temporarily suspend its Distribution Reinvestment Plan (DRIP) and Share Repurchase Program (SRP) Distribution Reinvestment Plan (DRIP) Investors Currently Participating in the DRIP will receive their July 2018 distribution (payable on August 1, 2018) in cash REIT II expects that the DRIP will resume as early as August 2018 (with the distribution payable on September 1, 2018) after the filing of a joint preliminary proxy statement Investors Currently Receiving Monthly Distributions in Cash are not affected Share Repurchase Program (SRP) Death, Disability, Incompetence (DDI) Requests: REIT II will not make any DDI repurchases at the end of July 2018 The next DDI repurchase is expected to take place on August 31, 2018 SRP paperwork must be on file and in good order by August 24, 2018 at 6:00pm Eastern Time Standard Repurchase Requests: REIT II will not make any standard repurchases at the end of July 2018 The next standard repurchase is expected to take place on August 31, 2018 SRP paperwork must be on file and in good order by August 24, 2018 at 6:00pm Eastern Time Post-closing, all investors must submit new paperwork to participate in the SRP After the transaction closes, should the demand for redemptions exceed available funding, the combined company expects to make pro-rata redemptions After the transaction closes, standard SRP requests that are in good order and have not been fully executed (due to the nature of pro-rata redemptions), will remain on file for future redemptions. There will be no need to resubmit paperwork after each pro-rata redemption

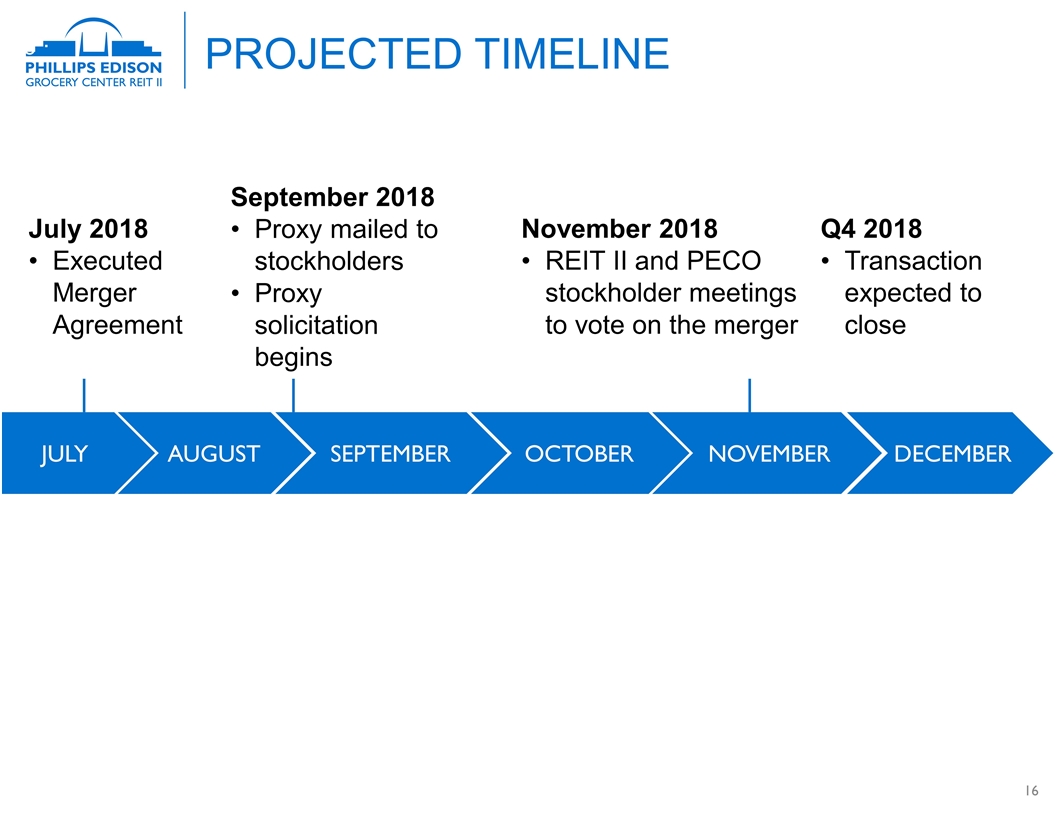

PROJECTED timeline OCTOBER SEPTEMBER July 2018 Executed Merger Agreement September 2018 Proxy mailed to stockholders Proxy solicitation begins November 2018 REIT II and PECO stockholder meetings to vote on the merger Q4 2018 Transaction expected to close JULY AUGUST NOVEMBER DECEMBER

Strategic Merger positions Combined company for increased growth & liquidity REIT II benefits from enhanced growth profile, lower leverage, improved distribution coverage, and efficiencies gained from size and scale: All meaningful steps toward liquidity Enhances Potential Public Market Valuation and Actively Positions Company for Liquidity Materially Increases Scale while Maintaining Exclusive Grocery Focus FFO Accretive and Improved Financial Growth Profile Transaction Consideration Does Not Include Internalization or Disposition Fees Terminates Asset Management Fees Paid by REIT II Reduces Leverage Ratio and Maintains Strong Balance Sheet Management will be the combined company’s largest shareholder – owning approximately 7.3% – aligning management and shareholder interests

Investor & Operational Inquiries: DST: (888) 518-8073 Financial Advisor & Broker Dealer Inquiries: Griffin Capital Securities: (866) 788-8614 Phillips Edison Contact: Michael Koehler, Director of Investor Relations InvestorRelations@PhillipsEdison.com (513) 338-2743 Download today’s materials at www.grocerycenterreit2.com/investors

Appendix

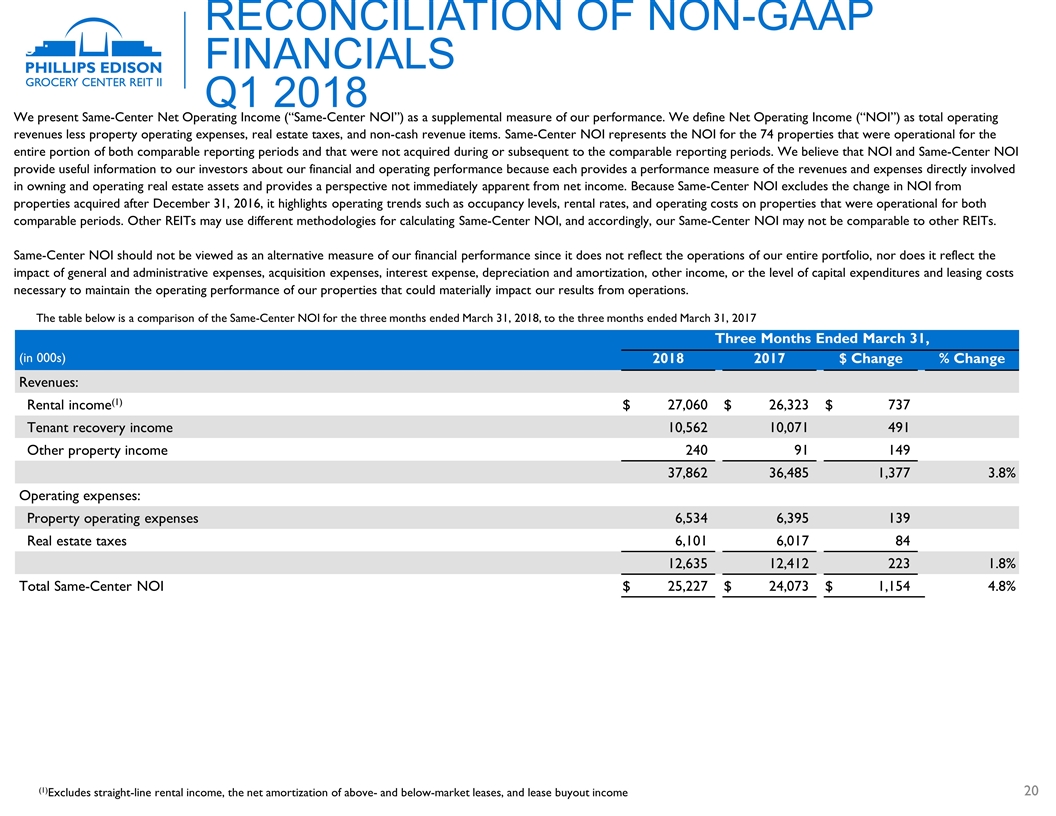

Reconciliation of Non-GAAP Financials Q1 2018 We present Same-Center Net Operating Income (“Same-Center NOI”) as a supplemental measure of our performance. We define Net Operating Income (“NOI”) as total operating revenues less property operating expenses, real estate taxes, and non-cash revenue items. Same-Center NOI represents the NOI for the 74 properties that were operational for the entire portion of both comparable reporting periods and that were not acquired during or subsequent to the comparable reporting periods. We believe that NOI and Same-Center NOI provide useful information to our investors about our financial and operating performance because each provides a performance measure of the revenues and expenses directly involved in owning and operating real estate assets and provides a perspective not immediately apparent from net income. Because Same-Center NOI excludes the change in NOI from properties acquired after December 31, 2016, it highlights operating trends such as occupancy levels, rental rates, and operating costs on properties that were operational for both comparable periods. Other REITs may use different methodologies for calculating Same-Center NOI, and accordingly, our Same-Center NOI may not be comparable to other REITs. Same-Center NOI should not be viewed as an alternative measure of our financial performance since it does not reflect the operations of our entire portfolio, nor does it reflect the impact of general and administrative expenses, acquisition expenses, interest expense, depreciation and amortization, other income, or the level of capital expenditures and leasing costs necessary to maintain the operating performance of our properties that could materially impact our results from operations. The table below is a comparison of the Same-Center NOI for the three months ended March 31, 2018, to the three months ended March 31, 2017 Three Months Ended March 31, Three Months Ended March 31, (in 000s) 2018 2018 2017 2017 $ Change $ Change % Change Revenues: Rental income(1) $ 27,060 $ 26,323 $ 737 Tenant recovery income 10,562 10,071 491 Other property income 240 91 149 37,862 36,485 1,377 3.8 % Operating expenses: Property operating expenses 6,534 6,395 139 Real estate taxes 6,101 6,017 84 12,635 12,412 223 1.8 % Total Same-Center NOI $ 25,227 $ 24,073 $ 1,154 4.8 % (1)Excludes straight-line rental income, the net amortization of above- and below-market leases, and lease buyout income

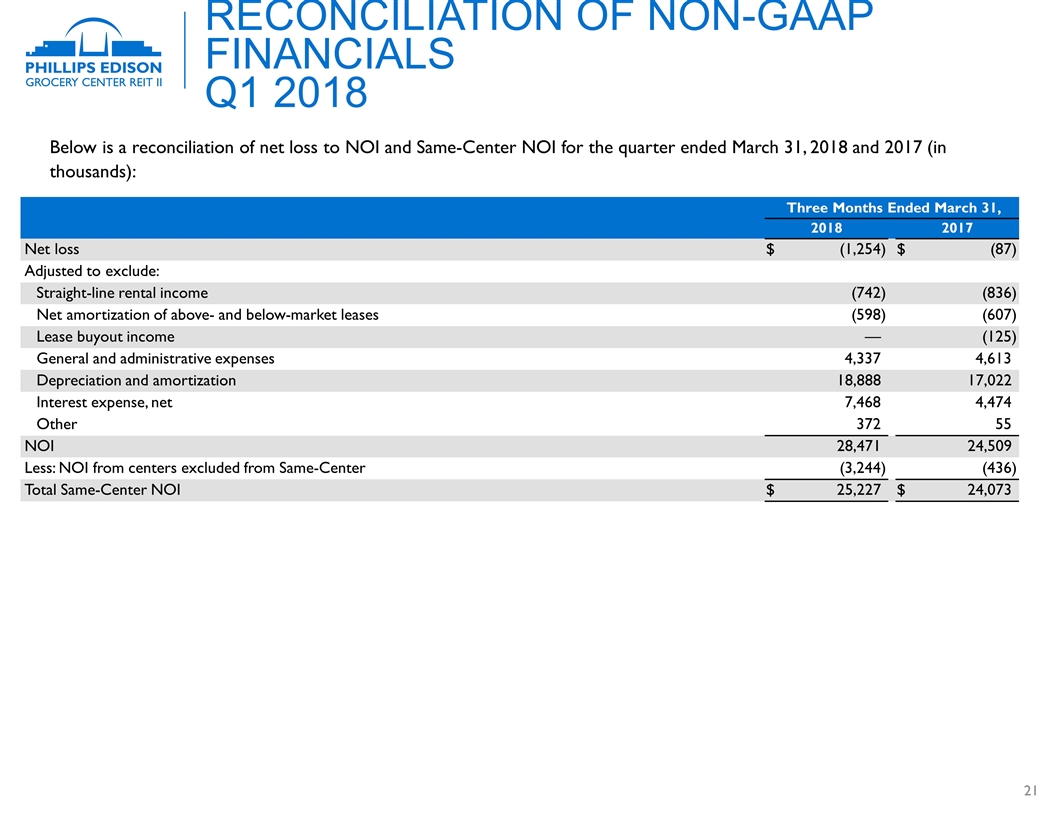

Reconciliation of Non-GAAP Financials Q1 2018 Three Months Ended March 31, Three Months Ended March 31, 2018 2018 2017 2017 Net loss $ (1,254 ) $ (87 ) Adjusted to exclude: Straight-line rental income (742 ) (836 ) Net amortization of above- and below-market leases (598 ) (607 ) Lease buyout income — (125 ) General and administrative expenses 4,337 4,613 Depreciation and amortization 18,888 17,022 Interest expense, net 7,468 4,474 Other 372 55 NOI 28,471 24,509 Less: NOI from centers excluded from Same-Center (3,244 ) (436 ) Total Same-Center NOI $ 25,227 $ 24,073 Below is a reconciliation of net loss to NOI and Same-Center NOI for the quarter ended March 31, 2018 and 2017 (in thousands):

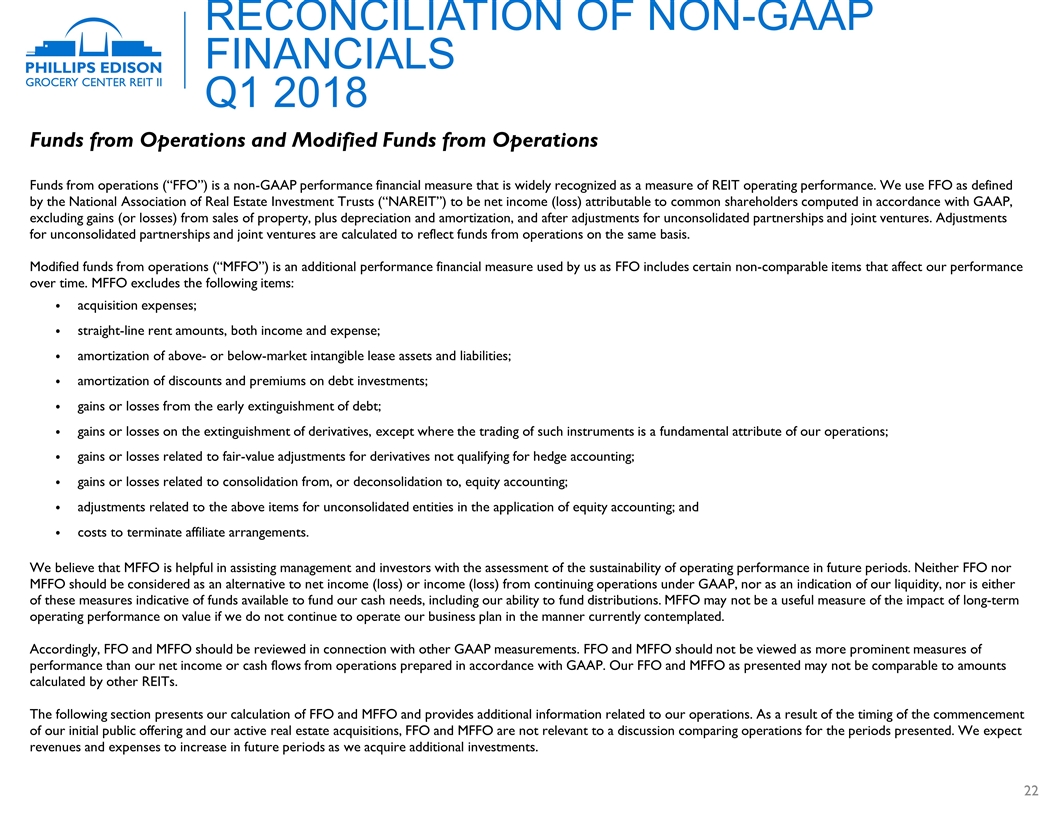

Reconciliation of Non-GAAP Financials Q1 2018 Funds from Operations and Modified Funds from Operations Funds from operations (“FFO”) is a non-GAAP performance financial measure that is widely recognized as a measure of REIT operating performance. We use FFO as defined by the National Association of Real Estate Investment Trusts (“NAREIT”) to be net income (loss) attributable to common shareholders computed in accordance with GAAP, excluding gains (or losses) from sales of property, plus depreciation and amortization, and after adjustments for unconsolidated partnerships and joint ventures. Adjustments for unconsolidated partnerships and joint ventures are calculated to reflect funds from operations on the same basis. Modified funds from operations (“MFFO”) is an additional performance financial measure used by us as FFO includes certain non-comparable items that affect our performance over time. MFFO excludes the following items: acquisition expenses; straight-line rent amounts, both income and expense; amortization of above- or below-market intangible lease assets and liabilities; amortization of discounts and premiums on debt investments; gains or losses from the early extinguishment of debt; gains or losses on the extinguishment of derivatives, except where the trading of such instruments is a fundamental attribute of our operations; gains or losses related to fair-value adjustments for derivatives not qualifying for hedge accounting; gains or losses related to consolidation from, or deconsolidation to, equity accounting; adjustments related to the above items for unconsolidated entities in the application of equity accounting; and costs to terminate affiliate arrangements. We believe that MFFO is helpful in assisting management and investors with the assessment of the sustainability of operating performance in future periods. Neither FFO nor MFFO should be considered as an alternative to net income (loss) or income (loss) from continuing operations under GAAP, nor as an indication of our liquidity, nor is either of these measures indicative of funds available to fund our cash needs, including our ability to fund distributions. MFFO may not be a useful measure of the impact of long-term operating performance on value if we do not continue to operate our business plan in the manner currently contemplated. Accordingly, FFO and MFFO should be reviewed in connection with other GAAP measurements. FFO and MFFO should not be viewed as more prominent measures of performance than our net income or cash flows from operations prepared in accordance with GAAP. Our FFO and MFFO as presented may not be comparable to amounts calculated by other REITs. The following section presents our calculation of FFO and MFFO and provides additional information related to our operations. As a result of the timing of the commencement of our initial public offering and our active real estate acquisitions, FFO and MFFO are not relevant to a discussion comparing operations for the periods presented. We expect revenues and expenses to increase in future periods as we acquire additional investments.

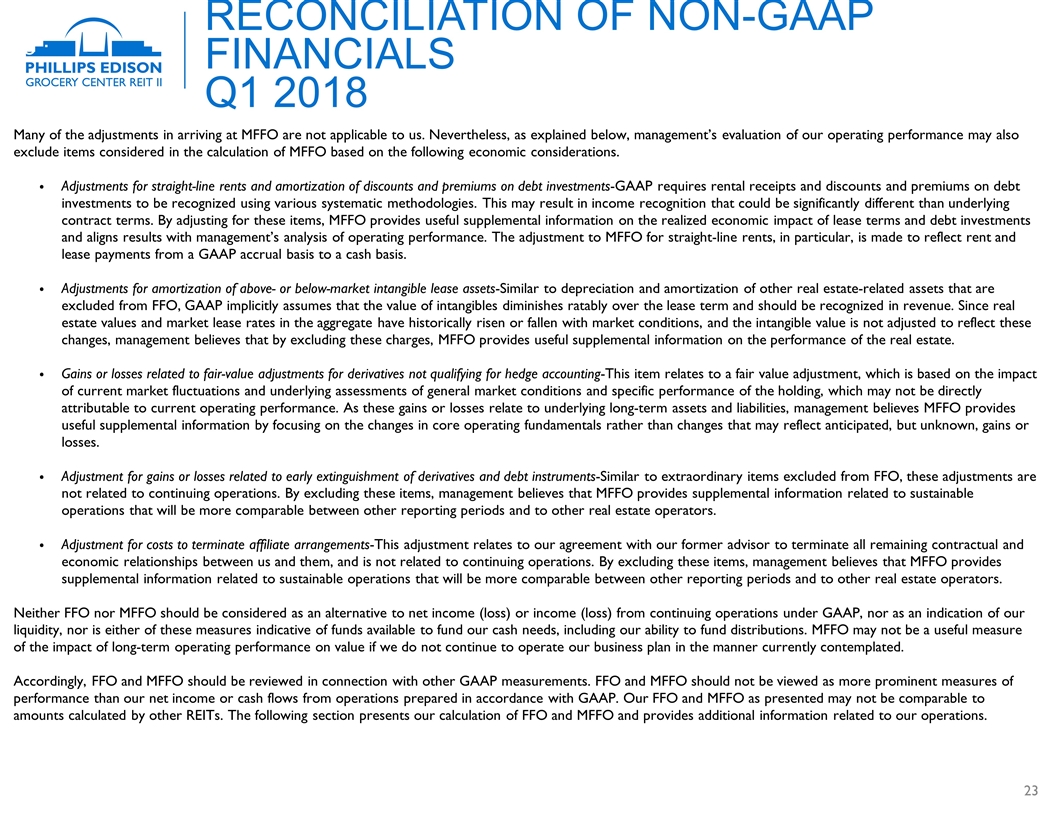

Reconciliation of Non-GAAP Financials Q1 2018 Many of the adjustments in arriving at MFFO are not applicable to us. Nevertheless, as explained below, management’s evaluation of our operating performance may also exclude items considered in the calculation of MFFO based on the following economic considerations. Adjustments for straight-line rents and amortization of discounts and premiums on debt investments-GAAP requires rental receipts and discounts and premiums on debt investments to be recognized using various systematic methodologies. This may result in income recognition that could be significantly different than underlying contract terms. By adjusting for these items, MFFO provides useful supplemental information on the realized economic impact of lease terms and debt investments and aligns results with management’s analysis of operating performance. The adjustment to MFFO for straight-line rents, in particular, is made to reflect rent and lease payments from a GAAP accrual basis to a cash basis. Adjustments for amortization of above- or below-market intangible lease assets-Similar to depreciation and amortization of other real estate-related assets that are excluded from FFO, GAAP implicitly assumes that the value of intangibles diminishes ratably over the lease term and should be recognized in revenue. Since real estate values and market lease rates in the aggregate have historically risen or fallen with market conditions, and the intangible value is not adjusted to reflect these changes, management believes that by excluding these charges, MFFO provides useful supplemental information on the performance of the real estate. Gains or losses related to fair-value adjustments for derivatives not qualifying for hedge accounting-This item relates to a fair value adjustment, which is based on the impact of current market fluctuations and underlying assessments of general market conditions and specific performance of the holding, which may not be directly attributable to current operating performance. As these gains or losses relate to underlying long-term assets and liabilities, management believes MFFO provides useful supplemental information by focusing on the changes in core operating fundamentals rather than changes that may reflect anticipated, but unknown, gains or losses. Adjustment for gains or losses related to early extinguishment of derivatives and debt instruments-Similar to extraordinary items excluded from FFO, these adjustments are not related to continuing operations. By excluding these items, management believes that MFFO provides supplemental information related to sustainable operations that will be more comparable between other reporting periods and to other real estate operators. Adjustment for costs to terminate affiliate arrangements-This adjustment relates to our agreement with our former advisor to terminate all remaining contractual and economic relationships between us and them, and is not related to continuing operations. By excluding these items, management believes that MFFO provides supplemental information related to sustainable operations that will be more comparable between other reporting periods and to other real estate operators. Neither FFO nor MFFO should be considered as an alternative to net income (loss) or income (loss) from continuing operations under GAAP, nor as an indication of our liquidity, nor is either of these measures indicative of funds available to fund our cash needs, including our ability to fund distributions. MFFO may not be a useful measure of the impact of long-term operating performance on value if we do not continue to operate our business plan in the manner currently contemplated. Accordingly, FFO and MFFO should be reviewed in connection with other GAAP measurements. FFO and MFFO should not be viewed as more prominent measures of performance than our net income or cash flows from operations prepared in accordance with GAAP. Our FFO and MFFO as presented may not be comparable to amounts calculated by other REITs. The following section presents our calculation of FFO and MFFO and provides additional information related to our operations.

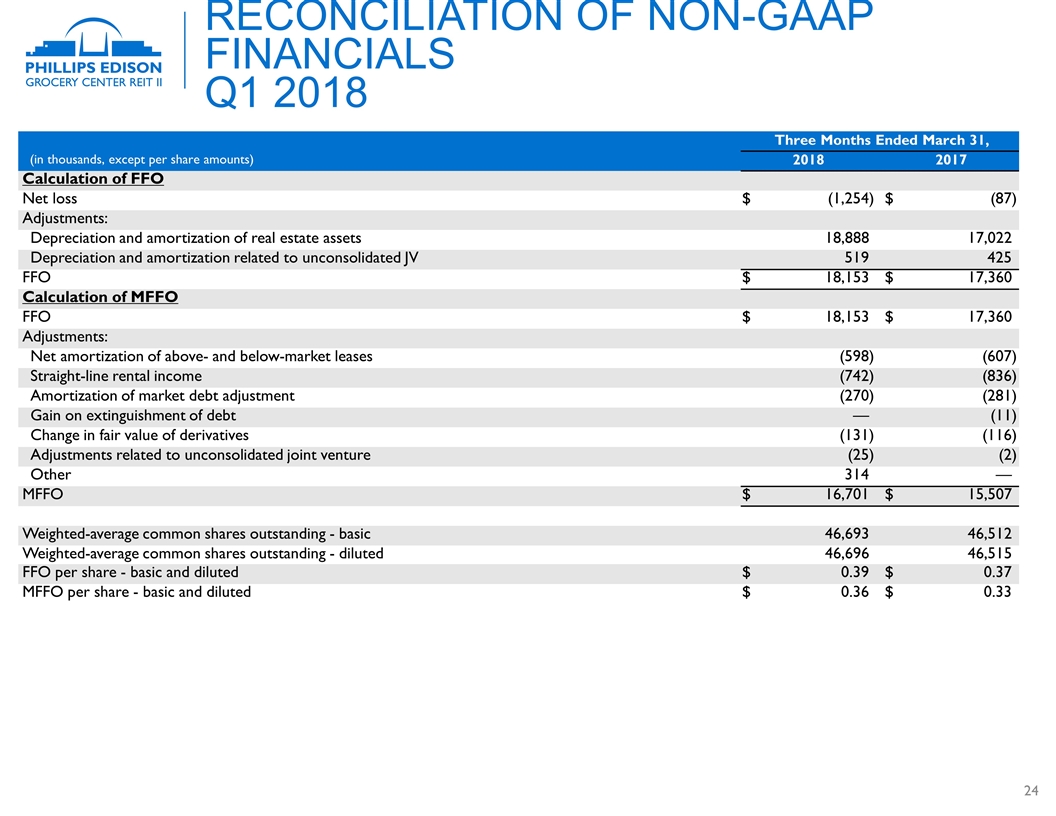

Reconciliation of Non-GAAP Financials Q1 2018 Three Months Ended March 31, Three Months Ended March 31, (in thousands, except per share amounts) 2018 2018 2017 2017 Calculation of FFO Net loss $ (1,254 ) $ (87 ) Adjustments: Depreciation and amortization of real estate assets 18,888 17,022 Depreciation and amortization related to unconsolidated JV 519 425 FFO $ 18,153 $ 17,360 Calculation of MFFO FFO $ 18,153 $ 17,360 Adjustments: Net amortization of above- and below-market leases (598 ) (607 ) Straight-line rental income (742 ) (836 ) Amortization of market debt adjustment (270 ) (281 ) Gain on extinguishment of debt — (11 ) Change in fair value of derivatives (131 ) (116 ) Adjustments related to unconsolidated joint venture (25 ) (2 ) Other 314 — MFFO $ 16,701 $ 15,507 Weighted-average common shares outstanding - basic 46,693 46,512 Weighted-average common shares outstanding - diluted 46,696 46,515 FFO per share - basic and diluted $ 0.39 $ 0.37 MFFO per share - basic and diluted $ 0.36 $ 0.33

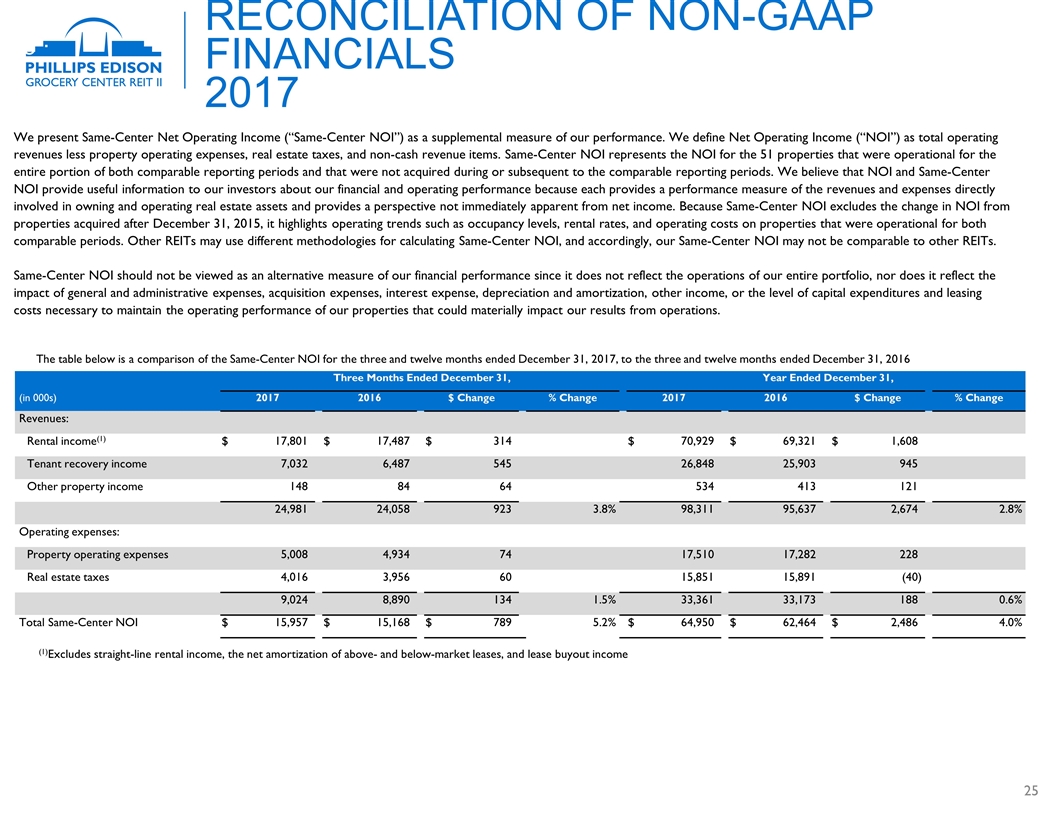

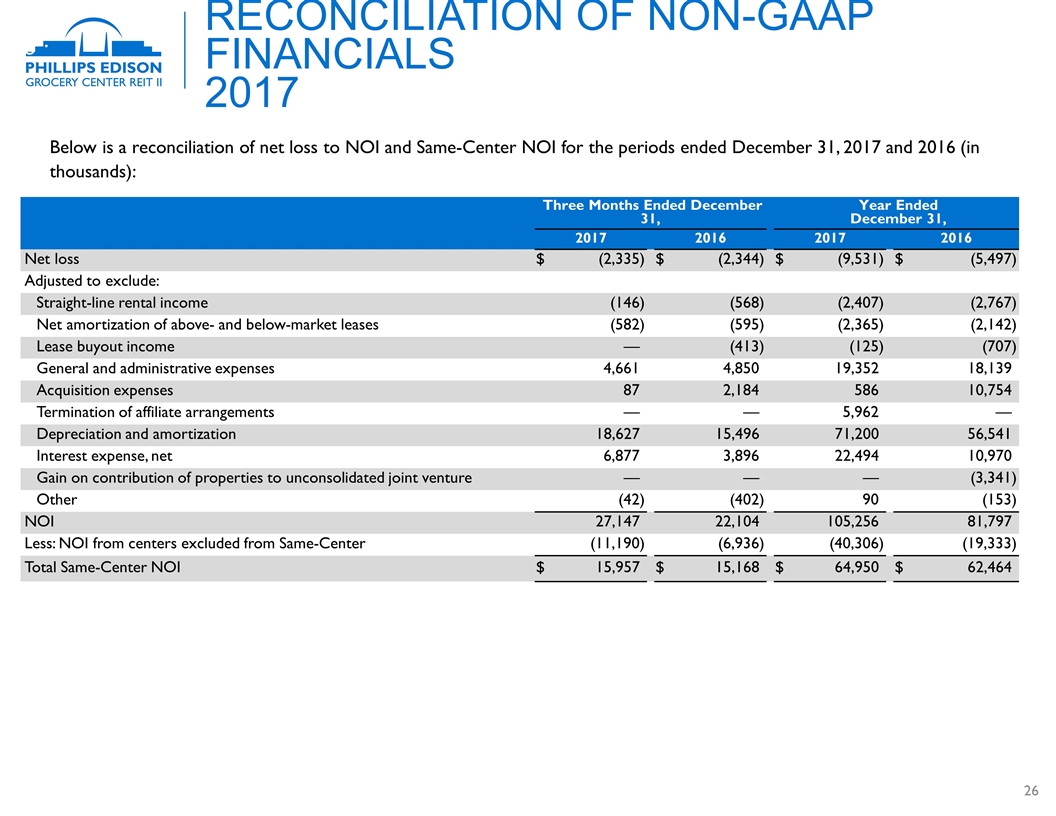

Reconciliation of Non-GAAP Financials 2017 We present Same-Center Net Operating Income (“Same-Center NOI”) as a supplemental measure of our performance. We define Net Operating Income (“NOI”) as total operating revenues less property operating expenses, real estate taxes, and non-cash revenue items. Same-Center NOI represents the NOI for the 51 properties that were operational for the entire portion of both comparable reporting periods and that were not acquired during or subsequent to the comparable reporting periods. We believe that NOI and Same-Center NOI provide useful information to our investors about our financial and operating performance because each provides a performance measure of the revenues and expenses directly involved in owning and operating real estate assets and provides a perspective not immediately apparent from net income. Because Same-Center NOI excludes the change in NOI from properties acquired after December 31, 2015, it highlights operating trends such as occupancy levels, rental rates, and operating costs on properties that were operational for both comparable periods. Other REITs may use different methodologies for calculating Same-Center NOI, and accordingly, our Same-Center NOI may not be comparable to other REITs. Same-Center NOI should not be viewed as an alternative measure of our financial performance since it does not reflect the operations of our entire portfolio, nor does it reflect the impact of general and administrative expenses, acquisition expenses, interest expense, depreciation and amortization, other income, or the level of capital expenditures and leasing costs necessary to maintain the operating performance of our properties that could materially impact our results from operations. The table below is a comparison of the Same-Center NOI for the three and twelve months ended December 31, 2017, to the three and twelve months ended December 31, 2016 Three Months Ended December 31, Three Months Ended December 31, Year Ended December 31, Year Ended December 31, (in 000s) 2017 2017 2016 2016 $ Change $ Change % Change 2017 2017 2016 2016 $ Change $ Change % Change Revenues: Rental income(1) $ 17,801 $ 17,487 $ 314 $ 70,929 $ 69,321 $ 1,608 Tenant recovery income 7,032 6,487 545 26,848 25,903 945 Other property income 148 84 64 534 413 121 24,981 24,058 923 3.8 % 98,311 95,637 2,674 2.8 % Operating expenses: Property operating expenses 5,008 4,934 74 17,510 17,282 228 Real estate taxes 4,016 3,956 60 15,851 15,891 (40 ) 9,024 8,890 134 1.5 % 33,361 33,173 188 0.6 % Total Same-Center NOI $ 15,957 $ 15,168 $ 789 5.2 % $ 64,950 $ 62,464 $ 2,486 4.0 % (1)Excludes straight-line rental income, the net amortization of above- and below-market leases, and lease buyout income

Reconciliation of Non-GAAP Financials 2017 Three Months Ended December 31, Three Months Ended December 31, Year Ended December 31, Year Ended December 31, 2017 2017 2016 2016 2017 2017 2016 2016 Net loss $ (2,335 ) $ (2,344 ) $ (9,531 ) $ (5,497 ) Adjusted to exclude: Straight-line rental income (146 ) (568 ) (2,407 ) (2,767 ) Net amortization of above- and below-market leases (582 ) (595 ) (2,365 ) (2,142 ) Lease buyout income — (413 ) (125 ) (707 ) General and administrative expenses 4,661 4,850 19,352 18,139 Acquisition expenses 87 2,184 586 10,754 Termination of affiliate arrangements — — 5,962 — Depreciation and amortization 18,627 15,496 71,200 56,541 Interest expense, net 6,877 3,896 22,494 10,970 Gain on contribution of properties to unconsolidated joint venture — — — (3,341 ) Other (42 ) (402 ) 90 (153 ) NOI 27,147 22,104 105,256 81,797 Less: NOI from centers excluded from Same-Center (11,190 ) (6,936 ) (40,306 ) (19,333 ) Total Same-Center NOI $ 15,957 $ 15,168 $ 64,950 $ 62,464 Below is a reconciliation of net loss to NOI and Same-Center NOI for the periods ended December 31, 2017 and 2016 (in thousands):

Funds from Operations and Modified Funds from Operations Funds from operations (“FFO”) is a non-GAAP performance financial measure that is widely recognized as a measure of REIT operating performance. We use FFO as defined by the National Association of Real Estate Investment Trusts (“NAREIT”) to be net income (loss), computed in accordance with GAAP excluding extraordinary items, as defined by GAAP, and gains (or losses) from sales of depreciable real estate property (including deemed sales and settlements of pre-existing relationships), plus depreciation and amortization on real estate assets and impairment charges, and after related adjustments for unconsolidated partnerships, joint ventures and noncontrolling interests. We believe that FFO is helpful to our investors and our management as a measure of operating performance because it, when compared year to year, reflects the impact on operations from trends in occupancy rates, rental rates, operating costs, development activities, general and administrative expenses, and interest costs, which are not immediately apparent from net income. Since the definition of FFO was promulgated by NAREIT, GAAP has expanded to include several new accounting pronouncements, such that management and many investors and analysts have considered the presentation of FFO alone to be insufficient. Accordingly, in addition to FFO, we use modified funds from operations (“MFFO”), which excludes from FFO the following items: acquisition expenses; straight-line rent amounts, both income and expense; amortization of above- or below-market intangible lease assets and liabilities; amortization of discounts and premiums on debt investments; gains or losses from the early extinguishment of debt; gains or losses on the extinguishment of derivatives, except where the trading of such instruments is a fundamental attribute of our operations; gains or losses related to fair-value adjustments for derivatives not qualifying for hedge accounting; gains or losses related to consolidation from, or deconsolidation to, equity accounting; adjustments related to the above items for unconsolidated entities in the application of equity accounting; and costs to terminate affiliate arrangements. We believe that MFFO is helpful in assisting management and investors with the assessment of the sustainability of operating performance in future periods and, in particular, after our acquisition stage is complete, because MFFO excludes acquisition expenses that affect operations only in the period in which the property is acquired. Thus, MFFO provides helpful information relevant to evaluating our operating performance in periods in which there is no acquisition activity. Reconciliation of Non-GAAP Financials 2017

Reconciliation of Non-GAAP Financials 2017 Many of the adjustments in arriving at MFFO are not applicable to us. Nevertheless, as explained below, management’s evaluation of our operating performance may also exclude items considered in the calculation of MFFO based on the following economic considerations. Adjustments for straight-line rents and amortization of discounts and premiums on debt investments-GAAP requires rental receipts and discounts and premiums on debt investments to be recognized using various systematic methodologies. This may result in income recognition that could be significantly different than underlying contract terms. By adjusting for these items, MFFO provides useful supplemental information on the realized economic impact of lease terms and debt investments and aligns results with management’s analysis of operating performance. The adjustment to MFFO for straight-line rents, in particular, is made to reflect rent and lease payments from a GAAP accrual basis to a cash basis. Adjustments for amortization of above- or below-market intangible lease assets-Similar to depreciation and amortization of other real estate-related assets that are excluded from FFO, GAAP implicitly assumes that the value of intangibles diminishes ratably over the lease term and should be recognized in revenue. Since real estate values and market lease rates in the aggregate have historically risen or fallen with market conditions, and the intangible value is not adjusted to reflect these changes, management believes that by excluding these charges, MFFO provides useful supplemental information on the performance of the real estate. Gains or losses related to fair-value adjustments for derivatives not qualifying for hedge accounting-This item relates to a fair value adjustment, which is based on the impact of current market fluctuations and underlying assessments of general market conditions and specific performance of the holding, which may not be directly attributable to current operating performance. As these gains or losses relate to underlying long-term assets and liabilities, management believes MFFO provides useful supplemental information by focusing on the changes in core operating fundamentals rather than changes that may reflect anticipated, but unknown, gains or losses. Adjustment for gains or losses related to early extinguishment of derivatives and debt instruments-Similar to extraordinary items excluded from FFO, these adjustments are not related to continuing operations. By excluding these items, management believes that MFFO provides supplemental information related to sustainable operations that will be more comparable between other reporting periods and to other real estate operators. Adjustment for costs to terminate affiliate arrangements-This adjustment relates to our agreement with our former advisor to terminate all remaining contractual and economic relationships between us and them, and is not related to continuing operations. By excluding these items, management believes that MFFO provides supplemental information related to sustainable operations that will be more comparable between other reporting periods and to other real estate operators. Neither FFO nor MFFO should be considered as an alternative to net income (loss) or income (loss) from continuing operations under GAAP, nor as an indication of our liquidity, nor is either of these measures indicative of funds available to fund our cash needs, including our ability to fund distributions. MFFO may not be a useful measure of the impact of long-term operating performance on value if we do not continue to operate our business plan in the manner currently contemplated. Accordingly, FFO and MFFO should be reviewed in connection with other GAAP measurements. FFO and MFFO should not be viewed as more prominent measures of performance than our net income or cash flows from operations prepared in accordance with GAAP. Our FFO and MFFO as presented may not be comparable to amounts calculated by other REITs. The following section presents our calculation of FFO and MFFO and provides additional information related to our operations.

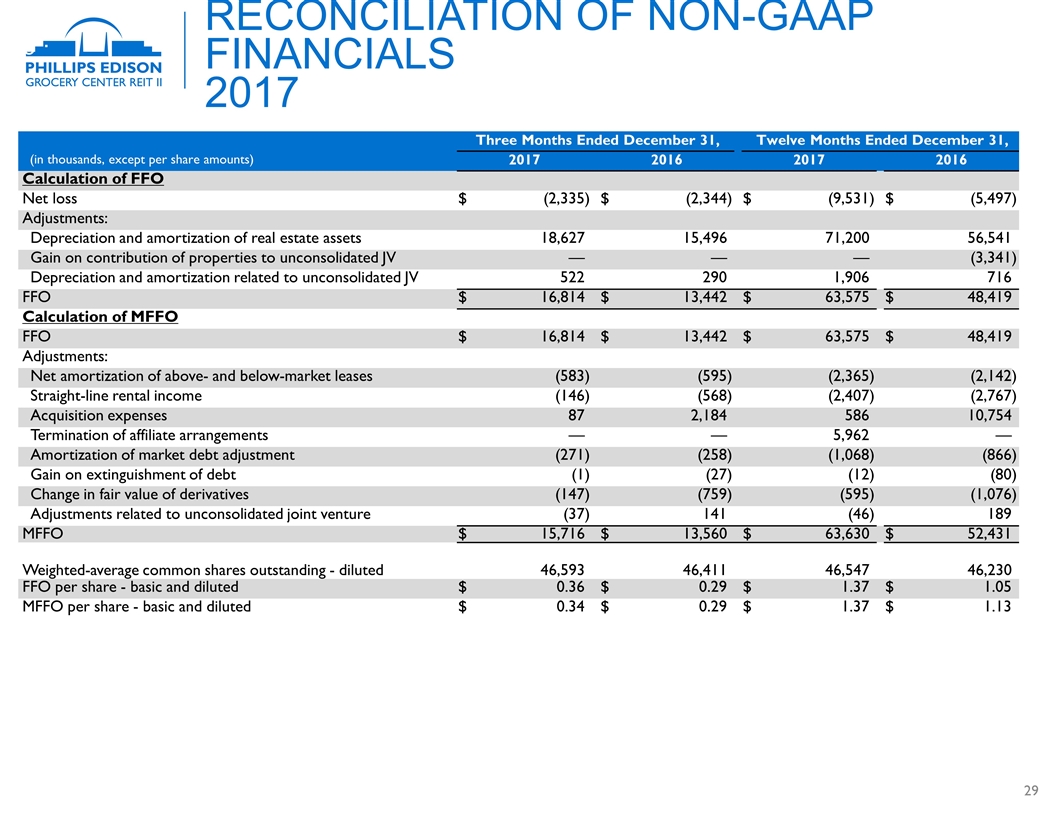

Reconciliation of Non-GAAP Financials 2017 Three Months Ended December 31, Three Months Ended December 31, Twelve Months Ended December 31, Twelve Months Ended December 31, (in thousands, except per share amounts) 2017 2017 2016 2016 2017 2017 2016 2016 Calculation of FFO Net loss $ (2,335 ) $ (2,344 ) $ (9,531 ) $ (5,497 ) Adjustments: Depreciation and amortization of real estate assets 18,627 15,496 71,200 56,541 Gain on contribution of properties to unconsolidated JV — — — (3,341 ) Depreciation and amortization related to unconsolidated JV 522 290 1,906 716 FFO $ 16,814 $ 13,442 $ 63,575 $ 48,419 Calculation of MFFO FFO $ 16,814 $ 13,442 $ 63,575 $ 48,419 Adjustments: Net amortization of above- and below-market leases (583 ) (595 ) (2,365 ) (2,142 ) Straight-line rental income (146 ) (568 ) (2,407 ) (2,767 ) Acquisition expenses 87 2,184 586 10,754 Termination of affiliate arrangements — — 5,962 — Amortization of market debt adjustment (271 ) (258 ) (1,068 ) (866 ) Gain on extinguishment of debt (1 ) (27 ) (12 ) (80 ) Change in fair value of derivatives (147 ) (759 ) (595 ) (1,076 ) Adjustments related to unconsolidated joint venture (37 ) 141 (46 ) 189 MFFO $ 15,716 $ 13,560 $ 63,630 $ 52,431 Weighted-average common shares outstanding - diluted 46,593 46,411 46,547 46,230 FFO per share - basic and diluted $ 0.36 $ 0.29 $ 1.37 $ 1.05 MFFO per share - basic and diluted $ 0.34 $ 0.29 $ 1.37 $ 1.13