______________________________________________________________________

SALE-PURCHASE AGREEMENT

between

AG/WP FAIRLAWN OWNER, L.L.C.,

a Delaware limited liability company,

Seller,

and

THE PHILLIPS EDISON GROUP LLC,

an Ohio limited liability company,

Purchaser.

Premises:

Fairlawn Town Centre

Fairlawn, Ohio

_____________________________________________________________________

TABLE OF CONTENTS

1 | Sale-Purchase | 1 |

2 | Purchase Price | 2 |

3 | Assignment of Sanborn Contract | 3 |

4 | Closing Date | 3 |

5 | Violations | 4 |

6 | Apportionments | 6 |

7 | Closing Documents | 11 |

8 | Title Insurance and Survey Matters | 13 |

9 | Disposition of Downpayment | 15 |

10 | Purchaser’s Default | 16 |

11 | Representations | 16 |

12 | Fixtures and Personal Property | 22 |

13 | Brokers | 22 |

14 | Condemnation and Destruction | 22 |

15 | Escrow | 24 |

16 | Closing Costs | 25 |

17 | Seller’s Covenants | 26 |

18 | Approval of Leases, Contracts | 27 |

19 | Non-Liability | 28 |

20 | Seller’s Default | 28 |

21 | Condition of Premises | 29 |

22 | Notices | 31 |

23 | Entire Agreement | 33 |

24 | Amendments | 33 |

25 | No Waiver | 33 |

26 | Successors and Assigns | 34 |

27 | Partial Invalidity | 35 |

28 | Paragraph Headings | 35 |

29 | Governing Law | 35 |

30 | Binding Effect | 35 |

31 | No Recording or Lis Pendens | 35 |

32 | Prevailing Party to Receive Attorneys’ Fees | 36 |

33 | Tax-Deferred Exchange | 36 |

34 | Confidentiality | 37 |

35 | Due Diligence Period | 37 |

36 | Estoppel Certificates | 38 |

37 | Survival | 41 |

38 | Arbitration of Matters in Dispute | 42 |

39 | Submission To Jurisdiction | 43 |

40 | Waiver Of Jury Trial | 43 |

41 | Certain Definitions | 43 |

42 | Determination of Estimated Calculations | 44 |

43 | No Third Party Beneficiaries | 44 |

44 | Time of Performance | 45 |

45 | Counterpart Execution; Execution by Facsimile Transmission/ PDF Format | 45 |

46 | Ambiguities Not Construed Against Drafter | 45 |

47 | No Special Relationship Between Seller and Purchaser | 45 |

48 | No Financing Contingency | 45 |

49 | Assumed Loan | 45 |

50 | Acknowledgement | 48 |

51 | Books and Records | 48 |

52 | Giant Eagle Contingency | 49 |

Exhibits

Exhibit Description

A Description of the Land

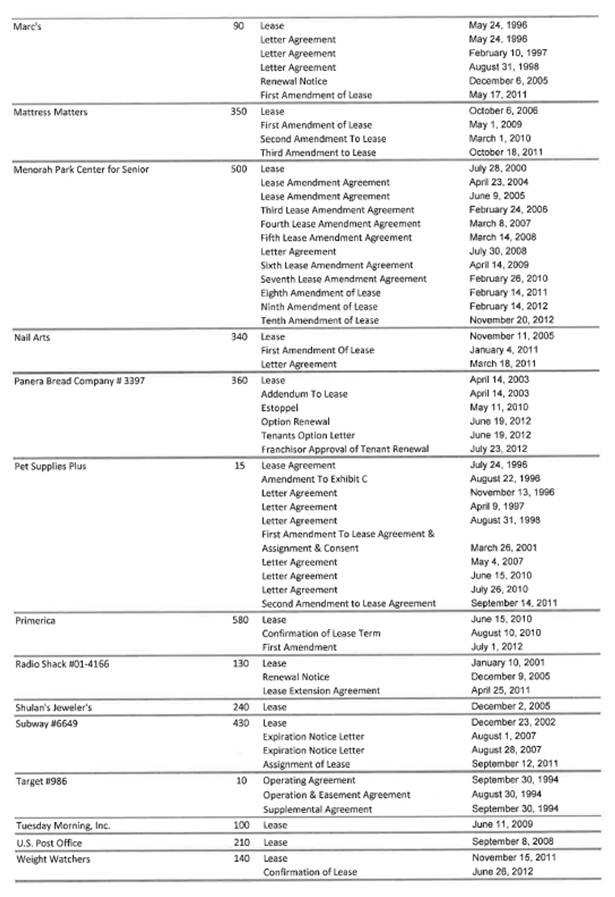

B Existing Leases

C Existing Contracts

D Existing Violations

E Form of Deed

F Form of Bill of Sale

G Form of Assignment and Assumption of Leases

H Form of Assignment and Assumption of Contract

I Form of Assignment and Assumption of Intangible Property

J Form of FIRPTA Certification

K Form of Notice to Tenants

L Form of Notice to Contract Party

M Form of Assignment and Assumption of O&M Plan Documents

N Notice of O&M Plan Documents Transfer

O Owner’s Title Affidavit

P Existing Title/Survey Matters

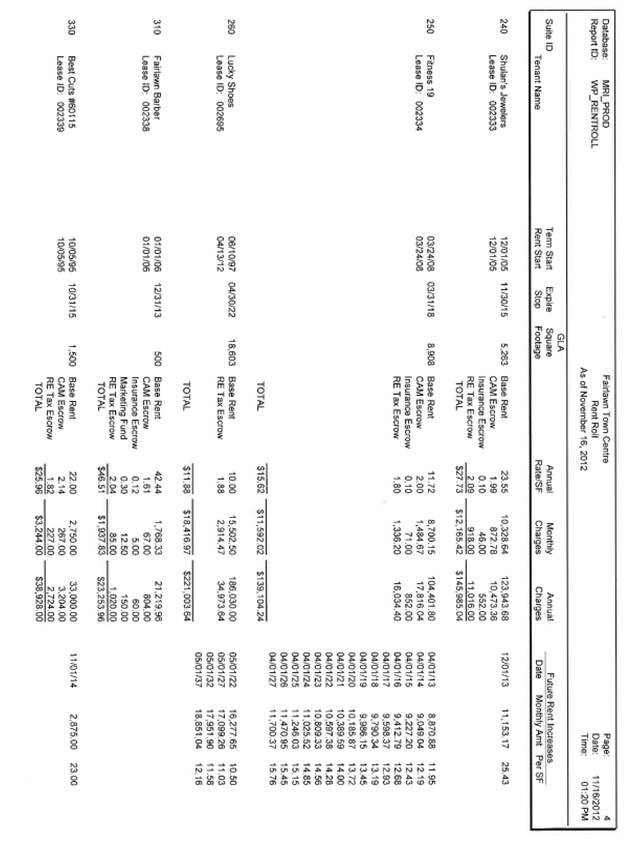

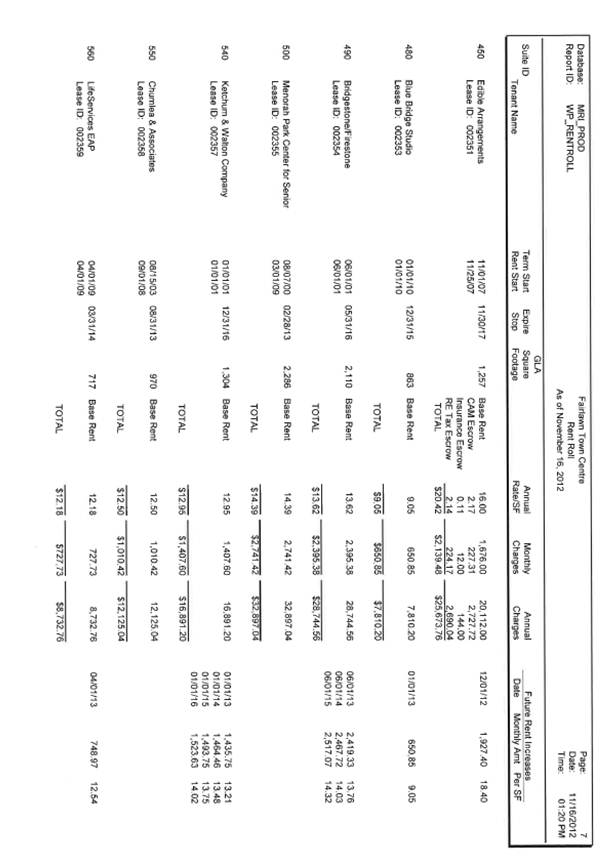

Q Rent Roll

R List of Material Litigation

S Environmental Reports

T Existing Work Required Under Leases/Outstanding Leasing Costs

U Reserved.

V O&M Plan Documents

W List of Required Estoppels

X Form of Seller Estoppel Certificate

Y Form of Tenant Estoppel Certificate

SALE-PURCHASE AGREEMENT

THIS SALE-PURCHASE AGREEMENT (this “Agreement”), is made as of this 13th day of December, 2012 (the “Effective Date”), between AG/WP FAIRLAWN OWNER, L.L.C., a limited liability company organized under the laws of the State of Delaware, having an office at c/o Angelo, Gordon & Co., L.P., 245 Park Avenue, 26th Floor, New York, New York 10167 (“Seller”), and THE PHILLIPS EDISON GROUP LLC, a limited liability company organized under the laws of the State of Ohio, having an office at 1150 North Lake Drive, Cincinnati, Ohio 45249 (“Purchaser”).

W I T N E S S E T H:

WHEREAS, Seller is the owner of the Premises (as hereinafter defined); and

WHEREAS, Seller desires to sell, and Purchaser desires to purchase, the Premises, on the terms and conditions set forth herein.

NOW, THEREFORE, in consideration of the mutual covenants and agreements hereinafter set forth, and for other good and valuable consideration, the mutual receipt and legal sufficiency of which are hereby acknowledged, Seller and Purchaser hereby agree as follows:

1.1. Seller agrees to sell and convey to Purchaser, and Purchaser agrees to purchase from Seller, upon the terms and conditions hereinafter set forth, the following (collectively, the “Premises”):

(a) all that certain plot, piece and parcel of land located in the City of Fairlawn, County of Summit and the State of Ohio, described in Exhibit A attached hereto and made a part hereof, together with all easements, rights of way, privileges, appurtenances and other rights, if any, pertaining thereto (the “Land”);

(b) all buildings, structures and improvements located on the Land and all of Seller’s right, title and interest in and to any and all fixtures attached thereto (collectively, the “Improvements”);

(c) all equipment, machinery, apparatus, appliances, and other articles of personal property located on and used in connection with the operation of the Improvements (collectively, the “Personal Property”), to the extent any of same are owned by Seller;

(d) all of Seller’s right, title and interest in and to the Sanborn Contract (as such capitalized term is hereinafter defined);

(e) to the extent assignable and subject to the terms hereof, all licenses, franchises, permits, certificates of occupancy, authorizations and approvals used in or relating to the ownership, occupancy or operation of any part of the Improvements (the “Permits”);

(f) all of Seller’s right, title and interest in and to the leases and occupancy agreements described on Exhibit B attached hereto and made a part hereof (as amended, modified, renewed or extended as of the Effective Date, the “Existing Leases”), and all Approved Lease Amendments and Approved New Leases (as such capitalized terms are hereinafter defined) (the Existing Leases, the Approved Lease Amendments and the Approved New Leases are referred to herein, collectively, as the “Leases”);

(g) to the extent assignable and subject to the terms hereof, all of the interest of Seller in any and all rights, warranties and guaranties pertaining to the Land, Improvements, Personal Property, the Sanborn Contract, Permits and Leases (collectively the “Intangible Property”); and

(h) all of Seller’s right, title and interest in and to the documents and other materials listed in Exhibit V (collectively, the “O&M Plan Documents”);

(i) to the extent assignable, all of Seller’s right, title and interest in and to the name “Fairlawn Town Centre” as it relates to the Premises.

Subject to the terms of this Agreement, including, without limitation, Section 49 below, the purchase price for the Premises (the “Purchase Price”) is Forty-Two Million and 00/100 Dollars ($42,000,000), payable as follows:

2.1. Within one (1) Business Day after the Effective Date , Purchaser shall deliver the amount of Two Hundred Thousand and 00/100 Dollars ($200,000) (the “Initial Deposit”), by wire transfer of immediately available federal funds to the order of [Land Services USA, Inc.] (in such capacity, the “Escrow Agent”), which Initial Deposit shall be held by Escrow Agent in escrow pursuant to the provisions of Section 15 of this Agreement. If the Initial Deposit is not received by the Escrow Agent within such one (1) Business Day period, this Agreement shall automatically terminate.

2.2. In the event Purchaser does not terminate this Agreement at the expiration of the Due Diligence Period (as hereinafter defined) pursuant to Section 35 of this Agreement, Purchaser shall, on or prior to one (1) Business Day after the expiration of the Due Diligence Period, deliver the amount of Four Hundred Thousand and 00/100 Dollars ($400,000) (the “Additional Deposit”) by wire transfer of immediately available federal funds to the order of Escrow Agent. As used herein, (a) “Deposit” shall mean the Initial Deposit, together with the Additional Deposit (to the extent same is deposited with Escrow Agent pursuant to the provisions of Section 35 below) and (b) “Downpayment” shall mean the Deposit together with all interest thereon.

2.3 Purchaser acknowledges and agrees that time shall be of the essence with respect to Purchaser’s obligation to deliver the Initial Deposit and the Additional Deposit. The Downpayment shall automatically become nonrefundable upon the expiration of the Due Diligence Period, unless Purchaser terminates (or is deemed to have terminated) this Agreement in accordance with the express provisions of this Agreement and Purchaser is entitled to the return of the Downpayment in accordance with the express provisions of Section 9 of this Agreement or as otherwise expressly provided in this Agreement.

2.4. An amount equal to the Purchase Price less the Downpayment on the Closing Date (as hereinafter defined), as adjusted for prorations and apportionments as herein provided, by wire transfer of immediately available federal funds to an account or accounts designated by Seller (such funds, the “Closing Funds”); provided, however, solely in the event that Purchaser assumes the Assumed Loan (as hereinafter defined) pursuant to Section 49 below, an amount equal to the outstanding principal balance of the Assumed Loan (the “Assumed Loan Balance”) on the Closing Date shall be subtracted from the Purchase Price. In the event that the Closing Funds are not received on or before 3:00 P.M. (New York time) on the Closing Date, then Purchaser shall be deemed to have defaulted under this Agreement.

2

3. Assignment of Sanborn Contract.

3.1. Purchaser acknowledges that Seller has disclosed to it that the Premises is subject to the contracts and agreements described on Exhibit C attached hereto and made a part hereof (as amended, modified, renewed or extended as of the Effective Date, the “Existing Contracts”). Seller shall terminate all Existing Contract at Closing at Seller’s expense, in which event Seller shall indemnify Purchaser from any damage, cost or liability (including, without limitation, reasonable attorneys’ fees and costs of enforcing the foregoing indemnity) arising from such termination; provided, however, at Closing, except as provided in Section 3.2 below, Seller shall assign to Purchaser and Purchaser shall assume that certain Proposal for Continued Operation, Maintenance, and Monitoring Services, Addendum #1 – from June 2012 through May 2013, dated as of June 27, 2012, by and between Sanborn, Head & Associates, Inc., as consultant, and Seller, as client, which is subject to those certain Terms and Conditions, dated as of May 4, 2010 (the “Sanborn Contract”).

3.2. If the Sanborn Contract is not assignable by its terms and the required consent to the assignment thereof is not obtained by the Closing Date, then the parties shall nevertheless proceed to Closing and Seller shall terminate the Sanborn Contract at Closing at Seller’s expense, in which event Seller shall indemnify Purchaser from any damage, cost or liability (including, without limitation, reasonable attorneys’ fees and costs of enforcing the foregoing indemnity) arising from such termination. Purchaser agrees that the failure of Seller to obtain any such consent to assignment of the Sanborn Contract shall not constitute a default by Seller hereunder, constitute a failure of condition precedent in favor of Purchaser or grant Purchaser any right or remedy.

4. Closing Date.

4.1. The consummation of the transactions contemplated hereby (the “Closing”), shall take place through escrow at the offices of the Escrow Agent, on the date that is fifteen (15) days after the expiration of the Due Diligence Period (unless an earlier date is agreed to by Seller and Purchaser in writing) (the “Initial Scheduled Closing Date”).

4.2. Notwithstanding the foregoing provisions of this Section 4, (A) Purchaser shall have the one-time right to cause the Initial Scheduled Closing Date to be adjourned for a period of up to fifteen (15) days by delivering Seller written notice of such election at least one (1) Business Day prior to the Initial Scheduled Closing Date (such date, the “Purchaser Adjourned Closing Date”) in order (i) to allow the Purchaser to satisfy the Loan Assumption Condition (as hereinafter defined) (it being agreed that if Purchaser extends pursuant to this clause (i) it shall use good faith efforts to cause the satisfaction of the Loan Assumption Condition on or before the Purchaser Adjourned Closing Date) and/or (ii) in the event that the Estoppel Condition (as such term is hereinafter defined) has not been satisfied on or before five (5) days prior to the Initial Scheduled Closing Date (but only to the extent Seller does not elect to extend the Initial Scheduled Closing Date in accordance with its rights under this Agreement in order to continue to cause the Estoppel Condition to be satisfied), and (B) in the event the Purchaser reasonably determines that the Loan Assumption Condition will not be satisfied by the Initial Scheduled Closing Date (or, if the Purchaser has previously adjourned the Initial Closing Date to the Purchaser Adjourned Closing Date, then by Purchaser Adjourned Closing Date), then Purchaser shall have the one-time right to cause the Initial Scheduled Closing Date or the Purchaser Adjourned Closing Date, as applicable, to be adjourned for a period of up to fifteen (15) days by delivering Seller written notice of such election at least one (1) Business Day prior to the Initial Scheduled Closing Date or the Purchaser Adjourned Closing Date, as applicable (such date, the “Purchaser Adjourned Closing Date II”). For the avoidance of doubt, (x) Purchaser shall not have the right to adjourn the Closing for any reason other than for the specific reason set forth in this Section 4.2, and (y) if Purchaser elects to exercise its rights to adjourn the Closing under Section 4.2(B) above, it shall be deemed to waive any rights to adjourn the Closing under Section

3

4.2(A)(i) above, but Purchaser shall continue to have its right to adjourn the Closing under Section 4.2(A)(ii) above in event that the Estoppel Condition has not been satisfied on or before five (5) days prior to the Purchaser Adjourned Closing Date II (but only to the extent Seller does not elect to extend the Purchaser Adjourned Closing Date II in accordance with its rights under this Agreement in order to continue to cause the Estoppel Condition to be satisfied), and (z) in no event shall Purchaser have the right to adjourn the Closing for more than thirty (30) days in the aggregate (as expressly provided in this Section 4.2).

4.3. Notwithstanding the foregoing provisions of this Section 4, Seller shall have the right, by delivering notice to Purchaser on or before the then scheduled Closing Date, to adjourn the Closing one or more times for any reason specified in this Agreement (including, without limitation, to cure title matters and/or to obtain consents and approvals of third parties as herein specified) and for the time period specified in this Agreement (but in no event for more than forty-five (45) days in aggregate) to a date specified by Seller in such notice (any date to which Seller so adjourns the Closing pursuant to this Section 4.3 being referred to herein as a “Seller Adjourned Closing Date”).

4.4. As used herein, the term “Closing Date” shall mean the Initial Scheduled Closing Date, the Purchaser Adjourned Closing Date, the Purchaser Adjourned Closing Date II or, if the Closing is adjourned by Seller, any Seller Adjourned Closing Date. It is expressly agreed by Seller and Purchaser that time is of the essence with respect to Purchaser’s and Seller’s obligation to close this transaction on the Closing Date. For the avoidance of doubt, Purchaser acknowledges that if Seller adjourns the Closing Date pursuant to any right of adjournment granted hereunder, then time shall be of the essence with respect to Purchaser’s and Seller’s obligation to close this transaction on such adjourned Closing Date.

Purchaser shall accept title to the Premises subject to all violations of law or municipal ordinances, orders or requirements issued by the departments of buildings, fire, labor, health or other federal, state, county, municipal or other departments and governmental agencies having jurisdiction against or affecting the Premises, and any outstanding work orders, whether outstanding as of the Effective Date or noticed at any time on or before the expiration of the Due Diligence Period (each, an “Existing Violation”). Any violation that is noticed (i.e., issued by the applicable governmental authority) after the expiration of the Due Diligence Period is referred to herein as a “New Violation”. The Existing Violations and the New Violations are referred to herein, collectively, as the “Violations”. To the extent that the Seller receives written notice of any New Violation between the Effective Date and the Closing Date, Seller shall deliver to Purchaser written notice of such New Violation on or before the earlier of one (1) day prior to the Closing Date or five (5) days after it becomes aware of the existence of any New Violation. Purchaser and Seller agree that the following shall apply in respect of any Violation:

(a) In respect of Existing Violations, Seller shall have no restoration, repair or other obligation or liability of any kind or nature with respect thereto and Purchaser shall be required to take title to the Premises without adjustment of the Purchase Price. Without limiting the generality of the foregoing, and notwithstanding anything to the contrary contained in this Agreement, Seller shall have no obligation to obtain, update or modify any certificate of occupancy for all or any portion of the Premises, nor shall it be a condition to Purchaser’s obligation to close title hereunder that Seller obtain, update or modify any such certificate of occupancy.

(b) In respect of New Violations:

(i) Purchaser shall deliver notice to Seller (“Purchaser’s Violations Notice”) on or before the earlier of one (1) day prior to the Closing Date or five (5) days after it becomes aware of the existence

4

of any New Violation (it being acknowledged and agreed by Purchaser that Purchaser’s failure to deliver Purchaser’s Violations Notice within such time period shall be deemed to be (x) Purchaser’s waiver of any rights under this Section 5(b) and (y) Purchaser’s agreement to take title to the Premises subject to such New Violation(s) without adjustment of the Purchase Price).

(ii) Within five (5) Business Days after Seller receives Purchaser’s Violations Notice (and if the expiration of such five (5) Business Day period is after the Closing Date, then, at the option of Seller, the Closing shall be adjourned to the date three (3) Business Days after the expiration of such five (5) Business Day period), Seller shall deliver notice to Purchaser (“Seller’s Violations Response Notice”) stating either (x) that Seller agrees, at Seller’s sole option, to (A) cure such New Violation prior to the Closing, (B) credit Purchaser at Closing against the Purchase Price in an amount equal to the reasonably estimated cost of curing same (it being agreed that if there is a dispute as to the amount of the credit under this clause (B) then the provisions of Section 42 of this Agreement shall apply) or (C) credit Purchaser at Closing against the Purchase Price an amount equal to the reasonably estimated diminution in value to the Premises caused by such New Violation (it being agreed that if there is a dispute as to the amount of the credit under this clause (C) then the provisions of Section 42 of this Agreement shall apply), or (y) that Seller does not elect to cure such New Violation or grant Purchaser such credit against the Purchase Price. Seller’s failure to deliver Seller’s Violations Response Notice within such five (5) Business Day period shall be deemed to be Seller’s election under clause (y) at 5:00 p.m. (New York time) on the last day of such five (5) Business Day period. In the event that Seller’s reasonably estimated cost of curing any such New Violation (when aggregated with any other New Violations properly noticed by Purchaser to Seller pursuant to the terms of this Agreement) is less than $75,000, then Seller shall be required to make Seller’s election under clause (x).

(iii) If, in Seller’s Violations Response Notice, Seller makes (or is required to make) the election under clause (x) of Section 5(b)(ii) above, then Seller shall, at Seller’s sole option, either cause the applicable New Violation to be cured prior to the Closing (and Seller shall be entitled to adjourn the Closing one or more times (but for not more than twenty (20) days in the aggregate) to effectuate such cure) or grant Purchaser a credit against the Purchase Price at Closing pursuant to either subclause (B) or (C) of Section 5(b)(ii)(x) above (it being agreed that if there is a dispute as to the amount of such credit under this Section 5(b)(iii), then the provisions of Section 42 of this Agreement shall apply). If Seller agrees to cure a New Violation as aforesaid and thereafter fails so to do within the above time period, then the Closing shall take place and Seller shall grant Purchaser the foregoing credit against the Purchase Price. If, in Seller’s Violations Response Notice, Seller makes (or is deemed to have made) the election under clause (y) of Section 5(b)(ii) above, then by the earlier of one (1) day prior to the Closing Date (as it may have been adjourned by Seller pursuant to Section 5(b)(ii) above, or five (5) days after Purchaser receives Seller’s Violations Response Notice making such election, Purchaser shall deliver notice to Seller (“Purchaser’s Violations Response Notice”) stating either (x) that Purchaser elects to accept title to the Premises subject to the applicable New Violation without adjustment of the Purchase Price, in which event the Closing hereunder shall occur without any further obligation of Seller under this Section 5, or (y) that Purchaser elects to terminate this Agreement, in which event the provisions of Section 9 of this Agreement shall apply to such termination (and if Purchaser fails to deliver any such notice on or before the expiration of such five (5) days period, Purchaser shall be deemed to have elected to proceed under clause (y) above).

(iv)Without limiting the generality of the foregoing provisions of this Section 5, in the event that Purchaser takes title to the Premises without raising any objection to any New Violation in accordance with the provisions of this Section 5, same shall constitute a complete waiver of any right Purchaser may have to object to such New Violation or to make any claim against Seller on account thereof and any such claim is hereby waived by Purchaser.

5

(c) Purchaser shall not, without first obtaining the prior written consent of Seller, request that any governmental authority inspect or otherwise evaluate the condition of the Premises in respect of the existence of Violations, provided that the foregoing shall not prohibit Purchaser from making customary inquiries of governmental authorities as to whether Violations have been noticed by any such governmental authorities (it being agreed that such customary inquiries shall expressly permit Purchaser to request a zoning compliance letter from the applicable governmental authorities).

(d) Purchaser (i) acknowledges that Seller has disclosed to Purchaser and/or Purchaser is otherwise aware of the existence of the matters listed on Exhibit D attached hereto and made a part hereof, (ii) agrees that same constitute Existing Violations for purposes of this Section 5, and (iii) acknowledges that, except as set forth in Section 11.1, Seller has not made any representation regarding such Existing Violations nor made any representation that such matters constitute all Existing Violations.

6.1. The following are to be apportioned as of the Closing Date:

(i) Real property taxes and assessments (including, without limitation, any assessments relating to Permitted Title/Survey Exceptions (as hereinafter defined), business improvement district assessments or similar charges), water rates and charges, and sewer taxes, in each case, not otherwise payable directly to the taxing authority by any tenant under a Lease. Seller and Purchaser each agree to deliver to the other, as appropriate, the required portion of any funds received by Seller or Purchaser, as the case may be, in order to effectuate the foregoing.

(ii) Fixed, escalation, additional and percentage rent, parking charges and all other charges under the Leases (including, without limitation, electricity and utility surcharges, administrative fees in connection with security deposits held by Seller under the Leases), if, as and when collected in accordance with Section 6.6 of this Agreement (all of the foregoing being collectively referred to as “Rents”).

(iii) Charges under the Sanborn Contract.

(iv) To the extent that Purchaser assumes the Assumed Loan, interest payable under the Assumed Loan.

(v) All other items customarily apportioned in connection with the sale of similar properties similarly located.

The parties acknowledge agree that to the extent that any deposits made by Seller on account with utility companies servicing the Premises are returned to Seller on or before the Closing Date, Purchaser shall provide Purchaser’s own utility deposits directly to the applicable utility companies; provided, however, in the event that that Seller is not able to obtain such refunds on or before the Closing Date, then Seller shall receive a credit at Closing in the amounts of such unreturned deposits (and Seller and Purchaser each agrees to cooperate to effectuate the transfer of any such unreturned deposits); provided, further, however, if after the Closing Date the Seller actually receives any portion of such unreturned deposit for which Seller was given a credit at Closing, then Seller shall promptly remit such portion to Purchaser.

6.2. If the real property taxes and assessments (including, without limitation, any assessments relating to Permitted Title/Survey Matters, business improvement district assessments or similar charges), water rates and charges, and sewer taxes, in each case, not otherwise payable directly to the taxing authority by any tenant under a Lease are not finally fixed before the Closing Date, the

apportionments thereof made at the Closing shall be based on the real property taxes and assessments assessed and reflected in the most recently issued tax duplicate, or on estimated water and sewer charges (and the parties acknowledge and agree that notwithstanding anything to the contrary contained in this Agreement, including, without limitation, Section 6.11 below, or any Seller Document, such prorations made at the Closing shall be final and shall not be subject to any recalculation after the Closing Date regardless of the final fixed amounts of the real property taxes, assessments and/or water and sewer charges obtained after the Closing Date).

6.3. (i) If the Premises or any part thereof shall be or shall have been affected by any bond or special assessment prior to the Closing Date, such bond or special assessment due and relating to the period of time prior to the Closing Date shall be paid by Seller and such bond or special assessment due or relating to the period of time from and after the Closing Date shall be paid by Purchaser. If any bond or special assessment on the Premises is payable in installments, then the installment for the current period shall be prorated (with Purchaser assuming the obligation to pay any installments due from and after the Closing Date) (it being agreed that if there is a dispute as to the obligations of the parties under this Section 6.3(i), then the provisions of Section 42 of this Agreement shall apply).

(ii) If the Premises or any part thereof shall be or shall have been affected by any bond or special assessment on or subsequent to the Closing Date, whether or not payable in annual installments, the entire amount of such assessment shall be paid by Purchaser.

6.4. If there are any water meters on the Premises (other than meters measuring water consumption costs which are the obligation of tenants to pay under Leases), Seller shall furnish readings, and the unfixed water rates and charges and sewer taxes and rents, if any, based thereon for the intervening time, shall be apportioned on the basis of such last readings. If there is any fuel on hand, Seller shall furnish a reading, and the unfixed charges for such fuel, for the period from the date of such reading until the Closing Date shall be apportioned based upon such reading.

6.5. The amount of any unpaid taxes, assessments, water charges, sewer taxes and rents and vault charges and taxes for which Seller is obligated to pay and discharge under Section 6.2, with interest and penalties thereon through and including the Closing Date may, at the option of Seller, be satisfied at Closing out of the Purchase Price, provided that official bills therefor with interest and penalties thereon are furnished by Seller at the Closing. In addition, at the Closing, Seller shall receive a credit against the amount of any unpaid taxes Seller is obligated to pay and discharge under Section 6.2 in an amount equal to the amount that will become due and owing by the tenants that pay such taxes in lump sum payments. If there are any other liens or encumbrances which Seller is paying and discharging pursuant to Section 8 of this Agreement, Seller may use any portion of the Purchase Price to satisfy the same, provided that the Title Company (as hereinafter defined) shall be willing to insure Purchaser against collection of such liens and/or encumbrances, including interest and penalties, in which event such liens and encumbrances shall not be objections to title.

6.6. (i) To the extent that Purchaser receives Rents under Leases (including monthly payments of escalation and percentage rents and “pass throughs”) after the Closing Date, the amount of such Rents shall be applied in the following order of priority: (x) first, to the calendar month in which the Closing occurs, (y) second, to any calendar month or months following the calendar month in which the Closing occurred until such tenant is current on post-Closing Rents, and (z) third, to the calendar months preceding the Closing Date until such tenant is current on pre-Closing Rents. Purchaser shall render an accounting to Seller with respect to any Rents received from each tenant that owes Rent to Seller as of the Closing Date until, as a result of the application of Rents pursuant to this Section 6.6, such tenant has paid all Rents owed to Seller for that period of time prior to the Closing Date. The obligation to render such accounting to Seller shall terminate upon the earlier to occur of (A) Seller having been paid all Rents

7

owed to Seller for that period of time prior to the Closing Date, and (B) the first (1st) anniversary of the Closing Date.

(ii) Notwithstanding the foregoing provisions of this Section 6.6, Purchaser and Seller acknowledge that Rents in the nature of percentage rents (“Percentage Rents”) under certain Leases for each calendar year may be collected in advance monthly based upon estimated gross sales under the applicable Lease by Seller and may subsequently be subject to adjustment, on an annualized basis, after the expiration of the calendar year for which such Percentage Rents are due based upon the reconciliation of annualized gross sales under the applicable Lease by Seller. In furtherance of the foregoing, Purchaser and Seller agree that in the event any tenant is obligated to pay any such Percentage Rents to Seller, then solely with respect to such Percentage Rents for the calendar year in which the Closing Date occurs, Purchaser shall render an accounting to Seller with respect thereto within thirty (30) days after the date on which Purchaser, as landlord under the applicable Lease, has reconciled the annualized gross sales under such Lease, and, in the event the applicable tenant is obligated to render a payment on account of the Percentage Rents payable under its Lease to the landlord thereunder for the calendar year in which the Closing Date occurs, then such payment shall be prorated on a “straight-line” basis between Purchaser and Seller, based upon the number of days in such calendar year that Purchaser and Seller were the owner of the Premises, and in the event the applicable tenant is entitled to a reimbursement on account of the Percentage Rents payable under its Lease to the landlord thereunder for the calendar year in which the Closing Date occurs, then such reimbursement shall be prorated on a “straight-line” basis between Purchaser and Seller based upon the number of days in such calendar year that Purchaser and Seller were the owner of the Premises. In connection with the foregoing, Percentage Rents shall be pro-rated at Closing based on amounts billed by Seller, and any reconciliation shall be completed on a post-Closing basis (and each party shall provide to the other all reasonably requested information with respect to the Percentage Rents in order to complete such reconciliation).

(iii) Notwithstanding the foregoing provisions of this Section 6.6, Purchaser and Seller acknowledge that Rents in the nature of so called “CAM” charges (collectively, “CAM Charges”) under certain Leases for each calendar year may be collected in advance monthly based upon estimated operating expenses under the applicable Lease by Seller and may subsequently be subject to adjustment, on an annualized basis, after the expiration of the calendar year for which such CAM Charges are due based upon the reconciliation of annualized operating expenses under the applicable Lease by Seller. In furtherance of the foregoing, Purchaser and Seller agree that in the event any tenant is obligated to pay any such CAM Charges to Seller, then solely with respect to such CAM Charges for the calendar year in which the Closing Date occurs, Purchaser shall render an accounting to Seller with respect thereto within thirty (30) days after the date on which Purchaser, as landlord under the applicable Lease, has reconciled the annualized so called “CAM” charges under such Lease, and, in the event the applicable tenant is obligated to render a payment on account of the CAM Charges payable under its Lease to the landlord thereunder for the calendar year in which the Closing Date occurs, then such payment shall be prorated on a “straight-line” basis between Purchaser and Seller, based upon the number of days in such calendar year that Purchaser and Seller were the owner of the Premises, and in the event the applicable tenant is entitled to a reimbursement on account of the CAM Charges payable under its Lease to the landlord thereunder for the calendar year in which the Closing Date occurs, then such reimbursement shall be prorated on a “straight-line” basis between Purchaser and Seller based upon the number of days in such calendar year that Purchaser and Seller were the owner of the Premises. In connection with the foregoing, CAM Charges shall be pro-rated at Closing based on amounts billed by Seller, and any reconciliation shall be completed on a post-Closing basis (and each party shall provide to the other all reasonably requested information with respect to the CAM Charges in order to complete such reconciliation).

(iv) Purchaser shall have no obligation to collect any and all Rents due pursuant to the Leases that would otherwise be payable to Seller pursuant to the terms and conditions of this Agreement.

Notwithstanding the foregoing, if Purchaser shall commence any legal action to collect any amounts due from a tenant under a Lease and such tenant shall also owe amounts which Seller shall be entitled to receive pursuant to the provisions of this Agreement, then, at Seller’s option, Purchaser shall include in Purchaser’s legal action the claim for amounts due to Seller, and Seller shall reimburse Purchaser for a portion of the reasonable and actual out-of-pocket legal fees and disbursements incurred by Purchaser in prosecuting such action in an amount equal to the total amount of such fees and disbursements multiplied by a fraction, the numerator of which is the total amount realized by Seller in such action and the denominator of which is the total amount realized by Seller and Purchaser in such action. If Seller is entitled, in accordance with the provisions of this Agreement, to all or any portion of any Rents owed by any tenant under a Lease and such tenant shall be in default of such tenant’s obligation to pay such Rents, Seller reserves the right to commence any and all appropriate legal proceedings to collect such amounts (but Seller shall not commence any action against a tenant to dispossess such tenant from possession of space in the Premises), and Purchaser agrees to cooperate with Seller, at Seller’s sole cost and expense, in connection with such proceedings; provided, however, that Purchaser, at Seller’s request and without cost to Purchaser, shall (1) assign to Seller all rights to all amounts owed Seller from tenants prior to and as of Closing including, without limitation, all rights to collect from such tenants for all such amounts owed; and (2) execute and deliver to Seller any and all documents Seller shall reasonably request in order to effectuate such assignment (clause (1) and (2) collectively, the “Retained Rights”). The Retained Rights shall survive the Closing.

(v) Without limiting the foregoing provisions of the Section 6.6, Seller shall reasonably cooperate with Purchaser and otherwise exercise commercially reasonable efforts prior to and subsequent to the Closing Date (if same has not been completed prior to the Closing) in order to obtain a Certificate of Transfer of Title to Leased Property and Lease Assignment and Assumption (or similar instrument) (the “USPS Documents”) from the United States Postal Service (“USPS”). If USPS does not enter into the USPS Documents prior to the Closing, then anything in this Agreement to the contrary notwithstanding, if, by virtue thereof, USPS pays its rent or additional rent to Seller in lieu of Purchaser for any period from and after the Closing Date, the same shall be held in trust by Seller (on Purchaser’s behalf) and paid in accordance with this Section 6.6.

6.7. Prior to the Closing, Purchaser and Seller shall cooperate to arrange for utility services to the Premises to be discontinued in Seller’s name, as of the day immediately prior to the Closing Date, and to be reinstated in Purchaser’s name, as of the Closing Date. In the event that the foregoing cannot be effectuated, then Seller shall furnish readings of the applicable utility meters to a date not more than thirty (30) days prior to the Closing Date, and the unfixed charges, if any, based thereon for the intervening time, shall be apportioned on the basis of such last readings.

6.8. (a) Seller agrees that it shall be responsible for the payment of the commissions payable to brokers, including, without limitation, commissions payable to the Exclusive Leasing Agent referred to in Section 6.8(c) below under the Exclusive Leasing Agreement referred to in Section 6.8(c) below (collectively, “Leasing Commissions”), the costs incurred or to be incurred for tenant improvements (“Tenant Improvement Costs”), and all other out-of-pocket costs and expenses, including, without limitation, legal fees, costs and disbursements and tenant relocation costs (collectively, “Other Leasing Costs”; together with any Leasing Commissions and Tenant Improvement Costs, “Leasing Costs”) arising out of Leases that were executed before the Effective Date.

(b) Notwithstanding the provisions of Section 6.8(a) above, Purchaser agrees that if the Closing occurs, it shall be responsible for the payment of all Leasing Costs arising out of, under or in connection with any Approved Lease Amendments and Approved New Leases (and a future renewal of, extension of, or expansion under any Approved Lease Amendments and Approved New Leases). In connection with the foregoing, Purchaser hereby (x) assumes, effective as of the Closing Date, the

9

obligation to pay all Leasing Costs with respect to the leasing matters described in in this clause (b), (y) indemnifies Seller against any liability arising therefrom, and (z) agrees that if Seller pays any such amount in respect of any such leasing matters described in this clause (b) prior to the Closing Date, then at Closing Purchaser shall reimburse Seller for same.

(c) Seller has informed Purchaser that Seller is party to a certain Exclusive Leasing Agreement, dated as of June 3, 2012 (as amended, the “Exclusive Leasing Agreement”) with Charter Realty and Development Corp., a Delaware corporation (the “Exclusive Leasing Agent”), as agent. Seller agrees to terminate the Exclusive Leasing Agreement as of the Closing Date.

(d) Purchaser hereby indemnifies Seller and holds Seller harmless from and against any and all liabilities (including, without limitation, reasonable attorneys’ fees, costs and disbursements and costs incurred in the enforcement of the foregoing indemnity) arising out of Purchaser’s failure to comply with Purchaser’s obligations under this Section 6.8. The foregoing indemnification by Purchaser shall survive the Closing indefinitely. Seller hereby indemnifies Purchaser and holds Purchaser harmless from and against any and all liabilities (including, without limitation, reasonable attorneys’ fees, costs and disbursements and costs incurred in the enforcement of the foregoing indemnity) arising out of Seller’s failure to comply with Seller’s obligations under this Section 6.8. The foregoing indemnification by Seller shall survive the Closing for a period of one (1) year.

6.9. It is the intention of the parties for Seller to transfer to Purchaser concurrently with the Closing as a credit against the Purchase Price all security deposits of tenants under the Leases, together with any interest accrued on such security deposits; provided, however, prior to the expiration of the Due Diligence Period, upon written notice to Purchaser, Seller shall have the right, subject to and in accordance with the terms of the Leases, to deduct from any security deposit any amount due from a tenant of the Premises as a result of a default (after the expiration of any expressly provided notice and grace periods) by such tenant under such tenant’s Lease; provided, further, however, Seller shall use commercially reasonable efforts to pursue its rights under the Leases to require the applicable tenants to replenish such security deposits in accordance with the terms of the Leases (it being acknowledged and agreed that the failure of the tenants to replenish such security deposits shall not (i) be a condition to any of Purchaser’s obligations under this Agreement, including, without limitation, Closing (b) give Purchase any right to terminate this Agreement, and (c) give rise to any remedy of any kind against Seller).

6.10. At Closing, to the extent that Purchaser assumes the Assumed Loan, Seller shall be credited with the amounts of any escrows and/or holdbacks held by or on the Lender’s (as hereinafter defined) behalf in connection with the Assumed Loan and such escrows and holdbacks shall be assigned by Seller to Purchaser at Closing pursuant to the Loan Assumption Documents (as hereinafter defined).

6.11. Subject to the provisions of Section 37 of this Agreement, in the event the Closing occurs, the provisions of this Section 6 shall survive the Closing Date for one (1) year and either party shall have the right prior to expiration of such one (1) year period to require that errors and adjustments related to computations and calculations under this Section 6 be corrected and the parties agree that any errors and adjustments not raised prior to the expiration of such one (1) year period shall be deemed to be waived. For the avoidance of doubt, the parties acknowledge that after the expiration of such one (1) year period, the indemnification obligations of Seller, if any, contained in this Section 6, shall expire, and that the indemnification obligations of Purchaser, if any, contained in this Section 6 shall survive the Closing Date for a period of one (1) year (except as otherwise expressly provided in this Section 6).

10

7. Closing Documents.

7.1. At the Closing, Seller shall deliver (or caused to be delivered) to Purchaser the following:

(a) a limited warranty deed, executed by Seller, in the form attached hereto as Exhibit E and made a part hereof (the “Deed”), duly executed by Seller and acknowledged on behalf of Seller;

(b)a quitclaim bill of sale, in the form attached hereto as Exhibit F and made a part hereof (the “Bill of Sale”), executed by Seller;

(c) an assignment and assumption of Leases, in the form attached hereto as Exhibit G and made a part hereof (the “Assignment and Assumption of Leases”), executed by Seller;

(d) an assignment and assumption of the Sanborn Contract, in the form attached hereto as Exhibit H and made a part hereof (the “Assignment and Assumption of Contract”), executed by Seller;

(e) an assignment and assumption of Intangible Property, in the form attached hereto as Exhibit I and made a part hereof (the “Assignment and Assumption of Intangible Property”), executed by Seller;

(f) a “non-foreign person certification” that meets the requirements of Section 1445(b)(2) of the Internal Revenue Code of 1986, as amended, or any successor statute thereto (“Code”), in the form attached hereto as Exhibit J and made a part hereof, executed by (or on behalf of) Seller;

(g) a signed notice to the tenants of the Premises, substantially in the form attached hereto as Exhibit K and made a part hereof (the “Notice to Tenants”), executed by Seller;

(h) a signed notice to the service provider under the Sanborn Contract, substantially in the form attached hereto as Exhibit L and made a part hereof (the “Notice to Contract Party”), executed by Seller;

(i) all forms, affidavits and certificates required to be filed in connection with the imposition and/or payment of any and all applicable federal, state, county, municipal and other transfer taxes with respect to the transactions set forth herein (collectively, the “Conveyance Tax Documents”), in proper form for submission, prepared, executed and acknowledged by Seller;

(j) the Tenant Estoppel Certificates (as hereinafter defined) and/or Seller Estoppel Certificates (as hereinafter defined) to the extent required to be delivered by Seller pursuant to Section 36 of this Agreement;

(k) such documents (such as limited liability company resolutions, corporate resolutions or partnership authorizations and certified limited liability company, corporate or partnership organizational documents) as are reasonably required by the Title Company to evidence the authorization of the transactions contemplated by this Agreement;

(l) on or before five (5) Business Days after Closing, Seller shall deliver to Purchaser’s offices at 11501 Northlake Drive, Cincinnati, Ohio 45249, Attention Director of Lease Administration, (i) all original Leases (or copies if Seller and/or its property and/or asset manager do not have possession of originals), lease files, all plans and specifications with respect to the Premises correspondence files and other books and records, keys to all leased premises, security codes, if any, and maintenance agreements (e.g., HVAC maintenance agreement) relating solely to the Premises and to the extent in Seller’s and/or

its property and/or asset manager’s possession, and (ii) all original Assumed Loan Documents (or copies if Seller and/or its property and/or asset manager do not have possession of originals), loan files, correspondence files and other books and records related solely to the Assumed Loan and to the extent in Seller’s and/or its property and/or asset manager’s possession;

(m) to the extent the same are in the possession of Seller and are transferable to Purchaser, all original licenses, certificates and permits pertaining to the Premises and required for the use or occupancy thereof;

(n) an assignment and assumption of the O&M Plan Documents, in the form attached hereto as Exhibit M and made a part hereof (the “Assignment and Assumption of O&M Plan Documents”), executed by Seller;

(o) a notice of the Assignment and Assumption of O&M Plan Documents to the Ohio Environmental Protection Agency, substantially in the form attached hereto as Exhibit N and made a part hereof (the “Notice of O&M Plan Documents Transfer”)(it being agreed that any requested changes to such form shall neither increase Seller’s obligations hereunder nor decrease any of Seller’s rights and protections hereunder), which Notice of O&M Plan Documents Transfer shall include evidence of Purchaser’s compliance with Section 10 of that certain Operation and Maintenance Agreement, dated October 29, 2002 (the “O&M Agreement”) with respect to the provision of reasonable and adequate funds in the amount of at least $8,500 to comply with the O&M Agreement, executed by Seller;

(p) the USPS Documents, executed by Seller;

(q) an owner’s title affidavit in the form of Exhibit O attached hereto, executed by Seller;

(r) subject to terms and conditions of Section 11 below, a certificate executed by Seller indicating that the representations and warranties of Seller set forth in Section 11.1 are true and correct on the Closing Date in all material respects, which certificate shall describe any changes to such representations and warranties as to which Seller has actual knowledge as of the Closing Date;

(s) to the extent that Purchaser assumes the Assumed Loan, any Loan Assumption Documents required to be executed by Seller to satisfy the condition in Section 49.2(c) and (d);

(t) exclusive possession of the Premises, subject to the rights of all tenants of the Premises, the Permitted Title/Survey Exceptions, any obligations expressly assumed by the Purchaser pursuant to this Agreement and Seller Document and applicable laws;

(u) such other documents, instruments and/or deliveries as are required to be delivered by Seller pursuant to the terms of this Agreement.

7.2. At the Closing, Purchaser shall deliver to Seller the following:

(a) the Closing Funds;

�� (b) the Assignment and Assumption of Leases, executed by Purchaser;

(c) the Assignment and Assumption of Contract, executed by Purchaser;

(d) the Assignment and Assumption of Intangible Property, executed by Purchaser;

12

(e) reserved;

(f) the Notice to Contract Party, executed by Purchaser;

(g) the Conveyance Tax Documents, executed and acknowledged by Purchaser, if required by applicable law, each in proper form for submission;

(h) such documents (such as limited liability company resolutions, corporate resolutions or partnership authorizations and certified limited liability company, corporate or partnership organizational documents) as are reasonably required by Title Company evidencing the authorization of the purchase of the Premises by Purchaser and the delivery by Purchaser of all of the Closing documents required by this Agreement;

(j) the Assignment and Assumption of O&M Plan Documents, executed by Purchaser;

(k) the Notice of O&M Plan Documents Transfer, executed by Purchaser;

(l) the USPS Documents, executed by Purchaser;

(m) to the extent that Purchaser assumes the Assumed Loan, the Loan Assumption Documents; and

(n) such other documents, instruments and/or deliveries as are required to be delivered by Purchaser pursuant to the terms of this Agreement (including, without limitation, documents, agreements and opinions to be delivered in connection with the assumption of the Assumed Loan pursuant to Section 49 hereof).

7.3. The acceptance of transfer of title to the Premises by Purchaser shall be deemed to be full performance and discharge of any and all obligations on the part of Seller to be performed pursuant to the provisions of this Agreement, except where such agreements and obligations are specifically stated to survive the Closing.

8. Title Insurance and Survey Matters.

8.1. Prior to the Effective Date Seller delivered to Purchaser Seller’s existing survey of the Premises (the “Existing Survey”). Purchaser shall obtain and deliver to Seller (i) an update of the Existing Survey or a new survey (any such update or new survey being referred to as the “Updated Survey”) and (ii) a commitment for title insurance (the “Title Commitment”) from First American Title Insurance Company (the “Title Company”) with respect to the Premises upon the earlier to occur of Purchaser’s receipt of same and the expiration of the Due Diligence Period. The Existing Survey or the Updated Survey, as applicable, are referred to herein individually or collectively as the “Survey”. If the Title Commitment or Survey discloses exceptions to title which are both (A) not included within the list of permitted title matters listed on Exhibit P attached hereto and made a part hereof (the “Existing Title/Survey Matters”) and (B) material and adverse to Purchaser in Purchaser’s reasonable judgment (any such exception being referred to herein as an “Unpermitted Title/Survey Matters”), then Purchaser shall have the right to give Seller notice of any such Unpermitted Title/Survey Matters on or prior to the earlier of (X) ten (10) days after Purchaser’s receipt of the Title Commitment and Survey and (Y) the expiration of the Due Diligence Period (such earlier date, the “Title/Survey Objection Out Date”). Any matters revealed by the Title Commitment and/or Survey that are not objected to by Purchaser on or prior to the Title/Survey Objection Out Date shall be deemed “Permitted Title/Survey Exceptions”. In

13

addition, any matters revealed by the Title Commitment and/or Survey that do not constitute Unpermitted Title/Survey Matters, regardless of whether Purchaser objects thereto, shall constitute Permitted Title/Survey Exceptions. Seller shall have ten (10) Business Days following the receipt of any such notice in which to give Purchaser notice that Seller will either (a) cause such Unpermitted Title/Survey Matter(s) to be deleted from the Title Commitment or Survey or insured against by the Title Company or (b) not cause such Unpermitted Title/Survey Matter(s) to be deleted from the Title Commitment or Survey or insured against by the Title Company. If Seller gives notice pursuant to clause (a) above, then Seller will cause such Unpermitted Title/Survey Matter(s) to be deleted from the Title Commitment or Survey, or cause such Unpermitted Title/Survey Matter(s) to be insured against by the Title Company, prior to the Closing Date (and Seller shall have the right to adjourn the Closing Date one or more times (but for not more than thirty (30) days in the aggregate) in order to effectuate same); provided, however, if at Closing Seller has failed to cause any such Unpermitted Title/Survey Matter(s) to be deleted from the Title Commitment or Survey, or insured against by the Title Company, then Purchaser’s sole and absolute remedy shall be to terminate this Agreement at Closing (in which event the provisions of Section 9 of this Agreement shall apply to such termination). If Seller (i) fails to give any such notice within said ten (10) Business Day period, or (ii) gives notice pursuant to clause (b) above, then Purchaser shall give written notice to Seller within three (3) Business Days following the earlier of the expiration of such ten (10) Business Day period or the giving of such notice by Seller either (x) terminating this Agreement (in which event the provisions of Section 9 of this Agreement shall apply to such termination) or (y) waiving the right to terminate this Agreement as a result of any such Unpermitted Title/Survey Matter(s). If Purchaser fails to deliver such notice terminating this Agreement pursuant to clause (x) above within said three (3) Business Day period, then Purchaser shall be deemed to have elected under clause (x) above. If Purchaser elects under clause (y) above in accordance with the foregoing, then any Unpermitted Title/Survey Matters previously objected to by Purchaser shall become Permitted Title/Survey Exceptions. Purchaser acknowledges that Seller shall be entitled to deliver Seller’s notice under clause (a) or clause (b) above in Seller’s sole and absolute discretion subject to the provisions of Section 8.3 of this Agreement and that Purchaser shall be required to accept title to the Premises subject to all Permitted Title/Survey Exceptions. Notwithstanding anything to contrary contained herein, in the event that Purchaser fails to obtain (I) the Title Commitment in the time period set forth in this Section 8.1 and submit any objections thereto within such time period set forth above, then Purchaser will be deemed to have waived its right to object to matters appearing on the Title Commitment (or update thereto) pursuant to Section 8.1 or Section 8.2, and (II) an Updated Survey in the time period set forth in this Section 8.1 and submit any objections thereto within such time period set forth above, then Purchaser will be deemed to have waived its right to object to matters appearing on any Updated Survey (or update thereto) pursuant to Section 8.1 or Section 8.2.

8.2. Except as provided in Section 8.1 above, in the event that any update of the Title Commitment or the Survey shows any new matters or conditions which are both (A) not included within the list of Existing Title/Survey Matters, and (B) material and adverse to Purchaser in Purchaser’s reasonable judgment, Purchaser shall deliver notice (each such notice, a “Purchaser’s Title/Survey Update Notice”) thereof to Seller prior to the date that is the earlier of (X) the Closing Date or (Y) the date that is five (5) Business Days after Purchaser receives such update of the Title Commitment or the Survey (and if Purchaser fails to deliver such notice within such five (5) Business Day (or shorter) period, then Purchaser shall be deemed to have accepted such matters or conditions as Permitted Title/Survey Exceptions). Seller shall have ten (10) Business Days following the receipt of any Purchaser’s Title/Survey Update Notice (and if the expiration of such ten (10) Business Day period is after the Closing Date, then, at the option of Seller, the Closing shall be adjourned to the date three (3) Business Days after the expiration of such ten (10) Business Day period) in which to give Purchaser notice (each such notice, a “Seller’s Title/Survey Update Response”) that Seller will either (a) cause such new matter or condition to be deleted from the Title Commitment or Survey or insured against by the Title Company, or (b) not cause such new matter or condition to be deleted from the Title Commitment or Survey or

14

insured against by the Title Company. If Seller gives a Seller’s Title/Survey Update Response pursuant to clause (a), then Seller will cause such new matter or condition to be deleted from the Title Commitment or Survey or insured against by the Title Company, to occur on or prior to the Closing Date, as same may be adjourned pursuant to the foregoing provisions of this Section 8.2 (and Seller shall have the further right to adjourn the Closing Date one or more times (but for not more than fifteen (15) days in the aggregate) in order to effectuate same); provided, however, if at Closing Seller has failed to cause any such new matter or condition to be deleted from the Title Commitment or Survey, or insured against by the Title Company, then Purchaser’s sole and absolute remedy shall be to terminate this Agreement at Closing (in which event the provisions of Section 9 of this Agreement shall apply to such termination). If Seller (i) fails to give any Seller’s Title/Survey Update Response within said ten (10) Business Day period, or (ii) gives notice pursuant to clause (b), then Purchaser will deliver written notice to Seller on or before the earlier of (I) one (1) Business Day prior to the Closing Date (as same may be adjourned pursuant to the foregoing provisions of this Section 8.2) or (II) the date that is three (3) Business Days following the earlier of the expiration of such ten (10) Business Day period or the delivery of the Seller’s Title/Survey Update Response either (x) terminating this Agreement (in which event the provisions of Section 9 of this Agreement shall apply to such termination) or (y) waiving the right to terminate this Agreement as a result of any such new matter or condition. If Purchaser fails to deliver such notice terminating this Agreement pursuant to clause (x) within said three (3) Business Day (or shorter) period, then Purchaser shall be deemed to have elected under clause (x) above. If Purchaser elects to waive the right to terminate this Agreement pursuant to clause (y) above, then any new matter or condition previously objected to by Purchaser shall become Permitted Title/Survey Exceptions. Purchaser acknowledges that Seller shall be entitled to deliver Seller’s notice under clause (a) or clause (b) above in Seller’s sole and absolute discretion subject to the provisions of Section 8.3 of this Agreement and that Purchaser shall be required to accept title to the Premises subject to all Permitted Title/Survey Exceptions.

8.3. Notwithstanding anything contained herein to the contrary, except as specified in this Section 8.3, Seller shall have no obligation to take any steps, bring any action or proceeding or incur any effort or expense whatsoever to cure any title or survey objection, provided, however, notwithstanding the foregoing, Seller shall cause to be removed as exceptions to title (a) the liens of any mortgages or deeds of trust of Seller affecting the Premises (other than the Assumed Loan, to the extent that Purchaser assumes it as provided in Section 49 hereof), and (b) any mechanic’s or materialmen’s liens filed against the Premises due to work performed at the Premises by Seller at Seller’s direction (and Seller shall have the right to adjourn the Closing Date one or more times (but for not more than twenty (20) days in the aggregate) in order to effectuate same), and (c) any lien or encumbrance placed upon the Property subsequent to the Effective Date without Seller’s consent and not as a result of Seller’s action or omission, provided, however, the total amount required to be expended by Seller in respect of this Section 8.3(c) shall not exceed $75,000.00 (and Seller shall have the right to adjourn the Closing Date one or more times (but for not more than fifteen (15) days in the aggregate) in order to effectuate same).

9. Disposition of Downpayment.

If (a) Purchaser is entitled to and does elect to terminate this Agreement in accordance with the provisions of Sections 5, 8, 11, 14, 20, 35, 36 or 52 of this Agreement, or (b) Seller is entitled to and does elect to terminate this Agreement in accordance with the provisions of Section 11 of this Agreement, then Seller and Purchaser shall direct Escrow Agent to refund to Purchaser the Downpayment (or such portion thereof as shall have been deposited with Escrow Agent). Upon such delivery of the Downpayment to Purchaser, this Agreement shall terminate and neither party to this Agreement shall have any further rights or obligations hereunder, except for the Post-Termination Obligations (as hereinafter defined), which shall survive such termination.

10. Purchaser’s Default.

(a) If Purchaser shall default hereunder (after taking into consideration any cure periods specified in Section 10(b) below, if applicable) in its obligation to purchase the Premises in the manner required pursuant to this Agreement or otherwise fails or refuses to perform Purchaser’s obligation to purchase the Premises in accordance with this Agreement (including, without limitation, such a failure which is due to a breach of any of Purchaser’s Representations (as hereinafter defined) discovered prior to Closing) (such default, a “Closing Default”), Seller, as Seller’s sole remedy (except as provided in this Section 10), shall have the right to cause Escrow Agent to deliver to Seller the Downpayment, as and for Seller’s liquidated damages (the parties hereto acknowledging that it would be difficult or impossible to accurately ascertain the amount of Seller’s damages), whereupon this Agreement shall terminate and neither party shall have any further rights or obligations under this Agreement other than the Post-Termination Obligations, which shall survive such termination. If Purchaser shall default under this Agreement as a result of a breach of Section 17.4 or Section 34, then the Seller shall have all rights available to it at law or in equity without limitation. Notwithstanding the foregoing, the liquidated damages limitation set forth above shall have no application to any claim made by Seller against Purchaser based on Purchaser’s obligations under the Post-Termination Obligations, and in the event Seller has a claim against Purchaser based on any such Post-Termination Obligations, Seller shall be entitled to recover damages for such claim in addition to retention of the Downpayment. For example, if under Section 17.4 of this Agreement Purchaser is obligated to indemnify Seller for damages of $10,000 and Purchaser defaults under this Agreement, then Seller shall be entitled to receive $10,000 plus the entire Downpayment plus amounts under Section 32 of this Agreement.

(b) If, at any time on or prior to the Closing Date, Purchaser shall default hereunder and, by the nature of such default, such default is capable of being cured (such a default, a “Curable Default”), Purchaser shall have until the earlier to occur of (x) the date ten (10) days after Purchaser receives notice from Seller of such Curable Default, and (y) the Closing Date, to cause such Curable Default to be cured to the reasonable satisfaction of Seller. If such Curable Default is not cured on or before the earlier of such dates, then the Purchaser shall be deemed to have defaulted under this Agreement and the provisions of Section 10(a) above shall apply to such default.

11.1. Seller hereby represents and warrants to Purchaser that, as of the Effective Date:

(a) Seller is a limited liability company duly organized and in good standing under the laws of the State of Delaware, and is (or will be by Closing) in good standing under the laws of the State where the Premises are located;

(b) the execution, delivery and performance of this Agreement by Seller (i) are within Seller’s corporate, partnership, limited liability company or other applicable powers and (ii) have been duly authorized by all necessary corporate, partnership, limited liability company or other applicable action;

(c) reserved;

(d) attached hereto as Exhibit Q is a rent roll (the “Rent Roll”) for the Premises, which Rent Roll, is accurate in all material respects as of the Effective Date;

16

(e) except as set forth on Exhibit R, there is no litigation pending with respect to the Premises (other than as is covered by insurance), and, to the actual knowledge of Seller, there is no litigation threatened in writing with respect to the Premises (other than as is covered by insurance);

(f) Seller is not a “foreign person” within the meaning of Section 1445 of the Code;

(g) except with respect to Purchaser, Seller has not granted to any person or entity any option or other right to purchase to the Property and no person or entity has any option or other right to purchase the Property;

(h) Seller has not (i) made a general assignment for the benefit of creditors, (ii) filed a petition for voluntary bankruptcy or filed a petition or answer seeking reorganization or any arrangement or composition, extension or readjustment of its indebtedness, (iii) consented, in any creditor’s proceeding, to the appointment of a receiver or trustee of Seller or any of its property or any part thereof, of (iv) been named as a debtor in an involuntary bankruptcy proceeding or received a written notice threatening the same;

(i) no condemnation or eminent domain proceedings are pending or, to the actual knowledge of Seller, have been threatened in writing with respect to the Premises;

(j) Seller does not directly employ any employees;

(k) to the actual knowledge of Seller, except as set forth in the environmental reports listed on Exhibit S, Seller has not received any written notice alleging a violation of any law with respect to the Premises relating to any Environmental Conditions (as hereinafter defined);

(l) Exhibit B sets forth a true, correct and complete list of all Existing Leases in effect as of the Effective Date (and none of the Existing Leases have been modified, except as set forth on Exhibit B). Each Existing Lease set forth on Exhibit B represents the entire written agreement between Seller and the applicable tenant with respect to the Premises;

(m) to the actual knowledge of Seller, except as set forth on Exhibit D, Seller has not received any written notice of any Existing Violation which remains uncured as of the Effective Date;

(n) except as otherwise set forth on Exhibit T, Seller has performed all work required of the landlord under the Existing Leases and paid in full all Leasing Costs payable by Seller in connection with the Existing Leases;

(o) Seller is not (i) identified on any Governmental List (as hereinafter defined), or otherwise qualifies as a Prohibited Person (as hereinafter defined) or (ii) in violation of any applicable law, rule or regulation relating to anti-money laundering or anti-terrorism, including, without limitation, any applicable law, rule or regulation related to transacting business with Prohibited Persons or the requirements of any Anti-Terrorism Law (as hereinafter defined). As used herein the term (A) “Anti-Terrorism Law” shall mean (w) the Uniting and Strengthening America by Providing Appropriate Tools Required to Intercept and Obstruct Terrorism (USA PATRIOT) Act of 2001, Pub. Law No. 107-56, 115 Stat. 296 (2001); (x) the International Emergency Economic Powers Act, 50 U.S.C. §§ 1701 et. seq. (2003); (y) the Trading with the Enemy Act, 50 U.S.C. App. §§ 1 et. seq. (2003); and (z) other similar laws enacted or promulgated from time to time; in each case, together with any executive orders, rules or regulations promulgated thereunder, including, without limitation, temporary regulations, all as amended or otherwise modified from time to time; (B) “Governmental List” shall mean (x) the List of Specially Designated Nationals and Blocked Persons promulgated by the U.S. Department of the Treasury Office of

17

Foreign Assets Control from time to time and (y) any other similar list (including, without limitation, any list of Prohibited Persons) promulgated by any governmental authority from time to time; and (C) “Prohibited Person” shall mean any Person who is (x) designated by the United States federal government as a terrorist or as a suspected terrorist, whether on a Governmental List, or otherwise or (y) otherwise subject to trade, anti-money laundering or anti-terrorism restrictions under United States federal or state law from time to time, including, without limitation, under any Anti-Terrorism Law;

(p) Seller has not delivered any written notices to any of the tenants under the Existing Leases asserting that such tenant is in default under any of the Existing Leases (other than defaults which have been cured or waived), and, to Seller’s actual knowledge, no tenant is in default under any of the Existing Leases;

(q) Except as set forth in the Existing Leases, no tenants of the Premises under Existing Leases are entitled to any concessions, rebates, allowances, or free rent for any period after the Closing; and

(r) to the actual knowledge of Seller, no event of default currently exists under the Assumed Loan.

11.2. Purchaser hereby represents and warrants to Seller that, as of the Effective Date:

(a) Except as provided in this Agreement, Purchaser has not paid or agreed to pay any consideration to Seller or to any agent or representative of Seller in order to induce Seller to enter into this Agreement;

(b) Purchaser is a limited liability company, validly existing, duly organized and in good standing under the laws of the State of Ohio and is (or will be by Closing) in good standing under the laws of the State where the Premises are located;

(c) the execution, delivery and performance of this Agreement by Purchaser (i) are within Purchaser’s corporate, partnership, limited liability company or other applicable powers, and (ii) have been duly authorized by all necessary corporate, partnership, limited liability company or other applicable action;

(d) Purchaser is not and is not acting on behalf of (i) an “employee benefit plan” within the meaning of Section 3(3) of ERISA/the Employee Retirement Income Security Act of 1974, as amended (“ERISA”), (ii) a “plan” within the meaning of Section 4975 of the Code or (iii) an entity deemed to hold “plan assets” within the meaning of 29 C.F.R. §2510.3-101, as modified by Section 3(42) of ERISA, of any such employee benefit plan or plan;

(e) Neither Purchaser, nor any person or entity who owns any direct or indirect equity or other interest in or controls Purchaser is (x) identified on any Governmental List, or otherwise qualifies as a Prohibited Person or (y) in violation of any applicable law, rule or regulation relating to anti-money laundering or anti-terrorism, including, without limitation, any applicable law, rule or regulation related to transacting business with Prohibited Persons or the requirements of any Anti-Terrorism Law. No funds or assets directly or indirectly invested in Purchaser constitute the property of or are beneficially owned, directly or indirectly, by any person or entity which is (A) identified on any Governmental List, or otherwise qualifies as a Prohibited Person or (B) in violation of any applicable law, rule or regulation relating to anti-money laundering or anti-terrorism, including, without limitation, any applicable law, rule or regulation related to transacting business with Prohibited Persons or the requirements of any Anti-Terrorism Law; and

(f) Purchaser is a Permitted Assignee (as hereinafter defined) or an Affiliated Assignee (as hereinafter defined).

11.3. (a) Each of the representations and warranties set forth in Section 11.1 of this Agreement (collectively, “Seller’s Representations”) shall be deemed to have been remade at and as of the Closing Date with the same force and effect as if first made on and as of the Closing Date; provided, that, at the Closing, Seller may submit to Purchaser one (1) or more schedules, certified by Seller as true and correct as of the Closing Date, which modify or update any of Seller’s Representations, or any exhibits referred to therein, to reflect matters, if any, which arise subsequent to the Effective Date, and Seller’s Representations shall be deemed to have been remade with the changes, if any, set forth in such schedule or schedules; provided, however, notwithstanding anything to the contrary contained in this Agreement, including, without limitation, Section 11, Seller’s Representation made in Section 11.1(r) shall not be required to be remade at and as of the Closing Date (i.e., such Seller’s Representation shall only be required to be true in all material respect as of the Effective Date).

(b) If prior to Closing, Seller’s Representations, as made as of the Effective Date, are determined to be untrue in any material respect as of the Effective Date or if Seller’s Representations, as remade on the Closing Date, shall result in Seller’s Representations made as of the Effective Date being untrue in any material respect as of the Closing Date, then, Purchaser may, at Purchaser’s option and as Purchaser’s sole remedy (Purchaser specifically waiving any right to bring any action against Seller for damages arising therefrom), either (i) terminate this Agreement by notice in writing to Seller, in which event (subject to the provisions of this Section 11.3) the provisions of Section 9 of this Agreement shall apply to such termination, and, solely in the event that a Seller’s Representation was actually false in any material respect when made on the Effective Date (as opposed to a Seller’s Representation that first becomes untrue after the Effective Date, due to changed circumstances or matters which arise or first come to Seller’s attention after the Effective Date), Seller shall reimburse Purchaser for Purchaser’s reasonable out-of-pocket expenses actually incurred by Purchaser in connection with the transaction contemplated by this Agreement, through the date of such termination; provided, however, such expenses shall not exceed Seventy Five Thousand and 00/100 Dollars ($75,000), in the aggregate, when taking into account any other Seller reimbursement of Purchaser’s expenses set forth in this Agreement)(such obligation of Seller shall survive such termination of this Agreement and shall be payable upon demand by Purchaser), or (ii) waive the same and accept title to the Premises without any abatement of the Purchase Price; provided, however, that Purchaser shall have no right to terminate this Agreement as a result of any modification to or updating of Seller’s Representations to reflect (it being acknowledged and agreed that Purchaser may still have other rights to terminate this Agreement pursuant to the express terms and conditions of this Agreement, including, Sections 5, 14 and 36):

(w) Approved New Leases and/or Approved Lease Amendments;

(x) changes after the Effective Date to the Rent Roll that arise after the Effective Date (it being expressly acknowledged and agreed by Purchaser that the risk of changes to the Rent Roll or the leasing status of the Premises, for any reason after the Effective Date is Purchaser’s risk and no such change is intended to grant Purchaser any right to terminate this Agreement or obtain any damages from Seller);