Third Quarter 2017 Results Presentation Thursday, November 9, 2017

2 www.phillipsedison.com Agenda R. Mark Addy - Executive Vice President • Portfolio Results • Financial Results • Shareholder Repurchase Program (SRP) Jeff Edison - Chairman and CEO • Estimated Value per Share Update • Acquisition of Phillips Edison Limited Partnership (PELP) • Liquidity Question and Answer Session

3 www.phillipsedison.com Forward-Looking Statement Disclosure This presentation and the corresponding call may contain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. These statements include, but are not limited to, statements related to the Company’s expectations regarding the performance of its business, its financial results, its liquidity and capital resources, the quality of the Company’s portfolio of grocery anchored shopping centers and other non-historical statements. You can identify these forward-looking statements by the use of words such as “outlook,” “believes,” “expects,” “potential,” “continues,” “may,” “will,” “should,” “seeks,” “approximately,” “projects,” “predicts,” “intends,” “plans,” “estimates,” “anticipates,” or the negative version of these words or other comparable words. Such forward- looking statements are subject to various risks and uncertainties, such as the risks that retail conditions may adversely affect our base rent and, subsequently, our income, and that our properties consist primarily of retail properties and our performance, therefore, is linked to the market for retail space generally, as well as other risks described under the section entitled "Risk Factors" in the Company's Annual Report on Form 10-K for the year ended December 31, 2016, and the Company's Quarterly Report on Form 10-Q for the quarter ended September 30, 2017, as such factors may be updated from time to time in the Company’s periodic filings with the SEC, which are accessible on the SEC’s website at www.sec.gov. Accordingly, there are or will be important factors that could cause actual outcomes or results to differ materially from those indicated in these statements. These factors should not be construed as exhaustive and should be read in conjunction with the other cautionary statements that are included in this presentation, the corresponding call and in the Company’s filings with the SEC. The Company undertakes no obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future events, or otherwise.

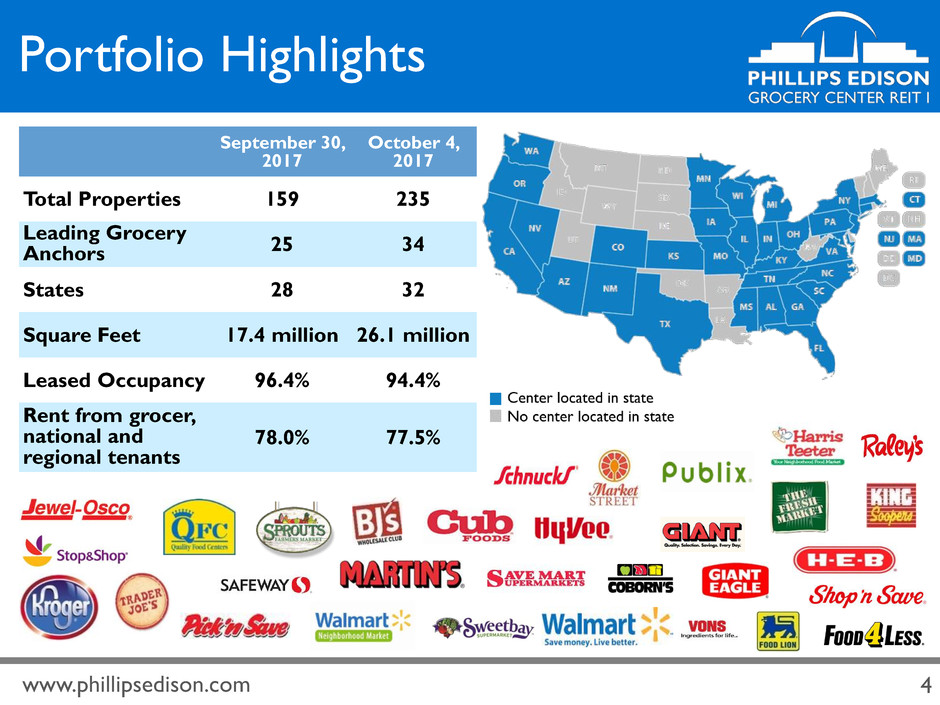

4 www.phillipsedison.com Portfolio Highlights September 30, 2017 October 4, 2017 Total Properties 159 235 Leading Grocery Anchors 25 34 States 28 32 Square Feet 17.4 million 26.1 million Leased Occupancy 96.4% 94.4% Rent from grocer, national and regional tenants 78.0% 77.5%

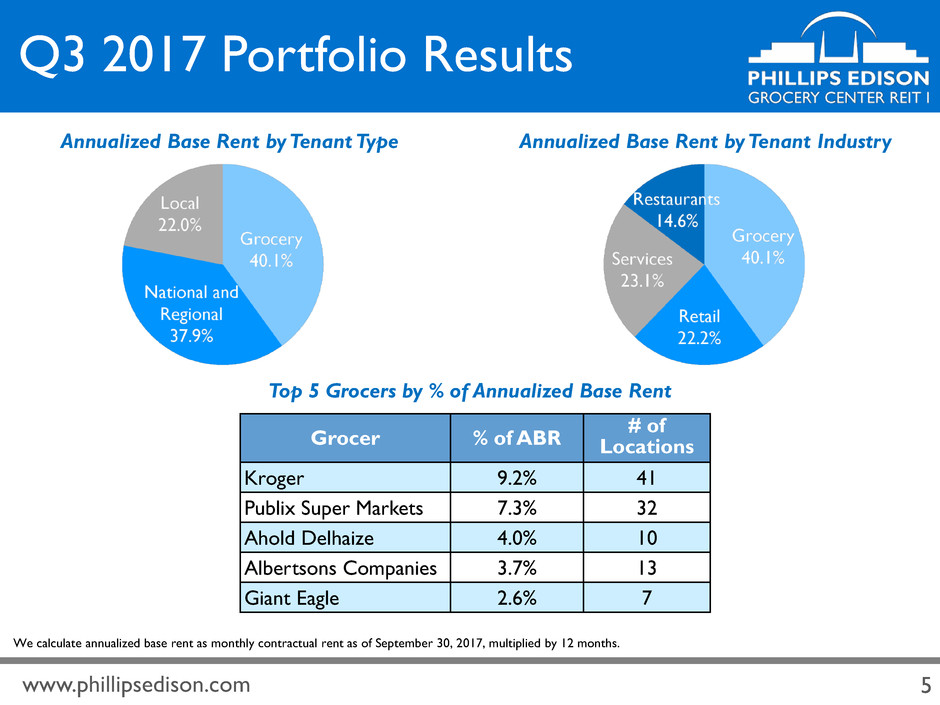

5 www.phillipsedison.com Q3 2017 Portfolio Results Grocer % of ABR # of Locations Kroger 9.2% 41 Publix Super Markets 7.3% 32 Ahold Delhaize 4.0% 10 Albertsons Companies 3.7% 13 Giant Eagle 2.6% 7 Top 5 Grocers by % of Annualized Base Rent Annualized Base Rent by Tenant Type Annualized Base Rent by Tenant Industry We calculate annualized base rent as monthly contractual rent as of September 30, 2017, multiplied by 12 months.

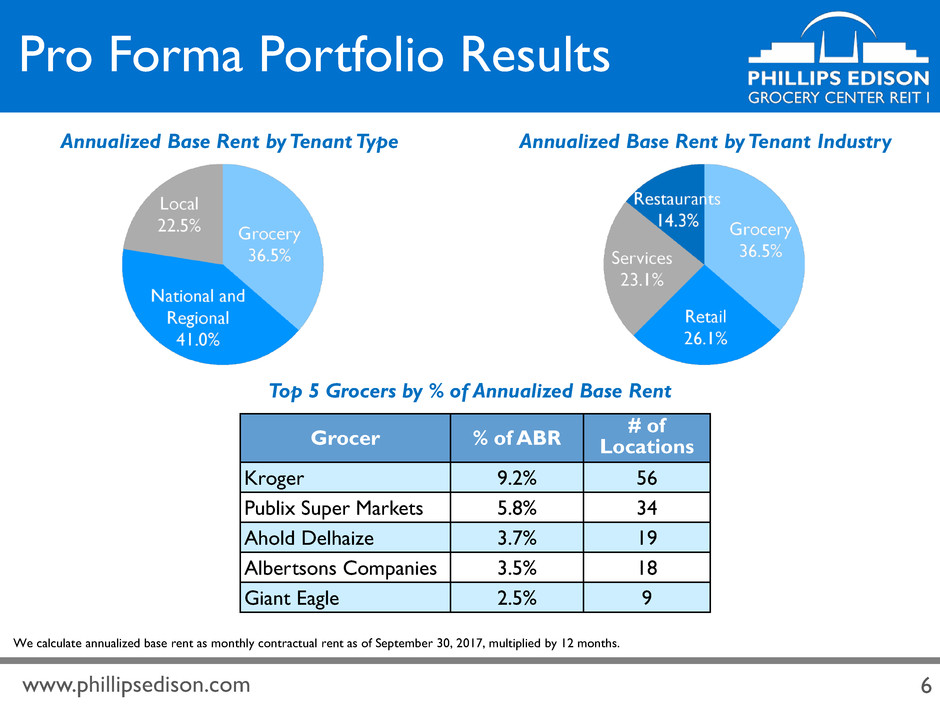

6 www.phillipsedison.com Pro Forma Portfolio Results Grocer % of ABR # of Locations Kroger 9.2% 56 Publix Super Markets 5.8% 34 Ahold Delhaize 3.7% 19 Albertsons Companies 3.5% 18 Giant Eagle 2.5% 9 Top 5 Grocers by % of Annualized Base Rent Annualized Base Rent by Tenant Type Annualized Base Rent by Tenant Industry We calculate annualized base rent as monthly contractual rent as of September 30, 2017, multiplied by 12 months.

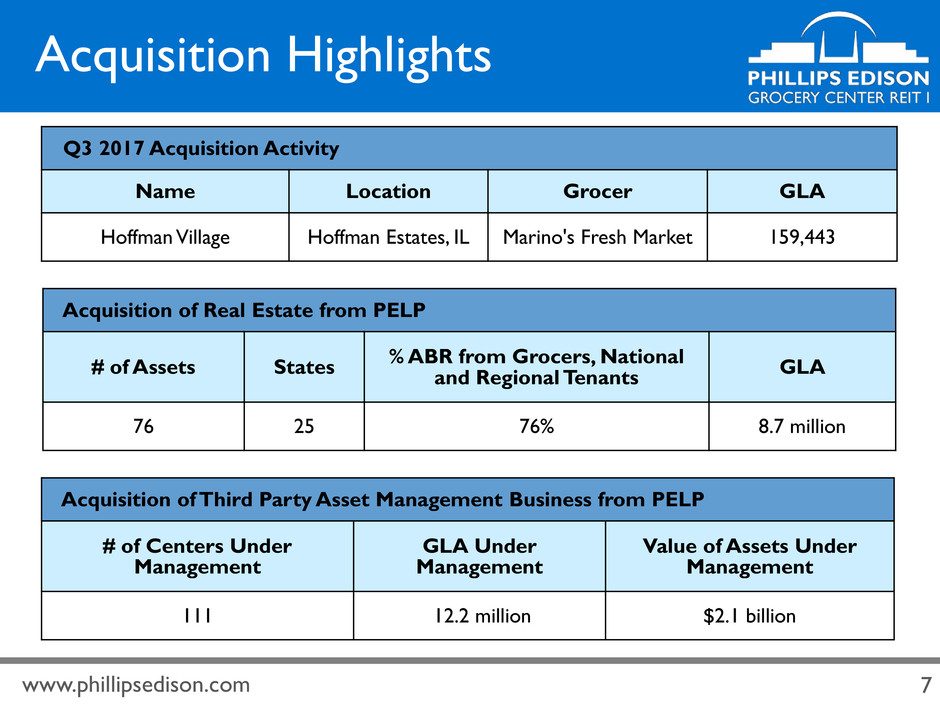

7 www.phillipsedison.com Acquisition Highlights Q3 2017 Acquisition Activity Name Location Grocer GLA Hoffman Village Hoffman Estates, IL Marino's Fresh Market 159,443 Acquisition of Real Estate from PELP # of Assets States % ABR from Grocers, National and Regional Tenants GLA 76 25 76% 8.7 million Acquisition of Third Party Asset Management Business from PELP # of Centers Under Management GLA Under Management Value of Assets Under Management 111 12.2 million $2.1 billion

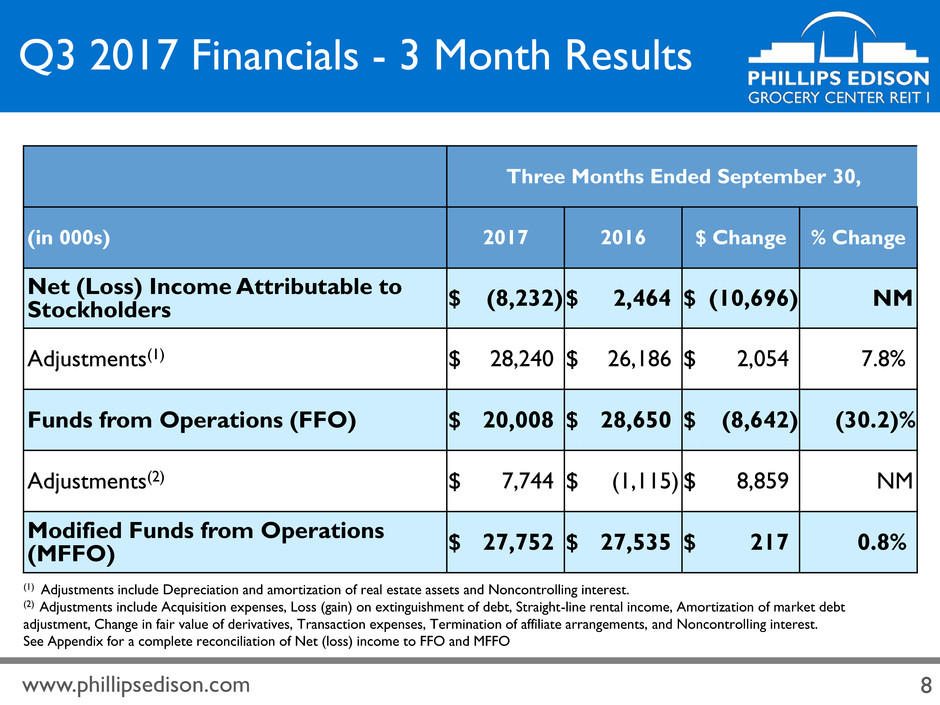

8 www.phillipsedison.com Q3 2017 Financials - 3 Month Results Three Months Ended September 30, (in 000s) 2017 2016 $ Change % Change Net (Loss) Income Attributable to Stockholders $ (8,232 ) $ 2,464 $ (10,696 ) NM Adjustments(1) $ 28,240 $ 26,186 $ 2,054 7.8 % Funds from Operations (FFO) $ 20,008 $ 28,650 $ (8,642 ) (30.2 )% Adjustments(2) $ 7,744 $ (1,115 ) $ 8,859 NM Modified Funds from Operations (MFFO) $ 27,752 $ 27,535 $ 217 0.8 % (1) Adjustments include Depreciation and amortization of real estate assets and Noncontrolling interest. (2) Adjustments include Acquisition expenses, Loss (gain) on extinguishment of debt, Straight-line rental income, Amortization of market debt adjustment, Change in fair value of derivatives, Transaction expenses, Termination of affiliate arrangements, and Noncontrolling interest. See Appendix for a complete reconciliation of Net (loss) income to FFO and MFFO

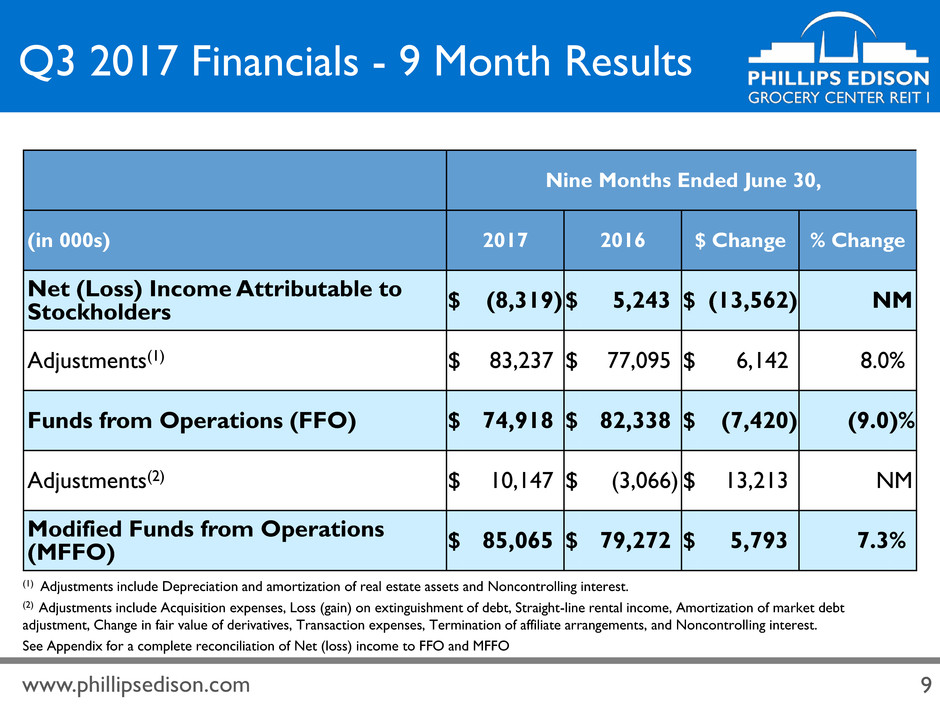

9 www.phillipsedison.com Q3 2017 Financials - 9 Month Results Nine Months Ended June 30, (in 000s) 2017 2016 $ Change % Change Net (Loss) Income Attributable to Stockholders $ (8,319 ) $ 5,243 $ (13,562 ) NM Adjustments(1) $ 83,237 $ 77,095 $ 6,142 8.0 % Funds from Operations (FFO) $ 74,918 $ 82,338 $ (7,420 ) (9.0 )% Adjustments(2) $ 10,147 $ (3,066 ) $ 13,213 NM Modified Funds from Operations (MFFO) $ 85,065 $ 79,272 $ 5,793 7.3 % (1) Adjustments include Depreciation and amortization of real estate assets and Noncontrolling interest. (2) Adjustments include Acquisition expenses, Loss (gain) on extinguishment of debt, Straight-line rental income, Amortization of market debt adjustment, Change in fair value of derivatives, Transaction expenses, Termination of affiliate arrangements, and Noncontrolling interest. See Appendix for a complete reconciliation of Net (loss) income to FFO and MFFO

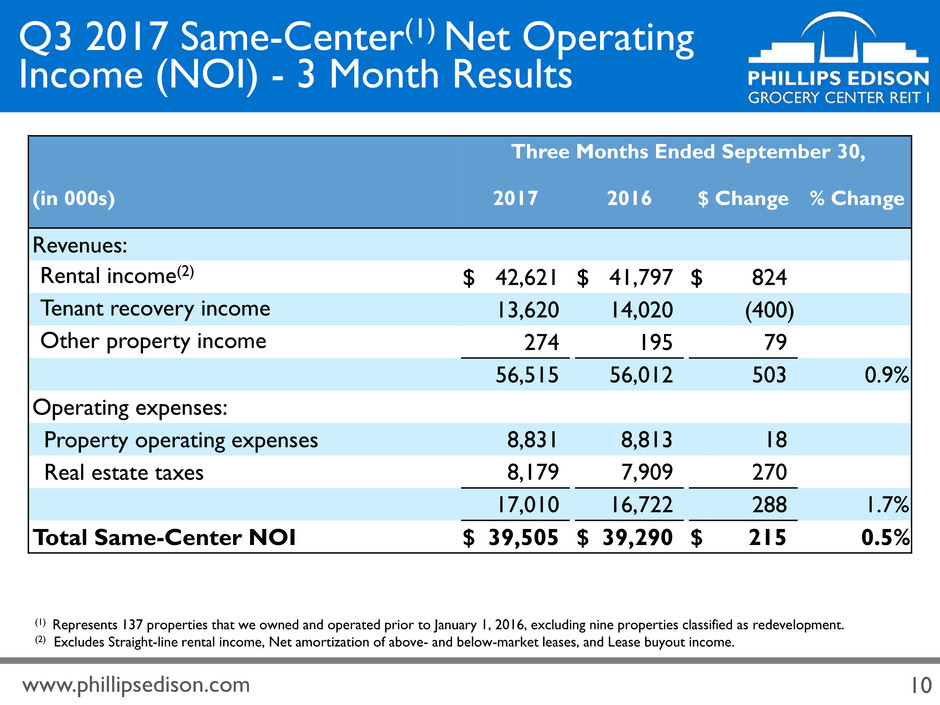

10 www.phillipsedison.com Q3 2017 Same-Center(1) Net Operating Income (NOI) - 3 Month Results Three Months Ended September 30, (in 000s) 2017 2016 $ Change % Change Revenues: Rental income(2) $ 42,621 $ 41,797 $ 824 Tenant recovery income 13,620 14,020 (400 ) Other property income 274 195 79 56,515 56,012 503 0.9 % Operating expenses: Property operating expenses 8,831 8,813 18 Real estate taxes 8,179 7,909 270 17,010 16,722 288 1.7 % Total Same-Center NOI $ 39,505 $ 39,290 $ 215 0.5 % (1) Represents 137 properties that we owned and operated prior to January 1, 2016, excluding nine properties classified as redevelopment. (2) Excludes Straight-line rental income, Net amortization of above- and below-market leases, and Lease buyout income.

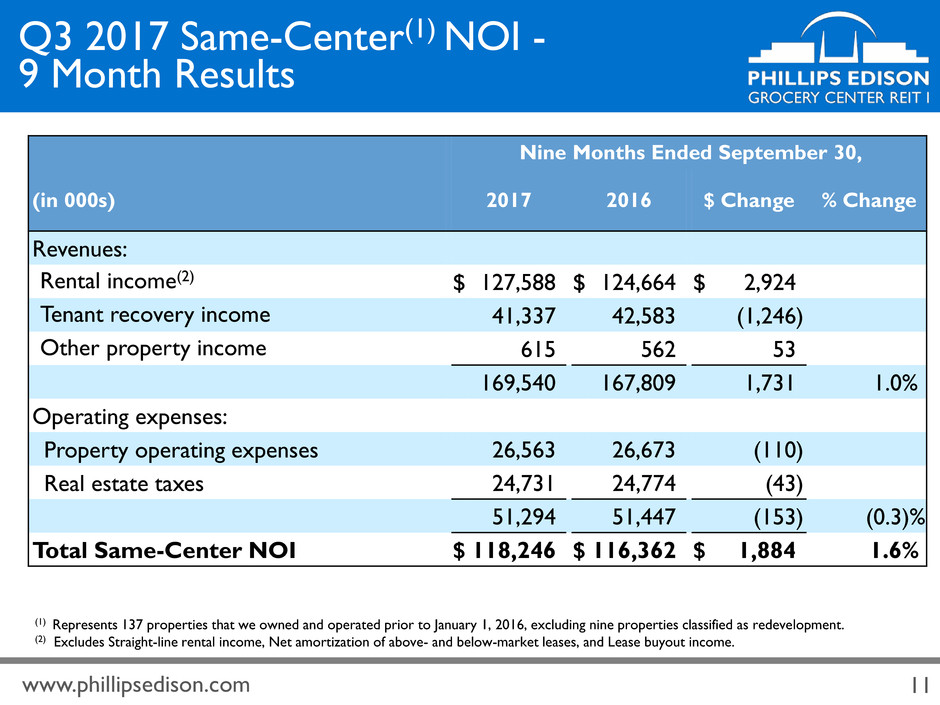

11 www.phillipsedison.com Q3 2017 Same-Center(1) NOI - 9 Month Results Nine Months Ended September 30, (in 000s) 2017 2016 $ Change % Change Revenues: Rental income(2) $ 127,588 $ 124,664 $ 2,924 Tenant recovery income 41,337 42,583 (1,246 ) Other property income 615 562 53 169,540 167,809 1,731 1.0 % Operating expenses: Property operating expenses 26,563 26,673 (110 ) Real estate taxes 24,731 24,774 (43 ) 51,294 51,447 (153 ) (0.3 )% Total Same-Center NOI $ 118,246 $ 116,362 $ 1,884 1.6 % (1) Represents 137 properties that we owned and operated prior to January 1, 2016, excluding nine properties classified as redevelopment. (2) Excludes Straight-line rental income, Net amortization of above- and below-market leases, and Lease buyout income.

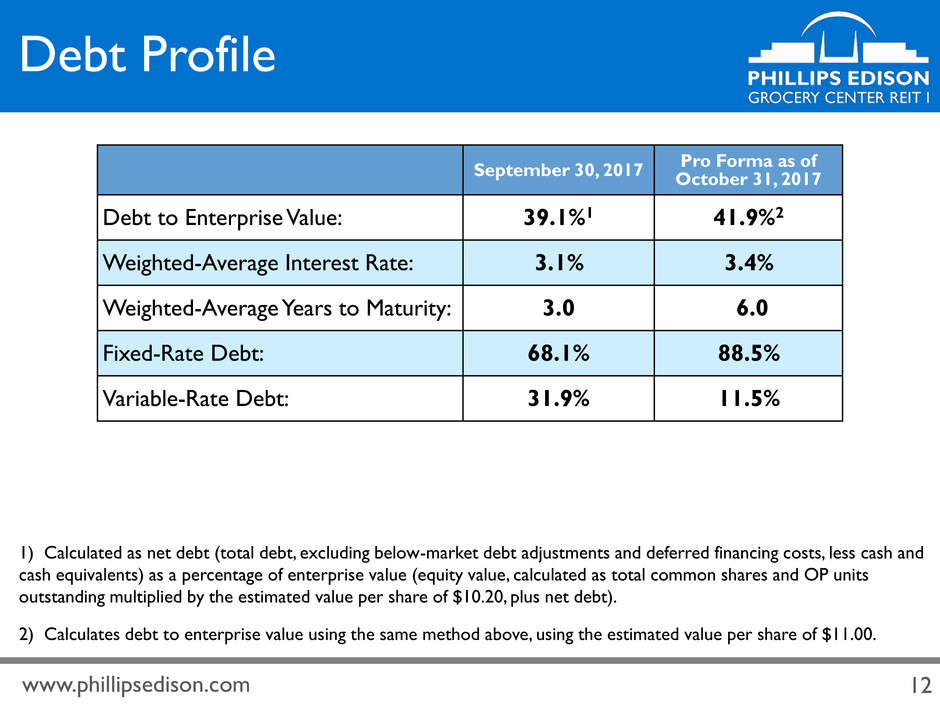

12 www.phillipsedison.com Debt Profile 1) Calculated as net debt (total debt, excluding below-market debt adjustments and deferred financing costs, less cash and cash equivalents) as a percentage of enterprise value (equity value, calculated as total common shares and OP units outstanding multiplied by the estimated value per share of $10.20, plus net debt). 2) Calculates debt to enterprise value using the same method above, using the estimated value per share of $11.00. September 30, 2017 Pro Forma as of October 31, 2017 Debt to Enterprise Value: 39.1%1 41.9%2 Weighted-Average Interest Rate: 3.1% 3.4% Weighted-Average Years to Maturity: 3.0 6.0 Fixed-Rate Debt: 68.1% 88.5% Variable-Rate Debt: 31.9% 11.5%

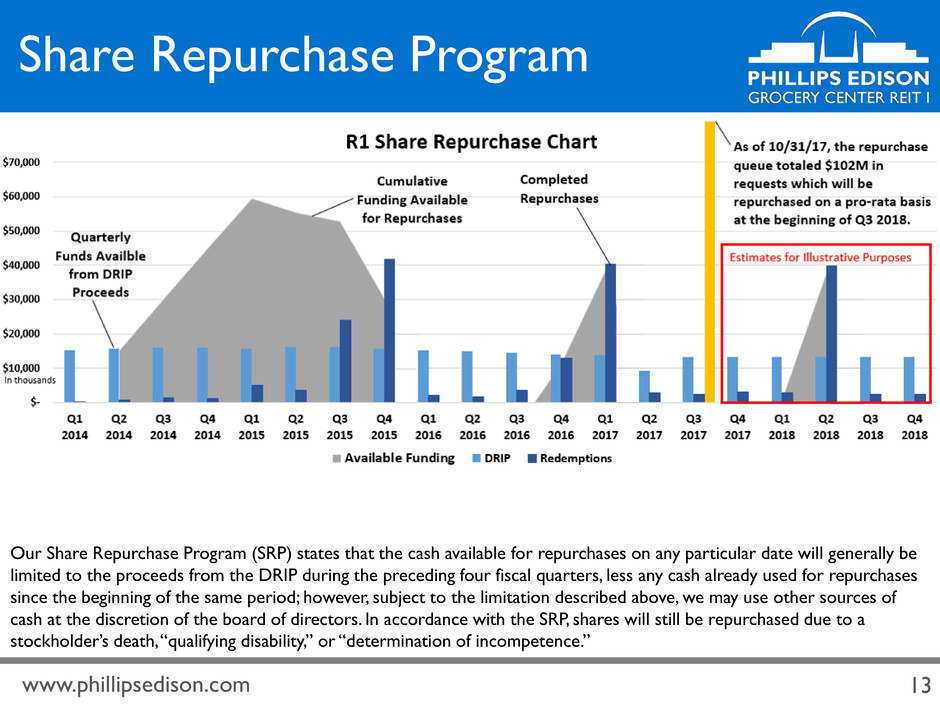

13 www.phillipsedison.com Share Repurchase Program Our Share Repurchase Program (SRP) states that the cash available for repurchases on any particular date will generally be limited to the proceeds from the DRIP during the preceding four fiscal quarters, less any cash already used for repurchases since the beginning of the same period; however, subject to the limitation described above, we may use other sources of cash at the discretion of the board of directors. In accordance with the SRP, shares will still be repurchased due to a stockholder’s death, “qualifying disability,” or “determination of incompetence.”

14 www.phillipsedison.com Estimated Value per Share Update • Duff & Phelps, a third-party valuation firm, produced an estimated value per share in the range of $10.34 to $11.70 as of October 5, 2017 • The Board of Directors increased the estimated value per share by 8% to $11.00* • 10% increase from the original offering price of $10.00 per share · Represents the increased value of the company after the PELP acquisition · Illustrates the value of the the company's real estate management platform · Confirms the strength of grocery-anchored retail real estate *As of November 8, 2017. Please note that the estimated value per share is not intended to represent an enterprise or liquidation value of our company. It is important to remember that the estimated value per share may not reflect the amount you would obtain if you were to sell your shares or if we liquidated our assets. Further, the estimated value per share is as of a moment in time, and the value of our shares and assets may change over time as a result of several factors including, but not limited to, future acquisitions or dispositions, other developments related to individual assets, and changes in the real estate and capital markets, and we do not undertake to update the estimated value per share to account for any such events. You should not rely on the estimated value per share as being an accurate measure of the then-current value of your shares in making a decision to buy or sell your shares, including whether to participate in our dividend reinvestment plan or our SRP. For a description of the methodology and assumptions used to determine the estimated value per share, see our recent 8-K filing made with the U.S. Securities and Exchange Commission.

15 www.phillipsedison.com Acquired PELP on October 4, 2017 • We acquired 76 real estate assets and the third-party asset management businesses from our sponsor, PELP • Formed an internally-managed REIT exclusively focused on grocery-anchored shopping centers with a total enterprise value of approximately $4 billion • The combined enterprise owns: · Diversified portfolio of 235 shopping centers comprising approximately 26.1 million sq. ft. located in 32 states · Third-party asset management business that manages over $2 billion of grocery-anchored shopping centers. • The proposal to approve the transaction was approved by 91.4% of the shares which were voted by proxy on the matter

16 www.phillipsedison.com Benefits of the Acquisition • Expected to be immediately 8% - 10% accretive to MFFO per share • Estimated pro forma dividend coverage expected to exceed 100% • Realized meaningful cost synergies through internal management • Strengthened balance sheet • Increased future earnings growth potential • Improved valuation potential resulting from increased earnings, scale and internalized manager • Asset management fees provide consistent, predictable income through market cycles • Managed portfolios provide embedded acquisition pipeline with increased opportunities for growth We are now the largest internally-managed REIT exclusively focused on grocery-anchored properties

17 www.phillipsedison.com Management Aligned with Shareholders • Equity-based consideration and earn-out aligned management with stockholders and preserves capital for future investments • Management is now the Company's largest stockholder, owning 10.0% of the combined company, with a long term view of increasing stockholder value • Earn-out structure incentivizes future performance - including a liquidity event and achievement of certain fundraising targets for REIT III All positive steps toward a liquidity event for PECO Shareholders

18 www.phillipsedison.com Changing our Name to: Phillips Edison & Company, Inc.

19 www.phillipsedison.com Market Update - Competitive Market Reflects Demand for Quality Real Estate • Amazon - Whole Foods: $13.7 billion investment into brick & mortar · Amazon Fresh cutting back delivery to select markets • German grocers - Investing and expanding in the U.S. market · Lidl - Investing $3.0 billion to open 100 stores by the end of summer 2018 · Aldi - Investing $3.4 billion to remodel stores and expand footprint • Traditional Grocers continues to evolve · Sprouts - reported strong Q3 results despite its meaningful geographic overlap with Whole Foods' price reductions · Raised sales and earnings estimates - opened 32 stores YTD · Kroger: delivery (Instacart), ClickList (shop online, pick up in store), private label, meal kits, ready-to-eat, data collection, etc. · Q2 2017 rebound in same-store sales - positive quarter

20 www.phillipsedison.com Question and Answer Session If you are logged in to the webcast presentation, you can submit a question by typing it into the text box, and clicking submit.

For More Information: Thank You InvestorRelations@PhillipsEdison.com www.phillipsedison.com DST: (888) 518-8073 Griffin Capital Securities: (866) 788-8614

Appendix

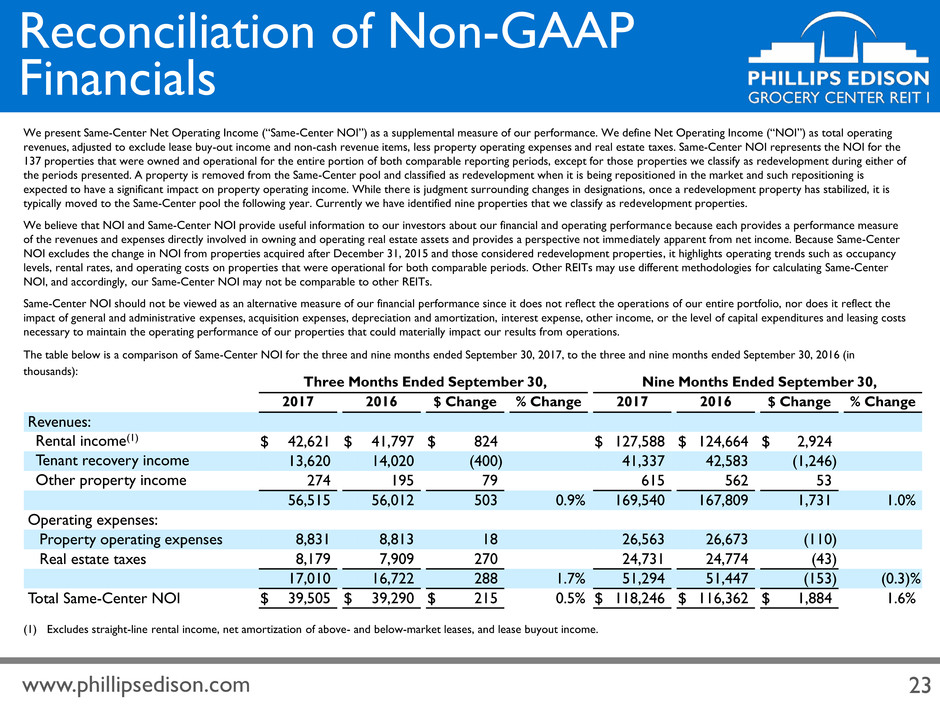

23 www.phillipsedison.com We present Same-Center Net Operating Income (“Same-Center NOI”) as a supplemental measure of our performance. We define Net Operating Income (“NOI”) as total operating revenues, adjusted to exclude lease buy-out income and non-cash revenue items, less property operating expenses and real estate taxes. Same-Center NOI represents the NOI for the 137 properties that were owned and operational for the entire portion of both comparable reporting periods, except for those properties we classify as redevelopment during either of the periods presented. A property is removed from the Same-Center pool and classified as redevelopment when it is being repositioned in the market and such repositioning is expected to have a significant impact on property operating income. While there is judgment surrounding changes in designations, once a redevelopment property has stabilized, it is typically moved to the Same-Center pool the following year. Currently we have identified nine properties that we classify as redevelopment properties. We believe that NOI and Same-Center NOI provide useful information to our investors about our financial and operating performance because each provides a performance measure of the revenues and expenses directly involved in owning and operating real estate assets and provides a perspective not immediately apparent from net income. Because Same-Center NOI excludes the change in NOI from properties acquired after December 31, 2015 and those considered redevelopment properties, it highlights operating trends such as occupancy levels, rental rates, and operating costs on properties that were operational for both comparable periods. Other REITs may use different methodologies for calculating Same-Center NOI, and accordingly, our Same-Center NOI may not be comparable to other REITs. Same-Center NOI should not be viewed as an alternative measure of our financial performance since it does not reflect the operations of our entire portfolio, nor does it reflect the impact of general and administrative expenses, acquisition expenses, depreciation and amortization, interest expense, other income, or the level of capital expenditures and leasing costs necessary to maintain the operating performance of our properties that could materially impact our results from operations. The table below is a comparison of Same-Center NOI for the three and nine months ended September 30, 2017, to the three and nine months ended September 30, 2016 (in thousands): Three Months Ended September 30, Nine Months Ended September 30, 2017 2016 $ Change % Change 2017 2016 $ Change % Change Revenues: Rental income(1) $ 42,621 $ 41,797 $ 824 $ 127,588 $ 124,664 $ 2,924 Tenant recovery income 13,620 14,020 (400 ) 41,337 42,583 (1,246 ) Other property income 274 195 79 615 562 53 56,515 56,012 503 0.9 % 169,540 167,809 1,731 1.0 % Operating expenses: Property operating expenses 8,831 8,813 18 26,563 26,673 (110 ) Real estate taxes 8,179 7,909 270 24,731 24,774 (43 ) 17,010 16,722 288 1.7 % 51,294 51,447 (153 ) (0.3 )% Total Same-Center NOI $ 39,505 $ 39,290 $ 215 0.5 % $ 118,246 $ 116,362 $ 1,884 1.6 % (1) Excludes straight-line rental income, net amortization of above- and below-market leases, and lease buyout income. Reconciliation of Non-GAAP Financials

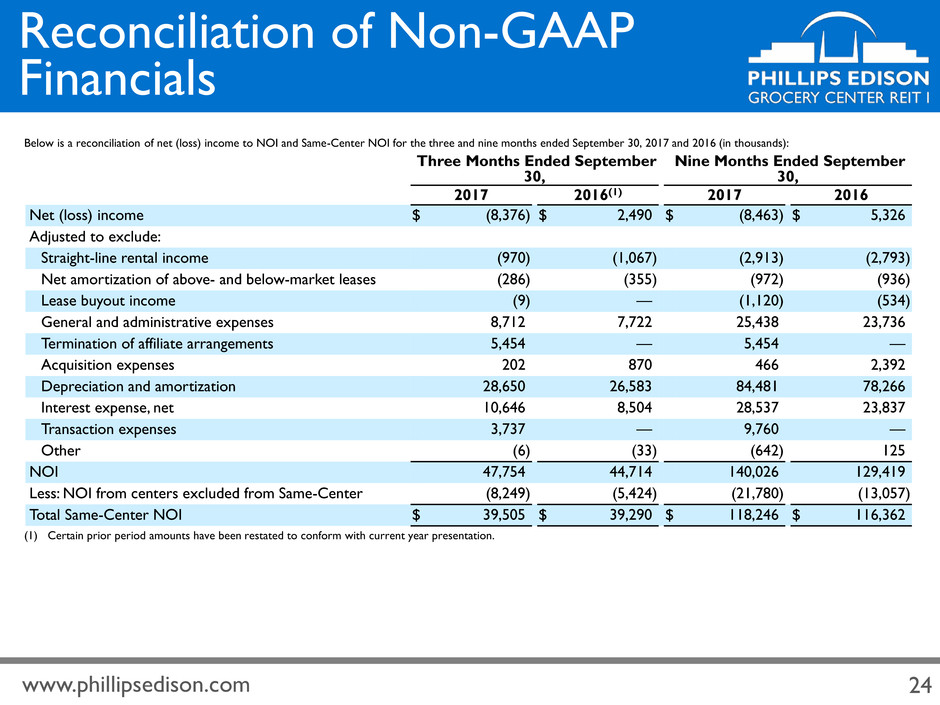

24 www.phillipsedison.com Below is a reconciliation of net (loss) income to NOI and Same-Center NOI for the three and nine months ended September 30, 2017 and 2016 (in thousands): Three Months Ended September 30, Nine Months Ended September 30, 2017 2016(1) 2017 2016 Net (loss) income $ (8,376 ) $ 2,490 $ (8,463 ) $ 5,326 Adjusted to exclude: Straight-line rental income (970 ) (1,067 ) (2,913 ) (2,793 ) Net amortization of above- and below-market leases (286 ) (355 ) (972 ) (936 ) Lease buyout income (9 ) — (1,120 ) (534 ) General and administrative expenses 8,712 7,722 25,438 23,736 Termination of affiliate arrangements 5,454 — 5,454 — Acquisition expenses 202 870 466 2,392 Depreciation and amortization 28,650 26,583 84,481 78,266 Interest expense, net 10,646 8,504 28,537 23,837 Transaction expenses 3,737 — 9,760 — Other (6 ) (33 ) (642 ) 125 NOI 47,754 44,714 140,026 129,419 Less: NOI from centers excluded from Same-Center (8,249 ) (5,424 ) (21,780 ) (13,057 ) Total Same-Center NOI $ 39,505 $ 39,290 $ 118,246 $ 116,362 Reconciliation of Non-GAAP Financials (1) Certain prior period amounts have been restated to conform with current year presentation.

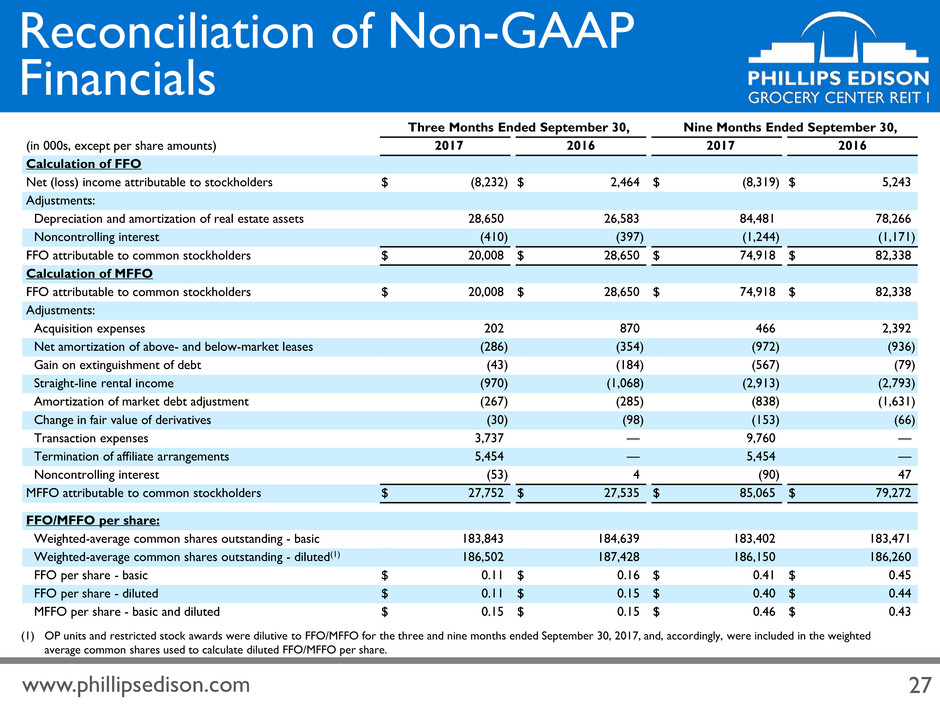

25 www.phillipsedison.com Funds from Operations and Modified Funds from Operations FFO is a non-GAAP financial measure that is widely recognized as a measure of REIT operating performance. We use FFO as defined by the National Association of Real Estate Investment Trusts (“NAREIT”) to be net income (loss), computed in accordance with GAAP, adjusted for gains (or losses) from sales of depreciable real estate property (including deemed sales and settlements of pre-existing relationships), plus depreciation and amortization on real estate assets and impairment charges, and after related adjustments for unconsolidated partnerships, joint ventures, and noncontrolling interests. We believe that FFO is helpful to our investors and our management as a measure of operating performance because, when compared year over year, it reflects the impact on operations from trends in occupancy rates, rental rates, operating costs, development activities, general and administrative expenses, and interest costs, which are not immediately apparent from net income. Since the definition of FFO was promulgated by NAREIT, GAAP has expanded to include several new accounting pronouncements, such that management and many investors and analysts have considered the presentation of FFO alone to be insufficient. Accordingly, in addition to FFO, we use MFFO, which, as defined by us, excludes from FFO the following items: • acquisition and transaction expenses; • straight-line rent amounts, both income and expense; • amortization of above- or below-market intangible lease assets and liabilities; • amortization of discounts and premiums on debt investments; • gains or losses from the early extinguishment of debt; • gains or losses on the extinguishment of derivatives, except where the trading of such instruments is a fundamental attribute of our operations; • gains or losses related to fair value adjustments for derivatives not qualifying for hedge accounting; • adjustments related to the above items for joint ventures and noncontrolling interests and unconsolidated entities in the application of equity accounting; • termination of affiliate arrangements. We believe that MFFO is helpful in assisting management and investors with the assessment of the sustainability of operating performance in future periods and, in particular, after our acquisition stage is complete, because MFFO excludes acquisition expenses that affect operations only in the period in which the property is acquired. Thus, MFFO provides helpful information relevant to evaluating our operating performance in periods in which there is no acquisition activity. Reconciliation of Non-GAAP Financials

26 www.phillipsedison.com Many of the adjustments in arriving at MFFO are not applicable to us. Nevertheless, as explained below, management’s evaluation of our operating performance may also exclude items considered in the calculation of MFFO based on the following economic considerations. • Adjustments for straight-line rents and amortization of discounts and premiums on debt investments—GAAP requires rental receipts and discounts and premiums on debt investments to be recognized using various systematic methodologies. This may result in income recognition that could be significantly different than underlying contract terms. By adjusting for these items, MFFO provides useful supplemental information on the realized economic impact of lease terms and debt investments and aligns results with management’s analysis of operating performance. The adjustment to MFFO for straight-line rents, in particular, is made to reflect rent and lease payments from a GAAP accrual basis to a cash basis. • Adjustments for amortization of above- or below-market intangible lease assets—Similar to depreciation and amortization of other real estate-related assets that are excluded from FFO, GAAP implicitly assumes that the value of intangibles diminishes ratably over the lease term and should be recognized in revenue. Since real estate values and market lease rates in the aggregate have historically risen or fallen with market conditions, and the intangible value is not adjusted to reflect these changes, management believes that by excluding these charges, MFFO provides useful supplemental information on the performance of the real estate. • Gains or losses related to fair value adjustments for derivatives not qualifying for hedge accounting—This item relates to a fair value adjustment, which is based on the impact of current market fluctuations and underlying assessments of general market conditions and specific performance of the holding, which may not be directly attributable to current operating performance. As these gains or losses relate to underlying long-term assets and liabilities, management believes MFFO provides useful supplemental information by focusing on the changes in core operating fundamentals rather than changes that may reflect anticipated, but unknown, gains or losses. • Adjustment for gains or losses related to early extinguishment of derivatives and debt instruments—These adjustments are not related to continuing operations. By excluding these items, management believes that MFFO provides supplemental information related to sustainable operations that will be more comparable between other reporting periods and to other real estate operators. • Adjustment for the termination of affiliate arrangements—This adjustment is related to our redemption of Class B units at the current estimated value per share that had been earned by our former advisor for historical asset management services, and is not related to continuing operations. By excluding this item, management believes that MFFO provides supplemental information related to sustainable operations that will be more comparable between other reporting periods and to other real estate operators. Neither FFO nor MFFO should be considered as an alternative to net income (loss) or income (loss) from continuing operations under GAAP, nor as an indication of our liquidity, nor is either of these measures indicative of funds available to fund our cash needs, including our ability to fund distributions. MFFO may not be a useful measure of the impact of long-term operating performance on value if we do not continue to operate our business plan in the manner currently contemplated. Accordingly, FFO and MFFO should be reviewed in connection with other GAAP measurements. FFO and MFFO should not be viewed as more prominent measures of performance than our net income or cash flows from operations prepared in accordance with GAAP. Our FFO and MFFO, as presented, may not be comparable to amounts calculated by other REITs. Reconciliation of Non-GAAP Financials

27 www.phillipsedison.com Three Months Ended September 30, Nine Months Ended September 30, (in 000s, except per share amounts) 2017 2016 2017 2016 Calculation of FFO Net (loss) income attributable to stockholders $ (8,232 ) $ 2,464 $ (8,319 ) $ 5,243 Adjustments: Depreciation and amortization of real estate assets 28,650 26,583 84,481 78,266 Noncontrolling interest (410 ) (397 ) (1,244 ) (1,171 ) FFO attributable to common stockholders $ 20,008 $ 28,650 $ 74,918 $ 82,338 Calculation of MFFO FFO attributable to common stockholders $ 20,008 $ 28,650 $ 74,918 $ 82,338 Adjustments: Acquisition expenses 202 870 466 2,392 Net amortization of above- and below-market leases (286 ) (354 ) (972 ) (936 ) Gain on extinguishment of debt (43 ) (184 ) (567 ) (79 ) Straight-line rental income (970 ) (1,068 ) (2,913 ) (2,793 ) Amortization of market debt adjustment (267 ) (285 ) (838 ) (1,631 ) Change in fair value of derivatives (30 ) (98 ) (153 ) (66 ) Transaction expenses 3,737 — 9,760 — Termination of affiliate arrangements 5,454 — 5,454 — Noncontrolling interest (53 ) 4 (90 ) 47 MFFO attributable to common stockholders $ 27,752 $ 27,535 $ 85,065 $ 79,272 FFO/MFFO per share: Weighted-average common shares outstanding - basic 183,843 184,639 183,402 183,471 Weighted-average common shares outstanding - diluted(1) 186,502 187,428 186,150 186,260 FFO per share - basic $ 0.11 $ 0.16 $ 0.41 $ 0.45 FFO per share - diluted $ 0.11 $ 0.15 $ 0.40 $ 0.44 MFFO per share - basic and diluted $ 0.15 $ 0.15 $ 0.46 $ 0.43 Reconciliation of Non-GAAP Financials (1) OP units and restricted stock awards were dilutive to FFO/MFFO for the three and nine months ended September 30, 2017, and, accordingly, were included in the weighted average common shares used to calculate diluted FFO/MFFO per share.