First Quarter 2018 Results Presentation Thursday, May 10, 2018

Agenda Prepared Remarks R. Mark Addy - Executive Vice President • Intro & Portfolio Update Jeff Edison - Chairman and CEO • Estimated Value per Share Update & Market Commentary Devin Murphy - CFO • Financial Results R. Mark Addy - Executive Vice President • Share Repurchase Program & Liquidity Question and Answer Session www.phillipsedison.com/investors 2

Forward-Looking Statement Disclosure This presentation and the corresponding call may contain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. These statements include, but are not limited to, statements related to the Company’s expectations regarding the performance of its business, its financial results, its liquidity and capital resources, the quality of the Company’s portfolio of grocery-anchored shopping centers, and other non-historical statements. You can identify these forward-looking statements by the use of words such as “outlook,” “believes,” “expects,” “potential,” “continues,” “may,” “will,” “should,” “seeks,” “approximately,” “projects,” “predicts,” “intends,” “plans,” “estimates,” “anticipates,” or the negative version of these words or other comparable words. Such forward- looking statements are subject to various risks and uncertainties, such as the risks that retail conditions may adversely affect our base rent and, subsequently, our income, and that our properties consist primarily of retail properties and our performance, therefore, is linked to the market for retail space generally, as well as other risks that are described under the section entitled “Risk Factors” in the Company’s Annual Report on Form 10-K for the year ended December 31, 2017, as such factors may be updated from time to time in the Company’s periodic filings with the SEC, which are accessible on the SEC’s website at www.sec.gov. Accordingly, there are or will be important factors that could cause actual outcomes or results to differ materially from those indicated in these statements. These factors should not be construed as exhaustive and should be read in conjunction with the other cautionary statements that are included in this presentation, the corresponding call and in the Company’s filings with the SEC. The Company undertakes no obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future events, or otherwise. www.phillipsedison.com/investors 3

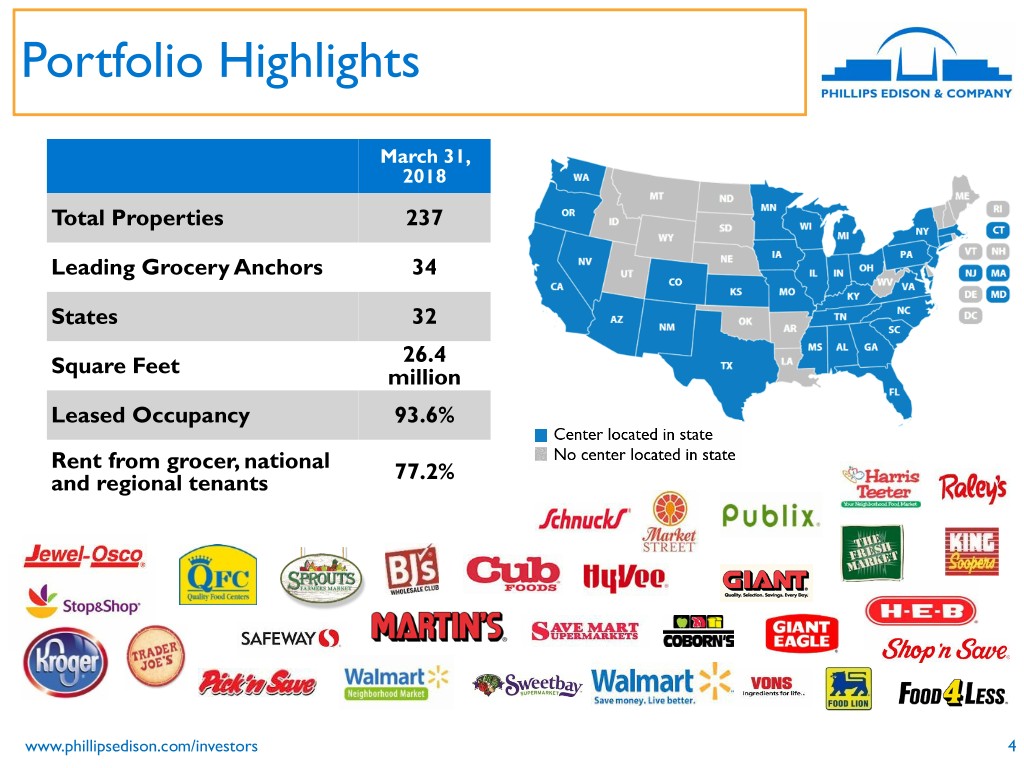

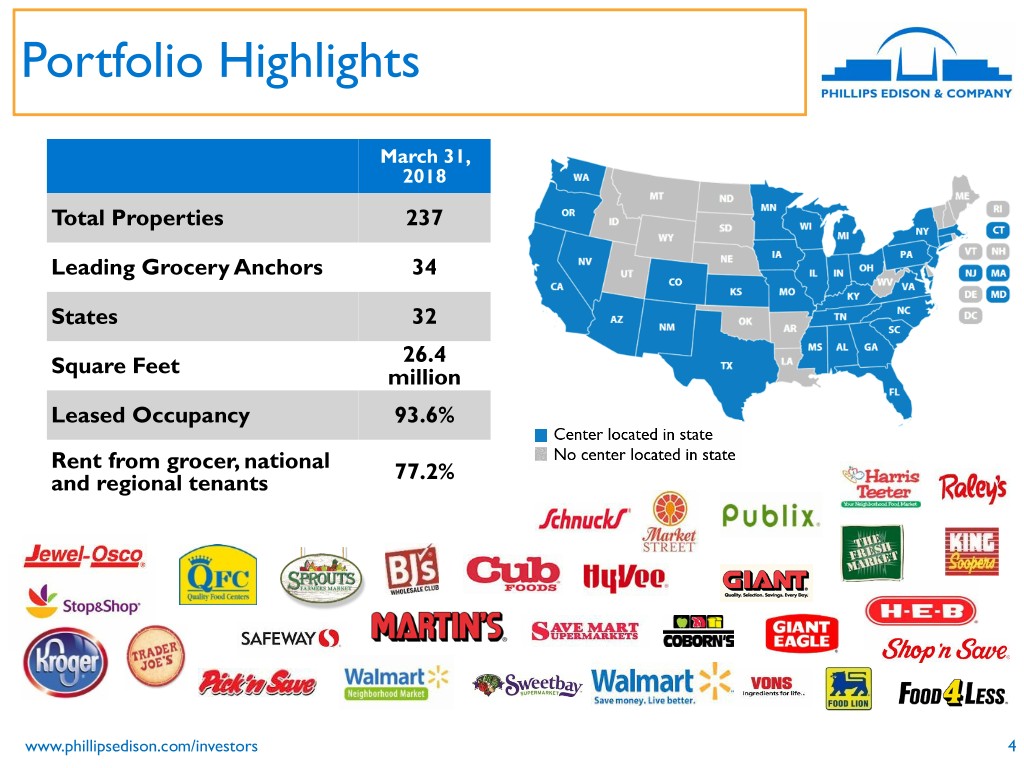

Portfolio Highlights March 31, 2018 Total Properties 237 Leading Grocery Anchors 34 States 32 26.4 Square Feet million Leased Occupancy 93.6% Rent from grocer, national and regional tenants 77.2% www.phillipsedison.com/investors 4

Q1 2018 Portfolio Results Annualized Base Rent by Tenant Type Annualized Base Rent by Tenant Industry Top 5 Grocers by % of Annualized Base Rent Grocer % of ABR # of Locations Kroger 9.2% 55 Publix Super Markets 6.1% 37 Ahold Delhaize 3.6% 19 Albertsons Companies 3.4% 17 Giant Eagle 2.4% 9 We calculate annualized base rent as monthly contractual rent as of March 31, 2018, multiplied by 12 months. www.phillipsedison.com/investors 5

Q1 2018 Highlights First Quarter 2018 Highlights (vs. First Quarter 2017) • Acquired one grocery-anchored shopping center for $8.4 million • Net loss totaled $1.8 million • Pro forma same-center net operating income (NOI)1 increased 4.3% to $61.3 million • Funds from operations (FFO) increased 40.4% ◦ 20.0% increase to $0.18 per diluted share • FFO totaled 104% of regular distributions made during the quarter • Modified funds from operations (MFFO) increased 46.9% ◦ 20.0% increase to $0.18 per diluted share 1) NOI = Net Operating Income; Pro forma NOI reflects adjustments for the PELP acquisition. See Slide 19 for more information. www.phillipsedison.com/investors 6

Estimated Value per Share • Duff & Phelps, an independent third-party valuation firm, produced an estimated value per share in the range of $10.35 to $11.75 as of March 31, 2018 • On May 9, 2018, the company’s board of directors established the estimated value per share of its common stock and operating partnership units at $11.05, which is the midpoint of the range Represents a 10.5% increase from original offering price of $10.00 per share Illustrates the successful integration of Phillips Edison Limited Partnership's ⦁ (PELP) assets and investment management business and the continued ⦁ growth of our owned centers Please note that the estimated value per share is not intended to represent an enterprise or liquidation value of our company. It is important to remember that the estimated value per share may not reflect the amount you would obtain if you were to sell your shares or if we liquidated our assets. Further, the estimated value per share is as of a moment in time, and the value of our shares and assets may change over time as a result of several factors including, but not limited to, future acquisitions or dispositions, other developments related to individual assets, and changes in the real estate and capital markets, and we do not undertake to update the estimated value per share to account for any such events. You should not rely on the estimated value per share as being an accurate measure of the then-current value of your shares in making a decision to buy or sell your shares, including whether to participate in our dividend reinvestment plan or our share repurchase program. For a description of the methodology and assumptions used to determine the estimated value per share, see our recent 10-Q filing made with the U.S. Securities and Exchange Commission. www.phillipsedison.com/investors 7

Shopping Center Real Estate Market Update • Publicly traded peers continue to trade at a discount to NAV As of April 30, our publicly traded peers were trading at an average discount to NAV of approximately 29%* ⦁ We believe this is a disconnect between the public and private valuations of retail real estate ⦁ • However, retail real estate fundamentals remain strong at the property level Driven by solid Q1 2018 earnings, share prices were up approximately 5% during the first week of earnings ⦁ • Shopping centers in leading markets continue to sell at relatively expensive valuations • We believe this gap between public and private valuations will close over time * SNL Financial. Peers include: BRX, CDR, KIM, KRG, REG, ROIC, RPAI, RPT, WRI www.phillipsedison.com/investors 8

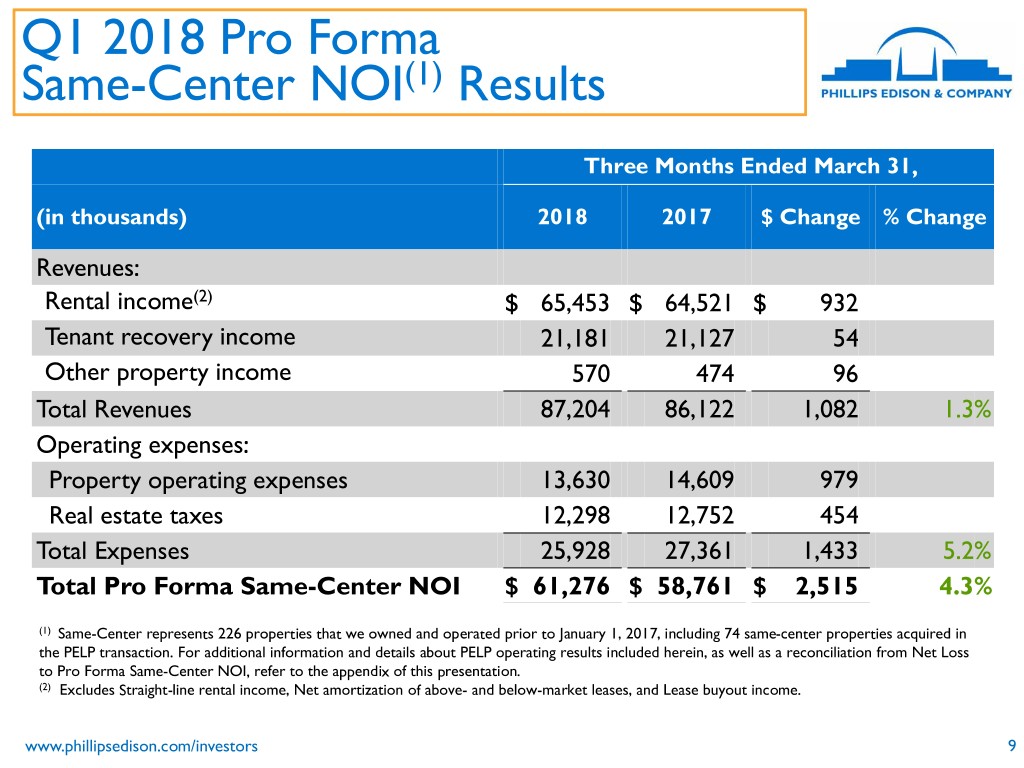

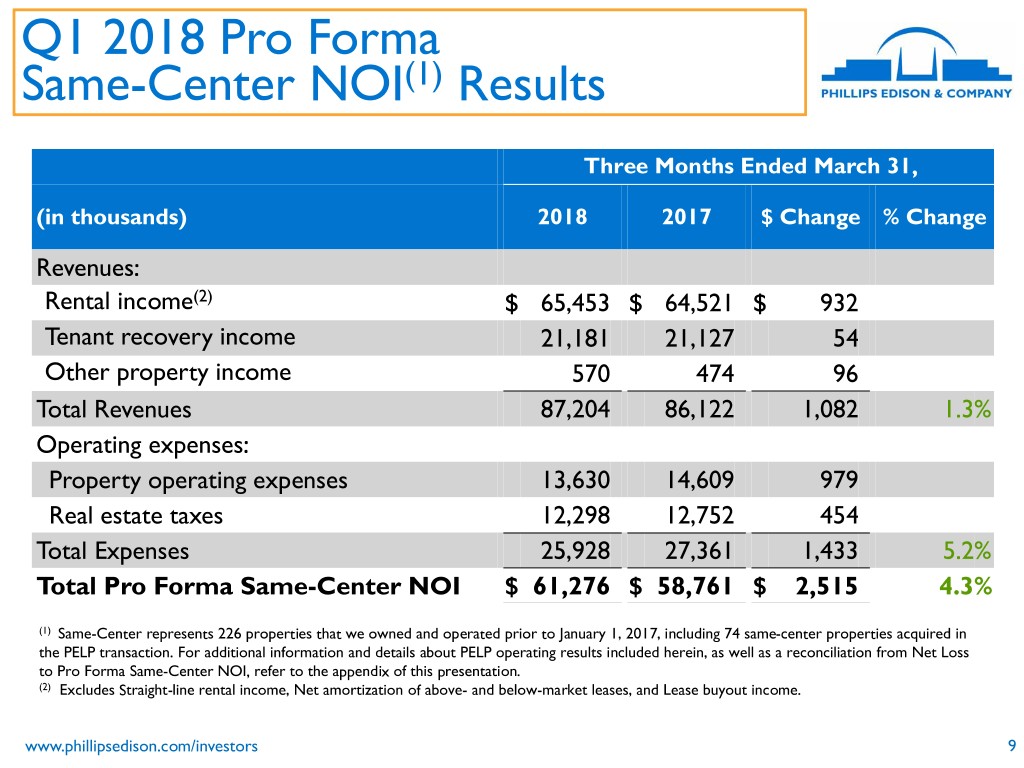

Q1 2018 Pro Forma Same-Center NOI(1) Results Three Months Ended March 31, (in thousands) 2018 2017 $ Change % Change Revenues: Rental income(2) $ 65,453 $ 64,521 $ 932 Tenant recovery income 21,181 21,127 54 Other property income 570 474 96 Total Revenues 87,204 86,122 1,082 1.3% Operating expenses: Property operating expenses 13,630 14,609 979 Real estate taxes 12,298 12,752 454 Total Expenses 25,928 27,361 1,433 5.2% Total Pro Forma Same-Center NOI $ 61,276 $ 58,761 $ 2,515 4.3% (1) Same-Center represents 226 properties that we owned and operated prior to January 1, 2017, including 74 same-center properties acquired in the PELP transaction. For additional information and details about PELP operating results included herein, as well as a reconciliation from Net Loss to Pro Forma Same-Center NOI, refer to the appendix of this presentation. (2) Excludes Straight-line rental income, Net amortization of above- and below-market leases, and Lease buyout income. www.phillipsedison.com/investors 9

Q1 2018 Financials Results Three Months Ended March 31, (in thousands) 2018 2017 $ Change % Change Net (Loss) Income $ (1,837) $ 1,134 $ (2,971) NM Adjustments(1) 42,202 27,624 14,578 52.8% FFO Attributable to Stockholders and Convertible Noncontrolling Interests 40,365 28,758 11,607 40.4% Adjustments(2) 1,823 (32) 1,855 NM MFFO $ 42,188 $ 28,726 $ 13,462 46.9% Diluted FFO Attributable to Stockholders and Convertible Noncontrolling Interests/Share $0.18 $0.15 $0.03 20.0% Diluted MFFO/Share $0.18 $0.15 $0.03 20.0% (1) Adjustments include depreciation and amortization of real estate assets and noncontrolling interest not convertible into common stock. (2) Adjustments include amortization of above- and below market leases, amortization and depreciation of corporate assets, gain on extinguishment of debt, straight-line rent, amortization of market debt adjustment, change in fair value of derivatives, and other. *See Appendix for a complete reconciliation of net (loss) income to FFO and MFFO www.phillipsedison.com/investors 10

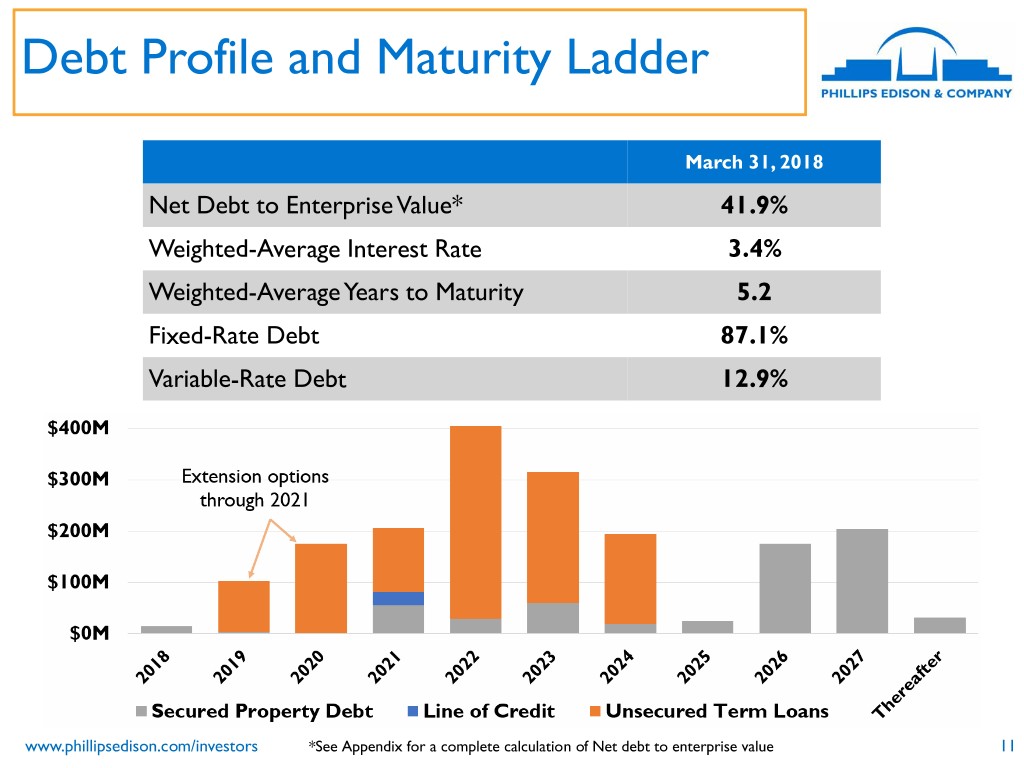

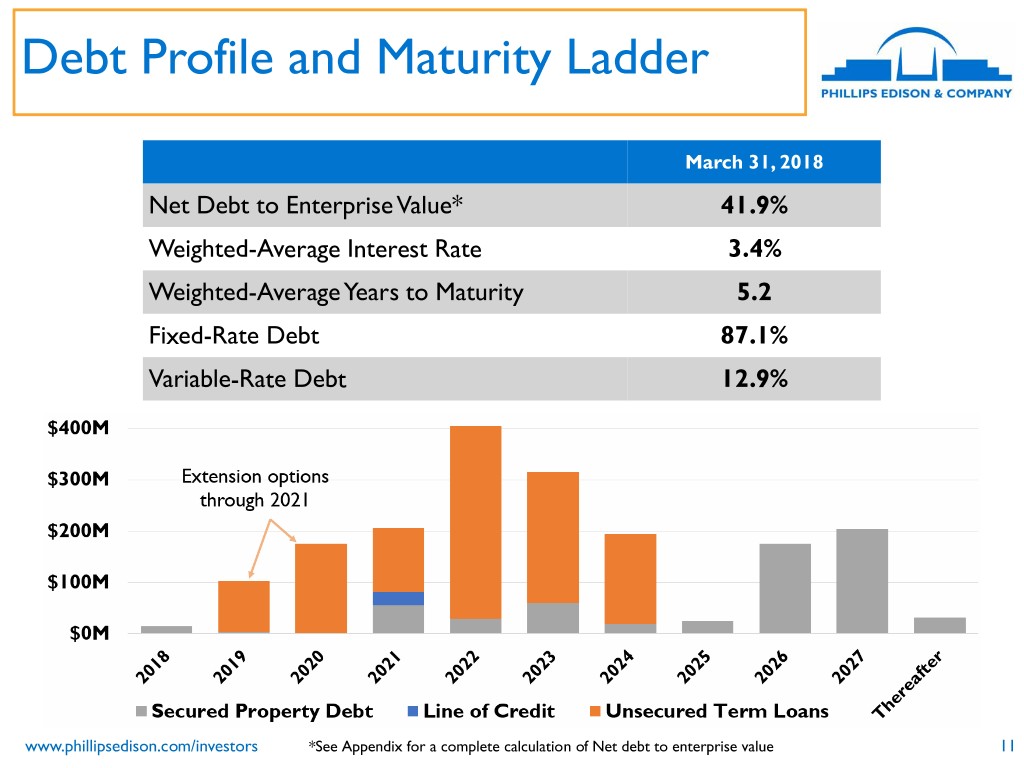

Debt Profile and Maturity Ladder March 31, 2018 Net Debt to Enterprise Value* 41.9% Weighted-Average Interest Rate 3.4% Weighted-Average Years to Maturity 5.2 Fixed-Rate Debt 87.1% Variable-Rate Debt 12.9% www.phillipsedison.com/investors *See Appendix for a complete calculation of Net debt to enterprise value 11

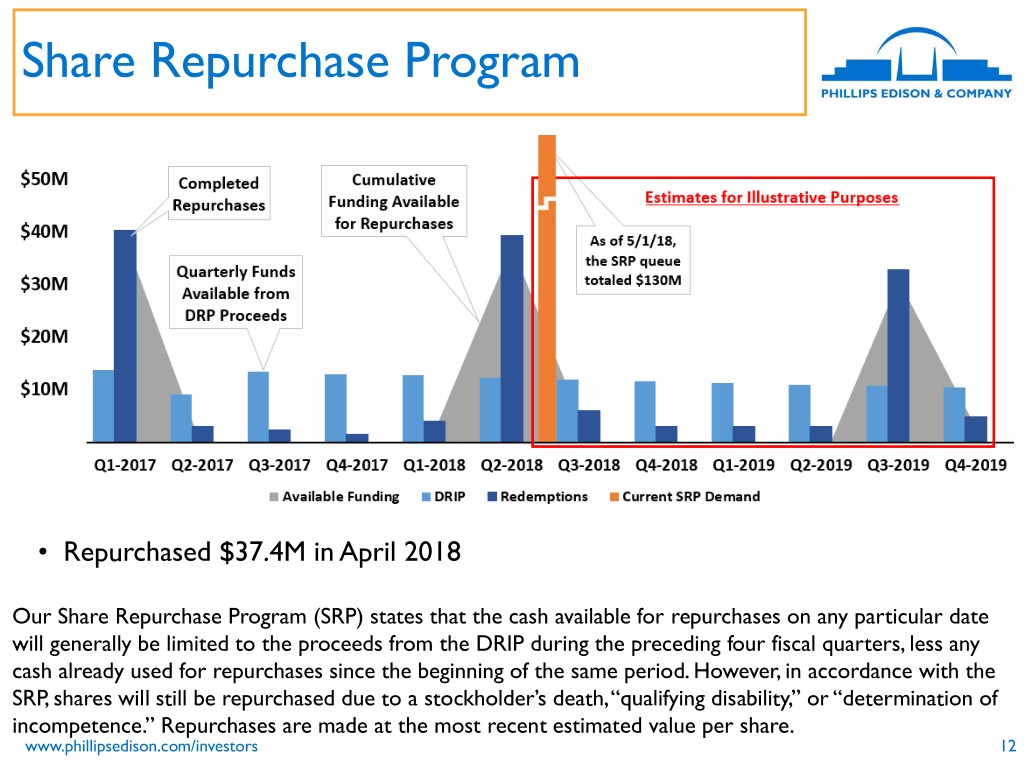

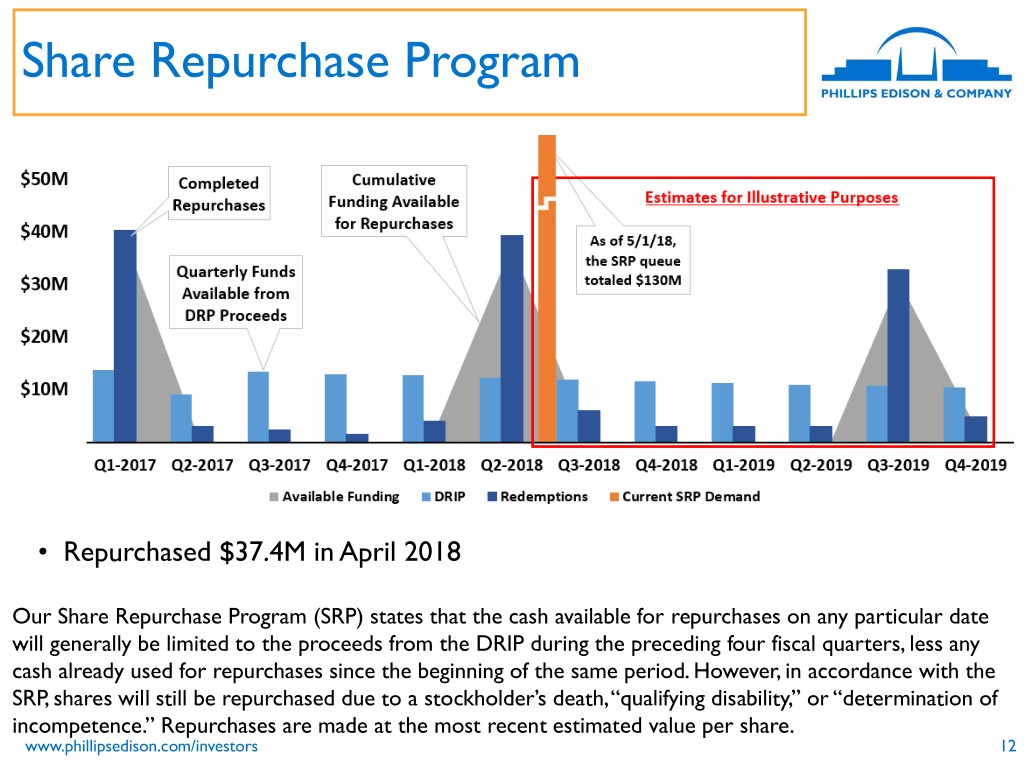

Share Repurchase Program • Repurchased $37.4M in April 2018 Our Share Repurchase Program (SRP) states that the cash available for repurchases on any particular date will generally be limited to the proceeds from the DRIP during the preceding four fiscal quarters, less any cash already used for repurchases since the beginning of the same period. However, in accordance with the SRP, shares will still be repurchased due to a stockholder’s death, “qualifying disability,” or “determination of incompetence.” Repurchases are made at the most recent estimated value per share. www.phillipsedison.com/investors 12

Liquidity • The acquisition of PELP was a positive step towards a potential liquidity event • Management is now the Company’s largest stockholder currently owning over 9% of the combined company, with a long term view of increasing shareholder value • Earn-out structure incentivizes future performance - motivation to effect a liquidity event for PECO and achieve certain fundraising targets for REIT III • Our management and board of directors are continually evaluating our liquidity options. We believe that a patient approach is prudent in order to successfully complete a full cycle liquidity event at an attractive price www.phillipsedison.com/investors 13

Question and Answer Session If you are logged in to the webcast presentation, you can submit a question by typing it into the text box, and clicking submit. www.phillipsedison.com/investors 14

For More Information: InvestorRelations@PhillipsEdison.com www.phillipsedison.com/investors DST: (888) 518-8073 Griffin Capital Securities: (866) 788-8614

Appendix

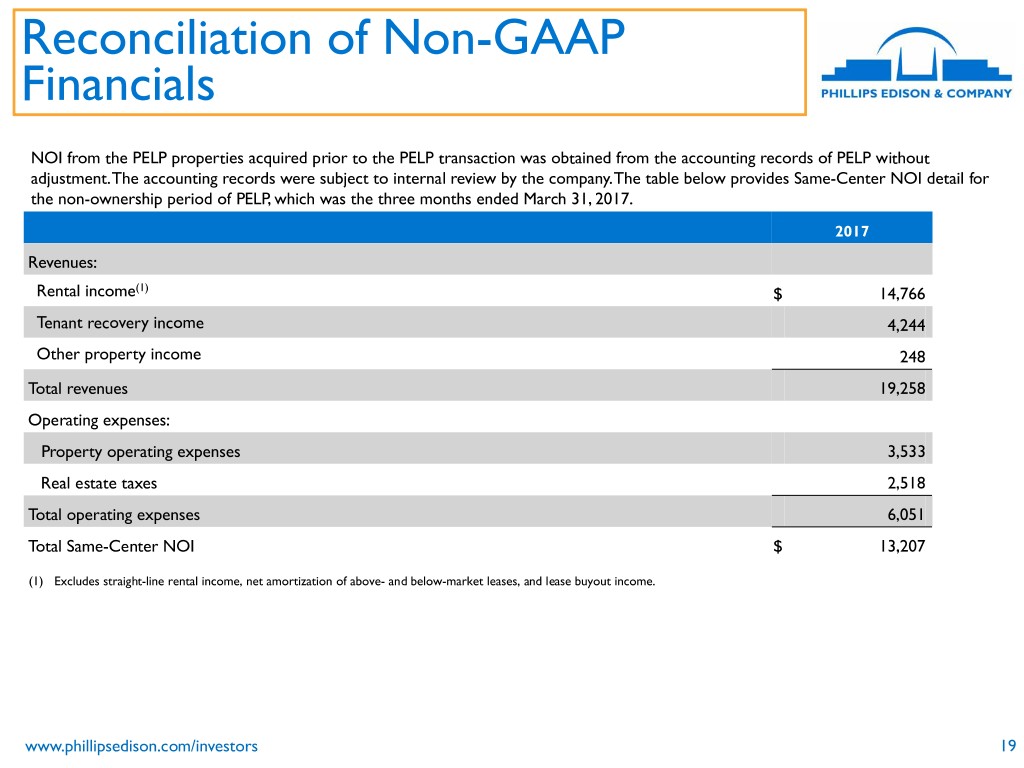

Reconciliation of Non-GAAP Financials Same-center NOI represents the NOI for the properties that were owned and operational for the entire portion of both comparable reporting periods, except for the properties we currently classify as redevelopment. For purposes of evaluating Same-center NOI on a comparative basis, and in light of the PELP transaction, we are presenting Pro Forma Same-center NOI, which assumes the PELP properties were acquired on January 1, 2017. This perspective allows us to evaluate Same-center NOI growth over a comparable period. Pro Forma Same-center NOI is not necessarily indicative of what actual Same-center NOI and growth would have been if the PELP transaction had occurred on January 1, 2017, nor does it purport to represent Same-center NOI and growth for future periods. Pro Forma Same-center NOI highlights operating trends such as occupancy rates, rental rates, and operating costs on properties that were operational for both comparable periods. Other REITs may use different methodologies for calculating Same-center NOI, and accordingly, our Pro Forma Same-center NOI may not be comparable to other REITs. Pro Forma Same-center NOI should not be viewed as an alternative measure of our financial performance since it does not reflect the operations of our entire portfolio, nor does it reflect the impact of general and administrative expenses, acquisition expenses, depreciation and amortization, interest expense, other income, or the level of capital expenditures and leasing costs necessary to maintain the operating performance of our properties that could materially impact our results from operations. www.phillipsedison.com/investors 17

Reconciliation of Non-GAAP Financials Below is a reconciliation of Net (Loss) Income to NOI and Same-Center NOI for the three months ended March 31, 2018 and 2017 (in thousands): Three Months Ended March 31, 2018 2017 Net (loss) income $ (1,837) $ 1,134 Adjusted to exclude: Fees and management income (8,712) — Straight-line rental income (1,080) (493) Net amortization of above- and below-market leases (1,007) (331) Lease buyout income (23) (27) General and administrative expenses 10,461 7,830 Depreciation and amortization 46,427 27,624 Interest expense, net 16,779 8,390 Other 201 1,635 Property management allocations to third-party assets under management(1) 3,602 — Owned Real Estate NOI 64,811 45,762 Less: NOI from centers excluded from same-center (3,535) (208) NOI prior to October 4, 2017, from same-center properties acquired in the PELP transaction — 13,207 Total Pro Forma Same-Center NOI $ 61,276 $ 58,761 (1) This represents property management expenses allocated to third-party owned properties based on the property management fee that is provided for in the individual management agreements under which our investment management business provides services. www.phillipsedison.com/investors 18

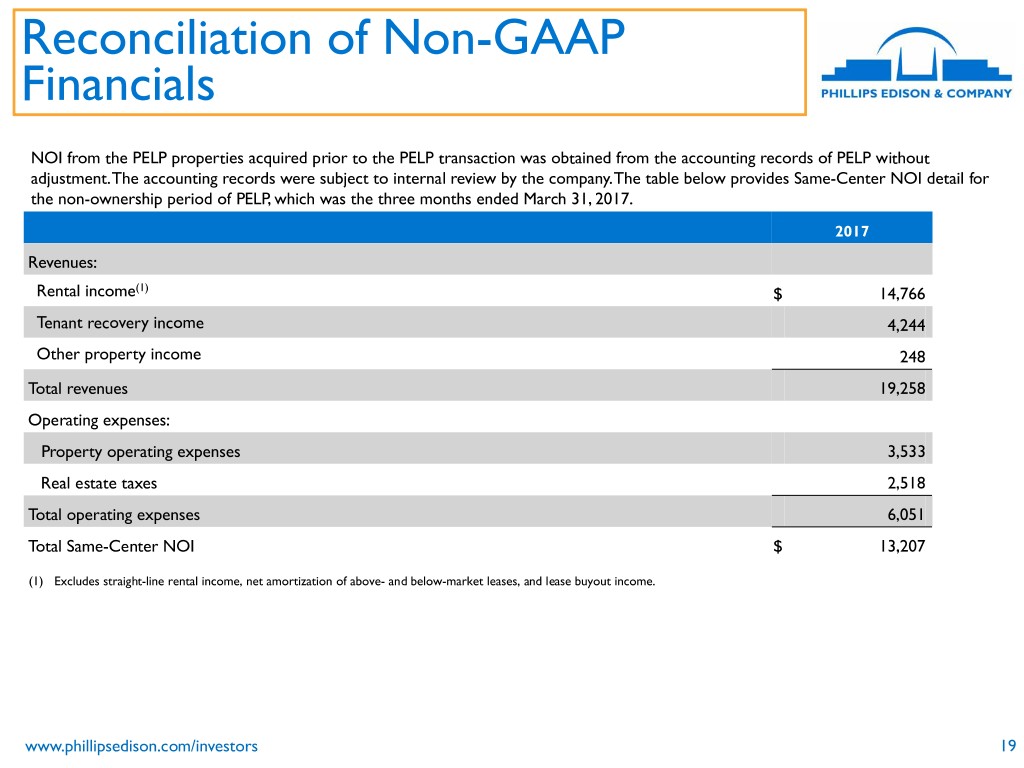

Reconciliation of Non-GAAP Financials NOI from the PELP properties acquired prior to the PELP transaction was obtained from the accounting records of PELP without adjustment. The accounting records were subject to internal review by the company. The table below provides Same-Center NOI detail for the non-ownership period of PELP, which was the three months ended March 31, 2017. 2017 Revenues: Rental income(1) $ 14,766 Tenant recovery income 4,244 Other property income 248 Total revenues 19,258 Operating expenses: Property operating expenses 3,533 Real estate taxes 2,518 Total operating expenses 6,051 Total Same-Center NOI $ 13,207 (1) Excludes straight-line rental income, net amortization of above- and below-market leases, and lease buyout income. www.phillipsedison.com/investors 19

Reconciliation of Non-GAAP Financials Funds from Operations and Modified Funds from Operations FFO is a non-GAAP performance financial measure that is widely recognized as a measure of REIT operating performance. The National Association of Real Estate Investment Trusts (“NAREIT”) defines FFO as net income (loss) attributable to common shareholders computed in accordance with GAAP, excluding gains (or losses) from sales of property, plus depreciation and amortization, and after adjustments for impairment losses on depreciable real estate and impairments of in-substance real estate investments in investees that are driven by measurable decreases in the fair value of the depreciable real estate held by the unconsolidated partnerships and joint ventures. Adjustments for unconsolidated partnerships and joint ventures are calculated to reflect funds from operations on the same basis. We calculate FFO Attributable to Stockholders and Convertible Noncontrolling Interests in a manner consistent with the NAREIT definition, with an additional adjustment made for noncontrolling interests that are not convertible into common stock. MFFO is an additional performance financial measure used by us as FFO includes certain non-comparable items that affect our performance over time. MFFO excludes the following items: • acquisition and transaction expenses; • straight-line rent amounts, both income and expense; • amortization of above- or below-market intangible lease assets and liabilities; • amortization of discounts and premiums on debt investments; • gains or losses from the early extinguishment of debt; • gains or losses on the extinguishment of derivatives, except where the trading of such instruments is a fundamental attribute of our operations; • gains or losses related to fair value adjustments for derivatives not qualifying for hedge accounting; and • adjustments related to the above items for joint ventures and noncontrolling interests and unconsolidated entities in the application of equity accounting. We believe that MFFO is helpful in assisting management and investors with the assessment of the sustainability of operating performance in future periods. We believe it is more reflective of our core operating performance and provides an additional measure to compare our performance across reporting periods on a consistent basis by excluding items that may cause short-term fluctuations in net income (loss) but have no impact on cash flows. FFO, FFO Attributable to Stockholders and Convertible Noncontrolling Interests, and MFFO should not be considered alternatives to net income (loss) or income (loss) from continuing operations under GAAP, as an indication of our liquidity, nor as an indication of funds available to cover our cash needs, including our ability to fund distributions. MFFO may not be a useful measure of the impact of long-term operating performance on value if we do not continue to operate our business plan in the manner currently contemplated. Accordingly, FFO, FFO Attributable to Stockholders and Convertible Noncontrolling Interests, and MFFO should be reviewed in connection with other GAAP measurements, and should not be viewed as more prominent measures of performance than net income (loss) or cash flows from operations prepared in accordance with GAAP. Our FFO, FFO Attributable to Stockholders and Convertible Noncontrolling Interests, and MFFO, as presented, may not be comparable to amounts calculated by other REITs. www.phillipsedison.com/investors 20

Reconciliation of Non-GAAP Financials Three Months Ended March 31, (in thousands, except per share amounts) 2018 2017(1) Calculation of FFO Attributable to Stockholders and Convertible Noncontrolling Interests Net (loss) income $ (1,837) $ 1,134 Adjustments: Depreciation and amortization of real estate assets 42,299 27,624 FFO attributable to the Company 40,462 28,758 Adjustments attributable to noncontrolling interests not convertible into common stock (97) — FFO attributable to stockholders and convertible noncontrolling interests $ 40,365 $ 28,758 Calculation of MFFO FFO attributable to stockholders and convertible noncontrolling interests $ 40,365 $ 28,758 Adjustments: Net amortization of above- and below-market leases (1,007) (331) Depreciation and amortization of corporate assets 4,128 — Gain on extinguishment of debt, net — (524) Straight-line rent (1,057) (493) Amortization of market debt adjustment (272) (278) Other 31 1,594 MFFO $ 42,188 $ 28,726 FFO Attributable to Stockholders and Convertible Noncontrolling Interests/MFFO per share Weighted-average common shares outstanding - diluted(2) 230,360 186,022 FFO attributable to stockholders and convertible noncontrolling interests per share - diluted(2) $ 0.18 $ 0.15 MFFO per share - diluted $ 0.18 $ 0.15 (1) Certain prior period amounts have been restated to conform with current year presentation. (2) OP units and restricted stock awards were dilutive to FFO Attributable to Stockholders and Convertible Noncontrolling Interests and MFFO for the three months ended March 31, 2018 and 2017, and, accordingly, were included in the weighted-average common shares used to calculate diluted FFO Attributable to Stockholders and Convertible Noncontrolling Interests/MFFO per share. www.phillipsedison.com/investors 21

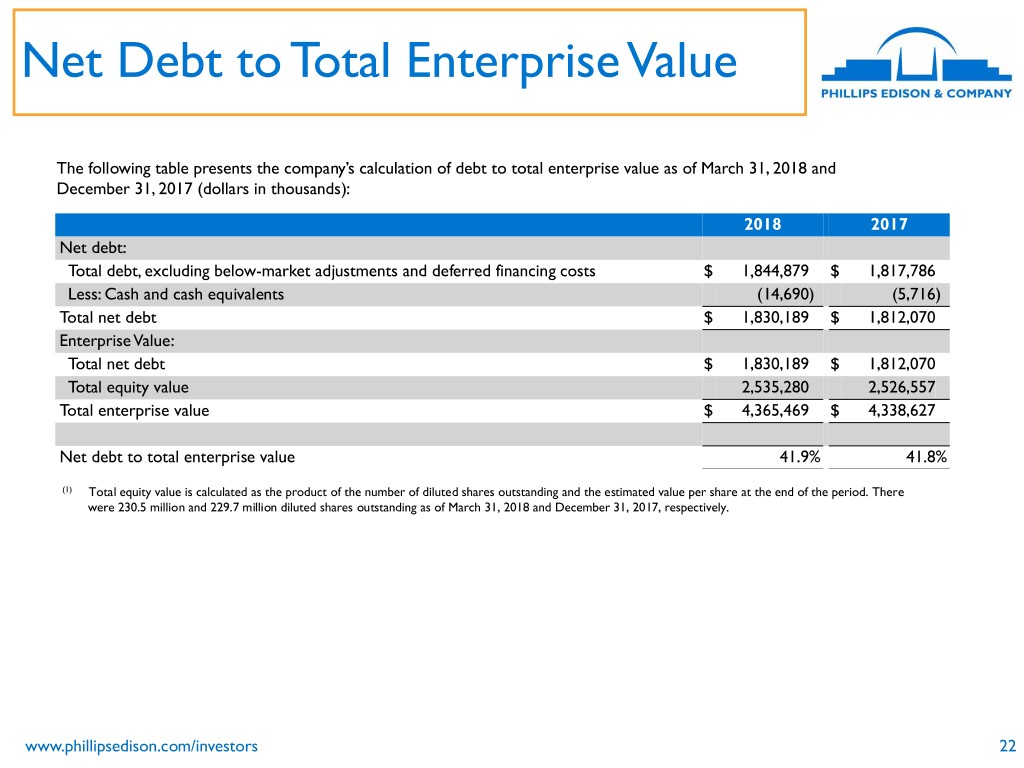

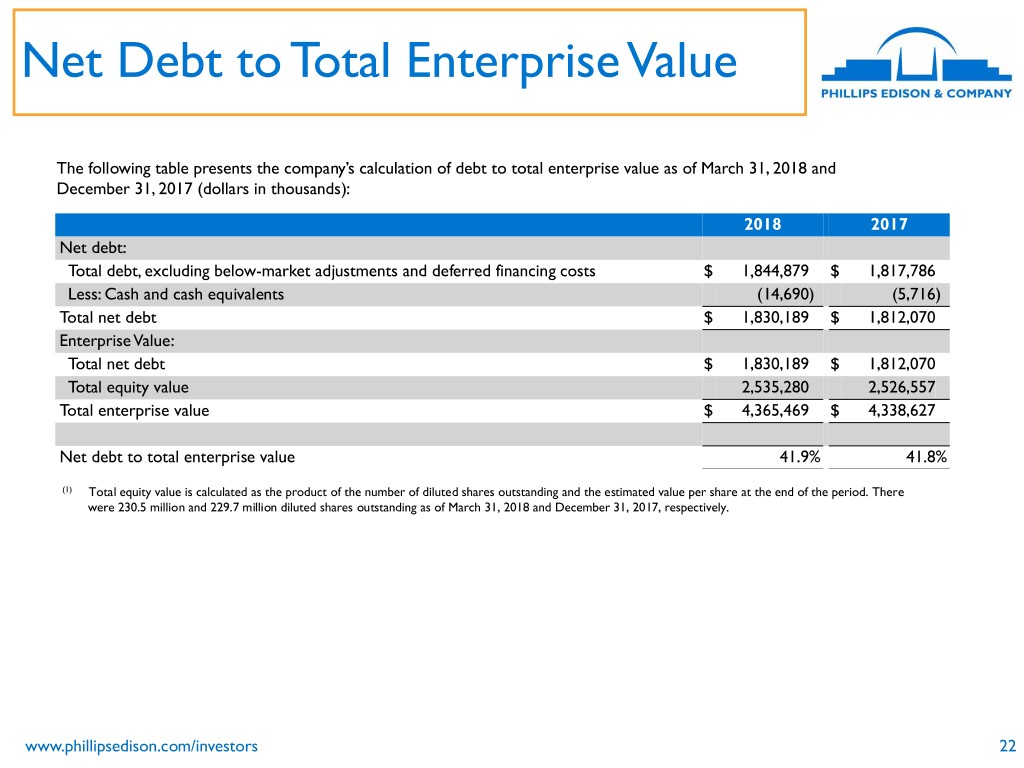

Net Debt to Total Enterprise Value The following table presents the company’s calculation of debt to total enterprise value as of March 31, 2018 and December 31, 2017 (dollars in thousands): 2018 2017 Net debt: Total debt, excluding below-market adjustments and deferred financing costs $ 1,844,879 $ 1,817,786 Less: Cash and cash equivalents (14,690) (5,716) Total net debt $ 1,830,189 $ 1,812,070 Enterprise Value: Total net debt $ 1,830,189 $ 1,812,070 Total equity value 2,535,280 2,526,557 Total enterprise value $ 4,365,469 $ 4,338,627 Net debt to total enterprise value 41.9% 41.8% (1) Total equity value is calculated as the product of the number of diluted shares outstanding and the estimated value per share at the end of the period. There were 230.5 million and 229.7 million diluted shares outstanding as of March 31, 2018 and December 31, 2017, respectively. www.phillipsedison.com/investors 22