| | | | | | | | | | | | | | | | | | | | | | | |

| | |

| Filed pursuant to Rule 424(b)(4)

Registration No. 333-260297 | |

| Prospectus 9,730,776 shares | |

| | | | | | | |

| | Expensify, Inc. Class A common stock This is an initial public offering of shares of Class A common stock by Expensify, Inc. We are offering 2,608,696 shares of our Class A common stock and the selling stockholders identified in this prospectus are offering an additional 7,122,080 shares of Class A common stock. We will not receive any proceeds from the sale of shares by the selling stockholders. The initial public offering price is $27.00 per share of Class A common stock. Prior to this offering, there has been no public market for our common stock. Our Class A common stock has been approved for listing on The Nasdaq Global Select Market ("Nasdaq") under the symbol “EXFY.” Following this offering, we will have three classes of common stock: Class A, LT10 and LT50 common stock. This is a novel capital structure that differs significantly from those of other companies that have dual or multiple class capital structures. The rights of holders of Class A, LT10 and LT50 common stock are identical, except for voting, transfer and conversion rights. Each share of Class A common stock is entitled to one vote. Each share of LT10 and LT50 common stock is entitled to 10 and 50 votes, respectively, and is convertible into one share of Class A common stock only upon, and generally cannot be transferred without, satisfaction of certain notice and other requirements, including a restricted period of 10 months and 50 months, respectively. All of the shares of LT10 and LT50 common stock will be held by a voting trust pursuant to a voting trust agreement. This means that, for the foreseeable future, the control of our company will be concentrated with the voting trust, notwithstanding the number of outstanding shares of Class A common stock. For additional information, see the section titled “Description of capital stock—Common stock.” We are an “emerging growth company” as defined under the federal securities laws and, as such, have elected to comply with certain reduced reporting requirements. | |

| | | | | | | |

| | | | Per share | | Total | |

| Initial public offering price | | $27.00 | | $262,730,952 | |

| Underwriting discounts and commissions(1) | | $1.89 | | $18,391,167 | |

| Proceeds to Expensify, Inc., before expenses | | $25.11 | | $65,504,357 | |

| Proceeds to the selling stockholders, before expenses | | $25.11 | | $178,835,429 | |

| | | | | | | |

| (1)See “Underwriting” for a description of the compensation payable to the underwriters. Certain of the selling stockholders have granted the underwriters the option for a period of 30 days to purchase up to an additional 1,459,616 shares from them, in each case at the initial price to the public less the underwriting discounts and commissions. Investing in our common stock involves a high degree of risk. See “Risk factors” beginning on page 20. Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities nor passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense. The underwriters expect to deliver the shares to purchasers on or about November 15, 2021. | |

| J.P. Morgan | Citigroup | BofA Securities | |

| Piper Sandler | JMP Securities | Loop Capital Markets | |

| November 9, 2021. | | | | | | |

| | | | | | | |

Table of contents

__________________

Through and including December 4, 2021 (the 25th day after the date of this prospectus), all dealers effecting transactions in these securities, whether or not participating in this offering, may be required to deliver a prospectus. This is in addition to a dealer’s obligation to deliver a prospectus when acting as an underwriter and with respect to an unsold allotment or subscription.

__________________

Neither we, the selling stockholders nor the underwriters have authorized anyone to provide any information or to make any representations other than those contained in this prospectus or in any free writing prospectuses prepared by or on behalf of us or to which we have referred you. Neither we, the selling stockholders nor the underwriters take responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. This prospectus is an offer to sell only the shares offered hereby, but only under circumstances and in jurisdictions where it is lawful to do so. The information contained in this prospectus or in any applicable free writing prospectus is current only as of its date, regardless of its time of delivery or any sale of shares of our Class A common stock. Our business, financial condition, results of operations and prospects may have changed since that date.

For investors outside the United States: Neither we nor the underwriters have done anything that would permit this offering or possession or distribution of this prospectus or any free writing prospectus we may provide to you in connection with this offering in any jurisdiction where action for that purpose is required, other than in the United States. You are required to inform yourselves about and to observe any restrictions relating to this offering and the distribution of this prospectus and any such free writing prospectus outside the United States.

Prospectus summary

This summary highlights selected information contained in greater detail elsewhere in this prospectus. This summary is not complete and does not contain all of the information you should consider in making your investment decision. Before investing in our common stock, you should carefully read this entire prospectus. You should carefully consider, among other things, the sections titled “Risk factors,” “Special note regarding forward-looking statements” and “Management’s discussion and analysis of financial condition and results of operations” and our consolidated financial statements and the related notes included elsewhere in this prospectus. Unless the context otherwise requires, the terms “Expensify,” the “company,” “we,” “us,” “our” and similar references in this prospectus refer to Expensify, Inc. and its consolidated subsidiaries.

Overview

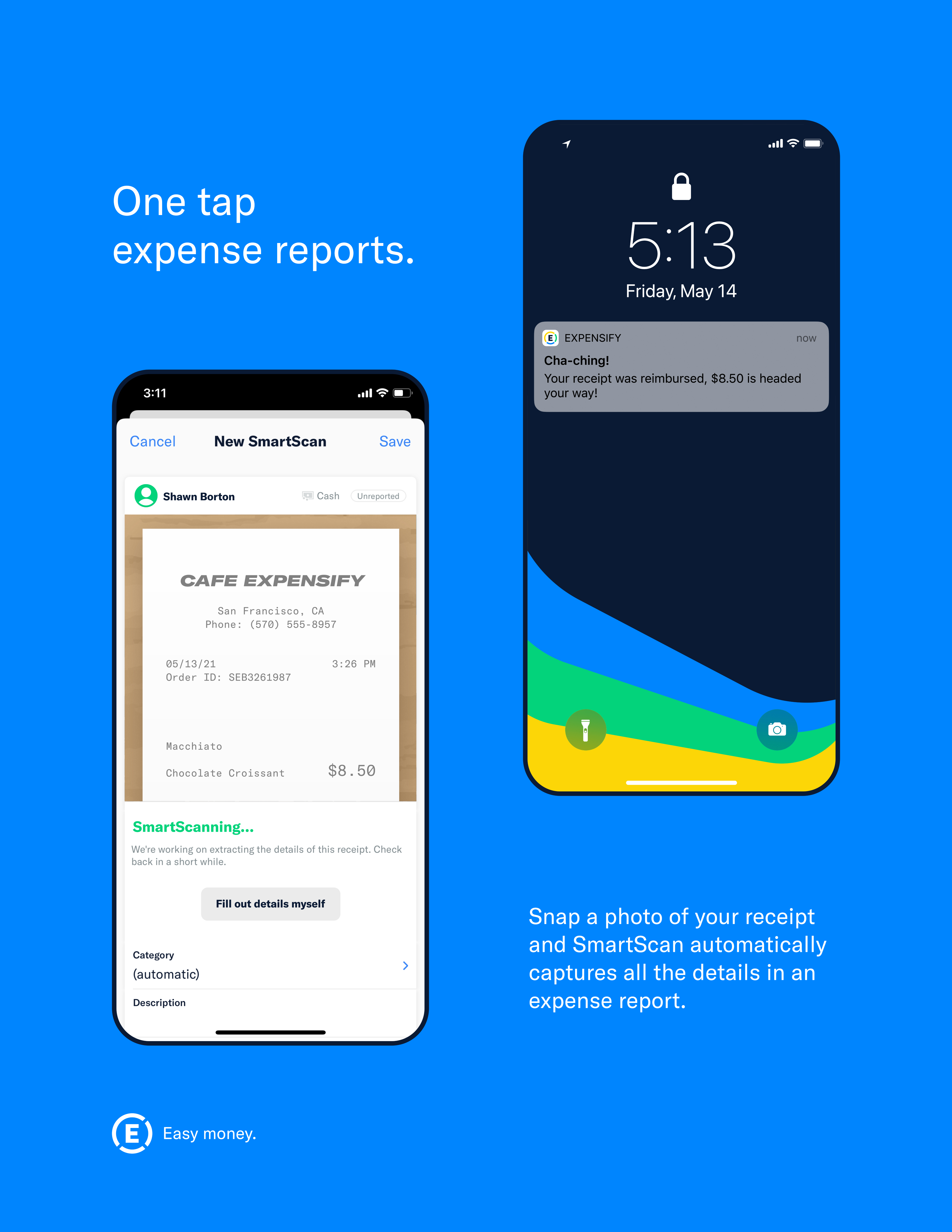

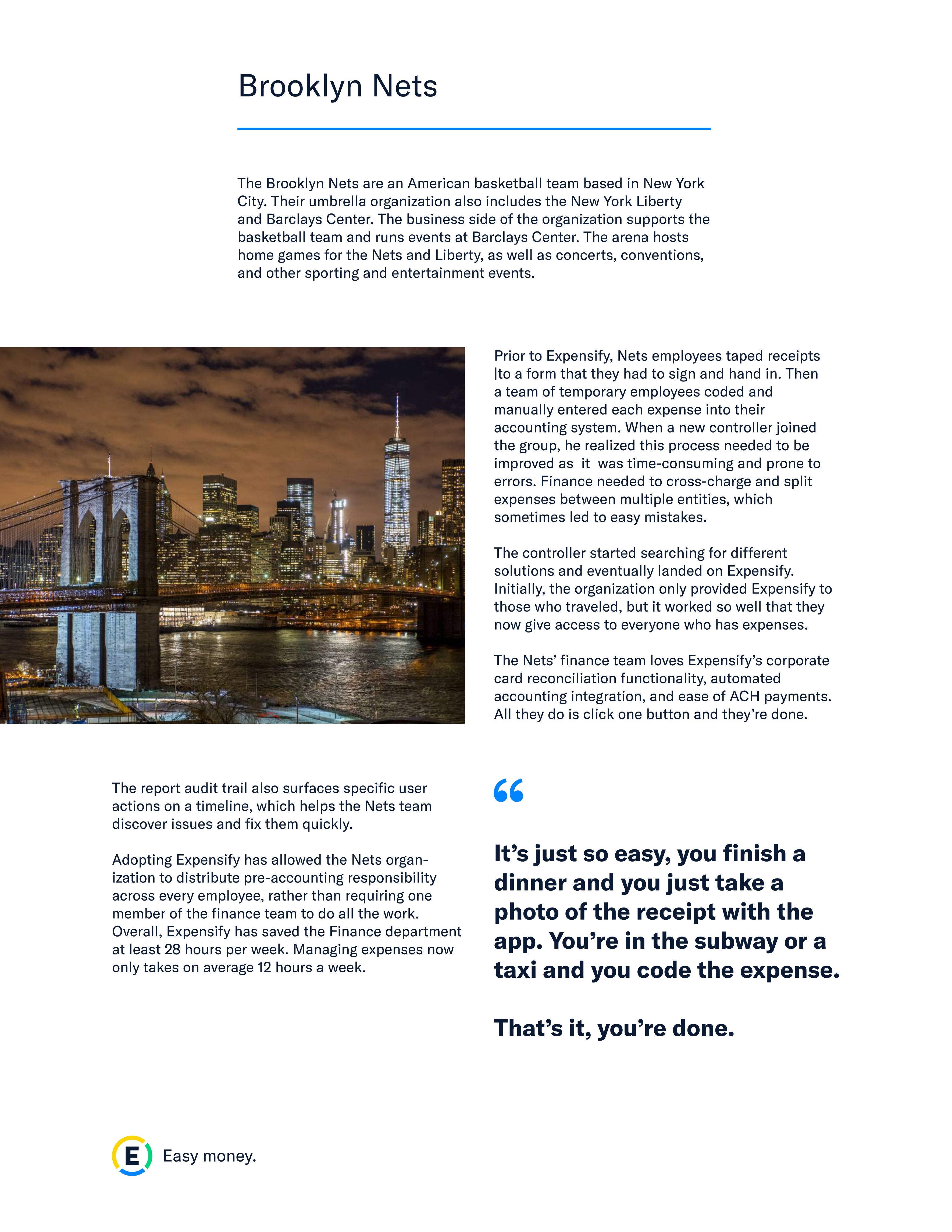

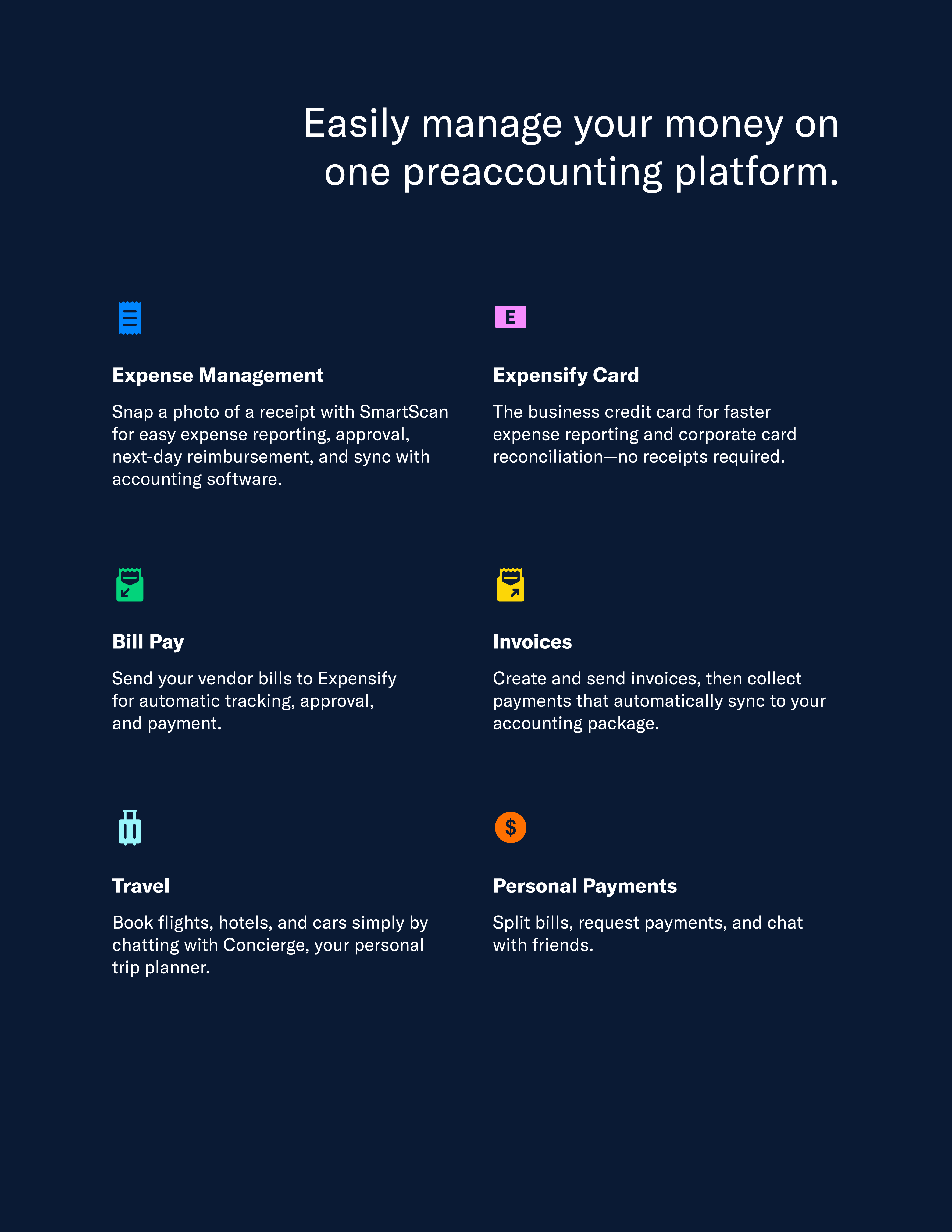

Expensify is a cloud-based expense management software platform that helps the smallest to the largest businesses simplify the way they manage money. Every day, people from all walks of life in organizations around the world use Expensify to scan and reimburse receipts from flights, hotels, coffee shops, office supplies and ride shares. Since our founding in 2008, we have added over 10 million members to our community, and processed and automated over 1.1 billion expense transactions on our platform, freeing people to spend less time managing expenses and more time doing the things they love. For the quarter ended June 30, 2021, an average of 639,000 paid members across 53,000 companies and over 200 countries and territories used Expensify to make money easy.

Small and medium businesses (“SMBs”) are the cornerstone of the global economy, making up over 99% of businesses and approximately 70% of employment in Organization for Economic Cooperation and Development ("OECD") countries. Despite their significance, the vast majority of SMBs still rely on manual, inefficient processes to manage the critical back office functions that power their businesses every day. As SMBs seek to modernize back office functions like expense management to better compete in today’s digital economy, we believe they will look for comprehensive technologies that are easy to discover, implement, purchase, manage and use. At the same time, individual employees are becoming a powerful source of change as they increasingly expect to bring their own choice of technology into the workplace.

Since the beginning of Expensify, our North Star has been improving the experience of the actual end users of expense management software: everyday employees. We designed Expensify to be easy to set up, integrate, configure and use from any device, which has enabled us to serve employees of all types and organizations of all sizes, industries and geographies.

Our intense focus on improving the everyday experience of regular employees with an easy-to-use but powerful platform has enabled a viral, “bottom-up” business model that is capital efficient and extremely scalable. By allowing people to spend less time managing receipts and more time pursuing their real goals, our users (who we refer to as members) have adopted, championed and spread Expensify to their colleagues, managers and friends. We believe our happy members are the best form of marketing and our self-service, bottom-up approach takes advantage of strong, organic word-of-mouth adoption. Underlying our platform is a secure, scalable and defensible technology and user-centric legal foundation that supports and fuels our viral growth. The combination of these factors has allowed us to avoid the costly pitfalls of traditional, top-down enterprise sales and marketing methods that focus solely on decision makers, and invest our time and resources on making features our members love. This has created a massive, untapped and growing market opportunity for us that we believe we are in prime position to capture.

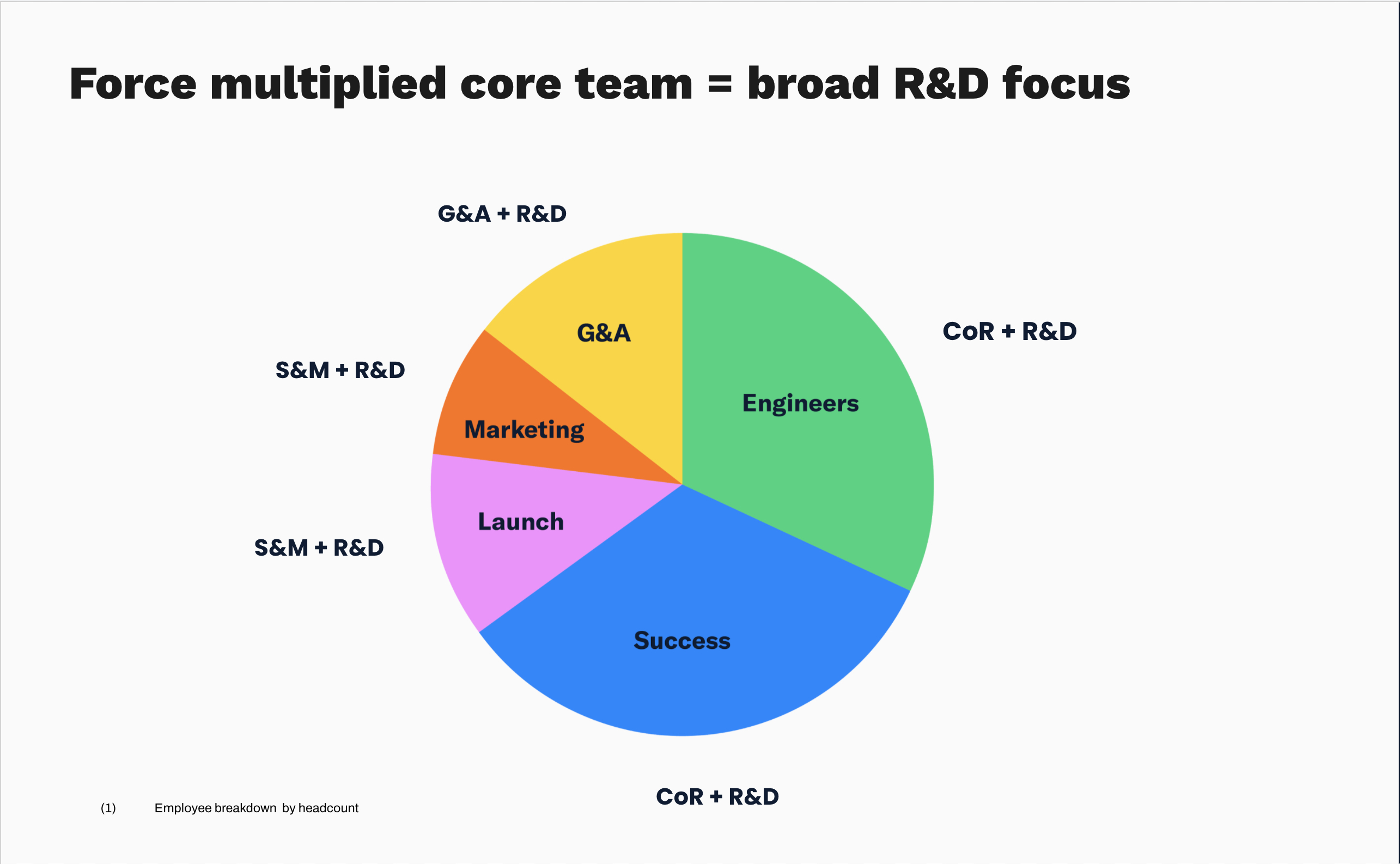

Behind our platform is a company with passionate people and a unique culture that guides everything we do. Our company operates with a flat, generalist organizational structure united by a robust set of common values that foster the long-term happiness and retention of our employees. The efficiency of our business model allows us to prioritize attracting, retaining and inspiring talented, ambitious and humble

people committed to a long-term vision. We are a team that likes to solve real problems, and though expense reports are problematic for most people, there are other pressing problems facing our world that we want to also help solve. In 2020, we launched our 501(c)(3) non-profit, Expensify.org, to increase transparency in the donation process while connecting with donors, volunteers and people in need across five relevant issues facing our communities today: housing equity, youth advocacy, food security, reentry services and climate justice. The Expensify platform and our expertise in expense management enables us to connect donors and volunteers directly through our platform and cut out the administrative expenses that take away from typical donations. We believe that our unique culture, our commitment to all of our stakeholders, and our long-term vision are critical components to the success of our company. We are committed to transparent and robust environmental, social and governance practices and disclosures. Our core stakeholders include employees, members, customers, shareholders and communities we impact. We engage with stakeholders to inform product development and company operations, and aim to align with all stakeholders towards long-term sustainable growth.

We believe that our unique approach has created a highly scalable and efficient business model. We have experienced rapid growth in recent periods. Our revenue was $80.5 million and $88.1 million in the years ended December 31, 2019 and 2020, respectively. Our net income (loss) was $1.2 million and $(1.7) million in the years ended December 31, 2019 and 2020, respectively. Our adjusted EBITDA was $7.6 million and $26.8 million in the years ended December 31, 2019 and 2020, respectively. For the six months ended June 30, 2020 and 2021, our revenue was $40.6 million and $65.0 million, respectively. Our net income was $3.5 million and $14.7 million in the six months ended June 30, 2020 and 2021, respectively. Our adjusted EBITDA was $9.2 million and $22.9 million in the six months ended June 30, 2020 and 2021, respectively. See the section titled “Management’s discussion and analysis of financial condition and results of operations” for additional information on our non-GAAP metrics.

Our industry

SMBs are the bedrock of the global economy and have distinctive technology requirements

Small and medium businesses are the foundation of the global economy. According to the OECD, SMBs, defined as firms with fewer than 250 employees, make up over 99% of all businesses and approximately 70% of all employment across the 36 OECD countries.

Given their size, SMBs typically have one person overseeing the discovery and implementation of new systems, a responsibility that is often in addition to their core job function. As a result, SMBs have specific requirements when adopting new technologies:

•Easy to discover. SMBs increasingly rely on online channels for finding new technologies and heavily consider recommendations from experts, friends and colleagues.

•Easy to implement. IT departments within SMBs are often one person or the business owner themselves and are incapable of taking time away from their business to support cumbersome implementation, maintenance and training requirements.

•Easy to purchase. With no procurement department and limited resources, the individuals making the purchasing decision at SMBs often prefer vendors with transparent, self-service monthly subscription plans that can be paid by credit card.

•Easy to manage. SMBs prefer a single, comprehensive platform from one provider that can solve multiple pain points.

•Easy to use. Many SMBs prioritize ease of use and convenience over cost and seek solutions with elegant, intuitive user experiences that require no training or expertise to operate.

Back office processes are critical to every SMB, but remain antiquated and inefficient

Back office functions, such as HR, accounting and expense management, are ubiquitous and fundamental activities for businesses of every size and industry. Despite the mission criticality of these

activities, the vast majority of SMBs rely on manual, inefficient processes to manage and execute most back office functions. To compete in today’s increasingly digital economy, SMBs require modern solutions that can automate and streamline manual, time-consuming back-office functions to reduce costs and allow managers to focus on higher value, strategic activities.

Every business manages expenses, most do it manually

While the accounting function has seen some improvements in efficiency with the advent of cloud-based accounting platforms, the critical data-gathering processes that precede the accounting workflow (“preaccounting”) have largely remained unchanged since the last century. Expense management, which refers to the collection, processing, auditing and reimbursement of employee expenses, is one of these preaccounting processes, and is among the most complicated. For most SMBs, the standard procedure for expense management remains manual and laborious, with employees filing expense claims by physically tracking down and handing in receipts, or scanning and attaching receipts to emails for approval. As a result, employees, accountants and managers across every business unit are bogged down by time-consuming, manual tasks related to expense management, reducing their productivity and job satisfaction.

The modern day employee is increasingly empowered to drive technology change

Traditionally, business software solutions have been sold to key decision makers, deployed by centralized IT departments, and forced onto employees with little regard to end user experiences and their unique workflows. In recent years, the consumerization of enterprise technology has completely transformed this framework. In the SMB segment, employees are even more influential in driving company-wide adoption: with infrequent technology evaluation and less employees per company than enterprises, SMBs require a smaller critical mass for technological change.

Limitations of traditional approaches

We believe both existing solutions and their underlying business models have fundamental shortcomings that limit their ability to solve the inefficiencies of expense management and other back-office functions for SMBs.

Existing solutions

We believe the vast majority of SMBs still rely on manual, cumbersome methods to manage expenses, with employees physically filing expense claims via paper and pen or spreadsheets, and managers chasing employees across the organization for receipts, confirming expenses one-by-one and performing repetitive data entry on multiple platforms to synchronize information. A small subset of SMBs use more modern form-based software tools, but these solutions typically optimize the experience for decision makers and ignore the needs and preferences of regular, everyday employees. All of these solutions possess one or more of the following limitations that fail to address the back-office challenges faced by SMBs:

•Not designed for the employee;

•Multiple, disparate product lines for different features;

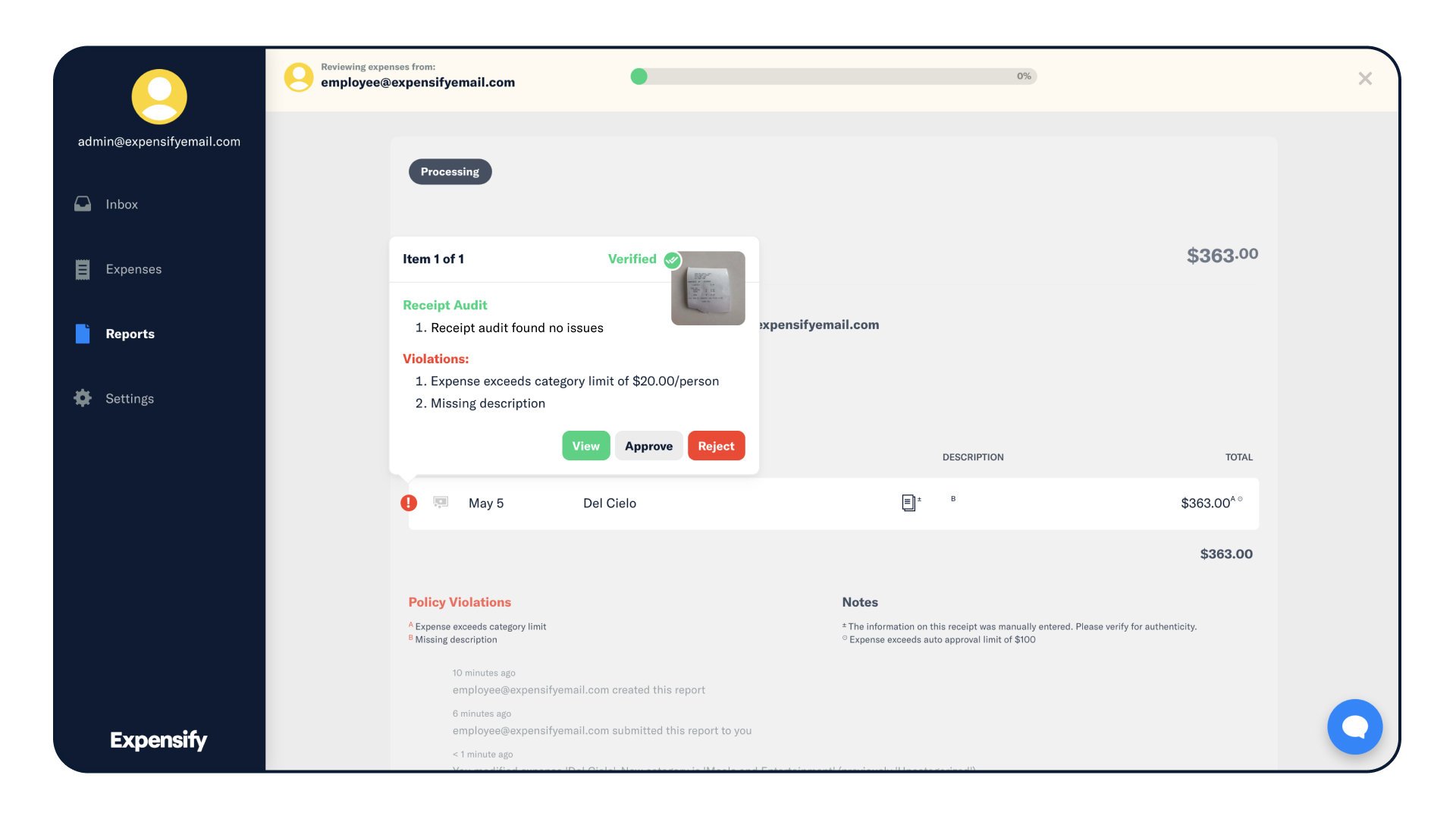

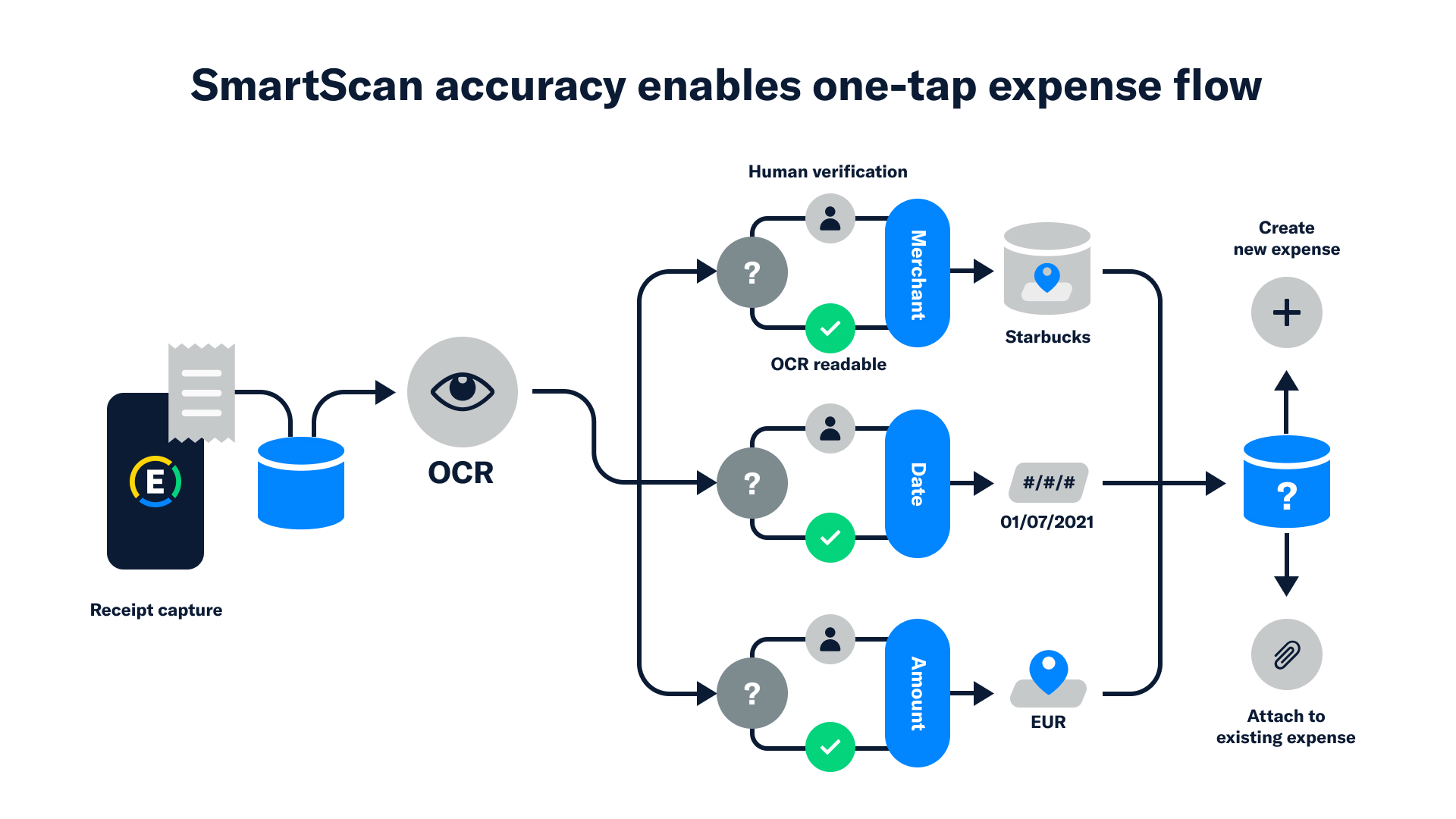

•Inaccurate receipt scanning;

•Lack purposeful automation;

•Lack integration with key systems and applications; and

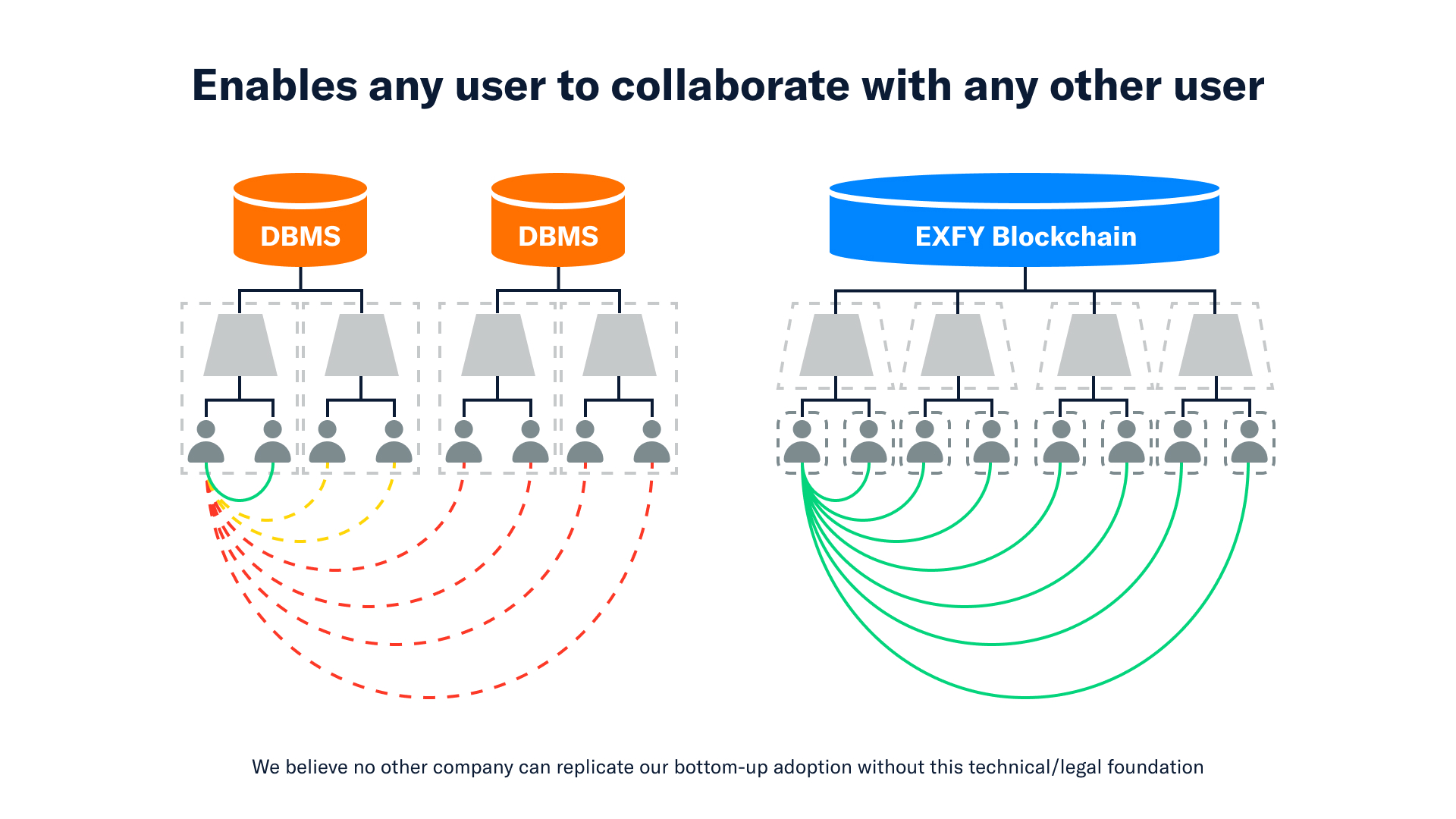

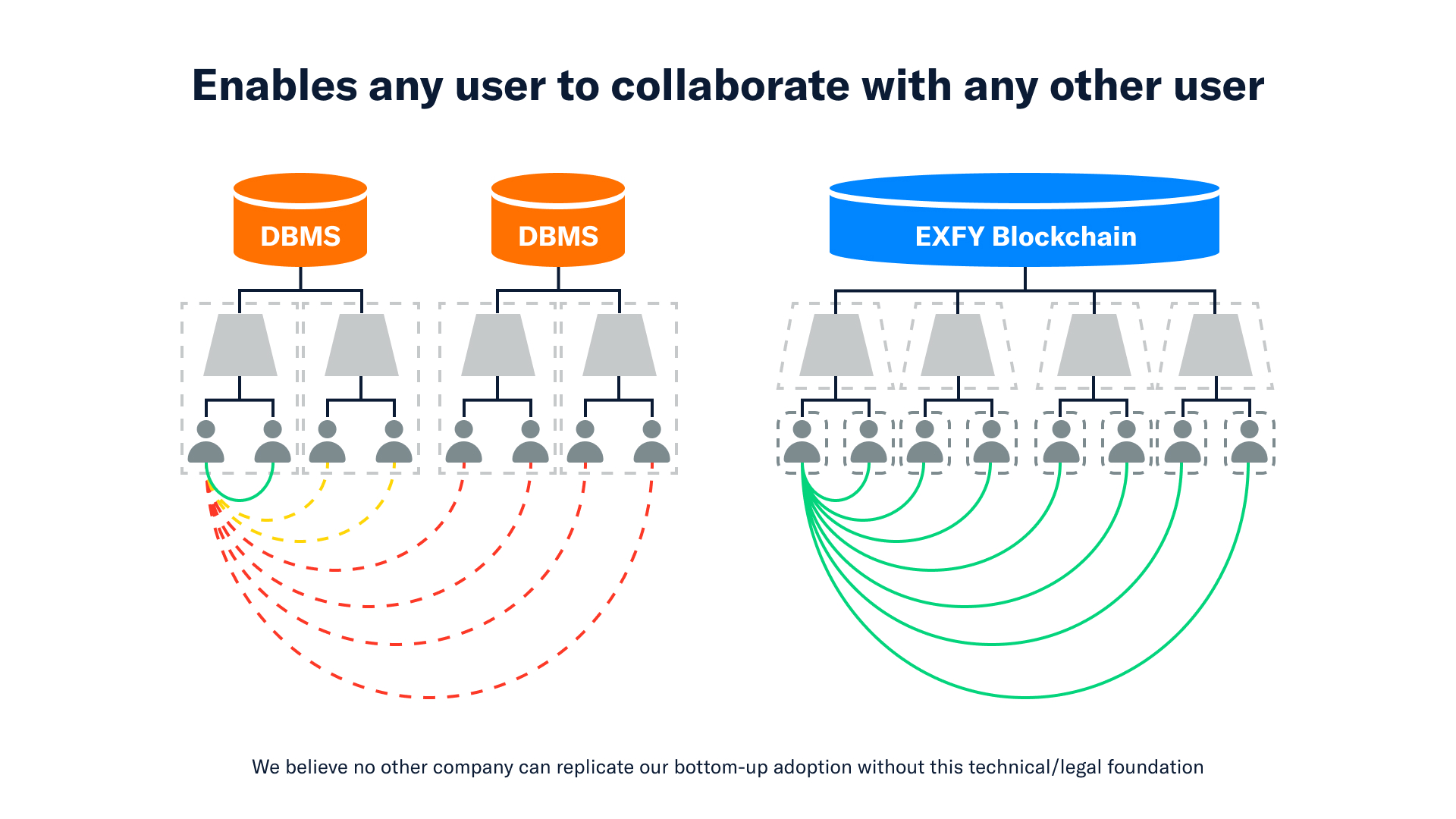

•Partitioned database design.

Traditional approaches

The traditional approach for software sales has historically been “top-down,” whereby software providers deploy costly, targeted ads and a legion of sales representatives focused on selling large, multi-year deals with vague product specifications to decision makers and business owners. This type of approach poses key challenges for traditional software providers, including:

•High cost of sale. The traditional top-down approach relies on an army of salespeople to sell, retain and upsell decision makers, requiring an ever-increasing pipeline of sales talent.

•SMB decision makers are hard to identify and talk to. Discovering and buying software is typically not the core job function for anyone at most SMBs, and software providers leveraging a top-down approach struggle to identify, engage with and sell to key decision makers at SMBs.

•Contracts and sales processes tailored to enterprises. Traditional enterprise sales models are designed to address long procurement processes, which emphasize pricing and control features over the user experience.

•Company-owned data and legal terms. Traditional approaches have a legal structure where all employee data is owned by the company. This company-centric legal approach acts as an impediment to viral employee adoption within and across organizations.

Our market opportunity

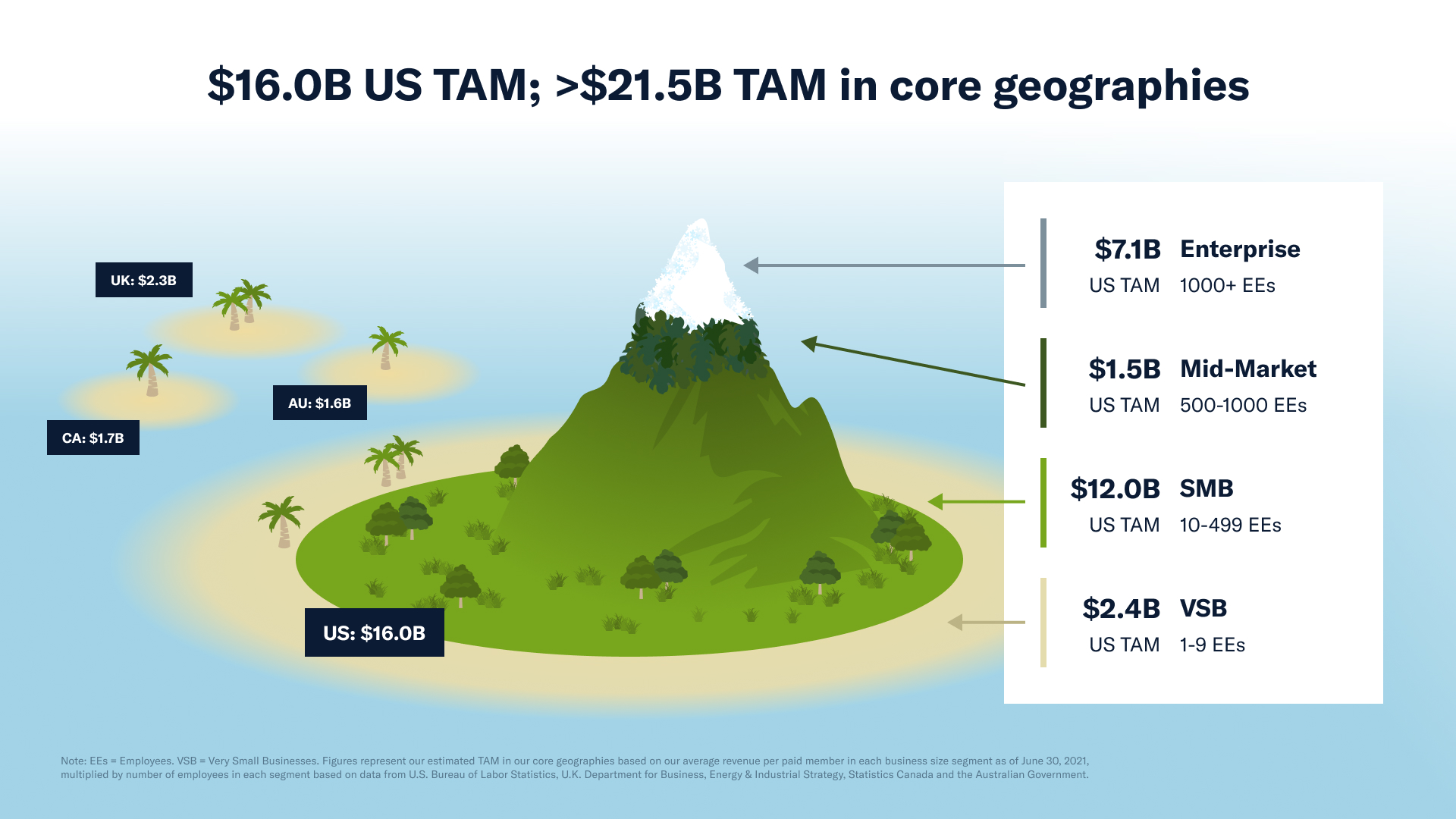

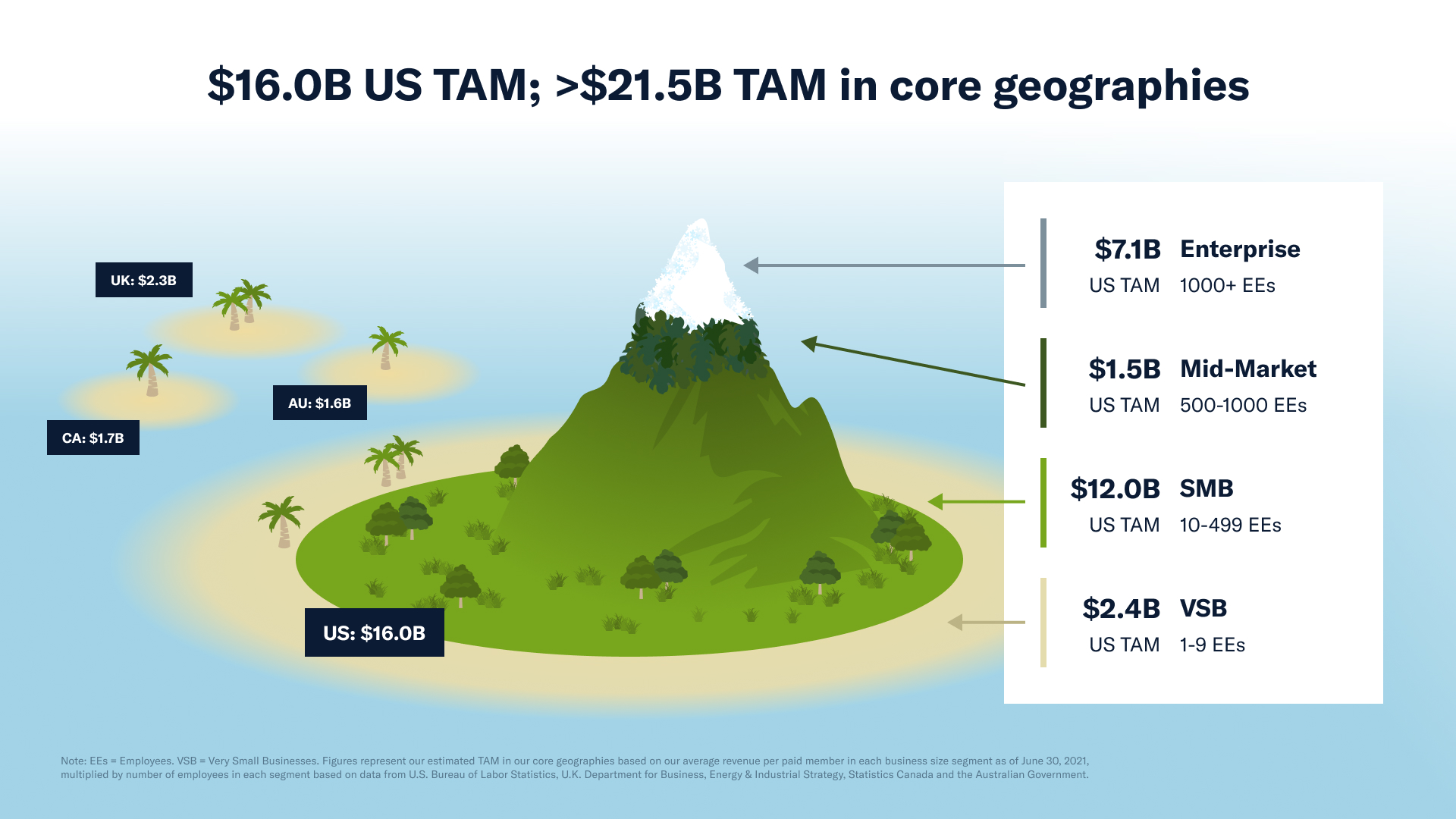

We believe we address a massive market opportunity today that is significantly underpenetrated by modern solutions. We estimate our total addressable market (“TAM”) was approximately $16.0 billion in the United States and $21.5 billion in our core geographies in 2020, which consisted of the United States, United Kingdom, Canada and Australia in 2020. To estimate our TAM in the United States, we identified the number of employees at SMBs with less than 1,000 employees based on data from the U.S. Bureau of Labor Statistics and segmented these companies into three cohorts based on number of employees: (1) companies with 1-9 employees, (2) companies with 10-499 employees, and (3) companies with 500-999 employees. We then multiplied the total number of employees in each cohort by our average revenue per paid member in each such cohort as of June 30, 2021. Given our focus on SMBs, this

excludes the U.S. market opportunity for companies with greater than 1,000 employees, which we estimate to be $7.1 billion using the same methodology described above.

To estimate our TAM in our core geographies outside of the United States, in the United Kingdom, Canada, and Australia, we identified the number of employees in SMBs in these geographies based on data from the United Kingdom Department for Business, Energy & Industrial Strategy, Statistics Canada and the Australian Government. We then multiplied the total number of employees at SMBs in these geographies by our average revenue per paid member for customers with less than 1,000 paid members as of June 30, 2021. SMBs are defined as businesses with fewer than 1,000 employees in the United States, businesses with fewer than 250 employees in the United Kingdom, businesses with fewer than 500 employees in Canada and businesses with fewer than 200 employees in Australia. We believe there is considerable runway for long-term growth given the majority of our market opportunity is untapped; we estimate that the majority of SMBs within our core geographies have not adopted end-to-end software solutions and are using manual processes for expense management today.

We believe we are able to monetize approximately three times the amount of average revenue per user (“ARPU”) in our target market of SMBs compared to some of our enterprise competitors' list prices. In addition to being able to monetize SMBs at a higher ARPU in comparison to enterprise competitors, SMBs by nature tend to grow at a faster rate than enterprises.

We believe there are multiple sources of upside to our TAM in the near-term future:

•Monetizing transactions on our platform. We launched the Expensify Card for early access to a limited number of customers in late 2019 and then launched fully in early 2020. We estimate that the current TAM for our Expensify Card will be approximately $17 billion by 2022. We arrived at our TAM by multiplying an industry standard take rate by the estimated small business credit card spend in the United States in 2022 according to a study by the Mercator Advisory Group.

•Platform expansion. While expense management tends to touch the majority of company employees at least once or twice in a given year, a smaller population are consistently paid members of expense management. We plan to increase our TAM by launching features that will be relevant to all of our customers’ employees every month, resulting in more paid members and more revenue per customer even at the same paid member price.

•Continued international expansion. We believe there is a large, untapped opportunity outside of our core geographies.

Our approach

Since our founding, we have taken a unique approach to expense management built on key, complementary elements:

•Platform strategy hyper-focused on the employee. We designed Expensify to be easily configured and used by every single employee within an organization, not just decision makers or managers.

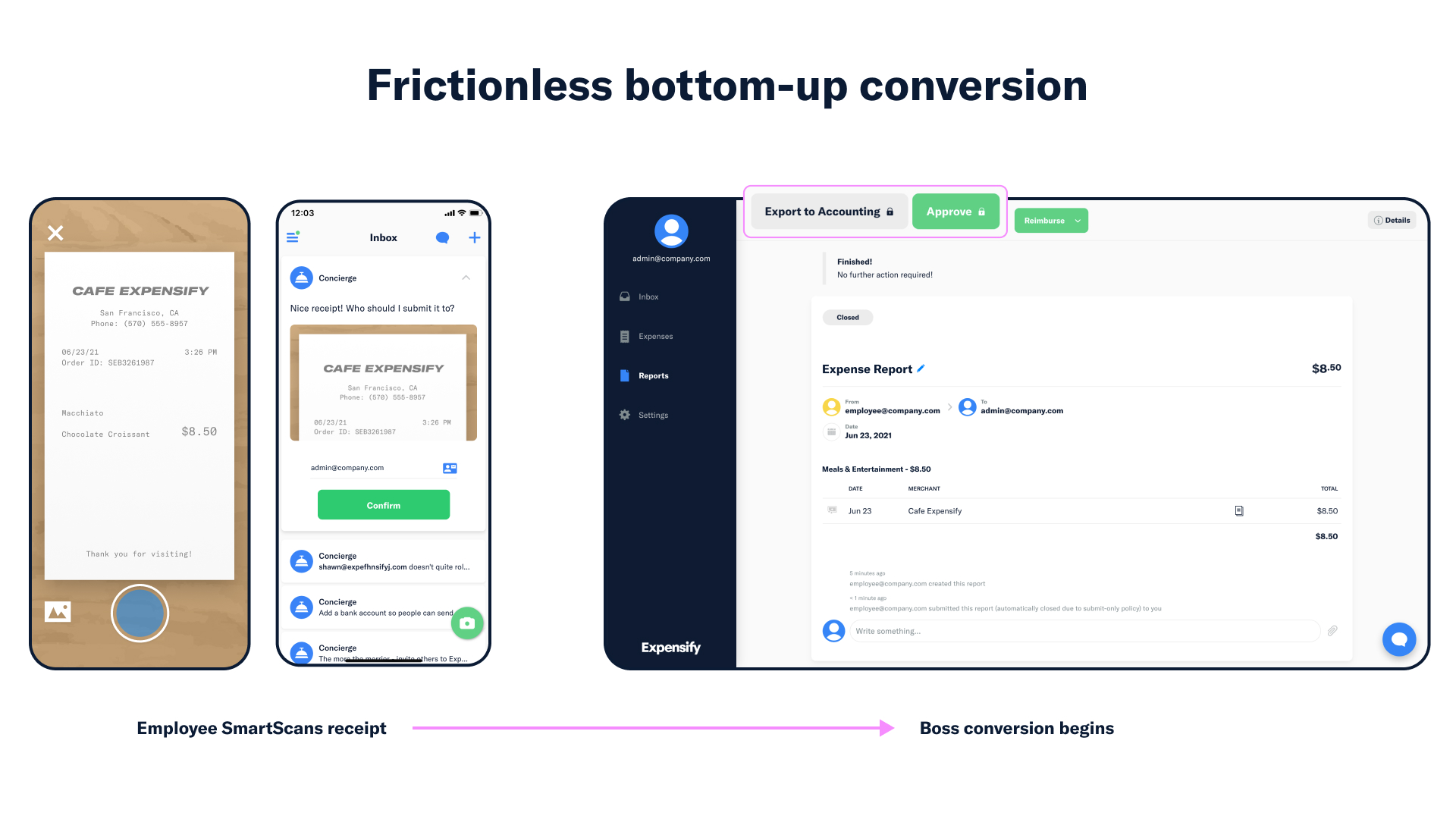

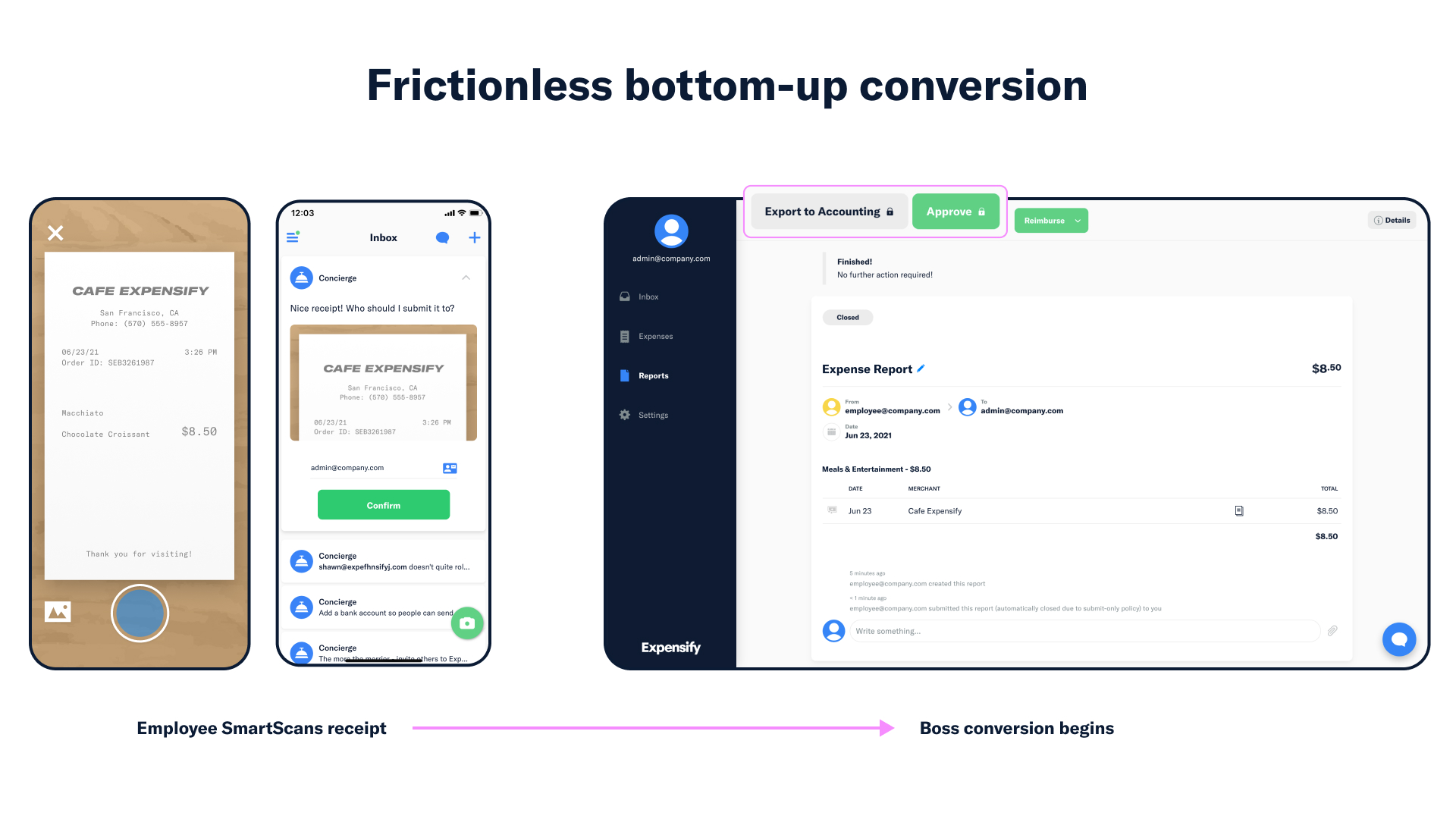

•Viral, bottom-up business model driven by the employee. Our employee-focused platform strategy enables a viral, “bottom-up” adoption cycle that starts with an individual employee. After signing up for free on the website or downloading our free app to submit expenses and realizing the benefits of using Expensify, our enthusiastic members champion our platform internally, spreading it via word-of-mouth to other employees and convincing decision makers to adopt Expensify company-wide.

•Word-of-mouth adoption supported by a market consensus approach. We believe that our happy members are the best form of marketing. We strive to build a superior platform that makes the lives of employees and admins easier so that they become our champions and promote us to other individuals and organizations. We deploy large scale brand advertising to build on this platform

superiority and help create market consensus that Expensify is the category leader for expense management software.

•Unique company culture and long-term vision. Our platform strategy and business model are complemented by our unique company culture and intense focus on the long-term happiness of our employees.

We believe that these elements of our approach are hard to replicate, self-reinforcing and work together to drive a powerful competitive advantage.

Our platform strategy

Our platform strategy centers around the following key concepts:

•Built for everyone. We designed our platform to be used by everyone in an organization, from employees to managers to the finance department. We believe that the more intuitive and simple Expensify is, the more employees and administrators will want to use it.

•Easy to set up. We believe that by making our platform easily accessible, simple to set up and easily configurable attracts more members to download and try Expensify.

•Designed to improve experiences for all members. We believe that always having the pain points of our members at the center of every technology decision and feature we develop enables us to consistently deliver an improved experience for every employee in an organization.

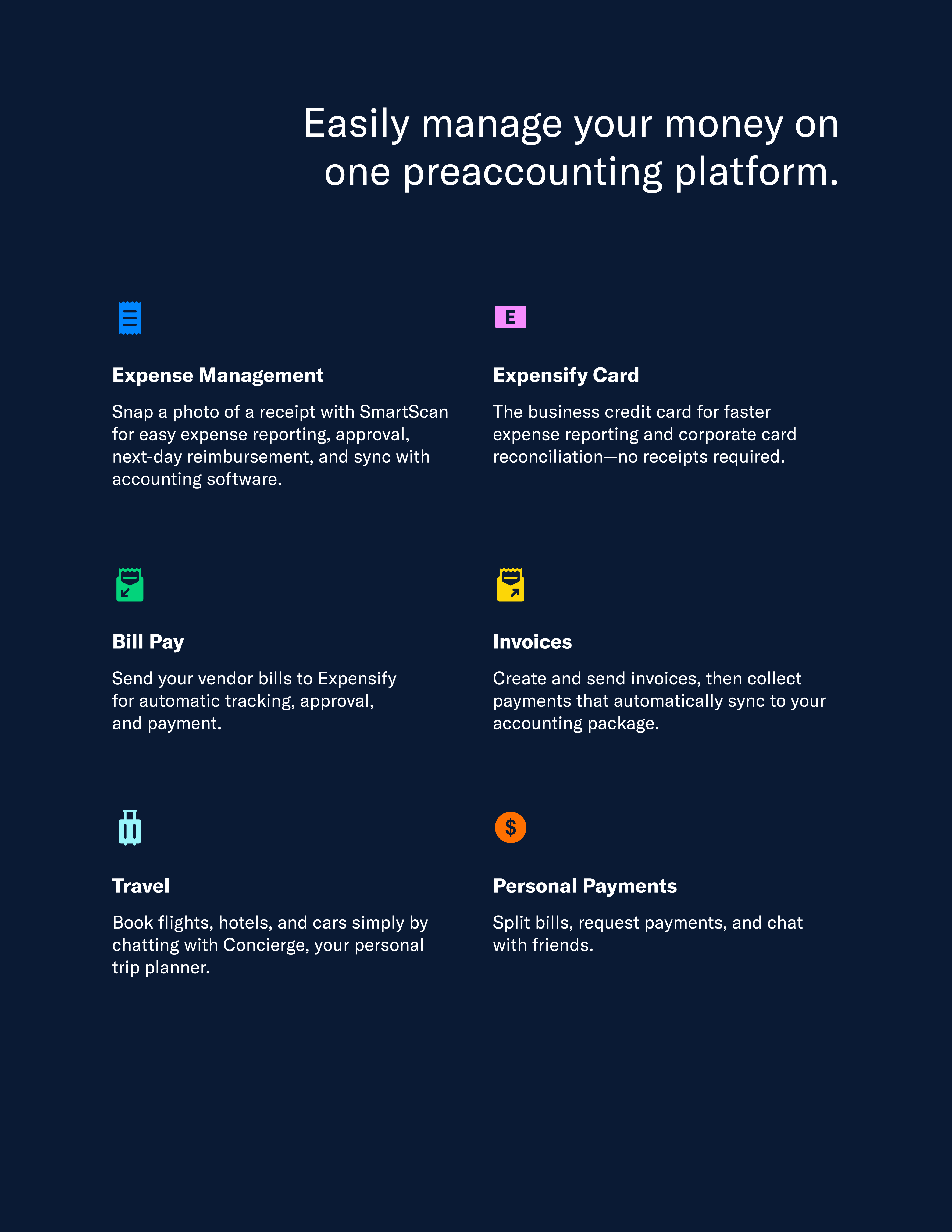

•One platform, many features. Expensify is one platform, with one price that unlocks access to every feature on the platform, from expense management to bill payment. Our features are just different configurations of the same underlying tool, and are not different products in some kind of combined suite.

•Highly integrated. We designed our platform to easily integrate with other business and consumer applications.

We believe that elements of our platform strategy are a critical driver of the viral, widespread adoption of Expensify across and between any type of organization.

Our business model

Our platform strategy enables a viral “bottom-up” business model that is capital efficient and extremely scalable. The adoption of Expensify within an organization often starts with the individual employee, who downloads our mobile application or signs up on our website for free and uses it to easily submit expenses to their manager with a few taps. After the employee realizes the benefits of our platform, they become a champion of Expensify and often spread it internally to other employees. With multiple employees using Expensify and valuable features simplifying the manager’s job, the decision maker purchases a subscription to Expensify and becomes a paying customer with a few members.

We offer simple, transparent and flexible subscription plans for both individuals and businesses that are completely self-service and payable by credit card. In the quarter ended June 30, 2021, 95% of our revenue came from recurring, automated monthly payments made via credit cards. We designed our pricing plans to facilitate the easy adoption of our platform by the smallest mom-and-pop stores to the largest and most complex organizations.

We believe that our happy members are the best form of marketing, and our self-service, bottom-up approach takes advantage of strong, organic word-of-mouth adoption. We support this powerful word-of-mouth marketing with large-scale brand advertising to build market consensus that Expensify is the software of choice for expense management.

We believe that our frictionless, viral and bottom-up business model and word-of-mouth adoption allows us to not rely on traditional outbound marketing efforts that are costly and often ineffective. As a result, we can dedicate our energy and resources on strengthening our brand, improving our features and making it easier for more people to adopt Expensify.

Our culture

At Expensify, our culture is deeply embedded in everything we do.

Our culture is centered on the belief that a life well lived is one that enables you to achieve the following three life goals, which we all work towards with a long-term mindset: Live Rich, Have Fun and Save The World.

We believe that there are three common qualities critical to achieving these three goals and the success of our company: Talent, Ambition and Humility

Finally, our long-term commitment to our three life goals is guided by two simple rules: Get Shit Done and Don’t Ruin It for Everyone Else.

We believe that our unique culture and our employees’ happiness and long-term commitment to Expensify is a critical component of our success.

Our competitive strengths

We believe our platform strategy, business model and culture provide us with competitive strengths that will allow us to maintain our position as a category leader for expense management and extend our leadership to improving other back-office functions.

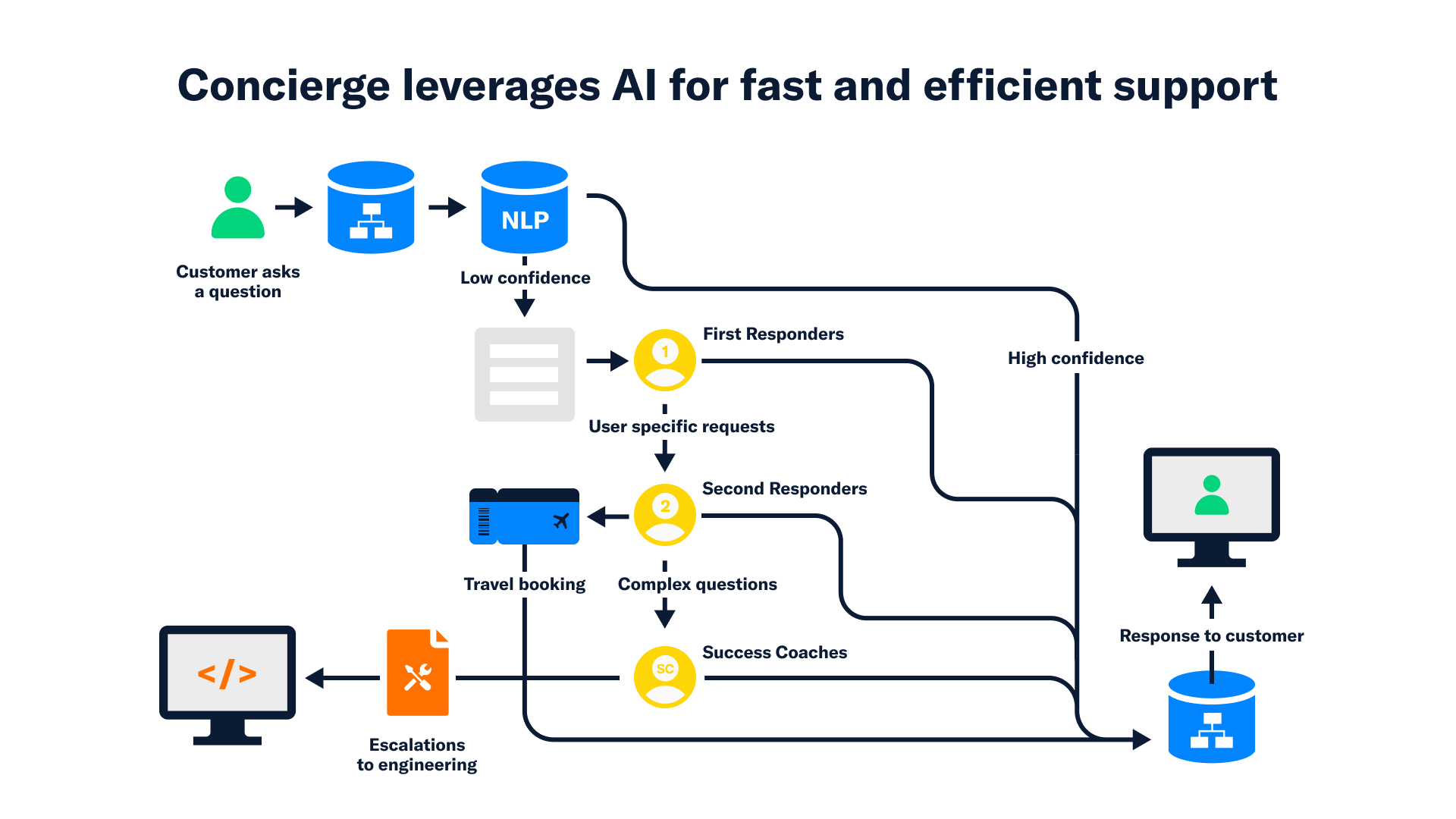

•Hyper-focus on an improved experience for our members. Since our inception, our principal goal has been to offer a single, intuitive and powerful platform with features designed for the actual end users of expense management software: everyday employees.

•Viral, bottom-up business model. We leverage an efficient, self-service business model driven by the viral, bottom-up adoption of our platform by employees.

•Recognized market consensus and efficient word-of-mouth. Our members drive the adoption and expansion of Expensify within organizations, and our platform and business model are intensely focused on improving their everyday experience.

•Employee-centric legal structure and database design. Our platform is built on Bedrock, a proprietary and private distributed database that enables us to consolidate all members into a single database and maintain a direct legal relationship with each of them, where they own all their underlying data and control their account status. This non-partitioned, employee-owned account design underpins our success with bottom-up adoption.

•Nimble and extremely loyal team with a shared, long-term vision. Our efficient business model allows us to prioritize our resources to attract, retain and inspire a vastly more talent-dense team than our competition. We have achieved impressive levels of retention, which provides the necessary corporate patience and ambition to execute a truly massive, long-term vision.

Our growth strategies

We intend to drive the growth of our business by executing on the following strategies:

•Build new features that create additional value for existing members;

•Build new features that attract new members beyond employees who submit expenses;

•Build viral loops into our member experience that increase adoption by new customers;

•Expand and monetize transaction volume from existing and new customers;

•Promote Expensify’s culture and values;

•Continue to strengthen our market consensus;

•Expand integrations and strengthen partnerships; and

•Expand internationally.

Expensify.org

We started Expensify.org to “create a just and generous world” with the belief that doing good is good for business. In these challenging times, we believe that businesses cannot turn a blind eye to the effects of their decisions, or sit on the sidelines for the most important social issues of this generation. There can be no sustainable, profitable growth without a market that is fair, inclusive and universal. Defending, improving and expanding this market is a core responsibility of any business that intends to last as long as we do.

The Voting Trust

Prior to the completion of this offering, all of our outstanding shares of LT10 and LT50 common stock, representing approximately 82.6% of the combined voting power and 16.8% of the economic interest in us immediately following the completion of this offering, will be contributed by the beneficial holders of such shares (the “Trust Beneficiaries”) to a new voting trust (the "Voting Trust”) formed pursuant to a voting trust agreement (the “Voting Trust Agreement"), under which all decisions with respect to the voting (but not the disposition) of such shares of LT10 and LT50 common stock, as well as any other shares of any class of common stock held in the Voting Trust from time to time, will be made by the trustees of the Voting Trust (the “Trustees”) in their sole and absolute discretion, with no responsibility under the Voting Trust Agreement as stockholder, trustee or otherwise, except for his or her own individual malfeasance. The initial Trustees of the Voting Trust will be David Barrett, our CEO, Ryan Schaffer, our CFO, and Jason Mills, our Chief Product Officer. The Voting Trust and its Trustees will, for the foreseeable future, have significant influence over our corporate management and affairs, and will be able to control virtually all matters requiring stockholder approval. The Voting Trust is irrevocable and terminates upon the earlier of the written agreement between us and the Trustees and the date on which all shares of LT10 and LT50 common stock automatically convert into shares of Class A common stock in accordance with the terms of our amended and restated certificate of incorporation, which will occur when all of the then-outstanding shares of LT10 and LT50 common stock represent, in the aggregate, less than 2% of all then-outstanding shares of common stock.

Risk factor summary

Our business is subject to a number of risks and uncertainties of which you should be aware before making a decision to invest in our Class A common stock. These risks are more fully described in the section titled “Risk factors” immediately following this prospectus summary. These risks include, among others, the following:

•Our quarterly and annual results of operations have fluctuated in the past and may fluctuate significantly in the future and may not meet our expectations or those of investors or securities analysts.

•We experienced rapid growth in recent periods prior to the COVID-19 pandemic, and those growth rates may not be indicative of our future growth, and we may not be able to maintain profitability.

•The COVID 19 pandemic has materially adversely affected, and may continue to materially adversely affect, our business and our ability to grow. Whether or not a result of the COVID-19 pandemic, a

sustained general economic downturn, an uneven recovery, or continued instability could materially and adversely affect our business, results of operations and financial condition and growth prospects.

•Our expense management feature drives the majority of our subscriptions, and any failure of this feature to satisfy customer demands or to achieve increased market acceptance could adversely affect our business, results of operations, financial condition and growth prospects.

•If we fail to adapt and respond effectively to rapidly changing technology, evolving industry standards and changing customer needs or preferences, our platform may become less competitive.

•If we are unable to attract new customers on a cost-effective basis, convert individuals and organizations using our free basic expense management feature and trial subscriptions into paying customers, retain existing customers and expand usage within organizations, our revenue growth will be harmed.

•We may fail to accurately predict the optimal pricing strategies necessary to attract new customers, retain existing customers and respond to changing market conditions.

•We may not successfully develop or introduce new features, enhancements, integrations, capabilities and versions of our existing features that achieve market acceptance, and our business could be harmed and our revenue could suffer as a result.

•We face significant competition, the market in which we operate is rapidly evolving, and if we do not compete effectively, our results of operations and financial condition could be harmed.

•The estimates of market opportunity and forecasts of market growth included in this prospectus may prove to be inaccurate. Even if the market in which we compete achieves the forecasted growth, our business could fail to grow at similar rates, if at all.

•We depend on our senior management team, as well as a single professional services firm for a significant portion of our finance function, and the loss of any key employees or our outsourced finance team could adversely affect our business.

•Our failure to protect our sites, networks and systems against security breaches, or otherwise to protect our confidential information or the confidential information of our members, customers, or other third parties, would damage our reputation and brand, and substantially harm our business and results of operations.

•Our business depends on a strong brand, and if we are not able to maintain and enhance our brand, our ability to expand our base of customers may be impaired, and our business and results of operations will be harmed.

•Our culture has contributed to our success, and if we cannot maintain this culture as we grow, we could lose the high employee engagement fostered by our culture, which could harm our business.

•Sales to customers outside the United States and our international operations expose us to risks inherent in international sales and operations.

•We receive, process, store and use business and personal information, which subjects us to governmental regulation and other legal obligations related to data protection and security, and our actual or perceived failure to comply with such obligations could harm our business and expose us to liability.

•If we fail to manage our technical operations infrastructure, or experience service outages, interruptions, or delays in the deployment of our platform, our results of operations may be harmed.

•The multiple class structure of our common stock and the ownership of substantially all of our LT10 and LT50 common stock by Trust Beneficiaries through the Voting Trust have the effect of concentrating voting control with the Voting Trust for the foreseeable future, which will limit your ability

to influence corporate matters, including a change in control. We are controlled by the Voting Trust, whose interests may differ from those of our public stockholders. Our amended and restated certificate of incorporation also delegates significant authority to an Executive Committee.

Recent developments

Preliminary consolidated financial results for the fiscal quarter ended September 30, 2021

The following preliminary consolidated financial information for the fiscal quarter ended September 30, 2021 is based upon our estimates and subject to completion of our financial closing procedures. Moreover, this data has been prepared solely on the basis of currently available information by, and is the responsibility of, Expensify, Inc. This information should be read in conjunction with our audited consolidated financial statements and related notes, our unaudited consolidated financial statements and related notes and “Management’s discussion and analysis of financial condition and results of operations” for prior periods included elsewhere in this prospectus. Our independent registered public accounting firm, Ernst and Young LLP, has not audited or reviewed, and does not express an opinion with respect to, this data. This summary is not a comprehensive statement of our financial results for this period, and our actual results may differ from these estimates due to the completion of our financial closing procedures and final adjustments and other developments that may arise between the date of this prospectus and the time our final quarterly consolidated financial statements are completed. Our actual results for the fiscal quarter ended September 30, 2021 will not be available until after the completion of this offering. There can be no assurance that these estimates will be realized, and these estimates are subject to risks and uncertainties, many of which are not within our control.

We have prepared estimates of the following preliminary consolidated financial data for the fiscal quarter ended September 30, 2021:

| | | | | | | | | | | |

| Fiscal quarter ended

September 30, 2021 |

| Low | | High |

| Consolidated statements of income data: | (in thousands) |

| Revenue | $ | 36,605 | | | $37,635 |

| Income (loss) from operations | $ | (11,636) | | | $(10,955) |

| Net income (loss) | $ | (12,148) | | | $(8,099) |

| Key business metrics: | | | |

Paid members(1) | 660 | | 670 |

(1)For additional information, please see the section titled “Management’s discussion and analysis of financial condition and results of operations—Key business metrics and non-GAAP financial measures.”

Revenue

Our preliminary estimated revenue is expected to be between $36.6 million and $37.6 million for the fiscal quarter ended September 30, 2021, which represents a range of increase of approximately $14.9 million to $15.9 million compared to the fiscal quarter ended September 30, 2020, which was due to an increase in paid members.

Income (loss) from operations and net income (loss)

Our preliminary estimated income (loss) from operations is expected to be between $(11.6) million and $(11.0) million for the fiscal quarter ended September 30, 2021, which represents a range of decrease of approximately $6.5 million to $5.9 million compared to the fiscal quarter ended September 30, 2020.

Our preliminary estimated net income (loss) is expected to be between $(12.1) million and $(8.1) million for the fiscal quarter ended September 30, 2021, which represents a range of decrease of approximately $5.2 million to $1.2 million compared to the fiscal quarter ended September 30, 2020.

Our preliminary estimated income (loss) from operations and net income (loss) both decreased compared to the fiscal quarter ended September 30, 2020 due to one time special bonus expenses, which are expected to be between $26.0 million and $27.0 million during the fiscal quarter ended September 30, 2021 to employees as described under "Management's discussion and analysis of financial condition and results of operations—Critical accounting policies and estimates—Cash bonuses."

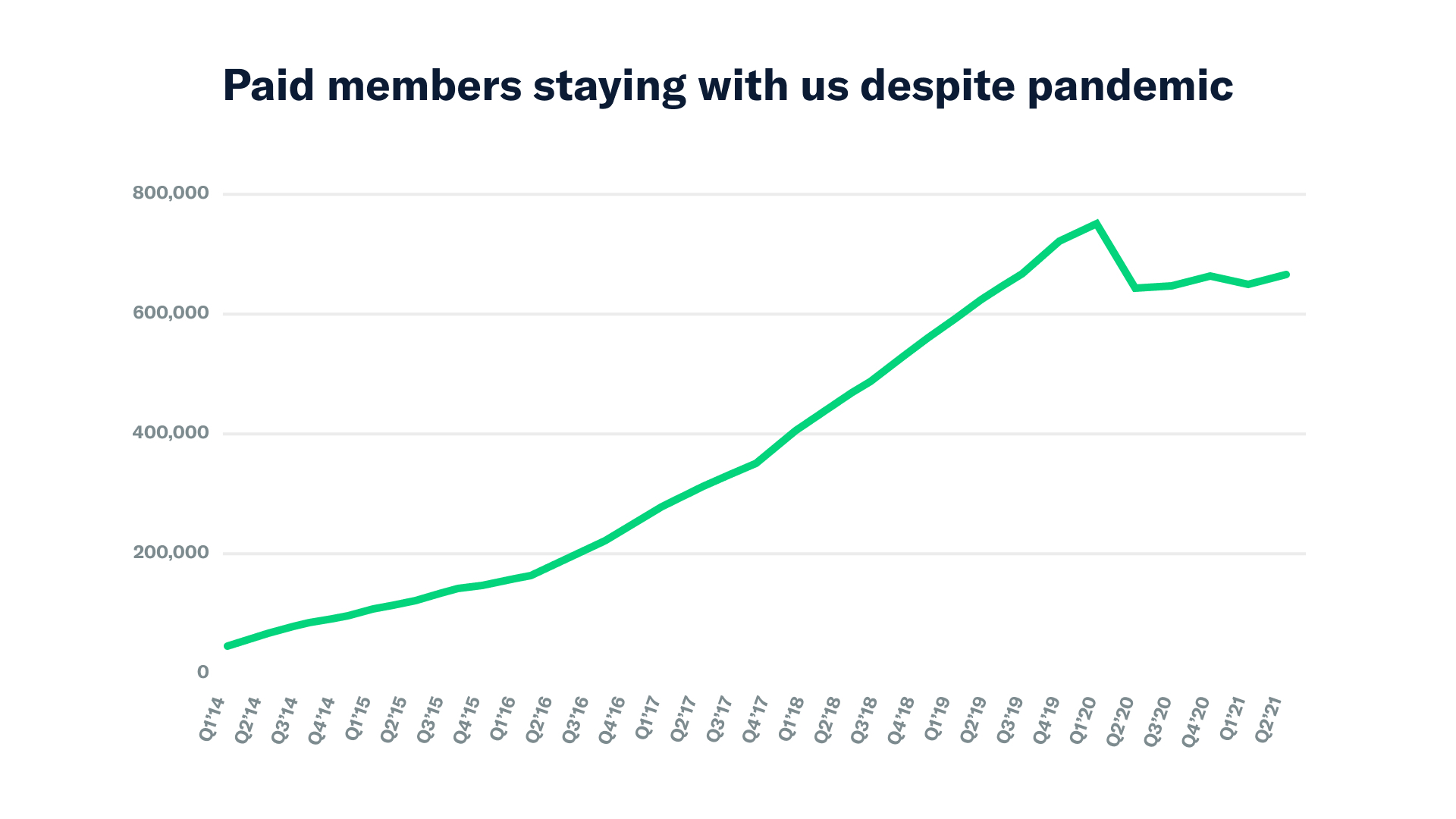

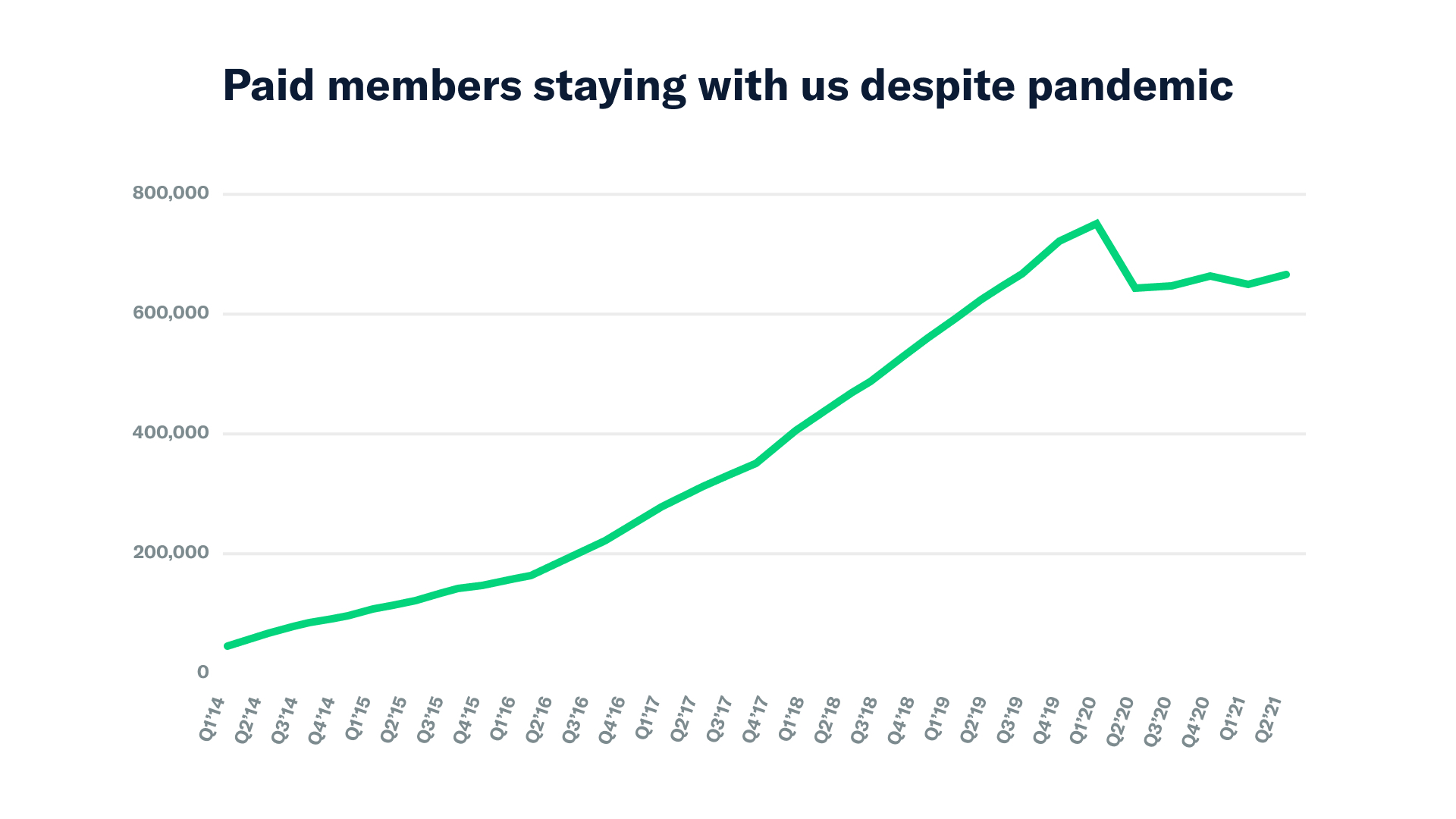

Paid members

Our preliminary estimated number of average paid members as of September 30, 2021 are expected to be between 660,000 and 670,000, an increase of 21,000 to 31,000 from our average paid members as of June 30, 2021 and an increase of 27,000 to 37,000 from our average paid members as of September 30, 2020. Our preliminary estimated number of average paid members increased due to improving economic business conditions and our increased investments in sales and marketing.

This recent developments section includes forward-looking statements. All statements contained herein other than statements of historical facts, including, without limitation, statements regarding our expectations regarding our financial and operating results for the fiscal quarter ended September 30, 2021, and our future financial and business performance, are forward-looking statements. The words “anticipate,” “believe,” “continue,” “estimate,” “expect,” “intend,” “may,” “will” and similar expressions are intended to identify forward-looking statements. We have based these forward-looking statements largely on our current expectations and projections about future events and financial trends that we believe may affect our financial condition, results of operations, business strategy, short-term and long-term business operations and objectives and financial needs. These forward-looking statements are subject to a number of risks and uncertainties, including, without limitation, risks related to our growth and ability to sustain our revenue growth rate, competition in the markets in which we operate, market growth, our ability to innovate and manage our growth and the impact of the COVID-19 pandemic and associated global economic uncertainty. For additional information regarding the various risks and uncertainties inherent in estimates of this type, see “Special note regarding forward-looking statements” and “Risk factors” elsewhere in this prospectus.

Our corporate information

Our corporate headquarters are located at 401 SW 5th Ave, Portland, Oregon 97204. Our telephone number is (971) 365-3939. Our principal website address is use.expensify.com. The information on or accessed through our website is not incorporated in this prospectus or the registration statement of which this prospectus forms a part, and potential investors should not rely on such information in making a decision to purchase our Class A common stock in this offering.

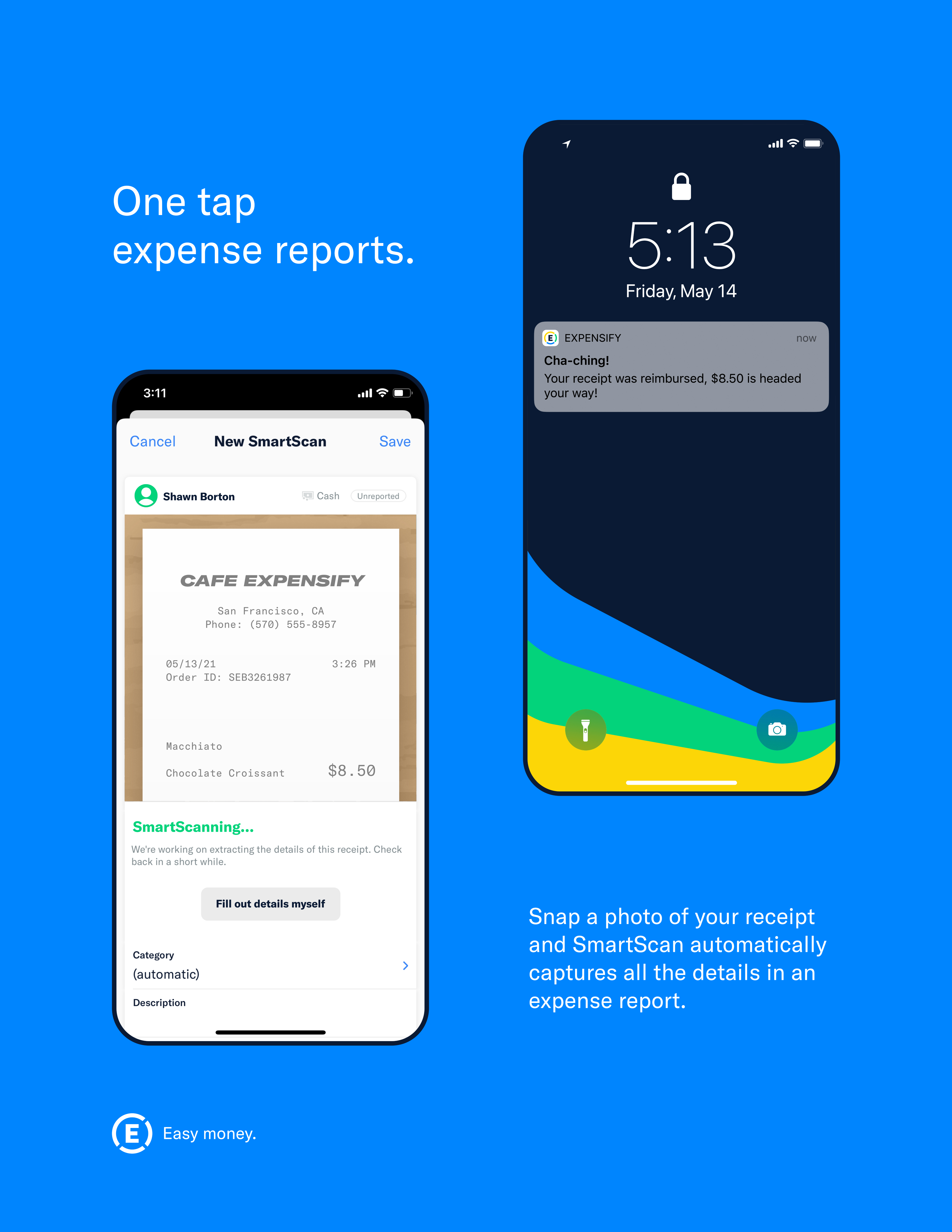

“Expensify,” “SMARTSCAN,” the Expensify logo and other trademarks, trade names or service marks of Expensify, Inc. appearing in this prospectus are the property of Expensify, Inc. All other trademarks, trade names and service marks appearing in this prospectus are the property of their respective owners. Solely for convenience, the trademarks and trade names in this prospectus may be referred to without the ® and ™ symbols, but such references should not be construed as any indicator that their respective owners will not assert their rights thereto.

Implications of being an emerging growth company

We qualify as an “emerging growth company” as defined in the Jumpstart Our Business Startups Act of 2012, or the JOBS Act. An emerging growth company may take advantage of certain reduced reporting and other requirements that are otherwise generally applicable to public companies. As a result:

•we are required to present only two years of audited financial statements and two years of related Management’s Discussion and Analysis of Financial Condition and Results of Operations disclosure;

•we are not required to engage an auditor to report on our internal control over financial reporting pursuant to Section 404(b) of the Sarbanes-Oxley Act of 2002, or the Sarbanes-Oxley Act;

•we are not required to comply with any requirement that may be adopted by the Public Company Accounting Oversight Board, or the PCAOB, regarding mandatory audit firm rotation or a supplement to the auditor’s report providing additional information about the audit and the financial statements (i.e., an auditor discussion and analysis);

•we are not required to submit certain executive compensation matters to stockholder advisory votes, such as “say-on-pay,” “say-on-frequency” and “say-on-golden parachutes;” and

•we are not required to comply with certain disclosure requirements related to executive compensation, such as the requirement to disclose the correlation between executive compensation and performance and the requirement to present a comparison of our Chief Executive Officer’s compensation to our median employee compensation.

We may take advantage of these reduced reporting and other requirements until the last day of our fiscal year following the fifth anniversary of the completion of this offering, or such earlier time that we are no longer an emerging growth company. However, if certain events occur prior to the end of such five-year period, including if we have more than $1.07 billion in annual gross revenue, have more than $700 million in market value of our common stock held by non-affiliates, or issue more than $1.0 billion of non-convertible debt over a three-year period, we will cease to be an emerging growth company prior to the end of such five-year period. We may choose to take advantage of some, but not all, of the available exemptions. We have elected to adopt the reduced requirements with respect to our financial statements and the related selected financial data and Management’s Discussion and Analysis of Financial Condition and Results of Operations disclosure. As a result, the information that we provide to stockholders may be different from the information disclosed by other public companies.

The JOBS Act permits an emerging growth company like us to take advantage of an extended transition period to comply with new or revised accounting standards applicable to public companies. We have elected to use this extended transition period to enable us to comply with new or revised accounting standards that have different effective dates for public and private companies until the earlier of the date we (1) are no longer an emerging growth company or (2) affirmatively and irrevocably opt out of the extended transition period provided in the JOBS Act. As a result, our consolidated financial statements may not be comparable to companies that comply with new or revised accounting pronouncements as of public company effective dates.

The offering

| | | | | |

| Class A common stock offered by us | 2,608,696 shares. |

| |

| Class A common stock offered by the selling stockholders | 7,122,080 shares. |

| |

| Option to purchase additional shares of Class A common stock offered by the selling stockholders | Certain selling stockholders have granted the underwriters an option for a period of 30 days to purchase up to 1,459,616 additional shares of our Class A common stock. |

| |

| Class A common stock to be outstanding immediately after this offering | 67,347,706 shares. |

| |

| LT10 common stock to be outstanding after this offering | 7,332,640 shares. |

| |

| LT50 common stock to be outstanding after this offering | 6,224,160 shares. |

| |

| Total common stock to be outstanding after this offering | 80,904,506 shares. |

| |

| Voting rights | We have three series of common stock, Class A, LT10 and LT50 common stock. The rights of holders of Class A, LT10 and LT50 common stock are identical, except for voting, transfer and conversion rights. Each share of Class A common stock is entitled to one vote. Each share of LT10 common stock and LT50 common stock is entitled to 10 and 50 votes, respectively, and is convertible into one share of Class A common stock only upon satisfaction of certain notice and other requirements, including the applicable restricted period. Prior to the completion of this offering, all of our outstanding shares of LT10 common stock and LT50 common stock, representing approximately 82.6% of the combined voting power and 16.8% of the economic interest in us immediately following the completion of this offering, will be contributed by the Trust Beneficiaries to the Voting Trust formed pursuant to the Voting Trust Agreement under which all decisions with respect to the voting (but not the disposition) of such shares of Class A, LT10 and LT50 common stock, as well as any other shares of any class of common stock held in the Voting Trust from time to time, will be made by the Trustees in their sole and absolute discretion, with no responsibility under the Voting Trust Agreement as stockholder, trustee or otherwise, except for his or her own individual malfeasance. See “Description of capital stock.” |

| | | | | |

| Use of proceeds | We estimate that the net proceeds to us from this offering will be approximately $59.3 million, based upon the initial offering price of $27.00 per share, and after deducting underwriting discounts and commissions and estimated offering expenses payable by us. We will not receive any proceeds from the sale of Class A common stock by the selling stockholders in this offering. We currently intend to use the net proceeds from this offering for general corporate purposes, including working capital, operating expenses and capital expenditures. We also intend on using a portion of the net proceeds we receive from this offering to pay discretionary cash bonuses to our employees during the fourth quarter of the year ended December 31, 2021, in an amount currently estimated to range from $27.5 million to $32.2 million (as described under "Management's discussion and analysis of financial condition and results of operations—Critical accounting policies and estimates—Cash bonuses"). We will have broad discretion in the way that we use the net proceeds of this offering. See the section titled “Use of proceeds” for additional information. |

| |

| Risk factors | See “Risk factors” and the other information included in this prospectus for a discussion of factors you should carefully consider before deciding to invest in shares of our Class A common stock. |

| |

| Nasdaq trading symbol | “EXFY” |

The number of shares of our common stock that will be outstanding immediately after this offering is based on 76,811,910 shares of Class A common stock (including all shares of our convertible preferred stock on an as-converted basis) outstanding as of June 30, 2021 and excludes:

•warrants to purchase 300,000 shares of our common stock at $0.07 per share and 130,080 shares of our common stock at $0.53 per share, all of which will automatically convert into warrants to purchase an aggregate of 430,080 shares of Class A common stock upon the reclassification of all outstanding shares of our common stock into an equivalent number of shares of our Class A common stock;

•2,662,470 shares of common stock issuable upon exercise of outstanding stock options as of June 30, 2021 granted under our 2009 Stock Plan, with a weighted-average exercise price of $0.27 per share;

•5,902,760 shares of common stock issuable upon exercise of outstanding stock options as of June 30, 2021 granted under our 2019 Plan, with a weighted-average exercise price of $1.71 per share;

•223,400 shares of common stock issuable upon exercise of outstanding stock options granted subsequent to June 30, 2021 under our 2019 Plan, with a weighted-average exercise price of $12.97 per share;

•11,676,932 shares of Class A common stock reserved for future issuance under our 2021 Incentive Award Plan and 2021 Non-Qualified Employee Stock Purchase and Matching Plan; and

•4,339,690 and 4,339,690 shares of Class A and LT50 common stock, respectively, issuable upon the vesting of restricted stock units, or RSUs, granted by our board of directors subsequent to June 30, 2021 under our 2019 Plan that became effective immediately prior to the effectiveness of the registration statement on Form S-1, of which this prospectus is a part.

Except as otherwise indicated, all information in this prospectus assumes or gives effect to the following:

•the filing and effectiveness of our amended and restated certificate of incorporation and the adoption of our amended and restated bylaws, each of which will occur immediately prior to the completion of this offering;

•the reclassification of all outstanding shares of our common stock, of which 34,780,520 shares were outstanding as of June 30, 2021, into an equivalent number of shares of our Class A common stock, which occurred in connection with the filing and effectiveness of an amendment to our current amended and restated certificate of incorporation immediately prior to the effectiveness of the registration statement on Form S-1, of which this prospectus is a part;

•the completion of an exchange offer open to all of our employees and other service providers, whereby participants in the exchange offer have elected to exchange, on a one-for-one basis, an aggregate of 13,556,800 shares of our Class A common stock for 7,332,640 shares of our LT10 common stock and 6,224,160 shares of our LT50 common stock (the “Exchange Offer”), which occurred immediately prior to the effectiveness of the registration statement on Form S-1, of which this prospectus is a part;

•the automatic conversion of all outstanding shares of our convertible preferred stock into an aggregate of 42,031,390 shares of Class A common stock immediately prior to the completion of this offering;

•a 10 for 1 forward split of our common stock, which was effected on October 27, 2021;

•the exercise by our employees and other service providers of an aggregate of 1,483,900 outstanding options to purchase shares of our common stock subsequent to June 30, 2021 and prior to the completion of the Exchange Offer (the "Option Exercise");

•no exercise of any other outstanding options or warrants or settlement of outstanding RSUs referred to above; and

•no exercise by the underwriters of their option to purchase from the selling stockholders up to 1,459,616 additional shares of our Class A common stock.

Summary consolidated financial and other data

The following tables summarize our consolidated financial and other data for the periods and as of the dates indicated. The summary consolidated statements of income data for the years ended December 31, 2019 and 2020 have been derived from our audited consolidated financial statements included elsewhere in this prospectus. The summary consolidated statements of income data for the six months ended June 30, 2020 and 2021 and our summary consolidated balance sheet data as of June 30, 2021 have been derived from our unaudited interim consolidated financial statements that are included elsewhere in this prospectus. We have prepared the unaudited interim consolidated financial statements on the same basis as the audited consolidated financial statements and have included all adjustments, consisting only of normal recurring adjustments that, in our opinion, are necessary to state fairly the information set forth in those consolidated financial statements. Our historical results are not necessarily indicative of the results to be expected in any future period, and the results of operations for the six months ended June 30, 2021 are not necessarily indicative of the results to be expected for the full year ending December 31, 2021 or any future period. You should read this data together with our audited consolidated financial statements and related notes included elsewhere in this prospectus and the sections titled “Selected consolidated financial and other data” and “Management’s discussion and analysis of financial condition and results of operations.” Our historical results for any prior period are not necessarily indicative of our future results.

| | | | | | | | | | | | | | | | | | | | | | | |

| Year ended December 31, | | Six months ended June 30, |

| 2019 | | 2020 | | 2020 | | 2021 |

| Consolidated statements of income: | (in thousands, except share and per share data) |

| Revenue | $80,460 | | $88,072 | | $40,641 | | $65,024 |

Cost of revenue, net(1) | 31,985 | | 32,414 | | 15,438 | | 15,571 |

| Gross margin | 48,475 | | 55,658 | | 25,203 | | 49,453 |

| Operating expenses: | | | | | | | |

Research and development(1) | 4,110 | | 6,728 | | 2,377 | | 5,971 |

General and administrative(1) | 15,930 | | 33,372 | | 10,138 | | 17,494 |

Sales and marketing(1) | 27,188 | | 9,888 | | 6,323 | | 6,947 |

| Total operating expenses | 47,228 | | 49,988 | | 18,838 | | 30,412 |

| Income from operations | 1,247 | | 5,670 | | 6,365 | | 19,041 |

| Interest and other expenses, net | (2,757) | | (2,718) | | (1,514) | | (1,506) |

| (Loss) income before income taxes | (1,510) | | 2,952 | | 4,851 | | 17,535 |

| Benefit (provision) for income taxes | 2,751 | | (4,662) | | (1,365) | | (2,861) |

| Net income (loss) | $1,241 | | $(1,710) | | $3,486 | | $14,674 |

| | | | | | | |

| Less: income allocated to participating securities | (1,241) | | — | | (2,907) | | (9,426) |

| Net income (loss) attributable to common stockholders | $— | | $(1,710) | | $579 | | $5,248 |

| Net income (loss) per share attributable to common stockholders: | | | | | | | |

| Basic | $— | | $(0.06) | | $0.02 | | $0.18 |

| Diluted | $— | | $(0.06) | | $0.02 | | $0.13 |

| Weighted-average shares of common stock used to compute net income (loss) per share attributable to common stockholders: | | | | | | | |

| Basic | 25,921,890 | | 27,424,480 | | 26,663,418 | | 29,680,220 |

| Diluted | 25,921,890 | | 27,424,480 | | 35,495,100 | | 41,216,420 |

| | | | | | | |

| Net income (loss) attributable to common stockholders | | | $(1,710) | | | | $5,248 |

Pro forma adjustment on undistributed income allocated to participating securities(2) | | | — | | | | 9,426 |

| Pro forma net income (loss) attributable to common stockholders, basic and diluted | | | $(1,710) | | | | $14,674 |

| Pro forma net income (loss) per share attributable to common stockholders: | | | | | | | |

| Basic | | | $(0.03) | | | | $0.21 |

| Diluted | | | $(0.03) | | | | $0.18 |

| Weighted-average shares of common stock used to compute pro forma net income (loss) per share attributable to common stockholders: | | | | | | | |

| Basic | | | 69,455,870 | | | | 71,711,610 |

| Diluted | | | 69,455,870 | | | | 83,247,810 |

| | | | | | | |

(1)Includes stock-based compensation expense as follows:

| | | | | | | | | | | | | | | | | | | | | | | |

| Year ended December 31, | | Six months ended June 30, |

| 2019 | | 2020 | | 2020 | | 2021 |

| (in thousands) |

| Cost of revenue, net | $846 | | $2,272 | | $324 | | $425 |

| Research and development | 741 | | 2,469 | | 240 | | 328 |

| General and administrative | 1,496 | | 12,648 | | 516 | | 708 |

| Sales and marketing | 404 | | 448 | | 106 | | 137 |

| Total stock-based compensation expense | $3,487 | | $17,837 | | $1,186 | | $1,598 |

| | | | | | | |

(2)The pro forma adjustment on undistributed income allocated to participating securities is the add back of undistributed earnings for the period allocated to convertible preferred stockholders up to the amount of the undeclared stated dividends for the period. As all convertible preferred stockholders convert to common stockholders upon the initial public offering, any undistributed earnings allocated to participating securities will not apply to the pro forma period as no participating securities exist in the pro forma.

| | | | | | | | | | | | | | | | | |

| As of June 30, 2021 |

| Actual | | Pro forma(1) | | Pro forma as adjusted(2) |

| (in thousands) |

| Consolidated balance sheet data: | | | | | |

| Cash and cash equivalents | $45,429 | | $46,701 | | $76,142 |

Working capital(3) | 39,574 | | 40,846 | | 70,287 |

| Total current assets | 92,112 | | 93,384 | | 122,825 |

| Total assets | 116,795 | | 118,067 | | 147,508 |

| Total current liabilities | 52,538 | | 52,538 | | 52,538 |

| Total liabilities | 85,483 | | 85,483 | | 85,483 |

| Convertible preferred stock, par value $0.0001; 4,203,139 shares authorized, issued and outstanding at December 31, 2019, December 31, 2020 and June 30, 2021 (unaudited) (aggregate liquidation preference of $24,929,457 at December 31, 2019, December 31, 2020 and June 30, 2021 (unaudited)), actual; no shares authorized, issued, and outstanding, pro forma and pro forma as adjusted | 45,105 | | — | | — |

| Accumulated deficit | (37,674) | | (37,674) | | (37,674) |

| Total stockholders' equity (deficit) | (13,793) | | 32,584 | | 62,025 |

| | | | | |

(1)The pro forma column reflects: (i) the automatic conversion of all outstanding shares of our convertible preferred stock into an aggregate of 42,031,390 shares of our Class A common stock immediately prior to the completion of this offering; (ii) the reclassification of all outstanding shares of our common stock into an equivalent number of shares of Class A common stock, which will occur in connection with the filing and effectiveness of our amended and restated certificate of incorporation immediately prior to the effectiveness of the registration statement on Form S-1, of which this prospectus is a part; (iii) the completion of the Exchange Offer, pursuant to which an aggregate of 13,556,800 shares of our Class A common stock will be exchanged for 7,332,640 and 6,224,160 newly issued shares of our LT10 and LT50 common stock, respectively; (iv) the exercise of 1,483,900 outstanding stock options pursuant to the Option Exercise, which will occur prior to the completion of the Exchange Offer; and (v) the filing and effectiveness of our amended and restated certificate of incorporation immediately prior to the effectiveness of the registration statement on Form S-1, of which this prospectus is a part.

(2)The pro forma as adjusted column reflects: (i) the pro forma adjustments described above, (ii) the issuance and sale by us of 2,608,696 shares of Class A common stock in this offering at an initial public offering price of $27.00 per share, after deducting the underwriting discounts and commissions and estimated offering expenses payable by us, and (iii) the use of approximately $29.9 million of net proceeds, which is the midpoint of the estimated range set forth under "Use of proceeds", to pay discretionary cash bonuses to our employees during the fourth quarter of the year ended December 31, 2021.

(3)We define working capital as current assets less current liabilities. See our audited consolidated financial statements and related notes included elsewhere in this prospectus for further details regarding our current assets and current liabilities.

Key business metrics and non-GAAP financial measures

We review the following key metrics and non-GAAP financial measures to evaluate our business, measure our performance, identify trends affecting our business, formulate business plans and make

strategic decisions. Accordingly, we believe that these key business metrics and non-GAAP financial measures provide useful information to investors and others in understanding and evaluating our results of operations in the same manner as our management team. These key business metrics and non-GAAP financial measures are presented for supplemental informational purposes only, should not be considered a substitute for financial information presented in accordance with GAAP, and may be different from similarly titled metrics or measures presented by other companies.

Paid members

The following table sets forth the average number of paid members for the quarters ended March 31, 2018 through June 30, 2021.

| | | | | |

| Quarter ended | Paid members (1) (in thousands) |

| March 31, 2018 | 406 |

| June 30, 2018 | 447 |

| September 30, 2018 | 486 |

| December 31, 2018 | 535 |

| March 31, 2019 | 577 |

| June 30, 2019 | 623 |

| September 30, 2019 | 662 |

| December 31, 2019 | 714 |

| March 31, 2020 | 742 |

| June 30, 2020 | 630 |

| September 30, 2020 | 633 |

| December 31, 2020 | 645 |

| March 31, 2021 | 631 |

| June 30, 2021 | 639 |

| |

(1)We define paid members as the average number of users (employees, contractors, volunteers, team members, etc.) who are billed on Collect or Control plans (as described under "Management's discussion and analysis of financial condition and results of operations") during any particular quarter.

Non-GAAP financial measures

The following table summarizes certain financial measures that are not calculated and presented in accordance with GAAP (“non-GAAP financial measures”), along with the most directly comparable GAAP measure, for each period presented below.

| | | | | | | | | | | | | | | | | | | | | | | |

| Year ended December 31, | | Six months ended June 30, |

| 2019 | | 2020 | | 2020 | | 2021 |

| (in thousands, except percentages) |

| Net income (loss) | $1,241 | | $(1,710) | | $3,486 | | $14,674 |

| Net income (loss) margin | 2 | % | | (2) | % | | 9 | % | | 23 | % |

Adjusted EBITDA(1) | $ | 7,579 | | $26,755 | | $9,160 | | $22,933 |

Adjusted EBITDA margin(1) | 9% | | 30% | | 23% | | 35% |

| | | | | | | |

(1)We define Adjusted EBITDA as net income (loss) excluding provision for income taxes, interest and other expenses, net, depreciation and amortization and stock based compensation. We define Adjusted EBITDA margin as Adjusted EBITDA divided by total revenue for the same period.

For additional information about our key business metrics and non-GAAP financial measures, including a reconciliation to the most directly comparable GAAP measure, please see the section titled “Management’s discussion and analysis of financial condition and results of operations—Key business metrics and non-GAAP financial measures.”

Risk factors

Investing in our Class A common stock involves a high degree of risk. You should carefully consider the risks described below, as well as the other information in this prospectus, including our consolidated financial statements and “Management’s discussion and analysis of financial condition and results of operations,” before deciding whether to invest in our Class A common stock. The occurrence of any of the events or developments described below could materially and adversely affect our business, financial condition, results of operations and growth prospects. In such an event, the market price of our Class A common stock could decline, and you may lose all or part of your investment. Additional risks and uncertainties not presently known to us or that we currently believe are not material may also impair our business, financial condition, results of operations and growth prospects.

Risks related to our business

Our quarterly and annual results of operations have fluctuated in the past and may fluctuate significantly in the future and may not meet our expectations or those of investors or securities analysts.

Our quarterly and annual results of operations, including the levels of our revenue, deferred revenue, working capital and cash flows, have varied significantly in the past and may vary significantly in the future, such that period-to-period comparisons of our results of operations may not be meaningful. Our quarterly and annual financial results may fluctuate due to a variety of factors, many of which are outside of our control and may be difficult to predict, including, but not limited to:

•the level of demand across our platform and for individual features within our platform;

•our ability to grow or maintain our gross logo retention rate and net seat retention rate (each as described under the section titled "Management's discussion and analysis of financial condition and results of operations—Key factors affecting our performance—Retaining existing customers"), expand usage within organizations, retain and increase sales to existing customers and attract new members and customers;

•our ability to convert individuals and organizations using our free features or trial subscriptions into paying customers;

•our ability to predictably generate revenue through marketing and sales efforts;

•the timing and success of new features, integrations, capabilities and enhancements by us to our platform, or by our competitors to their products, or any other changes in the competitive landscape of our market;

•our ability to grow and maintain our relationships and/or integrations with our network of third-party partners, including integration partners, channel partners and professional service partners;

•our ability to regulate members and member interactions on an increasingly collaborative platform;

•our ability to grow revenue share and customer referrals from our partner ecosystem;

•our ability to attract new customers and retain existing customers;

•the success of our customers’ businesses;

•our ability to achieve widespread acceptance and use of our platform and features, including the Expensify Card and any new features we may introduce;

•our ability to retain customers on annual subscriptions;

•our ability to maintain and improve employee efficiency, and our ability to manage third party, outsourced or open source workers to provide value-added services like receipt processing, customer support and engineering;

•errors in our forecasting of the demand for our platform and features, which would lead to lower revenue, increased costs, or both;

•the amount and timing of operating expenses and capital expenditures, as well as entry into operating leases, that we may incur to maintain and expand our business and operations and to remain competitive;

•the timing of expenses and recognition of revenue;

•actual or perceived security breaches, technical difficulties, or interruptions to our platform and features;

•pricing pressure as a result of competition or otherwise;

•ineffective pricing strategies that could limit customer base expansion, revenue growth and subscription renewals;

•adverse litigation judgments, other dispute-related settlement payments, or other litigation-related costs;

•the number of new employees hired;

•the timing of the grant or vesting of equity awards to employees, directors, or consultants;

•declines in the values of foreign currencies relative to the U.S. dollar;

•changes in, and continuing uncertainty in relation to, the legislative or regulatory environment;

•legal and regulatory compliance costs in new and existing markets;

•costs and timing of expenses related to the potential acquisition of talent, technologies, businesses or intellectual property, and their integration, including potentially significant amortization costs and possible write-downs;

•health epidemics, such as the COVID-19 pandemic, or other conditions that impact travel and business spending; and

•general economic and market conditions in either domestic or international markets, including geopolitical uncertainty and instability and their effects on software spending.

Any one or more of the factors above may result in significant fluctuations in our quarterly and annual results of operations, which may negatively impact the trading price of our Class A common stock. You should not rely on our past results as an indicator of our future performance.

The variability and unpredictability of our quarterly and annual results of operations or other operating metrics could result in our failure to meet our expectations or those of investors or analysts with respect to revenue or other metrics for a particular period. If we fail to meet or exceed such expectations for these or any other reasons, the trading price of our Class A common stock would fall, and we would face costly litigation, including securities class action lawsuits.

We experienced rapid growth in recent periods prior to the COVID-19 pandemic, and those growth rates may not be indicative of our future growth, and we may not be able to maintain profitability.

We experienced rapid growth in recent periods prior to the COVID-19 pandemic. Our business has been impacted by the COVID-19 pandemic, with declines in revenue and paid members due to government-imposed lock-downs, a decrease in business travel and other expense-generating activity, and SMBs

downsizing or going out of business, among other things. While we have seen an increase in paid members and improvements in revenue since the low point of the pandemic, our growth rate may not return to pre-pandemic levels. Even if our revenue and paid members continue to increase in the near term, we expect that our growth rate will decline as a result of a variety of factors, including the maturation of our business. Further, as we operate in a new and rapidly changing category of preaccounting software, widespread acceptance and use of our platform and features, particularly our expense management feature, is critical to our future growth and success. We believe our growth depends on a number of factors, including, but not limited to, our ability to:

•attract new individuals and organizations to use our features, particularly our expense management feature;

•convert individuals and organizations using our free features or trial subscriptions into paying customers;

•grow or maintain our gross logo retention rate and net seat retention rate, and expand usage within organizations;

•price our subscription plans effectively and competitively;

•retain our existing individual and organizational customers;

•achieve widespread acceptance and use of our platform and features, including in markets outside of the United States;

•continue to successfully advance our bottom-up sales strategy as well as strategic relationships with our channel partners;

•continue to maintain and build a platform and brand that drives word of mouth exposure to new potential members;

•grow or maintain our brand through marketing, advertising campaigns, partnerships and other methods;

•gain member traction for and generate revenue from our new features and services;

•grow or maintain current levels of consideration from a vendor and/or fees generated through transaction-based features;

•expand the features and capabilities of our platform and features;

•provide excellent customer experience and customer support;

•maintain the security and reliability of our platform and features;

•maintain the trust of our customers;

•successfully compete against established companies and new market entrants, as well as existing software tools;

•successfully respond to other competitive challenges in the United States and globally;

•attract, hire and retain highly skilled personnel;

•weather the impact of the COVID-19 pandemic and the end of the COVID-19 pandemic on our business;

•obtain, expand, maintain, enforce and protect our intellectual property portfolio;

•operate as a public company;

•grow our member and customer base in new countries and/or markets, and increase awareness of our brand on a global basis; and

•obtain and maintain compliance and licenses material to our current and future businesses, and comply with existing and new applicable laws and regulations including in markets outside of the United States.

If we are unable to accomplish these tasks, our growth, including our revenue growth, would be harmed. We also expect our operating expenses to increase in future periods, and if our revenue growth does not increase to offset these anticipated increases in our operating expenses, our business, results of operations, and financial condition will be harmed, and we may not be able to maintain profitability.

The COVID-19 pandemic has materially adversely affected, and may continue to materially adversely affect, our business and our ability to grow. Whether or not a result of the COVID-19 pandemic, a sustained general economic downturn, an uneven recovery, or continued instability could materially and adversely affect our business, results of operations, financial condition and growth prospects.

The COVID-19 pandemic and the measures attempting to contain and control its spread have significantly curtailed the movement of people, goods and services worldwide. The effects of the COVID-19 pandemic, including stay at home, business closure and other restrictive orders, and the resulting changes in business and consumer expenditures and other behaviors, have disrupted our business and impacted our employees, partners, third-party service providers and customers.