Exhibit 99.2

This presentation includes statements that are, or may be deemed, “forward - looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 , as amended . In some cases, these forward - looking statements can be identified by the use of forward - looking terminology, including the terms “believes”, “estimates”, “anticipates”, “expects”, “plans”, “intends”, “may”, “could”, “might”, “will”, “should”, “approximately” or, in each case, their negative or other variations thereon or comparable terminology, although not all forward - looking statements contain these words . They appear in a number of places throughout this presentation and include statements regarding our intentions, beliefs, projections, outlook, analyses or current expectations, concerning, among other things, the demand for contract development & manufacturing organization services growing, our recognizing revenue in 2024 from over $ 20 M in Scorpius signed manufacturing contracts, expected high margins and long - term profitability, leveraging fixed costs as revenue continues to grow resulting in high margins and long - term profitability, being well positioned to capitalize on the growing market, becoming cash flow positive by early 2025 the industry in which we operate and the trends that may affect the industry or us and statements regarding preliminary unaudited results . By their nature, forward - looking statements involve risks and uncertainties because they relate to events, competitive dynamics, and healthcare, regulatory and scientific developments and depend on the economic circumstances that may or may not occur in the future or may occur on longer or shorter timelines than anticipated . Although we believe that we have a reasonable basis for each forward - looking statement contained in this presentation, we caution you that forward - looking statements are not guarantees of future performance and that our actual results of operations, financial condition and liquidity, and the development of the industry in which we operate may differ materially from the forward - looking statements contained in this presentation as a result of, among other factors, the factors referenced in the “Risk Factors” section of our Annual Report on Form 10 - K for the year ended December 31 , 2022 , our quarterly reports on Form 10 - Q for the subsequent quarters and our other subsequent filings with the Securities and Exchange Commission (collectively, our “SEC Filings”) . In addition, even if results of operations, financial condition and liquidity, and the development of the industry in which we operate are consistent with the forward - looking statements contained in this presentation, they may not be predictive of results or developments in future periods . Any forward - looking statements that we make in this presentation speak only as of the date of such statement, and we undertake no obligation to update such statements to reflect events or circumstances after the date of this presentation, except as required by law . Forward Looking Statement 2

Full - Service CDMO Focused on Biologic Production for the Middle Market Scorpius seeks to differentiate itself from competitors with a comprehensive mix of service offerings and a nimble, “boutique” approach to project planning and execution 3

Investment Highlights » Pure - play biologics CDMO offering a comprehensive range of services from process and analytical development through clinical - stage and small - scale commercial cGMP manufacturing » Growing demand for Contract Development & Manufacturing Organization (CDMO) services and significant shortage of dedicated clinical - scale manufacturing capacity within the industry » Began 2023 with $3M in signed contracts, which has grown to over $21M in signed contracts , with recognized revenue from a substantial number of these contracts expected in 2024 » Installed capacity to support a large and growing pipeline and backlog that is being driven by new customer acquisition and existing customer/program expansion » Customers include many premier biopharma and emerging biotech companies , as well as leading research institutions » Ability to leverage fixed costs as revenue continues to grow; expected to result in high margins and long - term profitability 4

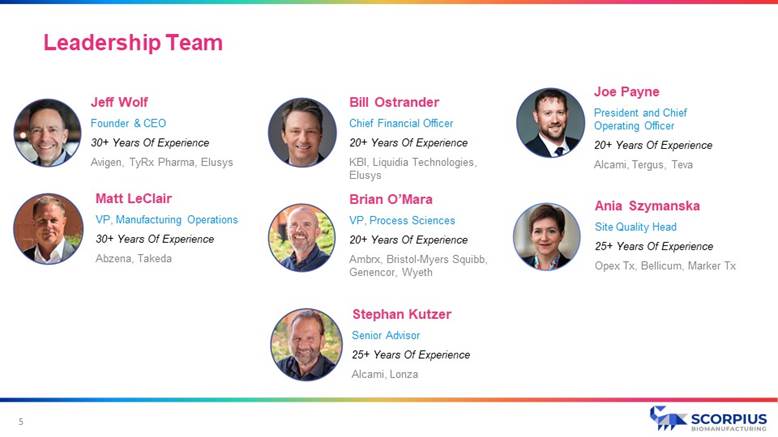

Leadership Team Joe Payne President and Chief Operating Officer 20+ Years Of Experience Alcami, Tergus, Teva Brian O’Mara VP, Process Sciences 20+ Years Of Experience Ambrx, Bristol - Myers Squibb, Genencor, Wyeth Stephan Kutzer Senior Advisor 25+ Years Of Experience Alcami, Lonza Matt LeClair VP, Manufacturing Operations 30+ Years Of Experience Abzena, Takeda Bill Ostrander Chief Financial Officer 20+ Years Of Experience KBI, Liquidia Technologies, Elusys Jeff Wolf Founder & CEO 30+ Years Of Experience Avigen, TyRx Pharma, Elusys Ania Szymanska Site Quality Head 25+ Years Of Experience Opex Tx, Bellicum, Marker Tx 5

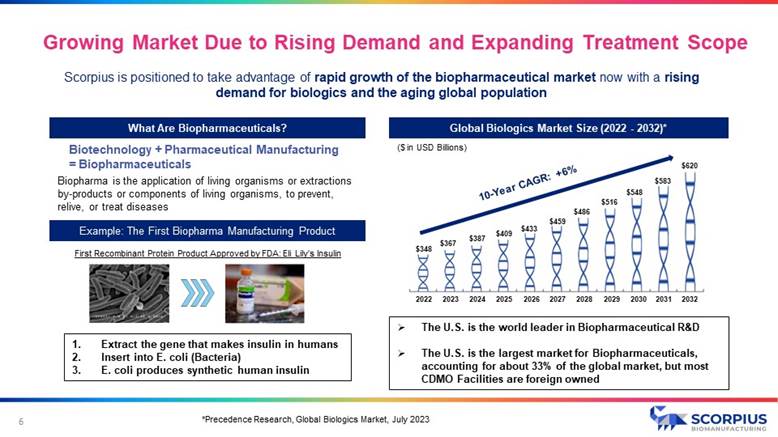

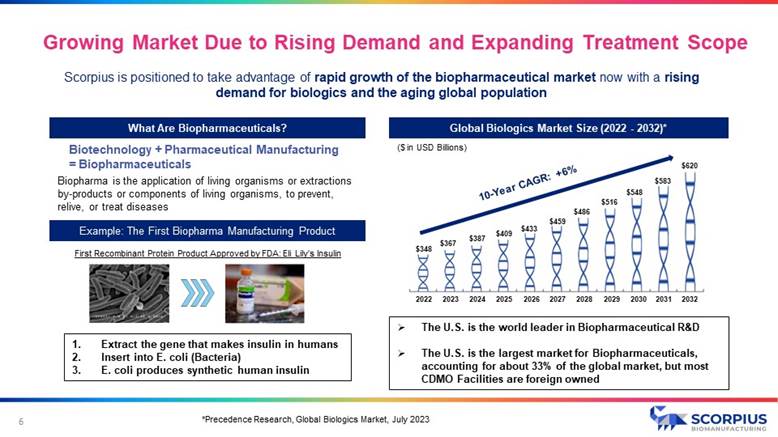

Scorpius is positioned to take advantage of rapid growth of the biopharmaceutical market now with a rising demand for biologics and the aging global population *Precedence Research, Global Biologics Market, July 2023 Growing Market Due to Rising Demand and Expanding Treatment Scope 6 What Are Biopharmaceuticals? Global Biologics Market Size (2022 - 2032)* Biotechnology + Pharmaceutical Manufacturing = Biopharmaceuticals Biopharma is the application of living organisms or extractions by - products or components of living organisms, to prevent, relive, or treat diseases Example: The First Biopharma Manufacturing Product First Recombinant Protein Product Approved by FDA: Eli Lily’s Insulin 1. Extract the gene that makes insulin in humans 2. Insert into E. coli (Bacteria) 3. E. coli produces synthetic human insulin ($ in USD Billions) » The U.S. is the world leader in Biopharmaceutical R&D » The U.S. is the largest market for Biopharmaceuticals, accounting for about 33% of the global market, but most CDMO Facilities are foreign owned $348 $367 $387 $409 $433 $459 $486 $516 $548 $583 $620 2022 2023 2024 2025 2026 2027 2028 2029 2030 2031 2032

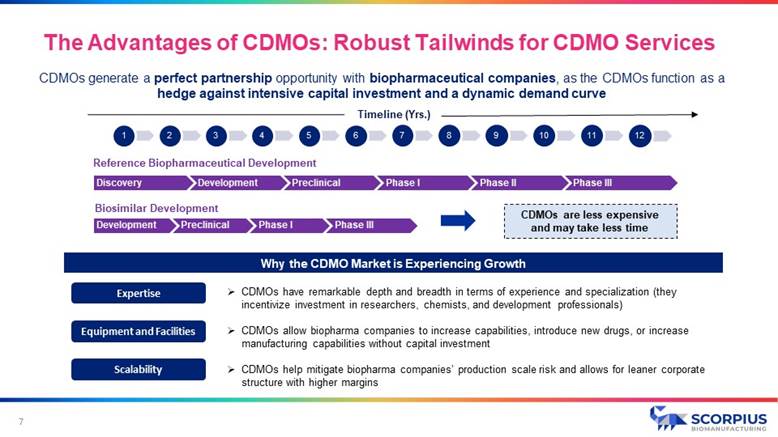

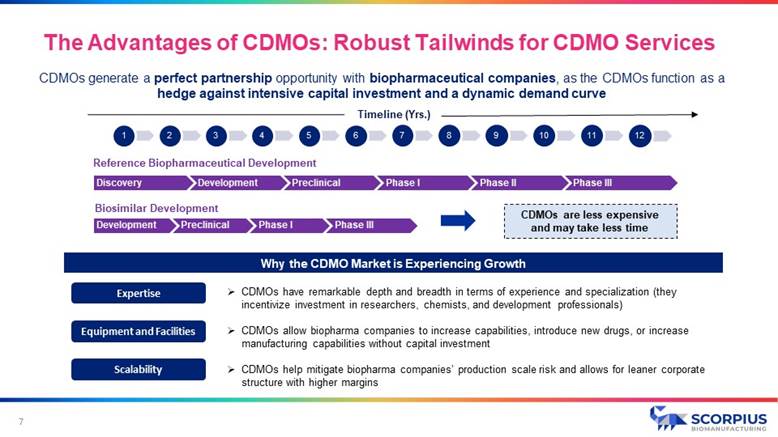

CDMOs generate a perfect partnership opportunity with biopharmaceutical companies , as the CDMOs function as a hedge against intensive capital investment and a dynamic demand curve 7 Timeline (Yrs.) Reference Biopharmaceutical Development Biosimilar Development CDMOs are less expensive and may take less time Why the CDMO Market is Experiencing Growth Discovery Development Preclinical Phase I Phase II Phase III Development Preclinical Phase I Phase III » CDMOs have remarkable depth and breadth in terms of experience and specialization (they incentivize investment in researchers, chemists, and development professionals) » CDMOs allow biopharma companies to increase capabilities, introduce new drugs, or increase manufacturing capabilities without capital investment » CDMOs help mitigate biopharma companies’ production scale risk and allows for leaner corporate structure with higher margins 1 2 3 4 5 6 7 8 9 10 11 12 Expertise Equipment and Facilities Scalability The Advantages of CDMOs: Robust Tailwinds for CDMO Services

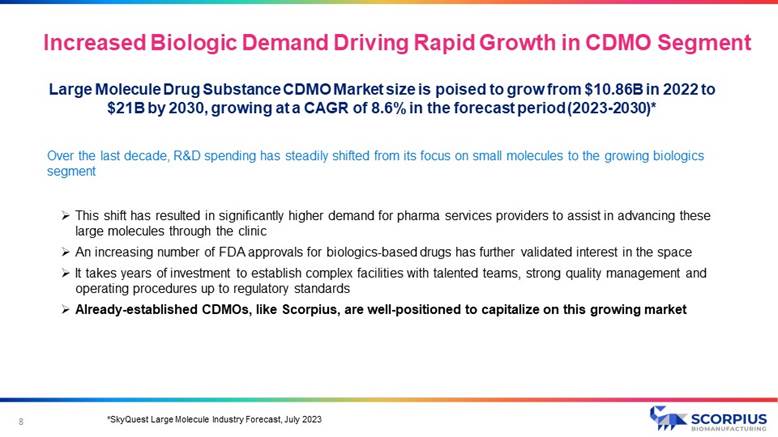

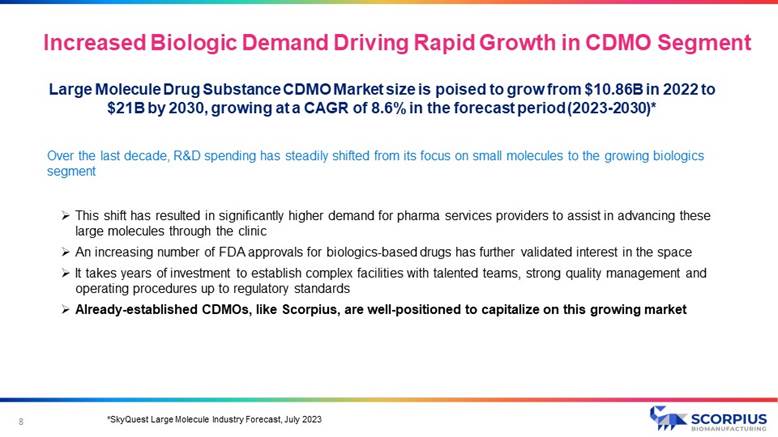

Large Molecule Drug Substance CDMO Market size is poised to grow from $10.86B in 2022 to $21B by 2030, growing at a CAGR of 8.6% in the forecast period (2023 - 2030)* *SkyQuest Large Molecule Industry Forecast, July 2023 Over the last decade, R&D spending has steadily shifted from its focus on small molecules to the growing biologics segment » This shift has resulted in significantly higher demand for pharma services providers to assist in advancing these large molecules through the clinic » An increasing number of FDA approvals for biologics - based drugs has further validated interest in the space » It takes years of investment to establish complex facilities with talented teams, strong quality management and operating procedures up to regulatory standards » Already - established CDMOs, like Scorpius, are well - positioned to capitalize on this growing market 8 Increased Biologic Demand Driving Rapid Growth in CDMO Segment

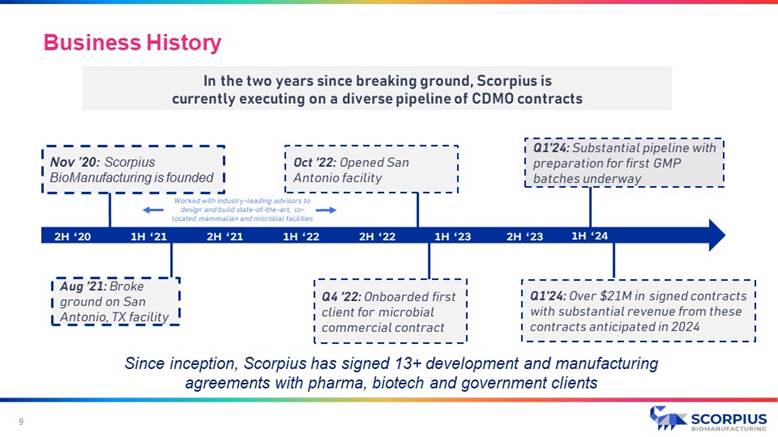

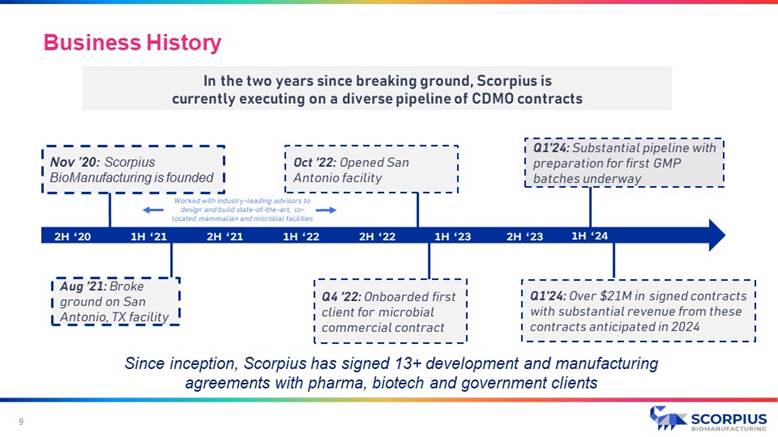

Nov ’20: Scorpius BioManufacturing is founded Aug ’21: Broke ground on San Antonio, TX facility Q4 ’22: Onboarded first client for microbial commercial contract Oct ’22: Opened San Antonio facility 2H ‘21 1H ‘22 2H ‘22 1H ‘23 2H ‘23 2H ‘20 1H ‘21 In the two years since breaking ground, Scorpius is currently executing on a diverse pipeline of CDMO contracts Q1’24: Substantial pipeline with preparation for first GMP batches underway Worked with industry - leading advisors to design and build state - of - the - art, co - located mammalian and microbial facilities 1H ‘24 Q1’24: Over $21M in signed contracts with substantial revenue from these contracts anticipated in 2024 Since inception, Scorpius has signed 13+ development and manufacturing agreements with pharma, biotech and government clients Business History 9

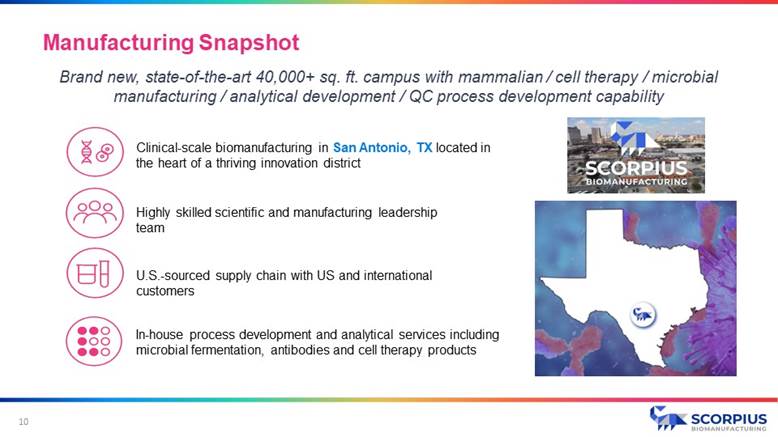

Clinical - scale biomanufacturing in San Antonio, TX located in the heart of a thriving innovation district Highly skilled scientific and manufacturing leadership team U.S. - sourced supply chain with US and international customers In - house process development and analytical services including microbial fermentation, antibodies and cell therapy products Brand new, state - of - the - art 40,000+ sq. ft. campus with mammalian / cell therapy / microbial manufacturing / analytical development / QC process development capability Manufacturing Snapshot 10

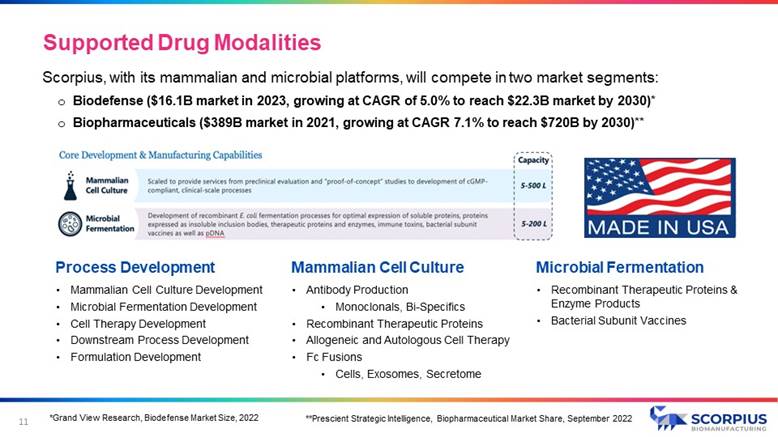

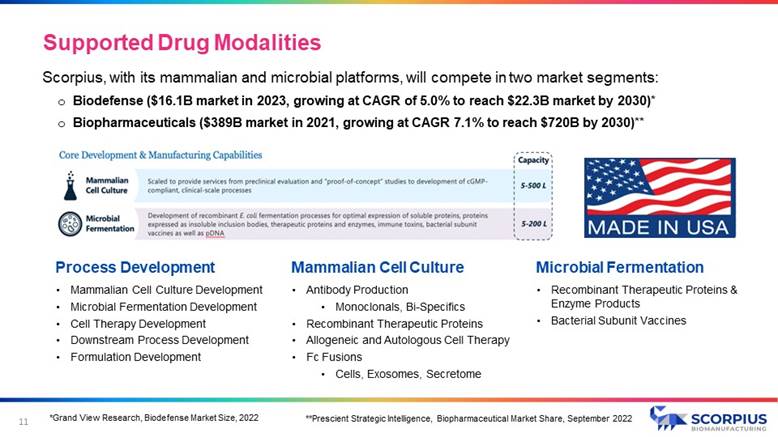

11 Supported Drug Modalities Mammalian Cell Culture • Antibody Production • Monoclonals, Bi - Specifics • Recombinant Therapeutic Proteins • Allogeneic and Autologous Cell Therapy • Fc Fusions • Cells, Exosomes, Secretome Microbial Fermentation • Recombinant Therapeutic Proteins & Enzyme Products • Bacterial Subunit Vaccines Scorpius, with its mammalian and microbial platforms, will compete in two market segments: o Biodefense ($16.1B market in 2023, growing at CAGR of 5.0% to reach $22.3B market by 2030)* o Biopharmaceuticals ($389B market in 2021, growing at CAGR 7.1% to reach $720B by 2030)** Process Development • Mammalian Cell Culture Development • Microbial Fermentation Development • Cell Therapy Development • Downstream Process Development • Formulation Development *Grand View Research, Biodefense Market Size, 2022 **Prescient Strategic Intelligence, Biopharmaceutical Market Share, September 2022

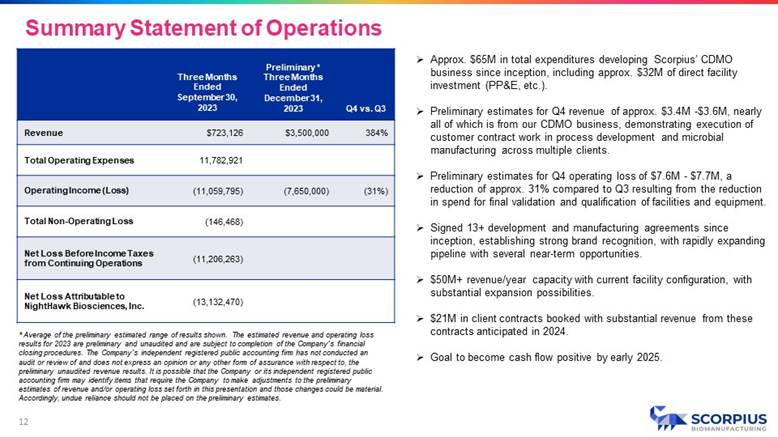

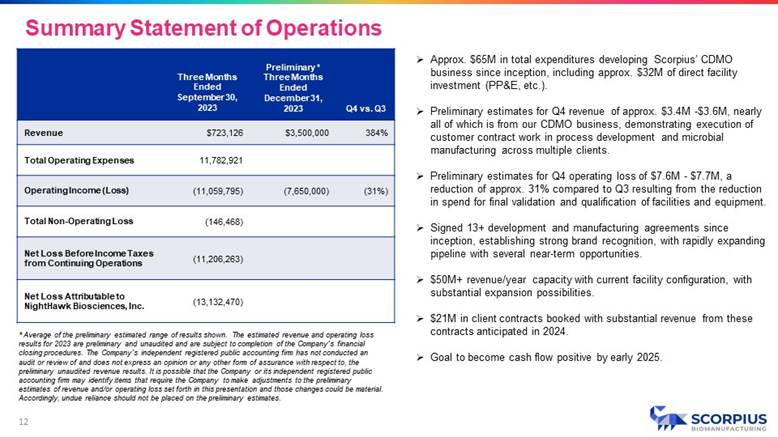

» Approx. $65M in total expenditures developing Scorpius’ CDMO business since inception, including approx. $32M of direct facility investment (PP&E, etc.). » Preliminary estimates for Q4 revenue of approx. $3.4M - $3.6M, nearly all of which is from our CDMO business, demonstrating execution of customer contract work in process development and microbial manufacturing across multiple clients. » Preliminary estimates for Q4 operating loss of $7.6M - $7.7M, a reduction of approx. 31% compared to Q3 resulting from the reduction in spend for final validation and qualification of facilities and equipment. » Signed 13+ development and manufacturing agreements since inception, establishing strong brand recognition, with rapidly expanding pipeline with several near - term opportunities. » $50M+ revenue/year capacity with current facility configuration, with substantial expansion possibilities. » $21M in client contracts booked with substantial revenue from these contracts anticipated in 2024. » Goal to become cash flow positive by early 2025. Q4 vs. Q3 Preliminary * Three Months Ended December 31, 2023 Three Months Ended September 30, 2023 384% $3,500,000 $723,126 Revenue 11,782,921 Total Operating Expenses (31%) (7,650,000) (11,059,795) Operating Income (Loss) (146,468) Total Non - Operating Loss (11,206,263) Net Loss Before Income Taxes from Continuing Operations (13,132,470) Net Loss Attributable to NightHawk Biosciences, Inc. * Average of the preliminary estimated range of results shown. The estimated revenue and operating loss results for 2023 are preliminary and unaudited and are subject to completion of the Company’s financial closing procedures. The Company’s independent registered public accounting firm has not conducted an audit or review of and does not express an opinion or any other form of assurance with respect to, the preliminary unaudited revenue results. It is possible that the Company or its independent registered public accounting firm may identify items that require the Company to make adjustments to the preliminary estimates of revenue and/or operating loss set forth in this presentation and those changes could be material. Accordingly, undue reliance should not be placed on the preliminary estimates. Summary Statement of Operations 12

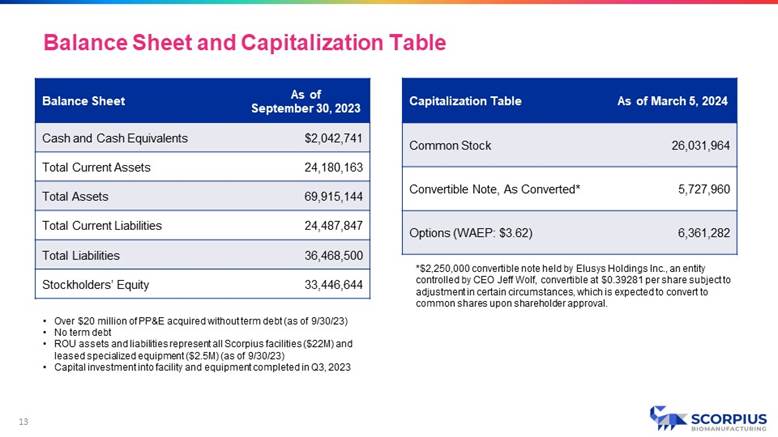

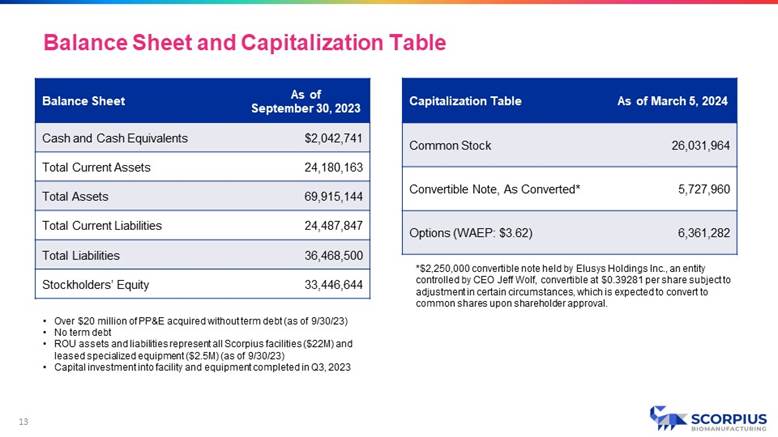

As of September 30, 2023 Balance Sheet $2,042,741 Cash and Cash Equivalents 24,180,163 Total Current Assets 69,915,144 Total Assets 24,487,847 Total Current Liabilities 36,468,500 Total Liabilities 33,446,644 Stockholders’ Equity As of March 5, 2024 Capitalization Table 26,031,964 Common Stock 5,727,960 Convertible Note, As Converted* 6,361,282 Options (WAEP: $3.62) *$2,250,000 convertible note held by Elusys Holdings Inc., an entity controlled by CEO Jeff Wolf, convertible at $0.39281 per share subject to adjustment in certain circumstances, which is expected to convert to common shares upon shareholder approval. • Over $20 million of PP&E acquired without term debt (as of 9/30/23) • No term debt • ROU assets and liabilities represent all Scorpius facilities ($22M) and leased specialized equipment ($2.5M) (as of 9/30/23) • Capital investment into facility and equipment completed in Q3, 2023 Balance Sheet and Capitalization Table 13

2024 Goals » Deliver seamless execution on signed manufacturing contracts » Expand pipeline with target biotech, pharma, and research customers » Streamline operations to deliver at scale » Bolster and strengthen in - house development and analytical services » Develop talent and culture, creating a team that can win long - term Laser - Focused on driving revenue and cash flow 14

Summary 15 » Growing demand for Contract Development & Manufacturing Organization (CDMO) services and significant shortage of dedicated clinical - scale manufacturing capacity within the industry » Scorpius began 2023 with $3M of signed manufacturing contracts, which has grown to over $21M in signed manufacturing contracts , with recognized revenue from a substantial number of these contracts expected in 2024 » Customers include many premier pharma and biotech companies as well as leading research institutions » Ability to leverage fixed costs as revenue continues to grow; expected to result in higher margins and long - term profitability

Media and Investor Relations Contact David Waldman ir@scorpiusbiologics.com 16

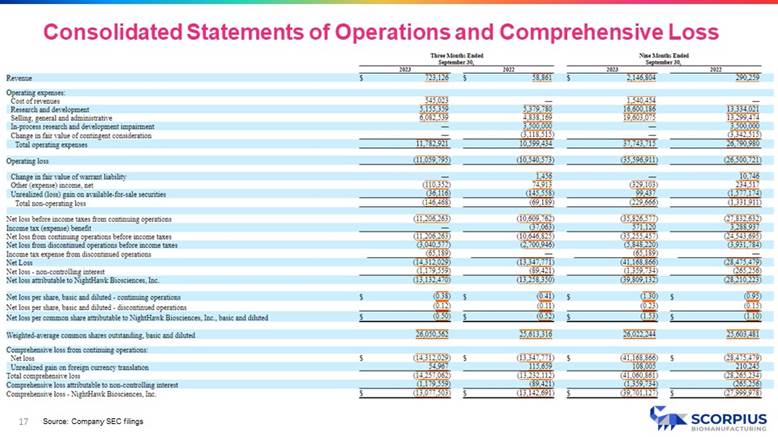

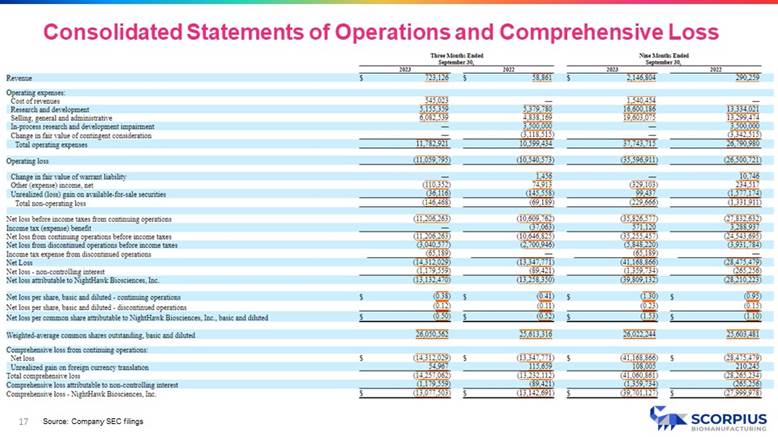

17 Source: Company SEC filings Consolidated Statements of Operations and Comprehensive Loss

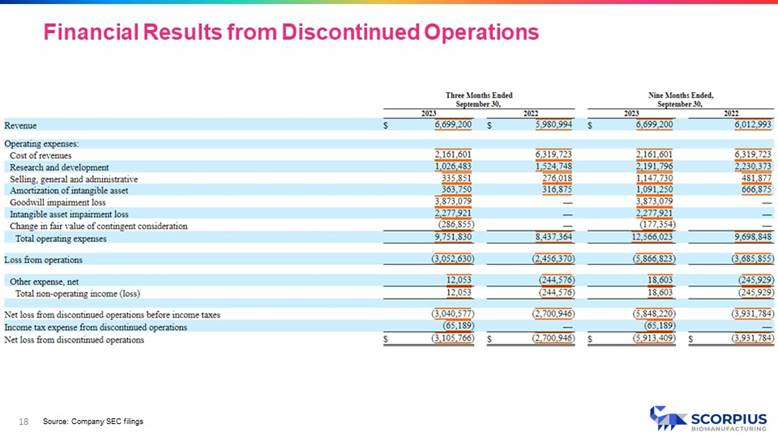

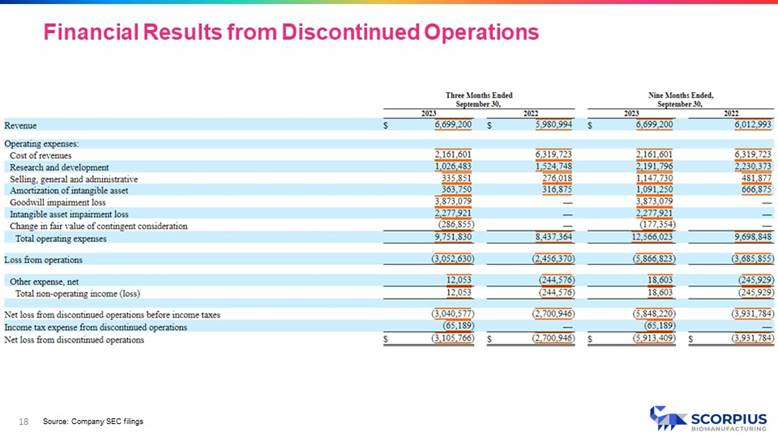

18 Source: Company SEC filings Financial Results from Discontinued Operations