EXHIBIT 99.2

JOINT LETTER TO BOARD OF DIRECTORS DATED AUGUST 21, 2012

Sent via post, facsimile & electronic mail

The Board of Directors of

China Hydroelectric Corporation

Building A #2105,

Ping’An International Finance Center

No.3 Xinyuan South Road, Chaoyang District

Beijing, People’s Republic of China 10027

Fax: +86 10 8444 2788

August 21, 2012

Re: China Hydroelectric Corporation (the “Company”)

Dear Members of the Board of Directors,

The undersigned shareholders, who collectively hold over 40% of the currently outstanding equity of the Company (collectively, the “Shareholders”), are writing this letter to members of the Board of Directors (the “Board”) to highlight various serious concerns regarding the Company’s failure to meet the Shareholders’ expectations, and to formally make certain requests in accordance with the Company’s amended and restated memorandum of association (the “Memorandum”) and amended and restated articles of association (the “Articles”), as set forth below.

As the Board is aware, in the Company’s latest report on Form 20-F for the fiscal year ended December 31, 2011, (the “2011 Form 20-F”), the Company’s independent auditors, Ernst & Young Hua Ming, raised “substantial doubt about [the Company’s] abilityto continue as a going concern” (emphasis added). This is particularly troubling in light of (1) the severe and continuing underperformance of the Company’s stock, (2) continuing increases in the Company’s general and administrative expenses (“G&A Expenses”) as set forth in the 2011 Form 20-F, (3) failure to secure adequate long term funding to meet the Company’s liquidity needs, (4) lack of proper alignment of interests of the management operating in China (“Management”), and (5) inadequate leadership to execute on the Company’s near and long-term growth strategy.

Specifically, the Shareholders highlight each of the Company’s failures above since its initial public offering on January 25, 2010 (“IPO”):

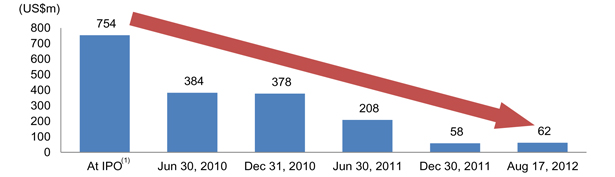

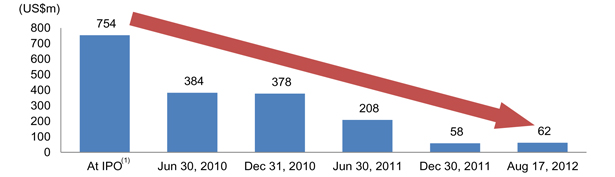

1. Failure to create shareholder value with 92.2% decline in stock price

Since the Company’s IPO, the Company’s stock price has declined 92.2% to US$1.15 per American Depositary Share (“ADS”) as of August 17, 2012 versus the IPO price of US$14.80 per ADS. During that same period, the Halter USX China Index of comparable US-listed Chinese companies declined only 20.5% and the S&P500 increased by 29.3%.

The Shareholders believe that this severe decline in stock price is a reflection of the Company’s inconsistent financial performance, lack of growth strategy, and lack of leadership. We believe the Board and the Management of the Company can no longer rely on the excuse that its stock underperformance is a result of the general negative public sentiment of US-listed Chinese companies as similarly situated companies (as indicated by the Halter USX China Index) have not suffered nearly as much of a decline in stock price over the relevant period.

1

CHC stock performance versus S&P500 and Halter USX China Index

Source: Capital IQ.

2. Increase in General and Administrative Expenses while profits declined and asset based remained the same

As members of the Board are aware, some of the Shareholders have individually communicated to the Management and certain Board members their concerns regarding the high cash and total G&A Expenses of the Company, particularly the expenses attributable to the Company’s presence and operations in the United States. We further note that during recent years, the Company has continued to increase its G&A Expenses despite a similar sized asset base while its performance has dramatically declined and its market capitalization has eroded significantly. Moreover, the Management has displayed an unwillingness to discuss or even entertain with the Shareholders any possible meaningful line-by-line reductions in G&A Expenses and has instead brushed off Shareholder concerns in this regard.

G&A Expenses

| | | | | | | | | | | | | | | | | | |

| | | 2008 | | | 2009 | | | 2010 | | | 2011(1) | |

G&A Expenses (US$k) | | | 6,761 | | | | 9,099 | | | | 19,440 | | | | 29,028 | |

G&A Expenses excl. ESOP Expense (US$k)(2) | | | 6,761 | | | | 8,528 | | | | 15,825 | | | | 18,549 | |

Installed capacity at year end (MW) | | | 271 | | | | 377 | | | | 549 | | | | 548 | |

G&AExpenses per MW capacity (US$k/MW) | | | 25 | | | | 24 | | | | 35 | | | | 53 | |

G&AExpenses excl. ESOP Expense per MWcapacity (US$k/MW)(2) | | | 25 | | | | 23 | | | | 29 | | | | 34 | |

Source: Company SEC filings.

(1) Represents continuing operations only.

(2) Excludes share-based compensation expense.

CHC Market Capitalization

Source: Company IPO prospectus and Capital IQ.

(1) Based on IPO price of US$14.80 per ADS.

2

Rather than decrease G&A Expenses, based on the Company’s own SEC filings reflected above, it has increased G&A Expenses by approximately US$10M in FY2011 as compared to FY2010 despite the Company’s (a) similar sized asset base, (b) worsening financial performance, and (c) concerns regarding its ability to continue as a going concern. The increase in G&A Expenses was partially attributed to a share option exchange which rewarded employees by converting their share options with an exercise price of US$7.70 per share to share options with an exercise price of US$0.46 per share that became fully vested on December 21, 2011 (a year during which the Company reported a net loss of US$55M and had its worst historical performance to date). Moreover, in addition to the share option exchange program, the Company took on additional expenses and issued over 9 million additional options to purchase shares with an exercise price of US$0.62 per share – primarily to four senior management employees – immediately after announcing the worst financial performance of the Company and highlighting the going concern issues related to the Company. Furthermore, the options were issued only a few weeks before announcing positive news of tariff hikes at various hydropower plants owned by the Company and shortly before the Company formally announced that its revenue has increased substantially due to higher rainfall.

While in the Company’s recent quarterly earnings announcement, the Company does show a decrease in G&A Expenses over the past two quarters of 2012, the Company has attributed such decrease, in part, to lower stock-based compensation expense (the “ESOP Expense”) in such period as a result of unamortized cost of stock-based compensation pertaining to 2009 and 2010 stock option grants being written off in the fourth quarter of 2011. In short, the primary reason for the G&A Expense decrease in the first two quarters of 2012 was because the Company took that entire ESOP Expense in the fourth quarter of 2011 as opposed to amortizing such ESOP Expense during this same period. In fact, excluding the ESOP Expense (which is a non-cash item), the Company actually increased its G&A Expenses from the first half of FY2012 when compared with the first half of FY2011.

The Shareholders believe that current G&A Expenses continue to be excessive based on the Company’s installed capacity. An increase by US$10 million in G&A Expenses in FY2011 with similar size of installed capacity should be deemed a failure on the part of the Board and Management to control costs in a year where the Company lost US$55 million and the auditors have raised going concern issues. The Shareholders believe it is incumbent on the Board and Management to control such costs and expenses particularly in a period where there are going concern issues.

3. The Company has failed to secure adequate long term funding to meet its liquidity needs

In its 2011 Form 20-F, the Company reported that its “liquidity position poses risk to [its] operations” with a working capital deficiency of approximately US$138.7 million, and further disclosed that the Company’s auditors raised doubt about its ability to continue as a going concern. As you are aware, one of the Shareholders has made numerous written proposals offering to support the Company’s liquidity needs by investing up to its pro rata share in any new financing at premiums to the then current share price. Indeed, on the Company’s request, such Shareholder even introduced potential third party institutional investors to help fill the Company’s financing gap.

However, despite such support from this Shareholder and interest from various third party institutional investors, the Company has yet to consummate any such financing. Instead, based on the 2011 Form 20-F, it appears that Management has opted to meet the Company’s liquidity needs by securing financing in a piecemeal fashion, including obtaining short-term loans from banks and other non-financial institutions at interest rates as high as 21.6% annually. This type of “emergency” financing is very expensive when compared with a more deliberate and considered financing plan, and has been value destructive to shareholders of the Company.

Moreover, in the Company’s recent quarterly earnings announcement, the Company disclosed that it still maintained a working capital deficiency of US$127.5 million, but only secured US$74.2 million of new financings. In fact, in the same earnings report, the Company notes that its “liquidity condition raises substantial doubt about its ability to remain a going concern.”

The Shareholders would like to re-iterate that they still have faith in the business prospects of the Company despite its liquidity condition. Indeed, certain Shareholders are even willing to infuse more capital at premium to current market prices and are willing to consider terms at least comparable or better than other financing terms the Company may be considering to assist the Company’s liquidity condition. We request the Board and Management to give equal chance to all shareholders to provide additional financing to the Company.

3

4. The Company has not properly aligned interests of key management in China

As disclosed in its 2011 Form 20-F, the Company approved an option exchange program whereby it cancelled 10,384,000 partially unvested share options at an exercise price of US$7.70 per share, and reissued 416,956 share options at an exercise price of US$0.46 per share to the same employees and non-employee consultants. The reissued share options not only had a lower exercise price, but also were fully vested as of December 21, 2011. Moreover, the Company incurred an immediate expense of US$6.8 million for the existing options at the time of the exchange.

In addition, on May 1, 2012, the Company announced that the Board had issued an additional 9,979,998 stock options with an exercise price of US$0.62 per share from the share options that were cancelled in the option exchange described above to certain employees and non-employee consultants. Additionally, out of the total new share options issued, 95% of those share options went to four management employees and more than 50% of the share options went to employees who are neither based in China nor have any day to day responsibilities in the operations of the Company in China. These new options were issued after the announcement of one of the worst financial performances in the Company’s history in the 2011 Form 20-F.

The Shareholders do not believe the exchange and issue of options in view of the Company’s current financial predicament and in light of the continued underperformance of its share price demonstrates proper alignment of interests of key management with the interest of shareholders and the overall performance of the Company. In addition, the Shareholders believe that the underperformance of the share price after announcing the issuance of employee stock options despite positive news of tariff hikes at various hydropower plants owned by the Company is reflective of the market’s similar concerns with actions taken by Management in restructuring these employee options.

The Company incurred a significant expense for the share option exchange and the issuance of additional share options both of which primarily benefited only four senior management members. The Shareholders believe the Company should allocate the employee share option plan to a larger number of employees based on actual performance for the benefit of the Company instead of granting share options at depressed exercise prices immediately after announcing one of the worst financial performances in the Company’s history in the 2011 Form 20-F.

5. Failure by Company to execute on strategy

The Shareholders believe that the Board and Management have not provided any clear guidance on how they plan to address (a) the substantial decrease in shareholder value, (b) a clear, sustainable long term financing plan to resolve the Company’s liquidity needs, (c) a plan to reduce costs and general and administrative expenses in a meaningful way, and (d) the lack of viable future growth strategy.

Shareholders’ Requests

The Company’s auditors have stated in Note 2(a) of its report on the Company’s financial statements filed with the 2011 Form 20-F that the “continued operation of the Group is dependent upon the Group’s ability in raising additional capital, obtaining additional financing and improving future operating financial results.” The Shareholders believe that the specific examples set forth above show that the Company’s current leadership is unable to raise sufficient capital, obtain additional financing or improve the overall financial health of the Company. The Shareholders believe that it is in the best interests of the Company to replace certain members of the Board and elect new Board members to reinvigorate the Company to drive it in a new direction.

4

Accordingly, the Board is put on notice that certain undersigned Shareholders have already converted their ADSs into ordinary shares of the Company via written notice to the Company’s depositary, and the undersigned Shareholders, which represent holders of at least one-third of the issued shares of the Company, are calling an extraordinary general meeting (“EGM”), pursuant to a notice of EGM dated as of the date of this letter in accordance with all applicable requirements set forth in the Articles, to replace certain members of the Board and elect new Board members as set out below.

The undersigned Shareholders make the following formal requests that:

| | 1. | Pursuant to the attached notice of EGM, an extraordinary general meeting be called on September 28, 2012 at 9 a.m. Beijing time, at Building A #2105, Ping’An International Financial Center, No.3 Xinyuan South Road, Chao Yang District, Beijing, People’s Republic of China 100027 (or such other place as agreed by the Shareholders and the Company) to enable shareholders of the Company to vote to: |

| | a. | remove certain members of the Board as set forth in the attached notice of EGM; and |

| | b. | elect the following new members to the Board: (i) James Tie Li, (ii) Amit Gupta, (iii) Moonkyung Kim; (iv) Jui Kian Lim; and (v) Yun Pun Wong. |

The Shareholders would also like to re-elect and/or retain Dr. Yong Cao and Dr. You-Su Lin as directors on the Board and would like to recommend Dr. You-Su Lin as Chairman of the Board and James Tie Li as the CEO and President of the Company to maintain operational continuity.

| | 2. | The record date of the extraordinary general meeting be set as of the date of this letter; |

| | 3. | The Company deliver the following certified copies of the register of members to O’Melveny & Myers LLP, at Two Embarcadero Center, 28th Floor, San Francisco, CA 94111-3823 Facsimile: +1-415-984-8701, Attn: Paul Scrivano: (1) a certified copy of the Company’s register of members dated as of the date immediately following the conversion of certain of the Shareholders’ ADSs into ordinary shares and, (2) a certified copy of the Company’s register of members as of the date immediately following the setting and occurrence of any record date established with respect to the EGM (including any adjournments, postponements or re-schedulings thereof); |

| | 4. | The Company adopt a viable plan to (a) reduce G&A Expenses, (b) resolve its long term financing needs, in part, by discussing potential financing from existing Shareholders, and (c) provide an employee incentive plan that aligns the interest of Management and other Company employees with those of the shareholders and the Company; and |

| | 5. | All information requested with respect to the ADSs set forth inAttachment A hereto be provided to O’Melveny & Myers LLP, at Two Embarcadero Center, 28th Floor, San Francisco, CA 94111-3823 Facsimile: +1-415-984-8701, Attn: Paul Scrivano. |

Lastly, the Company is hereby placed on notice that any action or delay by the Board or the Company to thwart or deny the exercise of shareholders’ right under the Company’s Memorandum or Articles to call an extraordinary general meeting will constitute unlawful manipulation of the Company’s corporate machinery in an attempt to entrench existing Management and directors to the wilful detriment of the Company and its shareholders. The undersigned Shareholders further notify the Company that any such actions by the Company or the Board may result in the undersigned Shareholders (or any one of them) taking all necessary steps to enforce their rights under applicable law, including without limitation, litigation against the Company, Management, and any individual Board member in the Cayman Islands and in the State of New York. In particular, as the Company failed to obtain shareholder approval on its proposed amendment to the Articles at last year’s annual general meeting to allow the Board to authorize classes of preferred stock, the Board is not entitled to exercise any power to issue preferred stock and the Shareholders would deem such action as against the best interests of the Company and its shareholders and in violation of (a) the Company’s Memorandum and Articles and (b) each member of the Board’s fiduciary duties towards the Company and the shareholders of the Company. Further, any proposed issuance of stock, stock options or other securities, and any amendment of existing warrants or stock options (including, without limitation, changes to exercise prices of such warrants or stock options) to dilute existing shareholders between the date hereof and the proposed EGM will be considered an improper exercise of the Board’s powers for the purpose ofattempting to alter the voting majorities of the Company. As the Management has already publicly expressed that the Company will not seek working capital and expansion financing by issuing securities at such depressed share prices in its latest earnings announcement on August 16, 2012, the Shareholders would view any issuance of new securities, whether such issuance is disguised as equity financing, a merger and/or acquisition, or otherwise, as a sham transaction designed solely to thwart the Shareholders’ ability to vote for and support the initiatives highlighted in this Joint Letter.

5

Certain other shareholders have expressed support for the undersigned Shareholders’ initiatives set forth in this Joint Letter, although they have not, at this stage, signed a voting agreement or entered into any other agreement, arrangement or understanding, formal or informal, with the Shareholders related to the transactions contemplated hereunder. Including such other supporting shareholders, over 50% of the outstanding shares of the Company are in favor of or supportive of the initiatives intended to enhance shareholder value set out in this Joint Letter.

We urge the Board to swiftly act in the best interests of the Company to address the above concerns of the shareholders who represent a majority equity interest in the Company. In addition, we demand representation on the Board which has been repeatedly denied to us so that we can prevent further value destructive actions and turn a promising company around to financial stability and growth, so as to increase shareholder value. We would also like to remind the members of the Board that shareholders had rejected a request to amend the Articles of the Company to give the Board a blank check approval to issue dilutive share capital in the annual general meeting held on October 31, 2011. Given the loss of confidence in the current Board by significant shareholders of the Company, we will request them to obtain shareholder approval for any equity or equity linked offering.

We believe our requests are very reasonable in light of the issues we have highlighted in this letter, and would like to thank you in advance for your prompt attention to these requests and to the Shareholders’ general and specific concerns. We respectfully request your written response to our requests by no later than close of business, Eastern Standard Time, August 31, 2012.

Please copy your written response to: O’Melveny & Myers LLP, Two Embarcadero Center, 28th Floor, San Francisco, CA 94111-3823 Facsimile: +1-415-984-8701, Attn: Paul Scrivano.

6

Sincerely,

| | | | | | | | |

| CPI BALLPARK INVESTMENTS LTD | | | | SWISS RE FINANCIAL PRODUCTS CORPORATION |

| | | | |

| by | | /s/ Georges A. Robert | | | | by | | /s/ Hank Chance |

| Name: Georges A. Robert | | | | Name: Hank Chance |

| | |

| Title: Authorized Signatory | | | | Title: Authorized Signatory |

| | | | | | | | |

| CHINA ENVIRONMENT FUND III, L.P. | | | | AQUA RESOURCES ASIA HOLDINGS LIMITED |

| By: | | China Environment Fund III | | | | | | |

| | Management, L.P., its general partner | | | | |

| By: | | China Environment Fund III Holdings | | | | |

| | Ltd., its general partner | | | | |

| | | | | | | | |

| | | | |

| by | | /s/ Yun Pun Wong | | | | by | | /s/ Kimberly Tara |

| Name: Yun Pun Wong | | | | Name: Kimberly Tara |

| | |

| Title: Authorized Signatory | | | | Title: Authorized Signatory |

| | | | | | | | |

| ABRAX | | | | IWU INTERNATIONAL LTD. |

| | | | |

| by | | /s/ Manuel Salvisberg | | | | by | | /s/ Li Wu Fehlmann |

| Name: Manuel Salvisberg | | | | Name: Li Wu Fehlmann |

| | |

| Title: Authorized Signatory | | | | Title: Authorized Signatory |

Cc: John Kuhns, Chairman and CEO

7

Attachment A

ADS Information Demand

| | 1. | A certified list and CD-ROM or diskette or other electronic file in a non-image data format of the Company’s registered ADS holders (a) as of the date hereof, (b) as of the date immediately following the conversion of certain of the Shareholders’ ADSs into ordinary shares and (c) following the setting and occurrence of any record date established with respect to the EGM (including any adjournments, postponements or re-schedulings thereof), as of such record date, showing the names, addresses and number of ADSs held by such holders, together with such computer processing data and instructions as are necessary to make use of such CD-ROM or diskette or other electronic file; |

| | 2. | All information in or which comes into the Company’s, its transfer agent’s or its depositary’s or any of their agents’ possession or control, or which can reasonably be obtained from brokers, dealers, banks, clearing agencies or voting trustees or their nominees concerning the names, addresses and number of ADSs held by the participating brokers and banks named in the individual nominee names of Cede & Co. and other similar nominees of any central certificate depository system, including respondent bank listings and omnibus proxies and Cede & Co. depository listings, as of the date hereof and following the setting and occurrence of any record date established with respect to the extraordinary general meeting (including any adjournments, postponements or re-schedulings thereof), as of such record date; and |

| | 3. | All information in the Company’s or its depositary’s possession or control, or which can reasonably be obtained from brokers, dealers, banks, clearing agencies or voting trustees relating to the names and addresses of and number of ADSs held by the non-objecting beneficial owners of ADSs pursuant to Rule 14(b)-1(b) or Rule 14b-2(b) under the Securities Exchange Act of 1934 (“NOBOs”) and a NOBO list and CD-ROM or diskette or other electronic file in a non-image data format in descending order balance or such other format as may be currently in the possession of the Company or its depositary (together with such computer processing data and instructions as are necessary to make use of such CD-ROM or diskette or other electronic file), as of the date hereof and following the setting and occurrence of any record date established with respect to the extraordinary general meeting (including any adjournments, postponements or re-schedulings thereof), as of such record date. |

8