Exhibit 99.2

JOINT LETTER TO BOARD OF DIRECTORS DATED AUGUST 30, 2012

Sent via post, facsimile & electronic mail

The Board of Directors of

China Hydroelectric Corporation

Building A #2105,

Ping’An International Finance Center

No.3 Xinyuan South Road, Chaoyang District

Beijing, People’s Republic of China 10027

Fax: +86 10 8444 2788

August 30, 2012

Re: China Hydroelectric Corporation (the “Company”)

Dear Members of the Board of Directors,

We, the undersigned shareholders of the Company representing over 40% of the outstanding shares of the Company (collectively, the “Shareholders”), are writing to follow-up on our joint letter to the Board of Directors of the Company (the “Board”) dated August 21, 2012 (the “August 21 Joint Letter”). Since August 21, we have made repeated requests to the Company and members of the Board to discuss the concerns raised in our August 21 Joint Letter; however, we have yet to receive any meaningful response to these requests from either the Company or the Board. Instead, the Company announced that, on August 22, 2012, “James” Tie Li resigned as President of the Company “for reasons unrelated to actions recently taken by certain shareholders of the Company” and that the Board had received the August 21 Joint Letter and “[was] currently evaluating the letter and plans to respond to the Shareholder Group in due course.”

Given the Board and the Company’s lack of formal response to either the August 21 Joint Letter or our subsequent requests to discuss our concerns set forth therein as well as developments at the Company since our delivery of the August 21 Joint Letter to the Board, we believe we have no other choice but to take the actions articulated in this letter.

Accordingly, the Shareholders hereby notify the Company of certain actions and reiterate their concerns, as follows:

1. The Shareholders formally call an EGM to be held on September 28, 2012 and amend and restate the EGM Notice and Proxy Card filed on August 21, 2012

The Shareholders hold ordinary shares of the Company comprising over one-third of the issued and outstanding ordinary shares of the Company. Accordingly, in order to address the concerns raised in this letter as well as the August 21 Joint Letter, the Shareholders hereby notify the Company and the Board that they have called an extraordinary general meeting (“EGM”) of the Company to be held on September 28, 2012 pursuant to the Company’s articles of association (the “Articles”). The Shareholders attach asExhibit A hereto an amended and restated Notice of Extraordinary General Meeting of the Shareholders and Proxy Statement (the “EGM Materials”) to be delivered to the shareholders of the Company who are entitled to vote their Company shares at the EGM. The purpose of the EGM is to remove certain current directors of the Company in favor of the election of a slate of directors to be nominated by the Shareholders, as further specified in the EGM Materials.

2. The Shareholders have set the record date as of August 29, 2012

Pursuant to the Articles, the Shareholders have set August 29, 2012 (the “Record Date”) as the record date for the purpose of determining shareholders of the Company who are entitled to notice of or to vote at the EGM scheduled for September 28, 2012.

3. On August 30, 2012, the Shareholders first mailed the EGM Materials to shareholders of the Company who held ordinary shares of the Company as of the Record Date

The Shareholders hereby inform the Board that on August 30, 2012, the Shareholders first mailed the EGM Materials to shareholders of the Company who held ordinary shares of the Company as of the Record Date, and that, pursuant to the Articles and Cayman Islands law, notice of the EGM will be deemed to have been properly provided as of August 31, 2012, which is the date following the date that the EGM Materials were first mailed to the shareholders of the Company.

4. The Shareholders hereby request that the Company release the Register of Members as of the Record Date, and formally notify New York Stock Exchange, Inc. (the “NYSE”) that the record date of the EGM has been set as August 29, 2012

The Shareholders hereby formally demand that the Company release, to the Shareholders, the Company’s Register of Members as of August 29, 2012, and promptly notify the NYSE that the record date of the EGM has been set as of August 29, 2012.

5. The Shareholders reiterate the concerns set forth in the August 21 Joint Letter

The Shareholders maintain their concerns for the Company as set forth in the August 21 Joint Letter, and reiterate those same concerns, which are replicated inExhibit Bhereto. Further, to help address their concerns, the Shareholders believe an EGM to remove certain directors and appoint new directors in accordance with the EGM Materials attached hereto asExhibit A is in the best interests of the Company.

The Shareholders continue to request that the Board make itself available to discuss the concerns and requests set forth in this letter and the August 21 Joint Letter. The Shareholders are hopeful that the Board is cognizant of its fiduciary duties, and will exercise the duties and powers of directors in a manner that is in the best interest of the Company and its shareholders, and in particular, to avoid any mergers, acquisitions, dilutive issuances or other similar transactions during the period prior to the EGM that would be deemed as actions solely to thwart the Shareholders’ ability to vote for and support the initiatives highlighted in this letter.

* * * * *

Sincerely,

| | | | | | |

| CPI BALLPARK INVESTMENTS LTD | | SWISS RE FINANCIAL PRODUCTS CORPORATION |

| | | |

| by | | /s/ Georges A Robert | | by | | /s/ Hank Chance |

| Name: | | Georges A Robert | | Name: | | Hank Chance |

| Title: | | Authorized Signatory | | Title: | | Authorized Signatory |

| | |

CHINA ENVIRONMENT FUND III, L.P. By: China Environment Fund III Management, L.P., its general partner By: China Environment Fund III Holdings Ltd., its general partner | | AQUA RESOURCES ASIA HOLDINGS LIMITED |

| | | | | | |

| by | | /s/ Yun Pun Wong | | by | | /s/ Kimberly Tara |

| Name: | | Yun Pun Wong | | Name: | | Kimberly Tara |

| Title: | | Authorized Signatory | | Title: | | Authorized Signatory |

| | | | | | |

| ABRAX | | IWU INTERNATIONAL LTD. |

| | | |

| by | | /s/ Manuel Salvisberg | | by | | /s/ Li Wu Fehlmann |

| Name: | | Manuel Salvisberg | | Name: | | Li Wu Fehlmann |

| Title: | | Authorized Signatory | | Title: | | Authorized Signatory |

Cc: John Kuhns, Chairman and CEO

Exhibit A

Incorporated herein by reference to Exhibit 99.3 of this Schedule 13D.

Exhibit B

1. Failure to create shareholder value with 92.2% decline in stock price

Since the Company’s IPO, the Company’s stock price has declined 92.2% to US$1.15 per American Depositary Share (“ADS”) as of August 17, 2012 versus the IPO price of US$14.80 per ADS. During that same period, the Halter USX China Index of comparable US-listed Chinese companies declined only 20.5% and the S&P500 increased by 29.3%.

The Shareholders believe that this severe decline in stock price is a reflection of the Company’s inconsistent financial performance, lack of growth strategy, and lack of leadership. We believe the Board and the Management of the Company can no longer rely on the excuse that its stock underperformance is a result of the general negative public sentiment of US-listed Chinese companies as similarly situated companies (as indicated by the Halter USX China Index) have not suffered nearly as much of a decline in stock price over the relevant period.

CHC stock performance versus S&P500 and Halter USX China Index

Source: Capital IQ.

2. Increase in General and Administrative Expenses while profits declined and asset based remained the same

As members of the Board are aware, some of the Shareholders have individually communicated to the Management and certain Board members their concerns regarding the high cash and total G&A Expenses of the Company, particularly the expenses attributable to the Company’s presence and operations in the United States. We further note that during recent years, the Company has continued to increase its G&A Expenses despite a similar sized asset base while its performance has dramatically declined and its market capitalization has eroded significantly. Moreover, the Management has displayed an unwillingness to discuss or even entertain with the Shareholders any possible meaningful line-by-line reductions in G&A Expenses and has instead brushed off Shareholder concerns in this regard.

G&A Expenses

| | | | | | | | | | | | | | | | | | |

| | | 2008 | | | 2009 | | | 2010 | | | 2011(1) | |

G&A Expenses (US$k) | | | 6,761 | | | | 9,099 | | | | 19,440 | | | | 29,028 | |

G&A Expenses excl. ESOP Expense (US$k)(2) | | | 6,761 | | | | 8,528 | | | | 15,825 | | | | 18,549 | |

Installed capacity at year end (MW) | | | 271 | | | | 377 | | | | 549 | | | | 548 | |

G&AExpenses per MW capacity (US$k/MW) | | | 25 | | | | 24 | | | | 35 | | | | 53 | |

G&AExpenses excl. ESOP Expense per MWcapacity (US$k/MW)(2) | | | 25 | | | | 23 | | | | 29 | | | | 34 | |

Source: Company SEC filings.

(1) Represents continuing operations only.

(2) Excludes share-based compensation expense.

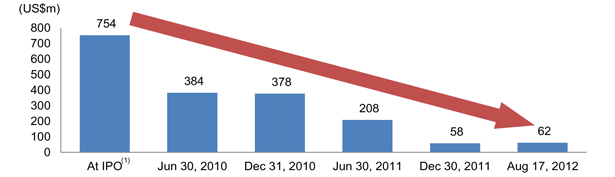

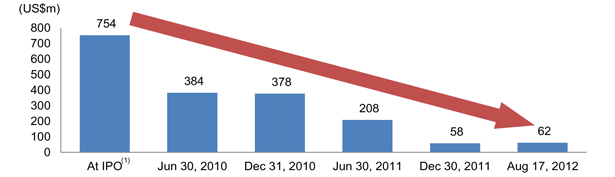

CHC Market Capitalization

Source: Company IPO prospectus and Capital IQ.

(1) Based on IPO price of US$14.80 per ADS.

Rather than decrease G&A Expenses, based on the Company’s own SEC filings reflected above, it has increased G&A Expenses by approximately US$10M in FY2011 as compared to FY2010 despite the Company’s (a) similar sized asset base, (b) worsening financial performance, and (c) concerns regarding its ability to continue as a going concern. The increase in G&A Expenses was partially attributed to a share option exchange which rewarded employees by converting their share options with an exercise price of US$7.70 per share to share options with an exercise price of US$0.46 per share that became fully vested on December 21, 2011 (a year during which the Company reported a net loss of US$55M and had its worst historical performance to date). Moreover, in addition to the share option exchange program, the Company took on additional expenses and issued over 9 million additional options to purchase shares with an exercise price of US$0.62 per share – primarily to four senior management employees – immediately after announcing the worst financial performance of the Company and highlighting the going concern issues related to the Company. Furthermore, the options were issued only a few weeks before announcing positive news of tariff hikes at various hydropower plants owned by the Company and shortly before the Company formally announced that its revenue has increased substantially due to higher rainfall.

While in the Company’s recent quarterly earnings announcement, the Company does show a decrease in G&A Expenses over the past two quarters of 2012, the Company has attributed such decrease, in part, to lower stock-based compensation expense (the “ESOP Expense”) in such period as a result of unamortized cost of stock-based compensation pertaining to 2009 and 2010 stock option grants being written off in the fourth quarter of 2011. In short, the primary reason for the G&A Expense decrease in the first two quarters of 2012 was because the Company took that entire ESOP Expense in the fourth quarter of 2011 as opposed to amortizing such ESOP Expense during this same period. In fact, excluding the ESOP Expense (which is a non-cash item), the Company actually increased its G&A Expenses from the first half of FY2012 when compared with the first half of FY2011.

The Shareholders believe that current G&A Expenses continue to be excessive based on the Company’s installed capacity. An increase by US$10 million in G&A Expenses in FY2011 with similar size of installed capacity should be deemed a failure on the part of the Board and Management to control costs in a year where the Company lost US$55 million and the auditors have raised going concern issues. The Shareholders believe it is incumbent on the Board and Management to control such costs and expenses particularly in a period where there are going concern issues.

3. The Company has failed to secure adequate long term funding to meet its liquidity needs

In its 2011 Form 20-F, the Company reported that its “liquidity position poses risk to [its] operations” with a working capital deficiency of approximately US$138.7 million, and further disclosed that the Company’s auditors raised doubt about its ability to continue as a going concern. As you are aware, one of the Shareholders has made numerous written proposals offering to support the Company’s liquidity needs by investing up to its pro rata share in any new financing at premiums to the then current share price. Indeed, on the Company’s request, such Shareholder even introduced potential third party institutional investors to help fill the Company’s financing gap.

However, despite such support from this Shareholder and interest from various third party institutional investors, the Company has yet to consummate any such financing. Instead, based on the 2011 Form 20-F, it appears that Management has opted to meet the Company’s liquidity needs by securing financing in a piecemeal fashion, including obtaining short-term loans from banks and other non-financial institutions at interest rates as high as 21.6% annually. This type of “emergency” financing is very expensive when compared with a more deliberate and considered financing plan, and has been value destructive to shareholders of the Company.

Moreover, in the Company’s recent quarterly earnings announcement, the Company disclosed that it still maintained a working capital deficiency of US$127.5 million, but only secured US$74.2 million of new financings. In fact, in the same earnings report, the Company notes that its “liquidity condition raises substantial doubt about its ability to remain a going concern.”

The Shareholders would like to re-iterate that they still have faith in the business prospects of the Company despite its liquidity condition. Indeed, certain Shareholders are even willing to infuse more capital at premium to current market prices and are willing to consider terms at least comparable or better than other financing terms the Company may be considering to assist the Company’s liquidity condition. We request the Board and Management to give equal chance to all shareholders to provide additional financing to the Company.

4. The Company has not properly aligned interests of key management in China

As disclosed in its 2011 Form 20-F, the Company approved an option exchange program whereby it cancelled 10,384,000 partially unvested share options at an exercise price of US$7.70 per share, and reissued 416,956 share options at an exercise price of US$0.46 per share to the same employees and non-employee consultants. The reissued share options not only had a lower exercise price, but also were fully vested as of December 21, 2011. Moreover, the Company incurred an immediate expense of US$6.8 million for the existing options at the time of the exchange.

In addition, on May 1, 2012, the Company announced that the Board had issued an additional 9,979,998 stock options with an exercise price of US$0.62 per share from the share options that were cancelled in the option exchange described above to certain employees and non-employee consultants. Additionally, out of the total new share options issued, 95% of those share options went to four management employees and more than 50% of the share options went to employees who are neither based in China nor have any day to day responsibilities in the operations of the Company in China. These new options were issued after the announcement of one of the worst financial performances in the Company’s history in the 2011 Form 20-F.

The Shareholders do not believe the exchange and issue of options in view of the Company’s current financial predicament and in light of the continued underperformance of its share price demonstrates proper alignment of interests of key management with the interest of shareholders and the overall performance of the Company. In addition, the Shareholders believe that the underperformance of the share price after announcing the issuance of employee stock options despite positive news of tariff hikes at various hydropower plants owned by the Company is reflective of the market’s similar concerns with actions taken by Management in restructuring these employee options.

The Company incurred a significant expense for the share option exchange and the issuance of additional share options both of which primarily benefited only four senior management members. The Shareholders believe the Company should allocate the employee share option plan to a larger number of employees based on actual performance for the benefit of the Company instead of granting share options at depressed exercise prices immediately after announcing one of the worst financial performances in the Company’s history in the 2011 Form 20-F.

5. Failure by Company to execute on strategy

The Shareholders believe that the Board and Management have not provided any clear guidance on how they plan to address (a) the substantial decrease in shareholder value, (b) a clear, sustainable long term financing plan to resolve the Company’s liquidity needs, (c) a plan to reduce costs and general and administrative expenses in a meaningful way, and (d) the lack of viable future growth strategy.