As filed with the Securities and Exchange Commission on June 11, 2010

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-22358

Rochdale Structured Claims Fixed Income Fund, LLC

(Exact name of registrant as specified in charter)

570 Lexington Avenue

New York, New York 10022-6837

(Address of principal executive offices) (Zip code)

Kurt Hawkesworth

570 Lexington Avenue

New York, New York 10022-6837

(Name and address of agent for service)

212-702-3500

Registrant's telephone number, including area code

Date of fiscal year end: September 30

Date of reporting period: March 31, 2010

Item 1. Reports to Stockholders.

Rochdale Structured Claims Fixed Income Fund, LLC

Semi-Annual Report

March 31, 2010

Rochdale Structured Claims Fixed Income Fund, LLC

Semi-Annual Report

March 31, 2010

| TABLE OF CONTENTS | |

Page | |

| Financial Statements | |

| Statement of Assets, Liabilities and Members' Capital | 2 |

| Statement of Operations | 3 |

| Statements of Changes in Members' Capital | 4 |

| Statement of Cash Flows | 5 |

| Investment Breakdown | 6 |

| Notes to Financial Statements | 7-12 |

| Financial Highlights | 13 |

| Approval of Investment Advisory Agreement | |

| Additional Information |

2

| Rochdale Structured Claims Fixed Income Fund, LLC |

| STATEMENTS OF ASSETS, LIABILITIES AND MEMBERS' CAPITAL |

| March 31, 2010 (Unaudited) |

| ASSETS: | ||||||

| Crescit Eundo Finance I, LLC Note, 8.10%, Series 2009-A, | ||||||

| February 15, 2040, at value (cost $38,964,000) | $ | 38,964,000 | ||||

| Federated Prime Obligations Fund, 0.09% | 206,918 | |||||

| Interest receivable | 140,287 | |||||

| Prepaid expenses | 27,637 | |||||

| Total assets | 39,338,842 | |||||

| LIABILITIES: | ||||||

| Distribution payable | 183,094 | |||||

| Payable to Advisor | 27,637 | |||||

| Offering costs payable | 268,887 | |||||

| Accrued expenses and other liabilities | 45,412 | |||||

| Total liabilities | 525,030 | |||||

| TOTAL MEMBERS' CAPITAL | $ | 38,813,812 | ||||

| Capital Units outstanding | ||||||

| (Unlimited number of Units authorized, no par value) | 39,004.19 | |||||

| Net asset value, offering and redemption | ||||||

| price per Unit (net assets/Units outstanding) | $ | 995.12 | ||||

See accompanying notes to financial statements.

3

| Rochdale Structured Claims Fixed Income Fund, LLC | |||||

| STATEMENT OF OPERATIONS | |||||

| For the Period from February 24, 2010* through March 31, 2010 (Unaudited) | |||||

| INVESTMENT INCOME: | ||||||

| Interest Income | $ | 307,018 | ||||

| EXPENSES: | ||||||

| Advisory fees | 9,422 | |||||

| Service fees | 9,422 | |||||

| Fund accounting and fund administration fees | 9,722 | |||||

| Registration expense | 3,599 | |||||

| Audit fees | 5,104 | |||||

| Custody fees | 583 | |||||

| Legal fees | 2,188 | |||||

| Directors fees | 2,188 | |||||

| Insurance expense | 751 | |||||

| Miscellaneous | 2,433 | |||||

| Net Expenses | 45,412 | |||||

| NET INVESTMENT INCOME | $ | 261,606 | ||||

| * Commencement of operations. | ||||||

See accompanying notes to financial statements.

4

| Rochdale Structured Claims Fixed Income Fund, LLC | ||||||

| Statement of Changes in Members' Capital | ||||||

| Period February 24, 2010* | |||||||

| through March 31, 2010(1) | |||||||

| FROM OPERATIONS | |||||||

| Net investment income | $ | 261,606 | |||||

| Net Increase in Members' Capital Resulting From Operations | 261,606 | ||||||

| DISTRIBUTIONS TO SHAREHOLDERS | |||||||

| From net investment income | (144,094) | ||||||

| From return of capital | (39,000) | ||||||

| Total distributions to members | (183,094) | ||||||

| INCREASE FROM TRANSACTIONS IN MEMBERS' CAPITAL | |||||||

| Proceeds from sales of members' capital units | 38,904,187 | ||||||

| Offering costs | (268,887) | ||||||

| Net proceeds from Members' capital units | 38,635,300 | ||||||

| Total increase in Members' Capital | 38,713,812 | ||||||

| MEMBERS' CAPITAL | |||||||

| Beginning of period | 100,000 | ||||||

| End of period | $ | 38,813,812 | |||||

| * | Commencement of operations. | ||||||

| (1) | Unaudited. | ||||||

See accompanying notes to financial statements.

5

| Rochdale Structured Claims Fixed Income Fund, LLC | |||||

| Statement of Cash Flows | |||||

| For the Period from February 24, 2010* through March 31, 2010 (Unaudited) | |||||

| CASH FLOW FROM OPERATING ACTIVITIES | ||||||

| Net increase in members' capital resulting from operations | $ | 261,606 | ||||

| Adjustments to reconcile net increase in members' capital | ||||||

| resulting from operations to net cash used in operating activities | ||||||

| Purchase of note receivable | (39,003,000) | |||||

| Principal repayment of note receivable | 39,000 | |||||

| Change in operating assets and liabilities | ||||||

| Interest receivable | (140,287) | |||||

| Prepaid expenses | (27,637) | |||||

| Distribution payable | 183,094 | |||||

| Payable to Advisor | 65,240 | |||||

| Organization costs payable | (37,603) | |||||

| Offering costs payable | 268,887 | |||||

| Accrued expenses and other liabilities | 45,412 | |||||

| Net cash used in operating activities | (38,345,288) | |||||

| CASH FLOWS FROM FINANCING ACTIVITIES | ||||||

| Proceeds from sales of members' capital units | 38,904,187 | |||||

| Offering costs | (268,887) | |||||

| Distributions | (183,094) | |||||

| Net cash from financing activities | 38,452,206 | |||||

| Net change in cash and cash equivalents | 106,918 | |||||

| CASH AND CASH EQUIVALENTS | ||||||

| Beginning of period | 100,000 | |||||

| End of period | $ | 206,918 | ||||

| * Commencement of operations. | ||||||

See accompanying notes to financial statements.

6

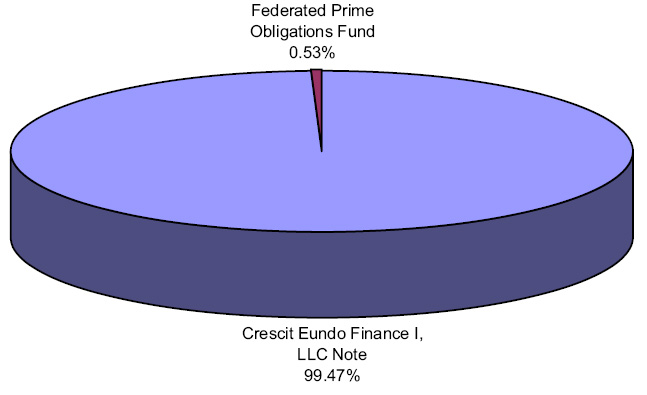

| Rochdale Structured Claims Fixed Income Fund, LLC | ||||||||

| March 31, 2010 (Unaudited) | ||||||||

| Investment Breakdown | ||||||||

| (as a % of total investments) | ||||||||

See accompanying notes to financial statements.

7

| Rochdale Structured Claims Fixed Income Fund |

| Financial Highlights |

| Period from | ||||||

February 24, 2010* | ||||||

| through | ||||||

3/31/2010(1) |

| TOTAL RETURN - NET | (0.12%) | (2) | |||||||

| RATIOS/SUPPLEMENTAL DATA | |||||||||

| Members' Capital, end of period (000's) | $ | 38,814 | |||||||

| Portfolio Turnover | 0.10% | (2) | |||||||

| Ratio of Net Investment Income to Average Net Assets | 6.92% | (3) | |||||||

| Ratio of Expenses to Average Nets Assets | 1.20% | (3) | |||||||

| * | Commencement of operations. | ||||||||

| (1) | Unaudited. | ||||||||

| (2) | Not Annualized. | ||||||||

| (3) | Annualized. | ||||||||

| Total return is calculated for all members taken as a whole and an individual member's return may vary from these Fund returns based on the timing of capital transactions. | ||||||

| The expense ratios are calculated for all members taken as a whole. The computation of such ratios based on the amount of expenses assessed to an individual member's capital may vary from these ratios based on the timing of capital transactions. | ||||||

See accompanying notes to financial statements.

8

Rochdale Structured Claims Fixed Income Fund, LLC

Notes to Financial Statements

| 1. | Organization |

Rochdale Structured Claims Fixed Income Fund, LLC (the "Fund") is a Delaware limited liability company registered under the Investment Company Act of 1940, as amended, as a closed-end, non-diversified, management investment company. The Fund’s investment objective is to seek a steady level of current income with low volatility through investment in promissory notes secured by interests in receivables from insurance companies related to structured settlements.

Rochdale Investment Management LLC (the “Advisor” or “Rochdale”) is an investment adviser registered under the Investment Advisers Act of 1940, as amended, to serve as the Advisor for the Fund.

Each Member (“Member”) must certify that they are a qualified investor or “accredited investor” under Federal securities law and subscribe for a minimum initial investment in the Fund of $25,000. Brokers selling units may establish higher minimum investment requirements than the Fund and may independently charge transaction fees and additional amounts in return for their services in addition to receiving a portion of the sales charge. The Fund is an illiquid investment and no member will have the right to require the Fund to redeem its units. The existence of the Fund is not expected to be perpetual, but will instead be self-liquidating over time or sold, with an expected life of between seven and fifteen years from inception.

| 2. | Significant Accounting Policies |

The following accounting policies are in accordance with accounting principles generally accepted in the United States and are consistently followed by the Fund.

Security Valuation

The Fund intends to invest substantially all of its investable assets in the 8.10% Fixed Rate Note, Series 2009-A, which may be represented by one or more certificates (“Note”) issued by a special purpose entity, Crescit Eundo Finance I, LLC.

The value of the collateral underlying the Note depends on a number of factors unique to the structured settlement industry. These include, but are not limited to, the nature and quality of the Underlying Settlements; the ratings and creditworthiness of the Annuity Providers who are obligated under the terms of the Underlying Settlements, the terms which are, in turn, subject to court orders (or acknowledgment letters in the case of Owned Annuities) to remit payments to entities, including Settlement Funding, LLC, that are wholly-owned by Peach Holdings, LLC; the physical security of the documents that evidence the Underlying Settlements; and the extent to which the Fund may be assured that the Fund’s security

9

Rochdale Structured Claims Fixed Income Fund, LLC

Notes to Financial Statements

| 2. | Significant Accounting Policies (continued) |

Security Valuation (continued)

interest in the collateral is properly perfected in accordance with the protections afforded secured creditors under Article 9 of the Uniform Commercial Code.

The Fund’s Board has approved fair value procedures pursuant to which the Fund will value its investment in the Note. The fair value procedures recognize that the Note is illiquid and that no market currently exists for it, save for the potential that the Advisor may be able to effect a negotiated sale of the Note held by the Fund.

The Fund adopted fair valuation accounting standards which establish an authoritative definition of fair value and set out a hierarchy for measuring fair value. These standards

require additional disclosures about the various inputs and valuation techniques used to develop the measurements of fair value and a discussion in changes in valuation techniques and related inputs during the period. These standards define fair value as the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. Management has determined that these standards had no material impact on the Fund’s financial statements. The fair value hierarchy is organized into three levels based upon the assumptions (referred to as “inputs”) used in pricing the asset or liability. These standards state that “observable inputs” reflect the assumptions market participants would use in pricing the asset or liability based on market data obtained from independent sources and “unobservable inputs” reflect an entity’s own assumptions about the assumptions market participants would use in pricing the asset or liability. These inputs are summarized in the three broad levels listed below:

Level 1 - Unadjusted quoted prices in active markets for identical assets or liabilities that the Fund has the ability to access.

Level 2 - Observable inputs other than quoted prices included in level 1 that are observable for the asset or liability, either directly or indirectly. These inputs may include quoted prices for the identical instrument on an inactive market, prices for similar instruments, interest rates, prepayment speeds, credit risk, yield curves, default rates and similar data.

Level 3 - Unobservable inputs for the asset or liability, to the extent relevant observable inputs are not available, representing the Fund’s own assumptions about the assumptions a market participant would use in valuing the asset or liability, and would be based on the best information available.

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in these securities.

As of March 31, 2010 the long-term investment held was a Level 3 input as per the fair valuation accounting standards. The short-term investment held was a level 1 input as of March 31, 2010. The following is a reconciliation of the beginning and ending balances for

10

Rochdale Structured Claims Fixed Income Fund, LLC

Notes to Financial Statements

| 2. | Significant Accounting Policies (continued) |

Security Valuation (continued)

assets and liabilities measured at fair value using significant unobservable inputs (Level 3) during the period ended March 31, 2010:

| Investment in Security | |||

| Balance, beginning of year | $ | 0 | |

| Realized loss | 0 | ||

| Change in unrealized appreciation/depreciation | 0 | ||

| Net Purchases | |||

| 38,964,000 | |||

| Balance, end of year | $ | 38,964,000 | |

In March 2008, accounting standards regarding disclosures about derivative instruments and hedging activity standards were issued and effective for fiscal years beginning after November 15, 2008. These standards are intended to improve financial reporting for derivative instruments by requiring enhanced disclosure that enables investors to understand how and why an entity uses derivatives, how derivatives are accounted for, and how derivative instruments affect an entity’s results of operations and financial position. These standards do not have any impact on the Fund’s financial statement disclosures because the Fund has not maintained any positions in derivative instruments or engaged in hedging activities.

In May 2009, the FASB issued subsequent event standards. The Fund has adopted these standards which requires an entity to recognize in the financial statements the effects of all subsequent events that provide additional evidence about conditions that existed at the date of the balance sheet. For non-recognized subsequent events that must be disclosed to keep the financial statements from being misleading, an entity will be required to disclose the nature of the event as well as an estimate of its financial effect, or a statement that such an estimate cannot be made.

In June 2009, the accounting standards codification and the hierarchy of generally accepted accounting principles standards were issued and are effective for interim and annual reporting periods ending after September 15, 2009. These standards are intended to establish the FASB Codification as the source of authoritative accounting principles recognized by the FASB to be applied to nongovernmental entities in preparation of financial statements in conformity with GAAP.

11

Rochdale Structured Claims Fixed Income Fund, LLC

Notes to Financial Statements

| 2. | Significant Accounting Policies (continued) |

Security Valuation (continued)

In January 2010, the Financial Accounting Standards Board (“FASB”) issued Accounting Standards Update “Improving Disclosures about Fair Value Measurements” that requires additional disclosures regarding fair value measurements. Certain required disclosures are effective for interim and annual reporting periods beginning after December 15, 2009, and other required disclosures are effective for fiscal years beginning after December 15, 2010, and for interim periods within those fiscal years. The Fund is evaluating the implications of the amendment to the standard and the impact to the financial statements.

Organization Expenses

Expenses incurred by the Fund in connection with the organization were expensed as incurred. The Advisor has agreed to reimburse the Fund for these expenses, subject to potential recovery (see Note 4).

Fund Expenses

The Fund will bear all expenses incurred in its business. The expenses of the Fund include, but are not limited to, the following: management fees, legal fees; accounting and auditing fees; custody fees; costs of computing the Fund’s net asset value; expenses of preparing, printing, and distributing prospectuses, Statement of Additional Information, and any other material (and any supplements or amendments thereto), reports, notices, other communications to Members, and proxy material; expenses of preparing, printing, and filing

reports and other documents with government agencies; expenses of Members’ and Board meetings; Member record keeping and Member account services, fees, and disbursements; insurance premiums; fees for investor services and other types of expenses as may be approved from time to time by the Board.

Federal Income Taxes

The Fund intends to be treated as a partnership for Federal income tax purposes. Each Member is responsible for the tax liability or benefit relating to such Member’s distributive share of taxable income or loss. Therefore, no federal income tax provision is reflected in the accompanying financial statements.

Deferred Offering Costs

Offering Costs were charged to Members’ capital in proportion to the number of units sold during the offering period.

Use of Estimates

The preparation of financial statements in conformity with accounting principles generally accepted in the United States requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of expenses during the reporting period. Actual results could differ from those estimates.

12

Rochdale Structured Claims Fixed Income Fund, LLC

Notes to Financial Statements

| 3. | Investment Management |

The Fund has an investment management agreement (“Investment Management Agreement”) with Rochdale. The Advisor is responsible for providing investment advisory management, certain administrative services and conducts relations with the service providers to the Fund.

The Fund will pay the Advisor an investment management fee at an annual rate equal to 0.25% of the Fund’s month-end net assets. The investment management fee will accrue and be payable monthly.

| 4. | Expense Reimbursement |

The Advisor has contractually agreed to waive and/or reimburse the Fund’s expenses to the extent needed to limit the Fund’s annual operating expenses to 1.40% of net assets. To the extent that the Advisor reimburses or absorbs fees and expenses, it may seek payment of such amounts for three years after the year in which the expenses were reimbursed or absorbed. The Fund will make no such payment, however, if its total annual operating expenses exceed the expense limit in effect at the time the expenses were reimbursed or at the time these payments are proposed.

On May 12, 2010, the expense agreement described above was terminated and a new Reimbursement Agreement was executed that allows the Advisor to request recoupment of Covered Fund Costs, as defined in the agreement (including Offering Costs) only if the distribution to Members with respect to the year for which the recoupment is sought would (after taking into account the amount of recoupment) equal or exceed the Minimum Annual Distribution, 7.00% per annum per Unit. The Fund and the Advisor agree that the Advisor may request recoupment of expenses absorbed by the Advisor in the prior three years in years in which the Minimum Annual Distribution is not achieved so long as the Fund’s actual annual expenses plus the amount of any requested recoupment with respect to such year, does not exceed 1.40% of net assets.

At March 31, 2010, the cumulative amount available for reimbursement that has been paid and/or waived by the Advisor on behalf of the Fund was $306,490. This amount may be reimbursed by September 30, 2013.

| 5. | Shareholder Servicing Arrangement |

The Fund will pay a fee to the Advisor (or its affiliates) at an annual rate of 0.25% of the Fund’s month-end net assets, including assets attributable to the Advisor (or its affiliates).

Services provided include, but are not limited to, handling Member inquiries regarding the Fund (e.g., responding to questions concerning investments in the Fund, and reports and tax information provided by the Fund); assisting in the enhancement of relations and

13

Rochdale Structured Claims Fixed Income Fund, LLC

Notes to Financial Statements

| 5. | Shareholder Servicing Arrangement (continued) |

communications between Members and the Fund; assisting in the establishment and maintenance of Member accounts with the Fund; and assisting in the maintenance of Fund records containing Member information.

| 6. | Distribution to Members |

The Fund intends to make distributions to Members on a monthly basis in aggregate amounts representing substantially all of its net investment income, if any, during the year. The Fund also intends to distribute monthly proceeds from any principal paydowns on the Note, which will be designated as a return of capital to Members. Although the Fund does not expect to realize long-term capital gains except under extraordinary circumstances (such as the sale of all or a substantial portion of the Note), if it does earn such gains, they will be paid out once each year (unless otherwise permitted by the 1940 Act). The Fund will make distributions only if authorized by the Board and declared by the Fund out of assets legally available for these distributions.

| 7. | Investment Transactions |

For the period ended March 31, 2010, the aggregate purchases (excluding short-term securities) were $39,003,000 and sales of investments were $39,000.

14

Rochdale Structured Claims Fixed Income Fund, LLC

Approval of Investment Advisory Agreement

At the organizational meeting held on November 10, 2009, the Board of Managers (the “Board”) of the Rochdale Structured Claims Fixed Income Fund, LLC (the “Fund”), including all of the Managers (“Independent Managers”) who are not “interested persons” (as such term is defined in Section 2(a)(19) of the 1940 Act), met in person and voted to approve the proposed investment advisory agreement (“Agreement”) between the Fund and Rochdale Investment Management, LLC (the “Advisor” or “Rochdale”). In approving the Agreement, the Board, had before it information with respect to the unique nature of the Fund, the role of the Advisor in the design and development of the Fund’s investment program and the extent of Rochdale’s commitment to wai ve its fees and/or bear expenses associated with the operation of the Fund.

In connection with such approval, the Board, with the assistance of independent counsel, considered their legal responsibilities and reviewed the management and oversight services to be provided by Rochdale. In particular, the Board considered the investment concept represented by the Fund and the ability of the Advisor in developing the Fund’s strategy based upon that concept. Based on the information presented, the Board concluded that the expected nature and quality of the advisory services to be provided by the Advisor supported approval of the Agreement.

The Board also reviewed the proposed advisory fees and the projected overall expenses of the Fund. Although the Board was presented with certain information regarding expected Fund expenses, information relating to other closed-end funds was not relied upon in light of the unique nature of the Fund. Additionally, because the Fund had not commenced operations, and although informed with respect to Rochdale’s fees and commitment to waive its fees and/or bear expenses associated with the operation of the Fund, the Board did not rely upon the general information provided by Rochdale with respect to Rochdale’s profitability as related to the Fund. Similarly, because the Fund is a closed-end vehicle and had not commenced operations, the Board did not consider the potential for economies of scale.& #160; In concluding that the proposed fees were reasonable and as indicated above, the Board had before it information with respect to the unique nature of the Fund and the role of the Advisor in the design and development of the Fund’s investment program.

After reviewing this information and such other matters as the Managers considered necessary to the exercise of their reasonable business judgment, and without identifying any single factor as being determinative, the Board, including the Independent Managers, unanimously approved the Agreement.

15

Rochdale Structured Claims Fixed Income Fund, LLC

Additional Information

Proxy Voting Policies and Procedures

You may obtain a description of the Fund’s proxy voting policies and procedures and information regarding how the Fund voted proxies relating to portfolio securities without charge, upon request, by contacting the Fund directly at 1-800-245-9888; or on the EDGAR Database on the SEC’s website at www.sec.gov.

Portfolio Holdings Disclosure

The Fund will file its complete schedule of portfolio holdings with the SEC at the end of the first and third fiscal quarters on Form N-Q within sixty days of the end of the quarter to which it relates. The Fund’s Forms N-Q will be available on the SEC’s website at www.sec.gov, and may also be reviewed and copied at the SEC’s Public Reference Room in Washington, D.C. Information on the operation of the Public Reference Room may be obtained by calling 1-202-942-8090.

16

Item 2. Code of Ethics.

Not applicable for semi-annual reports.

Item 3. Audit Committee Financial Expert.

Not applicable for semi-annual reports.

Item 4. Principal Accountant Fees and Services.

Not applicable for semi-annual reports.

Item 5. Audit Committee of Listed Registrants.

Not applicable to registrants who are not listed issuers (as defined in Rule 10A-3 under the Securities Exchange Act of 1934).

Item 6. Investments.

Schedule of Investments is included as part of the report to shareholders filed under Item 1 of this Form.

Item 7. Disclosure of Proxy Voting Policies and Procedures for Closed-End Management Investment Companies.

Not applicable.

Item 8. Portfolio Managers of Closed-End Management Investment Companies.

The following table provides information as of March 31, 2010:

PORTFOLIO MANAGER DISCLOSURE

List of Portfolio Managers and Biographical Information

Name | Title | Length of Service | Business Experience During Past 5 Years | Role of Portfolio Manager |

Carl Acebes | Chairman and Board Member | Since Inception | Founder and Chief Investment Officer of Rochdale Investment Management LLC. Founder of Rochdale Securities Corporation and the Rochdale Corporation. | Heads the team of investment professionals and is intricately involved in the firms day to day investment management and research work. |

Garrett R. D’Alessandro | President and Secretary | Since Inception | President, CEO and Director of Research of Rochdale Investment Management LLC. | Directs portfolio management strategies and investment research efforts and determines companies that satisfy the firm’s criteria for inclusion in client portfolios. |

Name | Number of Registered Investment Companies Managed and Total Assets for Such Accounts (Including The Trust) | Beneficial Ownership of Equity Securities In Trust | Number of Other Pooled Investment Vehicles Managed and Total Assets for Such Accounts | Number of Other Accounts Managed and Total Assets For Such Accounts |

Carl Acebes | 7, $437 million | $0 | 10, $532 million | 99, $43 million |

| Garrett R. D’Alessandro | 7, $437 million | $0 | 10, $532 million | 184, $287 million |

Mr. Acebes receives an annual salary established by the Manager. Salary levels are based on the overall performance of the Manager and not on the investment performance of any particular Portfolio or account. Like the Manager’s other employees, Mr. Acebes is eligible for a bonus annually. Such bonuses are also based on the performance of the Manager as a whole and not on the investment performance of any particular Portfolio or account. Additionally, Mr. Acebes owns a substantial portion of the Manager and, accordingly, benefits from any profits earned by the Manager.

Mr. D’Alessandro receives an annual salary established by the Manager. Salary levels are based on the overall performance of the Manager and not on the investment performance of any particular Portfolio or account. Like the Manager’s other employees, Mr. D’Alessandro is eligible for a bonus annually. Such bonuses are also based on the performance of the Manager as a whole and not on the investment performance of any particular Portfolio or account. Additionally, Mr. D’Alessandro owns a substantial portion of the Manager and, accordingly, benefits from any profits earned by the Manager.

Item 9. Purchases of Equity Securities by Closed-End Management Investment Company and Affiliated Purchasers.

Not applicable.

Item 10. Submission of Matters to a Vote of Security Holders.

The registrant’s nominating committee charter does not contain any procedures by which shareholders may recommend nominees to the registrant’s board of managers.

Item 11. Controls and Procedures.

| (a) | The registrant’s President/Chief Executive Officer and Treasurer/Chief Financial Officer have reviewed the registrant's disclosure controls and procedures (as defined in Rule 30a-3(c) under the Investment Company Act of 1940 (the “Act”)) as of a date within 90 days of the filing of this report, as required by Rule 30a-3(b) under the Act and Rules 13a-15(b) or 15d-15(b) under the Securities Exchange Act of 1934. Based on their review, such officers have concluded that the disclosure controls and procedures are effective in ensuring that information required to be disclosed in this report is appropriately recorded, processed, summarized and reported and made known to them by others within the registrant and by the registrant’s service provider. |

| (b) | There were no changes in the registrant's internal control over financial reporting (as defined in Rule 30a-3(d) under the Act) that occurred during the second fiscal quarter of the period covered by this report that has materially affected, or is reasonably likely to materially affect, the registrant's internal control over financial reporting. |

Item 12. Exhibits.

| (a) | (1) Any code of ethics or amendment thereto, that is the subject of the disclosure required by Item 2, to the extent that the registrant intends to satisfy Item 2 requirements through filing an exhibit. Not Applicable. |

(2) A separate certification for each principal executive and principal financial officer pursuant to Section 302 of the Sarbanes-Oxley Act of 2002. Filed herewith.

(3) Any written solicitation to purchase securities under Rule 23c-1 under the Act sent or given during the period covered by the report by or on behalf of the registrant to 10 or more persons. Not applicable during this period.

| (b) | Certifications pursuant to Section 906 of the Sarbanes-Oxley Act of 2002. Furnished herewith. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

(Registrant) Rochdale Structured Claims Fixed Income Fund, LLC

By (Signature and Title) /s/ Garrett R. D’Alessandro

Garrett R. D’Alessandro, President

Date 6/9/2010

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

By (Signature and Title) /s/ Garrett R. D’Alessandro

Garrett R. D’Alessandro, President

Date 6/9/2010

By (Signature and Title) /s/ Edmund Towers

Edmund Towers, Treasurer

Date 6/9/2010