As filed with the Securities and Exchange Commission on January 6, 2014

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-2358

City National Rochdale Structured Claims Fixed Income Fund

(Exact name of registrant as specified in charter)

570 Lexington Avenue

New York, NY 10022-6837

(Address of principal executive offices) (Zip code)

Kurt Hawkesworth

570 Lexington Avenue

New York, NY 10022-6837

(Name and address of agent for service)

212-702-3500

Registrant's telephone number, including area code

Date of fiscal year end: September 30

Date of reporting period: September 30, 2013

Item 1. Reports to Stockholders.

City National Rochdale Structured Claims Fixed Income Fund (RSCFIF)

Annual Report

September 30, 2013

Dear Fellow Shareholders,

The City National Rochdale Structured Claims Fixed Income Fund ("RSCFIF" or the "Fund") offers an opportunity for portfolio diversification through an investment in a pool of structured legal settlements with an investment objective that seeks safety of principal and above average current income. The Fund is collateralized by a note secured by cash flows from a diversified pool of annuities, purchased to cover structured legal settlements that have been acquired through a formal legal process from the claimants. Investment returns are generated by the interest income of cash flow payments received from each underlying annuity.

While we see an improving US economy, with increasing GDP growth, we also continue to have uncertainty about the future path of U.S. fiscal policy. We believe European growth and sovereign debt is still in the early stages of recovery. For these reasons, as well as concerns similar to the early part of 2013, associated with the tapering of the Government bond purchasing program by the Federal Reserve, there is potential volatility in the fixed income market. Though the fundamentals across numerous fixed income sectors remain relatively sound, the challenge for investors against this uncertain backdrop is how to earn more from their fixed income portfolios without taking on too much risk. In our minds, U.S. Treasuries, although nominally safe, are paying too low of a yield due to the policy actions taken by the Federal Reserve. The alternative continues to require taking more credit risk at a time when economic growth, while improving, remains uncertain.

In light of this, we believe the expected stability and known values of RSCFIF’s cash flows make the Fund an ideal fixed income investment for such uncertain times. Compared to equivalent fixed income securities, the yield from RSCFIF provides above average levels of current income with low volatility and strong credit quality. In addition, although we do not see inflation as being a significant risk over the next 12 months, should it occur, a solid income producing investment like RSCFIF is likely to generate a relatively good yield, even after inflation.

Overall, the advantage of RSCFIF lies in preservation of principal, reliability of cash flows, and the high yield it brings to a portfolio. The Fund is backed by well-diversified, investment grade insurance companies, which are, in our view, highly secured. Furthermore, we believe during volatile equity market periods, such as we are currently experiencing, the addition of non-equity, non-traditional investments has the added benefit of providing significant diversification value to a portfolio.

570 Lexington Avenue, New York, NY 10022-6837 | Tel. 800-245-9888/212-702-3500 | Fax 212-702-3535 | www.rochdale.com

San Francisco | Orlando | Dallas | Richmond

Sincerely,

Garrett R. D’Alessandro, CFA, CAIA, AIF®

Chief Executive Officer & President

Rochdale Investment Management LLC

Important Disclosures

Performance quoted represents past performance and is unaudited. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate, so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted. The most recent month-end performance can be obtained by calling 800-245-9800.

An investor should consider carefully the Fund’s investment objectives, risks, charges, and expenses. The Private Offering Memorandum contains this and other important information about the investment company, and it may be obtained by calling 800-245-9800. Please read it carefully before investing. RIM Securities LLC, the affiliated broker dealer for Rochdale Investment Management LLC and the Distributor of the Fund, 570 Lexington Avenue, New York, NY 10022.

The views expressed herein represent the opinions of Rochdale Investment Management and are subject to change without notice at anytime. This information should not in any way be construed to be investment, financial, tax, or legal advice or other professional advice or service, and should not be relied on in making any investment or other decisions.

As with all investment strategies, there are risks associated with its implementation. Applicable risks include, but are not limited to, market risk, inflation risk, credit risk, and government policy risk. There is no guarantee that investment objectives will be met and the entire investment may be lost.

Rochdale Structured Claims Fixed Income Fund is considered a long term investment with limited liquidity and should not be invested in by investors whose objectives conflict with these characteristics. The limited liquidity of the Fund, due to the absence of a public market and a current investor’s limited transfer options to other investors, results in the lack of available market prices during the life of the Fund. Valuation will be provided as detailed in the Private Offering Memorandum and may be inaccurate and may also affect the value and expenses of the Fund. The Fund invests in a single issuer note, making it a non-diversified fund and more susceptible than a diversified fund to any single economic, financial, insurance industry, political or regulatory occurrence that may affect annuities, insurance companies or the Special Purpose Entity (“SPE”) structure. Performance and likelihood of future payments depend on factors such as the business standing of the SPE and its affiliates, the insurance companies, ratings of the insurer, federal and state regulation as well as human error during the transfer process.

570 Lexington Avenue, New York, NY 10022-6837 | Tel. 800-245-9888/212-702-3500 | Fax 212-702-3535 | www.rochdale.com

San Francisco | Orlando | Dallas | Richmond

City National Rochdale Structured Claims Fixed Income Fund, LLC

Annual Report

September 30, 2013

City National Rochdale Structured Claims Fixed Income Fund, LLC

Annual Report

September 30, 2013

TABLE OF CONTENTS

Page

| Report of Independent Registered Public Accounting Firm | 1 | |

| Financial Statements | ||

| Statement of Assets | 2 | |

| Statement of Operations | 3 | |

| Statements of Changes in Members' Capital | 4 | |

| Statement of Cash Flows | 5 | |

| Notes to Financial Statements | 6 - 14 | |

| Financial Highlights | 15 | |

| Investment Breakdown | 16 | |

Manager and Officer Information

Additional Information

| KPMG LLP Suite 2000 355 South Grand Avenue Los Angeles, CA 90071-1568 |

Report of Independent Registered Public Accounting Firm

The Board of Managers and Shareholders

City National Rochdale Structured Claims Fixed Income Fund, LLC:

We have audited the accompanying statement of net assets of City National Rochdale Structured Claims Fixed Income Fund, LLC (the Fund) (formerly, the Rochdale Structured Claims Fixed Income Fund, LLC) as of September 30, 2013, and the related statements of operations, changes in members capital, and cash flows and financial highlights for the year then ended. These financial statements and financial highlights are the responsibility of the Fund s management. Our responsibility is to express an opinion on these financial statements based on our audit. The accompanying statement of members capital for the year ended September 30, 2012 and financial highlights for the years ended September 30, 2012 and 2011 and the period from February 24, 2010 (commencement of operations) through September 30, 2010 were audited by other auditors whose report thereon dated November 29, 2012, expressed an unqualified opinion on that statement and financial highlights.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. Our procedures included confirmation of securities owned as of September 30, 2013 by correspondence with the custodian. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audit provide a reasonable basis for our opinion.

In our opinion, the financial statements referred to above present fairly, in all material respects, the financial position of City National Rochdale Structured Claims Fixed Income Fund, LLC as of September 30, 2013, and the results of its operations, changes in members capital, cash flows, and financial highlights for the year the ended, in conformity with U.S. generally accepted accounting principles.

January 2, 2014

KPMG LLP is a Delaware limited liability partnership, the U.S. member firm of KPMG International Cooperative (“KPMG International”), a Swiss entity. |

| STATEMENT OF NET ASSETS | |||||

| September 30, 2013 | |||||

| ASSETS: | |||||

| Investments in Securities: 100.6% | |||||

| Promissory Note: 99.6% | |||||

| Crescit Eundo Finance I, LLC Note, 8.10%, Series 2009-A, | $ | 35,273,690 | |||

February 15, 2040;(1)(2) at fair value (cost $33,682,869) | |||||

| Short-Term Investments: 1.0% | |||||

First American Government Obligations Fund (cost $371,376) | 371,376 | ||||

Total Investments in Securities (cost $34,054,245)(3) | 35,645,066 | ||||

| Interest receivable | 121,260 | ||||

| Prepaid expenses | 748 | ||||

| Total assets | 35,767,074 | ||||

| LIABILITIES: | |||||

| Distribution payable | 278,185 | ||||

| Payable to Advisor | 14,133 | ||||

| Accrued expenses and other liabilities | 55,714 | ||||

| Total liabilities | 348,032 | ||||

| NET ASSETS | $ | 35,419,042 | |||

| ANALYSIS OF NET ASSETS | |||||

| Paid in Capital | 33,828,221 | ||||

| Unrealized Appreciation | 1,590,821 | ||||

| TOTAL MEMBERS' PAID IN CAPITAL | $ | 35,419,042 | |||

| Capital Units outstanding | |||||

| (Unlimited number of Units authorized, no par value) | 39,004 | ||||

| Net asset value, offering and redemption | |||||

| price per Unit (net assets/Units outstanding) | $ | 908.08 | |||

| (1) | Illiquid restricted security. | ||||

| (2) | Fair valued by Valuation Committee as delegated by the Fund's Board of Managers. | ||||

| (3) | Tax cost of investments is the same. | ||||

| The accompanying notes are an integral part of these financial statements. | |||||

2

| City National Rochdale Structured Claims Fixed Income Fund, LLC | |||||

| STATEMENT OF OPERATIONS | |||||

| Year Ended September 30, 2013 | |||||

| INVESTMENT INCOME: | |||||

| Interest Income | $ | 2,782,178 | |||

| EXPENSES: | |||||

| Advisory fees | 85,811 | ||||

| Service fees | 85,811 | ||||

| Fund accounting and fund administration fees | 81,843 | ||||

| Legal fees | 38,586 | ||||

| Audit fees | 20,652 | ||||

| Board of Managers fees | 5,381 | ||||

| Other | 3,032 | ||||

| Custody fees | 2,961 | ||||

| Insurance expense | 1,616 | ||||

| Total Expenses | 325,693 | ||||

| Net Investment Income | 2,456,485 | ||||

| REALIZED AND UNREALIZED GAIN (LOSS) ON INVESTMENTS | |||||

| Net change to fair value of promissory note | (284,393) | ||||

| Net Increase in Members' Capital Resulting from Operations | $ | 2,172,092 | |||

| The accompanying notes are an integral part of these financial statements. | |||||

3

| City National Rochdale Structured Claims Fixed Income Fund, LLC | |||||||||

| STATEMENT OF CHANGES IN MEMBERS' CAPITAL | |||||||||

| Year Ended | Year Ended | ||||||||

| September 30, 2013 | September 30, 2012 (1) | ||||||||

| FROM OPERATIONS | |||||||||

| Net investment income | $ | 2,456,485 | $ | 2,520,732 | |||||

| Net change in fair value of promissory note | (284,393 | ) | 430,965 | ||||||

| Net Increase in Members' Capital Resulting From Operations | 2,172,092 | 2,951,697 | |||||||

| DISTRIBUTIONS TO SHAREHOLDERS | |||||||||

| From net investment income | (2,334,386 | ) | (2,393,765 | ) | |||||

| From return of capital | (1,301,917 | ) | (1,472,884 | ) | |||||

| Total Distributions to Members | (3,636,303 | ) | (3,866,649 | ) | |||||

| Net Decrease in Member's Capital | (1,464,211 | ) | (914,952 | ) | |||||

| MEMBERS' CAPITAL | |||||||||

| Beginning of year | 36,883,253 | 37,798,205 | |||||||

| End of year | $ | 35,419,042 | $ | 36,883,253 | |||||

| (1) Prior year has been revised. See Note 8. | |||||||||

The accompanying notes are an integral part of these financial statements.

4

| City National Rochdale Structured Claims Fixed Income Fund, LLC | ||||

| STATEMENT OF CASH FLOWS | ||||

| Year Ended September 30, 2013 | ||||

| CASH FLOW FROM OPERATING ACTIVITIES | ||||

| Net increase in members' capital resulting from operations | $ | 2,172,092 | ||

| Adjustments to reconcile net increase in members' capital | ||||

| resulting from operations to net cash from operating activities | ||||

| Net change in fair value of promissory note | 284,393 | |||

| Principal repayment of note receivable | 1,301,917 | |||

| Purchases of money market investments | (4,763,487 | ) | ||

| Redemptions of money market investments | 4,794,927 | |||

| Change in operating assets and liabilities | ||||

| Interest receivable | 4,689 | |||

| Prepaid expenses | 3,484 | |||

| Payable to Advisor | (148,552 | ) | ||

| Accrued expenses and other liabilities | (4,682 | ) | ||

| Net cash from operating activities | 3,644,781 | |||

| CASH FLOWS FROM FINANCING ACTIVITIES | ||||

| Distributions | (3,644,781 | ) | ||

| Net cash used in financing activities | (3,644,781 | ) | ||

| Net change in cash and cash equivalents | - | |||

| CASH AND CASH EQUIVALENTS | ||||

| Beginning of year | - | |||

| End of year | $ | - | ||

| The accompanying notes are an integral part of these financial statements. | ||||

5

City National Rochdale Structured Claims Fixed Income Fund, LLC

Notes to Financial Statements

September 30, 2013

| 1. | Organization |

City National Rochdale Structured Claims Fixed Income Fund, LLC (the "Fund"), formerly the Rochdale Structured Claims Fixed Income Fund, is a Delaware limited liability company registered under the Investment Company Act of 1940, as amended, as a closed-end, non-diversified, management investment company. The Fund’s investment objective is to seek a steady level of current income with low volatility through investment in promissory notes secured by interests in receivables from insurance companies related to structured settlements.

The Fund’s Board of Managers (the “Board”) is responsible for the Fund’s management, including supervision of the duties performed by City Rochdale LLC, formerly Rochdale Investment Management LLC, which serves as investment adviser (the “Advisor” of the Fund.

Each Shareholder (“Member”) must certify that they are a qualified investor or “accredited investor” under Federal securities law and subscribe for a minimum initial investment in the Fund of $25,000. Brokers selling units may establish higher minimum investment requirements than the Fund and may independently charge transaction fees and additional amounts in return for their services in addition to receiving a portion of the sales charge. The Fund is an illiquid investment and no Member will have the right to require the Fund to redeem its units. The existence of the Fund is not expected to be perpetual, but will instead be self-liquidating over time or sold, with an expected life of between seven and fifteen years from inception.

| 2. | Significant Accounting Policies |

The following accounting policies are in accordance with accounting principles generally accepted in the United States and are consistently followed by the Fund.

Security Valuation

All investments are carried at fair value. The Fund invested substantially all of its investable assets in the 8.10% Fixed Rate Note, Series 2009-A, which is represented by one certificate (“Note”) issued by a special purpose entity, Crescit Eundo Finance I, LLC.

The value of the Note is linked to the value of the collateral underlying the Note, which depends on a number of factors unique to the structured settlement industry. These include, but are not limited to, the nature, quality and timing of the underlying settlements; the ratings and creditworthiness of the annuity providers who are obligated under the terms of the underlying settlements, the terms which are, in turn, subject to court orders (or acknowledgment letters in the case of owned annuities) to remit payments to entities, including Settlement Funding, LLC, that are wholly-owned by Peach Holdings, LLC; the physical security of the documents that evidence the underlying settlements; and the extent to which the Fund may be assured that the Fund’s security interest in the collateral is properly perfected in accordance with the protections afforded secured creditors under Article 9 of the Uniform Commercial Code.

6

City National Rochdale Structured Claims Fixed Income Fund, LLC

Notes to Financial Statements

September 30, 2013

The Fund’s Board has approved fair value procedures pursuant to which the Fund will value its investment in the Note. The fair value procedures recognize that the Note is illiquid and that no market currently exists for it, save for the potential that the Advisor may be able to effect a negotiated sale of the Note held by the Fund. The valuation shall be updated no less frequently than quarterly. These updates shall be based on various factors, as deemed appropriate by the Pricing Committee, including without limitation, the following:

| (i) | Comparisons with other fixed income opportunities available in the credit markets and spreads, on a risk adjusted basis such as, without limitation: |

| (a) | Swap rates: the variable rate available in a swap contract for the fixed rate payable under the Note; |

| (b) | Interest Rates: the Fed Funds rate (i.e. that amount the Federal Reserve charges banks for overnight borrowing) and other prevailing interest rates in the U.S.; |

| (c) | Credit Ratings: the weighted average rating of the annuity providers issuing the annuity contracts which constitute the receivables; and |

| (d) | Subjective Factors: relative liquidity, creditworthiness and underlying collateral. |

| (ii) | Information obtained by the Advisor from the issuer of the Note relating to the financial position of such issuer and relevant affiliates; |

| (iii) | Cash flows payable by Annuity Providers under the transaction related agreements; |

| (iv) | Credit Ratings assigned to the various Annuity Providers; |

| (v) | The occurrence of any significant market or company specific event that may affect the issuer, its affiliates, their capital structure (as contemplated under the terms of the transaction related documents) or the structured settlement industry; and |

7

| (vi) | Reported changes, if any, in the quality of the underlying collateral as a result of changes in such ratings, the creditworthiness of the issuer, its affiliates or the Annuity Providers or specific factors that may affect the value of collateral. |

In 2013 the discounted cash flow model used to value the note was modified to provide for more direct linking of assumptions related to market returns and liquidity assumptions.

Money Market Fund

The fair value of the money market fund is the net asset value of the mutual fund investment which is calculated on a daily basis. The money market fund is registered and regulated by the SEC. The money market fund invests in government obligations, exclusively in short term U.S. government securities. The money market fund provides for daily liquidity.

Fair Value Measurements

The Fund follows fair valuation accounting standards which establish an authoritative definition of fair value and set out a hierarchy for measuring fair value. These standards require additional disclosures about the various inputs and valuation techniques used to develop the measurements of fair value and a discussion in changes in valuation techniques and related inputs during the period. These standards define fair value as the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. The fair value hierarchy is organized into three levels based upon the assumptions (referred to as “inputs”) used in pricing the asset or liability. These standards state that “observable inputs” reflect the assumptions market participants would use in pricing the asset or liability based on market data obtained from independent sources and “unobservable inputs” reflect an entity’s own assumptions about the assumptions market participants would use in pricing the asset or liability. These inputs are summarized in the three broad levels listed below:

Level 1 - Unadjusted quoted prices in active markets for identical assets or liabilities that the Fund has the ability to access.

Level 2 - Observable inputs other than quoted prices included in Level 1 that are observable for the asset or liability, either directly or indirectly. These inputs may include quoted prices for the identical instrument on an inactive market, prices for similar instruments, interest rates, prepayment speeds, credit risk, yield curves, default rates and similar data.

Level 3 - Unobservable inputs for the asset or liability, to the extent relevant observable inputs are not available, representing the Fund’s own assumptions about the assumptions a market participant would use in valuing the asset or liability, and would be based on the best information available.

8

City National Rochdale Structured Claims Fixed Income Fund, LLC

Notes to Financial Statements

September 30, 2013

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in these securities.

The following is a summary of the inputs used to value the Fund’s investments at September 30, 2013:

| Description | Quoted Prices in Active Markets for Identical Assets (Level 1) | Significant Other Observable Inputs (Level 2) | Significant Unobservable Inputs (Level 3) | Total | ||||||||||||

| Note | $ | - | $ | - | $ | 35,273,690 | $ | 35,273,690 | ||||||||

| Money Market Fund | 371,376 | - | - | 371,376 | ||||||||||||

| $ | 371,376 | $ | - | $ | 35,273,690 | $ | 35,645,066 | |||||||||

The Fund’s policy is to recognize transfers in and transfers out of each Level as of the beginning of the year. There were no transfers in or out of Level 1, Level 2 or Level 3 of the fair value hierarchy during the reporting period, as compared to their classification from the most recent annual report.

The following is a reconciliation of the beginning and ending balances for assets and liabilities measured at fair value using significant unobservable inputs (Level 3) during the year ended September 30, 2013:

Investment in Note | ||||

| Balance, September 30, 2012 | $ | 36,860,000 | ||

| �� Realized gain/(loss) | – | |||

| Change in unrealized fair value | (284,393 | ) | ||

| Purchases | – | |||

| Principal payments | (1,301,917 | ) | ||

| Balance, September 30, 2013 | $ | 35,273,690 | ||

Net unrealized gains related to Level 3 investments amounted to $2,681,702 as of September 30, 2013.

9

City National Rochdale Structured Claims Fixed Income Fund, LLC

Notes to Financial Statements

September 30, 2013

The change in unrealized gain (loss) in 2013 related to Level 3 investments still held as of September 30, 2013 amounted to $(284,393).

Quantitative Information about Level 3 Fair Value Measurements held in the Fund:

| Description | Fair Value at Sept. 30,2013 | Valuation Technique | Unobservable Input | Value | ||||

Promissory Note | $35,273,690 | Discounted Cash Flow | Discount Rate | 7.52% |

An increase in the discount rate used would result in a lower fair value measurement.

Restricted securities include securities that have not been registered under the Securities Act of 1933, as amended, and securities that are subject to restrictions on resale. The Fund may invest in restricted securities that are consistent with the Fund’s investment objective and investment strategies. In some cases, the issuer of restricted securities has agreed to register such securities for resale, at the issuer’s expense either upon demand by the Fund or in connection with another registered offering of the securities. Investments in restricted securities are valued at fair value as determined in good faith in accordance with procedures adopted by the Board. It is possible that the estimated value may differ significantly from the amount that might ultimately be realized in the near term, and the difference could be material. At September 30, 2013, the Fund was invested in one restricted security: Crescit Eundo Finance I, LLC Note fair valued at $35,273,690 constituting 99.59% of the Fund’s net assets, acquired February 24, 2010 with a cost basis of $33,682,869.

Fund Expenses

The Fund bears expenses incurred in its business. The expenses of the Fund include, but are not limited to, the following: management fees, legal fees; accounting and auditing fees; custody fees; costs of computing the Fund’s net asset value; expenses of preparing, printing, and filing reports and other documents with government agencies; expenses of Members’ and Board meetings; Member record keeping and Member account services, fees, and disbursements; insurance premiums; fees for investor services and other types of expenses as may be approved from time to time by the Board.

Federal Income Taxes

The Fund’s tax year end is December 31. The Fund intends to be treated as a partnership for U.S. Federal income tax purposes. Each Member is responsible for the tax liability or benefit relating to such Member’s distributive share of taxable income or loss. Therefore, no federal income tax provision is reflected in the accompanying financial statements.

10

City National Rochdale Structured Claims Fixed Income Fund, LLC

Notes to Financial Statements

September 30, 2013

The Fund has adopted accounting standards regarding recognition and measurement of tax positions taken or expected to be taken on a tax return. The Fund recognizes the effect of tax positions when they are more likely than not of being sustained. The Fund has concluded that there is no impact on the Fund’s net assets or results of operations and no tax liability resulting from unrecognized tax benefits relating to uncertain income tax positions taken or expected to be taken on its tax returns. These standards require the Fund to analyze all open tax years, as defined by the statute of limitations, for all major jurisdictions. Open tax years are those open for exam by taxing authorities and include the 2010 through 2012 tax years. During the fiscal year ended September 30, 2013, distributions in the amount of $2,334,386 and $1,301,917 were, for tax purposes, ordinary income and return of capital, respectively.

Subsequent Events

The Fund has adopted financial reporting rules regarding subsequent events which require an entity to recognize in the financial statements the effects of all subsequent events that provide additional evidence about conditions that existed at the date of the statement of net assets. Management has evaluated the Fund’s related events and transactions that occurred subsequent to September 30, 2013 through January 3, 2014, the date the financial statements were available for issuance. There were no events or transactions that occurred during this period that materially impacted the amounts or disclosures in the Fund’s financial statements.

Use of Estimates

The preparation of financial statements in conformity with accounting principles generally accepted in the United States requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of expenses during the reporting period. Actual results could differ from those estimates.

| 3. | Investment Management |

The Fund has an investment management agreement with City National Rochdale. The Advisor is responsible for providing investment advisory management, certain administrative services and conducts relations with the service providers to the Fund.

The Fund will pay the Advisor an investment management fee at an annual rate equal to 0.25% of the Fund’s month-end net assets. The investment management fee will accrue and be payable monthly.

11

City National Rochdale Structured Claims Fixed Income Fund, LLC

Notes to Financial Statements

September 30, 2013

| 4. | Expense Reimbursement |

The Advisor has contractually agreed to waive and/or reimburse the Fund’s expenses to the extent needed to limit the Fund’s annual operating expenses to 1.40% of net assets. To the extent that the Advisor reimburses or absorbs fees and expenses, it may seek payment of such amounts for three years after the year in which the expenses were reimbursed or absorbed. The Fund will make no such payment, however, if its total annual operating expenses exceed the expense limit in effect at the time the expenses were reimbursed or at the time these payments are proposed. At September 30, 2013, there were no outstanding amounts subject to recoupment by the Advisor.

5. Shareholder Servicing Arrangement

The Fund will pay a shareholder servicing fee to the Advisor (or its affiliates) at an annual rate of 0.25% of the Fund’s month-end net assets, including assets attributable to the Advisor (or its affiliates). Services provided include, but are not limited to, handling Member inquiries regarding the Fund (e.g., responding to questions concerning investments in the Fund, and reports and tax information provided by the Fund); assisting in the enhancement of relations and communications between Members and the Fund; assisting in the establishment and maintenance of Member accounts with the Fund; and assisting in the maintenance of Fund records containing Member information.

12

City National Rochdale Structured Claims Fixed Income Fund, LLC

Notes to Financial Statements

September 30, 2013

6. Distribution to Members

The Fund intends to make distributions to Members on a monthly basis in aggregate amounts representing substantially all of its net investment income, if any, during the year. The Fund also intends to distribute monthly proceeds from any principal paydowns on the Note, which will be designated as a return of capital to Members. Although the Fund does not expect to realize long-term capital gains except under extraordinary circumstances (such as the sale of all or a substantial portion of the Note), if it does earn such gains, they will be paid out once each year (unless otherwise permitted by the 1940 Act). The Fund will make distributions only if authorized by the Board and declared by the Fund out of assets legally available for these distributions.

7. Investment Transactions

For the year ended September 30, 2013, excluding short-term securities and U.S. Government securities, principal repayments on securities were $1,301,917. There were no purchases or sales of U.S. Government securities during the year ended September 30, 2013.

8. Prior Period Adjustments

In 2010 the Fund incurred various obligations related to offering costs incurred with its initial offering to Members. These costs were initially paid by the Advisor on the Fund’s behalf and the Fund appropriately charged paid in capital at the time of the offering, with a corresponding liability to reflect the amount due to by the Fund to the Advisor. During 2013 it was identified that the payments made in 2012 and 2011 of $126,967 and $88,117 respectively had been inappropriately charged to against investment income as recoupments of previously reimbursed expenses, resulting in misstatements to net investment income for the amount of the payments.

During the fiscal year ended September 2012 the Fund also inappropriately recorded out of balance capital unit transfers to the Fund in the net amount of $11,224.

For fiscal periods prior to 2013, fair valuation models utilized market inputs that resulted in fair value approximating the cost basis of the investment. In evaluating fair value in 2013, management allowed for the inclusion of different market inputs for interest rate changes in the fair value determination and the Fund recorded its investment at a fair value other than cost. In recording the resulting appreciation to the asset in 2013, management reassessed the previously recorded fair values which approximated cost (since time of investment acquisition) for changes resulting from use of the new market inputs and determined it was appropriate to revise previously stated fair values in order to properly reflect changes in the recorded fair value in the appropriate periods.

13

City National Rochdale Structured Claims Fixed Income Fund, LLC

Notes to Financial Statements

September 30, 2013

The statement of changes for 2012 as well as financial highlights for 2012 and prior periods have been revised to reflect the correction of the errors related to expense recoupments and capital activity, as well as the prior fair valuation estimates. The revisions to the 2012 statement of changes which have been assessed individually and collectively as immaterial to the previously reported balances reflect the following:

| As Previously Reported | As Revised | ||||

| 2012 Activity | |||||

| Net Investment Income | $2,393,765 | $2,520,732 | |||

| Net Change in Appreciation | $0 | $430,965 | |||

| Net Capital Activity | ($11,224) | $0 | |||

| Net Assets | |||||

| September 30, 2012 | 34,781,791 | 36,883,253 | |||

| September 30, 2011 | 36,265,839 | 37,799,205 | |||

The impact of the revisions made for 2012 and prior periods on the reported per share activity, ratios, and returns which was assessed as immaterial is presented within the financial highlights.

14

City National Rochdale Structured Claims Fixed Income Fund, LLC

| Period from | ||||||||||||||||

| February 24, 2010* | ||||||||||||||||

| Year Ended | Year Ended | Year Ended | through | |||||||||||||

| September 30, 2013 | September 30, 2012 | September 30, 2011 | September 30, 2010 | |||||||||||||

| Net Asset Value, beginning of period | $ | 945.63 | (3) | $ | 969.09 | (5) | $ | 1,027.43 | (3) | $ | 993.10 | |||||

| Income from investment operations: | ||||||||||||||||

| Net investment income | 62.98 | 64.64 | (4) | 66.86 | (4) | 41.00 | ||||||||||

| Net unrealized gain (loss) on promissory note | (7.29 | ) | 11.05 | (5) | (10.51 | ) (5) | 47.55 | (5) | ||||||||

| Total from investment operations | 55.69 | 75.69 | 56.35 | 88.55 | ||||||||||||

| Less Distributions: | ||||||||||||||||

| From net investment income | (59.86 | ) | (61.38 | ) | (64.57 | ) | (41.00 | ) | ||||||||

| From return on capital | (33.38 | ) | (37.77 | ) | (50.12 | ) | (13.22 | ) | ||||||||

| Total distributions | (93.24 | ) | (99.15 | ) | (114.69 | ) | (54.22 | ) | ||||||||

| Net asset value, end of period | $ | 908.08 | $ | 945.63 | (3) | $ | 969.09 | (3) | $ | 1,027.43 | (3) | |||||

| TOTAL RETURN - NET | 6.20 | % | 8.22 | %(6) | 5.75 | %(6) | 9.09 | %(1)(6)(11) | ||||||||

| RATIOS/SUPPLEMENTAL DATA | ||||||||||||||||

| Members' Capital, end of period ($000's) | $ | 35,419 | $ | 36,883 | (7) | $ | 37,798 | (7) | $ | 40,074 | (7) | |||||

| Portfolio Turnover | 0.00 | % | 0.00 | % | 0.00 | % | 1.72 | %(1) | ||||||||

| Ratio of Net Investment Income to Average Net Assets: | 6.81 | % | 6.75 | %(8) | 6.67 | %(8) | 4.06 | %(2)(8) | ||||||||

| Ratio of Gross Expenses to Average Net Assets | 0.90 | % | 0.99 | %(9) | 1.02 | %(9) | 0.70 | %(2)(9) | ||||||||

| Ratio of Net Expenses to Average Net Assets: | 0.90 | % | 0.99 | %(10) | 1.12 | %(10) | 0.70 | %(2)(10) | ||||||||

| * | Commencement of operations. | ||||||||||||

| (1) | Not Annualized. | ||||||||||||

| (2) | Annualized. | ||||||||||||

| (3) | Amounts have been revised from previously reported amounts of $891.99, $929.76, and $979.88 as of September 30, 2012, 2011, and 2010 respectively. See Note 8. | ||||||||||||

| (4) | Amounts have been revised from previously reported amounts of $61.38 and $64.57 for the years or periods ended September 30, 2012 and 2011, respectively. See Note 8. | ||||||||||||

| (5) | Amounts have been revised from previously reported amounts of $0 for the years or periods ended September 30, 2012, 2011, and 2010 respectively. See Note 8. | ||||||||||||

| (6) | Amounts have been revised from previously reported amounts of 6.94%, 6.92%, and 4.21% for the years or periods ended September 30, 2012, 2011, and 2010 | ||||||||||||

| respectively. See Note 8. | |||||||||||||

| (7) | Amounts have been revised from previously reported amounts of $34,782, $36,266, and $38,220 as of September 30, 2012, 2011, and 2010 respectively. See Note 8. | ||||||||||||

| (8) | Amounts have been revised from previously reported amounts of 7.09%, 7.05%, and 6.92% as of September 30, 2012, 2011, and 2010 respectively. See Note 8. | ||||||||||||

| (9) | Amounts have been revised from previously reported amounts of 1.04%, 1.06%, and 1.20% as of September 30, 2012, 2011, and 2010 respectively. See Note 8. | ||||||||||||

| (10) | Amounts have been revised from previously reported amounts of 1.40%, 1.40%, and 1.20% as of September 30, 2012, 2011, and 2010 respectively. See Note 8. | ||||||||||||

| (11) | Represents total return on a net asset value basis. Using the initial offering price of $1,000.00, including offering costs of $6.90, total return for the period was 8.34% | ||||||||||||

| as revised from previously reported amount of 3.49% (see Note 8). | |||||||||||||

| Total return is calculated for all Members taken as a whole. | |||||||||||||

| The expense ratios are calculated for all Members taken as a whole. | |||||||||||||

| The accompanying notes are an integral part of these financial statements. | |||||||||||||

15

City National Rochdale Structured Claims Fixed Income Fund, LLC

September 30, 2013

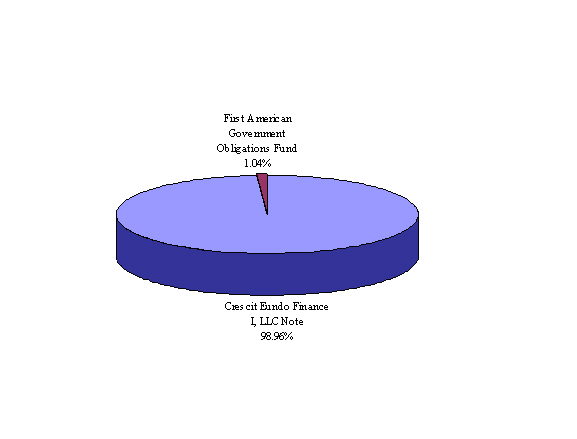

Investment Breakdown

(as a % of total investments)

The accompanying notes are an integral part of these financial statements.

16

| The Managers of the Fund, who were elected by the shareholders of the Fund, are responsible for the overall management of the Fund, including, general supervision and review of the investment activities of the Fund. The Managers, in turn, elect the officers of the Fund, who are responsible for administering the day to day operations of the Fund. The current Managers and Officers, their affiliations and principal occupations for the past five years are set forth below. The Statement of Additional Information includes additional information about the Managers and is available, without charge, by calling 1-866-209-1967. | |||||||||||

| Affiliated Board Members and Officers of the Fund | |||||||||||

| Number of | Other | ||||||||||

| Position(s) | Term of Office | Funds in Fund | Directorships | ||||||||

| Held with | and | Principal Occupation(s) | Complex Overseen | Held by | |||||||

| Name, Address and Age | Fund | Length of Time Served | During the Past Five Years | by Board Member | Manager 1 | ||||||

| Affiliated Board Members | |||||||||||

| Andrew Clare | Board Member | Through December 31, 2020; | Attorney and Partner, Loeb & Loeb, a law firm (1972 - present). | 1 | * | ||||||

| 570 Lexington Avenue | Board Member since | ||||||||||

| New York, NY 10022 | March 2013 | ||||||||||

| Year of Birth: 1945 | |||||||||||

| Jon Hunt | Board Member | Ten years from election; | Consultant to Management (2012 - present), Chief Operating | 1 | * | ||||||

| 570 Lexington Avenue | Board Member since | Officer (1998 - 2012), Director (2003 - 2012), Convergent Capital | Nuveen Commodities | ||||||||

| New York, NY 10022 | March 2013 | Management LLC (investment management holding company); | Asset Management, member | ||||||||

| Year of Birth: 1951 | Director, AMBS Investment Management, LLC (1998 - present); | of Independent Committee | |||||||||

| SKBA Capital Management, LLC (1998 - 2011); Mid-Continent | (2012 – present) | ||||||||||

| Capital Management LLC (2006 - 2012); Clifford Swan Investment | |||||||||||

| Capital LLC (2000 - 2011); Convergent Wealth Advisors, LLC | |||||||||||

| (2006 - 2011); Independence Investments, LLC (2006 - 2009); | |||||||||||

| and Lee Munder Capital Group, LLC (2009 - 2012). | |||||||||||

| Officers of the Fund | |||||||||||

| Garrett R. D'Alessandro | President | Since Inception | President, Chief Executive Officer and Co-Chief Investment | N/A | N/A | ||||||

| 570 Lexington Avenue | Chief Executive | Officer of City National Rochdale Investment Management, | |||||||||

| New York, NY 10022 | Officer | LLC. | |||||||||

| Year of Birth: 1957 | |||||||||||

| Kurt Hawkesworth | Secretary | Since Inception | Senior Executive Vice President, Chief Operating Officer and | N/A | N/A | ||||||

| 570 Lexington Avenue | General Counsel of City National Rochdale Investment | ||||||||||

| New York, NY 10022 | Management, LLC. | ||||||||||

| Year of Birth: 1971 | |||||||||||

| William O'Donnell | Treasurer | Since 2011 | Chief Financial Officer of City National Rochdale Investment | N/A | N/A | ||||||

| 570 Lexington Avenue | Management ,LLC since July 2011; Financial Consultant, | ||||||||||

| New York, NY 10022 | & October 2009 to June 2011; Financial Officer, Compliance | ||||||||||

| Year of Birth: 1964 | Officer Corporate Secretary Trustee - Clay Finlay Pension Plan | ||||||||||

| of Clay Finlay LLC, October 1990 to to September 2009. | |||||||||||

| Michael Gozzillo | Chief Compliance | Since 2013 | 2012 to Present: Senior Vice President & Chief Compliance | N/A | N/A | ||||||

| 570 Lexington Avenue | Officer | Officer, City National Rochdale Investment Management, LLC; | |||||||||

| New York, NY 10022 | Chief Compliance Officer, CNI Charter Funds. 2008 to 2012: | ||||||||||

| Year of Birth: 1965 | Director & Compliance Officer, TIAA-CREF; Chief Compliance | ||||||||||

| Officer, TIAA-CREF LifeInsurance Separate Accounts. | |||||||||||

| MANAGER AND OFFICER INFORMATION, Continued | |||||||||||

| Independent Board Members | |||||||||||

| Number of | Other | ||||||||||

| Position(s) | Term of Office | Funds in Fund | Directorships | ||||||||

| Held with | and | Principal Occupation(s) | Complex Overseen | Held by | |||||||

| Name, Address and Age | Fund | Length of Time Served | During the Past Five Years | by Board Member | Manager 1 | ||||||

Irwin G. Barnet, Esq. 3 | Board Member | Through December 31, 2015; | Attorney and of counsel, Reed Smith LLP, a law firm (2009 - | 1 | * | ||||||

| 570 Lexington Avenue | Chairman | Board Member since | present); Partner, Reed Smith LLP (2003 - 2008); Attorney and | ||||||||

| New York, NY 10022 | March 2013 and Chairman | principal, Crosby, Heafey, Roach & May P.C., a law firm | |||||||||

| Year of Birth: 1938 | since March 2013 | (2000 - 2002); Attorney and principal, Sanders, Barnet, | |||||||||

| Goldman, Simons & Mosk, a law firm (1980 - 2000). | |||||||||||

| Daniel A. Hanwacker, Sr. | Board Member | Ten years from election; | CEO and President, Hanwacker Associates, Inc. (asset | 1 | * | ||||||

| 570 Lexington Avenue | Board Member since | management consulting and executive search services). | |||||||||

| New York, NY 10022 | June 2011 | ||||||||||

| Year of Birth: 1951 | |||||||||||

| Vernon C. Kozlen | Board Member | Through December 31, 2018; | Retired (2007 - present). President and Chief Executive Officer, | 1 | * | ||||||

| 570 Lexington Avenue | Board Member since | CNI Charter Funds (2000 - 2007); Executive Vice President and | Windermere Jupiter Fund, LLC, | ||||||||

| New York, NY 10022 | March 2013 | Director of Asset Management Development, CNB (1996 - | CMS/Ironwood Multi-Strategy | ||||||||

| Year of Birth: 1943 | 2007); Director, Reed, Conner & Birdwell LLC (2000 - 2007) | Fund LLC, CMS/Barlow Long- | |||||||||

| and Convergent Capital Management, LLC (2003 - 2007); | -Short Equity Fund, LLC 4 | ||||||||||

| Chairman of the Board, CNAM (2001 - 2005); Chairman of | |||||||||||

| the Board, City National Securities, Inc. (1999 - 2005) | |||||||||||

| Director, CNAM (2001 - 2006), and City National | |||||||||||

| Securities, Inc. (1999 - 2006). | |||||||||||

| Jay C. Nadel | Board Member | Ten years from election; | Financial Services Consultant | 1 | * | ||||||

| 570 Lexington Avenue | Board Member since | Lapolla Industries, | |||||||||

| New York, NY 10022 | June 2011 | Inc. (2007 - present) | |||||||||

| Year of Birth: 1958 | |||||||||||

| William R. Sweet | Board Member | Through March 31, 2015; | Retired. Executive Vice President, Union Bank of California | 1 | * | ||||||

| 570 Lexington Avenue | Board Member since | (1985 - 1996) | |||||||||

| New York, NY 10022 | March 2013 | ||||||||||

| Year of Birth: 1937 | |||||||||||

| MANAGER AND OFFICER INFORMATION, Continued | |||||||||||

| Independent Board Members | |||||||||||

| Number of | Other | ||||||||||

| Position(s) | Term of Office | Funds in Fund | Directorships | ||||||||

| Held with | and | Principal Occupation(s) | Complex Overseen | Held by | |||||||

| Name, Address and Age | Fund | Length of Time Served | During the Past Five Years | by Board Member | Manager 1 | ||||||

James Wolford 5 | Board Member | Ten years from election; | Chief Financial Officer, Pacific Office Properties, a real estate | 1 | * | ||||||

| 570 Lexington Avenue | Board Member since | investment trust (April 2010 - present); Chief Financial Officer, | |||||||||

| New York, NY 10022 | March 2013 | Bixby Land Company, a real estate company (2004 - March | |||||||||

| Year of Birth: 1954 | 2010); Regional Financial Officer, AIMCO, a real estate | ||||||||||

| investment trust (2004). Chief Financial Officer, DBM Group, a | |||||||||||

| direct mail marketing company (2001 - 2004); Senior Vice | |||||||||||

| President and Chief Operating Officer, Forecast Commercial | |||||||||||

| Real Estate Service, Inc. (2000 - 2001); Senior Vice President | |||||||||||

and Chief Financial Officer, Bixby Ranch Company (1985 - 2000). | |||||||||||

| 1 | The information in this column relates only to directorships in companies required to file certain reports with the SEC under the various federal securities laws. | ||||||||||

| 3 | During 2010, 2011 and 2012, Reed Smith LLP, of which Mr. Barnet is an attorney and of counsel, provided legal services to City National, the parent company of CNAM. In 2010, 2011 and 2012, the firm billed City National $391,192, $423,600 and $452,607, respectively, for these services. The other Independent Managers have determined that Mr. Barnet should continue to be classified as a manager who is not an “interested person” of the Fund, as defined in the 1940 Act, because Mr. Barnet was not involved with rendering any of these legal services to City National, and because Mr. Barnet’s interest in the fees billed by his firm to City National was insignificant. | ||||||||||

| 4 | Convergent Wealth Advisors, LLC, which is under common control with City National, serves as investment adviser to Windermere Jupiter Fund, LLC, CMS/Ironwood Multi-Strategy Fund, LLC and CMS/Barlow Long-Short Equity Fund, LLC, each of which is a private investment fund. | ||||||||||

| 5 | Bixby Land Company (“Bixby”), of which Mr. Wolford was the Chief Financial Officer until March 31, 2010, had obtained various loans from City National. The other Independent Managers have determined that Mr. Wolford should continue to be classified as a manager who is not an “interested person” of the Fund, as defined in the 1940 Act, because City National’s existing loans to the Company were made in the ordinary course of business and because of the minimal benefits of the loans to Mr. Wolford. | ||||||||||

| * | Includes CNI Charter Funds, City National Rochdale High Yield Alternative Strategies Master Fund LLC, City National Rochdale High Yield Alternative Strategies Fund LLC, City National Rochdale High Yield Alternative Strategies Fund TEI LLC, City National Rochdale Alternative Total Return Fund LLC, City National Rochdale International Trade Fixed Income Fund and City National Rochdale Royalty Rights Fund. | ||||||||||

| ** | The Advisor is owned by City National Bank. | ||||||||||

BOARD APPROVAL OF ADVISORY AGREEMENT (UNAUDITED)

The Board of Managers of City National Rochdale Structured Claims Fixed Income Fund, LLC (the “Fund”) is comprised of eight Managers, six of whom are independent of the Fund’s investment adviser (the “Independent Managers”). During the six months ended September 30, 2013, the Board and the Independent Managers approved renewal of the Fund’s advisory agreement (the “Agreement”) with Rochdale Investment Management, LLC (“Rochdale”), as described below. During that period, certain related name changes occurred, as follows:

| · | Prior to September 10, 2013, the name of the Fund was Rochdale Structured Claims Fixed Income Fund, LLC. |

| · | Effective September 10, 2013, Rochdale, the investment adviser of the Fund, changed its name to City National Rochdale, LLC. |

General Information

The following information summarizes the Board’s considerations associated with its review of the Agreement. In connection with their deliberations, the Board considered such information and factors as they believed, in light of the legal advice furnished to them and their own business judgment, to be relevant. As described below, the Board considered the nature, quality and extent of the various investment advisory and administrative services performed by Rochdale. In considering these matters, the Independent Managers discussed the approval of the Agreement with management and in private sessions with their independent counsel at which no representatives of Rochdale were present.

The Board reviewed extensive materials regarding investment results of Rochdale, advisory fee and expense comparisons, financial information, descriptions of various functions such as compliance monitoring and portfolio trading practices, and information about the personnel providing investment management and administrative services to the Fund. They also took into account information they received at past meetings of the Board and its committees with respect to these matters.

In deciding to approve renewal of the Agreement, the Board and the Independent Managers did not identify a single factor as controlling and this summary does not describe all of the matters considered. In addition, each Board member did not necessarily attribute the same weight to each matter. However, the Board and the Independent Managers concluded that each of the various factors referred to below favored such approval.

Nature, Extent and Quality of Services

In reviewing the services provided by Rochdale, the Board considered a variety of matters, including the background, education and experience of its key portfolio management and operational personnel; its overall financial strength and stability; its resources and efforts to retain, attract and motivate capable personnel to serve the Fund; and the overall general quality and depth of its organization. The Board also took into account the experience, capability and integrity of its senior management; its investment philosophy and processes; its trading practices; and its commitment and systems in place with regard to compliance with applicable laws and regulations. The Board found all of these matters to be satisfactory.

Investment Performance

The Board assessed the performance of the Fund compared with its benchmark index for the one- and three-year and since inception periods ended June 30, 2013. The Board observed that the Fund outperformed the Barclays Intermediate Aggregate Bond Index plus 300 basis points for each period. In addition, the Board observed that the Fund continued to produce at least a 7% annualized return since the Fund was launched in 2010. The Board concluded that Rochdale continued to provide satisfactory management and oversight services to the Fund.

Advisory Fees and Fund Expenses

The Board reviewed information regarding the advisory fees charged by Rochdale to the Fund and the total expenses of the Fund (as a percentage of its average annual net assets). The Board noted that it was difficult to gather a peer group for comparison due to the unique investment strategy of the Fund and lack of public information regarding the Fund’s competitors. The Board reviewed, however, fee and expense information from samples of closed-end funds and private funds with alternative investment strategies compiled by U.S. Bancorp Fund Services, LLC, the Fund’s administrator, in consultation with Rochdale.

The Board observed that the investment advisory fees paid by the Fund were significantly lower than the median advisory fee of a sample of 155 peer alternative funds. The Board noted that Rochdale does not manage assets of any other clients using the same strategies as those used by the Fund and therefore it could not compare the fees charged by Rochdale to the Fund to those charged to its other clients. The Board considered that the total expense ratio of the Fund was below the median of 11 peer alternative funds that voluntarily report their total expense ratios. The Board concluded that the advisory fee charged by Rochdale to the Fund was fair and reasonable, and the total expenses of the Fund continued to be reasonable.

Profitability, Benefits to Rochdale and Economies of Scale

The Board considered information prepared by Rochdale relating to its costs and profits with respect to the Fund. The Board also considered the benefits received by Rochdale and its affiliates as a result of Rochdale’s relationship with the Fund, including investment advisory fees paid to Rochdale; fees paid to Rochdale’s affiliate, RIM Securities, LLC, for providing distribution services to the Fund; benefits to City National Bank’s wealth management business as a result of the availability of the Fund to its customers; and the intangible benefits of any favorable publicity arising in connection with the Fund’s performance. The Board noted Rochdale’s representation that no significant economies of scale with respect to the Fund had been realized in the last year. The Board also noted that although there were no advisory fee breakpoints, based on Rochdale’s operations significant economies of scale were not likely to be realized until the asset levels of the Fund were significantly higher than their current levels.

Conclusions

Based on their review, including their consideration of each of the factors referred to above, the Board and the Independent Managers concluded that the compensation payable to Rochdale with respect to the Fund pursuant to the Agreement is fair and reasonable in light of the nature and quality of the services being provided by Rochdale to the Fund and its shareholders, and that renewal of the Agreement was in the best interest of the Fund and its shareholders.

City National Rochdale Structured Claims Fixed Income Fund, LLC

Additional Information

Proxy Voting Policies and Procedures

You may obtain a description of the Fund’s proxy voting policies and procedures and information regarding how the Fund voted proxies relating to portfolio securities without charge, upon request, by contacting the Fund directly at 1-800-245-9888; or on the EDGAR Database on the SEC’s website at www.sec.gov.

Portfolio Holdings Disclosure

The Fund will file its complete schedule of portfolio holdings with the SEC at the end of the first and third fiscal quarters on Form N-Q within sixty days of the end of the quarter to which it relates. The Fund’s Forms N-Q will be available on the SEC’s website at www.sec.gov, and may also be reviewed and copied at the SEC’s Public Reference Room in Washington, D.C. Information on the operation of the Public Reference Room may be obtained by calling 1-202-942-8090.

Item 2. Code of Ethics.

The registrant has adopted a code of ethics that applies to the registrant’s principal executive officer and principal financial officer. The registrant has not made any amendments to its code of ethics during the period covered by this report. The registrant has not granted any waivers from any provisions of the code of ethics during the period covered by this report.

The registrant undertakes to provide to any person without charge, upon request, a copy of its code of ethics by mail when they call the registrant at 1-866-209-1967.

Item 3. Audit Committee Financial Expert.

The registrant’s board of managers has determined that there are at least two audit committee financial experts serving on its audit committee. William R. Sweet, Jay C. Nadel and Daniel A. Hanwacker are the “audit committee financial experts” and are considered to be “independent” as each term is defined in Item 3 of Form N-CSR.

Item 4. Principal Accountant Fees and Services.

The registrant has engaged its principal accountant to perform audit services, audit related services, tax services and other services during the past two fiscal years. “Audit services” refer to performing an audit of the registrant's annual financial statements or services that are normally provided by the accountant in connection with statutory and regulatory filings or engagements for those fiscal years. “Audit-related services” refer to the assurance and related services by the principal accountant that are reasonably related to the performance of the audit. “Tax services” refer to professional services rendered by the principal accountant for tax compliance, tax advice, and tax planning. The following table details the aggregate fees billed or expected to be billed for each of the last two fiscal years for audit fees, audit-related fees, tax fees and other fees by the principal accountant.

| FYE 9/30/2013 | FYE 9/30/2012 | ||

| Audit Fees | $25,000 | ||

| Audit-Related Fees | $ | $0 | |

| Tax Fees | $ | $10,000 | |

| All Other Fees | $ | $0 | |

The audit committee has adopted pre-approval policies and procedures that require the audit committee to pre-approve all audit and non-audit services of the registrant, including services provided to any entity affiliated with the registrant.

The percentage of fees billed by Tait, Weller & Baker LLP applicable to non-audit services pursuant to waiver of pre-approval requirement were as follows:

| FYE 9/30/2013 | FYE 9/30/2012 | |

| Audit-Related Fees | 0.0% | 0.0% |

| Tax Fees | 0.0% | 0.0% |

| All Other Fees | 0.0% | 0.0% |

All of the principal accountant hours spent on auditing the registrant’s financial statements were attributed to work performed by full-time permanent employees of the principal accountant.

The following table indicates the non-audit fees billed or expected to be billed by the registrant’s accountant for services to the registrant and to the registrant’s investment adviser (and any other controlling entity, etc.—not sub-adviser) for the last two years. The audit committee of the board of managers has considered whether the provision of non-audit services that were rendered to the registrant's investment adviser is compatible with maintaining the principal accountant's independence and has concluded that the provision of such non-audit services by the accountant has not compromised the accountant’s independence.

| Non-Audit Related Fees | FYE 9/30/2013 | FYE 9/30/2012 | |

| Registrant | $ | $10,000 | |

| Registrant’s Investment Adviser | $ | $0 | |

Item 5. Audit Committee of Listed Registrants.

Not applicable to registrants who are not listed issuers (as defined in Rule 10A-3 under the Securities Exchange Act of 1934).

Item 6. Investments.

Schedule of Investments is included as part of the report to shareholders filed under Item 1 of this Form.

Item 7. Disclosure of Proxy Voting Policies and Procedures for Closed-End Management Investment Companies.

Not applicable since the Fund invests exclusively in non-voting securities.

Item 8. Portfolio Managers of Closed-End Management Investment Companies.

The following table provides information as of September 30, 2013:

PORTFOLIO MANAGER DISCLOSURE

List of Portfolio Managers and Biographical Information

Name | Title | Length of Service | Business Experience During Past 5 Years | Role of Portfolio Manager |

William C. Miller Jr. | Senior Vice President and Director- Fixed Income Investments | Since 2013 | Senior Vice President and Director- Fixed Income Investments, specializes in the research, analysis and selection of fixed income securities | Heads the team of investment professionals and is intricately involved in the firm’s day to day fixed income investments research. |

Garrett R. D’Alessandro | Chief Executive Officer | Since Inception | President, Chief Executive Officer, Co-Chief Investment Officer, and Director of Research of City National Rochdale LLC. | Directs portfolio management strategies and investment research efforts and determines companies that satisfy the firm’s criteria for inclusion in client portfolios. |

Name | Number of Registered Investment Companies Managed and Total Assets for Such Accounts (Including The Trust) | Beneficial Ownership of Equity Securities In Trust | Number of Other Pooled Investment Vehicles Managed and Total Assets for Such Accounts | Number of Other Accounts Managed and Total Assets For Such Accounts |

William C. Miller Jr. | 6, $6,031.6 million | $0 | 0, $0 | 54, $416.4 million |

Garrett R. D’Alessandro | 5, $1,319 million | $0 | 1, $9 million | 121, $272 million |

Mr. Miller receives an annual salary established by City National Rochdale, LLC (the “Manager”). Salary levels are based on the overall performance of the Manager and not on the investment performance of any particular Portfolio or account. Like the Manager’s other employees, Mr. Miller is eligible for a bonus annually. Such bonuses are also based on the performance of the Manager as a whole and not on the investment performance of any particular Portfolio or account.

Mr. D’Alessandro receives an annual salary established by the Manager. Salary levels are based on the overall performance of the Manager and not on the investment performance of any particular Portfolio or account. Like the Manager’s other employees, Mr. D’Alessandro is eligible for a bonus annually. Such bonuses are also based on the performance of the Manager as a whole and not on the investment performance of any particular Portfolio or account. Additionally, Mr. D’Alessandro owns a substantial portion of the Manager and, accordingly, benefits from any profits earned by the Manager.

Item 9. Purchases of Equity Securities by Closed-End Management Investment Company and Affiliated Purchasers.

Not applicable.

Item 10. Submission of Matters to a Vote of Security Holders.

The registrant’s nominating committee charter does not contain any procedures by which shareholders may recommend nominees to the registrant’s board of managers.

Item 11. Controls and Procedures.

| (a) | The registrant’s President/Chief Executive Officer and Treasurer/Chief Financial Officer have reviewed the registrant's disclosure controls and procedures (as defined in Rule 30a-3(c) under the Investment Company Act of 1940 (the “Act”)) as of a date within 90 days of the filing of this report, as required by Rule 30a-3(b) under the Act and Rules 13a-15(b) or 15d-15(b) under the Securities Exchange Act of 1934. Based on their review, such officers have concluded that the disclosure controls and procedures are effective in ensuring that information required to be disclosed in this report is appropriately recorded, processed, summarized and reported and made known to them by others within the registrant and by the registrant’s service provider. |

| (b) | There were no changes in the registrant's internal control over financial reporting (as defined in Rule 30a-3(d) under the Act) that occurred during the second fiscal quarter of the period covered by this report that has materially affected, or is reasonably likely to materially affect, the registrant's internal control over financial reporting. |

Item 12. Exhibits.

| (a) | (1) Any code of ethics or amendment thereto, that is the subject of the disclosure required by Item 2, to the extent that the registrant intends to satisfy Item 2 requirements through filing an exhibit. Not Applicable. |

(2) A separate certification for each principal executive and principal financial officer pursuant to Section 302 of the Sarbanes-Oxley Act of 2002. Filed herewith.

(3) Any written solicitation to purchase securities under Rule 23c-1 under the Act sent or given during the period covered by the report by or on behalf of the registrant to 10 or more persons. Not applicable during this period.

| (b) | Certifications pursuant to Section 906 of the Sarbanes-Oxley Act of 2002. Furnished herewith. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

(Registrant) City National Rochdale Structured Claims Fixed Income Fund LLC

By (Signature and Title) /s/ Garrett R. D’Alessandro

Garrett R. D’Alessandro, President

Date 1/3/2014

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

By (Signature and Title) /s/ Garrett R. D’Alessandro

Garrett R. D’Alessandro, President

Date 1/3/2014

By (Signature and Title) /s/ William O’Donnell

William O’Donnell, Treasurer

Date 1/3/2014