IFM Investments Limited

Annual Report on Form 20-F

2009

As filed with the Securities and Exchange Commission on June 30, 2010

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

____________________

FORM 20-F

____________________

| | (Mark One) | |

| | | £ | REGISTRATION STATEMENT PURSUANT TO SECTION 12(B) OR 12(G) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| | OR |

| | | R | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| | | | For the fiscal year ended December 31, 2009. |

| | OR |

| | | £ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| | | | For the transition period from to |

| | OR |

| | | £ | SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| | | | Date of event requiring this shell company report |

Commission file number: 001-34598

____________________

IFM Investments Limited

(Exact name of Registrant as specified in its charter)

____________________

N/A

(Translation of Registrant’s name into English)

Cayman Islands

(Jurisdiction of incorporation or organization)

26/A, East Wing

Hanwei Plaza No.7, Guanghua Road, Chaoyang District

Beijing 100004, People’s Republic of China

(Address of principal executive offices)

Donald Zhang

26/A, East Wing

Hanwei Plaza No.7, Guanghua Road, Chaoyang District

Beijing 100004, People’s Republic of China

Phone: (86 10) 6561-7788

Facsimile: (86 10) 6561-3321

____________________

(Name, Telephone, E-mail and/or Facsimile number and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act:

| Title of Each Class | | Name of each exchange on which registered |

| American Depositary Shares, each representing fifteen Class A ordinary shares, par value US$0.001 per share | | New York Stock Exchange |

____________________

Securities registered or to be registered pursuant to Section 12(g) of the Act:

None

(Title of Class)

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act:

None

(Title of Class)

____________________

Indicate the number of outstanding shares of each of the Issuer’s classes of capital or common stock as of the close of the period covered by the annual report.

As of December 31, 2009, we had 260,000,00 ordinary shares, par value US$0.001 per share, 200,000,000 Series A preferred shares and 111,367,270 Series B preferred shares outstanding; as of June 21, 2010, we had 606,117,475 Class A ordinary shares and 80,502,938 Class B ordinary shares, par value US$0.001 per share, outstanding.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No x

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934. Yes o No x

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes o No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer o Accelerated filer o Non-accelerated filer x

Indicate by check mark which basis of accounting the registrant has been to prepare the financial statements included in this filing:

U.S. GAAP x International Financial Reporting Standards as issued by the International Accounting Standards Board o Other o

If “other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow.

Item 17 o Item 18 o

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No x

(APPLICABLE ONLY TO ISSUERS INVOLVED IN BANKRUPTCY PROCEEDINGS DURING THE PAST FIVE YEARS)

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Sections 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court. Yes o No o

| | | | Page |

| Introduction | |

| Item 1. | | Identity of Directors, Senior Management and Advisors | 3 |

| Item 2. | | Offer Statistics and Expected Timetable | 3 |

| Item 3. | | Key Information | 3 |

| Item 4. | | Information on the Company | 20 |

| Item 4A. | | Unresolved Staff Comments | 35 |

| Item 5. | | Operating and Financial Review and Prospects | 35 |

| Item 6. | | Directors, Senior Management and Employees | 53 |

| Item 7. | | Major Shareholders and Related Party Transactions | 59 |

| Item 8. | | Financial Information | 61 |

| Item 9. | | The Offer and Listing | 62 |

| Item 10. | | Additional Information | 63 |

| Item 11. | | Quantitative and Qualitative Disclosures About Market Risk | 68 |

| Item 12. | | Description of Securities Other Than Equity Securities | 69 |

| Item 13. | | Defaults, Dividend Arrearages and Delinquencies | 70 |

| Item 14. | | Material Modifications to the Rights of Security Holders and Use of Proceeds | 70 |

| Item 15. | | Controls and Procedures | 71 |

| Item 16A. | | Audit Committee Financial Expert | 72 |

| Item 16B. | | Code of Ethics | 72 |

| Item 16C. | | Principal Accountant Fees and Services | 72 |

| Item 16D. | | Exemptions from the Listing Standards for Audit Committees | 72 |

| Item 16E. | | Purchases of Equity Securities by the Issuer and Affiliated Purchasers | 72 |

| Item 16F. | | Change in Registrant’s Certifying Accountant | 72 |

| Item 16G. | | Corporate Governance | 72 |

| Item 17. | | Financial Statements | 74 |

| Item 18. | | Financial Statements | 74 |

| Item 19. | | Exhibits | 74 |

CONVENTIONS WHICH APPLY TO THIS FORM

Unless otherwise indicated, references in this annual report on Form 20-F to:

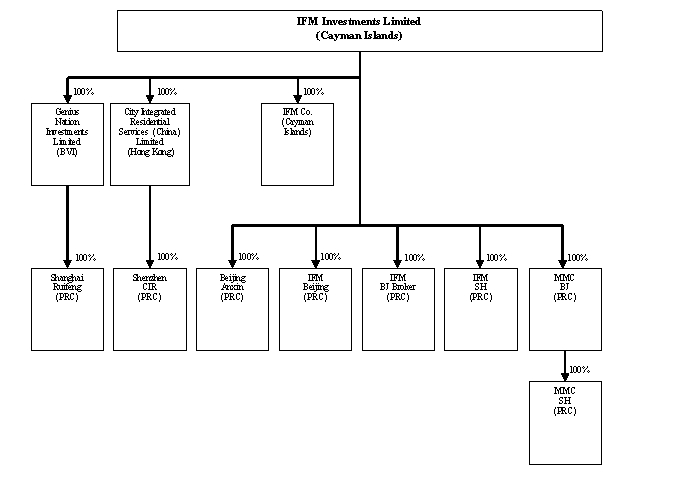

| | • | “we,” “us,” “our” and “our company” refer to IFM Investments Limited, a Cayman Islands company, and its predecessor entities and its subsidiaries; |

| | | |

| | • | “ADSs” are to our American depositary shares, each of which represents fifteen (15) Class A ordinary shares; |

| | | |

| | • | “ADRs” are to the American depositary receipts, which, if issued, evidence our ADSs; |

| | | |

| | • | “China” and the “PRC” are to the People’s Republic of China, excluding Taiwan and the special administrative regions of Hong Kong and Macau; |

| | | |

| | • | “Shares” or “ordinary shares” are to our ordinary shares, par value US$0.001 per share which include both Class A ordinary shares and Class B ordinary shares; |

| | | |

| | • | “RMB” and “Renminbi” are to the legal currency of China; and |

| | | |

| | • | “US$” and “U.S. dollars” are to the legal currency of the United States. |

Unless otherwise indicated, references to our principal subsidiaries in this annual report on Form 20-F are specified as follows:

| | • | “Beijing Anxin” is to Beijing Anxinruide Real Estate Brokerage Co., Limited, a company incorporated in the PRC; |

| | | |

| | • | “IFM Beijing” is to Beijing Aifeite International Franchise Consultant Co., Limited, a company incorporated in the PRC; |

| | | |

| | • | “IFM BJ Broker” is to Beijing IFM International Real Estate Brokerage Co., Limited, a company incorporated in the PRC; |

| | | |

| | • | IFM Co.” is to IFM Company Limited, a company incorporated in the Cayman Islands; |

| | | |

| | • | “IFM SH” is to Shanghai Yaye Real Estate Brokerage Co., Limited, a company incorporated in the PRC; |

| | | |

| | • | “MMC BJ” is to Beijing Kaishengjinglue Guarantee Co., Limited, a company incorporated in the PRC; |

| | | |

| | • | “MMC SH” is to Shanghai Kaiyi Investment Consultant Management Co., Limited, a company incorporated in the PRC; |

| | | |

| | • | “Shanghai Ruifeng” is to Shanghai Ruifeng Real Estate Investments Consulting Co., Limited, a company incorporated in the PRC; and |

| | | |

| | • | “Shenzhen CIR” is to CIR Real Estate Consultant (Shenzhen) Co., Limited, a company incorporated in the PRC. |

This annual report contains translations of certain Renminbi amounts into U.S. dollars at specified rates. Unless otherwise stated, the translation of Renminbi into U.S. dollars has been made at the noon buying rate in effect on December 31, 2009, which was RMB6.8259 to US$1.00, the rate as certified by the H.10 weekly statistical release of the Federal Reserve Board on December 31, 2009. We make no representation that the Renminbi or dollar amounts referred to in this annual report could have been or could be converted into U.S. dollars or Renminbi, as the case may be, at any particular rate or at all.

This annual report contains references to compound annual growth rate, which represents the rate of return on an annualized basis over the relevant time period.

CENTURY 21® is a registered trademark owned by a subsidiary of Realogy Corporation.

FORWARD-LOOKING STATEMENTS

This annual report on Form 20-F contains forward-looking statements that relate to future events, including our future operating results and conditions, our prospects and our future financial performance and condition. These statements involve known and unknown risks, uncertainties and other factors, including those listed under “Key Information—Risk Factors,” which may cause our actual results, performance or achievements to be materially different from any future results, performances or achievements expressed or implied by the forward-looking statements.

Forward-looking statements typically are identified by words or phrases such as “may,” “will,” “expect,” “anticipate,” “aim,” “estimate,” “intend,” “plan,” “believe,” “potential,” “continue,” “is/are likely to” or other similar expressions or the negative of these words or expressions. We have based these forward-looking statements largely on our current expectations and projections about future events and financial trends that we believe may affect our financial condition, results of operations, business strategy and financial needs. These forward-looking statements include, among other things, statements relating to:

| | • | our anticipated growth strategies; |

| | | |

| | • | our future business development, results of operations and financial condition; |

| | | |

| | • | expected changes in our net revenues and certain cost or expense items; |

| | | |

| | • | our ability to attract clients and further enhance our brand recognition; and |

| | | |

| | • | trends and competition in the real estate services industry. |

The forward-looking statements made in this annual report on Form 20-F relate only to events or information as of the date on which the statements are made in this annual report. Except as required by law, we undertake no obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events or otherwise, after the date on which the statements are made or to reflect the occurrence of unanticipated events. You should read thoroughly this annual report and the documents that we refer to in this annual report with the understanding that our actual future results may be materially different from and worse than what we expect. We qualify all of our forward-looking statements by these cautionary statements.

PART I

Item 1. IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISORS

Not Applicable.

Item 2. OFFER STATISTICS AND EXPECTED TIMETABLE

Not Applicable.

| A. | SELECTED FINANCIAL DATA |

The following selected consolidated financial information and operating data for the periods and as of the dates indicated should be read in conjunction with our audited consolidated financial statements and related notes and “Operating and Financial Review and Prospects” included elsewhere in this annual report. Our selected consolidated statement of operations data for the years ended December 31, 2007, 2008 and 2009 and selected consolidated balance sheet data as of December 31, 2008 and 2009 have been derived from our audited consolidated financial statements, which are included elsewhere in this annual report. Our selected consolidated statement of operations data for the year ended December 31, 2006 and selected consolidated balance sheet d ata as of December 31, 2006 and 2007 have been derived from our financial statements not included in this annual report. Our audited consolidated financial statements have been prepared and presented in accordance with accounting principles generally accepted in the United States of America, or US GAAP. The historical results are not necessarily indicative of results to be expected in any future period.

We underwent a reorganization in 2006 to become the holding company of our various subsidiaries. Our reorganization became effective on August 24, 2006. Prior to the reorganization, we managed our franchise services business through a number of companies owned by our founders. We have not included financial information for the year ended December 31, 2005, as such information is not available on a basis that is consistent with the consolidated financial information for the years ended December 31, 2006, 2007, 2008 and 2009. As our company was not created until 2006 in connection with the reorganization as described in this annual report, the preparation of consolidated financial information for our company prior to such date would require the preparation of consolidated financial information on a predecessor entity basis for the various companies comprising the operations of our company at that time. Such group would include two companies incorporated in the Cayman Islands and seven companies incorporated in the PRC. No financial accounts were prepared in accordance with US GAAP for our company or our subsidiaries, nor were consolidated accounts prepared for our company for 2005. Although accounts were prepared for each of the companies incorporated in the PRC on a basis to comply with PRC tax reporting laws and regulations, or PRC Statutory Accounting, given that it would be inappropriate to prepare accounts for the non-PRC companies on the basis of PRC Statutory Accounting, in order to fairly present consolidated financial information for 2005, our company would need to adopt uniform US GAAP accounting conventions for all nine entities, which would differ significantly from PRC Statutory Accounting.

As such, our consolidated financial statements cannot be provided on a US GAAP basis or home-country GAAP basis without unreasonable effort or expense. Furthermore, we believe that the omission of selected financial data for those years would not have a material impact on a reader’s understanding of our financial results and condition, and related trends.

| | | For the Years Ended December 31, | |

| | | 2006 | | | 2007 | | | 2008 | | | 2009 | |

| | | RMB | | | RMB | | | RMB | | | RMB | | | (US$)(1) | |

| | | (In thousands, except per share and per ADS data) | |

| Statement of Operations Data: | | | | | | | | | | | | | | | |

| Revenue | | | | | | | | | | | | | | | |

| Net revenues | | | 38,425 | | | | 189,029 | | | | 273,359 | | | | 651,656 | | | | 95,468 | |

| Costs and Expenses | | | | | | | | | | | | | | | | | | | | |

| Commissions and other agent related costs | | | (4,620 | ) | | | (82,866 | ) | | | (151,550 | ) | | | (289,146 | ) | | | (42,360 | ) |

| Operating costs | | | (9,914 | ) | | | (79,886 | ) | | | (146,457 | ) | | | (119,605 | ) | | | (17,522 | ) |

| Selling, general and administrative expenses | | | (40,285 | ) | | | (94,471 | ) | | | (102,952 | ) | | | (101,421 | ) | | | (14,858 | ) |

| Total costs and expenses | | | (54,819 | ) | | | (257,223 | ) | | | (400,959 | ) | | | (510,172 | ) | | | (74,740 | ) |

| (Loss) income from operations | | | (16,394 | ) | | | (68,194 | ) | | | (127,600 | ) | | | 141,484 | | | | 20,728 | |

| Interest income | | | 848 | | | | 1,708 | | | | 4,441 | | | | 2,244 | | | | 329 | |

| Interest expense | | | (1,299 | ) | | | - | | | | - | | | | - | | | | - | |

| Foreign currency exchange loss | | | (1,537 | ) | | | (5,485 | ) | | | (5,526 | ) | | | (496 | ) | | | (73 | ) |

| (Loss) income before income tax and share of associates’ losses | | | (18,382 | ) | | | (71,971 | ) | | | (128,685 | ) | | | 143,232 | | | | 20,984 | |

| Income tax | | | (799 | ) | | | (394 | ) | | | (2,076 | ) | | | (8,275 | ) | | | (1,212 | ) |

| Share of associates’ losses | | | (373 | ) | | | (409 | ) | | | (1,126 | ) | | | (162 | ) | | | (24 | ) |

| Net (loss) income | | | (19,554 | ) | | | (72,774 | ) | | | (131,887 | ) | | | 134,795 | | | | 19,748 | |

| Non-controlling interest | | | 1,524 | | | | (1,347 | ) | | | (431 | ) | | | 246 | | | | 36 | |

| Net (loss) income attributable to IFM Investments Limited | | | (18,030 | ) | | | (74,121 | ) | | | (132,318 | ) | | | 135,041 | | | | 19,784 | |

| Net (loss) income per share | | | | | | | | | | | | | | | | | | | | |

| Basic | | | (0.07 | ) | | | (0.31 | ) | | | (0.57 | ) | | | 0.21 | | | | 0.03 | |

| Diluted | | | (0.07 | ) | | | (0.31 | ) | | | (0.57 | ) | | | 0.20 | | | | 0.03 | |

| Net (loss) income per ADS | | | | | | | | | | | | | | | | | | | | |

| Basic | | | (1.12 | ) | | | (4.69 | ) | | | (8.54 | ) | | | 3.11 | | | | 0.46 | |

| Diluted | | | (1.12 | ) | | | (4.69 | ) | | | (8.54 | ) | | | 3.06 | | | | 0.45 | |

Weighted average number of ordinary shares used in per share calculations (2) : | | | | | | | | | | | | | | | | | | | | |

| Basic | | | 260,000 | | | | 260,000 | | | | 260,000 | | | | 260,000 | | | | 260,000 | |

| Diluted | | | 260,000 | | | | 260,000 | | | | 260,000 | | | | 264,396 | | | | 264,396 | |

| (1) | Unless otherwise noted, all translations from Renminbi to U.S. dollars have been made at a rate of RMB6.8259 to US$1.00, the rate as certified by the H.10 weekly statistical release of the Federal Reserve Board on December 31, 2009. |

| (2) | On January 4, 2010, we effected a share split whereby all of our issued and outstanding 26,000,000 ordinary shares of par value US$0.01 each, 20,000,000 Series A preferred shares of par value US$0.01 each and 11,136,727 Series B preferred shares of par value US$0.01 each were divided into 260,000,000 ordinary shares of US$0.001 par value each, 200,000,000 Series A preferred shares of par value US$0.001 each and 111,367,270 Series B preferred shares of par value US$0.001 each, respectively, and the number of our authorized shares was increased from 101,374,676 to 1,013,746,760. The share split has been retroactively reflected for all years presented herein. Each ADS represents fifteen (15) ordinary shares. |

| | | As of December 31, | |

| | | Actual | | | Actual | | | Actual | | | Actual | | | Pro Forma As Adjusted(2) | |

| | | 2006 | | | 2007 | | | 2008 | | | 2009 | | | 2009 | |

| | | RMB | | | RMB | | | RMB | | | RMB | | | (US$)(1) | | | RMB | | | (US$)(1) | |

| | | (In thousands) | |

| Balance Sheet Data: | | | | | | | | | | | | | | | | | | | | | |

| Cash and cash equivalents | | | 110,505 | | | | 331,216 | | | | 176,977 | | | | 334,589 | | | | 49,018 | | | | - | | | | - | |

| Restricted cash | | | 6,793 | | | | 14,497 | | | | 17,213 | | | | 28,784 | | | | 4,217 | | | | - | | | | - | |

| Accounts receivable, net | | | 6,437 | | | | 9,965 | | | | 13,633 | | | | 61,938 | | | | 9,074 | | | | - | | | | - | |

| Amount due from related parties | | | 80,789 | | | | 44,068 | | | | 38,110 | | | | 386 | | | | 57 | | | | - | | | | - | |

| Property and equipment, net | | | 5,822 | | | | 42,467 | | | | 42,954 | | | | 41,181 | | | | 6,033 | | | | - | | | | - | |

| Intangible assets, net | | | 27,943 | | | | 26,317 | | | | 29,796 | | | | 27,825 | | | | 4,076 | | | | - | | | | - | |

| Total assets | | | 255,750 | | | | 513,187 | | | | 360,895 | | | | 543,834 | | | | 79,672 | | | | - | | | | - | |

| Accrued expenses and other current liabilities | | | 38,535 | | | | 52,234 | | | | 53,597 | | | | 130,668 | | | | 19,143 | | | | - | | | | - | |

| Total liabilities | | | 106,073 | | | | 145,647 | | | | 111,356 | | | | 157,340 | | | | 23,050 | | | | - | | | | - | |

| Convertible redeemable preferred shares | | | 172,131 | | | | 469,971 | | | | 501,892 | | | | 518,318 | | | | 75,934 | | | | - | | | | - | |

| Total shareholders’ (deficit) equity | | | (22,454 | ) | | | (102,431 | ) | | | (252,353 | ) | | | (131,824 | ) | | | (19,312 | ) | | | 391,409 | | | | 57,342 | |

| (1) | Unless otherwise noted, all translations from Renminbi to U.S. dollars have been made at a rate of RMB6.8259 to US$1.00, the rate as certified by the H.10 weekly statistical release of the Federal Reserve Board on December 31, 2009. |

| | |

| (2) | Our consolidated balance sheet data as of December 31, 2009 is adjusted to give effect to the automatic conversion of all our ordinary and preferred shares into 418,339,339 Class A and 80,502,938 Class B ordinary shares immediately prior to the closing of our initial public offering, and the issuance and sale of ADSs by us in such offering. |

| | | For the Years Ended or as of December 31, | |

| | | 2007 | | | 2008 | | | 2009 | |

| | | | | | | | | | |

| Other Financial and Operating Data: | | | | | | | | | |

| Company-owned brokerage services | | | | | | | | | |

| Net revenues (in thousands of RMB) | | | 151,692 | | | | 206,076 | | | | 590,222 | |

Average number of operating sales offices(1) | | | 143 | | | | 279 | | | | 248 | |

| Average monthly net revenues per operating sales office (in thousands of RMB) | | | 88.4 | | | | 61.6 | | | | 198.3 | |

| Mortgage management services | | | | | | | | | | | | |

| Net revenues (in thousands of RMB) | | | — | | | | 10,650 | | | | 32,926 | |

| Loan amount of referred mortgages (in thousands of RMB) | | | — | | | | 1,879,500 | | | | 5,956,100 | |

| Franchise services | | | | | | | | | | | | |

| Net revenues (in thousands of RMB) | | | 37,337 | | | | 56,633 | | | | 28,223 | |

| Number of regional sub-franchisors as of year end | | | 23 | | | | 28 | | | | 30 | |

| (1) | | Equals the sum of the number of operating sales offices that existed at the end of each month in the applicable year, divided by the number of months in such year. |

EXCHANGE RATE INFORMATION

Our business is primarily conducted in China, and all of our revenues and expenses are denominated in Renminbi. Unless otherwise noted, all translations from Renminbi to U.S. dollars have been made at a rate of RMB6.8259 to US$1.00, the rate as certified by the H.10 weekly statistical release of the Federal Reserve Board on December 31, 2009. We do not represent that Renminbi or U.S. dollar amounts could be converted into U.S. dollars or Renminbi, as the case may be, at any particular rate, the rates below or at all.

The following table sets forth the noon buying rate for U.S. dollars in New York City for cable transfers in Renminbi as certified for customs purposes by Federal Reserve Bank of New York for period ends indicated through December 2008 and the H.10 weekly statistical release of the Federal Reserve Board for period ends indicated from and after January 2009. These rates are provided solely for your convenience and will not use in the preparation of our periodic reports or any other information to be provided to you.

| | | Noon Buying Rate | |

| Period | | End | | | Average(1) | | | Low | | | High | |

| | | (RMB per US$1.00) | |

| 2004 | | | 8.2765 | | | | 8.2768 | | | | 8.2774 | | | | 8.2764 | |

| 2005 | | | 8.0702 | | | | 8.1826 | | | | 8.2765 | | | | 8.0702 | |

| 2006 | | | 7.8041 | | | | 7.9579 | | | | 8.0702 | | | | 7.8041 | |

| 2007 | | | 7.2946 | | | | 7.5806 | | | | 7.8127 | | | | 7.2946 | |

| 2008 | | | 6.8225 | | | | 6.9193 | | | | 7.2946 | | | | 6.7800 | |

| 2009 | | | 6.8259 | | | | 6.8295 | | | | 6.8470 | | | | 6.8176 | |

| December | | | 6.8259 | | | | 6.8275 | | | | 6.8299 | | | | 6.8244 | |

| 2010 | | | | | | | | | | | | | | | | |

| January | | | 6.8268 | | | | 6.8269 | | | | 6.8295 | | | | 6.8258 | |

| February | | | 6.8258 | | | | 6.8285 | | | | 6.8330 | | | | 6.8258 | |

| March | | | 6.8258 | | | | 6.8262 | | | | 6.8270 | | | | 6.8254 | |

| April | | | 6.8247 | | | | 6.8256 | | | | 6.8275 | | | | 6.8229 | |

| May | | | 6.8305 | | | | 6.8275 | | | | 6.8310 | | | | 6.8245 | |

| June (through June 21, 2010) | | | 6.7968 | | | | 6.8276 | | | | 6.8323 | | | | 6.7968 | |

| (1) | Annual averages are calculated by using the average of the exchange rates on the last day of each month during the relevant year. Monthly averages are calculated by using the average of the daily rates during the relevant month. |

| B. | CAPITALIZATION AND INDEBTEDNESS |

Not applicable.

| C. | REASONS FOR THE OFFER AND USE OF PROCEEDS |

Not applicable.

Risks Relating to Our Business

Our business is susceptible to fluctuations in the real estate market in China, and the property market in China is volatile and at an early stage of development, which could have a material and adverse effect on our business, financial condition and results of operations.

We conduct our real estate services business primarily in China, and our business depends substantially on the conditions of the real estate market in China. The real estate market in China remains at an early stage of development, and social, political, economic, legal and other factors may affect its development. For example, the lack of a mature and active secondary market for private properties and the limited amount of mortgage loans available to individuals in China may result in fluctuations in residential real estate markets. Although demand for private residential property in China has grown rapidly in recent years, this growth has often been coupled with volatile market conditions and fluctuations in property prices. For example, the rapid expansion of the property market in major provinces and cities, such as Beijing , Shanghai and Shenzhen, in the early 1990s, led to an oversupply in the mid-1990s and a corresponding fall in property values and rentals in the second half of the decade. We believe our business has been affected by fluctuations in the real estate market in China. For instance, our average monthly net revenues per operating sales office decreased by 36% and 23% in Beijing and Shanghai respectively, from 2007 to 2008. We believe this decrease was partially due to the weakness of the real estate market in China in 2008. On the other hand, our average monthly net revenues per operating sales office increased by 321.3% and 173.4% in these cities during the year ended December 31, 2009 compared to the same period in 2008. We believe such

increase was partially due to the recovery of real estate market in China during 2009. See “Item 5. Operating and Financial Review and Prospects—A. Operating Results—Results of Operations.” The PRC property market may experience, and transaction volume may be impacted by, undersupply or oversupply and property price fluctuations caused by economic, social, political and other factors. Any future overdevelopment in the property sector or other adverse changes in the economic, political or social environment in China may result in an oversupply of properties and a decrease in property prices and overall transaction activities, which could materially and adversely affect our business, financial condition and results of operations.

In addition, as all of our company-owned sales offices are strategically located in large metropolitan areas in Beijing, Shanghai and Shenzhen, any decrease in demand or any other adverse developments in these regions may materially and adversely affect our business, financial condition and results of operations.

Adverse developments in general business and economic conditions could have a material and adverse effect on our business, financial condition and results of operations.

Our business and operations are sensitive to general business and economic conditions globally and in China. These include short-term and long-term interest rates, inflation or deflation, fluctuations in debt and equity capital markets, consumer confidence and the general condition of the PRC and world economies. Certain recent adverse developments in the global financial markets have impacted the global economy. These developments include, among others, a general slowdown of economic growth in China, the U.S. and elsewhere globally, and substantial volatility and tightening of liquidity in financial and real estate markets. Numerous general business and economic factors could contribute to a real estate market downturn and adversely affect our business, including: (1) any systemic weakness in the banking and financial sectors; (2) any substantial declines in the stock markets or continued stock market volatility; (3) any increase in levels of unemployment; (4) a lack of available credit and lack of confidence in the financial sector; and (5) any general economic downturn in China or the global economy. Adverse developments in these general business and economic conditions could have a material and adverse effect on our business, financial condition and results of operations.

Our business could be materially and adversely affected by any government measures influencing China’s real estate industry.

The real estate market in China is typically affected by changes in government policies affecting the financial markets and related areas. In the past, the PRC government has adopted various administrative measures to restrain what it perceived as unsustainable growth in the real estate market, particularly when the real estate market in China has experienced rapid and significant growth. In 2007, home sales and prices in China rose rapidly to unprecedented levels, culminating in a housing downturn beginning in late 2007 due to the PRC government’s intervention in the real estate market to stabilize market prices and reduce market speculation. Although home sales and prices in China recovered in 2009, the PRC real estate market could experience a prolonged downturn in the future, which could have a material and adverse im pact on our business, financial condition and results of operations. The PRC government has promulgated a series of policies since late 2009 to cool down what is considered to be an over heated real estate market. These policies have aimed to stem rising prices by targeting financing rules, multiple-unit ownership and tax policy. Particularly, under the Circular on Determined Suppression of the Exceedingly Rapid Rise of Certain Urban Housing Prices, issued by the State Council on 17 April 2010, high down payment will be required if a family (including the borrower, spouse and minor children) purchases its first unit of self-occupied residential premises with a floor area of 90 square meeters or more, and higher down payment and loan interest will be imposed if a family purchases a second unit of residential premises. Meanwhile, in regions where the prices of commodity residential premises are exceedingly high or rising too rapidly, or where property is in short supply, commercial banks may suspend the grant of mortgage loans for purchase of a third unit or more of residential premises according to the risk position, and for non-local residents failing to provide at least one year's proof of local tax payment or social insurance contributions. These measures could affect the demand for real estate and thus adversely affect our real estate service business. Any of the following could cause a decline in home sales and prices or the related revenue we generate from our business:

| | • | any contractionary monetary policy adopted by the PRC government, including any significant rise in interest rates; |

| | | |

| | • | any adverse development in the credit markets and/or mortgage financing markets resulting from PRC government policies, such as the recent announcement in April 2010 regarding the stringent down-payment and interest rate requirements aimed at curtailing multiple home buyers; |

| | | |

| | • | any significant increase in transaction costs as a result of changes in PRC government policies regarding real estate transaction taxes, such as the recent announcement regarding the reinstatement of a sales tax on residential property sales by individuals within five years of purchase; |

| | | |

| | • | any adverse change in PRC government policies regarding the acquisition and/or ownership of real estate property, such as recently announced restrictions since April 2010 on the purchase of multiple homes for residents and non-residents in Beijing; |

| | | |

| | • | any adverse change in PRC national or local government policies or practices regarding brokerage, referral or franchise business or related fees and commissions; or |

| | | |

| | • | any other PRC government policies or regulations that burden real estate transactions or ownership. |

We experienced net losses for the years ended December 31, 2007 and 2008, and there is no assurance that we will be profitable in the future.

During the years ended December 31, 2007 and 2008, we experienced net losses of RMB72.8 million and RMB131.9 million, respectively, primarily due to expenses arising from the addition of a significant number of company-owned sales offices and, to a lesser extent, in 2008, the effects of the global economic downturn on the real estate industry in China. Consequently, our accumulated deficit was RMB268.0 million and RMB135.2 million as of December 31, 2008 and December 31, 2009, respectively. We expect to continue to increase costs and operating expenses as we implement initiatives to continue to grow our business, particularly our company-owned brokerage services business. If our net revenues do not increase to offset any expected increases in costs and operating expenses, we will not be profitable. You should not consider our r evenue growth in recent periods as indicative of our future performance. Net revenues in future periods could decline or grow more slowly than we expect. Although we had net income of RMB134.8 million for the year ended December 31, 2009, we cannot assure you that we will be profitable in the coming year, or that we will be able to maintain profitability in the future.

We do not own the CENTURY 21® brand and our right to use the CENTURY 21® brand is subject to risks and limitations.

Realogy owns the CENTURY 21® brand and system. Through our wholly owned subsidiary IFM Company Limited, or IFM Co, we hold the exclusive right to franchise, manage and operate the CENTURY 21 ® franchise network in China. Our interests and business strategies could be different from those of Realogy. See “Item 4. Information on the Company – B. Business Overview—Our Relationship with Realogy.” Any adverse development in our relationship with Realogy could have a material and adverse effect on our business, financial condition and results of operations.

Our rights to use the CENTURY 21® brand are set forth in our master sub-franchise agreement with Realogy. The master sub-franchise agreement has a term of 25 years starting from March 2000, extendable at our election for additional terms of 25 years upon payment of renewal fees. As contractual rights, our rights to use the CENTURY 21 ® brand remain subject to the risks and limitations customarily associated with contractual relationships, including but not limited to, a party’s right to terminate the agreement in the event the other party materially breaches the agreement, a party ’s right to terminate in certain specified circumstances, and the risk that the contract may be voided if either party were to enter bankruptcy or a similar restructuring process. An agreement could be rejected in connection with a bankruptcy of another party thereto if, in the business judgment of a trustee of a party, as debtor-in-possession, rejection of the contract would benefit a party’s estate. A bankruptcy by our licensor or any owner of the CENTURY 21 ® trademarks or system know-how could impede our right to use the CENTURY 21 ® brand and system. Any such adverse development could result in, among other things, an inability to use the CENTURY 21 ® brand and system, incurrence of material expenses in connection with building our brand or acquiring another brand to support our company-owned brokerage business and franchise services business, payment of fees or compensation relating to settlements with the regional sub-franchisors or franchisees that terminate their franchise relationships with us, or diminished market recognition, any or all of which could have a material and adverse effect on our business, financial condition and results of operations.

If the value of the CENTURY 21® brand or image diminishes, it could have a material and adverse effect on our business, financial condition and results of operations.

We believe the CENTURY 21® brand is associated with leadership in integrated and high quality real estate services among real estate market participants in China. The CENTURY 21 ® brand is important to our operations. Our continued success in maintaining and enhancing the CENTURY 21 ® brand and our image depends on our ability to satisfy customer needs by further developing and maintaining the quality of our services across our operations, as well as our ability to respond to competitive pressures. If we were unable to satisfy customer needs or if our public image or reputation we re otherwise diminished, our business transactions with our customers or the commission or franchise fees that we charge could decline, and we could face difficulties in attracting and retaining regional sub-franchisors, franchisees or sales professionals. If the value of the CENTURY 21 ® brand diminishes globally or in China, our business, financial condition and results of operations may be materially and adversely affected.

Any failure to protect our brand, trademarks and other intellectual property rights could have a negative impact on our business.

We believe the CENTURY 21® brand owned by Realogy and the trade secrets, copyrights and other intellectual property rights owned by us are important to our success. Any unauthorized use of these intellectual properties could harm our competitive advantages and business. Historically, China has not protected intellectual property rights to the same extent as the United States and infringement of intellectual property rights continues to pose a serious risk of doing business in China. Monitoring and preventing

unauthorized use is difficult. The measures we take to protect our intellectual property rights may not be adequate. Furthermore, the application and enforcement of laws governing intellectual property rights in China and abroad is uncertain and evolving, and could involve substantial risks. If we are unable to adequately protect the intellectual property rights that we own or use, we may lose these rights and our business, financial condition and results of operations may be materially and adversely affected.

Our continuing reliance on our information systems, which include our proprietary Sales Information System, or SIS, and our Human Resource and Commission Information System, or HCIS, each of which is copyright protected, depends in large part on retaining our proprietary rights to these information systems. We have also imposed contractual obligations on employees and consultants and taken other precautionary measures to maintain the confidentiality of our proprietary information, and have restricted the use of that proprietary information other than for our company’s benefit. If the copyrights for our information system are infringed, or our sales professionals, staff and consultants otherwise do not honor their contractual obligations and misappropriate our information systems , databases or other proprietary information, our business, financial condition and results of operations may be materially and adversely affected.

Competition in the real estate brokerage business in China is intense and may adversely affect our business, financial condition and results of operations.

Competition in the real estate brokerage business in China is intense, especially in the densely populated areas. We primarily compete with Centaline (China) Property Consultants Limited in the Beijing, Shanghai and Shenzhen markets for secondary real estate brokerage business, and to a lesser extent, with E-house (China) Holdings Limited in these cities for primary real estate brokerage business. We also compete with regional competitors in each of the regions where we own and operate sales offices. Some of these companies may have greater financial resources than we do, including greater marketing budgets and technological advantages. In addition, the secondary real estate brokerage industry has low capital commitment requirements for small operations, lowering the barriers to entry for new participants, especially participan ts pursuing alternative methods of marketing real estate, such as internet-based listing services. Real estate brokers compete for sales and marketing business primarily on the basis of the services offered, reputation, brand recognition, personal contacts, local expertise and brokerage commission rates. Any decrease in the market average brokerage commission rate may adversely affect our net revenues and profits. We also compete for the services of qualified sales professionals. Such competition could reduce commissions retained by our company after giving effect to the split with sales professionals and could increase the amounts that we spend on recruiting and retaining sales professionals.

We face competition in the franchise services business.

For our franchise services business, our products consist of our brand name and the support services we provide to our regional sub-franchisors and franchisees. We compete with regional and local real estate brokerage brand franchisors. In addition, other international real estate services brand franchisors, such as Coldwell Banker, have entered or plan to enter into the China market. Upon the expiration of a franchise agreement, a franchisee may choose to obtain a franchise from one of our competitors or operate as an independent broker. Competitors may offer our regional sub-franchisors and franchisees whose franchise agreements are expiring similar or better products and services at rates lower than what we or our regional sub-franchisors charge. To remain competitive in the sale of franchises and to retain our existing regi onal sub-franchisors and franchisees, we may have to reduce the fees we charge our regional sub-franchisors or franchisees.

We face competition in the mortgage management services business.

We face competition in the mortgage management services business from in-house mortgage management teams of our competitors in the brokerage business, commercial banks and specialized mortgage management services providers. Additionally, there may be adverse changes in national or local mortgage and banking practices, such as a recent agreement among certain commercial banks in Shanghai and Beijing to collectively cease to pay mortgage referral commissions in connection with secondary real estate transactions. Any increase in the level of competition or any negative development described above could materially and adversely affect our business, financial condition and results of operations.

If our company-owned or franchised sales offices fail to obtain or maintain licenses or permits necessary to engage in the real estate brokerage business, our business, financial condition and results of operations could be materially and adversely affected.

Our company-owned sales offices and franchised sales offices are required to obtain and maintain certain licenses and permits to engage in the real estate brokerage business. We and our regional sub-franchisors also need licenses and permits to operate our CENTURY 21 ® franchise network in China.

These licenses and permits are typically required to be renewed every one or two years. We are also subject to numerous national, provincial and local laws and regulations specific to the services we provide. If we or our regional sub-franchisors or franchisees fail to obtain or maintain the licenses and permits for conducting our company-owned brokerage or franchise services businesses required by law, the relevant governmental authorities may order us to suspend relevant operations or impose fines or other penalties. There is no assurance that we, our company-owned sales offices or our franchised sales offices will be able to obtain or renew these licenses in a timely manner, or at all.

Regional sub-franchisors and franchisees could take actions that could harm our business.

We do not own or control certain of our regional sub-franchisors and franchisees. These regional sub-franchisors and franchisees may not operate their business in a manner consistent with our standards, or may not hire and train qualified sales professionals and other employees. If these regional sub-franchisors or franchisees were to provide a diminished quality of service to their customers, our brand, reputation and goodwill may suffer. Additionally, our regional sub-franchisors and franchisees may engage in or be accused of engaging in unlawful or tortious conduct. Such conduct, or the accusation of such conduct, could harm our brand image, reputation or goodwill. Any of these incidents could in turn materially and adversely affect our business, financial condition and results of operations.

Our regional sub-franchisors and franchisees owned by independent business operators may from time to time disagree with our interpretation of our respective rights and obligations under the franchise agreements or fail to make timely service fees payments thereunder. This has led to disputes among the regional sub-franchisors, the franchisees and us in the past. We expect such disputes to occur from time to time in the future as we continue to offer franchise rights to third parties. To the extent we have such disputes, the attention of our management and our regional sub-franchisors or the franchisees will be diverted and our reputation may suffer as a result. Any of the aforementioned situations could have a material and adverse effect on our business, financial condition and results of operations.

The loss of any members of our senior management or other key sales professionals and staff could adversely affect our financial performance.

Our success depends on the continued service of our key executive officers, particularly Mr. Donald Zhang and Mr. Harry Lu. We do not carry key man life insurance on any of our personnel. The loss of the services of one or more members of our senior management team could hinder our ability to effectively manage our business and implement our growth strategies. If we lose the services of any of our key executive officers, we cannot assure you that we will be able to appoint or integrate adequate replacement personnel into our operations in a timely manner. Our failure to do so could in turn disrupt our operations and the growth of our business.

Our success largely depends on the efforts and abilities of our senior management team and the management teams of regional sub-franchisors and sales offices owned and operated by us. Our ability to retain our management teams is generally subject to numerous factors, including the compensation packages we offer and our ability to maintain a cohesive company culture and other factors. Any prolonged downturn in the real estate market and any cost cutting measures we implement could result in significant attrition among our current managers. If any member of our senior management team or other key sales professionals and staff joins a competitor or forms a competing company, we may lose customers, key sales professionals and staff, and we may not be able to promptly fill their positions with comparably qualified individuals without a significant increase in costs. Any of the foregoing adverse developments could materially and adversely affect our business, financial condition and results of operations.

We are subject to risks related to litigation filed by or against us, and adverse litigation results may harm our business and financial condition.

We have been, and may in the future be, a party to litigation and other proceedings filed by or against us, including actions relating to intellectual property, franchise or sub-franchise arrangements with our regional franchisors or franchisees, or vicarious liability based upon the conduct of our individual sales professionals and staff or agents. For example, we have occasionally resorted to litigation against certain of our regional sub-franchisors with whom we have terminated our relevant sub-franchise relationship for the sub-franchisor’s material breach of the regional sub-franchise agreement. In addition, we have litigated against third parties who have infringed the CENTURY 21 ® trademark. Although we have historically been succes sful in such litigation, we cannot predict the cost of such proceedings or their ultimate outcome, including any remedies or damages that may be awarded, and adverse results in such litigation and other proceedings may harm our business, financial condition and results of operations.

We are subject to risks related to the interim guarantees that we provide to our mortgage management services customers in Beijing.

As is customary in the mortgage management industry in Beijing, we provide interim guarantees to commercial banks in respect of the mortgage loans they extend to property buyers prior to the time when the mortgage registration certificate is issued to the bank by the applicable property registry. See “Item 4. Information on the Company—B. Business Overview—Our Services—Mortgage Management Services.” If a bank fails to obtain the mortgage registration certificate or the property buyer defaults on his payment obligations during the term of an interim guarantee, we may be required to pay the amount of the delinquent mortgage payments or any measurable loss suffered by the bank. If multiple home buyers default on their payment obligations at around the same time, we will be required to make significant pa yments to the banks to satisfy our guarantee obligations. If we are unable to recover the amounts paid with respect to our guarantees, we will suffer financial losses. As of December 31, 2008 and December 31, 2009, the contingent guarantee obligation in connection with our provision of interim guarantees amounted to RMB227.8 million and RMB718.7 million, respectively. We have not experienced any losses associated with our interim guarantees for the years ended December 31, 2007, 2008 and 2009. If substantial and widespread defaults by our customers occur at the time when the real estate market deteriorates rapidly and for a sustained period and we are called upon to honor our guarantees, our financial condition and results of operations will be materially and adversely affected.

We rely on our information systems to operate our business and maintain our competitiveness, and any disruption to it could harm our business.

Our business depends upon the use of information systems, including systems providing real-time and in-depth management and sales information and support to our network of sales offices and marketing efforts. We rely significantly on our in-house information technology team with support from third-party outsourcing firms, to develop, maintain and regularly upgrade our information systems. In addition, some operations of these information systems depend upon third party technologies, systems and services. We cannot assure you that we will continue to have access to the products or services provided by our third party providers on commercially reasonable terms, or at all. We also cannot assure you that we will be able to continue to effectively operate and maintain our information systems, or to effectively retain our key personn el for the maintenance and management of our information systems.

In addition, we expect to refine and enhance our information systems on an ongoing basis, and we expect that advanced new technologies and systems will continue to be introduced. We may not be able to replace our existing information systems or introduce new information systems as quickly as our competitors or in a cost-effective manner.

In addition, our information systems are vulnerable to damage or interruption from various causes, including (1) natural disasters, war and acts of terrorism, (2) power losses, computer system failures, internet and telecommunications or data network failures, operator error, losses and corruption of data, and similar events and (3) computer viruses, penetration by individuals seeking to disrupt operations or misappropriate information and other physical or electronic breaches of security. While we maintain certain disaster recovery capabilities for critical functions in most of our businesses, these capabilities may not successfully prevent a disruption to or material and adverse effect on our businesses or operations in the event of a disaster or other business interruption. Any extended interruption in our inf ormation systems could significantly reduce our ability to conduct our business and generate revenue. Additionally, we do not carry business interruption insurance for any losses that may occur.

If we cannot manage our growth, our operating results or profitability could be materially and adversely affected.

We have experienced substantial growth since we began operations in 2000. Our net revenues amounted to RMB38.4 million in 2006, RMB189.0 million in 2007, RMB273.4 million in 2008, and RMB651.7 million in 2009. We intend to continue to expand our operations, which will continue to place substantial demands on our managerial, operational, financial, technological and other resources. Our planned expansion will also place significant demands on us to ensure that our brand does not suffer as a result of any decreases, whether actual or perceived, in the quality of our services. In order to manage and support our growth, we must continue to improve our existing operational, administrative and technological systems and our financial and management controls, and recruit, train and retain additional qualified sales professionals as wel l as other administrative and sales and marketing personnel, particularly as we expand into new markets. We may not be able to effectively and efficiently manage the growth of our operations, recruit and retain qualified personnel and integrate new expansion into our operations. During our expansion, we may also face other difficulties as a result of a number of factors, many of which are beyond our control, such as any general unfavorable conditions in the real estate market, cost overruns due to price increases by third party vendors or delays or denials of required approvals by relevant government authorities. As a result, our operating results or profitability could be materially and adversely affected.

We may not be successful in our business expansions through future acquisitions.

We have established our company-owned brokerage services business in Shanghai and Shenzhen through acquisitions. In territories where we do not have company-owned sales offices, one of our expansion strategies is to establish our own brokerage services business by acquiring existing chains of sales stores or regional sub-franchisors when their operations become mature and profitable. However, our experience in Shanghai and Shenzhen may not be replicable in other areas of China. The success of our acquisition strategy will also depend upon our ability to negotiate with acquisition targets on favorable terms, and to finance and complete these transactions.

We also need to effectively integrate newly-acquired brokerage businesses into our existing operations, which may involve complex operational and personnel-related challenges, including rectifying possible inconsistencies in standards, controls, procedures and policies, maintaining important business relationships, overcoming local cultural differences, and controlling unanticipated expenses related to such integration. We may also incur material costs relating to such integration. A prolonged diversion of management’s attention and any delays or difficulties we encounter in connection with the integration of any business that we have acquired or may acquire in the future could prevent us from realizing the anticipated cost savings and revenue growth from our acquisitions.

We may be unable to obtain adequate financing to fund our capital requirements.

We expect that over the next several years, a substantial portion of our cash flow will be used to finance the expansion of our company-owned brokerage services business to increase our market share in existing markets and to expand our geographical presence. Although we anticipate that our available funds and expected cash flows from operations will be sufficient to meet our cash needs for at least the next twelve months, this assumption is based on management’s ability to successfully execute its business plan, which includes increasing sales, generating positive operating cash flows and obtaining additional funding to support longer term capital requirements. We cannot assure you that we will obtain such financing at a reasonable cost or at all. Our inability to finance our planned capital expenditures or future acquis itions could materially and adversely affect our business, financial condition and results of operations.

We may not be able to successfully execute our business development strategy, which could have a material and adverse effect on our business, financial condition and results of operations.

We plan to continue to expand our business into new geographical areas in China and to enter into new businesses to diversify our portfolio of products and services. Because China is a large and diverse market, home buying trends and demands may vary significantly by region, and our experience in the markets in which we currently operate may not be applicable in other parts of China. As a result, we may not be able to leverage our experience to expand into other parts of China or to enter into businesses with respect to new products or services. When we enter new markets, we may face intense competition from companies with greater experience or an established presence in the targeted areas or from other companies with similar expansion targets. In addition, our business model may not be successful in new and untested markets. T herefore, we may not be able to successfully execute our business development strategy, which could have a material and adverse effect on our business, financial condition and results of operations.

We may not maintain sufficient insurance coverage for the risks associated with our business operations.

Risks associated with our businesses and operations include but are not limited to claims for wrongful acts committed by our sales professionals, disputes with our regional sub-franchisors or franchisees that we do not own, the loss of intellectual property rights or the failure of information technology systems crucial to our operations, the loss of key personnel and risks posed by natural disasters. Any of these risks may result in significant losses. We maintain insurance coverage we consider customary in China for the industry in which we operate and in compliance with the insurance requirements imposed on us by our master sub-franchise agreement with Realogy. However, we cannot assure you that our insurance coverage is sufficient to cover any losses that we may sustain, or that we will be able to successfully claim our los ses under our existing insurance policy on a timely basis or at all.

If we incur any loss not covered by our insurance policies, or the compensated amount is significantly less than our actual loss or is not timely paid, our business, financial condition and results of operations could be materially and adversely affected.

When preparing our consolidated financial statements for the years ended December 31, 2007 and 2008, we noted one material weakness in our internal control over financial reporting. If we fail to implement and maintain effective internal control over financial reporting, our ability to accurately report our financial results may be impaired, which could adversely impact investor confidence and the market price of our ADSs.

Prior to our initial public offering, we were a private company with limited accounting and other resources with which to adequately address our internal controls and procedures. When preparing our consolidated financial statements for the years ended December 31, 2007 and 2008, we noted one material weakness in our internal control over financial reporting relating to a lack of sufficient resources to perform period-end financial reporting procedures, address complex accounting issues under US GAAP and prepare and review financial statements and related disclosures under US GAAP. This material weakness resulted in adjustments to the company’s consolidated financial statements for the years ended December 31, 2007 and 2008.

If the material weakness is not remedied or recurs, or if we identify additional weaknesses or fail to timely and successfully implement new or improved controls, our ability to assure timely and accurate financial reporting may be adversely affected, we may be required to restate our financial statements, and we could suffer a loss of investor confidence in the reliability of our financial statements, which in turn could negatively impact the trading price of our ADSs, result in lawsuits being filed against us by our shareholders, or otherwise harm our reputation.

Seasonality in the real estate market could adversely affect our business.

The real estate brokerage business is subject to seasonal fluctuations. Historically, real estate brokerage revenues and transaction volumes have generally been low during January and February as well as the late summer months in China. However, many of our expenses, such as those relating to leasing, administrative or sales and marketing efforts, are fixed and cannot be reduced during a seasonal slowdown. As a result, our operating results have fluctuated from quarter to quarter. These fluctuations are likely to continue and operating results for any period may not be indicative of our performance in any future period. If our operating results for any quarterly period fall below investor expectations or estimates by securities research analysts, the trading price of our ADSs may decline.

Our corporate actions are substantially controlled by Mr. Donald Zhang and Mr. Harry Lu.

As of the date of this annual report, Mr. Donald Zhang, our chairman and chief executive officer, and Mr. Harry Lu, our vice chairman and president, beneficially own approximately 38.4% of our outstanding shares. Accordingly, Messrs. Zhang and Lu have significant influence in determining the outcome of any corporate transaction or other matters submitted to our shareholders for approval, including mergers, consolidations and the sale of all or substantially all of our assets, the election of directors and other significant corporate actions. This concentration of ownership may also discourage, delay or prevent a change in control of our company, which could deprive our shareholders of an opportunity to receive a premium for their shares as part of a sale of our company and might reduce the price of our ADSs. These act ions may be taken even if they are opposed by our other shareholders.

As a foreign private issuer, we are permitted to, and we will, rely on exemptions from certain New York Stock Exchange corporate governance standards applicable to U.S. issuers, including the requirements that a majority of an issuer’s directors consist of independent directors. This may afford less protection to our holders of ordinary shares and ADSs.

Section 303A of the Corporate Governance Rules of the New York Stock Exchange requires listed companies to have, among other things, a majority of its board members be independent and a nominating and corporate governance committee consisting solely of independent directors. As a foreign private issuer, however, we are permitted to, and we will, follow home country practice in lieu of the above requirements. The corporate governance practice in our home country, the Cayman Islands, does not require a majority of our board to consist of independent directors or the implementation of a nominating and corporate governance committee. Since a majority of our board of directors will not consist of independent directors as long as we rely on the foreign private issuer exemption, fewer board members will be exercising independent judgm ent and the level of board oversight on the management of our company may decrease as a result.

An occurrence of a widespread health epidemic or other outbreaks could have a material and adverse effect on our business, financial condition and results of operations.

Our business could be adversely affected by the effects of Influenza A virus subtype H1N1, or A (H1N1), Severe Acute Respiratory Syndrome, or SARS, avian influenza or other epidemics or outbreaks on the economic and business climate. A prolonged outbreak of A (H1N1), any recurrence of SARS, avian influenza or other adverse public health developments in China or elsewhere in the world could have a material and adverse effect on our business operations. Such outbreaks could significantly impact the real estate market and cause a temporary closure of our facilities. Such impact or closures would severely disrupt our operations and adversely affect our business, financial condition and results of operations. Our operations could be disrupted if any of our sales professionals, staff or customers were suspected of having

A (H1N1), SARS or avian influenza, since this could require us to quarantine some or all of our sale professional and staff or disinfect our facilities and may deter our customers or potential customers from visiting our sales offices. In addition, our business, financial condition and results of operations could be adversely affected to the extent that A (H1N1), SARS, avian influenza or other outbreak harms the global or Chinese economy in general.

Risks Related to Doing Business in China

Adverse changes in economic and political policies of the PRC government could have a material and adverse effect on overall economic growth in China, which could materially and adversely affect our business.

We conduct substantially all of our business operations in China. As the real estate sector is highly sensitive to business and personal discretionary spending levels, it tends to decline during general economic downturns. Accordingly, our business, financial condition, results of operations and prospects depend to a significant degree on economic developments in China. China’s economy differs from the economies of most other countries in many respects, including with respect to the amount of government involvement in the economy, the general level of economic development, growth rates and government control of foreign exchange and the allocation of resources. While the PRC economy has experienced significant growth in the past 30 years, this growth has remained uneven across different periods, regions and among various e conomic sectors. The PRC government has implemented various measures to encourage economic development and guide the allocation of resources. The PRC government also exercises significant control over China’s economic growth through the allocation of resources, controlling the payment of foreign currency-denominated obligations, setting monetary policy and providing preferential treatment to particular industries or companies. Since late 2003, the PRC government has implemented a number of measures, such as increasing the People’s Bank of China’s statutory deposit reserve ratio and imposing commercial bank lending guidelines, which had the effect of slowing the growth of credit availability. In 2008 and 2009, however, in response to the global financial crisis, the PRC government has loosened such requirements. Any future actions and policies adopted by the PRC government could materially affect the Chinese economy and slow the growth of the real estate market in China, which could material ly and adversely affect our business.

We rely principally on dividends and other distributions on equity paid by our subsidiaries in China to fund our cash and financing requirements, and any limitation on the ability of our subsidiaries to make payments to us could have a material and adverse effect on our ability to conduct our business.

We are an offshore holding company, and we rely principally on dividends from our subsidiaries in China for our cash requirements, including for the service of any debt we may incur. Current PRC regulations permit our subsidiaries to pay dividends to us only out of their accumulated profits, if any, determined in accordance with Chinese accounting standards and regulations. In addition, each of our subsidiaries in China is required to set aside a certain amount of its after-tax profits each year, if any, to fund certain statutory reserves. These reserves are not distributable as cash dividends. Furthermore, if our subsidiaries in China incur debt on their own behalf in the future, the instruments governing the debt may restrict their ability to pay dividends or make other payments to us. Any limitation on the ability of our sub sidiaries to distribute dividends or other payments to us could materially and adversely limit our ability to grow, make investments or acquisitions that could be beneficial to our businesses, pay dividends or otherwise fund and conduct our business.

PRC regulation of loans to and direct investments in PRC entities by offshore holding companies may delay or prevent us from using the proceeds of our initial public offering to make loans or additional capital contributions to our PRC operating subsidiaries.

We may make loans to our PRC subsidiaries. Any loans to or investments in our PRC subsidiaries are subject to approval by or registration with relevant governmental authorities in China. We may also decide to finance our subsidiaries by means of capital contributions. According to the relevant PRC regulations on foreign-invested enterprises in China, depending on the total amount of investment, capital contributions to our PRC operating subsidiaries may be subject to the approval of the PRC Ministry of Commerce or its local branches. We may not obtain these government approvals on a timely basis, if at all, with respect to future capital contributions by us to our subsidiaries. If we fail to receive such approvals, our ability to use the proceeds of our initial public offering and to capitalize our PRC operations may be negativ ely affected, which could adversely affect our liquidity and our ability to fund and expand our business.

Fluctuations in the value of the RMB may have a material and adverse effect on your investment.

The value of the RMB against the U.S. dollar and other currencies may fluctuate and is affected by, among other things, changes in political and economic conditions and the foreign exchange policy adopted by the PRC government. On July 21, 2005, the PRC government changed its policy of pegging the value of the Renminbi to the U.S. dollar. Under the new policy, the Renminbi is permitted to fluctuate within a narrow and managed band against a basket of certain foreign currencies. Following the removal of the U.S. dollar peg, the Renminbi appreciated more than 20% against the U.S. dollar over the following three years. Since July 2008, however, the Renminbi has traded stably within a narrow range against the U.S. dollar.

There remains significant international pressure on the PRC government to adopt an even more flexible currency policy, which could result in a further and more significant appreciation of the Renminbi against foreign currencies. Our revenues and costs are mostly denominated in the Renminbi, and a significant portion of our financial assets are also denominated in the Renminbi. Any significant fluctuations in the exchange rate between the Renminbi and the U.S. dollar may materially and adversely affect our cash flows, revenues, earnings and financial position, and the amount of and any dividends we may pay on our ADSs in U.S. dollars. Any fluctuations in the exchange rate between the RMB and the U.S. dollar could also result in foreign currency translation losses for financial reporting purposes.

Governmental control of currency conversion may limit our ability to utilize our revenues effectively and affect the value of your investment.

The PRC government imposes controls on the convertibility of the RMB into foreign currencies and, in certain cases, the remittance of currency out of China. We receive substantially all of our revenues in RMB. Under our current corporate structure, our Cayman Islands holding company may rely on dividend payments from our PRC subsidiaries to fund any cash and financing requirements we may have. Under existing PRC foreign exchange regulations, payments of current account items, including profit distributions, interest payments and trade and service-related foreign exchange transactions, can be made in foreign currencies without prior approval from State Administration of Foreign Exchange by complying with certain procedural requirements. Therefore, our PRC subsidiaries are able to pay dividends in foreign currencies to us without prior approval from State Administration of Foreign Exchange by complying with certain procedural requirements. But approval from or registration with appropriate government authorities is required where RMB is to be converted into foreign currency and remitted out of China to pay capital expenses such as the repayment of loans denominated in foreign currencies. This could affect the ability of our PRC subsidiaries to obtain foreign exchange through debt or equity financing, including by means of loans or capital contributions from us. The PRC government may also at its discretion restrict access in the future to foreign currencies for current account transactions. If the foreign exchange control system prevents us from obtaining sufficient foreign currencies to satisfy our foreign currency demands, we may not be able to pay dividends in foreign currencies to our shareholders, including holders of our ADSs.

Recent PRC regulations relating to the establishment of offshore special purpose companies by PRC domestic residents may subject our PRC resident beneficial owners to personal liability, limit our ability to inject capital into our PRC subsidiaries, limit our subsidiaries’ ability to increase their registered capital or distribute profits to us, or may otherwise adversely affect us.

China has regulations that subject our PRC subsidiaries to additional restrictions if we have beneficial owners of our company who are PRC residents that have not properly filed with authorities in China. See “Item 4. Information on the Company—B. Business Overview—Regulations—Regulations on Foreign Exchange Registration of Offshore Investment by PRC Residents.” Currently, we do not have beneficial owners whom we know to be PRC residents. However, we cannot provide any assurances that any PRC resident who becomes our beneficial owner in the future will be able to comply with relevant State Administration of Foreign Exchange of the PRC, or SAFE regulations in a timely manner, or at all. Any failure or inability of our PRC resident beneficial owners to comply with the registration procedures may subj ect such PRC resident beneficial owners to certain fines and legal sanctions, restrict our cross-border investment and financing activities, or limit our PRC subsidiaries’ ability to distribute dividends or obtain foreign exchange-denominated loans.

As it remains uncertain how the SAFE regulations will be interpreted or implemented, we cannot predict how these regulations will affect our business operations or future strategy. For example, we may be subject to more stringent review and approval processes with respect to our foreign exchange activities, such as remittance of dividends and foreign-currency-denominated borrowings, which may adversely affect our business, financial condition and results of operations. In addition, if we decide to acquire a PRC domestic company, we cannot assure you that we or the owners of such company, as the case may be, will be able to obtain the necessary approvals or complete the necessary filings and registrations required by the SAFE regulations. This may restrict our ability to implement our acquisition strategy and could adversely aff ect our business and prospects.