- TDOC Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

425 Filing

Teladoc Health (TDOC) 425Business combination disclosure

Filed: 2 Oct 20, 5:05pm

Filed by Teladoc Health, Inc.

Pursuant to Rule 425 under the Securities Act of 1933

and deemed filed pursuant to Rule 14a-6

under the Securities Exchange Act of 1934

Subject Company: Livongo Health, Inc.

Commission File No. 001-38983

Date: October 2, 2020

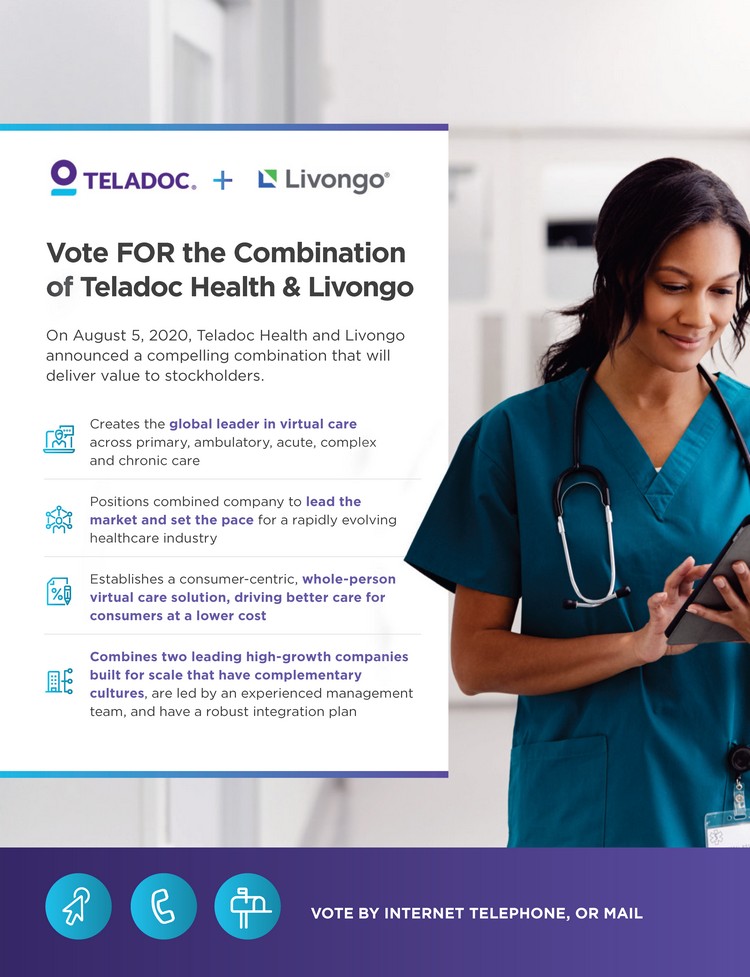

| Vote FOR t of Teladoc On August 5, 2020, announced a compe deliver value to stoc Creates the glo across primary, and chronic car Positions combi market and set healthcare indu Establishes a co virtual care sol consumers at a Combines two built for scale t cultures, are led team, and have he Combination o s t Teladoc Health and Livongo Health & Livong lling combination that will kholders. bal leader in virtual care ambulatory, acute, complex e deliver value to stockholders. Creates the global leader in virtual care across primary, ambulatory, acute, complex and chronic care ned company to lead the the pace for a rapidly evolving stry healthcare industry nsumer-centric, whole-person ution, driving better care for lower cost consumers at a lower cost hat have complementary a robust integration plan leading high-growth companie by an experienced managemen team, and have a robust integration plan VOTE BY INTERNET TELEPHONE, OR MAIL |

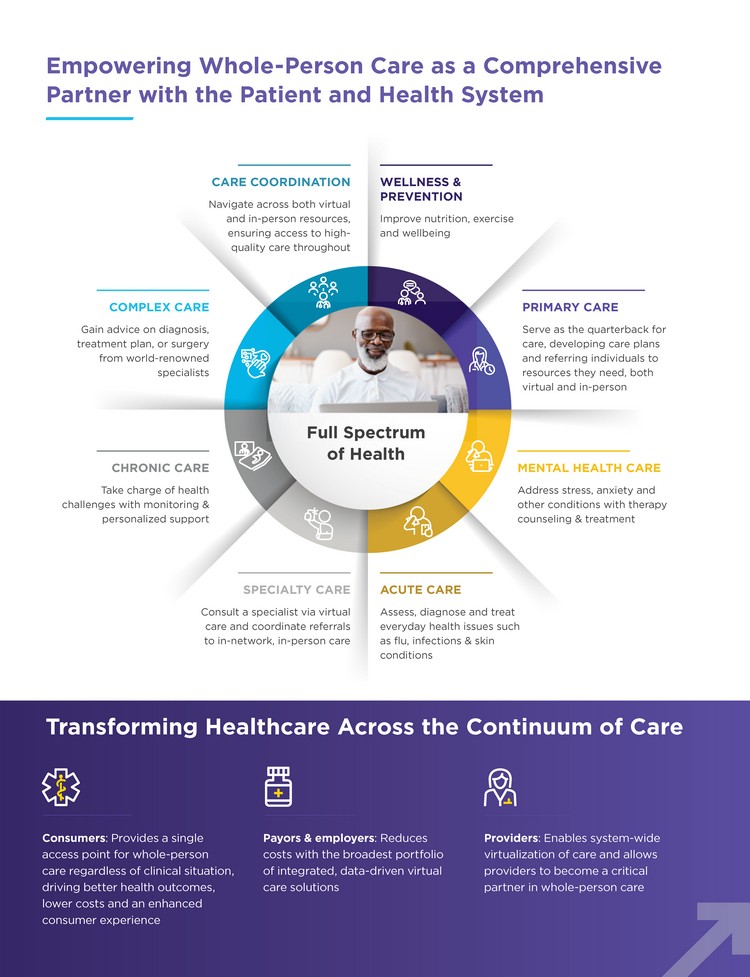

| Empowering Whole-Person Care as a Comprehensive Partner with the Patient and Health System CARE COORDINATION Navigate across both virtual and in-person resources, ensuring access to high-quality care throughout WELLNESS & PREVENTION Improve nutrition, exercise and wellbeing COMPLEX CARE Gain advice on diagnosis, treatment plan, or surgery from world-renowned specialists PRIMARY CARE Serve as the quarterback for care, developing care plans and referring individuals to resources they need, both virtual and in-person CHRONIC CARE Take charge of health challenges with monitoring & personalized support Full Spectrum of Health MENTAL HEALTH CARE Address stress, anxiety and other conditions with therapy counseling & treatment SPECIALTY CARE Consult a specialist via virtual care and coordinate referrals to in-network, in-person care ACUTE CARE Assess, diagnose and treat everyday health issues such as flu, infections & skin conditions Transforming Healthcare Across the Continuum of Care Consumers: Provides a single access point for whole-person care regardless of clinical situation, driving better health outcomes, lower costs and an enhanced consumer experience Payors & employers: Reduces costs with the broadest portfolio of integrated, data-driven virtual care solutions Providers: Enables system-wide virtualization of care and allows providers to become a critical partner in whole-person care |

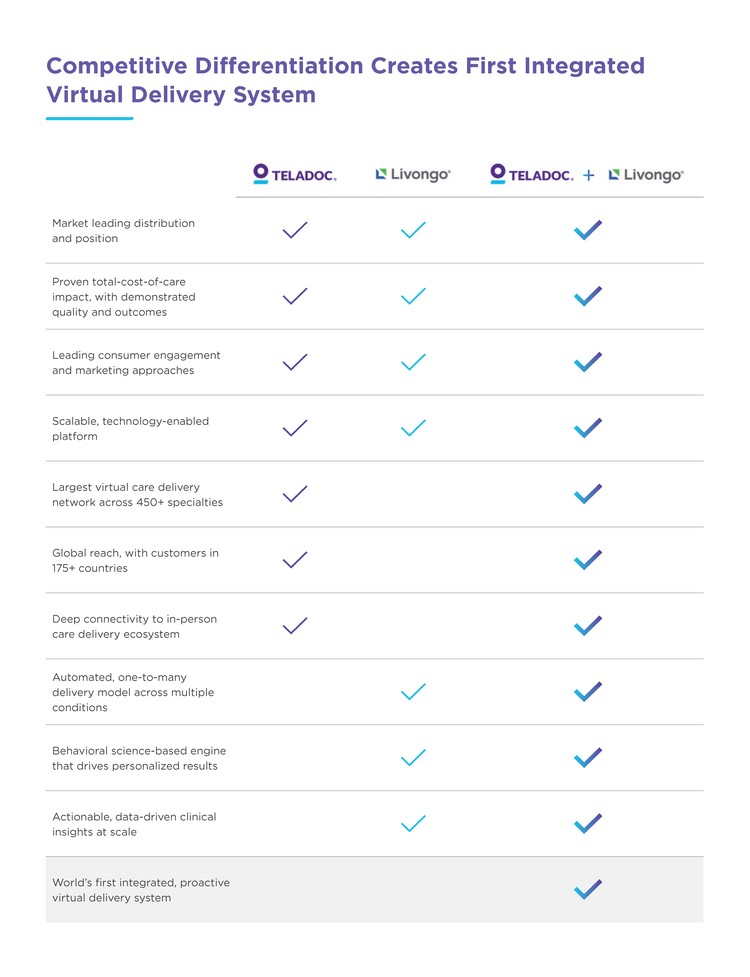

| Market leading distribution and position Proven total-cost-of-care impact, with demonstrated quality and outcomes Leading consumer engagement and marketing approaches Scalable, technology-enabled platform Largest virtual care delivery network across 450+ specialties Global reach, with customers in 175+ countries Deep connectivity to in-person care delivery ecosystem Automated, one-to-many delivery model across multiple conditions Behavioral science-based engine that drives personalized results Actionable, data-driven clinical insights at scale World’s first integrated, proactive virtual delivery system |

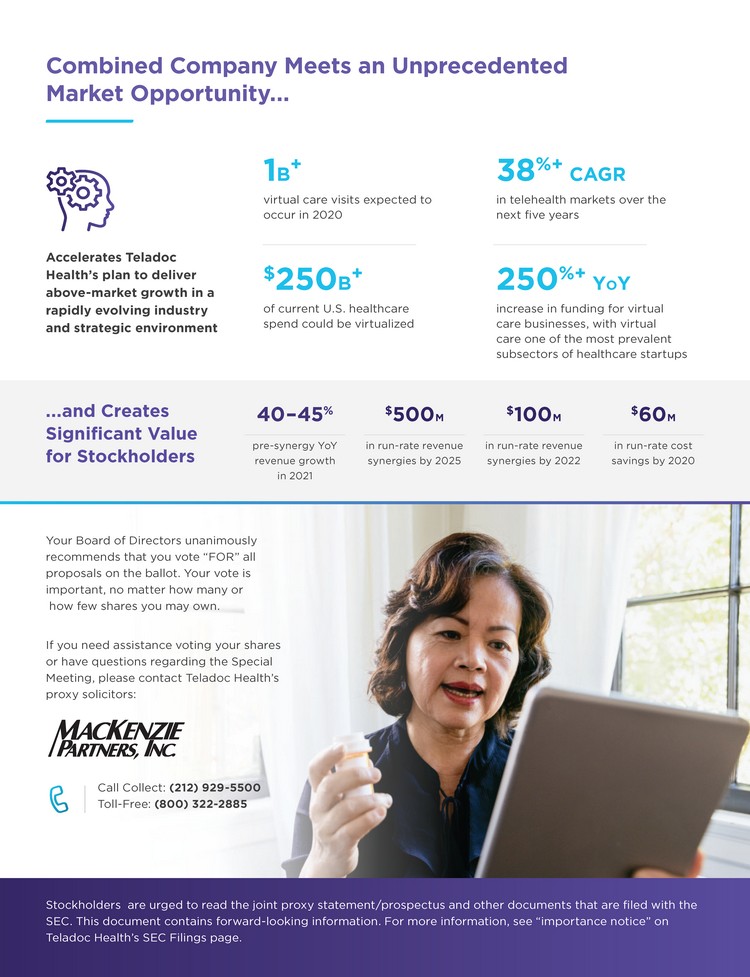

| 1 B CAGR virtual care visits expected to occur in 2020 in telehealth markets over the next five years Accelerates Teladoc Health’s plan to deliver above-market growth in a B 250%+ YOY rapidly evolving industry and strategic environment of current U.S. healthcare spend could be virtualized increase in funding for virtual care businesses, with virtual care one of the most prevalent subsectors of healthcare startups ...and Creates Significant Value for Stockholders 40–45% pre-synergy YoY revenue growth in 2021 $500M in run-rate revenue synergies by 2025 $100M in run-rate revenue synergies by 2022 $60M in run-rate cost savings by 2020 Your Board of Directors unanimously recommends that you vote “FOR” all proposals on the ballot. Your vote is important, no matter how many or how few shares you may own. If you need assistance voting your shares or have questions regarding the Special Meeting, please contact Teladoc Health’s proxy solicitors: Call Collect: (212) 929-5500 Toll-Free: (800) 322-2885 Stockholders are urged to read the joint proxy statement/prospectus and other documents that are filed with the SEC. This document contains forward-looking information. For more information, see “importance notice” on Teladoc Health’s SEC Filings page. |

| IMPORTANT REMINDER Dear Fellow Stockholder: By now, you should have received your proxy materials for the Teladoc Health Special Meeting of stockholders related to the proposed merger with Livongo scheduled to take place on October 29, 2020. Your Board of Directors unanimously recommends that you vote “FOR” all proposals on the ballot. Your vote is important, no matter how many or how few shares you may own. Since our IPO, Teladoc Health has moved ahead of the industry and delivered substantial value to stockholders by launching dozens of products and partnerships and strategically acquiring companies. Now, by combining with Livongo, we are creating an entirely new category of whole-person virtual care at a time when the world needs and demands it. The combination of Teladoc Health and Livongo meets an unprecedented market opportunity. Together, we will provide the only consumer centered virtual care platform for the full spectrum of health needs, creating a new standard in global healthcare delivery, access and experience. TOGETHER, TELADOC HEALTH AND LIVONGO: Delivers significant financial benefits and value creation for stockholders through clearly identifiable run-rate revenue synergies of $100 million by 2022 and $500 million by 2025, and $60 million in run-rate cost synergies by 2022 Reduce costs for payors and employers with the broadest portfolio of integrated, data-driven virtual care solutions Enable providers to achieve system-wide virtualization of care and become a critical partner in whole-person care Provide consumers with a single access point for whole-person care regardless of clinical situation, driving better health outcomes, lower costs and an enhanced consumer experience Led by a proven, visionary management team and talented employees with shared values, committed to the combined company’s success If you have not already done so, PLEASE CAST YOUR VOTE TODAY by telephone, via the Internet, or by signing, dating and returning the enclosed proxy card in the envelope provided. Instructions on how to vote your shares by Internet or telephone are enclosed with this letter. On behalf of the Board of Directors, thank you for taking the time to vote your shares. Sincerely, The Teladoc Health Board of Directors If you need assistance voting your shares or have questions regarding the Special Meeting, please contact Teladoc Health’s proxy solicitors: Call Collect: (212) 929-5500 Toll-Free: (800) 322-2885 |

| Cautionary Note Regarding Forward-Looking Statements This communication contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These forward-looking statements generally include statements regarding the potential transaction between Teladoc Health, Inc. (“Teladoc”) and Livongo Health, Inc. (“Livongo”), including any statements regarding the expected timetable for completing the potential transaction, the ability to complete the potential transaction, the expected benefits of the potential transaction (including anticipated synergies, projected financial information and future opportunities) and any other statements regarding Teladoc’s and Livongo’s future expectations, beliefs, plans, objectives, results of operations, financial condition and cash flows, or future events or performance. These statements are often, but not always, made through the use of words or phrases such as “anticipate,” “intend,” “plan,” “believe,” “project,” “estimate,” “expect,” “may,” “should,” “will” and similar expressions. All such forward-looking statements are based on current expectations of Teladoc’s and Livongo’s management and therefore involve estimates and assumptions that are subject to risks, uncertainties and other factors that could cause actual results to di er materially from the results expressed in the statements. Key factors that could cause actual results to di er materially from those projected in the forward-looking statements include the ability to obtain the requisite Teladoc and Livongo stockholder approvals; uncertainties as to the timing to consummate the potential transaction; the risk that a condition to closing the potential transaction may not be satisfied; the risk that the anticipated U.S. federal income tax treatment of the transaction is not obtained; litigation relating to the potential transaction that have been or could be instituted against Teladoc, Livongo or their respective directors; the e ects of disruption to Teladoc’s or Livongo’s respective businesses; restrictions during the pendency of the potential transaction that may impact Teladoc’s or Livongo’s ability to pursue certain business opportunities or strategic transactions; the e ect of this communication on Teladoc’s or Livongo’s stock prices; transaction costs; Teladoc’s ability to achieve the benefits from the proposed transaction; Teladoc’s ability to e ectively integrate acquired operations into its own operations; the ability of Teladoc or Livongo to retain and hire key personnel; unknown liabilities; and the diversion of management time on transaction-related issues. Other important factors that could cause actual results to di er materially from those in the forward-looking statements include the e ects of industry, market, economic, political or regulatory conditions outside of Teladoc’s or Livongo’s control (including public health crises, such as pandemics and epidemics); changes in laws and regulations applicable to Teladoc’s business model; changes in market conditions and receptivity to Teladoc’s services and o erings; results of litigation; the loss of one or more key clients of Teladoc (including potential adverse reactions or changes to business relationships resulting from the announcement or completion of the potential transaction); changes to Teladoc’s abilities to recruit and retain qualified providers into its network; the impact of the COVID-19 pandemic on the parties’ business and general economic conditions; risks regarding Livongo’s ability to retain clients and sell additional solutions to new and existing clients; Livongo’s ability to attract and enroll new members; the growth and success of Livongo’s partners and reseller relationships; Livongo’s ability to estimate the size of its target market; uncertainty in the healthcare regulatory environment; and the factors set forth under the heading “Risk Factors” of Teladoc’s Annual Report and Livongo’s Annual Report, in each case on Form 10-K, and in subsequent filings with the U.S. Securities and Exchange Commission (the “SEC”). These risks, as well as other risks associated with the potential transaction, are more fully discussed in the joint proxy statement/prospectus filed with the SEC in connection with the proposed transaction. Other unpredictable or unknown factors not discussed in this communication could also have material adverse e ects on forward-looking statements. Neither Teladoc nor Livongo assumes any obligation to update any forward-looking statements, except as required by law. Readers are cautioned not to place undue reliance on these forward-looking statements that speak only as of the date hereof. No Ofer or Solicitation This communication does not constitute an o er to sell or the solicitation of an o er to buy any securities or a solicitation of any vote or approval, nor shall there be any sale of securities in any jurisdiction in which such o er, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No o er of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended. Important Information for Investors and Stockholders In connection with the potential transaction, Teladoc has filed a registration statement on Form S-4 (File No. 333-248568) with the SEC containing a prospectus of Teladoc that also constitutes a definitive joint proxy statement of each of Teladoc and Livongo. The registration statement, as amended, was declared e ective by the SEC on September 15, 2020. Each of Teladoc and Livongo commenced mailing copies of the definitive joint proxy statement/ prospectus to stockholders of Teladoc and Livongo, respectively, on or about September 15, 2020. Teladoc and Livongo may also file other documents with the SEC regarding the potential transaction. This communication is not a substitute for the joint proxy statement/prospectus or registration statement or for any other document that Teladoc or Livongo have filed or may file with the SEC in connection with the potential transaction. INVESTORS AND SECURITY HOLDERS OF TELADOC AND LIVONGO ARE URGED TO READ THE JOINT PROXY STATEMENT/PROSPECTUS AND OTHER DOCUMENTS THAT ARE FILED OR WILL BE FILED WITH THE SEC, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THESE DOCUMENTS, CAREFULLY AND IN THEIR ENTIRETY BECAUSE THEY CONTAIN IMPORTANT INFORMATION. Investors and security holders will be able to obtain free copies of the joint proxy statement/prospectus and other documents filed with the SEC by Teladoc or Livongo through the website maintained by the SEC at http://www.sec.gov. Copies of the documents filed with the SEC by Teladoc will be available free of charge on Teladoc’s website at https://ir.teladochealth.com and copies of the documents filed with the SEC by Livongo will be available free of charge on Livongo’s website at https://ir.livongo.com/. Additionally, copies may be obtained by contacting the investor relations departments of Teladoc or Livongo. Teladoc and Livongo and certain of their respective directors, certain of their respective executive ofcers and other members of management and employees may be considered participants in the solicitation of proxies with respect to the potential transaction under the rules of the SEC. Information about the directors and executive ofcers of Teladoc is set forth in its proxy statement for its 2020 annual meeting of stockholders, which was filed with the SEC on April 14, 2020. Information about the directors and executive ofcers of Livongo is set forth in its Annual Report on Form 10-K for the year ended December 31, 2019, which was filed with the SEC on March 24, 2020, and its proxy statement for its 2020 annual meeting of stockholders, which was filed with the SEC on April 6, 2020. These documents can be obtained free of charge from the sources indicated above. Additional information regarding the interests of such participants in the solicitation of proxies in respect of the potential transaction are included in the registration statement and joint proxy statement/prospectus and other relevant materials filed with the SEC. The term “Teladoc” and such terms as “the company,” “the corporation,” “our,” “we,” “us” and “its” may refer to Teladoc Health, Inc., one or more of its consolidated subsidiaries, or to all of them taken as a whole. All of these terms are used for convenience only and are not intended as a precise description of any of the separate companies, each of which manages its own a airs. |