united states

securities and exchange commission

washington, d.c. 20549

form N-CSR

certified shareholder report of registered management

investment companies

Investment Company Act file number 811-22356

Archer Investment Series Trust

(Exact name of registrant as specified in charter)

c/o Archer Investment Corporation

11711 N. College Ave., #200, Carmel, IN 46032

(Address of principal executive offices) (Zip code)

c/o Archer Investment Corporation

11711 N. College Ave., #200, Carmel, IN 46032

(Name and address of agent for service)

With copies to:

C. Richard Ropka, Esq.

Law Office of C. Richard Ropka

215 Fries Mill Road

Turnersville, NJ 08012

Registrant's telephone number, including area code: (800) 238-7701

Date of fiscal year end: August 31

Date of reporting period: August 31, 2024

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget ("OMB") control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

ANNUAL SHAREHOLDER REPORT

August 31, 2024

ARCHER BALANCED FUND

ARCHX

ADDITIONAL INFORMATION

This annual shareholder report contains important information about the Archer Balanced Fund – ARCHX (the “Fund”) for the period September 1, 2023 to August 31, 2024.

You can find additional information about the Fund at www.thearcherfunds.com. You can also request this information by contacting us at 1-800-238-7701.

expense Information

What were the Fund costs for the past year?

(based on a hypothetical $10,000 investment)

| Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment* |

| | | |

| Archer Balanced Fund | $130 | 1.20% |

*Annualized

managment’s discussion of fund performance

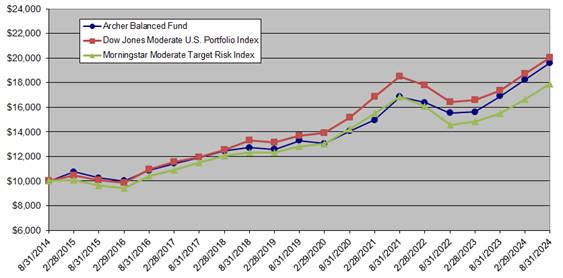

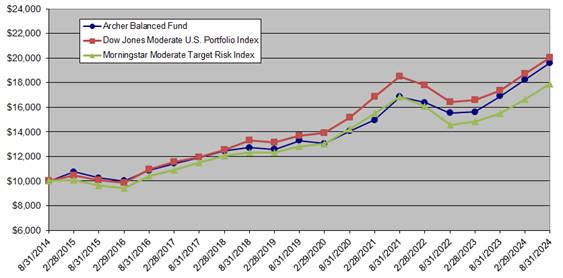

The Archer Balanced fund had a total return of 16.03% for the Year ended August 31, 2024 and an average annual return of 6.97% over the trailing ten years compared to a total return of 15.24% and 7.18% for the Dow Jones Moderate U.S. Portfolio Index, and 15.55% and 5.99% for the Morningstar Moderate Target Risk Index over the same periods.

The Fund maintained a balance of approximately 70% equities and 30% fixed income throughout most of the year. As rising valuations increased the equity weighting of the Fund, the managers selectively rebalanced the portfolio by reducing some equity positions and reallocating to capture improved yields on fixed income and money market holdings. The Fund's investment style has remained consistent within both equities and fixed income by maintaining a tilt towards large-cap value in equities and short- to intermediate-term investment grade companies in fixed income.

Equity Portfolio

We continue to focus on companies with sound balance sheets, steady revenue sources, strong cash flow, and reasonable valuations. Companies who can weather economic uncertainty by generating their own liquidity and maintain reasonable balance sheets have been rewarded as monetary policy has abruptly changed. Sectors historically favored by income investors such as Utilities, Financials, and REITs were pressured as yields rose dramatically in the bond markets throughout much of 2023. Our patience was rewarded late in the year and throughout much of 2024 as rates softened and the market began to recognize the value present in several of these beaten down sectors and companies. The fund maintains significant weighting in certain segments of the Financial, Industrial, Healthcare, and Technology sectors.

Fixed-Income Portfolio

Although the overall portfolio duration remains low, the managers have opportunistically added high quality, longer duration holdings to the portfolio. The managers believe that the risk added to the portfolio by dramatically lengthening portfolio duration and/or reducing credit quality does not offer material compensation at present. A more active Federal Reserve has added to volatility in the fixed income markets and many companies have weakened their balance sheets by issuing debt over the past several years to fund more stockholder friendly actions. We have maintained a more defensive posture by overweighting short- to intermediate-term maturities and keeping a close eye on the credit quality of issuers.

Performance graph

AVERAGE ANNUAL RETURNS

| | 1 Year | 5 Years | 10 Years | Ending Value |

| Archer Balanced Fund | 16.03% | 8.10% | 6.97% | $19,610 |

| Dow Jones Moderate U.S. Portfolio Index | 15.24% | 7.85% | 7.18% | $20,012 |

| Morningstar Moderate Target Risk Index | 15.55% | 6.94% | 5.99% | $17,895 |

Cumulative Performance Comparison of $10,000 Investment

Past performance is not a good predictor of future performance. The returns shown do not reflect taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares. Updated performance data current to the most recent month-end can be obtained by calling 1-800-238-7701.

Fund statistics

| | | | ADVISORY FEES |

| NET ASSETS: | PORTFOLIO HOLDINGS: | PORTFOLIO TURNOVER: | PAID BY FUND: |

| $50,724,730 | 92 | 11.69% | $186,230 |

INVESTMENT TYPE WEIGHTINGS

The following chart gives a visual breakdown of the Fund by the investment type. The underlying securities represent a percentage of the portfolio of investments.

| Archer Balanced Pie Chart | |

| Common Stocks | 66.80% |

| Corporate Bonds | 15.74% |

| Municipal Bonds | 3.98% |

| Real Estate Investment Trusts | 4.18% |

| Preferred Securities | 1.01% |

| Structured Notes | 0.35% |

| U.S. Govt. Agencies & Obligs. | 1.48% |

| Money Market Fund | 6.46% |

top ten holdings (% OF NET ASSETS)

| 1. | Federated Treasury Obligation Fund - Institutional Shares | 6.44% |

| 2. | Meta Platforms, Inc. Class A | 3.88% |

| 3. | WalMart, Inc. | 3.65% |

| 4. | Broadcom, Inc. | 3.34% |

| 5. | Microsoft Corp. | 3.04% |

| 6. | MasterCard, Inc. Class A | 3.00% |

| 7. | JPMorgan Chase & Co. | 2.91% |

| 8. | Lockheed Martin Corp. | 2.86% |

| 9. | Quanta Services, Inc. | 2.85% |

| 10. | NextEra Energy, Inc. | 2.84% |

| | Total % of Net Assets | 34.81% |

How has the fund changed

The Fund has not had any material changes during the year ended August 31, 2024.

Householding

To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). If you would prefer that your Archer Balanced Fund documents not be householded, please contact Archer Funds at 1-800-238-7701, or contact your financial intermediary. Your instructions will typically be effective within 30 days of receipt by Archer Funds or your financial intermediary.

For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, visit www.thearcherfunds.com or contact us at 1-800-238-7701.

| Archer Balanced Line Graph | |

| | Balanced Fund | Dow Jones Moderate | Morningstar Moderate |

| 08/31/14 | 10,000 | 10,000 | 10,000 |

| 02/28/15 | 10,735 | 10,451 | 10,066 |

| 08/31/15 | 10,250 | 10,090 | 9,634 |

| 02/29/16 | 10,018 | 9,877 | 9,415 |

| 08/31/16 | 10,867 | 10,928 | 10,427 |

| 02/28/17 | 11,433 | 11,532 | 10,892 |

| 08/31/17 | 11,920 | 11,921 | 11,479 |

| 02/28/18 | 12,448 | 12,545 | 12,019 |

| 08/31/18 | 12,724 | 13,309 | 12,325 |

| 02/28/19 | 12,588 | 13,131 | 12,313 |

| 08/31/19 | 13,287 | 13,712 | 12,790 |

| 02/29/20 | 13,056 | 13,895 | 13,017 |

| 08/31/20 | 14,057 | 15,150 | 14,223 |

| 02/28/21 | 14,972 | 16,857 | 15,499 |

| 08/31/21 | 16,843 | 18,521 | 16,862 |

| 02/28/22 | 16,368 | 17,797 | 16,086 |

| 08/31/22 | 15,546 | 16,439 | 14,545 |

| 02/28/23 | 15,622 | 16,595 | 14,831 |

| 08/31/23 | 16,902 | 17,366 | 15,487 |

| 02/29/24 | 18,239 | 18,731 | 16,627 |

| 08/31/24 | 19,610 | 20,012 | 17,895 |

ANNUAL SHAREHOLDER REPORT

August 31, 2024

ARCHER INCOME FUND

ARINX

ADDITIONAL INFORMATION

This annual shareholder report contains important information about the Archer Income Fund - ARINX (the “Fund”) for the period September 1, 2023 to August 31, 2024.

You can find additional information about the Fund at www.thearcherfunds.com. You can also request this information by contacting us at 1-800-238-7701.

expense Information

What were the Fund costs for the past year?

(based on a hypothetical $10,000 investment)

| Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment* |

| | | |

| Archer Income Fund | $99 | 0.96% |

*Annualized

managment’s discussion of fund performance

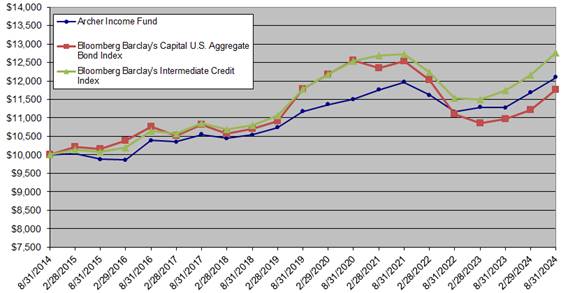

The Archer Income Fund returned 7.25% for the year ended August 31, 2024 and an average annual return of 1.92% over the trailing 10 years compared to 7.30% and 1.64% for the Bloomberg Barclay’s Capital US Aggregate Bond Index and 8.63% and 2.46% for the Bloomberg Barclay’s Intermediate Credit Index over the same time periods.

The Fund opened in March of 2011 and has turned in positive returns during what we would characterize as a volatile market for bond investors since the date of inception. The bond market continues to present investors with many challenges. As inflation concerns built in 2019, the Federal Reserve leaned towards more restrictive monetary policy, only to have to pivot to a more accommodative stance as trade related fears crept into the market. This accommodative trend accelerated dramatically as the pandemic took hold and policy makers were forced to provide fiscal stimulus while the Federal Reserve expanded its balance sheet significantly and promised to keep rates at, or near, zero percent for the foreseeable future. As it became clear that inflation created by the overwhelming accommodation of the pandemic era was not “transitory”, the Fed was forced to do another about face and begin their most aggressive tightening campaign in decades. The result was a sharp repricing of bonds across the curve with yields rising sharply and longer-term bond prices dropping significantly. More recently, the Fed reduced the benchmark Federal Funds Rate by half a percentage point and has telegraphed to the market that further measured reductions to their policy rate may be forthcoming. While broad measures of inflation have moderated, some pockets of sticky inflation remain. A more accommodative Federal Reserve, against the backdrop of continued economic growth and a growing deficit, has raised concerns about the potential for reigniting inflation and has kept a floor under longer-term interest rates.

The managers believe it is prudent to continue to position the portfolio to protect against interest-rate, default and currency risks. Our approach has allowed us to take advantage of opportunities presented when others have been forced to sell at attractive discounts, while maintaining liquidity and an effective duration much lower than that of our benchmark indices.

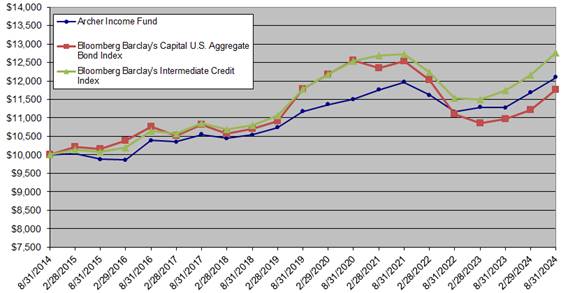

PERFORMANCE GRAPH

AVERAGE ANNUAL RETURNS

| | 1 Year | 5 Years | 10 Years | Ending Value |

| Archer Income Fund | 7.25% | 1.59% | 1.92% | $12,096 |

| Bloomberg Barclay's Capital U.S. Aggregate Bond Index | 7.30% | -0.04% | 1.64% | $11,765 |

| Bloomberg Barclay's Intermediate Credit Index | 8.63% | 1.58% | 2.46% | $12,758 |

Cumulative Performance Comparison of $10,000 Investment

Past performance is not a good predictor of future performance. The returns shown do not reflect taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares. Updated performance data current to the most recent month-end can be obtained by calling 1-800-238-7701.

Fund statistics

| | | | ADVISORY FEES |

| NET ASSETS: | PORTFOLIO HOLDINGS: | PORTFOLIO TURNOVER: | PAID BY FUND: |

| $19,625,873 | 106 | 23.30% | ($17,564) |

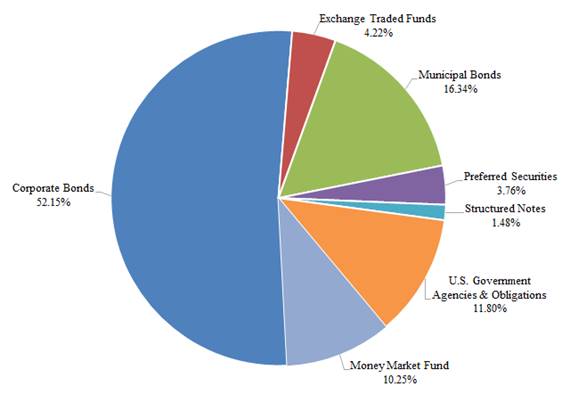

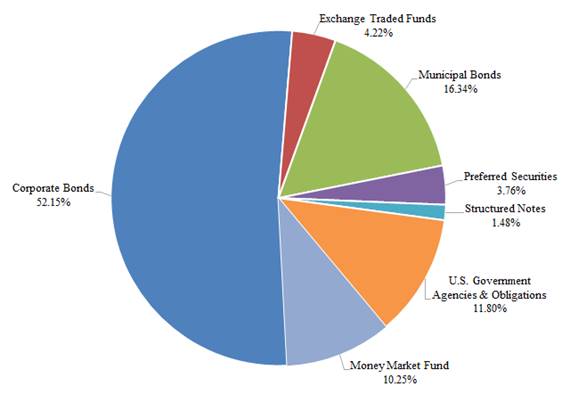

INVESTMENT TYPE WEIGHTINGS

The following chart gives a visual breakdown of the Fund by investment type. The underlying securities represent a percentage of the portfolio of investments.

| Archer income Pie Chart | |

| Corporate Bonds | 52.15% |

| Exchange Traded Funds | 4.22% |

| Municipal Bonds | 16.34% |

| Preferred Securities | 3.76% |

| Structured Notes | 1.48% |

| U.S. Govt. Agencies & Obligs. | 11.80% |

| Money Market Fund | 10.25% |

top ten holdings (% OF NET ASSETS)

| 1. | Federated Treasury Obligation Fund - Institutional Shares | 10.16% |

| 2. | U.S. Government Treasury Note/Bond, 3.875%, due 8/15/33 | 3.81% |

| 3. | Federal Home Loan Bank, 5.555%, due 2/15/33 | 2.81% |

| 4. | U.S. Government Treasury Note/Bond, 4.625%, due 2/28/25 | 2.80% |

| 5. | iShares 10+ Year Investment Grade Corporate Bond ETF | 2.67% |

| 6. | State Street Corp., 7.350%, due 6/15/26 | 2.66% |

| 7. | U.S. Government Treasury Bill, 0.000%, due 9/03/24 | 2.55% |

| 8. | Federal Farm Credit Bank, 5.570%, due 8/26/33 | 2.55% |

| 9. | U.S. Government Treasury Note/Bond, 3.875%, due 3/31/25 | 2.54% |

| 10. | Masco Corp., 7.750%, due 8/01/29 | 2.30% |

| | Total % of Net Assets | 34.85% |

How has the fund changed

The Fund has not had any material changes during the year ended August 31, 2024.

Householding

To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). If you would prefer that your Archer Income Fund documents not be householded, please contact Archer Funds at 1-800-238-7701, or contact your financial intermediary. Your instructions will typically be effective within 30 days of receipt by Archer Funds or your financial intermediary.

For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, visit www.thearcherfunds.com or contact us at 1-800-238-7701.

| Archer Income Line Graph | |

| | Income Fund | BBG Barclays Capital Agg. | BBG Barclays Intermediate Credit |

| 08/31/14 | 10,000 | 10000 | 10000 |

| 02/28/15 | 10,042 | 10225 | 10135 |

| 08/31/15 | 9,884 | 10155 | 10081 |

| 02/29/16 | 9,859 | 10379 | 10204 |

| 08/31/16 | 10,392 | 10761 | 10657 |

| 02/28/17 | 10,349 | 10526 | 10578 |

| 08/31/17 | 10,552 | 10814 | 10862 |

| 02/28/18 | 10,448 | 10579 | 10686 |

| 08/31/18 | 10,546 | 10701 | 10792 |

| 02/28/19 | 10,742 | 10914 | 11058 |

| 08/31/19 | 11,179 | 11789 | 11793 |

| 02/29/20 | 11,361 | 12189 | 12174 |

| 08/31/20 | 11,507 | 12553 | 12546 |

| 02/28/21 | 11,763 | 12358 | 12698 |

| 08/31/21 | 11,964 | 12542 | 12728 |

| 02/28/22 | 11,619 | 12031 | 12239 |

| 08/31/22 | 11,167 | 11098 | 11536 |

| 02/28/23 | 11,292 | 10862 | 11493 |

| 08/31/23 | 11,278 | 10965 | 11745 |

| 02/29/24 | 11,686 | 11223 | 12154 |

| 08/31/24 | 12,096 | 11765 | 12758 |

ANNUAL SHAREHOLDER REPORT

August 31, 2024

ARCHER STOCK FUND

ARSKX

ADDITIONAL INFORMATION

This annual shareholder report contains important information about the Archer Stock Fund - ARSKX (the “Fund”) for the period September 1, 2023 to August 31, 2024.

You can find additional information about the Fund at www.thearcherfunds.com. You can also request this information by contacting us at 1-800-238-7701.

expense Information

What were the Fund costs for the past year?

(based on a hypothetical $10,000 investment)

| Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment* |

| | | |

| Archer Stock Fund | $139 | 1.23% |

*Annualized

managment’s discussion of fund performance

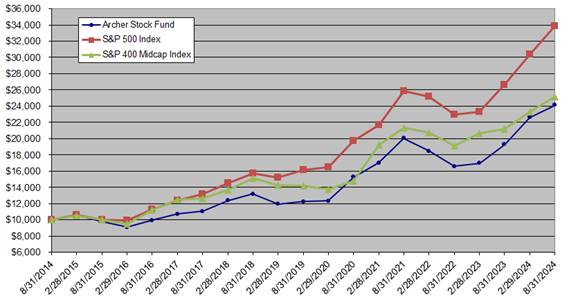

The Archer Stock Fund posted a return of 25.24% for the year ended August 31, 202 and an average annual return of 9.22% over the trailing 10 years. This compares to a return of 27.14% and 12.96% for the S&P 500 Index, and 18.72% and 9.65% for the S&P Midcap 400 Index over the same periods.

The Archer Stock Fund seeks to maximize capital appreciation by investing in the most attractive equity investment opportunities regardless of company size, sector, industry, or country domicile. Although managers closely monitor macro-economic conditions, positions in the fund are normally selected on their own merits using company fundamentals and valuation as a guide. There will be times when this method of selecting securities may lead to the relative over- or underweighting of sectors. The fund currently maintains relatively large weightings in healthcare, and technology companies. As of August 31, 2024, the Fund held 40 equity positions and a roughly 4% cash position. Although there may be times when the Fund holds greater or fewer positions, the managers will strive to limit the holdings of the Fund to 50 holdings. This results in a concentrated portfolio which can lead to periods of relative underperformance but will reduce turnover of the portfolio to create long-term shareholder value. We continue to seek out companies with strong balance sheets and the opportunity to improve sales and earnings over the long term.

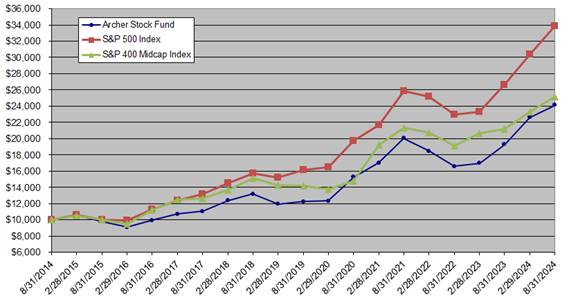

Performance graph

AVERAGE ANNUAL RETURNS

| | 1 Year | 5 Years | 10 Years | Ending Value |

| Archer Stock Fund | 25.24% | 14.58% | 9.22% | $24,159 |

| S&P 500 Index | 27.14% | 15.90% | 12.96% | $33,875 |

| S&P 400 Midcap Index | 18.72% | 12.15% | 9.65% | $25,142 |

Cumulative Performance Comparison of $10,000 Investment

Past performance is not a good predictor of future performance. The returns shown do not reflect taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares. Updated performance data current to the most recent month-end can be obtained by calling 1-800-238-7701.

Fund statistics

| | | | ADVISORY FEES |

| NET ASSETS: | PORTFOLIO HOLDINGS: | PORTFOLIO TURNOVER: | PAID BY FUND: |

| $25,227,166 | 41 | 8.56% | $77,664 |

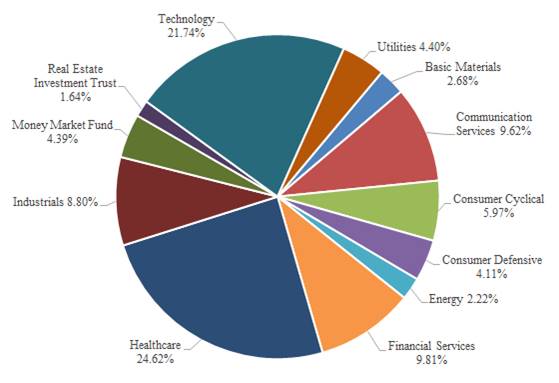

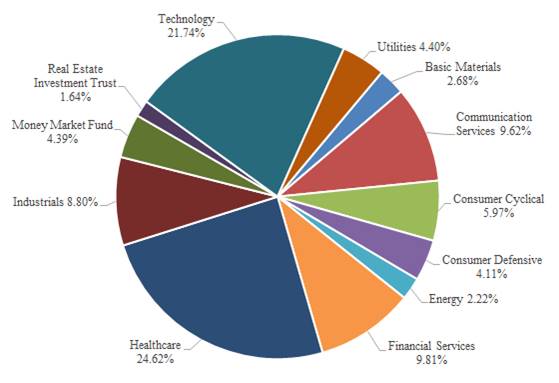

SECTOR WEIGHTINGS

The following chart gives a visual breakdown of the Fund by the sectors the underlying securities represent as a percentage of the portfolio of investments.

top ten holding (% OF NET ASSETS)

| 1. | NVIDIA Corp. | 4.64% |

| 2. | Federated Treasury Obligation Fund - Institutional Shares | 4.38% |

| 3. | Meta Platforms, Inc. Class A | 4.36% |

| 4. | NextEra Energy, Inc. | 3.59% |

| 5. | Alphabet, Inc. Class A | 3.59% |

| 6. | Microsoft Corp. | 3.44% |

| 7. | Apple, Inc. | 3.37% |

| 8. | Thermo Fisher Scientific, Inc. | 2.95% |

| 9. | JPMorgan Chase & Co. | 2.94% |

| 10. | United Rentals, Inc. | 2.88% |

| | Total % of Net Assets | 36.14% |

How has the fund changed

The Fund has not had any material changes during the year ended August 31, 2024.

Householding

To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). If you would prefer that your Archer Stock Fund documents not be householded, please contact Archer Funds at 1-800-238-7701, or contact your financial intermediary. Your instructions will typically be effective within 30 days of receipt by Archer Funds or your financial intermediary.

For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, visit www.thearcherfunds.com or contact us at 1-800-238-7701.

| Stock Fund Pie Chart | |

| | |

| Basic Materials | 2.68% |

| Communication Services | 9.62% |

| Consumer Cyclical | 5.97% |

| Consumer Defensive | 4.11% |

| Energy | 2.22% |

| Financial Services | 9.81% |

| Healthcare | 24.62% |

| Industrials | 8.80% |

| Money Market Fund | 4.39% |

| Real Estate Investment Trust | 1.64% |

| Technology | 21.74% |

| Utilities | 4.40% |

| Archer Stock Fund Line Graph | |

| | Stock Fund | S&P 500 | S&P 400 Midcap |

| 08/31/14 | 10000 | 10000 | 10000 |

| 02/28/25 | 10552 | 10612 | 10550 |

| 08/31/15 | 9803 | 10048 | 10000 |

| 02/29/16 | 9087 | 9955 | 9496 |

| 08/31/16 | 9931 | 11309 | 11230 |

| 02/28/17 | 10732 | 12440 | 12506 |

| 08/31/17 | 11067 | 13142 | 12618 |

| 02/28/18 | 12363 | 14566 | 13695 |

| 08/31/18 | 13176 | 15726 | 15138 |

| 02/28/19 | 11957 | 15248 | 14260 |

| 08/31/19 | 12235 | 16186 | 14162 |

| 02/29/20 | 12347 | 16497 | 13773 |

| 08/31/20 | 15292 | 19736 | 14758 |

| 02/28/21 | 17027 | 21659 | 19250 |

| 08/31/21 | 20028 | 25887 | 21362 |

| 02/28/22 | 18481 | 25209 | 20781 |

| 08/31/22 | 16606 | 22981 | 19138 |

| 02/28/23 | 16967 | 23270 | 20640 |

| 08/31/23 | 19291 | 26645 | 21177 |

| 02/29/24 | 22620 | 30356 | 23326 |

| 08/31/24 | 24159 | 33875 | 25142 |

ANNUAL SHAREHOLDER REPORT

August 31, 2024

ARCHER DIVIDEND GROWTH FUND

ARDGX

ADDITIONAL INFORMATION

This annual shareholder report contains important information about the Archer Dividend Growth Fund - ARDGX (the “Fund”) for the period September 1, 2023 to August 31, 2024.

You can find additional information about the Fund at www.thearcherfunds.com. You can also request this information by contacting us at 1-800-238-7701.

expense Information

What were the Fund costs for the past year?

(based on a hypothetical $10,000 investment)

| Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment* |

| | | |

| Archer Dividend Growth Fund | $108 | 0.98% |

*Annualized

managment’s discussion of fund performance

The Archer Dividend Growth Fund returned 19.39% for the year ended August 31, 2024 and 6.67% from the date of inception on September 1, 2016 compared to a return of 20.57% and 10.04% for the Dow Jones US Large-Cap Value Total Stock Market Index and 18.55% and 5.95% for the Morningstar Dividend Yield Focus Index over the same periods.

Performance Review

The Archer Dividend Growth Fund invests primarily in large and medium sized companies which we believe will provide long-term dividend payment growth for shareholders. Holdings are weighted towards companies with strong balance sheets and consistently increasing payouts to shareholders selling at an attractive discount to our estimate of fair value. This relatively deep value strategy has underperformed the broader market in recent years as the performance of many popular indices has been driven by an increasingly small number of high growth companies. The performance differential widened significantly during post-COVID rally as high growth technology and biotechnology companies attracted investor dollars away from the more stable, dividend paying, value segments of the market. Recently, the spread has begun to narrow as investors have recognized the value of stable cash flows and predictable business models. Anticipation of easier monetary policy and declining interest rates has also provided a tailwind to traditional dividend paying sectors including Utilities and REITs. Concerns surrounding the banking system early in 2023 and the sharp rise in bond market yields led to relative underperformance in 2022 and early 2023, particularly when compared to funds focusing on factors other than dividend payments.

Ultimately, we are confident in our portfolio of companies and believe value will be recognized in our holdings and offer attractive appreciation in addition to the growing dividend income stream. We believe the Archer Dividend Growth Fund offers an attractive alternative to investors seeking monthly income who are concerned about inflation and the erosion of real income.

Performance graph

AVERAGE ANNUAL RETURNS

| | 1 Year | 5 Years | Since Inception* | Ending Value |

| Archer Dividend Growth Fund | 19.39% | 7.75% | 6.76% | $16,871 |

| Dow Jones US Large-Cap Value Total Stock Market Index | 20.57% | 10.55% | 10.04% | $21,481 |

| Morningstar Dividend Yield Focus Index | 18.55% | 7.03% | 5.95% | $15,877 |

Cumulative Performance Comparison of $10,000 Investment

* Inception September 1, 2016.

Past performance is not a good predictor of future performance. The returns shown do not reflect taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares. Updated performance data current to the most recent month-end can be obtained by calling 1-800-238-7701.

Fund statistics

| | | | ADVISORY FEES |

| NET ASSETS: | PORTFOLIO HOLDINGS: | PORTFOLIO TURNOVER: | PAID BY FUND: |

| $23,518,489 | 41 | 14.03% | $12,187 |

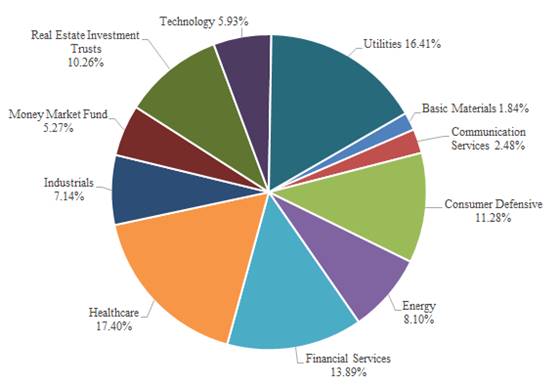

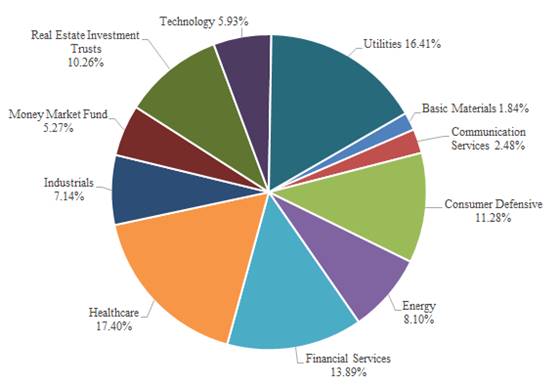

SECTOR WEIGHTINGS

The following chart gives a visual breakdown of the Fund by the sectors the underlying securities represent as a percentage of the portfolio of investments.

top ten holdings (% OF NET ASSETS)

| 1. | Federated Treasury Obligation Fund - Institutional Shares | 5.24% |

| 2. | AbbVie, Inc. | 3.83% |

| 3. | Iron Mountain, Inc. | 3.76% |

| 4. | Broadcom, Inc. | 3.32% |

| 5. | Merck & Co., Inc. | 3.23% |

| 6. | Regions Financial Corp. | 3.15% |

| 7. | Lockheed Martin Corp. | 3.08% |

| 8. | Manulife Financial Corp. | 3.02% |

| 9. | JPMorgan Chase & Co. | 3.01% |

| 10. | Coca-Cola FEMSA S.A.B. de C.V. ADR Series L | 2.81% |

| | Total % of Net Assets | 34.45% |

How has the fund changed

The Fund has not had any material changes during the year ended August 31, 2024.

Householding

To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). If you would prefer that your Archer Dividend Growth Fund documents not be householded, please contact Archer Funds at 1-800-238-7701, or contact your financial intermediary. Your instructions will typically be effective within 30 days of receipt by Archer Funds or your financial intermediary.

For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, visit www.thearcherfunds.com or contact us at 1-800-238-7701.

| Dividend Growth Pie Chart | |

| | |

| Basic Materials | 1.84% |

| Communication Services | 2.48% |

| Consumer Defensive | 11.28% |

| Energy | 8.10% |

| Financial Services | 13.89% |

| Healthcare | 17.40% |

| Industrials | 7.14% |

| Money Market Fund | 5.27% |

| Real Estate Investment Trusts | 10.26% |

| Technology | 5.93% |

| Utilities | 16.41% |

| Archer Dividend Growth Fund Line Graph |

| | | Dow Jones US Large | Morningstar Div |

| | Div Growth Fund | Cap Val Total Stock | Yield Focus |

| 9/1/2016 | 10000 | 10000 | 10000 |

| 2/28/2017 | 10653 | 11059 | 10330 |

| 8/31/2017 | 10404 | 11302 | 10254 |

| 2/28/2018 | 11014 | 12281 | 10498 |

| 8/31/2018 | 11891 | 12909 | 10907 |

| 2/28/2019 | 11641 | 12710 | 11245 |

| 8/31/2019 | 11617 | 13004 | 11297 |

| 2/29/2020 | 11169 | 12715 | 10303 |

| 8/31/2020 | 10703 | 13167 | 10324 |

| 2/28/2021 | 11760 | 15421 | 10908 |

| 8/31/2021 | 13867 | 17770 | 11906 |

| 2/28/2022 | 14270 | 17757 | 12820 |

| 8/31/2022 | 14215 | 16563 | 12653 |

| 2/28/2023 | 14440 | 17293 | 12881 |

| 8/31/2023 | 14131 | 17816 | 13393 |

| 2/29/2024 | 15082 | 19483 | 13961 |

| 8/31/2024 | 16871 | 21481 | 15877 |

ANNUAL SHAREHOLDER REPORT

August 31, 2024

ARCHER FOCUS FUND

AFOCX

ADDITIONAL INFORMATION

This annual shareholder report contains important information about the Archer Focus Fund - AFOCX (the “Fund”) for the period September 1, 2023 to August 31, 2024.

You can find additional information about the Fund at www.thearcherfunds.com. You can also request this information by contacting us at 1-800-238-7701.

expense Information

What were the Fund costs for the past year?

(based on a hypothetical $10,000 investment)

| Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment* |

| | | |

| Archer Focus Fund | $110 | 0.98% |

*Annualized

managment’s discussion of fund performance

The Archer Focus Fund returned 25.42% for the year ended August 31, 2024 and 10.97% from the date of inception on December 31, 2019 compared to a return of 22.06% and 10.72% for the Dow Jones Industrial Average Index over the same time periods.

Performance Review

The Archer Focus Fund seeks long-term growth of capital by investing in financially sound, large and medium-sized companies with dominant franchises. Under normal conditions, the Fund holds a relatively concentrated portfolio of 50 or fewer US common stocks. Potential investments are carefully screened for balance sheet strength, sustainable earnings and free cash flow, and durable market position. The Focus Fund maintained a relatively concentrated portfolio during the year and had 41 equity holdings as of August 31, 2024 with Communication Services, Healthcare, Technology, and Consumer Cyclical making up the largest sector weightings, while Basic Materials, Financials, and Energy were the smallest portfolio weightings. We remain confident in our holdings’ ability to weather shifting macroeconomic challenges as we focus on owning relatively large, financially stable companies with long-term earnings power.

Performance graph

AVERAGE ANNUAL RETURNS

| | 1 Year | Since Inception* | Ending Value |

| Archer Focus Fund | 25.42% | 10.97% | $16,264 |

| Dow Jones Industrial Average Index | 22.06% | 10.72% | $16,090 |

| S&P 500 Index | 27.14% | 14.59% | $18,893 |

Cumulative Performance Comparison of $10,000 Investment

* Inception December 30, 2019.

Past performance is not a good predictor of future performance. The returns shown do not reflect taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares. Updated performance data current to the most recent month-end can be obtained by calling 1-800-238-7701.

Fund statistics

| | | | ADVISORY FEES |

| NET ASSETS: | PORTFOLIO HOLDINGS: | PORTFOLIO TURNOVER: | PAID BY FUND: |

| $11,154,871 | 42 | 89.11% | ($17,284) |

SECTOR WEIGHTINGS

The following chart gives a visual breakdown of the Fund by the sectors the underlying securities represent as a percentage of the portfolio of investments.

top ten holdings (% OF NET ASSETS)

| 1. | Meta Platforms, Inc. Class A | 4.04% |

| 2. | Costco Wholesale Corp. | 3.80% |

| 3. | NVDIA Corp. | 3.42% |

| 4. | AvalonBay Communities, Inc. | 3.40% |

| 5. | Alphabet, Inc. Class A | 3.18% |

| 6. | PulteGroup, Inc. | 2.79% |

| 7. | Best Buy Co., Inc. | 2.74% |

| 8. | Atmos Energy Corp. | 2.72% |

| 9. | United Therapeutics Corp. | 2.57% |

| 10. | EMCOR Group, Inc. | 2.53% |

| | Total % of Net Assets | 31.19% |

How has the fund changed

The Fund has not had any material changes during the year ended August 31, 2024.

Householding

To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). If you would prefer that your Archer Focus Fund documents not be householded, please contact Archer Funds at 1-800-238-7701, or contact your financial intermediary. Your instructions will typically be effective within 30 days of receipt by Archer Funds or your financial intermediary.

For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, visit www.thearcherfunds.com or contact us at 1-800-238-7701.

| Archer Focus Pie Chart | |

| | |

| Basic Materials | 4.99% |

| Communication Services | 12.88% |

| Consumer Cyclical | 10.47% |

| Consumer Defensive | 7.61% |

| Energy | 6.83% |

| Financial Services | 6.39% |

| Healthcare | 12.12% |

| Industrials | 10.05% |

| Money Market Fund | 1.39% |

| Real Estate Investment Trusts | 7.94% |

| Technology | 11.91% |

| Utilities | 7.42% |

| Archer Focus Fund Line Graph | |

| | | Dow Jones Industrial | |

| | Archer Focus | Average Index | S&P 500 Index |

| 12/30/2019 | 10000 | 10000 | 10000 |

| 2/29/2020 | 8975 | 8969 | 9201 |

| 8/31/2020 | 10396 | 10157 | 11007 |

| 2/28/2021 | 11115 | 11157 | 12080 |

| 8/31/2021 | 12834 | 12876 | 14438 |

| 2/28/2022 | 12788 | 12451 | 14060 |

| 8/31/2022 | 11979 | 11709 | 12817 |

| 2/28/2023 | 12670 | 12253 | 12978 |

| 8/31/2023 | 12967 | 13182 | 14860 |

| 2/29/2024 | 14218 | 14952 | 16930 |

| 8/31/2024 | 16264 | 16090 | 18893 |

ANNUAL SHAREHOLDER REPORT

August 31, 2024

ARCHER MULTI CAP FUND

ALSMX

ADDITIONAL INFORMATION

This annual shareholder report contains important information about the Archer Multi Cap Fund – ALSMX (the “Fund”) for the period September 1, 2023 to August 31, 2024.

You can find additional information about the Fund at www.thearcherfunds.com. You can also request this information by contacting us at 1-800-238-7701.

expense Information

What were the Fund costs for the past year?

(based on a hypothetical $10,000 investment)

| Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment* |

| | | |

| Archer Multi Cap Fund | $108 | 0.95% |

*Annualized

managment’s discussion of fund performance

The Archer Multi Cap Fund returned 27.46% for the year ended August 31, 2024 and 10.53% from the date of inception on December 31, 2019. This compares to returns of 27.14% & 14.59% for the S&P 500 Index, 17.24% & 8.92% for the S&P 600 Small Cap Index, and 18.72% & 10.74% for the S&P 400 Mid Cap Index over the same periods.

Performance Review

The Archer Multi Cap Fund seeks long-term growth of capital by investing in up to 75 equity positions split evenly between the top 25 small, medium, and large publicly traded US companies at the beginning of each calendar year based on market capitalization. Position sizes are adjusted throughout the year driven by our proprietary quantitative and technical models and rebalanced annually. As of August 31, 2024 the Multi Cap fund maintained a slight overweighting to larger companies. Growth continues to be the overwhelming style factor of the fund. In terms of sector weightings, Industrials, Technology, Consumer Cyclical, and Healthcare companies were the largest holdings, while the fund maintained relatively little exposure to Consumer Staples, Real Estate, and Utilities. The relative overweighting of large companies aided relative performance during much of the year. A more recent broadening of performance leadership to small and midsized companies has helped improve performance relative to the blended benchmark, but the rapid changes to sector leadership and style factor performance has led to underperformance relative to the blended benchmark since inception. We continue to believe that the relatively balanced market cap exposure provided by the Fund will reward patient shareholders over time.

Performance graph

AVERAGE ANNUAL RETURNS

| | 1 Year | Since Inception* | Ending Value |

| Archer Multi Cap Fund | 27.46% | 10.53% | $15,964 |

| S&P 500 Index | 27.14% | 14.59% | $18,893 |

| S&P 600 Small Cap Index | 17.24% | 8.92% | $14,903 |

| S&P 400 Mid Cap Index | 18.72% | 10.74% | $16,111 |

| Synthetic Blend 33-33-33 | 21.00% | 11.67% | $16,745 |

Cumulative Performance Comparison of $10,000 Investment

* Inception December 30, 2019.

Past performance is not a good predictor of future performance. The returns shown do not reflect taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares. Updated performance data current to the most recent month-end can be obtained by calling 1-800-238-7701.

Fund statistics

| | | | ADVISORY FEES |

| NET ASSETS: | PORTFOLIO HOLDINGS: | PORTFOLIO TURNOVER: | PAID BY FUND: |

| $7,825,625 | 76 | 57.42% | ($21,751) |

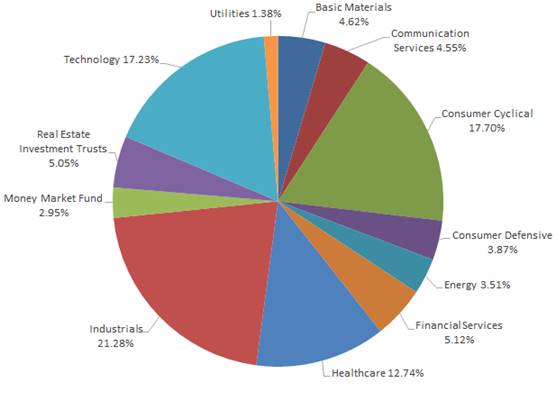

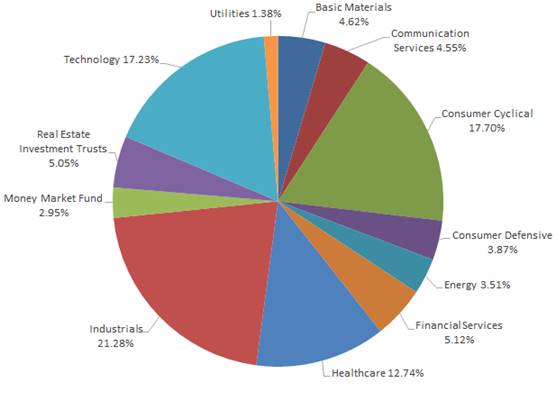

SECTOR WEIGHTINGS

The following chart gives a visual breakdown of the Fund by the sectors the underlying securities represent as a percentage of the portfolio of investments.

top ten holdings (% OF NET ASSETS)

| 1. | Morgan Stanley Institutional Liquidity Treasury Portfolio - Institutional Class | 2.94% |

| 2. | Mueller Industries, Inc. | 2.04% |

| 3. | Burlington Stores, Inc. | 1.95% |

| 4. | AAON, Inc. | 1.92% |

| 5. | Federal Signal Corp. | 1.91% |

| 6. | Abercrombie & Fitch Co. | 1.90% |

| 7. | NVDIA Corp. | 1.86% |

| 8. | AbbVie Inc. | 1.84% |

| 9. | SPX Technologies, Inc. | 1.82% |

| 10. | Broadcom, Inc. | 1.77% |

| | Total % of Net Assets | 19.95% |

How has the fund changed

The Fund has not had any material changes during the year ended August 31, 2024.

Householding

To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). If you would prefer that your Archer Multi Cap Fund documents not be householded, please contact Archer Funds at 1-800-238-7701, or contact your financial intermediary. Your instructions will typically be effective within 30 days of receipt by Archer Funds or your financial intermediary.

For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, visit www.thearcherfunds.com or contact us at 1-800-238-7701.

| Multi Cap Pie Chart | |

| | |

| Basic Materials | 4.62% |

| Communication Services | 4.55% |

| Consumer Cyclical | 17.70% |

| Consumer Defensive | 3.87% |

| Energy | 3.51% |

| Financial Services | 5.12% |

| Healthcare | 12.74% |

| Industrials | 21.28% |

| Money Market Fund | 2.95% |

| Real Estate Investment Trusts | 5.05% |

| Technology | 17.23% |

| Utilities | 1.38% |

| Archer Multi Cap Line Graph | | | | |

| | Multi Cap Fund | S&P 500 | S&P 600 | S&P 400 | Synthetic Blend |

| 12/30/2019 | 10000 | 10000 | 10000 | 10000 | 10000 |

| 2/29/2020 | 9120 | 9201 | 8707 | 8826 | 8910 |

| 8/31/2020 | 10355 | 11007 | 8920 | 9457 | 9774 |

| 2/28/2021 | 11883 | 12080 | 12769 | 12336 | 12488 |

| 8/31/2021 | 13572 | 14438 | 13729 | 13689 | 14071 |

| 2/28/2022 | 11923 | 14060 | 13299 | 13317 | 13673 |

| 8/31/2022 | 11207 | 12817 | 12055 | 12264 | 12484 |

| 2/28/2023 | 11257 | 12978 | 12823 | 13227 | 13128 |

| 8/31/2023 | 12525 | 14860 | 12711 | 13571 | 13838 |

| 2/29/2024 | 14831 | 16930 | 13644 | 14947 | 15287 |

| 8/31/2024 | 15964 | 18893 | 14903 | 16111 | 16745 |

Item 2. Code of Ethics.

(a) As of the end of the period covered by this report, the registrant has adopted a code of ethics that applies to the registrant's principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions, regardless of whether these individuals are employed by the registrant or a third party.

(b) For purposes of this item, “code of ethics” means written standards that are reasonably designed to deter wrongdoing and to promote:

(1) Honest and ethical conduct, including the ethical handling of actual or apparent conflicts of interest between personal and professional relationships;

(2) Full, fair, accurate, timely, and understandable disclosure in reports and documents that a registrant files with, or submits to, the Commission and in other public communications made by the registrant;

(3) Compliance with applicable governmental laws, rules, and regulations;

(4) The prompt internal reporting of violations of the code to an appropriate person or persons identified in the code; and

(5) Accountability for adherence to the code.

(c) Amendments: During the period covered by the report, there have not been any amendments to the provisions of the code of ethics.

(d) Waivers: During the period covered by the report, the registrant has not granted any express or implicit waivers from the provisions of the code of ethics.

(e) The Code of Ethics is not posted on registrant’s website.

(f) A copy of the Code of Ethics is attached as an exhibit.

Item 3. Audit Committee Financial Expert.

(a) The registrant’s Board of Trustees has determined that it does not have an audit committee financial expert serving on its audit committee. At this time, the registrant believes that the experience provided by each member of the audit committee together offer the registrant adequate oversight for the registrant’s level of financial complexity.

Item 4. Principal Accountant Fees and Services.

FY 2024 $ 54,000

FY 2023 $ 54,000

Registrant

FY 2024 $ 0

FY 2023 $ 0

Nature of the fees: Not applicable.

Registrant

FY 2024 $ 11,100

FY 2023 $ 11,100

Nature of the fees: Tax preparation and filing.

Registrant

FY 2024 $ 0

FY 2023 $ 0

Nature of the fees: Not applicable.

| (e) | (1) Audit Committee’s Pre-Approval Policies |

The audit committee approves all audit and non-audit related services and, therefore, has not adopted pre-approval policies and procedures described in paragraph (c)(7) of Rule 2-01 of Regulation S-X.

| (2) | Percentages of Services Approved by the Audit Committee |

None of the services described in paragraph (b) through (d) of this Item were approved by the audit committee pursuant to paragraph (c)(7)(i)(C) of Rule 2-01 of Regulation S-X.

(f) During audit of registrant's financial statements for the most recent fiscal year, less than 50 percent of the hours expended on the principal accountant's engagement were attributed to work performed by persons other than the principal accountant's full-time, permanent employees.

(g) The aggregate non-audit fees billed by the registrant's accountant for services rendered to the registrant, and rendered to the registrant's investment adviser (not including any sub-adviser whose role is primarily portfolio management and is subcontracted with or overseen by another investment adviser), and any entity controlling, controlled by, or under common control with the adviser that provides ongoing services to the registrant:

Registrant

FY 2024 $ 11,100

FY 2023 $ 11,100

(h) The registrant's audit committee has not considered whether the provision of non-audit services to the registrant's investment adviser (not including any sub-adviser whose role is primarily portfolio management and is subcontracted with or overseen by another investment adviser), and any entity controlling, controlled by, or under common control with the investment adviser that provides ongoing services to the registrant, that were not pre-approved pursuant to paragraph (c)(7)(ii) of Rule 2-01 of Regulation S-X, is compatible with maintaining the principal accountant's independence.

(i) Not applicable.

(j) Not applicable.

Item 5. Audit Committee of Listed Companies. Not applicable.

Item 6. Schedule of Investments. Not applicable – schedule filed with Item 7.

Item 7. Financial Statements and Financial Highlights for Open-End Management Companies.

THE ARCHER FUNDS

BALANCED FUND (ARCHX)

INCOME FUND (ARINX)

STOCK FUND (ARSKX)

DIVIDEND GROWTH FUND (ARDGX)

FOCUS FUND (AFOCX)

MULTI CAP FUND (ALSMX)

ANNUAL FINANCIAL STATEMENTS

August 31, 2024

| | | | |

| | | ARCHER BALANCED FUND | |

| | | SCHEDULE OF INVESTMENTS | |

| | | August 31, 2024 | |

| | | | |

| Shares/Principal | Fair Value |

| | | | |

| COMMON STOCKS - 66.55% | |

| | | | |

| Air Courier Services - 1.91% | |

| 3,250 | | FedEx Corp. | $ 971,002 |

| | | | |

| Aircraft Engines & Engine Parts - 2.05% | |

| 5,000 | | Honeywell International, Inc. | 1,039,550 |

| | | | |

| Beverages - 1.36% | |

| 4,000 | | PepsiCo, Inc. | 691,520 |

| | | | |

| Commercial Banks - 1.30% | |

| 11,000 | | Toronto Dominion Bank (Canada) | 659,120 |

| | | | |

| Electric Services - 3.51% | |

| 3,400 | | American Electric Power Company, Inc. | 340,952 |

| 17,900 | | NextEra Energy, Inc. | 1,441,129 |

| | | | 1,782,081 |

| Electrical Work - 2.85% | |

| 5,255 | | Quanta Services, Inc. | 1,445,808 |

| | | | |

| Electromedical & Electrotherapeutic Apparatus - 1.64% | |

| 9,400 | | Medtronic PLC. (Ireland) | 832,652 |

| | | | |

| Electronic Computers - 2.80% | |

| 6,200 | | Apple, Inc. | 1,419,800 |

| | | | |

| Food & Kindred Products - 1.03% | |

| 4,900 | | Nestle S.A. ADR | 523,908 |

| | | | |

| Guided Missiles & Space Vehicles & Parts - 2.86% | |

| 2,550 | | Lockheed Martin Corp. | 1,448,655 |

| | | | |

| National Commercial Banks - 2.91% | |

| 6,560 | | JPMorgan Chase & Co. | 1,474,688 |

| | | | |

| Petroleum Refining - 3.00% | |

| 6,300 | | Chevron Corp. | 932,085 |

| 5,000 | | Exxon Mobil Corp. | 589,700 |

| | | | 1,521,785 |

| Pharmaceutical Preparations - 9.11% | |

| 8,550 | | Bristol Myers Squibb Co. | 427,073 |

| 1,450 | | Eli Lilly & Co. | 1,392,029 |

| 5,000 | | Johnson & Johnson | 829,300 |

| 9,080 | | Merck & Co., Inc. | 1,075,526 |

| 31,000 | | Pfizer, Inc. | 899,310 |

| | | | 4,623,238 |

| Railroads, Line-Haul Operating - 2.32% | |

| 4,600 | | Union Pacific Corp. Class B | 1,178,014 |

| | | | |

| Retail - Drug Stores and Proprietary Stores - 1.21% | |

| 10,694 | | CVS Health Corp. | 612,125 |

| | | | |

| Retail - Lumber & Other Building Material Dealers - 1.60% | |

| 2,200 | | Home Depot, Inc. | 810,700 |

| | | | |

| Retail - Variety Stores - 3.65% | |

| 24,000 | | WalMart, Inc. | 1,853,520 |

| | | | |

| Rubber & Plastics Footwear - 0.82% | |

| 5,000 | | Nike, Inc. Class B | 416,600 |

| | | | |

| Semiconductors & Related Devices - 3.34% | |

| 10,400 | | Broadcom, Inc. | 1,693,328 |

| | | | |

| Services - Business Services - 5.02% | |

| 3,000 | | Accenture PLC. Class A (Ireland) | 1,025,850 |

| 3,150 | | MasterCard, Inc. Class A | 1,522,521 |

| | | | 2,548,371 |

| Services - Computer Programming, Data Processing, Etc. - 6.65% | |

| 8,600 | | Alphabet, Inc. Class A | 1,405,068 |

| 3,775 | | Meta Platforms, Inc. Class A | 1,967,945 |

| | | | 3,373,013 |

| Services - Medical Laboratories - 0.97% | |

| 2,150 | | Laboratory Corp. of America Holdings | 494,263 |

| | | | |

| Services - Miscellaneous Amusement & Recreation - 1.07% | |

| 6,000 | | Walt Disney Co. | 542,280 |

| | | | |

| Services - Prepackaged Software - 3.04% | |

| 3,700 | | Microsoft Corp. | 1,543,418 |

| | | | |

| Sugar & Confectionery Products - 0.53% | |

| 1,400 | | Hershey Co. | 270,284 |

| | | | |

| TOTAL FOR COMMON STOCKS (Cost $14,926,249) - 66.55% | 33,769,723 |

| | | | |

| CORPORATE BONDS - 15.70% (c) | |

| | | | |

| Air Transportation, Scheduled - 0.49% | |

| 250,000 | | Southwest Airlines Co., 5.250%, due 5/04/25 | 250,028 |

| | | | |

| Aircraft - 0.48% | |

| 250,000 | | Boeing Co., 2.600%, due 10/30/25 | 243,083 |

| | | | |

| Banks & Financial Institutions - 2.37% | |

| 500,000 | | Federal Farm Credit Bank, 5.570%, due 8/26/33 | 499,189 |

| 700,000 | | Federal Home Loan Bank, 5.555%, due 2/15/33 | 702,463 |

| | | | 1,201,652 |

| Commercial Banks - 0.19% | |

| 100,000 | | Royal Bank of Canada, 1.200%, due 4/27/26 (Canada) | 94,922 |

| | | | |

| Electric Services - 0.20% | |

| 100,000 | | Southern California Edison Co. Series E, 3.700%, due 8/01/25 | 98,947 |

| | | | |

| Financial Services - 0.26% | |

| 150,000 | | General Motors Financial Co., Inc., 3.100%, due 1/12/32 | 130,781 |

| | | | |

| Heating Equip, Except Elec & Warm Air; & Plumbing Fixtures - 1.11% | |

| 500,000 | | Masco Corp., 7.750%, due 8/01/29 | 564,335 |

| | | | |

| Investment Advice - 0.88% | |

| 200,000 | | Affiliated Managers Group, Inc., 3.500%, due 8/01/25 | 197,231 |

| 250,000 | | Janus Capital Group, Inc., 4.875%, due 8/01/25 | 249,409 |

| | | | 446,640 |

| National Commercial Banks - 2.95% | |

| 300,000 | | Banc of California, Inc., 5.250%, due 4/15/25 | 298,440 |

| 100,000 | | Bank of America Corp. Series L, 3.950%, due 4/21/25 | 99,218 |

| 150,000 | | Huntington Bancshares, Inc. Series E, 8.44298%, to 10/15/24 (3-Month SOFR + 3.14161%) (b) *** | 148,880 |

| 150,000 | | Huntington Bancshares, Inc. Series G, 4.450%, to 10/15/27 (a) (b) | 142,495 |

| 150,000 | | JPMorgan Chase & Co. Series B, 6.00929%, due 2/01/27 (3-Month SOFR + 0.76161%) *** | 146,641 |

| 150,000 | | Truist Financial Corp. Series M, 5.125%, to 12/15/27 (a) (b) | 144,656 |

| 300,000 | | US Bancorp, 3.700%, to 1/15/27 (a) (b) | 265,209 |

| 250,000 | | Wells Fargo & Co. Series MTN, 6.000%, due 10/28/25 | 250,110 |

| | | | 1,495,649 |

| Operative Builders - 0.30% | |

| 150,000 | | Lennar Corp., 4.750%, due 11/29/27 | 151,320 |

| | | | |

| Other Real Estate Investment Trust - 0.29% | |

| 6,000 | | Ready Capital Corp., 5.750%, due 2/15/26 | 145,020 |

| | | | |

| Paper Mills - 0.86% | |

| 400,000 | | Georgia-Pacifi, LLC, 7.250%, due 6/01/28 | 437,315 |

| | | | |

| Personal Credit Institutions - 0.49% | |

| 250,000 | | Discover Financial Services Series D, 6.125%, to 6/23/25 (a) (b) | 248,685 |

| | | | |

| Pharmaceutical Preparations - 0.19% | |

| 100,000 | | AbbVie, Inc., 3.200%, due 5/14/26 | 98,057 |

| | | | |

| Security Brokers, Dealers & Flotation Companies - 1.33% | |

| 400,000 | | Capital Southwest Corp., 3.375%, due 10/01/26 | 372,800 |

| 300,000 | | Jeffries Financial Group, Inc. Series MTN, 6.500%, 10/31/29 | 300,578 |

| | | | 673,378 |

| Services - Advertising Agencies - 0.39% | |

| 200,000 | | Omnicom Group, Inc., 3.600%, due 4/15/26 | 196,431 |

| | | | |

| Services - Equipment Rental & Leasing - 0.86% | |

| 200,000 | | Air Lease Corp., 3.625%, due 12/01/27 | 193,848 |

| 250,000 | | United Rentals, Inc., 3.875%, due 11/15/27 | 241,275 |

| | | | 435,123 |

| Services - Miscellaneous Amusement & Recreation - 0.51% | |

| 250,000 | | Walt Disney Co., 7.700%, due 10/30/25 | 257,751 |

| | | | |

| Services - Prepackaged Software - 0.48% | |

| 100,000 | | Oracle Corp., 1.650%, due 3/25/26 | 95,432 |

| 150,000 | | VMWare, Inc., 3.900%, due 8/21/27 | 147,421 |

| | | | 242,853 |

| State Commercial Banks - 1.07% | |

| 100,000 | | Citizens Financial Group, Inc., 4.350%, due 8/01/25 | 98,961 |

| 250,000 | | Eagle Bancorp, Inc., 5.750%, due 9/01/24 | 250,000 |

| 200,000 | | Fifth Third Bancorp Series L, 4.500%, to 9/30/25 (a) (b) | 195,974 |

| | | | 544,935 |

| | | | |

| TOTAL FOR CORPORATE BONDS (Cost $8,157,504) - 15.70% | 7,956,905 |

| | | | |

| MUNICIPAL BONDS - 3.97% (c) | |

| | | | |

| California - 0.08% | |

| 20,000 | | Porterville Unified School District, 7.250%, due 7/01/27 | 20,042 |

| 20,000 | | San Bernardino County Redevelopment Agency Series A, 3.625%, due 9/01/24 | 20,000 |

| | | | 40,042 |

| Georgia - 0.20% | |

| 99,000 | | Georgia State Local Govt. Cops Grantor Trust Series A, 4.750%, due 6/01/28 | 101,891 |

| | | | |

| Indiana - 0.62% | |

| 135,000 | | Evansville-Vanderburgh, IN School Bldg. Corp. Series B, 6.150% due 7/15/27 | 135,124 |

| 190,000 | | Fishers, IN Econ Development Revenue Taxable-P3 Project Series C, 2.650%, due 8/01/28 | 180,110 |

| | | | 315,234 |

| Maryland - 0.40% | |

| 200,000 | | Baltimore Board of School Commissioners City Schools Revenue, 5.692%, due 12/15/25 | 201,302 |

| | | | |

| Michigan - 0.49% | |

| 25,000 | | City of Coldwater, MI Water Supply & Wastewater System Revenue, 5.000%, due 8/01/26 | 26,095 |

| 227,500 | | Michigan State Taxable School Loan Series A, 3.200%, due 5/15/27 | 222,183 |

| | | | 248,278 |

| New York - 0.48% | |

| 250,000 | | New York City, NY Transitional Finance Authority Revenue, 2.760%, due 2/01/26 | 244,433 |

| | | | |

| Ohio - 0.52% | | |

| 250,000 | | New Albany, Floyd County Industry School First Mortgage, 5.000%, due 1/15/27 | 262,580 |

| | | | |

| Pennsylvania - 0.82% | |

| 250,000 | | East-Norriton-Plymouth-Whipain Joint Sewer Authority, 1.832%, due 8/01/28 | 229,570 |

| 200,000 | | Pennsylvania ST Txble-Ref-First-Refunding Series, 1.200%, due 8/01/26 | 188,948 |

| | | | 418,518 |

| Washington - 0.14% | |

| 70,000 | | Douglas County, WA School District No. 206 Eastmont Qualified School Construction, 4.700%, due 12/01/25 | 70,267 |

| | | | |

| Wisconsin - 0.22% | |

| 110,000 | | Greendale, WI Taxable Community Development, Series A, 4.750%, due 12/01/26 | 110,032 |

| | | | |

| TOTAL FOR MUNICIPAL BONDS (Cost $2,094,350) - 3.97% | 2,012,577 |

| | | | |

| REAL ESTATE INVESTMENT TRUSTS - 4.16% | |

| 5,100 | | Extra Space Storage, Inc. | 902,700 |

| 9,452 | | Prologis, Inc. | 1,208,155 |

| TOTAL FOR REAL ESTATE INVESTMENT TRUSTS (Cost $893,026) - 4.16% | 2,110,855 |

| | | | |

| PREFERRED SECURITIES - 1.00% | |

| | | | |

| Asset Management - 0.09% | |

| 4,000 | | B Riley Financial, Inc., 6.50%, due 09/30/26 | 46,280 |

| | | | |

| Motor Vehicles & Passenger Car Bodies - 0.30% | |

| 6,000 | | Ford Motor Co., 6.000%, due 12/01/59 | 150,240 |

| | | | |

| National Commercial Banks - 0.53% | |

| 150,000 | | BAC Capital Trust XIII Series F, 6.00083% (3-Month SOFR + 0.66161%) (b) *** | 125,096 |

| 150,000 | | PNC Capital Trust C, 6.177690%, due 6/01/28 (3-Month SOFR + 0.83161%) *** | 144,430 |

| | | | 269,526 |

| Telephone Communications (No Radio Telephone) - 0.08% | |

| 3,000 | | QWest Corp., 6.500%, due 9/01/56 | 42,150 |

| | | | |

| TOTAL FOR PREFERRED SECURITIES (Cost $611,396) - 1.00% | 508,196 |

| | | | |

| STRUCTURED NOTES - 0.35% (c) | |

| | | | |

| Security Brokers, Dealers & Flotation Companies - 0.35% | |

| 125,000 | | Goldman Sachs Group, Inc., 0.000%, due 11/13/28, Capped at 10% *** | 98,450 |

| 95,000 | | Morgan Stanley, Series MTN, 0.000%, due 8/30/28, Capped at 12% *** | 77,464 |

| | | | 175,914 |

| | | | |

| TOTAL FOR STRUCTURED NOTES (Cost $212,853) - 0.35% | 175,914 |

| | | | |

| U.S. GOVERNMENT AGENCIES & OBLIGATIONS- 1.48%%(c) | |

| 750,000 | | U.S. Government Treasury Note/Bond, 3.875%, due 8/15/33 | 748,682 |

| TOTAL FOR U.S. GOVERNMENT AGENCIES & OBLIGATIONS (Cost $709,044) - 1.48% | 748,682 |

| | | | |

| MONEY MARKET FUND - 6.44% | |

| 3,266,470 | | Federated Treasury Obligation Fund - Institutional Shares 5.13% ** (Cost $3,266,470) - 6.44% | 3,266,470 |

| | | | |

| TOTAL INVESTMENTS (Cost $30,870,892) - 99.65% | 50,549,322 |

| | | | |

| OTHER ASSETS LESS LIABILITIES, NET - 0.35% | 175,408 |

| | | | |

| NET ASSETS - 100.00% | $ 50,724,730 |

| | | | |

| (a) Security converts to floating rate after the indicated fixed-rate coupon period. | |

| (b) Perpetual security. Perpetual securities have no stated maturity date, but they may be called/redeemed by the issuer. | |

| (c) All Corporate Bonds, Municipal Bonds and Structured Notes are categorized as Level 2 | |

| of the fair value hierarchy. Refer to Note 3 of the accompanying notes to the financial statements for additional information. | |

| * Non-income producing security during period. | |

| ** Variable rate security; the coupon rate shown represents the yield at August 31, 2024. | |

| *** Variable Rate Security - Interest rate shown is rate in effect at August 31, 2024. | |

| For securities based on a published reference rate and spread, the reference rate and spread are indicated in the description above. | |

| ADR - American Depository Receipt | |

| SOFR- Secured Overnight Financial Rate, a benchmark interest rate for dollar-denominated derivatives and loans. | |

| 3-month is the period where it is a fixed period of 3 months a lender will lend at that cost. | |

| The accompanying notes are an integral part of these financial statements. | |

| | | | |

| | | ARCHER INCOME FUND | |

| | | SCHEDULE OF INVESTMENTS | |

| | | August 31, 2024 | |

| | | | |

| Shares/Principal | Fair Value |

| | | | |

| | | | |

| CORPORATE BONDS - 51.69% (c) | |

| | | | |

| Air Transportation, Scheduled - 0.76% | |

| 150,000 | | Southwest Airlines Co., 5.250%, due 5/04/25 | $ 150,017 |

| | | | |

| Aircraft - 0.74% | |

| 150,000 | | Boeing Co., 2.600%, due 10/30/25 | 145,850 |

| | | | |

| Banks & Financial Institutions - 5.36% | |

| 500,000 | | Federal Farm Credit Bank, 5.570%, due 8/26/33 | 499,189 |

| 550,000 | | Federal Home Loan Bank, 5.555%, due 2/15/33 | 551,935 |

| | | | 1,051,124 |

| Commercial Banks - 3.06% | |

| 100,000 | | Bank of Montreal Series MTN, 6.100%, due 8/29/28 (Canada) | 99,478 |

| 250,000 | | Bank of Montreal Series MTN, 5.650%, due 7/12/29 | 250,856 |

| 250,000 | | Toronto Dominion Bank Series GMTN, 6.100%, due 8/16/28 (Canada) | 250,078 |

| | | | 600,412 |

| Consumer Cyclical Services - 0.26% | |

| 55,000 | | Conservation Fund Series 2019, 3.4740%, due 12/15/29 | 51,523 |

| | | | |

| Dental Equipment & Supplies - 0.70% | |

| 150,000 | | Dentsply Sirona, Inc. 3.250%, to 06/01/30 | 136,327 |

| | | | |

| Financial Services - 1.50% | |

| 150,000 | | CommunityWide Federal Credit Union, 5.000%, due 12/08/25 | 151,309 |

| 150,000 | | General Motors Financial Company, Inc. Series C, 5.70%, to 9/30/30 (a) (b) | 143,817 |

| | | | 295,126 |

| General Building Contractors - Residential Buildings - 0.51% | |

| 100,000 | | Lennar Corp., 4.750%, due 11/29/27 | 100,880 |

| | | | |

| Heating Equip, Except Elec & Warm Air; & Plumbing Fixtures - 2.30% | |

| 400,000 | | Masco Corp., 7.750%, due 8/01/29 | 451,468 |

| | | | |

| Investment Advice - 1.01% | |

| 200,000 | | Affiliated Managers Group, Inc., 3.500%, due 8/01/25 | 197,231 |

| | | | |

| Miscellaneous Publishing - 0.51% | |

| 100,000 | | Thomson Reuters Corp., 3.85%, due 9/29/24 | 99,838 |

| | | | |

| Motor Vehicles & Passenger Car Bodies - 0.75% | |

| 150,000 | | Toyota Motor Credit Corp. Series MTN, 5.250%, due 2/22/2027 | 147,479 |

| | | | |

| National Commercial Banks - 10.39% | |

| 200,000 | | Banc of California, Inc., 5.250%, due 4/15/25 | 198,960 |

| 200,000 | | Bank of America Corp. Series MTN, 6.550%, due 10/20/33 | 203,296 |

| 150,000 | | Huntington Bancshares, Inc. Series E, 8.44298%, to 10/15/24 (3-Month SOFR + 3.14161%) (b) *** | 148,880 |

| 150,000 | | Huntington Bancshares, Inc. Series G, 4.450%, to 10/15/27 (a) (b) | 142,495 |

| 150,000 | | JPMorgan & Chase Co. Series B, 6.00929%, due 2/01/27 (3-Month SOFR + 0.76161%) *** | 146,642 |

| 150,000 | | JPMorgan & Chase Co. Series CC, 8.08929%, to 11/01/24 (3-Month SOFR + 2.84161) (b) *** | 151,328 |

| 200,000 | | Keycorp Series MTN, 2.250%, due 4/06/27 | 187,874 |

| 10,000 | | SouthState Bank Corp., 5.750%, to 6/01/25 (a) | 9,749 |

| 100,000 | | Truist Financial Corp. Series M, 5.125%, to 12/15/27 (a) (b) | 96,438 |

| 75,000 | | Truist Financial Corp. Series Q, 5.100%, to 3/01/30 (a) (b) | 72,797 |

| 150,000 | | TTCU Federal Credit Union Series CD, 5.000%, due 7/26/27 | 154,467 |

| 200,000 | | US Bancorp, 3.700%, to 1/15/27 (a) (b) | 176,806 |

| 350,000 | | Wells Fargo & Co. Series MTN, 5.200%, due 8/16/34 | 349,517 |

| | | | 2,039,249 |

| Natural Gas Distribution - 0.25% | |

| 50,000 | | National Fuel Gas Co., 5.200%, due 7/15/25 | 49,895 |

| | | | |

| Paper Mills - 2.55% | |

| 300,000 | | Georgia-Pacific, LLC, 7.250%, to due 6/01/28 | 327,986 |

| 150,000 | | Georgia-Pacific, LLC, 7.750%, to due 11/15/29 | 172,844 |

| | | | 500,830 |

| Personal Credit Institutions - 1.23% | |

| 100,000 | | Discover Financial Services Series D, 6.125%, to 6/23/25 (a) (b) | 99,474 |

| 150,000 | | OneMain Finance Corp., 3.500%, due 1/15/27 | 142,203 |

| | | | 241,677 |

| Real Estate Investment Trust - 0.49% | |

| 4,000 | | Ready Capital Corp., 5.750%, due 2/15/26 | 96,680 |

| | | | |

| Retail - Department Stores - 0.19% | |

| 35,000 | | Dillards, Inc., 7.750%, due 7/15/26 | 36,481 |

| | | | |

| Retail-Drug Stores and Proprietary Stores - 1.54% | |

| 300,000 | | CVS Health Corp., 5.300%, due 6/01/33 | 301,586 |

| | | | |

| Security Brokers, Dealers & Flotation Companies - 2.51% | |

| 100,000 | | Capital Southwest Corp., 3.375%, due 10/01/26 | 93,200 |

| 100,000 | | Goldman Sachs Group, Inc. Series MTN, 6.100%, due 8/31/28 | 99,644 |

| 150,000 | | Jefferies Financial Group, Inc. Series MTN, 6.000%, due 12/29/28 | 148,316 |

| 150,000 | | Jefferies Financial Group, Inc. Series MTN, 6.500%, due 10/31/29 | 150,289 |

| | | | 491,449 |

| Services - Equipment Rental & Leasing - 1.23% | |

| 100,000 | | Air Lease Corp., 3.625%, due 12/01/27 | 96,924 |

| 150,000 | | United Rentals, Inc., 3.875%, due 11/15/27 | 144,765 |

| | | | 241,689 |

| Services-Miscellaneous Amusement & Recreation - 2.69% | |

| 400,000 | | Walt Disney Co., 7.700%, due 10/30/25 | 412,401 |

| 100,000 | | Walt Disney Co., 6.750%, due 1/09/38 | 115,352 |

| | | | 527,753 |

| Services - General Medical & Surgical Hospitals - 1.36% | |

| 250,000 | | HCA Healthcare, Inc., 7.050%, due 12/01/27 | 265,672 |

| | | | |

| Services - Prepackaged Software - 0.75% | |

| 150,000 | | VMWare, Inc. 3.900%, due 8/21/27 | 147,421 |

| | | | |

| State Commercial Banks - 7.22% | |

| 150,000 | | Ally Financial, Inc. Series B, 4.700%, to 5/15/26 (a) (b) | 136,322 |

| 150,000 | | Eagle Bancorp, Inc., 5.750%, due 9/01/24 | 150,000 |

| 150,000 | | Fifth Third Bancorp Series L, 4.500%, to 9/30/25 (a) (b) | 146,981 |

| 350,000 | | First Citizens Bank, 6.125%, due 3/09/28 | 362,614 |

| 100,000 | | Hilltop Holdings, Inc., 5.000%, due 4/15/25 | 98,237 |

| 500,000 | | State Street Corp., 7.350%, due 6/15/26 | 522,246 |

| 150,000 | | SVB Financial Group, 4.100%, to 2/15/31 (a) (b) + | 562 |

| | | | 1,416,962 |

| Steel Works, Blast Furnaces & Rolling Mills (Coke Ovens) - 0.76% | |

| 150,000 | | Steel Dynamics, Inc., 5.000%, due 12/15/26 | 149,789 |

| | | | |

| Telephone Communications (No Radio Telephone) - 0.26% | |

| 50,000 | | Indiana Bell Tel Co., Inc., 7.300%, due 8/15/26 | 51,710 |

| | | | |

| Wholesale - Groceries & Related Products - 0.81% | |

| 152,000 | | Sysco Corp., 6.500%, due 8/01/28 | 158,876 |

| | | | |

| TOTAL FOR CORPORATE BONDS (Cost $10,369,098) - 51.69% | 10,144,994 |

| | | | |

| EXCHANGE TRADED FUNDS - 4.19% | |

| 5,000 | | iShares 5-10 Year Investment Grade Corporate Bond ETF | 265,300 |

| 10,000 | | iShares 10+ Year Investment Grade Corporate Bond ETF | 523,800 |

| 1,000 | | iShares US Preferred Stock ETF | 32,360 |

| TOTAL FOR EXCHANGE TRADED FUNDS (Cost $809,693) - 4.19% | 821,460 |

| | | | |

| MUNICIPAL BONDS - 16.19% (c) | |

| | | | |

| Florida -0.72% | |

| 150,000 | | North Miami Beach, FL, Water Revenue Series B, 2.311%, due 8/01/27 | 142,580 |

| | | | |

| Georgia - 1.02% | |

| 50,000 | | Georgia State Local Government Cops Grantor Trust Series A, 4.750%, due 6/01/28 | 51,460 |

| 150,000 | | Georgia Qualified School Construction Bond Series F, 4.000%, 2/01/26 | 149,115 |

| | | | 200,575 |

| Illinois - 0.93% | |

| 125,000 | | Illinois Build America Bond, 6.900%, 3/01/35 | 139,728 |

| 42,353 | | Illinois State Taxable Pension AGM CR, 5.100%, 6/01/33 | 42,726 |

| | | | 182,454 |

| Indiana - 5.30% | |

| 140,000 | | Beech Grove, IN Sch Bldg. Corp., 2.850%, due 7/05/25 | 138,271 |

| 165,000 | | Evansville-Vanderburgh, IN School Bldg. Corp. Series B, 5.900%, due 7/15/26 | 165,094 |

| 100,000 | | Evansville-Vanderburgh, IN School Bldg. Corp. Series B, 6.150%, due 7/15/27 | 100,092 |

| 50,000 | | Gary Community School Bldg. Corp., 3.200%, due 7/15/29 | 48,464 |

| 25,000 | | Gary Community School Bldg. Corp., 3.500%, due 1/15/33 | 23,728 |

| 140,000 | | Indiana State Housing & Community Development Authority Series A-2, 4.984%, 7/1/30 | 141,012 |

| 300,000 | | Plainfield Redevelopment Commission Series B, 2.000%, due 2/01/29 | 269,742 |

| 150,000 | | Schererville Income Econ Dev Revenue, 2.579%, due 1/15/30 | 133,950 |

| 20,000 | | Warsaw Industry Redevelopment District Tax Taxable Special Taxing District Series A, 4.750%, due 2/01/26 | 19,811 |

| | | | 1,040,164 |

| Maryland - 0.51% | |

| 100,000 | | Baltimore MD, Brd of Sch Commissioners City Schs Revenue, 5.692%, due 12/15/25 | 100,651 |

| | | | |

| Michigan - 0.88% | |

| 177,500 | | Michigan State Taxable School Loan Series A, 3.200%, due 5/15/27 | 173,352 |

| | | | |

| Nebraska - 0.56% | |

| 110,000 | | Omaha NE Special Obligation Taxable Ref Riverfront, 6.400%, due 2/01/26 | 111,077 |

| | | | |

| New York - 0.52% | |

| 100,000 | | New York St Dorm Auth Revenues, 5.289%, due 3/15/33 | 101,762 |

| | | | |

| Ohio - 1.96% | |

| 100,000 | | Avon, OH, General Obligations Various Purpose Improvement Refunding Bonds, Series 2020, 0.955%, due 12/01/25 | 95,699 |

| 60,000 | | Bloom & Carroll Ohio Loc Sch Dist, 5.800%, due 12/01/25 | 60,858 |

| 10,000 | | Cleveland, OH Income Tax Revenue Build America Bonds, 6.060%, due 10/01/26 | 10,150 |

| 100,000 | | Cleveland, OH Public Power Sys Revenue, 5.500%, due 11/15/38 | 100,034 |

| 125,000 | | JobsOhio Beverage Sys Stwd Lien Liquor Profits Revenue Refunding Bonds, Series 2020A, 2.268%, due 1/01/28 | 117,550 |

| | | | 384,291 |

| Oklahoma - 0.05% | |

| 10,000 | | Garfield County, OK Educational Facs Authority, 6.000%, due 9/01/24 | 10,000 |

| | | | |

| Oregon - 0.78% | |

| 150,000 | | Philomath, Oregon Sch District Series A, 5.472%, due 6/15/27 | 153,776 |

| | | | |

| Pennsylvania - 1.44% | |

| 200,000 | | East-Norriton-Plymouth-Whitpain Joint Sewer Authority, 1.832%, due 8/01/28 | 183,656 |

| 100,000 | | Pennsylvania Higher Educational Facs Authority Revenue Series AZ, 3.000%, due 6/15/25 | 98,746 |

| | | | 282,402 |

| Texas - 0.78% | |

| 43,000 | | North Texas Tollway Authority Series B-1, 8.410%, due 2/01/30 | 46,194 |

| 105,000 | | Somerset Hills Road District #4 Texas, 5.125%, 8/15/34 | 106,237 |

| | | | 152,431 |

| Washington - 0.73% | |

| 150,000 | | City of Bellevue, WA Series B, 0.751%, due 12/01/25 | 142,938 |

| | | | |

| TOTAL FOR MUNICIPAL BONDS (Cost $3,215,871) - 16.19% | 3,178,453 |

| | | | |

| PREFERRED SECURITIES - 3.73% | |

| | | | |

| Asset Management - 0.18% | |

| 3,000 | | B Riley Financial, Inc., 6.50%, due 09/30/26 | 34,710 |

| | | | |

| National Commercial Banks - 2.52% | |

| 100,000 | | BAC Capital Trust XIII Series F, 6.00083%, to 10/11/24 (3-month SOFR + 0.66161%) (b) *** | 83,398 |

| 100,000 | | Key Corp. Capital I, 6.33317%, due 7/01/28 (3-month SOFR + 1.00161%) *** | 95,637 |

| 200,000 | | Mellon Capital IV Series 1, 6.17018%, to 10/28/24 (3-Month SOFR + 0.82661%) (b) *** | 171,925 |

| 150,000 | | PNC Capital Trust C, 6.17769%, due 6/01/28 (3-Month SOFR + 0.83161) *** | 144,430 |

| | | | 495,390 |

| State Commercial Banks - 1.03% | |

| 4,000 | | Medallion Bank Utah Series F, 8.000%, to 4/01/25 (a) (b) | 99,425 |

| 4,000 | | Merchants Bancorp, Inc., 8.250%, to 10/01/27 (a) (b) | 102,840 |

| | | | 202,265 |

| | | | |

| TOTAL FOR PREFERRED SECURITIES (Cost $811,260) - 3.73% | 732,365 |

| | | | |

| STRUCTURED NOTES - 1.47% (c) | |

| | | | |

| Security Brokers, Dealers & Flotation Companies - 1.47% | |

| 100,000 | | Goldman Sachs Group, Inc. Series MTN, due 12/13/28, 0.000%, Capped at 10% *** | 80,195 |

| 120,000 | | Goldman Sachs Group, Inc., 0.000%, due 11/13/28, Capped at 10% *** | 94,512 |

| 114,000 | | Morgan Stanley, Series MTN, 0.000%, due 8/19/28, Capped at 10% *** | 92,681 |

| 25,000 | | Morgan Stanley, Series MTN, 0.000%, due 8/30/28, Capped at 12% *** | 20,385 |

| | | | 287,773 |

| | | | |

| TOTAL FOR STRUCTURED NOTES (Cost $351,737) - 1.47% | 287,773 |

| | | | |

| U.S. GOVERNMENT AGENCIES & OBLIGATIONS- 11.70% (c) | |

| 500,000 | | U.S. Government Treasury Bill, 0.000%, due 9/03/24 | 500,000 |

| 550,000 | | U.S. Government Treasury Note/Bond, 4.625%, due 2/28/25 | 549,583 |

| 500,000 | | U.S. Government Treasury Note/Bond, 3.875%, due 3/31/25 | 497,687 |

| 750,000 | | U.S. Government Treasury Note/Bond, 3.875%, due 8/15/33 | 748,682 |

| TOTAL FOR U.S. GOVERNMENT AGENCIES & OBLIGATIONS (Cost $2,256,201) - 11.70% | 2,295,952 |

| | | | |

| MONEY MARKET FUND - 10.16% | |

| 1,993,750 | | Federated Treasury Obligation Fund - Institutional Shares 5.13% ** (Cost $1,993,750) - 10.16% | 1,993,750 |

| | | | |

| TOTAL INVESTMENTS (Cost $19,807,610) - 99.13% | 19,454,747 |

| | | | |

| OTHER ASSETS LESS LIABILITIES, NET - 0.87% | 171,126 |

| | | | |

| NET ASSETS - 100.00% | $ 9,625,873 |

| | | | |

| (a) Security converts to floating rate after the indicated fixed-rate coupon period. | |

| (b) Perpetual security. Perpetual securities have no stated maturity date, but they may be called/redeemed by the issuer. | |

| (c) All Corporate Bonds, Municipal Bonds, Structured Notes, and U.S. Government Agencies & Obligations are | |

| categorized as Level 2 of the fair value hierarchy. Refer to Note 3 of the accompanying notes to the financial statements for additional information. |

| ** Variable rate security; the coupon rate shown represents the yield at August 31, 2024. | |

| *** Variable Rate Security - Interest rate shown is rate in effect at August 31, 2024. | |

| + Default Bonds | |

| For securities based on a published reference rate and spread, the reference rate and spread are indicated in the description above. | |

| SOFR- Secured Overnight Financial Rate, a benchmark interest rate for dollar-denominated derivatives and loans. | |

| 3-month is the period where it is a fixed period of 3 months a lender will lend at that cost. | |

| The accompanying notes are an integral part of these financial statements. | |

| | | | |

| | | ARCHER STOCK FUND | |

| | | SCHEDULE OF INVESTMENTS | |

| | | August 31, 2024 | |

| | | | |

| Shares/Principal | Fair Value |

| | | | |

| COMMON STOCKS - 93.76% | |

| | | | |

| Aircraft - 1.82% | |

| 2,640 | | Boeing Co. * | $ 458,674 |

| | | | |

| Aircraft Engines & Engine Parts - 1.96% | |

| 4,000 | | RTX Corp. | 493,360 |

| | | | |

| Beverages - 2.01% | |

| 7,000 | | The Coca-Cola Company | 507,290 |

| | | | |

| Electric Services - 4.39% | |

| 2,000 | | American Electric Power Company, Inc. | 200,560 |

| 11,260 | | NextEra Energy, Inc. | 906,543 |

| | | | 1,107,103 |

| Electronic Computers - 3.37% | |

| 3,714 | | Apple, Inc. | 850,506 |

| | | | |

| Fire, Marine & Casualty Insurance - 2.61% | |

| 1,385 | | Berkshire Hathaway, Inc. Class B * | 659,149 |

| | | | |

| Hospital & Medical Service Plans - 4.96% | |

| 9,200 | | Centene Corp. * | 725,236 |

| 890 | | UnitedHealth Group, Inc. | 525,278 |

| | | | 1,250,514 |

| Industrial Inorganic Chemicals - 2.68% | |

| 1,413 | | Linde PLC. (United Kingdom) | 675,767 |

| | | | |

| Industrial Instruments for Measurement, Display & Control - 1.47% | |

| 3,110 | | MKS Instruments, Inc. | 370,805 |

| | | | |

| Measuring & Controlling Devices - 2.95% | |

| 1,212 | | Thermo Fisher Scientific, Inc. | 745,465 |

| | | | |

| National Commercial Banks - 4.88% | |

| 12,000 | | Bank of America Corp. | 489,000 |

| 3,300 | | JPMorgan Chase & Co. | 741,840 |

| | | | 1,230,840 |

| Petroleum Refining - 2.21% | |

| 4,735 | | Exxon Mobil Corp. | 558,446 |

| | | | |

| Pharmaceutical Preparations - 7.26% | |

| 720 | | Eli Lilly & Co. | 691,215 |

| 3,400 | | Johnson & Johnson | 563,924 |

| 4,860 | | Merck & Co., Inc. | 575,667 |

| | | | 1,830,806 |

| Railroads, Line-Haul Operating - 2.13% | |

| 2,100 | | Union Pacific Corp. Class B | 537,789 |

| | | | |

| Retail - Catalog & Mail-Order Houses - 2.43% | |

| 3,440 | | Amazon.com, Inc. * | 614,040 |

| | | | |

| Retail - Drug Stores and Proprietary Stores - 2.07% | |

| 9,140 | | CVS Health Corp. | 523,174 |

| | | | |

| Retail - Lumber & Other Building Materials Dealers - 2.15% | |

| 1,470 | | Home Depot, Inc. | 541,695 |

| | | | |

| Retail - Retail Stores - 1.37% | |

| 980 | | Ulta Beauty, Inc. * | 345,783 |

| | | | |

| Semiconductors & Related Devices - 8.10% | |

| 3,370 | | Advanced Micro Devices, Inc. * | 500,647 |

| 9,800 | | NVIDIA Corp. | 1,169,826 |

| 3,410 | | Skyworks Solutions, Inc. | 373,702 |

| | | | 2,044,175 |

| Services - Business Services - 3.29% | |

| 1,425 | | Fiserv, Inc. * | 248,805 |

| 2,100 | | Visa, Inc. Class A | 580,377 |

| | | | 829,182 |

| Services - Computer Programming, Data Processing, Etc. - 7.95% | |

| 5,544 | | Alphabet, Inc. Class A | 905,779 |

| 2,110 | | Meta Platforms, Inc. Class A | 1,099,964 |

| | | | 2,005,743 |

| Services - Equipment Rental & Leasing - 2.88% | |

| 980 | | United Rentals, Inc. | 726,435 |

| | | | |

| Services - Medical Laboratories - 2.06% | |

| 2,260 | | Laboratory Corp. of America Holdings | 519,551 |

| | | | |

| Services - Miscellaneous Health & Allied Services - 2.81% | |

| 2,200 | | ICON PLC. (Ireland) * | 708,532 |

| | | | |

| Services - Miscellaneous Amusement & Recreation - 1.64% | |

| 4,590 | | Walt Disney Co. | 414,844 |

| | | | |

| Services - Prepackaged Software - 7.76% | |

| 1,057 | | Adobe, Inc. * | 607,151 |

| 5,870 | | Cloudflare, Inc. Class A * | 482,162 |

| 2,080 | | Microsoft Corp. | 867,651 |

| | | | 1,956,964 |

| Soap, Detergent, Cleaning Preparations, Perfumes, Cosmetics - 2.09% | |

| 3,068 | | Procter & Gamble Co. | 526,285 |

| | | | |

| Surgical & Medical Instruments & Apparatus - 2.46% | |

| 1,720 | | Stryker Corp. | 619,922 |

| | | | |

| TOTAL FOR COMMON STOCKS (Cost $10,922,615) - 93.76% | 23,652,839 |

| | | | |

| REAL ESTATE INVESTMENT TRUST - 1.63% | |

| 1,840 | | American Tower Corp. | 412,270 |

| TOTAL FOR REAL ESTATE INVESTMENT TRUST (Cost $300,523) - 1.63% | 412,270 |

| | | | |

| MONEY MARKET FUND - 4.38% | |

| 1,104,215 | | Federated Treasury Obligation Fund - Institutional Shares 5.13% ** (Cost $1,104,215) - 4.38% | 1,104,215 |

| | | | |

| TOTAL INVESTMENTS (Cost $12,327,353) - 99.77% | 25,169,324 |

| | | | |

| OTHER ASSETS LESS LIABILITIES, NET - 0.23% | 57,842 |

| | | | |

| NET ASSETS - 100.00% | $ 25,227,166 |

| | | | |

| * Non-income producing security during period. | |

| ** Variable rate security; the coupon rate shown represents the yield at August 31, 2024. | |

| The accompanying notes are an integral part of these financial statements. | |

| | | | |

| | | ARCHER FOCUS FUND | |

| | | SCHEDULE OF INVESTMENTS | |

| | | August 31, 2024 | |