As filed with the Securities and Exchange Commission on April 30, 2010

Registration No. 333-163450

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

AMENDMENT NO. 8

TO

FORM F-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

CHINA EDUCATION, INC.

(Exact name of Registrant as specified in its charter)

Not Applicable

(Translation of Registrant’s name into English)

| | | | |

| Cayman Islands | | 8200 | | Not Applicable |

(State or other jurisdiction of incorporation or organization) | | (Primary Standard Industrial Classification Code Number) | | (I.R.S. Employer Identification Number) |

700, Guo Ji Chuang Ye Yuan 1#

1 Shang Di Qi Jie Hai Dian District

Beijing 100085, People’s Republic of China

(8610) 6505-9488

(Address, including zip code, and telephone number, including area code, of Registrant’s principal executive offices)

CT Corporation System

111 Eighth Avenue

New York, New York 10011

(212) 664-1666

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

| | |

Gregory Sichenzia, Esq. Thomas A. Rose, Esq. Jeff Cahlon, Esq. Sichenzia Ross Friedman Ference LLP 61 Broadway, 32nd Floor New York, NY 10006 (212) 930-9700 Fax: (212) 930-9725 | | Kenneth S. Rose, Esq. Stephen A. Zelnick, Esq. Quyen Luu, Esq. Morse, Zelnick, Rose & Lander LLP 405 Park Avenue, Suite 1401 New York, NY 10022 (212) 838-1177 Fax: (212) 838-9190 |

Approximate date of commencement of proposed sale to the public: as soon as practicable after the effective date of this registration statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ¨

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

CALCULATION OF REGISTRATION FEE

| | | | | | | | |

| Title of Each Class of Securities to Be Registered | | Proposed Maximum

Aggregate Offering Price(1) | | | | Amount of

Registration Fee(2) |

Ordinary shares, par value $0.0001 per share | | $ | 24,500,000 | | | | $ | 1,336.34 |

Ordinary shares, par value $0.0001 per share, issuable upon exercise of Underwriters’ over-allotment | | $ | 3,675,000 | | | | $ | 235.83 |

Total | | | | | | | $ | 1,572.17 |

| (1) | Estimated solely for the purpose of determining the amount of registration fee in accordance with Rule 457(o) under the Securities Act of 1933. |

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the Registration Statement shall become effective on such date as the Commission, acting pursuant to such Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

| | |

| PRELIMINARY PROSPECTUS | | SUBJECT TO COMPLETION. DATED APRIL 30, 2010 |

3,500,000 Ordinary Shares

This is the initial public offering of ordinary shares of China Education, Inc., or China Education.

Prior to this offering, there has been no public market for our ordinary shares. We anticipate that the initial public offering price will be between $6.00 and $7.00 per ordinary share. We have applied for our ordinary shares to be listed on the NASDAQ Stock Market under the symbol “IEDU”.

Investing in our ordinary shares involves risks. See “Risk Factors” beginning on page 11 of this prospectus for a discussion of information that should be considered in connection with an investment in our securities.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

| | | | | | |

| | | Per ordinary

share | | Total |

Initial public offering price | | $ | | | $ | |

| | |

Underwriting discounts and commissions | | $ | | | $ | |

| | |

Proceeds, before expenses, to China Education, Inc. | | $ | | | $ | |

We have granted the underwriters an option to purchase up to an additional 525,000 ordinary shares from us and to cover over-allotments at the initial public offering price less underwriting discounts and commissions.

The underwriters expect to deliver the ordinary shares to purchasers on , 2010.

RODMAN & RENSHAW, LLC

The date of this prospectus is May , 2010.

TABLE OF CONTENTS

You should rely only on the information contained in this prospectus. Neither we nor the underwriters have authorized anyone to provide you with information that is different from that contained in this prospectus. This prospectus may only be used where it is legal to offer and sell these securities. The information in this prospectus is only accurate as of the date of this prospectus.

Until [—], 2010 (25 days after the date of this prospectus), all dealers that effect transactions in these securities, whether or not participating in this offering, may be required to deliver a prospectus. This is in addition to the dealer’s obligation to deliver a prospectus when acting as an underwriter and with respect to unsold allotments or subscriptions.

i

PROSPECTUS SUMMARY

This summary highlights information contained elsewhere in this prospectus and does not contain all of the information you should consider before investing in our ordinary shares. You should read this entire prospectus, including “Risk Factors” and the consolidated financial statements and related notes, before making an investment decision. Unless otherwise specifically stated, the information in this prospectus does not take into account the possible purchase of additional ordinary shares pursuant to the exercise of the over-allotment option. This prospectus includes forward-looking statements that involve risks and uncertainties. See “Forward-Looking Statements.” and “Risk Factors.”

Unless otherwise indicated, all historical and pro forma common stock and per share data in this prospectus have been retroactively restated to the earliest period presented to account for the 2.1437-to-1 reverse stock split effectuated on April 27, 2010 (the “Reverse Split”).

China Education, Inc.

Our Business

China Education, Inc. (“China Education”, “CEI”, “we”, “us”, or “our”) was incorporated in the Cayman Islands on August 2, 2007. We are wholly owned by Above Great Limited, a company incorporated in British Virgin Islands and controlled by Michael Qu, a Singapore citizen.

We operate two high schools and one post-secondary school in China. Our goal is to become a leading national chain of high schools, colleges and universities in China, through the acquisition of control of state and privately-owned high schools, colleges and universities.

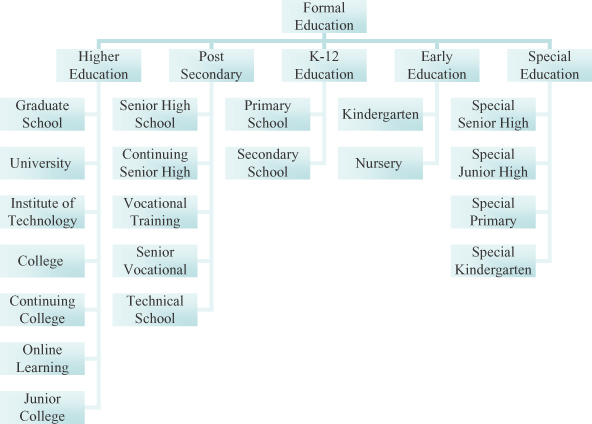

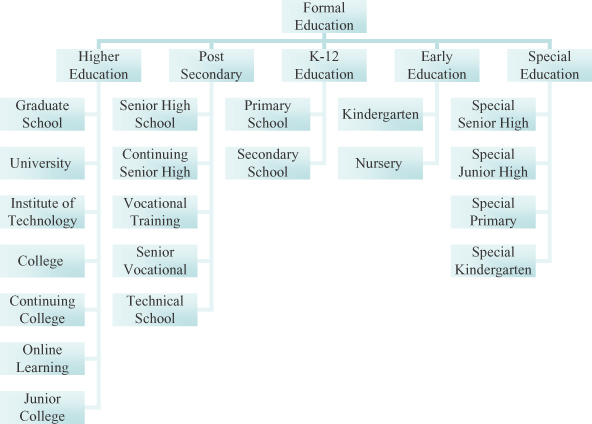

In China, all students are required to attend school through junior high school. No education beyond junior high school is required, and any education beyond junior high school, including senior high school and any post-secondary school, must be paid for by the student. Senior high school students typically range in age from 15 to 19. Students in post-secondary schools (or any educational institution beyond senior high school) typically range in age from 15 to 24.

We operate two senior high schools in Henan province: Branch of Suixian High School or “Suixian High School”, and Branch of Suixian Hui Nationality High School or “Suixian Hui High School”. Suixian High School, which has been in operation for 69 years, is one of the oldest and we believe the best senior high school in Henan province, having been recognized as a “Provincial Model Senior High School” by the Department of Education in Shangqiu city. The branch of the school which we operate is located on the campus beside Suixian Lake, on over 133,320 square meters, and currently has over 13,200 students. The school has an additional smaller branch downtown, which we do not have any interest in.

As a senior high school, the age range for students at Suixian High School is typically from 15 to 19, and the school’s students are not required to attend school or take a minimum course load.

Suixian Hui High School covers an area of more than 50,000 square meters, and has 9,700 students and 98 classrooms. The principal of Suixian Hui High School was recognized by the Ministry of Education as one of the best 99 teachers in China for year 2007. The school used to have an additional branch, located on another campus, which is no longer in operation.

As a senior high school, the age range for students at Suixian Hui High School is typically from 15 to 19, and the school’s students are not required to attend school or take a minimum course load.

In addition, we operate Shandong Foreign Affairs Translation Business Middling Special School or “Qingdao School”, which currently serves over 3,175 students on a campus located in Qingdao. An additional satellite campus ceased operations in October 2009. Qingdao School was ranked one of the 12 best vocational post-secondary schools in Shandong province by the Education Department of Shandong province. In 2009 the school received recruiting commitments from more than 300 national and international corporations. The

1

acquisition of Qingdao School has not been registered due to the need to complete payment of the purchase price, but a binding contract for the acquisition has been entered into and the parties are all treating the acquisition as having been completed.

As a post-secondary school, the age range for students at Qingdao School is typically from 20 to 24, and the school’s students are not required to attend school or take a minimum course load.

Our core business objective is to operate high schools, colleges and universities offering academic programs or providing education/training services to students through traditional “bricks and mortar” campuses. Such educational institutions generate revenues primarily through student tuition fees. We seek to acquire control of leading high schools, colleges and universities in urban communities in selected regions or cities. We intend to use a portion of the proceeds of this offering to acquire control of additional educational institutions to advance our goal of becoming a leading national chain of high schools, colleges and universities. We have no current arrangements or agreements for any specific acquisitions.

Due to restrictions on foreign ownership of educational institutions in China, we operate our business through our subsidiary located in China which provides consulting, investment and technical services to Beijing Frank Management and Investment Co., Ltd, or “the Management Company”, and the two high schools as well as one post-secondary school we currently operate. The Management Company owns the high schools and controls the post-secondary school we currently operate. We believe our Contractual Arrangements with the Management Company and the educational institutions we operate allow us to effectively control and derive substantially all of the economic benefits from the Management Company. See “Our Corporate History and Structure.”

Suixian High School, Suixian Hui High School and Qingdao School each have all of the required permits, registrations, licenses, and/or approvals required by the local government authority to operate under the management structure described in this prospectus. We have been advised by our PRC legal counsel, Sinowing Law LLP, that province level approval from Henan Education Commission is higher level approval than the local city level approval from local city Education Bureau and local city Education Bureau follows the instructions from Henan Education Commission and Henan Education Commission only approve the important schools unlike local city Education Bureau which approves all the schools for their permits, therefore the approvals from Henan Education Commission constitutes the private schools education permits. Since Suixian schools have received this higher province level approval, which does not need to be renewed, we are not pursuing renewal of the private education permit. We received private funded school education permit for Qingdao School on February 10, 2010.

The Management Company intended to pay for the schools for which it entered into acquisition agreements in August 2005 and January 2008 mainly through the offering proceeds (which offering was already contemplated). In the absence of this offering, we would seek to raise proceeds through private placements for such payments. The Management Company would not be able to pay for the acquisition absent the offering proceeds and proceeds from private placements.

Our Strengths

We believe the following strengths have contributed to our growth and differentiate us from our competitors:

| | • | | Early Mover advantage in acquiring control of bricks and mortar schools in China. We believe that as one of the first companies to pursue acquisitions of control of state and privately-owned educational service providers, we have established key relationships with local regulators as well as business leaders to enable us to successfully pursue our acquisition strategy; |

| | • | | Ability to Identify and Pursue Attractive Acquisition Opportunities on Favorable Terms. We have implemented an acquisition strategy that has delivered proven results with the two high schools and one post-secondary school we have acquired control of and currently operate; |

2

| | • | | Ability to Expand and Improve the Efficiency of Acquired Education Providers. We believe our operational control of the two high schools and one post-secondary school we have acquired control of has resulted in expansions of facilities and improvements in operational efficiencies; |

| | • | | Strong, Experienced and Stable Management Team with Extensive Industry Experience and Proven Track Record. Our management team has extensive experience in the education industry and has good relationships with (central and local) government officers in the education industry; |

| | • | | We believe our acquisitions of control of educational institutions present a mutually beneficial opportunity for both private owners or local government officers and target high schools, universities and colleges; |

| | • | | Our ability to tailor school improvement programs to meet local needs and contexts and build upon where educational institutions currently are; |

| | • | | Focus on high-quality courses and superior support and services for our course participants; and |

| | • | | Highly scalable and adaptable business model. |

Our Strategy

Our goal is to establish and strengthen our position as a leading educational services chain in China by pursuing the following growth strategies:

| | • | | Acquire control of Additional High-Quality Educational Service Providers such as leading high schools, colleges and universities. We seek to acquire control of high-quality state and privately-owned high schools, colleges and universities and leverage our education management expertise to improve the operational and administrative efficiency and reduce the operating costs of those high schools, colleges and universities; |

| | • | | Organic growth by improving teaching quality/course offerings and operations across schools and universities and introducing new education programs and services (nursing training and certification for overseas markets). |

| | • | | Further Increase Efficiency by Standardizing and Centralizing Functions and Practices Across Our Educational Institutions. We have designed a management improvement program to improve our operational efficiency, control overall costs and enhance our competitiveness; |

| | • | | Further develop JV ventures with well recognized overseas universities. |

| | • | | Recruit and retain the best teachers in the region and in the nation; and |

| | • | | Pursue selective strategic acquisitions and alliances at attractive valuation. Focus on high schools, colleges and universities that have existing strong financial positions. |

Our Challenge

We face challenges and risks from competition and operational issues, in our operations in China and in our corporate structure which are described below:

| | • | | Competition in the China Education Industry.The China education industry is highly competitive. Competition among schools is primarily driven by reputation. In all of the geographical areas in which we expect to operate, there are schools, colleges, universities and other educational services providers, such as training and language learning centers, which provide services comparable to those that the schools and colleges we operate offer or expect to offer. Competition between Chinese schools and colleges has intensified in recent years due to the growing privatization of educational institutions and new policies that allow students to choose their teachers and the schools they would like to attend. |

3

| | • | | Operational Issues and Implementation of Business Strategy.We face the following challenges in the operation of high schools, colleges and universities and the implementation of our business strategy: |

| | • | | our ability to access sufficient capital to fund our acquisition strategy and development projects; |

| | • | | effectively manage our growth and expanding operations; |

| | • | | issues related to the implementation of our acquisition strategy, such as integration issues, minimizing the assumption of unknown and contingent liabilities and the ability to obtain the necessary government approvals; and |

| | • | | issues related to education operations in China, including the continued availability of tax benefits, the existence and distribution of educational products, and changes in government regulations. |

| | • | | Operations in China and Corporate Structure. In addition to the economic, political and legal risks related to operations in China, our corporate structure presents a number of risks including: |

| | • | | the ability of holders of ordinary shares to enforce judgments and legal rights in China; |

| | • | | changes in PRC regulations governing the foreign ownership of education companies; |

| | • | | the financial impact of the conversion to non-preferential tax treatment status for the two high schools and one post-secondary school we operate; |

| | • | | restrictions on educational institution operations and the ability of the educational institutions to pay dividends to the Management Company; and |

| | • | | conflicts of interest created by our corporate structure and lack of direct ownership of the two high schools and one post-secondary school we operate. |

| | • | | Limitations on access to capital to fund our acquisition strategy and development projects. Our growth and primary business strategy are limited due to the preferential tax treatment status of the schools we operate, as a result of which the only funds generated by operations that we are permitted to use for acquisitions and development of additional schools are service fees that we may receive from the schools. We have deferred receipt of service fees and expect to do so in the future; therefore, we have limitations on our access to capital to fund our acquisition and development projects, which are our primary business strategy for growth. |

See “Risk Factors” for a further discussion of these challenges and risks related to our business.

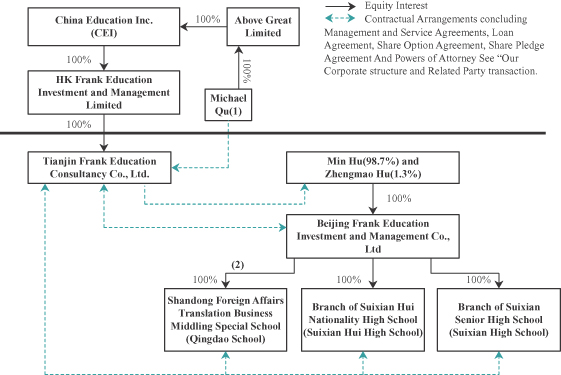

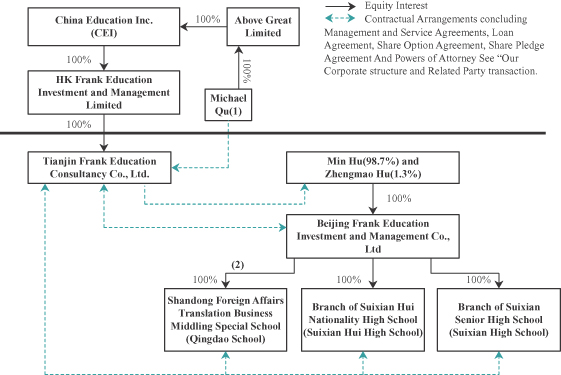

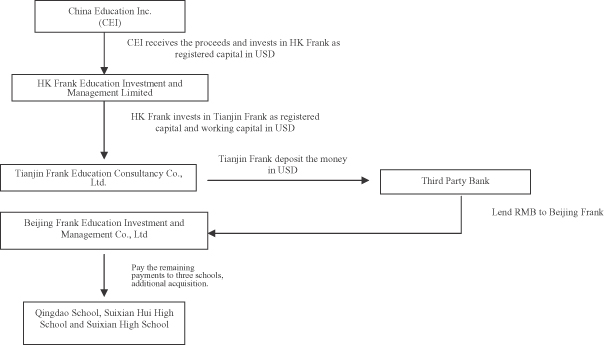

Our Corporate History and Structure

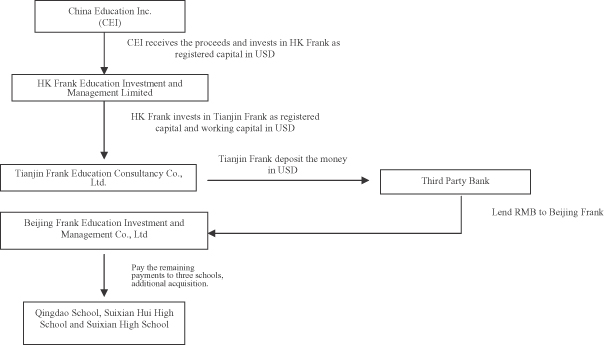

China Education, Inc., a Cayman Islands exempted company with limited liability, was incorporated on August 2, 2007. Our wholly-owned Hong Kong subsidiary, HK Frank Education Investment and Management Limited, or HK Frank, is a limited liability company that was incorporated in January 2008, which owns 100% of the equity interests of our Chinese subsidiary, Tianjin Frank Consultancy Co., Ltd., or Tianjin Frank. Tianjin Frank is a limited liability company that was established on July 31, 2009 located in the Tianjin Binhai Hightech Park in Tianjin.

The Management Company was incorporated as a limited liability company in China on December 29, 2004. Zhengmao Hu and Min Hu, citizens of the PRC currently own 1.3% and 98.7%, respectively, of the Management Company. The Management Company acquired Suixian High School on August 17, 2005, Suixian Hui High School on January 4, 2008 and Boyang on January 4, 2008, in order to indirectly own Qingdao School. With active participation of the seller, the change in ownership of Suixian High School and Suixian Hui High

4

School has already been completed and registered although no payments have been made. These changes comply with relevant PRC law and are irreversible in that the closing of the deal has been effectuated on part of the sellers and under the acquisition agreements the sellers do not have direct recourse to the title of the schools if the buyers default in payment of the acquisition price.

If no payments are ever made for the properties and/or the buyers default on the acquisition agreements, the recourse or remedy available for the sellers is to sue the buyers for monetary compensation in which event the buyers can elect to repay the amounts due by means other than selling the schools back to the sellers. If in any event the buyers elect to sell the schools to repay the acquisition price due, they are not obligated to sell the schools back to the sellers. The sellers do not have a direct claim on the title of the schools, and are in no better position with respect to acquiring title to the schools than a third party creditor of the buyers.

The reason such transactions may be irreversible when no payments have been made is because the parties under the acquisition agreements changed the registered ownership of the schools to the Management Company with respect to both Suixian High School and Suixian Hui High School prior to any payments having been made. Those changes are not reversible in PRC without the consent of buyer to return the registered ownership of the schools to the seller. The change in ownership of Qingdao Boyang has not been registered due to the outstanding remaining payment of the purchase price, but, pursuant to Article 4.1 of the share transfer agreement, dated January 4, 2008, between the Management Company and Rong Zhou and Chengwu Sun (the “Share Transfer Agreement”) the parties agreed that the transfer and control of the ownership of Qingdao Boyang has been effective upon the signing of the share transfer agreement although it is not irreversible. In addition, pursuant to a tripartite agreement, dated January 4, 2008 (the “Tripartite Agreement”), among the Management Company, Qingdao Peking University Resources Technology Department Co., Ltd (“Qingdao Resources”) and Qingdao Boyang Education Investment and Management Co., Ltd. (“Qingdao Boyang”), the Management Company agreed to pay to Qingdao Resources RMB37,765,000, which remains unpaid by the Management Company and represents a debt originally incurred by Qingdao Boyang on September 2, 2005, representing a portion of the purchase price for the Qingdao School under the acquisition agreement, in satisfaction of an unpaid balance owed by Qingdao Boyang to Qingdao Resources for a real estate sale. Qingdao Resource recognizes the transfer of ownership to the Management Company notwithstanding the fact that it is still owned RMB37,765,000 pursuant to the tripartite agreement and the fact that it is still owed US $10.1 million under the Share Transfer Agreement. Under Article 4.1 of the Share Transfer Agreement, the parties agreed that the transfer and control of the ownership of Qingdao Boyang has been effective upon the signing of the share transfer agreement. Notwithstanding the foregoing, because the transfer of ownership of Qingdao School to the Management Company is reversible, if the Management Company fails to make the required payments under the Share Transfer Agreement, and fails to obtain any further extension or waiver for such payments from the seller, the ownership of Qingdao School may revert back to the seller. No penalty is due for the unpaid amount because the seller agreed to waive damages for the unpaid amount under an amendment to the share transfer agreement. The management of the schools report to the Management Company any issues that need the owner’s involvements or decisions. The Management Company has the rights to appoint and control the management team members of schools. We can direct the Qingdao School in the normal business affairs as a controlling party. Therefore, Qingdao School is under the control of the Management Company.

We conduct our operations in China primarily through Contractual Arrangements among our PRC subsidiary, Tianjin Frank, the Management Company, the two individual shareholders of the Management Company, and the schools. Under these Contractual Arrangements, Tianjin Frank provides investment consulting, management consulting, education consulting and technical consulting services to the Management Company and the high schools and post-secondary school in exchange for service fees from the Management Company and the high schools and post-secondary school. Additionally, Min Hu and Zhengmao Hu have pledged their equity interests in the Management Company to Tianjin Frank. Tianjin Frank also has an exclusive

5

option to purchase all or part of the equity interests in, and/or the assets of, the Management Company when and to the extent permitted by applicable PRC law. We believe these Contractual Arrangements enable us to:

| | • | | exercise effective control over the Management Company and the high schools and post-secondary school; and |

| | • | | receive substantially all of the economic benefits from the Management Company which owns the high schools and controls post-secondary school we operate in consideration for the services provided by Tianjin Frank. |

As a result of Contractual Arrangements, we treat the Management Company as a variable interest entity, or VIE, and have consolidated its historical financial results in our financial statements in accordance with U.S. Generally Accepted Accounting Principles, or U.S.GAAP. We do not, however, own any equity interest in the Management Company or the high schools and post-secondary school we operate.

In June 2009, the FASB issued Accounting Standards Codification 810-10, “Consolidation—Overall” (“ASC 810-10”, previously SFAS 167, “Amendments to FASB Interpretation No. 46(R)”). This accounting standard will be effective for our fiscal year beginning January 1, 2010. This accounting standard eliminates exceptions of the previously issued pronouncement related to consolidation of qualifying special purpose entities, contains new criteria for determining the primary beneficiary, and increases the frequency of required reassessments to determine whether a company is the primary beneficiary of a variable interest entity. We do not believe the adoption of ASC 810-10 will have any significant impact on our consolidated financial statements or our operations. See “Management Discussion and Analysis of Our Financial Condition and Results of Operations Recent Accounting Pronouncements”.

PRC laws and regulations limit foreign ownership of primary and middle schools for students in grades one to nine. Our corporate structure allows us to acquire control of high schools and colleges in China by obtaining approvals only from local governments, without the need to obtain approvals from the Ministry of Education and the Ministry of Commerce. See “Regulation”. It also permits us to raise capital from investors outside of China.

In the opinion of Sinowing Law LLP, our PRC legal counsel:

| | • | | each of Tianjin Frank and the Management Company was duly incorporated and is validly existing under the laws of the PRC; |

| | • | | each of Suixian High School, Suixian Hui High School and Qingdao School was duly registered and is validly existing as a private non-enterprise entity with legal person status under the laws of the PRC; |

| | • | | the ownership structure of the Management Company complies with, and immediately after this offering will comply with, the current PRC laws and regulations; |

| | • | | our Contractual Arrangements with the Management Company are valid and binding on all parties to these arrangements and will not result in any violation of PRC laws or regulations currently in effect; and |

| | • | | the business operations of the Management Company comply with current PRC laws and regulations. |

There are, however, substantial uncertainties regarding the interpretation and application of current and future PRC laws and regulations. Accordingly, we cannot assure you that the PRC authorities will not ultimately take a view that is contrary to the opinion of our PRC legal counsel. If the PRC government finds that the agreements establishing the structure for us to operate our China business do not comply with PRC government restrictions on foreign ownership of schools, we may be subject to severe penalties and may be forced to cease our China operations. See “Risk Factors—Risks Related to Our Corporate Structure—Our corporate structure is subject to legal risks that could limit our ability to do business.”

Additionally, the only payments we expect to receive from the high schools and post-secondary school we operate are for the services we provide. Due to the preferential tax treatment status of the schools we operate, we

6

will not be able to use profits from the operations of the high schools and post-secondary school for reinvestment in our expansion of our business (other than reinvestment of the funds in the school from which the profits were derived) for distribution to our shareholders. As a result, for as long as the educational institutions we operate retain their preferential tax treatment status, the Management Company will be unable to use the profits from the operations of the educational institutions it owns for reinvestment in or expansion of its business (other than reinvestment of the funds in the educational institutions from which the profits were derived) or for distribution to its shareholders. Accordingly, we anticipate that at some point in the future the Management Company will convert the educational institutions we operate to non-preferential tax treatment entities to enable it to distribute their profits to the Management Company for use in other parts of its business. We are not able to predict the time of such conversion at this time. Factors to be considered in determining whether to undertake this conversion include, our ability to acquire control of additional educational institutions, the pace at which we are able to acquire control of additional educational institutions after the completion of this offering, our competitive position in the education industry in China and any negative impact the increase in tax expense will have on the network of educational institutions’ operating margins.

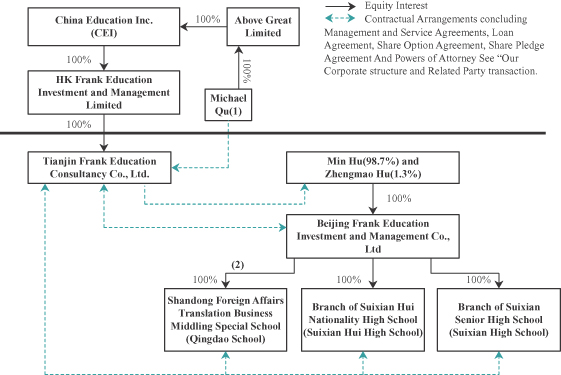

The following diagram illustrates our corporate structure and Contractual Arrangements of each of our subsidiaries and the Management Company and the educational institutions we operate, including the place of formation, as of the date of this prospectus.

| Note (1): | Michael Qu made a loan directly to Messrs. Hu in 2004. Michael Qu assigned his creditor rights to HK Frank in January 2008. On August 4, 2009, HK Frank assigned its creditor rights to Tianjin Frank. As a result of the foregoing, Tianjin Frank currently owes RMB15 million to Michael Qu. Mr. Qu owns 100% of Above Great Limited. Above Great Limited owns 100% of China Education, see “PRINCIPAL SHAREHOLDERS”. |

| Note (2): | Beijing Frank controls 100% Qingdao School through Qingdao Boyang. |

7

Corporate Information

Our principal executive office is located at 700, Guo Ji Chuang Ye Yuan 1#, 1 Shang Di Qi Jie Hai Dian District, Beijing 100085, People’s Republic of China. Our telephone number at this address is + (86 10) 6505 9488. Our registered office in the Cayman Islands is located at the offices of Offshore Incorporations (Cayman) Limited or OIL, Scotia Centre, 4th Floor, P.O. Box 2804, George Town, Grand Cayman KY1-1112, Cayman Islands. Our agent for service of process in the United States is CT Corporation System, located at 111 Eighth Avenue, New York, New York 10011.

Investors should contact us for any inquiries through the address and telephone number of our principal executive offices.

Conventions Which Apply to This Prospectus

Except where the context otherwise requires and for purposes of this prospectus only:

| | • | | “Chinese affiliated entity” or “Chinese affiliated entities” refers to the variable interest entity or variable interest entities through which we operate certain lines of our business and, which, pursuant to Contractual Arrangements, are effectively controlled by us and have transferred to us essentially all of the economic benefits of their businesses; |

| | • | | “China” or “PRC” refers to the People’s Republic of China, excluding for purposes of this prospectus Taiwan, Hong Kong and Macau; |

| | • | | “Contractual Arrangement” has the definition given to such term under Corporate Structure—Our Contractual Arrangements on page 43; |

| | • | | “shares” or “ordinary shares” refers to our ordinary shares; |

| | • | | “RMB” and “Renminbi” refer to the legal currency of China; |

| | • | | “$,” “dollars” and “U.S. dollars” refer to the legal currency of the United States; |

| | • | | “U.S GAAP” refers to the Generally Accepted Accounting Principles; |

| | • | | “registered students,” refer to students who either in the current period or in previous periods have paid tuition and are registered in an academic degree program; |

| | • | | “HK Frank” refers to HK Frank Education Investment and Management Limited; |

| | • | | “Tianjin Frank” refers to Tianjin Frank Consultancy Co., Ltd.; |

| | • | | “Suixian High School” refers to Branch of Suixian High School; |

| | • | | “Qingdao Boyang” refers to Qingdao Boyang Technology and Education Co., Ltd; |

| | • | | “Qingdao School” refers to Shandong Foreign Affairs Translation Business Middling Special School; and |

| | • | | “Suixian Hui High School” refers to Branch of Suixian Hui Nationality High School. |

8

The Offering

Offering price | We estimate that the initial public offering price will be between $6.00 and $7.00 per ordinary share. |

Ordinary shares in the offering | 3,500,000 |

Number of ordinary shares to be outstanding immediately after this offering | 13,109,554 ordinary shares. |

Over-allotment option | We have granted to the underwriters an option, which is exercisable within 45 days from the date of this prospectus, to purchase up to 525,000 additional ordinary shares. |

Use of proceeds | We estimate that our net proceeds from this offering without the exercise of the over-allotment option will be approximately $20.9 million, assuming an initial public offering price per ordinary share of $6.50, the mid-point of the estimated public offering price range set forth on the cover of this prospectus, and after deducting underwriting discounts and commissions and estimated offering expenses which are payable by us. |

We intend to use these net proceeds (i) to acquire control of additional educational institutions, (ii) to make the remaining payments on the purchase price of two high schools and one post-secondary school and (iii) for working capital and general corporate purposes. See “Reasons for Offer and Use of Proceeds.”

Risk factors | See “Risk Factors” and other information included in this prospectus for a discussion of factors you should carefully consider before deciding to invest in our ordinary shares. |

Proposed NASDAQ symbol | “IEDU” |

The number of ordinary shares that will be outstanding immediately after this offering:

| | • | | assumes the underwriters’ over-allotment option is not exercised; |

| | • | | excludes ordinary shares reserved for future issuances under our share incentive plan. |

9

Summary Consolidated Financial Data

The following summary consolidated financial data of China Education, presented in the table below, was derived from China Education’s audited consolidated financial statements for the years ended December 31, 2009, 2008, 2007 and 2006. This summary consolidated financial data should be read in conjunction with “Operating and Financial Review and Prospects” included elsewhere in this prospectus, and China Education’s audited consolidated financial statements, including the notes thereto, for the years ended December 31, 2009, 2008, 2007 and 2006, which are included in this prospectus, beginning on page F-1.

Our consolidated financial statements are prepared in accordance with U.S Generally Accepted Accounting Principles, or U.S GAAP. The historical results are not necessarily indicative of results to be expected in any future period.

| | | | | | | | | | | | | | | |

| | | For the Year Ended December 31, | |

| | | 2009 | | | 2008 | | | 2007 | | | 2006 | |

| | | US$ | | | US$ | | | US$ | | | US$ | |

| | | (in thousands, except share, per share and per ordinary

share data) | |

Consolidated Statement of Operations Data(1): | | | | | | | | | | | | | | | |

Revenue | | | 14,345 | | | | 10,957 | | | | 3,873 | | | 2,909 | |

Cost of sales | | | (4,427 | ) | | | (4,825 | ) | | | (1,694 | ) | | (1,333

| )

|

Gross Profit | | | 9,918 | | | | 6,132 | | | | 2,179 | | | 1,576 | |

General & administration expense | | | (2,519 | ) | | | (2,987 | ) | | | (635 | ) | | (693 | ) |

Finance cost | | | (171 | ) | | | (953 | ) | | | (473 | ) | | (305 | ) |

Operating income | | | 7,228 | | | | 2,192 | | | | 1,071 | | | 578 | |

Other revenue | | | 42 | | | | 66 | | | | 79 | | | 71 | |

Other expenses | | | (63 | ) | | | (500 | ) | | | — | | | (28 | ) |

Income before provision for tax | | | 7,207 | | | | 1,758 | | | | 1,150 | | | 621 | |

Income tax | | | — | | | | — | | | | — | | | — | |

Net income | | | 7,207 | | | | 1,758 | | | | 1,150 | | | 621 | |

Dividends | | | | | | | | | | | | | | | |

Earnings per share (basic and diluted) | | $ | 0.77 | | | $ | 0.19 | | | $ | 0.12 | | | — | |

Weighted average number of ordinary shares used in per share calculations: | | | 9,329,664 | | | | 9,329,664 | | | | 9,329,664 | | | — | |

Other Comprehensive Income | | | | | | | | | | | | | | | |

Foreign Currency Translation Adjustment | | | 7 | | | | 156 | | | | 83 | | | 13 | |

Comprehensive Income | | | 7,214 | | | | 1,914 | | | | 1,233 | | | 634 | |

| | | | | | | | |

| | | As of December 31, |

| | | 2009 | | 2008 | | 2007 | | 2006 |

| | | US$ | | US$ | | US$ | | US$ |

| | | (in thousands) |

Consolidated Balance Sheet Data: | | | | | | | | |

Cash and cash equivalents | | 772 | | 570 | | 75 | | 124 |

Total assets | | 55,924 | | 47,862 | | 16,680 | | 15,286 |

Total liabilities | | 44,428 | | 44,082 | | 14,814 | | 14,653 |

Total shareholders’ equity | | 10,996 | | 3,780 | | 1,866 | | 633 |

| (1) | Consolidated financial information has not been provided for the years ended December 31, 2005. We believe we would not be able to prepare consolidated financial statements of 2005 on a basis consistent with the years ended December 31, 2006, 2007, 2008 and 2009 in accordance with US GAAP without unreasonable effort and expense. |

10

RISK FACTORS

An investment in our ordinary shares involves significant risks. You should consider carefully all of the information in this prospectus, including the risks and uncertainties described below and our consolidated financial statements and related notes, before making an investment in our ordinary shares. Any of the following risks could have a material adverse effect on our business, financial condition and results of operations. In any such case, the market price of our ordinary shares could decline, and you may lose all or part of your investment.

Risks Related to Our Business

The preferential tax treatment status of the educational institutions we operate places limitations on our ability to freely operate our business, including limitations on pricing and our ability to withdraw profits from the educational institutions we operate for distribution to shareholders or for use in other parts of our business. The educational institutions we operate may incur additional costs if they seek to convert to non-preferential tax treatment status and we cannot assure you that the educational institutions we operate will be able to retain their preferential tax treatment status.

The educational institutions we operate are classified as educational institutions with preferential tax treatment, entitling them to certain tax benefits including exemption from income, turnover and property taxes. However, as a result of their preferential tax treatment status, the educational institutions we operate are prohibited from setting prices for educational services and accommodations above certain price thresholds set by the PRC government and are required to reinvest distributable profits into operations rather than being allowed to distribute profits as investment returns to the educational institutions’ owners. As a result, the educational institutions we operate are limited in the prices they may charge for educational services and accommodations and may not distribute their profits to the Management Company. These restrictions limit the financial returns the educational institutions we operate may achieve and prevent the Management Company from receiving profits from the educational institutions for investment in other high schools, colleges and universities, acquisitions of other high schools, colleges and universities or use in other parts of its business. The only fees we anticipate that Tianjin Frank and the Management Company will be able to receive from the educational institutions we operate are service fees to be paid by the educational institutions for technical services, investment and management consulting services provided by the Management Company and Tianjin Frank to the educational institutions we operate. As a result, for as long as the educational institutions we operate retain their preferential tax treatment status, the Management Company will be unable to use the profits from the operations of the educational institutions it owns for reinvestment in or expansion of its business (other than reinvestment of the funds in the educational institutions from which the profits were derived) or for distribution to its shareholders. Accordingly, we anticipate that at some point in the future the Management Company will convert the educational institutions we operate to non-preferential tax treatment entities to enable it to distribute their profits to the Management Company for use in other parts of its business. We are not able to predict the time of such conversion at this time. Factors to be considered in determining whether to undertake this conversion include, our ability to acquire control of additional educational institutions, the pace at which we are able to acquire control of additional educational institutions after the completion of this offering, our competitive position in the education industry in China and any negative impact the increase in tax expense will have on the network of educational institutions’ operating margins. Potential problems related to the conversion decision include, but are not limited to, the Management Company’s ability to obtain the necessary regulatory approvals for such a conversion. The conversion of the educational institutions we operate from entities that receive preferential tax treatment to entities that do not receive preferential tax treatment may result in an increase in the price of educational services provided by the network educational institutions in order to mitigate the effect of increased taxes and maintain the same profit margin. Any increase in prices for our services may result in the loss of price sensitive students. If the educational institutions we operate are converted into entities that do not receive preferential tax treatment entities, they will only be able to pay to the Management Company profits that have been generated from and after the date of conversion. An educational institution that does not receive preferential tax treatment is permitted to set its own pricing schemes and may distribute profits to its investors, but is required to pay corporate income taxes in China. As a result, if the Management Company converts the educational institutions

11

we operate to entities that do not receive preferential tax treatment, the educational institutions we operate will be less competitive against the state-sponsored high schools, colleges and universities which receive preferential tax treatment, as they will be required to pay income taxes on the their profits from and after the date of conversion. At the time of conversion, those educational institutions will become subject to corporate income tax in China and we will be required to make payments to the local governments. A change in laws or a failure by one of the educational institutions we operate to satisfy the requirements of maintaining preferential tax treatment status may cause one or more of the educational institutions we operate to lose preferential tax treatment status. As a result, we cannot assure you that the educational institutions we operate or expect to operate will continue to qualify as preferential tax treatment entities and enjoy this preferential tax treatment in the future. We also cannot assure you that the laws will remain the same and that the Management Company will be able to convert the educational institutions we operate to non-preferential tax treatment entities at times that are desirable for our business. A loss of preferential tax treatment status by any of the educational institutions we operate before the desired time, or an inability to convert any of the educational institutions we operate to non-preferential tax treatment status at the desired time, may have a material adverse effect on our business, competitive position, cash flows, financial condition, results of operations and prospects.

It is subject to the restriction in contract for Suixian High School and Suixian Hui High School to pay surplus in operation or profit to the Management Company pursuant to certain acquisition agreements between the Management Company and the local government.

According to the acquisition agreement to establish Suixian High School entered into between Management Company and local government on August 17, 2005, as well as the acquisition agreement to establish Suixian Hui High School entered into between Management Company and local government on January 4, 2008, the Management Company agrees that it will not withdraw funds or receive any dividend within five years after payment of the first installment of acquisition price, and the surplus in operation of the schools will be used for the development and expansion of the schools. Since the Management Company has not paid any acquisition price to the local government, such five-year period has not been commenced. These restrictions may prevent the Management Company from withdrawing funds or receiving dividend from Suixian High School and Suixian Hui High School, which also prevent the Management Company from using the surplus of Suixian High School and Suixian Hui High School for investment in or acquisition of other schools other than using for operation and expansion of the schools from which the surplus was generated. The only fees we anticipate that Tianjin Frank and the Management Company will be able to receive from Suixian High School and Suixian Hui High School are service fees to be paid by such schools for technical service, investment and management consulting services provided by the Management Company and Tianjin Frank to such schools we operate.

We have a relatively short operating history and are subject to the risks of a new enterprise, any one of which could limit growth, content and services, or market development.

We acquired control of our first high school in August 2005. We acquired control of an additional high school and a post-secondary school in January 2008. As a result, we have a limited operating history and our historical operating results may not provide a meaningful basis for you to evaluate our business and financial performance. We may not have sufficient experience to address the risks frequently encountered by companies with relatively short operating histories and our business model and ability to achieve satisfactory operating results are unproven.

Our present and future competitors may have longer operating histories, larger student enrollments, larger teams of professional staff and greater financial, technical, marketing and other resources. They may be able to devote more resources to the development and promotion of their brand name and reputation, and may be able to react more quickly to changing customer requirements and demands, deliver competitive services at lower prices or respond to new technologies, trends or user preferences more effectively than we can. They may be able to offer services and products with better performance and prices than ours with the result that their services and

12

products may gain greater market acceptance than ours. They may also offer free promotional services and products in connection with their marketing campaigns or significantly lower the prices for their services and products in order to attract students and capture additional market share. As a result, we may not be able to:

| | • | | maintain profitability; |

| | • | | raise sufficient capital to sustain and expand our business; |

| | • | | expand our business by acquiring control of and operating additional high schools, colleges and universities; |

| | • | | attract students to educational institutions we operate; |

| | • | | attract, retain and motivate qualified personnel; |

| | • | | respond to competitive market conditions; |

| | • | | respond to changes in our regulatory environment; or |

| | • | | maintain effective control of our costs and expenses. |

Any failure to address these risks may have a material adverse effect on our business, cash flows, financial condition, results of operations and prospects.

We are dependent on two high schools and one post-secondary school for all of our revenues. Any adverse development relating to any of these schools could materially and adversely affect our future results of operations.

Since our inception, Branch of Suixian High School, Branch of Suixian Hui Nationality High School and Shandong Foreign Affairs Translation Business Middling Special School have accounted for all of our revenues. Unless we are successful in acquiring control of and operating other educational institutions, all of our revenues will continue to be derived from these two high schools and one post-secondary school. As a result, any development that has a material adverse effect on one or more of these educational institutions may have a material adverse effect upon our business and financial performance, including developments such as the following:

| | • | | any reduction in student enrollment at any of these educational institutions; |

| | • | | an increase in competition from existing high schools, colleges and universities or other educational services providers or the establishment of new high schools in Suixian, Shandong or regions near these two cities; |

| | • | | the failure to make improvements or enhancements to educational products and other facilities in any of the educational institutions we operate in a timely manner; |

| | • | | the failure to attract and retain high quality teaching staff in any of the educational institutions we operate; |

| | • | | the failure to meet the demand for and level of service by students; and |

| | • | | fire, floods, earthquakes, power failures or similar events that may interrupt the normal operations of the educational institutions we operate. |

Any material change in the current demographic, economic, competitive or regulatory conditions applicable to any of educational institutions could adversely affect our operating results.

We may not be able to maintain our revenues and profitability as we operate in a highly competitive industry.

The education industry in China is highly competitive. Competition for students among high schools, colleges and other educational services providers has intensified in recent years as a result of the growth of the

13

education industry in China. For example, changes in enrollment expansion policies in higher education now enable students to choose their preferred high schools, colleges or universities. In all of the geographical areas in which we operate or expect to operate, there are high schools, colleges and universities and other educational services providers, such as training centers and language learning centers and supplementary classes, which provide services comparable to those that the educational institutions we operate offer or are expected to offer. Some high schools, colleges and universities that compete with the educational institutions we operate are owned by governmental agencies and can finance capital expenditures on a tax-exempt basis. Currently, the high schools and post-secondary school that we operate receive preferential tax treatments. According to the Notice of the Ministry of Finance and the State Administration of Taxation on Relevant Tax Issues concerning Education institutions Caishui 2004 No. 39, the education institutions with preferential tax treatment, which collect tuition fees, including extra charges for education under the government-mandated price ceilings, are entitled to tax benefits including exemption from income, turnover and property taxes. Some of the competitors or potential competitors of the educational institutions we operate may be larger, more established, have greater geographic coverage, offer a wider range of services or have more capital or other resources than we do. Each of the educational institutions we operate compete with one other main school, college or university as well as various other education centers and training centers in its community. If the competitors of the educational institutions we operate receive adequate financing, actively recruit teaching staff, expand their services and/or obtain favorable managed training contracts, the educational institutions we operate could face difficulties retaining existing students and attracting new students. The educational institutions we operate may also face these difficulties if any of their competitors expand existing educational institutions or open new educational institutions in the markets where the educational institutions we operate service. Increased competition may also reduce the fees that the educational institutions we operate are able to charge their students.

If we are unable to continue to attract course participants to enroll in our courses, our revenues may decline and we may not be able to maintain profitability.

The success of our business depends primarily on the number of enrollments in our courses and the amount of course fees that we can charge. Therefore, our ability to continue to attract course participants to enroll in our courses and maintain revenue growth is critical to the continued success and growth of our business. This in turn will depend on several factors, including our ability to develop new courses and enhance existing courses to respond to changes in market trends and demands of course participants, to effectively market our courses to a broader base of prospective course participants, to train and retain qualified lecturers and tutors, to develop additional high-quality educational content and to respond to competitive pressures. If we are unable to increase our enrollments in some of our relatively new courses and generate sufficient course fees to exceed the incremental costs associated with developing and delivering such new courses, we may be unable to maintain substantial revenue growth. In addition, the expansion of our courses, services and products in terms of the types of offerings may not succeed due to competition, our failure to effectively market our new courses, services and products or maintain their quality and consistency, or other factors. Furthermore, we may be unable to develop and offer additional content on commercially reasonable terms and in a timely manner, or at all, to keep pace with changes in market requirements. If we are unable to continue to attract course participants to enroll in our courses, our revenues may decline and we may not be able to maintain profitability.

We will need to raise additional capital to maintain the operations of the educational institutions and acquire control of additional educational institutions, which could require us to incur substantial additional indebtedness or issue additional ordinary shares or other equity securities. Our ability to obtain additional financing may be limited.

We will need to raise additional capital to maintain the operations of the educational institutions we operate, including investing in new education facilities, and acquire control of additional educational institutions. Our current cash and capital resources and proceeds from this offering will allow us to maintain our operations for approximately the next twelve months. The Management Company has not yet fully paid for the acquisition of Shandong Foreign Affairs Translation Business Middling Special School. The aggregate amount of remaining

14

payments as of December 31, 2008 due with respect to the purchase of this post-secondary school is approximately US $10.1 million. If we cannot raise additional capital, we will have to re-negotiate the terms of the acquisition, which we may not be able to do. If we are unable to raise additional capital or re-negotiate the terms of the acquisition, the Management Company may not be able to make the required payments, and may be declared in default under the acquisition agreement, in which event, it is possible that we may lose control of part or all of Qingdao School. It is possible that we may not be able to acquire control of additional educational institutions. We must continually assess the facilities needs of the schools we operate and upgrade educational products as a result of technological advances in the education industry. Our ability to obtain external financing in the future is subject to a variety of uncertainties, including:

| | • | | our future financial condition, results of operations and cash flows; |

| | • | | general market conditions for financing activities by companies in the education industry; |

| | • | | economic, political and other conditions in the PRC and elsewhere; |

| | • | | conditions of the U.S. and other capital markets in which we may seek to raise funds; and |

| | • | | PRC governmental regulation of foreign investment in educational services companies. |

We also need to expand the buildings of the educational institutions we operate to accommodate an expected increase in the number of student enrollments. Our failure to raise additional capital through future financings will restrict our ability to grow our operations.

Moreover, our planned acquisitions require a significant amount of capital, which we may not be able to raise in a timely manner or at all. In addition, if we issue equity securities to pay for acquisitions, we may dilute the value of your shares. If we borrow funds to finance acquisitions, such debt instruments may burden us with substantial fixed charges and may contain restrictive covenants that could, among other things, restrict us from distributing dividends. Acquisitions may also result in significant amortization expenses related to intangible assets. We have no current arrangements or agreements for any specific acquisitions.

Failure to attract and retain qualified personnel and experienced senior management could disrupt our operations and adversely affect our business and competitiveness.

Our continuing success is dependent, to a large extent, on our ability to attract and retain qualified personnel and experienced senior management. If one or more of our senior management team members are unable or unwilling to continue to work for us, we may not be able to replace them within a reasonable period of time or at all, and our business may be severely disrupted, our financial condition and results of operations may be materially and adversely affected and we may incur additional expenses in recruiting and training additional personnel. Although our senior management is subject to certain non-competition restrictions during, and after termination of their employment, we cannot assure you that such non-competition restrictions will be effective or enforceable under PRC law. If any of our senior management joins a competitor or forms a competing business, our business may be severely disrupted. We have no “key man” insurance with respect to our key personnel that would provide insurance coverage payable to us for loss of their employment due to death or otherwise.

Our operating results may vary significantly from quarter to quarter as a result of seasonal and other variations to which our business is subject. This may result in volatility or adversely affect our stock price.

We experience seasonality in results of operations primarily as a result of changes in the level of student enrollments during the course of the school year and the duration of the school year. Because many parents prepay for their children’s programs at the time of enrollment the enrollment dates correspond to the trends of revenue. We typically generate the largest portion of revenue in the third quarter, and we experience lower revenues from tuition fees in the fourth quarter. As our high schools and post-secondary school revenue grows at varying rates, these seasonal fluctuations may become more evident. As a result, we believe that quarter-to-quarter comparisons of our results of operations may not be a fair indicator and should not be relied upon as a measure of future performance.

15

If we are unable to successfully centralize operations for our existing or future operations, we may fail to achieve anticipated synergies, cost savings and growth opportunities and our business and prospects may be materially and adversely affected.

Our successful operation of the high schools and post-secondary school we operate and any additional high schools, colleges and universities we may acquire control of in the future depends in part upon our achieving improvements in the operational efficiencies of each of the high schools, colleges and universities and of the group of high schools, colleges and universities as a whole. In order to achieve these operational efficiencies, we seek to centralize our operations by, among other things, centralizing the procurement of educational products and materials, marketing efforts and information technology systems. If we are not able to successfully centralize our operations, we may not be able to realize all the anticipated synergies, cost savings and growth opportunities that we hope to achieve by operating a group of high schools, colleges and universities and our business and prospects may be materially and adversely affected.

New products and programs we develop may compete with our current programs.

We are presently developing, and will likely in the future develop programs that compete with our existing programs. For example, our primary school holiday classroom program will compete with the periodical training project within the same campus. These services will be similar to those offered by our vocational post-secondary school during the summer and winter holiday. We cannot assure you that the primary schools that choose to provide periodical training services will not compete directly with our vocational post-secondary school training program.

We may lose market share and our profitability may be materially and adversely affected, if we fail to compete effectively with our present and future competitors or to adjust effectively to changing market conditions and trends.

We face competition from providers of online vocational/career education, training, and expect to face increasing competition from existing competitors and new market entrants in the traditional education and test preparation market. The provision of professional education and test preparation courses over the Internet is a relatively recent concept. Although traditional classroom instruction is generally viewed as a more accepted method, online education is increasingly apparent as an acceptable means of receiving training and instruction. We therefore compete with providers of online education institutions and training centers in the various subject areas for which we offer courses. As our courses are conducted solely in traditional bricks and mortar schools, if the perception persists or increases that on-line forms of education and training are preferred, we may not be able to compete effectively with competitors engaging in on-line forms of education and training. In addition, due to low barriers to entry for Internet-based businesses, we expect to face increasing competition from both existing domestic competitors and new entrants on the online education side. We may face increased competition from international competitors that cooperate with local businesses to provide services based on the foreign partners’ technology and experience developed in their home markets.

If we fail to develop and introduce new courses, services and products that meet our target customers’ expectations, or adopt new technologies important to our business, our competitive position and ability to generate revenues may be materially and adversely affected.

Our core business is centered on acquiring control of schools that provide high school, college and university educations in urban communities. As the growing trend toward urbanization is expected to result in more people seeking job and career advancement opportunities in urban areas, the development of new courses, services and products is subject to risks and uncertainties. Unexpected technical, operational, logistical, regulatory or other problems could delay or prevent the introduction of one or more of new courses, service or products. Moreover, we cannot assure you that any of these courses, products and services will match the quality or popularity of those developed by our competitors, achieve widespread market acceptance or generate the desired level of income.

The technology used in internet and value-added telecommunications services and products in general, and in online education services in particular, has evolved a lot in recent years. The online course providers seek to satisfy the demand of self-taught learners for high-level education and part-time workers seeking time flexibility.

16

Providers of traditional education may lose part of the target course participants, if they fail to anticipate and adapt to such technological changes.

The education sector, in which all of our business is conducted, is subject to extensive regulation in China, and our ability to conduct business is highly dependent on our compliance with these regulatory frameworks.

The Chinese government regulates all aspects of the education sector, including licensing of parties to perform various services, pricing of tuition and other fees, curriculum content, standards for the operations of schools and learning centers associated with foreign participation. The laws and regulations applicable to the education sector are in some aspects vague and uncertain, and often lack detailed implementing regulations. These laws and regulations are subject to change, and new laws and regulations may be adopted, some of which may have retroactive application or have a negative effect on our business. For example, in 2003, the Chinese government adopted a new regulatory framework for Chinese-foreign cooperation in education. This new framework may encourage institutions with more experience, better reputations, greater technological know-how and larger financial resources than we have to compete against us and limit our growth. In addition, because the Chinese government and the public view the conduct of educational institutions as a vital social service, there is considerable ongoing scrutiny of the education sector and its participants.

We must comply with China’s extensive regulations on private and foreign participation in the education sector, which has caused us to adopt complex structural arrangements with our Chinese subsidiary and Chinese affiliated entity. If the relevant Chinese authorities decide our structural arrangements do not comply with these restrictions, we would be precluded from conducting some or all of our current business.

Chinese regulators have broad powers to regulate the tuition and other fees charged by schools and, as a result, can adversely impact the fees we receive from the schools to which we provide services, as well as the returns from the private primary and secondary schools operated by our Chinese affiliated entity. While China’s regulatory framework provides that investors in private schools are entitled to receive a “reasonable return” on their investment, there is no clear guidance in law as to what this term means.

Although our corporate structure and business are designed to comply with the limitations on foreign investment and participation in the education sector, we cannot assure you that we will not be found to be in violation of any current or future Chinese laws and regulations. There are substantial uncertainties regarding the interpretation and application of Chinese laws and regulations. If we or our Chinese subsidiary or Chinese affiliated entity are found to be or to have been in violation of Chinese laws or regulations limiting foreign ownership or participation in the education sector, the relevant regulatory authorities have broad discretion in dealing with such violation, including but not limited to:

| | • | | levying fines and confiscating illegal income; |

| | • | | restricting or prohibiting our use of the proceeds from this offering to finance our business and operations in China; |

| | • | | requiring us to restructure the ownership structure or operations of our Chinese subsidiary or Chinese affiliated entity; |

| | • | | requiring us to discontinue all or a portion of our business; and/or |

| | • | | revoking business licenses. |

Any of these or similar actions could cause significant disruption to our business operations or render us unable to conduct all or a substantial portion of our business operations.

Our planned business growth, rapidly changing operating environment and future acquisitions may strain our existing resources and have an adverse effect on our business operations.

We anticipate fast expansion of our business through organic growth and acquisitions as we seek to grow our customer base, expand our service and product offerings and pursue new market opportunities. Our operational, administrative and financial resources may be inadequate to sustain the rate of growth we plan to achieve. As the number of our course participants increases or their demands and needs change or as our business activities expand, we will need to increase our investment in network infrastructure, facilities and other areas of operations, and we will be required to improve existing, and implement new, operational, technological and

17

financial systems, procedures and controls, and to expand, train and manage our growing employee base. Furthermore, our management will be required to maintain and expand our relationships with our regional and online agents and other third parties necessary for the success of our business. If we are unable to manage our growth and expansion effectively, the quality of our services could deteriorate and our business may suffer.

In addition, if we are presented with appropriate opportunities, we may acquire control of additional educational institutions and other assets, products, technologies or businesses that are complementary to our existing business. Future acquisitions and the subsequent integration of new assets and businesses into our own would require significant attention from our management and could result in a diversion of resources from our existing business, which in turn could have an adverse effect on our business operations. Acquired assets or businesses may not generate the financial results we expect. In addition, acquisitions could result in the use of substantial amounts of cash, potentially dilutive issuances of equity securities, the occurrence of significant goodwill impairment charges, amortization expenses for other intangible assets and exposure to potential unknown liabilities of the acquired business. Moreover, the costs of identifying and consummating acquisitions may be significant. In addition to possible shareholders’ approval, we may also have to obtain approvals and licenses from the relevant government authorities in the PRC for the acquisitions and to comply with any applicable PRC laws and regulations, which could result in increased costs and delay.

The process of integrating new high schools, colleges and universities into our operations may result in unforeseen operating difficulties and expenditures and may not provide the benefits anticipated. The areas where we face risks include:

| | • | | difficulties integrating operations, personnel, technologies, products and information systems of the new high schools, colleges and universities; |

| | • | | potential loss of key employees of the new high schools, colleges and universities; |

| | • | | inability to maintain the key business relationships and the reputation of the new high schools, colleges and universities; |

| | • | | assumption of unknown or contingent liabilities by the Management Company of the new high schools, colleges and universities; and |

| | • | | diversion of management’s attention from other business concerns. |

Our failure to address any of these risks or to implement and improve our management, operational and financial information systems, or to expand, train, manage or motivate our workforce, could reduce or prevent our growth and may have a material adverse effect on our business, cash flows, financial condition, results of operations and prospects.

Compliance with rules and requirements applicable to public companies may cause us to incur increased costs, which may negatively affect our results of operations.

As a U.S. public company, we will incur significant legal, accounting and other expenses that we did not incur as a private company. In addition, the Sarbanes-Oxley Act, as well as rules subsequently implemented by the SEC and NASDAQ Stock Market, has required changes in corporate governance practices of U.S. public companies. We expect these rules and regulations to increase our legal, accounting and financial compliance costs.

In addition, our administrative staff will be required to perform additional tasks. For example, in anticipation of becoming a public company, we will need to adopt additional internal controls and disclosure controls and procedures, retain a transfer agent, adopt an insider trading policy and bear all of the internal and external costs of preparing and distributing periodic public reports in compliance with our obligations under the securities laws.

Furthermore, changing laws, regulations and standards relating to corporate governance and public disclosure, including the Sarbanes-Oxley Act and related regulations implemented by the Securities and Exchange Commission and the NASDAQ Stock Market, are creating uncertainty for public companies, increasing legal and financial compliance costs and making some activities more time consuming. We are currently evaluating and monitoring developments with respect to new and proposed rules and cannot predict or estimate the amount of additional costs we may incur or the timing of such costs. These laws, regulations and standards are subject to varying interpretations, in many cases due to their lack of specificity, and, as a result,

18