October 3, 2023 Asana Investor Day 2023

2 Forward-Looking Statements This presentation and the accompanying oral presentation include express and implied “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, including but not limited to, statements regarding our financial outlook, our ability to use artificial intelligence to accelerate our mission, our ability to expand our customer base, our ability to compete effectively in the work management industry, our ability to transition upmarket, our product development and roadmap, business strategy and plans, and market trends, opportunities and positioning. These forward-looking statements are based on current expectations, estimates, forecasts and projections. Words such as “expect,” “anticipate,” “should,” “believe,” “hope,” “target,” “project,” “goals,” “estimate,” “potential,” “predict,” “may,” “will,” “might,” “could,” “intend,” “shall” and variations of these terms and similar expressions are intended to identify these forward-looking statements, although not all forward-looking statements contain these identifying words. Forward-looking statements are subject to a number of risks and uncertainties, many of which involve factors or circumstances that are beyond our control. For example, our business could be impacted by the macroeconomic headwinds; the market for our platform may develop more slowly than expected or than it has in the past; our platform may not develop as anticipated, including the integration of new technologies such as artificial intelligence; our operating results may fluctuate more than expected; there may be significant fluctuations in our results of operations and cash flows related to our revenue recognition or otherwise; a network or data security incident that allows unauthorized access to our network or data or our customers’ data could damage our reputation; we could experience interruptions or performance problems associated with our technology, including a service outage; and global economic conditions could deteriorate. It is not possible for us to predict all risks, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results or outcomes to differ materially from those contained in any forward-looking statements we may make. Moreover, we operate in a competitive and rapidly changing market, and new risks may emerge from time to time. You should not rely upon forward-looking statements as predictions of future events. Additional risks and uncertainties that could cause actual outcomes and results to differ materially from those contemplated by the forward-looking statements are included under the caption “Risk Factors” and elsewhere in our most recent filings with the Securities and Exchange Commission (the “SEC”), including the Quarterly Report on Form 10-Q for the quarter ended July 31, 2023 and other documents we have filed, or will file, with the SEC. Although we believe that the expectations reflected in our statements are reasonable, we cannot guarantee that the future results, levels of activity, performance or events and circumstances described in the forward-looking statements will be achieved or occur. Moreover, neither we, nor any other person, assumes responsibility for the accuracy and completeness of these statements. Recipients are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date such statements are made and should not be construed as statements of fact. Except to the extent required by federal securities laws, we undertake no obligation to update any information or any forward-looking statements as a result of new information, subsequent events, or any other circumstances after the date hereof, or to reflect the occurrence of unanticipated events. Product roadmaps are subject to change and are not guaranteed. You should make purchase decisions based on what is available in the product at time of purchase and not on what is in a product roadmap. This presentation and the accompanying oral presentation also contain estimates and other statistical data made by independent parties and by us relating to market size and growth and other data about our industry and business. This data involves a number of assumptions and limitations, and you are cautioned not to give undue weight to such estimates. We have not independently verified the industry data generated by independent parties and contained in this presentation and, accordingly, we cannot guarantee their accuracy or completeness. In addition, projections, assumptions, and estimates of our future performance and the future performance of the markets in which we compete are necessarily subject to a high degree of uncertainty and risk. Use of Non-GAAP Financial Information In addition to the financials presented in accordance with U.S. generally accepted accounting principles ("GAAP"), this presentation includes the following non-GAAP metrics: gross profit, gross margin, operating margin, operating loss, operating expenses as a percentage of revenue, and free cash flow. The non-GAAP metrics are not intended to be used in lieu of GAAP presentations of results of operations. We believe that non-GAAP financial information, when taken collectively, may be helpful to investors because it provides consistency and comparability with our past financial performance and allows for greater transparency with respect to important metrics used by our management for financial and operational decision-making. There are a number of limitations related to the use of these non- GAAP metrics versus their nearest GAAP equivalents. For example, other companies may calculate non-GAAP metrics differently or may use other metrics to evaluate their performance, all of which could reduce the usefulness of our non-GAAP financial metrics as tools for comparison. We urge you to review the reconciliation of our non-GAAP financial measures to the most directly comparable GAAP financial measures set forth in the Appendix to this presentation, and not to rely on any single financial measure to evaluate our business.

3 Catherine Buan Head of Investor Relations WelcomeAsana Investor Day 2023

4 How AI will help us win the category | Dustin Moskovitz The Asana Difference | Alex Hood Winning the Enterprise | Anne Raimondi (Short break) Opportunities for growth and leverage | Tim Wan Q&A Agenda

5 Dustin Moskovitz Co-founder and Chief Executive Officer Chapter 1How AI will help us win the category

7 AI is an accelerant of our mission

8 We’re focused on the enterprise

9 Landing new enterprise customers

10 Landing new enterprise customers Increasing adoption

11 Landing new enterprise customers Increasing adoption Driving seat expansion

12 AI has joined the team

13 There’s a smarter way to work Drive clarity and accountability Maximize impact Scale with confidence

14 Asana’s Work Graph® + AI

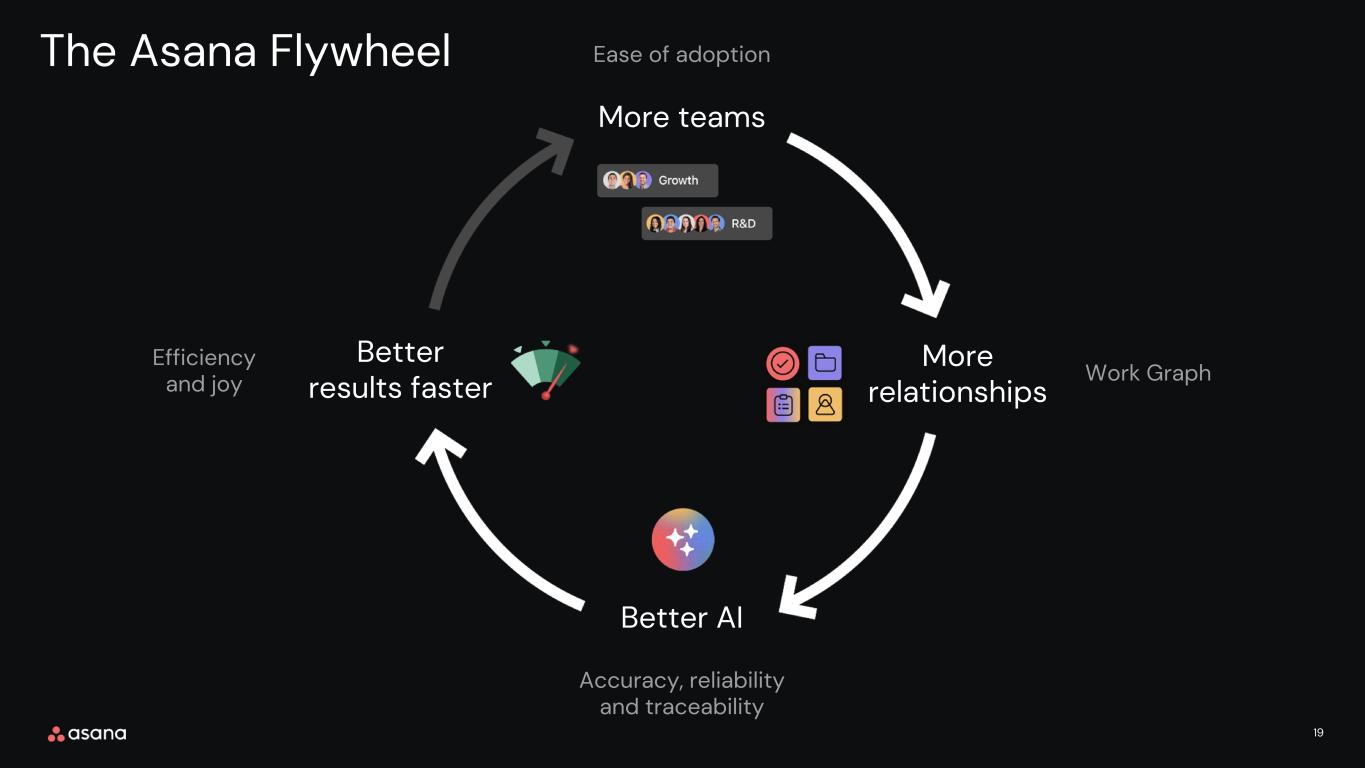

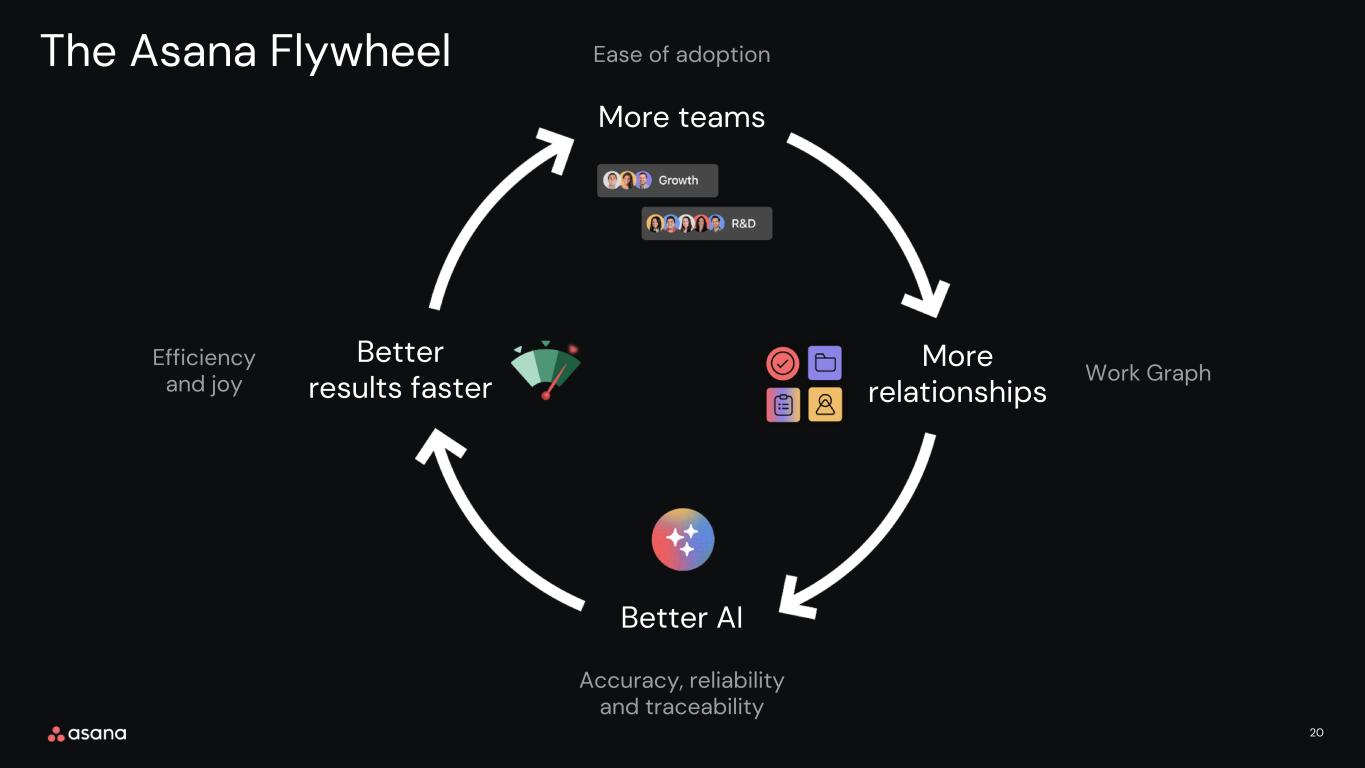

15 Asana Flywheel

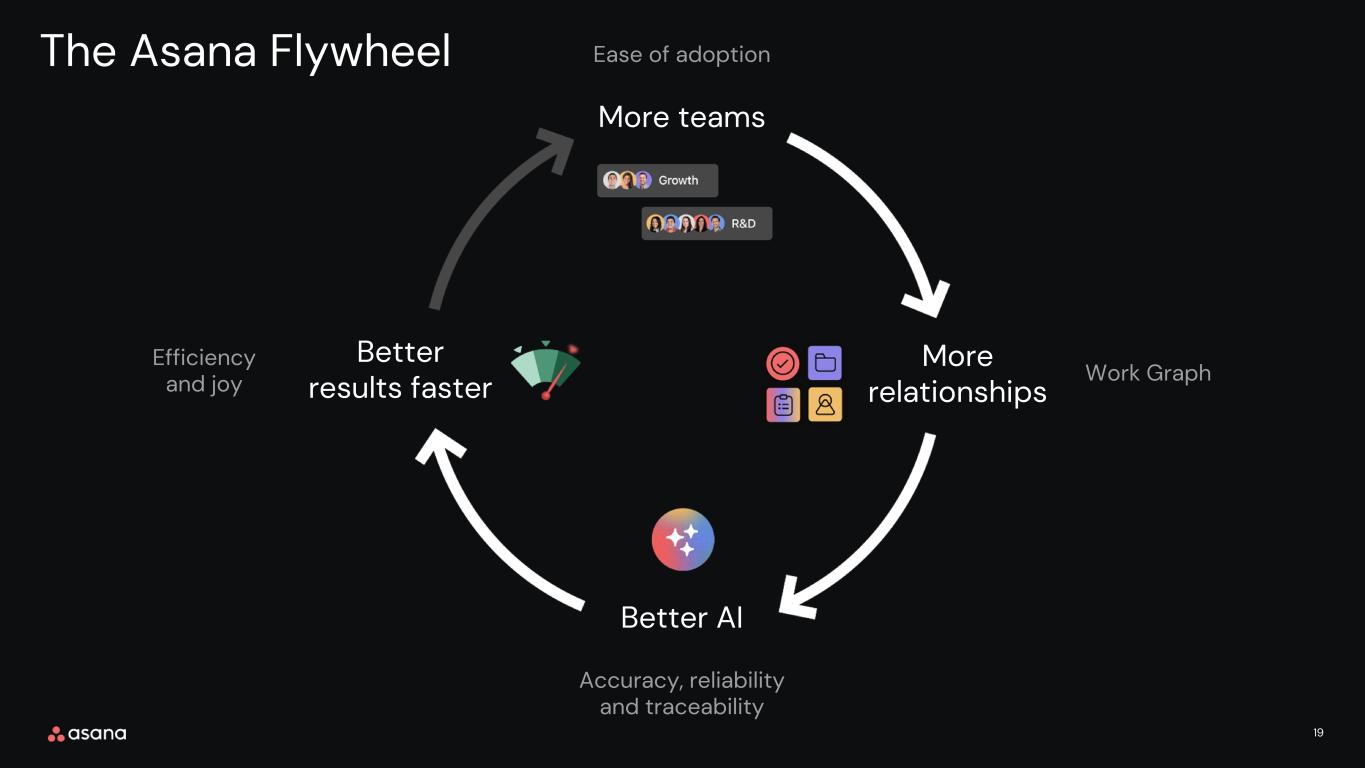

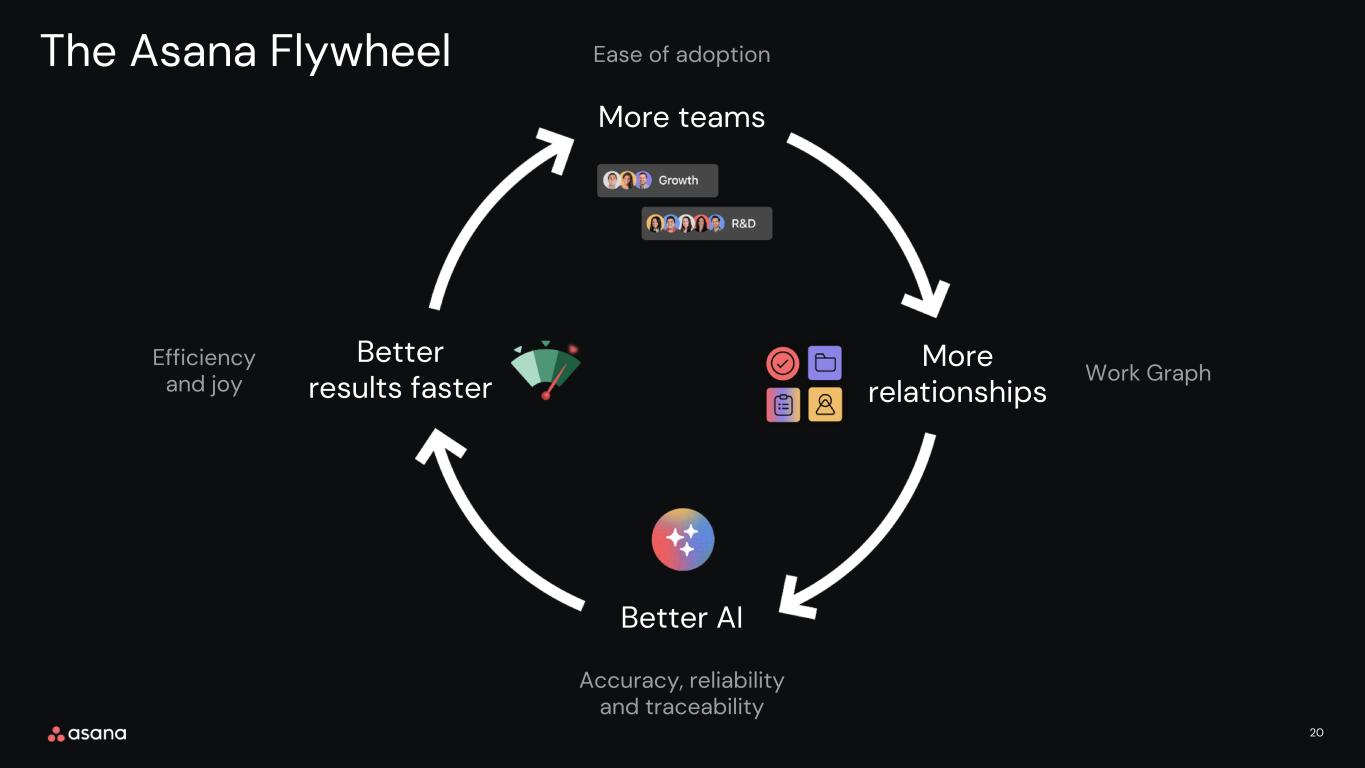

16 More teams Better AI More relationships Better results faster Ease of adoption Accuracy, reliability and traceability Work Graph Efficiency and joy The Asana Flywheel

17 More teams Better AI More relationships Better results faster Ease of adoption Accuracy, reliability and traceability Work Graph Efficiency and joy The Asana Flywheel

18 More teams Better AI More relationships Better results faster Ease of adoption Accuracy, reliability and traceability Work Graph Efficiency and joy The Asana Flywheel

19 More teams Better AI More relationships Better results faster Ease of adoption Accuracy, reliability and traceability Work Graph Efficiency and joy The Asana Flywheel

20 More teams Better AI More relationships Better results faster Ease of adoption Accuracy, reliability and traceability Work Graph Efficiency and joy The Asana Flywheel

21 More teams Better AI More relationships Better results faster Ease of adoption Accuracy, reliability and traceability Work Graph Efficiency and joy The Asana Flywheel

22 Quality work data matters

23 Asana’s Work Graph®

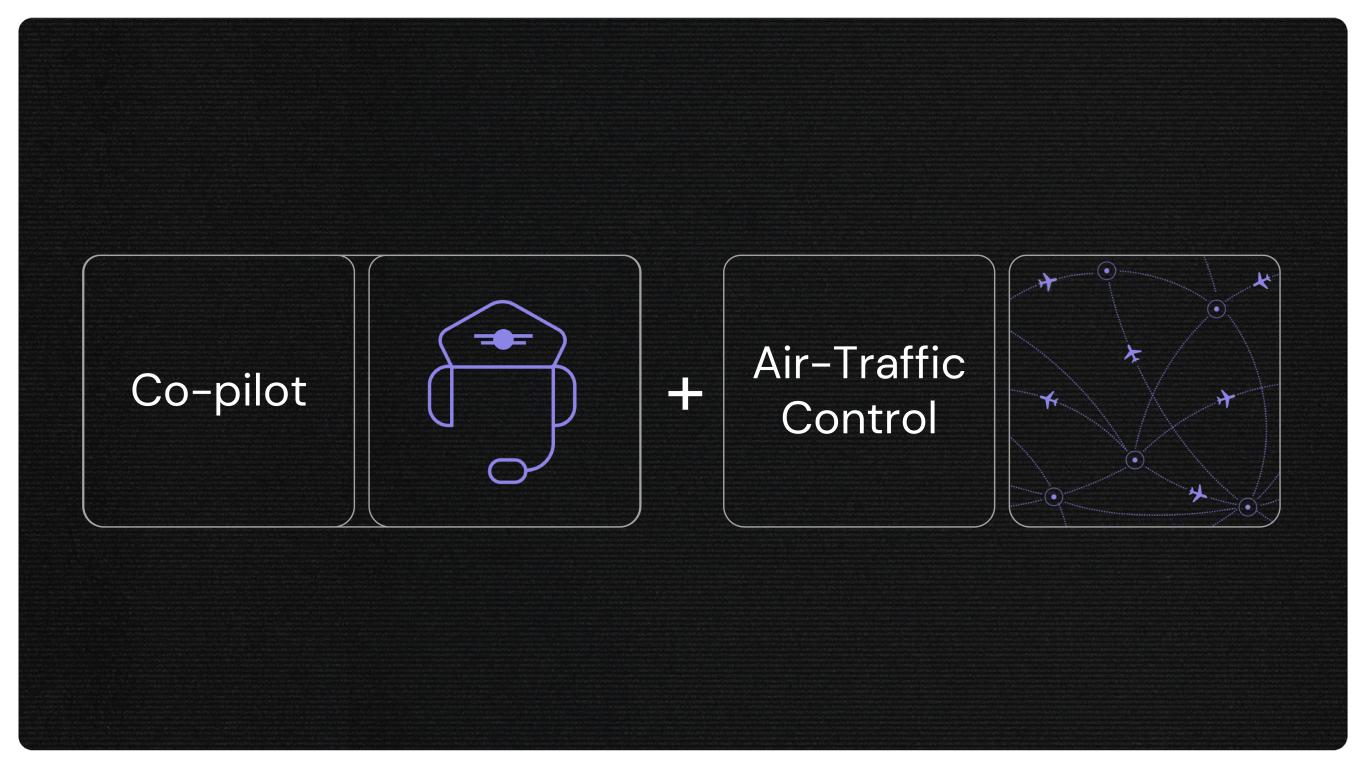

Air-Traffic Control+Co-pilot

l Air-Traffic Control+Co-pilot The Asana difference

28 Chief Product Officer Chapter 2The Asana Difference Alex Hood

29 Email Docs Spreadsheets How we work hasn't changed in 30 years

30

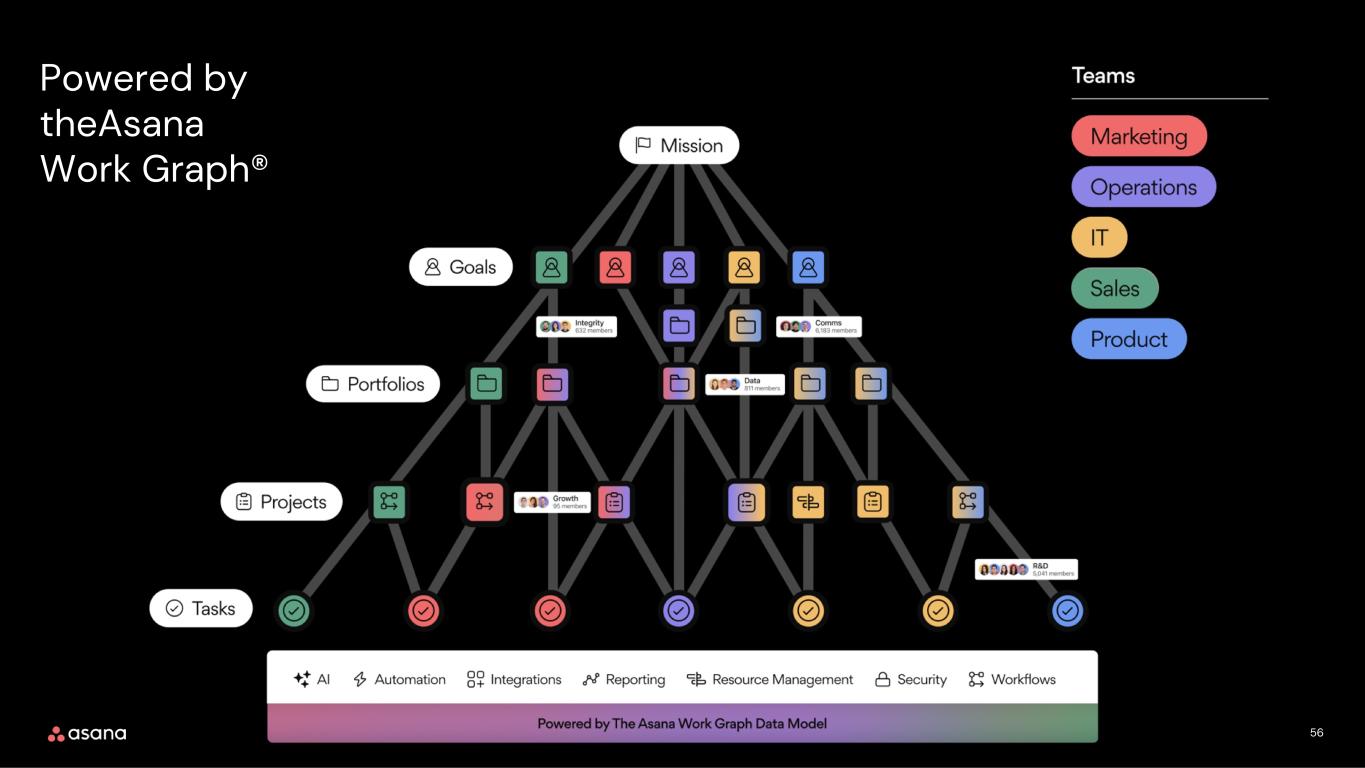

31 Powered by the Asana Work Graph®

32 The power of Asana Intelligence Maximize impact

33 The power of Asana Intelligence Maximize impact Drive clarity and accountability

34 The power of Asana Intelligence Maximize impact Drive clarity and accountability Scale with confidence

lThe Asana difference Air-Traffic Control+Co-pilot

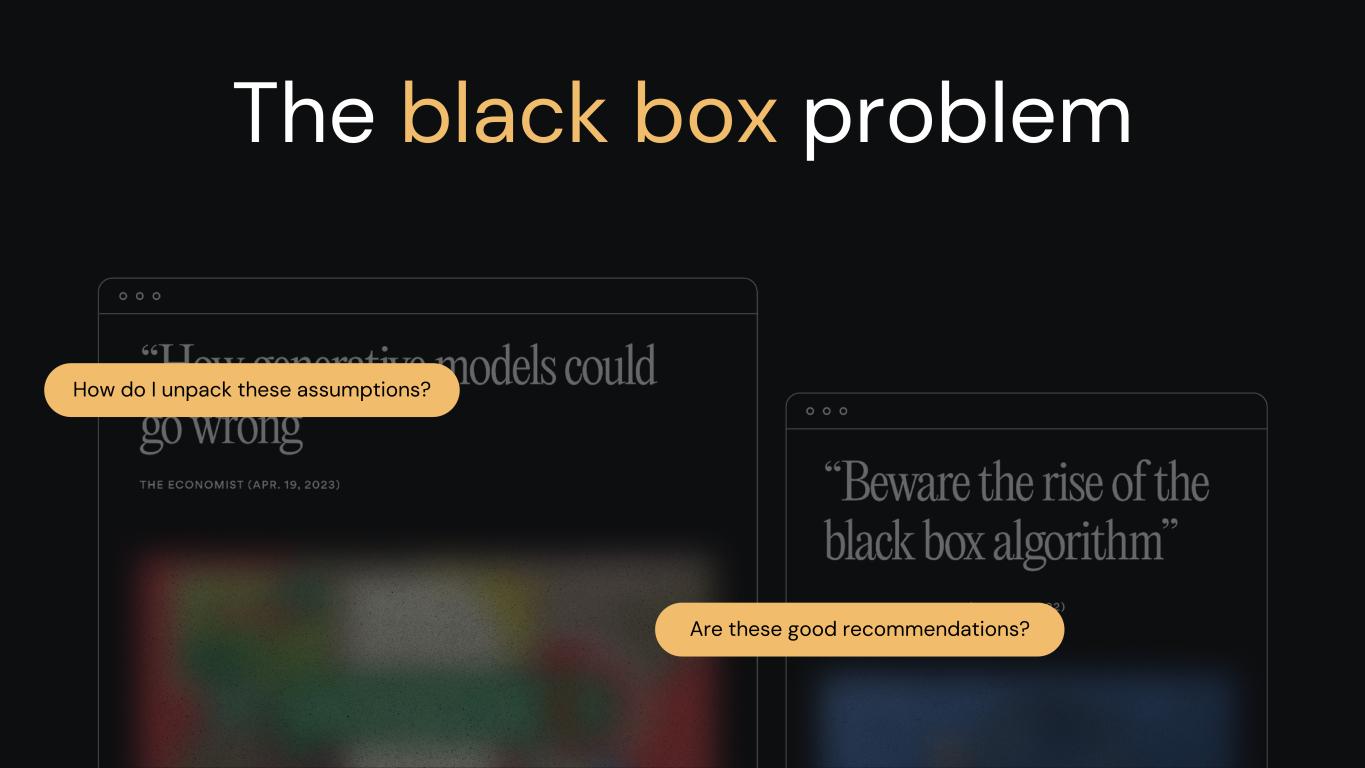

The black box problem 36

The black box problem Are these good recommendations? 37

The black box problem Are these good recommendations? How do I unpack these assumptions? 38

The black box problem Are these good recommendations? How do I unpack these assumptions? How do I trust this will help our teams make good decisions? 39

40 What does AI mean for our customers?

41

42

43

44

45 What does AI mean for our business?

46 Increasing ability to penetrate our TAM

47 Increasing ability to penetrate our TAM

48 Increasing ability to penetrate our TAM

The black box problem 49

The black box problem Are these good recommendations? 50

The black box problem Are these good recommendations? How do I unpack these assumptions? 51

The black box problem Are these good recommendations? How do I unpack these assumptions? How do I trust this will help our teams make good decisions? 52

53 Increasing ability to penetrate our TAM

54 Building for the enterprise

55

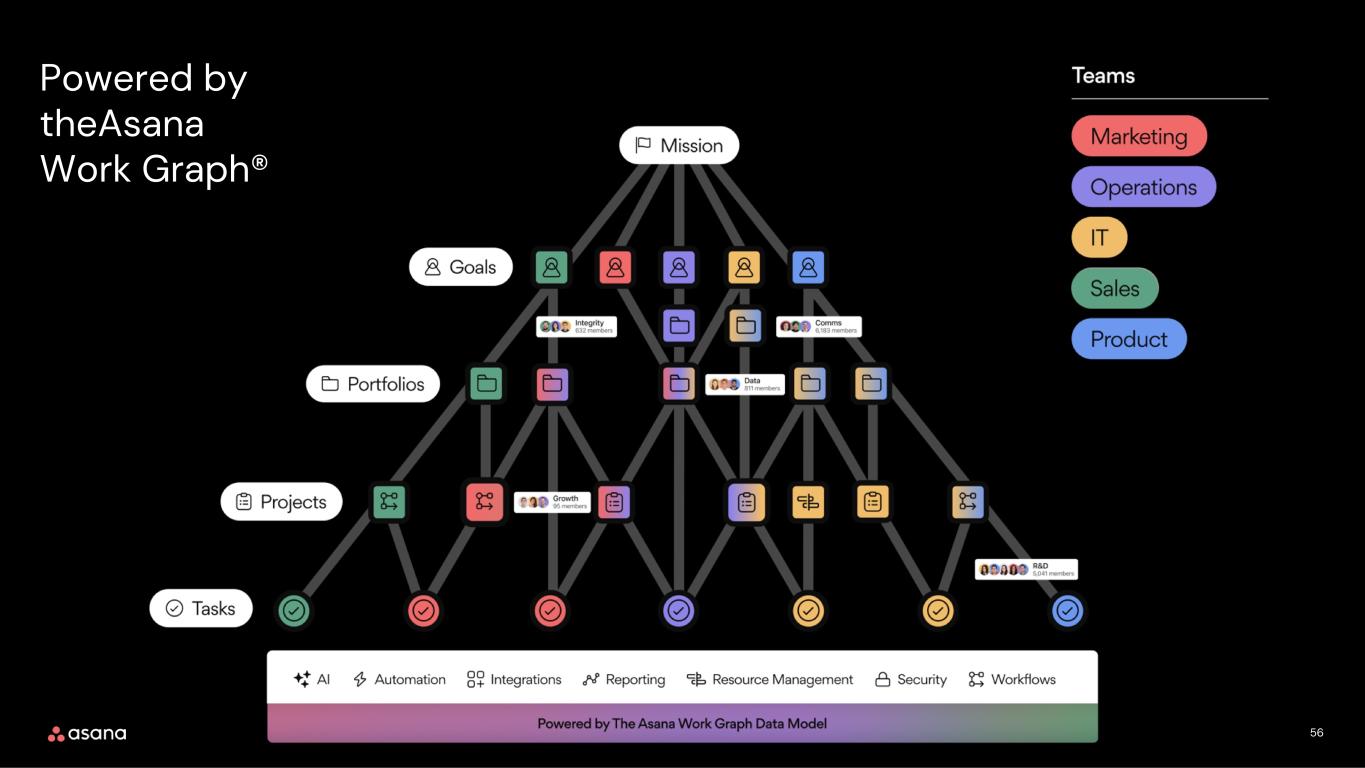

56 Powered by theAsana Work Graph®

57 Chapter 3Winning the Enterprise Anne Raimondi Chief Operating Officer

58 Agenda Customer fireside chat Foundation for product offerings Strategies for moving upmarket

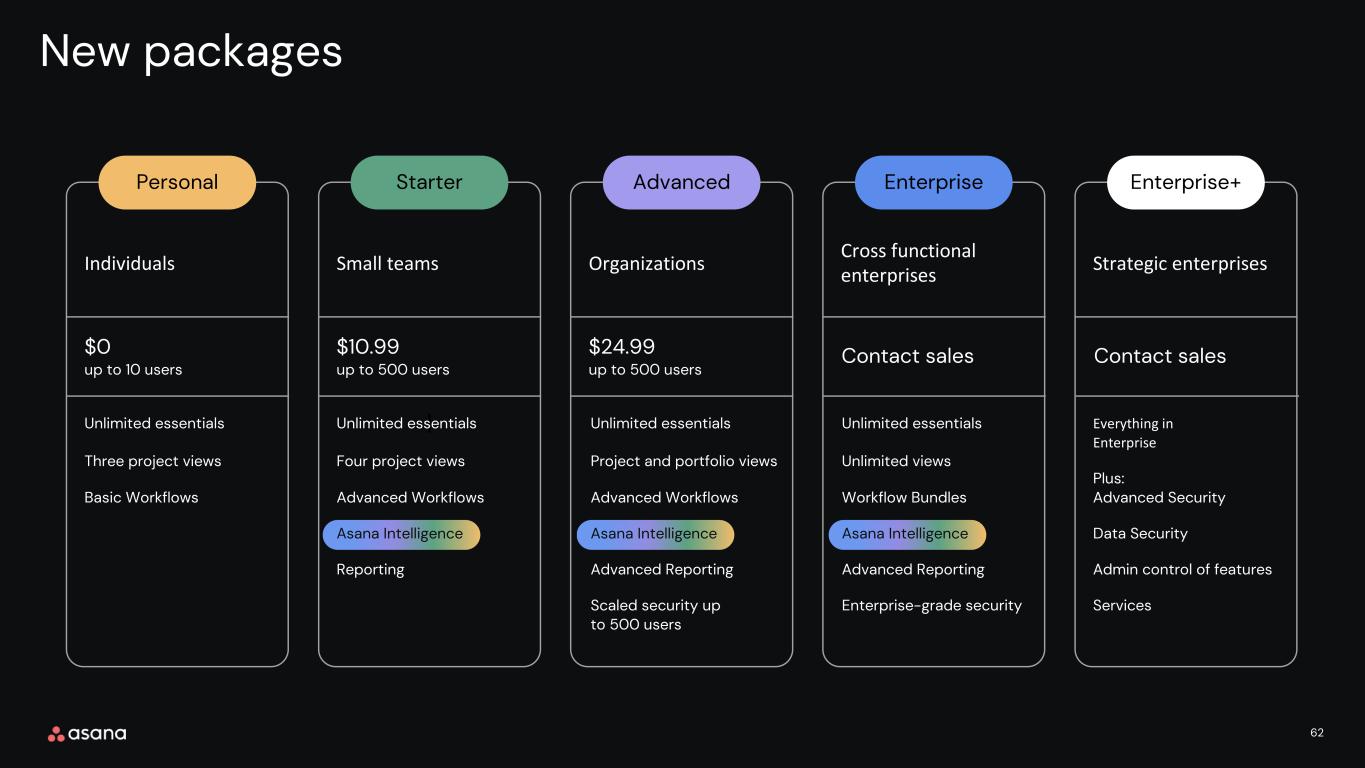

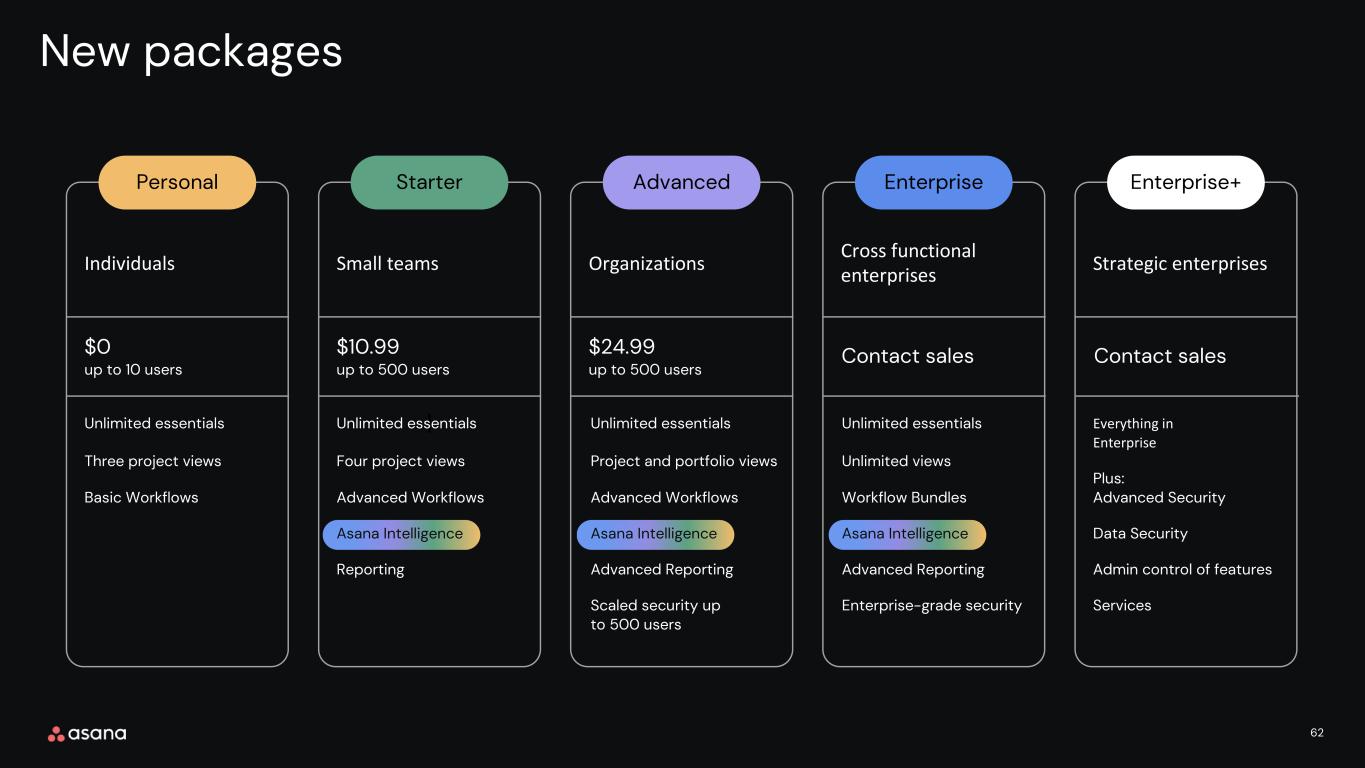

59 l Individuals Personal Starter Advanced Enterprise Enterprise+ $0 up to 10 users Small teams Organizations Cross functional enterprises Strategic enterprises $10.99 up to 500 users $24.99 up to 500 users Contact sales Contact sales Unlimited essentials Three project views Basic Workflows Unlimited essentials Four project views Advanced Workflows Asana Intelligence Reporting Unlimited essentials Project and portfolio views Advanced Workflows Asana Intelligence Advanced Reporting Scaled security up to 500 users Unlimited essentials Unlimited views Workflow Bundles Asana Intelligence Advanced Reporting Enterprise-grade security New packages Everything in Enterprise Plus: Advanced Security Data Security Admin control of features Services

60 l Individuals Personal Starter Advanced Enterprise Enterprise+ $0 up to 10 users Small teams Organizations Cross functional enterprises Strategic enterprises $10.99 up to 500 users $24.99 up to 500 users Contact sales Contact sales Unlimited essentials Three project views Basic Workflows Unlimited essentials Four project views Advanced Workflows Asana Intelligence Reporting Unlimited essentials Project and portfolio views Advanced Workflows Asana Intelligence Advanced Reporting Scaled security up to 500 users Unlimited essentials Unlimited views Workflow Bundles Asana Intelligence Advanced Reporting Enterprise-grade security New packages Everything in Enterprise Plus: Advanced Security Data Security Admin control of features Services

61 l Individuals Personal Starter Advanced Enterprise Enterprise+ $0 up to 10 users Small teams Organizations Cross functional enterprises Strategic enterprises $10.99 up to 500 users $24.99 up to 500 users Contact sales Contact sales Unlimited essentials Three project views Basic Workflows Unlimited essentials Four project views Advanced Workflows Asana Intelligence Reporting Unlimited essentials Project and portfolio views Advanced Workflows Asana Intelligence Advanced Reporting Scaled security up to 500 users Unlimited essentials Unlimited views Workflow Bundles Asana Intelligence Advanced Reporting Enterprise-grade security New packages Everything in Enterprise Plus: Advanced Security Data Security Admin control of features Services

62 l Individuals Personal Starter Advanced Enterprise Enterprise+ $0 up to 10 users Small teams Organizations Cross functional enterprises Strategic enterprises $10.99 up to 500 users $24.99 up to 500 users Contact sales Contact sales Unlimited essentials Unlimited views Workflow Bundles Asana Intelligence Advanced Reporting Enterprise-grade security Unlimited essentials Three project views Basic Workflows Everything in Enterprise Plus: Advanced Security Data Security Admin control of features Services New packages Unlimited essentials Four project views Advanced Workflows Asana Intelligence Reporting Unlimited essentials Project and portfolio views Advanced Workflows Asana Intelligence Advanced Reporting Scaled security up to 500 users

63 Summary of key changes to packaging strategy Enterprise+ plan

64 Summary of key changes to packaging strategy Enterprise+ plan AI features

65 Summary of key changes to packaging strategy User and feature limits across tiers AI features Enterprise+ plan

66 Foundation for growth Enterprise+ plan AI features User and feature limits

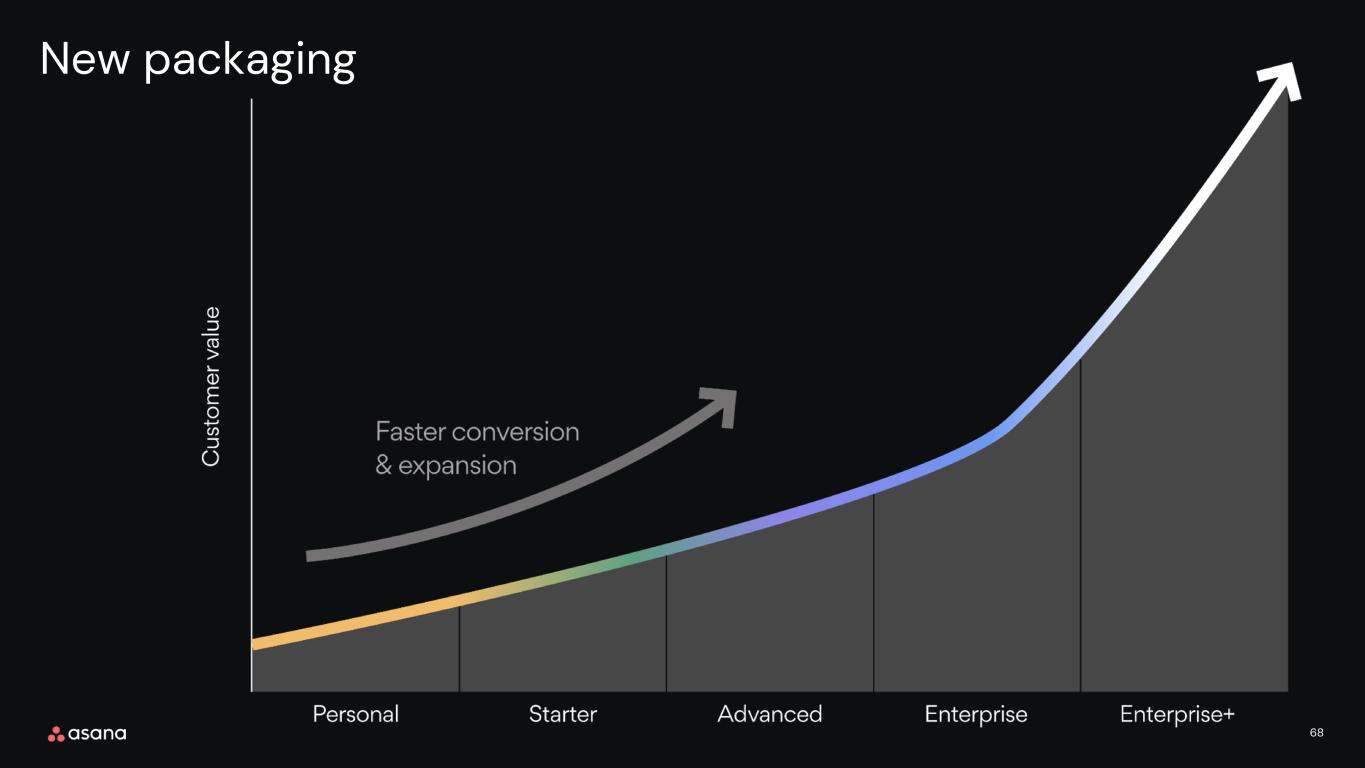

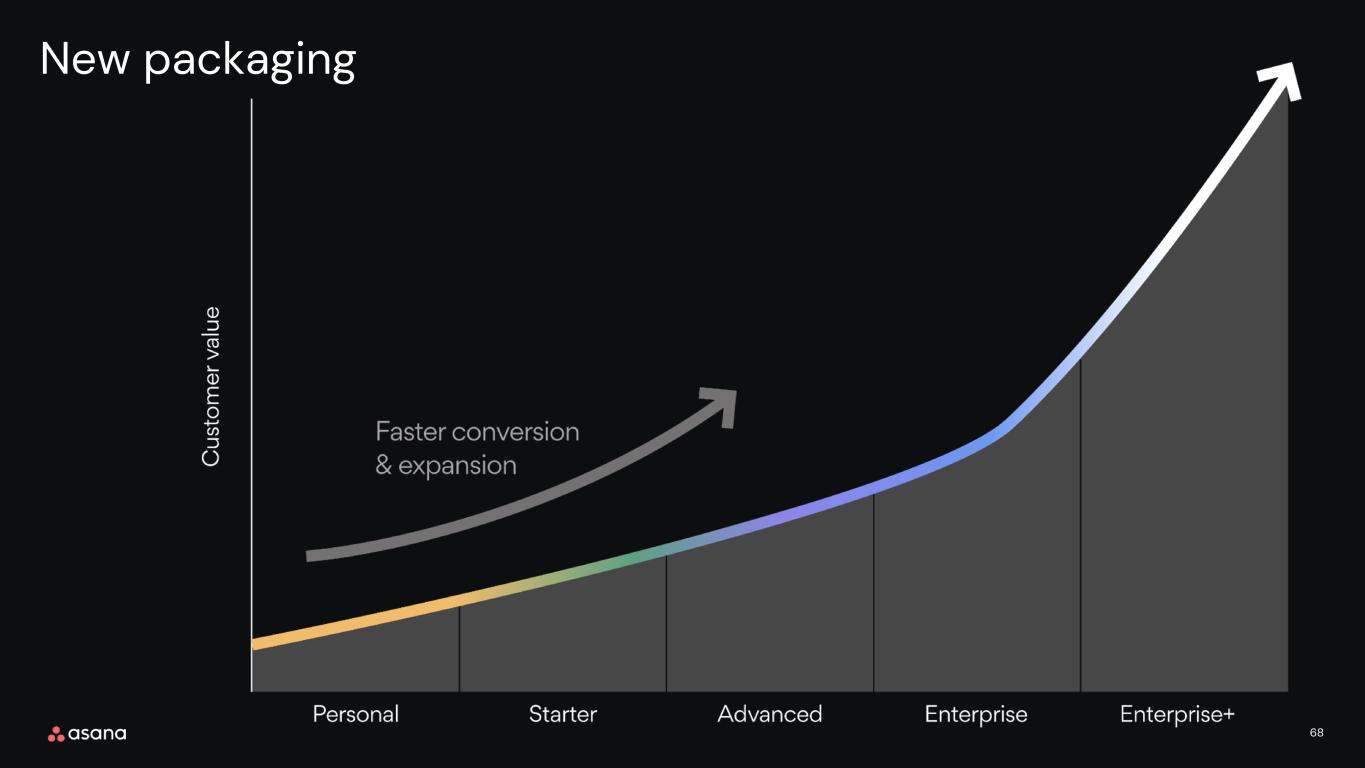

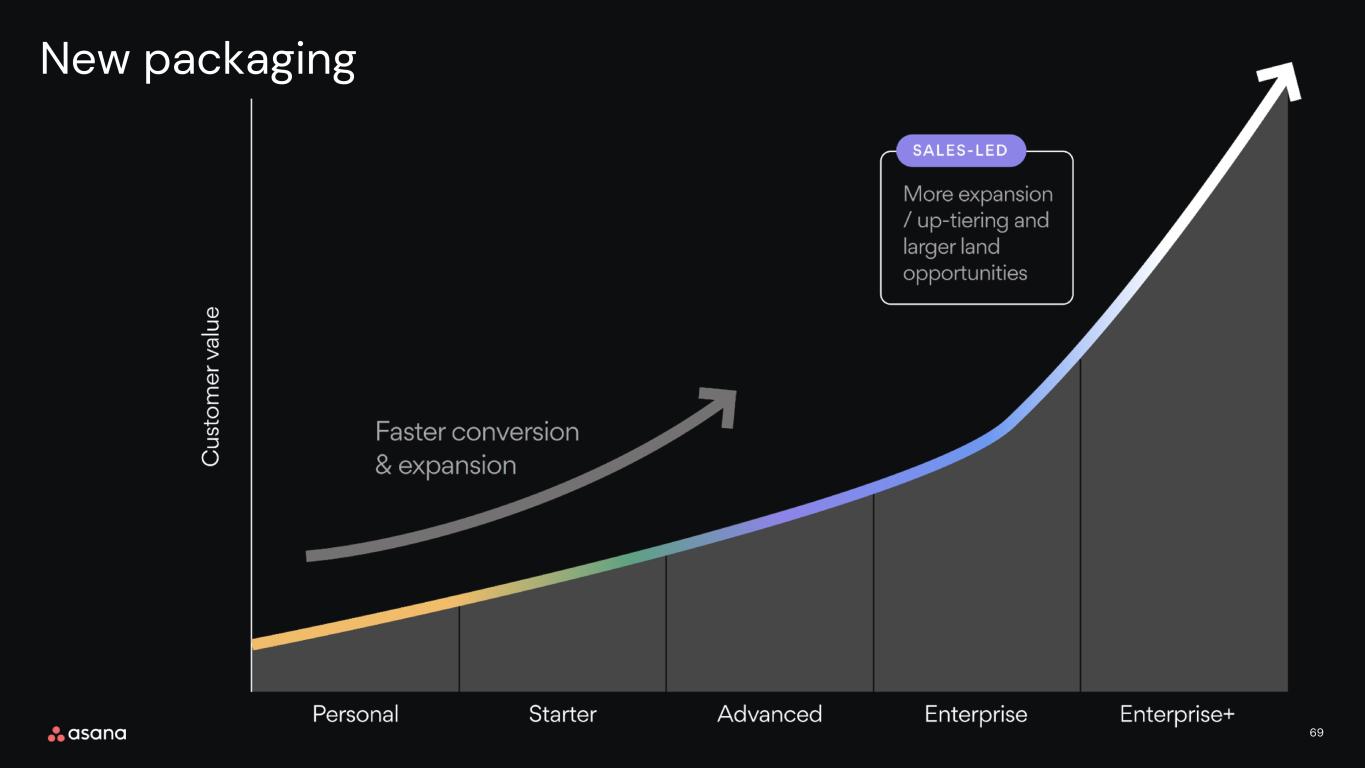

67 New packaging

68 New packaging

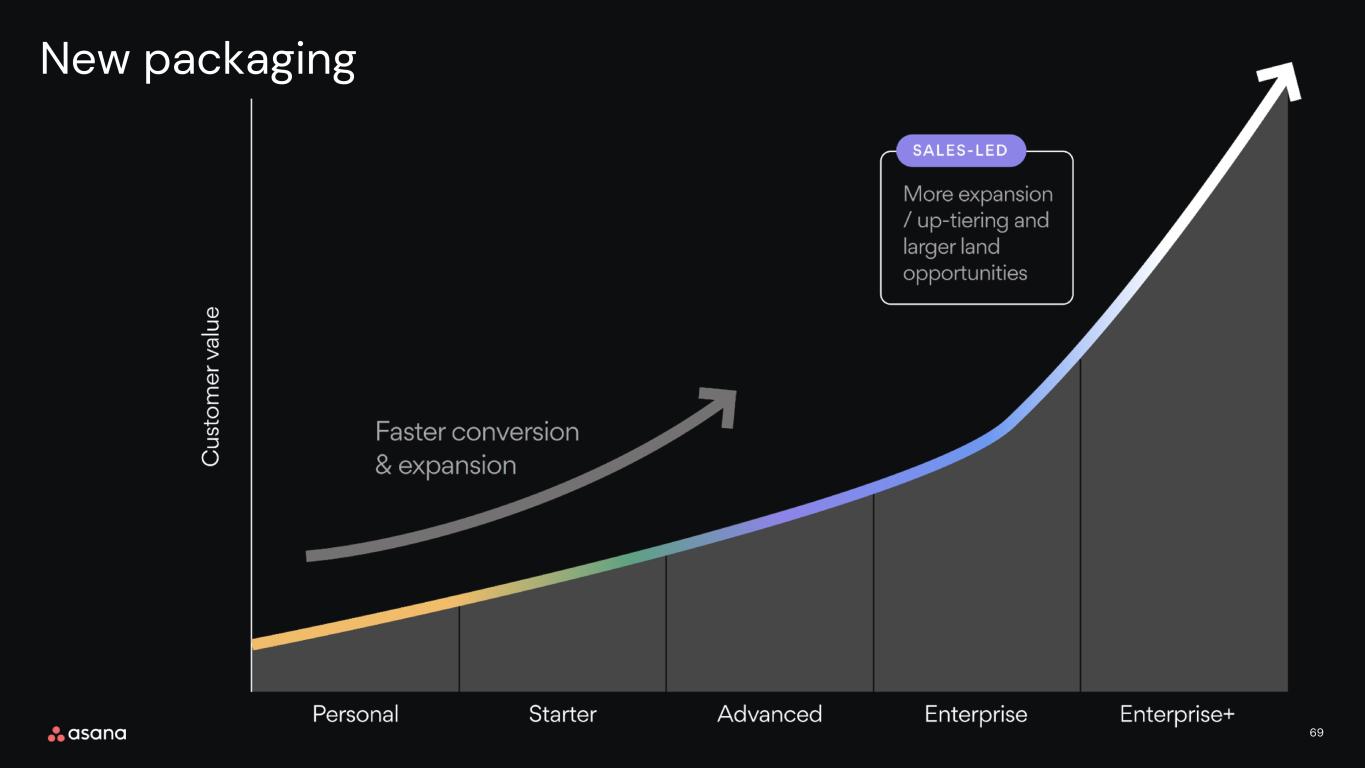

69 New packaging

70 New packaging

71 GTM leaders Neeracha Taychakhoonavudh Head of Customer Experience Shannon Duffy Chief Marketing Officer Ed McDonnell Chief Revenue Officer

72 Ed McDonnell Chief Revenue Officer Fireside chat Strategies for moving upmarket

73 Chief Financial Officer Chapter 4Opportunities for growth and leverage Tim Wan 73

74 Agenda Upmarket traction Opportunities for growth Growth philosophy 74

75 Upmarket traction

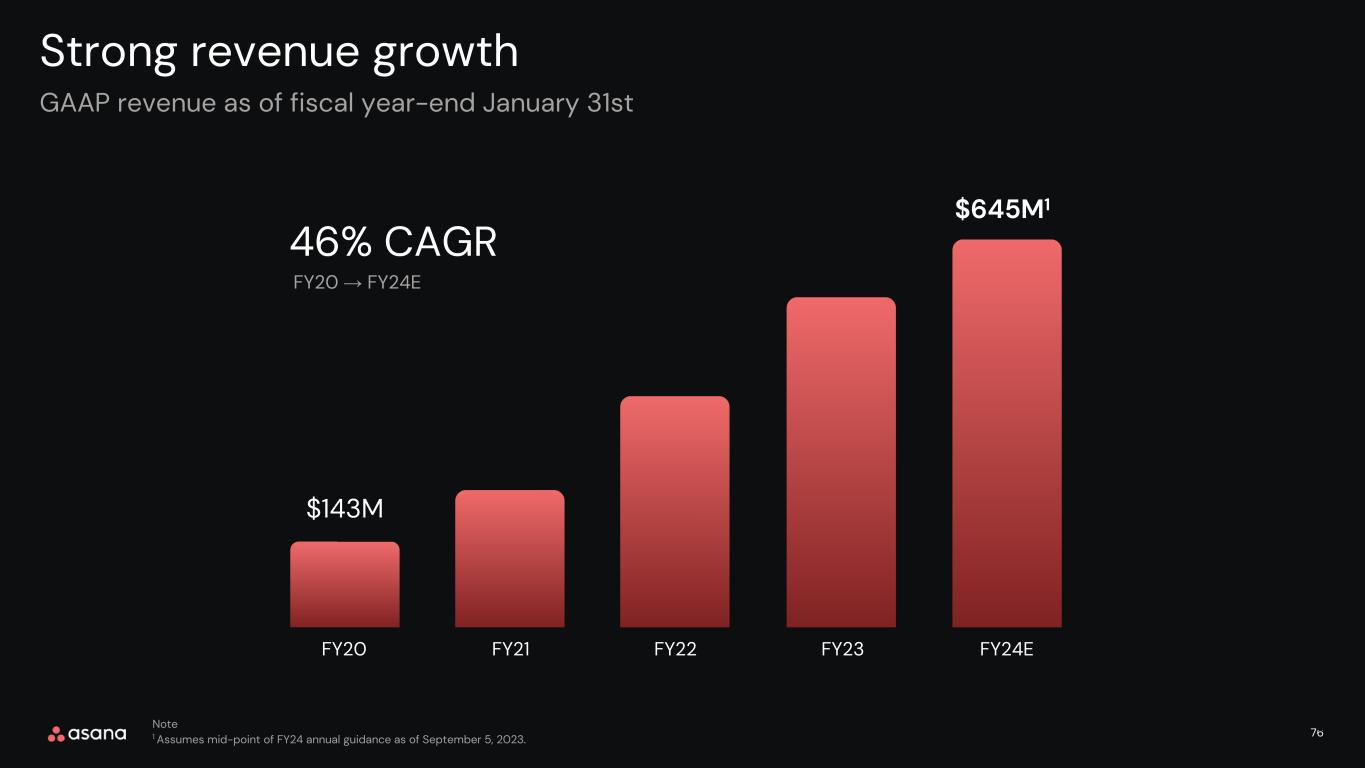

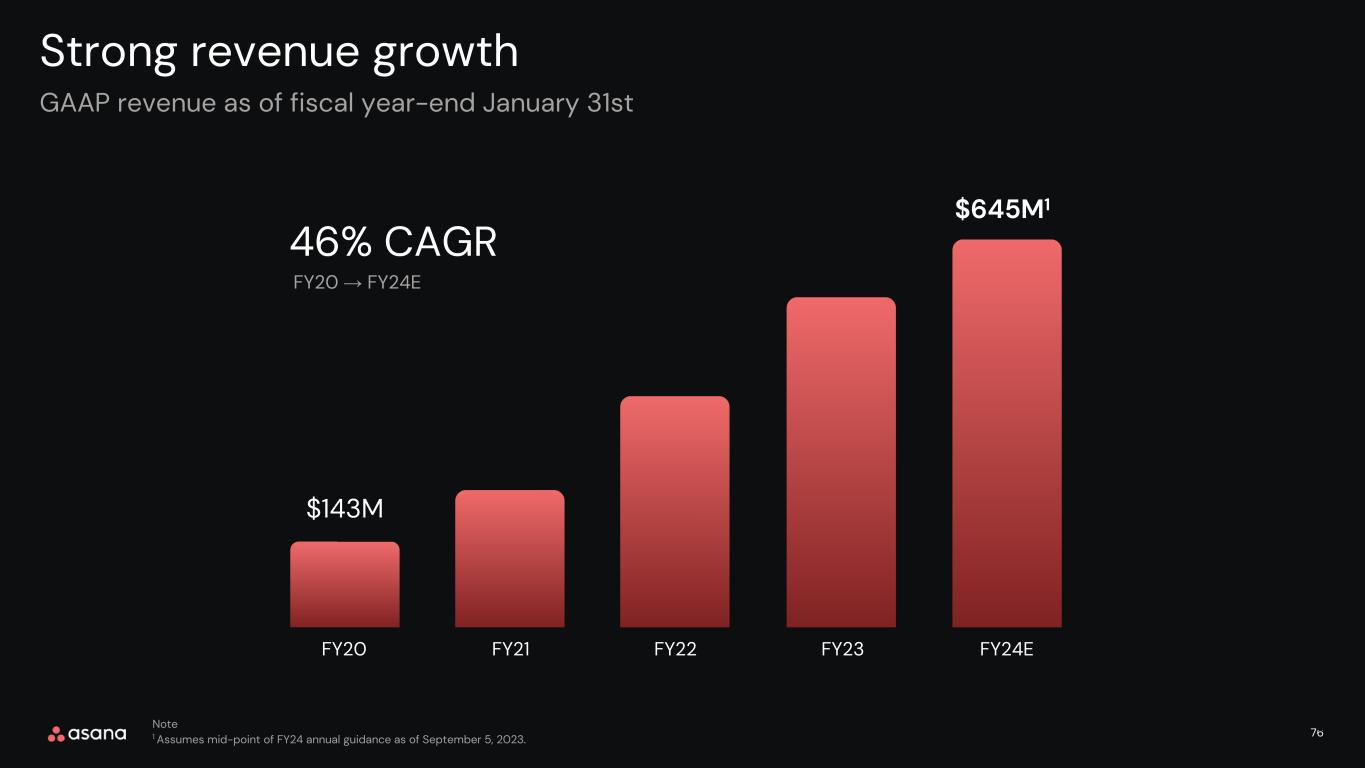

76 $143M $645M1 Strong revenue growth GAAP revenue as of fiscal year-end January 31st 46% CAGR FY20 → FY24E FY20 FY21 FY22 FY23 FY24E Note 1 Assumes mid-point of FY24 annual guidance as of September 5, 2023. 76

77 Number of Core customers Number of paying customers <$5K Notes Asana defines customers spending over $5,000 as those organizations on a paid subscription plan that had $5,000 or more in annualized GAAP revenues in a given quarter, respectively, inclusive of discount 44% CAGR >66K >126K 4,797 20,782 18% CAGR Driven by rapid Core customer acquisition Q2FY20 Q2FY24 Q2FY20 Q2FY24 ote Asana defines Core customers as those organizations on a paid subscription plan that had $5,000 or more in annualized GAAP revenues in a given quarter, inclusive of discounts. 77

78 >660K Number of paid seats in Core customersNumber of paid seats in <$5K customers Faster seat growth within our Core customers 47% CAGR >1.0M >410K >1.9M 11% CAGR Q2FY20 Q2FY24 Q2FY20 Q2FY24 Note Asana defines Core customers as those organizations on a paid subscription plan that had $5,000 or more in annualized GAAP revenues in a given quarter, inclusive of discounts. 78

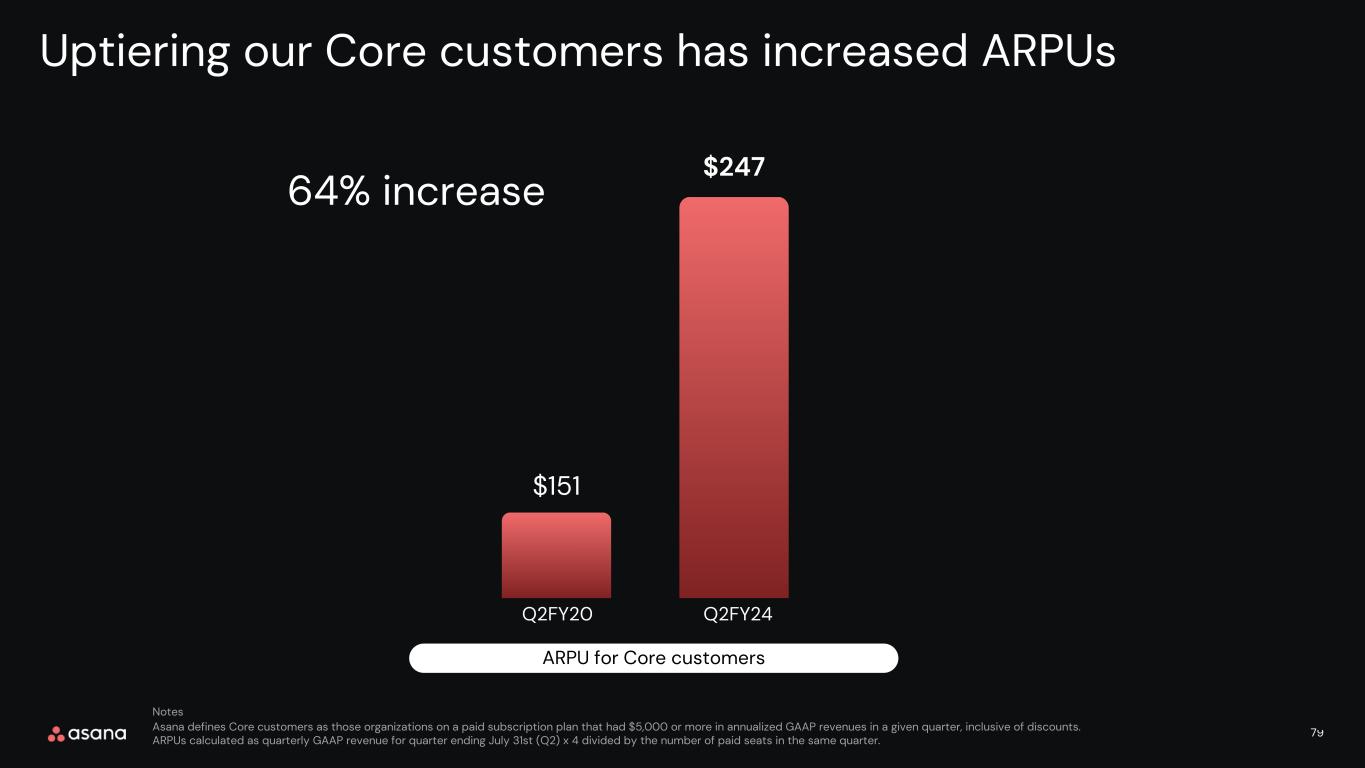

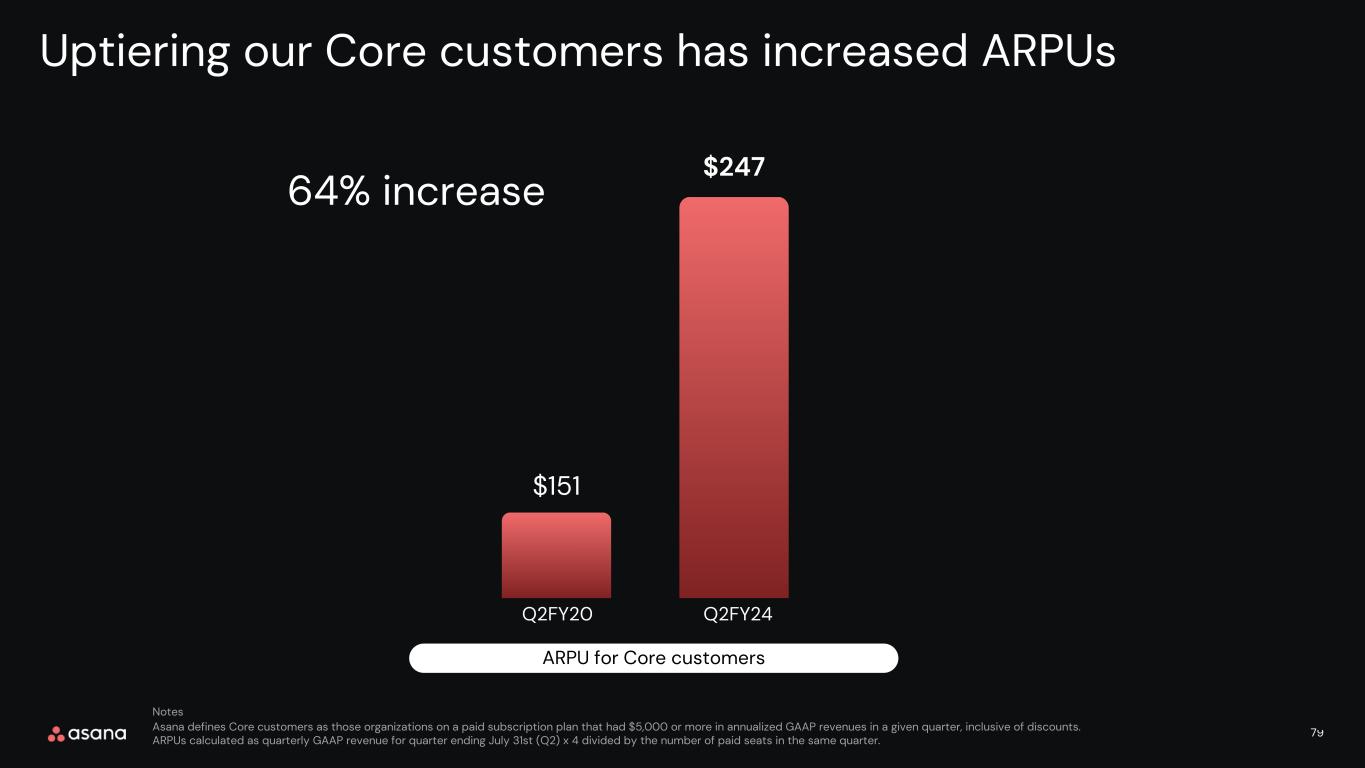

79 ARPU for Core customers $151 $247 Q2FY20 Q2FY24 64% increase Uptiering our Core customers has increased ARPUs Notes Asana defines Core customers as those organizations on a paid subscription plan that had $5,000 or more in annualized GAAP revenues in a given quarter, inclusive of discounts. ARPUs calculated as quarterly GAAP revenue for quarter ending July 31st (Q2) x 4 divided by the number of paid seats in the same quarter. 79

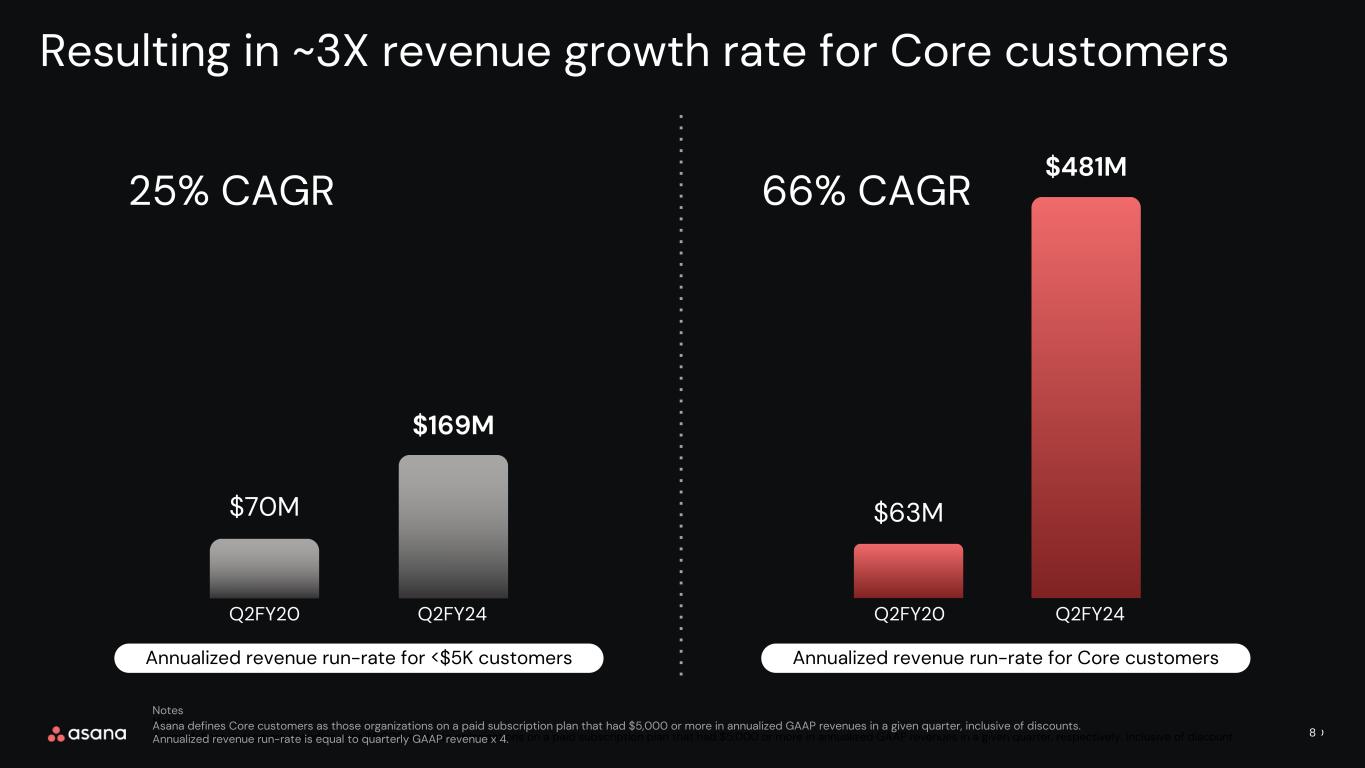

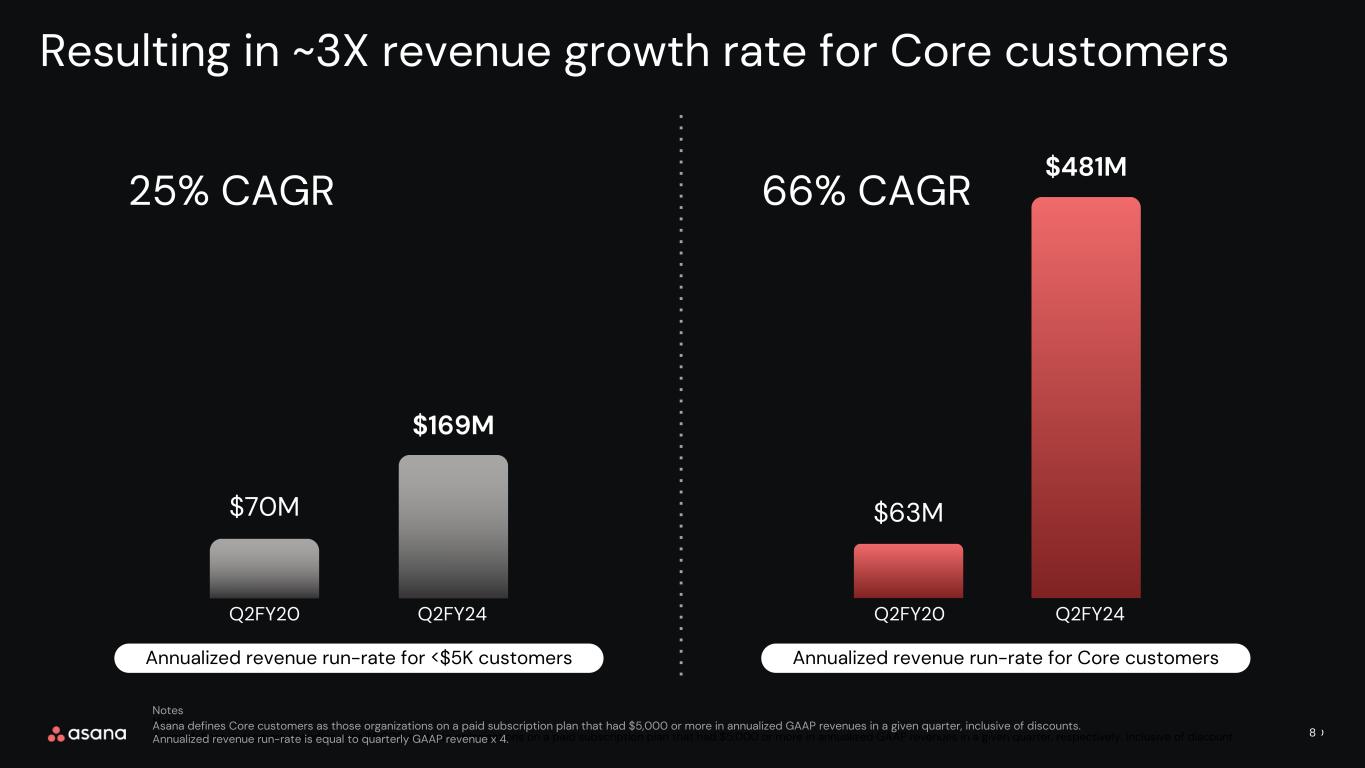

80 Annualized revenue run-rate for Core customersAnnualized revenue run-rate for <$5K customers Notes Asana defines customers spending over $5,000 as those organizations on a paid subscription plan that had $5,000 or more in annualized GAAP revenues in a given quarter, respectively, inclusive of discount Resulting in ~3X revenue growth rate for Core customers 66% CAGR $70M $169M $63M $481M 25% CAGR Q2FY20 Q2FY24 Q2FY20 Q2FY24 Notes Asana defines Core customers as those organizations on a paid subscription plan that had $5,000 or more in annualized GAAP revenues in a given quarter, inclusive of discounts. nnualized revenue run-rate is equal to quarterly GAAP revenue x 4. 80

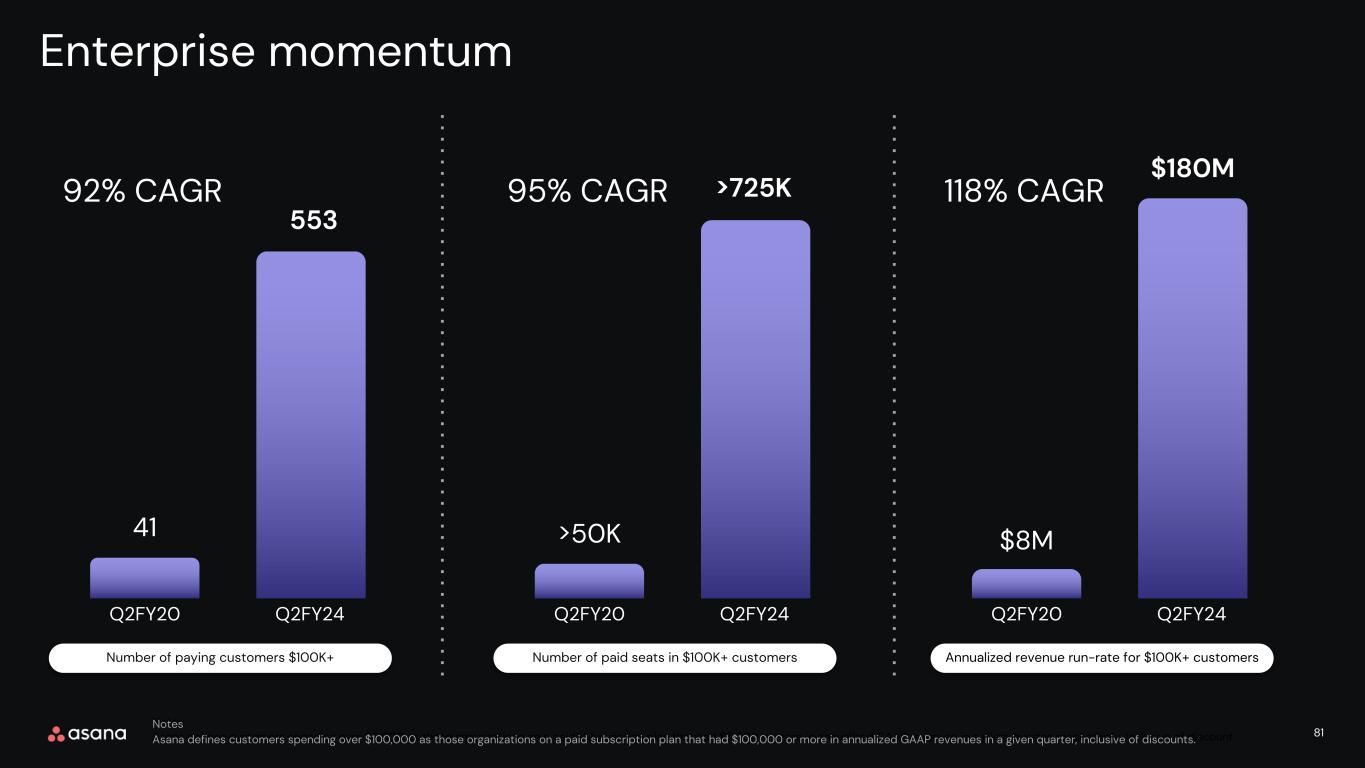

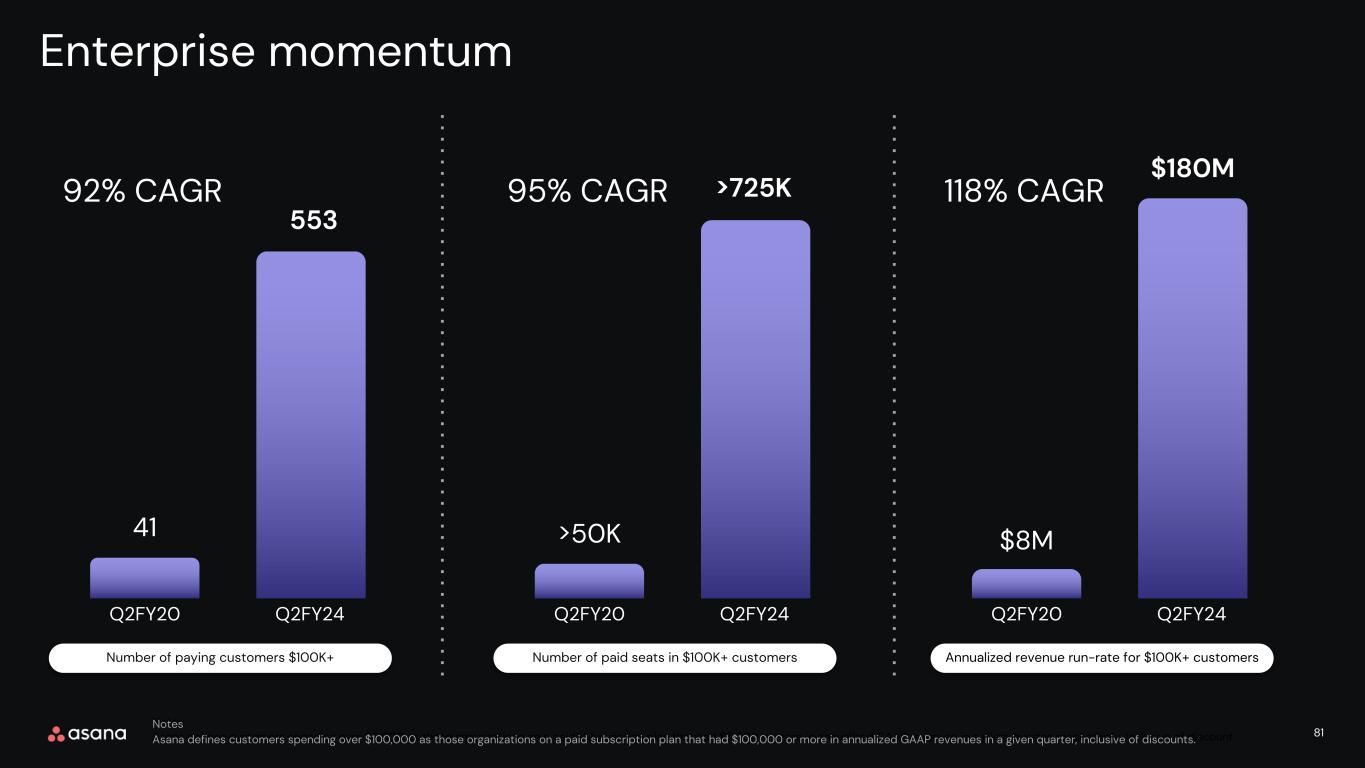

81 92% CAGR 95% CAGR 118% CAGR $8M Q2FY20 Number of paying customers $100K+ Notes Asana defines customers spending over $5,000 as those organizations on a paid subscription plan that had $5,000 or more in annualized GAAP revenues in a given quarter, respectively, inclusive of discount 41 553 Enterprise momentum Q2FY20 Q2FY24 otes Asana defines custo ers spending over $100,000 as those organizations on a paid subscription plan that had $100,000 or more in annualized GAAP revenues in a given quarter, inclusive of discounts. Number of paid seats in $100K+ customers >50K >725K Q2FY20 Q2FY24 Annualized revenue run-rate for $100K+ customers $180M Q2FY24 81

82 ~35X Additional Lifetime Value1 $325K $100K+ Customer Average ACV $23K Core Customer Average ACV Notes 1 Lifetime Value = average customer ACV divided by annual logo churn % multiplied by gross margin. ACV = Annualized GAAP revenue per quarter divided by total number of customers at end of quarter. Asana defines Core customers as those organizations on a paid subscription plan that had $5,000 or more in annualized GAAP revenues in a given quarter, inclusive of discounts. Asana defines customers spending over $100,000 as those organizations on a paid subscription plan that had $100,000 or more in annualized GAAP revenues in a given quarter, inclusive of discounts. Expanding upmarket drives leverage in the business 82

83 Enterprise strength across multiple verticals Professional Services Media Consumer + Retail AutomotiveHealthcare Industrial

84 Opportunities for growth 84

85 Dollar-based net retention rate trends for Core customers User growth more prone to macro tail/headwinds, while ARPU & churn see greater resilience Q2FY 19 Use rs ARPU Rete ntio n Q2FY 20 Use rs ARPU Rete ntio n Use rs ARPU Rete ntio n Q2FY 21 Q2FY 22 Use rs ARPU Rete ntio n Q2FY 23 Use rs ARPU Rete ntio n Q2FY 24 85 Note Each Q2 NRR indexed to actual NRR as of Q2FY19.

86 >110%1 Q2FY 19 Q2FY 20 Q2FY 21 Q2FY 22 Q2FY 23 Q2FY 24 Use rs ARPU Rete ntio n Fu tu re >125%1 >120%+ 86 Dollar-based net retention rate trends for Core customers User growth more prone to macro tail/headwinds, while ARPU & churn see greater resilience Note Each Q2 NRR indexed to actual NRR as of Q2FY19. 1 Disclosed NRRs as of Q2FY22 and Q2FY24. Disclosed NRR is a trailing 4 quarter average calculation.

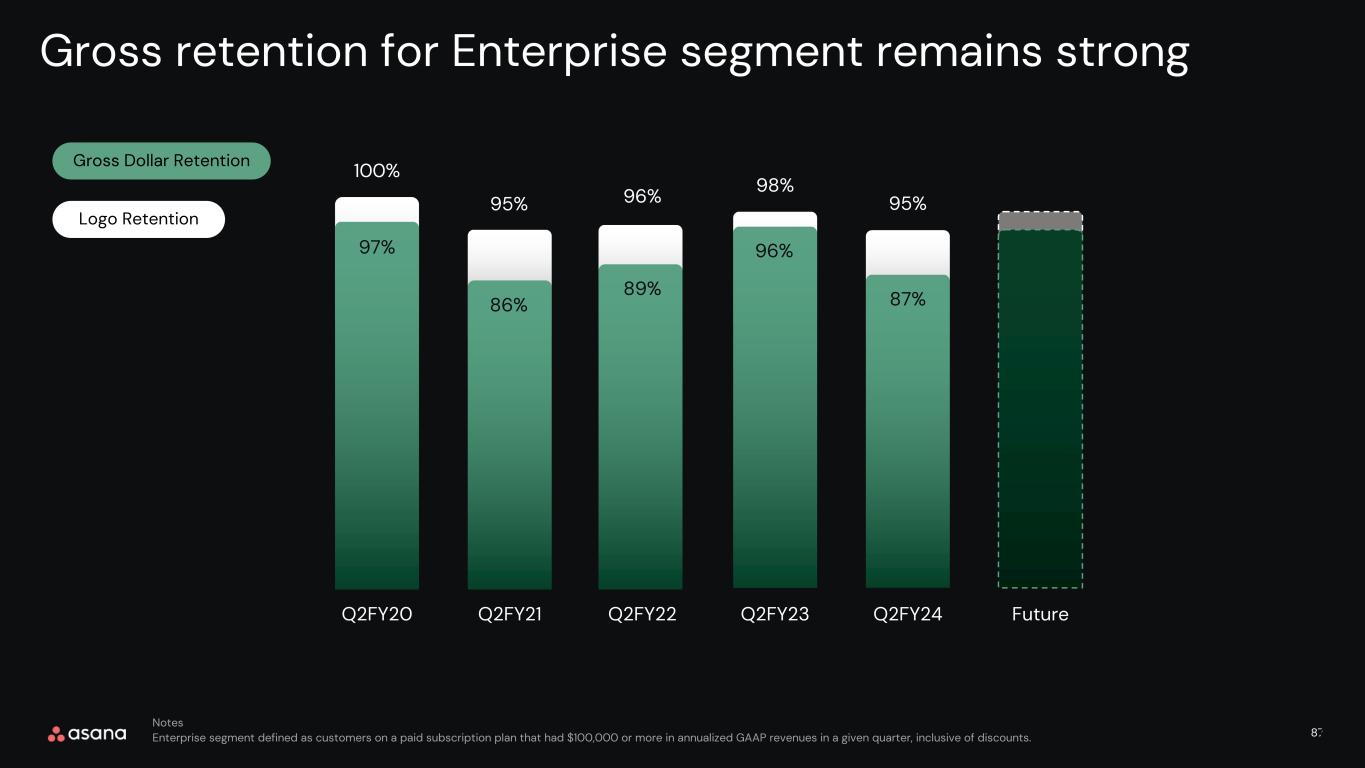

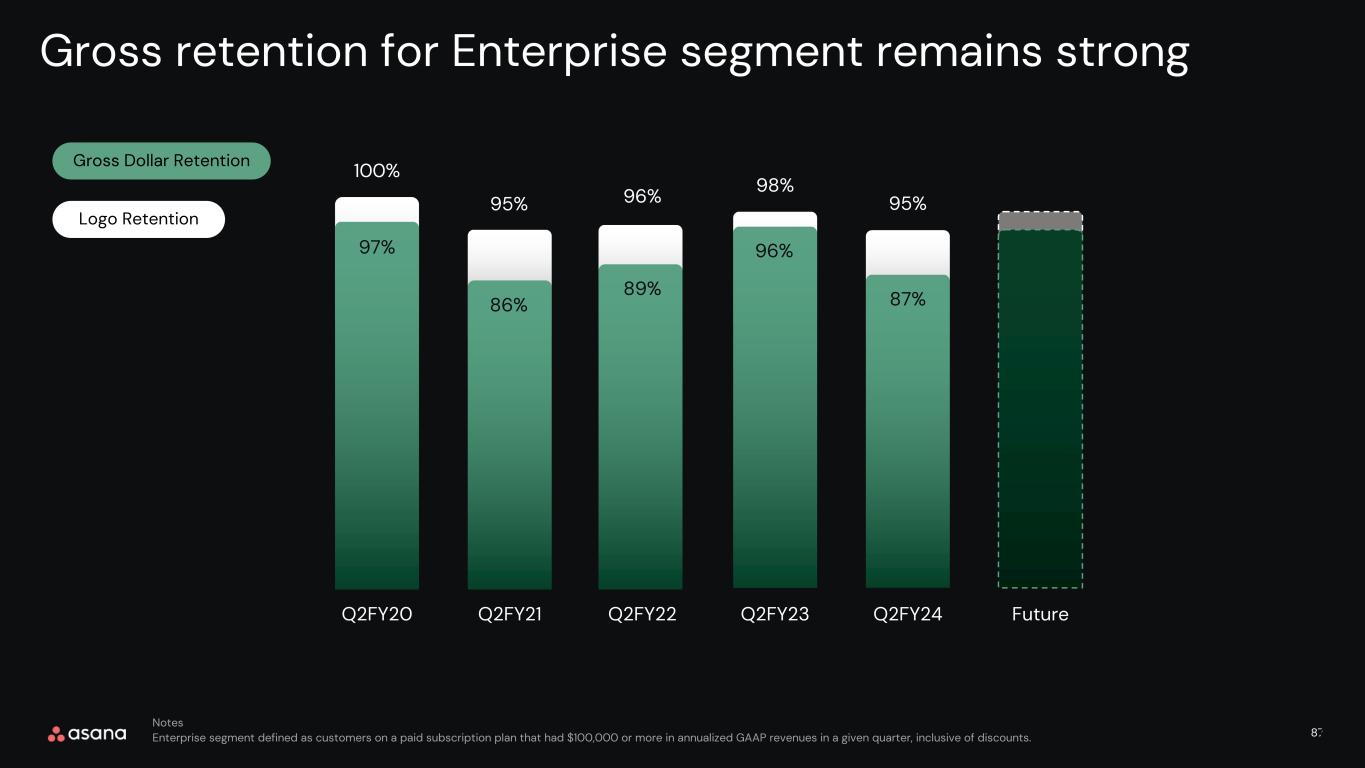

87 98% Logo Retention Gross Dollar Retention 97% 86% 89% 96% 87% 100% 96% 95% Q2FY20 Q2FY21 Q2FY22 Q2FY23 Q2FY24 Future Notes Enterprise segment defined as customers on a paid subscription plan that had $100,000 or more in annualized GAAP revenues in a given quarter, inclusive of discounts. Gross retention for Enterprise segment remains strong 87 95%

88 15% CAGR Sources IDC Worldwide Collaborative Applications Forecast 2023-2027. IDC Worldwide Project and Portfolio Management Software Forecast, 2022-2026 and Asana estimates. Collaborative Work Management is a large & growing market $79B 2027 $45B 2023 88

89 ~2M paid seats today in our Core customers ~2M paid seats Notes Asana defines Core customers as those organizations on a paid subscription plan that had $5,000 or more in annualized GAAP revenues in a given quarter, inclusive of discounts. 89

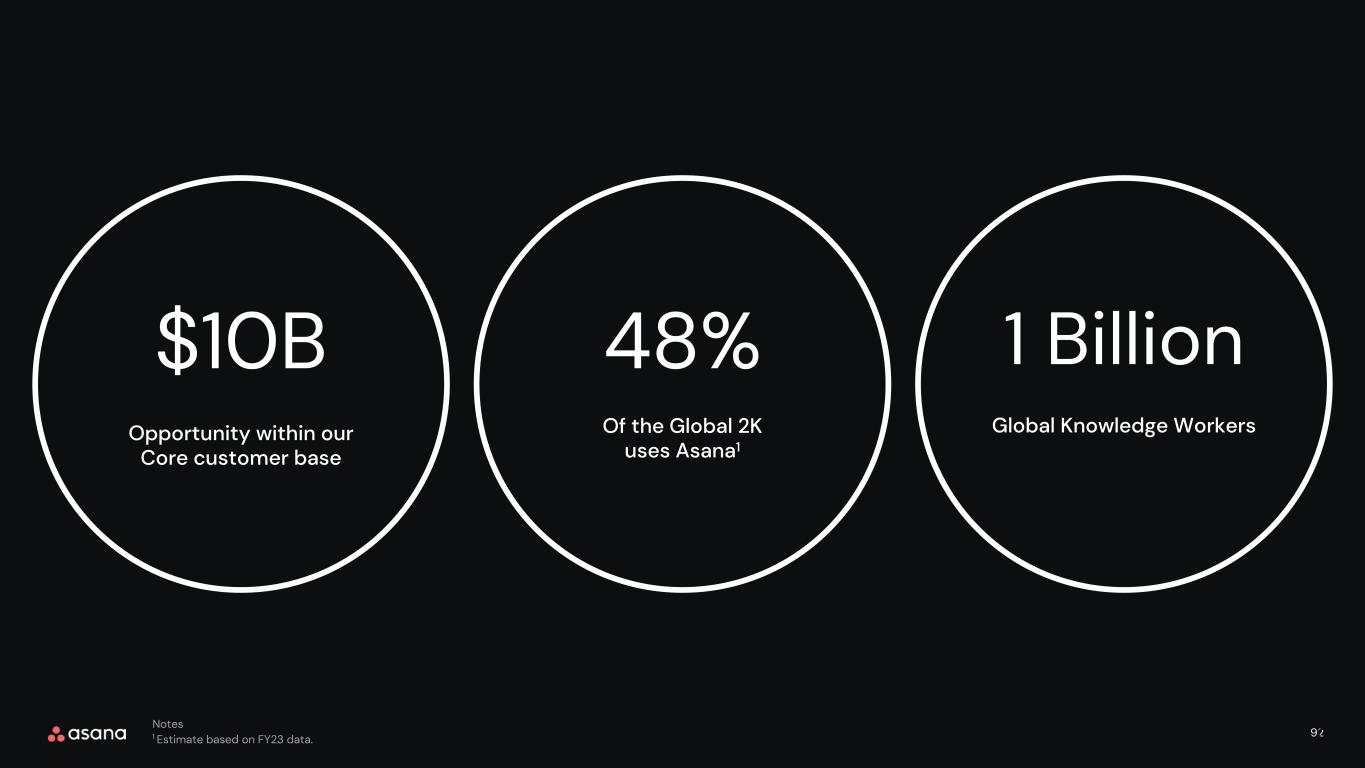

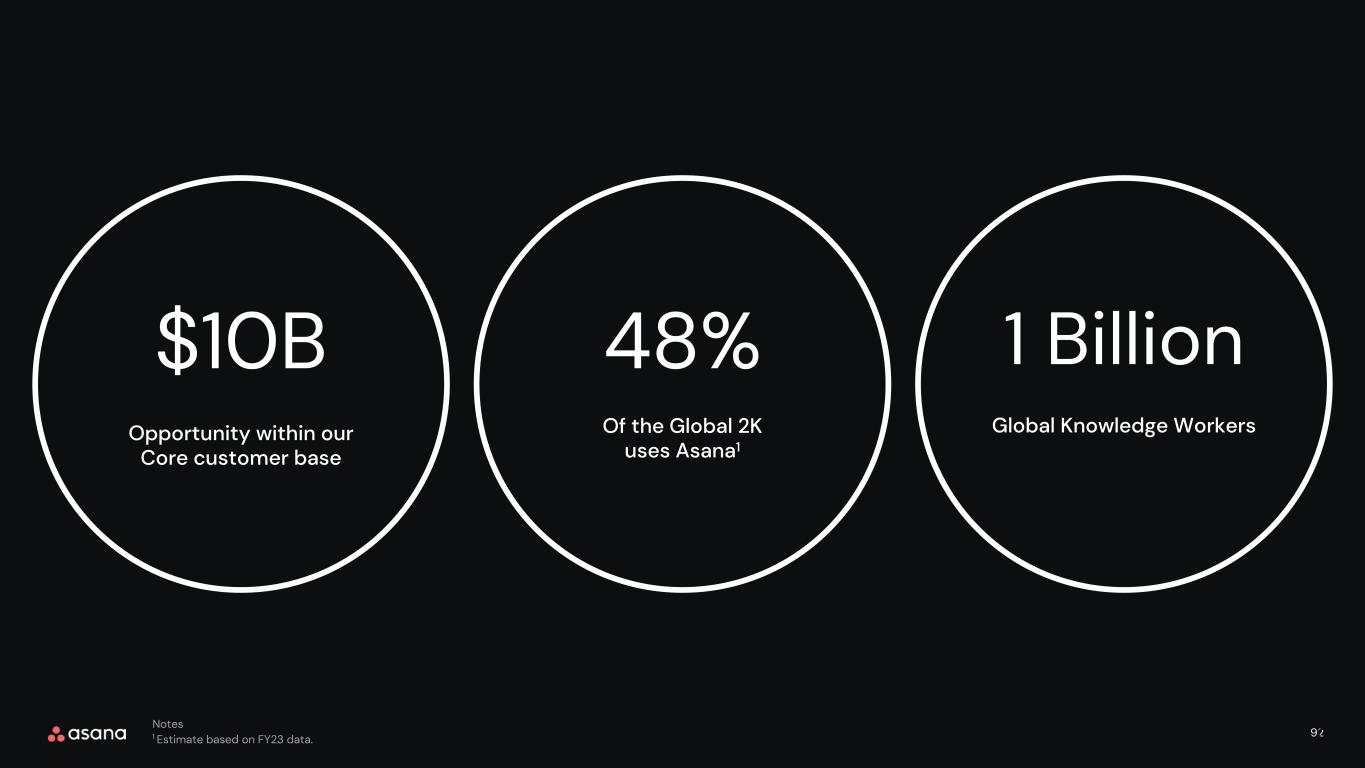

90 A $10 billion opportunity within existing Core customers <5% penetration in Core customer base ~40M knowledge workers ~2M paid seats Notes Asana defines Core customers as those organizations on a paid subscription plan that had $5,000 or more in annualized GAAP revenues in a given quarter, inclusive of discounts. 90

91 ~2M paid seats Asana has a greenfield opportunity to provide value to one billion global Knowledge Workers ~40M knowledge workers 1B knowledge workers1 91 Notes 1 Estimate based on September 2019 report by Forrester Research, Inc.

92 Opportunity within our Core customer base $10B Global Knowledge Workers 1 Billion Of the Global 2K uses Asana1 48% 92 Notes 1 Estimate based on FY23 data.

9393 Foundation for growth Enterprise+ plan AI features User and feature limits

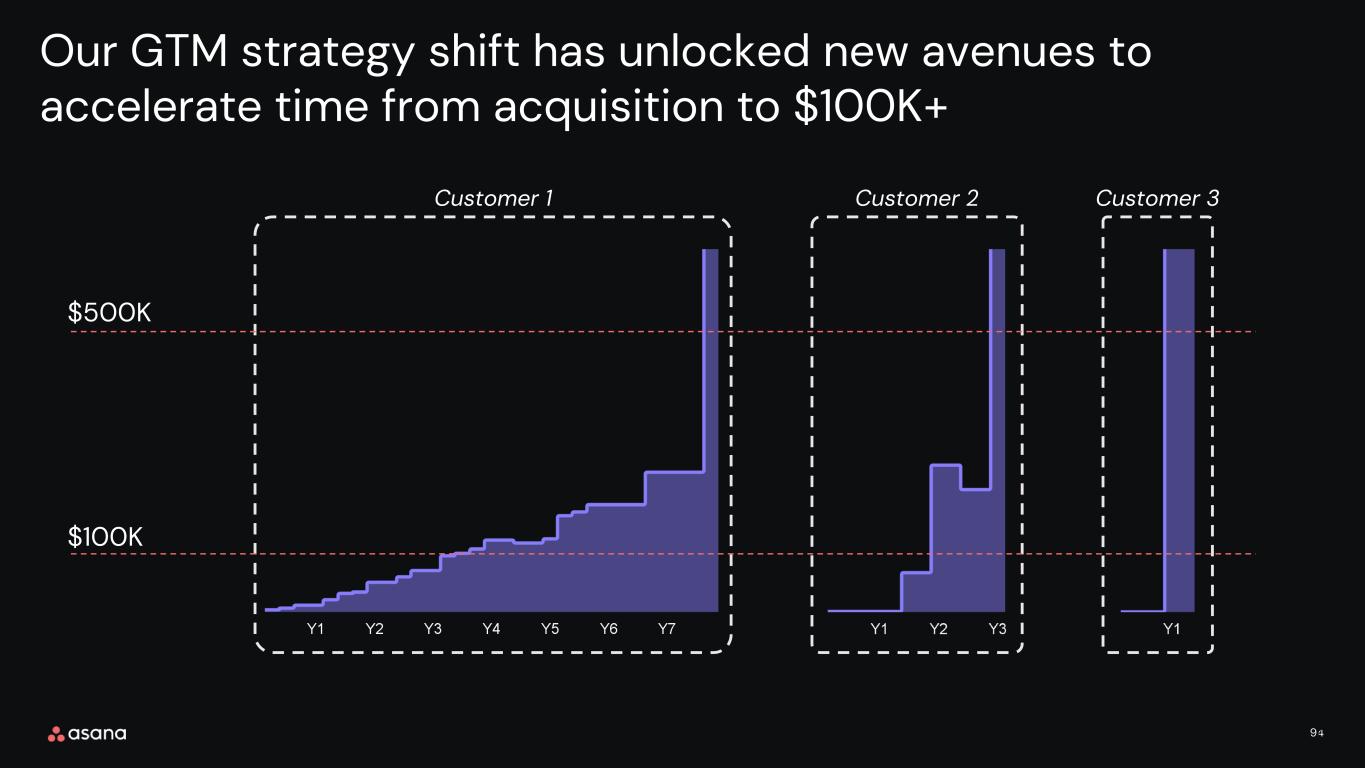

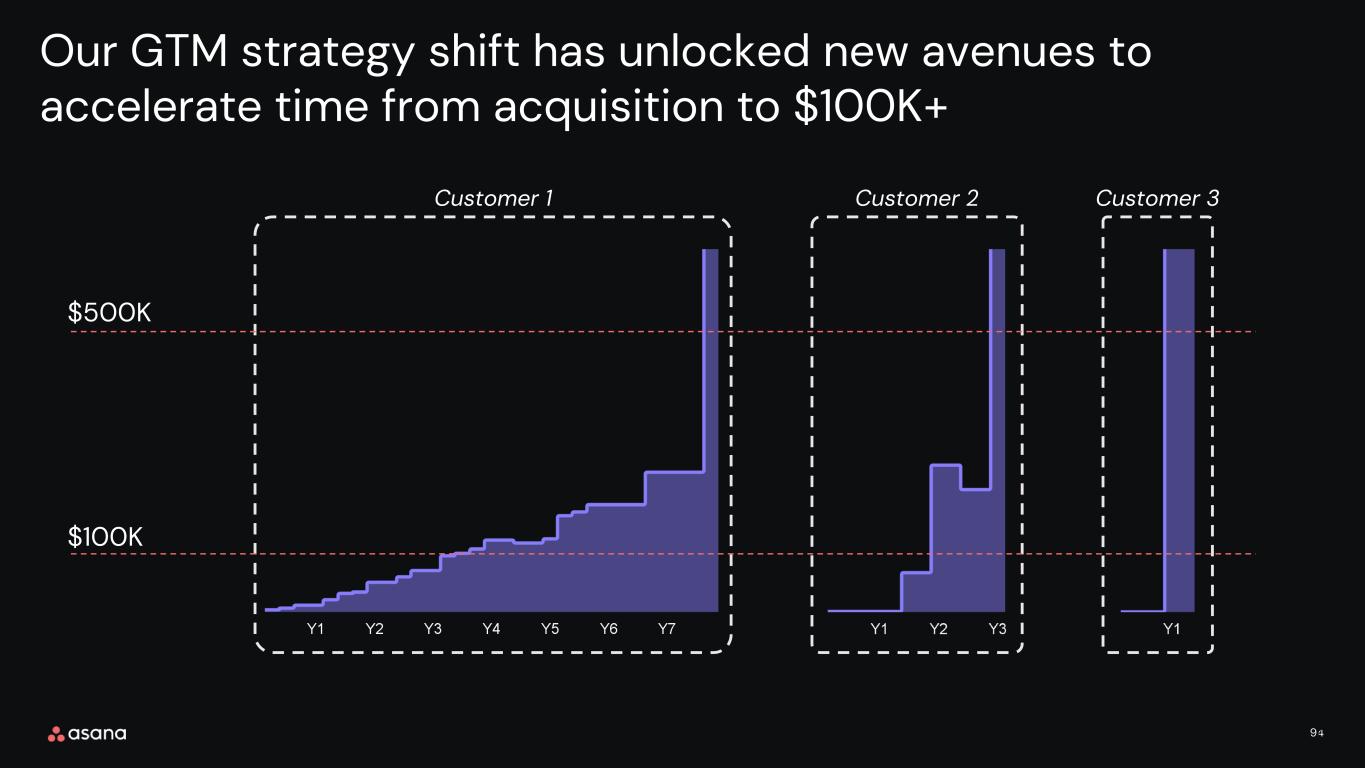

94 Our GTM strategy shift has unlocked new avenues to accelerate time from acquisition to $100K+ 94 $500K $100K Customer 1 Customer 2 Customer 3

95 Growth philosophy 95

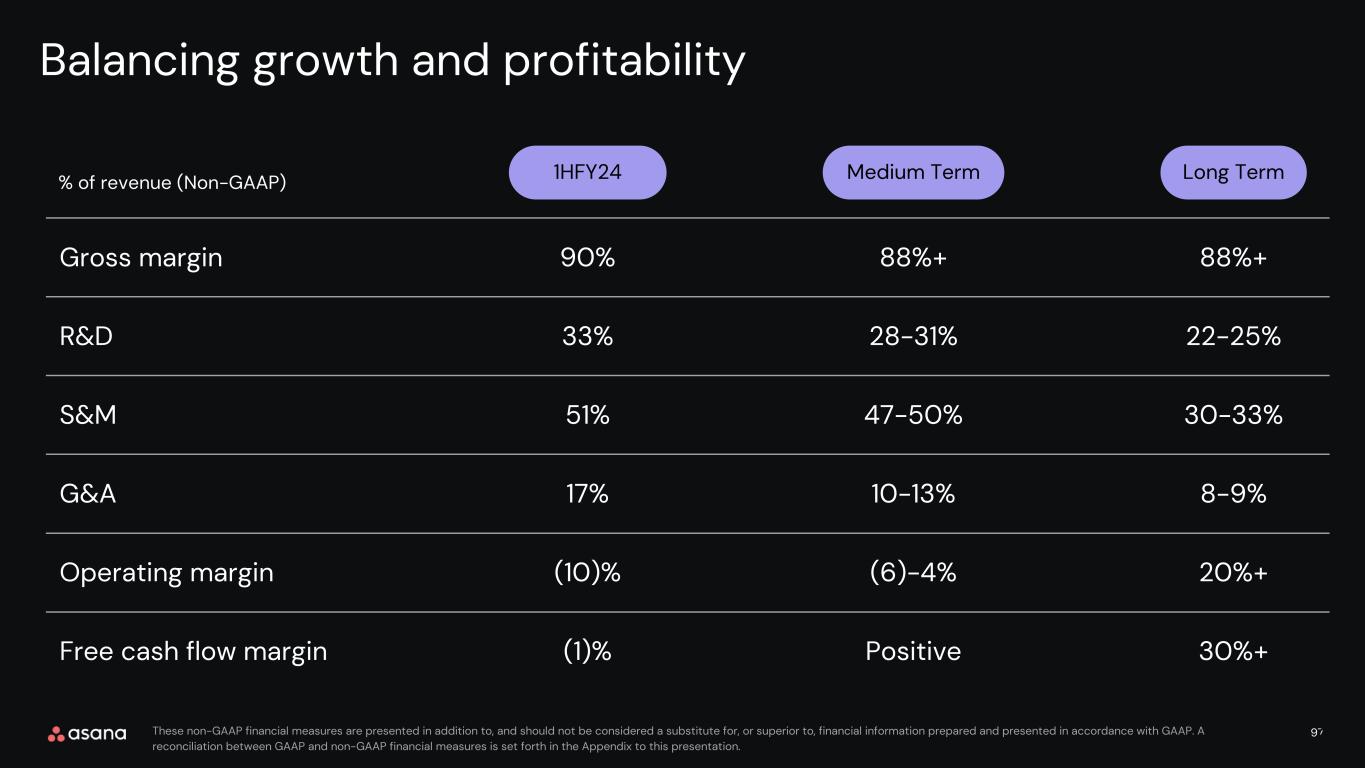

96 Balancing growth and profitability FY20 1HFY24 86% 90% 45% 33% 67% 51% 22% 17% (49)% (10)% (31)% (1)% Gross margin R&D S&M G&A Operating margin Free cash flow margin → → → → → → % of revenue (Non-GAAP) 96These non-GAAP financial measures are presented in addition to, and should not be considered a substitute for, or superior to, financial information prepared and presented in accordance with GAAP. A reconciliation between GAAP and non-GAAP financial measures is set forth in the Appendix to this presentation.

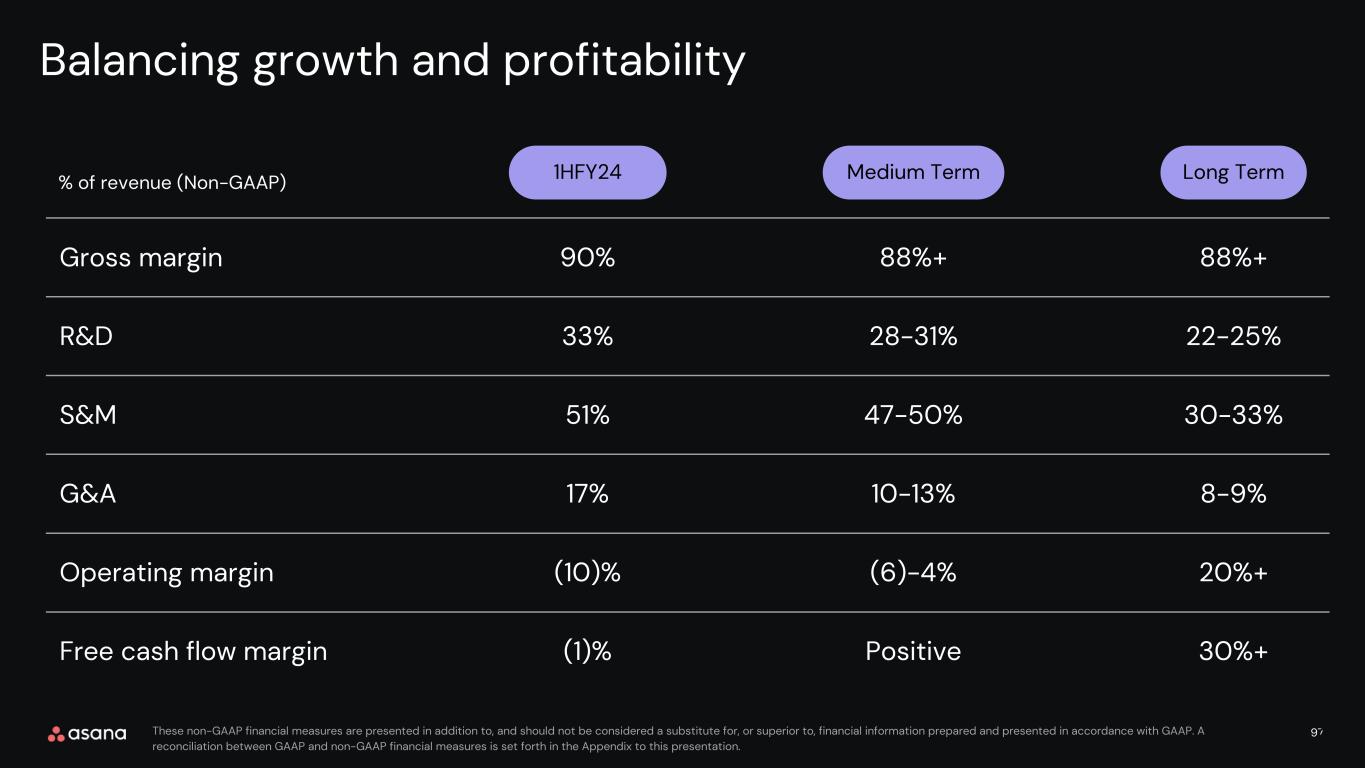

97 1HFY24 90% 33% 51% 17% (10)% (1)% Balancing growth and profitability Medium Term Long Term 88%+ 88%+ 28-31% 22-25% 47-50% 30-33% 10-13% 8-9% (6)-4% 20%+ Positive 30%+ Operating margin Free cash flow margin Gross margin R&D S&M G&A 97 % of revenue (Non-GAAP) These non-GAAP financial measures are presented in addition to, and should not be considered a substitute for, or superior to, financial information prepared and presented in accordance with GAAP. A reconciliation between GAAP and non-GAAP financial measures is set forth in the Appendix to this presentation.

98 Expansion into our core customers Levers for accelerating growth 98

99 Expansion into our core customers Acquire new enterprise customers Levers for accelerating growth 99

100 Expansion into our core customers Acquire new enterprise customers New packaging with Asana Intelligence Levers for accelerating growth 100

101 Q&A 101

102 102

103 GAAP to Non-GAAP Reconciliation 103 Appendix

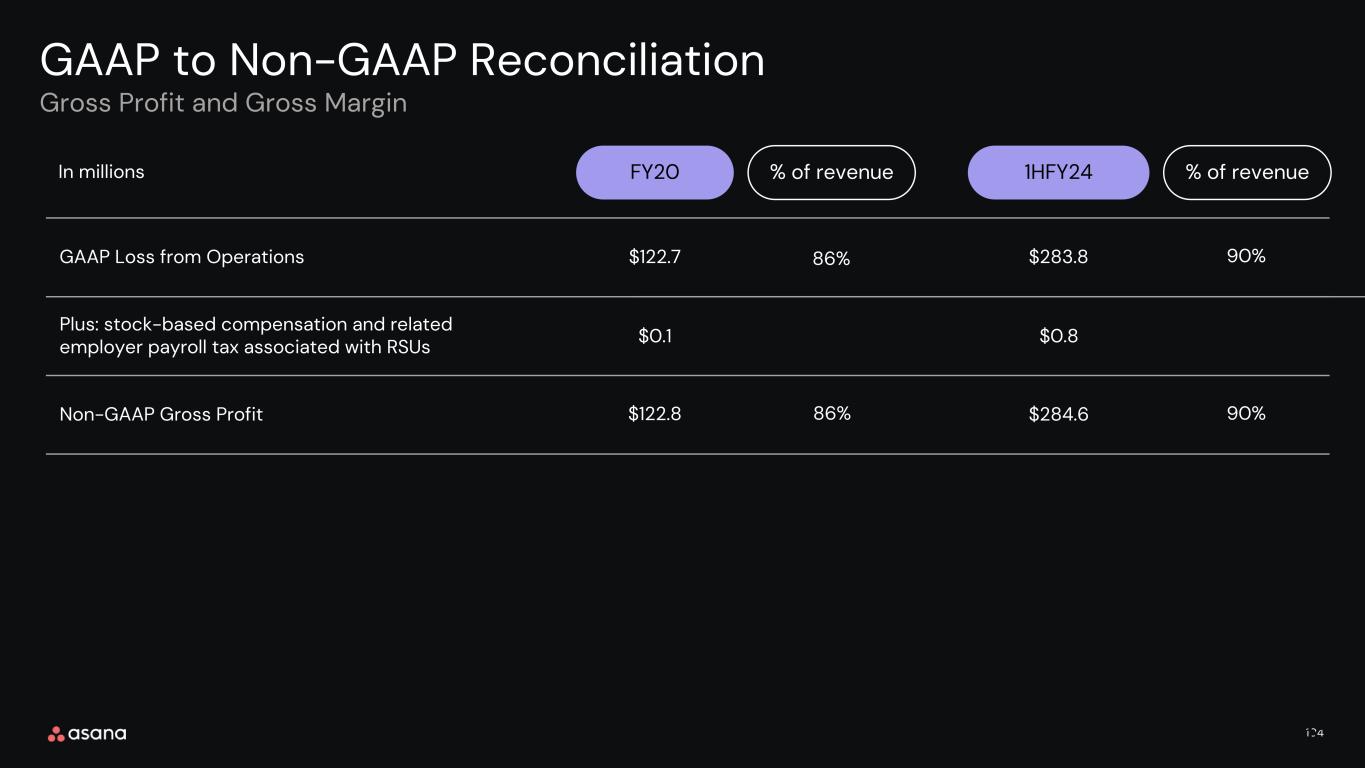

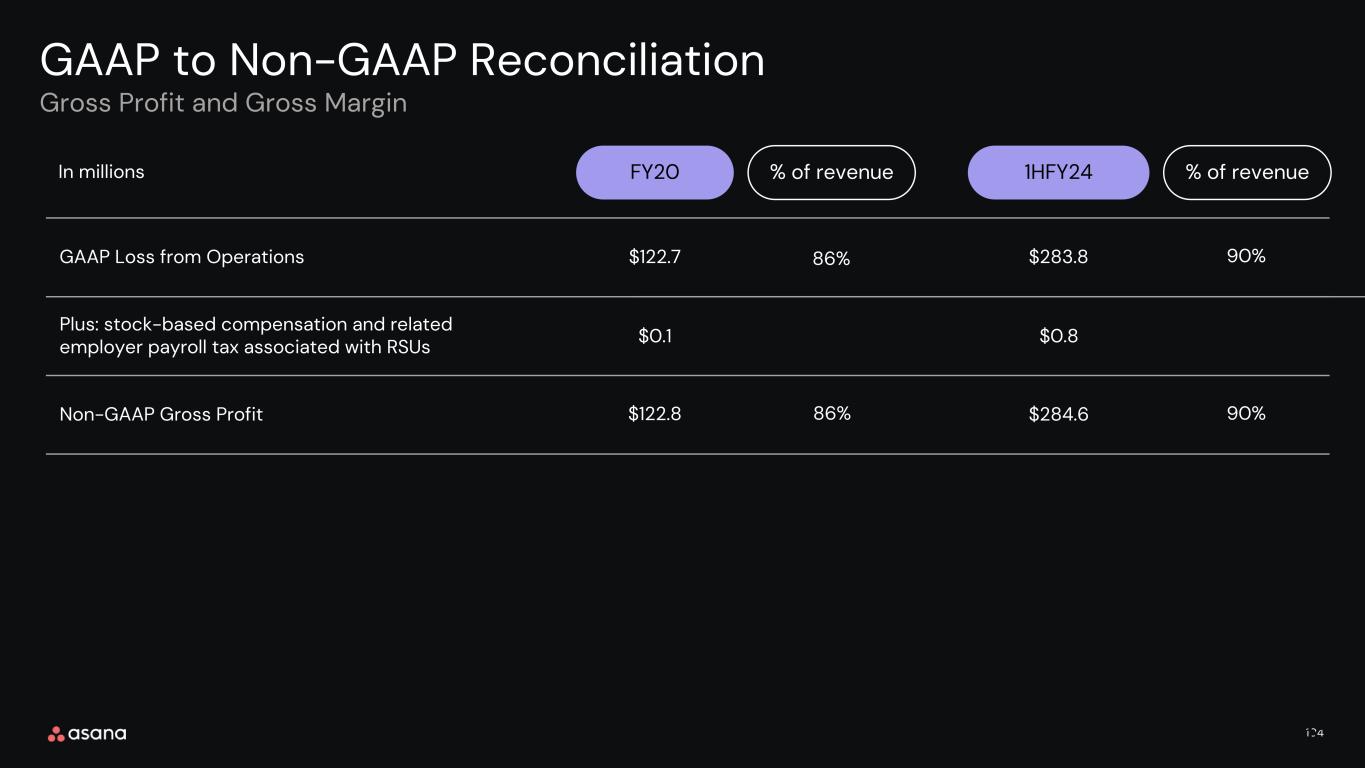

104 FY20 GAAP to Non-GAAP Reconciliation 1HFY24 GAAP Loss from Operations Plus: stock-based compensation and related employer payroll tax associated with RSUs In millions 104 Gross Profit and Gross Margin % of revenue % of revenue Non-GAAP Gross Profit $122.7 $283.8 $0.1 $122.8 86% $0.8 $284.6 90% 90%86%

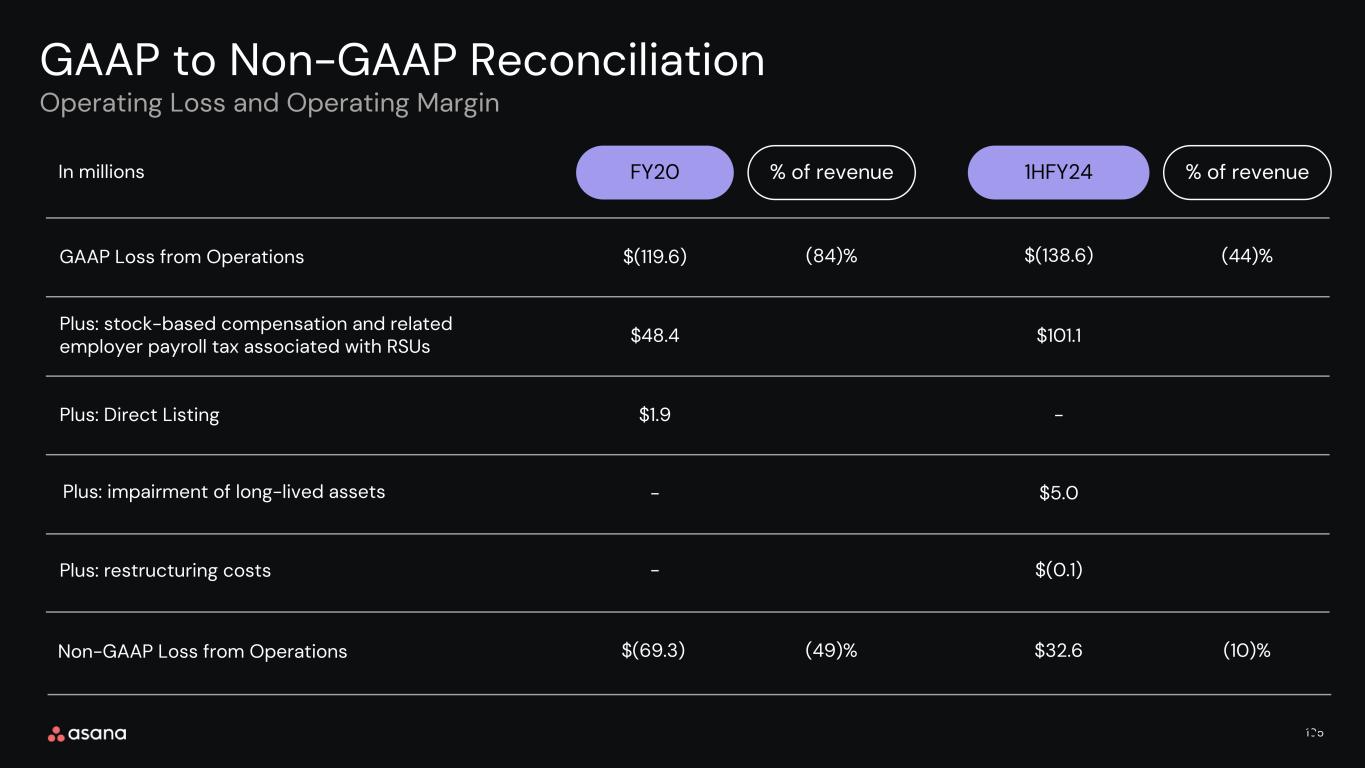

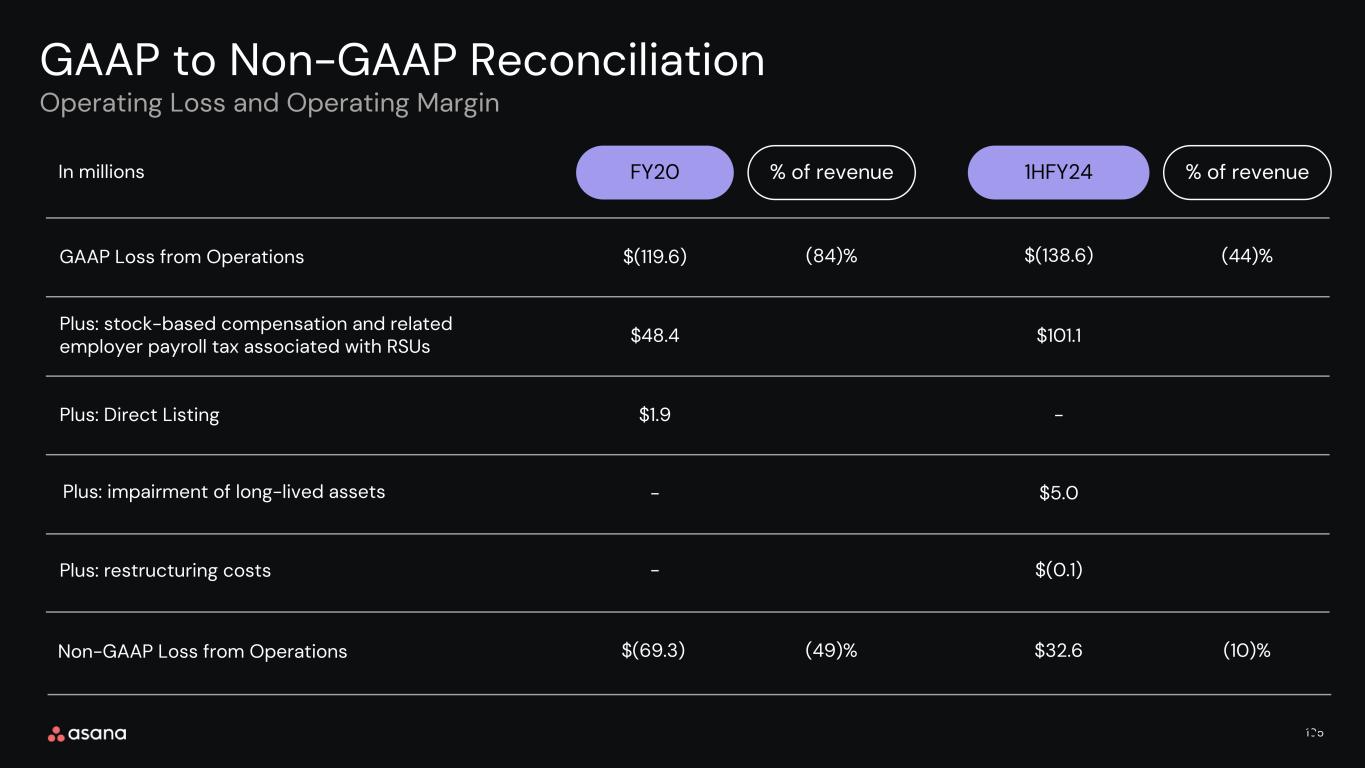

105 FY20 GAAP to Non-GAAP Reconciliation 1HFY24 GAAP Loss from Operations Plus: stock-based compensation and related employer payroll tax associated with RSUs In millions 105 Operating Loss and Operating Margin % of revenue % of revenue Plus: Direct Listing $(119.6) $48.4 $1.9 (84)% - $101.1 - (44)% $5.0 $(138.6) Non-GAAP Loss from Operations $(69.3) (49)% $32.6 (10)% Plus: restructuring costs - $(0.1) Plus: impairment of long-lived assets

106 FY20 GAAP to Non-GAAP Reconciliation 1HFY24 GAAP Research and Development Less: stock-based compensation and related employer payroll tax associated with RSUs In millions 106 Research and Development % of revenue % of revenue Non-GAAP research and development $89.7 $160.7 $(24.9) $64.8 45% $(56.6) $104.1 63% 51% 33%

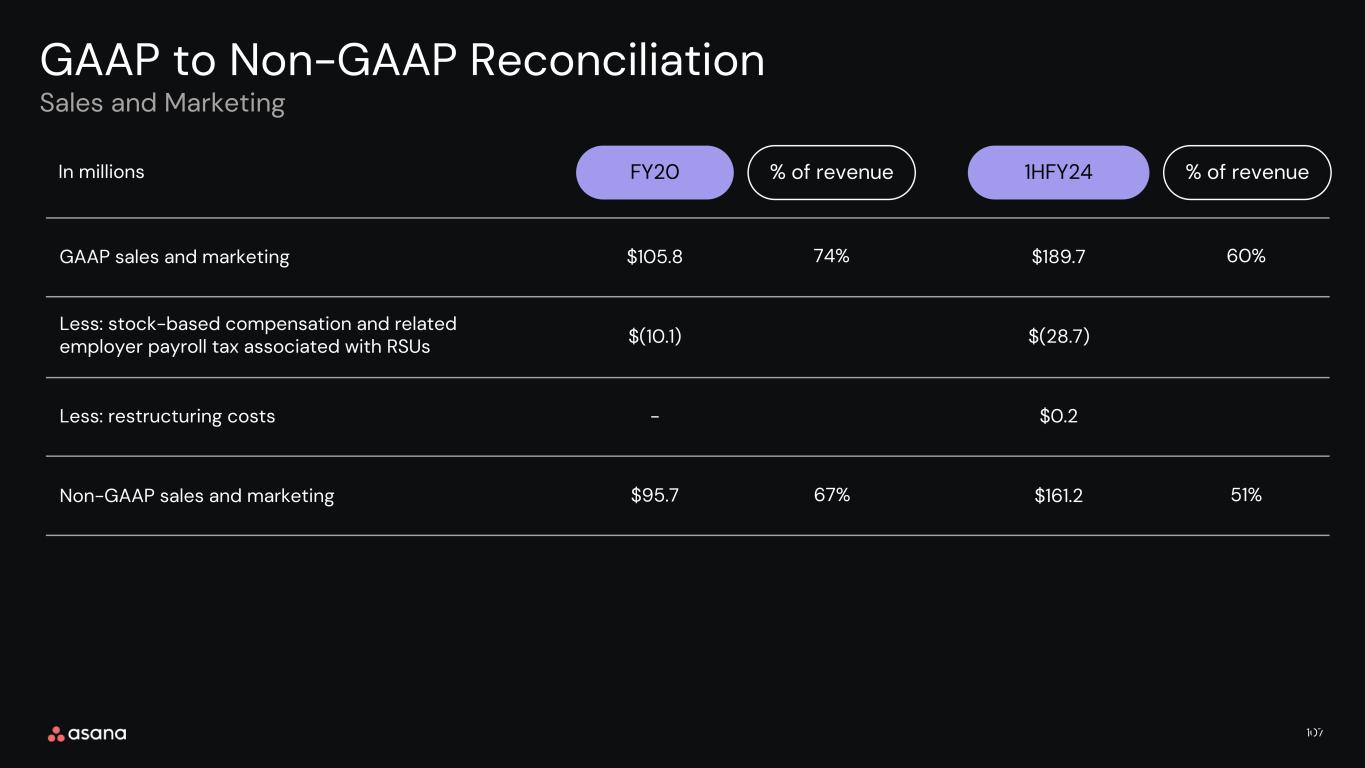

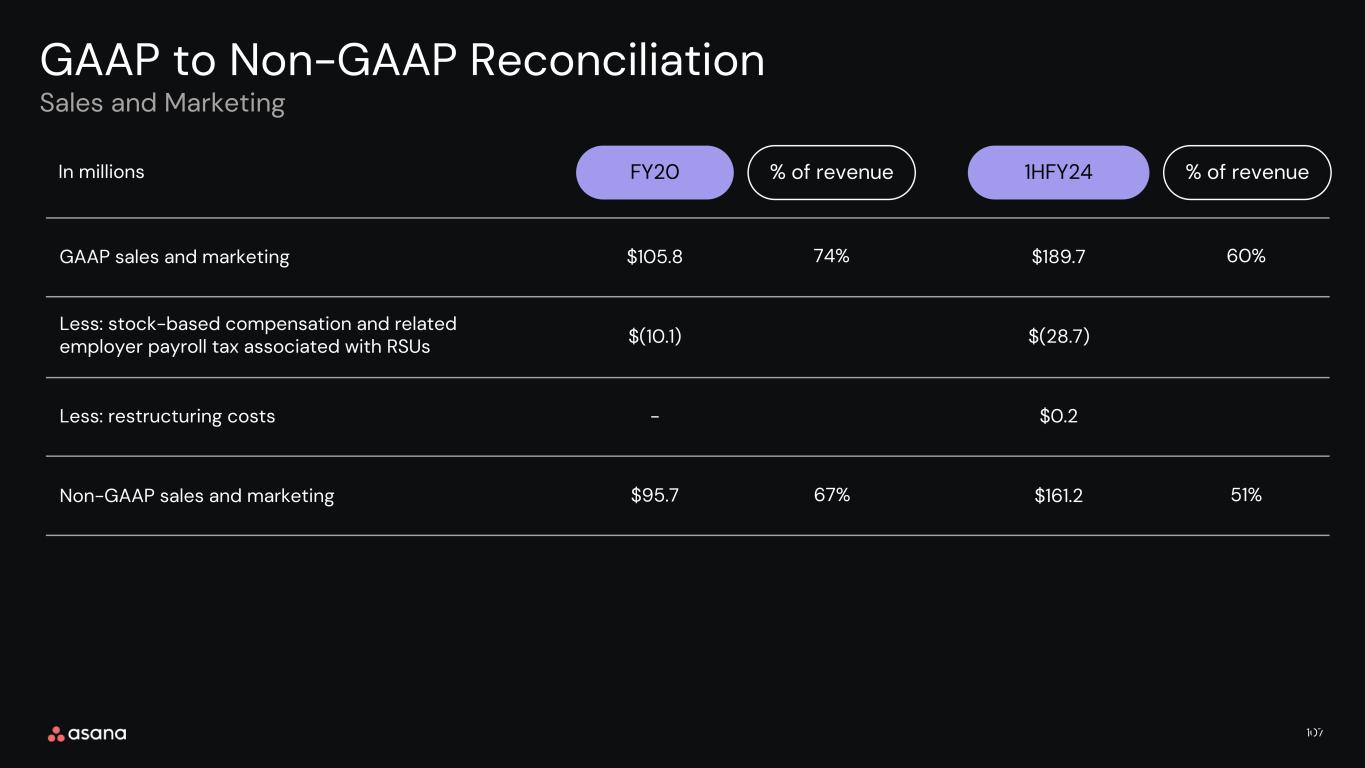

107 GAAP to Non-GAAP Reconciliation 107 Sales and Marketing FY20 1HFY24 GAAP sales and marketing Less: stock-based compensation and related employer payroll tax associated with RSUs In millions % of revenue % of revenue Less: restructuring costs $105.8 $189.7 $(10.1) - $(28.7) $0.2 74% 60% Non-GAAP sales and marketing $95.7 67% $161.2 51%

108 FY20 GAAP to Non-GAAP Reconciliation 1HFY24 GAAP general and administrative Less: stock-based compensation and related employer payroll tax associated with RSUs In millions General and Administrative % of revenue % of revenue Less: direct listing expenses $46.8 $(13.2) $(1.9) 33% Less: impairment of long-lived assets Less: restructuring costs - - $(15.0) - 23% $(5.0) $72.0 Non-GAAP general and administrative $31.7 22% $52.0 17% -

109 FY20 Free cash flow 1HFY24 Net cash provided by (used in) operating activities Less: purchases of property and equipment In millions % of revenue % of revenue Less: capitalized internal-use software Plus: purchases of property and equipment from build-out of corporate headquarters Plus: direct listing expenses Plus: restructuring costs paid Free cash flow $(40.1) $(6.9) $(0.4) $2.6 $0.2 - $(44.6) (31)% $5.6 $(6.0) $(2.3) - - $0.7 $(2.0) (1)%

110 110