SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

Check the appropriate box:

| | |

| ☐ | | Preliminary Proxy Statement |

| |

| ☐ | | Confidential, for Use of the Commission Only (as permitted by Rule14a-6(e)(2)) |

| |

| ☐ | | Definitive Proxy Statement |

| |

| ☒ | | Definitive Additional Materials |

| |

| ☐ | | Soliciting Material Pursuant to Section 240.14a-11(c) or Section 240.14a-12 |

WESTERN ASSET MORTGAGE DEFINED OPPORTUNITY FUND INC.

(Name of Registrant as Specified in Its Charter)

Payment of Filing Fee (Check the appropriate box):

| | | | |

| |

| ☒ | | No fee required. |

| |

| ☐ | | Fee computed on table below per Exchange Act Rules14a-6(i) (1) and0-11. |

| | |

| | (1) | | Title of each class of securities to which transaction applies: |

| | (2) | | Aggregate number of securities to which transaction applies: |

| | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | | Proposed maximum aggregate value of transaction: |

| | (5) | | Total fee paid: |

| |

| ☐ | | Fee paid previously with preliminary materials. |

| |

| ☐ | | Check box if any part of the fee is offset as provided by Exchange Act Rule0-11(a) (2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by the registration statement number, or the Form or Schedule and the date of its filing. |

| | |

| | (1) | | Amount Previously Paid: |

| | (2) | | Form, Schedule or Registration Statement No.: |

| | (3) | | Filing Party: |

| | (4) | | Date Filed: |

November 5, 2019

IMPORTANT: ACTION REQUIRED

Dear Stockholder:

We recently sent you materials relating to a special meeting of stockholders of Western Asset Mortgage Defined Opportunity Fund, Inc. (DMO) that will be held on November 22, 2019. At the meeting, there will be a vote on an important proposal that would extend the Fund’s life by eliminating the current March 1, 2022 termination date.You are receiving this letter because we have not yet received your vote.

The Fund’s Board and Management recommend that you vote FOR the proposal.

Institutional Shareholder Services, Inc., an independent proxy advisory firm, recently recommended that stockholders vote FOR the proposal.

By eliminating the term, you will have continued access to the Fund’s portfolio and the income it generates.

Voting is quick and easy! Vote today using one of the following options:

Log on to the website shown on your proxy card. Please have your proxy card in hand to access your control number (located in the box) and follow theon-screen instructions.

| | 2. | VOTE BY TOUCH-TONE TELEPHONE |

Call the toll-free number listed on your proxy card. Please have your proxy card in hand to access your control number (located in the box) and follow the recorded instructions.

Complete, sign and date the proxy card and then return it in the enclosed postage paid envelope.

| | 4. | SPEAK TO A PROXY VOTING SPECIALIST |

If you have any questions regarding the proposal, or need assistance with voting, call toll-free1-866-875-8614. Specialists are available Monday – Friday, 9 a.m. – 11 p.m. ET, and Saturday 12p.m.-6 p.m.

THE FUND HAS DELIVERED ATTRACTIVE ANNUALIZED TOTAL RETURNS.

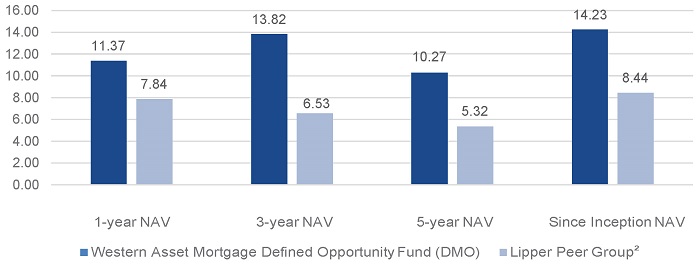

Performance of DMO Vs. Peers1

1Performance is based on net asset value (NAV) as of June 30, 2019 and assumes all reinvestment of distributions at NAV. Returns include the deduction of management fees, operating expenses and all other fund expenses, and do not reflect the deduction of brokerage commissions or taxes that investors may pay on distributions or the sale of shares.

2 Lipper Peer Group is the Lipper U.S. MortgageClosed-End Funds Category Average. Lipper defines this peer group as funds that invest primarily in U.S. government agency and/ornon-agency mortgage backed securities. Lipper is an independent, nationally recognized provider of investment company information.

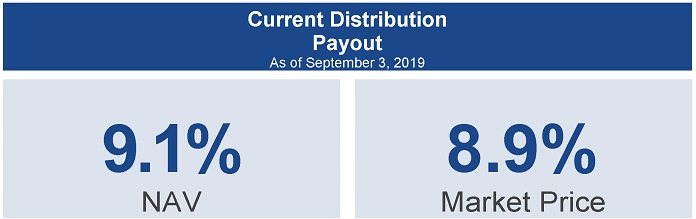

Since inception through September 3, 2019, DMO has paid a total of $27.52 per share in distributions.

Past performance is no guarantee of future results.

Please see proxy statement for more information on this proposal and other changes.

Thank you for your prompt attention to this matter. If you have already voted, we appreciate your participation.

Performance is no guarantee of future results. The information provided is not intended to be a forecast of future events, a guarantee of future results or investment advice.

All investments are subject to risk including the possible loss of principal.

DMO 11/6