UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-22369

Western Asset Mortgage Opportunity Fund Inc.

(Exact name of registrant as specified in charter)

620 Eighth Avenue, 49th Floor, New York, NY 10018

(Address of principal executive offices) (Zip code)

Robert I. Frenkel, Esq.

Legg Mason & Co., LLC

100 First Stamford Place

Stamford, CT 06902

(Name and address of agent for service)

Registrant’s telephone number, including area code: (888) 777-0102

Date of fiscal year end: December 31

Date of reporting period: June 30, 2020

| ITEM 1. | REPORT TO STOCKHOLDERS. |

The Semi-Annual Report to Stockholders is filed herewith.

| | |

| Semi-Annual Report | | June 30, 2020 |

WESTERN ASSET

MORTGAGE OPPORTUNITY FUND INC.

(DMO)

Beginning in January 2021, as permitted by regulations adopted by the Securities and Exchange Commission, the Fund intends to no longer mail paper copies of the Fund’s shareholder reports like this one, unless you specifically request paper copies of the reports from the Fund or from your financial intermediary (such as a broker-dealer or bank). Instead, the reports will be made available on a website, and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you invest through a financial intermediary and you already elected to receive shareholder reports electronically (“e-delivery”), you will not be affected by this change and you need not take any action. If you have not already elected e-delivery, you may elect to receive shareholder reports and other communications from the Fund electronically by contacting your financial intermediary.

You may elect to receive all future reports in paper free of charge. If you invest through a financial intermediary, you can contact your financial intermediary to request that you continue to receive paper copies of your shareholder reports. That election will apply to all Legg Mason Funds held in your account at that financial intermediary. If you are a direct shareholder with the Fund, you can call the Fund at 1-888-888-0151, or write to the Fund by regular mail at P.O. Box 505000, Louisville, KY 40233 or by overnight delivery to Computershare, 462 South 4th Street, Suite 1600, Louisville, KY 40202 to let the Fund know you wish to continue receiving paper copies of your shareholder reports. That election will apply to all Legg Mason Funds held in your account held directly with the fund complex.

|

| INVESTMENT PRODUCTS: NOT FDIC INSURED • NO BANK GUARANTEE • MAY LOSE VALUE |

Fund objectives

The Fund’s primary investment objective is to provide current income. As a secondary investment objective, the Fund will seek capital appreciation.

The Fund seeks to achieve its investment objectives by investing primarily in a diverse portfolio of mortgage-backed securities and mortgage whole loans. Investments in mortgage-backed securities consist primarily of non-agency residential mortgage-backed securities and commercial mortgage-backed securities.

| | |

| II | | Western Asset Mortgage Opportunity Fund Inc. |

Letter from the chairman

Dear Shareholder,

We are pleased to provide the semi-annual report of Western Asset Mortgage Opportunity Fund Inc. for the six-month reporting period ended June 30, 2020. Please read on for Fund performance information during the Fund’s reporting period.

Special shareholder notice

On July 31, 2020, Franklin Resources, Inc. (“Franklin Resources”) acquired Legg Mason, Inc. in an all-cash transaction. As a result of the transaction, Legg Mason Partners Fund Advisor, LLC (“LMPFA”), Western Asset Management Company, LLC and Western Asset Management Company Limited became indirect, wholly-owned subsidiaries of Franklin Resources. Under the Investment Company Act of 1940, as amended, consummation of the transaction automatically terminated the management and subadvisory agreements that were in place for the Fund prior to the transaction. The Fund’s manager and subadvisers continue to provide uninterrupted services with respect to the Fund pursuant to new management and subadvisory agreements that were approved by Fund stockholders.

Franklin Resources, whose principal executive offices are at One Franklin Parkway, San Mateo, California 94403, is a global investment management organization operating, together with its subsidiaries, as Franklin Templeton. As of June 30, 2020, after giving effect to the transaction described above, Franklin Templeton’s asset management operations had aggregate assets under management of approximately $1.4 trillion.

| | |

| Western Asset Mortgage Opportunity Fund Inc. | | III |

Letter from the chairman

As always, we remain committed to providing you with excellent service and a full spectrum of investment choices. We also remain committed to supplementing the support you receive from your financial advisor. One way we accomplish this is through our website, www.lmcef.com. Here you can gain immediate access to market and investment information, including:

| • | | Fund prices and performance, |

| • | | Market insights and commentaries from our portfolio managers, and |

| • | | A host of educational resources. |

We look forward to helping you meet your financial goals.

Sincerely,

Jane Trust, CFA

Chairman, President and Chief Executive Officer

July 31, 2020

| | |

| IV | | Western Asset Mortgage Opportunity Fund Inc. |

Performance review

For the six months ended June 30, 2020, Western Asset Mortgage Opportunity Fund Inc. returned -23.56% based on its net asset value (“NAV”)i and -23.47% based on its New York Stock Exchange (“NYSE”) market price per share. The Fund’s unmanaged benchmark, the ICE BofA U.S. Floating Rate Home Equity Loan Asset Backed Securities Indexii, returned -0.57% for the same period. The Lipper U.S. Mortgage Closed-End Funds Category Averageiii returned -10.40% over the same time frame. Please note that Lipper performance returns are based on each fund’s NAV.

During this six-month period, the Fund made distributions to shareholders totaling $0.85 per share. As of June 30, 2020, the Fund estimates that 77% of the distributions were sourced from net investment income and 23% constituted a return of capital.* The performance table shows the Fund’s six-month total return based on its NAV and market price as of June 30, 2020. Past performance is no guarantee of future results.

| | | | |

| Performance Snapshot as of June 30, 2020 (unaudited) | |

| Price Per Share | | 6-Month Total Return** | |

| $ 14.08 (NAV) | | | -23.56 | %† |

| $ 14.67 (Market Price) | | | -23.47 | %‡ |

All figures represent past performance and are not a guarantee of future results. Performance figures for periods shorter than one year represent cumulative figures and are not annualized.

** Total returns are based on changes in NAV or market price, respectively. Returns reflect the deduction of all Fund expenses, including management fees, operating expenses, and other Fund expenses. Returns do not reflect the deduction of brokerage commissions or taxes that investors may pay on distributions or the sale of shares.

† Total return assumes the reinvestment of all distributions, including returns of capital, if any, at NAV.

‡ Total return assumes the reinvestment of all distributions, including returns of capital, if any, in additional shares in accordance with the Fund’s Dividend Reinvestment Plan.

Looking for additional information?

The Fund is traded under the symbol “DMO” and its closing market price is available in most newspapers under the NYSE listings. The daily NAV is available online under the symbol “XDMOX” on most financial websites. Barron’s and The Wall Street Journal’s Monday edition both carry closed-end fund tables that provide additional information. In addition, the Fund issues a quarterly press release that can be found on most major financial websites as well as www.lmcef.com (click on the name of the Fund).

In a continuing effort to provide information concerning the Fund, shareholders may call 1-888-777-0102 (toll free), Monday through Friday from 8:00 a.m. to 5:30 p.m. Eastern Time, for the Fund’s current NAV, market price and other information.

| * | These estimates are not for tax purposes. The Fund will issue a Form 1099 with final composition of the distributions for tax purposes after year-end. A return of capital is not taxable and results in a reduction in the tax basis of a shareholder’s investment. For more information about a distribution’s composition, please refer to the Fund’s distribution press release or, if applicable, the Section 19 notice located in the press release section of our website, www.lmcef.com (click on the name of the Fund). |

| | |

| Western Asset Mortgage Opportunity Fund Inc. | | V |

Performance review (cont’d)

Thank you for your investment in Western Asset Mortgage Opportunity Fund Inc. As always, we appreciate that you have chosen us to manage your assets and we remain focused on achieving the Fund’s investment goals.

Sincerely,

Jane Trust, CFA

Chairman, President and Chief Executive Officer

July 31, 2020

RISKS: The Fund is a non-diversified, closed-end management investment company designed primarily as a long-term investment and not as a trading vehicle. The Fund is not intended to be a complete investment program and, due to the uncertainty inherent in all investments, there can be no assurance that the Fund will achieve its investment objective. The Fund’s common stock is traded on the New York Stock Exchange. Similar to stocks, the Fund’s share price will fluctuate with market conditions and, at the time of sale, may be worth more or less than the original investment. Shares of closed-end funds often trade at a discount to their net asset value. Because the Fund is non-diversified, it may be more susceptible to economic, political, or regulatory events than a diversified fund. The Fund’s investments are subject to a number of risks, including credit risk, inflation risk and interest rate risk. As interest rates rise, bond prices fall, reducing the value of the Fund’s fixed income holdings. The Fund may invest in lower-rated high-yield bonds (commonly known as “junk bonds”), which are subject to greater liquidity risk and credit risk (risk of default) than higher-rated obligations. MBS are subject to additional risks, including: (1) credit risk associated with the performance of the underlying mortgage properties and of the borrowers owning these properties; (2) adverse changes in economic conditions and circumstances, which are more likely to have an adverse impact on MBS secured by loans on certain types of commercial properties than on those secured by loans on residential properties; (3) prepayment risk, which can lead to significant fluctuations in value of the MBS and can limit the potential gains in a declining interest rate environment; (4) loss of all or part of the premium, if any, paid; and (5) decline in the market value of the security, whether resulting from changes in interest rates, prepayments on the underlying mortgage collateral or perceptions of the credit risk associated with the underlying mortgage collateral. To the extent the Fund invests in mortgage whole loans, certain of these risks may be magnified. In addition, risks associated with investments in whole loans include geographic concentration risk and risks relating to the reliance on third-party servicers to service and manage the mortgage whole loan. The Fund may invest in securities backed by subprime or distressed mortgages which involve a higher degree of risk and chance of loss. Leverage may result in greater volatility of NAV and the market price of common shares and increases a shareholder’s risk of loss. The Fund may make significant investments in derivative instruments. Derivative instruments can be illiquid, may disproportionately increase losses, and have a potentially large impact on Fund performance. The Fund is not guaranteed by the U.S. government, the U.S. Treasury or any government agency. The Fund may also invest in money market funds, including funds affiliated with the Fund’s manager and subadvisers.

| | |

| VI | | Western Asset Mortgage Opportunity Fund Inc. |

All investments are subject to risk including the possible loss of principal. Past performance is no guarantee of future results. All index performance reflects no deduction for fees, expenses or taxes. Please note that an investor cannot invest directly in an index.

| i | Net asset value (“NAV”) is calculated by subtracting total liabilities, including liabilities associated with financial leverage (if any), from the closing value of all securities held by the Fund (plus all other assets) and dividing the result (total net assets) by the total number of the common shares outstanding. The NAV fluctuates with changes in the market prices of securities in which the Fund has invested. However, the price at which an investor may buy or sell shares of the Fund is the Fund’s market price as determined by supply of and demand for the Fund’s shares. |

| ii | The ICE BofA U.S. Floating Rate Home Equity Loan Asset Backed Securities Index (formerly known as ICE BofAML U.S. Floating Rate Home Equity Loan Asset Backed Securities Index) tracks the performance of U.S. dollar-denominated investment grade floating-rate asset-backed securities collateralized by home equity loans publicly issued in the U.S. domestic market. Qualifying securities must have an investment grade rating, at least one year remaining to final stated maturity, a floating-rate coupon, and an original deal size for the collateral group of at least $250 million. |

| iii | Lipper, Inc., a wholly-owned subsidiary of Reuters, provides independent insight on global collective investments. Returns are based on the six-month period ended June 30, 2020, including the reinvestment of all distributions, including returns of capital, if any, calculated among the 8 funds in the Fund’s Lipper category. |

| | |

| Western Asset Mortgage Opportunity Fund Inc. | | VII |

(This page intentionally left blank.)

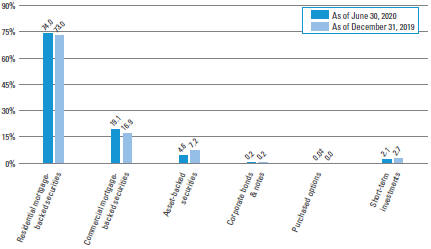

Fund at a glance† (unaudited)

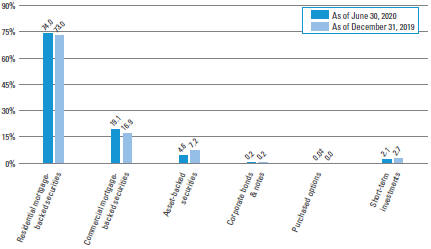

Investment breakdown (%) as a percent of total investments

| † | The bar graph above represents the composition of the Fund’s investments as of June 30, 2020 and December 31, 2019 and does not include derivatives, such as written options, futures contracts and swap contracts. The Fund is actively managed. As a result, the composition of the Fund’s investments is subject to change at any time. |

| ‡ | Represents less than 0.01%. |

| | |

| Western Asset Mortgage Opportunity Fund Inc. 2020 Semi-Annual Report | | 1 |

Schedule of investments (unaudited)

June 30, 2020

Western Asset Mortgage Opportunity Fund Inc.

| | | | | | | | | | | | | | | | |

| Security‡ | | Rate | | | Maturity

Date | | | Face

Amount | | | Value | |

| Residential Mortgage-Backed Securities (a) — 102.7% | | | | | | | | | | | | | |

Adjustable Rate Mortgage Trust, 2005-5 1A1 | | | 3.394 | % | | | 9/25/35 | | | $ | 121,699 | | | $ | 97,338 | (b) |

Adjustable Rate Mortgage Trust, 2005-7 2A21 | | | 3.462 | % | | | 10/25/35 | | | | 287,158 | | | | 259,155 | (b) |

Adjustable Rate Mortgage Trust, 2005-12 5A1 (1 mo. USD LIBOR + 0.500%) | | | 0.685 | % | | | 3/25/36 | | | | 234,090 | | | | 117,344 | (b) |

Aegis Asset Backed Securities Trust, 2005-3 M3 (1 mo. USD LIBOR + 0.490%) | | | 0.675 | % | | | 8/25/35 | | | | 3,460,000 | | | | 2,689,042 | (b) |

AFC Trust, 2000-3 1A (1 mo. USD LIBOR + 0.750%) | | | 0.935 | % | | | 10/25/30 | | | | 831,625 | | | | 762,523 | (b)(c) |

Alternative Loan Trust, 2005-11CB 3A3, IO (-1.000 x 1 mo. USD LIBOR + 5.000%) | | | 4.816 | % | | | 6/25/35 | | | | 1,544,583 | | | | 246,233 | (b) |

Alternative Loan Trust, 2005-14 3A1 | | | 2.701 | % | | | 5/25/35 | | | | 166,498 | | | | 122,974 | (b) |

Alternative Loan Trust, 2005-36 4A1 | | | 3.299 | % | | | 8/25/35 | | | | 289,828 | | | | 271,233 | (b) |

Alternative Loan Trust, 2005-J10 1A1 (1 mo. USD LIBOR + 0.500%) | | | 0.685 | % | | | 10/25/35 | | | | 802,573 | | | | 583,539 | (b) |

Alternative Loan Trust, 2006-HY10 1A1 | | | 3.075 | % | | | 5/25/36 | | | | 268,123 | | | | 229,858 | (b) |

Alternative Loan Trust, 2006-J8 A5 | | | 6.000 | % | | | 2/25/37 | | | | 93,135 | | | | 60,310 | |

Alternative Loan Trust, 2007-3T1 2A1 | | | 6.000 | % | | | 3/25/27 | | | | 103,159 | | | | 106,827 | |

Alternative Loan Trust, 2007-23CB A8 (-4.000 x 1 mo. USD LIBOR + 28.400%) | | | 27.662 | % | | | 9/25/37 | | | | 493,449 | | | | 737,096 | (b) |

Alternative Loan Trust, 2007-OA8 1A1 (1 mo. USD LIBOR + 0.180%) | | | 0.365 | % | | | 6/25/47 | | | | 1,124,923 | | | | 919,754 | (b) |

American Home Mortgage Assets Trust, 2005-2 2A1A | | | 3.260 | % | | | 1/25/36 | | | | 833,568 | | | | 641,176 | (b) |

American Home Mortgage Investment Trust, 2007-2 2A (1 mo. USD LIBOR + 0.800%) | | | 0.985 | % | | | 3/25/47 | | | | 12,735,445 | | | | 593,496 | (b) |

American Home Mortgage Investment Trust, 2007-A 4A (1 mo. USD LIBOR + 0.900%) | | | 1.085 | % | | | 7/25/46 | | | | 1,869,943 | | | | 875,987 | (b)(c) |

Banc of America Alternative Loan Trust, 2005-9 1CB5, IO (-1.000 x 1 mo. USD LIBOR + 5.100%) | | | 4.916 | % | | | 10/25/35 | | | | 2,332,591 | | | | 311,308 | (b) |

Banc of America Funding Corp., 2015-R3 2A2 | | | 0.298 | % | | | 2/27/37 | | | | 2,623,487 | | | | 2,242,472 | (b)(c) |

Banc of America Funding Trust, 2004-B 6A1 | | | 2.466 | % | | | 12/20/34 | | | | 361,473 | | | | 283,131 | (b) |

Banc of America Funding Trust, 2004-C 3A1 | | | 3.915 | % | | | 12/20/34 | | | | 317,363 | | | | 295,827 | (b) |

Banc of America Funding Trust, 2006-D 2A1 | | | 3.499 | % | | | 5/20/36 | | | | 35,627 | | | | 32,552 | (b) |

Banc of America Funding Trust, 2006-F 1A1 | | | 4.049 | % | | | 7/20/36 | | | | 136,040 | | | | 131,296 | (b) |

Banc of America Funding Trust, 2014-R5 1A2 (6 mo. USD LIBOR + 1.500%) | | | 2.077 | % | | | 9/26/45 | | | | 3,750,000 | | | | 2,729,410 | (b)(c) |

Banc of America Funding Trust, 2015-R2 9A2 | | | 0.446 | % | | | 3/27/36 | | | | 4,511,405 | | | | 3,783,425 | (b)(c) |

Banc of America Funding Trust, 2015-R4 4A3 | | | 9.263 | % | | | 1/27/30 | | | | 12,024,366 | | | | 5,948,274 | (b)(c) |

See Notes to Financial Statements.

| | |

| 2 | | Western Asset Mortgage Opportunity Fund Inc. 2020 Semi-Annual Report |

Western Asset Mortgage Opportunity Fund Inc.

| | | | | | | | | | | | | | | | |

| Security‡ | | Rate | | | Maturity

Date | | | Face

Amount | | | Value | |

| Residential Mortgage-Backed Securities (a) — continued | | | | | | | | | | | | | |

Bayview Financial Asset Trust, 2007-SR1A M1 (1 mo. USD LIBOR + 0.800%) | | | 1.747 | % | | | 3/25/37 | | | $ | 2,047,551 | | | $ | 1,876,414 | (b)(c) |

Bayview Financial Asset Trust, 2007-SR1A M2 (1 mo. USD LIBOR + 0.900%) | | | 2.561 | % | | | 3/25/37 | | | | 2,492,812 | | | | 2,341,678 | (b)(c) |

Bayview Financial Asset Trust, 2007-SR1A M3 (1 mo. USD LIBOR + 1.150%) | | | 2.811 | % | | | 3/25/37 | | | | 1,129,403 | | | | 1,075,130 | (b)(c) |

BCAP LLC Trust, 2011-RR2 1A4 | | | 3.810 | % | | | 7/26/36 | | | | 3,236,984 | | | | 2,141,007 | (b)(c) |

Bear Stearns ALT-A Trust, 2005-9 25A1 | | | 3.850 | % | | | 11/25/35 | | | | 254,738 | | | | 206,050 | (b) |

Bear Stearns Asset Backed Securities I Trust, 2005-CL1 A1 | | | 0.500 | % | | | 9/25/34 | | | | 52,742 | | | | 50,520 | (b) |

Bellemeade Re Ltd., 2017-1 B1 (1 mo. USD LIBOR + 4.750%) | | | 4.935 | % | | | 10/25/27 | | | | 1,070,000 | | | | 961,954 | (b)(c) |

Bellemeade Re Ltd., 2018-1A M2 (1 mo. USD LIBOR + 2.900%) | | | 3.085 | % | | | 4/25/28 | | | | 510,000 | | | | 476,143 | (b)(c) |

Chase Mortgage Finance Trust, 2006-S3 2A1 | | | 5.500 | % | | | 11/25/21 | | | | 149,948 | | | | 92,776 | |

ChaseFlex Trust, 2005-2 3A3, IO (-1.000 x 1 mo. USD LIBOR + 5.500%) | | | 5.316 | % | | | 6/25/35 | | | | 7,756,798 | | | | 1,814,439 | (b) |

Chevy Chase Funding LLC Mortgage-Backed Certificates, 2006-2A A1 (1 mo. USD LIBOR + 0.130%) | | | 0.315 | % | | | 4/25/47 | | | | 99,235 | | | | 94,512 | (b)(c) |

CHL Mortgage Pass-Through Trust, 2005-2 2A1 (1 mo. USD LIBOR + 0.640%) | | | 0.825 | % | | | 3/25/35 | | | | 63,304 | | | | 59,075 | (b) |

CHL Mortgage Pass-Through Trust, 2005-9 1A1 (1 mo. USD LIBOR + 0.600%) | | | 0.785 | % | | | 5/25/35 | | | | 82,483 | | | | 68,197 | (b) |

CHL Mortgage Pass-Through Trust, 2005-11 3A3 | | | 2.762 | % | | | 4/25/35 | | | | 337,003 | | | | 265,102 | (b) |

CHL Mortgage Pass-Through Trust, 2005-11 6A1 (1 mo. USD LIBOR + 0.600%) | | | 0.785 | % | | | 3/25/35 | | | | 55,595 | | | | 45,265 | (b) |

CHL Mortgage Pass-Through Trust, 2005-18 A7 (-2.750 x 1 mo. USD LIBOR +19.525%) | | | 19.018 | % | | | 10/25/35 | | | | 15,111 | | | | 20,125 | (b) |

CHL Mortgage Pass-Through Trust, 2005- HY10 1A1 | | | 4.095 | % | | | 2/20/36 | | | | 69,967 | | | | 59,534 | (b) |

CHL Mortgage Pass-Through Trust, 2005- HYB9 1A1 (12 mo. USD LIBOR + 1.750%) | | | 3.939 | % | | | 2/20/36 | | | | 127,248 | | | | 114,990 | (b) |

Citicorp Mortgage Securities Trust, 2007-8 B1 | | | 5.977 | % | | | 9/25/37 | | | | 2,819,142 | | | | 1,819,739 | (b) |

Citigroup Mortgage Loan Trust, 2006-AR5 2A1A | | | 3.120 | % | | | 7/25/36 | | | | 270,947 | | | | 195,279 | (b) |

Citigroup Mortgage Loan Trust, 2008-3 A3 | | | 6.100 | % | | | 4/25/37 | | | | 5,707,126 | | | | 3,059,396 | (c) |

Citigroup Mortgage Loan Trust Inc., 2004- HYB3 1A | | | 4.361 | % | | | 9/25/34 | | | | 45,925 | | | | 43,194 | (b) |

See Notes to Financial Statements.

| | |

| Western Asset Mortgage Opportunity Fund Inc. 2020 Semi-Annual Report | | 3 |

Schedule of investments (unaudited) (cont’d)

June 30, 2020

Western Asset Mortgage Opportunity Fund Inc.

| | | | | | | | | | | | | | | | |

| Security‡ | | Rate | | | Maturity

Date | | | Face

Amount | | | Value | |

| Residential Mortgage-Backed Securities (a) — continued | | | | | | | | | | | | | |

Citigroup Mortgage Loan Trust Inc., 2004-UST1 A2 | | | 2.772 | % | | | 8/25/34 | | | $ | 21,452 | | | $ | 20,298 | (b) |

Citigroup Mortgage Loan Trust Inc., 2005-5 1A5 | | | 2.856 | % | | | 8/25/35 | | | | 133,176 | | | | 110,333 | (b) |

Countrywide Asset-Backed Certificates Trust, 2006-SD3 A1 (1 mo. USD LIBOR + 0.330%) | | | 0.515 | % | | | 7/25/36 | | | | 443,193 | | | | 421,311 | (b)(c) |

Countrywide Asset-Backed Certificates Trust, 2007-SEA1 1A1 (1 mo. USD LIBOR + 0.550%) | | | 0.735 | % | | | 5/25/47 | | | | 398,042 | | | | 333,030 | (b)(c) |

Credit-Based Asset Servicing & Securitization LLC, 2006-SL1 A3 (1 mo. USD LIBOR + 0.440%) | | | 0.625 | % | | | 9/25/36 | | | | 3,821,221 | | | | 426,101 | (b)(c) |

CSFB Mortgage-Backed Pass-Through Certificates, 2005-10 3A3 | | | 5.500 | % | | | 11/25/35 | | | | 296,405 | | | | 237,033 | |

CSMC Resecuritization Trust, 2006-1R 1A2 (-2.750 x 1 mo. USD LIBOR + 19.525%) | | | 19.020 | % | | | 7/27/36 | | | | 443,254 | | | | 595,221 | (b)(c) |

CSMC Trust, 2010-18R 6A5 | | | 3.768 | % | | | 9/28/36 | | | | 1,488,682 | | | | 1,537,622 | (b)(c) |

CSMC Trust, 2014-11R 9A2 (1 mo. USD LIBOR + 0.140%) | | | 0.308 | % | | | 10/27/36 | | | | 4,453,765 | | | | 3,503,916 | (b)(c) |

CSMC Trust, 2015-2R 7A2 | | | 3.482 | % | | | 8/27/36 | | | | 3,436,725 | | | | 2,636,472 | (b)(c) |

CSMC Trust, 2017-RPL1 B1 | | | 3.069 | % | | | 7/25/57 | | | | 3,052,442 | | | | 2,302,799 | (b)(c) |

CSMC Trust, 2017-RPL1 B2 | | | 3.069 | % | | | 7/25/57 | | | | 3,501,991 | | | | 2,388,057 | (b)(c) |

CSMC Trust, 2017-RPL1 B3 | | | 3.069 | % | | | 7/25/57 | | | | 2,977,486 | | | | 1,639,642 | (b)(c) |

CSMC Trust, 2017-RPL1 B4 | | | 3.069 | % | | | 7/25/57 | | | | 3,358,042 | | | | 560,088 | (b)(c) |

CWABS Revolving Home Equity Loan Trust, 2004-L 2A (1 mo. USD LIBOR + 0.280%) | | | 0.465 | % | | | 2/15/34 | | | | 52,580 | | | | 49,281 | (b) |

Deutsche Mortgage Securities Inc. Mortgage Loan Trust, 2006-PR1 2PO, PO | | | 0.000 | % | | | 4/15/36 | | | | 22,195 | | | | 16,406 | (c) |

Deutsche Mortgage Securities Inc. Mortgage Loan Trust, 2006-PR1 4AS1, IO | | | 9.045 | % | | | 4/15/36 | | | | 237,360 | | | | 50,374 | (b)(c) |

Deutsche Mortgage Securities Inc. Mortgage Loan Trust, 2006-PR1 4AS2, IO | | | 15.731 | % | | | 4/15/36 | | | | 226,118 | | | | 81,510 | (b)(c) |

Deutsche Mortgage Securities Inc. Mortgage Loan Trust, 2006-PR1 5AS1, IO | | | 10.622 | % | | | 4/15/36 | | | | 75,226 | | | | 25,361 | (b)(c) |

Deutsche Mortgage Securities Inc. Mortgage Loan Trust, 2006-PR1 5AS3, IO | | | 7.315 | % | | | 4/15/36 | | | | 273,703 | | | | 64,344 | (b)(c) |

Federal Home Loan Mortgage Corp. (FHLMC) Seasoned Credit Risk Transfer Trust, 2016-1 B, PO | | | 0.000 | % | | | 9/25/55 | | | | 12,302,721 | | | | 1,041,999 | (c) |

Federal Home Loan Mortgage Corp. (FHLMC) Seasoned Credit Risk Transfer Trust, 2016-1 BIO, IO | | | 0.000 | % | | | 9/25/55 | | | | 29,537,827 | | | | 2,743,169 | (b)(c) |

See Notes to Financial Statements.

| | |

| 4 | | Western Asset Mortgage Opportunity Fund Inc. 2020 Semi-Annual Report |

Western Asset Mortgage Opportunity Fund Inc.

| | | | | | | | | | | | | | | | |

| Security‡ | | Rate | | | Maturity

Date | | | Face

Amount | | | Value | |

| Residential Mortgage-Backed Securities (a) — continued | | | | | | | | | | | | | |

Federal Home Loan Mortgage Corp. (FHLMC) Seasoned Credit Risk Transfer Trust, 2016-1 XSIO, IO | | | 0.075 | % | | | 9/25/55 | | | $ | 205,297,117 | | | $ | 803,738 | (b)(c) |

Federal Home Loan Mortgage Corp. (FHLMC) Seasoned Credit Risk Transfer Trust, 2017-2 B, PO | | | 0.000 | % | | | 8/25/56 | | | | 11,487,150 | | | | 1,322,559 | (c) |

Federal Home Loan Mortgage Corp. (FHLMC) Seasoned Credit Risk Transfer Trust, 2017-2 BIO, IO | | | 0.000 | % | | | 8/25/56 | | | | 19,497,203 | | | | 1,934,210 | (b)(c) |

Federal Home Loan Mortgage Corp. (FHLMC) Seasoned Credit Risk Transfer Trust, 2017-2 M1 | | | 4.000 | % | | | 8/25/56 | | | | 1,170,000 | | | | 1,155,867 | (b)(c) |

Federal Home Loan Mortgage Corp. (FHLMC) Seasoned Credit Risk Transfer Trust, 2017-2 XSIO, IO | | | 0.075 | % | | | 8/25/56 | | | | 493,575,694 | | | | 1,466,907 | (b)(c) |

Federal Home Loan Mortgage Corp. (FHLMC) Seasoned Credit Risk Transfer Trust, 2019-2 M | | | 4.750 | % | | | 8/25/58 | | | | 681,000 | | | | 658,219 | (b)(c) |

Federal Home Loan Mortgage Corp. (FHLMC) Seasoned Credit Risk Transfer Trust, 2020-1 BXS | | | 1.082 | % | | | 8/25/59 | | | | 4,099,838 | | | | 2,220,155 | (b)(c) |

Federal Home Loan Mortgage Corp. (FHLMC) Structured Agency Credit Risk Debt Notes, 2016-DNA2 B (1 mo. USD LIBOR + 10.500%) | | | 10.685 | % | | | 10/25/28 | | | | 495,188 | | | | 529,550 | (b) |

Federal Home Loan Mortgage Corp. (FHLMC) Structured Agency Credit Risk Debt Notes, 2016-DNA3 B (1 mo. USD LIBOR + 11.250%) | | | 11.435 | % | | | 12/25/28 | | | | 1,030,443 | | | | 1,140,077 | (b) |

Federal Home Loan Mortgage Corp. (FHLMC) Structured Agency Credit Risk Debt Notes, 2016-DNA4 B (1 mo. USD LIBOR + 8.600%) | | | 8.785 | % | | | 3/25/29 | | | | 1,579,657 | | | | 1,564,913 | (b) |

Federal Home Loan Mortgage Corp. (FHLMC) Structured Agency Credit Risk Debt Notes, 2017-DNA1 B2 (1 mo. USD LIBOR + 10.000%) | | | 10.185 | % | | | 7/25/29 | | | | 2,651,245 | | | | 2,447,160 | (b) |

Federal Home Loan Mortgage Corp. (FHLMC) Structured Agency Credit Risk Debt Notes, 2017-DNA2 B2 (1 mo. USD LIBOR + 11.250%) | | | 11.435 | % | | | 10/25/29 | | | | 1,776,335 | | | | 1,698,876 | (b) |

Federal Home Loan Mortgage Corp. (FHLMC) Structured Agency Credit Risk Debt Notes, 2018-HQA2 B2 (1 mo. USD LIBOR + 11.000%) | | | 11.185 | % | | | 10/25/48 | | | | 3,000,000 | | | | 2,993,083 | (b)(c) |

Federal Home Loan Mortgage Corp. (FHLMC) Structured Agency Credit Risk Debt Notes, 2018-HRP1 B2 (1 mo. USD LIBOR + 11.750%) | | | 11.935 | % | | | 4/25/43 | | | | 5,606,229 | | | | 5,367,830 | (b)(c) |

See Notes to Financial Statements.

| | |

| Western Asset Mortgage Opportunity Fund Inc. 2020 Semi-Annual Report | | 5 |

Schedule of investments (unaudited) (cont’d)

June 30, 2020

Western Asset Mortgage Opportunity Fund Inc.

| | | | | | | | | | | | | | | | |

| Security‡ | | Rate | | | Maturity

Date | | | Face

Amount | | | Value | |

| Residential Mortgage-Backed Securities (a) — continued | | | | | | | | | | | | | |

Federal Home Loan Mortgage Corp. (FHLMC) Structured Agency Credit Risk Debt Notes, 2018-HRP2 B2 (1 mo. USD LIBOR + 10.500%) | | | 10.685 | % | | | 2/25/47 | | | $ | 3,530,000 | | | $ | 3,399,667 | (b)(c) |

Federal Home Loan Mortgage Corp. (FHLMC) Structured Agency Credit Risk Debt Notes, 2018-SPI4 B | | | 4.466 | % | | | 11/25/48 | | | | 4,865,652 | | | | 2,732,724 | (b)(c) |

Federal Home Loan Mortgage Corp. (FHLMC) Structured Agency Credit Risk Debt Notes, 2019-DNA1 B2 (1 mo. USD LIBOR + 10.750%) | | | 10.935 | % | | | 1/25/49 | | | | 1,500,000 | | | | 1,476,175 | (b)(c) |

Federal National Mortgage Association (FNMA), 2012-134 LS, IO (-1.000 x 1 mo. USD LIBOR + 6.150%) | | | 5.966 | % | | | 12/25/42 | | | | 2,693,502 | | | | 518,533 | (b) |

Federal National Mortgage Association (FNMA) — CAS, 2016-C01 1B (1 mo. USD LIBOR + 11.750%) | | | 11.935 | % | | | 8/25/28 | | | | 1,870,577 | | | | 2,073,486 | (b)(c) |

Federal National Mortgage Association (FNMA) — CAS, 2016-C02 1B (1 mo. USD LIBOR + 12.250%) | | | 12.435 | % | | | 9/25/28 | | | | 2,343,711 | | | | 2,663,753 | (b)(c) |

Federal National Mortgage Association (FNMA) — CAS, 2016-C03 1B (1 mo. USD LIBOR + 11.750%) | | | 11.935 | % | | | 10/25/28 | | | | 1,656,439 | | | | 1,900,977 | (b)(c) |

Federal National Mortgage Association (FNMA) — CAS, 2016-C04 1B (1 mo. USD LIBOR + 10.250%) | | | 10.435 | % | | | 1/25/29 | | | | 2,626,324 | | | | 2,860,235 | (b)(c) |

Federal National Mortgage Association (FNMA) — CAS, 2016-C06 1B (1 mo. USD LIBOR + 9.250%) | | | 9.435 | % | | | 4/25/29 | | | | 3,530,786 | | | | 3,796,586 | (b)(c) |

First Horizon Alternative Mortgage Securities Trust, 2005-AA6 3A1 | | | 3.329 | % | | | 8/25/35 | | | | 520,443 | | | | 461,773 | (b) |

First Horizon Alternative Mortgage Securities Trust, 2006-FA6 2A1, PAC | | | 6.250 | % | | | 11/25/36 | | | | 86,835 | | | | 52,514 | |

GS Mortgage Securities Corp. II, 2000-1A A (1 mo. USD LIBOR + 0.350%) | | | 2.465 | % | | | 3/20/23 | | | | 26,438 | | | | 26,486 | (b)(c) |

GSAA Resecuritization Mortgage Trust, 2005-R1 1A2, IO (-1.000 x 1 mo. USD LIBOR + 5.000%) | | | 4.816 | % | | | 4/25/35 | | | | 2,121,250 | | | | 379,990 | (b)(c) |

GSMPS Mortgage Loan Trust, 2005-RP1 1A4 | | | 8.500 | % | | | 1/25/35 | | | | 53,551 | | | | 61,468 | (c) |

GSMPS Mortgage Loan Trust, 2006-RP1 1A2 | | | 7.500 | % | | | 1/25/36 | | | | 358,547 | | | | 373,805 | (c) |

HarborView Mortgage Loan Trust, 2006-2 1A | | | 4.138 | % | | | 2/25/36 | | | | 17,689 | | | | 9,653 | (b) |

Home Equity Mortgage Trust, 2006-1 A3 (1 mo. USD LIBOR + 0.500%) | | | 0.685 | % | | | 5/25/36 | | | | 3,500,000 | | | | 1,374,480 | (b) |

See Notes to Financial Statements.

| | |

| 6 | | Western Asset Mortgage Opportunity Fund Inc. 2020 Semi-Annual Report |

Western Asset Mortgage Opportunity Fund Inc.

| | | | | | | | | | | | | | | | |

| Security‡ | | Rate | | | Maturity

Date | | | Face

Amount | | | Value | |

| Residential Mortgage-Backed Securities (a) — continued | | | | | | | | | | | | | |

HSI Asset Loan Obligation Trust, 2007-AR1 4A1 | | | 4.337 | % | | | 1/25/37 | | | $ | 116,956 | | | $ | 92,483 | (b) |

Impac CMB Trust, 2004-8 1A (1 mo. USD LIBOR + 0.720%) | | | 0.905 | % | | | 10/25/34 | | | | 267,610 | | | | 260,957 | (b) |

IndyMac INDA Mortgage Loan Trust, 2005-AR2 1A1 | | | 3.244 | % | | | 1/25/36 | | | | 70,962 | | | | 60,346 | (b) |

IndyMac INDX Mortgage Loan Trust, 2004-AR13 1A1 | | | 2.957 | % | | | 1/25/35 | | | | 55,637 | | | | 52,724 | (b) |

IndyMac INDX Mortgage Loan Trust, 2005-AR15 A2 | | | 3.555 | % | | | 9/25/35 | | | | 57,032 | | | | 46,456 | (b) |

IndyMac INDX Mortgage Loan Trust, 2006-AR7 5A1 | | | 3.501 | % | | | 5/25/36 | | | | 229,484 | | | | 189,945 | (b) |

IndyMac INDX Mortgage Loan Trust, 2006-AR9 3A3 | | | 3.385 | % | | | 6/25/36 | | | | 302,595 | | | | 295,662 | (b) |

IndyMac INDX Mortgage Loan Trust, 2006-AR11 1A1 | | | 3.575 | % | | | 6/25/36 | | | | 373,247 | | | | 323,852 | (b) |

JPMorgan Alternative Loan Trust, 2007-A1 3A1 | | | 3.607 | % | | | 3/25/37 | | | | 278,747 | | | | 263,270 | (b) |

JPMorgan Mortgage Trust, 2005-S3 1A1 | | | 6.500 | % | | | 1/25/36 | | | | 767,859 | | | | 629,273 | |

JPMorgan Mortgage Trust, 2007-S2 3A2 | | | 6.000 | % | | | 6/25/37 | | | | 48,925 | | | | 50,158 | |

JPMorgan Mortgage Trust, 2007-S2 3A3 | | | 6.500 | % | | | 6/25/37 | | | | 19,868 | | | | 20,378 | |

JPMorgan Mortgage Trust, 2007-S3 1A18 (1 mo. USD LIBOR + 0.500%) | | | 0.685 | % | | | 8/25/37 | | | | 2,386,677 | | | | 869,650 | (b) |

Legacy Mortgage Asset Trust, 2019-GS2 A1 | | | 3.750 | % | | | 1/25/59 | | | | 1,671,499 | | | | 1,706,305 | (c) |

Legacy Mortgage Asset Trust, 2019-GS2 A2 | | | 4.250 | % | | | 1/25/59 | | | | 4,520,000 | | | | 3,794,364 | (c) |

Legacy Mortgage Asset Trust, 2019-GS3 A1 | | | 3.750 | % | | | 4/25/59 | | | | 2,188,489 | | | | 2,243,632 | (c) |

Lehman Mortgage Trust, 2006-3 1A7, IO (-1.000 x 1 mo. USD LIBOR + 5.400%) | | | 5.216 | % | | | 7/25/36 | | | | 5,441,074 | | | | 1,574,077 | (b) |

Lehman Mortgage Trust, 2006-7 1A3, IO (-1.000 x 1 mo. USD LIBOR + 5.350%) | | | 5.166 | % | | | 11/25/36 | | | | 4,948,170 | | | | 1,194,596 | (b) |

Lehman Mortgage Trust, 2006-7 1A8 (1 mo. USD LIBOR + 0.180%) | | | 0.365 | % | | | 11/25/36 | | | | 3,617,712 | | | | 1,951,196 | (b) |

Lehman Mortgage Trust, 2006-7 3A2, IO (-1.000 x 1 mo. USD LIBOR + 7.150%) | | | 6.966 | % | | | 11/25/36 | | | | 5,360,114 | | | | 1,840,828 | (b) |

Lehman Mortgage Trust, 2007-5 2A3 (1 mo. USD LIBOR + 0.330%) | | | 0.515 | % | | | 6/25/37 | | | | 2,899,407 | | | | 380,499 | (b) |

Lehman XS Trust, 2006-19 A4 (1 mo. USD LIBOR + 0.170%) | | | 0.355 | % | | | 12/25/36 | | | | 556,932 | | | | 466,981 | (b) |

MASTR Adjustable Rate Mortgages Trust, 2004-12 5A1 | | | 4.582 | % | | | 10/25/34 | | | | 52,707 | | | | 52,136 | (b) |

See Notes to Financial Statements.

| | |

| Western Asset Mortgage Opportunity Fund Inc. 2020 Semi-Annual Report | | 7 |

Schedule of investments (unaudited) (cont’d)

June 30, 2020

Western Asset Mortgage Opportunity Fund Inc.

| | | | | | | | | | | | | | | | |

| Security‡ | | Rate | | | Maturity

Date | | | Face

Amount | | | Value | |

| Residential Mortgage-Backed Securities (a) — continued | | | | | | | | | | | | | |

MASTR Adjustable Rate Mortgages Trust, 2006-2 4A1 | | | 4.422 | % | | | 2/25/36 | | | $ | 9,660 | | | $ | 9,521 | (b) |

MASTR Adjustable Rate Mortgages Trust, 2006-OA1 1A1 (1 mo. USD LIBOR + 0.210%) | | | 0.395 | % | | | 4/25/46 | | | | 204,918 | | | | 180,989 | (b) |

MASTR Reperforming Loan Trust, 2005-1 1A4 | | | 7.500 | % | | | 8/25/34 | | | | 58,432 | | | | 54,003 | (c) |

Merrill Lynch Mortgage Investors Trust, 2006-A1 2A1 | | | 3.663 | % | | | 3/25/36 | | | | 529,489 | | | | 352,993 | (b) |

Morgan Stanley ABS Capital I Trust Inc., 2003-NC10 M2 (1 mo. USD LIBOR + 2.700%) | | | 2.885 | % | | | 10/25/33 | | | | 16,850 | | | | 15,769 | (b) |

Morgan Stanley Mortgage Loan Trust, 2006-8AR 1A2 (1 mo. USD LIBOR + 0.140%) | | | 0.325 | % | | | 6/25/36 | | | | 233,958 | | | | 79,543 | (b) |

Morgan Stanley Mortgage Loan Trust, 2007-5AX 2A3 (1 mo. USD LIBOR + 0.230%) | | | 0.415 | % | | | 2/25/37 | | | | 1,788,689 | | | | 745,759 | (b) |

Morgan Stanley Mortgage Loan Trust, 2007-15AR 4A1 | | | 3.343 | % | | | 11/25/37 | | | | 467,134 | | | | 416,639 | (b) |

Morgan Stanley Re-REMIC Trust, 2015-R2 1B (Federal Reserve U.S. 12 mo. Cumulative Avg 1 Year CMT + 0.710%) | | | 2.401 | % | | | 12/27/46 | | | | 919,269 | | | | 715,318 | (b)(c) |

New Century Home Equity Loan Trust, 2004-3 M3 (1 mo. USD LIBOR + 1.065%) | | | 1.250 | % | | | 11/25/34 | | | | 494,659 | | | | 489,603 | (b) |

New Residential Mortgage Loan Trust, 2019-6A A1IB, IO | | | 0.500 | % | | | 9/25/59 | | | | 42,641,153 | | | | 539,283 | (b)(c) |

Nomura Resecuritization Trust, 2014-5R 1A9 | | | 6.870 | % | | | 6/26/35 | | | | 1,759,430 | | | | 1,806,500 | (b)(c) |

PMT Credit Risk Transfer Trust, 2019-2R A (1 mo. USD LIBOR + 2.750%) | | | 2.934 | % | | | 5/27/23 | | | | 2,754,640 | | | | 2,419,559 | (b)(c) |

Popular ABS Mortgage Pass-Through Trust, 2005-5 MV2 (1 mo. USD LIBOR + 0.630%) | | | 0.815 | % | | | 11/25/35 | | | | 2,104,302 | | | | 1,611,831 | (b) |

Provident Home Equity Loan Trust, 2000-2 A1 (1 mo. USD LIBOR + 0.540%) | | | 0.725 | % | | | 8/25/31 | | | | 744,704 | | | | 638,846 | (b) |

RAAC Trust, 2006-RP3 A (1 mo. USD LIBOR + 0.270%) | | | 0.455 | % | | | 5/25/36 | | | | 269,673 | | | | 266,003 | (b)(c) |

Radnor RE Ltd., 2020-1 M2B (1 mo. USD LIBOR + 2.250%) | | | 2.435 | % | | | 2/25/30 | | | | 2,345,000 | | | | 1,677,748 | (b)(c) |

RALI Trust, 2005-QA3 CB4 | | | 4.040 | % | | | 3/25/35 | | | | 1,480,986 | | | | 850,878 | (b) |

RALI Trust, 2006-QA1 A11 | | | 4.298 | % | | | 1/25/36 | | | | 335,710 | | | | 267,623 | (b) |

RALI Trust, 2006-QA4 A (1 mo. USD LIBOR + 0.180%) | | | 0.365 | % | | | 5/25/36 | | | | 245,907 | | | | 219,062 | (b) |

RALI Trust, 2006-QO2 A1 (1 mo. USD LIBOR + 0.220%) | | | 0.405 | % | | | 2/25/46 | | | | 191,087 | | | | 54,941 | (b) |

See Notes to Financial Statements.

| | |

| 8 | | Western Asset Mortgage Opportunity Fund Inc. 2020 Semi-Annual Report |

Western Asset Mortgage Opportunity Fund Inc.

| | | | | | | | | | | | | | | | |

| Security‡ | | Rate | | | Maturity

Date | | | Face

Amount | | | Value | |

| Residential Mortgage-Backed Securities (a) — continued | | | | | | | | | | | | | |

RALI Trust, 2007-QA2 A1 (1 mo. USD LIBOR + 0.130%) | | | 0.315 | % | | | 2/25/37 | | | $ | 123,120 | | | $ | 121,914 | (b) |

RAMP Trust, 2004-RS4 MII2 (1 mo. USD LIBOR + 2.025%) | | | 2.210 | % | | | 4/25/34 | | | | 941,604 | | | | 787,244 | (b) |

RAMP Trust, 2004-SL3 A3 | | | 7.500 | % | | | 12/25/31 | | | | 295,943 | | | | 288,296 | |

RAMP Trust, 2005-SL2 A5 | | | 8.000 | % | | | 10/25/31 | | | | 359,988 | | | | 259,043 | |

RBSGC Mortgage Loan Trust, 2007-A 3A1 (1 mo. USD LIBOR + 0.350%) | | | 0.535 | % | | | 1/25/37 | | | | 2,803,585 | | | | 521,024 | (b) |

Redwood Funding Trust, 2019-1 PT | | | 4.213 | % | | | 9/27/24 | | | | 2,936,253 | | | | 2,985,864 | (c) |

Renaissance Home Equity Loan Trust, 2006-1 AF5 | | | 6.166 | % | | | 5/25/36 | | | | 539,486 | | | | 377,478 | |

Renaissance Home Equity Loan Trust, 2007-2 AF2 | | | 5.675 | % | | | 6/25/37 | | | | 445,054 | | | | 139,971 | |

Renaissance Home Equity Loan Trust, 2007-3 AF3 | | | 7.238 | % | | | 9/25/37 | | | | 1,697,273 | | | | 928,684 | |

Residential Asset Securitization Trust, 2005-A7 A2, IO (-1.000 x 1 mo. USD LIBOR + 7.250%) | | | 7.066 | % | | | 6/25/35 | | | | 1,709,842 | | | | 581,638 | (b) |

Residential Asset Securitization Trust, 2005- A13 1A3 (1 mo. USD LIBOR + 0.470%) | | | 0.655 | % | | | 10/25/35 | | | | 110,235 | | | | 80,300 | (b) |

Residential Asset Securitization Trust, 2006-A1 1A6 (1 mo. USD LIBOR + 0.500%) | | | 0.685 | % | | | 4/25/36 | | | | 1,522,416 | | | | 501,584 | (b) |

Residential Asset Securitization Trust, 2006-A1 1A7, IO (-1.000 x 1 mo. USD LIBOR + 5.500%) | | | 5.316 | % | | | 4/25/36 | | | | 3,155,266 | | | | 804,146 | (b) |

Residential Asset Securitization Trust, 2007-A2 1A1 | | | 6.000 | % | | | 4/25/37 | | | | 238,382 | | | | 191,050 | |

RFMSI Trust, 2006-S8 A12, IO (-1.000 x 1 mo. USD LIBOR + 5.400%) | | | 5.216 | % | | | 9/25/36 | | | | 4,065,407 | | | | 634,966 | (b) |

RFMSI Trust, 2006-SA2 4A1 | | | 5.355 | % | | | 8/25/36 | | | | 135,712 | | | | 114,664 | (b) |

RFMSI Trust, 2007-S6 1A6 (1 mo. USD LIBOR + 0.500%) | | | 0.685 | % | | | 6/25/37 | | | | 1,634,075 | | | | 1,256,876 | (b) |

RFMSI Trust, 2007-S6 1A13, IO (-1.000 x 1 mo. USD LIBOR + 5.500%) | | | 5.316 | % | | | 6/25/37 | | | | 1,634,075 | | | | 269,417 | (b) |

Structured Adjustable Rate Mortgage Loan Trust, 2004-18 1A2 | | | 3.434 | % | | | 12/25/34 | | | | 264,536 | | | | 249,719 | (b) |

Structured Adjustable Rate Mortgage Loan Trust, 2005-4 1A1 | | | 3.617 | % | | | 3/25/35 | | | | 130,633 | | | | 117,300 | (b) |

Structured Adjustable Rate Mortgage Loan Trust, 2005-4 5A | | | 4.009 | % | | | 3/25/35 | | | | 63,922 | | | | 59,843 | (b) |

See Notes to Financial Statements.

| | |

| Western Asset Mortgage Opportunity Fund Inc. 2020 Semi-Annual Report | | 9 |

Schedule of investments (unaudited) (cont’d)

June 30, 2020

Western Asset Mortgage Opportunity Fund Inc.

| | | | | | | | | | | | | | | | |

| Security‡ | | Rate | | | Maturity

Date | | | Face

Amount | | | Value | |

| Residential Mortgage-Backed Securities (a) — continued | | | | | | | | | | | | | |

Structured Adjustable Rate Mortgage Loan Trust, 2005-7 1A3 | | | 3.661 | % | | | 4/25/35 | | | $ | 59,557 | | | $ | 56,560 | (b) |

Structured Asset Investment Loan Trust, 2004-8 M9 (1 mo. USD LIBOR + 3.750%) | | | 3.935 | % | | | 9/25/34 | | | | 297,405 | | | | 262,861 | (b) |

Structured Asset Mortgage Investments II Trust, 2006-AR5 4A1 (1 mo. USD LIBOR + 0.220%) | | | 0.405 | % | | | 5/25/46 | | | | 571,530 | | | | 292,275 | (b) |

Wachovia Mortgage Loan Trust LLC, 2005-B 2A2 | | | 4.219 | % | | | 10/20/35 | | | | 16,693 | | | | 15,894 | (b) |

WaMu Mortgage Pass-Through Certificates Trust, 2005-AR2 B1 (1 mo. USD LIBOR + 0.530%) | | | 0.715 | % | | | 1/25/45 | | | | 1,635,662 | | | | 1,045,041 | (b) |

WaMu Mortgage Pass-Through Certificates Trust, 2005-AR13 A1C3 (1 mo. USD LIBOR + 0.490%) | | | 0.675 | % | | | 10/25/45 | | | | 182,780 | | | | 172,777 | (b) |

WaMu Mortgage Pass-Through Certificates Trust, 2005-AR15 A1C4 (1 mo. USD LIBOR + 0.400%) | | | 0.585 | % | | | 11/25/45 | | | | 776,469 | | | | 482,716 | (b) |

WaMu Mortgage Pass-Through Certificates Trust, 2006-AR16 2A2 | | | 3.332 | % | | | 12/25/36 | | | | 190,742 | | | | 173,651 | (b) |

Washington Mutual Mortgage Pass-Through Certificates Trust, 2005-8 1A6 (-3.667 x 1 mo. USD LIBOR + 23.283%) | | | 22.607 | % | | | 10/25/35 | | | | 186,976 | | | | 271,207 | (b) |

Washington Mutual Mortgage Pass-Through Certificates Trust, 2005-9 5A4 (-7.333 x 1 mo. USD LIBOR + 35.933%) | | | 34.580 | % | | | 11/25/35 | | | | 63,281 | | | | 141,451 | (b) |

Washington Mutual Mortgage Pass-Through Certificates Trust, 2005-10 2A3 (1 mo. USD LIBOR + 0.900%) | | | 1.085 | % | | | 11/25/35 | | | | 113,954 | | | | 94,630 | (b) |

Washington Mutual Mortgage Pass-Through Certificates Trust, 2006-AR10 A1 (1 mo. USD LIBOR + 0.100%) | | | 0.285 | % | | | 12/25/36 | | | | 385,546 | | | | 255,525 | (b) |

Wells Fargo Alternative Loan Trust, 2007-PA1 A12, IO (-1.000 x 1 mo. USD LIBOR +5.460%) | | | 5.276 | % | | | 3/25/37 | | | | 2,396,056 | | | | 389,835 | (b) |

Total Residential Mortgage-Backed Securities (Cost — $151,891,802) | | | | | | | | 158,899,538 | |

| Commercial Mortgage-Backed Securities (a) — 26.4% | | | | | | | | | | | | | |

BX Commercial Mortgage Trust, 2019-IMC F (1 mo. USD LIBOR + 2.900%) | | | 3.085 | % | | | 4/15/34 | | | | 2,000,000 | | | | 1,683,909 | (b)(c) |

Credit Suisse Commercial Mortgage Trust, 2006-C5 AJ | | | 5.373 | % | | | 12/15/39 | | | | 923,652 | | | | 425,301 | |

CSMC Trust, 2014-USA F | | | 4.373 | % | | | 9/15/37 | | | | 2,720,000 | | | | 2,042,804 | (c) |

See Notes to Financial Statements.

| | |

| 10 | | Western Asset Mortgage Opportunity Fund Inc. 2020 Semi-Annual Report |

Western Asset Mortgage Opportunity Fund Inc.

| | | | | | | | | | | | | | | | |

| Security‡ | | Rate | | | Maturity Date | | | Face Amount | | | Value | |

| Commercial Mortgage-Backed Securities (a) — continued | | | | | | | | | | | | | |

CSMC Trust, 2017-CHOP F (1 mo. USD LIBOR + 4.350%) | | | 4.535 | % | | | 7/15/32 | | | $ | 1,620,000 | | | $ | 1,082,338 | (b)(c) |

CSMC Trust, 2017-CHOP H (1 mo. USD LIBOR + 7.350%) | | | 7.535 | % | | | 7/15/32 | | | | 3,300,000 | | | | 1,922,337 | (b)(c) |

CSMC Trust, 2019-RIO B | | | 6.889 | % | | | 12/15/21 | | | | 3,000,000 | | | | 2,734,023 | (c) |

CSMC Trust, 2020-LOTS A | | | 4.725 | % | | | 7/15/22 | | | | 2,000,000 | | | | 2,003,782 | (b)(c) |

DBUBS Mortgage Trust, 2011-LC3A G | | | 3.750 | % | | | 8/10/44 | | | | 2,600,000 | | | | 906,100 | (c) |

FRESB Mortgage Trust, 2018-SB48 B | | | 3.798 | % | | | 2/25/38 | | | | 3,853,232 | | | | 2,880,201 | (b)(c) |

GMAC Commercial Mortgage Securities Inc., 2006-C1 AJ | | | 5.349 | % | | | 11/10/45 | | | | 103,118 | | | | 87,110 | (b) |

GS Mortgage Securities Trust, 2006-GG8 AJ | | | 5.622 | % | | | 11/10/39 | | | | 81,011 | | | | 56,060 | |

GS Mortgage Securities Trust, 2007-GG10 AJ | | | 6.015 | % | | | 8/10/45 | | | | 2,359,352 | | | | 1,029,733 | (b) |

GS Mortgage Securities Trust, 2019-SMP G (1 mo. USD LIBOR + 4.250%) | | | 4.435 | % | | | 8/15/32 | | | | 1,500,000 | | | | 795,923 | (b)(c) |

JPMorgan Chase Commercial Mortgage Securities Trust, 2006-LDP7 AJ | | | 6.273 | % | | | 4/17/45 | | | | 296,676 | | | | 150,500 | (b) |

JPMorgan Chase Commercial Mortgage Securities Trust, 2007-CB19 AJ | | | 6.074 | % | | | 2/12/49 | | | | 544,047 | | | | 217,880 | (b) |

JPMorgan Chase Commercial Mortgage Securities Trust, 2007-LD12 AJ | | | 6.710 | % | | | 2/15/51 | | | | 79,727 | | | | 75,677 | (b) |

JPMorgan Chase Commercial Mortgage Securities Trust, 2018-PHMZ M (1 mo. USD LIBOR + 8.208%) | | | 8.392 | % | | | 6/15/35 | | | | 3,000,000 | | | | 2,266,998 | (b)(c) |

JPMorgan Chase Commercial Mortgage Securities Trust, 2019-BOLT C (1 mo. USD LIBOR + 3.800%) | | | 3.985 | % | | | 7/15/34 | | | | 1,814,912 | | | | 1,621,493 | (b)(c) |

JPMorgan Chase Commercial Mortgage Securities Trust, 2019-BOLT D (1 mo. USD LIBOR + 6.550%) | | | 6.735 | % | | | 7/15/34 | | | | 907,456 | | | | 718,985 | (b)(c) |

JPMorgan Chase Commercial Mortgage Securities Trust, 2019-BOLT XCP, IO | | | 2.052 | % | | | 7/15/34 | | | | 13,611,838 | | | | 286,880 | (b)(c) |

JPMorgan Chase Commercial Mortgage Securities Trust, 2020-MKST G (1 mo. USD LIBOR + 4.250%) | | | 4.435 | % | | | 12/15/36 | | | | 1,520,000 | | | | 1,241,361 | (b)(c) |

JPMorgan Chase Commercial Mortgage Securities Trust, 2020-MKST H (1 mo. USD LIBOR + 6.750%) | | | 6.935 | % | | | 12/15/36 | | | | 1,520,000 | | | | 1,170,403 | (b)(c) |

JPMorgan Chase Commercial Mortgage Securities Trust, 2020-NNN GFL (1 mo. USD LIBOR + 3.000%) | | | 3.195 | % | | | 1/16/37 | | | | 760,000 | | | | 637,270 | (b)(c) |

See Notes to Financial Statements.

| | |

| Western Asset Mortgage Opportunity Fund Inc. 2020 Semi-Annual Report | | 11 |

Schedule of investments (unaudited) (cont’d)

June 30, 2020

Western Asset Mortgage Opportunity Fund Inc.

| | | | | | | | | | | | | | | | |

| Security‡ | | Rate | | | Maturity Date | | | Face

Amount | | | Value | |

| Commercial Mortgage-Backed Securities (a) — continued | | | | | | | | | | | | | |

JPMorgan Chase Commercial Mortgage Securities Trust, 2020-NNN HFL (1 mo. USD LIBOR + 4.000%) | | | 4.195 | % | | | 1/16/37 | | | $ | 760,000 | | | $ | 619,351 | (b)(c) |

ML-CFC Commercial Mortgage Trust, 2007-5 AJ | | | 5.450 | % | | | 8/12/48 | | | | 76,504 | | | | 45,393 | (b) |

ML-CFC Commercial Mortgage Trust, 2007-9 AJ | | | 6.155 | % | | | 9/12/49 | | | | 219,374 | | | | 84,826 | (b) |

ML-CFC Commercial Mortgage Trust, 2007-9 AJA | | | 6.155 | % | | | 9/12/49 | | | | 51,115 | | | | 19,760 | (b) |

Morgan Stanley Capital I Trust, 2007-IQ13 AJ | | | 5.438 | % | | | 3/15/44 | | | | 5,545 | | | | 5,543 | |

Morgan Stanley Capital I Trust, 2007-IQ16 AJ | | | 6.461 | % | | | 12/12/49 | | | | 167,028 | | | | 102,054 | (b) |

Motel 6 Trust, 2017-MTL6 F (1 mo. USD LIBOR + 4.250%) | | | 4.435 | % | | | 8/15/34 | | | | 1,203,672 | | | | 1,057,389 | (b)(c) |

Multifamily CAS Trust, 2019-01 CE (1 mo. USD LIBOR + 8.750%) | | | 8.935 | % | | | 10/15/49 | | | | 2,500,000 | | | | 1,962,502 | (b)(c) |

Multifamily CAS Trust, 2020-01 CE (1 mo. USD LIBOR + 7.500%) | | | 7.685 | % | | | 3/25/50 | | | | 1,500,000 | | | | 1,177,433 | (b)(c) |

Natixis Commercial Mortgage Securities Trust, 2019-FAME D | | | 4.544 | % | | | 8/15/36 | | | | 1,900,000 | | | | 1,647,669 | (b)(c) |

Natixis Commercial Mortgage Securities Trust, 2019-FAME E | | | 4.544 | % | | | 8/15/36 | | | | 950,000 | | | | 759,495 | (b)(c) |

Natixis Commercial Mortgage Securities Trust, 2019-TRUE A (1 mo. USD LIBOR + 2.011%) | | | 2.204 | % | | | 4/18/24 | | | | 1,280,000 | | | | 1,257,907 | (b)(c) |

Starwood Retail Property Trust, 2014-STAR D (1 mo. USD LIBOR + 3.500%) | | | 3.685 | % | | | 11/15/27 | | | | 1,000,000 | | | | 632,873 | (b)(c) |

Starwood Retail Property Trust, 2014-STAR E (1 mo. USD LIBOR + 4.400%) | | | 4.585 | % | | | 11/15/27 | | | | 1,600,000 | | | | 606,285 | (b)(c) |

Tharaldson Hotel Portfolio Trust, 2018-THL E (1 mo. USD LIBOR + 3.180%) | | | 3.355 | % | | | 11/11/34 | | | | 1,012,600 | | | | 850,621 | (b)(c) |

Tharaldson Hotel Portfolio Trust, 2018-THL F (1 mo. USD LIBOR + 3.952%) | | | 4.128 | % | | | 11/11/34 | | | | 769,576 | | | | 567,125 | (b)(c) |

Tharaldson Hotel Portfolio Trust, 2018-THL G (1 mo. USD LIBOR + 6.350%) | | | 6.525 | % | | | 11/11/34 | | | | 2,430,241 | | | | 1,771,189 | (b)(c) |

Tharaldson Hotel Portfolio Trust, 2018-THL H (1 mo. USD LIBOR + 9.800%) | | | 9.975 | % | | | 11/11/34 | | | | 1,620,161 | | | | 1,176,398 | (b)(c) |

UBS-Barclays Commercial Mortgage Trust, 2012-C2 G | | | 5.000 | % | | | 5/10/63 | | | | 3,130,000 | | | | 284,893 | (b)(c) |

UBS-Barclays Commercial Mortgage Trust, 2012-C2 H | | | 5.000 | % | | | 5/10/63 | | | | 3,149,979 | | | | 241,184 | (b)(c) |

Total Commercial Mortgage-Backed Securities (Cost — $56,000,683) | | | | | | | | 40,906,958 | |

See Notes to Financial Statements.

| | |

| 12 | | Western Asset Mortgage Opportunity Fund Inc. 2020 Semi-Annual Report |

Western Asset Mortgage Opportunity Fund Inc.

| | | | | | | | | | | | | | | | |

| Security‡ | | Rate | | | Maturity Date | | | Face Amount/ Units | | | Value | |

| Asset-Backed Securities — 6.5% | | | | | | | | | | | | | | | | |

AccessLex Institute, 2004-A B1 (28 day Auction Rate Security) | | | 0.000 | % | | | 7/1/39 | | | $ | 1,400,000 | | | $ | 1,213,010 | (b) |

Applebee’s Funding LLC/IHOP Funding LLC, 2019-1A A2II | | | 4.723 | % | | | 6/7/49 | | | | 2,000,000 | | | | 1,723,280 | (c) |

BankAmerica Manufactured Housing Contract Trust, 1996-1 B1 | | | 7.875 | % | | | 10/10/26 | | | | 7,866,000 | | | | 1,408,539 | |

BCMSC Trust, 1998-B A | | | 6.530 | % | | | 10/15/28 | | | | 435,854 | | | | 453,869 | (b) |

BCMSC Trust, 1999-A A3 | | | 5.980 | % | | | 3/15/29 | | | | 165,702 | | | | 165,725 | (b) |

Cascade MH Asset Trust, 2019-MH1 M | | | 5.985 | % | | | 11/25/44 | | | | 1,150,000 | | | | 1,128,588 | (b)(c) |

Firstfed Corp. Manufactured Housing Contract, 1997-2 B | | | 8.110 | % | | | 5/15/24 | | | | 165,417 | | | | 56,522 | (c) |

RBS Acceptance Inc., 1995-BA1 B2 | | | 9.000 | % | | | 8/10/20 | | | | 2,191,561 | | | | 11,781 | |

SMB Private Education Loan Trust, 2014-A R | | | 0.000 | % | | | 9/15/45 | | | | 6,875 | | | | 892,981 | (c) |

SoFi Professional Loan Program LLC, 2017-F R1 | | | 0.000 | % | | | 1/25/41 | | | | 34,000 | | | | 1,272,668 | (c) |

TES LLC, 2017-1A B | | | 7.740 | % | | | 10/20/47 | | | | 1,500,000 | | | | 1,334,630 | (c) |

VOYA CLO, 2017-2A D (3 mo. USD LIBOR + 6.020%) | | | 7.239 | % | | | 6/7/30 | | | | 400,000 | | | | 328,020 | (b)(c) |

Total Asset-Backed Securities (Cost — $13,932,375) | | | | | | | | | | | | 9,989,613 | |

| | | | |

| | | | | | | | | Face

Amount | | | | |

| Corporate Bonds & Notes — 0.3% | | | | | | | | | | | | | | | | |

| Consumer Staples — 0.3% | | | | | | | | | | | | | | | | |

Food & Staples Retailing — 0.3% | | | | | | | | | | | | | | | | |

CVS Pass-Through Trust (Cost — $486,914) | | | 9.350 | % | | | 1/10/23 | | | | 479,444 | | | | 488,119 | (c) |

| | | | | | | | | | | | | | | | | | | | |

| | | Counterparty | | | Expiration

Date | | | Contracts | | | Notional

Amount | | | | |

| Purchased Options — 0.0%†† | | | | | | | | | | | | | | | | | | | | |

| OTC Purchased Options — 0.0%†† | | | | | | | | | | | | | | | | | |

Interest rate swaption, Put @ 188.00bps (Cost — $58,228) | |

| Morgan Stanley

& Co. Inc. |

| | | 7/30/20 | | | | 2,300,000 | | | | 2,300,000 | | | | 77 | |

Total Investments before Short-Term Investments (Cost — $222,370,002) | | | | 210,284,305 | |

See Notes to Financial Statements.

| | |

| Western Asset Mortgage Opportunity Fund Inc. 2020 Semi-Annual Report | | 13 |

Schedule of investments (unaudited) (cont’d)

June 30, 2020

Western Asset Mortgage Opportunity Fund Inc.

| | | | | | | | | | | | |

| Security‡ | | Rate | | | Shares | | | Value | |

| Short-Term Investments — 3.0% | | | | | | | | | | | | |

Dreyfus Government Cash Management, Institutional Shares (Cost — $4,552,267) | | | 0.085 | % | | | 4,552,267 | | | $ | 4,552,267 | |

Total Investments — 138.9% (Cost — $226,922,269) | | | | | | | | 214,836,572 | |

Liabilities in Excess of Other Assets — (38.9)% | | | | | | | | | | | (60,132,119 | ) |

Total Net Assets — 100.0% | | | | | | | | | | $ | 154,704,453 | |

| ‡ | Securities held by the Fund are subject to a lien, granted to the lender, to the extent of the borrowing outstanding and any additional expenses. |

| †† | Represents less than 0.1%. |

| (a) | Collateralized mortgage obligations are secured by an underlying pool of mortgages or mortgage pass-through certificates that are structured to direct payments on underlying collateral to different series or classes of the obligations. The interest rate may change positively or inversely in relation to one or more interest rates, financial indices or other financial indicators and may be subject to an upper and/or lower limit. |

| (b) | Variable rate security. Interest rate disclosed is as of the most recent information available. Certain variable rate securities are not based on a published reference rate and spread but are determined by the issuer or agent and are based on current market conditions. These securities do not indicate a reference rate and spread in their description above. |

| (c) | Security is exempt from registration under Rule 144A of the Securities Act of 1933. This security may be resold in transactions that are exempt from registration, normally to qualified institutional buyers. This security has been deemed liquid pursuant to guidelines approved by the Board of Directors. |

| | |

Abbreviation(s) used in this schedule: |

| |

| bps | | — basis point spread (100 basis points = 1.00%) |

| |

| CAS | | — Connecticut Avenue Securities |

| |

| CLO | | — Collateralized Loan Obligation |

| |

| CMT | | — Constant Maturity Treasury |

| |

| IO | | — Interest Only |

| |

| LIBOR | | — London Interbank Offered Rate |

| |

| PAC | | — Planned Amortization Class |

| |

| PO | | — Principal Only |

| |

| REMIC | | — Real Estate Mortgage Investment Conduit |

| |

| Re-REMIC | | — Resecuritization of Real Estate Mortgage Investment Conduit |

| |

| USD | | — United States Dollar |

| | | | | | | | | | | | | | | | | | | | | | |

| Schedule of Written Options | | | | | | | | | | | | | | | |

| OTC Written Options | | | | | | | | | | | | | | | | | | | | |

| Security | | Counterparty | | Expiration Date | | | Strike Price | | | Contracts | | | Notional Amount | | | Value | |

| Interest rate swaption, Put (Premiums received — $58,391) | | Morgan Stanley

& Co. Inc. | | | 7/30/20 | | | | 155.00 | bps | | | 12,700,000 | | | $ | 12,700,000 | | | $ | 0 | (a) |

| (a) | Value is less than $1. |

See Notes to Financial Statements.

| | |

| 14 | | Western Asset Mortgage Opportunity Fund Inc. 2020 Semi-Annual Report |

Western Asset Mortgage Opportunity Fund Inc.

| | |

Abbreviation(s) used in this schedule: |

| |

| bps | | — basis point spread (100 basis points = 1.00%) |

At June 30, 2020, the Fund had the following open futures contracts:

| | | | | | | | | | | | | | | | | | | | |

| | | Number of Contracts | | | Expiration Date | | | Notional Amount | | | Market Value | | | Unrealized Appreciation (Depreciation) | |

| Contracts to Buy: | | | | | | | | | | | | | | | | | | | | |

| U.S. Treasury 5-Year Notes | | | 162 | | | | 9/20 | | | $ | 20,241,421 | | | $ | 20,370,235 | | | $ | 128,814 | |

| U.S. Treasury Ultra 10-Year Notes | | | 18 | | | | 9/20 | | | | 2,775,190 | | | | 2,834,719 | | | | 59,529 | |

| U.S. Treasury Ultra Long- Term Bonds | | | 36 | | | | 9/20 | | | | 7,501,923 | | | | 7,853,625 | | | | 351,702 | |

| | | | | | | | | | | | | | | | | | | | 540,045 | |

| | | | | |

| Contracts to Sell: | | | | | | | | | | | | | | | | | | | | |

| U.S. Treasury 2-Year Notes | | | 35 | | | | 9/20 | | | | 7,717,986 | | | | 7,728,984 | | | | (10,998) | |

| U.S. Treasury Long-Term Bonds | | | 65 | | | | 9/20 | | | | 11,251,059 | | | | 11,606,562 | | | | (355,503) | |

| | | | | | | | | | | | | | | | | | | | (366,501) | |

| Net unrealized appreciation on open futures contracts | | | | | | | $ | 173,544 | |

At June 30, 2020, the Fund had the following open swap contracts:

| | | | | | | | | | | | | | | | | | | | | | |

| OTC CREDIT DEFAULT SWAPS ON CREDIT INDICES — SELL PROTECTION1 | |

Swap Counterparty

(Reference Entity) | | Notional

Amount2 | | | Termination

Date | | | Periodic

Payments

Received by

the Fund† | | Market

Value3 | | | Upfront

Premiums

Paid

(Received) | | | Unrealized

Depreciation | |

| | | | | | | | | | | | | | | | | | |

| Morgan Stanley & Co. Inc. (Markit CMBX.NA.BBB-.8 Index) | | $ | 500,000 | | | | 10/17/57 | | | 3.000% Monthly | | $ | (113,853) | | | $ | (22,382) | | | $ | (91,471) | |

|

| OTC CREDIT DEFAULT SWAPS ON CREDIT INDICES — BUY PROTECTION4 | |

Swap Counterparty

(Reference Entity) | | Notional

Amount2 | | | Termination

Date | | | Periodic

Payments

Made by

the Fund† | | Market

Value3 | | | Upfront

Premiums

Paid

(Received) | | | Unrealized Appreciation | |

| Morgan Stanley & Co. Inc. (Markit CMBX.NA.BBB-.12 Index) | | $ | 870,000 | | | | 8/17/61 | | | 3.000% Monthly | | $ | 176,426 | | | $ | 72,906 | | | $ | 103,520 | |

| 1 | If the Fund is a seller of protection and a credit event occurs, as defined under the terms of that particular swap agreement, the Fund will either (i) pay to the buyer of protection an amount equal to the notional amount of the swap and take delivery of the referenced obligation or underlying securities comprising the referenced index or (ii) pay a net settlement amount in the form of cash or securities equal to the notional amount of the swap less the recovery value of the referenced obligation or underlying securities comprising the referenced index. |

See Notes to Financial Statements.

| | |

| Western Asset Mortgage Opportunity Fund Inc. 2020 Semi-Annual Report | | 15 |

Schedule of investments (unaudited) (cont’d)

June 30, 2020

Western Asset Mortgage Opportunity Fund Inc.

| 2 | The maximum potential amount the Fund could be required to pay as a seller of credit protection or receive as a buyer of credit protection if a credit event occurs as defined under the terms of that particular swap agreement. |

| 3 | The quoted market prices and resulting values for credit default swap agreements on asset-backed securities and credit indices serve as an indicator of the current status of the payment/performance risk and represent the likelihood of an expected loss (or profit) for the credit derivative had the notional amount of the swap agreement been closed/sold as of the period end. Decreasing market values (sell protection) or increasing market values (buy protection) when compared to the notional amount of the swap, represent a deterioration of the referenced entity’s credit soundness and a greater likelihood or risk of default or other credit event occurring as defined under the terms of the agreement. |

| 4 | If the Fund is a buyer of protection and a credit event occurs, as defined under the terms of that particular swap agreement, the Fund will either (i) receive from the seller of protection an amount equal to the notional amount of the swap and deliver the referenced obligation or the underlying securities comprising the referenced index or (ii) receive a net settlement amount in the form of cash or securities equal to the notional amount of the swap less the recovery value of the referenced obligation or the underlying securities comprising the referenced index. |

| † | Percentage shown is an annual percentage rate. |

See Notes to Financial Statements.

| | |

| 16 | | Western Asset Mortgage Opportunity Fund Inc. 2020 Semi-Annual Report |

Statement of assets and liabilities (unaudited)

June 30, 2020

| | | | |

| |

| Assets: | | | | |

Investments, at value (Cost — $226,922,269) | | | $214,836,572 | |

Interest receivable | | | 733,197 | |

Receivable for Fund shares sold | | | 530,386 | |

Deposits with brokers for open futures contracts | | | 342,078 | |

OTC swaps, at value (premiums paid — $72,906) | | | 176,426 | |

Receivable for open OTC swap contracts | | | 250 | |

Prepaid expenses | | | 9,032 | |

Total Assets | | | 216,627,941 | |

| |

| Liabilities: | | | | |

Loan payable (Note 5) | | | 60,000,000 | |

Distributions payable | | | 1,391,096 | |

Investment management fee payable | | | 142,291 | |

OTC swaps, at value (premiums received — $22,382) | | | 113,853 | |

Interest expense payable | | | 64,375 | |

Payable to broker — net variation margin on open futures contracts | | | 16,765 | |

Due to custodian | | | 10,827 | |

Directors’ fees payable | | | 5,728 | |

Payable for open OTC swap contracts | | | 435 | |

Written options, at value (premiums received — $58,391) | | | 0 | * |

Accrued expenses | | | 178,118 | |

Total Liabilities | | | 61,923,488 | |

| Total Net Assets | | | $154,704,453 | |

| |

| Net Assets: | | | | |

Par value ($0.001 par value; 10,984,078 shares issued and outstanding; 100,000,000 shares authorized) | | | $10,984 | |

Paid-in capital in excess of par value | | | 203,427,467 | |

Total distributable earnings (loss) | | | (48,733,998) | |

| Total Net Assets | | | $154,704,453 | |

| |

| Shares Outstanding | | | 10,984,078 | |

| |

| Net Asset Value | | | $14.08 | |

| * | Amount represents less than $1. |

See Notes to Financial Statements.

| | |

| Western Asset Mortgage Opportunity Fund Inc. 2020 Semi-Annual Report | | 17 |

Statement of operations (unaudited)

For the Six Months Ended June 30, 2020

| | | | |

| |

| Investment Income: | | | | |

Interest | | $ | 9,309,207 | |

| |

| Expenses: | | | | |

Investment management fee (Note 2) | | | 1,250,327 | |

Interest expense (Notes 3 and 5) | | | 1,072,067 | |

Commitment fees (Note 5) | | | 77,304 | |

Audit and tax fees | | | 68,337 | |

Legal fees | | | 63,972 | |

Transfer agent fees | | | 40,080 | |

Directors’ fees | | | 35,113 | |

Fund accounting fees | | | 15,989 | |

Custody fees | | | 11,061 | |

Shareholder reports | | | 10,489 | |

Stock exchange listing fees | | | 6,257 | |

Insurance | | | 1,888 | |

Miscellaneous expenses | | | 7,136 | |

Total Expenses | | | 2,660,020 | |

Less: Fee waivers and/or expense reimbursements (Note 2) | | | (254,528) | |

Net Expenses | | | 2,405,492 | |

| Net Investment Income | | | 6,903,715 | |

| |

| Realized and Unrealized Gain (Loss) on Investments, Futures Contracts, Written Options, Swap Contracts, Forward Foreign Currency Contracts and Foreign Currency Transactions (Notes 1, 3 and 4): | | | | |

Net Realized Loss From: | | | | |

Investment transactions | | | (15,757,801) | |

Futures contracts | | | (3,007,021) | |

Swap contracts | | | (741,337) | |

Forward foreign currency contracts | | | (1,776) | |

Foreign currency transactions | | | (589) | |

Net Realized Loss | | | (19,508,524) | |

Change in Net Unrealized Appreciation (Depreciation) From: | | | | |

Investments | | | (34,863,160) | |

Futures contracts | | | (66,326) | |

Written options | | | 58,391 | |

Swap contracts | | | (54,693) | |

Forward foreign currency contracts | | | (839) | |

Foreign currencies | | | (380) | |

Change in Net Unrealized Appreciation (Depreciation) | | | (34,927,007) | |

| Net Loss on Investments, Futures Contracts, Written Options, Swap Contracts, Forward Foreign Currency Contracts and Foreign Currency Transactions | | | (54,435,531) | |

| Decrease in Net Assets From Operations | | $ | (47,531,816) | |

See Notes to Financial Statements.

| | |

| 18 | | Western Asset Mortgage Opportunity Fund Inc. 2020 Semi-Annual Report |

Statements of changes in net assets

| | | | | | | | |

For the Six Months Ended June 30, 2020 (unaudited) and the Year Ended December 31, 2019 | | 2020 | | | 2019 | |

| | |

| Operations: | | | | | | | | |

Net investment income | | $ | 6,903,715 | | | $ | 15,892,494 | |

Net realized loss | | | (19,508,524) | | | | (1,553,304) | |

Change in net unrealized appreciation (depreciation) | | | (34,927,007) | | | | 8,217,931 | |

Increase (Decrease) in Net Assets From Operations | | | (47,531,816) | | | | 22,557,121 | |

| | |

| Distributions to Shareholders From (Note 1): | | | | | | | | |

Total distributable earnings | | | (8,976,147) | | | | (20,068,443) | |

Return of capital | | | — | | | | (441,518) | |

Decrease in Net Assets From Distributions to Shareholders | | | (8,976,147) | | | | (20,509,961) | |

| | |

| Fund Share Transactions: | | | | | | | | |

Net proceeds from sale of shares (449,932 and 0 shares issued, respectively) (Note 8) | | | 6,103,919 | † | | | — | |

Reinvestment of distributions (26,223 and 35,526 shares issued, respectively) | | | 398,607 | | | | 713,330 | |

Increase in Net Assets From Fund Share Transactions | | | 6,502,526 | | | | 713,330 | |

Increase (Decrease) in Net Assets | | | (50,005,437) | | | | 2,760,490 | |

| | |

| Net Assets: | | | | | | | | |

Beginning of period | | | 204,709,890 | | | | 201,949,400 | |

End of period | | $ | 154,704,453 | | | $ | 204,709,890 | |

| † | Net of shelf registration offering costs of $113,936 and sales charges of $60,527. |

See Notes to Financial Statements.

| | |

| Western Asset Mortgage Opportunity Fund Inc. 2020 Semi-Annual Report | | 19 |

Statement of cash flows (unaudited)

For the Six Months Ended June 30, 2020

| | | | |

| |

| Increase (Decrease) in Cash: | | | | |

| Cash Flows from Operating Activities: | | | | |

Net decrease in net assets resulting from operations | | $ | (47,531,816) | |

Adjustments to reconcile net decrease in net assets resulting from operations to net cash provided (used) by operating activities: | | | | |

Purchases of portfolio securities | | | (22,908,749) | |

Sales of portfolio securities | | | 54,645,520 | |

Net purchases, sales and maturities of short-term investments | | | 3,457,658 | |

Net amortization of premium (accretion of discount) | | | 1,260,422 | |

Decrease in interest receivable | | | 356,857 | |

Increase in prepaid expenses | | | (4,469) | |

Decrease in other receivables | | | 53,500 | |

Decrease in receivable for open OTC swap contracts | | | 3,400 | |

Decrease in net premiums received for OTC swap contracts | | | (292,895) | |

Decrease in receivable from broker — net variation margin on open futures contracts | | | 20,718 | |

Decrease in investment management fee payable | | | (115,484) | |

Decrease in Directors’ fees payable | | | (1,592) | |

Decrease in interest expense payable | | | (168,375) | |

Decrease in accrued expenses | | | (79,398) | |

Increase in premiums received from written options | | | 58,391 | |

Increase in payable to broker — net variation margin on open futures contracts | | | 16,765 | |

Decrease in payable for open OTC swap contracts | | | (2,065) | |

Net realized loss on investments | | | 15,757,801 | |

Change in net unrealized appreciation (depreciation) of investments, written options, OTC swap contracts and forward foreign currency contracts | | | 34,860,301 | |

Net Cash Provided in Operating Activities* | | | 39,386,490 | |

| |

| Cash Flows from Financing Activities: | | | | |

Distributions paid on common stock (net of distributions payable) | | | (7,186,444) | |

Decrease in loan facility borrowings | | | (38,000,000) | |

Increase in due to custodian | | | 10,827 | |

Proceeds from sale of shares (net of receivable for Fund shares sold) | | | 5,573,533 | |

Net Cash Used by Financing Activities | | | (39,602,084) | |

| Net Decrease in Cash and Restricted Cash | | | (215,594) | |

| Cash and restricted cash at beginning of period | | | 557,672 | |

| Cash and restricted cash at end of period | | $ | 342,078 | |

| * | Included in operating expenses is cash of $1,297,618 paid for interest and commitment fees on borrowings. |

See Notes to Financial Statements.

| | |

| 20 | | Western Asset Mortgage Opportunity Fund Inc. 2020 Semi-Annual Report |

| | The following table provides a reconciliation of cash and restricted cash reported within the Statement of Assets and Liabilities that sums to the total of such amounts shown on the Statement of Cash Flows. |

| | | | |

| | | June 30, 2020 | |

| Cash | | | — | |

| Restricted cash | | | 342,078 | |

| Total cash and restricted cash shown in the Statement of Cash Flows | | $ | 342,078 | |

| | Restricted cash consists of cash that has been segregated to cover the Fund’s collateral or margin obligations under derivative contracts. It is separately reported on the Statement of Assets and Liabilities as Deposits with brokers. |

| | | | |

| |

| Non-Cash Financing Activities: | | | | |

Proceeds from reinvestment of distributions | | $ | 398,607 | |

See Notes to Financial Statements.

| | |

| Western Asset Mortgage Opportunity Fund Inc. 2020 Semi-Annual Report | | 21 |

Financial highlights

| | | | | | | | | | | | | | | | | | | | | | | | |

For a share of capital stock outstanding throughout each year ended December 31, unless

otherwise noted: | | | | |

| | | 20201,2 | | | 20191 | | | 20181 | | | 20171 | | | 20161 | | | 20151 | |

| | | | | | |

| Net asset value, beginning of period | | | $19.48 | | | | $19.28 | | | | $21.27 | | | | $20.70 | | | | $22.76 | | | | $24.75 | |

| | | | | | |

| Income (loss) from operations: | | | | | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | 0.65 | | | | 1.51 | | | | 1.65 | | | | 1.57 | | | | 1.47 | | | | 2.13 | |

Net realized and unrealized gain (loss) | | | (5.20) | | | | 0.65 | | | | 0.22 | | | | 2.28 | | | | (0.53) | | | | (0.80) | |

Total income (loss) from operations | | | (4.55) | | | | 2.16 | | | | 1.87 | | | | 3.85 | | | | 0.94 | | | | 1.33 | |

| | | | | | |

| Less distributions from: | | | | | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | (0.85) | 3 | | | (1.92) | | | | (3.03) | | | | (2.69) | | | | (2.95) | | | | (2.33) | |

Net realized gains | | | — | | | | — | | | | (0.83) | | | | (0.59) | | | | (0.05) | | | | (0.99) | |

Return of capital | | | — | | | | (0.04) | | | | — | | | | — | | | | — | | | | — | |

Total distributions | | | (0.85) | | | | (1.96) | | | | (3.86) | | | | (3.28) | | | | (3.00) | | | | (3.32) | |

| | | | | | |

| Net asset value, end of period | | | $14.08 | | | | $19.48 | | | | $19.28 | | | | $21.27 | | | | $20.70 | | | | $22.76 | |

| | | | | | |

| Market price, end of period | | | $14.67 | | | | $20.30 | | | | $20.39 | | | | $24.67 | | | | $22.79 | | | | $23.55 | |

Total return, based on NAV4,5 | | | (23.56) | % | | | 11.65 | % | | | 9.26 | % | | | 19.70 | % | | | 4.47 | % | | | 5.44 | % |

Total return, based on Market Price6 | | | (23.47) | % | | | 9.71 | % | | | (1.16) | % | | | 24.20 | % | | | 10.80 | % | | | 13.56 | % |

| | | | | | |

| Net assets, end of period (millions) | | | $155 | | | | $205 | | | | $202 | | | | $222 | | | | $216 | | | | $237 | |

| | | | | | |

| Ratios to average net assets: | | | | | | | | | | | | | | | | | | | | | | | | |

Gross expenses | | | 3.20 | %7 | | | 3.56 | % | | | 3.15 | % | | | 2.68 | % | | | 2.97 | % | | | 2.39 | % |

Net expenses | | | 2.89 | 7,8 | | | 3.56 | | | | 3.15 | | | | 2.68 | | | | 2.97 | | | | 2.39 | |

Net investment income | | | 8.30 | 7 | | | 7.73 | | | | 7.78 | | | | 7.29 | | | | 6.78 | | | | 8.65 | |

| | | | | | |

| Portfolio turnover rate | | | 9 | % | | | 17 | % | | | 33 | % | | | 35 | % | | | 23 | %9 | | | 24 | % |

| | | | | | |

| Supplemental data: | | | | | | | | | | | | | | | | | | | | | | | | |

Loan Outstanding, End of Period (000s) | | | $60,000 | | | | $98,000 | | | �� | $99,250 | | | | $101,750 | | | | $101,750 | | | | $80,500 | |

Asset Coverage Ratio for Loan Outstanding10 | | | 358 | % | | | 309 | % | | | 303 | % | | | 319 | % | | | 312 | % | | | 395 | % |

Asset Coverage, per $1,000 Principal Amount of Loan Outstanding10 | | | $3,578 | | | | $3,089 | | | | $3,035 | | | | $3,185 | | | | $3,124 | | | | $3,946 | |

Weighted Average Loan (000s) | | | $77,210 | | | | $98,072 | | | | $101,743 | | | | $101,750 | | | | $90,984 | | | | $99,544 | |

Weighted Average Interest Rate on Loan | | | 2.39 | % | | | 3.46 | % | | | 3.06 | % | | | 2.06 | % | | | 1.50 | % | | | 1.06 | % |

| 1 | Per share amounts have been calculated using the average shares method. |

See Notes to Financial Statements.

| | |

| 22 | | Western Asset Mortgage Opportunity Fund Inc. 2020 Semi-Annual Report |

| 2 | For the six months ended June 30, 2020 (unaudited). |

| 3 | The actual source of the Fund’s current fiscal year distributions may be from net investment income, return of capital or a combination of both. Shareholders will be informed of the tax characteristics of the distributions after the close of the fiscal year. |

| 4 | Performance figures may reflect compensating balance arrangements, fee waivers and/or expense reimbursements. In the absence of compensating balance arrangements, fee waivers and/or expense reimbursements, the total return would have been lower. Past performance is no guarantee of future results. Total returns for periods of less than one year are not annualized. |

| 5 | The total return calculation assumes that distributions are reinvested at NAV. Past performance is no guarantee of future results. Total returns for periods of less than one year are not annualized. |

| 6 | The total return calculation assumes that distributions are reinvested in accordance with the Fund’s dividend reinvestment plan. Past performance is no guarantee of future results. Total returns for periods of less than one year are not annualized. |

| 8 | Reflects fee waivers and/or expense reimbursements. |

| 9 | Excluding mortgage dollar roll transactions. If mortgage dollar roll transactions had been included, the portfolio turnover rate would have been 24%. |

| 10 | Represents value of net assets plus the loan outstanding at the end of the period divided by the loan outstanding at the end of the period. |

See Notes to Financial Statements.

| | |

| Western Asset Mortgage Opportunity Fund Inc. 2020 Semi-Annual Report | | 23 |

Notes to financial statements (unaudited)

1. Organization and significant accounting policies