| Table of Contents | |

| Fund Performance Discussion | 3 |

| Top Holdings and Allocations | 6 |

| Share Class Performance | 7 |

| Fund Expenses | 9 |

| Statement of Investments | 11 |

| Statement of Assets and Liabilities | 13 |

| Statement of Operations | 15 |

| Statements of Changes in Net Assets | 16 |

| Statement of Cash Flows | 17 |

| Financial Highlights | 18 |

| Notes to Financial Statements | 21 |

| Portfolio Proxy Voting Policies and Procedures; Updates to Statements of Investments | 35 |

| Trustees and Officers | 36 |

| Privacy Policy Notice | 37 |

Class A Shares

AVERAGE ANNUAL TOTAL RETURNS AT 5/31/13

| | Class A Shares of the Fund | | | |

| | | Lipper Equity Income Funds Index | | |

| | | | | |

| | | | | |

| | | | | |

The performance data quoted represents past performance, which does not guarantee future results. The investment return and principal value of an investment in the Fund will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Fund returns include changes in share price, reinvested distributions, and a 5.75% maximum applicable sales charge except where “without sales charge” is indicated. Current performance may be lower or higher than the performance quoted. Returns do not consider capital gains or income taxes on an individual’s investment. Returns for periods of less than one year are cumulative and not annualized. For performance data current to the most recent month-end, visit steelpath.com or call 1.888.614.6614.

| 2 | OPPENHEIMER STEELPATH MLP ALPHA PLUS FUND | |

Fund Performance Discussion

We thank you for investing with Oppenheimer SteelPath MLP Funds. Our current fiscal year ends on November 30, 2013 and we would like to share our thoughts on the latest semi-annual period (from December 1, 2012 to May 31, 2013).

Over the six-month reporting period, the Master Limited Partnership (“MLP”) sector, as measured by the Alerian MLP Index (AMZ), underperformed the broader markets, as measured by the S&P 500 Index. Notably, MLPs underperformed in the first of those months, December 2012, by approximately 400 basis points (bps) as it appears typical year-end tax loss selling may have also been combined with selling from investors looking to capture gains ahead of potential 2013 tax changes. Such personal income tax management seems often to impact MLPs more than the broader markets perhaps owing to the fact that the MLP investor base remains dominated by individual investors.

The December weakness was offset by a January rally of 11.9%. Over the 2012 calendar year, MLPs underperformed the broader markets by 14.7% and so the January rally appears to have largely reflected a bounce from this weakness. For context, since the inception of the AMZ, the January rally was second only to the 13.9% gain in January 2009 when the sector bounced from an over-sold condition in the wake of the financial crisis.

Following the January rally, the sector generally traded in line with the broader markets until underperforming in the last month of the period, May 2013, when fears of rising interest rates appeared to spark profit taking. While MLPs lost 2.9% in May versus a broader market gain of 2.0%, the sector provided greater stability than other yielding equities such as REITs, which lost 6.1%, and Utilities, which lost 10.0% over the month.

MLP public equity issuance over the six-month reporting period ended May 31, 2013, totaled $12.1 billion versus the $8.9 billion issued over the same period in the previous year. Potentially, this large equity issuance calendar may have contributed to the sector’s modest underperformance versus the broader markets. However, when considering only midstream, or infrastructure businesses, the public equity issuance total is reduced to $8.7 billion suggesting a better supply/demand fundamental for the midstream MLP subsectors.

MLPs, as measured by the AMZ, provided a simple return1 of 11.5% for the six-month period ended May 31, 2013 versus the 15.2% simple return provided by the S&P 500 Index. The performance comparison improved on a total return basis, after distributions or dividends paid are included. Over the same period, MLPs provided a 14.7% total return versus the 16.4% total return provided by the S&P 500 Index.

| 1 | Simple return reflects Index performance without including the impact of distributions/dividends. A simple return is also referred to as price return or price appreciation. Total return reflects Index performance including the impact of distributions/dividends. |

| | OPPENHEIMER STEELPATH MLP ALPHA PLUS FUND | 3 |

Macro Review

Each of the midstream-MLP subsectors provided strong average price performance for the six-month reporting period, albeit with large variations across individual names. However, those subsectors providing the best price performance continued to be those most clearly benefiting from the U.S. energy renaissance in the production of crude oil. In particular, the petroleum product and crude oil pipeline subsectors once again led performance across the MLP space.

The worst performing subsectors for the period were those subsectors that generally carry greater exposure to commodity prices. Specifically, two non-midstream MLP subsectors, coal and exploration and production (E&P) MLPs, provided weak returns for the period. Weakness within the coal subsector likely reflects continued market concern on the outlook for coal pricing in the face of abundant and cheap natural gas as a competing electric generating fuel and the potential for even greater regulatory pressure on the use of coal. E&P MLPs may have suffered from a tempering of expectations for crude oil pricing in the face of global economic growth that remains tame while crude production trends continue to improve. Also among the weakest subsectors for the period were the large-cap diversified MLPs. Weakness within this subsector appeared primarily related to depressed natural gas liquids (NGL) pricing which resulted in some disappointing guidance revisions and a market shift toward greater growth prospects that can generally be found in some of the smaller cap names.

Fund Review

Key contributors to the Oppenheimer SteelPath MLP Alpha Plus Fund were Genesis Energy, L.P. (GEL) and Plains All American Pipeline, LP (PAA).

GEL appeared to finally catch the attention of investors with another strong quarter of performance and a top tier distribution growth profile supported by ample cash flow coverage. The partnership has created a diverse and strategically well positioned footprint of crude oil handling and transportation assets and we believe is well positioned to continue to benefit from the macro trend of robust domestic crude oil production growth.

PAA continues to benefit from its diverse liquids handling footprint highlighted by a 9.8% year-over-year increase to its distribution rate, which outpaced the partnership’s previously increased guidance for distribution growth of 7-9%. Further, the partnership increased its 2013 distribution growth guidance from a range of 7-8% to 9-10% and, more recently, raised previous second quarter cash flow guidance by 10%.

Key detractors to the Oppenheimer SteelPath MLP Alpha Plus Fund were ONEOK Partners, L.P. (OKS) and Williams Partners, L.P. (WPZ).

| 4 | OPPENHEIMER STEELPATH MLP ALPHA PLUS FUND | |

OKS’s units came under pressure as natural gas liquids (NGL) price weakness resulted in disappointing guidance revisions for the coming year. However, the partnership’s large slate of fee-based organic growth projects are expected to significantly lower its exposure to commodity price changes post completion. Given the stability of projects under development, the partnership is looking for robust distribution growth of 8-12% per year for 2012-15.

WPZ’s unit price was impacted by a secondary equity offering during the first quarter 2013; secondary equity offerings typically result in some price weakness within the MLP sector. The partnership also lowered its 2013 guidance over the period. However, the partnership’s large slate of organic growth, or greenfield, projects provides a clear path to a substantial increase in fee-based cash flows which should reduce the impact of that portion of the partnership’s business that presents greater margin volatility.

Outlook

Though crude oil and NGL prices may disappoint the market in 2013, as production success could continue to outpace the logistical and industrial changes needed to spur demand, we remain confident in our outlook for midstream MLPs. We note both crude oil and NGL pricing could fall substantially while still supporting robust producer activity and volume growth to the benefit of energy infrastructure operators.

The opportunity set created by the macro trend of dramatic growth in domestic crude oil, natural gas, and NGL production volumes is widespread, robust and long-term in nature. We prefer to seek exposure to these dynamics through names with fee or fee-like exposure to this volume growth versus commodity price exposure as we believe such entities offer the most attractive risk-to-reward opportunity within the sector.

Sincerely,

The OFI SteelPath Investment Committee

| | OPPENHEIMER STEELPATH MLP ALPHA PLUS FUND | 5 |

Top Holdings and Allocations

TOP TEN MASTER LIMITED PARTNERSHIP HOLDINGS

Enterprise Products Partners LP | |

Plains All American Pipeline LP | |

Energy Transfer Equity LP | |

| |

Sunoco Logistics Partners LP | |

El Paso Pipeline Partners LP | |

| |

| |

MarkWest Energy Partners LP | |

Magellan Midstream Partners LP | |

Portfolio holdings and allocations are subject to change. Percentages are as of May 31, 2013, and based on net assets.

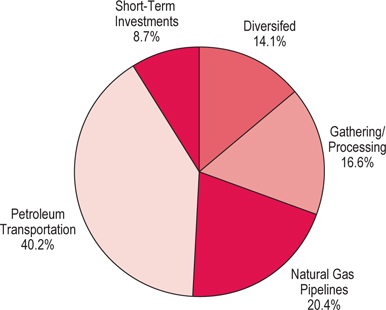

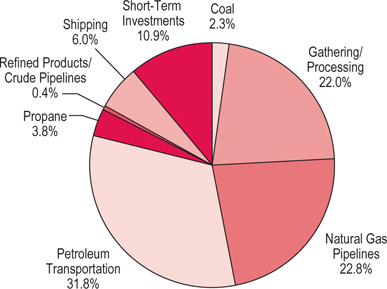

SECTOR ALLOCATION

Portfolio holdings and allocations are subject to change. Percentages are as of May 31, 2013, and are based on the total market value of Investments.

| 6 | OPPENHEIMER STEELPATH MLP ALPHA PLUS FUND | |

Share Class Performance

AVERAGE ANNUAL TOTAL RETURNS WITHOUT SALES CHARGE AS OF 5/31/13

AVERAGE ANNUAL TOTAL RETURNS WITH SALES CHARGE AS OF 5/31/13

| * | Effective June 28, 2013, Class I shares were renamed Class Y shares. See Note 7 of the Notes to Financial Statements for additional information. |

The performance data quoted represents past performance, which does not guarantee future results. The investment return and principal value of an investment in the Fund will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted. Returns do not consider capital gains or income taxes on an individual’s investment. For performance data current to the most recent month-end, visit steelpath.com or call 1.888.614.6614. Fund returns include changes in share price, reinvested distributions, and the applicable sales charge: for Class A shares, the current maximum initial sales charge of 5.75%; and for Class C, the contingent deferred sales charge of 1% for the 1-year period. There is no sales charge for Class Y shares. Returns for periods of less than one year are cumulative and not annualized.

The Fund’s performance is compared to the performance of the Lipper Equity Income Funds Index, the S&P 500 Index and the Alerian MLP Index. The Lipper Equity Income Funds Index includes the 30 largest equity income mutual funds tracked by Lipper, Inc. The S&P 500 Index is an index of large-capitalization equity securities that is a measure of the general domestic stock market. The Alerian MLP Index is a composite of the 50 most prominent energy Master Limited Partnerships that provides investors with an unbiased, comprehensive benchmark for this emerging asset class. The index, which is calculated using a float-adjusted, capitalization-weighted methodology, is disseminated real-time on a price-return basis (AMZ). The Fund has changed its broad-based benchmark Index from the Lipper Equity Income Funds Index to the S&P 500 Index, which it believes a more appropriate measure of

| | OPPENHEIMER STEELPATH MLP ALPHA PLUS FUND | 7 |

the Fund’s performance. Indices are unmanaged and cannot be purchased by investors. Index performance includes reinvestment of income, but does not reflect transaction costs, fees, expenses or taxes. Index performance is shown for illustrative purposes only as a benchmark for the Fund’s performance, and does not predict or depict performance of the Fund. The Fund’s performance reflects the effects of the Fund’s business and operating expenses.

The Fund’s investment strategy and focus can change over time. The mention of specific fund holdings does not constitute a recommendation by OFI SteelPath, Inc. or its affiliates.

Before investing in any of the Oppenheimer funds, investors should carefully consider a fund’s investment objectives, risks, charges and expenses. Fund prospectuses and summary prospectuses contain this and other information about the funds, and may be obtained by asking your financial advisor, visiting steelpath.com, or calling 1.888.614.6614. Read prospectuses and summary prospectuses carefully before investing.

Shares of Oppenheimer funds are not deposits or obligations of any bank, are not guaranteed by any bank, are not insured by the FDIC or any other agency, and involve investment risks, including the possible loss of the principal amount invested.

| 8 | OPPENHEIMER STEELPATH MLP ALPHA PLUS FUND | |

Fund Expenses

Fund Expenses. As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, which may include sales charges (loads) on purchase payments, contingent deferred sales charges on redemptions; and (2) ongoing costs, including management fees; distribution and service fees; and other Fund expenses. These examples are intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The examples are based on an investment of $1,000.00 invested at the beginning of the period and held for the entire 6-month period ended May 31, 2013.

Actual Expenses. The first section of the table provides information about actual account values and actual expenses. You may use the information in this section for the class of shares you hold, together with the amount you invested, to estimate the expense that you paid over the period. Simply divide your account value by $1,000.00 (for example, an $8,600.00 account value divided by $1,000.00 = 8.60), then multiply the result by the number in the first section under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes. The second section of the table provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio for each class of shares, and an assumed rate of return of 5% per year for each class before expenses, which is not the actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example for the class of shares you hold with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as front-end or contingent deferred sales charges (loads), or a $24.00 fee imposed annually on accounts valued at less than $10,000 (subject to exceptions described in the Statement of Additional Information). Therefore, the “hypothetical” section of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | OPPENHEIMER STEELPATH MLP ALPHA PLUS FUND | 9 |

| Beginning Account Value December 1, 2012 | Ending Account Value May 31, 2013 | Expenses Paid During 6 Months Ended May 31, 2013 |

| | | |

| | | |

| Class Y * | 1,000.00 | 1,156.20 | 11.64 |

| | | | |

Hypothetical (5% return before expenses) | | | |

| | | |

| | | |

| Class Y * | 1,000.00 | 1,014.20 | 10.87 |

Expenses are equal to the Fund’s annualized expense ratio for that class, multiplied by the average account value over the period, multiplied by 182/365 (to reflect the one-half year period). Those annualized expense ratios, excluding indirect expenses from affiliated funds and deferred tax benefit/(expense), based on the 6-month period ended May 31, 2013 are as follows:

The expense ratios reflect voluntary waivers and/or reimbursements of expenses by the Fund’s Manager. Some of these undertakings may be modified or terminated at any time, as indicated in the Fund’s prospectus. The “Financial Highlights” tables in the Fund’s financial statements, included in this report, also show the gross expense ratios, without such waivers or reimbursements, if applicable.

| * | Effective June 28, 2013, Class I shares were renamed Class Y shares. See Note 7 of the Notes to Financial Statements for additional information. |

| 10 | OPPENHEIMER STEELPATH MLP ALPHA PLUS FUND | |

STATEMENT OF INVESTMENTS May 31, 2013 / Unaudited |

Master Limited Partnership Shares — 138.4% | |

| Diversified — 21.2% | | | | |

Enterprise Products Partners LP 1 | | | 144,835 | | | $ | 8,601,751 | |

ONEOK Partners LP 1 | | | 54,018 | | | | 2,795,972 | |

Williams Partners LP 1 | | | 88,196 | | | | 4,400,098 | |

| Total Diversified | | | | | | | 15,797,821 | |

| | | | | | | | | |

| Gathering/Processing — 25.7% | |

Access Midstream Partners LP 1 | | | 71,222 | | | | 3,063,970 | |

DCP Midstream Partners LP 1 | | | 47,010 | | | | 2,247,078 | |

MarkWest Energy Partners LP 1 | | | 73,739 | | | | 4,854,976 | |

Regency Energy Partners LP 1 | | | 98,386 | | | | 2,522,617 | |

| Targa Resources Partners LP | | | 60,403 | | | | 2,809,344 | |

Western Gas Equity Partners LP 1 | | | 8,529 | | | | 319,155 | |

Western Gas Partners LP 1 | | | 56,192 | | | | 3,305,775 | |

| Total Gathering/Processing | | | | | | | 19,122,915 | |

| | | | | | | | | |

| Natural Gas Pipelines — 30.9% | |

El Paso Pipeline Partners LP 1 | | | 153,965 | | | | 6,326,422 | |

Energy Transfer Equity LP 1 | | | 131,052 | | | | 7,490,932 | |

Spectra Energy Partners LP 1 | | | 98,759 | | | | 3,516,808 | |

TC Pipelines LP 1 | | | 130,348 | | | | 5,679,263 | |

| Total Natural Gas Pipelines | | | | | | | 23,013,425 | |

| Petroleum Transportation — 60.6% | |

Buckeye Partners LP 1 | | | 54,100 | | | $ | 3,578,174 | |

Enbridge Energy Partners LP 1 | | | 67,092 | | | | 1,979,885 | |

Genesis Energy LP 1 | | | 121,782 | | | | 6,107,367 | |

Holly Energy Partners LP 1 | | | 179,459 | | | | 6,453,346 | |

Magellan Midstream Partners LP 1 | | | 89,742 | | | | 4,665,687 | |

MPLX LP 1 | | | 13,590 | | | | 504,597 | |

NuStar Energy LP 1 | | | 72,021 | | | | 3,355,458 | |

Oiltanking Partners LP 1 | | | 11,162 | | | | 552,519 | |

Plains All American Pipeline LP 1 | | | 141,258 | | | | 7,935,874 | |

Sunoco Logistics Partners LP 1 | | | 106,567 | | | | 6,451,566 | |

Tesoro Logistics LP 1 | | | 38,640 | | | | 2,397,226 | |

Transmontaigne Partners LP 1 | | | 28,182 | | | | 1,183,362 | |

| Total Petroleum Transportation | | | | | | | 45,165,061 | |

| | | | | | | | | |

| Total Master Limited Partnership Shares | |

| (identified cost $98,931,278) | | | | 103,099,222 | |

| | | | | | | | | |

| Short-Term Investments — 2.1% | |

| Money Market — 2.1% | | | | | |

Fidelity Treasury Portfolio, 0.010% 2 | | | | | | | | |

| (identified cost $ 1,566,265) | | | 1,566,265 | | | | 1,566,265 | |

| | | | | | | | | |

| Total Investments — 140.5% | | | | | |

| (identified cost $100,497,543) | | | | 104,665,487 | |

| Liabilities In Excess of Other Assets — (40.5)% | | | | (30,189,198 | ) |

| Net Assets — 100.0% | | | $ | 74,476,289 | |

| | OPPENHEIMER STEELPATH MLP ALPHA PLUS FUND | 11 |

STATEMENT OF INVESTMENTS Unaudited / (Continued) |

Footnotes to Statement of Investments

| 1. | As of May 31, 2013, all or a portion of the security has been pledged as collateral for a Fund loan. The market value of the securities in the pledged account totaled $53,265,435 as of May 31, 2013. |

| 2. | Variable rate security; the coupon rate represents the rate at May 31, 2013. |

| See accompanying Notes to Financial Statements. |

| 12 | OPPENHEIMER STEELPATH MLP ALPHA PLUS FUND | |

STATEMENT OF ASSETS AND LIABILITIES May 31, 2013 / Unaudited |

| Assets | | | |

| Investment securities: | | | |

| At acquisition cost | | $ | 100,497,543 | |

| At fair value | | $ | 104,665,487 | |

| Cash | | | 813,325 | |

| Deferred tax asset | | | 296,106 | |

| Dividends receivable | | | 32 | |

| Receivable for investments sold | | | 439,638 | |

| Receivable for capital stock sold | | | 2,272,609 | |

| | | 33,323 | |

| Total assets | | | 108,520,520 | |

| | | | |

| Liabilities | | | | |

| Interest Expense Payable | | | 22,977 | |

| Payable for capital stock redeemed | | | 6,121,004 | |

| Payable for investments purchased | | | 145,856 | |

| Deferred tax liability | | | 1,681,623 | |

| Payable to Advisor | | | 83,518 | |

| Payable for 12b-1 fees, Class A | | | 8,067 | |

| Payable for 12b-1 fees, Class C | | | 6,885 | |

| Line of credit | | | 25,914,571 | |

| | | 59,730 | |

| Total liabilities | | | 34,044,231 | |

| | | | |

| Net Assets | | $ | 74,476,289 | |

| | | | |

| Composition of Net Assets | | | | |

Par value of shares of beneficial interest | | $ | 6,683 | |

Additional paid-in capital | | | 72,130,615 | |

Undistributed net investment loss, net of deferred taxes | | | (293,166 | ) |

Accumulated undistributed net realized gains on investments, net of deferred taxes | | | 14,688 | |

Net unrealized appreciation on investments, net of deferred taxes | | | 2,617,469 | |

| Net Assets | | $ | 74,476,289 | |

| | | | |

Net Asset Value, Offering Price and Redemption Proceeds Per Share ($0.001 Par Value, Unlimited Shares Authorized) | | | | |

| Class A Shares: | | | | |

| Net asset value and redemption proceeds per share | | $ | 11.13 | |

| | $ | 11.81 | |

| Class C Shares: | | | | |

Net asset value, offering price and redemption proceeds per share | | $ | 11.06 | |

| Class Y Shares: * | | | | |

Net asset value, offering price and redemption proceeds per share | | $ | 11.18 | |

| See accompanying Notes to Financial Statements. |

| | OPPENHEIMER STEELPATH MLP ALPHA PLUS FUND | 13 |

STATEMENT OF ASSETS AND LIABILITIES Unaudited / (Continued) |

| Net Assets: | | | |

| | $ | 44,626,437 | |

| | | 5,881,521 | |

| | | 23,968,331 | |

| Total Net Assets | | $ | 74,476,289 | |

| | | | | |

| Shares Outstanding: | | | | |

| | | 4,008,235 | |

| | | 531,754 | |

| | | 2,143,239 | |

| Total Shares Outstanding | | | 6,683,228 | |

| * | Effective June 28, 2013, Class I shares were renamed Class Y shares. See Note 7 of the Notes to Financial Statements for additional information. |

| See accompanying Notes to Financial Statements. |

| 14 | OPPENHEIMER STEELPATH MLP ALPHA PLUS FUND | |

STATEMENT OF OPERATIONS For the Six Months Ended May 31, 2013 / Unaudited |

| Investment Income | | | |

| Distributions from Master Limited Partnerships | | $ | 1,275,542 | |

| Less return of capital on distributions | | | (1,275,542 | ) |

| | | 102 | |

| Total investment income | | | 102 | |

| | | | |

| Expenses | | | | |

| Investment advisory fee | | | 209,862 | |

| Registration fees | | | 46,528 | |

| Legal, auditing, and other professional services | | | 39,620 | |

| Transfer agent fees | | | 34,775 | |

| Administrative fees | | | 27,310 | |

| 12b-1 fees, Class A | | | 25,715 | |

| Custody fees | | | 10,748 | |

| 12b-1 fees, Class C | | | 10,306 | |

| Printing and postage | | | 9,690 | |

| Trustees' fees | | | 5,545 | |

| CCO fees | | | 132 | |

| Insurance premiums | | | 33 | |

| | | 2,869 | |

| Total expenses, before waivers | | | 423,133 | |

| | | (93,305 | ) |

| Net expenses, before interest on Line of Credit and deferred taxes | | | 329,828 | |

Interest expense on Line of Credit | | | 69,892 | |

| Net expenses, before deferred taxes | | | 399,720 | |

| | | | |

| Net investment loss, before deferred taxes | | | (399,618 | ) |

| | | 148,658 | |

| Net investment loss, net of deferred taxes | | | (250,960 | ) |

| | | | |

| Net Realized and Unrealized Gains on Investments: | | | | |

| Net Realized Gains | | | | |

| Investments | | | 95,841 | |

| | | (35,653 | ) |

Net realized gains, net of deferred taxes | | | 60,188 | |

| Net Change in Unrealized Appreciation | | | | |

| Investments | | | 3,894,946 | |

| | | (1,448,920 | ) |

| Net change in unrealized appreciation, net of deferred taxes | | | 2,446,026 | |

| | | | |

Net realized and unrealized gains on investments, net of deferred taxes | | | 2,506,214 | |

| Change in net assets resulting from operations | | $ | 2,255,254 | |

| See accompanying Notes to Financial Statements. |

| | OPPENHEIMER STEELPATH MLP ALPHA PLUS FUND | 15 |

STATEMENT OF CHANGES IN NET ASSETS |

| | For the Six Months Ended May 31, 2013 (Unaudited) | | | For the Period Ended November 30, 2012 * | |

| Operations | | | | | | |

| Net investment loss, net of deferred taxes | | $ | (250,960 | ) | | $ | (42,206 | ) |

| Net realized gains/(losses) on investments, net of deferred taxes | | | 60,188 | | | | (45,500 | ) |

Net change in unrealized appreciation on investments, net of deferred taxes | | | 2,446,026 | | | | 171,443 | |

| Change in net assets resulting from operations | | | 2,255,254 | | | | 83,737 | |

| | | | | | | | |

| Distributions to Shareholders | | | | | | | | |

| Distributions to shareholders from return of capital: | | | | | | | | |

| Class A shares | | | (724,730 | ) | | | (118,634 | ) |

| Class C shares | | | (84,429 | ) | | | (15,486 | ) |

| | | (352,223 | ) | | | (59,951 | ) |

| Change in net assets resulting from distributions to shareholders | | | (1,161,382 | ) | | | (194,071 | ) |

| | | | | | | | |

| Beneficial Interest Transactions | | | | | | | | |

| Class A | | | 37,068,939 | | | | 6,958,027 | |

| Class C | | | 5,278,938 | | | | 589,566 | |

| | | 21,911,917 | | | | 1,685,364 | |

Change in net assets resulting from capital share transactions | | | 64,259,794 | | | | 9,232,957 | |

| Change in net assets | | | 65,353,666 | | | | 9,122,623 | |

| | | | | | | | |

| Net Assets | | | | | | | | |

| | | 9,122,623 | | | | — | |

| End of period | | $ | 74,476,289 | | | $ | 9,122,623 | |

| | | | | | | | | |

| Undistributed net investment loss, net of deferred taxes | | $ | (293,166 | ) | | $ | (42,206 | ) |

| * | The Fund commenced operations on the close of business December 30, 2011. |

| ** | Effective June 28, 2013, Class I shares were renamed Class Y shares. See Note 7 of the Notes to Financial Statements for additional information. |

| See accompanying Notes to Financial Statements. |

| 16 | OPPENHEIMER STEELPATH MLP ALPHA PLUS FUND | |

STATEMENT OF CASH FLOWS May 31, 2013 / Unaudited |

| Cash flows from operating activities | | | |

| Net increase in net assets resulting from operations | | $ | 2,255,254 | |

| Non cash items included in operations: | | | | |

| | | 1,335,915 | |

| Adjustments to reconcile net increase in net assets resulting from operations to net cash used in operating activities: | | | | |

| Purchases of long-term portfolio investments | | | (89,221,120 | ) |

| Sales of long-term portfolio investments | | | 1,219,978 | |

| Purchases of short-term portfolio investments, net | | | (1,566,265 | ) |

| Return of capital distributions received from Master Limited Partnerships | | | 1,275,542 | |

| Increase in receivable for investments sold | | | (254,567 | ) |

| Increase in receivable for capital stock purchased | | | (2,272,609 | ) |

| Increase in prepaid expenses | | | (10,070 | ) |

| Increase in receivable for dividends | | | (32 | ) |

| Increase in payable to Advisor | | | 67,610 | |

| Increase in payable for capital stock redeemed | | | 6,116,240 | |

| Decrease in payable for investments purchased | | | (212,361 | ) |

| Decrease in other liabilities | | | (11,100 | ) |

| Increase in payable for 12b-1 fees, Class A | | | 6,623 | |

| Increase in payable for 12b-1 fees, Class C | | | 6,848 | |

| Increase in interest expense payable | | | 22,449 | |

| Net realized gain on investments | | | (95,841 | ) |

Net change in accumulated unrealized appreciation on investments | | | (3,894,946 | ) |

| Net cash used in operating activities | | | (85,232,452 | ) |

| | | | |

| Cash flows from financing activities | | | | |

| Proceeds from shares sold | | | 71,852,527 | |

| Payment of shares redeemed | | | (8,607,319 | ) |

| Distributions paid to shareholders, net of reinvestments | | | (146,797 | ) |

Net increase in line of credit | | | 22,753,367 | |

| Net cash provided by financing activities | | | 85,851,778 | |

| | | | |

| Net change in cash | | | 619,326 | |

Cash at beginning of period | | | 193,999 | |

| Cash at end of period | | $ | 813,325 | |

| Supplemental disclosure of cash flow information: |

| Cash paid on interest of $47,443. |

| Non-cash financing activities not included consist of reinvestment of dividends and distributions of $1,014,586. |

| See accompanying Notes to Financial Statements. |

| | OPPENHEIMER STEELPATH MLP ALPHA PLUS FUND | 17 |

| | Six Months Ended May 31, 2013 (Unaudited) | | | Period Ended November 30, 2012 1 | |

| Per Share Operating Data | | | | | | |

Net Asset Value, Beginning of Period | | $ | 9.93 | | | $ | 10.14 | |

| Loss from investment operations: | | | | | | | | |

Net investment income loss 2 | | | (0.08 | ) | | | (0.14 | ) |

Return of capital 2 | | | 0.26 | | | | 0.46 | |

| Net realized and unrealized gains | | | 1.35 | | | | 0.12 | |

Total from investment operations | | | 1.53 | | | | 0.44 | |

| Distributions to shareholders: | | | | | | | | |

| | | (0.33 | ) | | | (0.65 | ) |

| Net asset value, end of period | | $ | 11.13 | | | $ | 9.93 | |

| | | | | | | | |

Total Return, at Net Asset Value 3 | | | 15.47 | % | | | 4.56 | % |

| | | | | | | | | |

| Ratios/Supplemental Data | | | | | | | | |

| Ratio of Expenses to Average Net Assets: | | | | | | | | |

Net assets, end of period (in thousands) | | $ | 44,626 | | | $ | 6,915 | |

Before (waivers) and income tax expense 4 | | | 2.87 | % | | | 9.02 | % |

Expense (waivers) 4 | | | (0.45 | %) | | | (6.42 | %) |

Net of (waivers) and before income tax expense 4 | | | 2.42 | %5 | | | 2.60 | %5 |

Deferred tax expense 4, 6 | | | 7.97 | % | | | 4.04 | % |

Total expense 4 | | | 10.39 | % | | | 6.64 | % |

| | | | | | | | | |

Ratio of Investment Loss to Average Net Assets: 4 | | | | | | | | |

| Before (waivers) and income tax expense | | | (2.87 | %) | | | (9.02 | %) |

| Expense (waivers) | | | (0.45 | %) | | | (6.42 | %) |

| Net of (waivers) and before income tax expense | | | (2.42 | %) | | | (2.60 | %) |

Deferred tax benefit 7 | | | 0.90 | % | | | 0.97 | % |

| Net investment loss | | | (1.52 | %) | | | (1.63 | %) |

| | | | | | | | |

| Portfolio Turnover Rate | | | 3 | % | | | 69 | % |

| 1. | Shares commenced operations at the close of business February 6, 2012 |

| 2. | Per share amounts calculated based on average shares outstanding during the period. |

| 3. | Assumes an initial investment on the business day before the first day of the fiscal period, with all dividends and distributions reinvested in additional shares on the reinvestment date, and redemptions at the net asset value calculated on the last business day of the fiscal period. Sales charges are not reflected in the total returns. Total returns are not annualized for periods less than one full year. Returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. |

| 4. | Annualized for less than full period. |

| 5. | Includes interest expense. Without interest expense, the net expense ratio would be 2.00% for Class A. |

| 6. | Deferred tax expense estimate for the ratio calculation is derived from the net investment income/loss, and realized and unrealized gains/losses. |

| 7. | Deferred tax benefit for the ratio calculation is derived from net investment income/loss only. |

| See accompanying Notes to Financial Statements. |

| 18 | OPPENHEIMER STEELPATH MLP ALPHA PLUS FUND | |

FINANCIAL HIGHLIGHTS (Continued) |

| | Six Months Ended May 31, 2013 (Unaudited) | | | Period Ended November 30, 2012 1 | |

| Per Share Operating Data | | | | | | |

Net Asset Value, Beginning of Period | | $ | 9.91 | | | $ | 9.45 | |

| Loss from investment operations: | | | | | | | | |

Net investment income loss 2 | | | (0.11 | ) | | | (0.11 | ) |

Return of capital 2 | | | 0.32 | | | | 0.28 | |

| Net realized and unrealized gains | | | 1.27 | | | | 0.62 | |

Total from investment operations | | | 1.48 | | | | 0.79 | |

| Distributions to shareholders: | | | | | | | | |

| | | (0.33 | ) | | | (0.33 | ) |

| Net asset value, end of period | | $ | 11.06 | | | $ | 9.91 | |

| | | | | | | | |

Total Return, at Net Asset Value 3 | | | 14.99 | % | | | 8.39 | % |

| | | | | | | | | |

| Ratios/Supplemental Data | | | | | | | | |

| Ratio of Expenses to Average Net Assets: | | | | | | | | |

Net assets, end of period (in thousands) | | $ | 5,882 | | | $ | 604 | |

Before (waivers) and income tax expense 4 | | | 4.79 | % | | | 11.88 | % |

Expense (waivers) 4 | | | (1.61 | %) | | | (8.57 | %) |

Net of (waivers) and before income tax expense 4 | | | 3.18 | %5 | | | 3.31 | %5 |

Deferred tax expense 4, 6 | | | 7.70 | % | | | 4.16 | % |

Total expense 4 | | | 10.88 | % | | | 7.47 | % |

| | | | | | | | | |

Ratio of Investment Loss to Average Net Assets: 4 | | | | | | | | |

| Before (waivers) and income tax expense | | | (4.79 | %) | | | (11.88 | %) |

| Expense (waivers) | | | (1.61 | %) | | | (8.57 | %) |

| Net of (waivers) and before income tax expense | | | (3.18 | %) | | | (3.31 | %) |

Deferred tax benefit 7 | | | 1.18 | % | | | 1.23 | % |

| Net investment loss | | | (2.00 | %) | | | (2.08 | %) |

| | | | | | | | |

| Portfolio Turnover Rate | | | 3 | % | | | 69 | % |

| 1. | Shares commenced operations at the close of business May 22, 2012 |

| 2. | Per share amounts calculated based on average shares outstanding during the period. |

| 3. | Assumes an initial investment on the business day before the first day of the fiscal period, with all dividends and distributions reinvested in additional shares on the reinvestment date, and redemptions at the net asset value calculated on the last business day of the fiscal period. Sales charges are not reflected in the total returns. Total returns are not annualized for periods less than one full year. Returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. |

| 4. | Annualized for less than full period. |

| 5. | Includes interest expense. Without interest expense, the net expense ratio would be 2.75% for Class C. |

| 6. | Deferred tax expense estimate for the ratio calculation is derived from the net investment income/loss, and realized and unrealized gains/losses. |

| 7. | Deferred tax benefit for the ratio calculation is derived from net investment income/loss only. |

| See accompanying Notes to Financial Statements. |

| | OPPENHEIMER STEELPATH MLP ALPHA PLUS FUND | 19 |

FINANCIAL HIGHLIGHTS (Continued) |

| | Six Months Ended May 31, 2013 (Unaudited) | | | Period Ended November 30, 2012 2 | |

| Per Share Operating Data | | | | | | |

Net Asset Value, Beginning of Period | | $ | 9.96 | | | $ | 10.00 | |

| Loss from investment operations: | | | | | | | | |

Net investment income loss 3 | | | (0.08 | ) | | | (0.12 | ) |

Return of capital 3 | | | 0.27 | | | | 0.48 | |

| Net realized and unrealized gains | | | 1.36 | | | | 0.25 | |

Total from investment operations | | | 1.55 | | | | 0.61 | |

| Distributions to shareholders: | | | | | | | | |

| | | (0.33 | ) | | | (0.65 | ) |

| Net asset value, end of period | | $ | 11.18 | | | $ | 9.96 | |

| | | | | | | | |

Total Return, at Net Asset Value 4 | | | 15.62 | % | | | 6.33 | % |

| | | | | | | | | |

| Ratios/Supplemental Data | | | | | | | | |

| Ratio of Expenses to Average Net Assets: | | | | | | | | |

Net assets, end of period (in thousands) | | $ | 23,968 | | | $ | 1,604 | |

Before (waivers) and income tax expense 5 | | | 2.73 | % | | | 24.82 | % |

Expense (waivers) 5 | | | (0.57 | %) | | | (22.71 | %) |

Net of (waivers) and before income tax expense 5 | | | 2.16 | %6 | | | 2.11 | %6 |

Deferred tax expense 5, 7 | | | 8.00 | % | | | (2.88 | %) |

Total expense 5 | | | 10.16 | % | | | (0.77 | %) |

| | | | | | | | | |

Ratio of Investment Loss to Average Net Assets: 5 | | | | | | | | |

| Before (waivers) and income tax expense | | | (2.73 | %) | | | (24.82 | %) |

| Expense (waivers) | | | (0.57 | %) | | | (22.71 | %) |

| Net of (waivers) and before income tax expense | | | (2.16 | %) | | | (2.11 | %) |

Deferred tax benefit 8 | | | 0.81 | % | | | 0.79 | % |

| Net investment loss | | | (1.35 | %) | | | (1.32 | %) |

| | | | | | | | |

| Portfolio Turnover Rate | | | 3 | % | | | 69 | % |

| 1. | Effective June 28, 2013, Class I shares were renamed Class Y shares. See Note 7 of the Notes to Financial Statements for additional information. |

| 2. | The net asset value for the beginning of the period close of business December 30, 2011 (Commencement of Operations) through November 30, 2010 represents the initial contribution per share of $10. |

| 3. | Per share amounts calculated based on average shares outstanding during the period. |

| 4. | Assumes an initial investment on the business day before the first day of the fiscal period, with all dividends and distributions reinvested in additional shares on the reinvestment date, and redemptions at the net asset value calculated on the last business day of the fiscal period. Sales charges are not reflected in the total returns. Total returns are not annualized for periods less than one full year. Returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. |

| 5. | Annualized for less than full period. |

| 6. | Includes interest expense. Without interest expense, the net expense ratio would be 1.75% for Class I. |

| 7. | Deferred tax expense estimate for the ratio calculation is derived from the net investment income/loss, and realized and unrealized gains/losses. |

| 8. | Deferred tax benefit for the ratio calculation is derived from net investment income/loss only. |

| See accompanying Notes to Financial Statements. |

| 20 | OPPENHEIMER STEELPATH MLP ALPHA PLUS FUND | |

NOTES TO FINANCIAL STATEMENTS Unaudited |

1. Significant Accounting Policies

Oppenheimer SteelPath MLP Alpha Plus Fund (the “Fund”), a separate series of Oppenheimer SteelPath MLP Funds Trust, is a non-diversified open-end management investment company registered under the Investment Company Act of 1940, as amended. The Fund’s investment objective is to seek to provide investors with capital appreciation and, as a secondary objective, current income. The Fund’s investment adviser is OFI SteelPath, Inc. (the “Adviser” or “Manager”).

The Fund offers Class A, Class C, and Class Y shares (formerly Class I shares) for new purchase. Effective June 28, 2013, Class I shares were renamed Class Y shares. The former Class I shares are therefore referenced as Class Y shares throughout this report. Class A shares are sold at their offering price, which is normally net asset value plus a front-end sales charge. Class C shares are sold, without a front-end sales charge but may be subject to a contingent deferred sales charge (“CDSC”). Class Y shares are sold to certain institutional investors or intermediaries without either a front-end sales charge or a CDSC, however, the intermediaries may impose charges on their accountholders who beneficially own Class Y shares. All classes of shares have identical rights and voting privileges with respect to the Fund in general and exclusive voting rights on matters that affect that class alone. Earnings, net assets and net asset value per share may differ due to each class having its own expenses, such as transfer and shareholder servicing agent fees and shareholder communications, directly attributable to that class. Class A, and C shares have separate distribution and/or service plans under which they pay fees. Class Y shares do not pay such fees.

The following is a summary of significant accounting policies consistently followed by the Fund.

Master Limited Partnerships (“MLPs”). Under normal circumstances, the Fund seeks to achieve its investment objective by investing at least 80% of its net assets in the equity securities of MLPs.

MLPs issue common units that represent an equity ownership interest in a partnership and provide limited voting rights. MLP common units are registered with the Securities and Exchange Commission (“SEC”), and are freely tradable on securities exchanges such as the NYSE and the NASDAQ Stock Market (“NASDAQ”), or in the over-the-counter (“OTC”) market. An MLP consists of one or more general partners, who conduct the business, and one or more limited partners, who contribute capital. MLP common unit holders have a limited role in the partnership’s operations and management. The Fund, as a limited partner, normally would not be liable for the debts of the MLP beyond the amounts the Fund has contributed, but would not be shielded to the same extent that a shareholder of a corporation would be. In certain circumstances creditors of an MLP would have the right to seek return of capital distributed to a limited partner. This right of an MLP’s creditors would continue after the Fund sold its investment in the MLP.

| | OPPENHEIMER STEELPATH MLP ALPHA PLUS FUND | 21 |

NOTES TO FINANCIAL STATEMENTS Unaudited / (Continued) |

1. Significant Accounting Policies (Continued)

Concentration Risk. Under normal circumstances, the Fund intends to invest at least 80% of its total assets in securities of MLP’s, which are subject to certain risks, such as supply and demand risk, depletion and exploration risk, commodity pricing risk, acquisition risk, and the risk associated with the hazards inherent in midstream energy industry activities. A substantial portion of the cash flow received by the Fund is derived from investment in equity securities of MLPs. The amount of cash that a MLP has available for distributions, and the tax character of such distributions, are dependent upon the amount of cash generated by the MLPs operations.

Semiannual and Annual Periods. The last day of the Fund’s semiannual period was the last day the New York Stock Exchange was open for trading. The Fund’s financial statements have been presented through that date to maintain consistency with the Fund’s net asset value calculations used for shareholder transactions.

Allocation of Income, Expenses, Gains and Losses. Income, expenses (other than those attributable to a specific class), gains and losses are allocated on a daily basis to each class of shares based upon the relative proportion of net assets represented by such class. Operating expenses directly attributable to a specific class are charged against the operations of that class.

Federal Income Taxes:

The Fund does not intend to qualify as a regulated investment company pursuant to Subchapter M of the Internal Revenue Code, but will rather be taxed as a corporation. As a corporation, the Fund is obligated to pay federal, state and local income tax on taxable income. Currently, the maximum marginal regular federal income tax rate for a corporation is 35 percent. The Fund may be subject to a 20 percent alternative minimum tax on its federal alternative minimum taxable income to the extent that its alternative minimum tax exceeds its regular federal income tax. The Fund is currently using an estimated rate of 2.2% for state and local tax, net of federal tax expense.

The Fund’s income tax provision consists of the following as of May 31, 2013:

| Current tax expense (benefit) | | | |

| Federal | | $ | — | |

| State | | | — | |

| Total current tax expense | | $ | — | |

| | | | | |

| Deferred tax expense (benefit) | | | | |

| Federal | | $ | 1,256,909 | |

| State | | | 79,006 | |

| Total deferred tax expense | | $ | 1,335,915 | |

| 22 | OPPENHEIMER STEELPATH MLP ALPHA PLUS FUND | |

NOTES TO FINANCIAL STATEMENTS Unaudited / (Continued) |

1. Significant Accounting Policies (Continued)

The reconciliation between the federal statutory income tax rate of 35% and the effective tax rate on net investment income (loss) and realized and unrealized gain (loss) follows:

| | | |

| Application of staturory income tax rate | | $ | 1,256,909 | |

| State income taxes net of federal benefit | | | 79,006 | |

| Total income tax expense (benefit) | | $ | 1,335,915 | |

The Fund intends to invest its assets primarily in MLPs, which generally are treated as partnerships for federal income tax purposes. As a limited partner in the MLPs, the Fund reports its allocable share of the MLP’s taxable income in computing its own taxable income. The Fund’s tax expense or benefit will be included in the Statement of Operations based on the component of income or gains (losses) to which such expense or benefit relates. Deferred income taxes reflect the net tax effects of temporary differences between the carrying amounts of assets and liabilities for financial reporting purposes and the amounts used for income tax purposes. Such temporary differences are principally: (i) taxes on unrealized gains/(losses), which are attributable to the temporary difference between fair market value and tax basis, (ii) the net tax effects of temporary differences btween the carrying amounts of assets and liabilities for financial reporting and income tax purposes and (iii) the net tax benefit of accumulated net operating losses and capital loss carryforwards. Deferred tax assets and liabilities are measured using effective tax rates expected to apply to taxable income in the years such temporary differences are realized or otherwise settled. To the extent the Fund has a deferred tax asset, consideration is given to whether or not a valuation allowance is required. A valuation allowance is required if based on the evaluation criterion provided by ASC 740, Income Taxes (ASC 740) that it is more-likely-than-not that some portion or all of the deferred tax asset will not be realized. Among the factors considered in assessing the Fund’s valuation allowance: the nature, frequency and severity of current and cumulative losses, forecasts of future profitability, the duration of the statutory carryforward periods and the associated risks that operating and capital loss carryforwards may expire unused. At May 31, 2013, the Fund determined a valuation allowance was not required. From time to time, as new information becomes available, the Fund will modify its estimates or assumptions regarding the deferred tax liability or asset.

| | OPPENHEIMER STEELPATH MLP ALPHA PLUS FUND | 23 |

NOTES TO FINANCIAL STATEMENTS Unaudited / (Continued) |

1. Significant Accounting Policies (Continued)

Components of the Fund’s deferred tax assets and liabilities as of May 31, 2013 are as follows:

| Deferred tax assets: | | | |

| Net operating loss carryforward (tax basis) | | $ | 296,106 | |

| | | | | |

| Deferred tax liabilities: | | | | |

| Net unrealized gains on investment securities (tax basis) | | | (1,681,623 | ) |

| Total net deferred tax asset/(liability) | | $ | (1,385,517 | ) |

Unexpected significant decreases in cash distributions from the Fund’s MLP investments or significant declines in the fair value of its investments may change the Fund’s assessment regarding the recoverability of their deferred tax assets and may result in a valuation allowance. If a valuation allowance is required to reduce any deferred tax asset in the future, it could have a material impact on the Fund’s net asset value and results of operations in the period it is recorded.

The Fund may rely, to some extent, on information provided by the MLPs, which may not necessarily be timely, to estimate taxable income allocable to MLP units held in its portfolio, and to estimate its associated deferred tax benefit/(liability). Such estimates are made in good faith. From time to time, as new information becomes available, the Fund will modify its estimates or assumptions regarding its tax benefit/(liability).

The Fund’s policy is to classify interest and penalties associated with underpayment of federal and state income taxes, if any, as income tax expense on its Statements of Operations. As of May 31, 2013, the Fund does not have any interest or penalties associated with the underpayment of any income taxes.

The Fund files income tax returns in the U.S. federal jurisdiction and various states. All tax years since inception remain open and subject to examination by tax jurisdictions. The Fund has reviewed all major jurisdictions and concluded that there is no significant impact on the Fund’s net assets and no tax liability resulting from unrecognized tax benefits relating to uncertain tax positions expected to be taken on its tax returns. Furthermore, management of the Fund is not aware of any tax positions for which it is reasonably possible that the total amount of unrecognized tax benefit will significantly change in the next 12 months.

| 24 | OPPENHEIMER STEELPATH MLP ALPHA PLUS FUND | |

NOTES TO FINANCIAL STATEMENTS Unaudited / (Continued) |

1. Significant Accounting Policies (Continued)

At May 31, 2013, the Fund had net operating loss carryforwards for federal income tax purposes, which may be carried forward for 20 years, as follows:

| Expiration Date | | | |

| 11/30/2032 | | $ | 30,185 | |

| 11/30/2033 | | | 765,798 | |

| Total | | $ | 795,983 | |

During the period ended May 31, 2013, the Fund utilized $48,187 of capital loss carryforward.

At May 31, 2013, gross unrealized appreciation and depreciation of investments, based on cost for federal income tax purposes were as follows:

| Cost of Investments | | $ | 100,149,851 | |

| Gross Unrealized Appreciation | | $ | 6,436,506 | |

| Gross Unrealized Depreciation | | | (1,920,870 | ) |

| Net Unrealized Appreciation (Depreciation) on Investments | | $ | 4,515,636 | |

The difference between cost amounts for financial statement and federal income tax purposes is due primarily to timing differences in recognizing certain gains and losses in security transactions.

Trustees’ Compensation. The Board of Trustees has adopted a compensation deferral plan for independent trustees that enables trustees to elect to defer receipt of all or a portion of the annual compensation they are entitled to receive from the Fund. For purposes of determining the amount owed to the Trustee under the plan, deferred amounts are treated as though equal dollar amounts had been invested in shares of the Fund or in other Oppenheimer funds selected by the Trustee. The Fund purchases shares of the funds selected for deferral by the Trustee in amounts equal to his or her deemed investment, resulting in a Fund asset equal to the deferred compensation liability. Such assets are included as a component of “Other” within the asset section of the Statement of Assets and Liabilities. Deferral of trustees’ fees under the plan will not affect the net assets of the Fund, and will not materially affect the Fund’s assets, liabilities or net investment income per share. Amounts will be deferred until distributed in accordance with the compensation deferral plan.

Dividends and Distributions to Shareholders. Dividends and distributions to shareholders, which are determined in accordance with income tax regulations and may differ from U.S. generally accepted accounting principles, are recorded on the ex-dividend date. Dividends, if any, are declared and distributed quarterly for the Fund. The estimated characterization of the distributions paid will be either a dividend (ordinary income) or distribution (return of capital). This estimate is based on the Fund’s operating results during the period. It is anticipated that

| | OPPENHEIMER STEELPATH MLP ALPHA PLUS FUND | 25 |

NOTES TO FINANCIAL STATEMENTS Unaudited / (Continued) |

1. Significant Accounting Policies (Continued)

a significant portion of the distributions will be comprised of return of capital as a result of the tax character of cash distributions made by the Fund’s investments. The actual characterization of the distributions made during the period will not be determined until after the end of the fiscal year. The Fund will inform shareholders of the final tax character of the distributions on IRS Form DIV in February 2014. For the six months ended May 31, 2013, the Fund distributions are expected to be comprised of 100% return of capital.

Return of Capital Estimates: Distributions received from the Fund’s investments in MLPs generally are comprised of income and return of capital. The Fund records investment income and return of capital based on estimates made at the time such distributions are received. Such estimates are based on historical information available from each MLP and other industry sources. These estimates may subsequently be revised based on information received from MLPs after their tax reporting periods are concluded. For the six months ended May 31, 2013, the Fund estimated that 100% of the MLP distributions received would be treated as return of capital.

Investment Income. Dividend income is recorded on the ex-dividend date or upon ex-dividend notification in the case of certain foreign dividends where the ex-dividend date may have passed. Non-cash dividends included in dividend income, if any, are recorded at the fair market value of the securities received. Interest income is recognized on an accrual basis. Discount and premium, which are included in interest income on the Statement of Operations, are amortized or accreted daily.

Custodian Fees. “Custodian fees and expenses” in the Statement of Operations may include interest expense incurred by the Fund on any cash overdrafts of its custodian account during the period. Such cash overdrafts may result from the effects of failed trades in portfolio securities and from cash outflows resulting from unanticipated shareholder redemption activity. The Fund pays interest to its custodian on such cash overdrafts, to the extent they are not offset by positive cash balances maintained by the Fund, at a rate equal to the Federal Funds Rate plus 0.015%. The “Reduction to custodian expenses” line item, if applicable, represents earnings on cash balances maintained by the Fund during the period. Such interest expense and other custodian fees may be paid with these earnings.

Security Transactions. Security transactions are recorded on the trade date. Realized gains and losses on securities sold are determined on the basis of identified cost.

Indemnifications. The Fund’s organizational documents provide current and former trustees and officers with a limited indemnification against liabilities arising in connection with the performance of their duties to the Fund. In the normal course of business, the Fund may also enter into contracts that provide general indemnifications. The Fund’s maximum exposure under these arrangements is unknown as this would be dependent on future claims that may be made against the Fund. The risk of material loss from such claims is considered remote.

| 26 | OPPENHEIMER STEELPATH MLP ALPHA PLUS FUND | |

NOTES TO FINANCIAL STATEMENTS Unaudited / (Continued) |

1. Significant Accounting Policies (Continued)

Other. The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from those estimates.

The Fund calculates the net asset value of its shares as of the close of the New York Stock Exchange (the “Exchange”), normally 4:00 P.M. Eastern time, on each day the Exchange is open for trading.

The Fund’s Board has adopted procedures for the valuation of the Fund’s securities and has delegated the day-to-day responsibility for valuation determinations under those procedures to the Adviser. The Adviser has established a Valuation Committee which is responsible for determining a “fair valuation” for any security for which market quotations are not “readily available.” The Valuation Committee’s fair valuation determinations are subject to review, approval and ratification by the Fund’s Board at its next regularly scheduled meeting covering the calendar quarter in which the fair valuation was determined.

Valuation Methods and Inputs

Securities are valued using unadjusted quoted market prices, when available, as supplied primarily by third party pricing services or dealers.

The following methodologies are used to determine the market value or the fair value of the types of securities described below:

Securities traded on a registered U.S. securities exchange (including exchange-traded derivatives other than futures and futures options) are valued based on the last sale price of the security reported on the principal exchange on which it is traded, prior to the time when the Fund’s assets are valued. In the absence of a sale, the security is valued at the last sale price on the prior trading day, if it is within the spread of the current day’s closing “bid” and “asked” prices, and if not, at the current day’s closing bid price. A security of a foreign issuer traded on a foreign exchange but not listed on a registered U.S. securities exchange is valued based on the last sale price on the principal exchange on which the security is traded, as identified by the third party pricing service used by the Adviser, prior to the time when the Fund’s assets are valued. If the last sale price is unavailable, the security is valued at the most recent official closing price on the principal exchange on which it is traded. If the last sales price or official closing price for a foreign security is not available, the security is valued at the mean between the bid and asked price per the exchange or, if not available from the exchange, obtained from two dealers. If bid and asked prices are not available from either the

| | OPPENHEIMER STEELPATH MLP ALPHA PLUS FUND | 27 |

NOTES TO FINANCIAL STATEMENTS Unaudited / (Continued) |

2. Securities Valuation (Continued)

exchange or two dealers, the security is valued by using one of the following methodologies (listed in order of priority); (1) using a bid from the exchange, (2) the mean between the bid and asked price as provided by a single dealer, or (3) a bid from a single dealer.

Shares of a registered investment company that are not traded on an exchange are valued at that investment company’s net asset value per share.

Corporate and government debt securities (of U.S. or foreign issuers) and municipal debt securities, event-linked bonds, loans, mortgage-backed securities, collateralized mortgage obligations, and asset-backed securities are valued at the mean between the “bid” and “asked” prices utilizing evaluated prices obtained from third party pricing services or broker-dealers who may use matrix pricing methods to determine the evaluated prices.

Short-term money market type debt securities with a remaining maturity of sixty days or less are valued at cost adjusted by the amortization of discount or premium to maturity (amortized cost), which approximates market value. Short-term debt securities with a remaining maturity in excess of sixty days are valued at the mean between the “bid” and “asked” prices utilizing evaluated prices obtained from third party pricing services or broker-dealers.

A description of the standard inputs that may generally be considered by the third party pricing vendors in determining their evaluated prices is provided below.

| | Standard inputs generally considered by third-party pricing vendors |

| Corporate debt, government debt, municipal, mortgage-backed and asset-backed securities | | Reported trade data, broker-dealer price quotations, benchmark yields, issuer spreads on comparable securities, the credit quality, yield, maturity, and other appropriate factors. |

| Loans | | Information obtained from market participants regarding reported trade data and broker-dealer price quotations. |

| Event-linked bonds | | Information obtained from market participants regarding reported trade data and broker-dealer price quotations. |

If a market value or price cannot be determined for a security using the methodologies described above, or if, in the “good faith” opinion of the Adviser, the market value or price obtained does not constitute a “readily available market quotation,” or a significant event has occurred that would materially affect the value of the security the security is fair valued either (i) by a standardized fair valuation methodology applicable to the security type or the significant event as previously approved by the Valuation Committee and the Fund’s Board or

| 28 | OPPENHEIMER STEELPATH MLP ALPHA PLUS FUND | |

NOTES TO FINANCIAL STATEMENTS Unaudited / (Continued) |

2. Securities Valuation (Continued)

(ii) as determined in good faith by the Adviser’s Valuation Committee. The Valuation Committee considers all relevant facts that are reasonably available, through either public information or information available to the Adviser, when determining the fair value of a security. Fair value determinations by the Adviser are subject to review, approval and ratification by the Fund’s Board at its next regularly scheduled meeting covering the calendar quarter in which the fair valuation was determined. Those fair valuation standardized methodologies include, but are not limited to, valuing securities at the last sale price or initially at cost and subsequently adjusting the value based on: changes in company specific fundamentals, changes in an appropriate securities index, or changes in the value of similar securities which may be further adjusted for any discounts related to security-specific resale restrictions. When possible, such methodologies use observable market inputs such as unadjusted quoted prices of similar securities, observable interest rates, currency rates and yield curves. The methodologies used for valuing securities are not necessarily an indication of the risks associated with investing in those securities nor can it be assured that the Fund can obtain the fair value assigned to a security if it were to sell the security.

To assess the continuing appropriateness of security valuations, the Adviser, or its third party service provider who is subject to oversight by the Adviser, regularly compares prior day prices, prices on comparable securities, and sale prices to the current day prices and challenges those prices exceeding certain tolerance levels with the third party pricing service or broker source. For those securities valued by fair valuations, whether through a standardized fair valuation methodology or a fair valuation determination, the Valuation Committee reviews and affirms the reasonableness of the valuations based on such methodologies and fair valuation determinations on a regular basis after considering all relevant information that is reasonably available.

Classifications

Each investment asset or liability of the Fund is assigned a level at measurement date based on the significance and source of the inputs to its valuation. Various data inputs are used in determining the value of each of the Fund’s investments as of the reporting period end. These data inputs are categorized in the following hierarchy under applicable financial accounting standards:

| | 1) | Level 1-unadjusted quoted prices in active markets for identical assets or liabilities (including securities actively traded on a securities exchange) |

| | 2) | Level 2-inputs other than unadjusted quoted prices that are observable for the asset or liability (such as unadjusted quoted prices for similar assets and market corroborated inputs such as interest rates, prepayment speeds, credit risks, etc.) |

| | 3) | Level 3-significant unobservable inputs (including the Adviser’s own judgments about assumptions that market participants would use in pricing the asset or liability). |

| | OPPENHEIMER STEELPATH MLP ALPHA PLUS FUND | 29 |

NOTES TO FINANCIAL STATEMENTS Unaudited / (Continued) |

2. Securities Valuation (Continued)

The inputs used for valuing securities are not necessarily an indication of the risks associated with investing in those securities.

The table below categorizes amounts that are included in the Fund’s Statement of Assets and Liabilities as of May 31, 2013 based on valuation input level:

| | Level 1 — Unadjusted Quoted Prices | | | Level 2 — Other Significant Observable Inputs | | | Level 3 — Significant Unobservable Inputs | | | | |

| Assets Table | | | | | | | | | | | | |

| Investments, at Value: | | | | | | | | | | | | |

| Master Limited Partnership Shares* | | $ | 103,099,222 | | | $ | — | | | $ | — | | | $ | 103,099,222 | |

| Short Term Investments | | | 1,566,265 | | | | — | | | | — | | | | 1,566,265 | |

| Total Assets | | $ | 104,665,487 | | | $ | — | | | $ | — | | | $ | 104,665,487 | |

| * | For a detailed break-out of securities by major industry classification, please refer to the Statement of Investments. |

The Fund did not hold any Level 2 or Level 3 securities during the six months ended May 31, 2013.

There have been no transfers between pricing levels for the Fund. It is the Fund’s policy to recognize transfers at the end of the reporting period.

3. Shares of Beneficial Interest

The Fund has authorized an unlimited number of $0.001 par value shares of beneficial interest of each class. Transactions in shares of beneficial interest were as follows:

| | | Six Months Ended May 31, 2013 | | | Period Ended November 30, 2012 1 | |

| | | | | | | | | | | | |

| Class A | | | | | | | | | | | | |

| Sold | | | 3,970,485 | | | $ | 44,439,448 | | | | 763,735 | | | $ | 7,634,170 | |

| Dividends and/or distributions reinvested | | | 55,633 | | | | 625,073 | | | | 11,706 | | | | 115,630 | |

| Redeemed | | | (714,092 | ) | | | (7,995,582 | ) | | | (79,232 | ) | | | (791,773 | ) |

| Net increase | | | 3,312,026 | | | $ | 37,068,939 | | | | 696,209 | | | $ | 6,958,027 | |

| 30 | OPPENHEIMER STEELPATH MLP ALPHA PLUS FUND | |

NOTES TO FINANCIAL STATEMENTS Unaudited / (Continued) |

3. Shares of Beneficial Interest (Continued)

| | | | Six Months Ended May 31, 2013 | | | | Period Ended November 30, 2012 1 | |

| | | | Shares | | | | Amount | | | | Shares | | | | Amount | |

| Class C | | | | | | | | | | | | | | | | |

| Sold | | | 471,302 | | | $ | 5,284,006 | | | | 60,112 | | | $ | 580,917 | |

| Dividends and/or distributions reinvested | | | 5,399 | | | | 60,385 | | | | 1,554 | | | | 15,321 | |

| Redeemed | | | (5,913 | ) | | | (65,453 | ) | | | (700 | ) | | | (6,672 | ) |

| Net increase | | | 470,788 | | | $ | 5,278,938 | | | | 60,966 | | | $ | 589,566 | |

| | | | | | | | | | | | | | | | |

| Class Y | | | | | | | | | | | | | | | | |

| Sold | | | 2,002,024 | | | $ | 22,129,073 | | | | 283,356 | | | $ | 2,866,970 | |

| Dividends and/or distributions reinvested | | | 29,068 | | | | 329,128 | | | | 6,079 | | | | 59,951 | |

| Redeemed | | | (48,844 | ) | | | (546,284 | ) | | | (128,444 | ) | | | (1,241,557 | ) |

| Net increase | | | 1,928,248 | | | $ | 21,911,917 | | | | 160,991 | | | $ | 1,685,364 | |

| 1. | For the period from commencement of operations through November 30, 2012, for Class A, Class C, and Class Y shares. |

4. Purchases and Sales of Securities

The aggregate cost of purchases and proceeds from sales of securities, other than short-term obligations, for the six months ended May 31, 2013, were as follows:

| | | | | | |

| Investment securities | | $ | 89,221,120 | | | $ | 1,219,978 | |

5. Fees and Other Transactions with Affiliates

Management Fees. Under the investment advisory agreement, the Fund pays the Manager a management fee based on the daily net assets of the Fund at an annual rate as shown in the following table:

Net Assets up to $3 Billion | Net Assets Greater than

$3 Billion and up to $5 Billion | Net Assets in Excess of $5 Billion |

| 1.25% | 1.23% | 1.20% |

| | OPPENHEIMER STEELPATH MLP ALPHA PLUS FUND | 31 |

NOTES TO FINANCIAL STATEMENTS Unaudited / (Continued) |

5. Fees and Other Transactions with Affiliates (Continued)

The Advisor has agreed to limit fees and/or reimburse expenses of the Fund until at least March 31, 2015, to the extent that a Fund’s total annual fund operating expenses (exclusive of interest, taxes, such as deferred tax expenses, brokerage commissions, acquired fund fees and expenses, dividend costs related to short sales, and extraordinary expenses, such as litigation expenses, if any) exceed a certain limit with respect to each class of the Fund. The Expense Limitation Agreement has the effect of capping the Alpha Plus Fund’s class A, C, and Y share classes at 2.00%, 2.75%, and 1.75% respectively. The Fund’s net expenses will be higher than these amounts to the extent that the Fund incurs expenses excluded from the expense cap. Because the Fund’s deferred income tax expense is excluded from the expense cap, the Fund’s net expenses for each class of shares is increased by the amount of this expense. The Advisor can be reimbursed by the Fund within three years after the date the fee limitation and/or expense reimbursement has been made by the Advisor, provided that such repayment does not cause the expenses of any class of the Fund to exceed the foregoing limits. The fee limitation and/or expense reimbursement may be terminated or amended prior to March 31, 2015 with the approval of the Trust’s Board of Trustees.

The following table represents amounts eligible for recovery at May 31, 2013:

Eligible expense recoupment expiring: | | | |

| November 30, 2015 | | $ | 316,212 | |

| May 31, 2016 | | | 93,305 | |

During the period ended May 31, 2013, the Advisor did not recoup any expenses.

Distribution and Service Plan (12b-1) Fees. Under its General Distributor’s Agreement with the Fund, OppenheimerFunds Distributor, Inc. (the “Distributor”) acts as the Fund’s principal underwriter in the continuous public offering of the Fund’s classes of shares.

Service Plan for Class A Shares. The Fund has adopted a Service Plan (the “Plan”) for Class A shares under Rule 12b-1 of the Investment Company Act of 1940. Under the Plan, the Fund reimburses the Distributor for a portion of its costs incurred for services provided to accounts that hold Class A shares. Reimbursement is made periodically at an annual rate of up to 0.25% of the daily net assets of Class A shares of the Fund. The Distributor currently uses all of those fees to pay dealers, brokers, banks and other financial institutions periodically for providing personal service and maintenance of accounts of their customers that hold Class A shares. Any unreimbursed expenses the Distributor incurs with respect to Class A shares in any fiscal year cannot be recovered in subsequent periods. Fees incurred by the Fund under the Plan are detailed in the Statement of Operations.

| 32 | OPPENHEIMER STEELPATH MLP ALPHA PLUS FUND | |

NOTES TO FINANCIAL STATEMENTS Unaudited / (Continued) |

5. Fees and Other Transactions with Affiliates (Continued)

Distribution and Service Plans for Class C Shares. The Fund has adopted a Distribution and Service Plan (the “Plan”) for Class C shares under Rule 12b-1 of the Investment Company Act of 1940 to compensate the Distributor for its services in connection with the distribution of those shares and servicing accounts. Under the Plan, the Fund pays the Distributor an annual asset-based sales charge of 0.75% on Class C shares daily net assets. The Distributor also receives a service fee of 0.25% per year under the plan. If the Class C plan is terminated by the Fund or by the shareholders, the Board of Trustees and its independent trustees must determine whether the Distributor shall be entitled to payment from the Fund of all or a portion of the service fee and/or asset-based sales charge in respect to shares sold prior to the effective date of such termination. Fees incurred by the Fund under the Plan are detailed in the Statement of Operations. The Distributor determines its uncompensated expenses under the Plan at calendar quarter ends.

Sales Charges. Front-end sales charges and contingent deferred sales charges (“CDSC”) do not represent expenses of the Fund. They are deducted from the proceeds of sales of Fund shares prior to investment or from redemption proceeds prior to remittance, as applicable. The sales charges retained by the Distributor from the sale of shares and the CDSC retained by the Distributor on the redemption of shares is shown in the following table for the period indicated.

| | Class A Front-End Sales Charges Retained by Distributor | | | Class C Contingent Deferred Sales Charges Retained by Distributor | |

| May 31, 2013 | | $ | — | | | $ | — | |

The Fund has a $50 million revolving credit agreement with Bank of America, N.A. (“BOA Loan Agreement”) to engage in permitted borrowing. The Fund is permitted to borrow up to the lesser of one-third of the Fund’s total assets, or the maximum amount permitted pursuant to the Fund’s investment limitations. Amounts borrowed under the BOA Loan Agreement are invested by the Fund under the direction of the Manager, consistent with the Fund’s investment objectives and policies, and as such are subject to normal market fluctuations and investment risks, including the risk of loss due to a decline in value. The loan is fully collateralized throughout the term of the loan with securities or other assets of the Fund. Securities that have been pledged as collateral for the loan are indicated in the Schedule of

| | OPPENHEIMER STEELPATH MLP ALPHA PLUS FUND | 33 |

NOTES TO FINANCIAL STATEMENTS Unaudited / (Continued) |

6. Loan Pledge Agreement (Continued)

Investments. Bank of America shall have the right at any time, upon 180 days’ prior written notice to Alpha Plus Fund, or upon such shorter notice period as mutually agreed upon, to permanently terminate BOA Loan Agreement.

Borrowings under the BOA Loan Agreement are charged interest at a calculated rate computed by Bank of America based on LIBOR plus 0.90% per annum. A commitment fee at the rate of 0.10% per annum is charged for any undrawn portion of the credit facility. The loan is due 180 days following demand by Bank of America. The loan balance at May 31, 2013 was $25,914,571. For the six months ended May 31, 2013, information related to borrowings under the BOA Loan Agreement is as follows:

| | | | Maximum Amount

Borrowed During the Period |

| 1.10% | $11,341,230 | 182 | $69,892 | $25,917,576 |

Share Class Changes. Effective June 28, 2013 of the Fund, Class I shares were renamed Class Y shares. Class Y shares are sold at the net asset value per share without a sales charge directly to institutional investors that have special agreements with the Distributor for that purpose. They may include insurance companies, registered investment companies, employee benefit plans and Section 529 plans among others. Also on that date, the Fund began offering newly created Class I shares, which are only available to eligible institutional investors.

| 34 | OPPENHEIMER STEELPATH MLP ALPHA PLUS FUND | |

PORTFOLIO PROXY VOTING POLICIES AND PROCEDURES;

UPDATES TO STATEMENTS OF INVESTMENTS Unaudited |