- IQV Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

IQVIA (IQV) DEF 14ADefinitive proxy

Filed: 18 Feb 20, 5:14pm

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934 (Amendment No. 1)

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

☐ Preliminary Proxy Statement

☐ Confidential, for use of the Commission Only (as permitted by Rule 14a-6(e)(2))

☒ Definitive Proxy Statement

☐ Definitive Additional Materials

☐ Soliciting Material Pursuant to §240.14a-12

IQVIA HOLDINGS INC.

(Name of Registrant as Specified In Its Charter)

N/A

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

☒ No fee required.

☐ Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

| 1) | Title of each class of securities to which transaction applies: |

| 2) | Aggregate number of securities to which transaction applies: |

| 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on |

| 4) | Proposed maximum aggregate value of transaction: |

| 5) | Total fee paid: |

☐ Fee paid previously with preliminary materials.

☐ Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the

offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its

filing.

| 1) | Amount Previously Paid: |

| 2) | Form, Schedule or Registration Statement No.: |

| 3) | Filing Party: |

| 4) | Date Filed: |

|

| February 18, 2020

|

| |||

IQVIA HOLDINGS INC. 83 Wooster Heights Road Danbury, CT 06810 | ||||||

DearStockholder:

You are cordially invited to attend the 2020 Annual Meeting of Stockholders of IQVIA Holdings Inc. on Monday, April 6, 2020, at 9:00 am E.D.T. at the Ethan Allen Hotel, 21 Lake Avenue Extension, Danbury, Connecticut. The Notice of 2020 Annual Meeting of Stockholders and the Proxy Statement accompanying this letter describe the business to be conducted at the meeting and provide further information about IQVIA.

At IQVIA, we remain keenly focused on executing our strategy to advance healthcare treatment through leveraging unparalleled information, analytics, technology and knowledge assets. Every step we take in this journey brings us closer to our strategic purpose of improving patient outcomes. In the final year of our three-year merger integration program, IQVIA delivered strong operational and financial performance, as well as attractive returns to you, our shareholders.

2019 exceeded expectations. Reported revenue grew to$11.1 billion, representing8.0 percent year-over-year constant currency growth. Our Technology and Analytics Solutions and Research and Development Solutions segments contributed significantly to our results, delivering10.7 percent and6.9 percent growth, respectively. Adjusted Diluted Earnings per Share of$6.39, increased15.1 percent.

These strong results were driven by numerous operational achievements across our organization.

| • | Our Technology Solutions business had a pivotal year, with Orchestrated Customer Engagement (OCE) gaining significant traction, earning deserved credibility in the market. We won50 new OCE deals in 2019, compared to 30 in 2018, the first full year post-launch. To date, we havefour top-15 pharmaceutical clients who have made the decision to adopt our superior platform. |

| • | In Real World, we continued to build on our position as the market thought leader, driving innovations such as the use of real world comparator arms to eliminate the need for a placebo group. The team continues to invest in our rich clinical data assets, which now stands at800 million non-identified patients globally. |

| • | The Research and Development Solutions team won business with over250 new clients during the year. Importantly, we formed two preferred provider agreements with top 15 pharmaceutical clients. Our “see more, win more” strategy is working. We are clearly seeing more and winning more trials as sponsors come to realize the benefit of our highly differentiated capabilities. Our Research and Development Solutions backlog at December 31, 2019 reached a record$19 billion. |

| • | Contract Sales and Medical Solutions continued its turnaround in 2019. A new regionalized go-to-market approach, combined with a differentiated offering, drove new wins in the market and returned this business to growth. |

| • | We were named to FORTUNE’s list of World’s Most Admired Companies, recognized as one of America’s Best Employers for Women by Forbes, awarded Best Contract Research Organization Full-service Provider by Scrip Awards, and selected as the leader in Real World Data and Real World Evidence Services in a 2019 Life Science Strategy Group report. |

We maintain a strong balance sheet, flexible capital structure and attractive free cash flow profile that enables investments to further drive innovation and the continued return of cash to shareholders. During 2019, we completed a number of tuck-in acquisitions to further expand our technology platform and invested a further$582 million in internal development, mainly in software development and our technology infrastructure. We also returned$945 million to shareholders through the repurchase of6.6 million shares.

Our company remains uniquely positioned to address some of healthcare’s most complex challenges. We will continue to invest and innovate to advance patient outcomes and deliver value to our shareholders.

Ari Bousbib

Chairman and Chief Executive Officer

| IQVIA 2020 PROXY STATEMENT |

Notice of 2020 Annual Meeting

ofStockholders

2020 ANNUAL MEETING INFORMATION

Time and Date:

9:00 a.m. E.D.T.,

Monday, April 6, 2020

Place:

Ethan Allen Hotel

21 Lake Avenue Extension

Danbury, Connecticut

Record Date:

February 12, 2020

Important Notice Regarding the Availability of Proxy Materials for the 2020 Annual Meeting of Stockholders to Be Held April 6, 2020:

Our Notice of Meeting, Proxy Statement, Form of Proxy Card and 2019 Annual Report are available at:https://materials.proxyvote.com/46266C

YOUR VOTE IS IMPORTANT

To make sure your shares are represented, please cast your vote as soon as possible in one of the following ways:

INTERNET

Go to the website shown on your proxy card and related instructions |  | |

TELEPHONE

Use the toll-free number shown on your proxy card or voting instruction form |  | |

Mark, sign and date your proxy card and return it in the postage-paid envelope |  | |

AGENDA

| • | Proposal 1: Election of three Class I director nominees named in the accompanying Proxy Statement for athree-year term |

| • | Proposal 2:Advisory (non-binding) vote to approve executive compensation (say-on-pay) |

| • | Proposal 3: Ratification of our Audit Committee’s appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm for 2020 |

| • | Other business, if properly raised |

The Board of Directors recommends that you vote“FOR” each director nominee included in Proposal 1 and“FOR” each of the other proposals. The full text of these proposals is set forth in the accompanying Proxy Statement. Registered stockholders of the Company at the close of business on the record date are eligible to vote at the meeting.

We recommend that you review the information on the process for, and deadlines applicable to, voting, attending the meeting and appointing a proxy under “About the 2020 Annual Meeting” on page 90 of the Proxy Statement.

By Order of the Board of Directors,

Eric M. Sherbet

Executive Vice President,

General Counsel and Secretary

February 18, 2020

Danbury, Connecticut

| IQVIA 2020 PROXY STATEMENT | | i |

| IQVIA 2020 PROXY STATEMENT | | 1 |

StatementSummary | This Proxy Statement Summary highlights information contained elsewhere in this Proxy Statement, which is first being sent or made available to stockholders on or about February 18, 2020. This summary does not contain all of the information you should consider, so please read the entire Proxy Statement carefully before voting. |

MATTERS TO BE VOTED UPON

The following table summarizes the proposals to be voted upon at the 2020 Annual Meeting of Stockholders of IQVIA Holdings Inc. (“IQVIA”, the “Company”, “we” or “our”) to be held on April 6, 2020 (the “2020 Annual Meeting”) and voting recommendations of the Board of Directors of the Company (the “Board”) with respect to each proposal.

| Proposals | Required Approval | Board Recommendation | Page Reference | |||

| Election of Directors | Plurality of votes cast | FOR | 11 | |||

| Advisory vote to approve executive compensation (say-on-pay) | Not applicable1 | FOR | 39 | |||

| Ratification of independent auditor | Majority of votes cast | FOR | 82 | |||

| 1 | Because this is an advisory vote, there is no required approval. |

COMPANY OVERVIEW

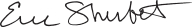

IQVIA is a leading global provider of advanced analytics, technology solutions and contract research services to the life sciences industry. Powered by the IQVIA CORE™, we deliver unique and actionable insights to help biotech, medical device, and pharmaceutical companies, medical researchers, government agencies, payers and other healthcare stakeholders tap into a deeper understanding of diseases, human behaviors and scientific advances, in an effort to advance their path toward cures. With approximately 67,000 employees, we conduct operations in more than 100 countries.

We have one of the largest and most comprehensive collections of healthcare information in the world, which includes more than 800 million comprehensive, longitudinal, non-identified patient records spanning sales, prescriptions, promotions, medical claims, electronic medical records, genomics, and social media. We standardize, curate, structure and integrate this data by applying our sophisticated analytics and leveraging our global technology infrastructure. This helps our clients run their organizations more efficiently and make better decisions to improve their clinical, commercial and financial performance.

We are a global leader in protecting individual patient privacy. We use a wide variety of privacy-enhancing technologies and safeguards to protect individual privacy while generating and analyzing information on a scale that helps healthcare stakeholders identify disease patterns and correlate with the precise treatment path and therapy needed for better outcomes.

| 2 | Proxy Statement Summary | IQVIA 2020 PROXY STATEMENT |

OUR STRATEGY AND PURPOSE

We believe we are well positioned for continued growth across the markets we serve. Our strategy for achieving growth includes:

|

Continuing to innovate by leveraging our information, advanced analytics, transformative technology and significant domain expertise

| |

|

Building upon our extensive client relationships

| |

|

Improving patient outcomes by accelerating healthcare stakeholders’ efforts to value and deliver treatments to patients

| |

|

Expanding the penetration of our offerings to the broader healthcare marketplace | |

|

Expanding our portfolio through effective capital deployment, including strategic tuck-in acquisitions

|

| IQVIA 2020 PROXY STATEMENT | Proxy Statement Summary | 3 |

FINANCIAL HIGHLIGHTS

2019 Key Financial Metrics

|

Year-over-Year Growth

| |

Revenue $11.1Bn | 6.5% | |

Adjusted EBITDA1 $2.4Bn | 7.9% | |

Adjusted Diluted EPS1 $6.39

| 15.1%

| |

Total Stockholder Return

| 33% |

2019 Capital Deployment

| ||||||

Cash Repatriation $1.1Bn

| Cash Returned to Stockholders via Repurchases $945M

| |||||

Investments in Product Development and Technology $582M

| Investments in Acquisitions $588M

| |||||

2019 Business Highlights

| ||||||

Clinical Development Net Book-to Bill Ratio 1.34x

|

Clinical Development Contracted Backlog $19Bn

| |||||

Clinical Development Customers 250+ R&D Solutions contracted business with over 250 new customers, including 13 of the top 20 pharmaceutical companies using CORE-powered smart trials

|

New OCE Technology Customer Wins 50 Versus 30 in 2018, the first full year since product launch

| |||||

| 1 | See reconciliation of non-GAAP items in the Appendix |

| 4 | Proxy Statement Summary | IQVIA 2020 PROXY STATEMENT |

Merger Integration Highlights

At the time of the Merger (as defined herein), we set the following goals:

• Accelerate clinical development to help bring drugs to market faster and more efficiently

• Integrate legacy company capabilities in the evolving real world evidence space

• Leverage technology across the organization to further differentiate our combined offerings

We also made a commitment to accelerate revenue growth by 100 to 200 basis points exiting 2019.

Entering 2019, the final year of our three-year Merger integration period, we delivered on our commitment of accelerated top line growth, with total revenue growth accelerating by over 200 basis points in 2019, compared to 2018.

We also made significant progress leveraging technology across the organization. In December 2017, the Orchestrated Customer Engagement (“OCE”) SaaS platform was launched. OCE is a disruptive technology and is highly differentiated compared to the current point solutions that exist in the market. It is not a traditional Customer Relationship Management (“CRM”) tool. Built on Salesforce’s Force.com and Marketing Cloud, as well as other best-in-class platforms, OCE is a collaborative tool that utilizes artificial intelligence and machine learning to integrate the various functions within our life sciences client’s commercial operations. At December 31, 2019, we had 80 clients deploying OCE globally.

In addition to OCE, we invested in many other technologies, including:

• further development of E360, a proven SaaS platform to access and drive scalable and global analytics on complex Real World Data

• the launch of E360 Genomics

• the launch of virtual trials, also platformed on Salesforce, a transformative technology that brings clinical research directly to patients and ultimately increases trial participation as we help clients reach diverse and difficult to recruit patients

• clinical and commercial content management tools

• regulatory, pharmacovigilance and many others | ||

| IQVIA 2020 PROXY STATEMENT | Proxy Statement Summary | 5 |

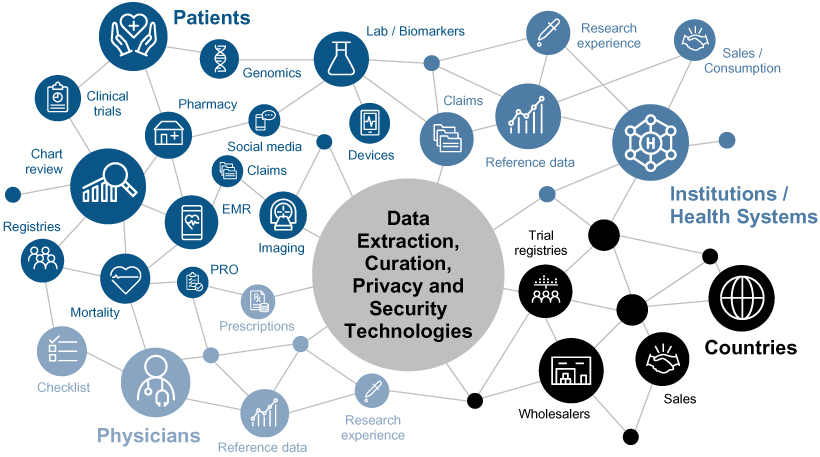

At the time of the Merger, we also set out to integrate the operations of both legacy organizations, committing to run-rate cost savings of $200 million exiting 2019, a goal that we achieved earlier than expected in 2019.

|

Merger Integration Period Capital Deployment

| ||||||

Cash Repatriation $3.4Bn

| Cash Returned to Stockholders via Repurchases $6.0Bn

| |||||

Investments in Product Development and Technology $1.5Bn

| Investments in Acquisitions $1.9Bn

| |||||

| 6 | Proxy Statement Summary | IQVIA 2020 PROXY STATEMENT |

Historical Financial Performance

| ||||||||||

| ||||||||||

| 1 | Dollar values in millions |

| 2 | Growth rates are at actual foreign currency exchange rates |

| 3 | See reconciliation of non-GAAP items in the Appendix |

Historical Financial Performance

Total Stockholder Return Since Merger Announcement (May 3, 2016 to December 31, 2019)

|

| (1) | Peer group consists of Cerner Corporation, Charles River Laboratories, Inc., Equifax Inc., ICON plc, IHS Markit Ltd., Laboratory Corporation of America Holdings, Nielsen N.V., PRA Health Sciences, Inc., Syneos Health, Inc., Thomson Reuters Corporation and Verisk Analytics, Inc. |

This performance graph shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) or incorporated by reference into any filing of IQVIA Holdings Inc. under the Exchange Act or under the Securities Act of 1933, as amended (the “Securities Act”), except as shall be expressly set forth by specific reference in such filing.

| IQVIA 2020 PROXY STATEMENT | Proxy Statement Summary | 7 |

CORPORATE GOVERNANCE HIGHLIGHTS

We have a history of strong corporate governance. We believe good governance is critical to achieving long-term stockholder value creation. We are committed to governance practices and policies that serve the long-term interests of the Company and its stockholders. The following table summarizes certain highlights of our corporate governance practices and policies:

| Each share of our common stock outstanding on the record date is entitled to one vote per matter presented to stockholders |

| Securities Trading Policy, including Anti-Hedging and Anti-Pledging terms |

| Regular Board and Committee Executive Sessions of Non-Management Directors |

| Risk Oversight by the Board and Committees |

| Multi-Year Vesting Requirements for Performance Share Awards |

| Annual Board and Committee Self Assessments |

| All directors except our Chief Executive Officer are independent |

| Audit Committee Approval Required for Related Party Transactions |

| Share Ownership Guidelines for both Directors and Key Executives |

| Comprehensive Whistleblower Policy in place |

| Adopted a proxy access bylaw |

| Lead Director, elected by the independent directors |

| Consider a broad range of diverse director candidates, including with respect to gender, race and ethnicity |

| Director Resignation Policy whereby directors are required to tender their resignation if they receive a number of withhold votes that is greater than 50% of all votes cast |

| Enhanced proxy statement disclosure on board composition, stockholder engagement and sustainability and corporate citizenship matters, among other enhancements |

| No “Poison Pill” (Stockholder Rights Plan) |

| No Excise Tax Gross-Ups on Severance or Change in Control Payments or Benefits |

| 8 | Proxy Statement Summary | IQVIA 2020 PROXY STATEMENT |

COMPENSATION PRACTICES

The Leadership Development and Compensation (“LDC”) Committee of the Board oversees the design and administration of our compensation programs. The executive compensation program is designed and administered in a manner that appropriately manages risk to safeguard the interests of our stockholders, as well as our employees. The following table summarizes key highlights of our compensation practices that drive our named executive compensation program:

WHAT WE DO

| Align executive pay with performance |

| Set challenging performance objectives for our named executive officers |

| Appropriately balance short- and long-term incentives |

| Align executive compensation with stockholder returns through performance-based long-term incentive awards |

| Use multi-year vesting requirements for long-term awards |

| Implement meaningful share ownership guidelines |

| Annual named executive officer performance evaluation by the LDC Committee |

| Robust clawback policy in place for our cash and equity incentive compensation for financial restatements |

| Include non-solicitation and non-competition provisions in awards agreements |

| Conduct an annual compensation risk review and assessment |

| Utilize expertise of an independent compensation consultant |

WHAT WE DON’T DO

| No contracts with multi-year guaranteed salary increases or non-performance bonus arrangements |

| No excise tax gross-ups |

| No single trigger equity vesting |

| No repricing of underwater stock options or SARs without stockholder approval |

| No payment of unearned dividends prior to vesting |

| No hedging or pledging of Company shares |

| IQVIA 2020 PROXY STATEMENT | Proxy Statement Summary | 9 |

SAY-ON-PAY

|

Stockholders showed strong support of our executive compensation program in our last “say-on-pay” vote at our 2017 annual meeting of stockholders, which our stockholders previously approved to hold every three years, with approximately 88% of votes cast in favor of the proposal. See Proposal No. 2: Non-Binding Vote on Executive Compensation on page 39 for further details on this year’s say-on-pay vote.

|

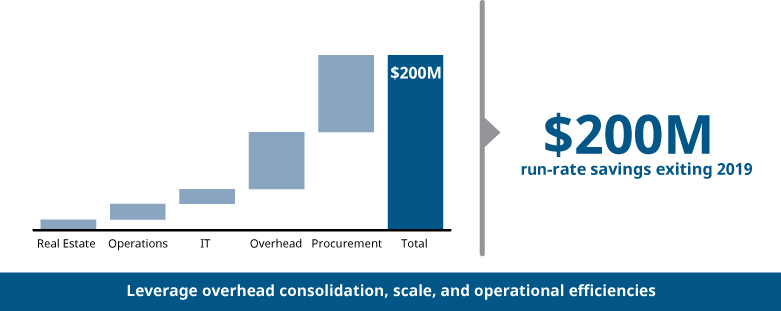

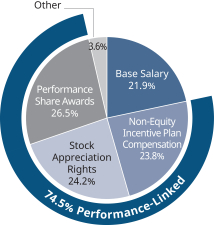

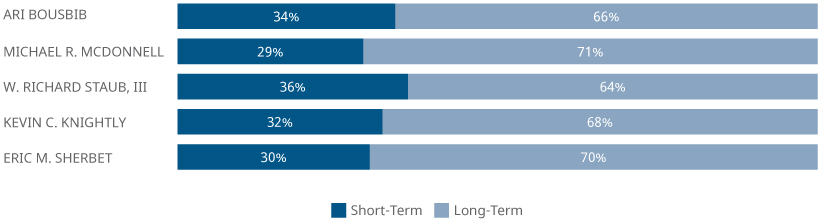

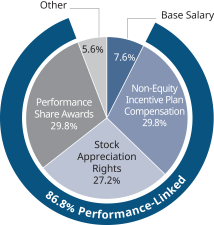

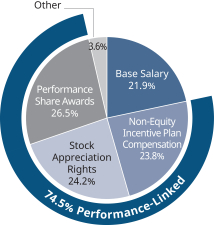

2019 COMPENSATION MIX

Our executive compensation program is focused on creating an alignment between executive compensation and business performance by rewarding our executive officers for the achievement of strategic goals that are intended to contribute to long-term stockholder value. We emphasize performance-based, variable compensation over fixed compensation. The following charts reflect the mix of pay for our Chief Executive Officer (86.8% performance-linked) and the average for our other executive officers who are listed in the “Summary Compensation Table” below and the other compensation tables included in this Proxy Statement (collectively, our “named executive officers”) as a group (74.5% performance-linked):

Chief Executive Officer

| Average of other Named Executive Officers

| |

|  |

| 10 | Proxy Statement Summary | IQVIA 2020 PROXY STATEMENT |

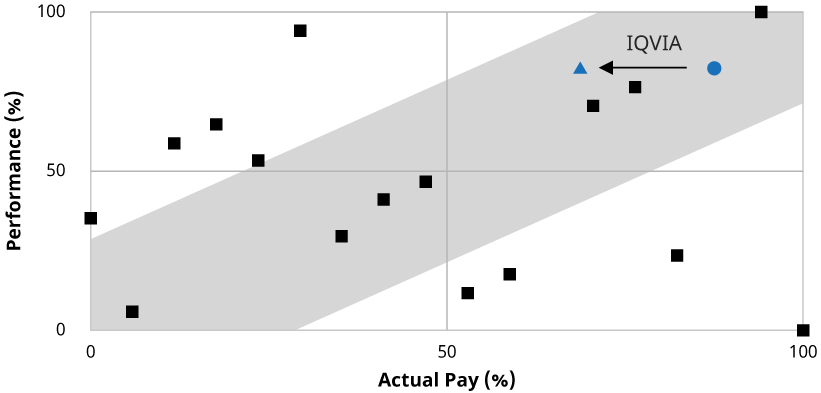

PAY-FOR-PERFORMANCE

The LDC Committee believes that our executive compensation program should align the interests of stockholders and management by providing a strong alignment between executive compensation and total stockholder return. The graph below shows the relative alignment of our Chief Executive Officer’s (including his predecessor’s compensation from January 1, 2016 until the closing of the Merger on October 3, 2016) historic pay against performance with respect to total stockholder return over the three-year period ended December 31, 2018 against a peer group determined by one of the leading proxy advisory firms. The three-year period ended December 31, 2018 is the latest period for which information is publicly available from the peer group.

Our Chief Executive Officer’s compensation during the three-year period ended December 31, 2018 included a special retention grant of restricted stock provided by the LDC Committee following the Merger that vests over a four-year period. The LDC Committee granted the award to our Chief Executive Officer to further incentivize his continued engagement and long-term commitment to our business and to recognize that our Chief Executive Officer, post-Merger, assumed responsibility for a much larger and more complex organization. When deciding the terms of this special retention grant, the LDC Committee considered the fact that approximately 90% of the value associated with the outstanding equity awards held by our Chief Executive Officer as of January 2017 would be fully vested or exercisable within approximately 12 months, making it much easier for a competitor to recruit our Chief Executive Officer and providing him with less of a financial incentive to stay in the face of a potential higher offer from another company. For the three-year period ended December 31, 2018, our performance with respect to total stockholder return was in the88th percentile and the total compensation, including the special retention equity grant, for our Chief Executive Officer was in the88th percentile, which indicates that our Chief Executive Officer’s pay and our performance are strongly aligned. Excluding our Chief Executive Officer’s special retention equity grant in 2017, his total compensation was in the69th percentile.

For details of our Chief Executive Officer’s 2019 compensation, see “Compensation of Named Executive Officers”.

Alignment of Historic CEO Pay

January 1, 2016 - December 31, 2018

| IQVIA (incudes 2017 Retention Grant) |

| IQVIA (excludes 2017 Retention Grant) |

| Peer Companies include Agilent Technologies, Inc., Automatic Data Processing, Inc., Bausch Health Companies Inc., Cognizant Technology Solutions Corp., DaVita, Inc., DXC Technology Co., IHS Markit Ltd., Laboratory Corp of America Holdings, Leidos Holdings, Inc., ManpowerGroup, Inc., Mylan NV, Nielsen Holdings PLC, Perrigo Co. Plc, Quest Diagnostics, Inc., Syneos Health, Inc., and Thermo Fisher Scientific, Inc. |

| IQVIA 2020 PROXY STATEMENT | | 11 |

Our Certificate of Incorporation provides for a board of directors divided into three classes, designated Class I, Class II and Class III. Each year, a different class of directors is elected at our annual meeting of stockholders and each elected director holds office for a 3-year term or until his or her successor is duly elected or until his or her earlier death, resignation, retirement, disqualification or removal.

This year,Class I directors

Carol J. Burt

Colleen A. Goggins

Ronald A. Rittenmeyer

will stand for election for a new term.

As Jonathan J. Coslet and Michael J. Evanisko, both Class I directors, will not stand for reelection at the 2020 Annual Meeting, the Board decided to rebalance the director classes. As a result, Colleen A. Goggins, who was serving as a Class II director, and Carol J. Burt, who was serving as a Class III director, will each stand for election this year as a Class I director. Following our 2020 Annual Meeting, assuming each director nominee is elected to a new term by the stockholders, the Board will consist of nine (9) directors, divided into the following three classes:

| Class | Directors | Year Term Expires | ||

Class I |

Carol J. Burt Colleen A. Goggins Ronald A. Rittenmeyer |

2023 | ||

Class II |

Ari Bousbib John M. Leonard, M.D. Todd B. Sisitsky |

2021 | ||

Class III |

John P. Connaughton John G. Danhakl James A. Fasano |

2022 | ||

Consistent with the requirements of our governance documents and upon the recommendation of the Nominating and Governance Committee, the Board has nominated Carol J. Burt, Colleen A. Goggins and Ronald A. Rittenmeyer for election for a new term as a Class I director at the 2020 Annual Meeting. If elected to a new term at the 2020 Annual Meeting, each Class I director nominee will be elected for a term of three years and serve until his or her successor is duly elected and qualified or until his or her earlier death, resignation, retirement, disqualification or removal.

The Board believes that each of the nominees has a record of integrity, a strong professional reputation and a record of entrepreneurial or managerial achievement. The specific experience, qualifications, attributes and skills of each nominee that led the Board to conclude that the individual should serve as a director are described in each nominee’s biography below.

Shares represented by executed proxies will be voted, if authority to do so is not withheld, for the election of the three nominees named above. In the event that any nominee should be unavailable for election as a result of an unexpected occurrence, and the Board does not, in that event, choose to reduce the size of the Board, such shares will be voted for the election of such substitute nominee as the Board may propose. Each person nominated for election has agreed to serve if elected, and management has no reason to believe that any nominee will be unable to serve. Directors are elected by a plurality of the votes cast at the 2020 Annual Meeting.

|

THE BOARD RECOMMENDS A VOTE“FOR” THE ELECTION OF

|

| 12 | Proposal No. 1 | IQVIA 2020 PROXY STATEMENT |

The following table sets forth, for the Class I director nominees and each person whose term of office as a director will continue in office after the 2020 Annual Meeting, certain information about them, including their ages as of the date of this Proxy Statement:

| Name | Age | Position Held with the Company | Audit(1) | N&G(2) | LDC(3) | Director Since | ||||||||||||||

Class I Directors to be elected to terms that will expire at the 2023 Annual Meeting of Stockholders |

| |||||||||||||||||||

Carol J. Burt | 62 | Director |

| X |

|

| 2019 |

| ||||||||||||

Colleen A. Goggins | 65 | Director |

| X |

|

| X |

|

| 2017 |

| |||||||||

Ronald A. Rittenmeyer | 71 | Director |

| X |

|

| Chair |

|

| 2016 |

| |||||||||

Class II Directors whose terms expire at the 2021 Annual Meeting of Stockholders |

| |||||||||||||||||||

Ari Bousbib | 58 | Chairman and Chief Executive Officer |

| 2016 |

| |||||||||||||||

John M. Leonard, M.D. | 62 | Lead Director |

| X |

|

| X |

|

| 2015 |

| |||||||||

Todd B. Sisitsky | 48 | Director |

| Chair |

|

| X |

|

| 2016 |

| |||||||||

Class III Directors whose terms expire at the 2022 Annual Meeting of Stockholders |

| |||||||||||||||||||

John P. Connaughton | 54 | Director |

| X |

|

| 2008 |

| ||||||||||||

John G. Danhakl | 63 | Director |

| X |

|

| X |

|

| 2016 |

| |||||||||

James A. Fasano | 49 | Director |

| Chair |

|

| 2016 |

| ||||||||||||

| (1) | Member of the Audit Committee of the Board |

| (2) | Member of the Nominating and Governance Committee of the Board |

| (3) | Member of the LDC Committee of the Board |

Diversity and Tenure. Consistent with our Corporate Governance Guidelines, the Board seeks a mix of directors that enhances the diversity of backgrounds, skills and experiences on the Board, including with respect to professional skills, relevant industry expertise, specialized experience, international experience, age, gender, race and ethnicity. The Board believes that considering diversity in our Board composition is consistent with the goal of creating a Board that best serves the needs of the Company and the interests of its stockholders, and it is one of the many factors considered when identifying individuals for Board service.

| IQVIA 2020 PROXY STATEMENT | Proposal No. 1 | 13 |

Since the Merger in 2016, and as the director nomination requirements of the Shareholders Agreement (as defined herein) have fallen away, the Board has been focused on refreshing the composition of the Board in order to ensure the appropriate mix of backgrounds, skills and experiences in light of the Company’s post-Merger strategy and to enhance the diversity of the Board. Since the Merger, two directors have retired from the Board and two directors, who are both women, have joined the Board. The Board expects to continue to seek new directors who will further enhance the mix of experiences and backgrounds of the current Board. The following statistics highlight the diversity of the composition of our Board following the 2020 Annual Meeting.

Gender

| Age Distribution | Significant Board Refreshment | ||||||||||

* 100% of new director appointments since the Merger have been female directors | 59 | Average Age of Directors 48-71 – Age Range | 8 | New Directors over Past5 Years | ||||||||

Qualifications and experience of directors. We believe our directors bring a well-rounded variety of experiences, qualifications, attributes and skills, and represent a mix of deep knowledge of the Company and fresh perspectives. As we review our long-term strategy, we continually assess the skills of our directors in evaluating what current and future skills and experiences will be required and weigh those skills when evaluating our current directors as well as potential director candidates. The table below summarizes certain of the key experiences, qualifications and core competencies of our directors.

| Skill1 | Total of 9 | |||||||||||||||||||||||||||||||||||||||

| Senior Leadership Experience

| 9 | ||||||||||||||||||||||||||||||||||||||

| Public Company Board Experience

| 6 | ||||||||||||||||||||||||||||||||||||||

| Healthcare Industry Experience

| 9 | ||||||||||||||||||||||||||||||||||||||

| Technology Industry Experience

| 4 | ||||||||||||||||||||||||||||||||||||||

| Financial Expertise

| 7 | ||||||||||||||||||||||||||||||||||||||

| Global Experience

| 8 | ||||||||||||||||||||||||||||||||||||||

| 1 | This high-level summary is not intended to be an exhaustive list of each of our directors’ skills or contributions to the Board. |

| 14 | Proposal No. 1 | IQVIA 2020 PROXY STATEMENT |

Set forth below is biographical information for the Class I director nominees and each person whose term of office as a director will continue after the 2020 Annual Meeting.

Class I Director for Election to a Three-Year Term Expiring at the 2023 Annual Meeting of Stockholders

| CAROL J.BURT | ||

Director Since2019

Independent

62 years old

Audit Committee(Member)

Audit Committee Financial Expert |

Burt-Hilliard Investments (2008-present) • Principal

Consonance Capital Partners (2013-present) • Senior Advisor • Member, Operating Council

WellPoint, Inc. (now Anthem, Inc.) (1997-2007) • SVP Corporate Finance and Development

Chase Securities (now J.P. Morgan) (1981-1996) • Managing Director and Head of the Healthcare Group (1992-1996)

Other U.S. public company directorships: • ResMed Inc. (Audit Committee and Compliance Oversight Committee)

Former U.S. public company directorships held in the past five years: • Envision Healthcare Corporation • WellCare Health Plans, Inc.

Other positions: • Member, Board of Directors, WellDyneRx, LLC; Global Medical Response Inc. • Member, Women Corporate Directors • Chair, Board of Directors, Colorado Chapter of The Nature Conservancy

Education: • Bachelor of Arts in Business Administration, the University of Houston | |

| ||

| Specific Experience: Because of her leadership experience and over 35 years of business experience in the health insurance, healthcare services and financial services industries and her experience serving on public company boards, we believe Ms. Burt is well qualified to serve on the Board. | ||

| IQVIA 2020 PROXY STATEMENT | Proposal No. 1 | 15 |

| COLLEEN A.GOGGINS | ||

Director Since2017

Independent

65years old

Audit Committee (Member)

Nominating and Governance

Audit Committee Financial Expert |

Johnson & Johnson (1981-2011) • Member, Executive Committee (2001-2011) • Worldwide Chairman, Consumer Group (2001-2011) • Company Group Chairman, North America (1998-2001) • President Consumer Products US (1995-1998)

Other U.S. public company directorships: • The Toronto-Dominion Bank (Risk Committee)

Former U.S. public company directorships held in the past five years: • Bausch Health Companies Inc. (f/k/a Valeant Pharmaceuticals International)

Other positions: • Member, Board of Directors, SIG Combibloc Group; Citymeals-on-Wheels New York City; University of Wisconsin Center for Brand and Product Management • Member, Supervisory Board, Bayer AG • Member, University of Wisconsin Foundation • Member, Board of Trustees, Institute of International Education

Education: • Master of Arts in Management, Kellogg School of Management • Bachelor of Science in Food Chemistry, University of Wisconsin-Madison | |

| ||

| Specific Experience: Because of Ms. Goggins’s extensive leadership and healthcare experience, we believe Ms. Goggins is well qualified to serve on the Board. Ms. Goggins was designated for nomination to the Board pursuant to the Shareholders Agreement described herein. The designation provisions in the Shareholders Agreement under which Ms. Goggins was designated to the Board terminated in 2018. | ||

| 16 | Proposal No. 1 | IQVIA 2020 PROXY STATEMENT |

| RONALD A.RITTENMEYER | ||

Director Since2016

Independent

71 years old

Audit Committee (Member)

LDC Committee (Chair)

Audit Committee Financial Expert |

Tenet Healthcare Corporation (2017-present) • Executive Chairman and Chief Executive Officer

Millennium Health (2016-2017) • Chairman and Chief Executive Officer

Electronic Data Systems Corporation (2005-2008) • Chairman and Chief Executive Officer (2007-2008) • President (2006-2007) • Chief Operating Officer (2005-2007) • Executive Vice President, Global Service Delivery (2005-2006)

Other U.S. public company directorships: • Tenet Healthcare Corporation

Former U.S. public company directorships held in the past five years: • American International Group, Inc. • IMS Health (predecessor to IQVIA) • Millennium Health

Education: • Master of Business Administration, Rockhurst University • Bachelor of Arts in Commerce and Economics (Finance), Wilkes University | |

| ||

| Specific Experience: Because of his leadership experience, over 30 years of business experience and extensive experience serving on public company boards, we believe Mr. Rittenmeyer is well qualified to serve on the Board. For his current term expiring at the 2020 Annual Meeting, Mr. Rittenmeyer was designated for nomination to the Board pursuant to the Shareholders Agreement described herein. The designation provisions in the Shareholders Agreement under which Mr. Rittenmeyer was designated to the Board terminated in 2018. | ||

| IQVIA 2020 PROXY STATEMENT | Proposal No. 1 | 17 |

| Class II Directors Continuing in Office until the 2021 Annual Meeting of Stockholders | ||

| ARIBOUSBIB | ||

Director Since 2016

Chairman and CEO

58 years old |

IQVIA Holdings Inc. (2010-present) • Chairman and Chief Executive Officer (2016-present) • Chairman and Chief Executive Officer of IMS Health (2010-2016)

United Technologies Corporation (1997-2010) • President of UTC’s commercial companies (Otis Elevator Company, Carrier Corporation, UTC Fire & Security and UTC Power Inc.) (2008-2010) • President, Otis Elevator Company (2002-2008) • Chief Operating Officer, Otis Elevator Company (2000-2002)

Other U.S. public company directorships: • The Home Depot, Inc. (Finance Committee and Audit Committee)

Former U.S. public company directorships held in the past five years: • IMS Health (predecessor to IQVIA)

Other positions: • Member, Harvard Medical School Health Care Policy Advisory Council

Education: • Master of Business Administration, Columbia University • Master of Science in Mathematics and Mechanical Engineering, Ecole Superieure des Travaux Publics, Paris | |

| ||

| Specific Experience: Because of Mr. Bousbib’s extensive leadership experience and service as our Chief Executive Officer, we believe Mr. Bousbib is well qualified to serve on the Board. Mr. Bousbib was designated for nomination to the Board pursuant to the Shareholders Agreement described herein. The designation provisions in the Shareholders Agreement under which Mr. Bousbib was designated to the Board terminated in 2018. | ||

| 18 | Proposal No. 1 | IQVIA 2020 PROXY STATEMENT |

| JOHN M.LEONARD, M.D. | ||

Director Since2015

Independent

Lead Director

62years old

Audit Committee (Member)

Nominating and Governance

Audit Committee Financial Expert |

Intellia Therapeutics, Inc. (2018-present) • Director, President and Chief Executive Officer

AbbVie Inc. (January 2013-December 2013) • Chief Scientific Officer and Senior Vice President of Research and Development

Abbott Laboratories (1992-2012) • Senior Vice President of Global Pharmaceutical Research and Development (2008-2012)

Other U.S. public company directorships: • Intellia Therapeutics, Inc.

Education: • Doctorate in Medicine, Johns Hopkins University • Bachelor of Arts in Biochemistry, University of Wisconsin-Madison | |

Specific Experience: Because of his leadership experience, including his over 30 years’ experience in medicine, research and management, we believe Dr. Leonard is well qualified to serve on the Board. Dr. Leonard was designated for nomination to the Board pursuant to the Shareholders Agreement described herein. The designation provisions in the Shareholders Agreement under which Dr. Leonard was designated to the Board terminated in 2018. | ||

| TODD B.SISITSKY | ||

Director Since2016

Independent

48years old

LDC Committee (Member)

Nominating and Governance |

TPG Capital (2003-present) • Co-Managing Partner

Other U.S. public company directorships: • Allogene Therapeutics, Inc. (Audit Committee, Nominating and Corporate Governance Committee)

Former U.S. public company directorships held in the past five years: • Endo International plc • IASIS Healthcare LLC • IMS Health (predecessor to IQVIA)

Other positions: • Chair, Board of Advisors, Dartmouth Medical School • Member, Board of Directors, Convey Health Solutions, Inc.; Adare Pharmaceuticals, Inc.; Immucor Inc.

Education: • Master of Business Administration, Stanford Graduate School of Business • Bachelor of Arts, Dartmouth College | |

| ||

Specific Experience: Because of his extensive experience in leadership, business and healthcare, we believe Mr. Sisitsky is well qualified to serve on the Board. Mr. Sisitsky was designated for nomination to the Board by TPG pursuant to the Shareholders Agreement described herein. TPG’s designation rights under the Shareholders Agreement ceased in 2019.

| ||

| IQVIA 2020 PROXY STATEMENT | Proposal No. 1 | 19 |

| Class III Directors Continuing in Office until the 2022 Annual Meeting of Stockholders | ||

| JOHN P.CONNAUGHTON | ||

Director Since2008

Independent

54years old

LDC Committee (Member) |

Bain Capital (1989-present) • Co-Managing Partner

Former U.S. public company directorships held in the past five years: • iHeartMedia, Inc.

Other positions: • Member, Board of Directors, The Boston Celtics • Member, Board of Trustees, The Berklee College of Music; University of Virginia McIntire Foundation

Education: • Master of Business Administration, Harvard Business School • Bachelor of Science in Commerce, University of Virginia

| |

| Specific Experience: Because of his extensive experience as a Managing Director of Bain Capital, service on other public company boards and over 15 years’ experience in the private equity industry, as well as extensive experience in the healthcare industry, we believe Mr. Connaughton is well qualified to serve on the Board. | ||

| JOHN G.DANHAKL | ||

Director Since2016

Independent

63years old

LDC Committee (Member)

Nominating and Governance |

Leonard Green & Partners, L.P. (1995-present) • Managing Partner

Former U.S. public company directorships held in the past five years: • IMS Health (predecessor to IQVIA)

Other positions: • Member, Board of Directors: Life Time Fitness, Inc.; Advantage Solutions Inc.; Charter NEX; Global Citizen CPA Global; Genani Corporation; Insight Global, Inc.; Mister Car Wash Holdings, Inc.; MultiPlan, Inc.; Savers, Inc.; SRS Distribution

Education: • Master of Business Administration, Harvard Business School • Bachelor of Arts in Economics, University of California at Berkeley

| |

| Specific Experience: Because of his extensive experience serving as a public company director and his extensive experience in leadership and business, we believe Mr. Danhakl is well qualified to serve on the Board. | ||

| 20 | Proposal No. 1 | IQVIA 2020 PROXY STATEMENT |

| JAMES A.FASANO | ||

Director Since2016

Independent

49years old

Audit Committee (Chair)

Audit Committee

Financial Expert |

Canada Pension Plan Investment Board (2004-present) • Managing Director

Former U.S. public company directorships held in the past five years: • IMS Health (predecessor to IQVIA)

Other positions: • Member, Board of Directors, NEWAsurion

Education: • Master of Business Administration, University of Chicago Graduate School of Business • Bachelor of Engineering, Royal Military College of Canada | |

Specific Experience: Because of Mr. Fasano’s extensive experience as a Managing Director at CPPIB and experience in finance and leadership roles, we believe he is well qualified to serve on the Board.

| ||

| IQVIA 2020 PROXY STATEMENT | | 21 |

The Board is responsible for supervision of the overall affairs of the Company. The Board oversees our senior management, to whom it has delegated authority to manage the day-to-day operations of the Company. Members of the Board are kept informed of our business through discussions with our Chief Executive Officer and other officers, by reviewing materials provided to them and by participating in regular, as well as special, meetings of the Board and its committees. In addition, to promote open discussion among our non-management and independent directors, those directors meet in regularly scheduled executive sessions without the participation of our Chief Executive Officer. The Board has adopted Corporate Governance Guidelines, which, together with our Certificate of Incorporation and Bylaws and the other documents listed below, form the governance framework for the Board and its committees. The following sections provide an overview of our corporate governance structure, including director independence and other criteria we use in selecting director nominees, our board leadership structure and the responsibilities of the Board and each of its committees.

DOCUMENTS ESTABLISHING OUR CORPORATE GOVERNANCE

The Board has a long-standing commitment to sound and effective corporate governance practices. The following key documents are the foundation of corporate governance at the Company:

• Corporate Governance Guidelines |

• Audit Committee Charter | |

• Code of Conduct | • LDC Committee Charter | |

• Certificate of Incorporation | • Nominating and Governance Committee Charter | |

• Bylaws

| ||

These documents and other important information on our corporate governance are posted in the “Corporate Governance” section of the “Investor Relations” section of our website under “Governance Documents” and “Committee Charters” and may be viewed at http://ir.iqvia.com. We will also provide printed copies of these documents free of charge to any stockholder who sends Investor Relations a request at: IQVIA Holdings Inc., 100 IMS Drive, Parsippany, New Jersey 07054.

| 22 | IQVIA’s Corporate Governance | IQVIA 2020 PROXY STATEMENT |

CORPORATE GOVERNANCE PRACTICES

IQVIA believes that a strong corporate governance framework is essential to our long-term success. We are committed to adopting and following strong corporate governance practices because we believe that such practices promote an environment of accountability for the Board and our senior management and otherwise promote the long-term interests of our stockholders. Our governance practices and policies include the following:

Independent Board |

All our directors are independent except for our Chairman and Chief Executive Officer | |

Independent Board committees |

Each of our three Board committees is composed solely of independent directors | |

Independent Lead Director; regular executive sessions |

We have an independent Lead Director, who was elected by our independent directors, who has comprehensive duties set forth in our Corporate Governance Guidelines, including leading regular executive sessions of the Board, where independent directors meet without management present | |

Annual Board and committeeself-assessment process |

The Board and each Board committee, led by their respective chairs, conducts a self-assessment annually to determine whether it is functioning efficiently and meeting its governance responsibilities | |

Active stockholder engagement |

We regularly meet with our stockholders to better understand their perspectives, and we enhanced our stockholder engagement and outreach efforts in 2019 | |

Robust Code of Conduct |

Our code of conduct, Doing the Right Thing, applies to our directors, officers and employees, including our principal executive officer, principal financial officer, principal accounting officer, controller or persons performing similar functions. The code of conduct is a guide to the responsibilities we share for ethical business conduct and paints a clear picture of what we stand for as an organization, what we expect from ourselves, and what we must do to maintain our reputation | |

Prohibition on hedging or pledging of Company stock |

Our securities trading policy prohibits hedging transactions with respect to, and the pledging of, our securities by any of our directors, officers or other employees or their immediate family members, except where the individual receives prior written approval from the General Counsel. In 2019, the General Counsel did not approve any stock hedging or pledging transactions and none of our current executive officers or directors have entered into any such hedging or pledging transactions | |

Share ownership requirements |

We have robust share ownership guidelines, which require our named executive officers to hold between 3 times and 6 times base salary. Our share ownership policy requires our executive officers to hold 50% of the net shares received by them as a result of the exercise, vesting or settlement of long-term incentive awards until they meet their required ownership levels | |

Clawback Policy |

We maintain a clawback policy that applies to current and former executive officers, among others, that provides for the recoupment of short- and long-term incentive compensation in the event of a financial restatement under specified circumstances | |

Director Resignation Policy |

Directors are required to tender their resignation if they receive a number of withhold votes that is greater than 50% of all votes cast | |

Adopted a proxy access right |

Eligible stockholders may, subject to certain requirements, include their own director nominees in our proxy materials |

| IQVIA 2020 PROXY STATEMENT | IQVIA’s Corporate Governance | 23 |

Chairman and Chief Executive Officer

Mr. Bousbib became our Chairman and Chief Executive Officer on October 3, 2016, in connection with the Merger. We believe that the current board leadership structure, with the Chairman and Chief Executive Officer roles combined, is appropriate and in the best interests of our stockholders because our Chief Executive Officer has a unique depth of knowledge about the Company and the varied and complex opportunities and challenges we face. The role of the Chairman is to set the agenda for the board meetings and to preside over general board sessions. When the Board meets in executive session without management present to evaluate management’s performance, these sessions are presided by our independent Lead Director. Independent directors also evaluate our leadership structure regularly and garner feedback from stockholders. Our Chairman and Chief Executive Officer and the Lead Director communicate regularly during the course of the year.

The current board leadership structure provides for effective and efficient leadership because, among other things, it recognizes the value of one person both speaking for and leading the Company and the Board. The Board recognizes that there may be circumstances in the future that would lead it to separate these offices, but it does not believe there is any reason to do so at this time. The Board believes that this subject is primarily a matter of the succession planning process and that it is in the best interest of the Company for the Board to make this determination when it elects a new Chief Executive Officer or under such other circumstances that it believes are best for the Company at a given point in time.

Lead Director; Executive Sessions

The Lead Director helps ensure there is an appropriate balance between management and the independent directors and that the independent directors are fully informed and able to discuss and debate the issues that they deem important. Our current Lead Director is Dr. Leonard. The responsibilities of the Lead Director, as outlined in our Corporate Governance Guidelines include, among others:

| Board Matter | Responsibility | |

Communicating with directors | Liaising between non-management directors and management | |

Executive sessions | Presiding at executive sessions of non-management directors | |

Board meetings | Presiding at all Board meetings when the Chairman is not present | |

Agendas | Consulting with the Chairman on matters pertinent to the Company and the Board, including meeting agendas, schedules and information sent to the Board | |

Communicating with stockholders | Consulting with major stockholders, as appropriate | |

The Board believes that one of the key elements of effective, independent oversight is that the independent directors meet in executive session on a regular basis without the presence of management. Accordingly, our independent directors meet separately in executive session at each regularly scheduled in-person Board meeting. Our independent directors held four executive sessions during 2019, all of which were led by the Lead Director.

Board Committees

To assist in carrying out its duties, the Board has delegated authority to three committees: the Audit Committee, the LDC Committee and the Nominating and Governance Committee. The Board held six (6) meetings during fiscal 2019. All of our current directors attended at least 75% of the total

| 24 | IQVIA’s Corporate Governance | IQVIA 2020 PROXY STATEMENT |

number of meetings of the Board and Board committees on which they served in 2019. Eight (8) directors attended the annual meeting of the stockholders in 2019.

The Board oversees the management of our business by our Chief Executive Officer and senior management. Our Certificate of Incorporation provides that the Board shall consist of at least five (5) directors but not more than seventeen (17) directors and that the number of directors may be fixed from time to time by resolution of the Board.

The Board is divided into three classes. Upon the expiration of the initial term of office for each class of directors, each director in such class shall be elected for a term of three years and serve until his or her successor is duly elected and qualified or until his or her earlier death, resignation, retirement, disqualification or removal. Any additional directorships resulting from an increase in the number of directors or a vacancy may be filled by the directors then in office.

In connection with the Merger, the Company entered into the Shareholders Agreement, which addresses, among other things, certain board designation rights, registration rights and transfer restrictions. The Board designation rights for each of the parties to the Shareholders Agreement have since ceased.

Following our 2020 Annual Meeting, the Board will be comprised of nine (9) directors, each of whom was designated for nomination as a director in accordance with our governance documents.

The Board conducted an assessment of the independence of each director and determined that, other than our Chief Executive Officer, each of our directors continuing in office after the 2020 Annual Meeting is currently independent:

8 of9 IQVIA Directors are Independent | › | • Carol J. Burt

• John P. Connaughton

• John G. Danhakl

• James A. Fasano | • Colleen A. Goggins

• John M. Leonard, M.D.

• Ronald A. Rittenmeyer

• Todd B. Sisitsky | |||

In accordance with our Corporate Governance Guidelines and the corporate governance standards of the New York Stock Exchange (“NYSE”), this determination of independence means that the Board finds that the director has no material relationship with the Company, directly or indirectly, that would interfere with his or her exercise of independent judgment as a director of the Company. With respect to directors who are members of the Audit Committee and the LDC Committee, the Board has determined that each director meets an even higher standard as required by Securities and Exchange Commission (the “SEC”) and NYSE rules.

The Board has also determined that Ms. Burt, Messrs. Fasano and Rittenmeyer and Dr. Leonard are “Audit Committee Financial Experts” as such term also is defined in SEC rules and that each member of the Audit Committee is financially literate.

| IQVIA 2020 PROXY STATEMENT | IQVIA’s Corporate Governance | 25 |

The Board has three standing committees:

| • | Audit Committee |

| • | Leadership Development and Compensation Committee |

| • | Nominating and Governance Committee |

From time to time, the Board may also create ad hoc or special committees for certain purposes. Each committee is comprised solely of independent, non-employee directors. The charter of each committee provides that non-management directors who are not members of such committee may nonetheless attend meetings of such committee, but they may not vote.

| 26 | IQVIA’s Corporate Governance | IQVIA 2020 PROXY STATEMENT |

AUDIT COMMITTEE | ||

2019 Meetings: The Audit Committee held eight (8) meetings during fiscal 2019

Members in 2019:

James A. Fasano (Chair)

Michael J. Evanisko

Colleen A. Goggins

John M. Leonard, M.D.

Ronald A. Rittenmeyer | Responsibilities:

• Assisting the Board in fulfilling its oversight responsibilities relating to: (i) the integrity of the Company’s financial statements, (ii) the Company’s compliance with legal and regulatory requirements, including its quality assurance function overseeing clinical trial services, (iii) the independent auditor’s qualifications and independence, (iv) the performance of the Company’s internal audit function and the independent auditor, and (v) the performance of the Company’s compliance and ethics program

• Reviewing and discussing with management and the independent auditor the annual and quarterly financial statements prior to the filing of the Company’s Annual Report on Form 10-K and Quarterly Reports onForm 10-Q

• Discussing earnings press releases and the financial information and earnings guidance included therein

• Overseeing the relationship between the Company and our independent registered public accounting firm, including:

• Having direct responsibility for its appointment, compensation and retention

• Reviewing the scope of its audit services

• Approving its non-audit services

• Reviewing and evaluating its independence

• Reviewing with internal auditors and the independent auditor the overall scope and plans for audits, including authority and organizational reporting lines and adequacy of staffing and compensation, and monitor the progress and results of such plans during the year

• Reviewing with internal auditors and the independent auditor any audit problems or difficulties, including any restrictions on the scope of the independent auditor’s activities or on access to requested information and any significant disagreements with management, and management’s response to such problems or difficulties

• Overseeing management’s implementation and maintenance of effective systems of internal controls over financial reporting and disclosure controls, and reviewing and discussing with management, internal auditors and the independent auditor the Company’s system of internal control, its financial and critical accounting policies and practices, policies relating to risk assessment and risk management and our major financial risk exposures

• Reviewing and approving all related party transactions and corporate opportunity transactions | |

| IQVIA 2020 PROXY STATEMENT | IQVIA’s Corporate Governance | 27 |

LEADERSHIP DEVELOPMENT AND | ||

| 2019 Meetings: The LDC Committee held five (5)

Members in 2019:

Ronald A. Rittenmeyer (Chair)

John P. Connaughton

John G. Danhakl

Todd B. Sisitsky | Responsibilities:

• Reviewing and approving corporate goals and objectives relevant to the compensation of our Chief Executive Officer and the officers of the Company who report directly to our Chief Executive Officer and all officers who are “insiders” subject to Section 16 of the Exchange Act (“Senior Officers”)

• Evaluating the performance of our Chief Executive Officer and other Senior Officers in light of those goals and objectives and, either as a committee or together with the other independent directors (as directed by the Board), determining and approving, or recommending to the Board for approval, the compensation levels for our Chief Executive Officer and other Senior Officers

• Making recommendations to the Board about the compensation of our directors

• Administering our equity-based plans and management incentive compensation plans and making recommendations to the Board about amendments to such plans and the adoption of any new employee incentive compensation plans

• Recommending to the Board ownership guidelines for the Senior Officers, other executives and non-employee directors, and periodically assessing these guidelines and recommending revisions as appropriate

• Establishing the terms of compensatory arrangements and policies to protect our business, including restrictions that apply to current and former Senior Officers

• Reviewing and approving all Senior Officer employment contracts and other compensatory, severance and change in control arrangements for current and former Senior Officers, reviewing and establishing our overall management compensation and benefits philosophy and policy, and reviewing and approving our policies and procedures for the grant of equity-based awards

• Establishing and reviewing periodically policies and procedures with respect to perquisites

• Reviewing our incentive compensation arrangements to determine whether they encourage excessive risk-taking, reviewing and discussing at least annually the relationship between risk management policies and practices and compensation, and evaluating compensation policies and practices that could mitigate any such risk

• Reviewing the processes for managing executive succession and the results of those processes | |

| 28 | IQVIA’s Corporate Governance | IQVIA 2020 PROXY STATEMENT |

NOMINATING AND GOVERNANCECOMMITTEE | ||

2019 Meetings: The Nominating and Governance Committee held four (4) meetings during fiscal 2019

Members in 2019:

Todd B. Sisitsky (Chair)

John G. Danhakl

Colleen A. Goggins

John M. Leonard, M.D. | Responsibilities:

• Identifying individuals qualified to become members of the Board, consistent with criteria approved by the Board

• Establishing processes for identifying and evaluating Board candidates, including nominees recommended by stockholders

• Recommending to the Board the persons to be nominated for election as directors and to each of the Board’s committees

• Developing and recommending to the Board a set of corporate governance principles

• Articulating to each director what is expected, including reference to the corporate governance principles and directors’ duties and responsibilities

• Reviewing and recommending to the Board practices and policies with respect to directors

• Evaluating and making recommendations to the Board regarding stockholder proposals that relate to corporate governance and other matters related to stockholders

• Overseeing the evaluation of the Board

The Nominating and Governance Committee will consider stockholders’ recommendations of nominees for membership on the Board. Stockholders may recommend candidates for membership on the Board to the Nominating and Governance Committee by submitting the names in writing to: Secretary, IQVIA Holdings Inc., 100 IMS Drive, Parsippany, New Jersey 07054.

The Bylaws specify certain time limitations, notice requirements and other procedures applicable to the submission of nominations before an annual or special meeting. These procedures are described below under the caption “Stockholder Proposals for 2021 Annual Meeting of Stockholders.” | |

| IQVIA 2020 PROXY STATEMENT | IQVIA’s Corporate Governance | 29 |

BOARD’S ROLE IN RISK OVERSIGHT

Our Board actively oversees our enterprise risk management program to ensure that we maintain effective risk management. Our Board’s role in risk oversight is consistent with our overall leadership structure—management is responsible for assessing and managing our risk exposures, and our Board maintains an oversight role, executed through open communication with management and independent oversight of strategic risks. Our Board considers key risk topics in its oversight, including risks associated with our strategic plan, our capital structure, our business activities, and social and environmental matters. Risks are identified by management and reviewed with the appropriate Board committee or the full Board for oversight.

In 2018, we established an Enterprise Risk Council, comprised of leaders from our principal functional areas and business units that meet on a quarterly basis, to update our enterprise risk framework used to identify and manage our key risks. The framework considers external and internal factors that could impede the achievement of our business objectives or damage our brand, reputation or financial condition. The Board reviews these key risks and the related framework annually, and the Board or appropriate Board committees discuss selected risks in more detail throughout the year, as discussed below.

While our Board has the ultimate oversight responsibility for the risk management process, our Board’s committees assist it in fulfilling its oversight responsibilities in certain areas of risk. In particular, our Audit Committee focuses on risks associated with our financial statements, internal accounting and financial controls, internal and external audits, cybersecurity, compliance with legal and regulatory matters and performance of our compliance and ethics program in connection therewith, including our guidelines and policies with respect to risk assessment and risk management and our major financial risk exposures. Our LDC Committee focuses on risks associated with our compensation policies and practices, including those for our executive officers. Our Nominating and Governance Committee focuses on risks associated with our corporate governance policies and practices.

Each of these committees reports to our Board with respect to the risk categories it oversees. These ongoing discussions enable our Board to monitor our risk exposure and evaluate our risk mitigation efforts. In addition, our risk management function conducts regular interviews and surveys of key employees relating to enterprise risk management and reports the results and analysis of such interviews and surveys to our Board.

SUCCESSION PLANNING FOR DIRECTORS AND EXECUTIVE OFFICERS

Directors. Vacancies on the Board may occur from time to time. The Bylaws provide that any vacancy caused by the death or resignation of a director may be filled by the affirmative vote of a majority of the directors then in office.

Subject to the terms of the Bylaws, the Nominating and Governance Committee is responsible for recommending to the Board the persons to be nominated for election as directors and to each of the Board’s committees. It is the Board’s policy that the composition of the Board at all times adhere to the standards of independence promulgated by the NYSE as further clarified herein and reflect a range of talents, ages, skills, character, diversity and expertise, particularly in the areas of accounting and finance, management, domestic and international markets, leadership and corporate governance, our industry and the markets we serve sufficient to provide sound and prudent guidance with respect to our operations and interests.

As provided in its Corporate Governance Guidelines, the Board also seeks to achieve a mix of directors that enhances the diversity of background, including with respect to professional skills, relevant

| 30 | IQVIA’s Corporate Governance | IQVIA 2020 PROXY STATEMENT |

industry experience, specialized expertise, international experience, gender, race and ethnicity, to maintain a diverse membership. The process of determining to add a new Board member and identifying qualified candidates begins well in advance of anticipated vacancies. Under this ongoing process, the Chairman of the Nominating and Governance Committee and our Chief Executive Officer monitor and maintain an open dialogue, and also consult with the other members of the Board, including our Lead Director, regarding the size of the Board, future retirements and director attributes desired for any new directorships. Once a decision has been made to recruit a new director, the Nominating and Governance Committee may retain an executive recruitment organization to assist it in its search by providing a range of qualified candidates.

The Board has been, and will continue to be, focused on a refreshment program to ensure the composition of the Board has the appropriate mix of diverse backgrounds, skills and experiences to support the Company’s strategy.

Executive Officers. In addition, the Board also plans for succession to the positions of Chairman of the Board and Chief Executive Officer as well as certain other senior management positions. To assist the Board, our Chief Executive Officer periodically provides the LDC Committee with an assessment of senior managers and of their potential to succeed him. He also provides the LDC Committee with an assessment of persons considered potential successors to certain other senior management positions. This assessment results from our leadership development and succession planning process, which involves three principal steps:

| • | Regional and global business unit and corporate staff function assessments to identify key employees and employees with high potential for increased responsibilities |

| • | Chief Executive Officer assessments of the leaders of the regional and global business units and corporate staff functions, focusing on senior executives’ development and succession |

| • | Board review and approval, focusing on Chief Executive Officer succession, key senior executives’ development and succession, the pool of high-potential executives and initiatives to improve retention and promote their development as company leaders |

We use tools and processes, followed by face-to-face reviews, to implement our leadership development and succession planning process. Through this process, we identify a pool of high-potential employees who are selected for development. Our development program emphasizes skills training, education and career planning.

HOW TO CONTACT THE BOARD AND ITS COMMITTEES

We have established a process by which stockholders and other interested parties can contact the Board, or a committee of the Board. To contact the Board or a Board committee, you can send an email to BoD@iqvia.com, or write to the following address:

Board of Directors

c/o Secretary

IQVIA Holdings Inc.

100 IMS Drive

Parsippany, New Jersey 07054

Communications will be distributed to the Chairman of the Board or the other members of the Board as appropriate depending on the facts and circumstances outlined in the communication received.

| IQVIA 2020 PROXY STATEMENT | IQVIA’s Corporate Governance | 31 |

SUSTAINABILITY AND CORPORATE CITIZENSHIP

Sustainability and Corporate citizenship are essential elements of our culture and vision. A focus on wellness and safety of our employees and customers, product innovation, environmental responsibility and ethical business practices is central to our success — and this culture of caring extends to the communities where we live and work. We strive to make a difference locally and globally.

We pay close attention to quality and compliance while embracing fresh ideas and new innovations. This dual commitment empowers us to improve healthcare — enhancing and advancing wellness and safety, strengthening supplier relationships, and supporting environmental stewardship.

We demonstrate this commitment by adopting policies and practices in specific areas related to sustainable development, including environment and health and safety; corporate social giving; workers’ human rights; protecting individual privacy; and ethical business practices.

| People | Public | Planet | ||||||

| Creating a workplace of highly engaged, safe, and healthy employees who follow the Code of Conduct | Engaging consistently and transparently in a manner that inspires participation and demonstrates leadership in sustainability

| Making a positive impact on the environments we work in | ||||||

People | ||||

Everyone at IQVIA, regardless of their role, contributes to a greater purpose. Our culture is based on five core values: Client focus, Results, Teamwork, Flawless execution, and Integrity. As a team, we are not only moving healthcare forward, we are leading the charge to take it further than ever before. We strive to give our best in everything we do. We embrace the challenge because we are uniquely positioned to make a tangible, meaningful difference.

Diversity and Inclusion. We are committed to maintaining a culture of inclusion in which people from all backgrounds can fully contribute to the growth and success of our business. We create this culture of inclusion for employees regardless of gender, race, color, creed, religion, marital status, age, national origin or ancestry, physical or mental disability, medical condition, veteran status, citizenship, sexual orientation, gender identity, or any other protected group status. As such, our business is focused on three core areas:

| 1. | Recruitment. IQVIA is committed to considering a range of qualified candidates for all positions and to hiring qualified individuals with a variety of backgrounds and experiences from within and outside the organization for positions at all levels. |

| 2. | Development & Progression. IQVIA is focused on having a diverse pipeline of talent moving up in our organization and providing opportunities for all employees to develop within their current role as well as towards their next role. |

| 3. | Retention. Once we hire the right people, we want them to stay. To increase employee engagement and retention, we consistently seek feedback from employees through surveys and focus groups. We will continue to use this feedback and review our processes to identify additional initiatives aimed to further increase employee retention. |

Public Recognition.We were named to the Forbes 2019 list of America’s Best Employers for Women and recognized again by FORTUNE as one of the World’s Most Admired Companies in 2019.

Employee Engagement Survey.In late 2018, we deployed our first company-wide employee engagement survey following the Merger. We received valuable feedback regarding employee roles, team environments, relationships with management and career progression. Using this feedback,

| 32 | IQVIA’s Corporate Governance | IQVIA 2020 PROXY STATEMENT |

action plans were developed at both global and local levels in 2019. We continue to harmonize our systems as well as implement tools and programs to equip employees with the resources they need for their jobs and help them take ownership of their careers. In 2020, we will continue to progress our employee engagement survey action plans.

Public | ||||

At IQVIA, we are inspired to advance health outcomes. Through collaboration, we hope to overcome some of the biggest challenges facing global health. A few examples of initiatives that IQVIA is engaged in include:

| • | Facilitating sharing insights on anti-cancer medicines. We established the Oncology Data Network, which delivers insights into how anti-cancer medicines are being used in Europe in real-time to participating centers across Europe within 24 hours to accelerate their clinical research efforts. |

| • | Supporting progress against antimicrobial resistance.IQVIA is part of the Centers for Disease Control and United Nations’ Antimicrobial Resistance Challenge, an effort to accelerate the fight against antimicrobial resistance across the globe. |

| • | Leading the Way in Drug Safety: IQVIA formed a novel alliance with the FDA Center for Biologics Evaluation and Research to monitor and evaluate the safety and effectiveness of various vaccines, blood products, and other biologics. |

| • | Fighting the Opioid Epidemic: IQVIA partnered with the American Medical Association’s Opioid Task Force to support strategies that target the nation’s opioid epidemic and continues to provide valuable insights into the ongoing efforts to combat this public health issue. |

| • | Collaborating with Cancer Researchers to Advance Real World Evidence: IQVIA collaborates with Friends of Cancer Research in a cross-industry effort to advance acceptance and drive future uses of real world evidence. |

| • | Providing the Public with Key Public Health Information. We provide key healthcare measurements for flu, allergy, and cough and cold season at the zip code level in the US through FluSTAR.com and its mobile app, giving consumers unique insights into the spread of flu and colds in the US. |

Planet | ||||