Filed by zulily, inc.

Pursuant to Rule 425 under the Securities Act of 1933

and deemed filed pursuant to Rule 14d-9 of the

Securities Exchange Act of 1934

Subject Company: zulily, inc.

Commission File No. 001-36188

Filed by zulily, inc.Liberty Interactive Acquisition of zulily

Pursuant to Rule 425 under the Securities Act of 1933

and deemed filed pursuant to Rule 14d-9 of the Securities Exchange Act of 1934

Subject Company: zulily, inc.

Commission File No. 001-36188

August 17, 2015

Forward-Looking Statements

This presentation includes certain forward-looking statements, including statements about the proposed acquisition of zulily by Liberty Interactive, the commencement of an exchange offer for shares of zulily common stock, the realization of estimated synergies and benefits from the proposed acquisition, business strategies, market potential, future financial prospects, new service and product offerings, and other matters that are not historical facts. These forward-looking statements involve many risks and uncertainties that could cause actual results to differ materially from those expressed or implied by such statements, including, without limitation, the satisfaction of conditions to the proposed acquisition and exchange offer. These forward-looking statements speak only as of the date of this presentation, and Liberty Interactive, QVC and zulily expressly disclaim any obligation or undertaking to disseminate any updates or revisions to any forward-looking statement contained herein to reflect any change in Liberty Interactive’s, QVC’s or zulily’s expectations with regard thereto or any change in events, conditions or circumstances on which any such statement is based. Please refer to the publicly filed documents of Liberty Interactive, QVC and zulily, including the most recent Forms 10-K and 10-Q for additional information about Liberty Interactive, QVC and zulily and about the risks and uncertainties related to the business of each of Liberty Interactive, QVC and zulily which may affect the statements made in this presentation.

Additional Information and Where to Find it

The exchange offer for the outstanding shares of zulily referenced in this communication has not yet commenced. This announcement is for informational purposes only and is neither an offer to purchase nor a solicitation of an offer to sell shares of zulily or Liberty Interactive or purchase shares of Liberty Interactive, nor is it a substitute for the registration statement and exchange offer materials that Liberty Interactive and/or its acquisition subsidiary will file with the U.S. Securities and Exchange Commission (the “SEC”) upon commencement of the exchange offer. At the time the offer is commenced, Liberty Interactive and/or its acquisition subsidiary will file exchange offer materials on Schedule TO and a registration statement on Form S-4 with the SEC, and zulily will file a Solicitation/Recommendation Statement on Schedule 14D-9 with the SEC with respect to the exchange offer. The exchange offer materials (including a Prospectus/Offer to Exchange, a related Letter of Transmittal and certain other offer documents) and the Solicitation/Recommendation Statement will contain important information. Holders of shares of zulily are urged to read these documents when they become available because they will contain important information that holders of zulily securities should consider before making any decision regarding tendering their securities. The Prospectus/Offer to Exchange, the related Letter of Transmittal and certain other offer documents, as well as the Solicitation/Recommendation Statement, will be made available to all holders of shares of zulily at no expense to them. The exchange offer materials and the Solicitation/Recommendation Statement will be made available for free at the SEC’s web site at http://wwwsec . .gov. Free copies of these documents will be made available by zulily by mail to zulily, inc., 2601 Elliott Avenue, Suite 200, Seattle, WA, 98121, Attention: Erica Yamamoto and free copies of the exchange offer materials will be made available by Liberty Interactive by directing a request to Liberty Interactive Corporation, 12300 Liberty Boulevard, Englewood, CO, 80112, Attention: Investor Relations, Telephone: (720) 875-5420.

In addition to the Prospectus/Offer to Exchange, the related Letter of Transmittal and certain other offer documents, as well as the Solicitation/Recommendation Statement, Liberty Interactive and zulily file annual, quarterly and special reports and other information with the SEC. You may read and copy any reports or other information filed by Liberty Interactive or zulily at the SEC public reference room at 100 F Street, N.E., Washington, D.C. 20549. Please call the SEC at 1-800-SEC-0330 for further information on the public reference room. Liberty Interactive’s and zulily’s filings with the SEC are also available to the public from commercial document-retrieval services and at the website maintained by the SEC at http://www.sec.gov.

Greg Maffei Darrell Cavens

President and CEO Co-founder, President and CEO Liberty Interactive Corporation zulily, inc.

Mike George Mark Vadon

President and CEO Co-founder and Chairman of the Board QVC, Inc. zulily, inc.

Compelling Transaction Expands QVC’s Leadership in Discovery Based Shopping

QVC acquiring leading, pure-play eCommerce platform with similar focus on discovery, customer engagement and experiential shopping

zulily has attractive profitability, unit economics and business model

Expands core demographic to “Millennial Moms”

Opportunity to cross promote and grow lifetime customer value

Complementary core competencies will enhance customer experience and accelerate growth opportunities

Leverages fulfillment, procurement and back-office efficiencies

Exciting opportunities for international expansion, new product categories and video commerce

Retaining highly-skilled management team

zulily is Strategic for QVC

Directly additive to QVC’s competitive position

Accelerates QVC’s growth rate

Expands already sizable eCommerce platform

QVC : $3.6b eCommerce revenue1 | zulily: $1.3b total revenue2

Further diversifies QVC’s multi-platform strategy in evolving digital landscape Provides highly-attractive new customer acquisition funnel

Efficient use of QVC’s capital structure and borrowing capacity

High ROI deployment of free cash flow

QVC will still continue to be able to devote vast majority of free cash to share repurchases Takes advantage of attractive interest rate environment

Meaningful revenue and cost synergies

QVC can help accelerate evolution of zulily’s platform

Bring scale and efficiency to combined brand portfolio Expand experiential shopping Further enhance customer experience

eCommerce leader, Mark Vadon, will provide valuable expertise as member of Liberty Interactive board of directors

1. Consolidated QVC eCommerce revenues for the twelve months ended Q2-15.

2. For the twelve months ended Q2-15; all eCommerce.

zulily Customer Value Propositions

FRESHNESS

surprise and delight every single day with new products, vendors and experiences

DISCOVERY

get access to products and brands she can’t find everywhere else

VALUE

provide a great value at reasonable price points

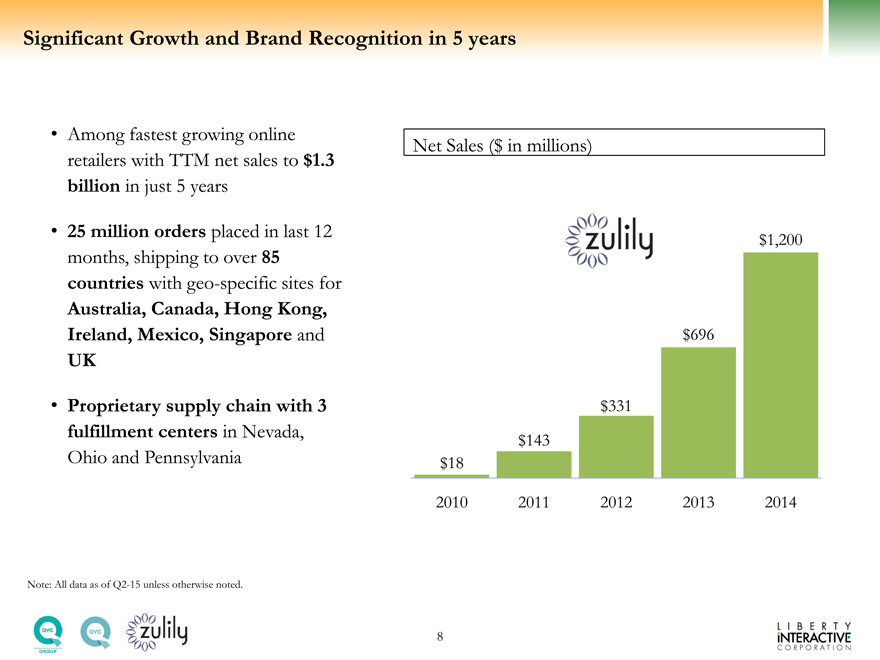

Significant Growth and Brand Recognition in 5 years

Among fastest growing online retailers with TTM net sales to $1.3 billion in just 5 years

25 million orders placed in last 12 months, shipping to over 85 countries with geo-specific sites for

Australia, Canada, Hong Kong, Ireland, Mexico, Singapore and UK

Proprietary supply chain with 3 fulfillment centers in Nevada, Ohio and Pennsylvania

$1,200

$696

$331

$143 $18

2010 2011 2012 2013 2014

Net Sales ($ in millions)

Note: All data as of Q2-15 unless otherwise noted.

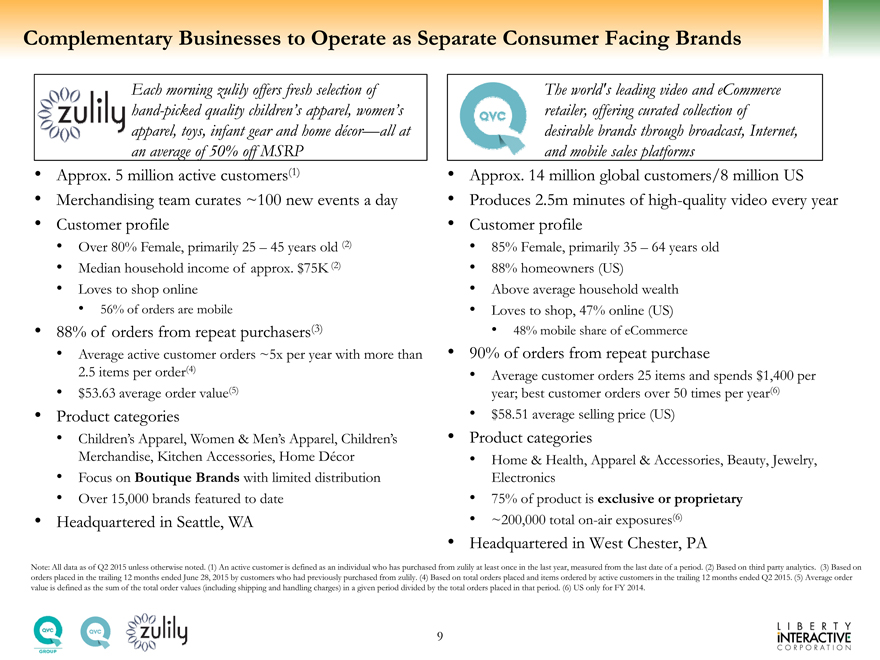

Complementary Businesses to Operate as Separate Consumer Facing Brands

Each morning zulily offers fresh selection of The world’s leading video and eCommerce

hand-picked quality children’s apparel, women’s retailer, offering curated collection of

apparel, toys, infant gear and home décor—all at desirable brands through broadcast, Internet,

an average of 50% off MSRP and mobile sales platforms

Approx. 5 million active customers(1) Approx. 14 million global customers/8 million US

Merchandising team curates ~100 new events a day Produces 2.5m minutes of high-quality video every year

Customer profile Customer profile

Over 80% Female, primarily 25 – 45 years old (2) 85% Female, primarily 35 – 64 years old

Median household income of approx. $75K (2) 88% homeowners (US)

Loves to shop online Above average household wealth

56% of orders are mobile Loves to shop, 47% online (US)

88% of orders from repeat purchasers(3) 48% mobile share of eCommerce

Average active customer orders ~5x per year with more than 90% of orders from repeat purchase

2.5 items per order(4) Average customer orders 25 items and spends $1,400 per

$53.63 average order value(5) year; best customer orders over 50 times per year(6)

Product categories $58.51 average selling price (US)

Children’s Apparel, Women & Men’s Apparel, Children’s Product categories

Merchandise, Kitchen Accessories, Home Décor Home & Health, Apparel & Accessories, Beauty, Jewelry,

Focus on Boutique Brands with limited distribution Electronics

Over 15,000 brands featured to date 75% of product is exclusive or proprietary

Headquartered in Seattle, WA ~200,000 total on-air exposures(6)

Headquartered in West Chester, PA

Note: All data as of Q2 2015 unless otherwise noted. (1) An active customer is defined as an individual who has purchased from zulily at least once in the last year, measured from the last date of a period. (2) Based on third party analytics. (3) Based on

orders placed in the trailing 12 months ended June 28, 2015 by customers who had previously purchased from zulily. (4) Based on total orders placed and items ordered by active customers in the trailing 12 months ended Q2 2015. (5) Average order

value is defined as the sum of the total order values (including shipping and handling charges) in a given period divided by the total orders placed in that period. (6) US only for FY 2014.

9

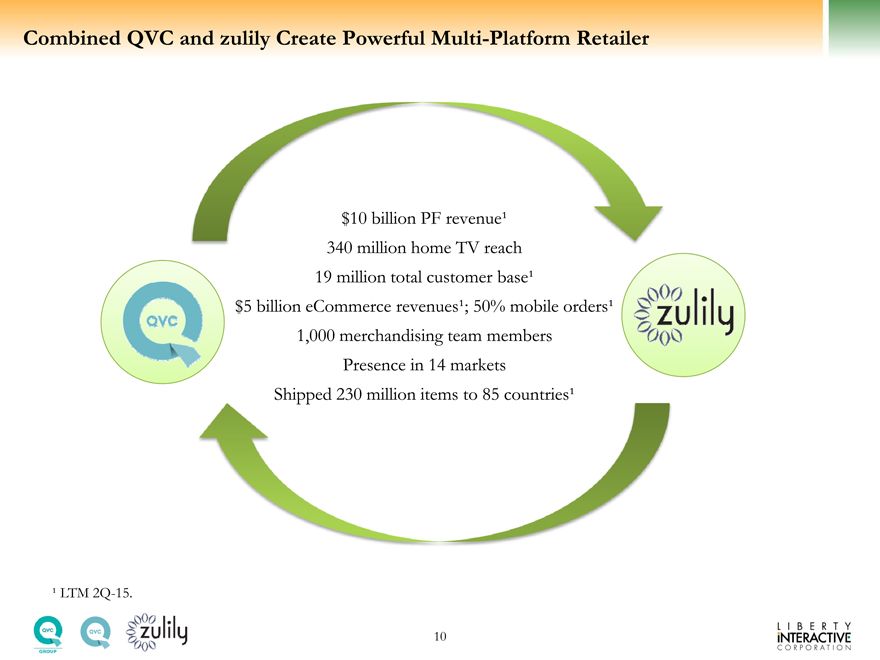

Combined QVC and zulily Create Powerful Multi-Platform Retailer

19 million total customer base $5 billion eCommerce revenues; 50% mobile orders 1,000 merchandising team members Presence in 14 markets Shipped 230 million items to 85 countries

¹ LTM 2Q-15.

10

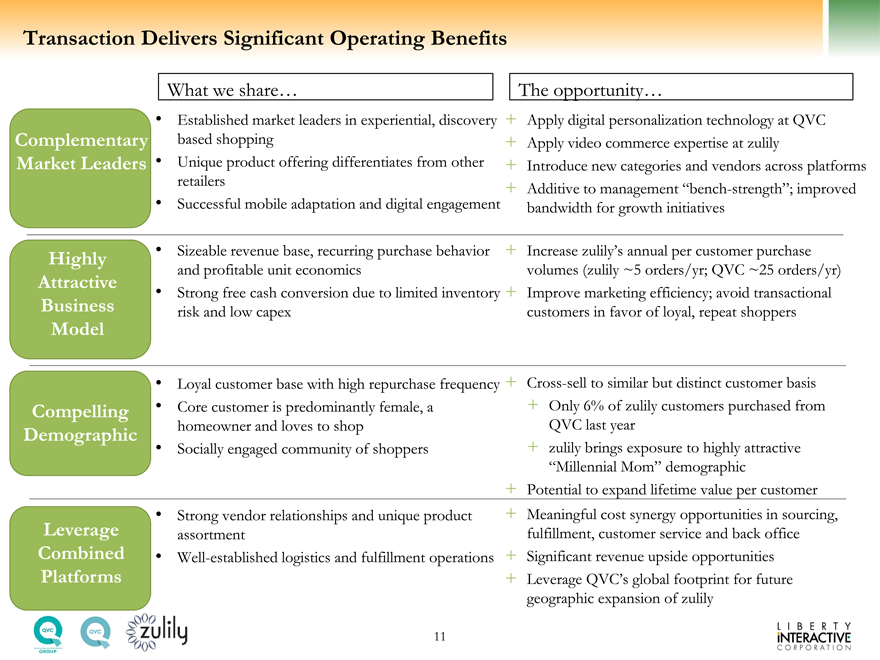

Transaction Delivers Significant Operating Benefits

Complementary Market Leaders

Highly Attractive Business Model

Complementary

Compelling Demographic

Leverage Combined Platforms

What we share… The opportunity…

Established market leaders in experiential, discovery Apply digital personalization technology at QVC

based shopping Apply video commerce expertise at zulily

Unique product offering differentiates from other Introduce new categories and vendors across platforms

retailers Additive to management “bench-strength”; improved

Successful mobile adaptation and digital engagement bandwidth for growth initiatives

Sizeable revenue base, recurring purchase behavior Increase zulily’s annual per customer purchase

and profitable unit economics volumes (zulily ~5 orders/yr; QVC ~25 orders/yr)

Strong free cash conversion due to limited inventory Improve marketing efficiency; avoid transactional

risk and low capex customers in favor of loyal, repeat shoppers

Loyal Market customer Leaders base with high repurchase frequency Cross-sell to similar but distinct customer basis

Core customer is predominantly female, a Only 6% of zulily customers purchased from

homeowner and loves to shop QVC last year

Socially engaged community of shoppers zulily brings exposure to highly attractive

“Millennial Mom” demographic

Potential to expand lifetime value per customer

Strong vendor relationships and unique product Meaningful cost synergy opportunities in sourcing,

assortment fulfillment, customer service and back office

Well-established logistics and fulfillment operations Significant revenue upside opportunities

Leverage QVC’s global footprint for future

geographic expansion of zulily

11

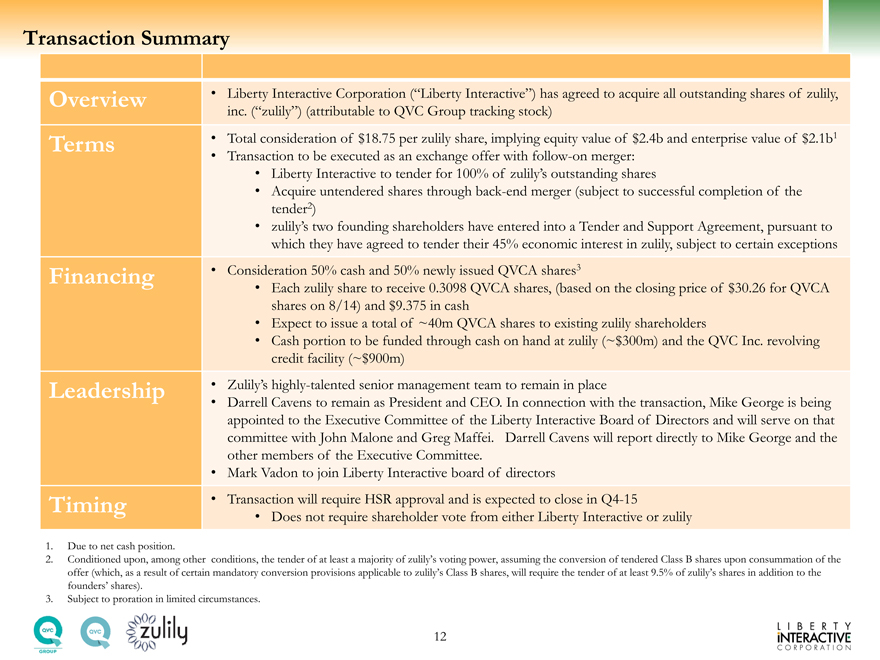

Transaction Summary

Overview Liberty Interactive Corporation (“Liberty Interactive”) has agreed to acquire all outstanding shares of zulily,

inc. (“zulily”) (attributable to QVC Group tracking stock)

Terms Total consideration of $18.75 per zulily share, implying equity value of $2.4b and enterprise value of $2.1b1

Transaction to be executed as an exchange offer with follow-on merger:

Liberty Interactive to tender for 100% of zulily’s outstanding shares

Acquire untendered shares through back-end merger (subject to successful completion of the

tender2)

zulily’s two founding shareholders have entered into a Tender and Support Agreement, pursuant to

which they have agreed to tender their 45% economic interest in zulily, subject to certain exceptions

Financing Consideration 50% cash and 50% newly issued QVCA shares3

Each zulily share to receive 0.3098 QVCA shares, (based on the closing price of $30.26 for QVCA

shares on 8/14) and $9.375 in cash

Expect to issue a total of ~40m QVCA shares to existing zulily shareholders

Cash portion to be funded through cash on hand at zulily (~$300m) and the QVC Inc. revolving

credit facility (~$900m)

Leadership Zulily’s highly-talented senior management team to remain in place

Darrell Cavens to remain as President and CEO. In connection with the transaction, Mike George is being

appointed to the Executive Committee of the Liberty Interactive Board of Directors and will serve on that

committee with John Malone and Greg Maffei. Darrell Cavens will report directly to Mike George and the

other members of the Executive Committee.

Mark Vadon to join Liberty Interactive board of directors

Timing Transaction will require HSR approval and is expected to close in Q4-15

Does not require shareholder vote from either Liberty Interactive or zulily

1. Due to net cash position.

2. Conditioned upon, among other conditions, the tender of at least a majority of zulily’s voting power, assuming the conversion of tendered Class B shares upon consummation of the

offer (which, as a result of certain mandatory conversion provisions applicable to zulily’s Class B shares, will require the tender of at least 9.5% of zulily’s shares in addition to the

founders’ shares).

3. Subject to proration in limited circumstances.

12

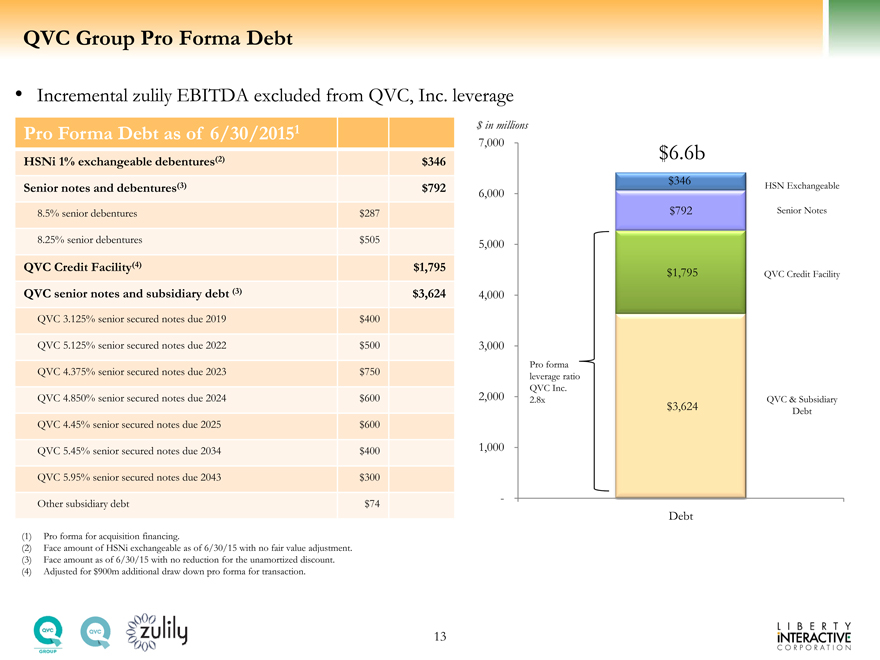

QVC Group Pro Forma Debt

Incremental zulily EBITDA excluded from QVC, Inc. leverage

Pro Forma Debt as of 6/30/20151

HSNi 1% exchangeable debentures(2) $346

Senior notes and debentures(3) $792

8.5% senior debentures $287

8.25% senior debentures $505

QVC Credit Facility(4) $1,795

QVC senior notes and subsidiary debt (3) $3,624

QVC 3.125% senior secured notes due 2019 $400

QVC 5.125% senior secured notes due 2022 $500

QVC 4.375% senior secured notes due 2023 $750

QVC 4.850% senior secured notes due 2024 $600

QVC 4.45% senior secured notes due 2025 $600

QVC 5.45% senior secured notes due 2034 $400

QVC 5.95% senior secured notes due 2043 $300

Other subsidiary debt $74

(1) | | Pro forma for acquisition financing. |

(2) | | Face amount of HSNi exchangeable as of 6/30/15 with no fair value adjustment. |

(3) | | Face amount as of 6/30/15 with no reduction for the unamortized discount. |

(4) | | Adjusted for $900m additional draw down pro forma for transaction. |

$ in millions

7,000 $6.6b $346

HSN Exchangeable

6,000

$792 Senior Notes

5,000

$1,795 QVC Credit Facility

4,000

3,000

Pro forma leverage ratio QVC Inc.

2,000 2.8x QVC & Subsidiary

$3,624 Debt

1,000

-

Debt

13