UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF

REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-22391

Nuveen Build America Bond Fund

(Exact name of registrant as specified in charter)

Nuveen Investments

333 West Wacker Drive

Chicago, IL 60606

(Address of principal executive offices) (Zip code)

Kevin J. McCarthy

Nuveen Investments

333 West Wacker Drive

Chicago, IL 60606

(Name and address of agent for service)

Registrant's telephone number, including area code: (312) 917-7700

Date of fiscal year end: March 31

Date of reporting period: March 31, 2011

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget ("OMB") control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. ss. 3507.

ITEM 1. REPORTS TO STOCKHOLDERS.

INVESTMENT ADVISER NAME CHANGE

Effective January 1, 2011, Nuveen Asset Management, the Funds’ investment adviser, changed its name to Nuveen Fund Advisors, Inc. (“Nuveen Fund Advisors”). Concurrently, Nuveen Fund Advisors formed a wholly-owned subsidiary, Nuveen Asset Management, LLC, to house its portfolio management capabilities.

NUVEEN INVESTMENTS COMPLETES STRATEGIC COMBINATION WITH FAF ADVISORS

On December 31, 2010, Nuveen Investments completed the strategic combination between Nuveen Asset Management, LLC, the largest investment affiliate of Nuveen Investments, and FAF Advisors. As part of this transaction, U.S. Bancorp – the parent of FAF Advisors – received cash consideration and a 9.5% stake in Nuveen Investments in exchange for the long term investment business of FAF Advisors, including investment management responsibilities for the non-money market mutual funds of the First American Funds family.

The approximately $27 billion of mutual fund and institutional assets managed by FAF Advisors, along with the investment professionals managing these assets and other key personnel, have become part of Nuveen Asset Management, LLC. With these additions to Nuveen Asset Management, LLC, this affiliate now manages more than $100 billion of assets across a broad range of strategies from municipal and taxable fixed income to traditional and specialized equity investments.

This combination does not affect the investment objectives or strategies of the Funds in this report. Over time, Nuveen Investments expects that the combination will provide even more ways to meet the needs of investors who work with financial advisors and consultants by enhancing the multi-boutique model of Nuveen Investments, which also includes highly respected investment teams at HydePark, NWQ Investment Management, Santa Barbara Asset Management, Symphony Asset Management, Tradewinds Global Investors and Winslow Capital. Nuveen Investments managed approximately $206 billion of assets as of March 31, 2011.

Table of Contents

| | |

| Chairman’s Letter to Shareholders | 4 |

| Portfolio Manager’s Comments | 5 |

| Dividend and Share Price Information | 10 |

| Performance Overviews | 11 |

| Report of Independent Registered Public Accounting Firm | 13 |

| Portfolios of Investments | 14 |

| Statement of Assets and Liabilities | 25 |

| Statement of Operations | 26 |

| Statement of Changes in Net Assets | 27 |

| Statement of Cash Flows | 28 |

| Financial Highlights | 29 |

| Notes to Financial Statements | 32 |

| Board Members & Officers | 41 |

| Annual Investment Management Agreement Approval Process | 46 |

| Board Approval of Sub-Advisory Arrangements | 58 |

| Reinvest Automatically, Easily and Conveniently | 59 |

| Glossary of Terms Used in this Report | 61 |

| Other Useful Information | 63 |

Chairman’s

Letter to Shareholders

Dear Shareholders,

In 2010, the global economy recorded another year of recovery from the financial and economic crises of 2008, but many of the factors that caused the downturn still weigh on the prospects for continued improvement. In the U.S., ongoing weakness in housing values has put pressure on homeowners and mortgage lenders. Similarly, the strong earnings recovery for corporations and banks is only slowly being translated into increased hiring or more active lending. Globally, deleveraging by private and public borrowers has inhibited economic growth and that process is far from complete.

Encouragingly, constructive actions are being taken by governments around the world to deal with economic issues. In the U.S., the recent passage of a stimulatory tax bill relieved some of the pressure on the Federal Reserve to promote economic expansion through quantitative easing and offers the promise of sustained economic growth. A number of European governments are undertaking programs that could significantly reduce their budget deficits. Governments across the emerging markets are implementing various steps to deal with global capital flows without undermining international trade and investment.

The success of these government actions could determine whether 2011 brings further economic recovery and financial market progress. One risk associated with the extraordinary efforts to strengthen U.S. economic growth is that the debt of the U.S. government will continue to grow to unprecedented levels. Another risk is that over time there could be inflationary pressures on asset values in the U.S. and abroad, because what happens in the U.S. impacts the rest of the world economy. Also, these various actions are being taken in a setting of heightened global economic uncertainty, primarily about the supplies of energy and other critical commodities. In this challenging environment, your Nuveen investment team continues to seek sustainable investment opportunities and to remain alert to potential risks in a recovery still facing many headwinds. On your behalf, we monitor their activities to assure they maintain their investment disciplines.

As you will note elsewhere in this report, on December 31, 2010, Nuveen Investments completed a strategic combination with FAF Advisors, Inc., the manager of the First American Funds. The combination adds highly respected and distinct investment teams to meet the needs of investors and their advisors and is designed to benefit all fund shareholders by creating a fund organization with the potential for further economies of scale and the ability to draw from even greater talent and expertise to meet those investor needs.

As of the end of April, 2011, Nuveen Investments had completed the refinancing of all of the Auction Rate Preferred Securities issued by its taxable closed-end funds and 89% of the MuniPreferred shares issued by its tax-exempt closed-end funds. Please consult the Nuveen Investments web site, www.Nuveen.com, for the current status of this important refinancing program.

As always, I encourage you to contact your financial consultant if you have any questions about your investment in a Nuveen Fund. On behalf of the other members of your Fund Board, we look forward to continuing to earn your trust in the months and years ahead.

Sincerely,

Robert P. Bremner

Chairman of the Board

May 19, 2011

4 Nuveen Investments

Portfolio Manager’s Comments

Nuveen Build America Bond Fund (NBB)

Nuveen Build America Bond Opportunity Fund (NBD)

Portfolio manager Daniel Close discusses U.S. economic and municipal market conditions, key investment strategies and the performance of the Nuveen Build America Bond Fund (NBB) and the Nuveen Build America Bond Opportunity Fund (NBD). Dan, who joined Nuveen in 2000, has managed NBB since its inception in April 2010 and NBD since its inception in November 2010.

What factors affected the U.S. economy and municipal market during the reporting period ended March 31, 2011?

During this period, the U.S. economy demonstrated some signs of improvement, supported by the efforts of both the Federal Reserve (Fed) and the federal government. For its part, the Fed continued to hold the benchmark fed funds rate in a target range of zero to 0.25% since cutting it to this record low level in December 2008. At its April 2011 meeting (following the end of this reporting period), the central bank renewed its commitment to keeping the fed funds rate at “exceptionally low levels” for an “extended period.” The Fed also left unchanged its second round of quantitative easing, which calls for purchasing $600 billion in longer-term U.S. Treasury bonds by June 30, 2011. The goal of this plan is to lower long-term interest rates and thereby stimulate economic activity and create jobs. The federal government continued to focus on implementing the economic stimulus package passed in early 2009 aimed at providing job creation, tax relief, fiscal assistance to state and local governments and expansion of unemployment benefits and other federal social welfare programs.

In the first quarter of 2011, the U.S. economy, as measured by the U.S. gross domestic product (GDP), grew at an annualized rate of 1.8%, marking the seventh consecutive quarter of positive growth. The employment picture continued to improve gradually, with the national jobless rate registering 8.8% in March 2011, its lowest level since March 2009 and down from 9.7% a year earlier. While the Fed’s longer-term inflation expectations remained stable, inflation posted its largest twelve month gain since December 2009, as the Consumer Price Index (CPI) rose 2.7% year-over-year as of March 2011, driven mainly by increased prices for energy. The core CPI (which excludes food and energy) increased 1.2% over this period, staying within the Fed’s unofficial objective of 2.0% or lower for this measure. The housing market continued to be a weak spot in the economy. For the twelve months ended February 2011 (most recent data available at the time this report was prepared), the average home price in the Standard & Poor’s (S&P) Case-Shiller index of 20 major metropolitan areas lost 3.3%, with 10 of the 20 metropolitan areas hitting their lowest levels since housing prices peaked in 2006.

Certain statements in this report are forward-looking statements. Discussions of specific investments are for illustration only and are not intended as recommendations of individual investments. The forward-looking statements and other views expressed herein are those of the portfolio manager as of the date of this report. Actual future results or occurrences may differ significantly from those anticipated in any forward-looking statements and the views expressed herein are subject to change at any time, due to numerous market and other factors. The Funds disclaim any obligation to update publicly or revise any forward-looking statements or views expressed herein.

Any reference to credit ratings for portfolio holdings denotes the highest rating assigned by a Nationally Recognized Statistical Rating Organization (NRSRO) such as Standard & Poor’s (S&P), Moody’s or Fitch. AAA, AA, A and BBB ratings are investment grade; BB, B, CCC, CC, C and D ratings are below investment grade. Holdings and ratings may change over time.

Nuveen Investments 5

Looking at the overall municipal market, bond prices generally rose during this period, as the combination of strong demand and tight supply of new tax-exempt issuance created favorable market conditions. After rallying strongly over most of the period, the municipal market suffered a reversal in mid-November 2010, due largely to investor concerns about inflation, the federal deficit and the deficit’s impact on demand for U.S. Treasuries. Adding to this situation was media coverage of the strained finances of many state and local governments, which often failed to differentiate between gaps in these governments’ operating budgets and their ability to meet their debt service obligation. Toward the end of this period, we saw the environment in the municipal market improve, as crossover buyers—including hedge funds and life insurance companies—were attracted by municipal bond prices and tax-exempt yields, resulting in decreased outflows, declining yields and rising valuations.

What key strategies were used to manage NBB and NBD during this period?

The inception date for NBB was April 27, 2010, and for NBD it was November 23, 2010. Both NBB and NBD are designed to invest primarily in Build America Bonds (BABs) and other taxable municipal bonds. Bonds issued under the Build America Bond program, which ended December 31, 2010, offered municipal issuers a federal subsidy equal to 35% of a bond’s interest payments, often providing issuers with a lower-cost alternative to traditional tax-exempt debt.

The primary investment objective of these two Funds is to provide current income through investments in taxable municipal securities. Their secondary objective is to seek enhanced portfolio value and total return. The Funds offer strategic portfolio diversification opportunities for traditional municipal bond investors, while broadening participation to investors that have not traditionally purchased municipal bonds, including public and corporate retirement plans, endowments, life insurance companies, and sovereign wealth funds. For these investors, these Funds can offer investment-grade municipal credit, current income, and strong call protection.

Both NBB and NBD completed their initial investment process during this reporting period. Between April 2010, when NBB was introduced, and the end of the BAB program in December 2010, BAB issuance totaled $90.5 billion. Issuance was particularly heavy during the fourth quarter of 2010, as issuers uncertain about the extension of the BAB program sought to take advantage of the program’s terms before it expired. During this period, $44.1 billion in BABs were issued, accounting for 33% of new bonds issued in the municipal market. Within the 21 months between the first BAB issue in April 2009 and the last BAB issue in December 2010, $181.4 billion of Build America Bonds were issued. The secondary market for BABs continues to be active.

The ample supply of BAB issuance during the invest-up enabled us to purchase a good balance of BABs in both the primary (new issue) and secondary markets. Under the provisions of the Build America Bond program, only governmental entities could issue BABs. Issuance was heaviest in the general purpose/public improvement, education, transportation, and utilities sectors. Nonprofit 501(c)(3) organizations such as hospitals generally did not qualify as BABs issuers, limiting the availability of these bonds. Bonds with proceeds

6 Nuveen Investments

earmarked for refundings, working capital and private activities also were not covered by the BAB program. By the end of the program, all states except Montana and Rhode Island had issued BABs, with California, New York, Texas, Illinois and Ohio at the forefront in terms of issuance, followed by New Jersey, Washington, Pennsylvania, Florida and Georgia. This enabled us to add geographic diversity to the Funds. The majority of our purchases were at the long end of the yield curve.

During NBB’s invest-up period, we purchased a good mix of benchmark and non-benchmark BAB issues. Benchmark BAB issues are bonds whose cusip is over $250 million in size and therefore eligible for inclusion in the Barclays Capital Build America Bond (BAB) Index. Non-benchmark BAB issues are smaller, generally lower-profile issuers that can offer the same credit quality as benchmark issues, but may require a more detailed credit review before purchase. As part of its investment strategies, NBB uses an integrated leverage and hedging strategy to seek to enhance current income and total return, while working to maintain a level of interest rate risk similar to that of the Barclays Capital BAB Index. To implement leverage, NBB uses both bank borrowings and inverse floating rate securities. Duration shortening hedges, which can include shorting U.S. Treasury futures or long LIBOR swaps, were used to reduce the leverage-adjusted portfolio duration to a level close to that of the index. NBB’s integrated leverage strategy is discussed further on page nine.

After the completion of NBB’s invest-up period, we focused primarily on improving the Fund’s liquidity profile by purchasing additional benchmark, or index-eligible, BAB issues. These bonds, which were in good supply in the primary market during the fourth quarter of 2010, are currently in greater demand than non-benchmark issues and should be more liquid on a going-forward basis. Purchases were funded with the proceeds from sales of non-benchmark issues. Following the end of new issue BABs, we continued to sell non-benchmark and other non-BAB bonds and purchase BABs in the secondary market, focusing on adding benchmark issues where we had favorable credit opinions while these bonds were still readily available in the market.

During the last half of this period, we also shifted more of NBB’s leverage from bank borrowings to inverse floating rate securities. In our opinion, these securities currently offer a less expensive form of financing. NBB’s leverage, originally implemented as approximately 65% through borrowings and 35% through inverse floaters1, was approximately 80% funded by inverse floaters as of the end of this period.

In NBD, the heavy supply of new BABs during the last part of 2010 enabled us to complete the invest-up of this Fund primarily with purchases of BABs, with an emphasis on benchmark issues, and also to diversify NBD in terms of sector and credit. Shortly after the invest-up period began, we bought a number of long U.S. Treasury bonds to help bring NBD’s duration profile in line with that of the Fund’s benchmark, the Barclays Capital BAB Index. Toward the end of this period, we sold most of these non-BAB holdings and reinvested the proceeds in BABs. NBD uses a leverage strategy similar to that used in NBB using inverse floating rate securities only. Following the end of the new issue calendar, we continued to make small trades in the secondary market and worked to increase NBD’s liquidity. In early 2011, following a decline in the tax-exempt municipal market, both NBB and NBD purchased tax-exempt municipal bonds at attractive prices.

| 1 | Inverse floating rate securities, also known as inverse floaters, are created by depositing a municipal bond, typically with a fixed interest rate, into a special purpose trust created by a broker-dealer. This trust, in turn, (a) issues floating rate certificates typically paying short-term tax-exempt interest rates to third parties in amounts equal to some fraction of the deposited bond’s par amount or market value, and (b) issues an inverse floating rate certificate (sometimes referred to as an “inverse floater”) to an investor (such as a Fund) interested in gaining investment exposure to a long-term municipal bond. The income received by the holder of the inverse floater varies inversely with the short-term rate paid to the floating rate certificates’ holders, and in most circumstances the holder of the inverse floater bears substantially all of the underlying bond’s downside investment risk. The holder of the inverse floater typically also benefits disproportionately from any potential appreciation of the underlying bond’s value. Hence, an inverse floater essentially represents an investment in the underlying bond on a leveraged basis. |

Nuveen Investments 7

As the valuations on these bonds approached more appropriate levels near the end of this period, we sold these non-BABs at higher prices, thus benefiting the Funds.

During the period, the Funds also entered into interest rate and forward interest rate swap contracts to reduce the duration of each Fund’s portfolio, as well as to partially fix its interest cost of leverage.

Because the BAB program was not renewed at the end of December 2010, shareholders should note that both NBB and NBD have contingent term provisions stating that if there are no new issuances of BABs or similarly U.S. Treasury-subsidized taxable municipal bonds for any 24-month period ending on or before December 31, 2014, NBB and NBD will terminate on or around June 30, 2020, and December 31, 2020, respectively.

How did these Funds perform over this period?

Results for NBB and NBD, as well as relevant index information, are presented in the accompanying table.

| | | |

| Cumulative Total Returns on Net Asset Value | | |

| For periods ended 3/31/11 | | |

| | | |

| Since Inception | 4/27/10 | 11/23/10 |

| NBB* | 4.90% | N/A |

| NBD** | N/A | 3.73% |

Barclays Capital Build America Bond (BAB) Index2 | 2.88%* | 1.27%** |

For the period between their respective inceptions and March 31, 2011, the cumulative returns on net asset value (NAV) for NBB and NBD exceeded the returns for the Barclays Capital Build America Bond (BAB) Index, which reflect the same time periods.

Key management factors that influenced the Funds’ returns during this period included duration and yield curve positioning, credit exposure and sector allocation. In addition, individual security selection was positive for both NBB and NBD, as heavy issuance of BABs during the fourth quarter of 2010 gave us access to a robust array of bonds with attractive features from which to choose. The Funds’ use of leverage was an important factor affecting the Funds’ performance for this period. The impact of leverage is discussed in more detail on page nine.

During this period, bonds with intermediate and longer maturities generally performed well. Overall, duration was a positive contributor to NBB’s performance and a negative factor in NBD. This difference can be attributed to NBB’s overweighting of an intermediate segment of the yield curve that performed particularly well during this period.

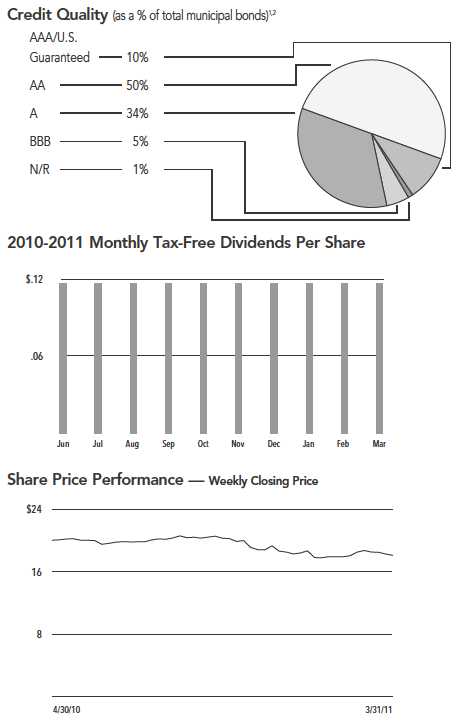

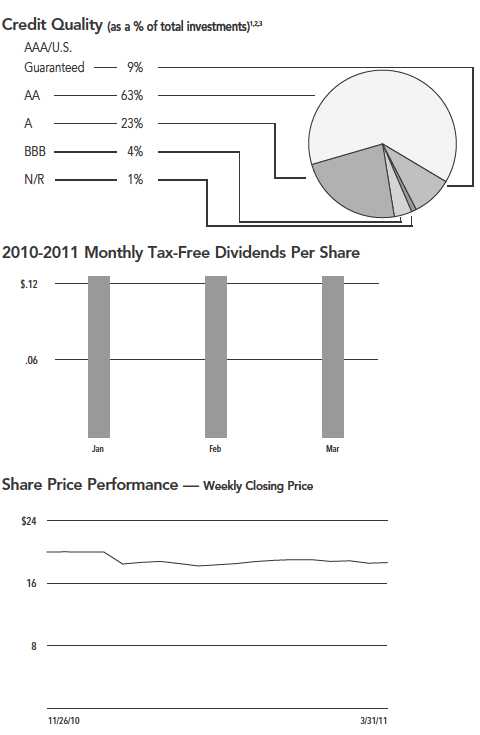

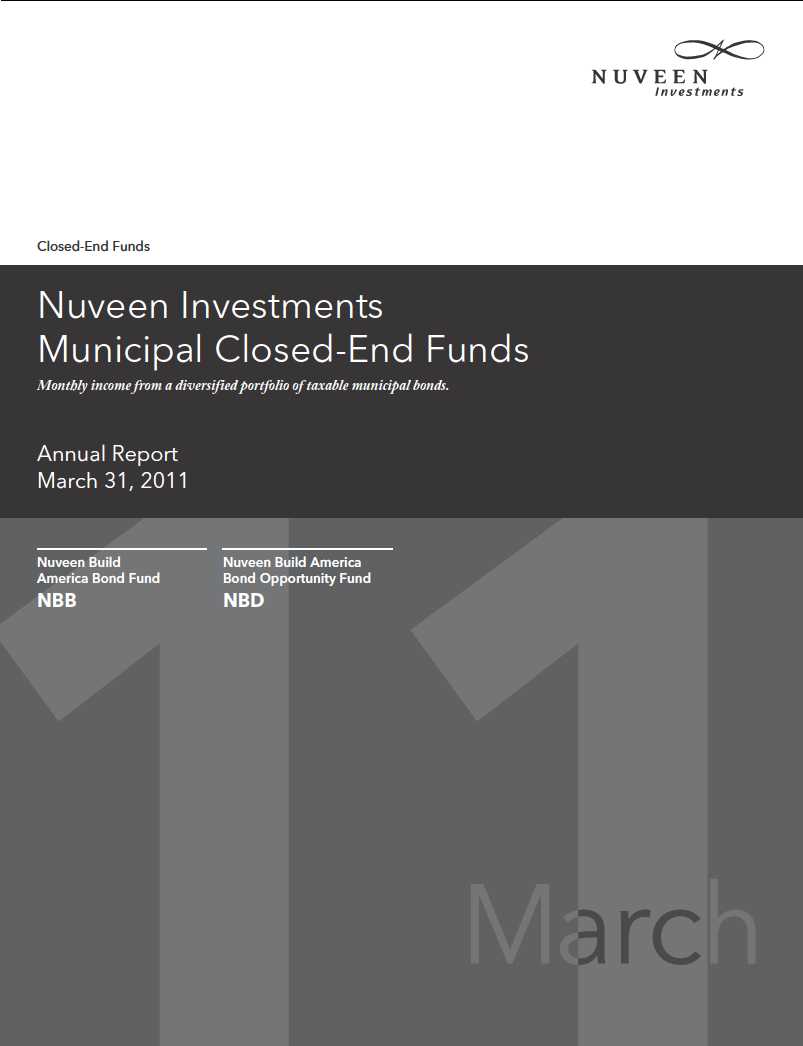

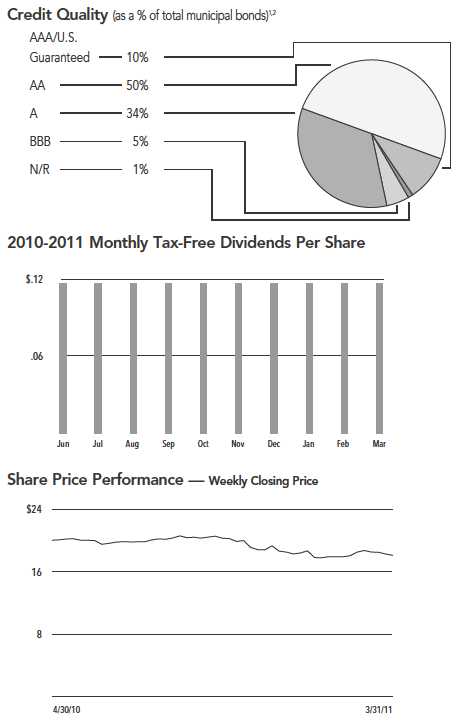

Both NBB and NBD were similarly weighted among the credit quality sectors, with their largest allocation in bonds rated AA, followed by A, AAA, BBB and non-rated bonds. On the whole, this credit rating exposure was negative for performance during this period.

The overall impact of sector exposure was positive in both NBB and NBD. The Funds’ sector allocations were well diversified, with the heaviest weightings in limited and general tax obligation bonds, utilities, transportation and water and sewer credits.

| * | The returns shown for NBB and the index represent the period from April 27, 2010 (NBB’s inception date), through March 31, 2011. |

| | |

| ** | The returns shown for NBD and the index represent the period from November 23, 2010 (NBD’s inception date), through March 31, 2011. |

| | |

| | Past performance is not predictive of future results. Current performance may be higher or lower than the data shown. Returns do not reflect the deduction of taxes that shareholders may have to pay on Fund distributions or upon the sale of Fund shares. |

| | |

| | For additional information, see the Performance Overview pages for NBB and NBD in this report. |

| | |

| 2 | The Barclays Capital Build America Bond (BAB) Index is an unleveraged index that comprises all direct pay Build America Bonds that are SEC-regulated, taxable, dollar-denominated, and have at least one year to final maturity, at least $250 million par amount outstanding, and are determined to be investment grade by Barclays Capital. This index does not reflect any initial or ongoing expenses and is not available for direct investment. |

IMPACT OF THE FUNDS’ LEVERAGE STRATEGIES ON PERFORMANCE

One important factor impacting the returns of these Funds relative to the comparative index was the Funds’ use of leverage. These Funds use leverage because their managers believe that, over time, leveraging provides opportunities for additional income and total return for shareholders. However, use of leverage also can expose shareholders to additional volatility. For example, as the prices of securities held by a Fund decline, the negative impact of these valuation changes on net asset value and total return is magnified by the use of leverage. Conversely, leverage may enhance returns during periods when the prices of securities held by the Funds’ generally are rising. Leverage made a positive contribution to the Funds’ performance over the reporting period.

Nuveen Investments 9

Dividend and Share Price Information

Introduced in April 2010, NBB declared its initial monthly distribution in June 2010 and maintained a stable monthly dividend throughout the remainder of the reporting period ended March 31, 2011. NBD, which was introduced in November 2010, declared its initial monthly dividend distribution in January 2011 and maintained a stable monthly dividend over the remainder of the period.

NBB and NBD seek to pay stable dividends at rates that reflect the Funds’ past results and projected future performance. During certain periods, the Funds may pay dividends at a rate that may be more or less than the amount of net investment income actually earned by the Funds during the period. If a Fund has cumulatively earned more than it has paid in dividends, it holds the excess in reserve as undistributed net investment income (UNII) as part of the Fund’s NAV. Conversely, if a Fund has cumulatively paid dividends in excess of its earnings, the excess constitutes negative UNII that is likewise reflected in the Fund’s NAV. The Funds will, over time, pay all of their net investment income as dividends to shareholders. As of March 31, 2011, both NBB and NBD had positive UNII balances for both tax and financial reporting purposes.

SHARE REPURCHASES AND PRICE INFORMATION

Since the inception of NBB’s repurchase program, NBB has not repurchased any of its outstanding shares. As of March 31, 2011, NBD is not authorized to repurchase its outstanding shares.

As of March 31, 2011, and during the reporting period, the Funds’ share prices were trading at (+) premiums/(-) discounts to their NAVs as shown in the accompanying table.

| | | Average |

| | 3/31/11 | (+) Premium/(-) Discount |

| Fund | (-) Discount | Since Inception |

| NBB | (-)4.24% | (+)0.29% |

| NBD | (-)4.12% | (-)0.50% |

10 Nuveen Investments

| | |

| NBB | Nuveen Build America Bond |

| Performance | Fund |

| OVERVIEW | |

| | as of March 31, 2011 |

| | | |

| Fund Snapshot | | |

| Share Price | | $18.06 |

| Net Asset Value (NAV) | | $18.86 |

| Premium/(Discount) to NAV | | -4.24% |

| Market Yield | | 7.77% |

| Net Assets ($000) | | $499,020 |

| Cumulative Total Return | | |

| (Inception 4/27/10) | | |

| | On Share Price | On NAV |

| Since Inception | -3.99% | 4.90% |

States2 | | |

| (as a % of total municipal bonds) | | |

| California | | 18.5% |

| New York | | 10.7% |

| Illinois | | 10.4% |

| Texas | | 5.6% |

| Ohio | | 4.8% |

| Georgia | | 4.3% |

| Washington | | 4.2% |

| Louisiana | | 3.6% |

| Michigan | | 3.4% |

| Indiana | | 3.2% |

| Florida | | 3.1% |

| Tennessee | | 2.9% |

| Oregon | | 2.7% |

| Virgin Islands | | 2.4% |

| Arizona | | 2.3% |

| New Jersey | | 2.3% |

| Virginia | | 2.2% |

| Other | | 13.4% |

Portfolio Composition2,3 | | |

| (as a % of total investments) | | |

| Tax Obligation/Limited | | 24.0% |

| Tax Obligation/General | | 23.0% |

| Utilities | | 21.0% |

| Transportation | | 13.1% |

| Water and Sewer | | 12.7% |

| Education and Civic Organizations | | 4.9% |

| Short-Term Investments | | 0.1% |

| Other | | 1.2% |

Build America Bond Allocation2 | |

| (as a % of total municipal bonds) | | |

| Build America Bonds | | 93.7% |

| Non-Build America Bonds | | 6.3% |

| | Refer to the Glossary of Terms Used in this Report for further definition of the terms used within this Fund’s Performance Overview page. |

| 1 | Ratings shown are the highest of Standard & Poor’s Group, Moody’s Investor Service, Inc. or Fitch, Inc. AAA includes bonds with an implied AAA rating since they are backed by U.S. Government or agency securities. AAA, AA, A and BBB ratings are investment grade; BB, B, CCC, CC, C and D ratings are below-investment grade. Holdings designated N/R are not rated by any of these national rating agencies. |

| 2 | Holdings are subject to change. |

| 3 | Excluding investments in derivatives. |

Nuveen Investments 11

| | |

| NBD | Nuveen Build |

| | America Bond |

| Performance | Opportunity Fund |

| OVERVIEW | |

| | as of March 31, 2011 |

| | | |

| Fund Snapshot | | |

| Share Price | | $18.63 |

| Net Asset Value (NAV) | | $19.43 |

| Premium/(Discount) to NAV | | -4.12% |

| Market Yield | | 8.12% |

| Net Assets ($000) | | $139,972 |

| Cumulative Total Return | | |

| (Inception 11/23/10) | | |

| | On Share Price | On NAV |

| Since Inception | -4.96% | 3.73% |

States2,3 | | |

| (as a % of total investments) | | |

| Illinois | | 12.7% |

| California | | 12.5% |

| New York | | 9.9% |

| Texas | | 7.6% |

| South Carolina | | 6.9% |

| New Jersey | | 5.4% |

| Michigan | | 5.2% |

| Colorado | | 4.3% |

| Pennsylvania | | 4.0% |

| Ohio | | 3.9% |

| Georgia | | 3.3% |

| Missouri | | 2.7% |

| Nevada | | 2.7% |

| District of Columbia | | 2.7% |

| Kentucky | | 2.1% |

| Other | | 14.1% |

Portfolio Composition2,3 | | |

| (as a % of total investments) | | |

| Tax Obligation/Limited | | 31.1% |

| Utilities | | 17.7% |

| Tax Obligation/General | | 16.3% |

| Water and Sewer | | 13.2% |

| Transportation | | 10.8% |

| Education and Civic Organizations | | 6.4% |

| Other | | 4.5% |

Build America Bond Allocation2,3 | |

| (as a % of total investments) | | |

| Build America Bonds | | 96.5% |

| Non-Build America Bonds | | 3.5% |

| | Refer to the Glossary of Terms Used in this Report for further definition of the terms used within this Fund’s Performance Overview page. |

| 1 | Ratings shown are the highest of Standard & Poor’s Group, Moody’s Investor Service, Inc. or Fitch, Inc. AAA includes bonds with an implied AAA rating since they are backed by U.S. Government or agency securities. AAA, AA, A and BBB ratings are investment grade; BB, B, CCC, CC, C and D ratings are below-investment grade. Holdings designated N/R are not rated by any of these national rating agencies. |

| 2 | Holdings are subject to change. |

| 3 | Excluding investments in derivatives. |

12 Nuveen Investments

Report of Independent

Registered Public Accounting Firm

The Board of Trustees and Shareholders

Nuveen Build America Bond Fund

Nuveen Build America Bond Opportunity Fund

We have audited the accompanying statements of assets and liabilities, including the portfolios of investments, of Nuveen Build America Bond Fund and Nuveen Build America Bond Opportunity Fund (the “Funds”) as of March 31, 2011, and the related statements of operations, changes in net assets, cash flows (Nuveen Build America Bond Fund only), and the financial highlights for the periods indicated therein. These financial statements and financial highlights are the responsibility of the Funds’ management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audits to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement. We were not engaged to perform an audit of the Funds’ internal control over financial reporting. Our audits included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Funds’ internal control over financial reporting. Accordingly, we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements and financial highlights, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. Our procedures included confirmation of securities owned as of March 31, 2011, by correspondence with the custodian and brokers or by other appropriate auditing procedures where replies from brokers were not received. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements and financial highlights referred to above present fairly, in all material respects, the financial positions of Nuveen Build America Bond Fund and Nuveen Build America Bond Opportunity Fund at March 31, 2011, and the results of their operations, changes in their net assets, their cash flows (Nuveen Build American Bond Fund only), and the financial highlights for the periods indicated therein in conformity with U.S. generally accepted accounting principles.

Chicago, Illinois

May 25, 2011

Nuveen Investments 13

| | |

| | Nuveen Build America Bond Fund |

| NBB | Portfolio of Investments |

| | March 31, 2011 |

| | | | | | |

| Principal | | | Optional Call | | |

| Amount (000) | | Description (1) | Provisions (2) | Ratings (3) | Value |

| | | Municipal Bonds | | | |

| | | Arizona – 2.5% (2.3% of Total Investments) | | | |

| $ 3,000 | | Arizona Board of Regents, University of Arizona, System Revenue Bonds, Build America Taxable | 8/20 at 100.00 | AA– | $ 3,006,540 |

| | | Bonds, Series 2010A, 6.423%, 8/01/35 | | | |

| 10,000 | | Mesa, Arizona, Utility System Revenue Bonds, Series 2010, 6.100%, 7/01/34 | No Opt. Call | Aa2 | 9,580,200 |

| 13,000 | | Total Arizona | | | 12,586,740 |

| | | California – 20.3% (18.5% of Total Investments) | | | |

| 500 | | California Infrastructure Economic Development Bond Bank, Revenue Bonds, University of | No Opt. Call | Aa2 | 498,620 |

| | | California San Francisco Neurosciences Building, Build America Taxable Bond Series 2010B, | | | |

| | | 6.486%, 5/15/49 | | | |

| 3,000 | | California State Public Works Board, Lease Revenue Bonds, Various Capital Projects, Build | No Opt. Call | A2 | 3,184,410 |

| | | America Taxable Bond Series 2009G-2, 8.361%, 10/01/34 | | | |

| 4,000 | | California State Public Works Board, Lease Revenue Bonds, Various Capital Projects, Build | 3/20 at 100.00 | A2 | 3,975,560 |

| | | America Taxable Bond Series 2010A-2, 8.000%, 3/01/35 | | | |

| 7,000 | | California State University, Systemwide Revenue Bonds, Build America Taxable Bond Series | No Opt. Call | Aa2 | 6,920,550 |

| | | 2010B, 6.484%, 11/01/41 | | | |

| 4,500 | | California State, General Obligation Bonds, Various Purpose Build America Taxable Bond Series | 3/20 at 100.00 | A1 | 4,845,735 |

| | | 2010, 7.950%, 3/01/36 | | | |

| 5,500 | | City and County of San Francisco Redevelopment Financing Authority, California, Taxable Tax | No Opt. Call | A1 | 5,663,680 |

| | | Allocation Revenue Bonds, San Francisco Redevelopment Projects, Series 2009F, 8.406%, 8/01/39 | | | |

| 5,000 | | Hayward Unified School District, Alameda County, California, General Obligation Bonds, Build | 8/20 at 100.00 | AA+ | 5,046,250 |

| | | America Taxable Bonds, Series 2010B, 7.350%, 8/01/43 – AGM Insured | | | |

| 950 | | Los Alamitos Unified School District, Orange County, California, General Obligation Bonds, | No Opt. Call | Aa2 | 900,268 |

| | | School Facilities Improvement, Build America Taxable Bond Series 2010C, 6.210%, 8/01/35 | | | |

| 15,000 | | Los Angeles Community College District, California, General Obligation Bonds, Build America | No Opt. Call | Aa1 | 15,716,250 |

| | | Taxable Bonds, Series 2010, 6.600%, 8/01/42 | | | |

| 10,000 | | Los Angeles Community College District, Los Angeles County, California, General Obligation | No Opt. Call | Aa1 | 10,477,500 |

| | | Bonds, Series 2010, 6.600%, 8/01/42 (UB) (4) | | | |

| 11,000 | | Los Angeles County Public Works Financing Authority, California, Lease Revenue Bonds, Multiple | No Opt. Call | A+ | 10,843,580 |

| | | Capital Projects I, Build America Taxable Bond Series 2010B, 7.618%, 8/01/40 | | | |

| 2,000 | | Los Angeles Department of Water and Power, California, Water System Revenue Bonds, Tender | No Opt. Call | Aa1 | 2,513,100 |

| | | Option Bond Trust T0003, 29.995%, 7/01/42 (IF) (4) | | | |

| 9,520 | | Napa Valley Unified School District, Napa County, California, General Obligation Bonds, Build | No Opt. Call | Aa2 | 9,558,651 |

| | | America Taxable Bond Series 2010B, 6.507%, 8/01/43 | | | |

| 3,000 | | Oakland Redevelopment Agency, California, Subordinated Housing Set Aside Revenue Bonds, | No Opt. Call | A | 2,946,720 |

| | | Federally Taxable Series 2011A-T, 7.500%, 9/01/19 | | | |

| 5,000 | | Orange County Sanitation District, California, Wastewater Revenue Bonds, Build America Taxable | No Opt. Call | AAA | 4,719,700 |

| | | Bond Series 2010A, 5.580%, 2/01/40 | | | |

| 2,355 | | San Bernardino Community College District, California, General Obligation Bonds, Election of | No Opt. Call | AA– | 2,491,307 |

| | | 2008, Build America Taxable Bond Series 2009C, 7.630%, 8/01/44 | | | |

| 4,000 | | San Francisco City and County, California, Certificates of Participation, 525 Golden Gate | No Opt. Call | AA– | 2,783,000 |

| | | Avenue, San Francisco Public Utilities Commission Office Project, Tender Option Bond Trust | | | |

| | | B001, 29.243%, 11/01/30 (IF) | | | |

| 1,000 | | Santa Barbara County, California, Certificates of Participation, Recovery Zone Economic | No Opt. Call | AA+ | 973,600 |

| | | Development Taxable Bonds, Series 2010A-2, 6.250%, 12/01/40 | | | |

| | | Stanton Redevelopment Agency, California, Consolidated Project Tax Allocation Bonds, | | | |

| | | Series 2011A: | | | |

| 275 | | 6.500%, 12/01/17 | No Opt. Call | A– | 272,440 |

| 295 | | 6.750%, 12/01/18 | No Opt. Call | A– | 289,873 |

| 2,500 | | Walnut Energy Center Authority, California, Electric Revenue Bonds, Turlock Irrigation | No Opt. Call | A+ | 2,465,425 |

| | | District, Build America Taxable Bonds, Series 2010B, 6.230%, 1/01/29 | | | |

| 4,000 | | West Kern Water District, California, Certificates of Participation, Land Acquisition Project, | No Opt. Call | AA– | 4,044,680 |

| | | Build America Bonds, Series 10B, 6.720%, 6/01/40 | | | |

| 100,395 | | Total California | | | 101,130,899 |

14 Nuveen Investments

| | | | | | |

| Principal | | | Optional Call | | |

| Amount (000) | | Description (1) | Provisions (2) | Ratings (3) | Value |

| | | Colorado – 1.9% (1.8% of Total Investments) | | | |

| $ 1,000 | | East Cherry Creek Valley Water and Sanitation District, Arapahoe County, Colorado, Water | 11/20 at 100.00 | A+ | $ 897,330 |

| | | Revenue Bonds, Build America Taxable Bond Series 2010B, 5.820%, 11/15/40 | | | |

| 3,000 | | Mesa State College, Colorado, Auxiliary Facilities Enterprise Revenue Bonds, Build America | No Opt. Call | Aa2 | 3,052,080 |

| | | Taxable Bond Series 2010B, 6.746%, 5/15/42 | | | |

| 1,000 | | Metropolitan State College of Denver, Colorado, Institutional Enterprise Revenue Bonds, | No Opt. Call | Aa2 | 952,130 |

| | | Federally Taxable Build America Bonds, Recovery Zone Economic Development Project, Series 2010, | | | |

| | | 6.000%, 12/01/40 | | | |

| 5,000 | | St. Vrain Valley School District RE-1J, Boulder, Larimer and Weld Counties, Colorado, General | 12/20 at 100.00 | Aa2 | 4,776,050 |

| | | Obligation Bonds, Build America Taxable Bond Series 2010B, 5.790%, 12/15/33 | | | |

| 10,000 | | Total Colorado | | | 9,677,590 |

| | | Connecticut – 1.3% (1.2% of Total Investments) | | | |

| 6,000 | | Harbor Point Infrastructure Improvement District, Connecticut, Special Obligation Revenue | 4/20 at 100.00 | N/R | 6,417,720 |

| | | Bonds, Harbor Point Project, Federally Taxable – Issuer Subsidy – Recovery Zone Economic | | | |

| | | Development Bond Series 2010B, 12.500%, 4/01/39 | | | |

| | | Florida – 3.4% (3.1% of Total Investments) | | | |

| 5,000 | | Florida Governmental Utilities Authority, North Fort Myers Utility Revenue Bonds, Federally | 10/20 at 100.00 | A2 | 5,091,200 |

| | | Taxable Build America Bonds, Series 2010B, 7.084%, 10/01/40 | | | |

| 6,195 | | Florida State Board of Education, Public Education Capital Outlay Bonds, Build America Taxable | 6/19 at 100.00 | AAA | 6,114,837 |

| | | Bonds, Series 2010G, 5.750%, 6/01/35 | | | |

| 500 | | Lake City, Florida, Utility System Revenue Bonds, Build America Taxable Bonds Series 2010B, | 7/20 at 100.00 | AA+ | 497,765 |

| | | 6.175%, 7/01/35 – AGC Insured | | | |

| 4,975 | | Orlando Community Redevelopment Agency, Florida, Tax Increment Revenue Bonds, Downtown | 9/20 at 100.00 | A1 | 5,295,639 |

| | | District, Direct Subsidy Build America Table Bond Series 2010B, 7.784%, 9/01/40 | | | |

| 16,670 | | Total Florida | | | 16,999,441 |

| | | Georgia – 4.7% (4.3% of Total Investments) | | | |

| 10,000 | | Georgia Municipal Electric Authority, Plant Vogtle Units 3 & 4 Project J Bonds, Taxable Build | No Opt. Call | A+ | 9,549,300 |

| | | America Bonds Series 2010A, 6.637%, 4/01/57 | | | |

| 15,000 | | Georgia Municipal Electric Authority, Plant Vogtle Units 3 & 4 Project P Bonds, Refunding | No Opt. Call | A– | 14,032,800 |

| | | Taxable Build America Bonds Series 2010A, 7.055%, 4/01/57 | | | |

| 25,000 | | Total Georgia | | | 23,582,100 |

| | | Illinois – 11.4% (10.4% of Total Investments) | | | |

| 5,000 | | Chicago Transit Authority, Illinois, Sales and Transfer Tax Receipts Revenue Bonds, Pension | No Opt. Call | AA | 4,938,400 |

| | | Funding Taxable Series 2008A, 6.899%, 12/01/40 | | | |

| 10,000 | | Chicago, Illinois, General Airport Revenue Bonds, O’Hare International Airport, Third Lien, | 1/20 at 100.00 | A1 | 9,859,800 |

| | | Build America Taxable Bond Series 2010B, 6.845%, 1/01/38 | | | |

| 10,000 | | Chicago, Illinois, Wastewater Transmission Revenue Bonds, Build America Taxable Bond Series | No Opt. Call | Aa3 | 10,278,100 |

| | | 2010B, 6.900%, 1/01/40 | | | |

| 10,000 | | Chicago, Illinois, Water Revenue Bonds, Taxable Second Lien Series 2010B, 6.742%, 11/01/40 | No Opt. Call | AA– | 10,262,100 |

| 5,610 | | Cook County, Illinois, General Obligation Bonds, Build America Taxable Bonds, Series 2010D, | No Opt. Call | AA | 5,394,520 |

| | | 6.229%, 11/15/34 | | | |

| 500 | | Illinois Finance Authority, Revenue Bonds, Illinois Institute of Technology, Refunding Series | 4/11 at 100.00 | Baa3 | 436,985 |

| | | 2006A, 6.100%, 4/01/15 | | | |

| 13,875 | | Illinois State, General Obligation Bonds, Taxable Build America Bonds, Series 2010-3, | No Opt. Call | A+ | 13,325,689 |

| | | 6.725%, 4/01/35 | | | |

| 2,680 | | Illinois Toll Highway Authority, Toll Highway Revenue Bonds, Build America Taxable Bonds, | No Opt. Call | AA– | 2,601,449 |

| | | Senior Lien Series 2009A, 6.184%, 1/01/34 | | | |

| 57,665 | | Total Illinois | | | 57,097,043 |

| | | Indiana – 3.5% (3.2% of Total Investments) | | | |

| | | Evansville Redevelopment Authority, Indiana, Lease Rental Revenue Bonds, Build America Taxable | | | |

| | | Bond Series 2010B: | | | |

| 1,250 | | 6.960%, 2/01/34 | 8/20 at 100.00 | Aa3 | 1,262,638 |

| 9,440 | | 7.210%, 2/01/39 | 8/20 at 100.00 | Aa3 | 9,585,848 |

Nuveen Investments 15

| | |

| | Nuveen Build America Bond Fund (continued) |

| NBB | Portfolio of Investments March 31, 2011 |

| | | | | | |

| Principal | | | Optional Call | | |

| Amount (000) | | Description (1) | Provisions (2) | Ratings (3) | Value |

| | | Indiana (continued) | | | |

| $ 5,000 | | Indiana University, Consolidated Revenue Bonds, Build America Taxable Bonds, Series 2010B, | 6/20 at 100.00 | Aaa | $ 4,893,700 |

| | | 5.636%, 6/01/35 | | | |

| 1,725 | | Speedway Redevelopment Authority, Indiana, Lease Rental Revenue Bonds, Federally Taxable Build | No Opt. Call | A+ | 1,695,917 |

| | | America Bonds, Series 2010A, 6.512%, 2/01/35 | | | |

| 17,415 | | Total Indiana | | | 17,438,103 |

| | | Kentucky – 1.0% (0.9% of Total Investments) | | | |

| 5,000 | | Kentucky Municipal Power Agency, Power Supply System Revenue Bonds, Prairie State Project, | 9/20 at 100.00 | AA+ | 5,208,250 |

| | | Tender Option Bond Trust B002, 28.928%, 9/01/37 – AGM Insured (IF) | | | |

| | | Louisiana – 4.0% (3.6% of Total Investments) | | | |

| 20,000 | | East Baton Rouge Sewage Commission, Louisiana, Revenue Bonds, Build America Taxable Bonds, | 2/20 at 100.00 | Aa2 | 19,961,000 |

| | | Series 2010B, 6.087%, 2/01/45 | | | |

| | | Massachusetts – 0.5% (0.4% of Total Investments) | | | |

| 2,000 | | Massachusetts, Transportation Fund Revenue Bonds, Accelerated Bridge Program, Tender Option | No Opt. Call | AAA | 2,318,000 |

| | | Bond Trust T0004, 25.436%, 6/01/40 (IF) (4) | | | |

| | | Michigan – 3.8% (3.4% of Total Investments) | | | |

| 14,650 | | Detroit City School District, Wayne County, Michigan, General Obligation Bonds, Build America | No Opt. Call | Aa2 | 15,335,620 |

| | | Taxable Bond Series 2009B, 7.747%, 5/01/39 | | | |

| 1,720 | | Jackson Public Schools, Jackson County, Michigan, General Obligation Bonds, Qualified School | 5/20 at 100.00 | Aa2 | 1,722,219 |

| | | Construction Bonds – Taxable Direct Payment, Series 2010B, 6.450%, 5/01/27 | | | |

| 1,000 | | Michigan Tobacco Settlement Finance Authority, Tobacco Settlement Asset-Backed Revenue Bonds, | 6/22 at 100.00 | Baa3 | 748,140 |

| | | Taxable Turbo Series 2006A, 7.309%, 6/01/34 | | | |

| 950 | | Monroe, Michigan, Limited Tax General Obligation Bonds, Taxable Recovery Zone Economic | 5/20 at 100.00 | A+ | 971,347 |

| | | Development Bonds, Series 2010, 6.650%, 5/01/27 | | | |

| 18,320 | | Total Michigan | | | 18,777,326 |

| | | Missouri – 0.4% (0.3% of Total Investments) | | | |

| 1,900 | | Missouri Joint Municipal Electric Utility Commission, Prairie State Power Project Revenue | 1/19 at 100.00 | A3 | 1,866,636 |

| | | Bond, Federally Taxable Build America Bonds – Direct Pay, Series 2009A, 6.890%, 1/01/42 | | | |

| | | Nebraska – 0.3% (0.3% of Total Investments) | | | |

| 1,670 | | District Energy Corporation, Nebraska, Facility Revenue Bonds, Build America Taxable Bonds, | 7/20 at 100.00 | Aa1 | 1,631,690 |

| | | Series 2010B, 5.901%, 7/01/32 | | | |

| | | Nevada – 2.3% (2.1% of Total Investments) | | | |

| 6,000 | | Clark County, Nevada, Airport Revenue Bonds, Senior Lien Series 2009B, 6.881%, 7/01/42 | 7/19 at 100.00 | Aa2 | 5,999,880 |

| 1,315 | | Las Vegas, Nevada, Certificates of Participation, City Hall Project, Build America Federally | 9/19 at 100.00 | AA– | 1,388,298 |

| | | Taxable Bonds, Series 2009B, 7.800%, 9/01/39 | | | |

| 4,000 | | North Las Vegas, Nevada, General Obligation Water and Wastewater Improvement Bonds, Build | No Opt. Call | Aa2 | 3,991,800 |

| | | America Taxable Bonds, Series 2010A, 6.572%, 6/01/40 | | | |

| 11,315 | | Total Nevada | | | 11,379,978 |

| | | New Jersey – 2.5% (2.3% of Total Investments) | | | |

| 11,500 | | New Jersey Turnpike Authority, Revenue Bonds, Build America Taxable Bonds, Series 2010A, | No Opt. Call | A+ | 12,501,190 |

| | | 7.102%, 1/01/41 | | | |

| | | New York – 11.8% (10.7% of Total Investments) | | | |

| 15,000 | | Dormitory Authority of the State of New York, State Personal Income Tax Revenue Bonds, Build | No Opt. Call | AAA | 14,160,450 |

| | | America Taxable Bonds, Series 2010D, 5.600%, 3/15/40 | | | |

| 10,000 | | Dormitory Authority of the State of New York, State Personal Income Tax Revenue Bonds, | No Opt. Call | AAA | 9,440,300 |

| | | Series 2010D, 5.600%, 3/15/40 (UB) | | | |

| 10,000 | | Long Island Power Authority, New York, Electric System Revenue Bonds, Build America Taxable | No Opt. Call | A– | 9,130,600 |

| | | Bond Series 2010B, 5.850%, 5/01/41 | | | |

| 4,750 | | Metropolitan Transportation Authority, New York, Transportation Revenue Bonds, Build America | No Opt. Call | A | 4,450,560 |

| | | Taxable Bonds, Series 2009A-1, 5.871%, 11/15/39 | | | |

16 Nuveen Investments

| | | | | | |

| Principal | | | Optional Call | | |

| Amount (000) | | Description (1) | Provisions (2) | Ratings (3) | Value |

| | | New York (continued) | | | |

| | | New York City Municipal Water Finance Authority, New York, Water and Sewer System Revenue | | | |

| | | Bonds, Second Generation Resolution, Build America Taxable Bonds, Series 2010DD: | | | |

| $ 2,025 | | 5.952%, 6/15/42 (UB) | No Opt. Call | AA+ | $ 2,080,809 |

| 2,595 | | 5.952%, 6/15/42 | No Opt. Call | AA+ | 2,666,518 |

| 1,595 | | New York City Municipal Water Finance Authority, New York, Water and Sewer System Revenue | No Opt. Call | AA+ | 1,654,733 |

| | | Bonds, Second Generation Resolution, Taxable Tender Option Bonds Trust T30001-2, | | | |

| | | 26.399%, 6/15/44 (IF) | | | |

| 5,500 | | New York City Transitional Finance Authority, New York, Building Aid Revenue Bonds, Build | No Opt. Call | AA– | 5,883,790 |

| | | America Taxable Bond Fiscal 2011 Series 2010S-1B, 6.828%, 7/15/40 | | | |

| 10,000 | | New York City Transitional Finance Authority, New York, Future Tax Secured Bonds, Build | No Opt. Call | AAA | 9,374,500 |

| | | America Taxable Bonds, Series 2010G-1, 5.467%, 5/01/40 | | | |

| 61,465 | | Total New York | | | 58,842,260 |

| | | Ohio – 5.3% (4.8% of Total Investments) | | | |

| 500 | | American Municipal Power Inc., Ohio, Combined Hydroelectric Projects Revenue Bonds, Federally | No Opt. Call | A | 506,400 |

| | | Taxable Build America Bonds, Series 2009B, 6.424%, 2/15/32 | | | |

| 10,000 | | American Municipal Power Inc., Ohio, Combined Hydroelectric Projects Revenue Bonds, Federally | No Opt. Call | A | 11,219,500 |

| | | Taxable Build America Bonds, Series 2010B, 7.834%, 2/15/41 | | | |

| 3,000 | | Circleville City School District, Pickaway County, Ohio, General Obligation School Facilities | 5/20 at 100.00 | Aa2 | 3,072,660 |

| | | Construction and Improvement Bonds, Build America Taxable Series 2010C, 6.300%, 11/01/40 | | | |

| | | Franklin County Convention Facilities Authority, Ohio, Lease Revenue Anticipation Bonds, | | | |

| | | Federally Taxable Direct Payment Build America Bonds, Series 2010: | | | |

| 570 | | 6.540%, 12/01/36 | No Opt. Call | AA | 547,388 |

| 4,490 | | 6.640%, 12/01/42 | No Opt. Call | AA | 4,361,317 |

| 5,000 | | Lucas County, Ohio, General Obligation Bonds, Taxable Arena improvement Series 2010, | 10/20 at 100.00 | Aa2 | 4,822,300 |

| | | 6.150%, 10/01/40 | | | |

| 1,760 | | Madison Local School District, Lake & Geauga Counties, Ohio, General Obligation Bonds, Build | 9/20 at 100.00 | Aa2 | 1,659,381 |

| | | America Taxable Bond Series 2010C, 6.050%, 4/01/42 | | | |

| 25,320 | | Total Ohio | | | 26,188,946 |

| | | Oregon – 2.9% (2.7% of Total Investments) | | | |

| 4,000 | | Oregon Department of Administrative Services, Certificates of Participation, Federally Taxable | 5/20 at 100.00 | Aa2 | 3,776,400 |

| | | Build America Bonds, Tender Option Bond Trust TN-011, 27.474%, 5/01/35 (IF) (4) | | | |

| 9,950 | | Warm Springs Reservation Confederated Tribes, Oregon, Tribal Economic Development | No Opt. Call | A3 | 10,804,904 |

| | | Bonds, Hydroelectric Revenue Bonds, Pelton Round Butte Project, Refunding Series 2009A, | | | |

| | | 8.250%, 11/01/19 | | | |

| 13,950 | | Total Oregon | | | 14,581,304 |

| | | Pennsylvania – 1.4% (1.3% of Total Investments) | | | |

| 3,000 | | Haverford Township School District, Delaware County, Pennsylvania, General Obligation Bonds, | 3/20 at 100.00 | AA+ | 2,937,960 |

| | | Federally Taxable Build America Bonds, Series 2010, 6.004%, 3/01/35 – AGC Insured | | | |

| 1,500 | | New Castle Sanitation Authority, Lawrence County, Pennsylvania, Sewer Revenue Bonds, Build | 6/20 at 100.00 | AA+ | 1,506,600 |

| | | America Taxable Bonds, Series 2010A, 6.506%, 6/01/41 – AGM Insured | | | |

| 2,800 | | Uniontown Area School District, Fayette County, Pennsylvania, General Obligation Bonds, | 10/20 at 100.00 | Aa3 | 2,781,968 |

| | | Federally Taxable Build America Bonds, Series 2010, 6.261%, 10/01/39 | | | |

| 7,300 | | Total Pennsylvania | | | 7,226,528 |

| | | South Carolina – 2.0% (1.8% of Total Investments) | | | |

| 205 | | South Carolina Public Service Authority, Electric System Revenue Bonds, Santee Cooper, | No Opt. Call | Aa2 | 281,106 |

| | | Federally Taxable Build America Tender Option Bond Trust T30002, 29.430%, 1/01/50 (IF) | | | |

| 8,985 | | South Carolina Public Service Authority, Electric System Revenue Bonds, Santee Cooper, | No Opt. Call | Aa2 | 9,652,316 |

| | | Series 2010A, 6.454%, 1/01/50 (UB) | | | |

| 9,190 | | Total South Carolina | | | 9,933,422 |

| | | Tennessee – 3.2% (2.9% of Total Investments) | | | |

| 15,000 | | Metropolitan Government Nashville & Davidson County Convention Center Authority, Tennessee, | No Opt. Call | A1 | 15,856,800 |

| | | Tourism Tax Revenue Bonds, Build America Taxable Bonds, Series 2010A-2, 7.431%, 7/01/43 | | | |

Nuveen Investments 17

| | |

| | Nuveen Build America Bond Fund (continued) |

| NBB | Portfolio of Investments March 31, 2011 |

| | | | | | |

| Principal | | | Optional Call | | |

| Amount (000) | | Description (1) | Provisions (2) | Ratings (3) | Value |

| | | Texas – 6.1% (5.6% of Total Investments) | | | |

| $ 10,000 | | North Texas Tollway Authority, System Revenue Bonds, Subordinate Lien Taxable Revenue Bonds, | 2/20 at 100.00 | Baa3 | $ 10,387,300 |

| | | Federally Taxable Build America Bonds, Series 2010-B2, 8.910%, 2/01/30 | | | |

| 15,000 | | North Texas Tollway Authority, System Revenue Bonds, Taxable Build America Bond Series 2009B, | No Opt. Call | A2 | 14,957,100 |

| | | 6.718%, 1/01/49 | | | |

| 5,000 | | San Antonio, Texas, General Obligation Bonds, Build America Taxable Bonds, Series 2010B, | 8/20 at 100.00 | AAA | 5,109,650 |

| | | 6.038%, 8/01/40 | | | |

| 30,000 | | Total Texas | | | 30,454,050 |

| | | Utah – 2.1% (1.9% of Total Investments) | | | |

| 5,000 | | Central Utah Water Conservancy District, Utah, Revenue Bonds, Federally Taxable Build America | 4/20 at 100.00 | AA+ | 4,587,750 |

| | | Bonds, Series 2010A, 5.700%, 10/01/40 | | | |

| 5,415 | | Midvale Redevelopment Agency, Utah, Tax Increment and Sales Tax Revenue Bonds, Federally | 5/20 at 100.00 | AA+ | 5,210,205 |

| | | Taxable Build America Bonds, Series 2010, 6.250%, 5/01/34 – AGM Insured | | | |

| 775 | | North Salt Lake, Utah, Sales Tax Revenue Bonds, Build America Taxable Bond Series 2010, | 12/19 at 100.00 | AA– | 741,900 |

| | | 5.800%, 6/15/30 | | | |

| 11,190 | | Total Utah | | | 10,539,855 |

| | | Vermont – 1.0% (0.9% of Total Investments) | | | |

| 5,000 | | University of Vermont and State Agricultural College, Revenue Bonds, Build America Bonds | No Opt. Call | Aa3 | 4,904,350 |

| | | Series 2010, 6.428%, 10/01/44 | | | |

| | | Virgin Islands – 2.6% (2.4% of Total Investments) | | | |

| 12,500 | | Virgin Islands Water and Power Authority, Electric System Revenue Bonds, Build America Taxable | No Opt. Call | AA+ | 12,946,250 |

| | | Bonds Series 2010C, 6.850%, 7/01/35 – AGM Insured | | | |

| | | Virginia – 2.4% (2.2% of Total Investments) | | | |

| 1,135 | | Metropolitan Washington DC Airports Authority, Virginia, Dulles Toll Road Revenue Bonds, | No Opt. Call | BBB+ | 1,114,888 |

| | | Series 2009D, 7.462%, 10/01/46 – AGC Insured | | | |

| 10,000 | | Metropolitan Washington DC Airports Authority, Virginia, Dulles Toll Road Revenue Bonds, | No Opt. Call | BBB | 9,682,700 |

| | | Dulles Metrorail Capital Improvement Project, Build America Taxable Bonds, Series 2010D, | | | |

| | | 8.000%, 10/01/47 | | | |

| 1,705 | | Tobacco Settlement Financing Corporation of Virginia, Tobacco Settlement Asset Backed Bonds, | 6/12 at 100.00 | Baa3 | 1,049,155 |

| | | Refunding Senior Lien Series 2007A1, 6.706%, 6/01/46 | | | |

| 12,840 | | Total Virginia | | | 11,846,743 |

| | | Washington – 4.6% (4.2% of Total Investments) | | | |

| 2,465 | | Auburn, Washington, Limited Tax General Obligation Bonds, Taxable Build America Bonds, Series | 6/20 at 100.00 | AA | 2,484,054 |

| | | 2010B, 6.243%, 12/01/39 | | | |

| 5,000 | | Grays Harbor County Public Utility District 1, Washington, Electric System Revenue Bonds, | No Opt. Call | A1 | 5,214,800 |

| | | Taxable Build America Bonds – Direct Payment, Series 2010A, 6.707%, 7/01/40 | | | |

| 5,000 | | King County Public Hospital District 1, Washington, Hospital Facilities Revenue Bonds, Valley | 6/20 at 100.00 | BBB+ | 5,090,150 |

| | | Medical Center, Build America Taxable Bonds, Series 2010B, 8.000%, 6/15/40 | | | |

| 5,000 | | Mason County Public Utility District 3, Washington, Electric Revenue Bonds, Build America | 6/20 at 100.00 | Aa3 | 4,823,100 |

| | | Taxable Bonds, Series 2010B, 6.347%, 12/01/40 | | | |

| 2,505 | | Okanogan County Public Utility District 1, Washington, Electric System Revenue Bonds, Build | No Opt. Call | A1 | 2,374,840 |

| | | America Taxable Bonds – Direct Payment, Series 2010B, 6.046%, 12/01/40 | | | |

| 4,000 | | Seattle, Washington, Municipal Light and Power Revenue Bonds, Federally Taxable Build America | No Opt. Call | Aa2 | 2,903,800 |

| | | Bonds, Tender Option Bond Trust T0001, 24.589%, 2/01/40 (IF) (4) | | | |

| 23,970 | | Total Washington | | | 22,890,744 |

18 Nuveen Investments

| | | | | | |

| Principal | | | Optional Call | | |

| Amount (000) | | Description (1) | Provisions (2) | Ratings (3) | Value |

| | | Wyoming – 0.4% (0.4% of Total Investments) | | | |

| $ 2,000 | | University of Wyoming, Facilities Improvement Revenue Bonds, Build America Taxable Bond Series | 6/20 at 100.00 | Aa2 | $ 1,949,937 |

| | | 2010C, 5.800%, 6/01/30 | | | |

| $ 547,575 | | Total Municipal Bonds (cost $560,917,578) – 109.6% | | | 546,734,895 |

Principal | | | | | |

| Amount (000) | | Description (1) | Coupon | Maturity | Value |

| | | Short-Term Investments – 0.1% (0.1% of Total Investments) | | | |

| $ 545 | | Repurchase Agreement with State Street Bank, dated 3/31/11, repurchase price $545,330, | 0.010% | 4/01/11 | 545,330 |

| | | collateralized by $555,000 U.S. Treasury Notes, 1.000%, due 4/30/12, value $561,196 | | | |

| | | Total Short-Term Investments (cost $545,330) | | | 545,330 |

| | | Total Investments (cost $561,462,908) – 109.7% | | | 547,280,225 |

| | | Borrowings – (8.8)% (5) | | | (44,000,000) |

| | | Floating Rate Obligations – (5.0)% | | | (24,810,000) |

| | | Other Assets Less Liabilities – 4.1% (6) | | | 20,549,743 |

| | | Net Assets – 100% | | | $ 499,019,968 |

| | | | | | | | | | | | |

| Investments in Derivatives | | | | | | | | | |

| | | | | | | | | | |

Swaps outstanding at March 31, 2011: | | | | | | | | | | |

| | | Fund | | | | Fixed Rate | | | | Unrealized | |

| | Notional | Pay/Receive | Floating Rate | Fixed Rate | | Payment | Effective | Termination | | Appreciation | |

| Counterparty | Amount | Floating Rate | Index | (Annualized) | | Frequency | Date (7) | Date | | (Depreciation) | |

| Barclays Bank PLC | $ | 94,000,000 | Receive | 3-Month USD-LIBOR | 3.778 | % | Semi-Annually | 2/17/12 | 2/17/40 | | $ | 10,738,776 | |

| JPMorgan | | 19,200,000 | Receive | 1-Month USD-LIBOR | 0.360 | | Monthly | 3/21/11 | 3/21/12 | | | 2,508 | |

| JPMorgan | | 19,200,000 | Receive | 1-Month USD-LIBOR | 1.193 | | Monthly | 3/21/11 | 3/21/14 | | | 129,393 | |

| Morgan Stanley | | 19,200,000 | Receive | 1-Month USD-LIBOR | 2.064 | | Monthly | 3/21/11 | 3/21/16 | | | 248,022 | |

| Morgan Stanley | | 26,000,000 | Receive | 3-Month USD-LIBOR | 4.435 | | Semi-Annually | 2/24/12 | 2/24/40 | | | 238,354 | |

| | | | | | | | | | | | $ | 11,357,053 | |

| | |

| (1) | All percentages shown in the Portfolio of Investments are based on net assets unless otherwise noted. |

| (2) | Optional Call Provisions (not covered by the report of independent registered public accounting firm): Dates (month and year) and prices of the earliest |

| | optional call or redemption. There may be other call provisions at varying prices at later dates. Certain mortgage-backed securities may be subject to peri- |

| | odic principal paydowns. |

| (3) | Ratings (not covered by the report of independent registered public accounting firm): Using the highest of Standard & Poor’s Group (“Standard & Poor’s”), |

| | Moody’s Investor Service, Inc. (“Moody’s”) or Fitch, Inc. (“Fitch”) rating. Ratings below BBB by Standard & Poor’s, Baa by Moody’s or BBB by Fitch are |

| | considered to be below investment grade. Holdings designated N/R are not rated by any of these national rating agencies. |

| (4) | Investment, or portion of investment, has been pledged to collateralize the net payment obligations for investments in derivatives and/or inverse floating |

| | rate transactions. |

| (5) | Borrowings as a percentage of Total Investments is 8.0%. |

| (6) | Other Assets Less Liabilities includes the Value and/or the Net Unrealized Appreciation (Depreciation) of derivative instruments as listed within Investments |

| | in Derivatives. |

| (7) | Effective date represents the date on which both the Fund and Counterparty commence interest payment accruals on each swap contract. |

| N/R | Not rated. |

| (IF) | Inverse floating rate investment. |

| (UB) | Underlying bond of an inverse floating rate trust reflected as a financing transaction. See Notes to Financial Statements, Footnote 1 – General Information |

| | and Significant Accounting Policies, Inverse Floating Rate Securities for more information. |

| USD-LIBOR | United States Dollar-London Inter-Bank Offered Rate. |

See accompanying notes to financial statements.

Nuveen Investments 19

| | | | | | |

| | | Nuveen Build America Bond Opportunity Fund | | |

| NBD | | Portfolio of Investments | | |

| | | March 31, 2011 |

| | | | | | |

| Principal | | | Optional Call | | |

| Amount (000) | | Description (1) | Provisions (2) | Ratings (3) | Value |

| | | California – 12.9% (12.5% of Total Investments) | | | |

| $ 1,030 | | Bay Area Toll Authority, California, Revenue Bonds, San Francisco Bay Area Toll Bridge, | No Opt. Call | A+ | $ 1,065,535 |

| | | Subordinate Lien, Build America Federally Taxable Bond Series 2010S-1, 7.043%, 4/01/50 | | | |

| 1,500 | | California State Public Works Board, Lease Revenue Bonds, Various Capital Projects, Build | No Opt. Call | A2 | 1,592,205 |

| | | America Taxable Bond Series 2009G-2, 8.361%, 10/01/34 | | | |

| 2,000 | | Hayward Unified School District, Alameda County, California, General Obligation Bonds, Build | 8/20 at 100.00 | AA+ | 2,018,500 |

| | | America Taxable Bonds, Series 2010B, 7.350%, 8/01/43 – AGM Insured | | | |

| 2,000 | | Los Angeles Community College District, Los Angeles County, California, General Obligation | No Opt. Call | Aa1 | 2,668,200 |

| | | Bonds, Tender Option Bond Trust TN027, 29.966%, 8/01/49 (IF) (4) | | | |

| 1,000 | | Los Angeles County Public Works Financing Authority, California, Lease Revenue Bonds, Multiple | No Opt. Call | A+ | 985,780 |

| | | Capital Projects I, Build America Taxable Bond Series 2010B, 7.618%, 8/01/40 | | | |

| 2,000 | | Los Angeles Department of Water and Power, California, Water System Revenue Bonds, Tender | No Opt. Call | AA | 2,513,100 |

| | | Option Bond Trust T0003, 29.995%, 7/01/42 (IF) | | | |

| 1,000 | | Oakland Redevelopment Agency, California, Subordinated Housing Set Aside Revenue Bonds, | No Opt. Call | A | 982,240 |

| | | Federally Taxable Series 2011A-T, 7.500%, 9/01/19 | | | |

| 1,500 | | San Diego County Regional Transportation Commission, California, Sales Tax Revenue Bonds, | No Opt. Call | AAA | 1,486,410 |

| | | Build America Taxable Bonds Series 2010A, 5.911%, 4/01/48 | | | |

| 2,000 | | San Francisco City and County, California, Certificates of Participation, 525 Golden Gate | No Opt. Call | AA– | 1,391,500 |

| | | Avenue, San Francisco Public Utilities Commission Office Project, Tender Option Bond Trust | | | |

| | | B001, 29.243%, 11/01/30 (IF) | | | |

| 315 | | Stanton Redevelopment Agency, California, Consolidated Project Tax Allocation Bonds, Series | No Opt. Call | A– | 308,177 |

| | | 2011A, 7.000%, 12/01/19 | | | |

| 3,000 | | The Regents of the University of California, Medical Center Pooled Revenue Bonds, Build | No Opt. Call | Aa2 | 2,976,540 |

| | | America Taxable Bonds, Series 2010H, 6.548%, 5/15/48 | | | |

| 17,345 | | Total California | | | 17,988,187 |

| | | Colorado – 4.4% (4.3% of Total Investments) | | | |

| 4,000 | | Colorado State Bridge Enterprise Revenue Bonds, Federally Taxable Build America Series 2010A, | No Opt. Call | AA | 4,173,640 |

| | | 6.078%, 12/01/40 | | | |

| 2,000 | | Regional Transportation District, Colorado, Sales Tax Revenue Bonds, FasTracks Project, Build | No Opt. Call | AA+ | 1,958,800 |

| | | America Series 2010B, 5.844%, 11/01/50 | | | |

| 6,000 | | Total Colorado | | | 6,132,440 |

| | | Connecticut – 1.1% (1.1% of Total Investments) | | | |

| 1,500 | | Harbor Point Infrastructure Improvement District, Connecticut, Special Obligation Revenue | 4/20 at 100.00 | N/R | 1,604,430 |

| | | Bonds, Harbor Point Project, Federally Taxable – Issuer Subsidy – Recovery Zone Economic | | | |

| | | Development Bond Series 2010B, 12.500%, 4/01/39 | | | |

| | | District of Columbia – 2.7% (2.7% of Total Investments) | | | |

| 800 | | District of Columbia, Income Tax Secured Revenue Bonds, Build America Taxable Bonds, Series | No Opt. Call | AAA | 808,024 |

| | | 2009E, 5.591%, 12/01/34 | | | |

| 3,000 | | District of Columbia, Income Tax Secured Revenue Bonds, Build America Taxable Bonds, Series | No Opt. Call | AAA | 3,012,570 |

| | | 2010F, 5.582%, 12/01/35 | | | |

| 3,800 | | Total District of Columbia | | | 3,820,594 |

| | | Georgia – 3.4% (3.3% of Total Investments) | | | |

| 2,000 | | Georgia Municipal Electric Authority, Plant Vogtle Units 3 & 4 Project J Bonds, Taxable Build | No Opt. Call | A+ | 1,909,860 |

| | | America Bonds Series 2010A, 6.637%, 4/01/57 | | | |

| 3,000 | | Georgia Municipal Electric Authority, Plant Vogtle Units 3 & 4 Project P Bonds, Refunding | No Opt. Call | A– | 2,806,560 |

| | | Taxable Build America Bonds Series 2010A, 7.055%, 4/01/57 | | | |

| 5,000 | | Total Georgia | | | 4,716,420 |

20 Nuveen Investments

| | | | | | |

| Principal | | | Optional Call | | |

| Amount (000) | | Description (1) | Provisions (2) | Ratings (3) | Value |

| | | Illinois – 13.1% (12.7% of Total Investments) | | | |

| $ 3,375 | | Chicago Transit Authority, Illinois, Sales Tax Receipts Revenue Bonds, Federally Taxable Build | No Opt. Call | AA | $ 3,007,598 |

| | | America Bonds, Series 2010B, 6.200%, 12/01/40 | | | |

| 4,350 | | Chicago, Illinois, Wastewater Transmission Revenue Bonds, Build America Taxable Bond Series | No Opt. Call | Aa3 | 4,470,974 |

| | | 2010B, 6.900%, 1/01/40 | | | |

| 500 | | Cook County, Illinois, General Obligation Bonds, Build America Taxable Bonds, Series 2010D, | No Opt. Call | AA | 480,795 |

| | | 6.229%, 11/15/34 | | | |

| 500 | | Illinois Finance Authority, Revenue Bonds, Illinois Institute of Technology, Refunding Series | 4/11 at 100.00 | Baa3 | 436,985 |

| | | 2006A, 6.100%, 4/01/15 | | | |

| 2,000 | | Illinois State, General Obligation Bonds, Build America Taxable Bonds, Series 2010-5, | No Opt. Call | A+ | 2,064,200 |

| | | 7.350%, 7/01/35 | | | |

| 3,000 | | Illinois Toll Highway Authority, Toll Highway Revenue Bonds, Build America Taxable Bonds, | No Opt. Call | AA– | 2,912,070 |

| | | Senior Lien Series 2009A, 6.184%, 1/01/34 | | | |

| 2,500 | | Northern Illinois Municipal Power Agency, Power Project Revenue Bonds, Prairie State Project, | No Opt. Call | A2 | 2,776,725 |

| | | Build America Taxable Bond Series 2010A, 7.820%, 1/01/40 | | | |

| 2,000 | | The Board of Trustee of Northern Illinois University, Auxiliary Facilities System Revenue | 4/20 at 100.00 | Aa3 | 2,148,920 |

| | | Bonds Federally Taxable Build America Series 2010, 7.947%, 4/01/35 – AGM Insured | | | |

| 18,225 | | Total Illinois | | | 18,298,267 |

| | | Indiana – 1.8% (1.8% of Total Investments) | | | |

| 2,500 | | Indianapolis Local Public Improvement Bond Bank, Indiana, Build America Taxable Bonds, Series | No Opt. Call | AA+ | 2,563,225 |

| | | 2010B-2, 6.116%, 1/15/40 | | | |

| | | Kentucky – 2.2% (2.1% of Total Investments) | | | |

| 3,000 | | Louisville and Jefferson County Metropolitan Sewer District, Kentucky, Sewer and Drainage | No Opt. Call | AA– | 3,079,980 |

| | | System Revenue Bonds, Build America Taxable Bonds Series 2010A, 6.250%, 5/15/43 | | | |

| | | Massachusetts – 1.7% (1.6% of Total Investments) | | | |

| 2,000 | | Massachusetts, Transportation Fund Revenue Bonds, Accelerated Bridge Program, Tender Option | No Opt. Call | AAA | 2,318,000 |

| | | Bond Trust T0004, 25.436%, 6/01/40 (IF) | | | |

| | | Michigan – 5.4% (5.2% of Total Investments) | | | |

| 3,000 | | Detroit City School District, Wayne County, Michigan, General Obligation Bonds, Build America | 5/20 at 100.00 | Aa2 | 2,870,730 |

| | | Taxable Bond Series 2010B, 6.845%, 5/01/40 | | | |

| 1,000 | | Grand Rapids, Michigan, Sanitary Sewer System Revenue Bonds, Build America Taxable Bond Series | No Opt. Call | AA+ | 1,023,330 |

| | | 2010A, 6.720%, 1/01/41 | | | |

| 2,000 | | Michigan Tobacco Settlement Finance Authority, Tobacco Settlement Asset-Backed Revenue Bonds, | 6/22 at 100.00 | Baa3 | 1,496,280 |

| | | Taxable Turbo Series 2006A, 7.309%, 6/01/34 | | | |

| 2,000 | | Wayne County Building Authority, Michigan, General Obligation Bonds, Jail Facilities, | 12/20 at 100.00 | A– | 2,097,900 |

| | | Federally Taxable Recovery Zone Economic Development Series 2010, 10.000%, 12/01/40 | | | |

| 8,000 | | Total Michigan | | | 7,488,240 |

| | | Minnesota – 1.9% (1.8% of Total Investments) | | | |

| 2,500 | | Western Minnesota Municipal Power Agency, Power Supply Revenue Bonds, Build America Taxable | No Opt. Call | A1 | 2,609,675 |

| | | Bond Series 2010C, 6.770%, 1/01/46 | | | |

| | | Mississippi – 1.7% (1.7% of Total Investments) | | | |

| 2,500 | | Mississippi State, General Obligation Bonds, Build America Taxable Bond Series 2010F, | No Opt. Call | AA | 2,425,850 |

| | | 5.245%, 11/01/34 | | | |

| | | Missouri – 2.8% (2.7% of Total Investments) | | | |

| 1,150 | | Curators of the University of Missouri, System Facilities Revenue Bonds, Build America Taxable | No Opt. Call | AA+ | 1,202,877 |

| | | Bonds, Series 2010, 5.792%, 11/01/41 | | | |

| 2,500 | | Missouri Joint Municipal Electric Utility Commission, Prairie State Power Project Revenue | No Opt. Call | A3 | 2,750,400 |

| | | Bond, Federally Taxable Build America Bonds – Direct Pay, Series 2010A, 7.897%, 1/01/42 | | | |

| 3,650 | | Total Missouri | | | 3,953,277 |

Nuveen Investments 21

| | |

| | Nuveen Build America Bond Opportunity Fund (continued) |

| NBD | Portfolio of Investments March 31, 2011 |

| | | | | | |

| Principal | | | Optional Call | | |

| Amount (000) | | Description (1) | Provisions (2) | Ratings (3) | Value |

| | | Nevada – 2.8% (2.7% of Total Investments) | | | |

| $ 1,615 | | Clark County, Nevada, Airport Revenue Bonds, Senior Lien Series 2009B, 6.881%, 7/01/42 | 7/19 at 100.00 | Aa2 | $ 1,614,968 |

| 2,000 | | Washoe County, Nevada, Highway Revenue, Motor Vehicle Fuel Tax Bonds, Federally Taxable Direct | No Opt. Call | A+ | 2,235,240 |

| | | Pay Build America Bonds, Series 2010E, 7.969%, 2/01/40 | | | |

| 3,615 | | Total Nevada | | | 3,850,208 |

| | | New Jersey – 5.5% (5.4% of Total Investments) | | | |

| 3,000 | | New Jersey Transportation Trust Fund Authority, Transportation System Bonds, Build America | No Opt. Call | Aa3 | 2,929,470 |

| | | Bonds Issuer Subsidy Program, Series 2010C, 5.754%, 12/15/28 | | | |

| 2,500 | | New Jersey Turnpike Authority, Revenue Bonds, Build America Taxable Bonds, Series 2010A, | No Opt. Call | A+ | 2,717,650 |

| | | 7.102%, 1/01/41 | | | |

| 2,050 | | Rutgers State University, New Jersey, Revenue Bonds, Build America Taxable Bond Series 2010H, | No Opt. Call | AA | 2,057,175 |

| | | 5.665%, 5/01/40 | | | |

| 7,550 | | Total New Jersey | | | 7,704,295 |

| | | New York – 10.1% (9.9% of Total Investments) | | | |

| 2,000 | | Dormitory Authority of the State of New York, State Personal Income Tax Revenue Bonds, Tender | No Opt. Call | AAA | 1,440,300 |

| | | Option Bond Trust B004, 24.523%, 3/15/40 (IF) | | | |

| 2,000 | | Metropolitan Transportation Authority, New York, Transportation Revenue Bonds, Federally | No Opt. Call | A | 2,051,120 |

| | | Taxable Issuer Subsidy Build America Bonds, Series 2010A, 6.668%, 11/15/39 | | | |

| 3,000 | | New York City Municipal Water Finance Authority, New York, Water and Sewer System Revenue | No Opt. Call | AA+ | 2,859,810 |

| | | Bonds, Second Generation Resolution, Build America Taxable Bonds, Fiscal 2011 Series 2010AA, | | | |

| | | 5.440%, 6/15/43 | | | |

| 2,000 | | New York City Municipal Water Finance Authority, New York, Water and Sewer System Revenue | No Opt. Call | AA+ | 2,074,900 |

| | | Bonds, Second Generation Resolution, Taxable Tender Option Bonds Trust T30001-2, | | | |

| | | 26.399%, 6/15/44 (IF) | | | |

| 2,955 | | New York City Transitional Finance Authority, New York, Building Aid Revenue Bonds, Build | No Opt. Call | AA– | 3,161,200 |

| | | America Taxable Bond Fiscal 2011 Series 2010S-1B, 6.828%, 7/15/40 | | | |

| 2,500 | | New York City, New York, General Obligation Bonds, Federally Taxable Build America Bonds, | 12/20 at 100.00 | AA | 2,596,450 |

| | | Series 2010-F1, 6.646%, 12/01/31 | | | |

| 14,455 | | Total New York | | | 14,183,780 |

| | | North Carolina – 1.0% (1.0% of Total Investments) | | | |

| 1,400 | | North Carolina Turnpike Authority, Triangle Expressway System State Annual Appropriation | 1/19 at 100.00 | AA | 1,446,732 |

| | | Revenue Bonds, Federally Taxable Issuer Subsidy Build America Bonds, Series 2009B, | | | |

| | | 6.700%, 1/01/39 | | | |

| | | Ohio – 4.0% (3.9% of Total Investments) | | | |

| 2,500 | | American Municipal Power Inc., Ohio, Meldahl Hydroelectric Projects Revenue Bonds, Federally | No Opt. Call | A | 2,603,600 |

| | | Taxable Build America Bonds, Series 2010B, 7.499%, 2/15/50 | | | |

| 3,000 | | Northeast Ohio Regional Sewer District, Wastewater Improvement Revenue Bonds, Build America | 11/20 at 100.00 | AA+ | 2,958,210 |

| | | Taxable Bonds, Series 2010, 6.038%, 11/15/40 | | | |

| 5,500 | | Total Ohio | | | 5,561,810 |

| | | Pennsylvania – 4.1% (4.0% of Total Investments) | | | |

| 1,000 | | Kiski Area School District, Westmoreland County, Pennsylvania, General Obligation Bonds, Build | 9/20 at 100.00 | Aa3 | 1,030,690 |

| | | America Taxable Bond Series 2010, 6.626%, 9/01/35 – AGM Insured | | | |

| 2,500 | | Pennsylvania State, General Obligation Bonds, Build America Taxable Bonds, Third Series 2010B, | 7/20 at 100.00 | Aa1 | 2,515,950 |

| | | 5.850%, 7/15/30 | | | |

| 2,500 | | Pennsylvania Turnpike Commission, Turnpike Revenue Bonds, Build America Taxable Bonds, Series | No Opt. Call | Aa3 | 2,210,425 |

| | | 2010B, 5.511%, 12/01/45 | | | |

| 6,000 | | Total Pennsylvania | | | 5,757,065 |

22 Nuveen Investments

| | | | | | |

| Principal | | | Optional Call | | |

| Amount (000) | | Description (1) | Provisions (2) | Ratings (3) | Value |