UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

| | |

| Investment Company Act file number | | 811‑22391 |

Nuveen Taxable Municipal Income Fund

(Exact name of registrant as specified in charter)

Nuveen Investments

333 West Wacker Drive

Chicago, IL 60606

(Address of principal executive offices) (Zip code)

Mark L. Winget

Nuveen Investments

333 West Wacker Drive

Chicago, IL 60606

(Name and address of agent for service)

| | |

| Registrant’s telephone number, including area code: | | (312) 917‑7700 |

| | |

| Date of fiscal year end: | | March 31 |

| | |

| Date of reporting period: | | March 31, 2023 |

Form N‑CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e‑1 under the Investment Company Act of 1940 (17 CFR 270.30e‑1). The Commission may use the information provided on Form N‑CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N‑CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N‑CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. ss. 3507.

| ITEM 1. | REPORTS TO STOCKHOLDERS. |

| | | | | | |

| | | |

| | Closed‑End Funds | | | | March 31, 2023 |

Nuveen Municipal

Closed‑End Funds

| | |

| | |

| Nuveen Taxable Municipal Income Fund | | NBB |

Annual

Report

Table

of Contents

| | | | |

| | | 3 | |

| |

| | | 4 | |

| |

| | | 5 | |

| |

| | | 7 | |

| |

| | | 8 | |

| |

| | | 10 | |

| |

| | | 11 | |

| |

| | | 13 | |

| |

| | | 14 | |

| |

| | | 24 | |

| |

| | | 25 | |

| |

| | | 26 | |

| |

| | | 27 | |

| |

| | | 28 | |

| |

| | | 30 | |

| |

| | | 41 | |

| |

| | | 58 | |

| |

| | | 59 | |

| |

| | | 60 | |

| |

| | | 61 | |

2

Chair’s Letter

to Shareholders

| | |

| | Dear Shareholders, |

| | The significant measures taken by the U.S. Federal Reserve (Fed) and other global central banks over the past year to contain inflation have begun to take effect. From March 2022 to May 2023, the Fed raised the target fed funds rate by 5.00% to a range of 5.00% to 5.25%, marking the fastest interest rate hiking cycle in its history. Across most of the world, inflation rates have fallen from their post-pandemic highs but currently remain well above the levels that central banks consider supportive of their economies’ long-term growth. |

| | At the same time, the U.S. and other large economies have remained surprisingly resilient, even as financial conditions have tightened. Despite contracting in the first half of 2022, U.S. gross domestic product grew 2.1% in the year overall compared to 2021 and expanded at a more moderate pace of 1.1% in the first quarter of 2023. A relatively strong jobs market has helped support consumer sentiment and spending despite historically high inflation. Markets are concerned that these conditions could keep upward pressure on prices and wages, although the recent collapse of three regional U.S. banks (Silicon Valley Bank, Signature Bank and First Republic Bank) and major European bank Credit Suisse is likely to add further downward pressure to the economy as the banking system slows lending in response. |

| | Fed officials are closely monitoring inflation data and other economic measures to modify their rate setting policy based upon these factors on a meeting‑by‑meeting basis. While uncertainty has increased given the unpredictable outcome of tighter credit conditions on the economy, the Fed remains committed to acting until it sees sustainable progress toward its inflation goals. In the meantime, markets are likely to continue reacting in the short term to news about inflation data, economic indicators and central bank policy. We encourage investors to keep a long-term perspective amid the short-term noise. Your financial professional can help you review how well your portfolio is aligned with your time horizon, risk tolerance and investment goals. |

| | On behalf of the other members of the Nuveen Fund Board, we look forward to continuing to earn your trust in the months and years ahead. |

| | |

| |

| | Terence J. Toth |

| |

| | Chair of the Board |

| |

| | May 22, 2023 |

3

Important Notices

For Shareholders of

Nuveen Taxable Municipal Income Fund (NBB)

Portfolio Manager Updates

Effective April 10, 2023, John V. Miller announced that he will retire from Nuveen on June 1, 2023 and will continue to serve as a portfolio manager of the Fund until that time. In conjunction with this announcement Kristen DeJong has been named a portfolio manager of the Fund. Daniel J. Close will continue to serve as portfolio manager of the Fund. The day‑to‑day operation of the Fund and the execution of its specific investment strategies is the primary responsibility of each of the Fund’s portfolio managers.

4

Portfolio Managers’

Comments

Nuveen Taxable Municipal Income Fund (NBB)

The Fund features portfolio management by Nuveen Asset Management, LLC (NAM), an affiliate of Nuveen Fund Advisors, LLC, the Fund’s investment adviser. Here, portfolio managers John V. Miller, CFA, Daniel J. Close, CFA, and Kristen M. DeJong, CFA, discuss U.S. economic and market conditions, key investment strategies and the Fund’s performance for the twelve-month reporting period ended March 31, 2023.

Portfolio Manager Update

Effective April 10, 2023 (subsequent to the close of this reporting period), Kristen M. DeJong, CFA, was added as a portfolio manager of the Nuveen Taxable Municipal Income Fund (NBB). John V. Miller, CFA, will retire from Nuveen on June 1, 2023, and will continue to serve as a portfolio manager until that time. There were no other changes to the Fund’s portfolio management team.

For more information on the Fund’s investment objectives and policies, please refer to the Shareholder Update section at the end of the report.

What factors affected the U.S. economy and municipal markets during the twelve-month reporting period ended March 31, 2023?

U.S. economic growth continued to moderate amid high inflation and tightening financial conditions during the twelve-month period ended March 31, 2023. In the first quarter of 2023, the economy expanded at an annualized rate of 1.1%, according to the preliminary estimate from the U.S. Bureau of Economic Analysis, slowing from 2.1% in 2022 overall. Inflation remained persistently high through the majority of the reporting period as China’s Zero-COVID restrictions (lifted in December 2022) and the Russia-Ukraine war worsened existing pandemic-related supply chain disruptions and drove food and energy prices higher. While the U.S. Federal Reserve (Fed) and other global central banks took aggressive measures to ease inflation, and supply chains and energy prices began to normalize toward the end of the reporting period, inflation levels remained much higher than central banks’ target levels.

Beginning in March 2022, the Fed raised its target fed funds rate nine times during the reporting period, bringing it from near zero at the start of 2022 to a range of 4.75% to 5.00% as of March 2023. One of the Fed’s rate increases occurred in March 2023, a decision that was closely watched because of the failure of Silicon Valley Bank and Signature Bank during the same month and uncertainty around the economic impact of these failures. Additionally, in March 2023, Swiss bank UBS agreed to buy Credit Suisse, which had been troubled for some time and was considered to be vulnerable in the current environment. For much of the reporting period, the Fed’s activity led to significant volatility in bond and stock markets. In addition, it contributed to an increase in the U.S. dollar’s value relative to major world currencies, which acts as a headwind to the profits of international companies and U.S. domestic companies with overseas earnings. Global currency and bond markets were further roiled in September 2022 by an unpopular fiscal spending proposal in the U.K. but recovered after the plans were abandoned.

During the reporting period, elevated inflation and higher borrowing costs weighed on some segments of the economy, including the real estate market. Consumer spending, however, has remained more resilient than expected, in part because of a still-strong labor market, another key gauge of the economy’s health. By July 2022, the economy had recovered the 22 million jobs lost since the beginning of the pandemic. As of March 2023, the unemployment rate remained near its pre‑pandemic low of 3.5%, although monthly job growth appeared to be slowing. The strong labor market and wage gains helped provide a measure of resilience to the U.S. economy in 2022 and early 2023, even as the Fed sought to soften job growth to help curb inflation pressures.

The broad municipal bond market was impacted by interest rate volatility and economic uncertainty during the reporting period. Municipal yields rose across the maturity spectrum, but the move was uneven. The greatest increase in yields was at the shorter end of the curve as markets priced in a more aggressive pace of monetary tightening to combat persistently high inflation. Yields at the long end of the municipal curve also rose significantly, but intermediate and intermediate-long maturities saw relatively smaller yield increases. Overall, shorter maturities generally outperformed longer maturities during the reporting period. In response to the rising interest rate environment and heightened market volatility, dealers reduced their inventories and investors increased redemptions from traditional municipal bond mutual funds. For much of the reporting period, credit spreads were generally stable given relatively strong municipal fundamentals, although there was some widening as the market sell‑off continued.

5

Portfolio Managers’ Comments (continued)

What key strategies were used to manage the Fund during the twelve-month reporting period ended March 31, 2023?

The Fund’s primary investment objective is to provide current income through investments in taxable municipal securities. The Fund’s secondary investment objective is to seek enhanced portfolio value and total return. In addition, the Fund will use an integrated leverage and hedging strategy, so that the Fund has the potential to enhance income and risk-adjusted total return over time. The Fund may employ leverage instruments such as bank borrowings, including loans from certain financial institutions, and portfolio investments that have the economic effect of leverage, including inverse floating rate securities. Inverse floating rate securities, sometimes referred to as “inverse floaters,” are the residual interest in a tender option bond (TOB) trust. These securities can be used for a variety of reasons, including duration management, income and total return enhancement.

During the reporting period, the Fund’s trading activity remained focused on pursuing its investment objectives. The Fund engaged in opportunistic trades to support the Fund’s income by reinvesting premiums received as part of the Fund’s hedging program as well as bond calls and maturities across a variety of sectors. The Fund also took advantage of opportunities late in the reporting period to selectively sell bonds across a range of coupon, call and maturity structures to help offset the hedging program costs.

How did the Fund perform during the twelve-month reporting period ended March 31, 2023?

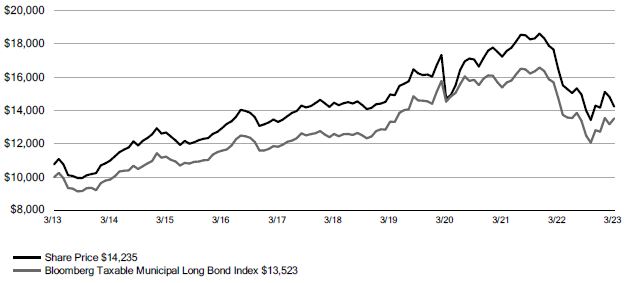

For the twelve months ended March 31, 2023, NBB underperformed the Bloomberg Taxable Municipal Long Bond Index. For the purposes of this Performance Commentary, references to relative performance are in comparison to the Bloomberg Taxable Municipal Long Bond Index.

The Fund’s use of leverage through inverse floating rate securities and reverse repurchase agreements detracted significantly from relative performance during the reporting period. However, the Fund’s use of leverage was accretive to overall common share income. Leverage is discussed in more detail in the Fund Leverage section of this report.

Also detracting from relative performance were the Fund’s overweight allocations to below investment grade and non‑rated bonds, which the benchmark does not include. While these credits underperformed, the portfolio management team believed they offered an attractive relative value opportunity.

These detractors were partially offset by positive contributions from the Fund’s duration-shortening hedge strategy. The Fund managed the duration of its portfolio by shorting interest rate futures contracts, which was beneficial as interest rates rose during the reporting period.

The Fund’s underperformance was also partially offset by overweight exposure to the shorter end of the yield curve, specifically the two to eight-year segment, which outperformed. The Fund held a corresponding underweight to the 12‑year and longer segment, which was also beneficial to relative performance because these bonds underperformed.

This material is not intended to be a recommendation or investment advice, does not constitute a solicitation to buy, sell or hold a security or an investment strategy, and is not provided in a fiduciary capacity. The information provided does not take into account the specific objectives or circumstances of any particular investor, or suggest any specific course of action. Investment decisions should be made based on an investor’s objectives and circumstances and in consultation with his or her advisors.

Certain statements in this report are forward-looking statements. Discussions of specific investments are for illustration only and are not intended as recommendations of individual investments. The forward-looking statements and other views expressed herein are those of the portfolio manager as of the date of this report. Actual future results or occurrences may differ significantly from those anticipated in any forward-looking statements, and the views expressed herein are subject to change at any time, due to numerous market and other factors. The Fund disclaims any obligation to update publicly or revise any forward-looking statements or views expressed herein.

For financial reporting purposes, the ratings disclosed are the highest rating given by one of the following national rating agencies: Standard & Poor’s Group (S&P), Moody’s Investors Service, Inc. (Moody’s) or Fitch, Inc. (Fitch). This treatment of split-rated securities may differ from that used for other purposes, such as for Fund investment policies. Credit ratings are subject to change. AAA, AA, A and BBB are investment grade ratings, while BB, B, CCC, CC, C and D are below investment grade ratings. Holdings designated N/R are not rated by these national rating agencies.

Bond insurance guarantees only the payment of principal and interest on the bond when due, and not the value of the bonds themselves, which will fluctuate with the bond market and the financial success of the issuer and the insurer. Insurance relates specifically to the bonds in the portfolio and not to the share prices of a Fund. No representation is made as to the insurers’ ability to meet their commitments.

Refer to the Glossary of Terms Used in this Report for further definition of the terms used within this section.

6

Fund Leverage

IMPACT OF THE FUND’S LEVERAGE STRATEGY ON PERFORMANCE

One important factor impacting the returns of the Fund’s common shares relative to its comparative benchmark was the Fund’s use of leverage through reverse repurchase agreements and investments in inverse floating rate securities, which represent leveraged investments in underlying bonds. The Fund uses leverage because our research has shown that, over time, leveraging provides opportunities for additional income. The opportunity arises when short-term rates that a Fund pays on its leveraging instruments are lower than the interest the Fund earns on its portfolio securities that it has bought with the proceeds of that leverage.

However, use of leverage can expose Fund common shares to additional price volatility. When the Fund uses leverage, the Fund’s common shares will experience a greater increase in their net asset value if the securities acquired through the use of leverage increase in value, but will also experience a correspondingly larger decline in their net asset value if the securities acquired through leverage decline in value. All this will make the shares’ total return performance more variable over time.

In addition, common share income in levered funds will typically decrease in comparison to unlevered funds when short-term interest rates increase and increase when short-term interest rates decrease. In recent quarters, fund leverage expenses have generally tracked the overall movement of short-term interest rates. While fund leverage expenses are higher than their prior year lows, leverage nevertheless continues to provide the opportunity for incremental common share income, particularly over longer-term periods.

The Fund’s use of leverage significantly detracted from relative performance during the reporting period. However, the Fund’s use of leverage was accretive to overall common share income.

As of March 31, 2023, the Fund’s percentages of leverage are as shown in the accompanying table.

| | | | |

| | | NBB | |

| | |

Effective Leverage* | | | 39.50% | |

Regulatory Leverage* | | | 0.00% | |

| | |

* Effective leverage is a Fund’s effective economic leverage, and includes both regulatory leverage and the leverage effects of reverse repurchase agreements, certain derivatives and other investments in a Fund’s portfolio that increase the Fund’s investment exposure. Currently, the leverage effects of Tender Option Bond (TOB) inverse floater holdings are included in effective leverage values, in addition to any regulatory leverage. Regulatory leverage consists of preferred shares issued or borrowings of a Fund. Both of these are part of a Fund’s capital structure. A Fund, however, may from time to time borrow on a typically transient basis in connection with its day‑to‑day operations, primarily in connection with the need to settle portfolio trades. Such incidental borrowings are excluded from the calculation of a Fund’s effective leverage ratio. Regulatory leverage is subject to asset coverage limits set forth in the Investment Company Act of 1940.

THE FUNDS’ LEVERAGE

Reverse Repurchase Agreements

As noted previously, the Fund used reverse repurchase agreements, in which the Fund sells to a counterparty a security that it holds with a contemporaneous agreement to repurchase the same security at an agreed-upon price and date. The Fund’s transactions in reverse repurchase agreements are as shown in the accompanying table.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Current Reporting Period | | | Subsequent to the Close of the Reporting Period | |

| | | | | | | | |

| Fund | | Outstanding

Balance as of

April 1, 2022 | | | Sales | | | Purchases | | | Outstanding

Balance as of

March 31, 2023 | | | Average

Balance

Outstanding | | | Sales | | | Purchases | | | Outstanding

Balance as of

May 22, 2023 | |

| | |

| NBB | | | $257,150,000 | | | | $1,358,660,275 | | | | $(1,428,860,275) | | | | $186,950,000 | | | | $206,994,809 | | | | $186,950,000 | | | | $(186,950,000) | | | | $186,950,000 | |

| | |

Refer to Notes to Financial Statements for further details on reverse repurchase agreements for the Fund.

7

Common Share Information

COMMON SHARE DISTRIBUTION INFORMATION

The following information regarding the Fund’s distributions is current as of March 31, 2023. The Fund’s distribution levels may vary over time based on the Fund’s investment activity and portfolio investments value changes.

During the current reporting period, the Fund’s distributions to common shareholders were as shown in the accompanying table.

| | | | |

| | | Per Common

Share

Amounts | |

| Monthly Distributions (Ex‑Dividend Date) | | NBB | |

| | |

| April | | | $0.1085 | |

| May | | | 0.1085 | |

| June | | | 0.1085 | |

| July | | | 0.1085 | |

| August | | | 0.1085 | |

| September | | | 0.1085 | |

| October | | | 0.0925 | |

| November | | | 0.0925 | |

| December | | | 0.0925 | |

| January | | | 0.0720 | |

| February | | | 0.0720 | |

| March | | | 0.0720 | |

| | |

| Total Distributions from Net Investment Income | | | $1.1445 | |

| | |

| |

| Yields | | NBB | |

| | |

Market Yield* | | | 5.36% | |

| | |

| * | Market Yield is based on the Fund’s current annualized monthly distribution divided by the Fund’s current market price as of the end of the reporting period. |

The Fund seeks to pay regular monthly dividends out of its net investment income at a rate that reflects its past and projected net income performance. To permit the Fund to maintain a more stable monthly dividend, the Fund may pay dividends at a rate that may be more or less than the amount of net income actually earned by the Fund during the period. Distributions to common shareholders are determined on a tax basis, which may differ from amounts recorded in the accounting records. In instances where the monthly dividend exceeds the earned net investment income, the Fund would report a negative undistributed net ordinary income. Refer to the Notes to Financial Statements for additional information regarding the amounts of undistributed net ordinary income and undistributed net long-term capital gains and the character of the actual distributions paid by the Fund during the period.

All monthly dividends paid by the Fund during the current reporting period were paid from net investment income. If a portion of the Fund’s monthly distributions is sourced from or comprised of elements other than net investment income, including capital gains and/or a return of capital, shareholders will be notified of those sources. For financial reporting purposes, per share amounts of the Fund’s distributions for the reporting period are presented in this report’s Financial Highlights. For income tax purposes, distribution information for the Fund as of its most recent tax year end is presented in the Notes to Financial Statements of this report.

NUVEEN CLOSED‑END FUND DISTRIBUTION AMOUNTS

The Nuveen Closed‑End Funds’ monthly and quarterly periodic distributions to shareholders are posted on www.nuveen.com and can be found on Nuveen’s enhanced closed‑end fund resource page, which is at https://www.nuveen.com/resource‑center‑closed‑end‑funds, along with other Nuveen closed‑end fund product updates. To ensure timely access to the latest information, shareholders may use a subscribe function, which can be activated at this web page (https://www.nuveen.com/subscriptions).

COMMON SHARE EQUITY SHELF PROGRAMS

During the current reporting period, the Fund was authorized by the Securities and Exchange Commission to issue additional common shares through an equity shelf program (Shelf Offering). Under these programs, the Fund, subject to market conditions, may raise additional capital from time to time in varying amounts and offering methods at a net price at or above the Fund’s NAV per common share. The maximum aggregate offering under these Shelf Offerings are as shown in the accompanying table.

8

| | | | |

| | | NBB | |

| | |

| Maximum aggregate offering | | $ | 162,000,000 | |

| | |

During the current reporting period, the Fund sold common shares through their Shelf Offerings at a weighted average premium to their NAV per common share as shown in the accompanying table.

| | | | |

| | | NBB | |

| | |

| Common shares sold through shelf offering | | | 772,413 | |

| Weighted average premium to NAV per common share sold | | | 1.65% | |

Refer to Notes to Financial Statements, for further details of Shelf Offerings and the Fund’s transactions.

COMMON SHARE REPURCHASES

During August 2022, the Fund’s Board of Trustees reauthorized an open-market share repurchase program, allowing the Fund to repurchase an aggregate of up to approximately 10% of its outstanding common shares.

During the current reporting period, the Fund did not repurchase any of its outstanding common shares. As of March 31, 2023, (and since the inception of the Fund’s repurchase programs), the Fund has cumulatively repurchased and retired its outstanding common shares as shown in the accompanying table.

| | | | |

| | | NBB | |

| | |

| Common shares cumulatively repurchased and retired | | | 0 | |

| Common shares authorized for repurchase | | | 2,905,000 | |

| | |

OTHER COMMON SHARE INFORMATION

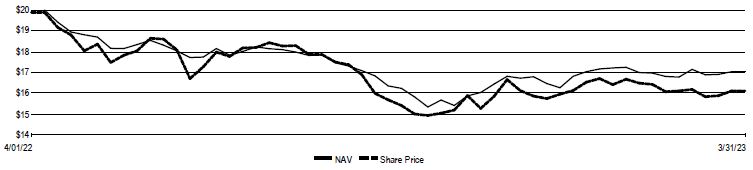

As of March 31, 2023, the Fund’s common share prices were trading at a premium/(discount) to its common share NAV, and trading at an average premium/(discount) to NAV during the current reporting period, as follows:

| | | | |

| | | NBB | |

| | |

| Common share NAV | | | $17.04 | |

| Common share price | | | $16.12 | |

| Premium/(Discount) to NAV | | | (5.40)% | |

| Average premium/(discount) to NAV | | | (2.38)% | |

| | |

9

About the Fund’s Benchmark

Bloomberg Taxable Municipal Long Bond Index: A rules-based index engineered for the long-term taxable municipal bond market. Bonds in the index have effective maturities of 10+ years. Index returns assume reinvestment of distributions, but do not reflect any applicable sales charges or management fees.

10

| | |

| NBB | | Nuveen Taxable Municipal Income Fund Performance Overview and Holding Summaries March 31, 2023 |

Refer to the Glossary of Terms Used in this Report for further definition of the terms used within this section.

Fund Performance*

| | | | | | | | | | | | |

| | | | | | Total Returns as of

March 31, 2023 |

| | | | | | Average Annual |

| | | Inception Date | | | 1‑Year | | | 5‑Year | | 10‑Year |

| NBB at Common Share NAV | | | 4/27/10 | | | | (8.98 | )% | | 0.64% | | 3.11% |

| NBB at Common Share Price | | | 4/27/10 | | | | (13.68 | )% | | 0.77% | | 3.59% |

| Bloomberg Taxable Municipal Long Bond Index | | | – | | | | (8.44 | )% | | 1.43% | | 3.06% |

*For purposes of Fund performance, relative results are measured against the Bloomberg Taxable Municipal Long Bond Index.

Performance data shown represents past performance and does not predict or guarantee future results. Current per‑formance may be higher or lower than the data shown. Returns do not reflect the deduction of taxes that shareholders may have to pay on Fund distributions or upon the sale of Fund shares. Returns at NAV are net of Fund expenses, and assume reinvestment of distributions. Comparative index return information is provided for the Fund’s shares at NAV only. Indexes are not available for direct investment.

Daily Common Share NAV and Share Price

Growth of an Assumed $10,000 Investment as of March 31, 2023 - Common Share Price

11

Performance Overview and Holdings Summaries March 31, 2023 (continued)

Holdings Summaries as of March 31, 2023

This data relates to the securities held in the Fund’s portfolio of investments as of the end of the reporting period. It should not be construed as a measure of performance for the Fund itself. Holdings are subject to change.

For financial reporting purposes, the ratings disclosed are the highest rating given by one of the following national rating agencies: Standard & Poor’s Group, Moody’s Investors Service, Inc. or Fitch, Inc. This treatment of split-rated securities may differ from that used for other purposes, such as for Fund investment policies. Credit ratings are subject to change. AAA, AA, A and BBB are investment grade ratings; BB, B, CCC, CC, C and D are below-investment grade ratings. Holdings designated N/R are not rated by these national rating agencies.

| | |

Fund Allocation (% of net assets) |

| Municipal Bonds | | 141.0% |

| Repurchase Agreements | | 1.1% |

| Other Assets & Liabilities, Net | | 3.0% |

| Reverse Repurchase Agreements, including accrued interest | | (37.7)% |

| Floating Rate Obligations | | (7.4)% |

| Net Assets | | 100% |

|

Portfolio Credit Quality (% of total investment exposure) |

| AAA | | 5.8% |

| AA | | 45.9% |

| A | | 24.6% |

| BBB | | 12.6% |

| BB or Lower | | 4.1% |

| N/R (not rated) | | 6.3% |

| N/A (not applicable) | | 0.7% |

| Total | | 100% |

| | |

Portfolio Composition1 (% of total investments) | | |

| Tax Obligation/Limited | | 30.6% |

| Transportation | | 20.5% |

| Utilities | | 15.8% |

| Tax Obligation/General | | 9.2% |

| Health Care | | 7.8% |

| Education and Civic Organizations | | 5.5% |

| Other | | 9.8% |

| Repurchase Agreements | | 0.8% |

| Total | | 100% |

| | |

States and Territories2 (% of total municipal bonds) | | |

| California | | 21.8% |

| New York | | 19.1% |

| Illinois | | 8.1% |

| Texas | | 7.1% |

| Washington | | 5.3% |

| Georgia | | 4.8% |

| Ohio | | 4.6% |

| Tennessee | | 3.0% |

| New Jersey | | 3.0% |

| District of Columbia | | 2.8% |

| Virginia | | 2.5% |

| South Carolina | | 2.5% |

| Oklahoma | | 2.2% |

| West Virginia | | 2.2% |

| Maryland | | 1.9% |

| Other | | 9.1% |

| Total | | 100% |

| 1 | “Other” sectors include four sectors that individually constitute less than 5.5% as a percentage of total investments. |

| 2 | See the Portfolio of Investments for the remaining states comprising “Other” and not listed in the table above. |

12

Report of Independent Registered

Public Accounting Firm

To the Shareholders and Board of Trustees

Nuveen Taxable Municipal Income Fund:

Opinion on the Financial Statements

We have audited the accompanying statement of assets and liabilities of Nuveen Taxable Municipal Income Fund (the Fund), including the portfolio of investments, as of March 31, 2023, the related statements of operations and cash flows for the year then ended, the statements of changes in net assets for each of the years in the two year period then ended, and the related notes (collectively, the financial statements) and the financial highlights for each of the years in the five year period then ended. In our opinion, the financial statements and financial highlights present fairly, in all material respects, the financial position of the Fund as of March 31, 2023, the results of its operations and its cash flows for the year then ended, the changes in its net assets for each of the years in the two year period then ended, and the financial highlights for each of the years in the five year period then ended, in conformity with U.S. generally accepted accounting principles.

Basis for Opinion

These financial statements and financial highlights are the responsibility of the Fund’s management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (PCAOB) and are required to be independent with respect to the Fund in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement, whether due to error or fraud. Our audits included performing procedures to assess the risks of material misstatement of the financial statements and financial highlights, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements and financial highlights. Such procedures also included confirmation of securities owned as of March 31, 2023, by correspondence with custodians and brokers; when replies were not received from brokers, we performed other auditing procedures. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements and financial highlights. We believe that our audits provide a reasonable basis for our opinion.

/s/ KPMG LLP

We have served as the auditor of one or more Nuveen investment companies since 2014.

Chicago, Illinois

May 26, 2023

13

| | |

| NBB | | Nuveen Taxable Municipal Income Fund Portfolio of Investments March 31, 2023 |

| | | | | | | | | | | | | | |

Principal Amount (000) | | Description (1) | | Optional Call

Provisions (2) | | Ratings (3) | | | Value |

| | | |

| | | | |

| | | | LONG-TERM INVESTMENTS - 141.0% (99.2% of Total Investments) | | | | | | | | | | |

| | | | |

| | | | MUNICIPAL BONDS - 141.0% (99.2% of Total Investments) | | | | | | | | | | |

| | | | |

| | | | Alaska - 0.6% (0.4% of Total Investments) | | | | | | | | | | |

| | | | |

| $ | 3,025 | | | Port Lions, Alaska, Revenue Bonds, Kodiak Area Native Association Project, Taxable Series 2022, 7.500%, 10/01/52 | | 10/32 at 100.00 | | | A+ | | | $ | 3,199,724 | |

| | | |

| | | | Total Alaska | | | | | | | | | 3,199,724 | |

| | | | | |

| | | | |

| | | | California - 30.8% (21.7% of Total Investments) | | | | | | | | | | |

| | | | |

| | | | ABAG Finance Authority for Non‑Profit Corporations, California, Special Tax Bonds, Community Facilities District 2004‑1 Seismic Safety Improvements 690 & 942 Market Street Project, Taxable Refunding Series 2018: | | | | | | | | | | |

| | 1,950 | | | 5.100%, 9/01/28 | | No Opt. Call | | | N/R | | | | 1,882,159 | |

| | 6,125 | | | 5.500%, 9/01/38 | | 9/28 at 100.00 | | | N/R | | | | 5,645,474 | |

| | | | |

| | 2,520 | | | Alameda Corridor Transportation Authority, California, Revenue Bonds, Refunding Taxable Subordinate Lien Series 2004B, 0.000%, 10/01/31 - AMBAC Insured | | No Opt. Call | | | BBB+ | | | | 1,617,941 | |

| | | | |

| | 55 | | | Bay Area Toll Authority, California, Revenue Bonds, San Francisco Bay Area Toll Bridge, Subordinate Lien, Build America Federally Taxable Bond Series 2010S‑1, 6.793%, 4/01/30 | | No Opt. Call | | | AA- | | | | 58,670 | |

| | | | |

| | | | California Infrastructure and Economic Development Bank, Revenue Bonds, J. David Gladstone Institutes Project, Taxable Series 2019: | | | | | | | | | | |

| | 2,480 | | | 4.000%, 10/01/39 | | 10/29 at 100.00 | | | A | | | | 2,025,962 | |

| | 8,260 | | | 4.658%, 10/01/59 | | 10/29 at 100.00 | | | A | | | | 6,507,806 | |

| | | | |

| | 1,000 | | | California Infrastructure and Economic Development Bank, Revenue Bonds, University of California San Francisco Neurosciences Building, Build America Taxable Bond Series 2010B, 6.486%, 5/15/49 | | No Opt. Call | | | AA | | | | 1,141,560 | |

| | | | |

| | 8,010 | | | California Municipal Finance Authority, Mobile Home Park Revenue Bonds, Windsor Mobile Country Club, Taxable Refunding Series 20202B, 6.375%, 11/15/48, 144A | | 11/30 at 100.00 | | | N/R | | | | 7,005,306 | |

| | | | |

| | 4,530 | | | California State Public Works Board, Lease Revenue Bonds, Various Capital Projects, Build America Taxable Bond Series 2009G‑2, 8.361%, 10/01/34 (4) | | No Opt. Call | | | Aa3 | | | | 5,747,392 | |

| | | | |

| | 7,010 | | | California State University, Systemwide Revenue Bonds, Build America Taxable Bond Series 2010B, 6.484%, 11/01/41 | | No Opt. Call | | | Aa2 | | | | 7,965,813 | |

| | | | |

| | 2,000 | | | California State, General Obligation Bonds, Build America Federally Taxable Series 2009, 7.550%, 4/01/39 | | No Opt. Call | | | Aa2 | | | | 2,594,420 | |

| | | | |

| | 4,110 | | | California State, General Obligation Bonds, Various Purpose, Build America Taxable Bond Series 2010, 7.600%, 11/01/40 (4) | | No Opt. Call | | | Aa2 | | | | 5,422,241 | |

| | | | |

| | 2,720 | | | California Statewide Communities Development Authority, California, Revenue Bonds, Loma Linda University Medical Center, Series 2014B, 6.000%, 12/01/24 | | No Opt. Call | | | BB+ | | | | 2,760,582 | |

| | | | |

| | 1,300 | | | California Statewide Community Development Authority, Health Revenue Bonds, Enloe Medical Center, Refunding Series 2022B, 7.140%, 8/15/47 - AGM Insured | | 8/32 at 100.00 | | | AA | | | | 1,419,080 | |

| | | | |

| | 2,025 | | | Chino Public Financing Authority, California, Local Agency Bonds, Refunding Series 2021A, 4.001%, 9/01/38 | | 9/31 at 100.00 | | | AA | | | | 1,814,886 | |

| | | | |

| | 3,800 | | | Golden State Tobacco Securitization Corporation, California, Enhanced Tobacco Settlement Asset-Backed Revenue Bonds, Taxable Series 2021A, 3.115%, 6/01/38 | | 6/31 at 100.00 | | | Aa3 | | | | 3,046,346 | |

14

| | | | | | | | | | | | | | |

Principal Amount (000) | | Description (1) | | Optional Call

Provisions (2) | | Ratings (3) | | | Value |

| | | |

| | | | |

| | | | California (continued) | | | | | | | | | | |

| | | | |

| $ | 5,000 | | | Golden State Tobacco Securitization Corporation, California, Enhanced Tobacco Settlement Asset-Backed Revenue Bonds, Taxable Series 2021B, 3.293%, 6/01/42 | | 6/31 at 100.00 | | | Aa3 | | | $ | 3,987,300 | |

| | | | |

| | | | Golden State Tobacco Securitization Corporation, California, Tobacco Settlement Asset-Backed Bonds, Taxable Senior Series 2021A‑1: | | | | | | | | | | |

| | 3,500 | | | 2.587%, 6/01/29 | | No Opt. Call | | | A | | | | 3,031,840 | |

| | 2,000 | | | 3.714%, 6/01/41 | | 12/31 at 100.00 | | | A- | | | | 1,569,840 | |

| | | | |

| | | | Los Angeles Community College District, California, General Obligation Bonds, Build America Taxable Bonds, Series 2010: | | | | | | | | | | |

| | 10,000 | | | 6.600%, 8/01/42, (UB) (5) | | No Opt. Call | | | Aaa | | | | 12,475,500 | |

| | 7,500 | | | 6.600%, 8/01/42 (4),(5) | | No Opt. Call | | | Aaa | | | | 9,356,625 | |

| | | | |

| | | | Los Angeles Community College District, Los Angeles County, California, General Obligation Bonds, Tender Option Bond Trust 2016-XTG002: | | | | | | | | | | |

| | 2,000 | | | 11.519%, 8/01/49, 144A, (IF) (5) | | No Opt. Call | | | Aaa | | | | 4,904,340 | |

| | | | |

| | | | Los Angeles County Public Works Financing Authority, California, Lease Revenue Bonds, Mulitple Capital Projects I, Build America Taxable Bond Series 2010B: | | | | | | | | | | |

| | 2,050 | | | 7.488%, 8/01/33 (4) | | No Opt. Call | | | AA+ | | | | 2,384,560 | |

| | 11,380 | | | 7.618%, 8/01/40 (4) | | No Opt. Call | | | AA+ | | | | 14,672,234 | |

| | | | |

| | 3,255 | | | Los Angeles Department of Airports, California, Revenue Bonds, Los Angeles International Airport, Build America Taxable Bonds, Series 2009C, 6.582%, 5/15/39 | | No Opt. Call | | | AA- | | | | 3,652,436 | |

| | | | |

| | 80 | | | Los Angeles Department of Water and Power, California, Power System Revenue Bonds, Federally Taxable - Direct Payment - Build America Bonds, Series 2010A, 5.716%, 7/01/39 | | No Opt. Call | | | Aa2 | | | | 86,959 | |

| | | | |

| | 1,785 | | | Los Angeles Department of Water and Power, California, Power System Revenue Bonds, Federally Taxable - Direct Payment - Build America Bonds, Series 2010D, 6.574%, 7/01/45 (4) | | No Opt. Call | | | Aa2 | | | | 2,128,345 | |

| | | | |

| | 4,000 | | | Los Angeles Department of Water and Power, California, Water System Revenue Bonds, Tender Option Bond Trust 2016-XFT906, 10.085%, 7/01/50, 144A, (IF) (5) | | No Opt. Call | | | AA+ | | | | 9,152,520 | |

| | | | |

| | 4,250 | | | Sacramento Public Financing Authority, California, Lease Revenue Bonds, Golden 1 Center, Series 2015, 5.637%, 4/01/50 (4) | | No Opt. Call | | | AA- | | | | 4,408,695 | |

| | | | |

| | 2,200 | | | San Diego County Regional Transportation Commission, California, Sales Tax Revenue Bonds, Build America Taxable Bonds Series 2010A, 5.911%, 4/01/48 | | No Opt. Call | | | AAA | | | | 2,491,610 | |

| | | | |

| | 1,500 | | | San Francisco City and County Public Utilities Commission, California, Water Revenue Bonds, Taxable Build America Bond Series 2010G, 6.950%, 11/01/50 | | No Opt. Call | | | Aa2 | | | | 1,844,370 | |

| | | | |

| | 1,000 | | | San Francisco City and County Redevelopment Financing Authority, California, Tax Allocation Revenue Bonds, San Francisco Redevelopment Projects, Taxable Series 2009E, 8.406%, 8/01/39 | | No Opt. Call | | | AA | | | | 1,283,940 | |

| | | | |

| | | | San Francisco City and County, California, Certificates of Participation, 525 Golden Gate Avenue, San Francisco Public Utilities Commission Office Project, Tender Option Bond 2016-XFT901: | | | | | | | | | | |

| | 4,000 | | | 10.040%, 11/01/41, 144A, (IF) (5) | | No Opt. Call | | | AA+ | | | | 6,466,240 | |

| | 2,000 | | | 10.040%, 11/01/41, 144A, (IF) (5) | | No Opt. Call | | | AA+ | | | | 3,233,120 | |

| | | | |

| | 2,000 | | | University of California Regents, Medical Center Pooled Revenue Bonds, Taxable Build America Bond Series 2010H, 6.548%, 5/15/48 (4) | | No Opt. Call | | | AA- | | | | 2,351,440 | |

15

| | |

| NBB | | Nuveen Taxable Municipal Income Fund (continued) Portfolio of Investments March 31, 2023 |

| | | | | | | | | | | | | | | | |

Principal

Amount (000) | | Description (1) | | Optional Call

Provisions (2) | | | Ratings (3) | | | Value | |

| | | |

| | | | |

| | | | California (continued) | | | | | | | | | | | | |

| | | | |

| $ | 2,505 | | | University of California, General Revenue Bonds, Limited Project, Build America Taxable Bond Series 2010F, 5.946%, 5/15/45 | | | No Opt. Call | | | | AA‑ | | | $ | 2,777,995 | |

| | | | |

| | 4,545 | | | Vernon, California, Electric System Revenue Bonds, Series 2008A, 8.590%, 7/01/38 | | | No Opt. Call | | | | BBB+ | | | | 5,481,270 | |

| | | |

| | | | Total California | | | | | | | | | | | 154,396,817 | |

| | | | | |

| | | | |

| | | | Colorado - 1.9% (1.3% of Total Investments) | | | | | | | | | | | | |

| | | | |

| | 4,335 | | | Colorado Bridge Enterprise, Revenue Bonds, Federally Taxable Build America Series 2010A, 6.078%, 12/01/40 (4) | | | No Opt. Call | | | | AA | | | | 4,766,983 | |

| | | | |

| | 3,100 | | | Denver School District 1, Colorado, General Obligation Bonds, Build America Taxable Bonds, Series 2009C, 5.664%, 12/01/33 (4) | | | No Opt. Call | | | | AA+ | | | | 3,351,007 | |

| | | | |

| | 1,230 | | | Regional Transportation District, Colorado, Sales Tax Revenue Bonds, Fastracks Project, Build America Series 2010B, 5.844%, 11/01/50 (4) | | | No Opt. Call | | | | AA+ | | | | 1,431,744 | |

| | | |

| | | | Total Colorado | | | | | | | | | | | 9,549,734 | |

| | | | | |

| | | | |

| | | | District of Columbia - 4.0% (2.8% of Total Investments) | | | | | | | | | | | | |

| | | | |

| | | | Metropolitan Washington Airports Authority, District of Columbia, Dulles Toll Road Revenue Bonds, Dulles Metrorail & Capital improvement Projects, Second Senior Lien, Build America Bond Series 2009D: | | | | | | | | | | | | |

| | 1,000 | | | 7.462%, 10/01/46 - AGM Insured | | | No Opt. Call | | | | AA | | | | 1,316,440 | |

| | 14,365 | | | 7.462%, 10/01/46 (4) | | | No Opt. Call | | | | A- | | | | 18,721,330 | |

| | | |

| | | | Total District of Columbia | | | | | | | | | | | 20,037,770 | |

| | | | | |

| | | | |

| | | | Florida - 2.0% (1.4% of Total Investments) | | | | | | | | | | | | |

| | | | |

| | 10,000 | | | Charlotte County Industrial Development Authority, Florida, Utility System Revenue Bonds, Town & Country Utilities Project, Taxable Series 2021B, 5.000%, 10/01/36, 144A | | | 10/31 at 100.00 | | | | N/R | | | | 8,706,000 | |

| | | | |

| | 1,400 | | | Miami, Florida, Special Obligation Revenue Bonds, Street & Sidewalk Improvement Program, Taxable Refunding Series 2018B, 4.808%, 1/01/39 - AGM Insured, 144A | | | 1/28 at 100.00 | | | | AA | | | | 1,301,930 | |

| | | |

| | | | Total Florida | | | | | | | | | | | 10,007,930 | |

| | | | | |

| | | | |

| | | | Georgia - 6.8% (4.8% of Total Investments) | | | | | | | | | | | | |

| | | | |

| | 2,293 | | | Georgia Municipal Electric Authority, Plant Vogtle Units 3 & 4 Project M Bonds, Taxable Build America Bonds Series 2010A, 6.655%, 4/01/57 | | | No Opt. Call | | | | A | | | | 2,542,432 | |

| | | | |

| | | | Georgia Municipal Electric Authority, Plant Vogtle Units 3 & 4 Project P Bonds, Refunding Taxable Build America Bonds Series 2010A: | | | | | | | | | | | | |

| | 5,737 | | | 7.055%, 4/01/57 - AGM Insured | | | No Opt. Call | | | | AA | | | | 6,531,632 | |

| | 18,654 | | | 7.055%, 4/01/57 (4) | | | No Opt. Call | | | | BBB+ | | | | 19,364,158 | |

| | | | |

| | 5,077 | | | Municipal Electric Authority of Georgia, Plant Vogtle Units 3 & 4 Project J Bonds, Taxable Build America Bonds Series 2010A, 6.637%, 4/01/57 | | | No Opt. Call | | | | A | | | | 5,577,643 | |

| | | |

| | | | Total Georgia | | | | | | | | | | | 34,015,865 | |

| | | | | |

| | | | |

| | | | Illinois - 11.5% (8.1% of Total Investments) | | | | | | | | | | | | |

| | | | |

| | 4,030 | | | Chicago Board of Education, Illinois, General Obligation Bonds, Dedicated Revenues, Series 2010C, 6.319%, 11/01/29 - BAM Insured (4) | | | No Opt. Call | | | | AA | | | | 4,228,598 | |

| | | | |

| | 8,680 | | | Chicago Transit Authority, Illinois, Sales Tax Receipts Revenue Bonds, Federally Taxable Build America Bonds, Series 2010B, 6.200%, 12/01/40 (4) | | | No Opt. Call | | | | AA | | | | 9,744,255 | |

| | | | |

| | 1,000 | | | Chicago Transit Authority, Illinois, Sales Tax Receipts Revenue Bonds, Taxable Refunding Series 2020B, 3.912%, 12/01/40 | | | No Opt. Call | | | | AA | | | | 876,760 | |

16

| | | | | | | | | | | | | | | | |

Principal

Amount (000) | | Description (1) | | Optional Call

Provisions (2) | | | Ratings (3) | | | Value | |

| | | |

| | | | |

| | | | Illinois (continued) | | | | | | | | | | | | |

| | | | |

| $ | 355 | | | Chicago, Illinois, General Airport Revenue Bonds, O’Hare International Airport, Third Lien, Taxable Build America Bond Series 2010B, 6.395%, 1/01/40 | | | No Opt. Call | | | | A+ | | | $ | 421,900 | |

| | | | |

| | 1,015 | | | Chicago, Illinois, Wastewater Transmission Revenue Bonds, Build America Taxable Bond Series 2010B, 6.900%, 1/01/40 | | | No Opt. Call | | | | A | | | | 1,165,728 | |

| | | | |

| | 3,495 | | | Chicago, Illinois, Water Revenue Bonds, Taxable Second Lien Series 2010B, 6.742%, 11/01/40 | | | No Opt. Call | | | | A | | | | 3,990,556 | |

| | | | |

| | 1,000 | | | Cook County, Illinois, General Obligation Bonds, Build America Taxable Bonds, Series 2010D, 6.229%, 11/15/34 | | | No Opt. Call | | | | A+ | | | | 1,102,750 | |

| | | | |

| | 3,180 | | | Illinois International Port District, Revenue Bonds, Taxable Refunding Series 2020, 5.000%, 1/01/35, 144A | | | 1/26 at 101.00 | | | | N/R | | | | 2,839,867 | |

| | | | |

| | 1,857 | | | Illinois State, General Obligation Bonds, Build America Taxable Bonds, Series 2010‑5, 7.350%, 7/01/35 | | | No Opt. Call | | | | A- | | | | 2,040,554 | |

| | | | |

| | 14,035 | | | Illinois State, General Obligation Bonds, Taxable Build America Bonds, Series 2010‑3, 6.725%, 4/01/35 (4) | | | No Opt. Call | | | | A- | | | | 14,981,099 | |

| | | | |

| | 10,312 | | | Illinois Toll Highway Authority, Toll Highway Revenue Bonds, Taxable Build America Bond Senior Lien Series 2009A, 6.184%, 1/01/34 (4) | | | No Opt. Call | | | | AA- | | | | 11,519,020 | |

| | | | |

| | 2,420 | | | Illinois Toll Highway Authority, Toll Highway Revenue Bonds, Taxable Build America Bond Senior Lien Series 2009B, 5.851%, 12/01/34 (4) | | | No Opt. Call | | | | AA- | | | | 2,655,176 | |

| | | | |

| | 400 | | | Northern Illinois Municipal Power Agency, Power Project Revenue Bonds, Prairie State Project, Build America Bond Series 2009C, 6.859%, 1/01/39 | | | No Opt. Call | | | | A2 | | | | 450,280 | |

| | | | |

| | 1,375 | | | Northern Illinois Municipal Power Agency, Power Project Revenue Bonds, Prairie State Project, Build America Taxable Bond Series 2010A, 7.820%, 1/01/40 | | | No Opt. Call | | | | A2 | | | | 1,712,810 | |

| | | |

| | | | Total Illinois | | | | | | | | | | | 57,729,353 | |

| | | | | |

| | | | |

| | | | Indiana - 1.2% (0.8% of Total Investments) | | | | | | | | | | | | |

| | | | |

| | 1,000 | | | Indianapolis Local Public Improvement Bond Bank, Indiana, Build America Taxable Bonds, Series 2010B‑2, 6.116%, 1/15/40 | | | No Opt. Call | | | | AA+ | | | | 1,108,080 | |

| | | | |

| | 5,000 | | | Knox County, Indiana, Economic Development Revenue Bonds, Good Samaritan Hospital Project, Taxable Series 2012B, 5.900%, 4/01/34 | | | No Opt. Call | | | | Baa3 | | | | 4,812,550 | |

| | | |

| | | | Total Indiana | | | | | | | | | | | 5,920,630 | |

| | | | | |

| | | | |

| | | | Kentucky - 1.7% (1.2% of Total Investments) | | | | | | | | | | | | |

| | | | |

| | 5 | | | Kentucky Municipal Power Agency, Power System Revenue Bonds, Prairie State Project, Build America Bond Series 2010B, 6.490%, 9/01/37 - AGM Insured | | | 4/23 at 100.00 | | | | AA | | | | 5,009 | |

| | | | |

| | 5,450 | | | Louisville and Jefferson County Metropolitan Sewer District, Kentucky, Sewer and Drainage System Revenue Bonds, Build America Taxable Bonds Series 2010A, 6.250%, 5/15/43 (4) | | | No Opt. Call | | | | AA | | | | 6,400,698 | |

| | | | |

| | 2,350 | | | Newport, Kentucky, Industrial Building Revenue Bonds, South Beach 1, LLC Project, Taxable Refunding Series 2022, 4.125%, 3/01/33 | | | No Opt. Call | | | | N/R | | | | 2,115,493 | |

| | | |

| | | | Total Kentucky | | | | | | | | | | | 8,521,200 | |

| | | | | |

| | | | |

| | | | Maryland - 2.7% (1.9% of Total Investments) | | | | | | | | | | | | |

| | | | |

| | 2,000 | | | Maryland Economic Development Corporation, Economic Development Revenue Bonds, Terminal Project, Refunding Series 2017B, 4.550%, 6/01/35 | | | No Opt. Call | | | | Baa2 | | | | 1,768,280 | |

| | | | |

| | | | Maryland Economic Development Corporation, Parking Facilities Revenue Bonds Baltimore City Project, Senior Parking Facilities Revenue, Series 2018B: | | | | | | | | | | | | |

| | 1,500 | | | 4.580%, 6/01/33 | | | 6/28 at 100.00 | | | | BBB- | | | | 1,354,320 | |

| | 2,945 | | | 4.790%, 6/01/38 | | | 6/28 at 100.00 | | | | A1 | | | | 2,518,417 | |

17

| | |

| NBB | | Nuveen Taxable Municipal Income Fund (continued) Portfolio of Investments March 31, 2023 |

| | | | | | | | | | | | | | | | |

Principal Amount (000) | | Description (1) | | Optional Call

Provisions (2) | | | Ratings (3) | | | Value | |

| | | |

| | | | |

| | | | Maryland (continued) | | | | | | | | | | | | |

| | | | |

| $ | 4,285 | | | 5.050%, 6/01/43 | | | 6/28 at 100.00 | | | | BBB‑ | | | $ | 3,564,948 | |

| | 5,350 | | | 5.320%, 6/01/51 | | | 6/28 at 100.00 | | | | BBB- | | | | 4,425,306 | |

| | | |

| | | | Total Maryland | | | | | | | | | | | 13,631,271 | |

| | | | | |

| | | | |

| | | | Massachusetts - 1.2% (0.8% of Total Investments) | | | | | | | | | | | | |

| | | | |

| | 4,000 | | | Massachusetts, Transporation Fund Revenue Bonds, Accelerated Bridge Program, Tender Option Bond Trust 2016-XFT907, 6.056%, 6/01/40, 144A, (IF) (5) | | | No Opt. Call | | | | AA+ | | | | 5,819,880 | |

| | | |

| | | | Total Massachusetts | | | | | | | | | | | 5,819,880 | |

| | | | | |

| | | | |

| | | | Mississippi - 0.4% (0.3% of Total Investments) | | | | | | | | | | | | |

| | | | |

| | 2,085 | | | Mississippi State, General Obligation Bonds, Taxable Build America Bond Series 2010F, 5.245%, 11/01/34 | | | No Opt. Call | | | | AA | | | | 2,185,080 | |

| | | |

| | | | Total Mississippi | | | | | | | | | | | 2,185,080 | |

| | | | | |

| | | | |

| | | | New Jersey - 4.2% (2.9% of Total Investments) | | | | | | | | | | | | |

| | | | |

| | 3,320 | | | New Jersey Educational Facilities Authority, Revenue Bonds, Seton Hall University, Taxable Series 2020D, 3.958%, 7/01/48 - AGM Insured | | | 7/30 at 100.00 | | | | AA | | | | 2,558,060 | |

| | | | |

| | 3,000 | | | New Jersey Turnpike Authority, Revenue Bonds, Build America Taxable Bonds, Series 2009F, 7.414%, 1/01/40 | | | No Opt. Call | | | | AA- | | | | 3,812,430 | |

| | | | |

| | 8,805 | | | New Jersey Turnpike Authority, Revenue Bonds, Build America Taxable Bonds, Series 2010A, 7.102%, 1/01/41 | | | No Opt. Call | | | | AA- | | | | 10,877,961 | |

| | | | |

| | 2,000 | | | Rutgers State University, New Jersey, Revenue Bonds, Taxable Build America Bond Series 2010H, 5.665%, 5/01/40 | | | No Opt. Call | | | | Aa3 | | | | 2,141,580 | |

| | | | |

| | 870 | | | South Jersey Port Corporation, New Jersey, Marine Terminal Revenue Bonds, Taxable Build America Bond Series 2009P‑3, 7.365%, 1/01/40 | | | No Opt. Call | | | | Baa1 | | | | 973,765 | |

| | | | |

| | 530 | | | South Jersey Transportation Authority, New Jersey, Transportation System Revenue Bonds, Build America Bond Series 2009A‑5, 7.000%, 11/01/38 | | | No Opt. Call | | | | BBB+ | | | | 587,643 | |

| | | |

| | | | Total New Jersey | | | | | | | | | | | 20,951,439 | |

| | | | | |

| | | | |

| | | | New York - 27.1% (19.0% of Total Investments) | | | | | | | | | | | | |

| | | | |

| | | | Dormitory Authority of the State of New York, Revenue Bonds, Montefiore Obligated Group, Taxable Series 2018B: | | | | | | | | | | | | |

| | 5,000 | | | 5.096%, 8/01/34 | | | No Opt. Call | | | | BBB- | | | | 4,687,300 | |

| | 1,415 | | | 4.946%, 8/01/48 - AGM Insured | | | 8/28 at 100.00 | | | | AA | | | | 1,319,657 | |

| | | | |

| | 25,000 | | | Dormitory Authority of the State of New York, State Personal Income Tax Revenue Bonds, Build America Taxable Bonds, Series 2010D, 5.600%, 3/15/40, (UB) (5) | | | No Opt. Call | | | | AA+ | | | | 26,573,250 | |

| | | | |

| | | | Dormitory Authority of the State of New York, State Personal Income Tax Revenue Bonds, Tender Option Bond Trust 30020: | | | | | | | | | | | | |

| | 2,000 | | | 5.746%, 3/15/40, 144A, (IF) (5) | | | No Opt. Call | | | | AA+ | | | | 2,629,360 | |

| | | | |

| | 5,100 | | | Long Island Power Authority, New York, Electric System Revenue Bonds, Build America Taxable Bond Series 2010B, 5.850%, 5/01/41 (4) | | | No Opt. Call | | | | A | | | | 5,423,595 | |

| | | | |

| | 680 | | | Metropolitan Transportation Authority, New York, Dedicated Tax Fund Bonds, Build America Taxable Bonds, Series 2010C, 7.336%, 11/15/39 | | | No Opt. Call | | | | AA | | | | 864,783 | |

| | | | |

| | 7,000 | | | Metropolitan Transportation Authority, New York, Transportation Revenue Bonds, Build America Taxable Bonds, Series 2009A‑1, 5.871%, 11/15/39 | | | No Opt. Call | | | | A3 | | | | 7,032,830 | |

| | | | |

| | 2,090 | | | Metropolitan Transportation Authority, New York, Transportation Revenue Bonds, Build America Taxable Bonds, Series 2010B‑1, 6.548%, 11/15/31 | | | No Opt. Call | | | | A3 | | | | 2,233,311 | |

18

| | | | | | | | | | | | | | | | |

Principal

Amount (000) | | Description (1) | | Optional Call

Provisions (2) | | | Ratings (3) | | | Value | |

| | | |

| | | | |

| | | | New York (continued) | | | | | | | | | | | | |

| | | | |

| $ | 10,925 | | | Metropolitan Transportation Authority, New York, Transportation Revenue Bonds, Federally Taxable Build America Bonds, Series 2010E, 6.814%, 11/15/40 (4) | | | No Opt. Call | | | | A3 | | | $ | 11,924,637 | |

| | | | |

| | 11,390 | | | Metropolitan Transportation Authority, New York, Transportation Revenue Bonds, Federally Taxable Issuer Subsidy Build America Bonds, Series 2010A, 6.668%, 11/15/39 (4) | | | No Opt. Call | | | | A3 | | | | 12,300,175 | |

| | | | |

| | 5,610 | | | Metropolitan Transportation Authority, New York, Transportation Revenue Bonds, Taxable Green Climate Certified Series 2020C‑2, 5.175%, 11/15/49 | | | No Opt. Call | | | | A3 | | | | 5,117,723 | |

| | | | |

| | 3,675 | | | Monroe County Industrial Development Corporation, New York, Revenue Bonds, Rochester Regional Health Project, Taxable Series 2020B, 4.600%, 12/01/46 | | | No Opt. Call | | | | BBB+ | | | | 3,037,020 | |

| | | | |

| | | | New York City Industrial Development Agency, New York, Installment Purchase and Lease Revenue Bonds, Queens Baseball Stadium Project, Series 2006: | | | | | | | | | | | | |

| | 2,000 | | | 6.027%, 1/01/46 - AGM Insured | | | No Opt. Call | | | | A1 | | | | 2,070,780 | |

| | 905 | | | 6.027%, 1/01/46 - AMBAC Insured, 144A | | | No Opt. Call | | | | AA | | | | 937,028 | |

| | | | |

| | 1,500 | | | New York City Municipal Water Finance Authority, New York, Water and Sewer System Revenue Bonds, Second Generation Resolution, Build America Taxable Bonds, Fiscal 2011 Series AA, 5.440%, 6/15/43 (4) | | | No Opt. Call | | | | AA+ | | | | 1,628,565 | |

| | | | |

| | 2,595 | | | New York City Municipal Water Finance Authority, New York, Water and Sewer System Revenue Bonds, Second Generation Resolution, Build America Taxable Bonds, Series 2010DD, 5.952%, 6/15/42 | | | No Opt. Call | | | | AA+ | | | | 2,978,956 | |

| | | | |

| | 2,025 | | | New York City Municipal Water Finance Authority, New York, Water and Sewer System Revenue Bonds, Second Generation Resolution, Build America Taxable Bonds, Series 2010DD, 5.952%, 6/15/42, (UB) | | | No Opt. Call | | | | AA+ | | | | 2,324,619 | |

| | | | |

| | | | New York City Municipal Water Finance Authority, New York, Water and Sewer System Revenue Bonds, Second Generation Resolution, Taxable Tender Option Bonds Trust T30001‑2: | | | | | | | | | | | | |

| | 3,595 | | | 7.662%, 6/15/44, 144A, (IF) | | | No Opt. Call | | | | AA+ | | | | 6,136,234 | |

| | | | |

| | 10,905 | | | New York City Transitional Finance Authority, New York, Building Aid Revenue Bonds, Fiscal 2011 Taxable Build America Bond Series 2010S‑1B, 6.828%, 7/15/40 (4) | | | No Opt. Call | | | | AA | | | | 12,587,096 | |

| | | | |

| | 10,000 | | | New York City Transitional Finance Authority, New York, Future Tax Secured Bonds, Build America Taxable Bonds, Series 2010G‑1, 5.467%, 5/01/40 (4) | | | No Opt. Call | | | | AAA | | | | 10,279,300 | |

| | | | |

| | | | Westchester County Health Care Corporation, New York, Senior Lien Revenue Bonds, Refunding Series 2010A: | | | | | | | | | | | | |

| | 5,495 | | | 8.572%, 11/01/40 | | | No Opt. Call | | | | BBB- | | | | 5,859,703 | |

| | 3,450 | | | 8.572%, 11/01/40 | | | No Opt. Call | | | | BBB- | | | | 3,678,494 | |

| | | | |

| | 2,970 | | | Westchester County Health Care Corporation, New York, Senior Lien Revenue Bonds, Series 2010‑C1, 8.572%, 11/01/40 - AGM Insured | | | No Opt. Call | | | | AA | | | | 3,820,252 | |

| | | |

| | | | Total New York | | | | | | | | | | | 135,444,668 | |

| | | | | |

| | | | |

| | | | Ohio - 6.5% (4.6% of Total Investments) | | | | | | | | | | | | |

| | | | |

| | | | American Municipal Power Inc., Ohio, Combined Hydroelectric Projects Revenue Bonds, Build America Bond Series 2010B: | | | | | | | | | | | | |

| | 6,350 | | | 7.834%, 2/15/41 (4) | | | No Opt. Call | | | | A1 | | | | 8,191,817 | |

| | 1,000 | | | 8.084%, 2/15/50 | | | No Opt. Call | | | | A1 | | | | 1,385,500 | |

| | | | |

| | 1,500 | | | American Municipal Power Inc., Ohio, Meldahl Hydroelectric Projects Revenue Bonds, Build America Bond Series 2010B, 7.499%, 2/15/50 | | | No Opt. Call | | | | A | | | | 1,905,270 | |

19

| | |

| NBB | | Nuveen Taxable Municipal Income Fund (continued) Portfolio of Investments March 31, 2023 |

| | | | | | | | | | | | | | | | |

Principal

Amount (000) | | Description (1) | | Optional Call

Provisions (2) | | | Ratings (3) | | | Value | |

| | | |

| | | | |

| | | | Ohio (continued) | | | | | | | | | | | | |

| | | | |

| $ | 7,040 | | | American Municipal Power Ohio Inc., Prairie State Energy Campus Project Revenue Bonds, Build America Bond Series 2009C, 6.053%, 2/15/43 (4) | | | No Opt. Call | | | | A1 | | | $ | 7,779,059 | |

| | | | |

| | 1,700 | | | Cincinnati City School District, Ohio, Certificates of Participation, School Energy Conservation Improvement Project, Taxable Series 2012, 5.150%, 6/15/32 | | | No Opt. Call | | | | Aa3 | | | | 1,761,812 | |

| | | | |

| | 2,300 | | | Columbus Regional Airport Authority, Ohio, Customer Facility Charge Revenue Bonds, Taxable Series 2019, 4.199%, 12/15/48 | | | 12/29 at 100.00 | | | | A3 | | | | 1,880,940 | |

| | | | |

| | 10,575 | | | Port of Greater Cincinnati Development Authority, Ohio, Special Obligation Tax Increment Financing Revenue Bonds, Cooperative Township Public Parking Project, Kenwood Collection Redevelopment, Refunding Senior Lien Series 2016A, 6.600%, 1/01/39 | | | 1/26 at 100.00 | | | | N/R | | | | 9,593,852 | |

| | | |

| | | | Total Ohio | | | | | | | | | | | 32,498,250 | |

| | | | | |

| | | | |

| | | | Oklahoma - 3.1% (2.2% of Total Investments) | | | | | | | | | | | | |

| | | | |

| | 18,200 | | | Oklahoma Development Finance Authority, Health System Revenue Bonds, OU Medicine Project, Taxable Series 2018D, 5.450%, 8/15/28 | | | No Opt. Call | | | | BB- | | | | 15,376,816 | |

| | | |

| | | | Total Oklahoma | | | | | | | | | | | 15,376,816 | |

| | | | | |

| | | | |

| | | | Oregon - 0.4% (0.3% of Total Investments) | | | | | | | | | | | | |

| | | | |

| | 2,450 | | | Port of Portland, Oregon, Portland International Airport Customer Facility Charge Revenue Bonds, Taxable Series 2019, 4.237%, 7/01/49 | | | 7/29 at 100.00 | | | | A | | | | 2,013,925 | |

| | | |

| | | | Total Oregon | | | | | | | | | | | 2,013,925 | |

| | | | | |

| | | | |

| | | | Pennsylvania - 1.4% (1.0% of Total Investments) | | | | | | | | | | | | |

| | | | |

| | 1,915 | | | Commonwealth Financing Authority, Pennsylvania, State Appropriation Lease Bonds, Build America Taxable Bonds, Series 2009D, 6.218%, 6/01/39 | | | No Opt. Call | | | | A1 | | | | 2,095,431 | |

| | | | |

| | 1,640 | | | Pennsylvania Turnpike Commission, Turnpike Revenue Bonds, Build America Taxable Bonds, Series 2009A, 6.105%, 12/01/39 | | | No Opt. Call | | | | AA- | | | | 1,883,212 | |

| | | | |

| | 2,715 | | | Pennsylvania Turnpike Commission, Turnpike Revenue Bonds, Build America Taxable Bonds, Series 2010B, 5.511%, 12/01/45 (4) | | | No Opt. Call | | | | AA- | | | | 2,985,143 | |

| | | |

| | | | Total Pennsylvania | | | | | | | | | | | 6,963,786 | |

| | | | | |

| | | | |

| | | | South Carolina - 3.5% (2.4% of Total Investments) | | | | | | | | | | | | |

| | | | |

| | | | South Carolina Public Service Authority, Electric System Revenue Bonds, Santee Cooper, Federally Taxable Build America Series 2010C: | | | | | | | | | | | | |

| | 2,000 | | | 6.454%, 1/01/50 - AGM Insured | | | No Opt. Call | | | | AA | | | | 2,343,340 | |

| | 1,550 | | | 6.454%, 1/01/50 | | | No Opt. Call | | | | A- | | | | 1,755,701 | |

| | 8,985 | | | 6.454%, 1/01/50, (UB) | | | No Opt. Call | | | | A- | | | | 10,177,399 | |

| | | | |

| | 205 | | | South Carolina Public Service Authority, Electric System Revenue Bonds, Santee Cooper, Federally Taxable Build America Tender Option Bond Trust T30002, 9.520%, 1/01/50, 144A, (IF) (5) | | | No Opt. Call | | | | A | | | | 341,030 | |

| | | | |

| | 2,585 | | | South Carolina Public Service Authority, Santee Cooper Revenue Obligations, Refunding Series 2013C, 5.784%, 12/01/41 - AGM Insured | | | No Opt. Call | | | | AA | | | | 2,707,425 | |

| | | |

| | | | Total South Carolina | | | | | | | | | | | 17,324,895 | |

| | | | | |

| | | | |

| | | | Tennessee - 4.2% (3.0% of Total Investments) | | | | | | | | | | | | |

| | | | |

| | 1,500 | | | Jackson, Tennessee, Hospital Revenue Bonds, Jackson-Madison County General Hospital Project, Series 2018B, 5.308%, 4/01/48 | | | No Opt. Call | | | | A2 | | | | 1,392,960 | |

20

| | | | | | | | | | | | | | | | |

Principal Amount (000) | | Description (1) | | Optional Call

Provisions (2) | | | Ratings (3) | | | Value | |

| | | |

| | | | |

| | | | Tennessee (continued) | | | | | | | | | | | | |

| | | | |

| | | | Memphis/Shelby County Economic Development Growth Engine Industrial Development Board, Tennessee, Tax Increment Revenue Bonds, Graceland Project, Senior Taxable Series 2017B: | | | | | | | | | | | | |

| $ | 4,750 | | | 5.200%, 7/01/37 | | | 7/27 at 100.00 | | | | BB | | | $ | 3,796,247 | |

| | 1,515 | | | 5.450%, 7/01/45 | | | 7/27 at 100.00 | | | | BB | | | | 1,136,826 | |

| | | | |

| | 5,010 | | | Metropolitan Government Nashville & Davidson County Convention Center Authority, Tennessee, Tourism Tax Revenue Bonds, Build America Taxable Bonds, Series 2010A‑2, 7.431%, 7/01/43 (4) | | | No Opt. Call | | | | A+ | | | | 6,096,168 | |

| | | | |

| | 7,350 | | | Metropolitan Government Nashville & Davidson County Convention Center Authority, Tennessee, Tourism Tax Revenue Bonds, Build America Taxable Bonds, Subordinate Lien Series 2010B, 6.731%, 7/01/43 (4) | | | No Opt. Call | | | | AA | | | | 8,574,069 | |

| | | |

| | | | Total Tennessee | | | | | | | | | | | 20,996,270 | |

| | | | | |

| | | | |

| | | | Texas - 10.0% (7.1% of Total Investments) | | | | | | | | | | | | |

| | | | |

| | 2,520 | | | Dallas Area Rapid Transit, Texas, Sales Tax Revenue Bonds, Taxable Build America Bonds, Series 2009B, 5.999%, 12/01/44 | | | No Opt. Call | | | | AA+ | | | | 2,868,743 | |

| | | | |

| | 15,410 | | | Dallas Convention Center Hotel Development Corporation, Texas, Hotel Revenue Bonds, Build America Taxable Bonds, Series 09B, 7.088%, 1/01/42 (4) | | | No Opt. Call | | | | A | | | | 17,835,842 | |

| | | | |

| | 1,000 | | | Fort Worth, Tarrant, Denton, Parker, Johnson, and Wise Counties, Texas, Special Tax Revenue Bonds, Taxable Series 2017B, 4.238%, 3/01/47 | | | 9/24 at 100.00 | | | | AA | | | | 872,770 | |

| | | | |

| | 2,315 | | | Houston, Texas, Airport System Special Facilities Revenue Bonds, Consolidated Rental Car Facility Project, Taxable Series 2001, 6.880%, 1/01/28 - NPFG Insured | | | No Opt. Call | | | | A | | | | 2,445,404 | |

| | | | |

| | 10,285 | | | North Texas Tollway Authority, System Revenue Bonds, Taxble Build America Bond Series 2009B, 6.718%, 1/01/49 (4) | | | No Opt. Call | | | | AA- | | | | 12,936,679 | |

| | | | |

| | | | San Antonio, Texas, Customer Facility Charge Revenue Bonds, Rental Car Special Facilities Project, Series 2015: | | | | | | | | | | | | |

| | 7,545 | | | 5.671%, 7/01/35 | | | 7/25 at 100.00 | | | | A | | | | 7,555,412 | |

| | 2,000 | | | 5.871%, 7/01/45 | | | 7/25 at 100.00 | | | | A | | | | 1,954,420 | |

| | | | |

| | 1,000 | | | San Antonio, Texas, Electric and Gas System Revenue Bonds, Junior Lien, Build America Taxable Bond Series 2010A, 5.808%, 2/01/41 | | | No Opt. Call | | | | Aa3 | | | | 1,105,280 | |

| | | | |

| | 10 | | | San Antonio, Texas, Electric and Gas System Revenue Bonds, Series 2012, 4.427%, 2/01/42 | | | No Opt. Call | | | | Aa2 | | | | 9,520 | |

| | | | |

| | | | Tarrant County Cultural Education Facilities Finance Corporation, Texas, Hospital Revenue Bonds, Hendrick Medical Center, Taxable Series 2021: | | | | | | | | | | | | |

| | 1,000 | | | 3.292%, 9/01/40 - AGM Insured | | | 9/30 at 100.00 | | | | AA | | | | 790,790 | |

| | 1,400 | | | 3.422%, 9/01/50 - AGM Insured | | | 9/30 at 100.00 | | | | AA | | | | 1,013,922 | |

| | | | |

| | 1,000 | | | Texas Private Activity Bond Surface Transporation Corporation, Revenue Bonds, NTE Mobility Partners LLC North Tarrant Express Managed Lanes Project, Taxable Refunding Senior Lien Series 2019B, 3.922%, 12/31/49 | | | No Opt. Call | | | | Baa2 | | | | 824,070 | |

| | | |

| | | | Total Texas | | | | | | | | | | | 50,212,852 | |

| | | | | |

| | | | |

| | | | Utah - 1.5% (1.1% of Total Investments) | | | | | | | | | | | | |

| | | | |

| | 8,500 | | | Salt Lake County, Utah, Convention Hotel Revenue Bonds, Taxable Series 2019, 5.750%, 10/01/47, 144A | | | 10/29 at

100.00 |

| | | N/R | | | | 7,482,380 | |

| | | |

| | | | Total Utah | | | | | | | | | | | 7,482,380 | |

| | | | | |

21

| | |

| NBB | | Nuveen Taxable Municipal Income Fund (continued) Portfolio of Investments March 31, 2023 |

| | | | | | | | | | | | | | | | | | | | |

Principal

Amount (000) | | Description (1) | | | | | Optional Call Provisions (2) | | | Ratings (3) | | | Value | |

| | | |

| | | | | |

| | | | Virginia - 3.5% (2.5% of Total Investments) | | | | | | | | | | | | | | | | |

| | | | |

| $ | 1,840 | | | Fredericksburg Economic Development Authority, Virginia, Revenue Bonds, Fredericksburg Stadium Project, Taxable Series 2019A, 5.500%, 9/01/49, 144A | | | | 9/29 at 100.00 | | | | AA | | | $ | 1,780,127 | |

| | | | |

| | 10,810 | | | Tobacco Settlement Financing Corporation of Virginia, Tobacco Settlement Asset Backed Bonds, Refunding Senior Lien Series 2007A, 6.706%, 6/01/46 | | | | 6/25 at 100.00 | | | | B- | | | | 10,030,599 | |

| | | | |

| | 5,635 | | | Virginia Small Business Finance Authority, Tourism Development Financing Program Revenue Bonds, Downtown Norfolk and Virginia Beach Oceanfront Hotel Projects, Series 2018B, 12.000%, 4/01/48, 144A | | | | 4/28 at 117.16 | | | | N/R | | | | 5,704,423 | |

| | | |

| | | | Total Virginia | | | | | | | | | | | | | | | 17,515,149 | |

| | | | | |

| | | | | |

| | | | Washington - 7.4% (5.2% of Total Investments) | | | | | | | | | | | | | | | | |

| | | | |

| | 4,000 | | | Seattle, Washington, Municipal Light and Power Revenue Bonds, Federally Taxable Build America Bonds, Tender Option Bond Trust 2016-XFT905, 4.975%, 2/01/40, 144A, (IF) (5) | | | | No Opt. Call | | | | AA | | | | 4,971,840 | |

| | | | |

| | 28,915 | | | Washington State Convention Center Public Facilities District, Lodging Tax Revenue Bonds, Build America Taxable Bond Series 2010B, 6.790%, 7/01/40 | | | | No Opt. Call | | | | Baa1 | | | | 32,143,938 | |

| | | |

| | | | Total Washington | | | | | | | | | | | | | | | 37,115,778 | |

| | | | | |

| | | | | |

| | | | West Virginia - 3.0% (2.1% of Total Investments) | | | | | | | | | | | | | | | | |

| | | | |

| | | | Tobacco Settlement Finance Authority, West Virginia, Tobacco Settlement Asset-Backed Bonds, Taxable Refunding Class 1 Senior Series 2020A: | | | | | | | | | | | | | |

| | 8,500 | | | 4.006%, 6/01/40 | | | | | | | 12/30 at 100.00 | | | | A- | | | | 6,839,355 | |

| | 10,800 | | | 4.306%, 6/01/49 | | | | | | | 12/30 at 100.00 | | | | BBB+ | | | | 8,356,392 | |

| | | |

| | | | Total West Virginia | | | | | | | | | | | | | | | 15,195,747 | |

| | | | | |

| | | | | |

| | | | Wisconsin - 0.4% (0.3% of Total Investments) | | | | | | | | | | | | | | | | |

| | | | |

| | 2,000 | | | Wisconsin Center District, Dedicated Tax Revenue Bonds, Supported by State Moral Obligation Taxable Senior Series 2020A, 4.473%, 12/15/47 - AGM Insured | | | | 12/30 at 100.00 | | | | AA | | | | 1,788,860 | |

| | | |

| | | | Total Wisconsin | | | | | | | | | | | | | | | 1,788,860 | |

| | | | | |

| | | | Total Long-Term Investments (cost $709,386,994) | | | | | | | | | | | | | | | 705,896,069 | |

| | | | | |

| | | | | |

Principal

Amount (000) | | Description (1) | | Coupon | | | Maturity | | | | | | Value | |

| | | |

| | | | |

| | | | SHORT-TERM INVESTMENTS - 1.1% (0.8% of Total Investments) | | | | | | | | | | | | | |

| | | | |

| | | | REPURCHASE AGREEMENTS - 1.1% (0.8% of Total Investments) | | | | | | | | | | | | | |

| | | | | |

| $ | 5,653 | | | Repurchase Agreement with Fixed Income Clearing Corporation, dated 3/31/23, repurchase price $5,653,221, collateralized by $5,972,700, U.S. Treasury Note, 2.250%, due 11/15/25, value $5,765,615 | | | 1.440% | | | | 4/03/23 | | | | | | | $ | 5,652,543 | |

| | | |

| | | | Total Repurchase Agreements (cost $5,652,543) | | | | | | | | | | | | | | | 5,652,543 | |

| | | | | |

| | | | | |

| | | | Total Short-Term Investments (cost $5,652,543) | | | | | | | | | | | | | | | 5,652,543 | |

| | | | | |

| | | | | |

| | | | Total Investments (cost $715,039,537) - 142.1% | | | | | | | | | | | | | | | 711,548,612 | |

| | | | | |

| | | | | |

| | | | Floating Rate Obligations - (7.4)% | | | | | | | | | | | | | | | (36,810,000 | ) |

| | | | | |

| | | |

| | | | Reverse Repurchase Agreements, including accrued interest - (37.7)%(6) | | | | | | | | (188,747,848 | ) |

| | | | | |

| | | | | |

| | | | Other Assets & Liabilities, Net - 3.0%(7) | | | | | | | | | | | | | | | 14,786,636 | |

| | | | | |

| | | | | |

| | | | Net Assets Applicable to Common Shares - 100% | | | | | | | | | | | | | | $ | 500,777,400 | |

| | | | | |

22

Investments in Derivatives

Futures Contracts - Short

| | | | | | | | | | | | | | | | | | | | |

| Description | | Number of Contracts | | | Expiration Date | | | Notional Amount | | | Value | | | Unrealized Appreciation (Depreciation) | |

| | |

| U.S. Treasury Ultra Bond | | | (1,353 | ) | | | 6/23 | | | $ | (182,687,950 | ) | | $ | (190,942,125 | ) | | $ | (8,254,175 | ) |

| | |

| (1) | All percentages shown in the Portfolio of Investments are based on net assets applicable to common shares unless otherwise noted. |

| (2) | Optional Call Provisions: Dates (month and year) and prices of the earliest optional call or redemption. There may be other call provisions at varying prices at later dates. Certain mortgage-backed securities may be subject to periodic principal paydowns. Optional Call Provisions are not covered by the report of independent registered public accounting firm. |

| (3) | For financial reporting purposes, the ratings disclosed are the highest of Standard & Poor’s Group (“Standard & Poor’s”), Moody’s Investors Service, Inc. (“Moody’s”) or Fitch, Inc. (“Fitch”) rating. This treatment of split-rated securities may differ from that used for other purposes, such as for Fund investment policies. Ratings below BBB by Standard & Poor’s, Baa by Moody’s or BBB by Fitch are considered to be below investment grade. Holdings designated N/R are not rated by any of these national rating agencies. Ratings are not covered by the report of independent registered public accounting firm. |

| (4) | Investment, or portion of investment, has been pledged to collateralize the net payment obligations for investments in reverse repurchase agreements. As of the end of the reporting period, investments with a value of $236,760,673 have been pledged as collateral for reverse repurchase agreements. |

| (5) | Investment, or portion of investment, has been pledged to collateralize the net payment obligations for investments in inverse floating rate transactions. |

| (6) | Reverse Repurchase Agreements, including accrued interest as a percentage of Total investments is 26.5%. |

| (7) | Other assets less liabilities includes the unrealized appreciation (depreciation) of certain over‑the‑counter (“OTC”) derivatives as presented on the Statement of Assets and Liabilities, when applicable. The unrealized appreciation (depreciation) of OTC cleared and exchange-traded derivatives is recognized as part of the cash collateral at brokers and/or the receivable or payable for variation margin as presented on the Statement of Assets and Liabilities, when applicable. |