Exhibit 99.2

Supplemental Operating and Financial Data

For the Period Ended March 31, 2015

Table of Contents

| | |

| | | Page |

| |

Company Overview | | 3 |

| |

Property Locations | | 4 |

| |

Analyst Coverage | | 5 |

| |

Summary Financial and Portfolio Data | | 6 |

| |

Financial Summary | | |

Consolidated Balance Sheets | | 7 |

Consolidated Statements of Operations | | 8 |

Reconciliation of Net Income to EBITDA | | 9 |

Reconciliation of Net Income to FFO and AFFO | | 10 |

Debt Summary | | 11 |

Common and Preferred Stock Data | | 12 |

| |

Portfolio Summary | | |

Acquisitions & Developments | | 13 |

Operating Portfolio Summary | | 14 |

Summary of Retail Leasing Activity | | 15 |

Same Property Analysis | | 16 |

Major Tenants | | 17 |

Expiration Schedule | | 18 |

Unconsolidated Investments | | 19 |

| |

Definitions | | 20 |

*Note: Financial and portfolio information reflects the consolidated operations of the

company and excludes unconsolidated entities unless otherwise noted.

Company Overview

| | | | | | | | |

| Corporate Headquarters | | | | Other Offices | | |

| Excel Trust, Inc. | | | | Atlanta, GA | | Salt Lake City, UT | | |

| 17140 Bernardo Center Dr., Ste 300 | | | | Dallas, TX | | Scottsdale, AZ | | |

| San Diego, CA 92128 | | | | Orlando, FL | | Stockton, CA | | |

| Tel: 858-613-1800 | | | | Richmond, VA | | | | |

| Email: info@exceltrust.com | | | | | | | | |

| Website: www.exceltrust.com | | | | | | | | |

| | | | | | | | |

| Executives & Senior Management | | |

| Gary B. Sabin - Chairman & CEO | | | | Spencer G. Plumb - President & COO | | |

| James Y. Nakagawa - CFO, Treasurer | | | | Mark T. Burton - CIO & SVP, Acquisitions | | |

| S. Eric Ottesen - SVP, General Counsel | | | | Greg R. Davis - VP, Capital Markets | | |

| | | | | | | | |

| Board of Directors | | |

| Gary B. Sabin (Chairman) | | | | Spencer G. Plumb | | | | |

| Mark T. Burton | | | | Bruce G. Blakley | | | | |

| Burland B. East III | | | | Robert E. Parsons, Jr. | | | | |

| Warren R. Staley | | | | | | | | |

| | | | | | | | |

| Transfer Agent and Registrar | | | | Corporate Counsel | | |

| Broadridge Corporate Issuer Solutions, Inc. | | | | Latham & Watkins | | | | |

| PO Box 1342 | | | | 12670 High Bluff Drive, | | |

| Brentwood, NY 11717 | | | | San Diego, CA 92130 | | | | |

| Tel: 877-830-4936 | | | | Tel: 858-523-5400 | | | | |

| Email: shareholder@broadridge.com | | | | | | | | |

| Website: www.broadridge.com | | | | | | | | |

Reported results and other information herein are preliminary and not final until the filing of Excel Trust’s report on Form 10-Q or Form 10-K with the Securities and Exchange Commission and, therefore, remain subject to adjustment.

Forward-Looking Statements

This Document contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 based on current expectations, forecasts and assumptions that involve risks and uncertainties that could cause actual outcomes and results to differ materially. These risks and uncertainties include, without limitation: general risks affecting the real estate industry (including, without limitation, the inability to enter into or renew leases, dependence on tenants’ financial condition, and competition from other developers, owners and operators of real estate); adverse economic or real estate developments in the retail industry or the markets in which the Company operates; increased interest rates and operating costs; decreased rental rates or increased vacancy rates; the Company’s failure to obtain necessary outside financing on favorable terms or at all; changes in the availability of additional acquisition opportunities; the Company’s inability to successfully complete real estate acquisitions or successfully operate acquired properties; the Company’s failure to qualify or maintain its status as a REIT; risks associated with the Company’s dependence on key personnel whose continued service is not guaranteed; and risks associated with downturns in domestic and local economies, and volatility in the securities markets. For a further list and description of such risks and uncertainties, see the reports filed by the Company with the Securities and Exchange Commission, including the Company’s most recent annual report on Form 10-K and quarterly reports on Form 10-Q. The Company disclaims any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

Page 3

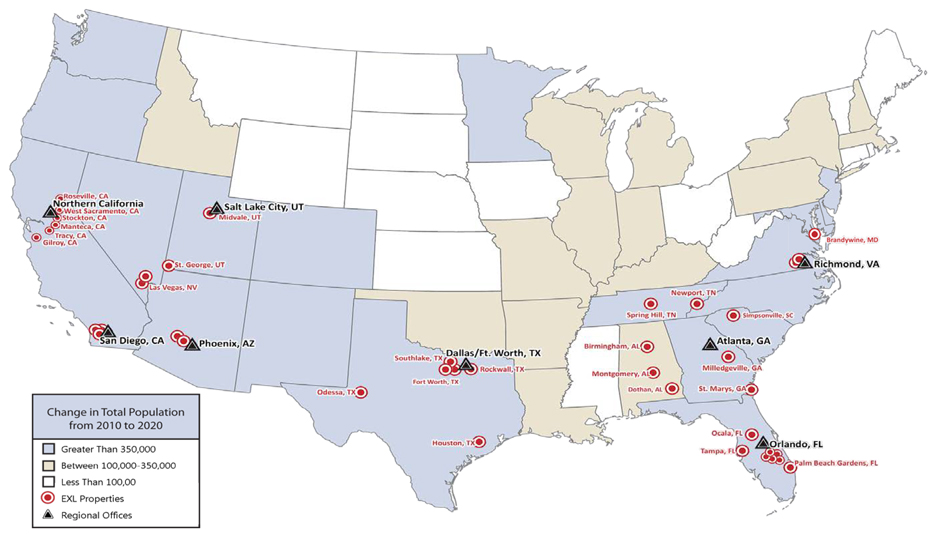

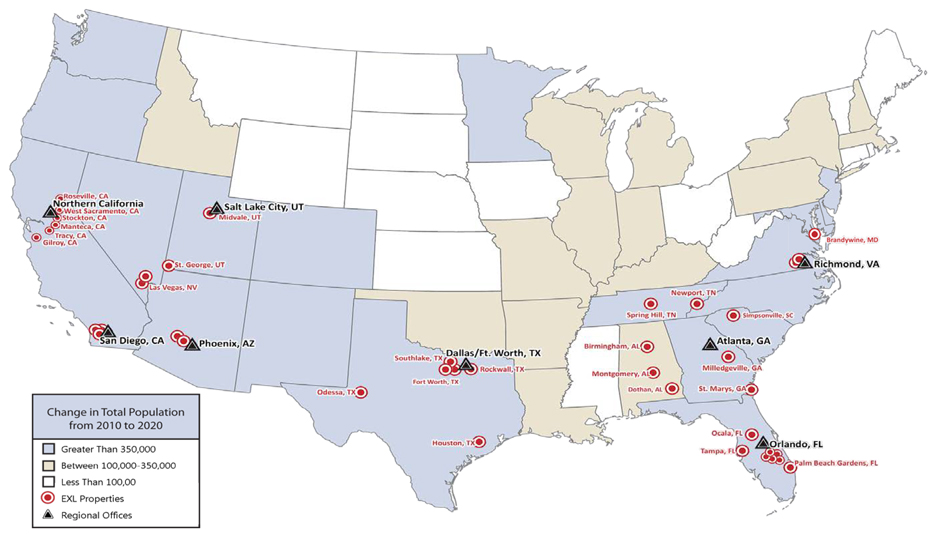

Property Locations

Page 4

Analyst Coverage

| | | | |

| Company | | Analyst | | Contact |

| | |

Barclays Capital | | Ross Smotrich | | (212) 526-2306 |

| | Linda Tsai | | (212) 526-9937 |

| | |

Cantor Fitzgerald | | Evan Smith | | (212) 915-1220 |

| | |

Hilliard Lyons | | Carol Kemple | | (502) 588-1839 |

| | |

KeyBanc | | Jordan Sadler | | (917) 368-2280 |

| | Todd Thomas | | (917) 368-2286 |

| | |

Raymond James | | Paul D. Puryear | | (727) 567-2253 |

| | Collin Mings | | (727) 567-2585 |

| | |

Sandler O’Neill + Partners | | Alexander Goldfarb | | (212) 466-7937 |

| | Ryan Peterson | | (212) 466-7927 |

| | |

Stifel, Nicolaus | | Nathan Isbee | | (443) 224-1346 |

| | Jennifer Hummert | | (443) 224-1288 |

| | |

Wells Fargo | | Jeff Donnelly | | (617) 603-4262 |

| | Tamara Fique | | (443) 263-6568 |

Page 5

Summary Financial and Portfolio Data (Consolidated)

| | | | |

| For the Period Ended March 31, 2015 | | | |

(Dollars and share data in thousands, except per share data) | | | |

| |

Portfolio Summary | | | | |

Total Gross Leasable Square Feet (GLA)-Operating Portfolio(1) | | | 7,145,777 | |

Percent Leased-Operating Portfolio | | | 94.4% | |

Percent Occupied-Operating Portfolio | | | 93.1% | |

Annualized Base Rent(2) | | $ | 110,296 | |

Total no. retail leases signed or renewed | | | 44 | |

Total sq. ft. retail leases signed or renewed | | | 239,058 | |

| |

Financial Results | | | | |

Net income (loss) attributable to the common stockholders | | $ | 17,628 | |

Net income (loss) per diluted share | | $ | 0.28 | |

Funds from operations (FFO) | | $ | 15,590 | |

FFO per diluted share | | $ | 0.24 | |

Adjusted funds from operations (AFFO) | | $ | 15,999 | |

AFFO per diluted share | | $ | 0.25 | |

EBITDA | | $ | 45,209 | |

| |

Assets | | | | |

Gross undepreciated real estate | | $ | 1,459,658 | |

Gross undepreciated assets | | $ | 1,739,871 | |

Total liabilities to gross undepreciated assets | | | 50.7% | |

Debt to gross undepreciated assets | | | 45.4% | |

| |

Capitalization | | | | |

Common shares outstanding | | | 63,403 | |

OP units outstanding | | | 1,020 | |

| | | | |

Total common shares and OP units | | | 64,423 | |

Closing price at quarter end | | $ | 14.02 | |

Equity capitalization | | $ | 903,210 | |

Series A convertible preferred shares (at liquidation preference of $25.00 per share) | | | 29,524 | |

Series B preferred shares (at liquidation preference of $25.00 per share) | | | 92,000 | |

Total debt(3) | | | 789,646 | |

| | | | |

Total capitalization | | $ | 1,814,380 | |

| | | | |

| |

Debt/total capitalization | | | 43.5% | |

Debt/EBITDA | | | 4.4 | |

| |

Common Stock Data | | | | |

Range of closing prices for the quarter | | $ | 13.43-14.38 | |

Weighted average common shares outstanding - diluted (EPS) | | | 64,987 | |

Weighted average common shares outstanding - diluted (FFO and AFFO) | | | 63,493 | |

Shares of common stock outstanding | | | 63,403 | |

| | (1) | Includes retail and office gross leasable area, but excludes gross leasable area from developments under construction and any planned development. |

| | (2) | Annualized Base Rent excludes rental revenue from non-stabilized development properties. |

| | (3) | Excludes debt discount or premium. |

Page 6

Balance Sheets

CONSOLIDATED BALANCE SHEETS

(Dollars in thousands)

| | | | | | | | | | | | | | | | | | | | |

| | | March 31, 2015 | | | December 31, 2014 | | | September 30, 2014 | | | June 30, 2014 | | | March 31, 2014 | |

ASSETS: | | | | | | | | | | | | | | | | | | | | |

| | | | | |

Property: | | | | | | | | | | | | | | | | | | | | |

Land | | $ | 433,635 | | | $ | 455,112 | | | $ | 409,013 | | | $ | 380,363 | | | $ | 380,368 | |

Buildings | | | 860,390 | | | | 921,604 | | | | 754,860 | | | | 647,401 | | | | 646,062 | |

Site improvements | | | 83,222 | | | | 87,305 | | | | 69,137 | | | | 64,769 | | | | 64,283 | |

Tenant improvements | | | 65,484 | | | | 70,549 | | | | 62,454 | | | | 56,459 | | | | 55,624 | |

Construction in progress | | | 16,927 | | | | 8,819 | | | | 26,697 | | | | 14,980 | | | | 8,028 | |

Less accumulated depreciation | | | (92,993) | | | | (90,543) | | | | (83,008) | | | | (75,834) | | | | (68,635) | |

| | | | | | | | | | | | | | | | | | | | |

Property, net | | | 1,366,665 | | | | 1,452,846 | | | | 1,239,153 | | | | 1,088,138 | | | | 1,085,730 | |

Cash and cash equivalents | | | 5,525 | | | | 6,603 | | | | 6,143 | | | | 183,749 | | | | 5,307 | |

Restricted cash | | | 94,102 | | | | 8,272 | | | | 7,707 | | | | 6,973 | | | | 8,535 | |

Tenant receivables, net | | | 5,772 | | | | 5,794 | | | | 4,404 | | | | 3,205 | | | | 3,746 | |

Lease intangibles, net | | | 110,068 | | | | 123,373 | | | | 81,796 | | | | 68,213 | | | | 73,013 | |

Deferred rent receivable | | | 10,376 | | | | 11,479 | | | | 10,824 | | | | 10,342 | | | | 9,819 | |

Other assets(1) | | | 20,404 | | | | 32,081 | | | | 36,022 | | | | 22,572 | | | | 21,143 | |

Real estate held for sale, net of accumulated amortization | | | 27,295 | | | | - | | | | - | | | | - | | | | - | |

Investment in unconsolidated entities | | | 6,671 | | | | 6,689 | | | | 8,378 | | | | 8,303 | | | | 8,405 | |

| | | | | | | | | | | | | | | | | | | | |

Total assets | | $ | 1,646,878 | | | $ | 1,647,137 | | | $ | 1,394,427 | | | $ | 1,391,495 | | | $ | 1,215,698 | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

LIABILITIES AND EQUITY: | | | | | | | | | | | | | | | | | | | | |

| | | | | |

Liabilities: | | | | | | | | | | | | | | | | | | | | |

Mortgages payable, net | | $ | 192,956 | | | $ | 192,748 | | | $ | 160,837 | | | $ | 207,048 | | | $ | 238,543 | |

Notes payable | | | 199,000 | | | | 238,000 | | | | 56,000 | | | | - | | | | 198,000 | |

Unsecured notes | | | 398,791 | | | | 398,758 | | | | 348,725 | | | | 348,693 | | | | 100,000 | |

Accounts payable and other liabilities | | | 37,920 | | | | 34,338 | | | | 40,821 | | | | 29,110 | | | | 23,964 | |

Liabilities of real estate held for sale | | | 2,207 | | | | - | | | | - | | | | - | | | | - | |

Lease intangibles, net | | | 37,439 | | | | 42,470 | | | | 36,260 | | | | 25,845 | | | | 26,967 | |

Dividends/distributions payable | | | 13,580 | | | | 12,857 | | | | 12,918 | | | | 13,160 | | | | 10,944 | |

| | | | | | | | | | | | | | | | | | | | |

Total liabilities | | | 881,893 | | | | 919,171 | | | | 655,561 | | | | 623,856 | | | | 598,418 | |

| | | | | |

Equity: | | | | | | | | | | | | | | | | | | | | |

Total stockholders’ equity | | | 752,253 | | | | 715,389 | | | | 727,094 | | | | 755,611 | | | | 605,665 | |

Non-controlling interests | | | 12,732 | | | | 12,577 | | | | 11,772 | | | | 12,028 | | | | 11,615 | |

| | | | | | | | | | | | | | | | | | | | |

Total equity | | | 764,985 | | | | 727,966 | | | | 738,866 | | | | 767,639 | | | | 617,280 | |

| | | | | | | | | | | | | | | | | | | | |

Total liabilities and equity | | $ | 1,646,878 | | | $ | 1,647,137 | | | $ | 1,394,427 | | | $ | 1,391,495 | | | $ | 1,215,698 | |

| | | | | | | | | | | | | | | | | | | | |

(1) Other assets is primarily comprised of deposits, notes receivable, prepaid expenses and furniture, fixtures, and equipment

Page 7

Statements of Operations

CONSOLIDATED STATEMENTS OF OPERATIONS

(In thousands, except per share data)

| | | | | | | | |

| | | Three Months Ended

March 31, 2015 | | | Three Months Ended

March 31, 2014 | |

| | |

Revenues: | | | | | | | | |

Rental revenue | | $ | 31,976 | | | $ | 24,908 | |

Tenant recoveries | | | 7,443 | | | | 5,256 | |

Other income | | | 1,072 | | | | 434 | |

| | | | | | | | |

Total revenues | | | 40,491 | | | | 30,598 | |

| | |

Expenses: | | | | | | | | |

Maintenance and repairs | | | 2,987 | | | | 2,223 | |

Real estate taxes | | | 4,417 | | | | 3,366 | |

Management fees | | | 643 | | | | 518 | |

Other operating expenses | | | 2,732 | | | | 1,731 | |

Changes in fair value of contingent consideration | | | - | | | | - | |

General and administrative | | | 4,348 | | | | 3,815 | |

Depreciation and amortization | | | 17,266 | | | | 11,796 | |

| | | | | | | | |

Total expenses | | | 32,393 | | | | 23,449 | |

| | | | | | | | |

| | |

Net operating income | | | 8,098 | | | | 7,149 | |

| | |

Interest expense | | | (7,551) | | | | (4,989) | |

Interest income | | | 50 | | | | 49 | |

Income (loss) from equity in unconsolidated entities | | | 134 | | | | 69 | |

Gain on acquisition of real estate and sale of land parcel | | | - | | | | - | |

Gain on sale of real estate assets | | | 19,661 | | | | - | |

| | |

| | | | | | | | |

Net income (loss) | | | 20,392 | | | | 2,278 | |

Net (income) loss attributable to non-controlling interests | | | (379) | | | | (83) | |

| | |

| | | | | | | | |

Net income (loss) attributable to Excel Trust, Inc. | | | 20,013 | | | | 2,195 | |

Preferred stock dividends | | | (2,385) | | | | (2,744) | |

Cost of redemption of preferred stock | | | - | | | | - | |

| | | | | | | | |

| | |

Net income (loss) attributable to the common stockholders | | $ | 17,628 | | | $ | (549) | |

| | | | | | | | |

| | |

Basic net income (loss) per share | | $ | 0.28 | | | $ | (0.01) | |

| | | | | | | | |

Diluted net income (loss) per share | | $ | 0.28 | | | $ | (0.01) | |

| | | | | | | | |

Weighted-average common shares outstanding - basic | | | 62,473 | | | | 47,785 | |

| | | | | | | | |

Weighted-average common shares outstanding - diluted | | | 64,987 | | | | 47,785 | |

| | | | | | | | |

The notes in the Form 10-Q or 10-K are an integral part of these condensed consolidated financial statements.

Page 8

Reconciliation of Net Income to EBITDA

(Earnings before Interest, Taxes, Depreciation & Amortization)

Excel Trust, Inc.’s EBITDA and a reconciliation to net income (loss) for the periods presented is as follows:

(Dollars in thousands)

| | | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended

March 31, 2015 | | | Three Months Ended

December 31, 2014 | | | Three Months Ended

September 30, 2014 | | | Three Months Ended

June 30, 2014 | | | Three Months Ended

March 31, 2014 | |

| | | | | |

Net income attributable to Excel Trust, Inc. | | $ | 20,392 | | | $ | 3,617 | | | $ | 1,218 | | | $ | 1,905 | | | $ | 2,195 | |

| | | | | |

Add: | | | | | | | | | | | | | | | | | | | | |

Interest expense | | | 7,551 | | | | 6,810 | | | | 6,387 | | | | 5,981 | | | | 4,989 | |

Depreciation and amortization | | | 17,266 | | | | 16,242 | | | | 11,212 | | | | 11,411 | | | | 11,796 | |

| | | | | | | | | | | | | | | | | | | | |

EBITDA | | $ | 45,209 | | | $ | 26,669 | | | $ | 18,817 | | | $ | 19,297 | | | $ | 18,980 | |

| | | | | | | | | | | | | | | | | | | | |

Page 9

Reconciliation of Net Income to FFO and AFFO

For the Period Ended March 31, 2015

(In thousands, except per share data)

Excel Trust, Inc.’s FFO and AFFO available to common stockholders and operating partnership unitholders and a reconciliation to net income(loss) for the three months ended March 31, 2015 and 2014 is as follows:

| | | | | | | | |

| | | Three Months Ended

March 31, 2015 | | | Three Months Ended

March 31, 2014 | |

| | |

Net income (loss) attributable to the common stockholders | | $ | 17,628 | | | $ | (549) | |

| | |

Add: | | | | | | | | |

Non-controlling interests in operating partnership | | | 289 | | | | (10) | |

Depreciation and amortization | | | 17,266 | | | | 11,796 | |

Deduct: | | | | | | | | |

Depreciation and amortization related to joint venture (1) | | | 68 | | | | 170 | |

Gain on sale of real estate assets | | | (19,661) | | | | - | |

| | | | | | | | |

Funds from operations (2) | | $ | 15,590 | | | $ | 11,407 | |

| | |

Adjustments: | | | | | | | | |

Gain on sale of equity securities | | | (308) | | | | - | |

Charge for developer profit participation interests | | | 327 | | | | - | |

Transaction costs | | | 405 | | | | 306 | |

Deferred financing costs | | | 567 | | | | 424 | |

Stock-based and other non-cash compensation expense | | | 1,063 | | | | 574 | |

Straight-line effects of lease revenue | | | (742) | | | | (592) | |

Amortization of above- and below-market leases | | | (618) | | | | (138) | |

Non-incremental capital expenditures | | | (288) | | | | (111) | |

Non-cash expenses (income) - including portion of joint ventures | | | 3 | | | | (9) | |

| | | | | | | | |

Adjusted funds from operations (2) | | $ | 15,999 | | | $ | 11,861 | |

| | | | | | | | |

| | |

Weighted average common shares outstanding | | | 62,473 | | | | 47,785 | |

Add(3): | | | | | | | | |

OP units | | | 1,020 | | | | 1,020 | |

Restricted stock | | | - | | | | - | |

| | | | | | | | |

Weighted average common shares outstanding - diluted (FFO and AFFO) | | | 63,493 | | | | 48,805 | |

| | | | | | | | |

| | |

Funds from operations per share (diluted) (4) | | $ | 0.24 | | | $ | 0.23 | |

Adjusted funds from operations per share (diluted) (4) | | $ | 0.25 | | | $ | 0.24 | |

| |

| | | | | |

| | |

Other Information(5): | | | | | | | | |

Leasing commissions paid | | $ | 337 | | | $ | 272 | |

Tenant improvements paid | | $ | 1,296 | | | $ | 1,257 | |

| (1) | Includes a reduction for the portion of consolidated depreciation and amortization expense that would be allocable to non-controlling interests and an increase for the the Company’s portion of depreciation and amortization expense related to its former investment in the unconsolidated La Costa Town Center property and current investment in The Fountains at Bay Hill property. |

| (2) | FFO and AFFO are described on the Definitions page. |

| (3) | The calculation of FFO for the three months ended March 31, 2015 and 2014 include 1,020,000 OP units, which are considered antidilutive for purposes of calculating diluted earnings per share. The three months ended March 31, 2015 and 2014 exclude 225,675 and 502,476 shares of restricted stock and 2,010,735 and 3,367,200 shares of common stock, respectively, potentially issuable pursuant to the conversion feature of the preferred stock based on the “if converted” method. |

| (4) | The calculation of funds from operations per share (diluted) and adjusted funds from operations per share (diluted) for the three months ended March 31, 2015 and 2014 includes a reduction of $131,000 and $132,000, respectively, for dividends paid to shares of restricted common stock in excess of earnings. |

| (5) | Excludes development properties and shell construction costs for value-add opportunities at operating properties. |

Page 10

Debt Summary (Consolidated)

For the Period Ended March 31, 2015

(Dollars in thousands)

| | | | | | | | | | | | | | | | | | |

| | | | | | % Total Debt | | |

Fixed Rate Debt(1) | | $ | 525,601 | | | 67% | |

| Variable Rate Debt(2) | | | 264,045 | | | 33% | |

| |

Total Debt(1) | | $ | 789,646 | | | 100% | |

Debt(1)/Gross Undepreciated Assets | | | 45.4% | | | | |

| | | | | | % Total Debt | |

Secured Debt(1) | | $ | 190,646 | | | 24% | |

Unsecured Debt | | | 599,000 | | | 76% | |

| |

Total Debt | | $ | 789,646 | | | 100% | |

Secured Debt to Gross Undepreciated Assets | | | 11.0% | |

| | | | | | | |

| Maturities by Year-Secured(3) | | Amount | | | % Total Debt | | | | Maturities by Year-Unsecured(3) | | Amount | | | Contractual Interest Rate | | % Total Debt |

| | | |

2015 | | $ | 47,650 | | | 6.0% | | | 2015(4) | | $ | 50,000 | | | 1.3% | | 6.3% |

2016 | | | 3,070 | | | 0.4% | | | 2016 | | | - | | | | | |

2017 | | | 42,192 | | | 5.3% | | | 2017 | | | - | | | | | |

2018 | | | 5,995 | | | 0.8% | | | 2018 | | | 199,000 | | | 1.5% | | 25.2% |

2019 | | | 6,390 | | | 0.8% | | | 2019 | | | - | | | | | |

2020 | | | 38,216 | | | 4.8% | | | 2020 | | | 75,000 | | | 4.4% | | 9.5% |

2021 | | | 1,447 | | | 0.2% | | | 2021 | | | - | | | | | |

2022 | | | 33,686 | | | 4.3% | | | 2022 | | | - | | | | | |

2023 | | | - | | | 0.0% | | | 2023 | | | 25,000 | | | 5.2% | | 3.2% |

2024 | | | - | | | 0.0% | | | 2024 | | | 250,000 | | | 4.6% | | 31.7% |

Beyond 2024 | | | 12,000 | | | 1.5% | | | Beyond 2024 | | | - | | | | | |

| | | |

Total | | $ | 190,646 | | | 24.1% | | | Total | | | $ 599,000 | | | 3.3% | | 75.9% |

| | | | |

| Mortgage Notes | | Amount | | | Contractual Interest Rate | | Maturity | | |

| |

The Promenade | | $ | 45,645 | | | 4.8% | | Nov-15 | |

5000 South Hulen | | | 13,110 | | | 5.6% | | Apr-17 | |

Lake Pleasant Pavilion | | | 27,418 | | | 6.1% | | Oct-17 | |

West Broad Marketplace | | | 3,045 | | | 2.5% | | Jan-18 | |

Rite Aid, Vestavia | | | 785 | | | 7.3% | | Oct-18 | |

Living Spaces-Promenade | | | 6,667�� | | | 7.9% | | Nov-19 | |

West Broad Village(2) | | | 39,700 | | | 3.3% | | May-20 | |

Downtown at the Gardens | | | 42,276 | | | 4.6% | | Jul-22 | |

Northside Mall(2) | | | 12,000 | | | 0.0% | | Nov-35 | |

| |

Total | | | 190,646 | | | 4.5% | | | |

Debt (discount) or premium | | | 2,310 | | | | | | |

| | | | | | | | | |

Mortgage notes, net | | $ | 192,956 | | | | | | |

| |

| | | | | | | | | | |

(1) Amount excludes debt discount or premium.

(2) Includes the Northside Plaza redevelopment revenue bonds to be used for the redevelopment of this property and our unsecured revolving credit facility. The revenue bonds are priced off the SIFMA index and reset weekly (the rate as of March 31, 2015 was 0.03%). The revenue bonds are secured by a $12.1 million letter of credit issued by the Company from the Company’s credit facility. The construction loan on the West Broad Marketplace property bears interest at LIBOR plus 2.30% (the rate as of March 31, 2015 was 2.49%). The $50.0 million unsecured term loan bears interest at LIBOR plus 1.15% (the rate as of March 31, 2015 was 1.33%). The unsecured revolving credit facility bears interest at LIBOR plus 0.90% to 1.70% (the rate as of March 31, 2015 was 1.48%).

(3) Includes monthly payments on outstanding principal as well as principal due at maturity.

(4) The Company entered into a $50.0 million term loan in December 2014, which bears interest at the rate of LIBOR plus a margin of 115 basis points with a maturity date of June 30, 2015. The term loan may be extended for an additional five months at the Company’s option and upon the payment of an extension fee.

Page 11

Common and Preferred Stock Data

For the Period Ended March 31, 2015

(In thousands, except per share data)

| | | | | | | | | | | | | | | | |

| | | Three Months Ended

March 31, 2015 | | | Three Months Ended

December 31, 2014 | | | Three Months Ended

September 30, 2014 | | | Three Months Ended

June 30, 2014 | |

Earning per share - share data | | | | | | | | | | | | | | | | |

Weighted average common shares outstanding - diluted | | | 64,987 | | | | 60,416 | | | | 60,389 | | | | 48,567 | |

| | | | | | | | | | | | | | | | |

Diluted common shares - EPS | | | 64,987 | | | | 60,416 | | | | 60,389 | | | | 48,567 | |

| | | | | | | | | | | | | | | | |

| | | | |

Funds from operations - share data | | | | | | | | | | | | | | | | |

Weighted average common shares outstanding | | | 62,473 | | | | 60,416 | | | | 60,389 | | | | 48,567 | |

Weighted average OP units outstanding | | | 1,020 | | | | 1,020 | | | | 1,020 | | | | 1,020 | |

Weighted average restricted stock outstanding | | | - | | | | 699 | | | | - | | | | 747 | |

| | | | | | | | | | | | | | | | |

Total potential dilutive common shares | | | 63,493 | | | | 62,135 | | | | 61,409 | | | | 50,334 | |

| | | | | | | | | | | | | | | | |

| | | | |

Total common shares (including restricted stock) outstanding | | | 63,403 | | | | 61,113 | | | | 61,116 | | | | 61,117 | |

Total OP units outstanding | | | 1,020 | | | | 1,020 | | | | 1,020 | | | | 1,020 | |

Total Series A convertible preferred shares outstanding | | | 1,181 | | | | 1,181 | | | | 1,331 | | | | 2,000 | |

Total Series B preferred shares outstanding | | | 3,680 | | | | 3,680 | | | | 3,680 | | | | 3,680 | |

| | | | |

Common share data | | | | | | | | | | | | | | | | |

High closing share price | | $ | 14.38 | | | $ | 13.50 | | | $ | 13.41 | | | $ | 13.92 | |

Low closing share price | | $ | 13.43 | | | $ | 11.93 | | | $ | 11.77 | | | $ | 12.32 | |

Average closing share price | | $ | 13.89 | | | $ | 12.80 | | | $ | 12.82 | | | $ | 12.95 | |

Closing price at end of period | | $ | 14.02 | | | $ | 13.39 | | | $ | 11.77 | | | $ | 13.33 | |

Dividends per share - annualized | | $ | 0.72 | | | $ | 0.70 | | | $ | 0.70 | | | $ | 0.70 | |

Dividend yield (based on closing share price at end of period) | | | 5.1 | % | | | 5.2 | % | | | 5.9 | % | | | 5.3 | % |

| | | | |

Dividends per share | | | | | | | | | | | | | | | | |

Common stock (EXL) | | $ | 0.1800 | | | $ | 0.1750 | | | $ | 0.1750 | | | $ | 0.1750 | |

Series A Convertible Perpetual Preferred stock | | $ | 0.4375 | | | $ | 0.4375 | | | $ | 0.4375 | | | $ | 0.4375 | |

Series B Preferred stock | | $ | 0.5078 | | | $ | 0.5078 | | | $ | 0.5078 | | | $ | 0.5078 | |

Page 12

Acquisitions & Developments

For the Period Ended March 31, 2015

(Dollars in thousands, except price per square foot)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Value-add Opportunities | | City | | State | | Estimated

Opening

Date(1) | | GLA to be

Constructed | | Land(2) | | | Improvements | | | Total

Carrying Amount(3) | | | Remaining

Estimated

Cost to

Complete | | | % GLA

Leased /

Committed(4) | | Major Tenants |

Plaza atRockwall - Phase III | | Rockwall | | TX | | Q4 2015 | | 10,560 | | $ | - | | | $ | 221 | | | $ | 221 | | | $ | 2,119 | | | 80% | | Chico’s, Soma, James Avery |

StadiumCenter - Expansion | | Manteca | | CA | | Q4 2015 | | 12,808 | | $ | - | | | $ | 103 | | | $ | 103 | | | $ | 2,697 | | | 100% | | Ulta |

Chimney Rock - Phase III | | Odessa | | TX | | Q4 2015 | | 13,500 | | $ | - | | | $ | 124 | | | $ | 124 | | | $ | 2,743 | | | 100% | | Petco |

| | | | | | | | | | |

Total | | | | | | | | 36,868 | | $ | - | | | $ | 448 | | | $ | 448 | | | $ | 7,559 | | | | | |

| | | | | | | | | | |

| Developments Under Construction | | City | | State | | Estimated

Opening

Date(1) | | GLA to be

Constructed | | Land(2) | | | Improvements | | | Total

Carrying

Amount(3) | | | Remaining

Estimated

Cost to

Complete | | | % GLA

Leased /

Committed(4) | | Major Tenants |

Chimney Rock - Phase II | | Odessa | | TX | | Q4 2015 | | 79,626 | | $ | 2,030 | | | $ | 7,627 | | | $ | 9,657 | | | $ | 4,009 | | | 61% | | Dickey’s BBQ, Mattress Firm,

Northern Tool |

Southlake Park Village | | Southlake (Dallas) | | TX | | Q2 2015 | | 186,045 | | $ | 16,060 | | | $ | 31,841 | | | $ | 47,901 | | | $ | 11,599 | | | 72% | | Fresh Market, REI, Michael’s |

West Broad Marketplace | | Richmond | | VA | | TBD | | 400,000 | | $ | 20,904 | | | $ | 4,180 | | | $ | 25,084 | | | $ | 54,416 | | | 61% | | Cabela’s, Wegmans |

| | | | | | | | | | |

Total | | | | | | | | 665,671 | | $ | 38,994 | | | $ | 43,648 | | | $ | 82,642 | | | $ | 70,024 | | | | | |

| | | | | | | | |

| Future Developments / Land | | City | | State | | Estimated

GLA to be

Constructed /

Land | | Estimated

Start Date | | Estimated

Project Cost | | | Projected Use | | | | | |

Plaza at Rockwall - Phase IV | | Rockwall | | TX | | 10,500 | | TBD | | | n/a | | | | Additional shop space | | | | | |

Park West Place - Expansion B | | Stockton | | CA | | 9,700 | | TBD | | | n/a | | | | Additional shop space | | | | | |

Stadium Center - Expansion | | Manteca | | CA | | 8,500 | | TBD | | | n/a | | | | Additional shop space | | | | | |

Chimney Rock - Phase IV | | Odessa | | TX | | 5.2 acres | | TBD | | | n/a | | | | Additional land to be sold or developed | | | | | |

Shops at Foxwood | | Ocala | | FL | | 1.0 acres | | TBD | | | n/a | | | | Additional land to be sold or developed | | | | | |

West Broad Village - Expansion B | | Richmond | | VA | | 1.2 acres | | TBD | | | n/a | | | | Additional land to be sold or developed | | | | | |

League City Town Center | | League City | | TX | | 0.9 acres | | TBD | | | n/a | | | | Additional land to be sold or developed | | | | | |

Brandywine Crossing - Phase II | | Brandywine | | MD | | 1.0 acres | | TBD | | | n/a | | | | Additional land to be sold or developed | | | | | |

(1) Opening Date represents the date at which the Company estimates that the majority of the gross leasable area will be open for business. A property is reclassified from development to the operating portfolio at the earlier of (i) 85.0% occupancy or (ii) one year from completion and delivery of the space.

(2) The Company has not allocated a separate value to land parcels at certain properties for developments that represent only a small portion of the overall property.

(3) Total Carrying Amount includes land value (where applicable), whereas Construction In Progress (CIP) values for development properties as listed in the Company’s SEC filings excludes land values.

(4) Includes square footage of buildings leased to tenants (including square footage of buildings on outparcels owned by the Company and ground leased to tenants) as well as signed non-binding letters of intent as of April 2015.

Page 13

Operating Portfolio Summary (Consolidated)

For the Period Ended March 31, 2015

(Dollars in thousands, except price per square foot)

| | | | | | | | | | | | | | | | | | | | |

| Property Name | | City | | State | | Year Built(1) | | Total GLA(2) | | Acquisition Date | | Price

Sq. Ft. | | Initial

Cost

Basis | | Percent

Leased

3/31/15 | | Percent

Leased

12/31/14 | | Major Tenants |

| Operating Portfolio | | | | | | | | | | | | | | | | | | | | |

West Broad

Village(3) | | Richmond | | VA | | 2009 | | 397,656 | | 10/19/2012 | | $257 | | $170,200 | | 76.8% | | 77.0% | | Whole Foods, REI, HomeGoods, Dave & Buster’s, South University |

Downtown at the

Gardens | | Palm Beach

Gardens | | FL | | 2005 | | 339,559 | | 10/1/2014 | | $413 | | $140,200 | | 97.3% | | 99.2% | | Whole Foods, Golfsmith, Urban Outfitters, Yard House, Cobb Theatres |

The Shops at Fort

Union | | Salt Lake

City | | UT | | 1974/2007 | | 688,549 | | 9/26/2014 | | $191 | | $131,500 | | 96.9% | | 96.9% | | Walmart, Smiths (Kroger), Gordmans, Dick’s, Bed, Bath & Beyond, Babies’ R’ Us, Ross, OfficeMax, Michaels, DSW, Petco, Ulta |

The

Promenade(4) | | Scottsdale | | AZ | | 1999 | | 566,663 | | 7/11/2011 | | $222 | | $126,000 | | 94.3% | | 94.2% | | Nordstrom Rack, Trader Joe’s, OfficeMax, PetSmart, Old Navy, Michael’s, Stein Mart, Cost Plus, Living Spaces, Lowe’s (non-owned) |

| Park West Place | | Stockton | | CA | | 2005 | | 603,464 | | 12/14/2010 | | $153 | | $92,500 | | 99.8% | | 99.4% | | Lowe’s, Kohl’s, Sports Authority, Jo-Ann, Ross, PetSmart, Office Depot, Target (non-owned) |

| Gilroy Crossing | | Gilroy | | CA | | 2004 | | 325,431 | | 4/5/2011 | | $210 | | $68,400 | | 100.0% | | 100.0% | | Kohl’s, Ross, Michaels, Bed Bath & Beyond, Target (non-owned) |

Brandywine

Crossing(5) | | Brandywine | | MD | | 2009/2014 | | 231,036 | | 10/1/2010 | | $242 | | $56,000 | | 95.3% | | 96.9% | | Safeway, Marshalls, Jo-Ann, Target (non-owned), Costco (non-owned) |

Highland

Reserve | | Roseville | | CA | | 2004 | | 191,415 | | 12/29/2014 | | $274 | | $52,500 | | 100.0% | | 98.5% | | Kohl’s, Sport Chalet, PetSmart, BevMo!, and Target (non-owned) |

Plaza at

Rockwall | | Rockwall | | TX | | 2007/2012 | | 432,096 | | 6/29/2010 | | $118 | | $50,800 | | 99.2% | | 99.2% | | Best Buy, Dick’s, Staples, Ulta, JC Penney, Belk, HomeGoods, Jo-Ann |

Riverpoint

Marketplace | | Sacramento | | CA | | 2009 | | 133,928 | | 12/19/2014 | | $327 | | $43,800 | | 97.0% | | 97.0% | | Ross, Petco, Ikea (non-owned), Walmart (non-owned), and Home Depot (non-owned) |

Lake Pleasant

Pavilion | | Phoenix

(Peoria) | | AZ | | 2007 | | 178,376 | | 5/16/2012 | | $234 | | $41,800 | | 91.8% | | 89.0% | | Target (non-owned), Marshalls, Bed Bath & Beyond, BevMo!, Tilly’s, Kirkland’s, The Dress Barn |

| Stadium Center | | Manteca | | CA | | 2006 | | 160,726 | | 7/1/2013 | | $256 | | $41,150 | | 95.5% | | 95.5% | | Ross, Jo-Ann, Office Max, Old Navy, Costco (non-owned) and Kohl’s (non-owned) |

| Dellagio | | Orlando | | FL | | 2009 | | 123,318 | | 10/19/2012 | | $325 | | $40,100 | | 80.1% | | 80.6% | | Flemings, Fifth Third Bank |

League City Town

Center | | League City

(Houston) | | TX | | 2008 | | 194,736 | | 8/1/2013 | | $203 | | $39,500 | | 96.4% | | 96.4% | | Ross, TJ Maxx, Michael’s, PetSmart,Staples, SuperTarget (non-owned) and Home Depot (non-owned) |

Vestavia Hills City

Center | | Birmingham

(Vestavia

Hills) | | AL | | 2002 | | 391,899 | | 8/30/2010 | | $89 | | $34,900 | | 89.1% | | 88.5% | | Publix, Dollar Tree, Stein Mart, Rave Motion Pictures |

The Crossings of

Spring Hill | | Nashville

(Spring Hill) | | TN | | 2008 | | 219,880 | | 12/19/2011 | | $141 | | $31,000 | | 95.5% | | 94.8% | | SuperTarget (non-owned), Kohl’s (non-owned), PetSmart, Ross, Bed Bath & Beyond |

| Tracy Pavilion | | Tracy | | CA | | 2006 | | 162,463 | | 1/24/2013 | | $189 | | $30,700 | | 95.7% | | 95.7% | | Marshalls, Ross, PetSmart, Staples, Ulta |

Red Rock

Commons | | St. George | | UT | | 2012 | | 134,152 | | 4/23/2010 | | $214 | | $28,700 | | 100.0% | | 99.1% | | Dick’s, PetSmart, Old Navy, Gap Outlet, Ulta |

Edwards

Theatres | | San Diego

(San Marcos) | | CA | | 1999 | | 100,551 | | 3/11/2011 | | $261 | | $26,200 | | 100.0% | | 100.0% | | Edwards Theatres (a subsidiary of Regal Cinemas) |

Rosewick

Crossing | | La Plata | | MD | | 2008 | | 115,972 | | 10/1/2010 | | $215 | | $24,900 | | 81.8% | | 81.8% | | Giant Food, Lowe’s (non-owned) |

EastChase Market

Center | | Montgomery | | AL | | 2008 | | 181,431 | | 2/17/2012 | | $136 | | $24,700 | | 98.9% | | 98.9% | | Dick’s, Jo-Ann, Bed Bath & Beyond, Michaels, Old Navy, Costco (non-owned) |

| Chimney Rock | | Odessa | | TX | | 2012 | | 204,270 | | 8/30/2012 | | $117 | | $23,800 | | 97.5% | | 97.5% | | Academy Sports, Best Buy, Marshalls, Kirkland’s, Ulta |

| Excel Centre | | San Diego | | CA | | 1999 | | 82,157 | | 4/23/2010 | | $288 | | $23,700 | | 90.4% | | 90.4% | | Kaiser Permanente, Excel Trust, UBS |

5000 South

Hulen | | Fort Worth | | TX | | 2005 | | 86,833 | | 5/12/2010 | | $252 | | $21,900 | | 95.4% | | 98.6% | | Barnes & Noble, Old Navy |

Anthem

Highlands | | Las Vegas

(Henderson) | | NV | | 2006 | | 118,763 | | 12/1/2011 | | $147 | | $17,500 | | 91.3% | | 91.3% | | Albertsons, CVS, Wells Fargo, Bank of America |

Centennial

Crossroads | | Las Vegas | | NV | | 2003 | | 105,415 | | 11/22/2013 | | $156 | | $16,400 | | 87.3% | | 87.3% | | Vons, Chase Bank |

| LA Fitness | | San Diego | | CA | | 2006 | | 38,000 | | 10/4/2013 | | $376 | | $14,300 | | 100.0% | | 100.0% | | LA Fitness |

| Pavilion Crossing | | Brandon | | FL | | 2012 | | 68,400 | | 10/1/2012 | | $192 | | $13,100 | | 98.2% | | 100.0% | | Publix |

Shops at

Foxwood | | Ocala | | FL | | 2010 | | 78,660 | | 10/19/2010 | | $160 | | $12,600 | | 90.8% | | 90.8% | | Publix, McDonald’s (non-owned) |

| Northside Plaza | | Dothan | | AL | | 2010 | | 171,670 | | 11/15/2010 | | $70 | | $12,400 | | 94.8% | | 94.8% | | Publix, Hobby Lobby, Books A Million |

Meadow Ridge

Plaza | | Orlando | | FL | | 2007 | | 45,199 | | 10/19/2012 | | $215 | | $9,700 | | 85.8% | | 85.8% | | Fifth Third Bank |

Shoppes of

Belmere | | Orlando | | FL | | 2008 | | 26,502 | | 10/19/2012 | | $366 | | $9,700 | | 100.0% | | 100.0% | | CVS |

Lake Burden

Shoppes | | Orlando | | FL | | 2008 | | 20,598 | | 10/19/2012 | | $413 | | $8,500 | | 87.6% | | 87.6% | | Walgreens |

| Five Forks Place | | Simpsonville | | SC | | 2002 | | 61,191 | | 4/23/2010 | | $127 | | $7,800 | | 98.5% | | 100.0% | | Publix |

| Mariner’s Point | | St. Marys | | GA | | 2001 | | 45,215 | | 7/20/2010 | | $146 | | $6,600 | | 84.1% | | 91.2% | | Shoe Show, Super Wal-Mart (non-owned) |

Newport Towne

Center | | Newport | | TN | | 2006 | | 60,100 | | 4/23/2010 | | $108 | | $6,500 | | 88.3% | | 82.6% | | Stage Stores (DBA Goody’s), Dollar Tree, Super Wal-Mart (non-owned) |

| Merchant Central | | Milledgeville | | GA | | 2004 | | 45,013 | | 6/30/2010 | | $136 | | $6,100 | | 83.9% | | 89.2% | | Dollar Tree, Super Wal-Mart (non-owned) |

| Cedar Square | | Duncanville

(Dallas) | | TX | | 2014 | | 14,490 | | 11/4/2013 | | $77 | | $1,116 | | 100.0% | | 100.0% | | Walgreens |

Total Operating

Portfolio | | Total | | | | | | 7,145,777 | | | | $201 | | $1,507,266 | | 94.4% | | 93.9% | | |

(1) Year built represents the year in which construction was completed or the date of the last major renovation.

(2) Total GLA represents total gross leasable area owned by the Company at the property (includes GLA of buildings on ground lease).

(3) The West Broad Village property is a mixed use shopping center that includes retail, office and 339 apartment units on the upper levels of the shopping center. However, the property’s total GLA listed herein excludes square footage of the apartments. As such, the approximate initial cost basis of the apartments of $68 million has been deducted from the price per square foot calculation.

(4) Includes an additional land parcel acquired in August 2013 with an initial cost basis of approximately $16.0 million.

(5) Includes additional land parcels acquired in November 2014 with an initial cost basis of approximately $11.5 million.

Page 14

Summary of Retail Leasing Activity (Consolidated)

For the Period Ended March 31, 2015

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Number of

Leases(1) | | | GLA | | | Weighted Average-

New Lease Rate(2) | | | Weighted Average-

Prior Lease Rate(2) | | | Percentage Increase or

(Decrease) | | Tenant Improvement

Allowance per Sq. Ft. | | | Weighted-Average

Lease Term (Yrs.) | | | |

| | | |

Comparable Leases | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

New leases(3) | | | 6 | | | | 15,169 | | | $ | 28.34 | | | $ | 31.20 | | | -9.2% | | $ | 2.04 | | | | 4.8 | | | |

Renewals/Options | | | 28 | | | | 173,919 | | | | 13.03 | | | | 12.65 | | | 3.0% | | | - | | | | 4.7 | | | |

| | | |

Total: Comparable Leases | | | 34 | | | | 189,088 | | | $ | 14.26 | | | $ | 14.14 | | | 0.8% | | $ | 0.16 | | | | 4.7 | | | |

| | | | | | | | |

Non-Comparable Leases | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Operating portfolio | | | 9 | | | | 47,228 | | | $ | 16.43 | | | | n/a | | | n/a | | $ | 2.92 | | | | 9.9 | | | |

Development | | | 1 | | | | 2,742 | | | | 40.00 | | | | n/a | | | n/a | | | 60.00 | | | | 7.0 | | | |

| |

| | | |

Total: Non-Comparable Leases | | | 10 | | | | 49,970 | | | $ | 17.73 | | | | n/a | | | n/a | | $ | 6.05 | | | | 9.7 | | | |

| | | | | | | | |

Total Leasing Activity | | | 44 | | | | 239,058 | | | $ | 14.98 | | | | n/a | | | n/a | | $ | 1.40 | | | | 5.7 | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

(1) Excludes month-to-month leases and leases involving office GLA.

(2) Lease rate represents final cash rent from the previous lease and the initial cash rent from the new lease and excludes the impact of changes in lease rates during the term.

(3) Represents leases signed on spaces for which there was a tenant within the last 12 months. Excludes leases signed at development properties.

Page 15

Same Property Analysis

For the Period Ended March 31, 2015

(In thousands, except per share amounts)

| | | | | | | | | | | | |

| | | Three Months Ended March 31, 2015 | | | Three Months Ended March 31, 2014 | | | Percentage Change | |

Same Property Portfolio (1) | | | | | | | | | | | | |

| | | |

Number of properties | | | 33 | | | | 33 | | | | | |

Rentable square feet | | | 5,751,681 | | | | 5,751,681 | | | | | |

Percent leased | | | 93.6% | | | | 92.9% | | | | 0.8% | |

| | | |

Percentage of total operating portfolio | | | 80.5% | | | | 100.0% | | | | | |

| | | |

Total revenues | | $ | 28,630 | | | $ | 28,551 | | | | 0.3% | |

| | | |

Total expenses | | | 7,313 | | | | 7,367 | | | | -0.7% | |

| | | | | | | | | | | | |

Same property - net operating income (GAAP basis) | | $ | 21,317 | | | $ | 21,184 | | | | 0.6% | |

| | | | | | | | | | | | |

Less: straight line rents, fair-value lease revenue, lease incentive revenue | | | (392) | | | | (574) | | | | -31.7% | |

Same property - net operating income (cash basis) | | $ | 20,925 | | | $ | 20,610 | | | | 1.5% | |

| | | | | | | | | | | | |

| (1) | Includes all properties purchased prior to January 1, 2014 (three month analysis). Excludes adjustments relating to prior year reimbursements. Also excludes our Lowe’s properties, which was sold in October 2014 and our Cedar Square property, in which the inline retail portion of the property was sold in November 2014. |

Page 16

Major Tenants By GLA (Consolidated)

For the Period Ended March 31, 2015

(Dollars in thousands, except rent per square foot)

| | | | | | | | |

| Total GLA-Operating Portfolio(1) | | | | 7,145,777 | | |

| | |

| | | | |

| | | Tenants | | # Stores | | Square Feet | | % of Total GLA |

|

| 1 | | Kohl’s | | 3 | | 264,904 | | 3.7% |

| 2 | | Publix | | 5 | | 245,351 | | 3.4% |

| 3 | | Ross Dress For Less | | 8 | | 229,126 | | 3.2% |

| 4 | | TJX Companies | | 7 | | 191,207 | | 2.7% |

| 5 | | Dick’s Sporting Goods | | 4 | | 189,336 | | 2.6% |

| 6 | | Bed Bath & Beyond | | 6 | | 170,099 | | 2.4% |

| 7 | | Lowe’s | | 1 | | 154,794 | | 2.2% |

| 8 | | PetSmart | | 8 | | 150,798 | | 2.1% |

| 9 | | Jo-Ann | | 6 | | 139,922 | | 2.0% |

| 10 | | Living Spaces(2) | | 1 | | 133,120 | | 1.9% |

|

| | Total Top 10 GLA | | 49 | | 1,868,657 | | 26.2% |

Major Tenants By ABR (Consolidated)

| | | | | | | | | | | | | | | | |

| Annualized Base Rent-Operating Portfolio (3) | | | $ 110,296 | | | |

| | | |

| | | | | | |

| | | Tenants | | # Stores | | Square Feet | | Rent Per Sq. Ft. | | | ABR | | | % ABR |

|

| 1 | | Ross Dress For Less | | 8 | | 229,126 | | $ | 12.73 | | | $ | 2,916 | | | 2.6% |

| 2 | | Publix | | 5 | | 245,351 | | | 11.15 | | | $ | 2,735 | | | 2.5% |

| 3 | | Kohl’s | | 3 | | 264,904 | | | 9.41 | | | $ | 2,493 | | | 2.3% |

| 4 | | PetSmart | | 8 | | 150,798 | | | 15.96 | | | $ | 2,407 | | | 2.2% |

| 5 | | Dick’s Sporting Goods | | 4 | | 189,336 | | | 12.65 | | | $ | 2,395 | | | 2.2% |

| 6 | | Edwards Theatres (Regal Cinemas) | | 1 | | 100,551 | | | 23.35 | | | $ | 2,348 | | | 2.1% |

| 7 | | Whole Foods | | 2 | | 102,742 | | | 21.42 | | | $ | 2,201 | | | 2.0% |

| 8 | | TJX Companies | | 7 | | 191,207 | | | 10.66 | | | $ | 2,037 | | | 1.8% |

| 9 | | Michaels | | 6 | | 134,772 | | | 13.51 | | | $ | 1,821 | | | 1.7% |

| 10 | | Kaiser Permanente | | 1 | | 38,432 | | | 45.97 | | | $ | 1,767 | | | 1.6% |

| | Total Top 10 Annualized Rent | | 45 | | 1,647,219 | | $ | 14.04 | | | $ | 23,120 | | | 21.0% |

| | | |

| | | | | | | | | | | |

(1) Includes gross leasable area associated with buildings on ground lease.

(2) Living Spaces is sub-leasing the building from Sears.

(3) Annualized Base Rent does not include rental revenue from multi-family properties and is further described on the Definitions page.

Page 17

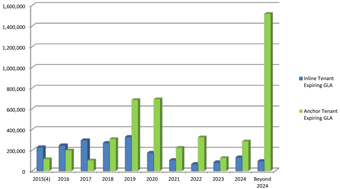

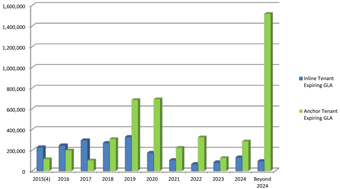

Expiration Schedule (Consolidated)

For the Period Ended March 31, 2015

| | | | | | | | |

| (Dollars in thousands, except rent per square foot) | | 3/31/2015 | | | 12/31/2014 | |

| | |

Total GLA - Operating Portfolio | | | 7,145,777 | | | | 7,551,956 | |

Total GLA Occupied - Operating Portfolio | | | 6,654,458 | | | | 6,989,765 | |

| | | | | | | | |

% Occupied | | | 93.1% | | | | 92.6% | |

| | |

Total GLA - Operating Portfolio | | | 7,145,777 | | | | 7,551,956 | |

Total GLA Leased - Operating Portfolio | | | 6,745,141 | | | | 7,088,293 | |

| | | | | | | | |

% Leased | | | 94.4% | | | | 93.9% | |

| | |

Retail GLA - Operating Portfolio(1) | | | 7,063,620 | | | | 7,213,617 | |

Retail GLA Occupied - Operating Portfolio | | | 6,580,174 | | | | 6,702,105 | |

| | | | | | | | |

% Occupied | | | 93.2% | | | | 92.9% | |

| | |

Retail GLA - Operating Portfolio(1) | | | 7,063,620 | | | | 7,213,617 | |

Retail GLA Leased - Operating Portfolio | | | 6,670,857 | | | | 6,800,633 | |

| | | | | | | | |

% Leased | | | 94.4% | | | | 94.3% | |

| | |

Total Retail Anchor GLA % Leased - Operating Portfolio | | | 99.1% | | | | 98.9% | |

Total Retail Inline GLA % Leased - Operating Portfolio | | | 85.6% | | | | 85.8% | |

| | |

Same Property GLA % Leased (Sequential) - Operating Portfolio(2) | | | 94.4% | | | | 94.4% | |

| | | | | | | | | | | | |

| | | Occupied

Retail GLA | | | % of Occupied Retail GLA | | Total Occupied Retail ABR | | | % of Total Occupied Retail ABR |

Occupied Retail Anchor GLA(3) | | | 4,567,575 | | | 69.4% | | $ | 56,887 | | | 52.8% |

Occupied Retail Inline GLA(3) | | | 2,012,599 | | | 30.6% | | | 50,907 | | | 47.2% |

| | | |

Total Occupied Retail GLA | | | 6,580,174 | | | 100.0% | | $ | 107,794 | | | 100.0% |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Year | | | | Anchor GLA Expiring | | | % of Total Occupied Retail GLA | | Anchor Rent Per Sq. Ft. | | | Inline GLA Expiring | | % of Total Occupied Retail GLA | | Inline Rent Per Sq. Ft. | | | Total Occupied Retail GLA Expiring | | % of Total Occupied Retail GLA | | Total Occupied Retail ABR Expiring | | | % of Total Retail ABR | | Average Rent Per Sq. Ft. | |

| | | | | | | |

2015 | | (4) | | | 112,405 | | | 1.7% | | $ | 13.43 | | | 227,141 | | 3.5% | | $ | 22.44 | | | 339,546 | | 5.2% | | $ | 6,605 | | | 6.1% | | $ | 19.45 | |

2016 | | | | | 197,167 | | | 3.0% | | $ | 11.68 | | | 245,385 | | 3.7% | | $ | 25.76 | | | 442,552 | | 6.7% | | $ | 8,624 | | | 8.0% | | $ | 19.49 | |

2017 | | | | | 100,652 | | | 1.5% | | $ | 14.06 | | | 294,911 | | 4.5% | | $ | 23.60 | | | 395,563 | | 6.0% | | $ | 8,375 | | | 7.8% | | $ | 21.17 | |

2018 | | | | | 307,656 | | | 4.7% | | $ | 14.04 | | | 269,819 | | 4.1% | | $ | 24.31 | | | 577,475 | | 8.8% | | $ | 10,878 | | | 10.1% | | $ | 18.84 | |

2019 | | | | | 685,232 | | | 10.4% | | $ | 14.72 | | | 326,973 | | 5.0% | | $ | 23.98 | | | 1,012,205 | | 15.4% | | $ | 17,926 | | | 16.6% | | $ | 17.71 | |

2020 | | | | | 691,664 | | | 10.5% | | $ | 14.73 | | | 173,981 | | 2.6% | | $ | 24.42 | | | 865,645 | | 13.2% | | $ | 14,437 | | | 13.4% | | $ | 16.68 | |

2021 | | | | | 222,282 | | | 3.4% | | $ | 13.07 | | | 103,134 | | 1.6% | | $ | 23.50 | | | 325,416 | | 4.9% | | $ | 5,328 | | | 4.9% | | $ | 16.37 | |

2022 | | | | | 324,317 | | | 4.9% | | $ | 12.78 | | | 65,133 | | 1.0% | | $ | 21.62 | | | 389,450 | | 5.9% | | $ | 5,552 | | | 5.2% | | $ | 14.26 | |

2023 | | | | | 124,354 | | | 1.9% | | $ | 12.85 | | | 82,017 | | 1.2% | | $ | 29.66 | | | 206,371 | | 3.1% | | $ | 4,030 | | | 3.7% | | $ | 19.53 | |

2024 | | | | | 284,865 | | | 4.3% | | $ | 10.29 | | | 129,623 | | 2.0% | | $ | 25.70 | | | 414,488 | | 6.3% | | $ | 6,262 | | | 5.8% | | $ | 15.11 | |

Beyond 2024 | | | | | 1,516,981 | | | 23.1% | | $ | 10.21 | | | 94,482 | | 1.4% | | $ | 45.34 | | | 1,611,463 | | 24.5% | | $ | 19,777 | | | 18.3% | | $ | 12.27 | |

| | | | | | | |

| | | | | | | | | | | | |

Total | | | | | 4,567,575 | | | 69.4% | | $ | 12.45 | | | 2,012,599 | | 30.6% | | $ | 25.29 | | | 6,580,174 | | 100.0% | | $ | 107,794 | | | 100.0% | | $ | 16.38 | |

| | | | | | | | | | | | |

| | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

(1) Retail figures exclude the Excel Centre and Promenade Corporate Center office properties.

(2) Same property GLA percent leased (sequential) excludes any properties that were reclassified to the operating portfolio, acquired, or disposed of during the quarter.

(3) Anchor Tenants and Inline Tenants are described on the Definitions page.

(4) Includes month-to-month leases and ground leases, but excludes percentage rent.

Page 18

Unconsolidated Investments

For the Period Ended March 31, 2015

(Dollars in thousands)

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | Financial Information | | Leasing Information | |

| Investment Partner | | Formation/Acquisition Date | | Property | | City | | State | | Total

GLA(1) | | | Total Assets | | Total Debt | | Ownership Interest | | Percent Leased | | ABR | |

| | | | | | |

MDC | | October 19, 2012 | | The Fountains at Bay Hill | | Orlando | | FL | | | 103,767 | | | $39,205 | | $23,805 | | 50% | | 92.4% | | $ | 3,016 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

(1) Total GLA represents total gross leasable area owned by the Company at the property (includes GLA of buildings on ground lease).

Summary Financial Information:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Balance Sheet(2) | | March 31, 2015 | | | Company Pro Rata | | | | | | | | | | | | | | | December 31, 2014 | | | Company Pro Rata | |

Assets: | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Investments in Real Estate | | $ | 36,238 | | | $ | 18,119 | | | | | | | | | | | | | | | $ | 36,387 | | | $ | 18,194 | |

Cash & cash equivalents | | | 922 | | | | 461 | | | | | | | | | | | | | | | | 868 | | | | 434 | |

Other assets | | | 2,045 | | | | 1,023 | | | | | | | | | | | | | | | | 2,102 | | | | 1,051 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total assets | | $ | 39,205 | | | $ | 19,603 | | | | | | | | | | | | | | | $ | 39,357 | | | $ | 19,679 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | |

Liabilities and members’ equity: | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Mortgage notes payable and secured loan | | $ | 23,805 | | | $ | 11,903 | | | | | | | | | | | | | | | $ | 23,952 | | | $ | 11,976 | |

Other liabilities | | | 1,886 | | | | 943 | | | | | | | | | | | | | | | | 1,857 | | | | 929 | |

Members’ equity | | | 13,514 | | | | 6,757 | | | | | | | | | | | | | | | | 13,548 | | | | 6,774 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total liabilities and equity | | $ | 39,205 | | | $ | 19,603 | | | | | | | | | | | | | | | $ | 39,357 | | | $ | 19,679 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | |

Company’s investment in unconsolidated entities | | | | | | $ | 6,671 | | | | | | | | | | | | | | | | | | | $ | 6,689 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | |

Income Statement | | Three Months Ended

March 31, 2015 | | | Company Pro Rata | | | | | | | | | | | | | | | Three Months Ended

March 31, 2014 | | | Company Pro Rata | |

Total revenues | | $ | 904 | | | $ | 452 | | | | | | | | | | | | | | | $ | 1,355 | | | $ | 560 | |

| | | | | | | | | | |

Expenses: | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Property operating expenses | | | 150 | | | | 75 | | | | | | | | | | | | | | | | 307 | | | | 107 | |

General and administrative | | | - | | | | - | | | | | | | | | | | | | | | | - | | | | - | |

Depreciation and amortization | | | 252 | | | | 126 | | | | | | | | | | | | | | | | 593 | | | | 230 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total expenses | | | 402 | | | | 201 | | | | | | | | | | | | | | | | 900 | | | | 337 | |

| | | | | | | | | | |

Interest expense | | | (235) | | | | (117) | | | | | | | | | | | | | | | | (476) | | | | (154) | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net income (loss) | | $ | 267 | | | $ | 134 | | | | | | | | | | | | | | | $ | (21) | | | $ | 69 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | |

Company’s income (loss) from equity in unconsolidated entities(2) | | | | | | $ | 134 | | | | | | | | | | | | | | | | | | | $ | 69 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

|

| |

(2) The Company’s income from equity in unconsolidated entities for the three months ended March 31, 2014 includes the Company’s proportionate shares of operating losses from its investment in La Costa Town Center prior to its sale on October 9, 2014. The investment is no longer included in the Company’s financial statements as of March 31, 2015.

| | | | |

| Unconsolidated Debt(3): | | | |

| |

| |

Fountains at Bay Hill: | | March 31, 2015 | |

Proportionate share of debt: | | $ | 11,903 | |

Maturity date: | | | December 1, 2021 | |

Fixed interest rate: | | | 3.75% | |

|

| |

(3) The outstanding mortgage note was refinanced in October 2014, which increased the notional amount, extended the maturity date and fixed the interest rate at 3.75%.

Page 19

Definitions

Adjusted Funds From Operations (AFFO): Adjusted Funds From Operations (AFFO) is a non-GAAP financial measure we believe is a useful supplemental measure of our performance. We compute AFFO by adding to FFO the non-cash compensation expense, amortization of prepaid financing costs and non-recurring transaction costs, and other one-time items, then subtracting straight-line rents, amortization of above and below market leases and non-incremental capital expenditures. Our computation may differ from the methodology for calculating AFFO utilized by other equity REITs and, accordingly, may not be comparable to such other REITs. AFFO should not be considered as an alternative to net income (loss) (computed in accordance with GAAP) as an indicator of Excel Trust’s financial performance or to cash flow from operating activities (computed in accordance with GAAP) as an indicator of Excel Trust’s liquidity, nor is it indicative of funds available to fund Excel Trust’s cash needs, including Excel Trust’s ability to pay dividends or make distributions.

Anchor Tenant: A tenant who occupies 10,000 square feet or more.

Annualized Base Rent:Annualized Base Rent is obtained by annualizing the cash rental rate (excluding reimbursements and percentage rent) for the final month of a reporting period. Annualized Base Rent does not include rental revenue from multi-family properties.

EBITDA: Earnings (excluding preferred stock dividends) before interest, taxes, depreciation and amortization.

Funds From Operations (FFO): Excel Trust considers FFO an important supplemental measure of its operating performance and believe it is frequently used by securities analysts, investors and other interested parties in the evaluation of REITs, many of which present FFO when reporting their results. FFO is intended to exclude GAAP historical cost depreciation and amortization of real estate and related assets, which assumes that the value of real estate assets diminishes ratably over time. Historically, however, real estate values have risen or fallen with market conditions. Because FFO excludes depreciation and amortization unique to real estate, gains and losses from property dispositions and extraordinary items, it provides a performance measure that, when compared year-over-year, reflects the impact to operations from trends in occupancy rates, rental rates, operating costs, development activities and interest costs, providing perspective not immediately apparent from net income.

Excel Trust computes FFO in accordance with standards established by the National Association of Real Estate Investment Trusts, or NAREIT. As defined by NAREIT, FFO represents net income (loss) (computed in accordance with generally accepted accounting principles, or GAAP), excluding real estate-related depreciation and amortization, impairment charges and net gains (losses) on the disposition of real estate assets and after adjustments for unconsolidated partnerships and joint ventures. Excel Trust’s computation may differ from the methodology for calculating FFO utilized by other equity REITs and, accordingly, may not be comparable to such other REITs. Further, FFO does not represent amounts available for management’s discretionary use because of needed capital service obligations, or other commitments and uncertainties. FFO should not be considered as an alternative to net income (loss) replacement or expansion, debt (computed in accordance with GAAP) as an indicator of Excel Trust’s financial performance or to cash flow from operating activities (computed in accordance with GAAP) as an indicator of Excel Trust’s liquidity, nor is it indicative of funds available to fund Excel Trust’s cash needs, including Excel Trust’s ability to pay dividends or make distributions.

Inline Tenant: Any tenant who does not qualify as an anchor tenant.

Leased: A space is considered leased when both Excel Trust and the tenant have executed the lease agreement.

Occupied: A space is considered occupied when the tenant has access to the space and revenue recognition has commenced (includes month-to-month tenants). If a tenant has vacated a space and Excel Trust has agreed to terminate the lease, the space is considered unoccupied as of the date of execution of the amended lease agreement.

Page 20