Use these links to rapidly review the document

TABLE OF CONTENTS

INDEX TO FINANCIAL STATEMENTS

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 10

GENERAL FORM FOR REGISTRATION OF SECURITIES

Pursuant to Section 12(b) or 12(g) of the Securities Exchange Act of 1934

TROPICANA LAS VEGAS HOTEL AND CASINO, INC.

(Exact name of registrant as specified in its charter)

| | |

Delaware

(State or other jurisdiction of

incorporation or organization) | | 27-0455607

(I.R.S. Employer

Identification No.)

|

3801 Las Vegas Boulevard South

Las Vegas, Nevada 89109

(Address of principal executive offices and zip code)

(702) 739-2722

(Registrant's telephone number, including area code)

with copies of correspondences to:

| | |

Joanne M. Beckett

Vice President and General Counsel

Tropicana Las Vegas Hotel and Casino, Inc.

3801 Las Vegas Boulevard South

Las Vegas, Nevada 89109 | | Janet S. McCloud

Glaser, Weil, Fink, Jacobs, Howard & Shapiro, LLP

Nineteenth Floor

10250 Constellation Boulevard

Los Angeles, California 90067

|

Securities to be registered pursuant to Section 12(b) of the Act:

None

Securities to be registered pursuant to Section 12(g) of the Act:

Class A Common Stock, $0.01 par value per share

(Title of class)

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act. (Check one):

| | | | | | |

| Large accelerated filer o | | Accelerated filer o | | Non-accelerated filer ý

(Do not check if a

smaller reporting company) | | Smaller reporting company o |

Table of Contents

TABLE OF CONTENTS

i

Table of Contents

EXPLANATORY NOTE

This registration statement on Form 10 is being filed voluntarily by Tropicana Las Vegas Hotel and Casino, Inc. in order to register its class A common stock pursuant to Section 12(g) under the Securities Exchange Act of 1934, as amended, or the Exchange Act.

Unless otherwise stated in this registration statement or unless the content otherwise requires, references to "we," "us," "our" or "our company" refer to the Tropicana Las Vegas Hotel and Casino, Inc. and its consolidated subsidiaries.

CAUTIONARY STATEMENT FOR PURPOSES OF THE "SAFE HARBOR" PROVISIONS OF THE PRIVATE SECURITIES LITIGATION REFORM ACT OF 1995

This registration statement contains certain "forward-looking statements" within the meaning of Section 27A of the Securities Act of 1933, as amended, or the Securities Act, and Section 21E of the Exchange Act. Forward-looking statements include information relating to future events, future financial performance, strategies, expectations, competitive environment, regulation and availability of resources, and include, without limitation, statements regarding: proposed expansion and renovation projects; expectations that regulatory developments or other matters will not have a material adverse effect or material impact on our financial position, results of operations or liquidity; statements concerning projections, predictions, expectations, estimates or forecasts as to our business, financial and operational results and future economic performance; and statements of management's goals and objectives and other similar expressions concerning matters that are not historical facts. Words such as "may," "should," "could," "would," "predicts," "potential," "continue," "expects," "anticipates," "future," "intends," "plans," "believes," "estimates" and similar expressions, as well as statements in future tense, identify forward-looking statements.

Forward-looking statements should not be read as a guarantee of future performance or results and will not necessarily be accurate indications of the times at, or by, which such performance or results will be achieved. Forward-looking statements are based on information available at the time those statements are made or management's good faith belief as of that time with respect to future events and are subject to risks and uncertainties that could cause actual performance or results to differ materially from those expressed in or suggested by the forward-looking statements. Important factors that could cause such differences include, but are not limited to:

- •

- our limited liquidity and capital resources and negative cash flow;

- •

- unprecedented and challenging recent global economic conditions and the availability and cost of credit to us and our customers as a result of market uncertainty and instability;

- •

- the amount of discretionary consumer spending on travel and corporate spending on conventions and business development in Las Vegas;

- •

- the impact of energy prices on our business;

- •

- our ability to implement our marketing strategy and compete in the highly competitive Las Vegas hotel, resort and casino market, and the availability of competing gaming venues and other forms of gambling venues outside the Las Vegas market;

- •

- disruptions of and inconveniences to our customers as a result of our capital improvements plan;

- •

- our dependence on one property;

- •

- our ability to obtain and/or maintain required registrations, findings of suitability, licenses, qualifications, permits and other approvals from the appropriate Nevada gaming authorities necessary for the ownership and operation of casino gaming facilities in Nevada;

1

Table of Contents

- •

- potential conflicts of interest between our company and Trilliant Gaming Nevada Inc., or Trilliant Gaming, which controls a significant percentage of our outstanding voting securities;

- •

- our dependence upon Armenco Holdings, LLC, or Armenco, a company controlled by Alex Yemenidjian, our Chairman of the Board, Chief Executive Officer and President, for the successful operation of the Tropicana Las Vegas Hotel and Casino, or the Tropicana Las Vegas, until such time as we obtain all necessary registrations, findings of suitability, licenses, qualifications, permits and other approvals from the appropriate Nevada gaming authorities necessary for the ownership and operation of gaming facilities in Nevada, and thereafter our dependence upon Trilliant Management, L.P., or Trilliant LP, an entity controlled by Armenco and Trilliant Gaming, for the successful operation of the Tropicana Las Vegas;

- •

- our ability to maintain relationships with our directors, executive officers, key employees and stockholders in accordance with Nevada gaming laws and the applicable Nevada gaming authorities;

- •

- the lack of a market for our securities;

- •

- changes in legislation and regulation over gaming operations in Nevada, including changes in state and local taxes and fees;

- •

- our ability to comply with a variety of governmental rules and regulations, including zoning, environmental, tax, construction and land-use laws, laws governing our relationship with our employees and regulations governing the preparation and sale of food and beverages;

- •

- increased costs in connection with the rejection of certain pre-petition contracts and other post-bankruptcy related costs;

- •

- the possibility that, as the acquirer of certain assets of Tropicana Entertainment, LLC, or Tropicana Entertainment, and its subsidiaries, we may be subject to liabilities that are not provided for in the bankruptcy plan of such entities;

- •

- the results of Tropicana Entertainment's administrative claims against us for post-bankruptcy petition administrative expenses;

- •

- the initiation and maintenance of litigation claims against us and the results of such claims and other disputes, including the dispute over the "Tropicana" trade name;

- •

- the continued service of our senior management team and key employees;

- •

- increased labor costs, work stoppages, other labor problems and unexpected shutdowns;

- •

- our ability to maintain our commercial arrangements with slot machine manufacturers and our ability to acquire the slot machines desired by our customers at competitive costs;

- •

- the occurrence of natural disasters or other catastrophic events, including war and terrorism;

- •

- our ability to obtain sufficient insurance coverage to replace or cover the full value of losses we may suffer; and

- •

- other factors discussed under the heading "Item 1A. Risk Factors" and elsewhere in this registration statement.

Forward-looking statements speak only as of the date the statements are made. You should not put undue reliance on any forward-looking statements. We assume no obligation to update forward-looking statements to reflect actual results, changes in assumptions, or changes in other factors affecting forward-looking information, except to the extent required by applicable securities laws. If we do update one or more forward-looking statements, no inference should be drawn that we will make additional updates with respect to those or other forward-looking statements.

2

Table of Contents

Item 1. BUSINESS.

The Company

Our company was formed in June 2009 for the purpose of owning and operating the Tropicana Las Vegas in connection with the reorganization of Tropicana Entertainment and certain of its subsidiaries, under Chapter 11 of Title 11 of the United States Code, or the Bankruptcy Code. Our principal executive offices are located at 3801 Las Vegas Boulevard South, Las Vegas, Nevada 89109. The telephone number for our executive offices is (720) 739-2722 and our web site iswww.troplv.com. The information on, or accessible through, our website does not constitute a part of, and is not incorporated into, this registration statement.

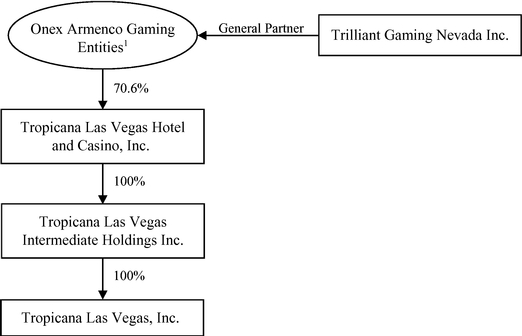

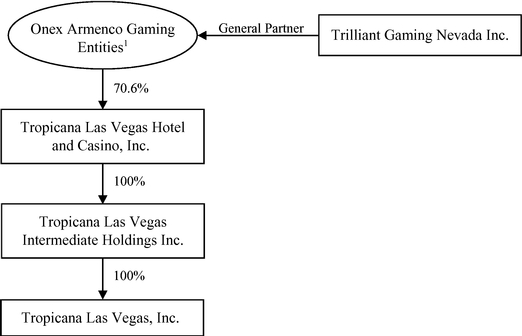

Corporate Structure

- (1)

- Consists of Onex Armenco Gaming I LP, Onex Armenco Gaming II LP, Onex Armenco Gaming III LP, Onex Armenco Gaming IV LP, Onex Armenco Gaming V LP, Onex Armenco Gaming VI LP, Onex Armenco Gaming VII LP, Onex Armenco Gaming IX LP, Onex Armenco Gaming X LP and Onex Armenco Gaming XI LP, or the Onex Armenco Gaming Entities. Trilliant Gaming is the general partner, and controls all voting and investment decisions, of the Onex Armenco Gaming Entities. Each of Mr. Alex Yemenidjian, our Chairman, Chief Executive Officer and President, Mr. Timothy Duncanson, one of our directors, and Mr. Gerald Schwartz, the chairman and controlling stockholder of Onex Corporation, owns one-third of the outstanding voting securities of Trilliant Gaming, and together Messrs. Yemenidjian, Duncanson and Schwartz own 100% of the outstanding voting securities of Trilliant Gaming.

Background

On May 5, 2008, Tropicana Entertainment together with certain of its subsidiaries, including subsidiary entities that owned and operated the Tropicana Las Vegas, specifically Adamar of Nevada, Hotel Ramada of Nevada LLC, Tropicana Development Company, LLC, Tropicana Enterprises, Tropicana Las Vegas Holdings, LLC, Tropicana Las Vegas Resort and Casino, LLC, and Tropicana Real

3

Table of Contents

Estate Company, LLC, or the LandCo Entities, filed voluntary petitions for relief, seeking to reorganize their businesses under the provisions of Chapter 11 of the Bankruptcy Code. Pending adoption of a plan of reorganization, Tropicana Entertainment continued to operate the LandCo Entities as debtors in possession under the jurisdiction and orders of the United States Bankruptcy Court for the District of Delaware, or the Bankruptcy Court, and in accordance with the applicable provisions of the Bankruptcy Code. On May 5, 2009, the Bankruptcy Court entered an order confirming the First Amended Joint Plan of Reorganization of Tropicana Las Vegas Holdings, LLC and Certain of Its Debtor Affiliates under Chapter 11 of the Bankruptcy Code, or the Bankruptcy Plan, proposed by the LandCo Entities. The Bankruptcy Plan was consummated and became effective on July 1, 2009. Pursuant to the Bankruptcy Plan, among other things:

- •

- our company was formed to own and operate the Tropicana Las Vegas, free and clear of substantially all liens and claims against the LandCo Entities;

- •

- we issued, on a pro rata basis, shares of our class A common stock, $0.01 par value per share, or Class A Common, to holders of secured claims under a $440 million senior credit facility of the LandCo Entities, or the LandCo Lenders, in partial satisfaction of the LandCo Lenders' secured claims under the senior credit facility;

- •

- certain of the LandCo Lenders subscribed to purchase $75 million of our Class A Convertible Participating Preferred Stock, or Class A Preferred, to provide operating capital for our company;

- •

- we entered into the Stockholders' Agreement, dated as of July 1, 2009, or the Stockholders' Agreement, with each of the LandCo Lenders as a condition to their receiving shares of Class A Common and Class A Preferred;

- •

- we issued a warrant to purchase up to 664,122 shares of our class B common stock, $0.01 par value per share, or the Class B Common, to Tropicana Entertainment, or the Tropicana Entertainment Warrant. The Tropicana Entertainment Warrant is exercisable by Tropicana Entertainment at any time on or prior to the earlier of (i) 5:00 pm, New York City time, on July 1, 2013, or (ii) a date on which we sell, lease, transfer or otherwise dispose of substantially all of our property, assets or business, another person or entity acquires all or substantially all of our shares of common stock or we consolidate with or merge with or into another person or entity or enter into a business combination with another person. The exercise price per share for the Tropicana Entertainment Warrant is equal to (a) $66,512,373 plus interest accrued from and after July 1, 2009 at the rate of 15% per annum, compounded annually, divided by (b) 664,122. In order to exercise the Tropicana Entertainment Warrant, Tropicana Entertainment is required to become a party to the Stockholders' Agreement;

- •

- we entered into a lease agreement, dated June 22, 2009, or the Armenco Lease Agreement, whereby we lease the real and non-gaming personal property of our hotel and casino, including the restaurants, lounges, retail shops and other related support facilities, and the operation thereof, to Armenco. Armenco separately acquired all of the gaming assets. At such time as we are able to obtain all governmental registrations, findings of suitability, licenses, qualifications, permits and approvals pursuant to the gaming laws and regulations of the State of Nevada and Clark County liquor and gaming codes necessary for us to own and operate our gaming facility directly, Armenco will transfer to us all of the gaming assets of Tropicana Las Vegas for nominal consideration, the lease agreement with Armenco will be terminated and we expect the operation of our hotel and casino to thereafter be managed by Trilliant LP pursuant to a management agreement we intend to enter into with Trilliant LP. Trilliant LP is a limited partnership that is controlled by its general partner, Trilliant Gaming; and

4

Table of Contents

- •

- we assumed the obligations and liabilities of the LandCo Entities under the Bankruptcy Plan, including the obligation to pay allowed administrative expenses associated with the LandCo Entities' chapter 11 cases, to pay allowed priority claims asserted against the LandCo Entities, to pay allowed "cure claims" associated with the LandCo Entities' assumption and assignment of certain contracts in connection with the Bankruptcy Plan, and to pay a "management fee" associated with the operation and management of the Tropicana Las Vegas between the time of confirmation and effectiveness of the Bankruptcy Plan.

We have paid approximately $2.5 million in allowed priority and cure claims and in non-professional fee administrative expenses and, with the exception of one disputed priority claim asserted in the amount of approximately $426,000 and one disputed priority tax claim asserted in the amount of approximately $42,200, we do not anticipate any material additions to such claims or expenses. Professionals employed at the expense of the bankruptcy estates of the LandCo Entities and other debtors have filed applications for allowance of approximately $13 million in professional fees and expenses against the LandCo Entities. We dispute and intend to object to many of those applications and believe that our liability in respect of such claimed professional fees and expenses will be materially less than the amounts requested, but we can give no assurance in this regard. Tropicana Entertainment, the former ultimate owner of the Tropicana Las Vegas, has asserted a claim of approximately $520,000 for management fees and an unliquidated contingent claim relating to alleged workers' compensation liabilities. We dispute a portion of the claimed management fee and currently are in discussions with Tropicana Entertainment regarding a resolution. We dispute the claim in respect of workers' compensation liabilities in its entirety.

The Tropicana Las Vegas Hotel and Casino

The Tropicana Las Vegas, originally developed in 1957, is located on an approximately 34-acre parcel on the "Las Vegas Strip" in Las Vegas, Nevada, and features 1,772 hotel rooms and a 50,000 square foot casino floor with approximately 859 slot machines and 24 table games. Other amenities include two restaurants, several lounges, an indoor-outdoor swimming pool, a five-acre water oasis and tropical garden, more than 100,000 square feet of flexible convention and meeting space, two theaters and 2,949 parking spaces. We believe that the property's central location, with neighbors including the MGM Grand Hotel & Casino, the Excalibur Hotel and Casino, the Luxor Hotel and Casino, the Monte Carlo Resort and Casino and the New York-New York Hotel and Casino, on a prime intersection collectively offering over 18,000 hotel rooms, allows us to benefit from a "cluster" effect resulting in increased pedestrian traffic, visitation and gaming play.

Our hotel offers 1,581 guest rooms ranging from 362 square feet to 464 square feet and 191 suites ranging from 729 square feet to 2,000 square feet. Services offered to our guests include a business center, room service, a fitness center and in-room high-speed internet access.

We have a 50,000 square foot casino floor featuring approximately 859 slot machines and 24 table games offering our customers a variety of gaming options including popular table games such as blackjack, baccarat, craps and roulette and a race and sports book.

The gaming assets located at the Tropicana Las Vegas are owned and operated by Armenco pursuant to the Armenco Lease Agreement and a bill of sale. After we obtain our gaming licenses, we expect our casino will be operated by Trilliant LP. See "—Nevada Gaming Regulation and Licensing," "Item 7. Certain Relationships and Related Transactions, and Director Independence—Lease

5

Table of Contents

Agreement" and "Item 7. Certain Relationships and Related Transactions, and Director Independence—Trilliant Management Agreement." The race and sports book is leased to an unrelated third party that operates it and pays us a flat fee under the terms of the lease.

We offer our customers two specialty room dining options (Bacio Pasta & Vino and Legends Steak & Seafood) with a combined total of approximately 224 seats and two casual dining restaurants (Havana Go Go Café and Player's Deli) with a combined total of approximately 200 seats. We own all the restaurants located on the property.

The Tropicana Las Vegas houses two live-show venues, the 883 seat Tiffany Theater and the 500 seat Mezzanine Theater. The Tiffany Theater is home to both Once Before I Go starring Wayne Newton, a live show featuring Mr. Las Vegas himself, and Xtreme Magic starring Dirk Arthur, a magic show featuring tigers and leopards. The Mezzanine Theater features the adults only Hypnosis Unleashed. In addition, there are several separate lounges available to guests including the Celebration Lounge and the Tropics Lounge. Currently, none of the shows are subject to long-term contracts, providing us flexibility in updating our entertainment concepts or planning for renovations to our entertainment venues.

Our convention and meeting facilities offer more than 100,000 square feet of flexible convention and meeting space. Room sizes range from 30' × 40' in the Tradewinds and Hawaiian rooms to our 288' × 100' Grand Ballroom. All rooms can be arranged for banquet, theater or classroom style seating.

We also offer other amenities, including, an indoor-outdoor swimming pool, an outdoor recreation area with individual cabanas, a pool with swim up blackjack, a five-acre water oasis and tropical garden, a beauty salon and a barber shop.

In July 2009, we announced a large-scale renovation of the Tropicana Las Vegas. We plan to spend approximately $125 million on capital improvements during 2009 and 2010, of which $24 million was spent in the six months ended December 31, 2009. The capital improvements include a master plan to make the Tropicana Las Vegas more attractive, including a full renovation of the hotel rooms and convention center, a refurbishment of the casino floor, the expansion and renovation of the race and sports book, redevelopment of the pool area, expansion and renovation of the showroom, enhancement of the food and beverage facilities, refurbishment of outdoor signage and the façade, and reconfiguration of the pedestrian bridge between the Tropicana Las Vegas and the MGM Grand Hotel & Casino. Apart from the master plan items, other capital improvements include back-of-house improvements, upgrades to information technology systems, installation of new slot machines and infrastructure upgrades. The capital improvements are scheduled to continue throughout 2010.

6

Table of Contents

Operations

Our company was formed with the primary purpose of owning and operating the Tropicana Las Vegas. However, until we, together with our directors, our executive officers and certain of our key employees and stockholders, have obtained the necessary registrations, licenses, findings of suitability, qualifications, permits and approvals, or, collectively, licenses, to own and operate our gaming facility directly, the success of the Tropicana Las Vegas and, in turn, our business will be substantially dependent upon the successful management and operation of the Tropicana Las Vegas by Armenco. We, together with our directors, executive officers and certain of our key employees and stockholders, have applied to the Nevada Gaming Commission, or the Nevada Commission, the Nevada State Gaming Control Board, or the Nevada Board, and the Clark County Liquor and Gaming Licensing Board, or the Clark County Board and, together with the Nevada Commission and the Nevada Board, the Nevada Gaming Authorities, and other applicable regulatory bodies for all governmental licenses that we believe to be necessary for us to own and operate our gaming facility. If our efforts to become licensed by the Nevada Gaming Authorities are successful, we will thereafter be dependent upon Trilliant Gaming for the successful operation of the Tropicana Las Vegas.

Customers of the Tropicana Las Vegas generally wager with cash and pay for non-gaming services with cash or credit cards, making our revenue essentially cash based (a small fraction of casino play and group-related hotel activity is conducted on a credit basis). Our net revenue, and in turn our results of operations, vary by month during the year. A variety of factors may affect the results of any interim period, including the timing of major Las Vegas conventions, the amount and timing of marketing and special events for our customers and the level of play during major holidays, including New Year. Our operating results are highly dependent on the volume of customers that visit the Tropicana Las Vegas, which in turn impacts the prices we can charge for our hotel rooms and other amenities. We market to different customer segments to manage our hotel occupancy, such as targeting conventions to ensure mid-week occupancy. Our results do not depend on key individual customers, though our success in marketing to customer groups, such as convention customers, or the financial health of customer segments, such as business travelers or high-end gaming customers from a particular country or region, can impact our results.

The Tropicana Las Vegas operates 24 hours a day, every day of the year. Other hotel amenities may be owned and operated by us, owned by us but managed by third parties for a fee or leased to third parties.

We operate in a highly competitive environment and compete against other gaming companies as well as other hospitality companies and companies that specialize in leisure and business travel.

The Tropicana Las Vegas competes with other Las Vegas hotels, resorts and casinos, including those located on the Las Vegas Strip, on the basis of overall atmosphere, range of amenities, level of service, price, location, entertainment offered, convention and meeting facilities, shopping and restaurant facilities, theme and size. Currently, there are approximately 30 major gaming properties located on or near the strip, 13 additional major gaming properties in the downtown area and additional gaming properties located in other areas of Las Vegas. Many of the competing properties have themes and attractions which draw a significant number of visitors and directly compete with our operations. Some of these facilities are operated by companies that have more than one operating facility, have greater name recognition and financial and marketing resources than us and market to the same target demographic group as we do.

7

Table of Contents

The following table provides certain historical information relating to Las Vegas gathered by the Las Vegas Convention and Visitors Authority for the period from January 1, 2009 to September 30, 2009 and for the preceding three years:

| | | | | | | | |

| |

| | Year Ended December 31, |

|---|

| | Period from

January 1, 2009 to

September 30, 2009 |

|---|

| | 2008 | | 2007 | | 2006 |

|---|

Room Inventory | | 141,190 | | 140,529 | | 132,947 | | 132,605 |

Visitor Volume | | 27,513,571 | | 37,481,552 | | 39,196,761 | | 38,914,889 |

Average Daily Room Rate | | $92.42 | | $119.19 | | $132.09 | | $119.66 |

Total Room Nights Occupied | | 31,856,271 | | 42,967,252 | | 43,978,733 | | 43,496,236 |

Convention Attendance | | 3,567,069 | | 5,899,725 | | 6,209,253 | | 6,307,961 |

Gaming Revenues | | $6,656,530,000 | | $9,796,970,000 | | $10,868,029,000 | | $10,643,206,000 |

The principal segments of the Las Vegas visitor market are free and independent travelers, gaming customers, convention attendees (encompassing people that attend exhibits, small meetings and corporate incentive programs) and tour and travel visitors. Our marketing strategy is aimed at attracting a mix of convention groups, tours and free and independent visitors midweek and gaming customers and free and independent travelers on the weekend.

The Tropicana Las Vegas draws a substantial number of customers from geographic areas outside of Las Vegas, especially California and Arizona, in which there are a significant number of Native American casinos. As a result, we face significant competition from gaming venues outside the Las Vegas market, including hotel casinos in the Mesquite, Laughlin, Reno and Lake Tahoe areas of Nevada, Atlantic City, New Jersey and other parts of the United States, gaming on Native American tribal lands and gaming on cruise ships. We also compete with state-sponsored lotteries, racetracks, off-track wagering, video lottery and video poker terminals, riverboats and card parlors. In addition, online gaming, despite its illegality in the United States, is a growing sector in the gaming industry. See "Item 1A. Risk Factors—Risks Related to Our Business—We face increasing competition from gaming venues in other geographic regions, other forms of legalized gambling and online gaming."

Our marketing efforts are targeted at both the visitor market (tourists and business travelers) in California, Arizona, Texas, Illinois and New York as well as local customers. To reach our customers, we employ both innovative forms of marketing, including use of major internet sites, search engine optimization and online social networks, as well as more traditional forms of marketing, including print, radio and television advertising, database marketing, hotel group sales, player development and public relations. We also target local residents through direct mail advertising and through hosting special events and parties specifically geared to the local population. In addition, we believe that our location on a prime intersection on the Las Vegas Strip allows us to benefit from a "cluster" effect, resulting in increased pedestrian traffic, visitation and gaming play.

As of January 13, 2010, we had approximately 1,118 active employees, with approximately 58% of such employees being unionized. We believe that our employees are critical to our success and seek to foster a productive work culture. We offer our employees what we believe to be competitive salaries, as well as a benefits package that includes medical and dental coverage. We believe that we have a good working relationship with both our union and non-union employees. See "Item 1A. Risk Factors—Risks Related to Our Business—Increased labor costs, work stoppages, other labor problems and unexpected shutdowns may limit our operational flexibility and negatively impact our future profits."

8

Table of Contents

Slot machine revenue represents a majority of the Tropicana Las Vegas' gaming revenue. It is important that we maintain and upgrade our slot machines and systems to keep them competitive with other casinos and attractive to gaming customers. In the past, slot machine sales were dominated by International Gaming Technology, or IGT, which commanded an approximate 75% of the market. A few other companies competed for the remaining 25%. In recent years the slot machine manufacturing industry has become significantly more competitive. It is estimated that IGT is shipping less than 50% of all new slot machines while its floor presence in casinos has fallen from 75% to 50%. Three other public gaming manufacturing companies have increased market share. Of note, WMS Industries Inc., Bally Technologies, Inc. and Aristocrat Leisure Limited all have significant market share. They all have very competitive and successful slot offerings. In addition to these three competitors, there are other providers such as the Atronic Group, Konami Digital Entertainment, Inc., Aruze Corp. and AC Coin & Slot that develop and manufacture slot machines. Currently, we have business relationships with all the slot machine manufacturers or their sales representatives.

While the cost of new slot machines has gone up to match the advances in technology, competition in the industry has driven discounting by most major manufacturers. It is not uncommon to receive discounts off the list price on the most popular slot machines. In addition, conversion kits are often available, which update slot machine software and game offerings for less than the cost of a new machine. As with most other casino companies, we are taking advantage of the conversion offerings to upgrade a significant portion of our slot machine floors. While the new slot machine technology is more expensive than in the past, it has allowed us to decrease our support staff through technology such as ticket-in, ticket-out, which returns a bar coded receipt instead of coinage. In the past, most major innovations in slot machine technology that have driven up slot machine prices have also improved revenue and profitability for casino operators.

Business Strategy

Our business strategy includes:

Capital Improvement Program. We believe that having facilities that are attractive and desirable to customers is critical to our competitiveness. We plan to spend approximately $125 million on capital improvements during 2009 and 2010, of which $24 million was spent in the six months ended December 31, 2009. The capital improvements include a master plan to make the Tropicana Las Vegas more attractive, including a full renovation of the hotel rooms and convention center, a refurbishment of the casino floor, the expansion and renovation of the race and sports book, redevelopment of the pool area, expansion and renovation of the showroom, enhancement of the food and beverage facilities, refurbishment of outdoor signage and the façade and reconfiguration of the pedestrian bridge between the Tropicana Las Vegas and MGM Grand Hotel & Casino. Apart from the master plan items, other capital improvements include back-of-house improvements, upgrades to information technology systems, installation of new slot machines and infrastructure upgrades. The capital improvements are scheduled to continue throughout 2010.

Focus on Customer Service. We continue to emphasize the importance of having a culture focused on customer service. In August 2009, we implemented leadership training for all management personnel to ensure that employees are extensively trained in their respective functional area and are able to respond immediately to customer needs. Customer satisfaction will continue to be a key basis of employee evaluation. We are continually seeking to promote and maintain an environment in which all employees feel a sense of commitment to customer service and customers feel welcome in the Tropicana Las Vegas.

9

Table of Contents

Gaming Mix Targeted To Customers. As of September 30, 2009, our casino floor housed approximately 859 slot machines and 24 table games. We continually evaluate the mix of gaming machines, gaming tables and non-gaming activities we offer as we seek to satisfy the preferences of the gaming customers we target.

Litigation

We are a plaintiff in a civil action pending in the United States District Court for the District of Nevada, calledTropicana Las Vegas, Inc. and Hotel Ramada of Nevada, LLC v. Aztar Corporation and Tropicana Entertainment, LLC (Case No. A09595469-B). We are seeking confirmation from the court that we have the right to use the "Tropicana" name based on implied and express agreements and the application of principles of estoppel. The defendants contend that they alone have a right to use the "Tropicana" name and, further, have asserted a counterclaim that we are infringing their purported trademark rights by using the "Tropicana" name in conducting our business. After the action was filed, the defendants removed it to the United States District Court for the District of Nevada; we moved to remand the action, which motion was granted, the effect being that the case has now returned to state court. Prior to remand, on January 8, 2010, we filed a Motion For Summary Judgment in the United States District Court for the District of Nevada, where the case was then pending. The motion asserts that we are entitled to judgment as a matter of law based on historical agreements concerning the property and the name Tropicana. The defendants have not responded to the Motion. Discovery is ongoing, and we therefore cannot express an opinion at this time on the outcome of the case.

Nevada Gaming Regulation And Licensing

The gaming industry is highly regulated. Gaming licenses, once obtained, can be suspended or revoked for a variety of reasons. We cannot assure you that we will obtain all required licenses on a timely basis or at all, or that, once obtained, the licenses will not be suspended, conditioned, limited or revoked. The ownership and operation of casino gaming facilities in the State of Nevada are subject to the Nevada Gaming Control Act and the regulations made under such Act, as well as to various local ordinances, or, collectively, the Nevada Gaming Laws. We are subject to the licensing and regulatory control of the Nevada Gaming Authorities.

In order for us to recognize revenue derived from gaming-related activities at the Tropicana Las Vegas, our subsidiary Tropicana Las Vegas, Inc. is required to be licensed by, the Nevada Gaming Authorities as a nonrestricted licensee, which we refer to herein as a company licensee. If it is granted gaming licenses, it will have to pay periodic fees and taxes. The gaming licenses will not be transferable. We cannot assure you that Tropicana Las Vegas, Inc. will be able to obtain all licenses from the Nevada Gaming Authorities on a timely basis, or at all, or that if obtained, such licenses will not be conditioned or limited. Tropicana Las Vegas Intermediate Holdings Inc., the intermediate company that owns Tropicana Las Vegas Inc., must be also be licensed as an intermediary company by the Nevada Gaming Authorities, which we refer to as the intermediary licensee. The company licensee and the intermediary licensee are collectively referred to as the licensed subsidiaries.

Tropicana Las Vegas Hotel and Casino, Inc. is required to be registered by the Nevada Commission as a "publicly traded corporation," which we refer to herein as a registered company, for the purposes of the Nevada Gaming Control Act. Certain of our directors, executive officers and key employees are also required to be licensed by the Nevada Gaming Authorities. Stockholders owning in

10

Table of Contents

excess of 10% of the registered company are also required to be licensed by the Nevada Gaming Authorities. The applications of our company and our subsidiaries, officers, directors and majority shareholders have been filed. We are aware of one stockholder that owns in excess of 10% of our company and needs to file an application for either a finding of suitability as a stockholder or an institutional investor waiver of such finding, as discussed below.

Once we have been registered by the Nevada Commission, we will be required to submit detailed financial and operating reports to the Nevada Commission and provide any other information that the Nevada Commission may require. Substantially all of our material loans, leases, sales of securities and similar financing transactions must be reported to, or approved by, the Nevada Gaming Authorities.

No person may become a stockholder of, or receive any percentage of the profits of, an intermediary company or company licensee without first obtaining licenses and approvals from the Nevada Gaming Authorities. The Nevada Gaming Authorities may investigate any individual who has a material relationship to or material involvement with us to determine whether the individual is suitable or should be licensed as a business associate of a gaming licensee. Certain of our directors, executive officers, key employees and stockholders, and all officers and directors of the licensed subsidiaries, are required to file applications with the Nevada Gaming Authorities and may be required to be licensed or found suitable by the Nevada Gaming Authorities. The Nevada Gaming Authorities may deny an application for licensing for any cause which they deem reasonable. A finding of suitability is comparable to licensing, and both require submission of detailed personal and financial information followed by a thorough investigation. An applicant for licensing or an applicant for a finding of suitability must pay or must cause to be paid all the costs of the investigation.

If the Nevada Gaming Authorities were to find an officer, director or key employee unsuitable for licensing or unsuitable to continue having a relationship with us, we would have to sever all relationships with that person. In addition, the Nevada Commission may require us to terminate the employment of any person who refuses to file appropriate applications. Determinations of suitability or questions pertaining to licensing are not subject to judicial review in Nevada.

If the Nevada Commission decides that we have violated the Nevada Gaming Control Act or any of its regulations, it could limit, condition, suspend or revoke our applications, or registrations and gaming license, once obtained. In addition, we and the persons involved could be subject to substantial fines for each separate violation of Nevada laws, at the discretion of the Nevada Commission. Further, the Nevada Commission could appoint a supervisor to operate the gaming-related activities at the Tropicana Las Vegas and, under specified circumstances, earnings generated during the supervisor's appointment (except for the reasonable rental value of the premises) could be forfeited to the State of Nevada. Limitation, conditioning or suspension of any gaming licenses we may obtain and the appointment of a supervisor could, and revocation of any such gaming license would, have a significant negative effect on our gaming operations.

Regardless of the number of shares or other interests held, any beneficial holder of the voting securities of a registered company may be required to file an application, be investigated and have that person's suitability as a beneficial holder of voting securities determined if the Nevada Commission has reason to believe that the ownership would otherwise be inconsistent with the declared policies of the State of Nevada. If the beneficial holder of such securities who must be found suitable is a corporation, partnership, limited partnership, limited liability company or trust, it must submit detailed business and

11

Table of Contents

financial information including a list of its beneficial owners. The applicant must pay all costs of the investigation incurred by the Nevada Gaming Authorities in conducting any investigation.

The Nevada Gaming Control Act requires any person who, individually or in association with others, acquires, directly or indirectly, beneficial ownership of more than 5% of the voting securities of a registered company to report the acquisition to the Nevada Commission. The Nevada Gaming Control Act requires any person who, individually or in association with others, acquires, directly or indirectly, beneficial ownership of more than 10% of a registered company's voting securities to apply to the Nevada Commission for a finding of suitability within 30 days after the Chairman of the Nevada Board mails the written notice requiring such filing. Under certain circumstances, an "institutional investor," as defined in the Nevada Gaming Control Act, which acquires more than 10%, but not more than 25%, of the registered company's voting securities may apply to the Nevada Commission for a waiver of a finding of suitability if the institutional investor holds the voting securities for investment purposes only. An institutional investor that has obtained a waiver may, in certain circumstances, own up to 29% of the voting securities of a registered company for a limited period of time and maintain the waiver. An institutional investor will not be deemed to hold voting securities for investment purposes unless the voting securities were acquired and are held in the ordinary course of business as an institutional investor and not for the purpose of causing, directly or indirectly, the election of a majority of the members of the board at directors of the registered company, a change in the corporate charter, bylaws, management, policies or operations of the registered company, or any of its gaming affiliates, or any other action which the Nevada Commission finds to be inconsistent with holding the registered company's voting securities for investment purposes only. Activities which are not deemed to be inconsistent with holding voting securities for investment purposes only include:

- •

- voting on all matters voted on by stockholders or interest holders;

- •

- making financial and other inquiries of management of the type normally made by securities analysts for informational purposes and not to cause a change in its management, policies or operations; and

- •

- other activities that the Nevada Commission may determine to be consistent with such investment intent.

The Nevada Commission may, in its discretion, require the holder of any debt or nonvoting security of a registered company to file applications, be investigated and be found suitable to own the debt or nonvoting security of the registered company if the Nevada Commission has reason to believe that the ownership would otherwise be inconsistent with the declared policies of the State of Nevada.

Any person who fails or refuses to apply for a finding of suitability or a license within 30 days after being ordered to do so by the Nevada Commission or by the Chairman of the Nevada Board, or who refuses or fails to pay the investigative costs incurred by the Nevada Gaming Authorities in connection with the investigation of its application, may be found unsuitable. The same restrictions apply to a record owner if the record owner, after request, fails to identify the beneficial owner. Any person found unsuitable and who holds, directly or indirectly, any beneficial ownership of any equity security or debt security of a registered company beyond the period of time as may be prescribed by the Nevada Gaming Commission may be guilty of a criminal offense. We will be subject to disciplinary action if, after we receive notice that a person is unsuitable to hold an equity interest or to have any other relationship with us, we:

- •

- pay that person any dividend or interest upon any securities;

- •

- allow that person to exercise, directly or indirectly, any voting right held by that person relating to our company;

12

Table of Contents

- •

- pay remuneration in any form to that person for services rendered or otherwise; or

- •

- fail to pursue all lawful efforts to require the unsuitable person to relinquish such person's voting securities including, if necessary, the immediate purchase of the securities for cash at fair market value.

A registered company may not make a public offering of its securities without the prior approval of the Nevada Commission if it intends to use the proceeds from the offering to construct, acquire or finance gaming facilities in Nevada, or to retire or extend obligations incurred for those purposes or for similar transactions. Once we become a registered company, any approval that we might receive in the future relating to future offerings will not constitute a finding, recommendation or approval by any of the Nevada Board or the Nevada Commission as to the accuracy or adequacy of the offering memorandum or the investment merits of the securities. Any representation to the contrary is unlawful.

The regulations of the Nevada Commission also provide that any entity which is not an "affiliated company," as that term is defined in the Nevada Gaming Control Act, or which is not otherwise subject to the provisions of the Nevada Gaming Control Act or regulations, that plans to make a public offering of securities intending to use such securities, or the proceeds from the sale thereof, for the construction or operation of gaming facilities in Nevada, or to retire or extend obligations incurred for such purposes, may apply to the Nevada Commission for prior approval of such offering. The Nevada Commission may find an applicant unsuitable based solely on the fact that it did not submit such an application, unless upon a written request for a ruling, referred to as a Ruling Request, the Nevada Board Chairman has ruled that it is not necessary to submit an application.

Once we become a registered company, we must obtain prior approval of the Nevada Commission with respect to a change in control through:

- •

- merger;

- •

- consolidation;

- •

- stock or asset acquisitions;

- •

- management or consulting agreements; or

- •

- any act or conduct by a person by which the person obtains control of us.

Entities seeking to acquire control of a registered company must satisfy the Nevada Board and Nevada Commission with respect to a variety of stringent standards before assuming control of the registered company. The Nevada Commission may also require controlling stockholders, officers, directors and other persons having a material relationship or involvement with the entity proposing to acquire control to be investigated and licensed as part of the approval process relating to the transaction.

The Nevada legislature has declared that some corporate acquisitions opposed by management, repurchases of voting securities and corporate defense tactics affecting Nevada gaming licenses or affecting registered companies that are affiliated with the operations permitted by Nevada gaming licenses may be harmful to stable and productive corporate gaming. The Nevada Commission has

13

Table of Contents

established a regulatory scheme to reduce the potentially adverse effects of these business practices upon Nevada's gaming industry and to further Nevada's policy to:

- •

- assure the financial stability of corporate gaming operators and their affiliates;

- •

- preserve the beneficial aspects of conducting business in the corporate form; and

- •

- promote a neutral environment for the orderly governance of corporate affairs.

Once we become a registered company, approvals may be required from the Nevada Commission before we can make exceptional repurchases of voting securities above their current market price and before a corporate acquisition opposed by management can be consummated. The Nevada Gaming Control Act also requires prior approval of a plan of recapitalization proposed by a registered company's board of directors in response to a tender offer made directly to its stockholders for the purpose of acquiring control.

License fees and taxes, computed in various ways depending on the type of gaming or activity involved, are payable to the State of Nevada and to the counties and cities in which the licensed subsidiaries respective operations are conducted. Depending upon the particular fee or tax involved, these fees and taxes are payable monthly, quarterly or annually and are based upon:

- •

- a percentage of the gross revenue received;

- •

- the number of gaming devices operated; or

- •

- the number of table games operated.

A live entertainment tax is also paid on charges for admission to any facility where certain forms of live entertainment are provided.

Any person who is licensed, required to be licensed, registered, required to be registered, or is under common control with those persons, or, collectively, licensees, and who proposes to become involved in a gaming venture outside of Nevada, is required to deposit with the Nevada Board, and thereafter maintain, a revolving fund in the amount of $10,000 to pay the expenses of investigation of the Nevada Board of the licensee's or registrant's participation in such foreign gaming. The revolving fund is subject to increase or decrease in the discretion of the Nevada Commission. Licensees and registrants are required to comply with the reporting requirements imposed by the Nevada Gaming Control Act. A licensee or registrant is also subject to disciplinary action by the Nevada Commission if it:

- •

- knowingly violates any laws of the foreign jurisdiction pertaining to the foreign gaming operation;

- •

- fails to conduct the foreign gaming operation in accordance with the standards of honesty and integrity required of Nevada gaming operations;

- •

- engages in any activity or enters into any association that is unsuitable because it poses an unreasonable threat to the control of gaming in Nevada, reflects or tends to reflect discredit or disrepute upon the State of Nevada or gaming in Nevada or is contrary to the gaming policies of Nevada;

- •

- engages in activities or enters into associations that are harmful to the State of Nevada or its ability to collect gaming taxes and fees; or

14

Table of Contents

- •

- employs, contracts with or associates with a person in the foreign operation who has been denied a license or finding of suitability in Nevada on the ground of unsuitability.

The conduct of gaming activities and the service and sale of alcoholic beverages at the Tropicana Las Vegas are subject to licensing, control and regulation by the Clark County Board. In addition to approving the licensee, the Clark County Board has the authority to approve all persons owning or controlling the stock of any business entity controlling a gaming or liquor license. All licenses are revocable and are not transferable. The Clark County Board has full power to limit, condition, suspend or revoke any license. Any disciplinary action could, and revocation would, have a substantial negative impact upon the operations of the Tropicana Las Vegas.

Additional Information

Following the effectiveness of this registration statement, we will be required to file annual, quarterly and current reports and other information with the United States Securities and Exchange Commission, or the Commission. You will be able to read and copy any reports, statements or other information filed by us, including this registration statement, at the Commission's Public Reference Room at 100 F Street, NE, Washington, D.C. 20549. Please call the Commission at 1-800-SEC-0330 for further information on the Public Reference Room. Our filings will also be available to the public from commercial document retrieval services and at the web site maintained by the Commission atwww.sec.gov.

Item 1A. RISK FACTORS.

An investment in our securities involves a high degree of risk. You should carefully consider the risks described below, together with the other information included in this registration statement, and the descriptions included in our financial statements and accompanying notes. Any of the risks described below, and others that we have not anticipated, could significantly and adversely affect our business, prospects, financial condition, results of operations and cash flows, which in turn could have a material adverse effect on the value of our securities.

We have limited liquidity and capital resources, have been operating at a loss with negative cash flow and may be unable to secure additional financing for our continued operations, which may cause our business to fail.

We have a limited amount of cash and do not have a credit facility upon which to draw. We have been operating at a loss with negative cash flow since we commenced operations on July 1, 2009. Our ability to generate cash from operations in the future depends, in significant part, upon the state of the gaming industry in Las Vegas, which in turn depends upon a number of factors including the state of the United States economy, the amount of discretionary consumer and corporate spending in Las Vegas and the level of competition in the Las Vegas casino market.

We have received commitments from some of our stockholders who have agreed to purchase additional shares of our preferred stock in a rights offering that will enable us to raise up to $75 million in additional capital. We expect such issuance to be consummated prior to the end of the first quarter of 2010. We may reduce the size of the rights offering if we are able to obtain debt financing. We can give no assurance that we will be able to obtain the debt financing on acceptable terms or at all, as to how much, if any, additional capital we may be able to raise from the debt financing or whether we will be successful in closing the rights offering for the full $75 million or whatever lesser amount we determine that we need.

15

Table of Contents

If we are unable to obtain additional capital through the proposed rights offering and/or the debt financing, or if such sources of capital are inadequate to fund our short-term or long-term liquidity requirements, we will attempt to procure additional financing, including debt financing or additional equity financing, to fund our operations and our capital expenditures. There can be no assurances that such sources of financing will be available to us on terms acceptable to us, if at all.

Recent global economic conditions have been unprecedented and challenging and have had, and continue to have, an adverse effect on the United States financial markets and the United States economy in general, which has had, and may continue to have, a material adverse effect on the availability of credit to us and our customers and, in turn, on our business and financial performance.

As a result of these current economic conditions, the cost and availability of credit has been, and may continue to be, adversely affected by illiquid credit markets and wider credit spreads. Concern about the stability of the credit markets generally and the strength of counterparties specifically has led many lenders and institutional investors to reduce, and in some cases cease to provide, credit to businesses and consumers. This has been particularly the case in Las Vegas, where lenders have dramatically reduced the availability of funds, and in some cases ceased to provide funds, for hotel, condominium, casino and resort development, expansion and remodeling projects. As a result of these market conditions, we may be unable to obtain debt financing or otherwise borrow funds for our business, which may adversely affect our liquidity and financial condition and impair our ability to complete needed capital improvements.

The Las Vegas hotel, casino and resort market's sensitivity to reductions in discretionary spending, combined with the continued weakness and possible further weakening in global economic conditions that has had and may continue to have a material adverse effect on consumer and corporate spending and tourism trends, may cause a further deterioration in our business, prospects, financial condition, results of operations and cash flows.

The current recession in the United States and ongoing global economic crisis, together with the limited availability of credit, has resulted in significant declines in discretionary consumer and corporate spending and changes in consumer preferences. Worldwide, consumers are traveling less and spending less when they do travel. Likewise, corporate spending on conventions and business development is being significantly curtailed as businesses cut their budgets. As a result, there has been a significant reduction in the amount of tourism and spending in Las Vegas. This reduction follows a long period of substantial growth in tourism and spending that fueled a dramatic expansion of the hotel, casino and resort market in Las Vegas, including significant additions to hotel room and condominium capacity, convention floor space, gaming facilities and attractions, with further additions in the pipeline as a result of large projects recently completed, such as CityCenter, that were begun prior to the current economic downturn. As a consequence, the economic conditions for businesses such as the hotel, casino and resorts market in Las Vegas have been and continue to be extremely challenging and are expected to continue to be challenging until demand from consumer and corporate spenders catches up to the current increased capacity in our market. Any further declines in consumer and corporate discretionary spending or changes in consumer preferences brought about by factors such as perceived or actual general economic conditions, the current housing crisis and credit crisis, the impact of high energy and food costs, the increased costs of travel, the potential for continued bank failures, perceived or actual decreases in disposable consumer income and wealth, effects of the current recession, changes in consumer confidence in the economy and fears of war and future acts of terrorism could further reduce customer demand for the amenities and services that we offer and have a material adverse effect on our business, prospects, financial condition, results of operations and cash flows.

16

Table of Contents

Energy price increases may adversely affect our cost of operations and our revenues and the discretionary spending of our customers.

We use significant amounts of electricity. Substantial increases in energy prices in the United States may negatively affect our operating results in the future. The extent of the impact is subject to the magnitude and duration of any energy and fuel price increases, but this impact could be material. In addition, energy and gasoline price increases for our customers could result in a decline in disposable income of potential customers and a corresponding decrease in visitation and spending at the Tropicana Las Vegas, which would negatively impact our revenues.

The Las Vegas hotel, resort and casino market in which we operate is highly competitive, and we may not have the resources needed to compete successfully or be successful in executing our marketing strategy.

The Tropicana Las Vegas competes with other Las Vegas hotels, resorts and casinos, in particular those located on the Las Vegas Strip, on the basis of overall atmosphere, range of amenities, level of service, price, location, entertainment offered, convention, shopping and restaurant facilities, theme and size. Currently, there are approximately 30 major gaming properties located on or near the Las Vegas Strip, 13 additional major gaming properties in the downtown area and additional gaming properties located in other areas of Las Vegas. Many of the competing properties have themes and attractions which draw a significant number of visitors and directly compete with our operations. Some of these facilities are owned by companies that have more than one operating facility, have greater name recognition and financial and marketing resources than us and may utilize such resources to market themselves more effectively to the same target demographic group as we do. Our ability to compete also depends, to a large extent, on our ability to successfully execute our marketing strategy, including factors such as targeting the appropriate demographic groups and utilizing forms of media with the geographic scope to successfully reach our targeted demographic groups. If we lack sufficient financial resources or liquidity to maintain the attractiveness of our facility or match the promotions, marketing and branding efforts of competitors, the number of customers at the Tropicana Las Vegas may decline, which may have an adverse effect on our financial performance. See "Item 1. Business—Marketing."

Furthermore, openings of additional major hotel casinos and high rise condos and significant expansions of existing properties containing large numbers of hotel rooms and attractions have occurred in Las Vegas recently and will put additional pressure on us to remain competitive. If we are unable to compete effectively, we could lose market share and have declining margins which could adversely affect our business and results of operations.

We face increasing competition from gaming venues in other geographic regions, other forms of legalized gambling and online gaming.

We face significant competition from gaming venues outside the Las Vegas market, including hotel casinos in the Mesquite, Laughlin, Reno and Lake Tahoe areas of Nevada, Atlantic City, New Jersey and other parts of the United States, gaming on Native American tribal lands and gaming on cruise ships. We also compete with state-sponsored lotteries, racetracks, off-track wagering, video lottery and video poker terminals, riverboats and card parlors. In addition, online gaming, despite its illegality in the United States, is a growing sector in the gaming industry. Online casinos offer a variety of games, including slot machines, roulette, poker and blackjack, with web-enabled technologies allowing individuals to game using credit or debit cards from any location.

As the Tropicana Las Vegas draws a substantial number of customers from certain other specific geographic areas, including California and Arizona, the availability of competing gaming venues, other forms of legalized gambling and online gaming in these and other parts of the United States has diverted some potential visitors away from Las Vegas, which has had and is expected to continue to have a negative effect on our business. In particular, we expect increasing competition from casinos

17

Table of Contents

operated on Native American tribal lands in California, which are permitted to operate video slot machines, blackjack and house-banked card games. The governor of California has entered into compacts with numerous tribes in California and has announced the execution of a number of new compacts with no limits on the number of gaming machines (which had been limited under the prior compacts). The federal government has also approved numerous compacts in California and casino-style gaming is now legal on those tribal lands. While the competitive impact on our operations from the continued growth of Native American gaming establishments in California remains uncertain, the proliferation of competing gaming venues in California and other areas, as well as other forms of legalized gambling and online gaming, could adversely affect our business and results of operations.

Furthermore, several states have considered legalizing casino gaming and others may in the future. Legalization of large-scale, unlimited casino gaming in or near any major metropolitan area or increased gaming in other areas could have a material adverse economic impact on our business and results of operations by diverting our customers to competitors in those areas. In particular, the expansion of casino gaming in or near any geographic area from which we attract or expect to attract a significant number of customers could have a material adverse effect on us.

We are undertaking a capital improvement program involving construction and renovations to, and closures of parts of, the Tropicana Las Vegas, which may result in disruptions of and inconveniences to our customers and, in turn, could harm our business.

The capital improvement program to make our facilities more attractive includes a full renovation of the hotel rooms and convention center, a refurbishment of the casino floor, the expansion and renovation of the race and sports book, redevelopment of the pool area, expansion and renovation of the showroom, enhancement of the food and beverage facilities, refurbishment of outdoor signage and the façade, and reconfiguration of the pedestrian bridge between our facility and the MGM Grand Hotel & Casino. As part of this program, we expect to close each of the two hotel towers and the pool for a period of time during the construction. While we expect our facility to remain open for business and we will seek to minimize the disruption and inconvenience to our customers during the construction and renovations, we cannot assure you that we will be successful in this regard. If customers choose not to visit our facility, including choosing to visit instead the hotel casinos of our competitors that are not under construction and renovation, our business may be harmed, both during the construction and renovation and afterwards to the extent customers decide not to return.

While we have attempted to estimate and budget for the costs of our capital improvement program, we cannot be certain that we will be able to complete the improvements to the Tropicana Las Vegas within the planned budget. In order to achieve cost savings, we are dealing directly with subcontractors instead of a single or limited number of general contractors, which can result in the process being more complicated and difficult to manage for us as the owner and operator of the Tropicana Las Vegas. We have limited experience in managing such a large capital improvement program, and there can be no assurance that we will be successful in managing the process. If we are unsuccessful, we may suffer delays and/or cost overruns. In addition, as the Tropicana Las Vegas facility is old, with some parts dating back to the 1950s, as we undertake the capital improvement program we may discover additional areas in which the facility requires renovation, refurbishment or repair that we had not anticipated and budgeted for, which could also result in delays and/or cost overruns with respect to the project.

18

Table of Contents

We are entirely dependent on one property for all of our cash flow, which subjects us to greater risks than a gaming company with more operating properties.

We do not expect to have material assets or operations other than the Tropicana Las Vegas and, therefore, we are entirely dependent upon the Tropicana Las Vegas for all of our cash flow. As a result, we are subject to a greater degree of risk than companies with properties in more than one location, including the following:

- •

- continued or worsening national recession;

- •

- weak local economic conditions;

- •

- increased competitive conditions;

- •

- consumer and corporate spenders' preferences for other hotels, resorts and casinos on the Las Vegas Strip, including as a result of the different themes and attractions of those competing facilities;

- •

- an increase in the cost of utilities for our property as a result of, among other things, power shortages in California or other western states with which Nevada shares a single regional power grid or a shortage of natural resources such as water;

- •

- natural and other disasters;

- •

- inaccessibility due to weather conditions, road construction or closure of primary access routes;

- •

- decline in air passenger traffic due to higher ticket costs or fears concerning air travel;

- •

- a decline in automobile traffic due to higher gasoline prices; and

- •

- changes in state and local laws and regulations, including those affecting gaming.

In addition, some of our competitors which have multiple operating properties are able to achieve cost savings, including through the use of centralized management, administrative and other services and superior purchasing power which we cannot match.

We are not currently licensed by Nevada gaming authorities to own and operate the gaming assets of the Tropicana Las Vegas.

The ownership and operation of casino gaming facilities in Nevada are governed by the Nevada Gaming Control Act and the regulations promulgated thereunder, as well as various local ordinances. In addition, the owners and operators of casino gaming facilities in Nevada are subject to the licensing and regulatory control of the Nevada Gaming Authorities. We are not currently licensed by the Nevada Gaming Authorities. As a result, we entered into a lease agreement, dated June 22, 2009, whereby we lease the real and non-gaming personal property of our hotel and casino, including the restaurants, lounges, retail shops and other related support facilities, and the operation thereof to Armenco. Armenco separately acquired all of the gaming assets. At such time as we are able to obtain all governmental registrations, findings of suitability, licenses, qualifications, permits and approvals pursuant to the Nevada Gaming Laws necessary for us to own and operate our gaming facility directly, Armenco will transfer to us all of the gaming assets of the Tropicana Las Vegas for nominal consideration, the lease agreement with Armenco will be terminated and we expect the operation of our hotel and casino to thereafter be managed by Trilliant LP pursuant to a management agreement we intend to enter into with Trilliant LP. See "Item 7. Certain Relationships and Related Transactions, and Director Independence—Lease Agreement."

We, together with our directors, our executive officers and certain of our key employees and stockholders, have applied to the Nevada Gaming Authorities and other applicable regulatory bodies for all governmental registrations, licenses, findings of suitability, qualifications, permits and approvals

19

Table of Contents

that we believe to be necessary for us to own and operate our gaming assets directly. However, there can be no assurance that we will be successful in obtaining, on a timely basis or at all, and if obtained that we will be successful in maintaining, renewing and not having suspended or revoked, the governmental registrations, licenses, findings of suitability, qualifications, permits and approvals necessary, presently or in the future, for us to own and operate our gaming assets directly.

Trilliant Gaming controls a significant percentage of our outstanding voting securities, and a conflict may arise between our interests and those of Trilliant Gaming.

Trilliant Gaming is the general partner of the Onex Armenco Gaming Entities. The Onex Armenco Gaming Entities, in the aggregate, own, and Trilliant Gaming has voting and investment control over, approximately 70.6% of our outstanding voting securities. Each of Mr. Alex Yemenidjian, our Chairman of the Board, Chief Executive Officer and President, Mr. Timothy Duncanson, one of our directors, and Mr. Gerald Schwartz, the chairman and controlling stockholder of Onex Corporation, owns one-third of the outstanding voting securities of Trilliant Gaming, and together Messrs. Yemenidjian, Duncanson and Schwartz own 100% of the outstanding voting securities of Trilliant Gaming. A stockholder agreement between Messrs. Yemenidjian, Duncanson and Schwartz sets forth the rights of each of them with respect to control of Trilliant Gaming and, in turn, our securities owned by the Onex Armenco Gaming Entities. The Onex Armenco Gaming Entities were formed by entities affiliated with Onex Corporation.

As a result of Trilliant Gaming's voting and investment control over our securities held by the Onex Armenco Gaming Entities, Trilliant Gaming may, among other things, exercise a controlling influence over our affairs, the election of directors and the approval of significant corporate transactions, including a merger or the sale of all or substantially all of our assets. Trilliant Gaming may have the ability to prevent any transaction that requires approval of our stockholders regardless of whether or not other stockholders believe that any such transaction is in our best interests and such other stockholders. Trilliant Gaming also controls the voting of greater than two-thirds of the outstanding shares of our Class A Preferred, giving it the power to amend or waive certain provisions of our Class A Preferred, including the power to waive the anti-dilution protections of such preferred stock.

We are dependent upon Armenco, a company controlled by our Chief Executive Officer, and after we become licensed we expect to be dependent upon Trilliant Management, L.P., an entity controlled by Trilliant Gaming, to operate the Tropicana Las Vegas.

The gaming assets of the Tropicana Las Vegas are owned by, and the other assets of the Tropicana Las Vegas are currently being leased to and operated by, Armenco, a company controlled by our Chairman of the Board, Chief Executive Officer and President, pursuant to a lease agreement, dated June 22, 2009. See "Item 7. Certain Relationships and Related Transactions, and Director Independence—Lease Agreement." We expect that this arrangement will continue until such time as we have obtained all governmental registrations, licenses, findings of suitability, qualifications, permits and approvals necessary for us to own and operate the Tropicana Las Vegas directly. Until we are able to own and operate the Tropicana Las Vegas directly, the success of the Tropicana Las Vegas and, in turn, our business, will be substantially dependent upon Armenco. If Armenco were to cease to operate the Tropicana Las Vegas before we are licensed by the Nevada Gaming Authorities, we would have to find another party to own and operate the Tropicana Las Vegas or we would have to close the Tropicana Las Vegas. There can be no assurance that we would be able to find any such other party to operate the Tropicana Las Vegas on favorable terms, or at all.

After we become licensed by the Nevada Gaming Authorities, the agreement with Armenco will be terminated and we expect the operation of the Tropicana Las Vegas to thereafter be managed by Trilliant LP pursuant to a management agreement we intend to enter with Trilliant LP. Trilliant LP is a

20

Table of Contents

limited partnership that is controlled by its general partner, Trilliant Gaming. The success of the Tropicana Las Vegas and, in turn, ours, will be substantially dependent upon Trilliant LP. There can be no assurance that Trilliant LP will be successful at managing the Tropicana Las Vegas or that the terms of the management agreement with Trilliant LP will turn out to be in our best interests.

Unless we are considered a "publicly traded corporation" under the Nevada Gaming Control Act, each of our stockholders must be found suitable by the Nevada Gaming Authorities or we may be required to sever all relationships with such stockholder.