UNITED STATES |

SECURITIES AND EXCHANGE COMMISSION |

WASHINGTON, D.C. 20549 |

| |

SCHEDULE 14A |

| |

Information Required in Proxy Statement Schedule 14A Information Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. ) |

| |

Filed by the Registrant ☒ |

| |

Filed by a Party other than the Registrant ☐ |

| |

Check the appropriate box: |

☐ | Preliminary Proxy Statement |

☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

☒ | Definitive Proxy Statement |

☐ | Definitive Additional Materials |

☐ | Soliciting Material Pursuant to §240.14a-12 |

| |

Tropicana Las Vegas Hotel and Casino, Inc. |

(Name of Registrant as Specified In Its Charter) |

| |

| |

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

| |

Payment of Filing Fee (Check the appropriate box): |

☒ | No fee required. |

☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | Title of each class of securities to which transaction applies: |

| | | |

| | (2) | Aggregate number of securities to which transaction applies: |

| | | |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | | |

| | (4) | Proposed maximum aggregate value of transaction: |

| | | |

| | (5) | Total fee paid: |

| | | |

☐ | Fee paid previously with preliminary materials. |

☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | Amount Previously Paid: |

| | | |

| | (2) | Form, Schedule or Registration Statement No.: |

| | | |

| | (3) | Filing Party: |

| | | |

| | (4) | Date Filed: |

| | | |

TROPICANA LAS VEGAS HOTEL AND CASINO, INC.

3801 Las Vegas Boulevard South

Las Vegas, Nevada 89109

NOTICE OF ANNUAL MEETINGOF STOCKHOLDERS

TO BE HELD ON APRIL 28, 2015

To the Stockholders:

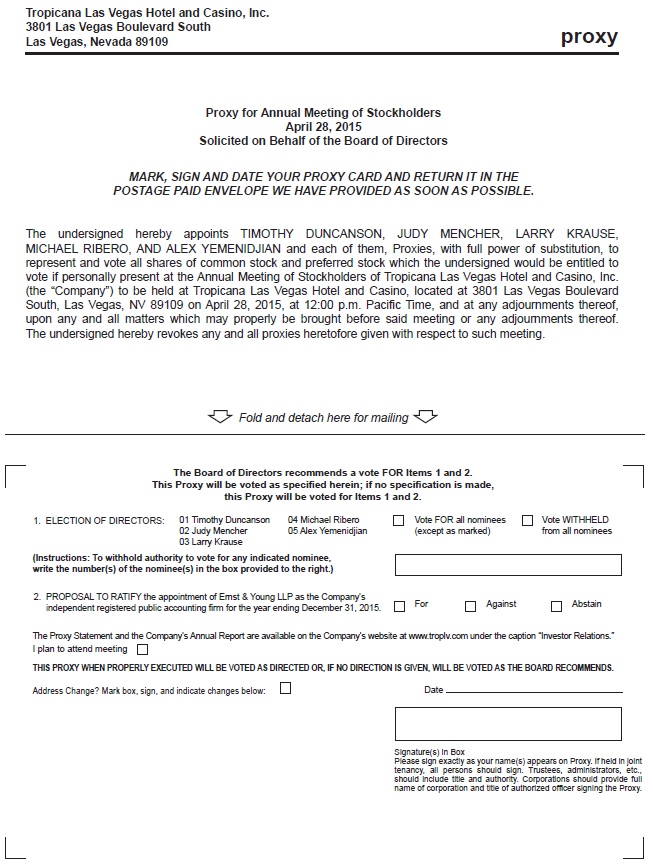

The Annual Meeting of Stockholders (the “Annual Meeting”) of Tropicana Las Vegas Hotel and Casino, Inc., a Delaware corporation (the “Company”), will be held at Tropicana Las Vegas Hotel and Casino, located at 3801 Las Vegas Boulevard South, Las Vegas, Nevada 89109 on April 28, 2015, at 12:00 p.m., Pacific Time, for the following purposes:

| | 1. | To elect five directors to serve on the Company’s Board of Directors for the coming year, each to hold office until the next annual meeting of stockholders (or until his or her respective successor has been elected and qualified or until his or her earlier resignation or removal); |

| | | |

| | 2. | To ratify the appointment of Ernst & Young LLP as the Company’s independent auditors for the year ending December 31, 2015; and |

| | | |

| | 3. | To act upon such other business as may properly come before the Annual Meeting or before any postponements or adjournments thereof. |

Stockholders of record at the close of business on March 10, 2015 are entitled to notice of and to vote at the Annual Meeting. A complete list of such stockholders will be available for examination by any stockholder during ordinary business hours at the Company’s executive offices, located at 3801 Las Vegas Boulevard South, Las Vegas, Nevada 89109, for a period of 10 days prior to the meeting date.

All stockholders are cordially invited to attend the Annual Meeting. You may vote in person by attending the Annual Meeting or by completing and returning your proxy card by mail. To submit your proxy card by mail, please cast your vote by completing, signing and dating the enclosed proxy card and returning promptly in the accompanying envelope.

YOUR BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS

THAT YOU VOTE “FOR” PROPOSALS 1 AND 2.

| | By Order of the Board of Directors, |

| | |

| | |

| |  |

| | Alex Yemenidjian |

| | Chairman of the Board, President |

| | and Chief Executive Officer |

| | |

March 19, 2015 | |

YOUR VOTE IS IMPORTANT.PLEASE DATE, SIGN AND MAIL THE ENCLOSED PROXY CARD.

Use of the enclosed envelope requires no postage for mailing in the United States.

Tropicana Las Vegas Hotel and Casino, Inc., Proxy Statement and Form 10-K for year ending December 31, 2014 are available at on our website atwww.troplv.com under Investor Relations.

Tropicana Las Vegas Hotel and Casino, Inc.

3801 Las Vegas Boulevard South

Las Vegas, Nevada 89109

PROXY STATEMENT

GENERAL INFORMATION

We are sending you this Proxy Statement in connection with the solicitation of proxies by our Board of Directors (the “Board” or “Board of Directors”) for use at the Annual Meeting of Stockholders of Tropicana Las Vegas Hotel and Casino, Inc., to be held at Tropicana Las Vegas Hotel and Casino, located at 3801 Las Vegas Boulevard South, Las Vegas, Nevada 89109 on April 28, 2015, at 12:00 p.m., Pacific Time, and at any postponements or adjournments thereof. Tropicana Las Vegas Hotel and Casino, Inc., together with its subsidiaries, is referred to herein as the “Company,” unless the context indicates otherwise.

Matters to be considered and acted upon at the meeting are set forth in the Notice of Annual Meeting accompanying this Proxy Statement and are more fully outlined herein. This Proxy Statement will be first mailed to stockholders on or about March 27, 2015.

Proposals

At the Annual Meeting, we are asking our stockholders to consider and vote upon:

1. the election of five directors to serve on the Company’s Board of Directors for the coming year, each to hold office until the next annual meeting of stockholders (or until his or her respective successor has been elected and qualified or until his or her earlier resignation or removal);

2. the ratification of the appointment of Ernst & Young LLP as the Company’s independent auditors for the year ending December 31, 2015; and

3. any other business as may properly come before the Annual Meeting or any postponements or adjournments thereof.

Voting Rights and Outstanding Shares

Only stockholders of record of our Class A Common Stock (“Class A Common”), Class A Convertible Participating Preferred Stock (“A1 Preferred”), Class A Series 2 Convertible Participating Preferred Stock (“A2 Preferred”), Class A Series 3 Convertible Participating Preferred Stock (“A3 Preferred”), and Class A Series 4 Convertible Participating Preferred Stock (“A4 Preferred and, together with the A1 Preferred, A2 Preferred and A3 Preferred, the “Class A Preferred”), in each case, on March 10, 2015, the record date, will be entitled to vote at the meeting. Each stockholder of record is entitled to one vote for each share of Class A Common held on that date on all matters that may come before the meeting; provided, however, that a holder of record of shares of our Class A Preferred held on that date will be deemed, for the purposes of voting at the annual meeting, to be a holder of record as of such date of such maximum number of shares of Class A Common into which such shares of our Class A Preferred would convert.

For the purposes of the meeting, holders of record of our Class A Common and our Class A Preferred will vote as one class. There is no cumulative voting in the election of directors. The authorized capital stock of the Company presently consists of: 16,500,000 shares of Class A Common; 16,500,000 shares of non-voting Class B Common Stock (“Class B Common”); and 2,062,202 shares of preferred stock. At the close of business on March 10, 2015, only 4,670,151shares of Class A Common Stock, 750,000 shares of A1 Preferred (convertible into an aggregate of 3,000,000 shares of Class A Common as of the record date), 545,585 shares of A2 Preferred (convertible into an aggregate of 2,182,340 shares of Class A Common Stock as of the record date), 350,000 shares of A3 Preferred (convertible into an aggregate of 2,333,333 shares of Class A Common as of the record date) and 416,500 shares of A4 Preferred (convertible into an aggregate of 4,165,000 shares of Class A Common as of the record date) were outstanding and entitled to vote.

You may vote in person by attending the meeting or by completing and returning a proxy by mail. To submit your proxy by mail, mark your vote on the enclosed proxy card, then follow the instructions on the card. All shares represented by properly submitted proxies will, unless such proxies have previously been revoked, be voted at the meeting in accordance with the directions on the proxies. If no direction is indicated, the shares will be voted in favor of the nominees for the Board of Directors listed in this Proxy Statement, and in favor of Proposal 2 as described herein. By signing, dating and returning the enclosed proxy card, you will confer discretionary authority on the named proxies to vote on any matter not specified in the Notice of Annual Meeting. Management knows of no other business to be transacted, but if any other matters do come before the meeting, the persons named as proxies or their substitutes will vote or act with respect to such other matters in accordance with their best judgment.

Quorum and Votes Required

For the purposes of this section, references to shares of Class A Common shall include shares of Class A Common that would be issuable upon full conversion of shares of Class A Preferred. The presence, in person or by proxy, of the holders of at least a majority of the total number of outstanding shares of the Class A Common is necessary to constitute a quorum at the meeting. The affirmative vote of a plurality of the votes cast at the meeting will be required for the election of directors. The individuals nominated for election to the Board of Directors have been selected pursuant to the terms and conditions of that certain Stockholders’ Agreement, dated July 1, 2009 (the “Stockholders’ Agreement”), among each of our stockholders and us, and, under the terms of such Stockholders’ Agreement, each of our stockholders are obligated to vote for such nominees. You should read the full text of the Stockholders’ Agreement, which was included as an exhibit in the Registration Statement filed on February 16, 2010. This will provide you with the required number and makeup of our board of directors.

The affirmative vote of a majority of the shares of Class A Common represented at the meeting in person or by proxy and entitled to vote on the proposals will be required for approval of Proposal 2, assuming that a quorum is present or represented at the meeting. A properly executed proxy marked “WITHHOLD AUTHORITY” with respect to the election of one or more directors will not be voted with respect to the director or directors indicated, and will have no effect. With respect to the other proposal, a properly executed proxy marked “ABSTAIN,” although counted for purposes of determining whether there is a quorum, will not be voted. Accordingly, an abstention will have the same effect as a vote cast against a proposal.

How to Revoke or Change Your Vote

Any proxy given pursuant to this solicitation may be changed or revoked by delivering written notice of your revocation to the Secretary of the Company at any time before the annual meeting. You may also revoke your proxy by attending the annual meeting and voting in person. Attendance at the Annual Meeting itself will not revoke a proxy.

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting onApril 28, 2015

This Proxy Statement and the Company’s Annual Report on Form 10-K will be available on the Company’s website atwww.troplv.comunder the caption “Investor Relations.” In the future, in accordance with rules and regulations recently adopted by the Securities and Exchange Commission (the “Commission”), instead of mailing a printed copy of our proxy materials, we may furnish proxy materials on the Internet. In that case, we will mail you a Notice of Internet Availability of Proxy Materials that will instruct you how to access and review the information in the proxy materials.

Voting Results

The voting results of the Annual Meeting will be published no later than four business days after the Annual Meeting on a Form 8-K filed with the Commission, which will be available on the Company’s website atwww.troplv.comunder the caption “Investor Relations.”

SECURITY OWNERSHIP OF CERTAIN BENEFICAL OWNERS AND MANAGEMENT

The following table sets forth information regarding the beneficial ownership of our Class A Common as of March 10, 2015 with regard to the following criteria (i) each person, or group of affiliated persons, known to us to own beneficially 5% or more of our outstanding common stock; (ii) each of our directors; (iii) each of our named executive officers; and (iv) all of our directors and named executive officers as a group. Under Commission rules, beneficial ownership of a class of capital stock includes any shares of such class as to which a person, directly or indirectly, has or shares voting power or investment power and also any shares as to which a person has the right to acquire such voting or investment power within 60 days through the exercise of any stock option, warrant or other right. If two or more persons share voting power or investment power with respect to specific securities, each such person is deemed to be the beneficial owner of such securities. Except as we otherwise indicate below and under applicable community property laws, we believe that the beneficial owners of the common stock listed below, based on information they have furnished to us, have sole voting and investment power with respect to the shares shown. Unless otherwise noted below, the address for each holder listed below is c/o Tropicana Las Vegas Hotel and Casino, Inc., 3801 Las Vegas Boulevard South, Las Vegas, Nevada 89109.

The calculations of beneficial ownership in this table are based on 4,670,151 shares of our Class A Common, 750,000 shares of our A1 Preferred, convertible into 3,000,000 shares of Class A Common (assuming an exchange ratio of 4:1), 545,585 shares of our A2 Preferred, convertible into 2,182,340 shares of Class A Common (assuming an exchange ratio of 4:1), 350,000 shares of our A3 Preferred, convertible into 2,333,333 of Class A Common (assuming an exchange ratio of 6.67:1), and 416,500 shares of our A4 Preferred, convertible into 4,165,000 of Class A Common (assuming an exchange ratio of 10:1), outstanding as of March 10, 2015.

Names of Beneficial Owner | | Beneficial Ownership

of Class A

Common | |

| | | Shares | | Percent | |

Principal Stockholders: | | | | | |

All stockholders party to the Stockholders’ Agreement(1) | | 16,350,824 | | 100.0 | % |

| | | | | | |

Directors and Executive Officers: | | | | | |

Alex Yemenidjian(2) | | 16,350,824 | | 100.0 | % |

Timothy Duncanson(2) | | 16,350,824 | | 100.0 | % |

Judy Mencher(3) | | 4,000 | | ** | |

Larry Krause(3) | | 4,000 | * | ** | |

Michael Ribero(3) | | 4,000 | | ** | |

Joanne Beckett | | — | | — | |

Jason Goudie | | — | | — | |

All Directors and Executive Officers as a Group (7 persons): | | 16,350,824 | | 100.0 | % |

Notes

(1) | All of our stockholders are a party to the Stockholders’ Agreement, which contains certain agreements as to voting. As a result, all of our stockholders may be deemed to be a group for the purposes of Section 13 of the Securities and Exchange Act of 1934, as amended, with each of such stockholders being deemed to have beneficial ownership of all of the shares owned by the group. However, except as otherwise noted, each of our stockholders disclaims beneficial ownership of shares of our capital stock not held directly by such stockholder. The table below shows the direct ownership (excluding the deemed beneficial ownership of shares held by other members of the group as a result of the Stockholders’ Agreement) of all of our stockholders of shares of our Class A Common assuming full conversion of all shares of A1 Preferred and A2 Preferred into Class A Common at an exchange ratio of 4:1, A3 Preferred into Class A Common at an exchange ratio of 6.67:1 and A4 Preferred into Class A Common at an exchange ratio of 10:1. The exchange ratio may increase to the extent dividends on the A1 Preferred, A2 Preferred, A3 Preferred, or A4 Preferred accrue and are unpaid. |

We currently have no stock options or other rights outstanding that would give any of our stockholders the right to acquire voting or investment power over additional shares of our capital stock, other than the rights of holders of our A1 Preferred, A2 Preferred, A3 Preferred and A4 Preferred to convert their shares of Class A Preferred into shares of Class A Common or our Class B Common. Class B Common, of which there are currently no outstanding shares, is identical in every respect to Class A Common except that Class B Common has no voting rights. Shares of Class A Common may be converted at any time for an equal number of shares of Class B Common, and vice versa. However, a holder of our shares of A1 Preferred, A2 Preferred, A3 Preferred, A4 Preferred or Class B Common may only convert such shares into Class A Common if such holder has received all necessary licenses, findings of suitability or other approvals from applicable Nevada gaming authorities.

(2) | Includes the 3,328,447 shares of Class A Common and 1,754,831 shares of Class A Preferred before conversion, all of which are considered beneficially owned by Trilliant Gaming (see Note 1 above). The remaining shares of Class A Common Stock indicated as being beneficially owned by Messrs. Yemenidjian and Duncanson are shares of Class A Common Stock and shares of Class A Common Stock issuable upon the conversion of shares of Class A Preferred Stock held by other parties to the Stockholders’ Agreement (see Note 1 below), which shares Messrs. Yemenidjian and Duncanson disclaim beneficial ownership. |

(3) | Each of Ms. Judy Mencher, Mr. Larry Krause and Mr. Michael Ribero was elected pursuant to the terms of the Stockholders’ Agreement, with Mr. Krause and Mr. Ribero being an independent director designated by OCP I LP, Onex Corporation and their affiliates, or the Onex Stockholders, and Ms. Mencher being an independent director appointed by our minority stockholders, defined as stockholders (other than Onex Corporation) with beneficial ownership of more than 5% of the outstanding shares of our capital stock. Ms. Mencher, Mr. Krause and Mr. Ribero meet the qualifications of an independent director under the rules promulgated by the New York Stock Exchange. Ms. Mencher, Mr. Krause and Mr. Ribero hold a small interest of Class A Common directly, however, each disclaims beneficial ownership of any shares of Class A Common beneficially owned by other parties. |

| | |

| * | Restricted stock with vesting schedule. |

| ** | Represents holding percentage of less than 1%. |

Principal Stockholder Table

Name and Address of Beneficial Owner (from Note 1 above) | | Class A Common Assuming Full Conversion of

A1 Preferred, A2 Preferred, A3 Preferred, and A4 Preferred. | |

| | | Shares | | | Percent | |

Trilliant Gaming Nevada Inc. (a)

161 Bay Street, Suite 4900

Toronto, Ontario Canada MSJ 2S1 | | | 13,513,904 | | | | 82.7 | % |

| | | | | | | | | |

Wells Fargo Principal Investment, LLC (b)

2450 Colorado Avenue, Suite 3000

Santa Monica, CA 90404-3575 | | | 1,437,135 | | | | 8.8 | % |

| | | | | | | | | |

H/2 Special Opportunities L.P. and H/2 Special Opportunities Ltd. (c)

c/o H/2 Capital Partners

680 Washington Boulevard,7th Floor

Stamford, CT 06901 | | | 824,629 | | | | 5.0 | % |

| | | | | | | | | |

Aozora Bank Ltd.

Attn: Naoki Sawa

3-1 Kudan-Minami 1-Chrome

Chiyoda-Ku 102-8660

Tokyo, Japan | | | 110,000 | | | | * | |

| | | | | | | | | |

Embassy & Co.

1555 N. Rivercenter Drive, Suite 302

Milwaukee, WI 53212-3958 | | | 100,000 | | | | * | |

| | | | | | | | | |

Federal Deposit Insurance Corporation Receiver/ Community Bank of Nevada

Attn: Capital Markets 8017-A

550 17th Street NW

Washington, DC 20429 | | | 100,000 | | | | * | |

| | | | | | | | | |

Fidelity ADV Series I Fidelity Advisors / Floating Rate High Income Fund (d)

c/o Fidelity Investments

Attn: Bank Debt Custody

82 Devonshire Street 21D

Boston, MA 02109-3605 | | | 48,650 | | | | * | |

| | | | | | | | | |

Newcastle CDO IX I Ltd.

c/o LaSalle Global Trust Services

Attn: Michael C. McLoughlin

1345 Avenue of the Americas, Floor 20

New York, NY 10105-2203 | | | 30,000 | | | | * | |

| | | | | | | | | |

State Street Bank & Trust (e)

PO Box 5756

Boston, MA 02206-5756 | | | 29,772 | | | | * | |

| | | | | | | | | |

Fifth Street Station LLC. (f)

505 5th Ave. S. STE 900

Seattle, WA 98104-3281 | | | 21,252 | | | | * | |

| | | | | | | | | |

Merrill Lynch Pierce Fenner & Smith Inc.

c/o The Bank of America

Attn: Information Mgmt Team

214 N Tyron Street NC1-027-15-01

Houston, TX 77002-3001 | | | 21,082 | | | | * | |

| | | | | | | | | |

US Bank NA (g)

Attn: Brenna Sears and Jessica Clark

1 Federal Street, 3rd Floor

Boston, MA 02110-2003 | | | 14,000 | | | | * | |

Name and Address of Beneficial Owner (from Note 1 above) | | Class A Common Assuming Full Conversion of

A1 Preferred, A2 Preferred, A3 Preferred, and A4 Preferred. | |

| | | Shares | | | Percent | |

General Electric Pension Trust (h)

c/o GE Asset Management Incorporated

Attn: Nancy Garofalo

3001 Summer Street, Suite 5

Stamford, CT 06905-4321 | | | 13,000 | | | | * | |

| | | | | | | | | |

Ocean Trails CLO I Ltd.

c/o West Gate Horizons Advisors LLC

Attn: Cheryl Wasilewski

633 W 5th Street, STE 6600

Los Angeles, CA 90071-1571 | | | 10,000 | | | | * | |

| | | | | | | | | |

Ocean Trails CLO II Ltd.

c/o West Gate Horizons Advisors LLC

Attn: Cheryl Wasilewski

633 W 5th Street, STE 6600

Los Angeles, CA 90071-1571 | | | 10,000 | | | | * | |

| | | | | | | | | |

WG Horizons CLO I

c/o West Gate Horizons Advisors LLC

Attn: Cheryl Wasilewski

633 W 5th Street, STE 6600

Los Angeles, CA 90071-1571 | | | 10,000 | | | | * | |

| | | | | | | | | |

Whitehorse V Ltd.

c/o Ethan Underwood

200 Crescent Court, Suite 1414

Dallas, TX 75201-6960 | | | 10,000 | | | | * | |

| | | | | | | | | |

Wells Capital Management, Inc. (i)

Attn: Will King

525 Market Street 10th Floor

San Francisco, CA 94105-2718 | | | 9,592 | | | | * | |

| | | | | | | | | |

Prospero CLO II BV

c/o The Bank of New York

Attn: Rawazba Boudiab

601 Travis Street, 16th Floor

Houston, TX 77002-3001 | | | 8,000 | | | | * | |

| | | | | | | | | |

EMSEG & Co. (j)

c/o Wells Fargo & Bank MN NA

PO Box 1450

WF 9919

Minneapolis, MN 55845 | | | 5,308 | | | | * | |

| | | | | | | | | |

USB Securities LLC

c/o Jordan Michels

677 Washington Blvd.

Stamford, CT 06901 | | | 5,000 | | | | * | |

| | | | | | | | | |

Credit Suisse Securities (USA)

Attn: David Rossilli /Dan Skrilivetsky

11 Madison Avenue 5th Floor

New York, NY 10010 | | | 3,500 | | | | * | |

| | | | | | | | | |

John Redmond

11492 Snow Creek Ave

Las Vegas, NV 89135 | | | 4,000 | | | | * | |

| | | | | | | | | |

Judy Mencher (l) | | | 4,000 | | | | * | |

Michael Ribero (l) | | | 4,000 | | | | * | |

Larry Krause (k and l) | | | 4,000 | | | | * | |

| | | | | | | | | |

Total | | | 16,350,824 | | | | 100 | % |

Notes

(a) | Consists of shares held by Onex Armenco Gaming I LP (1,931,407 shares of Class A Common, 382,623 shares of A1 Preferred, 284,823 shares of A2 Preferred, 179,501 shares of A3 Preferred and 251,598 shares of A4 Preferred), Onex Armenco Gaming II LP (358,245 shares of Class A Common, 23,058 shares of A1 Preferred, 18,048 shares of A2 Preferred, 11,258 shares of A3 Preferred, and 13,085 shares of A4 Preferred), Onex Armenco Gaming III LP (71,524 shares of Class A Common,14,170 shares of A1 Preferred, 10,547 shares of A2 Preferred, 6,647 shares of A3 Preferred, and 9,317 shares of A4 Preferred), Onex Armenco Gaming IV LP (45,922 shares of Class A Common, 9,097 shares of A1 Preferred, 6,773 shares of A2 Preferred, 4,268 shares of A3 Preferred, and 5,981 shares of A4 Preferred), Onex Armenco Gaming V LP (71,524 shares of Class A Common, 14,170 shares of A1 Preferred, 10,547 shares of A2 Preferred, 6,647 shares of A3 Preferred, and 9,317 shares of A4 Preferred), Onex Armenco Gaming VI LP (40,054 shares of Class A Common, 7,935 shares of A1 Preferred, 5,906 shares of A2 Preferred, 3,722 shares of A3 Preferred, and 5,217 shares of A4 Preferred), Onex Armenco Gaming VII LP (31,673 shares of Class A Common, 6,274 shares of A1 Preferred, 4,671 shares of A2 Preferred, 2,943 shares of A3 Preferred, and 4,126 shares of A4 Preferred), Onex Armenco Gaming IX LP (27,933 shares of Class A Common, 5,533 shares of A1 Preferred, 4,119 shares of A2 Preferred, 2,596 shares of A3 Preferred, and 3,638 shares of A4 Preferred) and Onex Armenco Gaming X LP (678,641 shares of Class A Common, 134,442 shares of A1 Preferred, 100,078 shares of A2 Preferred, 63,071 shares of A3 Preferred, and 88,404 shares of A4 Preferred) and Onex Armenco Gaming XI LP (71,524 shares of Class A Common, 14,170 shares of A1 Preferred, 10,547 shares of A2 Preferred, 6,647 shares of A3 Preferred, and 9,317 shares of A4 Preferred). Trilliant Gaming Nevada Inc. (“Trilliant Gaming”) is the general partner of, and controls all voting and investment decision of, each of the Onex Armenco Gaming Entities. Each of Mr. Alex Yemenidjian, our Chairman, Chief Executive Officer and President, Mr. Timothy Duncanson, one of our directors, and Mr. Gerald Schwartz, the chairman and controlling stockholder of Onex Corporation, owns one-third of the outstanding voting securities of Trilliant Gaming and together Messrs. Yemenidjian, Duncanson and Schwartz own 100% of the outstanding voting securities of Trilliant Gaming. A stockholders agreement among Messrs. Yemenidjian, Duncanson and Schwartz sets forth the rights of each of them with respect to control of Trilliant Gaming and, in turn, the securities of the Company owned by the Onex Armenco Gaming Entities. The Onex Armenco Gaming Entities were formed by entities affiliated with Onex Corporation. As a result, Trilliant Gaming and, in turn, Messrs. Yemenidjian, Duncanson and Schwartz, may be deemed to have beneficial ownership of the shares of Class A Common held by the Onex Armenco Gaming Entities, but disclaim beneficial ownership of shares held by parties other than these entities. Each of these entities disclaims beneficial ownership of shares held by parties other than these entities. |

(b) | Consists of 502,800 shares of Class A Common, 85,172 shares of A1 Preferred, 45,585 shares of A2 Preferred, 36,946 shares of A3 Preferred and 16,500 shares of A4 Preferred. Wells Fargo Principal Investments, LLC is a wholly-owned subsidiary of Wells Fargo & Company, or Wells Fargo, a diversified financial services company. Wells Fargo may be deemed to have beneficial ownership of shares of our company held by Wells Fargo Principal Investments, LLC. |

(c) | Consists of 294,672 shares of Class A Common, 48,701 shares of A1 Preferred, 40,865 shares of A2 Preferred, and 25,754 of A3 Preferred. H/2 Special Opportunities Ltd. has ownership of 3,839 shares of Class A Common and H/2 Special Opportunities L.P. owns the remaining shares. H/2 Special Opportunities Ltd. is wholly-owned by H/2 Opportunities L.P. By virtue of his status as the managing member of H/2 SOGP LLC, which is the general partner of H/2 L.P,; Spencer Haber may be deemed to be the beneficial owner of the shares of our company held directly by H/2 Special Opportunities L.P., and H/2 Opportunities Ltd., which shares may also be deemed to be beneficially owned by H/2 SOGP LLC and H/2 Special Opportunities L.P. |

(d) | Consists of 48,650 shares of Class A Common. Fidelity Advisor Series I: Fidelity Advisor Floating Rate High Income Fund (“Fidelity Advisor Series I”) is an open-end investment company registered under the Investment Company Act of 1940 and advised by Fidelity Management & Research Company, a wholly-owned subsidiary of FMR LLC and an investment adviser registered under the Investment Advisers Act of 1940. Fidelity Advisor Series I is the record owner of the shares reported but has reported that it does not have a pecuniary interest in such shares. |

(e) | Consists of shares held by Blazerman & Co. (5,000 shares of Class A Common and 333 shares of A2 Preferred), Cruiselake & Co. (840 shares of Class A2 Preferred), Deckship & Co. (7,500 shares of Class A Common) and Wateredge & Co. (7,500 shares of Class A Common and 1,270 shares of Class A1 Preferred). Each of these entities disclaims beneficial ownership of shares held by parties other than these entities. |

(f) | Consists of shares of 10,000 shares of Class A Common, 1,693 shares of A1 Preferred, and 1,120 shares of A2 Preferred. |

(g) | Consists of shares of Class A Common held by Veritas CLO I Ltd. (6,000 shares) and Veritas CLO II Ltd. (8,000 shares). Each of these entities disclaims beneficial ownership of shares held by parties other than these entities. |

(h) | Consists of 13,000 shares Class A Common. GE Capital Debt Advisors (“GECDA”) is an investment manager of General Electric Pension Trust (“GEPT”). GEPT shares voting and dispositive power over the shares reported and may be deemed to be the beneficial owner of such shares, though GEPT has a 100% pecuniary interest in the shares reported. |

(i) | Consists of shares of 2,500 shares of Class A Common, 1,269 shares of A1 Preferred, and 504 shares of A2 Preferred. |

(j) | Consists of shares of 2,500 shares of Class A Common, 423 shares of A1 Preferred, and 279 shares of A2 Preferred. |

(k) | Consists of Class A Common shares with a restricted vesting schedule. |

(l) | The address for each holder is c/o Tropicana Las Vegas Hotel and Casino, Inc., 3801 Las Vegas Boulevard South, Las Vegas, Nevada 89109. |

| | |

| * | Represents holding percentage of less than 1%. |

PROPOSAL 1 -ELECTION OF DIRECTORS

The Board of Directors recommends a vote FOR thenominees.

Information Concerning the Directors, Nominees and Executive Officers

One of the purposes of the Annual Meeting is to elect five directors, each of whom will serve until the next annual meeting of stockholders or until his or her respective successor has been elected and qualified or until his or her earlier resignation or removal. Pursuant to our bylaws, the number of directors is fixed at five. Pursuant to the Stockholders' Agreement, OCP I LP, Onex Corporation or any of their respective affiliates (collectively, the "Onex Stockholders") currently has the right to designate three members to the Board of Directors.

The following information is provided with respect to the directors, nominees and executive officers as of February 28, 2015. All of the nominees listed below currently serve on the Board of Directors and were previously elected by the stockholders or appointed by the Board pursuant to the Stockholders’ Agreement.

Name | | Age | | Position(s) |

Alex Yemenidjian | | 59 | | Chairman of the Board, CEO and President, and Nominee |

Timothy Duncanson | | 47 | | Director and Nominee |

Judy Mencher | | 58 | | Director and Nominee |

Michael Ribero | | 58 | | Director and Nominee |

Larry Krause | | 65 | | Director and Nominee |

Joanne Beckett | | 54 | | Vice President, General Counsel and Corporate Secretary |

Jason Goudie | | 43 | | Vice President and Chief Financial Officer |

Directors/Nominees

Alex Yemenidjian is our Chairman of the Board, Chief Executive Officer and President and has served as such since our company was founded in June 2009. Mr. Yemenidjian has served as Chairman of the Board and Chief Executive Officer of Armenco Holdings, LLC, a private holding company, since January 2005. He served as Chairman of the Board and Chief Executive Officer of Metro-Goldwyn-Mayer Inc., a video and theatrical production and distribution company, from April 1999 until April 2005 and was a director thereof from November 1997 until April 2005. Mr. Yemenidjian also served as a director of MGM Resorts International (formerly known as MGM MIRAGE or MGM Grand, Inc.), a hospitality and gaming company, from 1989 until 2005 and it’s Chief Operating Officer from June 1995 until April 1999. Mr. Yemenidjian is currently a director and chairman of the compensation committee as well as a member of the audit committee ofGuess?, Inc., an apparel and accessory design, marketing, distribution and licensing company, a director and chairman of the audit committee of Regal Entertainment Group, a public company that owns and operates multi-screen movie theaters, and a trustee of Baron Investment Funds Trust and Baron Select Funds, mutual funds. Mr. Yemenidjian has a bachelor degree in business administration and accounting from California State University, Northridge and a master’s degree in business taxation from the University of Southern California. Pursuant to the terms and conditions of the Stockholders’ Agreement, as long as Mr. Yemenidjian remains the Chief Executive Officer of our company, the Board of Directors must nominate, and the stockholders must elect, Mr. Yemenidjian as a director of our company. Therefore, the Stockholders’ Agreement does not provide the stockholders with any discretion whether or not to elect Mr. Yemenidjian.

Timothy Duncanson was appointed to our Board of Directors in June 2009 and serves as the chairman of our compensation and governance committee. Since January 2005, Mr. Duncanson has served as a managing director at Onex Corporation, a private equity investment and asset management company, and serves on the board of directors of several privately-held companies owned by Onex Corporation. Prior to joining Onex Corporation in 1999, Mr. Duncanson was an associate at Lazard Feres & Co LLC, an investment bank, and an investment analyst at Mutual Asset Management, a money management firm. Mr. Duncanson is currently lifetime member of the Corporation of Huron University College. Mr. Duncanson is a chartered financial analyst and has an honors degree in history from Huron University and has masters’ degrees in public policy and business administration from Harvard University. Mr. Duncanson was selected as a nominee by the Onex Stockholders pursuant to the terms and conditions of the Stockholders’ Agreement. Pursuant to the terms of the Stockholders’ Agreement, the Board of Directors must nominate, and the stockholders must elect, Mr. Duncanson as a director of our company. Therefore, the Stockholders’ Agreement does not provide the stockholders with any discretion whether or not to elect Mr. Duncanson.

Judy Mencher was appointed to our Board of Directors in June 2009. Ms. Mencher is senior advisor to Champlain Advisors, LLC, placement agent for private equity funds, since September 2012. Prior to that, Ms. Mencher was the President, Debt Investment Group for GB Merchant Partners, LLC, a Gordon Brothers Company from July 2010 through August 2012. Ms. Mencher was a co-founder of DDJ Capital Management, a high yield, special situations and distressed investment manager, and held a principal position from 1996 through 2010. Ms. Mencher has served on the board of a number of private companies owned by DDJ Capital Management. Prior to co-founding DDJ Capital Management, Ms. Mencher was a vice president and associate general counsel at Fidelity Investments, a financial services firm, from 1990 until 1996 and a partner at the law firm Goodwin Procter LLP from 1983 until 1990. Ms. Mencher serves on the board of directors of several private companies. Ms. Mencher has a bachelor degree in economics from Tufts University, a law degree and a master’s degree in business administration from Boston University. Ms. Mencher is currently a board member and member of the compensation committee for NMH, LLC. Ms. Mencher was selected as a nominee by the non-Onex Stockholders pursuant to the terms and conditions of the Stockholders’ Agreement. Pursuant to the terms of the Stockholders’ Agreement, the Board of Directors must nominate, and the stockholders must elect the nominee, Ms. Mencher as a director of our company. Therefore, the Stockholders’ Agreement does not provide the stockholders with any discretion whether or not to elect Ms. Mencher.

MichaelRibero was appointed to our Board of Directors in September 2011 and was our Strategic Advisor to the Office of the Chairman from March 19, 2012 through December 31, 2012. Mr. Ribero served as the Chairman of SONIFI Solutions from October 2014 through January 2015 and their Chief Executive Officer from March 2013 through September 2014. Prior to that, Mr. Ribero was founder and principal of Captive Commercial Media, LLC, an executive consulting firm focused on media, entertainment and hospitality from August 2009 through March 2013. Mr. Ribero previously served as president and chief executive officer of IdeaCast, Inc., a location-based television advertising company, from November 2008 until its sale in July 2009, and chairman and chief executive officer of Reactrix Inc., an out-of-home advertising company, from May 2003 until October 2008. From 2001 until 2003, Mr. Ribero was president of Brierley & Partners, a leading direct marketing and customer loyalty solutions provider, and president of e-Rewards, Inc., a loyalty based spin-off of Brierley & Partners. Prior to that, Mr. Ribero spent six years in the video gaming industry, including as executive vice president of worldwide publishing of Midway Games, Inc., an American video game publisher of Mortal Kombat and other popular video games, chairman and chief executive officer of Radical Entertainment, a Canadian video game developer and now subsidiary of the American video game publisher Activision Blizzard, Inc., and executive vice president and chief marketing officer of SEGA of America, Inc, the American subsidiary of the Japanese video game company SEGA Corporation. Before entering the video gaming industry, Mr. Ribero held positions in other industries including executive vice president and chief marketing and strategy officer of Hilton Hotels Corporation and vice president of marketing programs of Eastern Airlines, Inc. Mr. Ribero started his career in brand management at Proctor & Gamble, and currently serves on the board of directors of the U.S. Marketing College. Mr. Ribero has a bachelor degree in industrial engineering and operations research from the University of Florida. Mr. Ribero was designated for nomination to the Board by the Onex Stockholders. Pursuant to the terms of the Stockholders’ Agreement, the Board of Directors must nominate, and the stockholders must elect the nominee, Mr. Ribero as a director of our company. Therefore, the Stockholders’ Agreement does not provide the stockholders with any discretion whether or not to elect Mr. Ribero.

Larry Krause was appointed to our Board of Directors in July 2013. Mr. Krause currently is an outside consultant providing financial and accounting services. Mr. Krause served as the Managing Partner of Deloitte & Touche LLP’s Nevada practice from 2008 through May 2012. He initially joined Deloitte & Touche LLP as an Audit Partner in 2002. From 1999 until May 2002, Mr. Krause was the Partner-in-Charge of Arthur Andersen’s Las Vegas audit practice. Mr. Krause’s public accounting career spans nearly forty years with significant leadership positions in his firms’ hospitality and gaming industry practices. During this time, he served as lead client service partner for many publicly-held clients including Fortune 500 companies. Mr. Krause is a certified public accountant in Nevada and California. Mr. Krause is currently a board member and treasurer for the United Way of Southern Nevada. He has both a bachelor and master degree in business administration with a major in accounting from California State University, Northridge. Mr. Krause was designated for nomination to the Board by the Onex Stockholders. Pursuant to the terms of the Stockholders’ Agreement, the Board of Directors must nominate, and the stockholders must elect the nominee, Mr. Krause as a director of our company. Therefore, the Stockholders’ Agreement does not provide the stockholders with any discretion whether or not to elect Mr. Krause.

Executive Officers

Joanne Beckett has served as our Vice President, General Counsel and Corporate Secretary since June 2009. Prior to assuming this position, Ms. Beckett served as the senior vice president and general counsel at FX Luxury LLC, a company pursuing real estate and attraction-based projects, from February 2008 until June 2009, as senior vice president and general counsel of Golden Nugget, Inc., a hospitality and gaming company, from 1990 until February 2008 and as an associate at the law firm of Jolley, Urga, Wirth & Woodbury from 1986 until 1990. Ms. Beckett has a bachelor degree from the University of California, Irvine and a law degree from Pepperdine University.

Jason Goudie has served as our Vice President and Chief Financial Officer since July 2013. Prior to assuming this position, Mr. Goudie has served as the Chief Financial Officer of Aristocrat Technologies, Inc (“ATI”) from July 2011 through June 2013. ATI designs, manufactures, and sells gaming machines and casino management systems in North America and Latin America. From January 2008 through December 2010, Mr. Goudie was employed by The M Resort, LLC as the Chief Financial Officer and also had financial responsibility over a related company, Marnell Sher Gaming, LLC. Mr. Goudie’s roles with these companies included the financial responsibility for four separate hotel and casino operations in southern Nevada. In addition, Mr. Goudie has held various key financial and internal audit roles for Black Gaming and Harrah’s Entertainment, Inc. Mr. Goudie initially began his career with Arthur Andersen’s Nevada practice providing audit expertise to a number of hospitality and gaming clients. Mr. Goudie is a certified public accountant and has a bachelor’s degree in business administration with a major in accounting from the University of Nevada, Las Vegas.

CORPORATE GOVERNANCE

Nomination of Directors

The Board of Directors does not have a standing nominating committee. Identification, consideration and nomination of potential candidates to serve on the Board of Directors are currently determined pursuant to terms of the Stockholders’ Agreement. Under the Stockholders’ Agreement, the stockholders are responsible for the selection of the person to be nominated for directors, and the Board of Directors is obligated under the Stockholders’ Agreement to nominate such individuals properly selected by the stockholders under the Stockholders’ Agreement. In the absence of such contractual obligations, the Compensation and Governance Committee is discharged with the responsibility of developing criteria for Board membership and with the responsibility of identifying qualified candidates to become members of the board of directors. In such an event, the Compensation and Governance Committee, pursuant to its charter, would consider various factors, including personal and professional integrity, experience in corporate management, experience in our industry, experience as a director of a publicly held company, academic expertise in an area of our operations, and practical and mature business judgment. See “Compensation and Governance Committee.”

Because the nominees for directors are selected by the stockholders pursuant to the Stockholders Agreement, the Board of Directors does not currently have the discretion to take into consideration diversity or any other criteria for nominating individuals properly selected by the designated stockholders.

Pursuant to the Stockholders’ Agreement, the Board will currently only consider for nomination, and will nominate, individuals appointed by the appropriate stockholders under the Stockholders’ Agreement.

Director Independence

Although we are not subject to the rules promulgated by the New York Stock Exchange, for purposes of the Stockholders’ Agreement we have used the independence requirements set forth in these rules as a benchmark to determine whether our directors are independent. Pursuant to the Stockholders’ Agreement, two of the three directors appointed by the Onex Stockholders and the director appointed by the non-Onex Stockholders must qualify as “independent directors” under the rules of the New York Stock Exchange. Our board of directors has determined that Judy Mencher, Michael Ribero and Larry Krause meet such independence requirements.

Board Leadership Structure and Risk Oversight

Mr. Alex Yemenidjian is our Chairman of the Board (“Chairman”), Chief Executive Officer (“CEO”) and President and has served as such since our company was founded in June 2009. The Board believes that the most effective Board leadership structure for our company at the present time is for the CEO to continue to serve as Chairman of the Board. Combining the positions of Chairman and CEO provides our company with effective leadership in order to align the agenda of the Board with the dynamics of our company’s operations. The Board believes that Mr. Yemenidjian’s extensive knowledge of the company’s industry, operations and vision for its development makes him the best qualified person to serve as both Chairman and CEO. Because the CEO is ultimately responsible for the day-to-day operation of our company and for executing our company’s strategy, the Board believes that Mr. Yemenidjian is the director most qualified to act as Chairman of the Board.

The Board of Directors also believes that the Stockholders’ Agreement provides for independent oversight, including, the requirement that, as long as Mr. Yemenidjian is both a Director and the CEO of our company, the majority of the directors be independent directors. Furthermore, the various groups of stockholders are entitled to designate their respective nominee to the board of directors, and certain actions of the Company cannot be taken or be approved by the Board of Directors without the unanimous approval of all of the directors.

Our Board of Directors, together with management, oversees our company’s risk management and its ability to achieve our strategic objectives, to improve long-term organizational performance and to enhance stockholder value. Furthermore, the Audit Committee meets with our management to review the Company’s policies with respect to risk assessment and risk management. Because management of the company’s risks necessarily involves understanding the day-to-day activities of our company, the Board believes that having the CEO also function as the Chairman assists the Board in assessing the actions management has taken to limit, monitor or control our exposure to risks. In overseeing our risk management, the Board and the Audit Committee review with management the risks our company faces, the appropriate level of risk for our company, and what steps management is taking to manage those risks. While the Board of Directors has the ultimate oversight responsibility for the risk management process, various committees of the Board also have responsibility for risk management. The Audit Committee Charter provides that one of the Audit Committee’s responsibilities and duties is compliance oversight. The Audit Committee Charter provides that the Audit Committee shall discuss guidelines and policies governing the process by which our senior management and our relevant departments assess and manage our exposure to risk, as well as our major financial risk exposures and the steps management has taken to monitor and control such exposures. In addition, in setting compensation, the Compensation and Governance Committee strives to create incentives that encourage a level of risk-taking behavior consistent with our business strategy.

Code of Business Conduct and Ethics

The Board of Directors has adopted an Amended and Restated Code of Business Conduct and Ethics (the “Base Code of Conduct”) that applies to all of our directors and officers, including our senior financial officers, and other employees. In addition, the Audit Committee has adopted a Supplement to the Base Code of Conduct (the “Supplement” and, together with the Base Code of Conduct, the “Code of Conduct”) for senior financial officers with respect to full, fair, accurate, timely, and understandable disclosure in reports and documents that we file with, or submit to, the Commission and in other public communications made by us. The Code of Conduct establishes policies and procedures that the Board believes promote the highest standards of integrity, compliance with the law and personal accountability. The Company intends to disclose any changes in or waivers from this Code of Conduct by posting such information on our website atwww.troplv.comunder the caption “Investor Relations” or by filing a Form 8-K. The Code of Conduct is provided to all new directors, new officers, including new senior financial officer, and other new employees and the Supplement is provided to all new senior financial officers, in each case, each of whom is required to acknowledge in writing his or her receipt and understanding thereof and agreement to adhere to the principles contained therein.

Information Regarding Board and Committees

Board of Directors. The Board of Directors held four meetings during 2014. The work of our directors is performed not only at meetings of the Board of Directors and its committees, but also by consideration of our business through the review of documents and in numerous communications among Board members and others. During 2014, all members of the Board of Directors attended 100% of all meetings of the Board of Directors and the committees on which they served (held during the period for which they served). Directors are expected to attend each annual meeting of stockholders.

Audit Committee. For a complete discussion of the functions of the Audit Committee, see “Audit Committee” below. The current members of the Audit Committee are Larry Krause (Chair), Judy Mencher and Timothy Duncanson. The Audit Committee held four meetings during 2014.

Compensation and Governance Committee. For a complete discussion of the functions of the Compensation and Governance Committee, see “Compensation and Governance Committee” below. The current members of the Compensation and Governance Committee are Timothy Duncanson (Chair) and Judy Mencher. The Compensation and Governance Committee held three meetings during 2014.

GamingCompliance Committee. For a complete discussion of the functions of the Gaming Compliance, see “Gaming Compliance Committee” below. The current members of the Gaming Compliance Committee are Larry Krause (Chair) and other senior management. The Gaming Compliance Committee held seven meetings during 2014.

Compensation and Governance Committee

The responsibilities of the Compensation and Governance Committee (the “Compensation Committee”) are described in a written charter adopted by the Board of Directors. The Compensation Committee’s charter is posted on our website atwww.troplv.comunder the caption “Investor Relations.” The primary function of the Compensation Committee is to assist the Board of Directors in (1) nomination of directors, (2) developing and assessing our corporate governance policies and practices and (3) determining our compensation policies. With respect to nomination and corporate governance matters, the primary functions of the Compensation Committee is to: (1) absent superseding contractual obligations, such as those set forth in the Stockholders’ Agreement, develop and make recommendations to the Board of Directors for specific criteria for selecting directors, (2) absent superseding contractual obligations, make recommendations to the Board of Directors with respect to potential candidates to nominate for Board membership, (3) absent superseding contractual obligations, review and make recommendations to the Board of Directors with respect to membership on the Audit Committees, (4) develop, reassess and makes recommendations to the Chairman with respect to succession plans of our key officers elected by the Board, (5) oversee the annual self-evaluations of the Board as well as the Board’s evaluation of our management, (6) oversee the orientation program for new directors, and (7) assess and make recommendations with respect to our corporate governance practices. With respect to our compensation matters, the primary functions of the Compensation Committee is to (1) assess and make recommendations with respect to our compensation philosophy and policies, (2) approve corporate goals and objectives with respect to, and approve the composition and amount of, our compensation to our CEO, (3) review and approve compensation for our other officers, (4) review and make recommendations with respect to compensation for our non-management directors, (5) review and approve, and make recommendations to the Board with respect to, all employment agreements with officers, including any severance arrangements, (6) review, approve, and administer our incentive and compensation plans, and (7) review and discuss with management any public disclosure regarding our compensation policies.

In carrying out its functions, the Compensation Committee may delegate to a subcommittee of the Compensation Committee. In addition, the Compensation Committee consults with the executive officers to obtain performance results, legal and regulatory guidance, and market and industry data that may be relevant in determining compensation. In addition, the Compensation Committee consults with the Chief Executive Officer regarding the performance goals of the Company and of the executive officers. However, other than in connection with negotiating their respective employment agreements, the executive officers do not participate in determining the amount and type of compensation paid by the Company to the executive officers. Furthermore, the Compensation Committee has not engaged outside consultants on compensation-related matters. See “Executive and Director Compensation and Other Information—Executive Compensation—Compensation Discussion and Analysis.”

Audit Committee

The Audit Committee’s responsibilities are described in a written charter adopted by the Board of Directors, which is available on our website atwww.troplv.comunder the caption “Investor Relations.” The Audit Committee is responsible for providing independent, objective oversight of the Company’s financial reporting system. Amongst its various activities, the Audit Committee reviews:

| | ● | the adequacy of the Company’s internal controls and financial reporting process and the reliability of our financial statements; |

| | ● | the independence and performance of our internal auditors and independent accountants; and |

| | ● | our compliance with legal and regulatory requirements. |

The Audit Committee also appoints the independent accountants; reviews with such firm the plan, scope and results of the audit, the fees for the services performed, and periodically reviews their performance and independence from management.

Under the Code of Conduct, all conduct by an executive officer or a director that creates an actual, apparent, or potential conflict of interest must be fully disclosed to our General Counsel who will inform and seek the approval of the Audit Committee. Furthermore, the Audit Committee must discuss with management and the independent auditors any related-party transactions brought to the Audit Committee’s attention which could reasonably be expected to have a material impact on our financial statements.

The Audit Committee meets regularly in open sessions with the Company’s management, independent accountants and internal auditors. In addition, the Audit Committee meets regularly in closed sessions with the Company’s management, independent accountants and internal auditors, and reports its findings to the full Board of Directors.

The Board of Directors has determined that Mr. Krause (Chair of the Audit Committee) qualifies as an “audit committee financial expert,” as defined in Item 407(d)(5)(ii) of Regulation S-K.

Gaming ComplianceCommittee

The Company established a Gaming Compliance Committee (“Compliance Committee”) to oversee procedures to enhance the likelihood that no activities of the Company or any affiliate would impugn the reputation and integrity of the Company, any of the specific jurisdictions in which the Company maintains gaming operations, or the gaming industry in general.The Compliance Committee is responsible for insuring compliance with gaming laws applicable to the business operations of the Company in all jurisdictions in which the Company operates, performing probity review background investigations with respect to employees, directors, vendors and others providing services to the Company, and performing probity review background investigations with respect to proposed transactions and associations. The Compliance Committee will exercise its best efforts to identify and evaluate situations arising in the course of the business of the Company that may have a negative effect upon the objectives of gaming control.Thus, licensed gaming is conducted honestly and competitively and gaming is free from criminal and corruptive elements.

Appointments to the Compliance Committee are made by the Audit Committee, subject to any required approvals of Gaming Authorities. Appointments shall be for terms of no longer than three years. Members of the Compliance Committee may serve successive terms.

The Compliance Committee meets at least quarterly to review the information that has been gathered through reports, investigations or otherwise as required by its plan. As required by the circumstances, a special meeting (which may be conducted telephonically) may be called by any member and shall be called at the request of the Company.The Compliance Committee also meets in the first quarter of each year (or such other time as determined by the Audit Committee) with the Audit Committee to discuss the Annual Report submitted to the Chairman of the Nevada Board and to advise the Audit Committee of its activities and assessments of the plan over the preceding twelve months.

The Compliance Committee is not intended to displace the Board or the Company’s Executive Officers with decision-making authority but is intended to serve as an advisory body to better ensure that the Company’s goals of avoiding unsuitable situations and in entering into relationships exclusively with suitable persons remains satisfied.

Compensation Interlocks and Insider Participation

No interlocking relationship exists between the members of our board of directors and the board of directors or compensation committee or similar committees of any other company.

Review, Approval or Ratification of Transactions

Our Code of Conduct provides for the reporting, review and approval of potential conflicts of interest. Each potential conflict of interest that is reportable under our Code of Conduct is reviewed internally on a case by case basis. Any such reportable potential conflict of interest involving a director or an executive officer must be reported to our General Counsel and our Audit Committee for approval.

Because our Code of Conduct was designed to implement, among others, a procedure by which we can review and take action with respect to potential conflicts of interest, the criteria for determining which proposed transactions are reportable under the Code of Conduct are broad and are based on the goal of avoiding any actual or perception of conflict of interest. Therefore, the guidelines for reporting are not based on the threshold set forth in Item 404(a) of Regulation S-K (“Item 404(a)”), and transactions that may be reportable under Item 404(a) may not present a conflict of interest, and transactions that may not be reportable under Item 404(a) may be subject to the reporting and approval requirements under our Code of Conduct. Furthermore, the Code of Conduct is not applicable to any of our stockholders who is not otherwise an employee or a director of our company.

In addition, under the Stockholders’ Agreement, we are not permitted to enter into any agreement or arrangement, or any amendments thereto, with any director, officer or holder of 1% or more of our stock without the unanimous approval of the entire board of directors. Therefore, any potential transaction with any director, officer or a holder of 1% or more of our stock, including those transactions that would not otherwise be reportable under Item 404(a), must be reported to, and approved by, the entire board of directors.

Because the Stockholders’ Agreement and the Armenco Lease Agreement (discussed below) were executed in connection with the formation of our company, those agreements necessarily preceded any ratification or approval process.

Stockholder and Interested Parties Communications with the Board of Directors

All communication by the stockholders and interested parties should be in writing and should be addressed to the Corporate Secretary, Tropicana Las Vegas Hotel and Casino, Inc., 3801 Las Vegas Boulevard South, Las Vegas, Nevada 89109, Attention: Stockholder Communications. All inquiries are reviewed by the Corporate Secretary, who forwards to the Board a summary of all such correspondence and copies of all communications that she determines requires their attention. Matters relevant to other departments of the Company are directed to such departments with appropriate follow-up to ensure that inquiries are responded to in a timely manner. Matters relating to accounting, auditing and/or internal controls are referred to the Chairman of the Audit Committee and included in the report to the Board, together with a report of any action taken to address the matter. The Board of Directors or the Audit Committee, as the case may be, may direct such further action deemed necessary or appropriate.

TRANSACTIONS WITH RELATED PERSONS

Relationship with Trilliant Gaming Nevada Inc.

Trilliant Gaming is the general partner of the Onex Armenco Gaming Entities. The Onex Armenco Gaming Entities, in the aggregate, own, and Trilliant Gaming has voting and investment control over, approximately 82.7% of our outstanding voting securities. Each of Mr. Alex Yemenidjian, our Chairman of the Board, Chief Executive Officer and President, Mr. Timothy Duncanson, one of our directors, and Mr. Gerald Schwartz, the chairman and controlling stockholder of Onex Corporation, owns one-third of the outstanding voting securities of Trilliant Gaming, and together Messrs. Yemenidjian, Duncanson and Schwartz own 100% of the outstanding voting securities of Trilliant Gaming. A stockholder agreement between Messrs. Yemenidjian, Duncanson and Schwartz sets forth the rights of each of them with respect to control of Trilliant Gaming and, in turn, our securities owned by the Onex Armenco Gaming Entities. The Onex Armenco Gaming Entities were formed by entities affiliated with Onex Corporation.

As a result of Trilliant Gaming’s voting and investment control over our securities held by the Onex Armenco Gaming Entities, Trilliant Gaming may, among other things, exercise a controlling influence over our affairs, the election of directors and the approval of significant corporate transactions, including a merger or the sale of all or substantially all of our assets. Trilliant Gaming may have the ability to prevent any transaction that requires approval of our stockholders regardless of whether or not other stockholders believe that any such transaction is in our best interests and the interests of such other stockholders. Trilliant Gaming’s ability to exercise a controlling influence over our affairs is, to a certain extent, set forth in the Stockholders’ Agreement. Trilliant Gaming also controls the voting of greater than two-thirds of the outstanding shares of our Preferred Stock, giving it the power to amend or waive certain provisions thereof, including the power to waive the anti-dilution protections.

Currently, we are a party to a management agreement with Trilliant Management LP, a limited partnership that is controlled by its general partner, Trilliant Gaming (“Trilliant Management”), for the management and operation of the Tropicana Las Vegas (See “Trilliant Management Agreement”).

Armenco Lease Agreement

On June 22, 2009, we entered into a lease agreement with Armenco (the “Armenco Lease”), whereby we leased the real and non-gaming personal property of our hotel and casino, including the restaurants, lounges, retail shops and other related support facilities, and the operation thereof to Armenco until such time as we were able to obtain all governmental registrations, findings of suitability, licenses, qualifications, permits and approvals pursuant to the gaming laws and regulations of the State of Nevada and Clark County liquor and gaming codes necessary for us to own and operate our gaming facility directly. The Armenco Lease called for a fee equal to 2% of net revenues and 5% of EBITDA, each as defined, to be paid to Armenco. Armenco in turn paid rent in the amount of $1.00 per month. Armenco separately acquired the gaming assets.

Effective December 1, 2010 we received all licenses and necessary approvals and as a result, Armenco transferred to us all of the gaming assets of Tropicana Las Vegas for nominal consideration. The lease agreement with Armenco was terminated and the operation of our hotel and casino was thereafter managed by Trilliant Management pursuant to the Management Agreement.

As of December 31, 2014, the Company had $1.7 million as an accrued liability for management fees payable due to Armenco for the period of July 1, 2009 through November 30, 2010. Such fees are in addition to the compensation payable by us to our chief executive officer and director who holds a majority interest in Armenco.

Trilliant Management Agreement

Overview

Effective as of December 1, 2010, we obtained all governmental registrations, findings of suitability, licenses, qualifications, permits and approvals pursuant to the gaming laws and regulations of the State of Nevada and Clark County liquor and gaming codes necessary for us to own and operate our gaming facility directly. Armenco also transferred to us all the gaming assets of Tropicana Las Vegas for nominal consideration and the Armenco Lease was terminated as of December 1, 2010. The operation of our hotel and casino was thereafter managed by Trilliant Management pursuant to a management agreement, dated May 17, 2010 (the “Management Agreement”). The Management Agreement began December 1, 2010 and will terminate on November 30, 2020.

Trilliant Management is a limited partnership that is controlled by its general partner, Trilliant Gaming. Each of Mr. Alex Yemenidjian, our Chairman of the Board, Chief Executive Officer and President, Mr. Timothy Duncanson, one of our directors, and Mr. Gerald Schwartz, the chairman and controlling stockholder of Onex Corporation, owns one-third of the outstanding voting securities of Trilliant Gaming and together Messrs. Yemenidjian, Duncanson and Schwartz own 100% of the outstanding voting securities of Trilliant Gaming. A stockholder agreement between Messrs. Yemenidjian, Duncanson and Schwartz sets forth the rights of each of them with respect to control of Trilliant Gaming.

Services and Personnel

Trilliant Management will be responsible for the day-to-day operations of the Tropicana Las Vegas including:

| | ● | reviewing and approving the design and implementation of a detailed business plan; |

| | ● | reviewing and approving the annual budget prior to submission to the Board of Directors; |

| | ● | supervising the implementation of sales, marketing and promotional programs, credit policies and procedures, internal control systems and security procedures; |

| | ● | supervising the services of independent contractors; |

| | ● | supervising the purchase of goods necessary for the operation of the Tropicana Las Vegas; |

| | ● | approving insurance policies to adequately protect us and the Tropicana Las Vegas; |

| | ● | approving and supervising the implementation of leasing strategies and negotiating lease transactions; |

| | ● | advising us with respect to the selection of accountants and auditors; |

| | ● | approving the selection of all names, logos, trademarks and service marks used with the operation of the Tropicana Las Vegas; |

| | ● | supervising alterations, additions or improvements to the Tropicana Las Vegas; |

| | ● | approving financial reports in connection with government filings or as required by lenders in connection with financing transactions; |

| | ● | approving employee and personnel policies; and |

| | ● | supervising the negotiation of collective bargaining agreements relating to our employees. |

In addition to the responsibilities listed above, Trilliant Management will also hire and supervise all personnel subject to our right to veto the hiring of an employee or terminate the employment of an employee that jeopardizes any of our hotel casino’s gaming approvals, licenses or permits. All personnel of our hotel casino will be our employees.

Compensation

During each contract year, we will pay Trilliant Management an annual fee equal to the sum of:

| | ● | 2% of all revenue from the operation of our hotel casino, less complimentary housing, meals and other items granted to third parties by Trilliant Management for promotional purposes consistent with gaming industry practices, or the Revenue Fee; and |

| | ● | 5% of the amount of earnings before interest, taxes, depreciation and amortization, or EBITDA, from the operation of our hotel casino during the term of the Management Agreement, after EBITDA is reduced by the amount of the Revenue Fee. |

In addition, we will pay Trilliant Management’s out-of-pocket costs and expenses incurred for and during travel and related matters in furtherance of its duties under the Management Agreement.

For the year ended December 31, 2014, the fees Trilliant Management were entitled to receive under the Management Agreement totaled $2.3 million. For both Armenco and Trilliant Management, the Amended and Restated Loan agreement restricts our payments of management fees until the earlier of a) the date on which the outstanding principal has been repaid in full or b) the date on which EBITDA for the prior 12 month period is equal to or greater than $20.0 million, and upon the condition that no default or event of default is continuing under the Amended and Restated Loan Agreement. Pursuant to the Amended and Restated Loan Agreement, the Company is permitted to pay a portion of the management fees for reimbursement of tax liabilities actually incurred and paid. During the year ended December 31, 2014, we paid $81,262 for reimbursement of income tax liabilities.

As of December 31, 2014, the Company had $7.7 million as an accrued liability for management fees payable due to Trilliant Management for the period of December 1, 2010 through December 31, 2014. Such fees are in addition to the compensation payable by us to our chief executive officer and director who holds interest in Trilliant Gaming.

Employment Arrangements

The employment arrangements with Mr. Yemenidjian, Ms. Beckett and Mr. Goudie are described in “Executive and Director Compensation and Other Information—Executive Compensation—Compensation Discussion and Analysis—Employment Agreements.”

Indemnification

Our certificate of incorporation and bylaws provide that our company will provide directors and officers liability insurance coverage to our current directors and officers.

COMPENSATION AND GOVERNANCE COMMITTEE REPORT

The Compensation and Governance Committee has reviewed the “Compensation Discussion and Analysis” included in this proxy statement with management. Based on the Compensation and Governance Committee’s review and discussion with management, the Compensation and Governance Committee recommended to the Board of Directors that the Compensation Discussion and Analysis be included in this proxy statement.

| | Timothy Duncanson, Chairman |

| | Judy Mencher |

The foregoing report of the Compensation and Governance Committee does not constitute solicitingmaterial and should not be deemed filed or incorporated by reference into any otherCompany filing under the Securities Act or the Exchange Act, except to the extent theCompany specifically incorporates such report by reference therein.

EXECUTIVE AND DIRECTOR COMPENSATION AND OTHER INFORMATION

EXECUTIVE COMPENSATION

This section discusses material elements of our current policies and practices with respect to the compensation of our named executive officers and a summary of the compensation paid to our executive officers and directors.

Compensation Discussion and Analysis

Executive Compensation Philosophy and Objectives

Our executive compensation program is designed to provide our executive officers with compensation that is competitive in the marketplace and to reward and incentivize executive contributions to increasing and maximizing value to our stockholders. Specifically, the primary tenets of our executive compensation philosophy, similar to other companies in the Las Vegas hotel and casino industry, are the following:

Attract, retain and motivate qualified, high-performing executives. The compensation packages for our executive officers were initially designed and negotiated to attract each of them to our company. In addition, we must continually ensure that our executive compensation program is competitive and attractive to qualified executives with the level of industry experience that we generally seek such that we can continue to retain the services of our executive officers and, when needed, attract other executives to join our company.

Provide rewards commensurate with performance by emphasizing variable, at-risk compensation that is dependent on both company and individual achievements and continued service. Generally, our executive compensation plan is comprised of a “fixed” base salary and an annual cash bonus based on the achievement of performance targets and an executive officer’s continued service to us. We believe executives with higher levels of responsibility and a greater ability to influence enterprise results, which includes each of the named executive officers set forth in “Compensation of Named Executive Officers” below, should have a greater percentage of their total compensation based on variable compensation. We further believe such a focus directly rewards our senior executive team for creating, sustaining and, more importantly, increasing value to our stockholders.

With these tenets in mind, we intend to adhere to the following objectives when making executive compensation decisions:

| | ● | align our rewards strategy with our business objectives, including enhancing stockholder value and customer satisfaction; |

| | ● | support a culture of strong performance by rewarding employees for results; and |

| | ● | foster a shared commitment among our senior executives by aligning their individual goals with our goals. |

Setting of Executive Compensation

The compensation and governance committee of our board of directors structures our compensation program to encourage high performance, promote accountability and ensure that the interests of our executive officers are aligned with the interests of our stockholders. The compensation paid to our executive officers is also a function of the seniority of their position and their anticipated roles and responsibilities within our organization. In general, our philosophy provides that officers with higher levels of responsibility and a greater ability to influence results would have a greater percentage of their total compensation based on variable compensation. Given, that we are experiencing a highly competitive market, our current compensation program is more fixed in nature than it is expected to be in the future.

Elements of Executive Compensation

Base Salary. The compensation and governance committee of our board of directors determines each executive’s base salary after considering many factors, including job performance, skill sets, prior experience, each executive’s time in his or her position and external pressures to attract and retain executives under current market conditions. In addition, the annual salaries of the executives are reviewed from time to time by the committee, and adjustments are made when necessary in order for the salaries of our executives to be competitive with the salaries paid by other companies in the Las Vegas hotel, resort and casino industry.

Annual Incentive Awards. When appropriate, we intend to offer annual incentive awards for executive officers in the form of cash performance bonuses to encourage and reward achievement of our business goals and attract and retain key personnel. Performance bonuses are usually determined after the end of our fiscal year and are based on an assessment of the executive officer’s achievement of certain individual performance goals and our achievement of certain operating, financial and other corporate goals.