Valuation of Futures Contracts and the Computation of the Per Share NAV

Each Trust Series’ NAV is calculated once each NYSE Arca trading day. The per share NAV for a particular trading day is released after 4:00 p.m. New York time. Trading during the core trading session on the NYSE Arca typically closes at 4:00 p.m. New York time. The Trust Series’ Administrator uses the closing prices on the relevant Futures Exchanges of the Applicable Benchmark Component Futures Contracts (determined at the earlier of the close of such exchange or 2:30 p.m. New York time) for the contracts held on the Futures Exchanges, but calculates or determines the value of all other investments of such Trust Series using market quotations, if available, or other information customarily used to determine the fair value of such investments.

Results of Operations

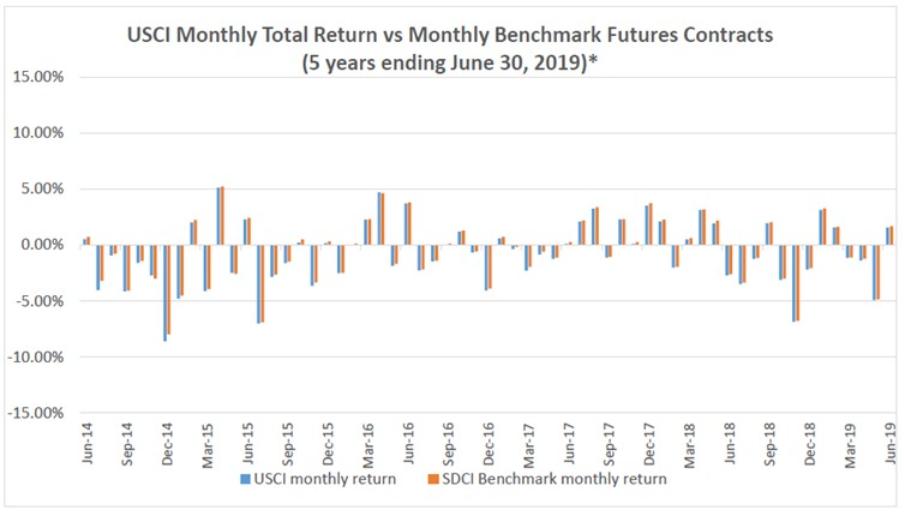

On July 30, 2010, USCI received a notice of effectiveness from the SEC for its registration of 50,000,000 shares on Form S-1 with the SEC. On August 10, 2010, USCI listed its shares on the NYSE Arca under the ticker symbol “USCI.” USCI established its initial offering per share NAV by setting the price at $50 and issued 100,000 shares to the initial Authorized Participant, Merrill Lynch Professional Clearing Corp., in exchange for $5,000,000 in cash on August 10, 2010. USCI commenced investment operations on August 10, 2010 by purchasing Futures Contracts traded on the Futures Exchanges. In order to satisfy NYSE Arca listing standards that at least 100,000 shares be outstanding at the beginning of the trading day on the NYSE Arca, USCF purchased the initial Creation Basket from the initial Authorized Participant at the initial offering price. The $1,000 fee that would otherwise be charged to the Authorized Participant in connection with an order to create or redeem was waived in connection with the initial Creation Basket. USCF agreed not to resell the shares comprising such basket except that it may require the initial Authorized Participant to repurchase all of these shares at a per share price equal to USCI’s per share NAV within five days following written notice from USCF, subject to the conditions that: (i) on the date of repurchase, the initial Authorized Participant must immediately redeem these shares in accordance with the terms of the Authorized Participant Agreement and (ii) immediately following such redemption at least 100,000 shares of USCI remain outstanding. USCF held such initial Creation Basket until September 3, 2010, at which time the initial Authorized Participant repurchased the shares comprising such basket in accordance with the specified conditions noted above. On September 14, 2011, USCF redeemed the 20 Sponsor Shares of USCI, and on September 19, 2011, USCF purchased 5 shares of USCI in the open market.

Since its initial offering of 50,000,000 shares, USCI has not registered any subsequent offerings of its shares. As of June 30, 2019, USCI had issued 35,050,000 shares, 9,450,000 of which were outstanding. As of June 30, 2019, there were 14,950,000 shares registered but not yet issued. More shares may have been issued by USCI than are outstanding due to the redemption of shares.

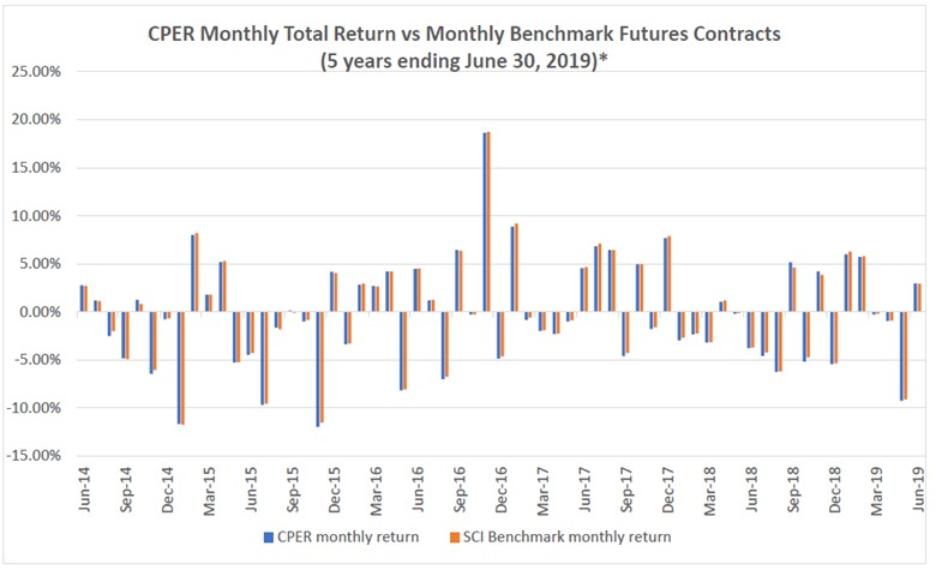

In connection with the Second Amended and Restated Trust Agreement dated November 10, 2010, CPER and USAG were designated as additional series of the Trust. Following the designation of the additional series, USCF made an initial capital contribution to the Trust. On November 10, 2010, the Trust transferred $1,000 to CPER, which was deemed a capital contribution to each series. On November 14, 2011, USCF received 40 Sponsor Shares of CPER in exchange for the previously received capital contribution, representing a beneficial interest in CPER. On December 7, 2011, USCF redeemed the 40 Sponsor Shares of CPER and purchased 40 shares of CPER in the open market. On April 13, 2012, USCF received 40 Sponsor Shares of USAG in exchange for the previously received capital contribution, representing a beneficial interest in USAG. On June 28, 2012, USCF redeemed the 40 Sponsor shares of USAG and on October 3, 2012, purchased 5 shares of USAG on the open market. USCF redeemed all Sponsor Shares of USAG on September 7, 2018. On September 7, 2018, at the close of markets, USAG ceased all trading and all of USAG’s assets were liquidated on September 12, 2018. Further, on May 8, 2019, USCF contributed $1,000 to XBET in exchange for 20 Sponsor Shares of the series, which was deemed an initial capital contribution to the series.

The order to permit listing CPER on the NYSE Arca was received on October 20, 2011. On November 15, 2011, CPER listed its shares on the NYSE Arca under the ticker symbol “CPER.” CPER established its initial offering per share NAV by setting the price at $25.00 and issued 100,000 shares to the initial Authorized Participant, Merrill Lynch Professional Clearing Corp., in exchange for $2,500,000 in cash on November 15, 2011. The $1,000 fee that would otherwise be charged to the Authorized Participant in connection with an order to create or redeem was waived in connection with the initial Creation Basket.