REVANCE 2018 INVESTOR DAY APRIL 19, 2018 Exhibit 99.2

Forward-Looking Statements / Safe Harbor / Market Data This presentation contains forward-looking statements, including statements related to: our financial outlook and other financial performance; the process and timing of anticipated future clinical development of our product candidates; our business strategy, goals, plans and prospects; timing and outcome of our clinical trials; our ability to obtain regulatory approval; the potential therapeutic and economic benefits and value of our product candidates and our technologies; demand for our product candidates and drivers of demand; market size, adoption rate and potential revenue; growth opportunities and product pipeline; our ability to leverage our investment in our development and manufacturing platform; and our intellectual property strategy. Forward-looking statements are subject to risks and uncertainties that could cause actual results to differ materially from our expectations. These risks and uncertainties include, but are not limited to: the outcome, cost and timing of our product development activities and clinical trials; the uncertain clinical development process, including the risk that clinical trials may not have an effective design; our ability to obtain and maintain regulatory approval of our product candidates; our ability to obtain funding for our operations; our plans to research, develop and commercialize our product candidates; our ability to achieve market acceptance of our product candidates; unanticipated costs or delays in research, development and commercialization efforts; the applicability of clinical study results to actual outcomes; the size and growth potential of the markets for our product candidates; our ability to successfully commercialize our product candidates and the timing of commercialization activities; the rate and degree of market acceptance of our product candidates; our ability to develop sales and marketing capabilities; the accuracy of our estimates regarding expenses, future revenues, capital requirements and needs for financing; and our ability to continue obtaining and maintaining intellectual property protection for our product candidates. These and other risks are described in the “Risk Factors” section of our Form 10-K filed with the Securities and Exchange Commission on March 2, 2018. This presentation also includes information about the global neuromodulator market, including growth and trends, that is based on various publicly available sources and on a number of assumptions and limitations. The industry data and third-party overview included in this presentation have been obtained from sources believed to be reliable, but we have not independently verified such information and assume no responsibility for the accuracy of such information. In addition, projections, assumptions and estimates of the future performance of the global neuromodulator market are necessary subject to a higher degree of uncertainty and risk due to a variety of factors, including those described above and in the “Risk Factors” section of our Form 10-K filed with the Securities and Exchange Commission on March 2, 2018. The “Risk Factors” section of our Form 10-K speaks only as of the date thereof. The forward-looking statements and market data in this presentation speak only as of the date hereof or the date specified. Revance disclaims any obligation to update such forward-looking statements and also disclaims any obligation to update or correct such market data. “Revance Therapeutics”, TransMTS, “Remarkable Science. Enduring Performance”, and the Revance logo are registered trademarks of Revance Therapeutics, Inc. All other trademarks or registered trademarks are the property of their respective owners.

Welcome to Revance’s First Investor Day Agenda Revance Overview Remarkable Science Clinical Update Regulatory Panel Enduring Performance To Market We Go Market Analysis Market Realities – Expert Panel Revance Product Launch Velocity Q&A Summary and Close

COMPANY OVERVIEW DAN BROWNE President & CEO APRIL 19, 2018

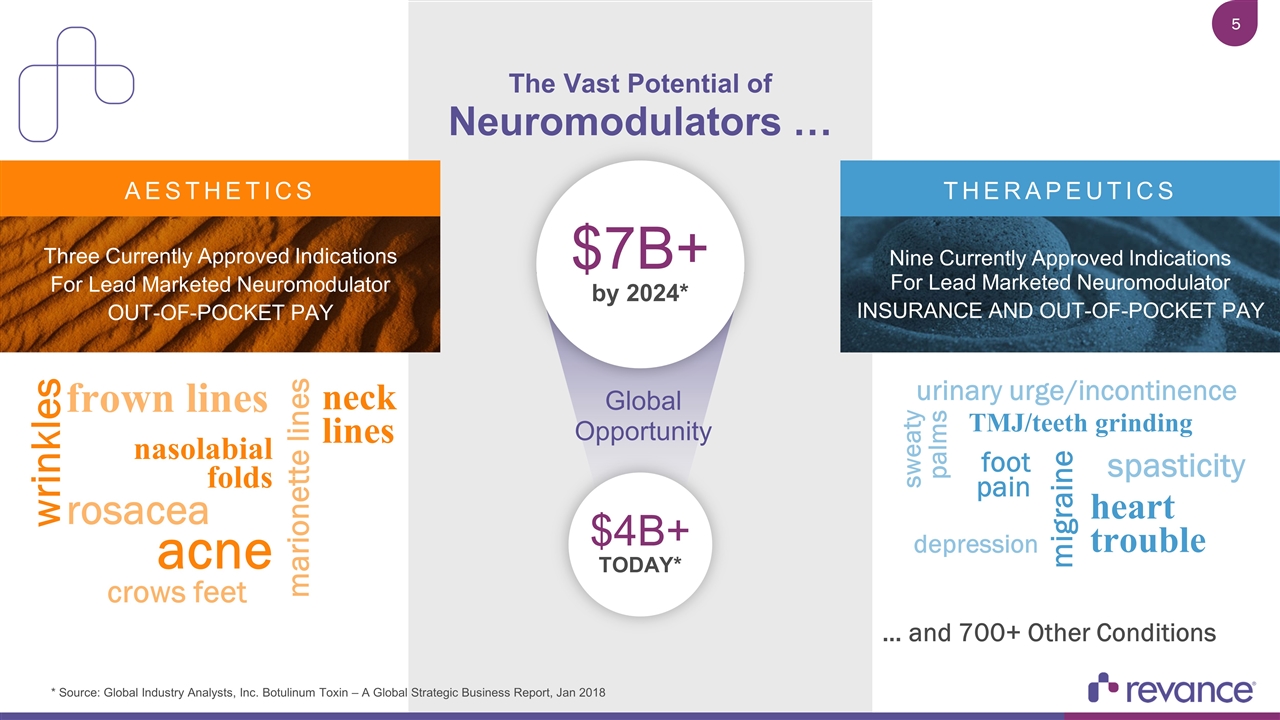

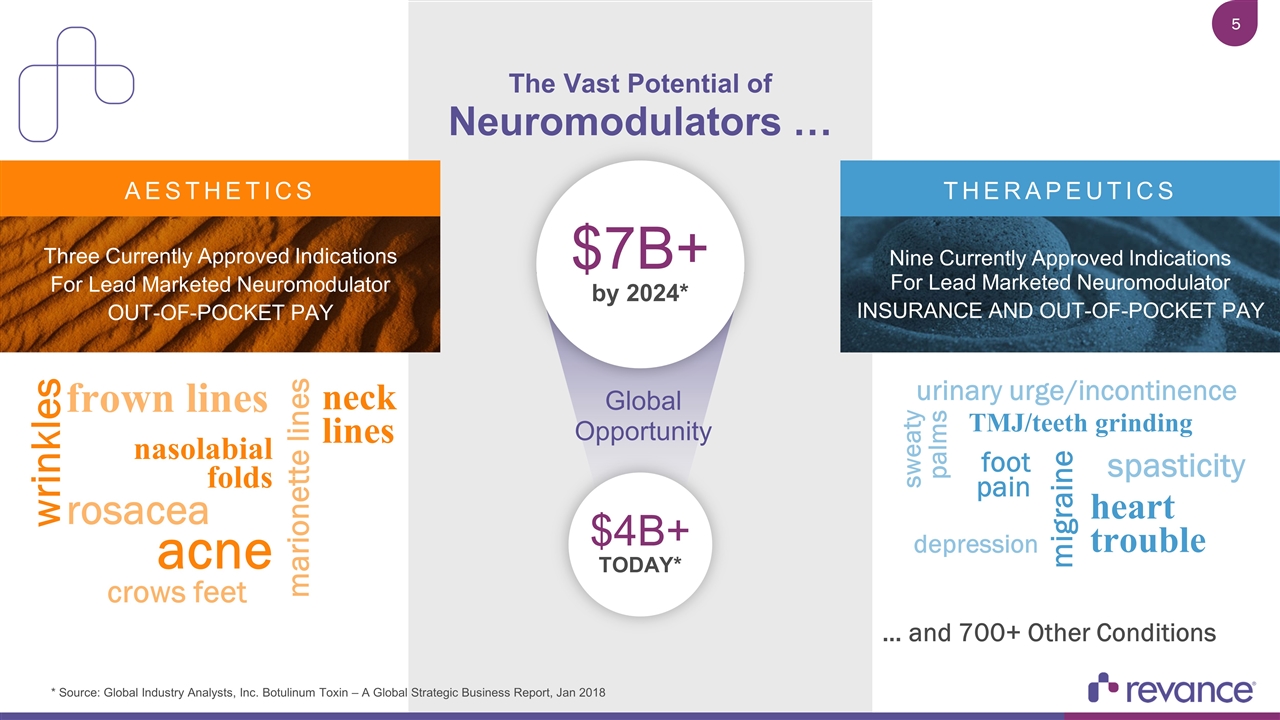

$7B+ by 2024* … and 700+ Other Conditions * Source: Global Industry Analysts, Inc. Botulinum Toxin – A Global Strategic Business Report, Jan 2018 $4B+ TODAY* nasolabial folds wrinkles frown lines marionette lines rosacea acne neck lines crows feet depression heart trouble migraine foot pain urinary urge/incontinence spasticity TMJ/teeth grinding sweaty palms The Vast Potential of Neuromodulators … THERAPEUTICS AESTHETICS Nine Currently Approved Indications For Lead Marketed Neuromodulator Insurance and Out-of-pocket Pay Three Currently Approved Indications For Lead Marketed Neuromodulator Out-of-pocket Pay Global Opportunity

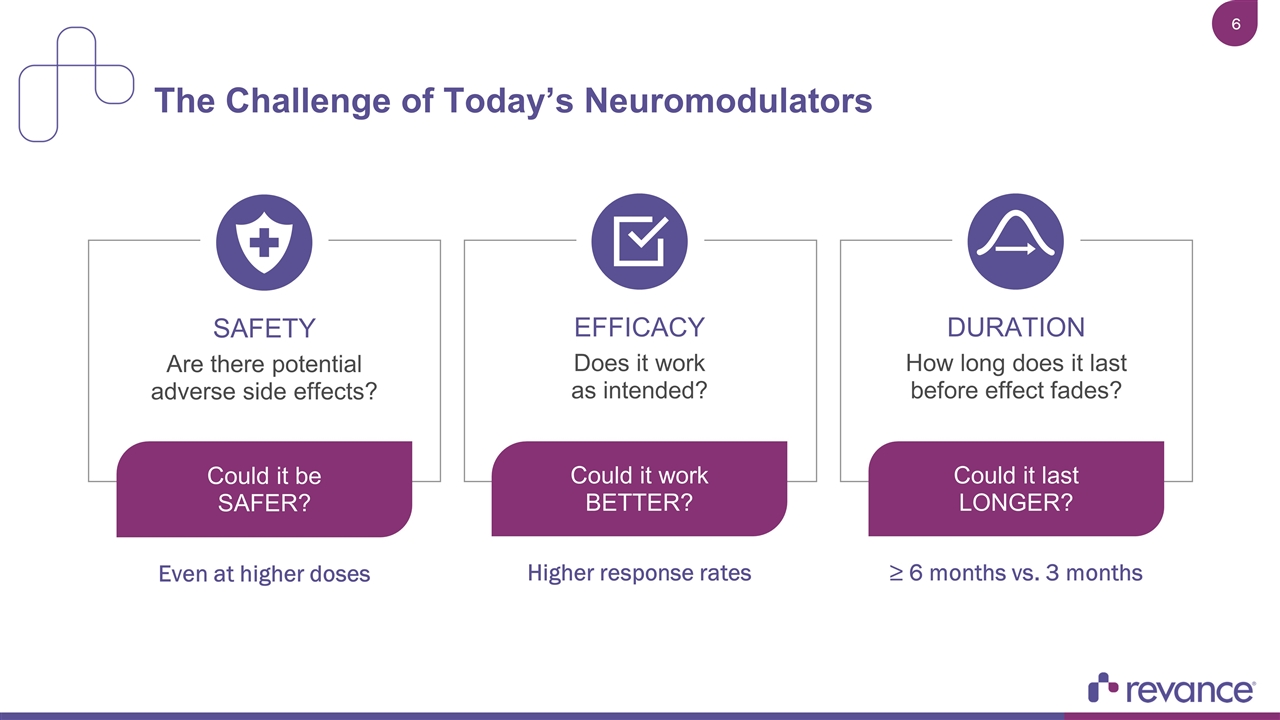

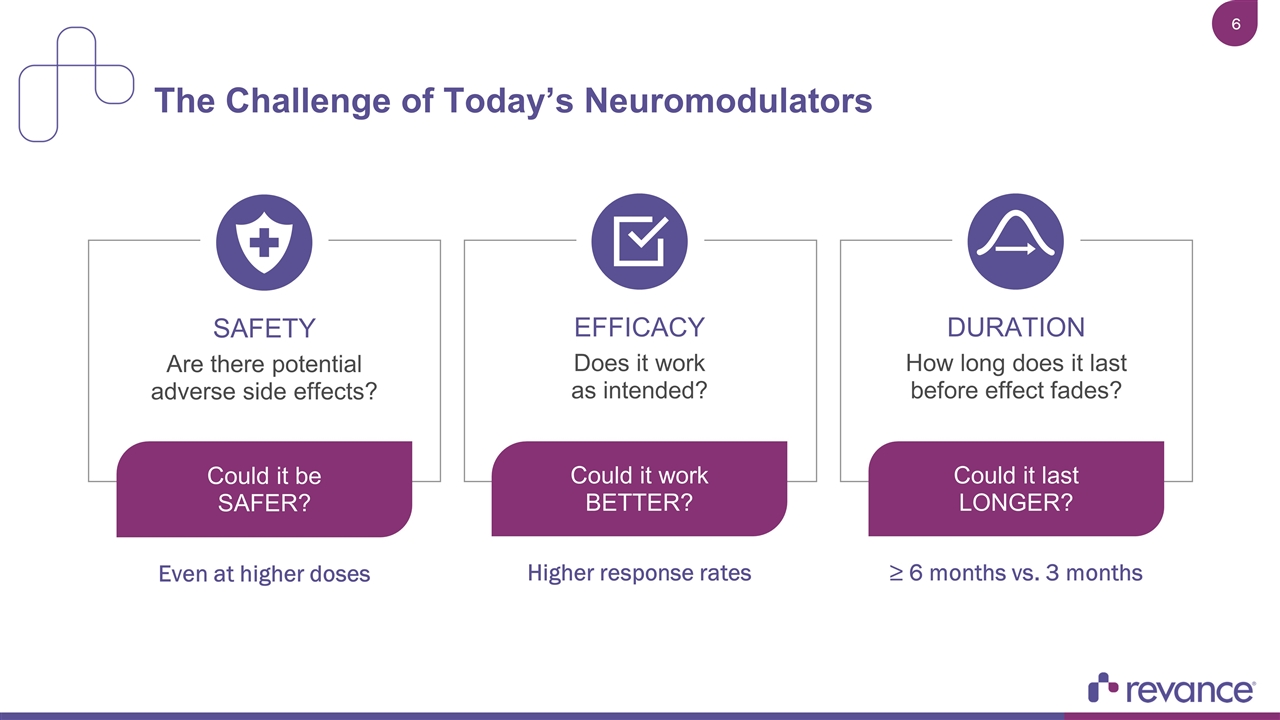

The Challenge of Today’s Neuromodulators Does it work as intended? EFFICACY Are there potential adverse side effects? SAFETY How long does it last before effect fades? DURATION Could it work BETTER? Higher response rates Could it last LONGER? ≥ 6 months vs. 3 months Could it be SAFER? Even at higher doses

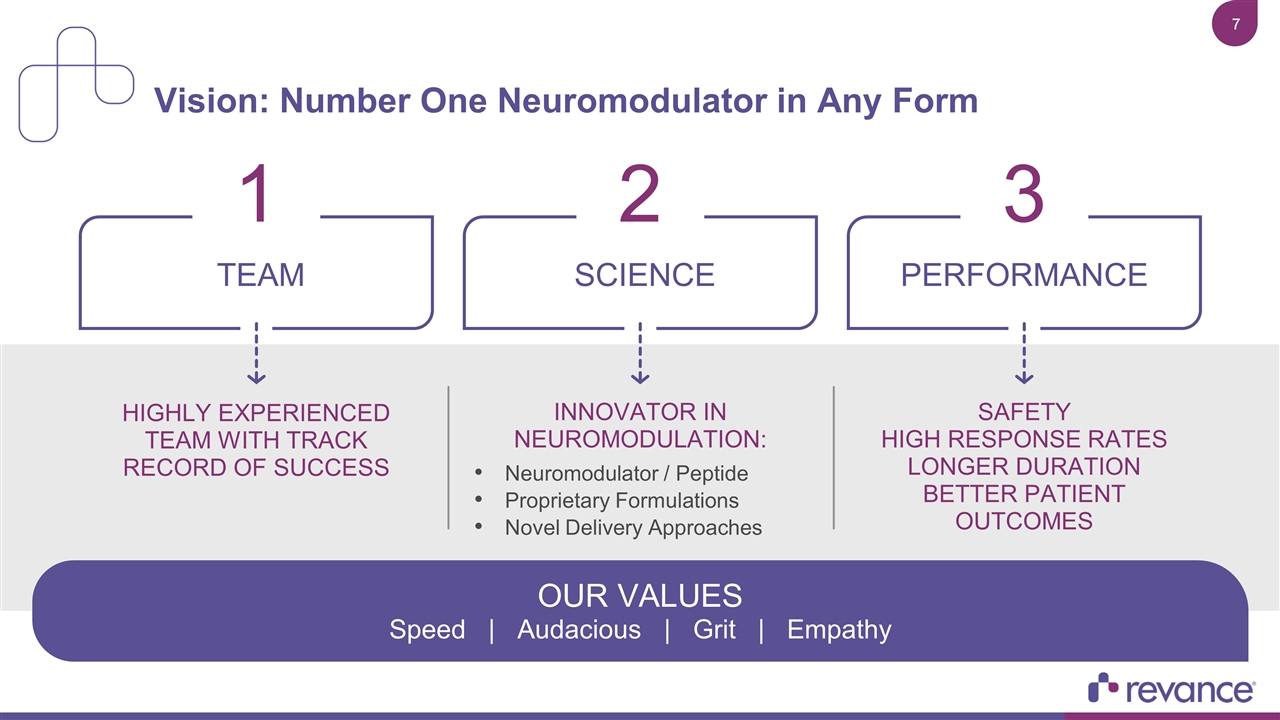

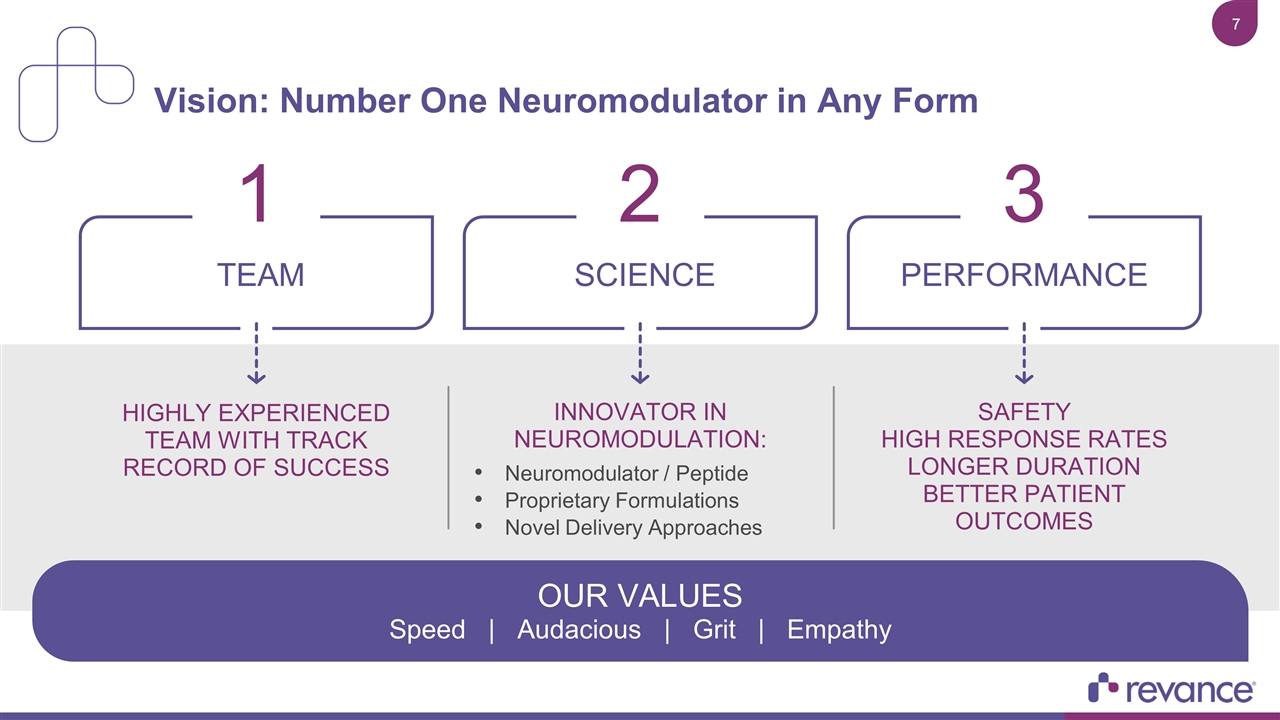

Vision: Number One Neuromodulator in Any Form SAFETY HIGH RESPONSE RATES LONGER DURATION BETTER PATIENT OUTCOMES TEAM 1 HIGHLY EXPERIENCED TEAM WITH TRACK RECORD OF SUCCESS INNOVATOR IN NEUROMODULATION: Neuromodulator / Peptide Proprietary Formulations Novel Delivery Approaches SCIENCE 2 PERFORMANCE 3 OUR VALUES Speed | Audacious | Grit | Empathy

DaxibotulinumtoxinA for Injection The Beauty of RT002 Platform First and only neuromodulator/peptide Exceptional stability, no animal/human excipients High response rates, long duration of effect Meets unmet need, significant global opportunity Global rights, expansive IP coverage RT002 is an investigational product

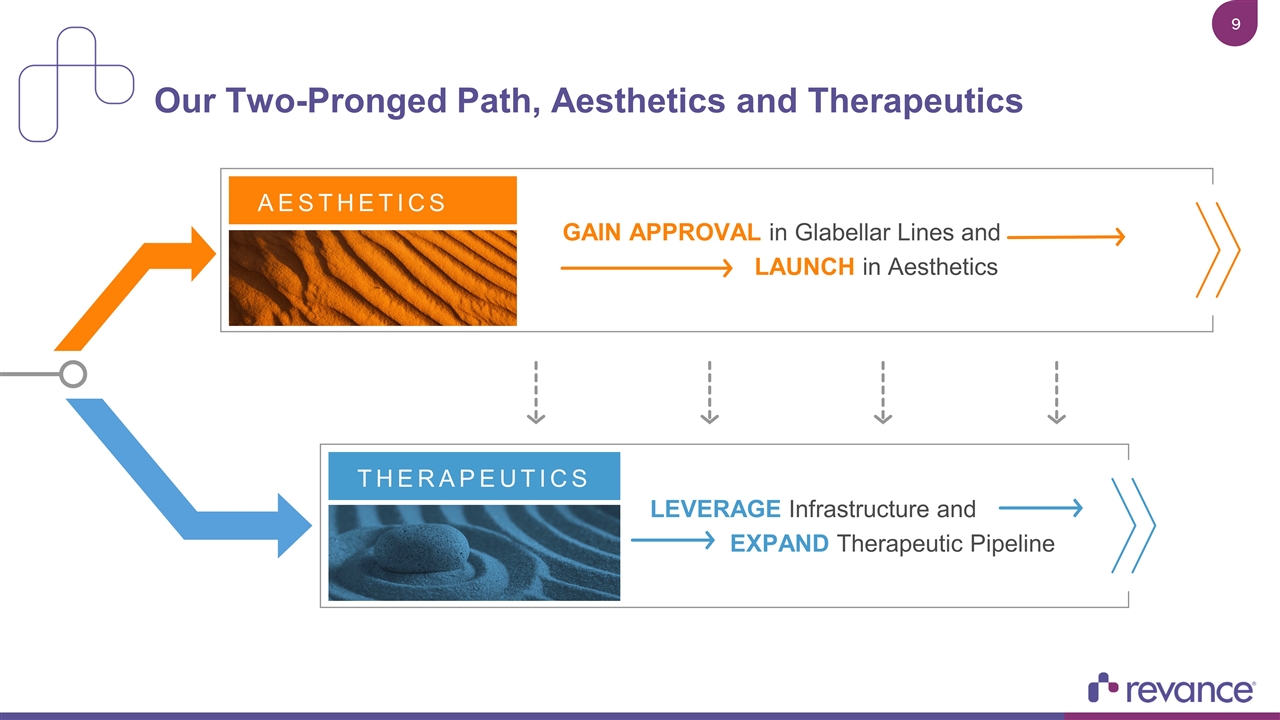

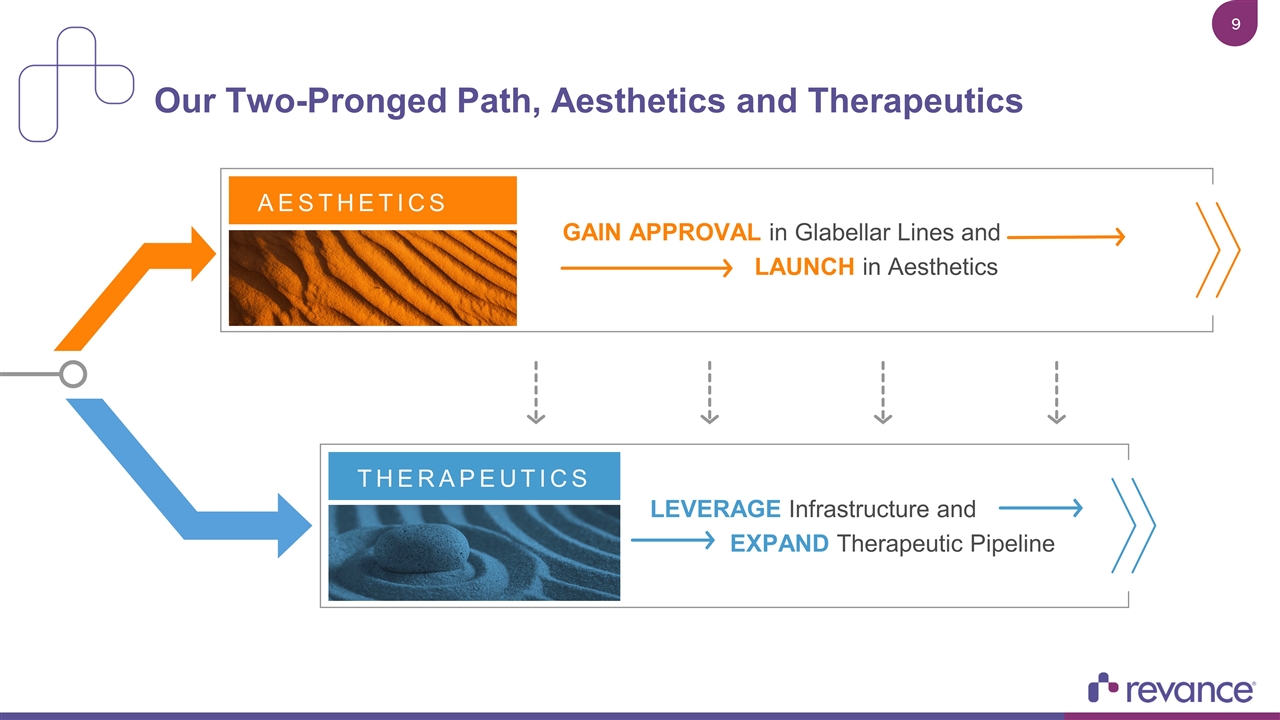

Our Two-Pronged Path, Aesthetics and Therapeutics LEVERAGE Infrastructure and EXPAND Therapeutic Pipeline THERAPEUTICS GAIN APPROVAL in Glabellar Lines and LAUNCH in Aesthetics AESTHETICS

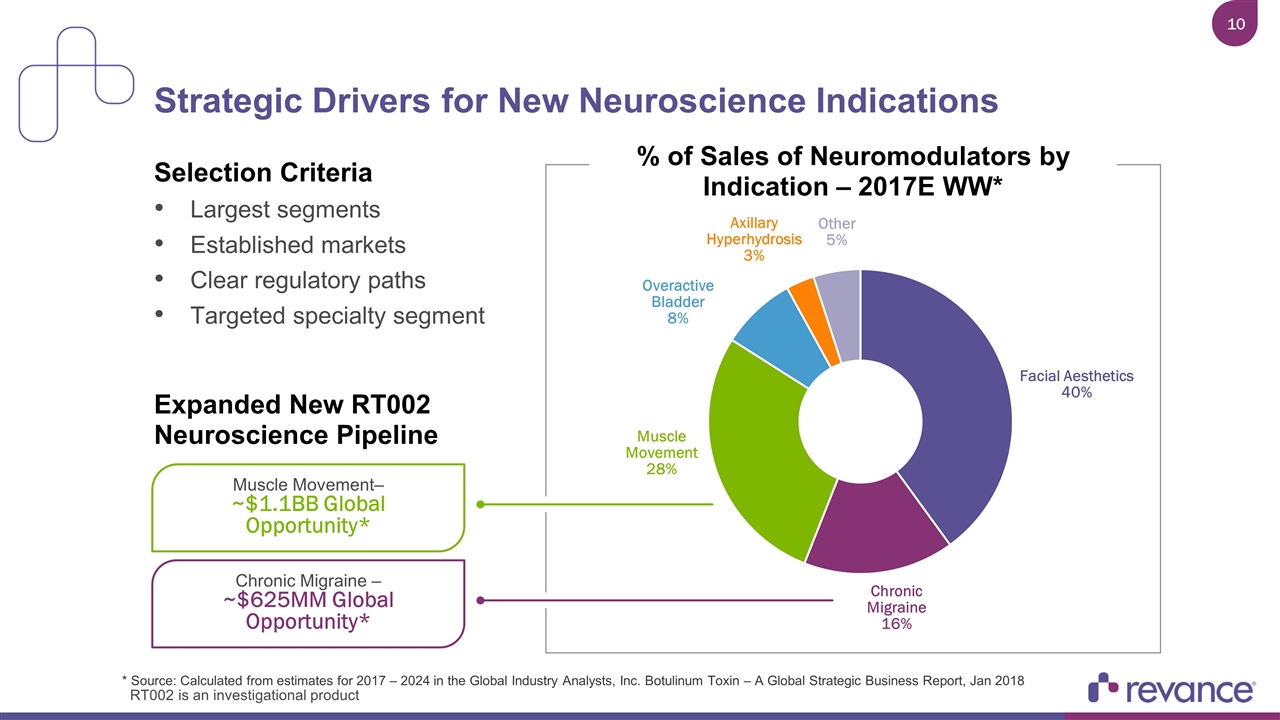

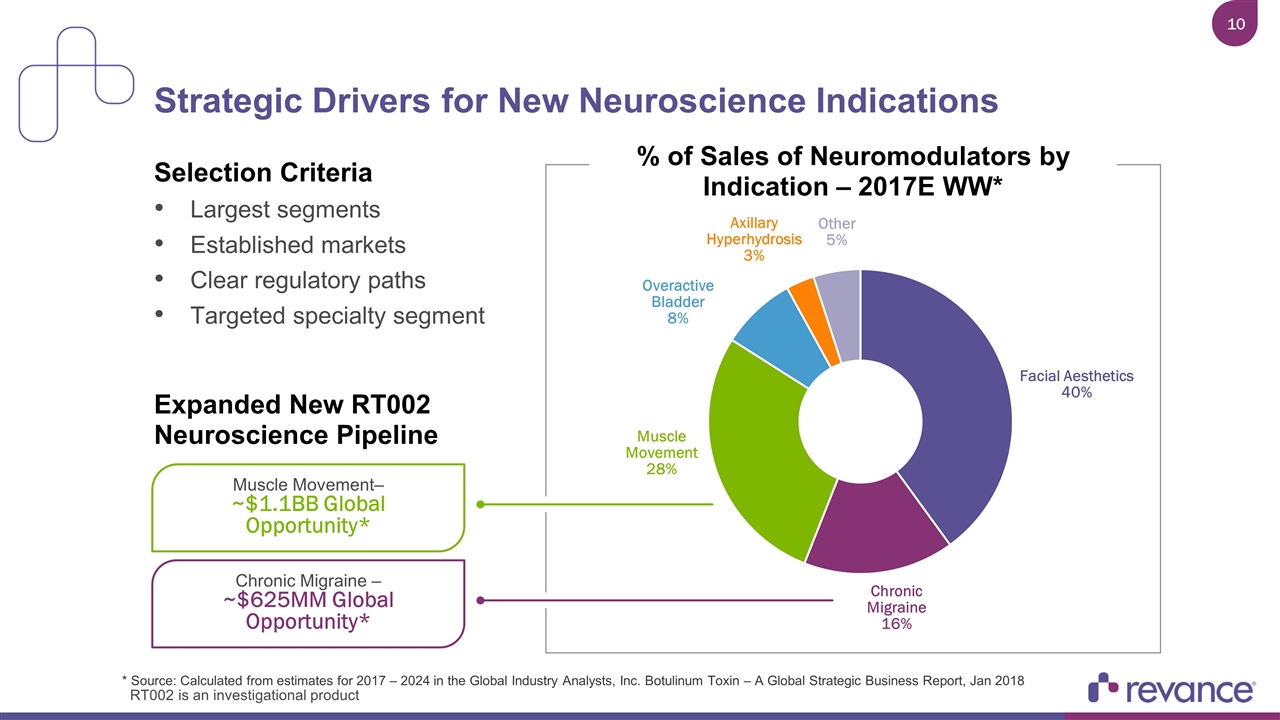

Strategic Drivers for New Neuroscience Indications % of Sales of Neuromodulators by Indication – 2017E WW* Selection Criteria Largest segments Established markets Clear regulatory paths Targeted specialty segment Expanded New RT002 Neuroscience Pipeline Muscle Movement– ~$1.1BB Global Opportunity* Chronic Migraine – ~$625MM Global Opportunity* * Source: Calculated from estimates for 2017 – 2024 in the Global Industry Analysts, Inc. Botulinum Toxin – A Global Strategic Business Report, Jan 2018 RT002 is an investigational product

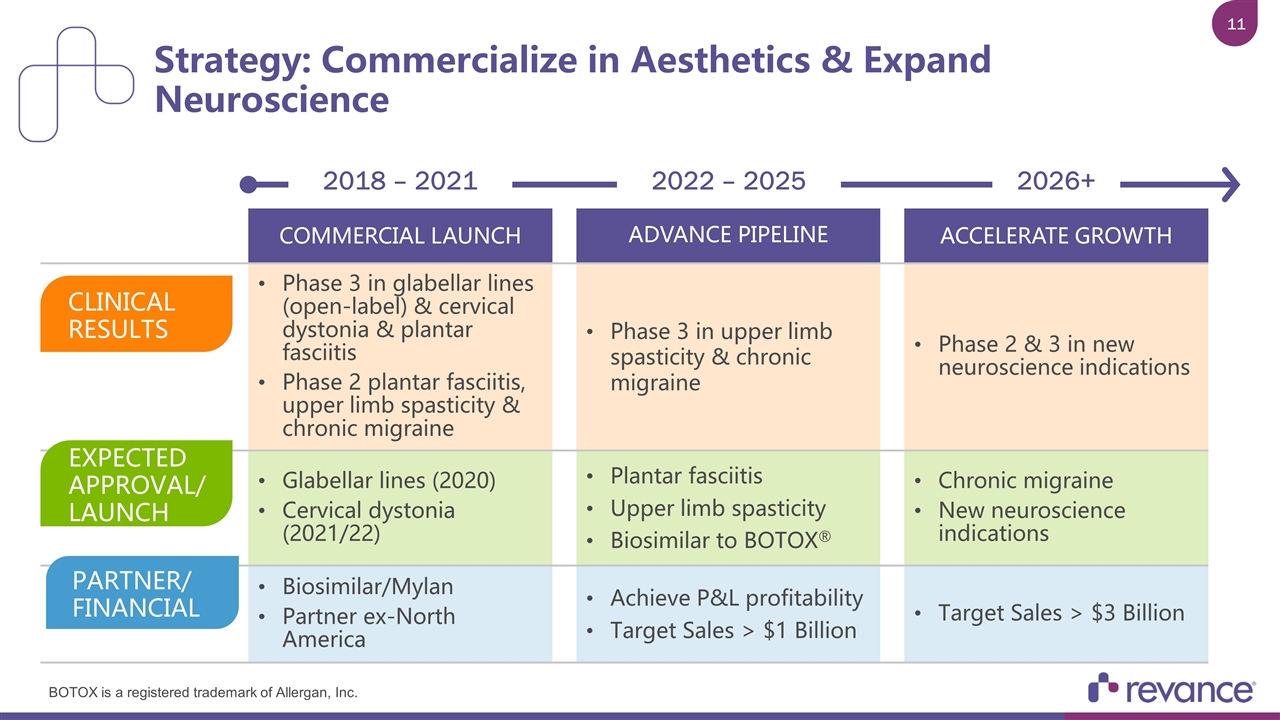

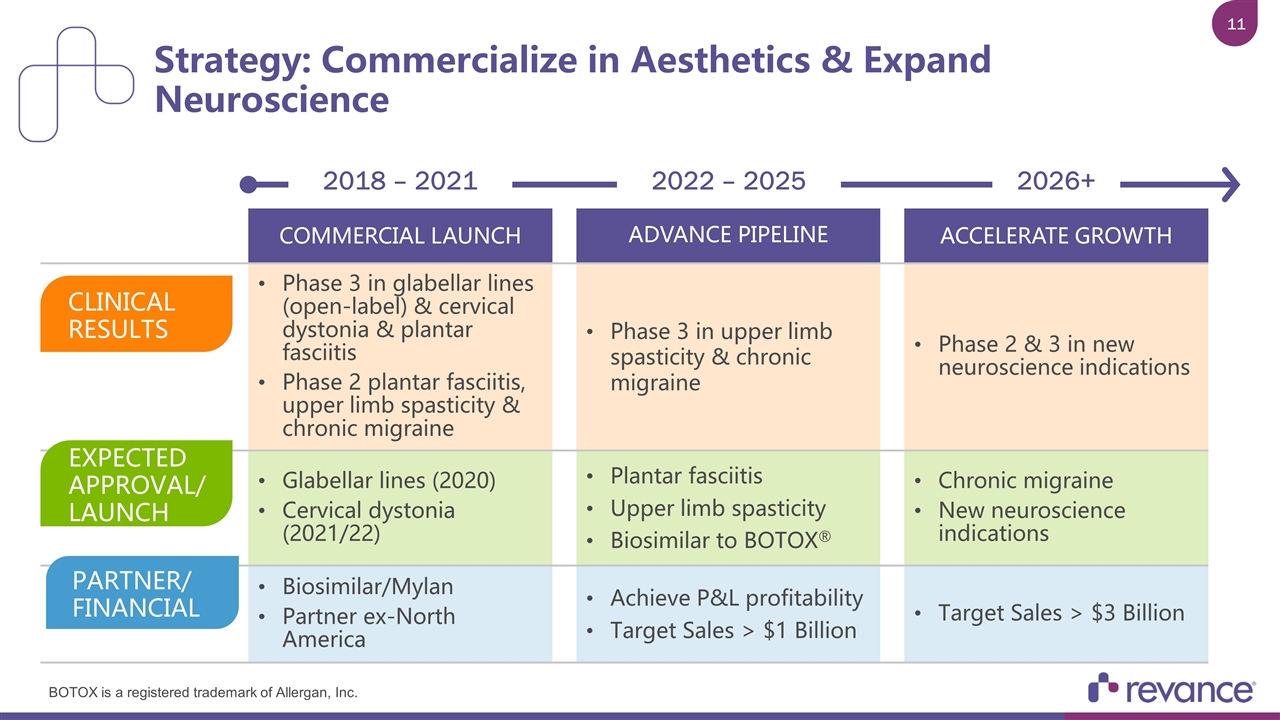

Strategy: Commercialize in Aesthetics & Expand Neuroscience 2018 – 2021 2022 – 2025 2026+ COMMERCIAL LAUNCH ADVANCE PIPELINE ACCELERATE GROWTH Phase 3 in glabellar lines (open-label) & cervical dystonia & plantar fasciitis Phase 2 plantar fasciitis, upper limb spasticity & chronic migraine Phase 3 in upper limb spasticity & chronic migraine Phase 2 & 3 in new neuroscience indications Glabellar lines (2020) Cervical dystonia (2021/22) Plantar fasciitis Upper limb spasticity Biosimilar to BOTOX® Chronic migraine New neuroscience indications Biosimilar/Mylan Partner ex-North America Achieve P&L profitability Target Sales > $1 Billion Target Sales > $3 Billion CLINICAL RESULTS EXPECTED APPROVAL/ LAUNCH PARTNER/ FINANCIAL BOTOX is a registered trademark of Allergan, Inc.

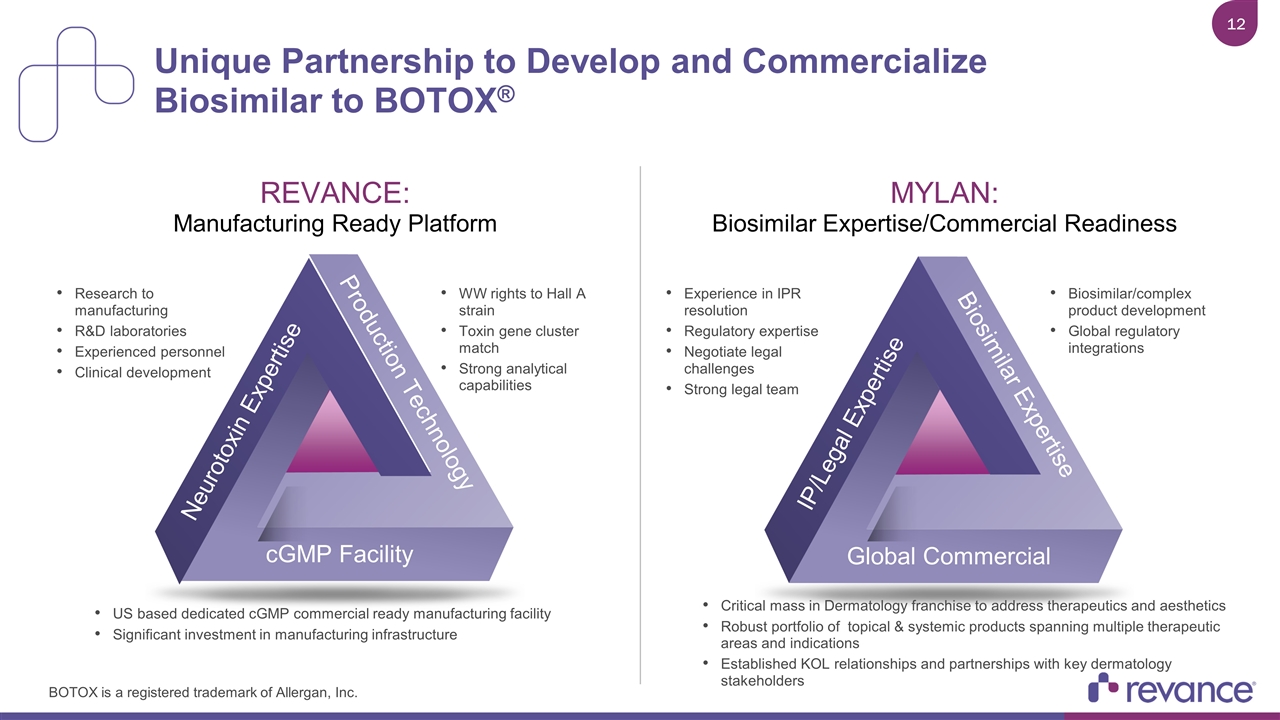

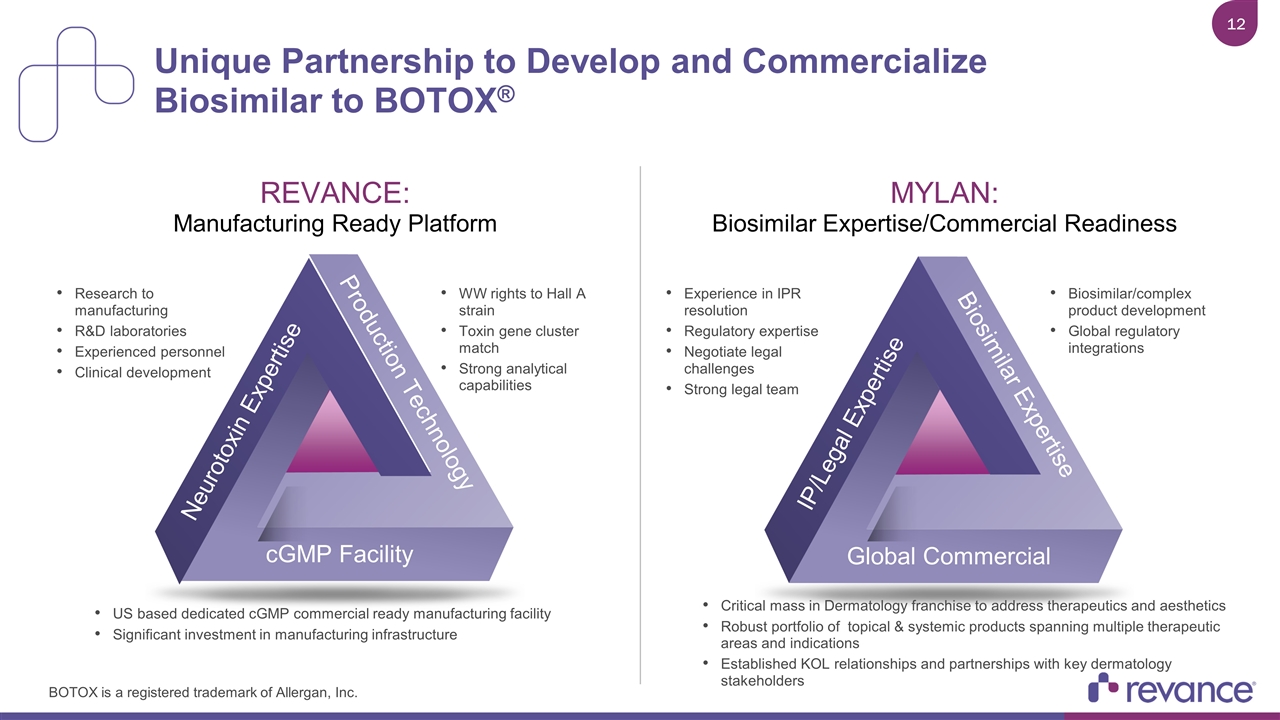

Unique Partnership to Develop and Commercialize Biosimilar to BOTOX® cGMP Facility Neurotoxin Expertise Production Technology Research to manufacturing R&D laboratories Experienced personnel Clinical development WW rights to Hall A strain Toxin gene cluster match Strong analytical capabilities US based dedicated cGMP commercial ready manufacturing facility Significant investment in manufacturing infrastructure REVANCE: Manufacturing Ready Platform Global Commercial IP/Legal Expertise Biosimilar Expertise Experience in IPR resolution Regulatory expertise Negotiate legal challenges Strong legal team Biosimilar/complex product development Global regulatory integrations Critical mass in Dermatology franchise to address therapeutics and aesthetics Robust portfolio of topical & systemic products spanning multiple therapeutic areas and indications Established KOL relationships and partnerships with key dermatology stakeholders MYLAN: Biosimilar Expertise/Commercial Readiness BOTOX is a registered trademark of Allergan, Inc.

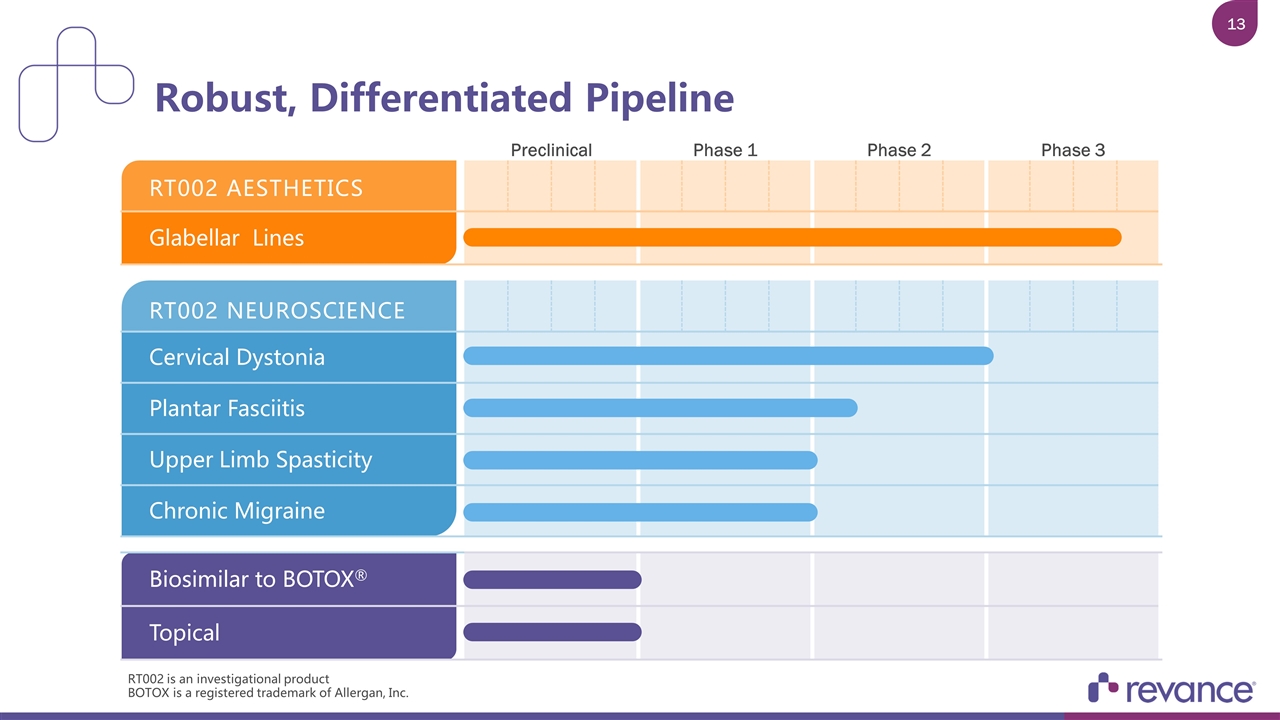

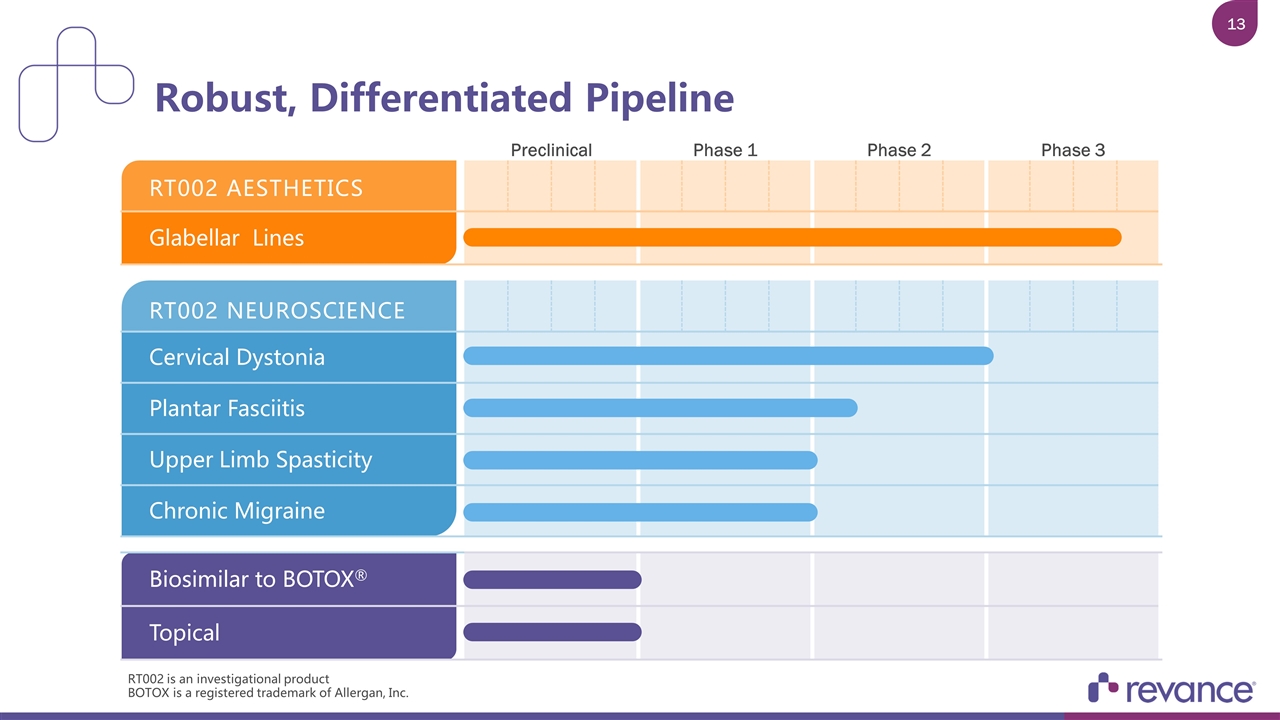

Robust, Differentiated Pipeline Biosimilar to BOTOX® Topical Preclinical Phase 1 Phase 2 Phase 3 RT002 AESTHETICS Glabellar Lines RT002 NEUROSCIENCE Cervical Dystonia Plantar Fasciitis Upper Limb Spasticity Chronic Migraine RT002 is an investigational product BOTOX is a registered trademark of Allergan, Inc.

Revance Product Launch Velocity Plan and strategy to drive adoption Review mechanism and clinical data for long duration for daxi (RT002) across both aesthetic and therapeutic indications Examine the growing aesthetic market from clinical & commercial perspectives Provide update on daxi programs currently in clinical development and new neuroscience therapeutic programs Objectives for Today Rationale and confidence to support labeling for long duratioN

Proven Team with Deep Experience & Expertise DAN BROWNE Co-Founder, President & CEO >30 years pharmaceutical and medical technology experience Various leadership roles in product development, sales and marketing ABHAY JOSHI, PH.D., M.B.A. COO >30 years global pharmaceutical and biotech experience in various leadership roles Extensive oversight of botulinum toxin development, strategy and ops LAUREN SILVERNAIL CFO & CBO >30 years finance and business development experience M&A and transactional experience in leadership roles Todd Zavodnick CCO, President, Aesthetics & Therapeutics >20 years domestic and international sales and marketing experience Leadership roles overseeing aesthetics and eye care products/markets ROMAN G. RUBIO, M.D. SVP, Clinical Development >15 years of drug development experience Early/late stage product development, med affairs and physician relations Susanne Fors, M.Sc. VP, Regulatory Affairs >20 years of global regulatory leadership and strategy experience Extensive regulatory experience with FDA, EMA and other national authorities Launch and Commercialization Clinical Development/Regulatory Manufacturing Today’s Speakers

REMARKABLE SCIENCE ABHAY JOSHI, Ph.D., M.B.A. Chief Operating Officer APRIL 19, 2018

Remarkable Science. Enduring Performance.™ Technological Innovation Highly Differentiated Neuromodular/Peptide Technology Strong Operational Execution US-Based cGMP Manufacturing Facility On Track to File Glabellar Lines BLA in 1H2019 Aesthetic and Therapeutic Pipeline

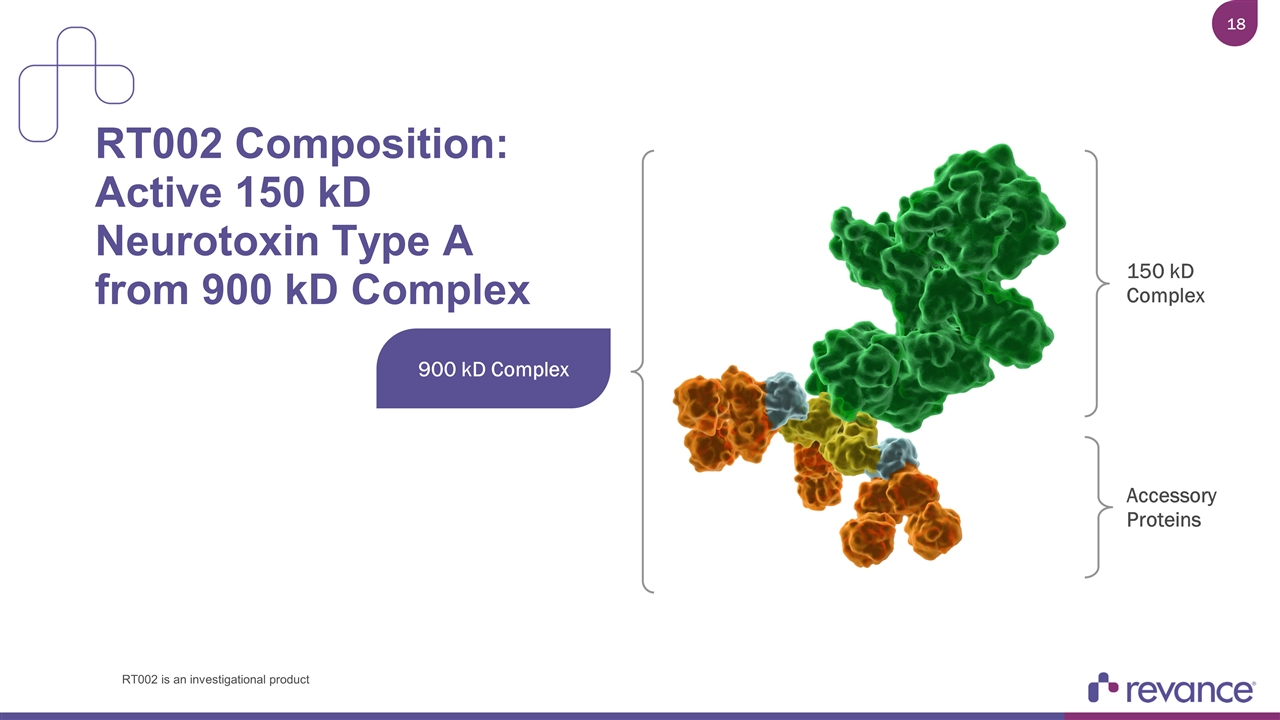

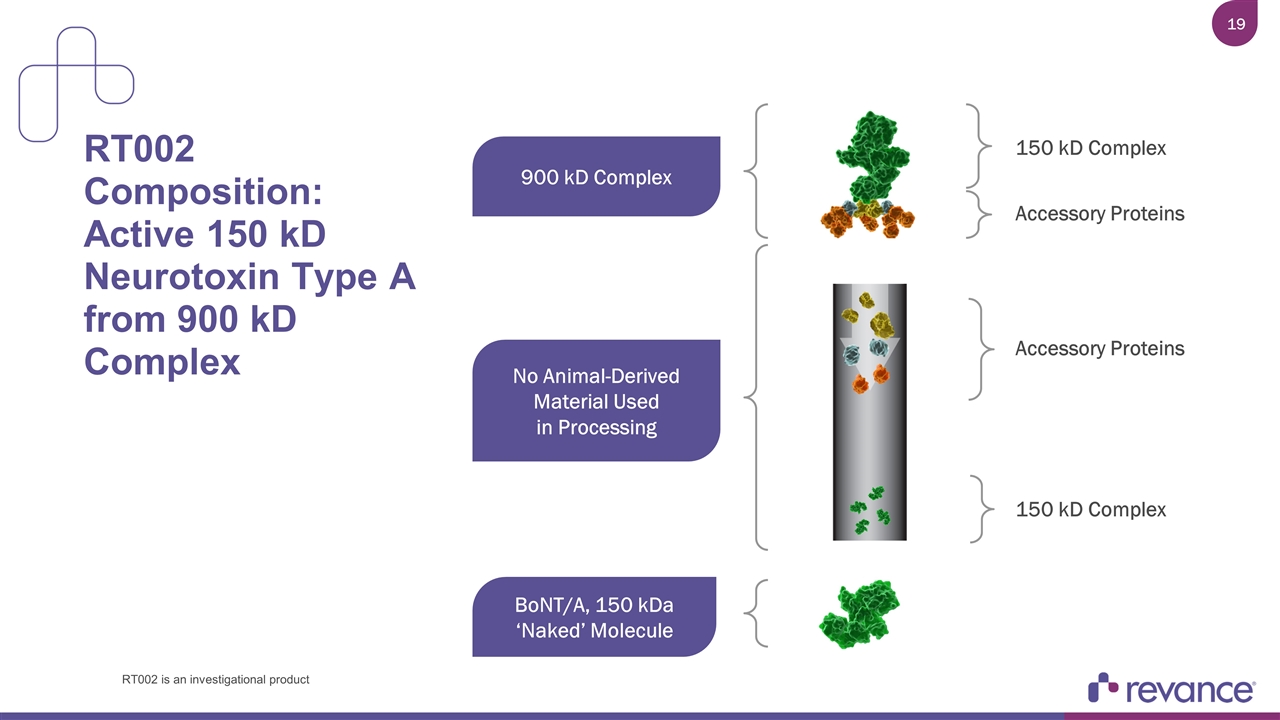

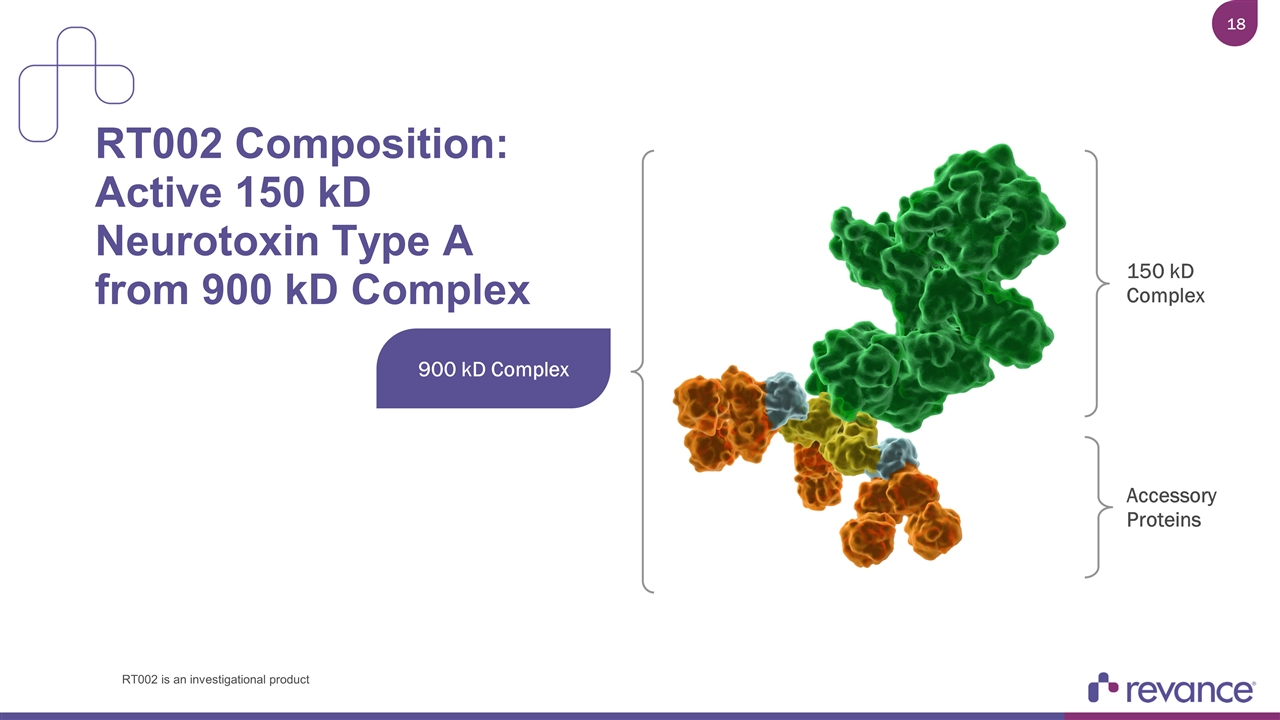

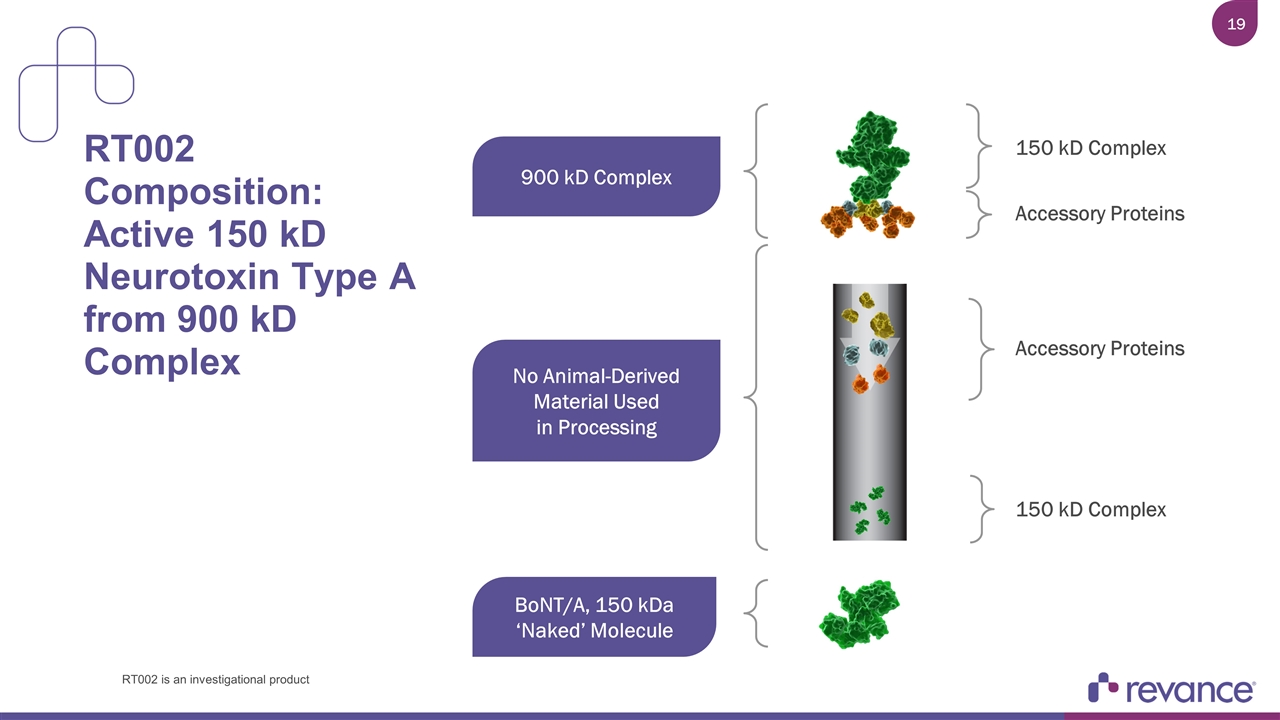

RT002 Composition: Active 150 kD Neurotoxin Type A from 900 kD Complex 900 kD Complex 150 kD Complex Accessory Proteins RT002 is an investigational product

RT002 Composition: Active 150 kD Neurotoxin Type A from 900 kD Complex 900 kD Complex 150 kD Complex Accessory Proteins BoNT/A, 150 kDa ‘Naked’ Molecule Accessory Proteins 150 kD Complex No Animal-Derived Material Used in Processing RT002 is an investigational product

RT002 Composition: Active 150 kD Neurotoxin Type A BoNT/A, 150 kDa ‘Naked’ Molecule RT002 is an investigational product

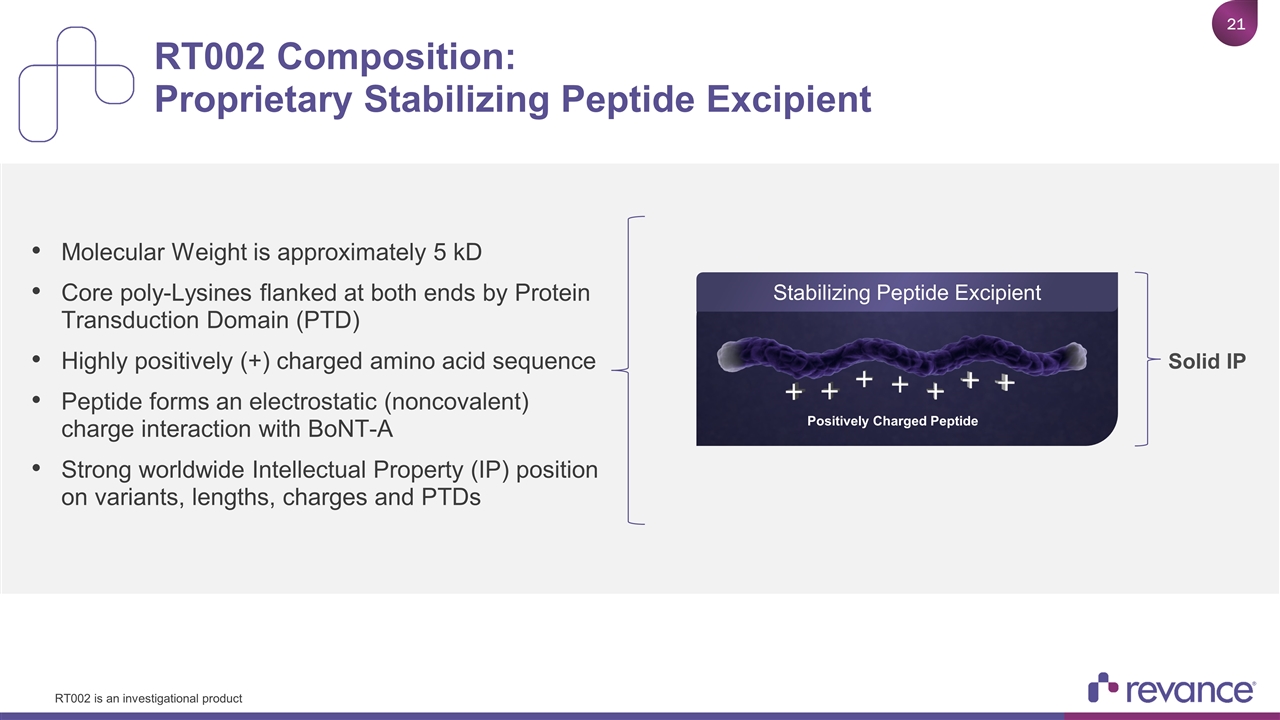

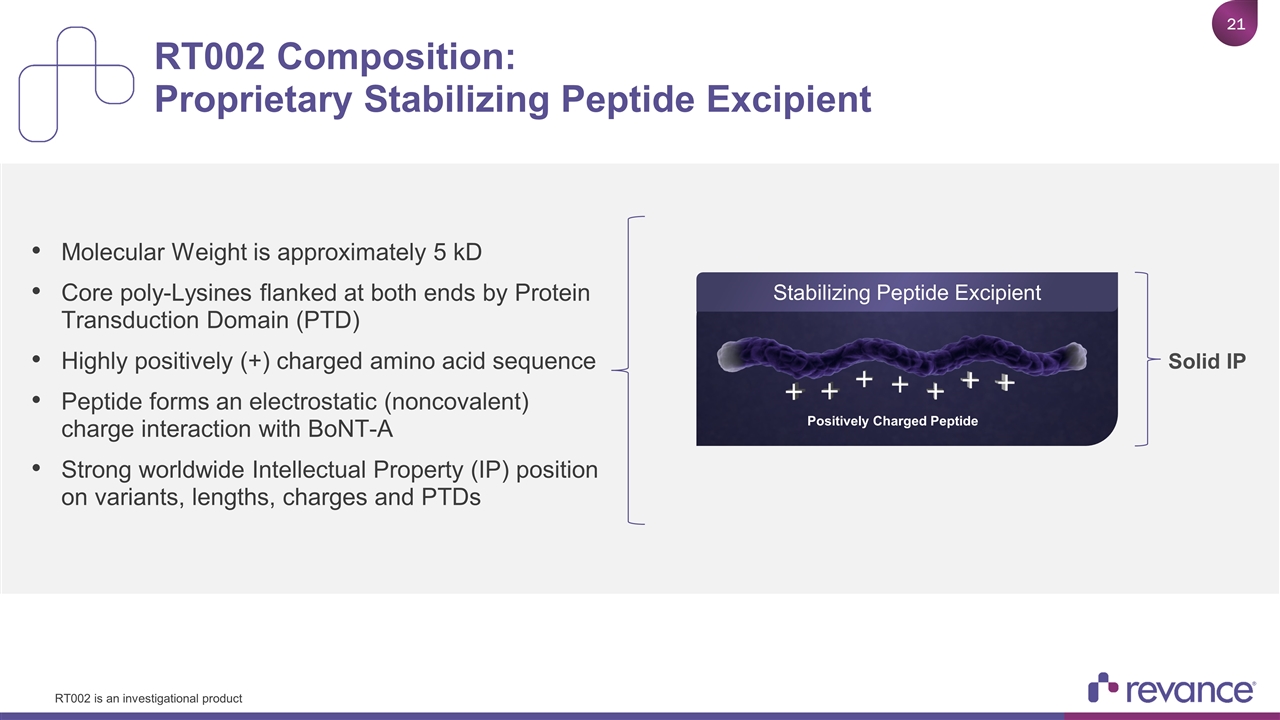

RT002 Composition: Proprietary Stabilizing Peptide Excipient Molecular Weight is approximately 5 kD Core poly-Lysines flanked at both ends by Protein Transduction Domain (PTD) Highly positively (+) charged amino acid sequence Peptide forms an electrostatic (noncovalent) charge interaction with BoNT-A Strong worldwide Intellectual Property (IP) position on variants, lengths, charges and PTDs DaxiA Positively Charged Peptide Solid IP Stabilizing Peptide Excipient RT002 is an investigational product

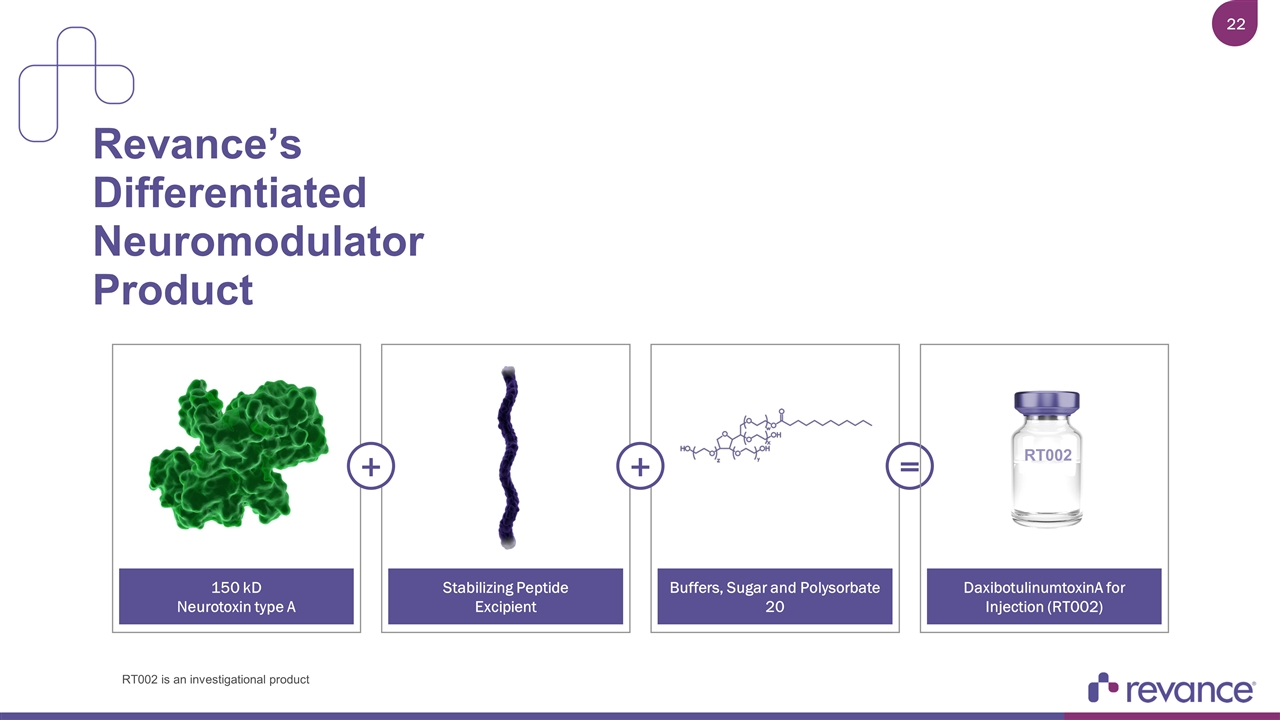

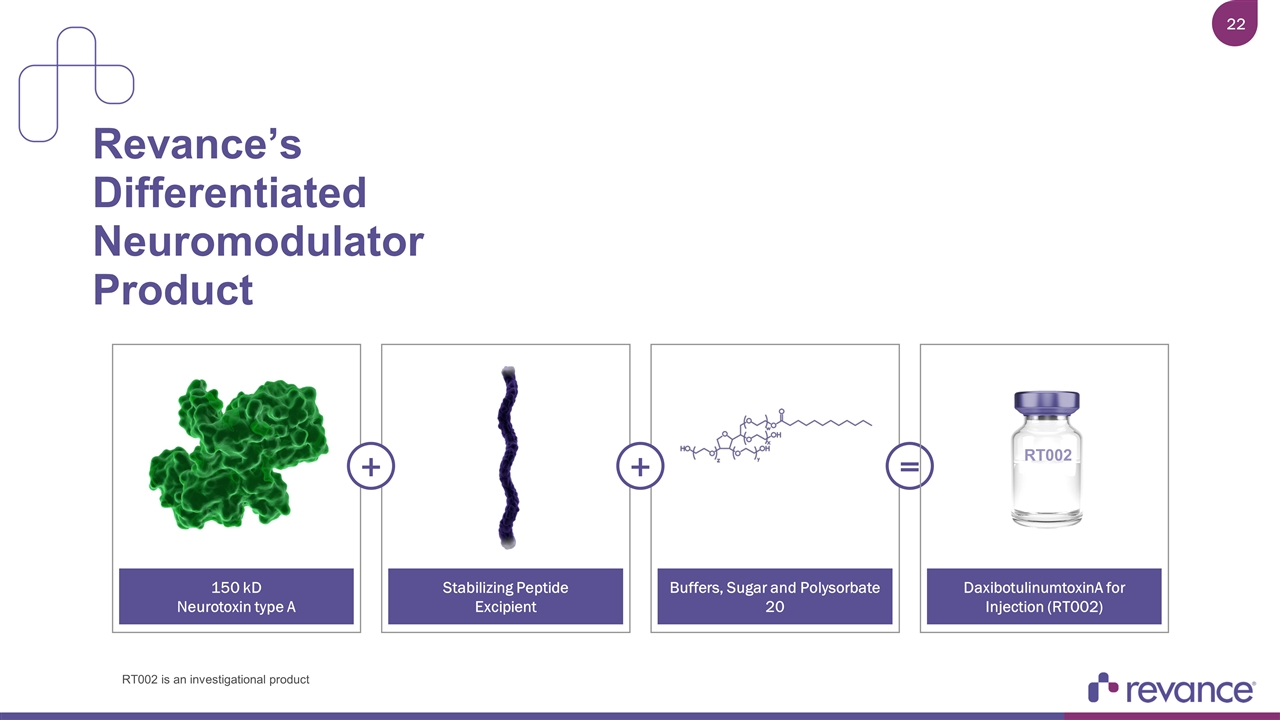

Revance’s Differentiated Neuromodulator Product 150 kD Neurotoxin type A Stabilizing Peptide Excipient Buffers, Sugar and Polysorbate 20 + + = DaxibotulinumtoxinA for Injection (RT002) RT002 RT002 is an investigational product

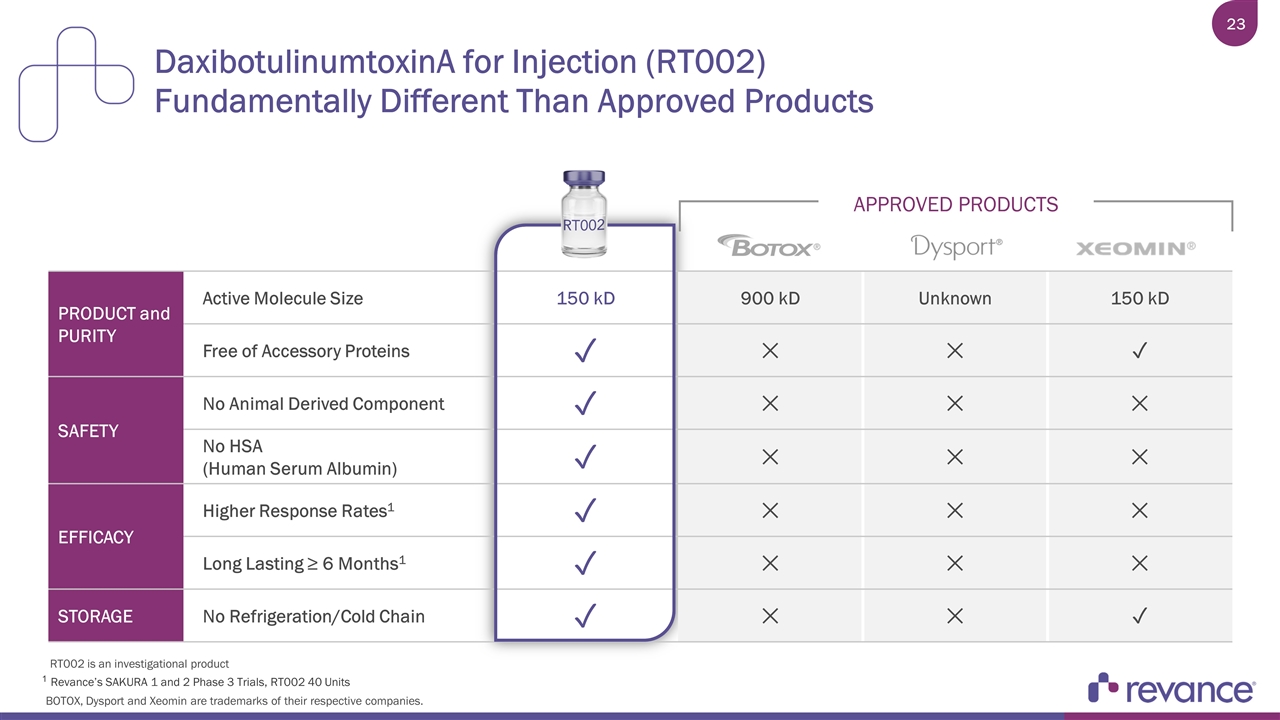

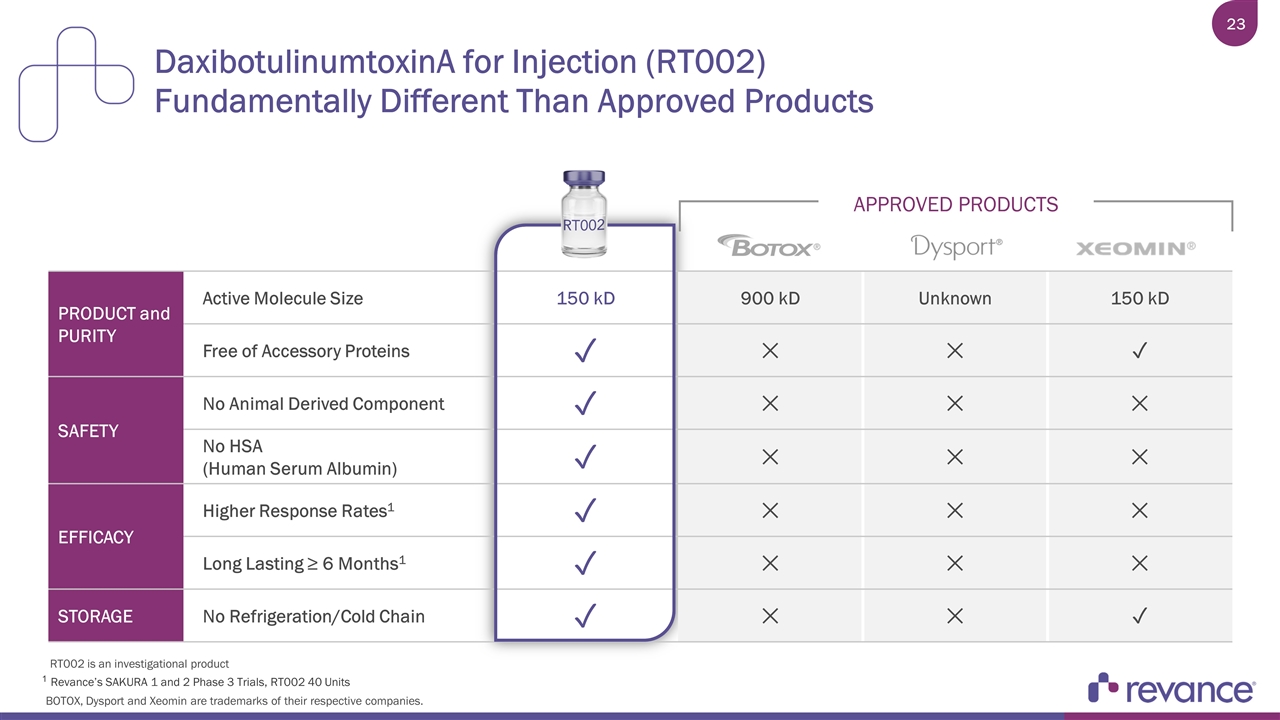

DaxibotulinumtoxinA for Injection (RT002) Fundamentally Different Than Approved Products PRODUCT and PURITY Active Molecule Size 150 kD 900 kD Unknown 150 kD Free of Accessory Proteins ✓ ✕ ✕ ✓ SAFETY No Animal Derived Component ✓ ✕ ✕ ✕ No HSA (Human Serum Albumin) ✓ ✕ ✕ ✕ EFFICACY Higher Response Rates1 ✓ ✕ ✕ ✕ Long Lasting ≥ 6 Months1 ✓ ✕ ✕ ✕ STORAGE No Refrigeration/Cold Chain ✓ ✕ ✕ ✓ APPROVED PRODUCTS 1 Revance’s SAKURA 1 and 2 Phase 3 Trials, RT002 40 Units BOTOX, Dysport and Xeomin are trademarks of their respective companies. RT002 is an investigational product

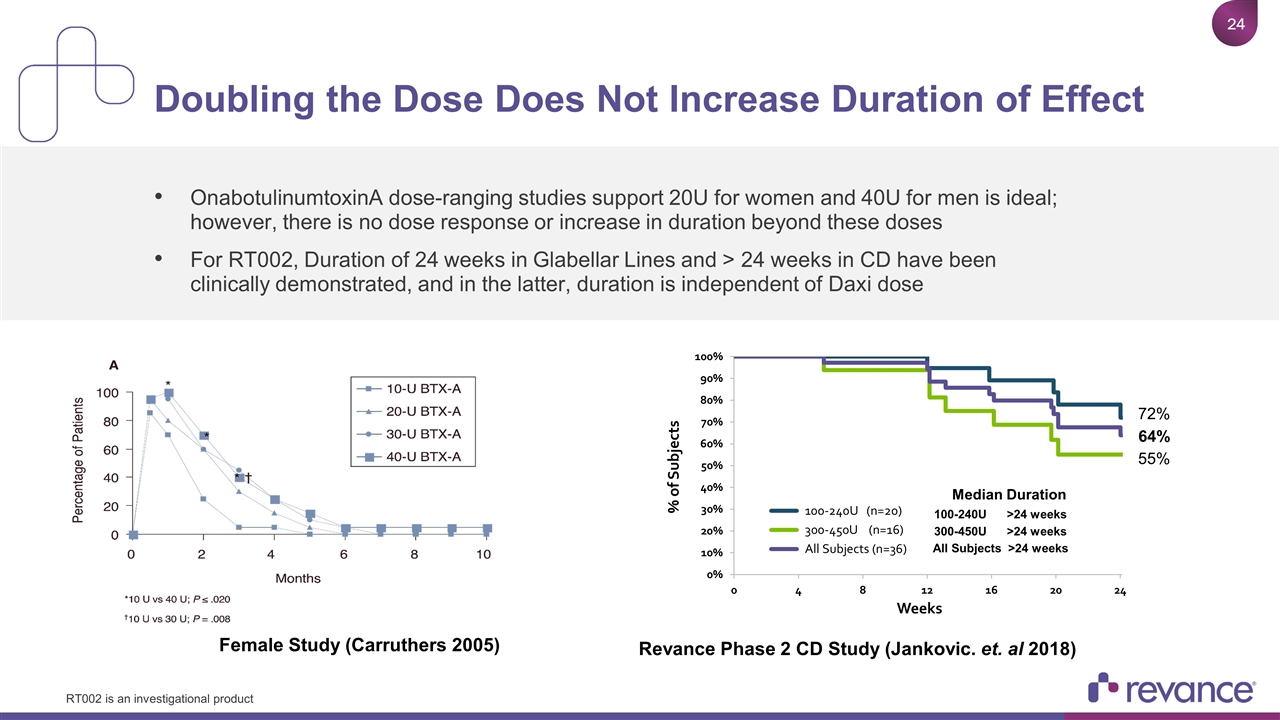

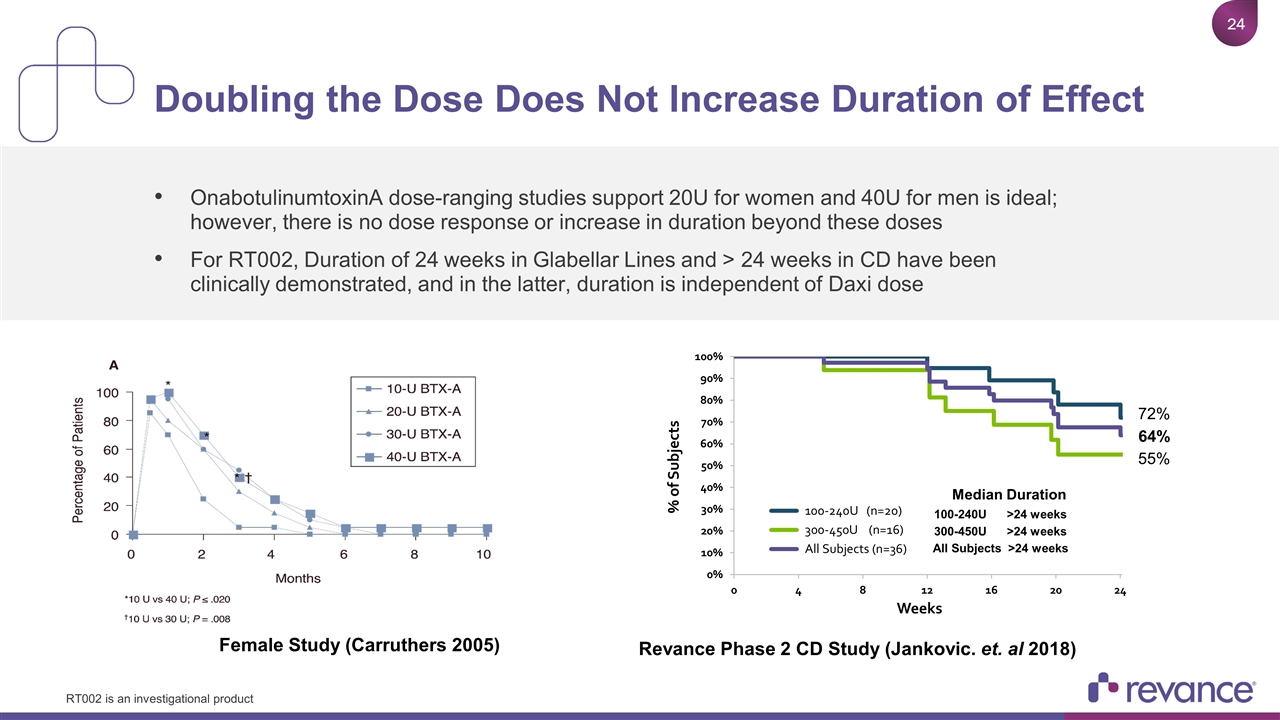

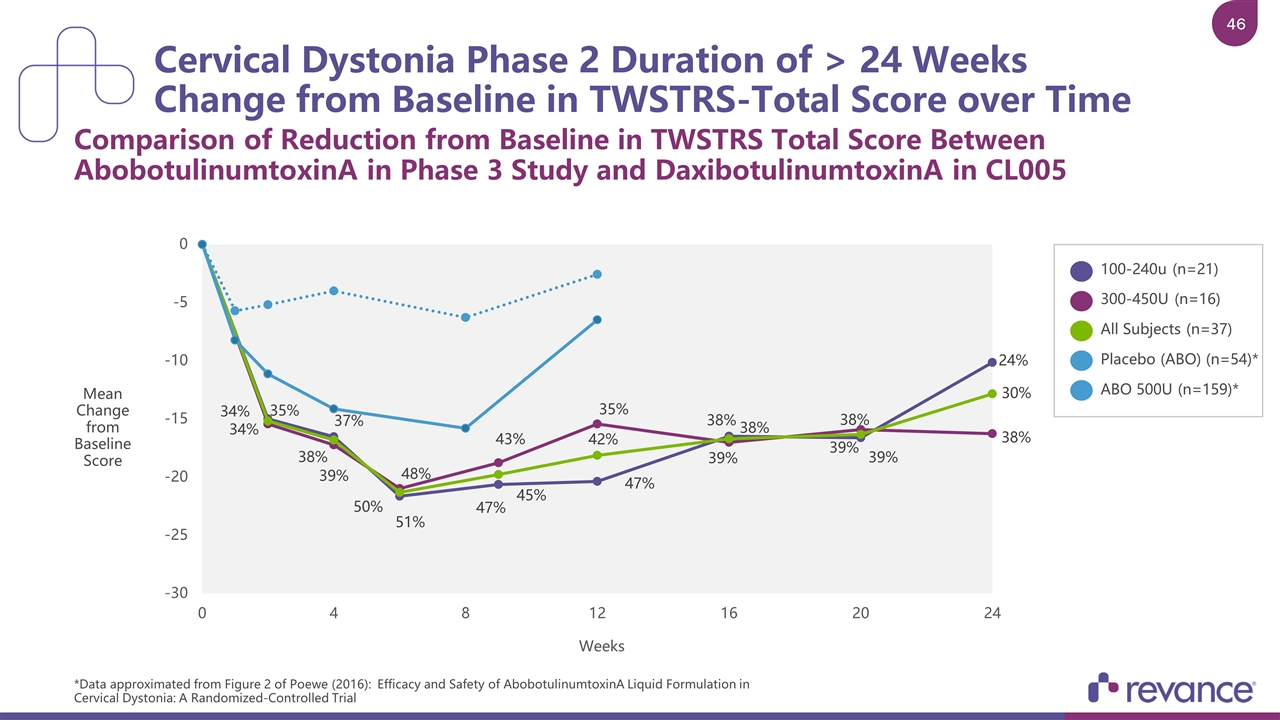

OnabotulinumtoxinA dose-ranging studies support 20U for women and 40U for men is ideal; however, there is no dose response or increase in duration beyond these doses For RT002, Duration of 24 weeks in Glabellar Lines and > 24 weeks in CD have been clinically demonstrated, and in the latter, duration is independent of Daxi dose Doubling the Dose Does Not Increase Duration of Effect Median Duration 100-240U >24 weeks 300-450U >24 weeks All Subjects >24 weeks 55% 64% 72% Female Study (Carruthers 2005) Revance Phase 2 CD Study (Jankovic. et. al 2018) RT002 is an investigational product

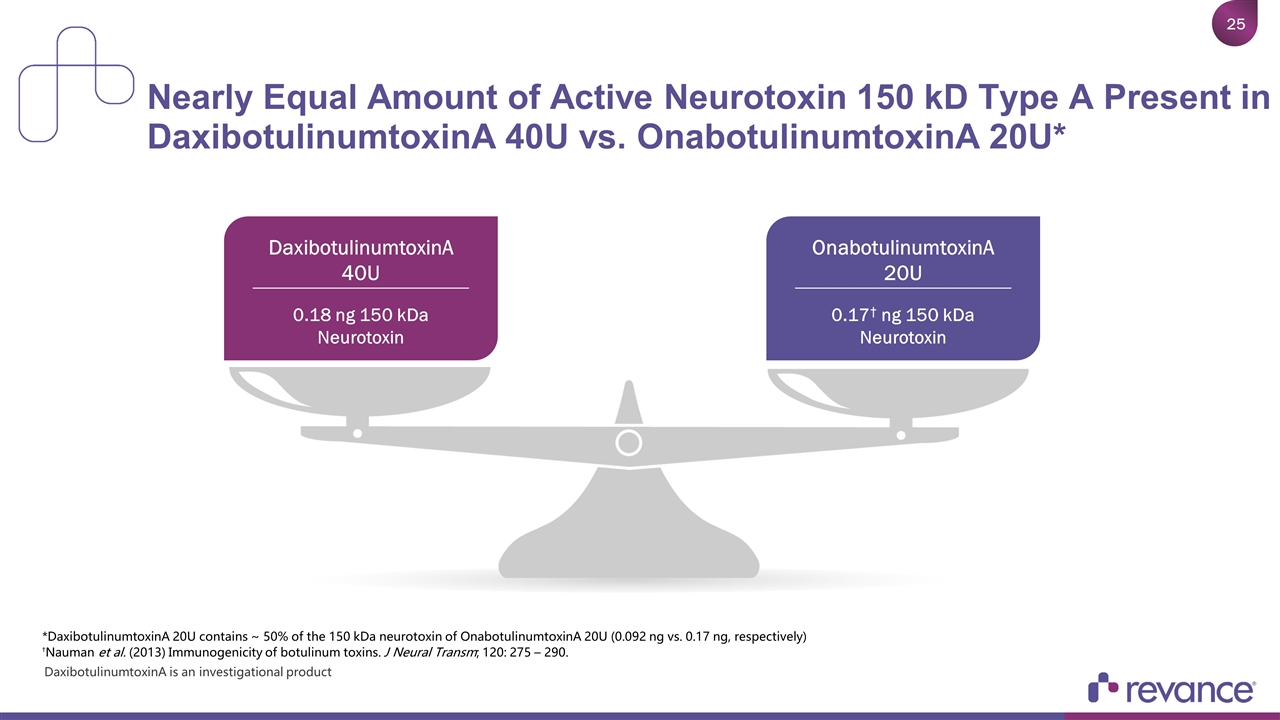

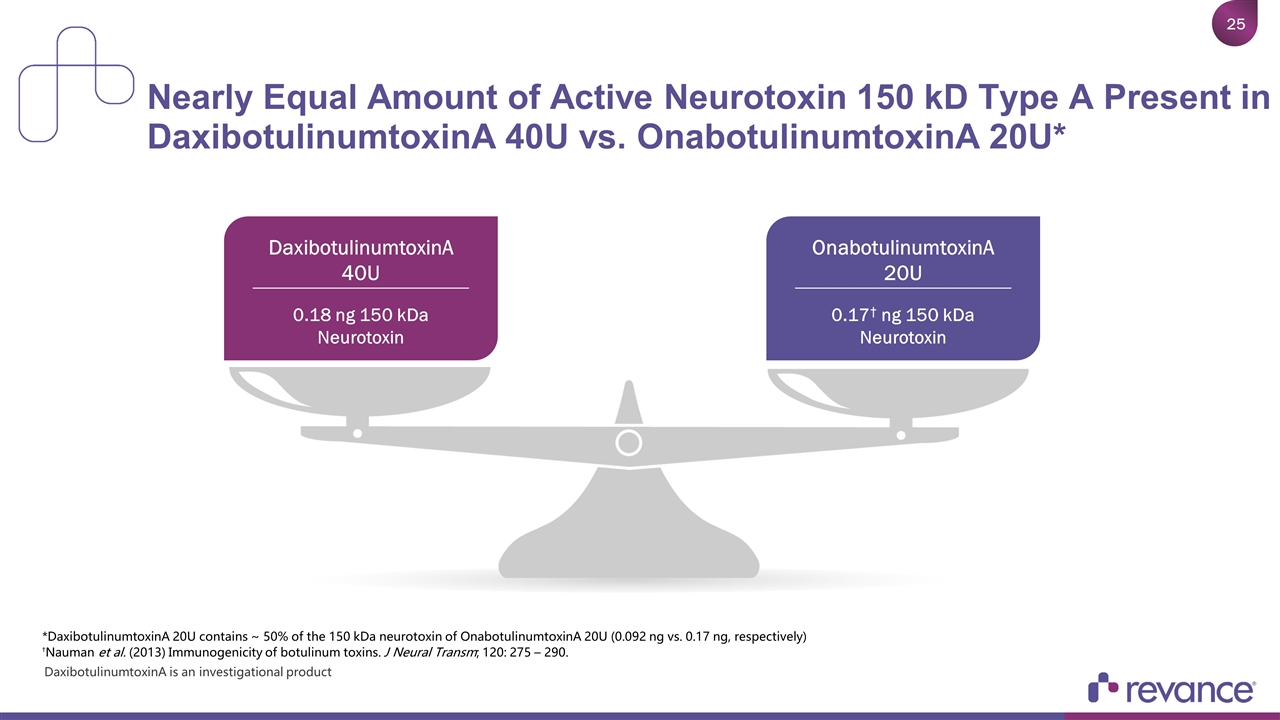

Nearly Equal Amount of Active Neurotoxin 150 kD Type A Present in DaxibotulinumtoxinA 40U vs. OnabotulinumtoxinA 20U* OnabotulinumtoxinA 20U 0.17† ng 150 kDa Neurotoxin DaxibotulinumtoxinA 40U 0.18 ng 150 kDa Neurotoxin *DaxibotulinumtoxinA 20U contains ~ 50% of the 150 kDa neurotoxin of OnabotulinumtoxinA 20U (0.092 ng vs. 0.17 ng, respectively) †Nauman et al. (2013) Immunogenicity of botulinum toxins. J Neural Transm; 120: 275 – 290. DaxibotulinumtoxinA is an investigational product

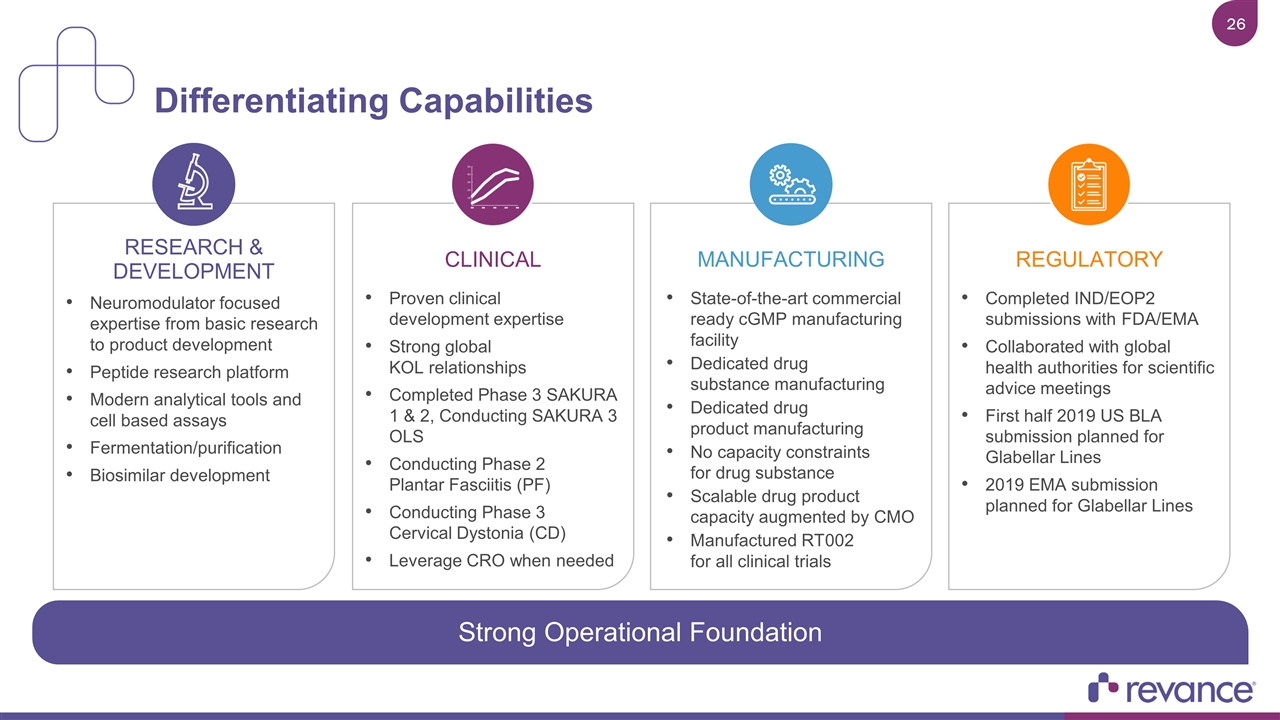

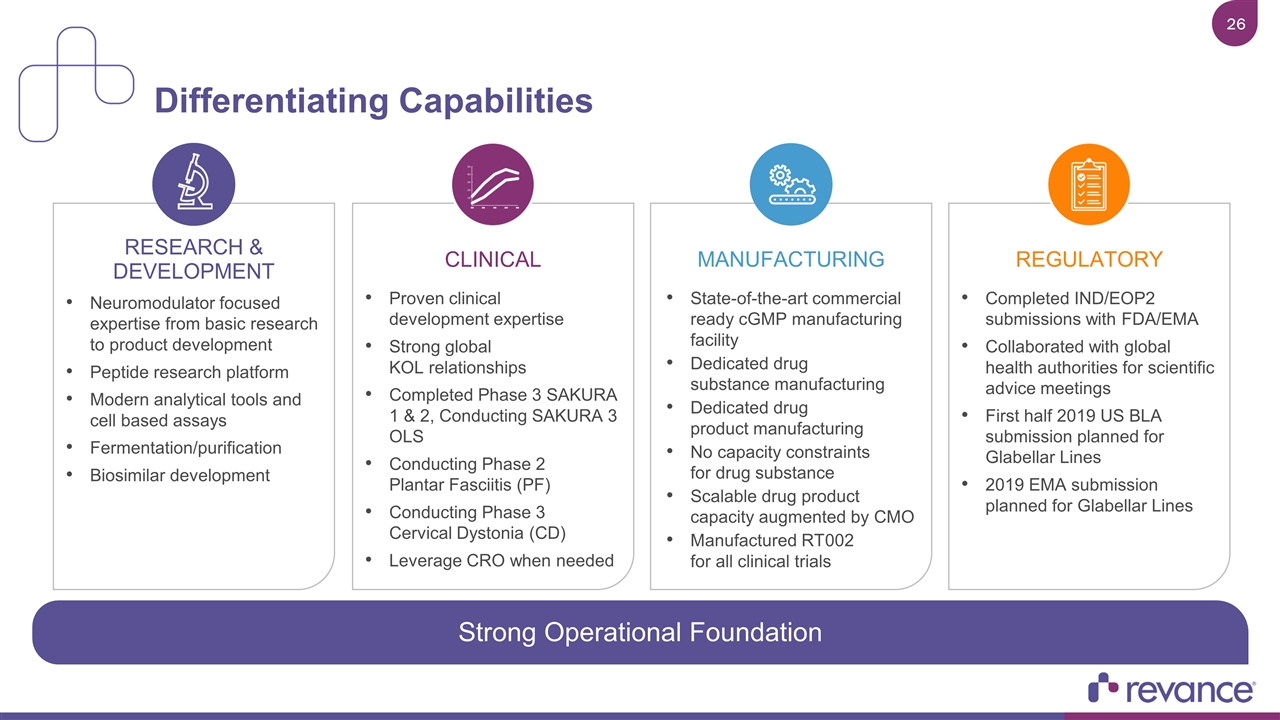

Differentiating Capabilities RESEARCH & DEVELOPMENT Neuromodulator focused expertise from basic research to product development Peptide research platform Modern analytical tools and cell based assays Fermentation/purification Biosimilar development REGULATORY Completed IND/EOP2 submissions with FDA/EMA Collaborated with global health authorities for scientific advice meetings First half 2019 US BLA submission planned for Glabellar Lines 2019 EMA submission planned for Glabellar Lines CLINICAL Proven clinical development expertise Strong global KOL relationships Completed Phase 3 SAKURA 1 & 2, Conducting SAKURA 3 OLS Conducting Phase 2 Plantar Fasciitis (PF) Conducting Phase 3 Cervical Dystonia (CD) Leverage CRO when needed MANUFACTURING State-of-the-art commercial ready cGMP manufacturing facility Dedicated drug substance manufacturing Dedicated drug product manufacturing No capacity constraints for drug substance Scalable drug product capacity augmented by CMO Manufactured RT002 for all clinical trials Strong Operational Foundation

Significant Investment in Commercial-Ready Manufacturing Facilities Located in the U.S. US Based Manufacturing for both Drug Substance and Drug Product State-of-the-Art Commercial-ready cGMP facility Drug Substance Capability to manufacture botulinum neurotoxin type A from 150 kD to 900 kD Drug Product End-to-end drug formulation, filling, lyophilization and packaging

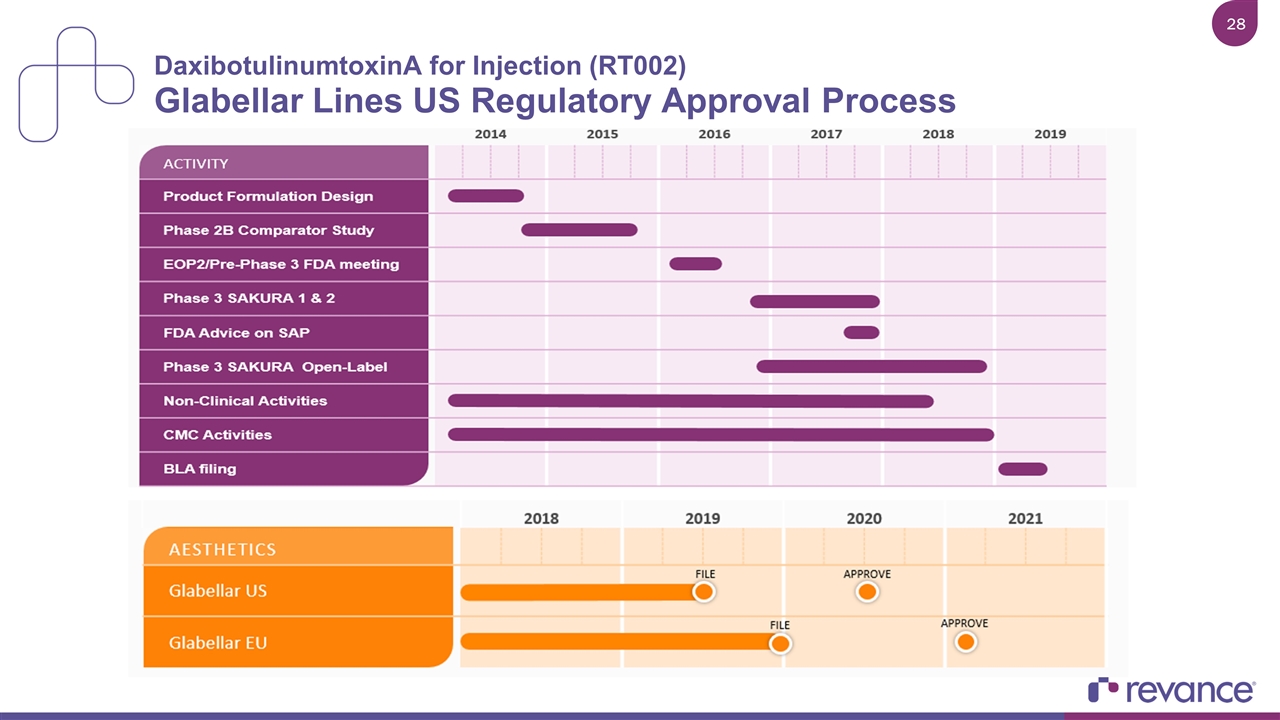

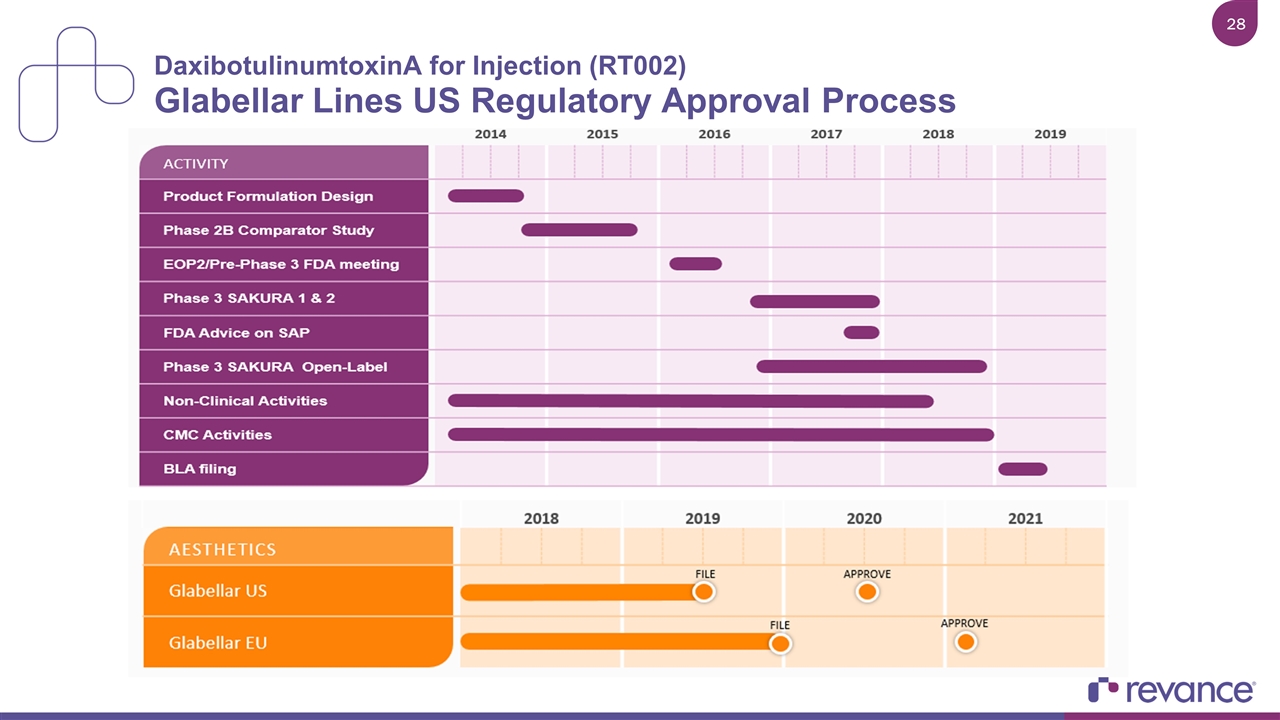

DaxibotulinumtoxinA for Injection (RT002) Glabellar Lines US Regulatory Approval Process

DaxibotulinumtoxinA for Injection (RT002) Product Profile/Mechanism of Action (MOA) Andreas Rummel, PhD - Senior Group Leader, Hannover Medical School, Hannover, Germany

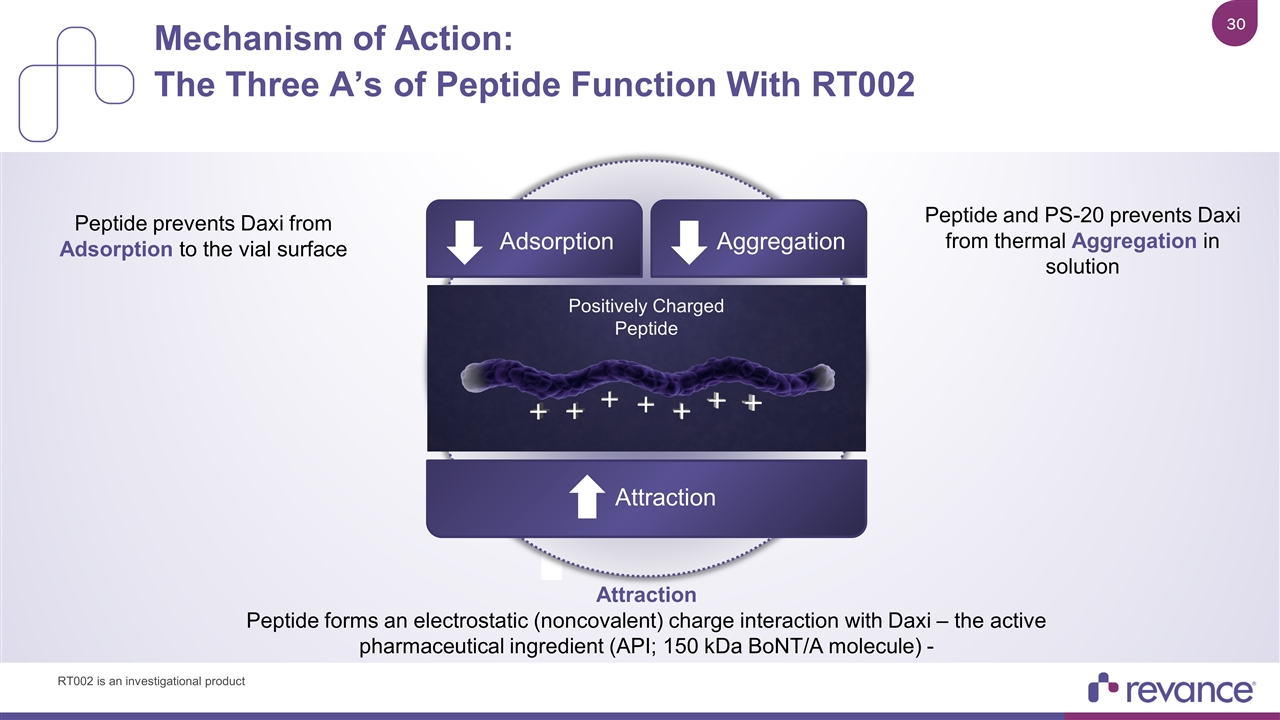

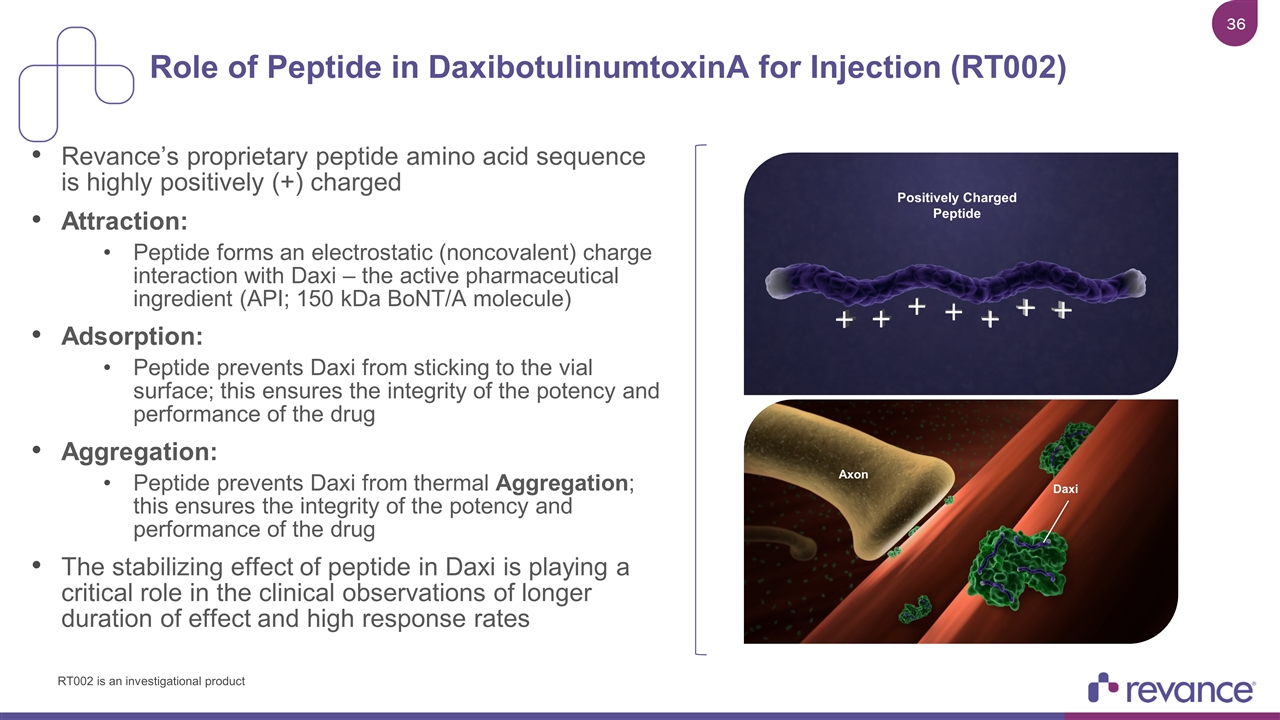

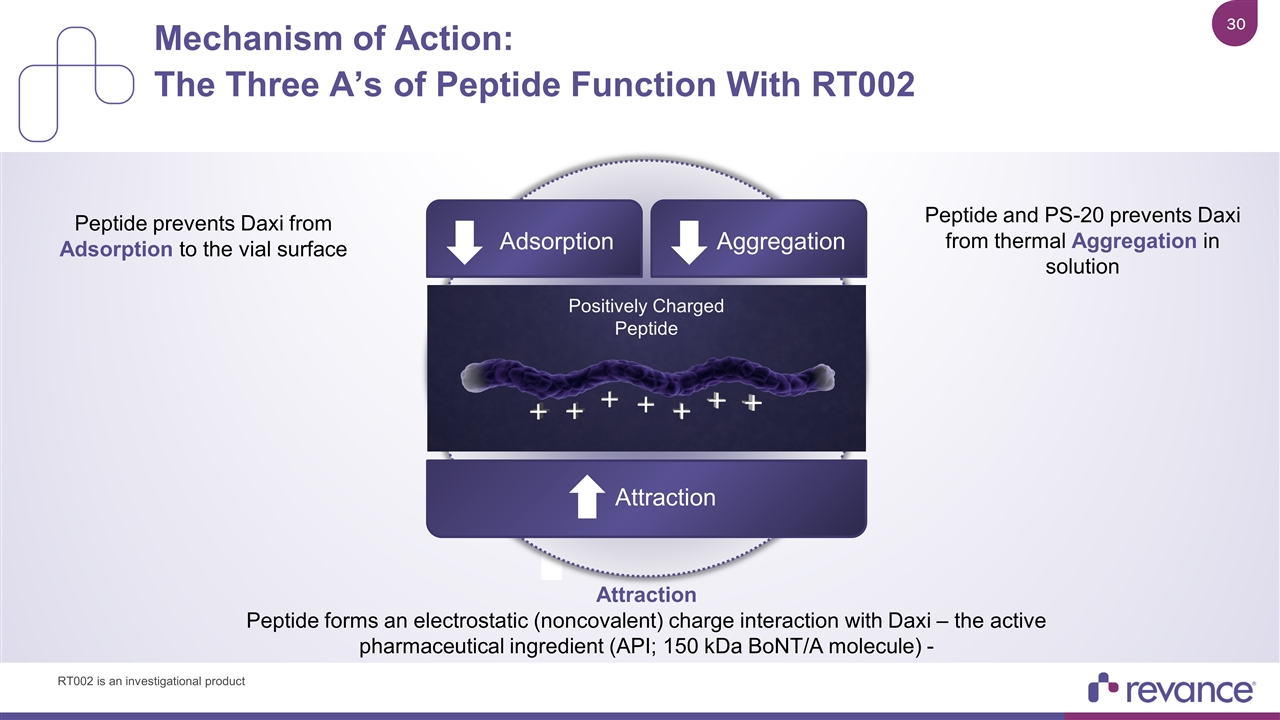

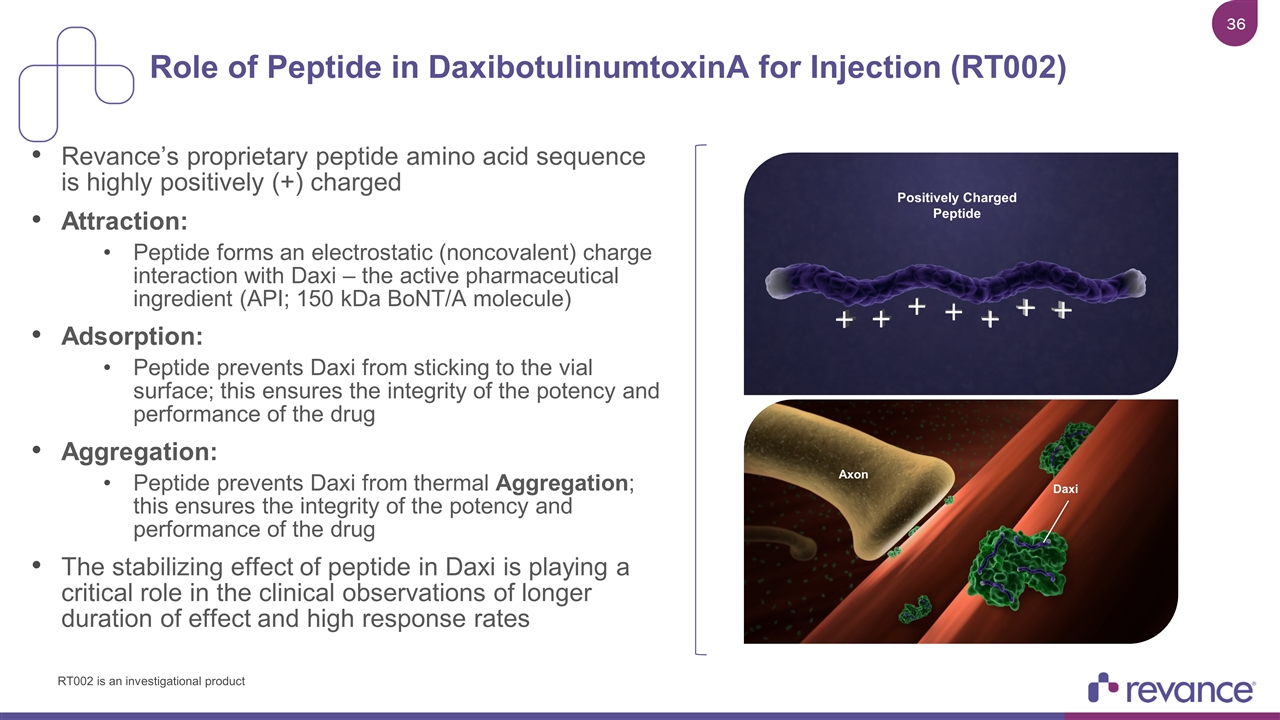

RTP004 prevents Daxi from sticking to the vial (Adsorption) Mechanism of Action: The Three A’s of Peptide Function With RT002 Aggregation Adsorption Attraction Positively Charged Peptide Attraction Peptide forms an electrostatic (noncovalent) charge interaction with Daxi – the active pharmaceutical ingredient (API; 150 kDa BoNT/A molecule) - Peptide prevents Daxi from Adsorption to the vial surface Peptide and PS-20 prevents Daxi from thermal Aggregation in solution RT002 is an investigational product

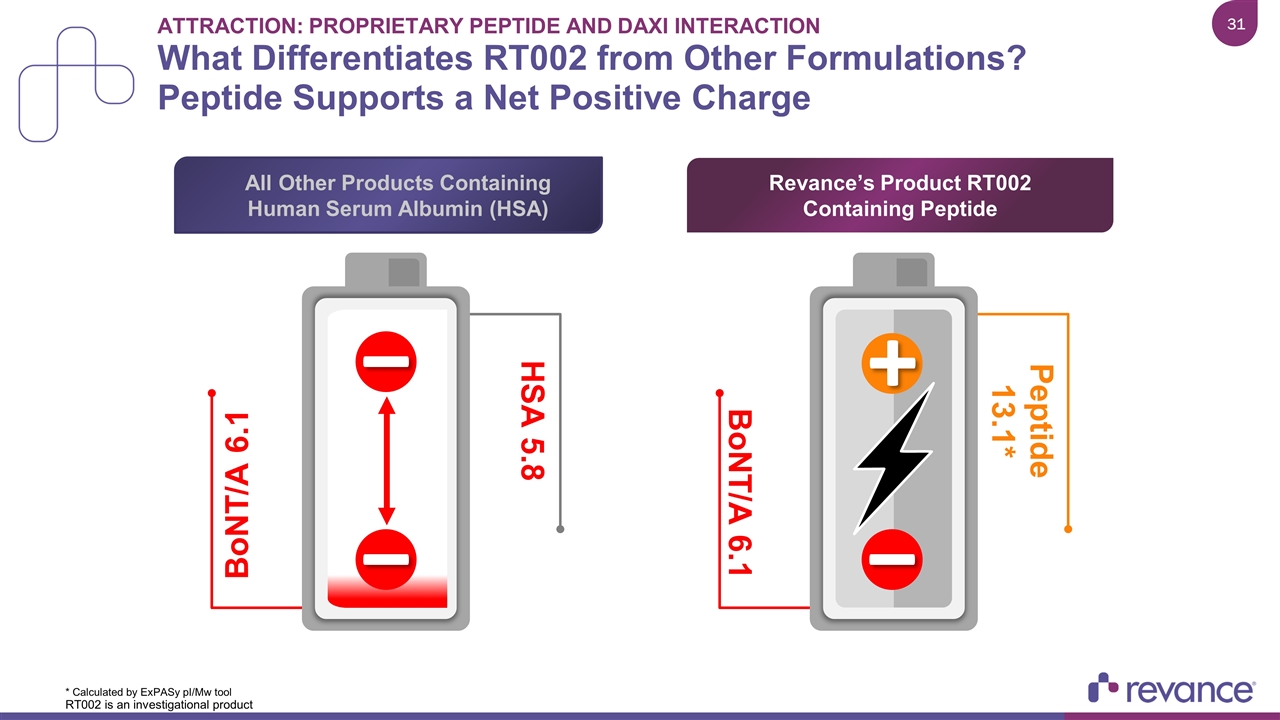

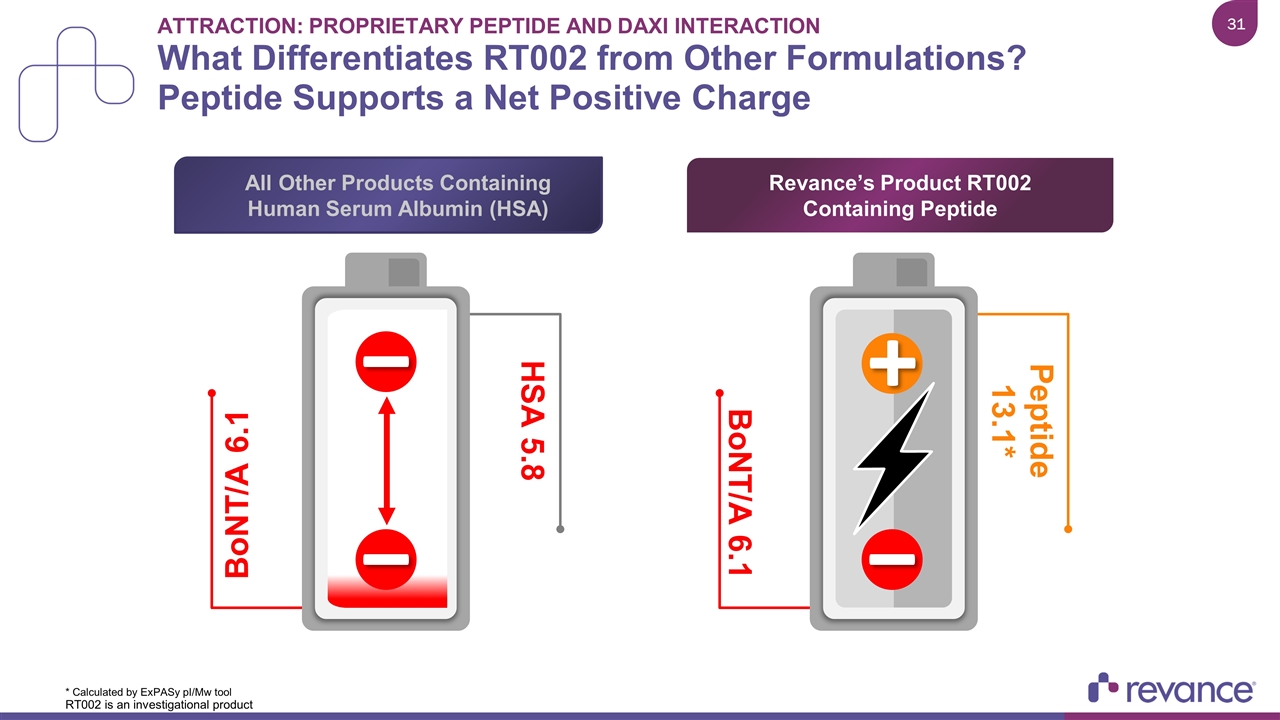

Attraction: Proprietary Peptide and Daxi Interaction What Differentiates RT002 from Other Formulations? Peptide Supports a Net Positive Charge * Calculated by ExPASy pI/Mw tool BoNT/A 6.1 HSA 5.8 BoNT/A 6.1 Peptide 13.1* Revance’s Product RT002 Containing Peptide All Other Products Containing Human Serum Albumin (HSA) RT002 is an investigational product

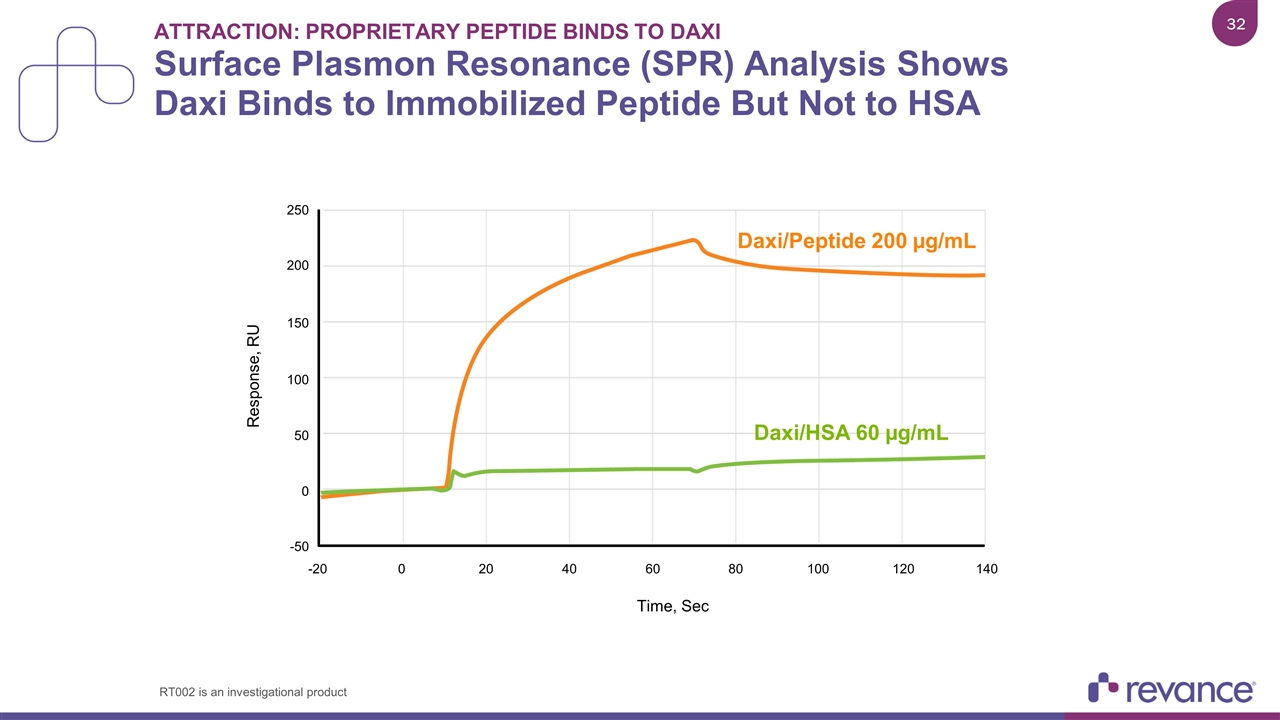

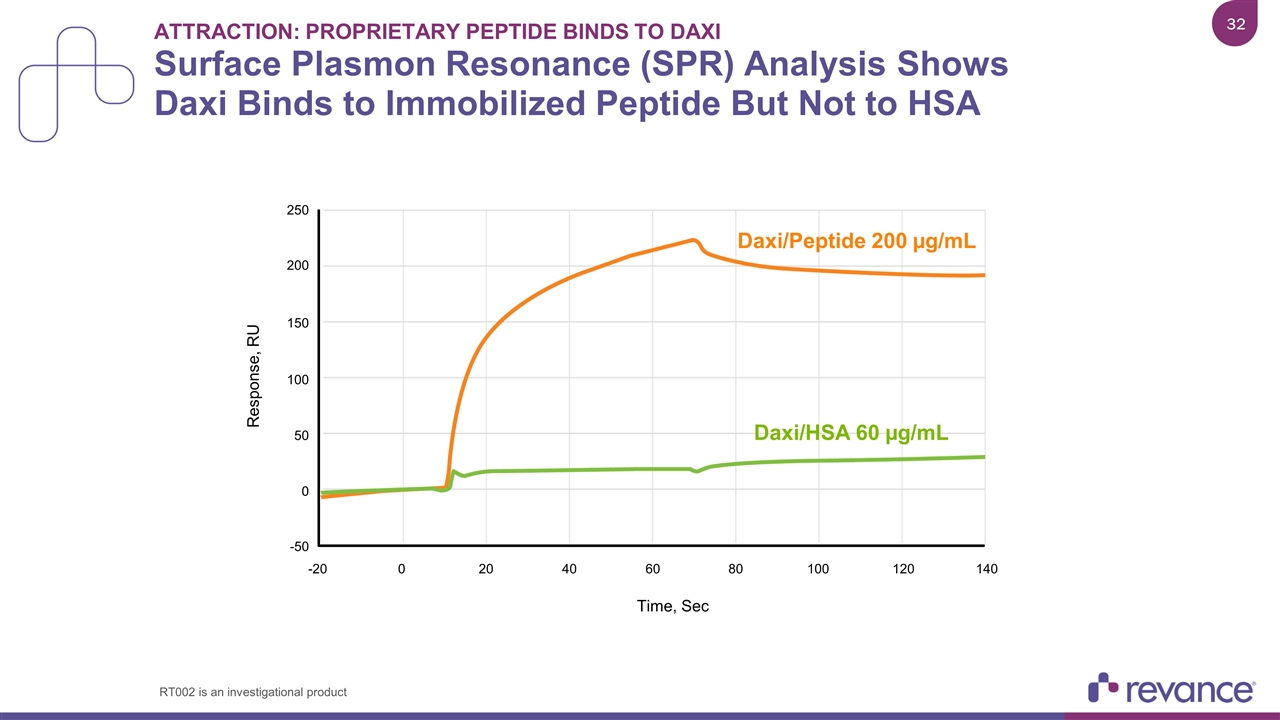

Attraction: Proprietary Peptide Binds to Daxi Surface Plasmon Resonance (SPR) Analysis Shows Daxi Binds to Immobilized Peptide But Not to HSA Time, Sec Daxi/Peptide 200 µg/mL Daxi/HSA 60 µg/mL 250 Response, RU 200 150 100 50 0 -50 -20 0 20 40 60 80 100 120 140 RT002 is an investigational product

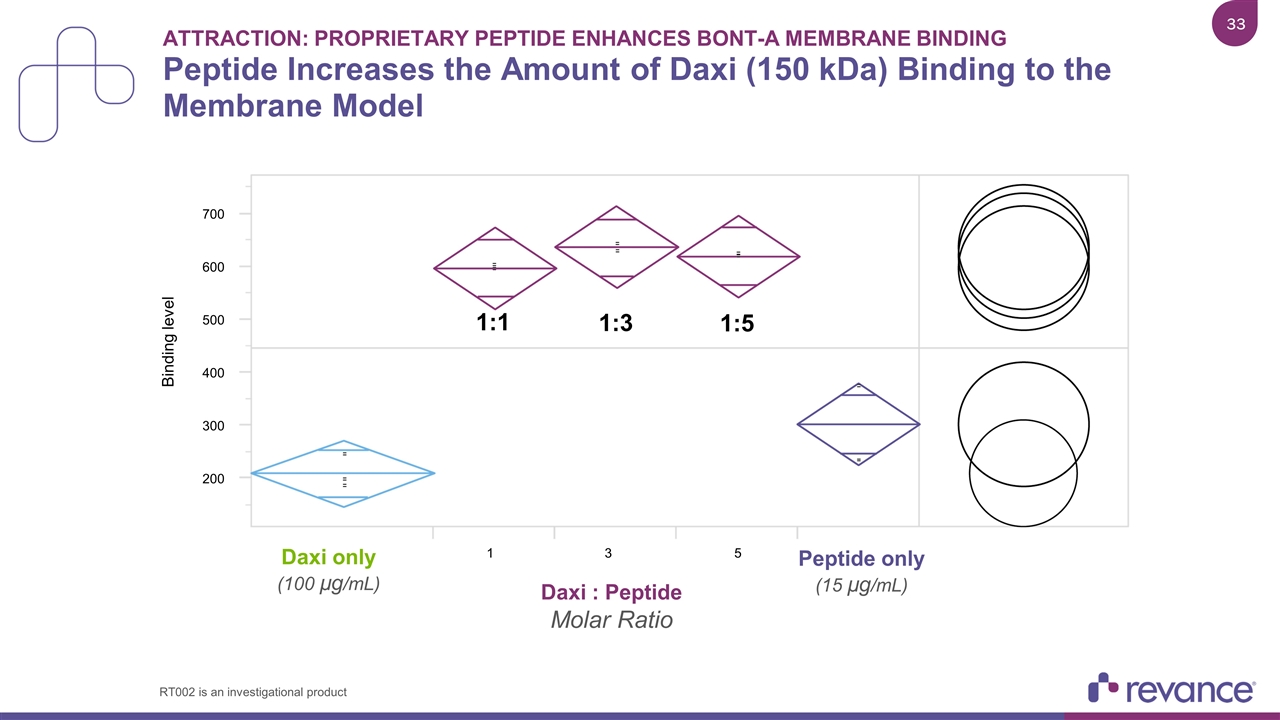

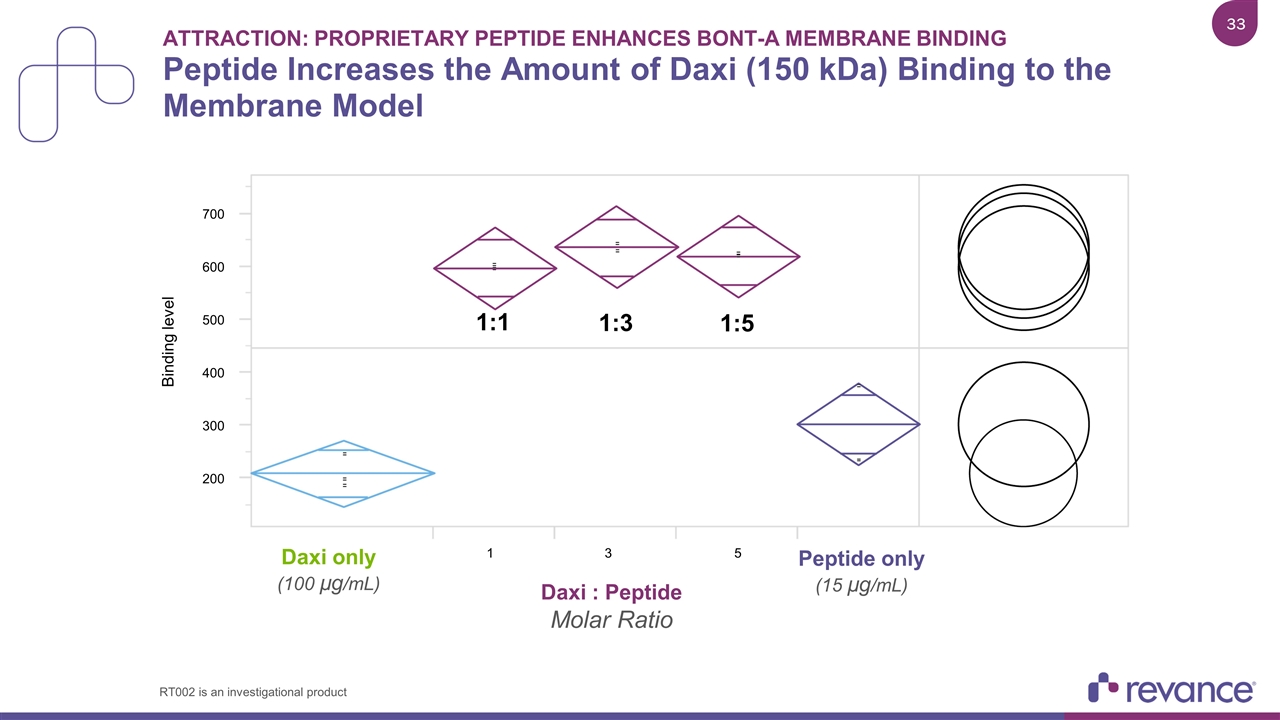

Attraction: Proprietary Peptide Enhances BoNT-A Membrane Binding Peptide Increases the Amount of Daxi (150 kDa) Binding to the Membrane Model 700 Binding level 1 600 500 400 300 200 3 5 Daxi only (100 µg/mL) 1:1 1:3 1:5 Peptide only (15 µg/mL) Daxi : Peptide Molar Ratio RT002 is an investigational product

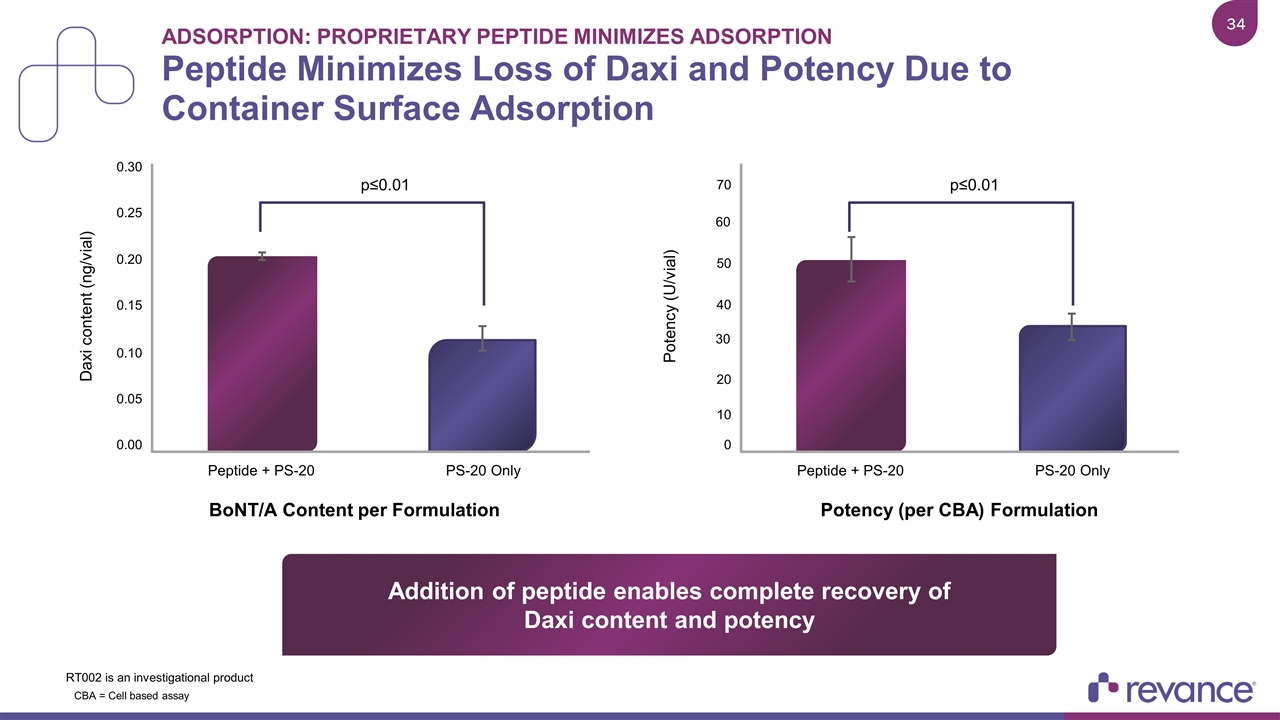

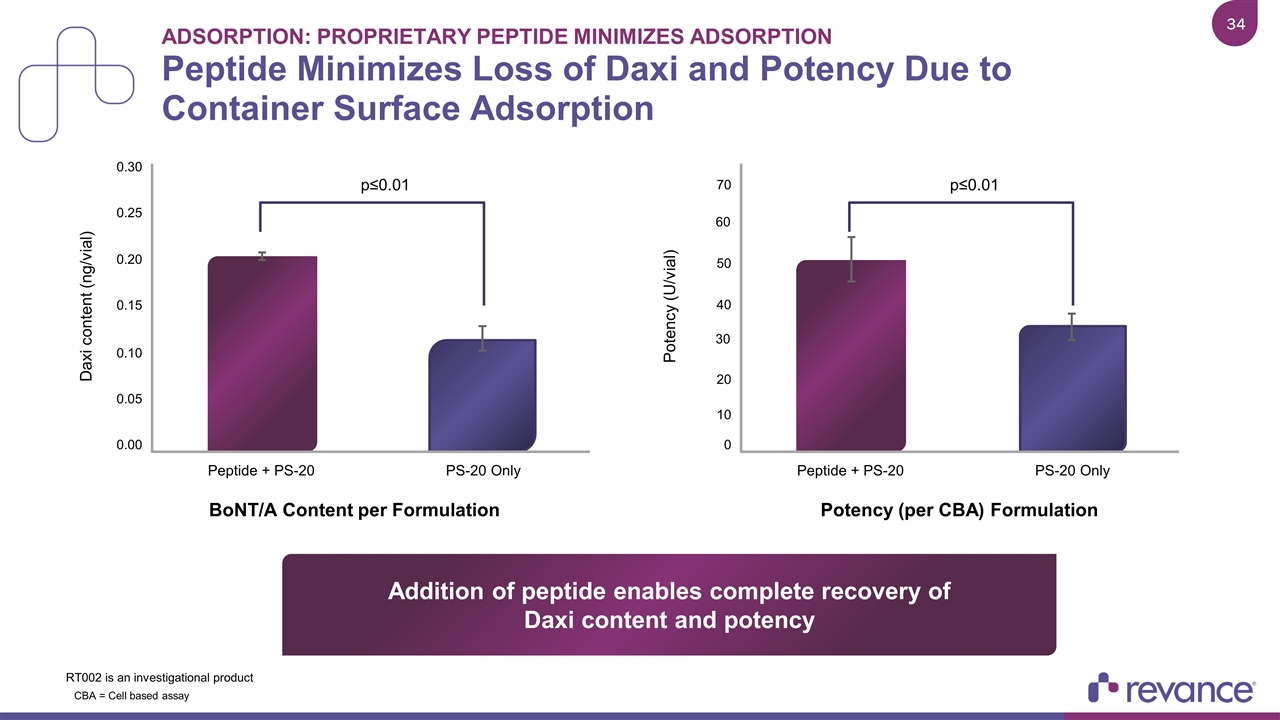

Adsorption: Proprietary Peptide Minimizes Adsorption Peptide Minimizes Loss of Daxi and Potency Due to Container Surface Adsorption 0.30 0.25 0.20 0.15 0.10 0.05 0.00 Daxi content (ng/vial) p≤0.01 Peptide + PS-20 BoNT/A Content per Formulation PS-20 Only 70 50 40 30 20 10 0 Potency (U/vial) p≤0.01 Peptide + PS-20 Potency (per CBA) Formulation PS-20 Only Addition of peptide enables complete recovery of Daxi content and potency 60 CBA = Cell based assay RT002 is an investigational product

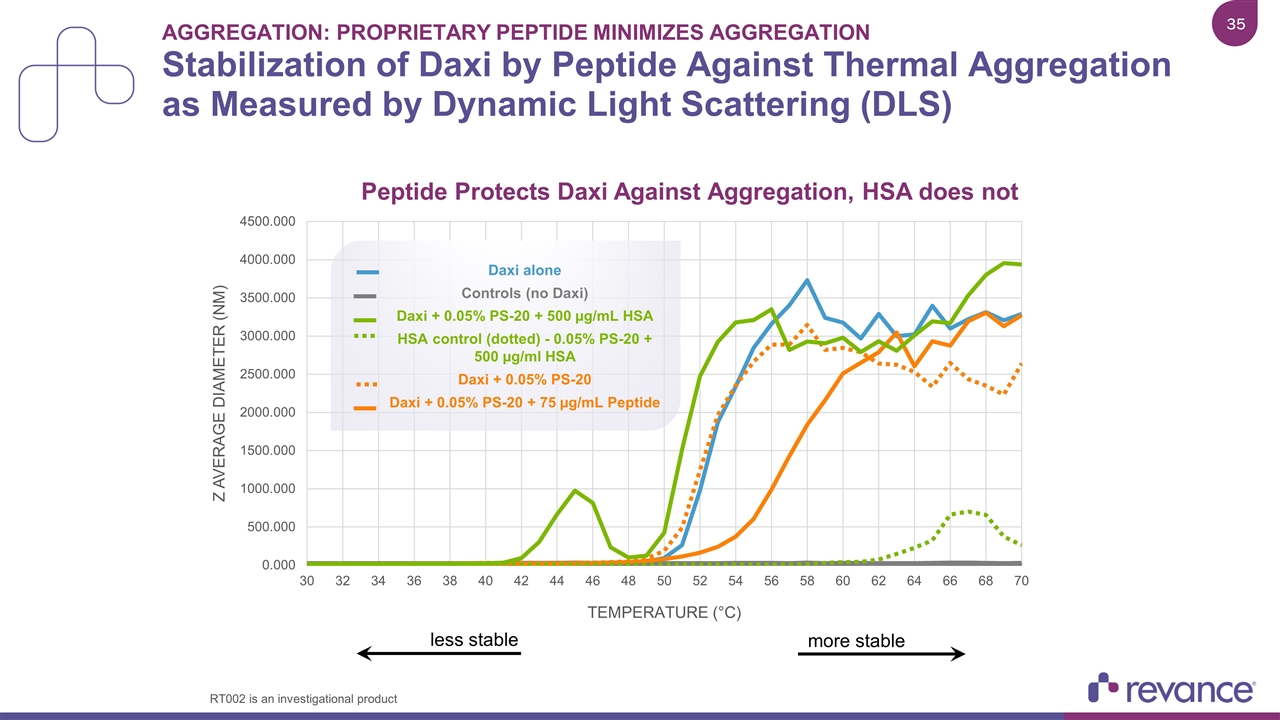

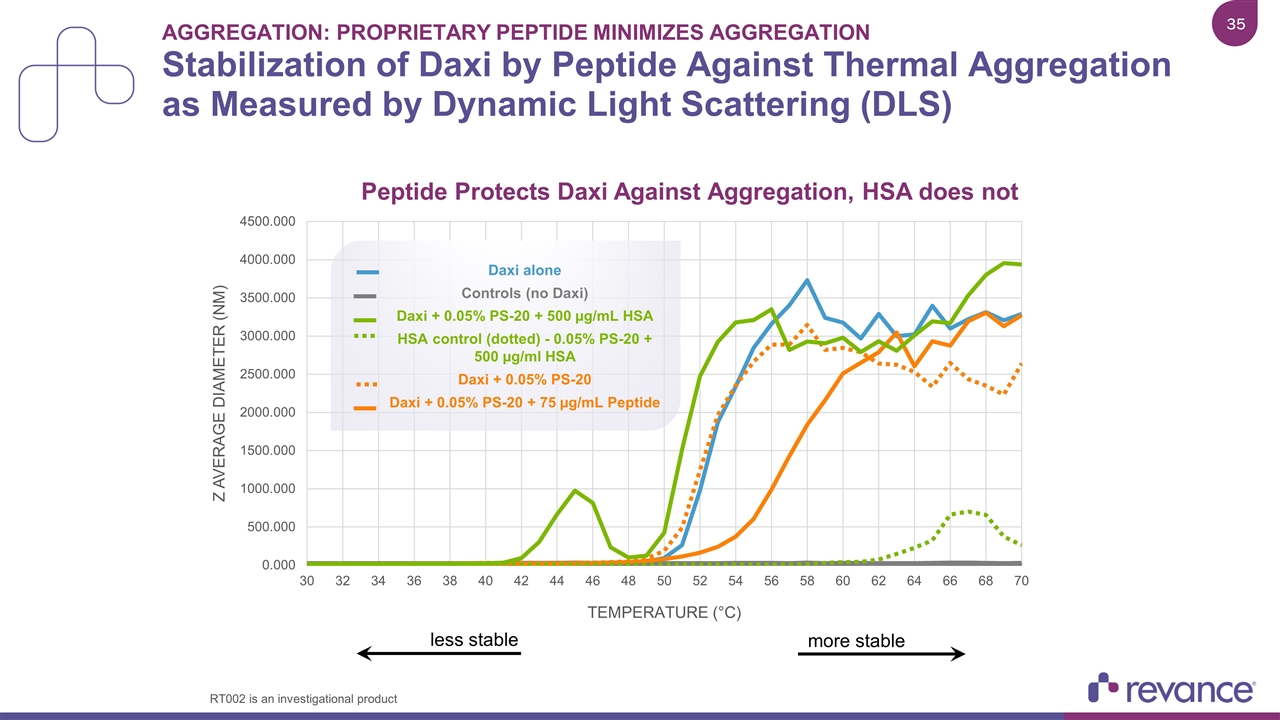

Aggregation: Proprietary Peptide Minimizes Aggregation Stabilization of Daxi by Peptide Against Thermal Aggregation as Measured by Dynamic Light Scattering (DLS) less stable more stable Daxi alone Controls (no Daxi) Daxi + 0.05% PS-20 + 500 µg/mL HSA HSA control (dotted) - 0.05% PS-20 + 500 µg/ml HSA Daxi + 0.05% PS-20 Daxi + 0.05% PS-20 + 75 µg/mL Peptide RT002 is an investigational product

Revance’s proprietary peptide amino acid sequence is highly positively (+) charged Attraction: Peptide forms an electrostatic (noncovalent) charge interaction with Daxi – the active pharmaceutical ingredient (API; 150 kDa BoNT/A molecule) Adsorption: Peptide prevents Daxi from sticking to the vial surface; this ensures the integrity of the potency and performance of the drug Aggregation: Peptide prevents Daxi from thermal Aggregation; this ensures the integrity of the potency and performance of the drug The stabilizing effect of peptide in Daxi is playing a critical role in the clinical observations of longer duration of effect and high response rates Role of Peptide in DaxibotulinumtoxinA for Injection (RT002) Axon Daxi Positively Charged Peptide RT002 is an investigational product

Clinical development Update Roman Rubio, M.D., Sr. Vice President, Clinical Development

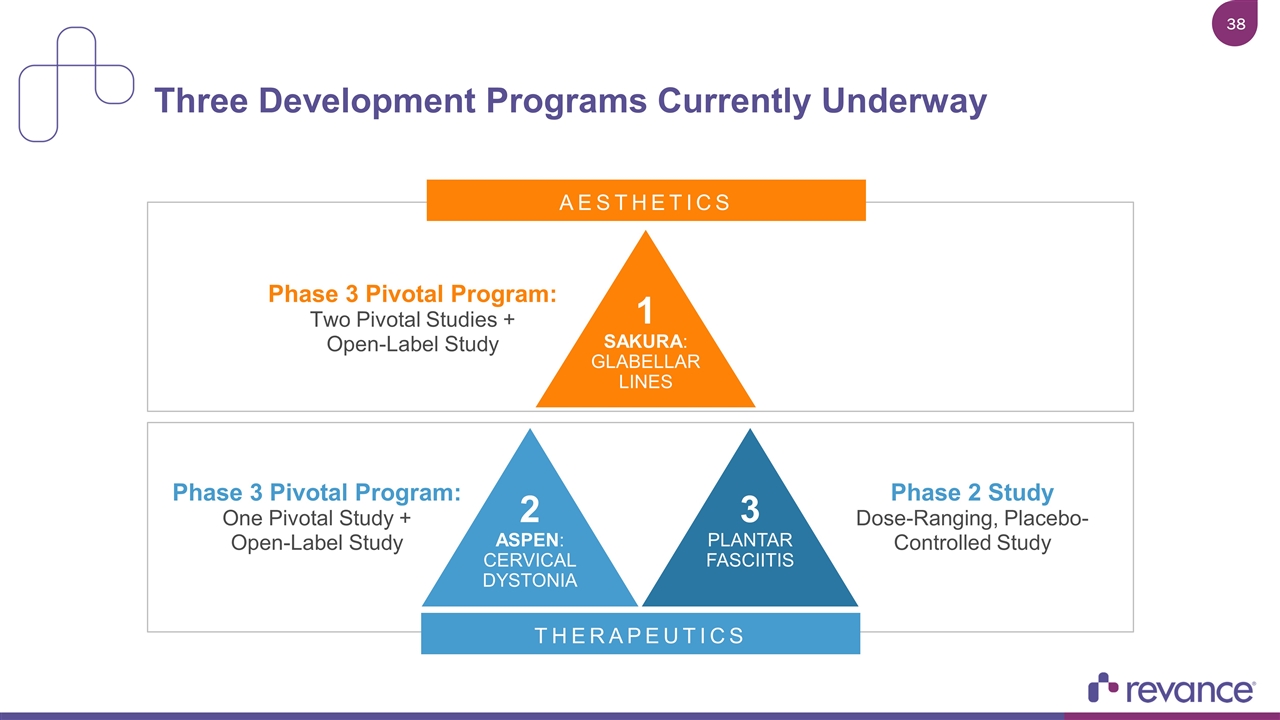

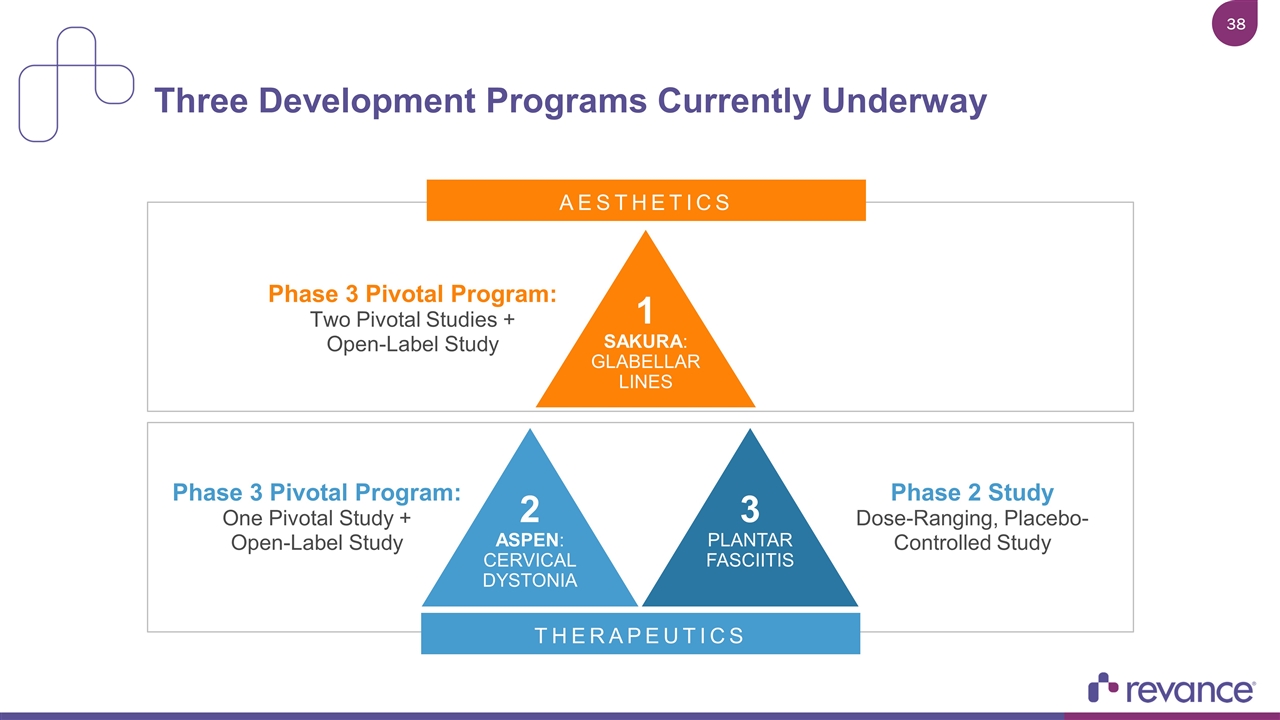

Three Development Programs Currently Underway 1 SAKURA: GLABELLAR LINES Phase 3 Pivotal Program: Two Pivotal Studies + Open-Label Study AESTHETICS THERAPEUTICS 2 ASPEN: CERVICAL DYSTONIA 3 PLANTAR FASCIITIS Phase 3 Pivotal Program: One Pivotal Study + Open-Label Study Phase 2 Study Dose-Ranging, Placebo-Controlled Study

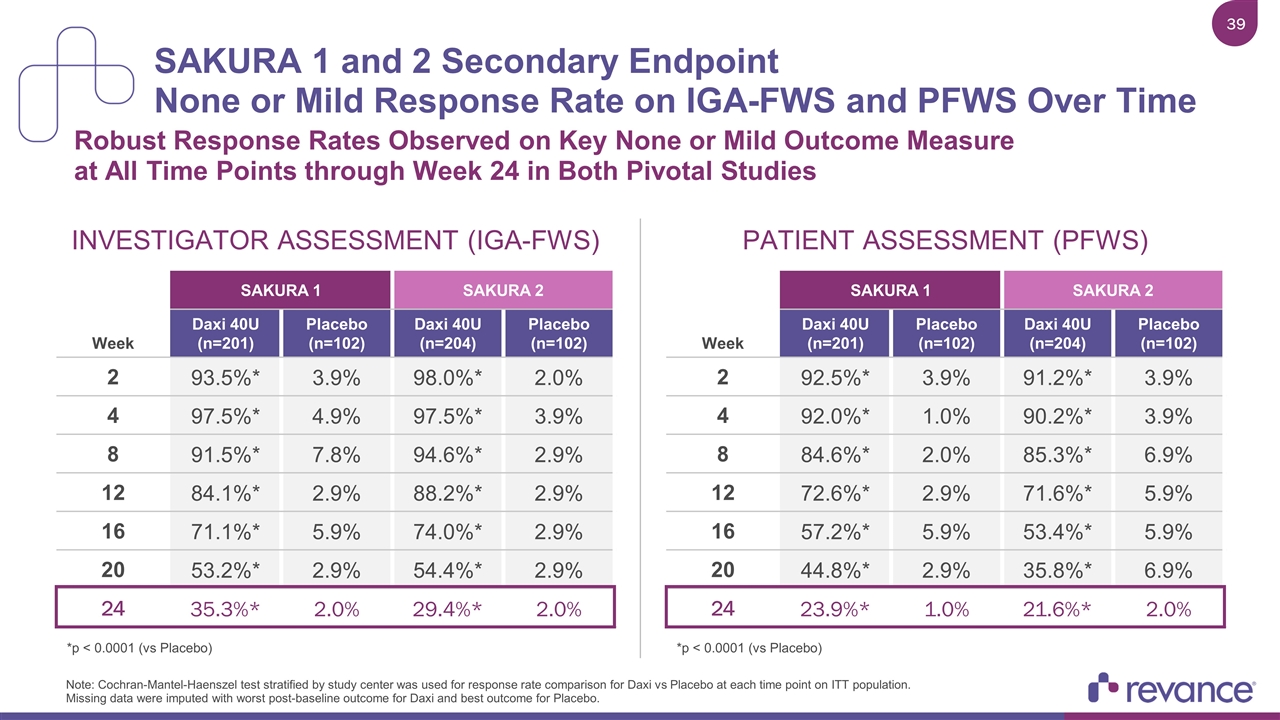

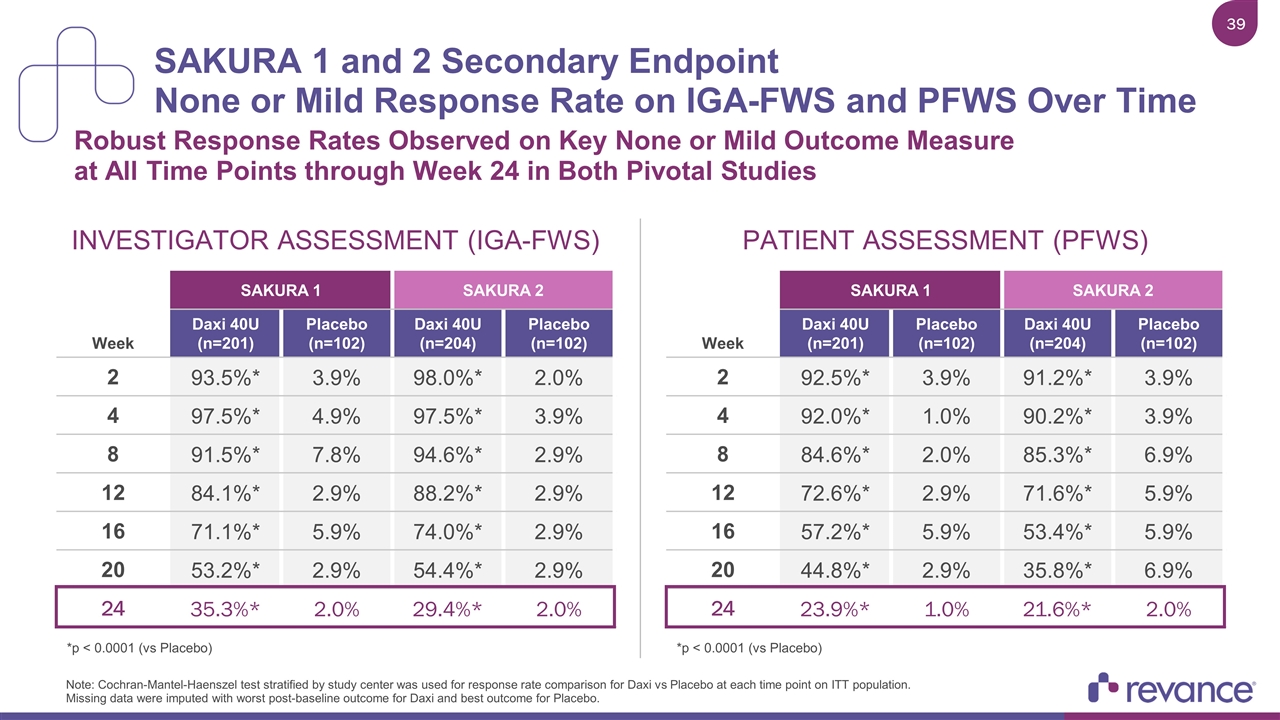

SAKURA 1 and 2 Secondary Endpoint None or Mild Response Rate on IGA-FWS and PFWS Over Time Robust Response Rates Observed on Key None or Mild Outcome Measure at All Time Points through Week 24 in Both Pivotal Studies Note: Cochran-Mantel-Haenszel test stratified by study center was used for response rate comparison for Daxi vs Placebo at each time point on ITT population. Missing data were imputed with worst post-baseline outcome for Daxi and best outcome for Placebo. SAKURA 1 SAKURA 2 Week Daxi 40U (n=201) Placebo (n=102) Daxi 40U (n=204) Placebo (n=102) 2 93.5%* 3.9% 98.0%* 2.0% 4 97.5%* 4.9% 97.5%* 3.9% 8 91.5%* 7.8% 94.6%* 2.9% 12 84.1%* 2.9% 88.2%* 2.9% 16 71.1%* 5.9% 74.0%* 2.9% 20 53.2%* 2.9% 54.4%* 2.9% 24 35.3%* 2.0% 29.4%* 2.0% INVESTIGATOR ASSESSMENT (IGA-FWS) SAKURA 1 SAKURA 2 Week Daxi 40U (n=201) Placebo (n=102) Daxi 40U (n=204) Placebo (n=102) 2 92.5%* 3.9% 91.2%* 3.9% 4 92.0%* 1.0% 90.2%* 3.9% 8 84.6%* 2.0% 85.3%* 6.9% 12 72.6%* 2.9% 71.6%* 5.9% 16 57.2%* 5.9% 53.4%* 5.9% 20 44.8%* 2.9% 35.8%* 6.9% 24 23.9%* 1.0% 21.6%* 2.0% PATIENT ASSESSMENT (PFWS) *p < 0.0001 (vs Placebo) *p < 0.0001 (vs Placebo)

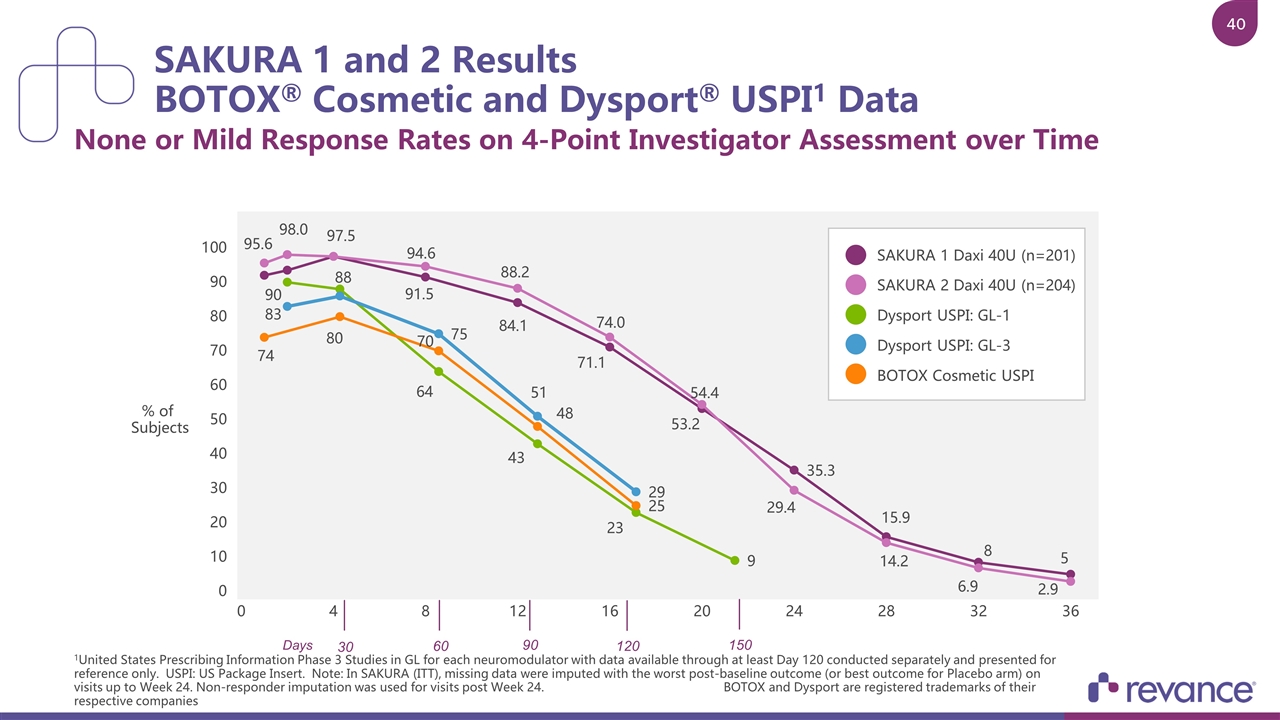

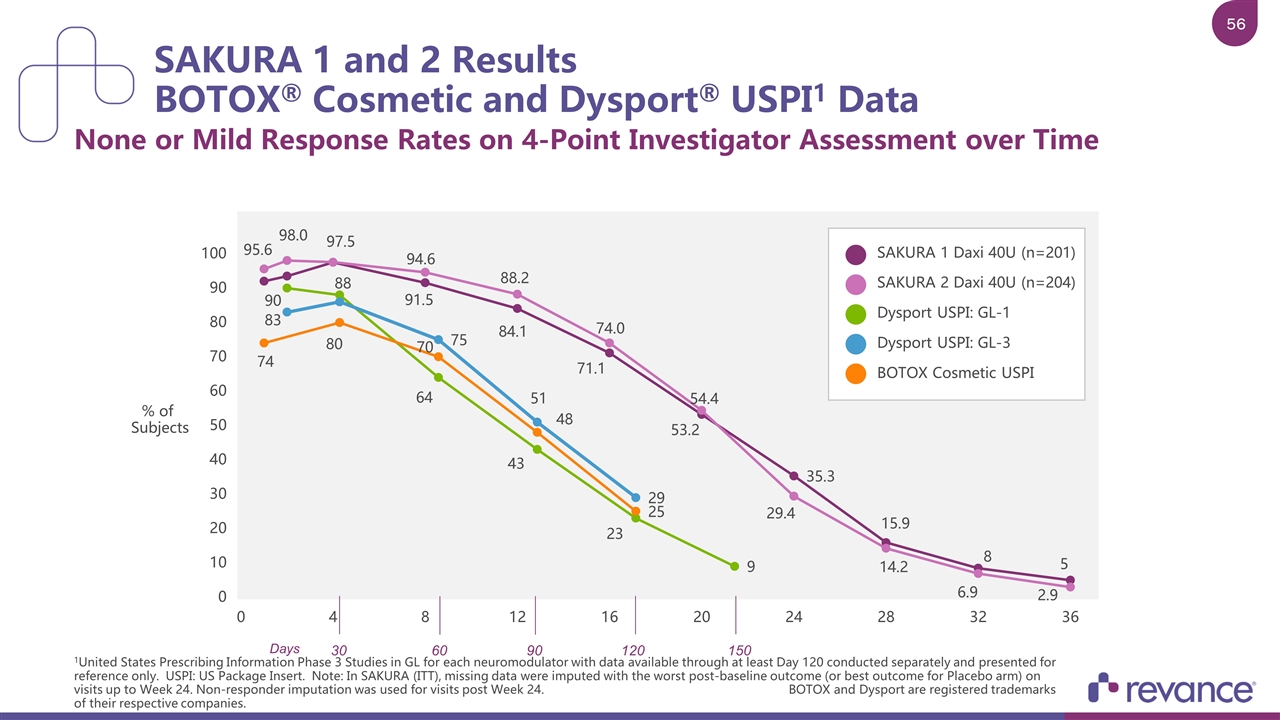

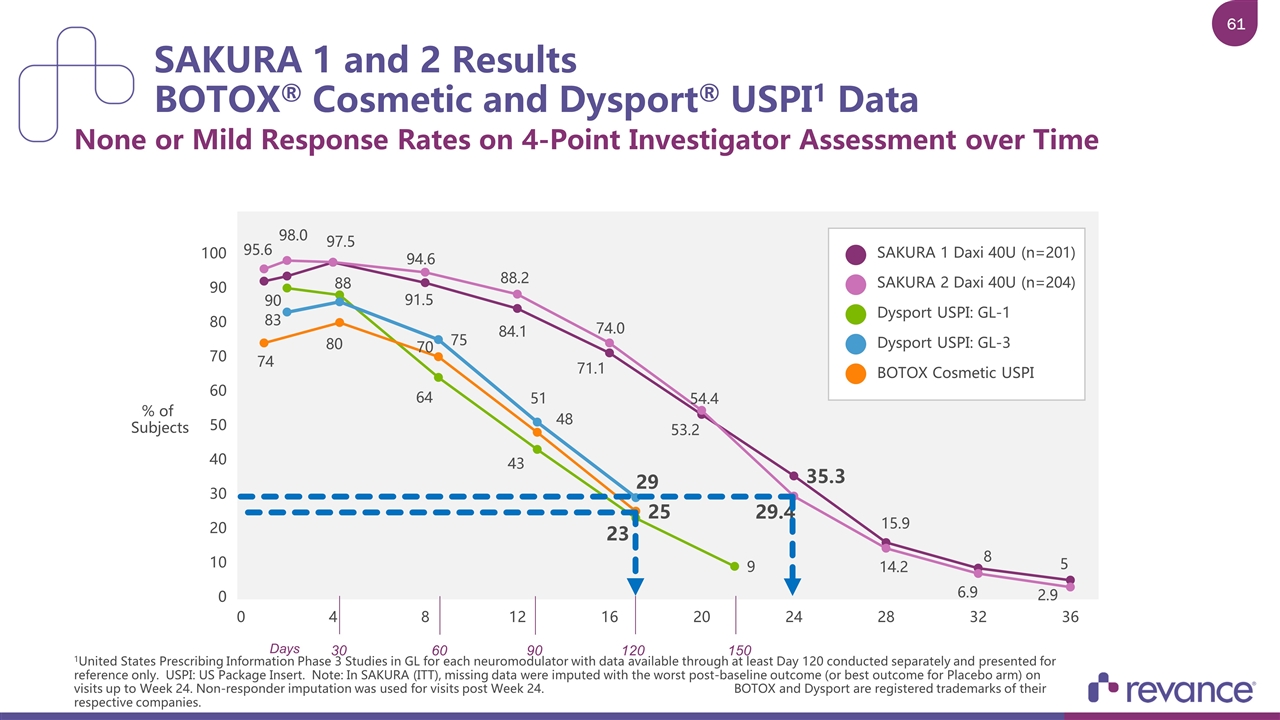

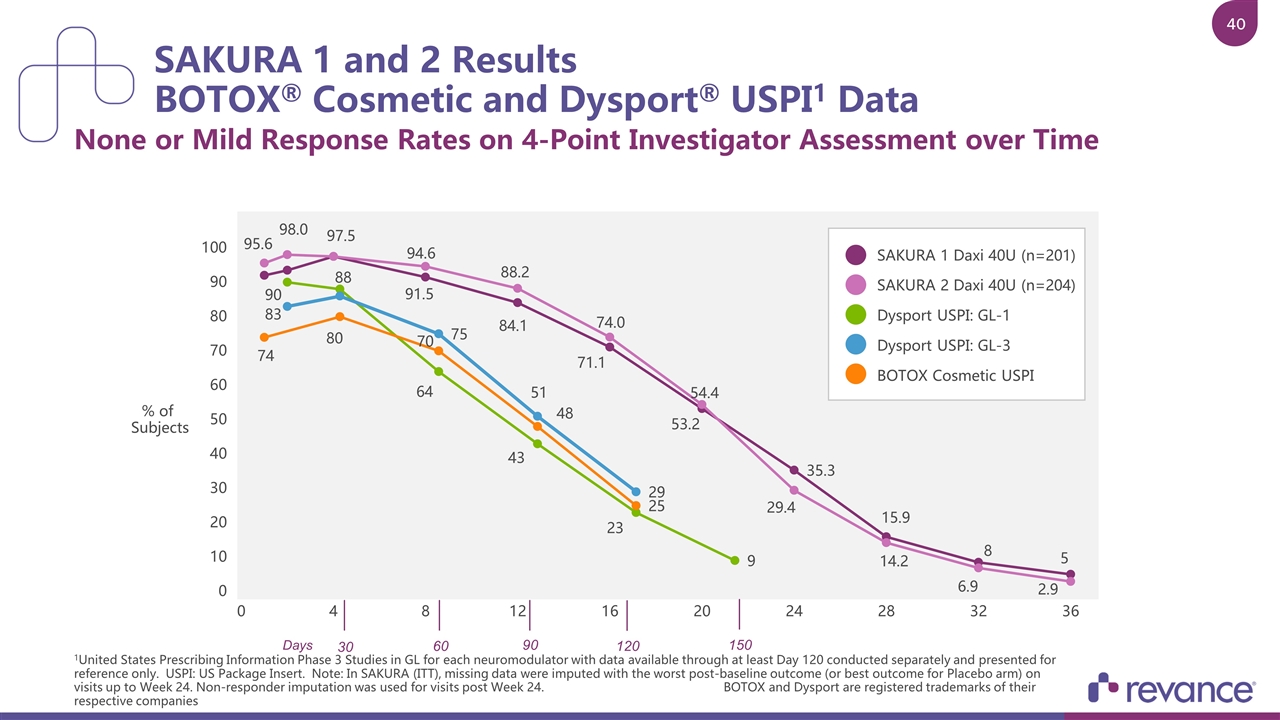

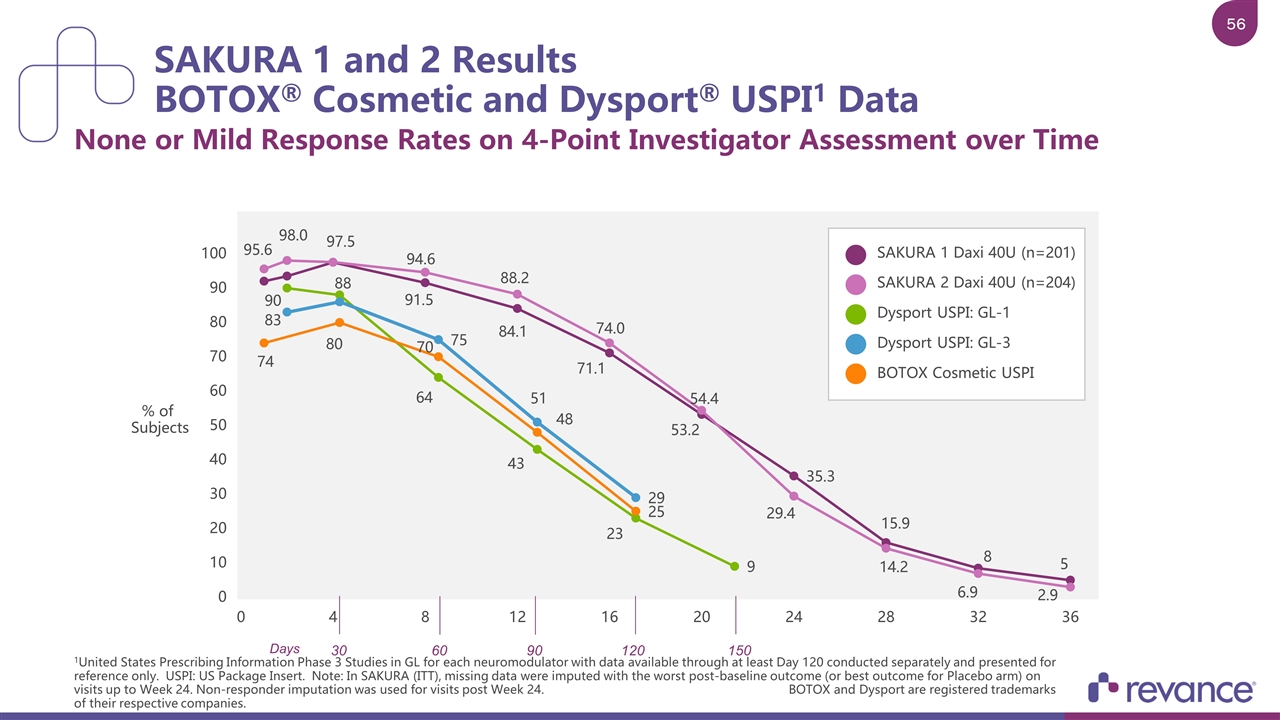

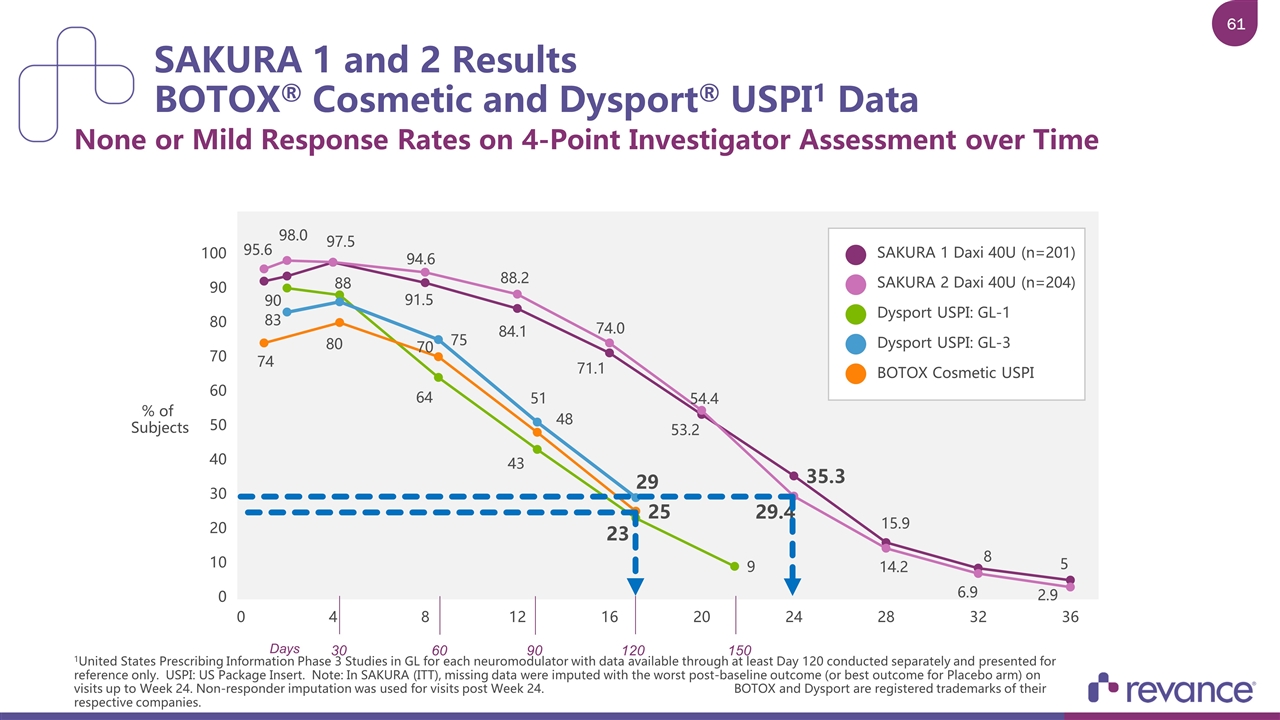

SAKURA 1 and 2 Results BOTOX® Cosmetic and Dysport® USPI1 Data None or Mild Response Rates on 4-Point Investigator Assessment over Time 1United States Prescribing Information Phase 3 Studies in GL for each neuromodulator with data available through at least Day 120 conducted separately and presented for reference only. USPI: US Package Insert. Note: In SAKURA (ITT), missing data were imputed with the worst post-baseline outcome (or best outcome for Placebo arm) on visits up to Week 24. Non-responder imputation was used for visits post Week 24. BOTOX and Dysport are registered trademarks of their respective companies SAKURA 1 Daxi 40U (n=201) SAKURA 2 Daxi 40U (n=204) Dysport USPI: GL-1 Dysport USPI: GL-3 BOTOX Cosmetic USPI % of Subjects 30 60 90 120 150 Days

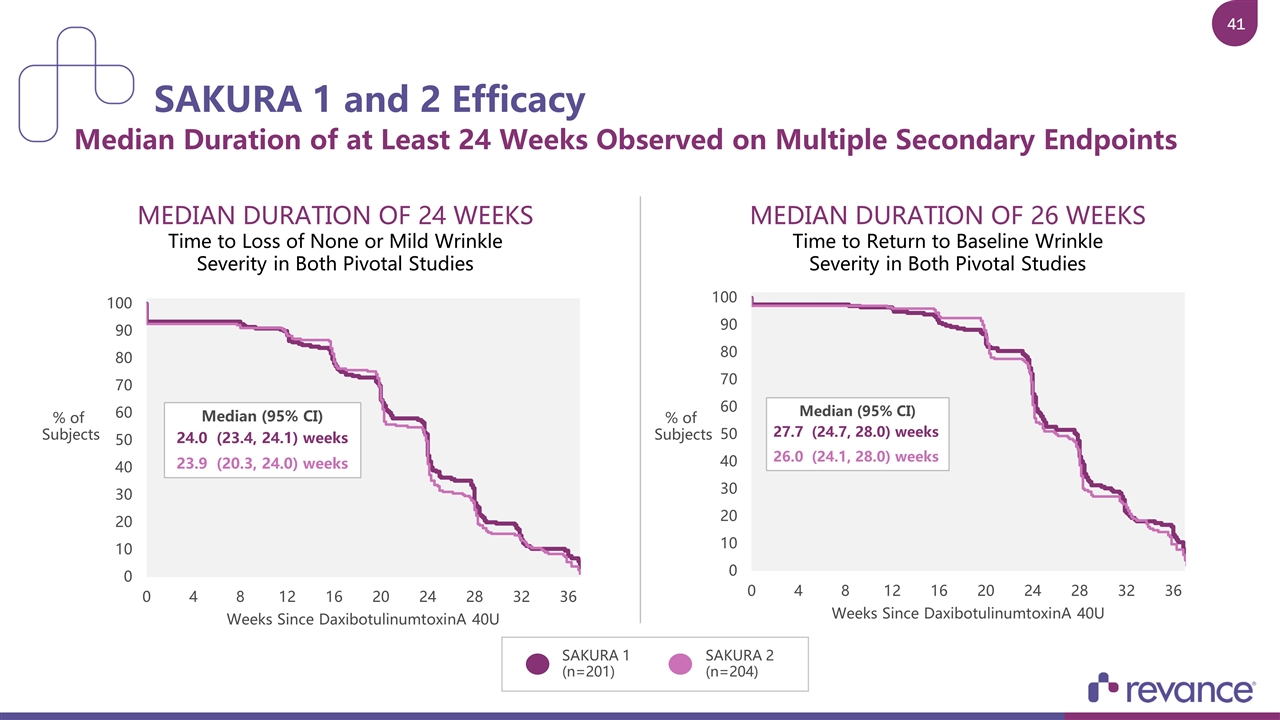

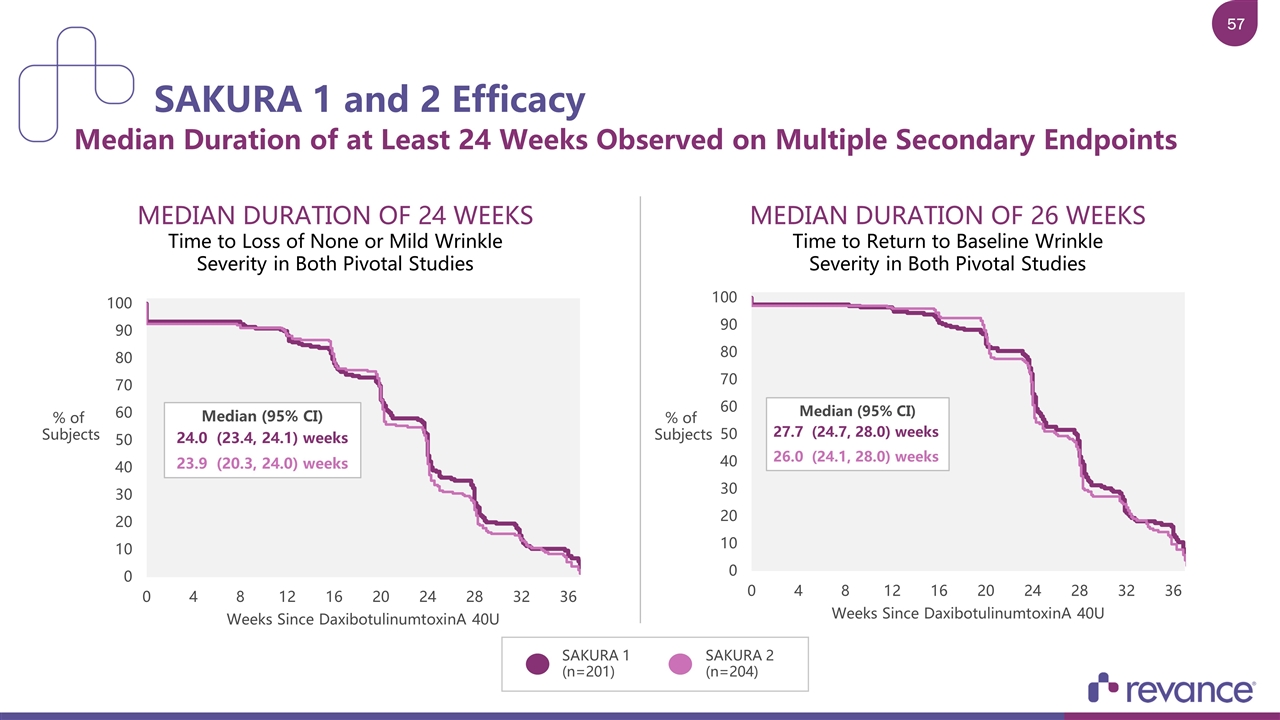

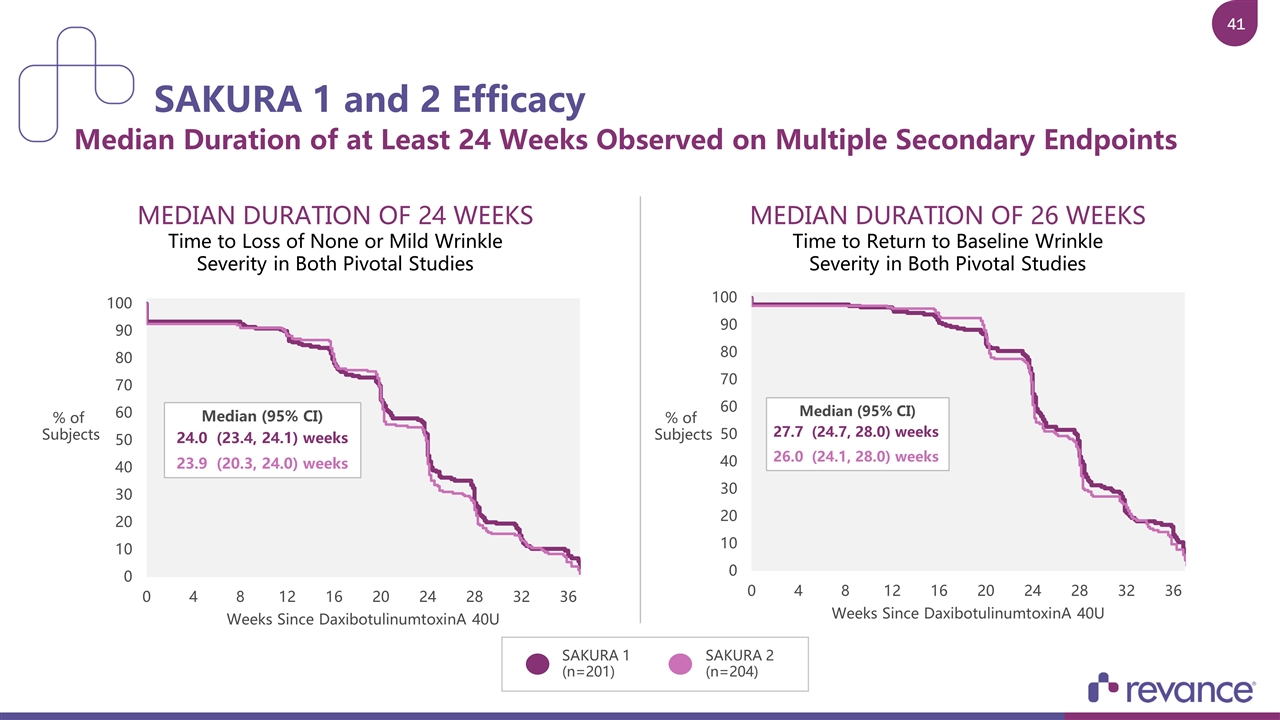

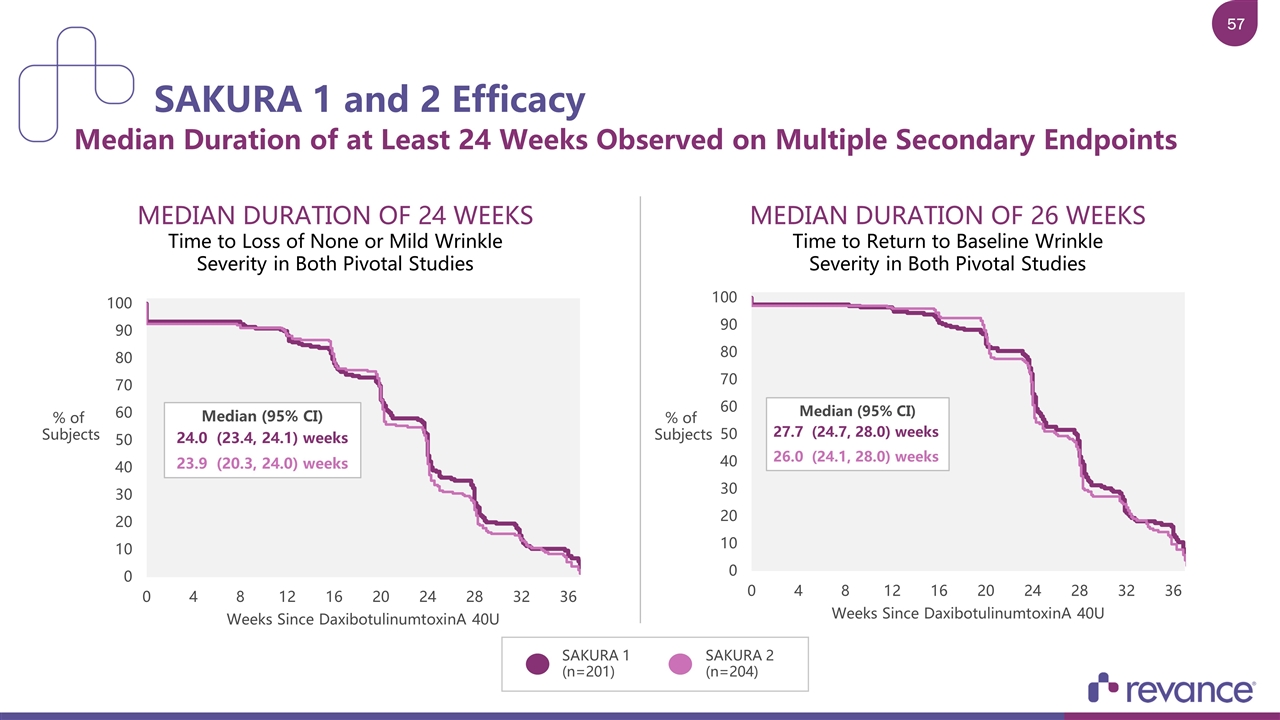

MEDIAN DURATION OF 24 WEEKS Time to Loss of None or Mild Wrinkle Severity in Both Pivotal Studies SAKURA 1 and 2 Efficacy Median Duration of at Least 24 Weeks Observed on Multiple Secondary Endpoints SAKURA 1 (n=201) SAKURA 2 (n=204) MEDIAN DURATION OF 26 WEEKS Time to Return to Baseline Wrinkle Severity in Both Pivotal Studies % of Subjects % of Subjects

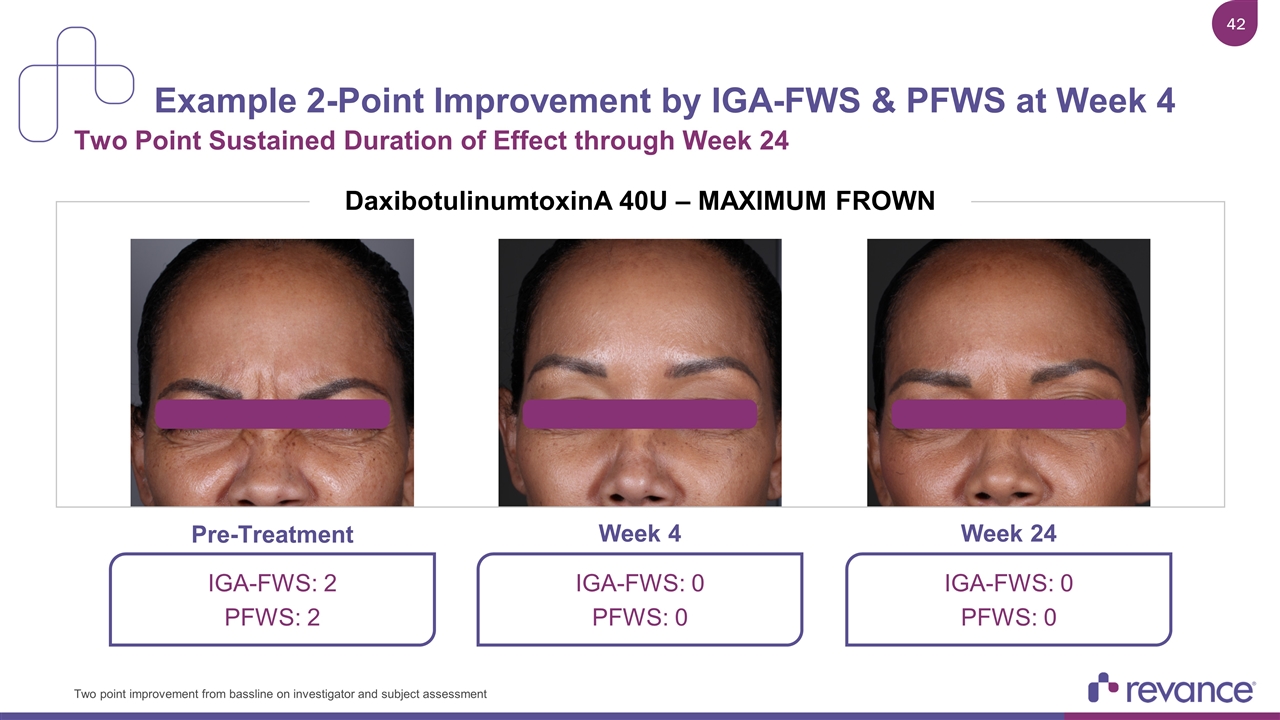

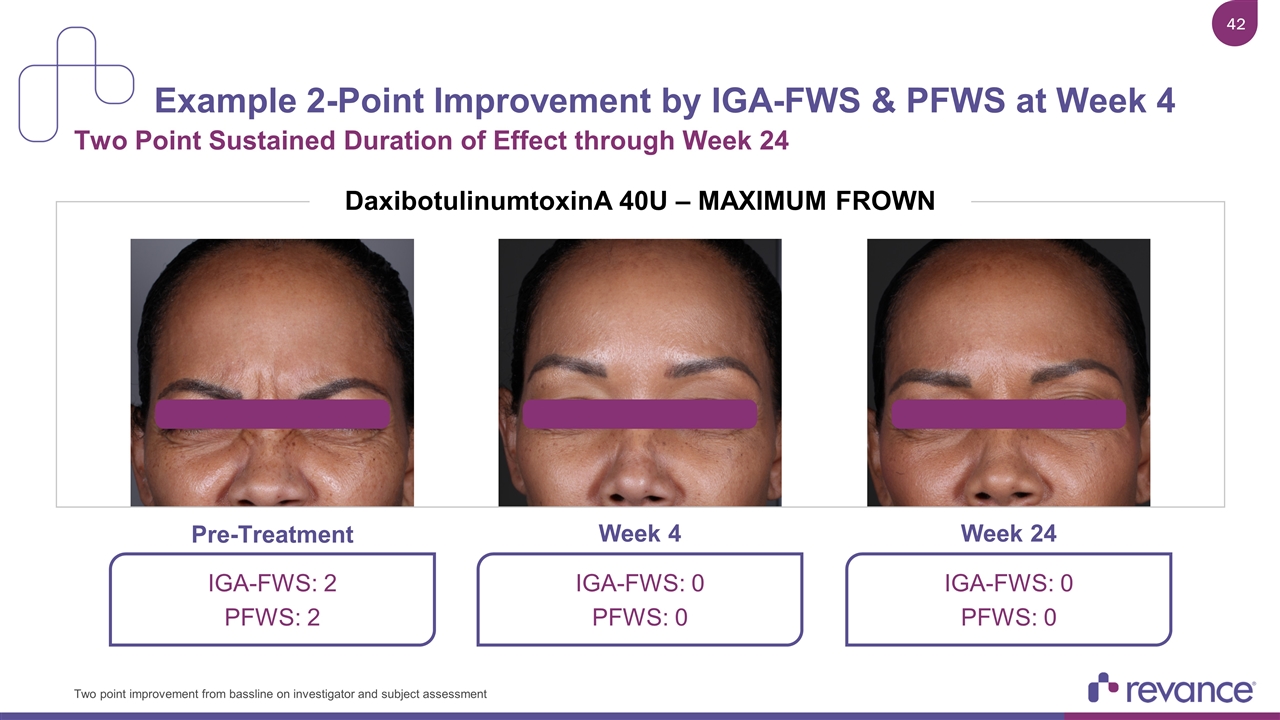

Example 2-Point Improvement by IGA-FWS & PFWS at Week 4 Two Point Sustained Duration of Effect through Week 24 Two point improvement from bassline on investigator and subject assessment IGA-FWS: 0 PFWS: 0 IGA-FWS: 0 PFWS: 0 IGA-FWS: 2 PFWS: 2 Week 4 Pre-Treatment Week 24 2 1 3 DaxibotulinumtoxinA 40U – MAXIMUM FROWN

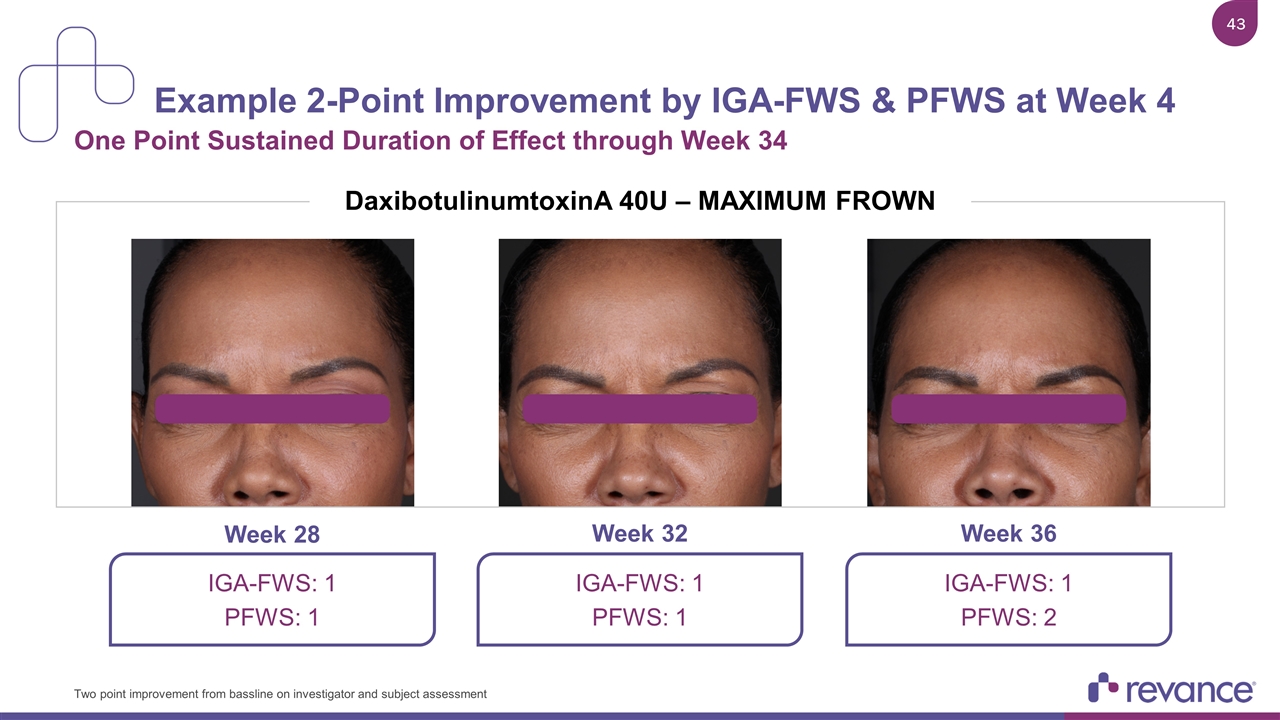

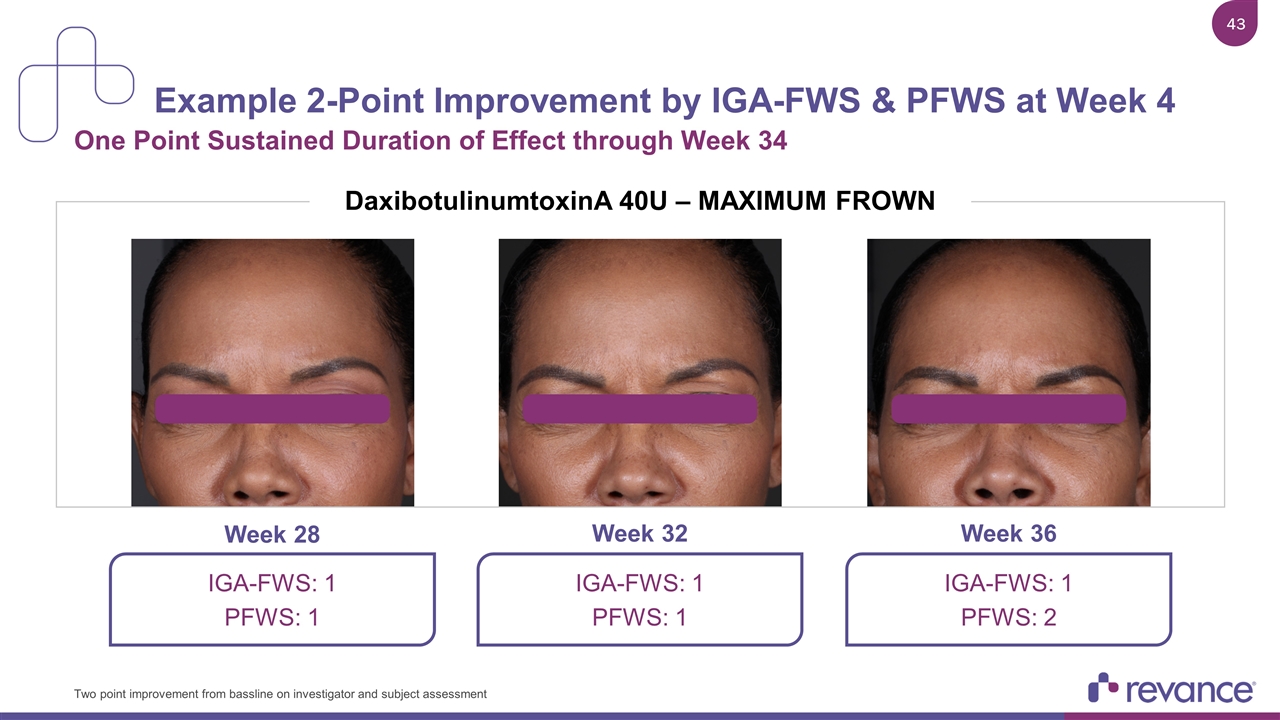

Example 2-Point Improvement by IGA-FWS & PFWS at Week 4 One Point Sustained Duration of Effect through Week 34 Week 32 Week 28 Week 36 Two point improvement from bassline on investigator and subject assessment DaxibotulinumtoxinA 40U – MAXIMUM FROWN IGA-FWS: 1 PFWS: 1 IGA-FWS: 1 PFWS: 2 IGA-FWS: 1 PFWS: 1

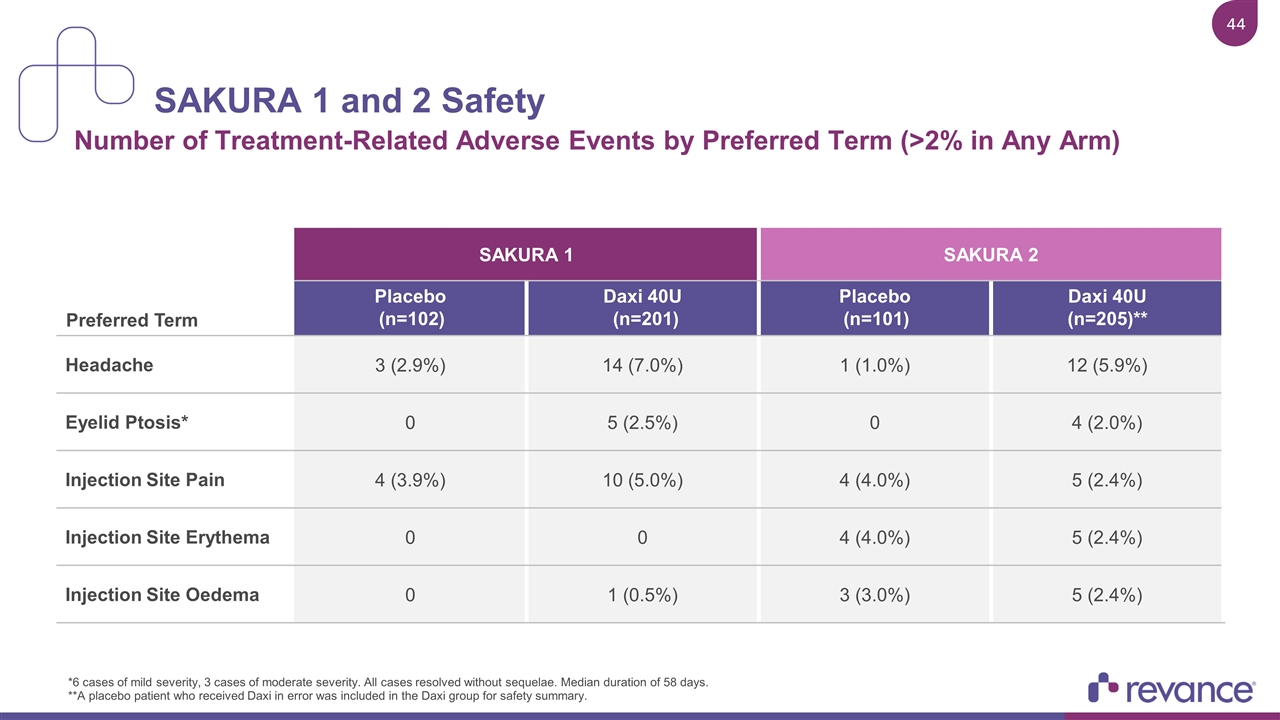

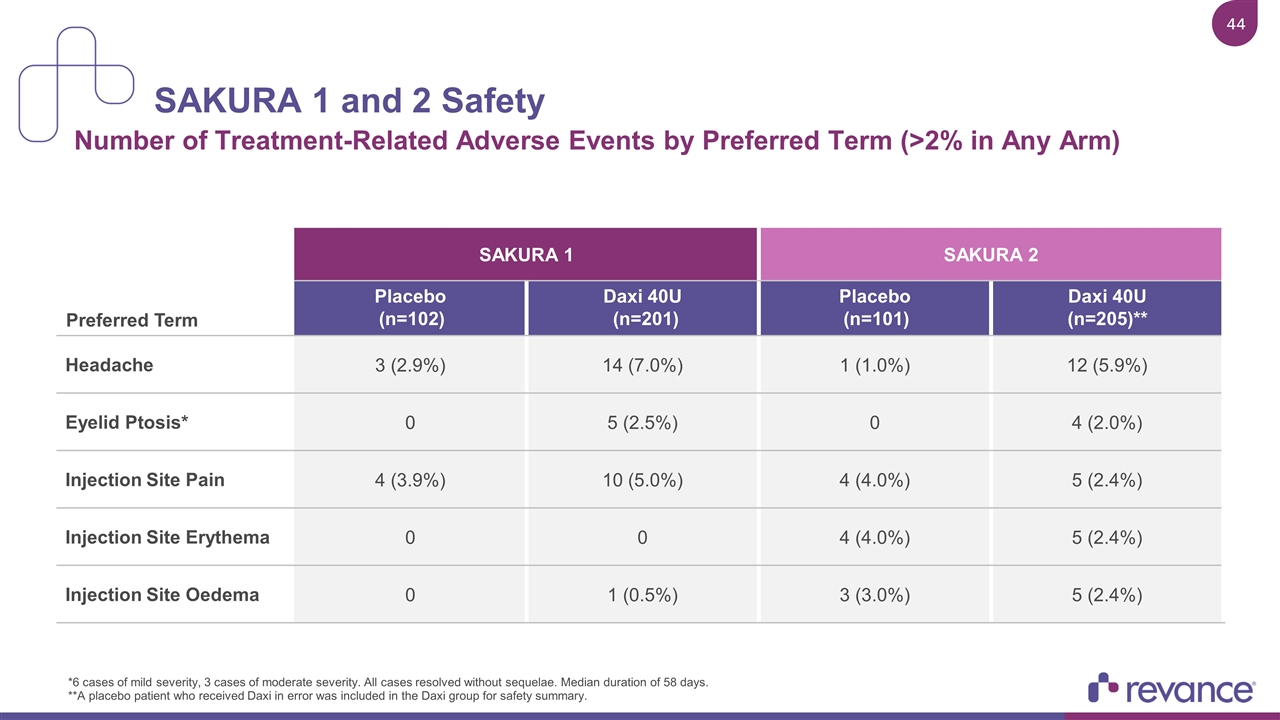

SAKURA 1 and 2 Safety Number of Treatment-Related Adverse Events by Preferred Term (>2% in Any Arm) *6 cases of mild severity, 3 cases of moderate severity. All cases resolved without sequelae. Median duration of 58 days. **A placebo patient who received Daxi in error was included in the Daxi group for safety summary. SAKURA 1 SAKURA 2 Preferred Term Placebo (n=102) Daxi 40U (n=201) Placebo (n=101) Daxi 40U (n=205)** Headache 3 (2.9%) 14 (7.0%) 1 (1.0%) 12 (5.9%) Eyelid Ptosis* 0 5 (2.5%) 0 4 (2.0%) Injection Site Pain 4 (3.9%) 10 (5.0%) 4 (4.0%) 5 (2.4%) Injection Site Erythema 0 0 4 (4.0%) 5 (2.4%) Injection Site Oedema 0 1 (0.5%) 3 (3.0%) 5 (2.4%)

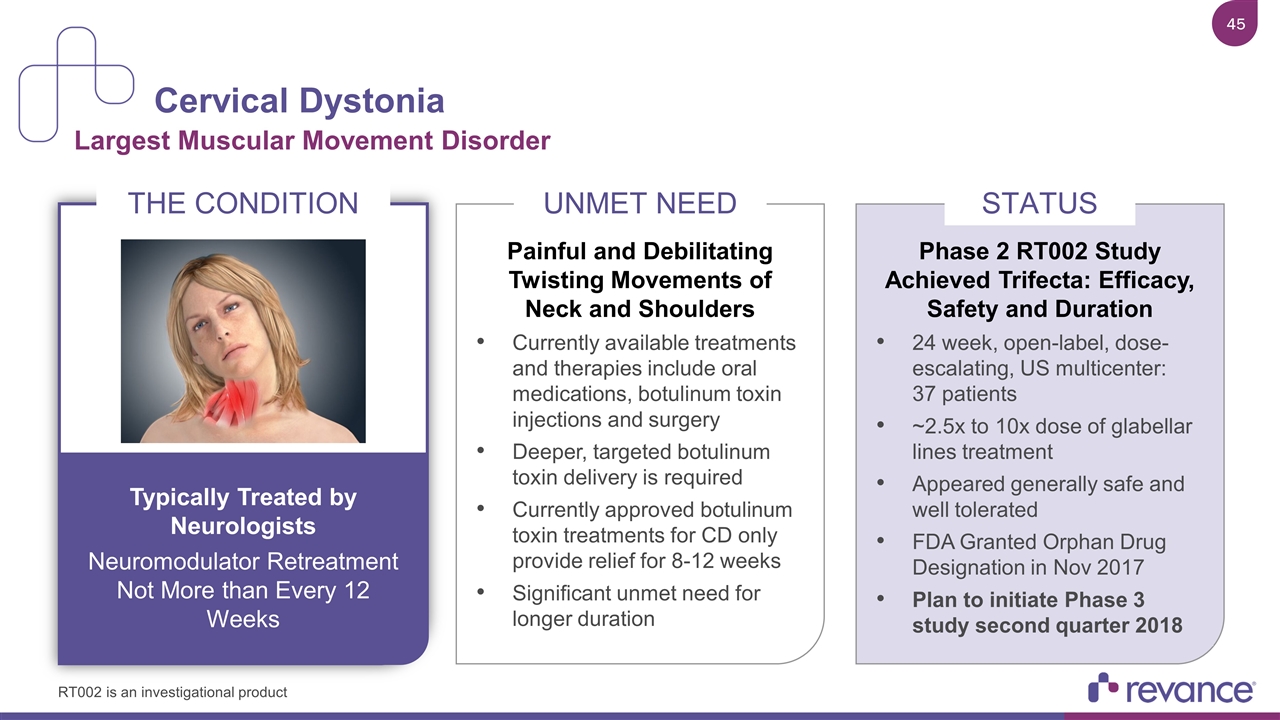

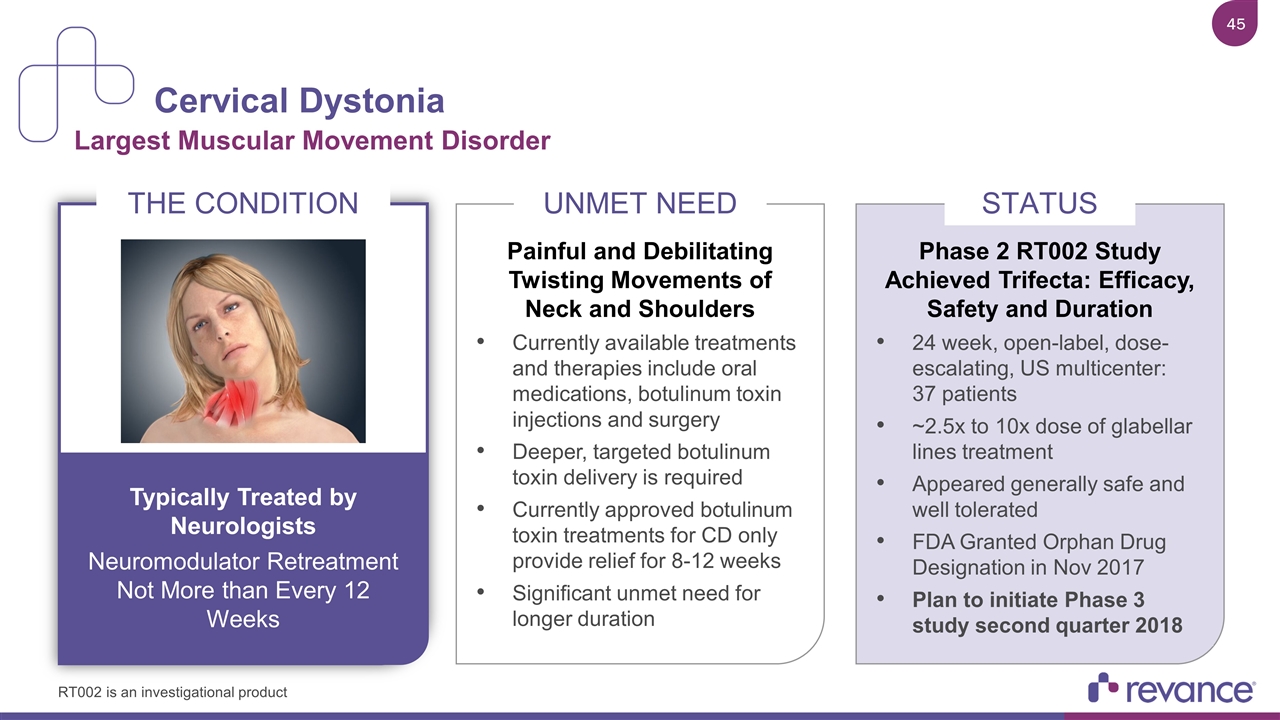

Cervical Dystonia Largest Muscular Movement Disorder THE CONDITION Typically Treated by Neurologists Neuromodulator Retreatment Not More than Every 12 Weeks Painful and Debilitating Twisting Movements of Neck and Shoulders Currently available treatments and therapies include oral medications, botulinum toxin injections and surgery Deeper, targeted botulinum toxin delivery is required Currently approved botulinum toxin treatments for CD only provide relief for 8-12 weeks Significant unmet need for longer duration UNMET NEED Phase 2 RT002 Study Achieved Trifecta: Efficacy, Safety and Duration 24 week, open-label, dose-escalating, US multicenter: 37 patients ~2.5x to 10x dose of glabellar lines treatment Appeared generally safe and well tolerated FDA Granted Orphan Drug Designation in Nov 2017 Plan to initiate Phase 3 study second quarter 2018 STATUS RT002 is an investigational product

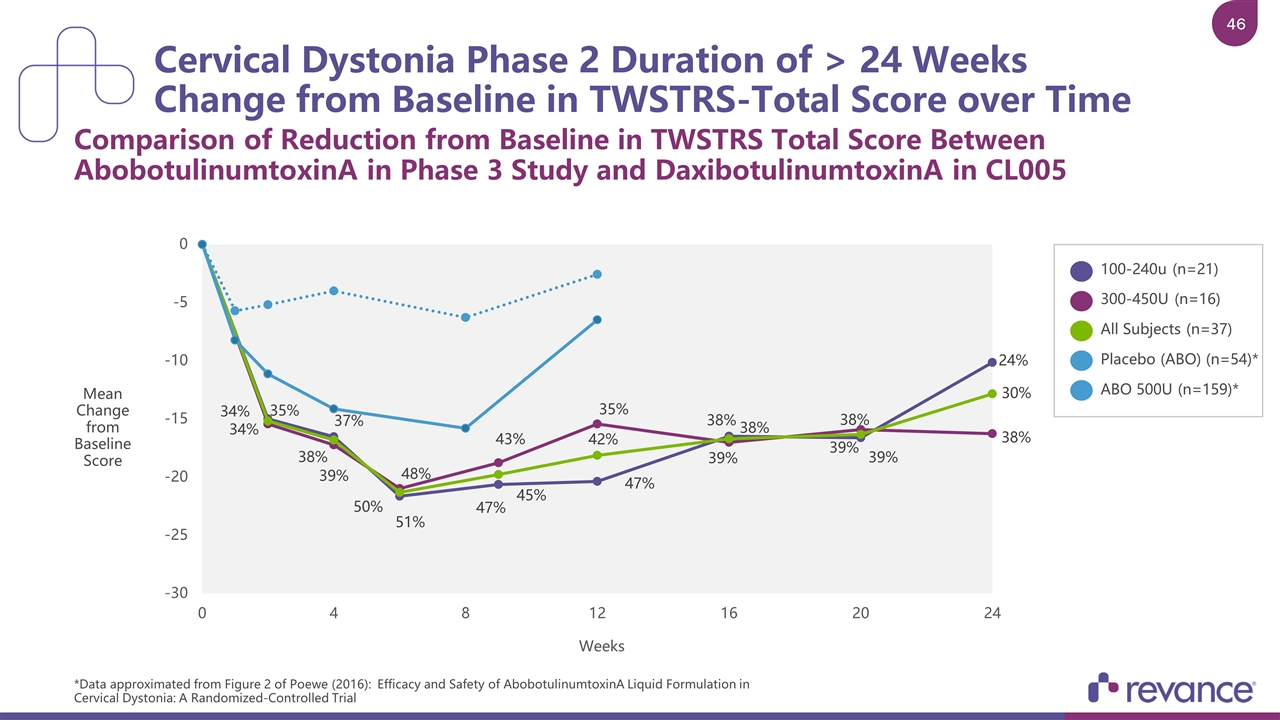

Cervical Dystonia Phase 2 Duration of > 24 Weeks Change from Baseline in TWSTRS-Total Score over Time Comparison of Reduction from Baseline in TWSTRS Total Score Between AbobotulinumtoxinA in Phase 3 Study and DaxibotulinumtoxinA in CL005 *Data approximated from Figure 2 of Poewe (2016): Efficacy and Safety of AbobotulinumtoxinA Liquid Formulation in Cervical Dystonia: A Randomized-Controlled Trial 100-240u (n=21) 300-450U (n=16) All Subjects (n=37) Placebo (ABO) (n=54)* ABO 500U (n=159)* Mean Change from Baseline Score

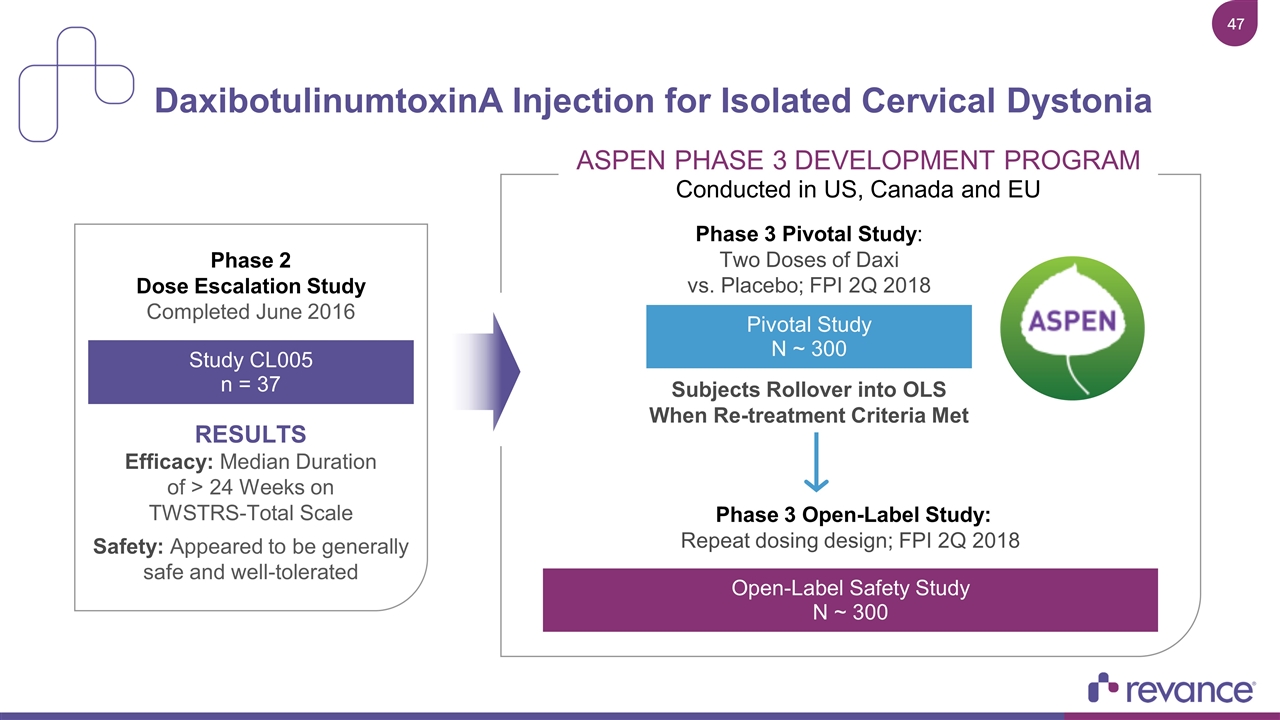

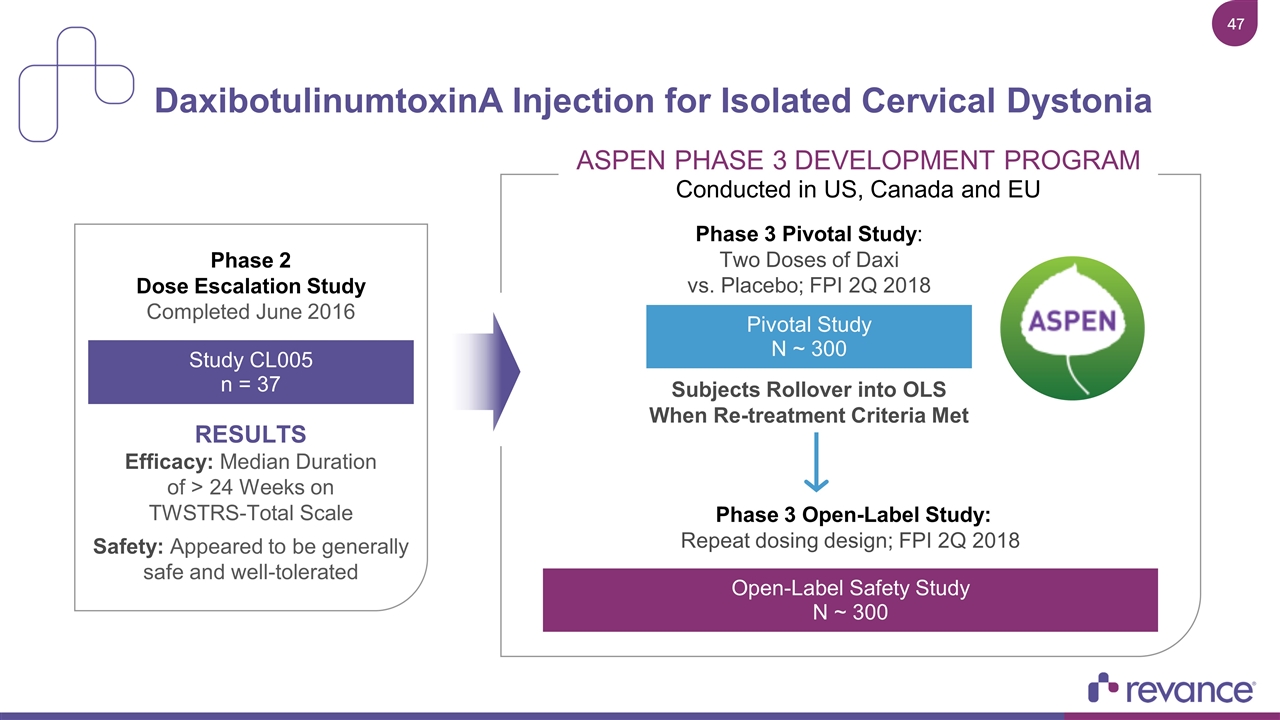

DaxibotulinumtoxinA Injection for Isolated Cervical Dystonia Phase 2 Dose Escalation Study Completed June 2016 RESULTS Efficacy: Median Duration of > 24 Weeks on TWSTRS-Total Scale Safety: Appeared to be generally safe and well-tolerated Study CL005 n = 37 Phase 3 Pivotal Study: Two Doses of Daxi vs. Placebo; FPI 2Q 2018 Phase 3 Open-Label Study: Repeat dosing design; FPI 2Q 2018 Subjects Rollover into OLS When Re-treatment Criteria Met Pivotal Study N ~ 300 Open-Label Safety Study N ~ 300 Pivotal Study N ~ 300 ASPEN PHASE 3 DEVELOPMENT PROGRAM Conducted in US, Canada and EU

Cervical Dystonia – ASPEN Phase 3 Program PIVOTAL PHASE 3 STUDY Designed to meet FDA regulatory requirements Study population: adult subjects with isolated cervical dystonia Two doses of Daxi for Injection studied vs. placebo Conducted at 75 study centers in US, Canada and Europe Primary Endpoint: Change in TWSTRS-total score from baseline Secondary Endpoints Include: Duration of effect, clinician and patient global impression of change, CDIP-58, SF-36 Randomized, Double-Blind, Placebo-Controlled, Parallel Group Study and Open-Label Repeat Dosing Study NEXT STEP NEXT STEP First patient to be dosed in 2Q 2018

Plantar Fasciitis Highly Prevalent Foot/Heel Disorder THE CONDITION Typically Treated by Podiatrists, Physiatrists and Orthopedic Surgeons UNMET NEED No Neuromodulator Currently Approved to Treat Plantar Fasciitis Estimated to affect 11 to 18 million individuals in the U.S. 2M+ patients in U.S. undergo treatment annually Current conservative treatments: NSAIDs, shoe inserts, stretching and exercises Second line treatments only provide temporary relief or unproven: Steroid injections, shock wave therapy, platelet rich plasma injections, and/or surgery PATHOPHYSIOLOGY Neuromodulator Acts at Three Different Levels to Address Disability and Pain Muscle relaxation: inhibition of flexor digitorum brevis muscle to alleviate tension on plantar fascia Pain Relief: inhibits release of pain mediators in neuromuscular junction, resulting in analgesic effect Anti-inflammatory effect: inhibition of inflammatory mediators within plantar fascia

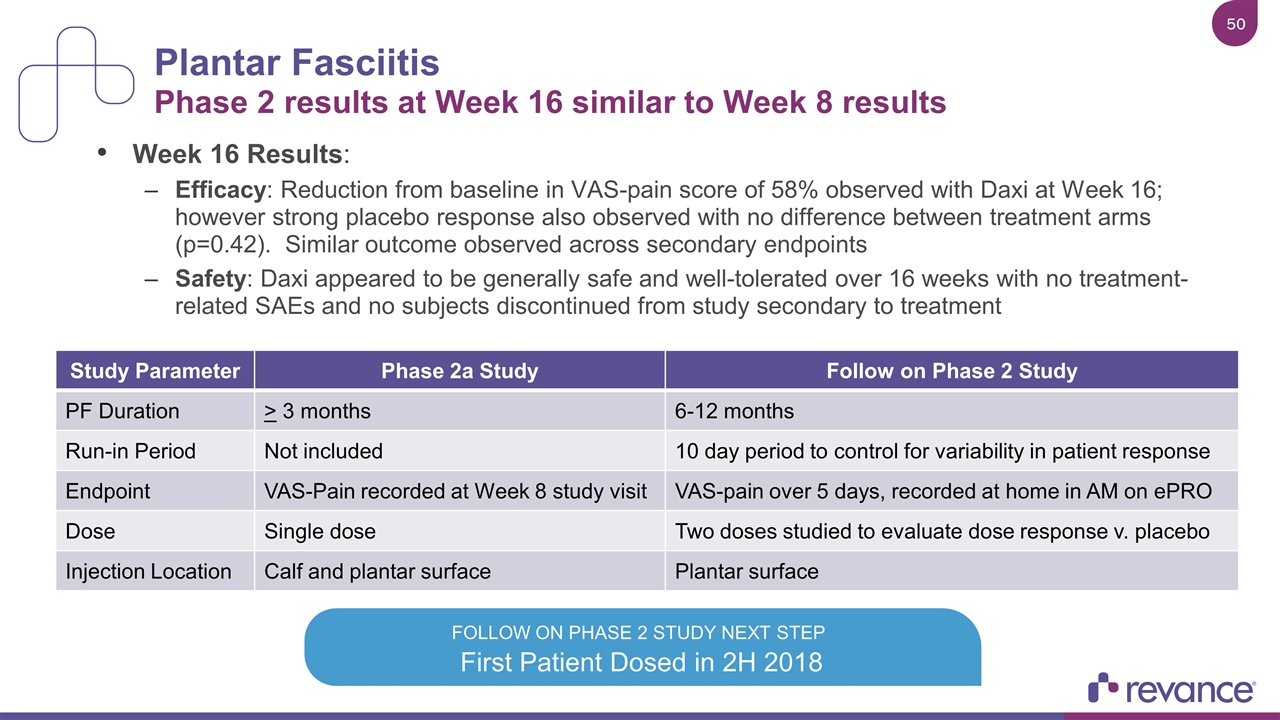

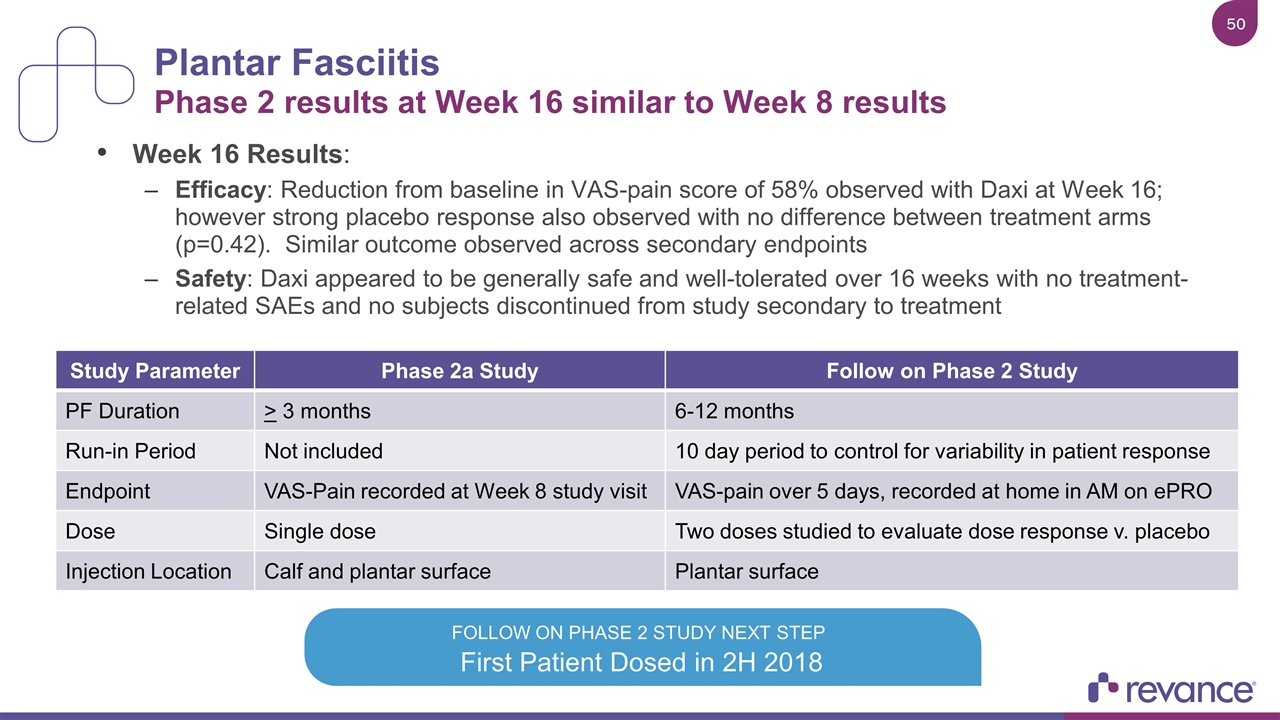

Plantar Fasciitis Phase 2 results at Week 16 similar to Week 8 results Week 16 Results: Efficacy: Reduction from baseline in VAS-pain score of 58% observed with Daxi at Week 16; however strong placebo response also observed with no difference between treatment arms (p=0.42). Similar outcome observed across secondary endpoints Safety: Daxi appeared to be generally safe and well-tolerated over 16 weeks with no treatment-related SAEs and no subjects discontinued from study secondary to treatment First Patient Dosed in 2H 2018 FOLLOW ON PHASE 2 STUDY NEXT STEP Study Parameter Phase 2a Study Follow on Phase 2 Study PF Duration > 3 months 6-12 months Run-in Period Not included 10 day period to control for variability in patient response Endpoint VAS-Pain recorded at Week 8 study visit VAS-pain over 5 days, recorded at home in AM on ePRO Dose Single dose Two doses studied to evaluate dose response v. placebo Injection Location Calf and plantar surface Plantar surface

Adult Upper Limb Spasticity Foundation Indication for Treatment of Dystonia UNMET NEED Spasms and Tightness of Muscles Caused by Stroke, MS, or Spinal Injuries Currently available treatments and therapies include oral medications, neuromodulators and intrathecal baclofen Significant unmet need exists among patients and caregivers for a longer lasting treatment RT002 uniquely designed to allow for longer duration of effect with potential for >24 week duration STATUS Leverage Experience with RT002 in Cervical Dystonia to Pursue Accelerated Development Path Protocol design and site identification underway Well-established regulatory path with validated endpoints Initial dosing study expected to be followed by Phase 3 pivotal studies Phase 2 initiation Q4 2018 THE CONDITION Chronic Neurologic Disorder Treated by Neurologists and Physiatrists Neuromodulator Retreatment Required Every 8-12 Weeks RT002 is an investigational product

Chronic Migraine >15 Headache Days per Month, 8 or More Days Feature Migraines* THE CONDITION Chronic Neurologic Disorder Primarily Treated by Neurologists Neuromodulator (BOTOX) Retreatment Required Every 12 Weeks UNMET NEED Migraine Is One of Most Prevalent Diseases in the World Affecting Almost 40M People in US1 Between 3 and 4M people in the US are estimated to suffer from chronic migraine1 BOTOX penetration limited to 6% of the US CM market2 Chronic migraine is both under-diagnosed and undertreated3 Current treatment with BOTOX requires 31 injections administered 4x year4 STATUS Program Design Underway to Prevent Significant Number of Headaches per Month Goal: to achieve similar or better efficacy than currently available neuromodulator therapy Novel approach to dosing: target fewer injections per treatment which may result in optimal efficacy/safety profile Potential long duration of effect Phase 2 initiation 2019 1. Credit Suisse Global Pharmaceuticals, December 14, 2017 2. Fourth Quarter and full year 2017 earnings conference call, February 6, 2018 3. Neurology Reviews. 2014 August; 22(8): 22 4. Botox PI *https://www.ichd-3.org/1-migraine/1-3-chronic-migraine/ BOTOX is a registered trademark of Allergan, Inc. RT002 is an investigational product

REGULATORY DISCUSSION Expert Panel Carmen Rodriguez - Regulatory Consultant Paul Lorenc, MD FACS - Aesthetic Plastic Surgery Susanne Fors, M. Sc. - Vice President Regulatory Affairs, Revance MODERATOR: Abhay Joshi, Ph.D., M.B.A., COO

Regulatory Panel Susanne Fors In 2014, FDA issued Draft Guidance for Industry: Upper Facial Lines: Developing Botulinum Toxin Drug Products. Guidance covers Glabellar Lines, Forehead Lines and Lateral Canthal Lines. Can you comment on the conduct of SAKURA studies in context of the Upper Facial Lines FDA guidance, and the primary and secondary endpoints expectations?

Regulatory Panel Dr. Paul Lorenc What data do you believe is the most clinically meaningful to physicians and patients from the SAKURA 1 and 2 studies?

SAKURA 1 and 2 Results BOTOX® Cosmetic and Dysport® USPI1 Data None or Mild Response Rates on 4-Point Investigator Assessment over Time 1United States Prescribing Information Phase 3 Studies in GL for each neuromodulator with data available through at least Day 120 conducted separately and presented for reference only. USPI: US Package Insert. Note: In SAKURA (ITT), missing data were imputed with the worst post-baseline outcome (or best outcome for Placebo arm) on visits up to Week 24. Non-responder imputation was used for visits post Week 24. BOTOX and Dysport are registered trademarks of their respective companies. SAKURA 1 Daxi 40U (n=201) SAKURA 2 Daxi 40U (n=204) Dysport USPI: GL-1 Dysport USPI: GL-3 BOTOX Cosmetic USPI % of Subjects 30 60 90 120 150 Days

MEDIAN DURATION OF 24 WEEKS Time to Loss of None or Mild Wrinkle Severity in Both Pivotal Studies SAKURA 1 and 2 Efficacy Median Duration of at Least 24 Weeks Observed on Multiple Secondary Endpoints SAKURA 1 (n=201) SAKURA 2 (n=204) MEDIAN DURATION OF 26 WEEKS Time to Return to Baseline Wrinkle Severity in Both Pivotal Studies % of Subjects % of Subjects

Regulatory Panel Carmen Rodriguez What would be the most compelling form of data presentation for Secondary Endpoints for DaxibotulinumtoxinA for Injection (Daxi) for Glabellar Lines label?

Regulatory Panel Carmen Rodriguez What are the key factors the FDA considers when defining a product label?

Regulatory Panel Susanne Fors 5. What features will the final Daxi label for Glabellar Lines likely include?

SAKURA 1 and 2 Results BOTOX® Cosmetic and Dysport® USPI1 Data None or Mild Response Rates on 4-Point Investigator Assessment over Time 1United States Prescribing Information Phase 3 Studies in GL for each neuromodulator with data available through at least Day 120 conducted separately and presented for reference only. USPI: US Package Insert. Note: In SAKURA (ITT), missing data were imputed with the worst post-baseline outcome (or best outcome for Placebo arm) on visits up to Week 24. Non-responder imputation was used for visits post Week 24. BOTOX and Dysport are registered trademarks of their respective companies. SAKURA 1 Daxi 40U (n=201) SAKURA 2 Daxi 40U (n=204) Dysport USPI: GL-1 Dysport USPI: GL-3 BOTOX Cosmetic USPI % of Subjects 30 60 90 120 150 Days

ENDURING PERFORMANCE TO MARKET WE GO

Global Neuromodulator market overview Daryl Bogard, Niche HealthCare Strategic Advisors, Inc.

Daryl Bogard Partner, Niche HealthCare Strategic Advisors Seamlessly transitioned from the corporate arena to the consulting world 30+ years pharmaceutical / medical device commercial experience Led AGN Global Marketing Research for >15 years in aesthetics & ophthalmology Areas of Expertise: Complex global market modeling Earnings call preparation & support Creation of dynamic models for market size, growth, share and predictive trends

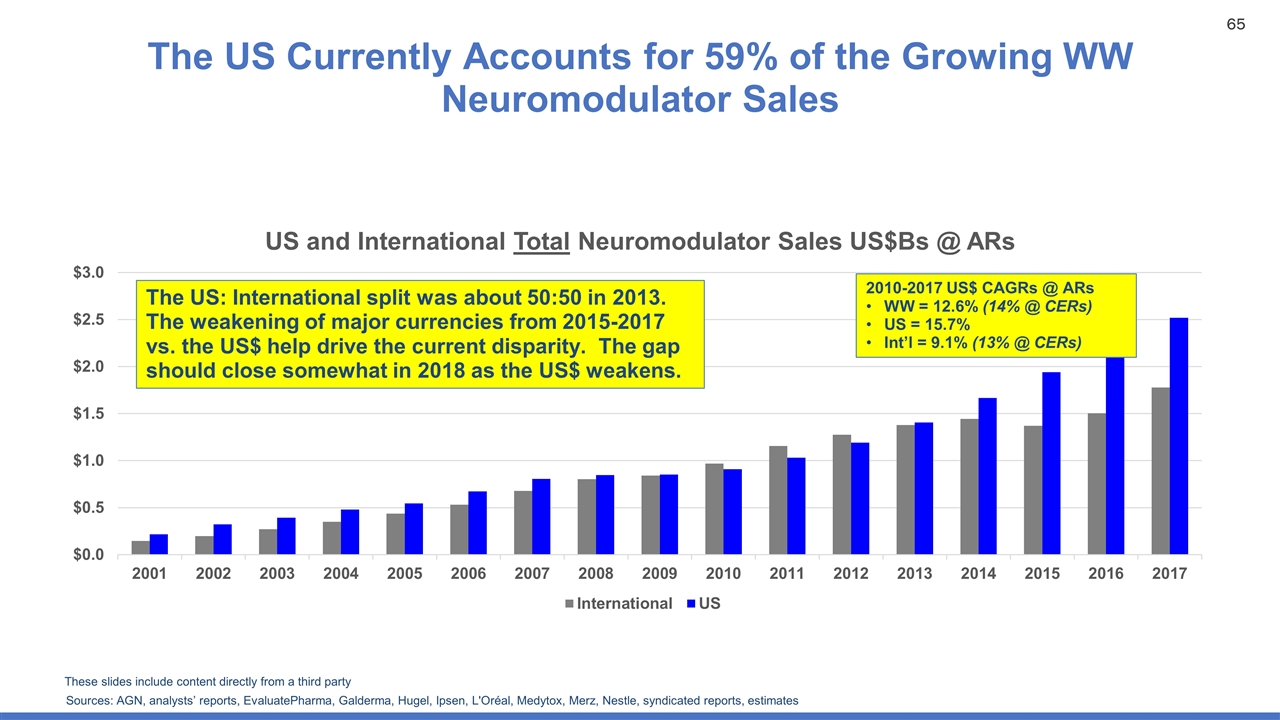

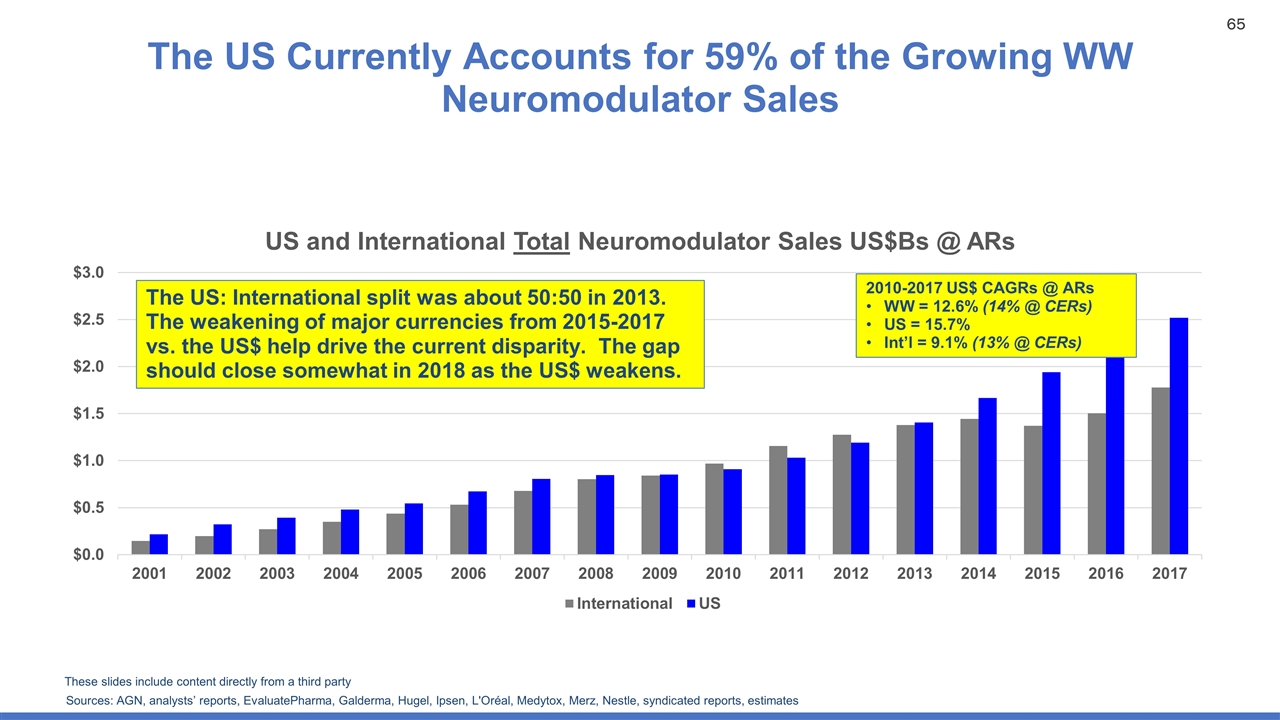

The US Currently Accounts for 59% of the Growing WW Neuromodulator Sales Sources: AGN, analysts’ reports, EvaluatePharma, Galderma, Hugel, Ipsen, L'Oréal, Medytox, Merz, Nestle, syndicated reports, estimates 2010-2017 US$ CAGRs @ ARs WW = 12.6% (14% @ CERs) US = 15.7% Int’l = 9.1% (13% @ CERs) The US: International split was about 50:50 in 2013. The weakening of major currencies from 2015-2017 vs. the US$ help drive the current disparity. The gap should close somewhat in 2018 as the US$ weakens. These slides include content directly from a third party

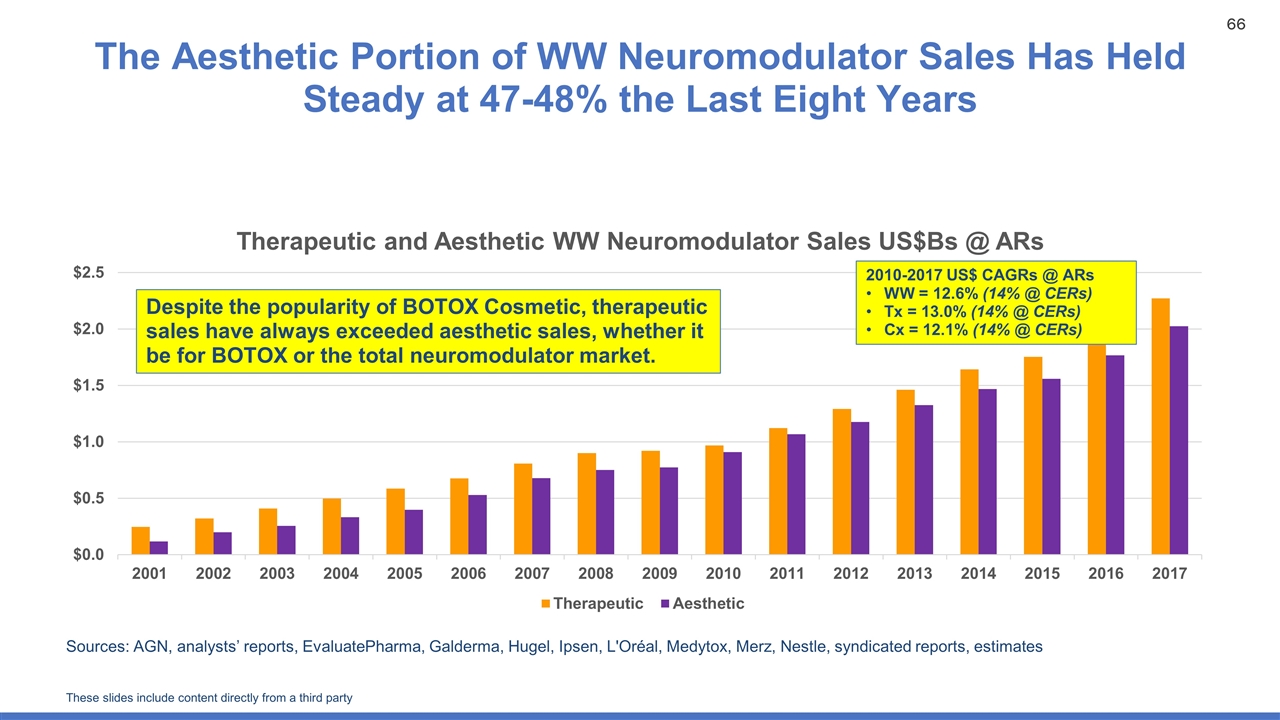

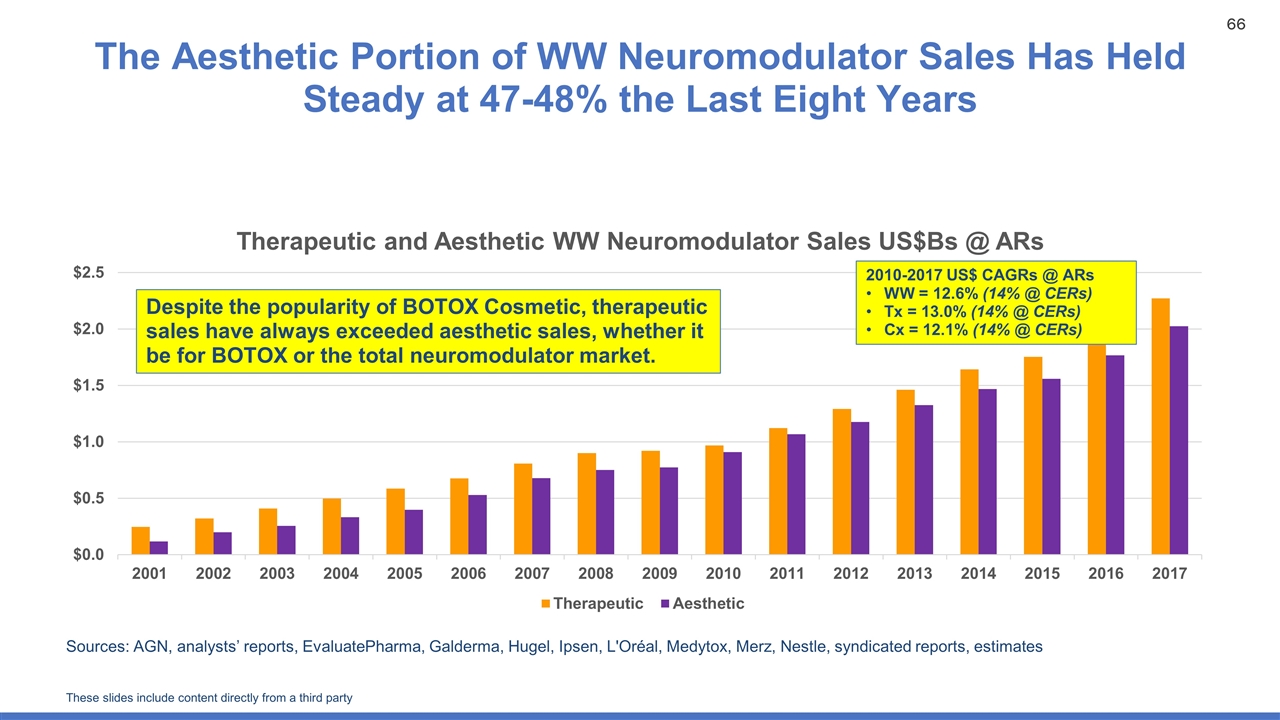

The Aesthetic Portion of WW Neuromodulator Sales Has Held Steady at 47-48% the Last Eight Years Sources: AGN, analysts’ reports, EvaluatePharma, Galderma, Hugel, Ipsen, L'Oréal, Medytox, Merz, Nestle, syndicated reports, estimates Despite the popularity of BOTOX Cosmetic, therapeutic sales have always exceeded aesthetic sales, whether it be for BOTOX or the total neuromodulator market. 2010-2017 US$ CAGRs @ ARs WW = 12.6% (14% @ CERs) Tx = 13.0% (14% @ CERs) Cx = 12.1% (14% @ CERs) These slides include content directly from a third party

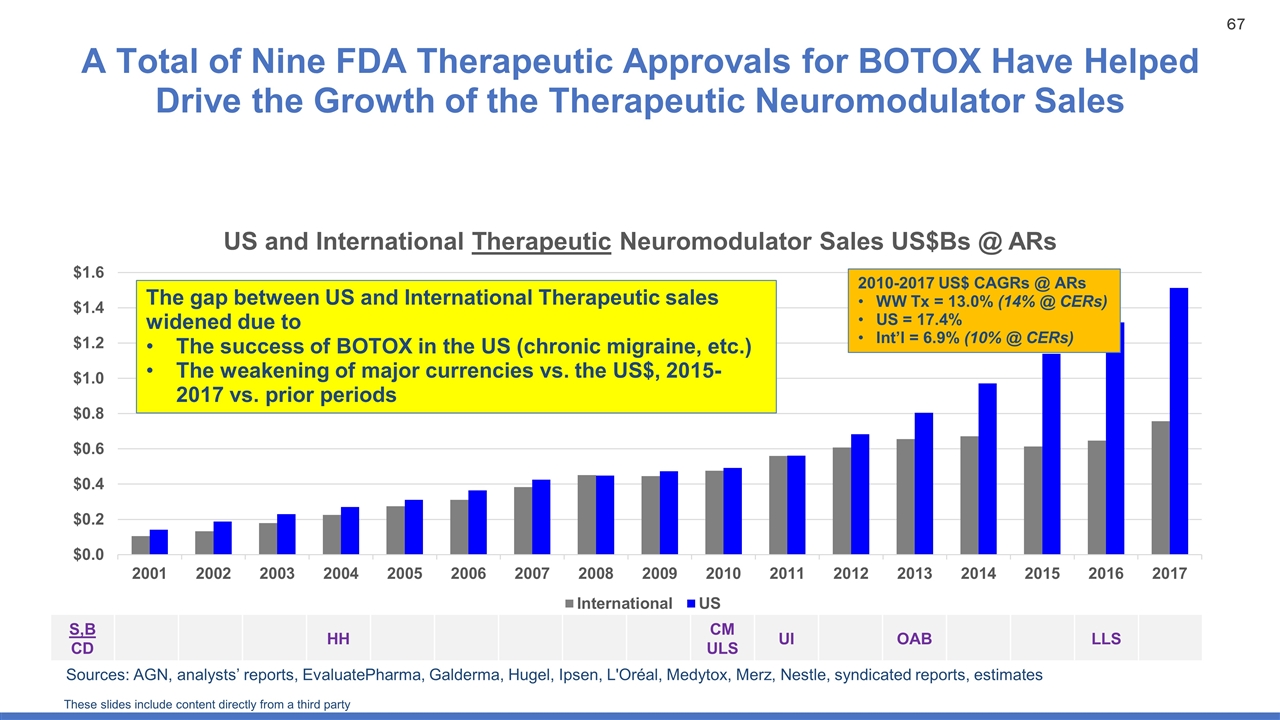

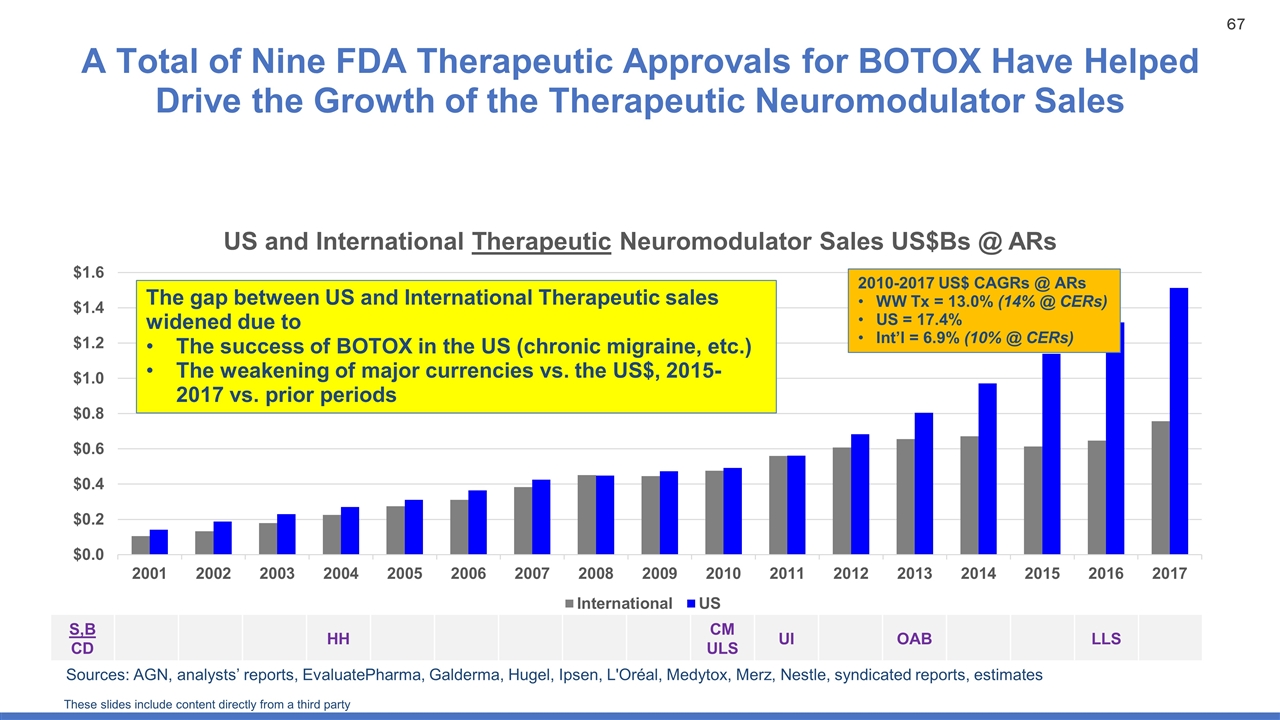

A Total of Nine FDA Therapeutic Approvals for BOTOX Have Helped Drive the Growth of the Therapeutic Neuromodulator Sales Sources: AGN, analysts’ reports, EvaluatePharma, Galderma, Hugel, Ipsen, L'Oréal, Medytox, Merz, Nestle, syndicated reports, estimates The gap between US and International Therapeutic sales widened due to The success of BOTOX in the US (chronic migraine, etc.) The weakening of major currencies vs. the US$, 2015-2017 vs. prior periods 2010-2017 US$ CAGRs @ ARs WW Tx = 13.0% (14% @ CERs) US = 17.4% Int’l = 6.9% (10% @ CERs) S,B CD HH CM ULS UI OAB LLS These slides include content directly from a third party

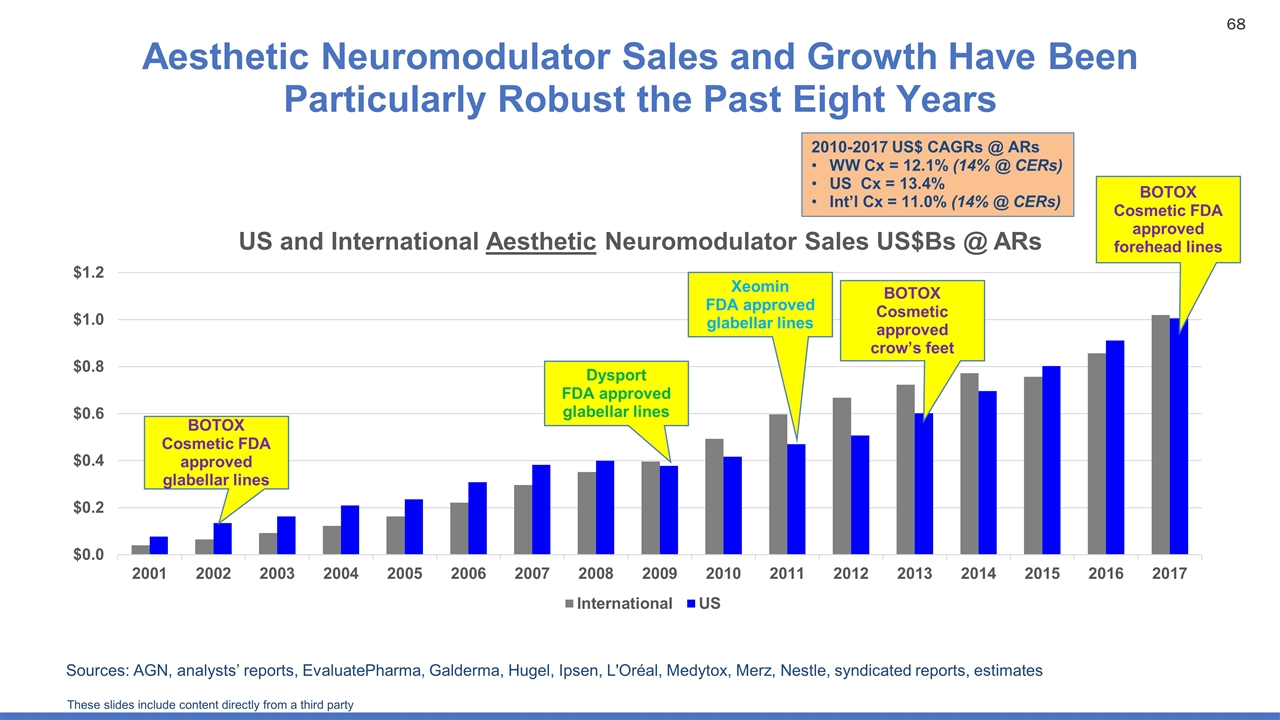

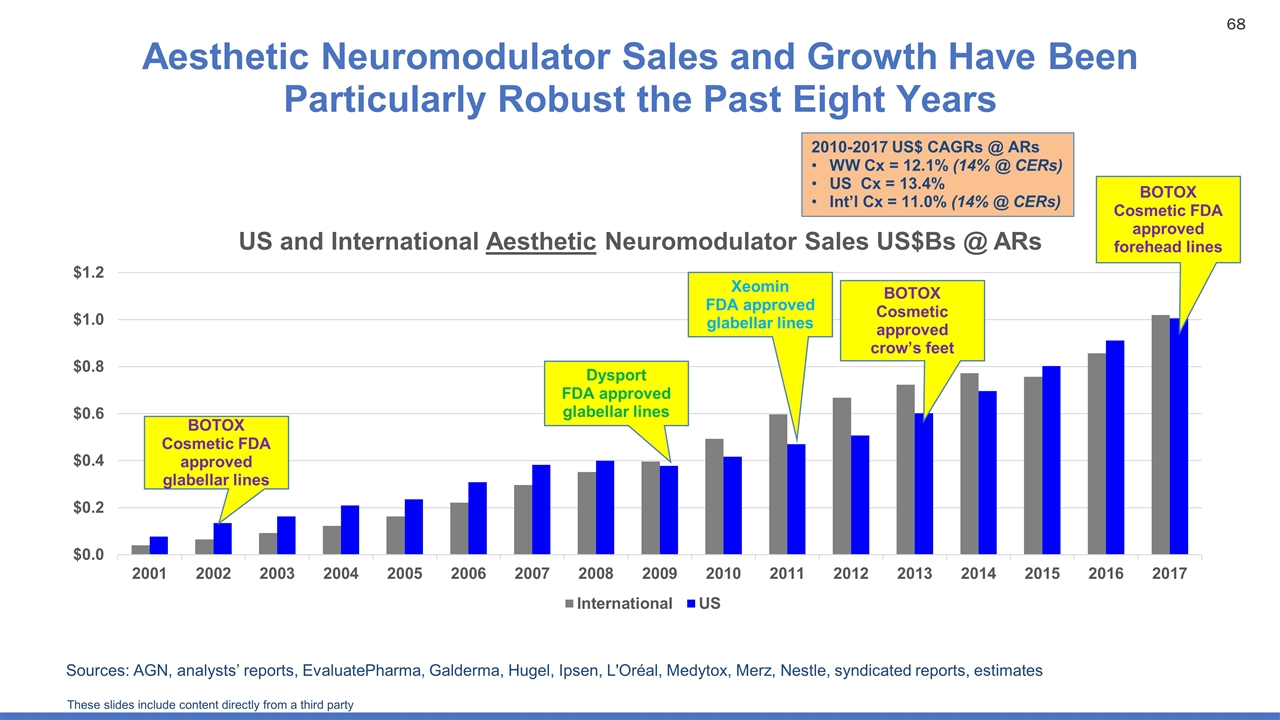

Aesthetic Neuromodulator Sales and Growth Have Been Particularly Robust the Past Eight Years Sources: AGN, analysts’ reports, EvaluatePharma, Galderma, Hugel, Ipsen, L'Oréal, Medytox, Merz, Nestle, syndicated reports, estimates BOTOX Cosmetic FDA approved glabellar lines BOTOX Cosmetic approved crow’s feet BOTOX Cosmetic FDA approved forehead lines Dysport FDA approved glabellar lines Xeomin FDA approved glabellar lines 2010-2017 US$ CAGRs @ ARs WW Cx = 12.1% (14% @ CERs) US Cx = 13.4% Int’l Cx = 11.0% (14% @ CERs) These slides include content directly from a third party

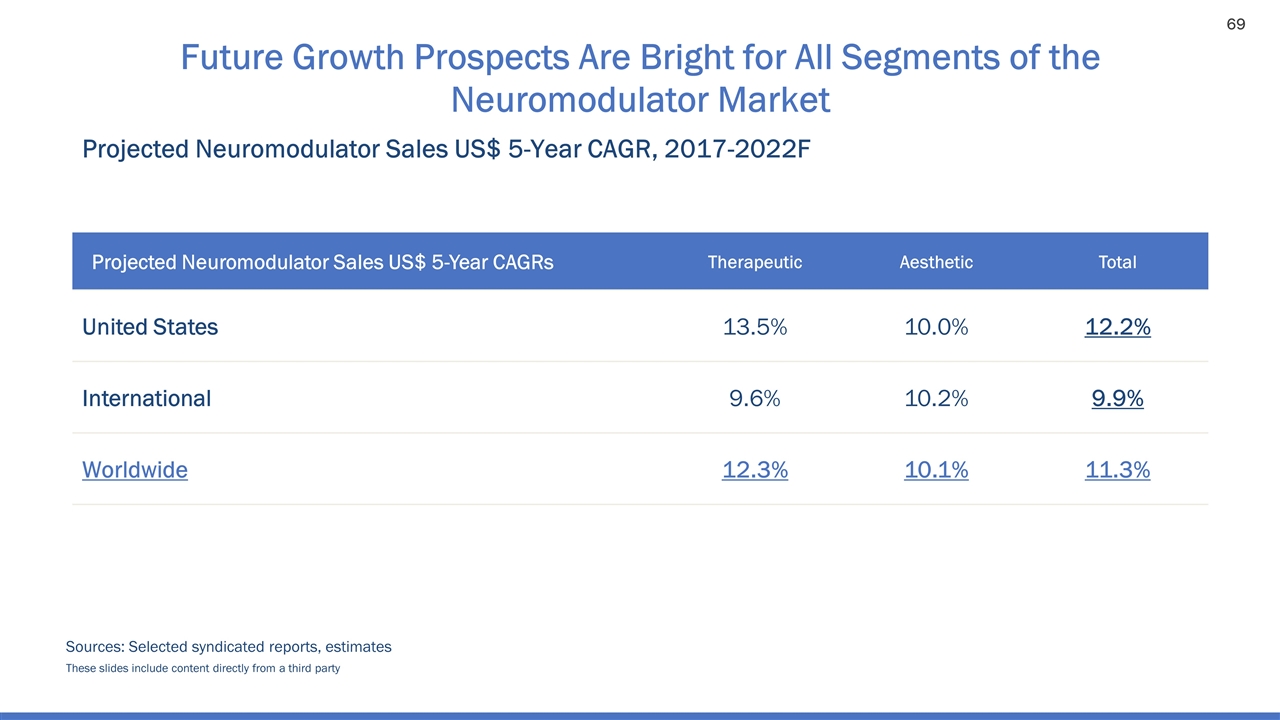

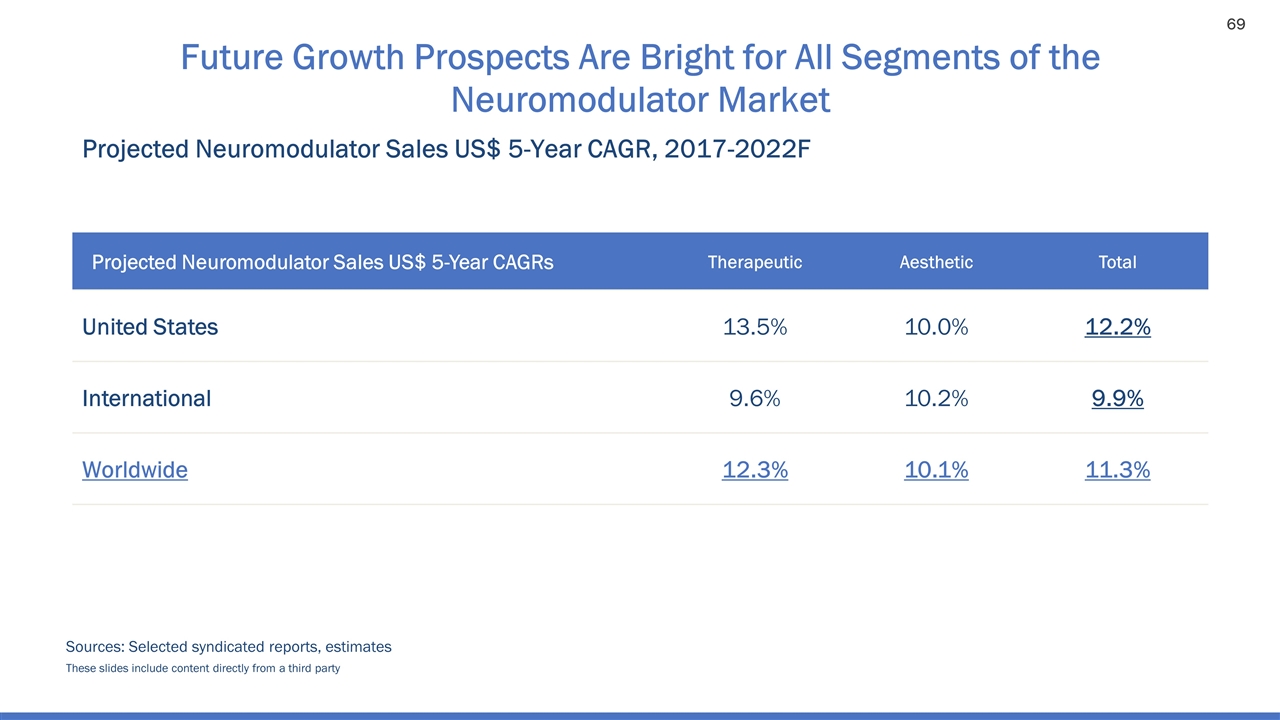

Future Growth Prospects Are Bright for All Segments of the Neuromodulator Market Projected Neuromodulator Sales US$ 5-Year CAGR, 2017-2022F Sources: Selected syndicated reports, estimates Projected Neuromodulator Sales US$ 5-Year CAGRs Therapeutic Aesthetic Total United States 13.5% 10.0% 12.2% International 9.6% 10.2% 9.9% Worldwide 12.3% 10.1% 11.3% These slides include content directly from a third party

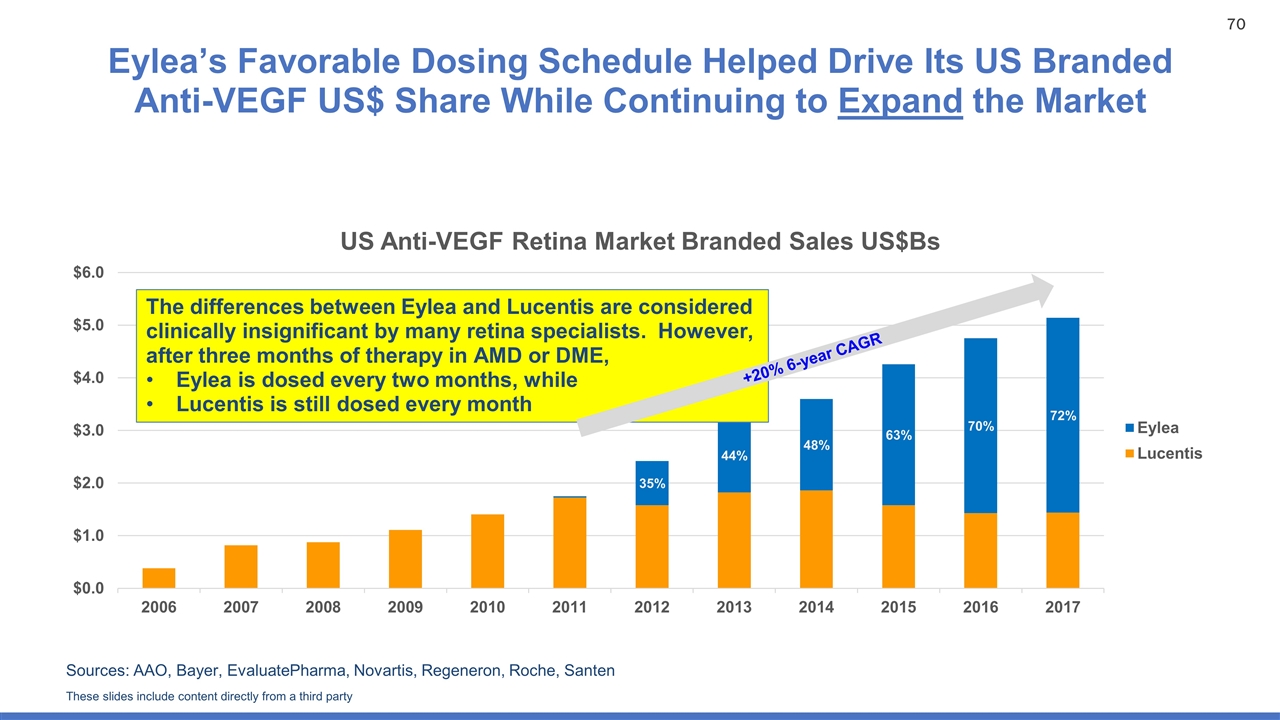

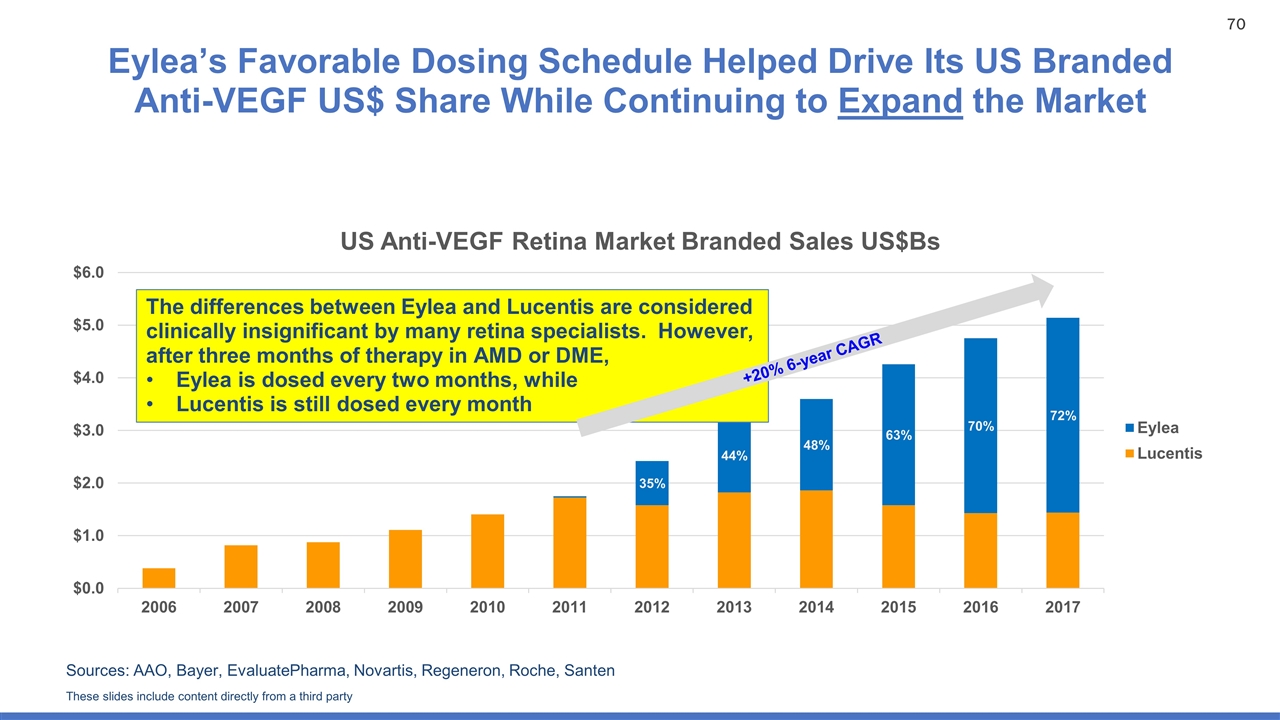

Eylea’s Favorable Dosing Schedule Helped Drive Its US Branded Anti-VEGF US$ Share While Continuing to Expand the Market Sources: AAO, Bayer, EvaluatePharma, Novartis, Regeneron, Roche, Santen The differences between Eylea and Lucentis are considered clinically insignificant by many retina specialists. However, after three months of therapy in AMD or DME, Eylea is dosed every two months, while Lucentis is still dosed every month +20% 6-year CAGR These slides include content directly from a third party

Global Neuromodulators Summary The neuromodulator opportunity is substantial: therapeutic and aesthetic US and International Growth rates in all segments has been in double digits and is expected to continue Therapeutic sales will expand with current and additional indications Aesthetic sales are underpenetrated and will continue to grow New entrant, lower-priced, short-acting neuromodulators will likely have a minimal to modest impact on the US market A longer-acting entrant is expected to spur US$ market growth These slides include content directly from a third party

MARKET REALITIES Expert Panel Grant Stevens, MD, FACS, Marina Plastic Surgery and Orange Twist Institute Joely Kaufman, MD, FAAD, Skin Associates of South Florida Tom Seery, CEO/Founder, RealSelf Jodi Kaback, Facial Injectable Consumer Moderator: Todd Zavodnick CCO and President, Aesthetics & Therapeutics

Grant Stevens, MD, FACS Practice Dynamics Board-certified Plastic Surgeon Founder and Director of Marina Plastic Surgery and the Institute, Medical Director of Orange Twist Brands Chairman of the USC-Marina Aesthetic Surgery Fellowship and the Director of the USC Division of Aesthetic Surgery Clinical Professor of Surgery USC 3rd Vice President ISAPS Authored more than 90 articles and chapters on aesthetic plastic surgery

Dedicated to Offering the Latest Advancements in Surgical Procedures and Injectables, Along with the Benefits of a Med Spa

Beauty for LIFE = Patient for LIFE™ 25 years 45 years 35 years 55 years These slides include content directly from a third party

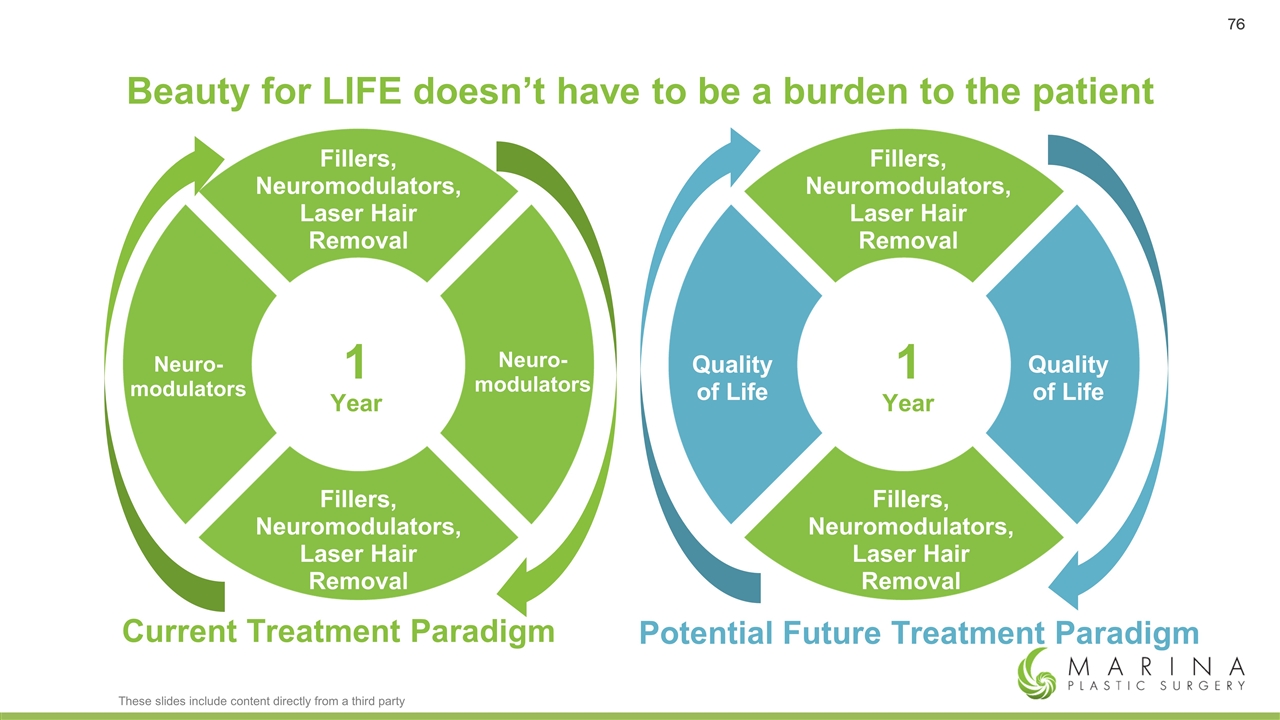

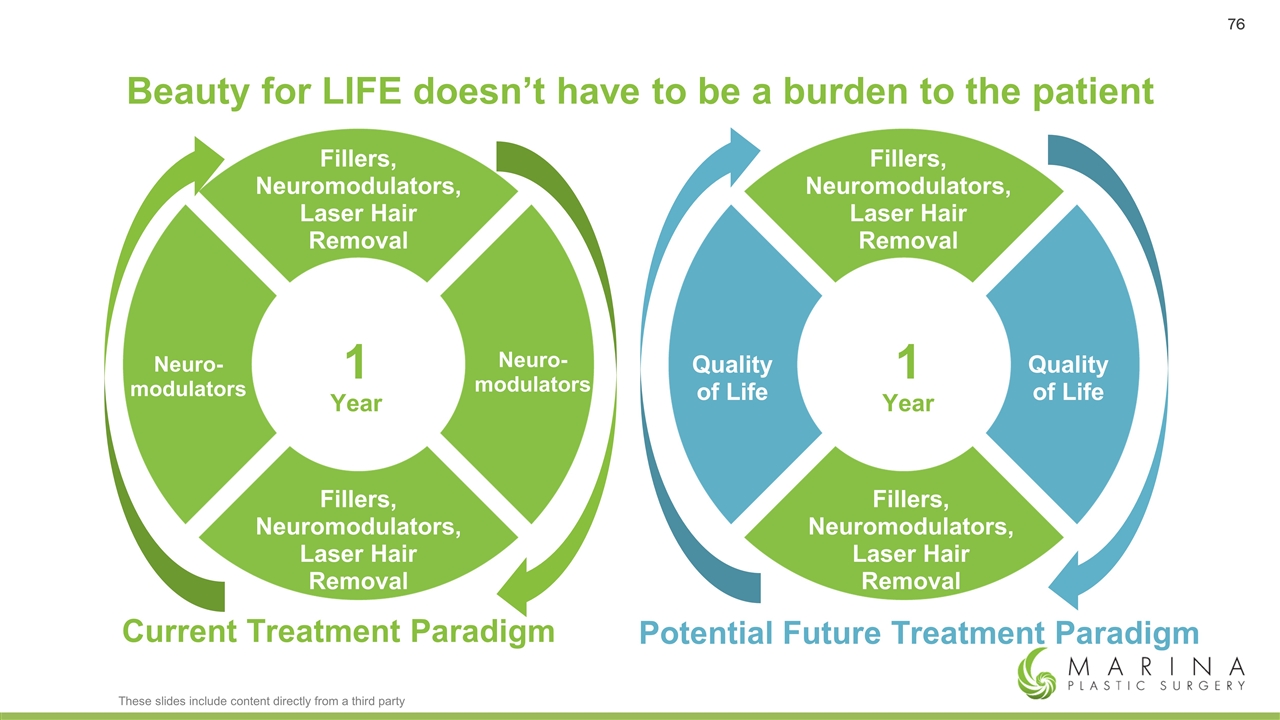

Beauty for LIFE doesn’t have to be a burden to the patient Fillers, Neuromodulators, Laser Hair Removal Fillers, Neuromodulators, Laser Hair Removal Fillers, Neuromodulators, Laser Hair Removal Fillers, Neuromodulators, Laser Hair Removal Neuro- modulators Neuro- modulators 1 Year 1 Year Quality of Life Quality of Life Current Treatment Paradigm Potential Future Treatment Paradigm These slides include content directly from a third party

Key questions surrounding new product innovation in aesthetics Product bundling & its ability to effect new entrants Longer duration products impacting practice revenue Introducing new innovation to “satisfied” consumers Breaking the consumer from the “household” name

Joely Kaufman, MD, FAAD Longer-Acting Potential Use Board-certified Dermatologist Private Practice in Coral Gables, Florida Voluntary Professor at University of Miami Director of Skin Research Institute Contributed to over 70 clinical trials in the dermatology space, with over 1/3 focusing on neuromodulator and dermal filler trials

Skin Research Institute My Practice

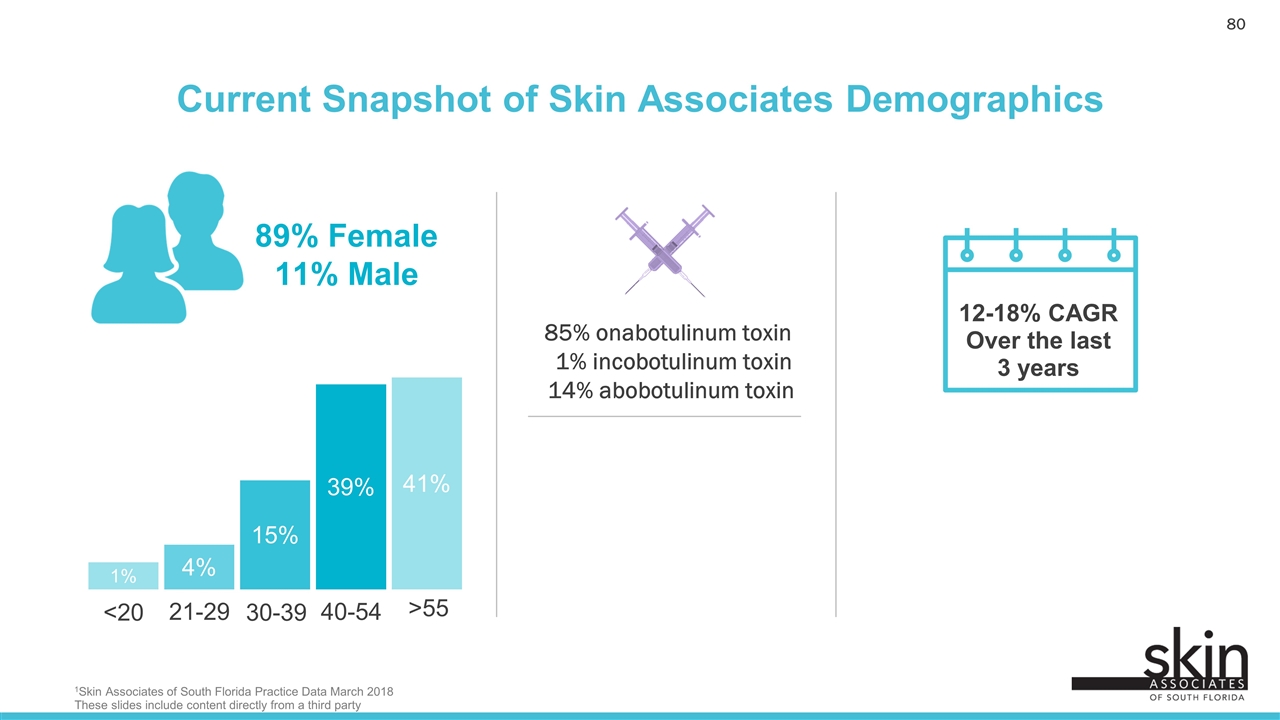

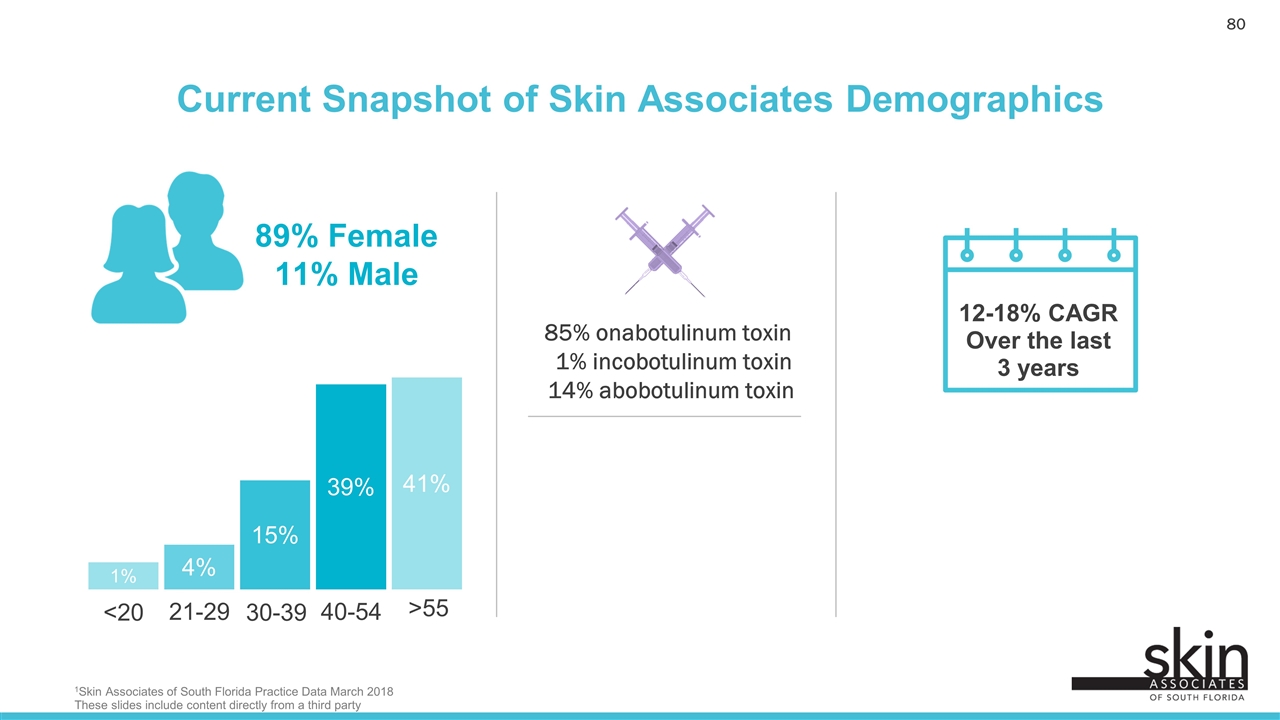

Current Snapshot of Skin Associates Demographics 12-18% CAGR Over the last 3 years 1% 4% 15% 39% <20 21-29 30-39 40-54 41% >55 89% Female 11% Male 85% onabotulinum toxin 1% incobotulinum toxin 14% abobotulinum toxin 1Skin Associates of South Florida Practice Data March 2018 These slides include content directly from a third party

My perspective on common RT002 questions: What do you find most appealing about RT002? How would RT002 change my overall practice flow? How do you switch a consumer off of an established brand? Do I anticipate a negative impact on revenue, if I use RT002 due to competitive product bundles and less treatments? How often would you mention RT002 to new patients and existing patients? How? My Practice Short-acting Long-acting

Digital moves the needle in aesthetics Tom Seery CEO/Founder Follow me on Instagram @realself @realself_tom

RealSelf is the leading digital marketplace in aesthetics where millions of consumers and thousands of HCP’s come together to share what’s “worth it,” ask and deliver expert advice... ….and ultimately connect for treatment, offline.

Digital is central to aesthetic trends and how brands reach consumers Millions of cosmetic procedure posts 94 Million unique annual visitors to reviews, photos, Q&A, video Neuromodulator brand hashtags 2,820,051 posts These slides include content directly from a third party

60% conduct plastic surgery research online Sources: RealSelf Google Analytics, September 2016 through August 2017, American Academy of Facial Plastic and Reconstructive Surgery, RealSelf consumer survey, September 2014 49% say social media directly influenced consideration or decision to have cosmetic procedure 400,000 visits to neuromodulators questions on RealSelf every month It’s how they research These slides include content directly from a third party

Top 3 Consumer Pain Points Concerns about the outcome Finding the right provider Understanding what procedure is right Source: RealSelf consumer survey, 2017 It’s how consumers get answers These slides include content directly from a third party

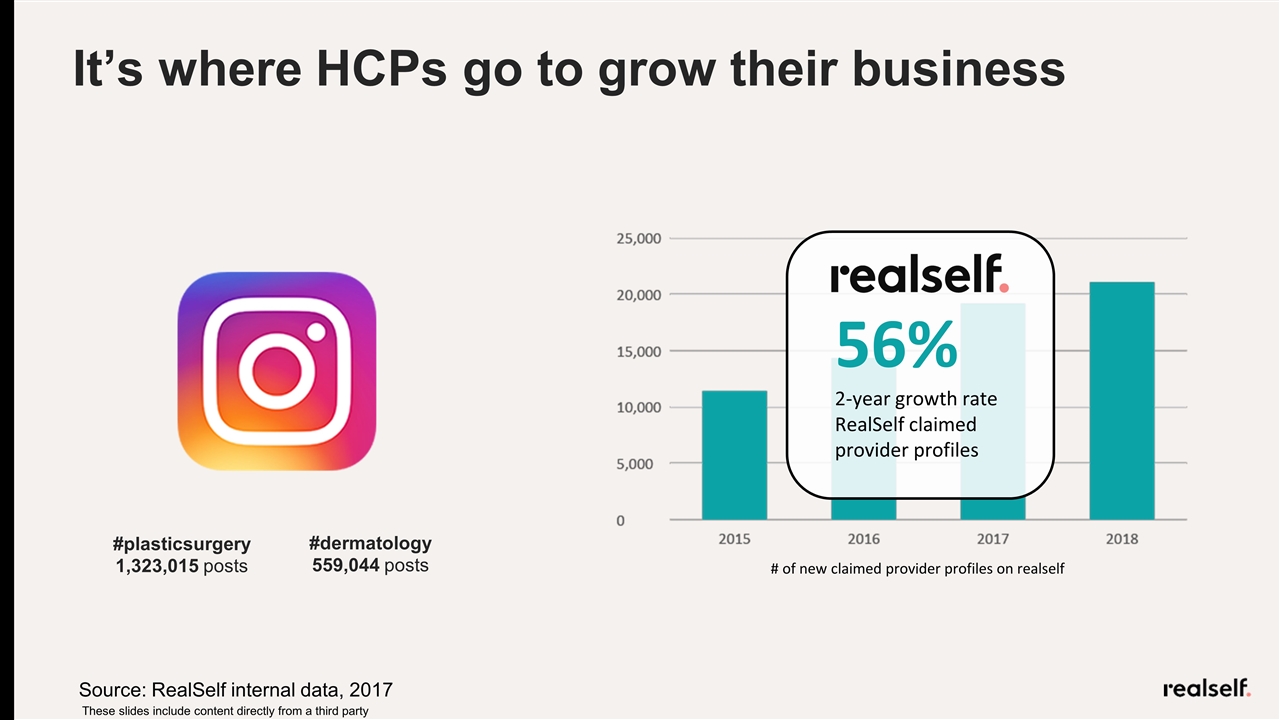

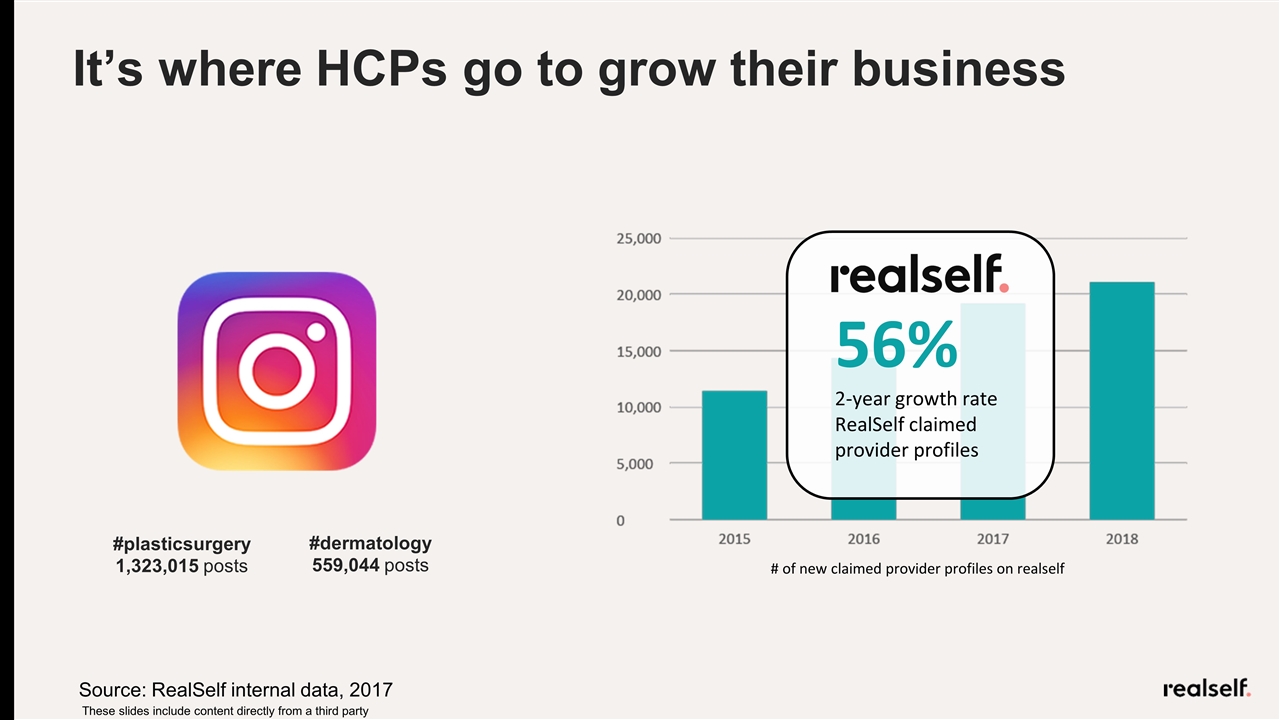

It’s where HCPs go to grow their business #plasticsurgery 1,323,015 posts #dermatology 559,044 posts # of new claimed provider profiles on realself 56% 2-year growth rate RealSelf claimed provider profiles Source: RealSelf internal data, 2017 These slides include content directly from a third party

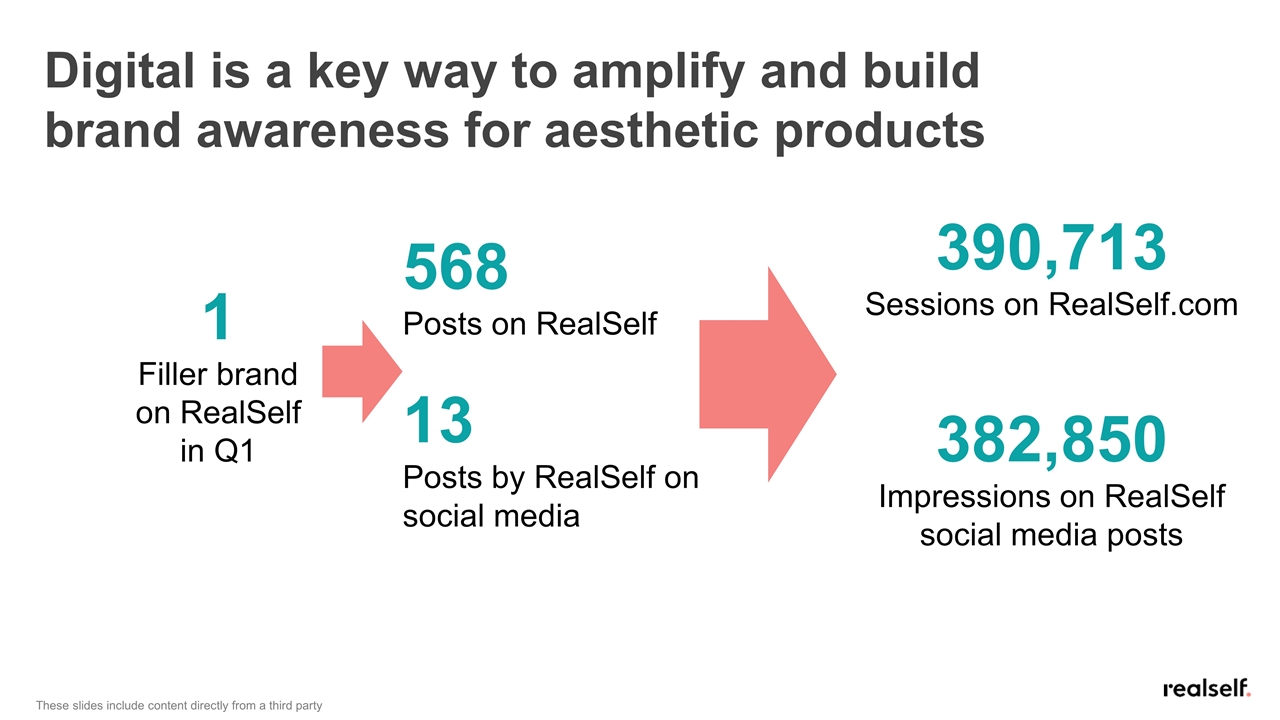

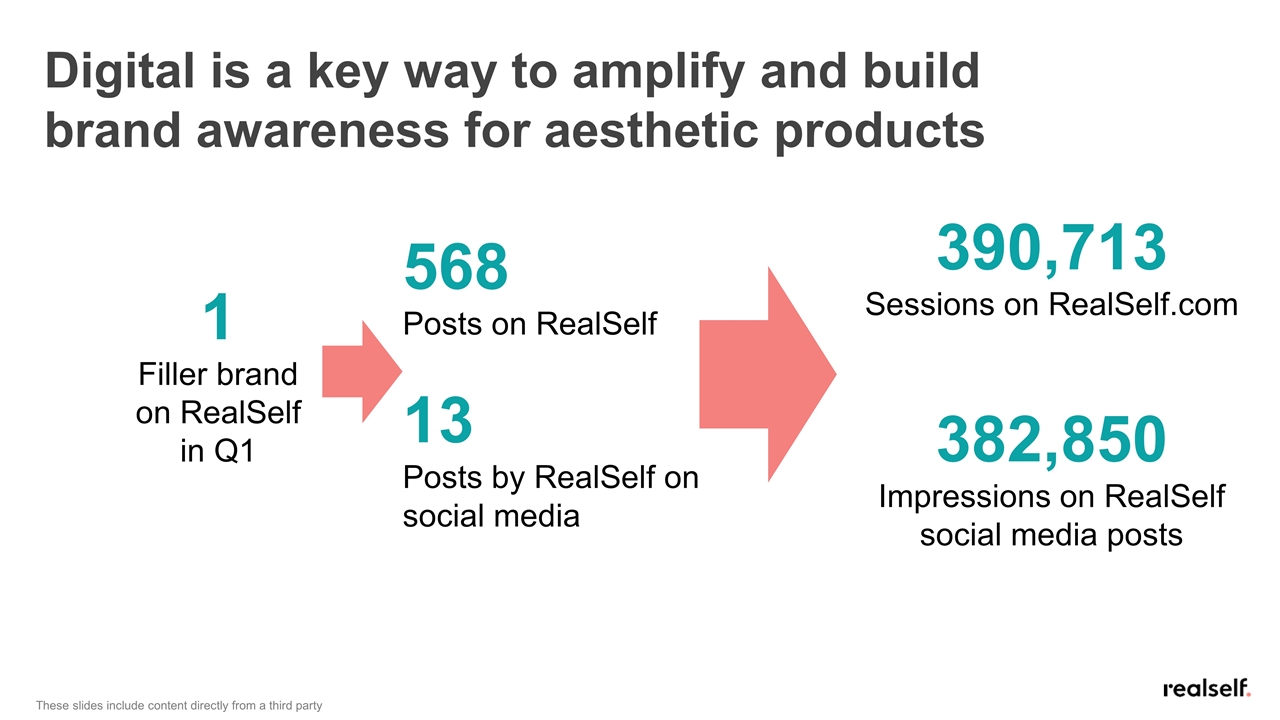

Digital is a key way to amplify and build brand awareness for aesthetic products 568 Posts on RealSelf 13 Posts by RealSelf on social media 390,713 Sessions on RealSelf.com 382,850 Impressions on RealSelf social media posts 1 Filler brand on RealSelf in Q1 These slides include content directly from a third party

vs vs vs New entrants with digital-first strategies upend traditional ways to grow awareness and share These slides include content directly from a third party

Jodi Kaback Facial Injectable Consumer Up Close & Personal Age: 47 Years Facial Injectable Use: 10 Years Neuromodulator and Dermal Fillers Profession: Event Planner/Fundraiser

REVANCE PRODUCT LAUNCH VELOCITY TODD ZAVODNICK Chief Commercial Officer, President Aesthetics and Therapeutics APRIL 19, 2018

I don’t believe in luck. I believe in preparation. − Bobby Knight

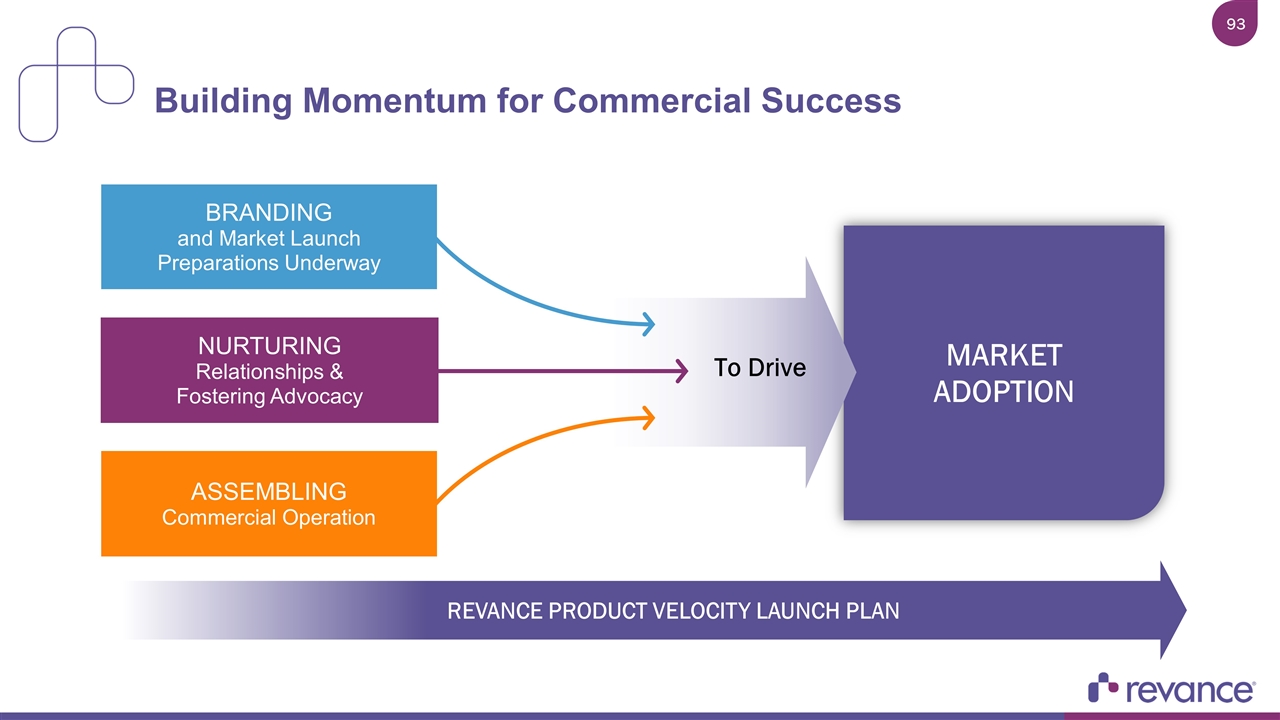

REVANCE PRODUCT VELOCITY LAUNCH PLAN Building Momentum for Commercial Success MARKET ADOPTION NURTURING Relationships & Fostering Advocacy ASSEMBLING Commercial Operation BRANDING and Market Launch Preparations Underway To Drive

Our Focus SALES COMMERCIAL OPERATIONS MARKETING DIGITAL MARKETING Our Focus

SALES Revance Advocacy Program Commercial Policy Development HCP Consumer Sales Force Sizing Our Focus SALES COMMERCIAL OPERATIONS MARKETING DIGITAL MARKETING Our Focus

FOUNDATION MARKETING Market Segmentation HCP/ Consumer Positioning Brand Identity Naming, Packaging Price Sensitivity Analysis Our Focus SALES COMMERCIAL OPERATIONS MARKETING DIGITAL MARKETING Our Focus

DIGITAL MARKETING Authentic Actively involved and building relationships with social communities and with the right partners Personalized Leveraging precise targeting, segmentation and personalization at scale Opportunistic Real-time intelligence and rapid response to capitalize on every opportunity Our Focus SALES COMMERCIAL OPERATIONS MARKETING DIGITAL MARKETING Our Focus

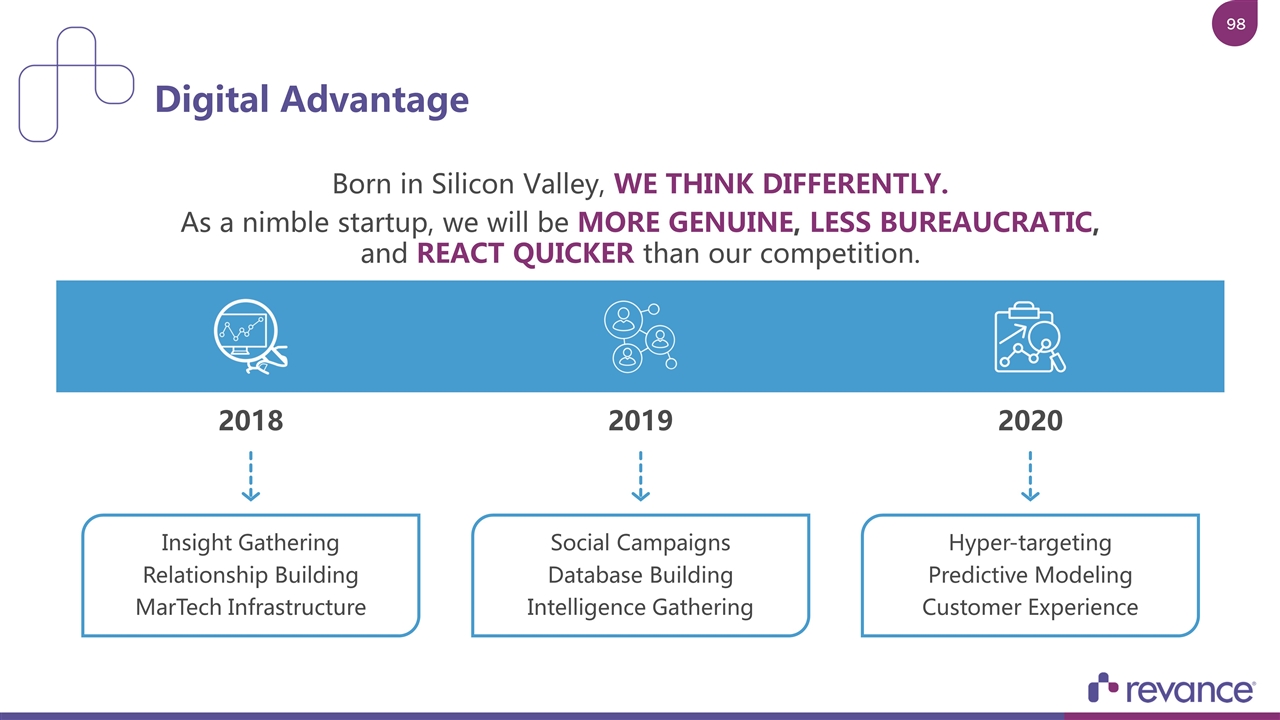

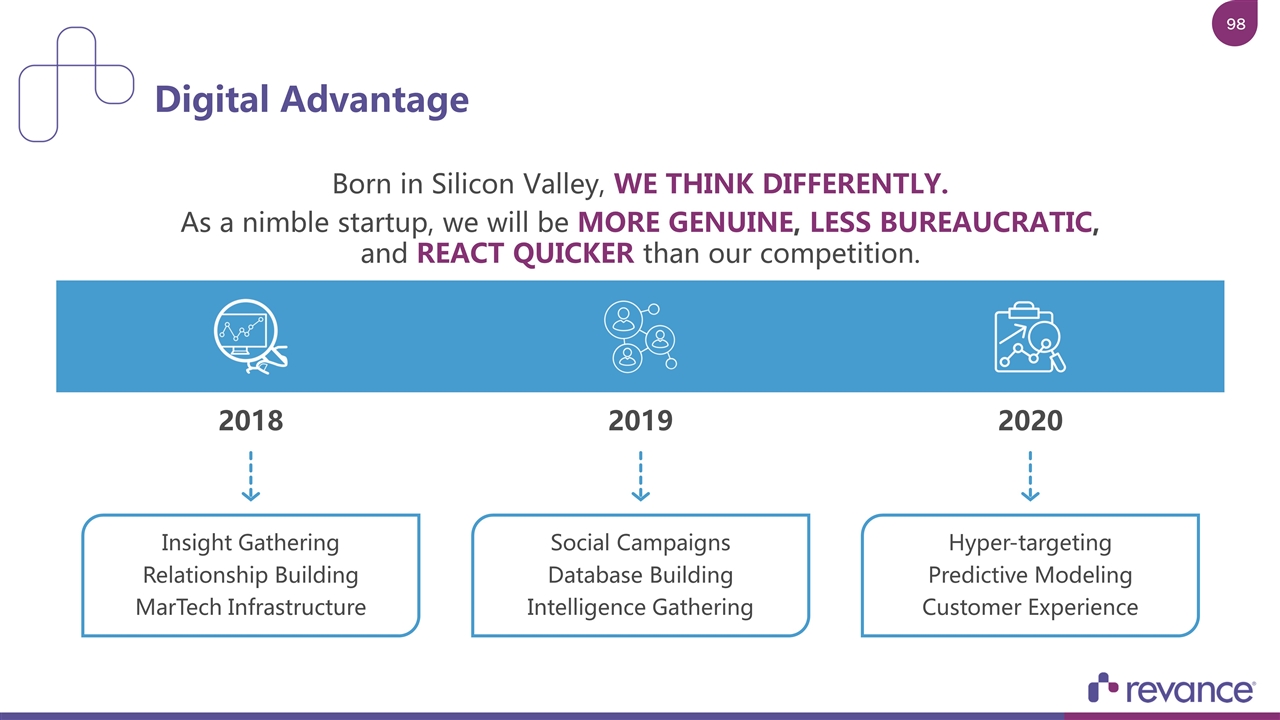

Born in Silicon Valley, WE THINK DIFFERENTLY. As a nimble startup, we will be MORE GENUINE, LESS BUREAUCRATIC, and REACT QUICKER than our competition. Digital Advantage Insight Gathering Relationship Building MarTech Infrastructure Social Campaigns Database Building Intelligence Gathering Hyper-targeting Predictive Modeling Customer Experience 2018 2019 2020

Our Focus SALES COMMERCIAL OPERATIONS MARKETING DIGITAL MARKETING Our Focus COMMERCIAL OPERATIONS Marketing Analytics Supply Chain Management Customer Relationship Management (CRM) Customer Service

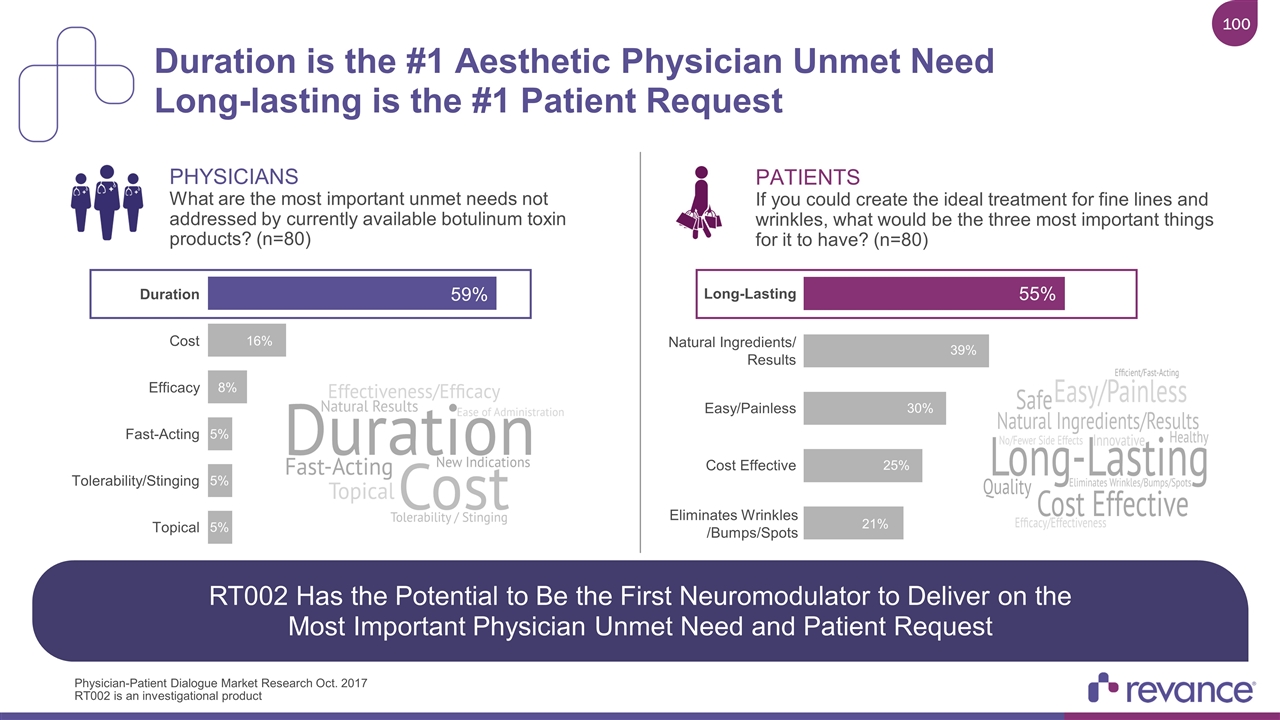

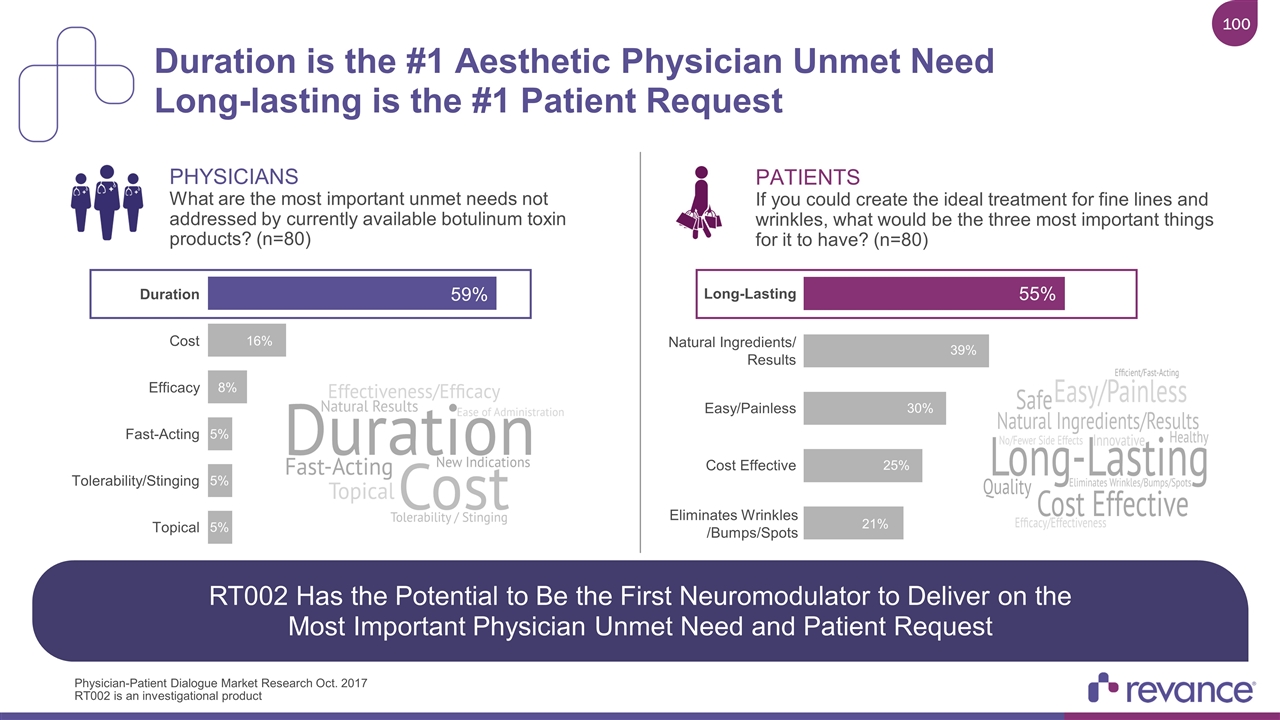

RT002 Has the Potential to Be the First Neuromodulator to Deliver on the Most Important Physician Unmet Need and Patient Request PATIENTS If you could create the ideal treatment for fine lines and wrinkles, what would be the three most important things for it to have? (n=80) PHYSICIANS What are the most important unmet needs not addressed by currently available botulinum toxin products? (n=80) Cost Effective Easy/Painless Long-Lasting Natural Ingredients/ Results Eliminates Wrinkles /Bumps/Spots Duration is the #1 Aesthetic Physician Unmet Need Long-lasting is the #1 Patient Request Physician-Patient Dialogue Market Research Oct. 2017 Efficacy Duration Cost Topical Tolerability/Stinging Fast-Acting RT002 is an investigational product

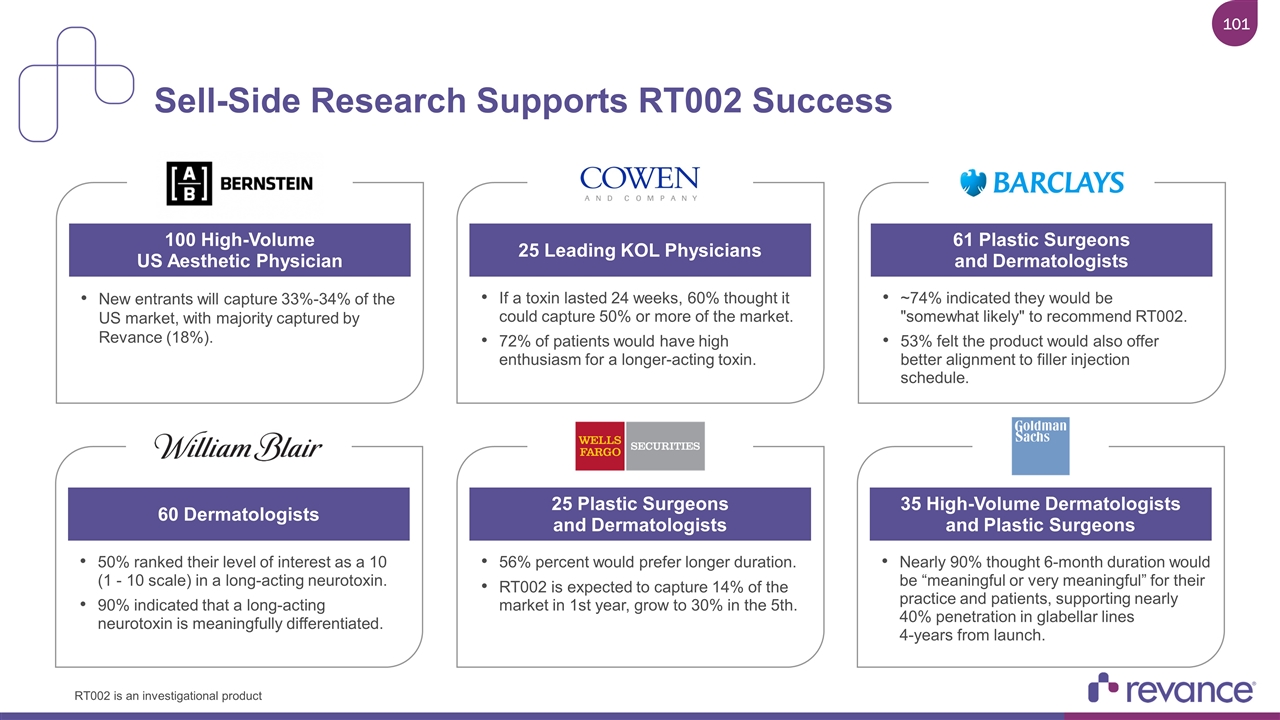

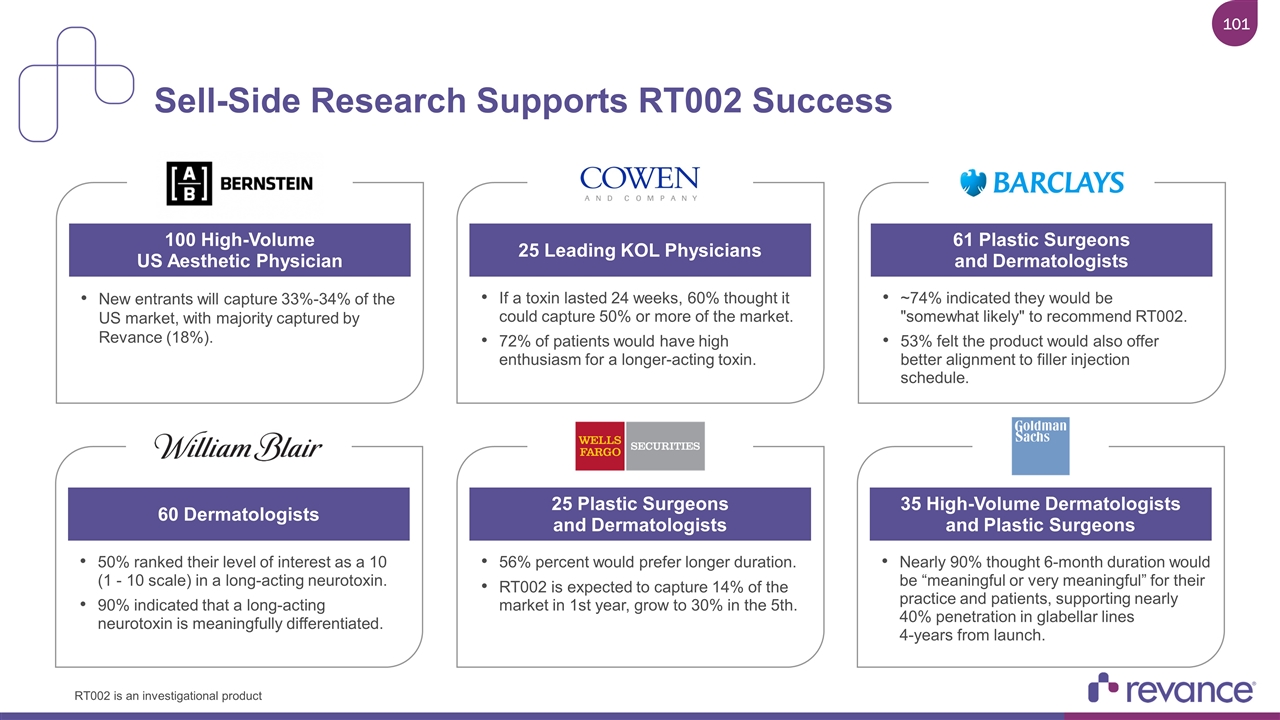

Sell-Side Research Supports RT002 Success New entrants will capture 33%-34% of the US market, with majority captured by Revance (18%). 100 High-Volume US Aesthetic Physician If a toxin lasted 24 weeks, 60% thought it could capture 50% or more of the market. 72% of patients would have high enthusiasm for a longer-acting toxin. 25 Leading KOL Physicians ~74% indicated they would be "somewhat likely" to recommend RT002. 53% felt the product would also offer better alignment to filler injection schedule. 61 Plastic Surgeons and Dermatologists 50% ranked their level of interest as a 10 (1 - 10 scale) in a long-acting neurotoxin. 90% indicated that a long-acting neurotoxin is meaningfully differentiated. 60 Dermatologists 56% percent would prefer longer duration. RT002 is expected to capture 14% of the market in 1st year, grow to 30% in the 5th. 25 Plastic Surgeons and Dermatologists Nearly 90% thought 6-month duration would be “meaningful or very meaningful” for their practice and patients, supporting nearly 40% penetration in glabellar lines 4-years from launch. 35 High-Volume Dermatologists and Plastic Surgeons RT002 is an investigational product

Proven Team with Deep Experience Assembling a Commercial Team of Industry Veterans TODD ZAVODNICK CCO and President, Aesthetics & Therapeutics >20 years domestic and international sales and marketing experience Leadership roles overseeing aesthetics and eye care products/markets ERICA BAZERKANIAN VP, Marketing Aesthetics & Therapeutics >20 years of experience in healthcare marketing New product development, market planning and product launches BEN PUTMAN VP, Digital 18 years of experience in digital strategy and execution Digital and social media strategy and innovation in healthcare advertising and new product launches Dustin Sjuts VP, Strategy and Sales, Aesthetics & Therapeutics >15 years global marketing, sales and operational experience within the medical aesthetics industry Leadership roles in product launches, go to market strategies, and in market growth plans MARC KORENBERG Senior Director, Commercial Operations >15 years in commercial operations, finance and analytics Build and lead domestic and international commercial operations, finance, analytics, strategic commercial partner leading market model design and implementation JESSIE ROEDER Associate Director, Marketing >12 years domestic and international healthcare sales and marketing experience Aesthetic and therapeutic launch excellence, market insights, and campaign development ERIC SANDERS Sr. Director, Therapeutics Marketing > 20 years biopharmaceutical commercial leadership Development of sales & marketing strategies, led co-promotion collaborations, oversight of buy & bill reimbursement REVANCE EXPERTISE Launch and Commercialization

QUESTIONS AND ANSWERS Dan Browne, President and CEO

INVESTOR DAY SUMMARY DAN BROWNE President & CEO

Closing Remarks * Source: Global Industry Analysts, Inc. Botulinum Toxin – A Global Strategic Business Report, Jan 2018 EXPANDing neuroscience Pipeline Cervical dystonia, plantar fasciitis, upper limb spasticity and chronic migraine REVANCE PRODUCT LAUNCH VELOCITY Aesthetics Ensuring preparation and targeted approach Daxi -Truly Differentiated Neuromodulator Confidence in BLA filing and 6-month label >$4 billion 2017 UNDER PENETRATED Global opportunity Expected to Grow to $7 Billion by 2024*

THANK YOU FOR JOINING US DAN BROWNE President & CEO