NUTEX HEALTH HOLDCO SUPPLEMENTAL INFORMATION

OVERVIEW

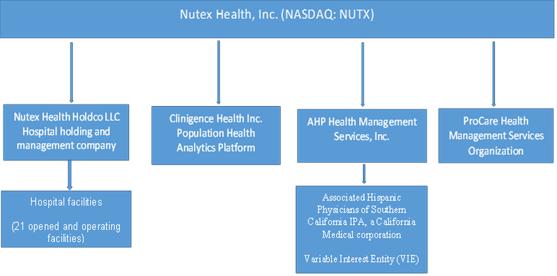

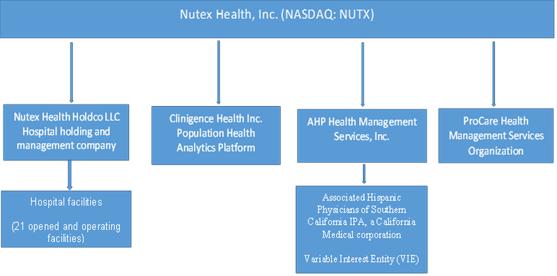

Nutex Health Inc. (“Nutex Health” or the “Company”), is a physician-led, technology-enabled healthcare services company comprised of its wholly owned subsidiary Nutex Health Holdco, LLC , with the 21 hospital facilities in eight states (hospital division), and a primary care-centric, risk-bearing population health management division. The hospital division implements and operates different innovative health care models, including micro-hospitals, specialty hospitals and hospital outpatient departments (HOPDs). The Population Health Management division owns and operates provider networks such as Independent Physician Associations (IPAs). Through its Management Services Organizations (MSOs), Nutex Health provides management, administrative and other support services to its affiliated hospitals and physician groups. The Company’s cloud-based proprietary technology platform aggregates clinical and claims data across multiple settings, information systems and sources to create a holistic view of patients and providers, which the Company believes allows for the delivery of greater quality care more efficiently.

The chart below shows the post merger structure of Nutex Health Inc.

On April 1, 2022, Clinigence Holdings, Inc. (now known as Nutex Health Inc.), a publicly traded Delaware corporation (the “Company”), consummated the previously announced business combination (the “Business Combination”) with Nutex Health Holdco pursuant to that certain Agreement and Plan of Merger, dated as of November 23, 2021 (as amended, modified, supplemented or waived, the “Merger Agreement”), by and among Nutex, Clinigence Holdings, Inc., Nutex Acquisition LLC (“Merger Sub”), Micro Hospital Holding LLC (solely for the purposes of certain sections), Nutex Health LLC (solely for the purposes of certain sections) and Thomas T. Vo, solely in his capacity as the representative of the equityholders of Nutex. Pursuant to the Merger Agreement, following the approval by the stockholders of Clinigence Holdings Inc. on March 16, 2022, Merger Sub merged with and into Nutex Health Holdco, with Nutex Health Holdco surviving as a wholly owned subsidiary of the Company (the “Merger”).

In connection with the Merger Agreement, Nutex Health Holdco entered into contribution agreements with holders of equity interests (“Nutex Owners”) of subsidiaries and affiliates of Nutex Health Holdco (the “Nutex Subsidiaries”) pursuant to which such Nutex Owners agreed to contribute equity interests in the Nutex Subsidiaries to Nutex in exchange for specified equity interests in Nutex Health Holdco. Nutex Owners having ownership interests representing approximately 84% of the agreed upon equity value of the Nutex Subsidiaries agreed to contribute all or a portion of their equity interests, as applicable. In the Merger, the Nutex Owners received aggregate of 592,791,712 shares of common stock of Nutex Health, representing approximately 90.9% of the 647,11,416 shares of common stock outstanding as of June 15,, 2022.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth information known to us, as of June 15, 2022, relating to the beneficial ownership of shares of common stock by: (i) each person who is known by us to be the beneficial owner of more than 5% of the Company’s outstanding common stock; (ii) each director; (iii) each executive officer; and (iv) all executive officers and directors as a group. Under securities laws, a person is considered to be the beneficial owner of securities owned by him (or certain persons whose ownership is attributed to him) or securities that can be acquired by him within 60 days, including upon the exercise of options, warrants or convertible securities.

The percentages shown are calculated based on 647,411,416 shares of Common Stock outstanding as of June 15, 2022.

| Name of Beneficial Owner | Amount and Nature of Beneficial Ownership | Percent of Class |

| Micro Hospital Holding LLC (1) | 267,706,960 | 41.35% |

| Premier Macy Management Holdings, LLC(2) | 42,134,210 | 6.51% |

| Michael L. Chang, Chief Medical Officer | 12,008,523 | 1.85% |

| Warren Hosseinion, President and Director (3) | 3,770,265 | .58% |

| Mitchell Creem, Director (4) | 365,074 | .29% |

| Cheryl Grenas, Director (5) | 19,280 | .00% |

| Michael Reed, Director (6) | 21,208 | .00% |

| John Waters, Director (7) | 546,421 | .08% |

| Michael Bowen, CFO (8) | 647,105 | .10% |

| Elisa Luqman, Chief Legal Officer (SEC) Secretary (9) | 679,976 | .11% |

| Pamela Montgomery, Chief Legal Officer (Healthcare) Secretary | - | .00% |

| Denise Pufal, COO | - | 00% |

| Larry Schimmel, Chief Medical Information Officer (10) | 499,731 | .08% |

| Executive Officers and Directors as a Group | 328,398,753 | 50.37% |

(1) Micro Hospital Holding LLC (“MHH” is the direct beneficial owner of 267,706,960 shares of Common Stock. Dr. Vo, the Chairman and Chief Executive Officer of the Company, as the 100% owner and sole manager of MHH, is the indirect beneficial owner of such shares.

(2) Premier Macy Management Holdings, LLC is the direct beneficial owner of 42,134,210 shares of Common Stock. Each of Dr. Young and Cynthia J. Young, as co-trustees of the First Amended & Restated Matthew Stephen Young & Cynthia Jane Young Joint Living Trust, the 99% owner of Macy GP LLC, the 100% owner of Premier Macy Management Holdings, LLC, can be deemed to be the indirect beneficial owners of the shares reported herein.

(3) Includes options to purchase 200,000 shares of the common stock at $1.50 per share, options to purchase 600,000 shares of the common stock at $1.61 per share and a warrant to purchase

(4) Includes 21,208 shares of Restricted Stock that vest 1/12th per month starting April 1, 2022, options to purchase 10,120 shares of the common stock at $5.56 per share, options to purchase 75,000 shares of common stock at $1.50 per share, options to purchase 45,000 shares at $1.61 and options to acquire 182,000 shares of common stock at $2.75 per share.

(5) Shares of Restricted Stock that vest that 1/12th per month starting April 1, 2022

(6) Shares of Restricted Stock that vest 1/12th per month starting April 1, 2022

(7) Includes 21,851 shares of Restricted Stock that vest 1/12th per month starting April 1, 2022, options to purchase, 102,800 shares of common stock at $1.50, 45,000 common shares at $1.61, per share, convertible debenture to purchase 64,516 common shares at $1.55, warrant to purchase 48,508 common shares at $1.55 per share and options to acquire 182,000 shares of common stock at $2.75 per share.

(8) Includes options to purchase 200,000 shares of Common Stock at $2.75 per share.

(9) Includes 1,370 shares of common stock held by Muhammad Luqman, Ms. Luqman’s husband, options to purchase 117,106 shares of the commons stock at $1.50 per share, options to purchase 400,000 shares of the common stock at $1.61 per share and options to purchase 150,000 shares of common stock at $2.75 per share.

(10) Includes options to purchase 6,288 shares of the common stock at $1.50 per share, options to purchase 30,000 shares of the common stock at $1.50 per share, convertible debenture to purchase 19,597 common shares at $1.55, warrant to purchase 9,799 common shares at $1.55 per share and options to acquire 200,000 shares of common stock at $2.75 per share.

HISTORICAL FINANCIAL INFORMATION

The following supplemental information relates to the historical financial information of Nutex Health Holdco prior to the Merger.

Expansion during the three months ended March 31, 2022

At the end of the first calendar quarter of 2022, the Company opened two new fully operational hospitals. Opening of a new hospital requires adequate medical equipment, supplies and staffing. Start-up costs associated with the opening of these two hospitals were paid by Nutex Health Holdco and are reflected in the increased general and administrative expenses for the three months ended March 31, 2022. Additionally, the Company bears the operating costs of the new facilities during the ramp up period to break-even and eventual profitability.

Expected Continued Expansion

The Company anticipates opening three more facilities in 2022. In connection with continued facilities expansion, we anticipate additional increases in operating expenses and capital expenditures relating to the planned hospital openings as well as sustaining the hospitals during their relative ramp up periods to break-even and eventual profitability. There can be no assurance that these additional facilities will open in the anticipated timing or at all, or that they will reach profitability during the time frames anticipated.

Revisions to Nutex Health Holdco Historical financial statements as of and for the nine months ended September 30, 2021 and as of and for the year ended December 31, 2020.

Nutex Health Holdco made the revisions described below to previously reported amounts in Nutex Health Holdco’s combined and consolidated financial statements. As set forth in more detail below, the Company has determined that these revisions are immaterial. Please read Note 2 to the historical audited combined and consolidated financial statements of Nutex Health Holdco as of and for the year ended December 31, 2021 and 2020 included as Exhibit 99.2 to this filing for a detailed description of the revisions as of and for the year ended December 31, 2020.

The Company revised (1) the classification of net income and (2) equity attributable to noncontrolling interests and corrected the presentation of items within the statement of cash flows. The Company evaluated these matters in accordance with SAB No. 99, Materiality, and SAB No. 108, Considering the Effects of Prior Year Misstatements when Quantifying Misstatements in Current Year Financial Statements and determined that their related impact was not material to Nutex’s financial statements for any prior annual or interim period. Nutex Health undertakes to correct previously reported financial information for these immaterial matters in its future filings, as applicable.

RISK FACTORS

The unaudited pro forma combined financial statements for Nutex Health Inc., the combined company, are presented for illustrative purposes only, and future results may differ materially from the unaudited pro forma financial statements.

The unaudited pro forma combined financial statements contained in this report are presented for illustrative purposes only and for several reasons, may not be an indication of the combined company’s financial condition or results of operations following the completion of the Merger. The unaudited pro forma combined financial statements have been derived from the historical financial statements of Clinigence and Nutex Health Holdco and adjustments and assumptions have been made regarding the combined company after giving effect to the Merger. The information upon which these adjustments and assumptions have been made is preliminary, and these kinds of adjustments and assumptions are difficult to make with accuracy. Moreover, the pro forma financial statements do not reflect all costs that are expected to be incurred by the combined company in connection with the merger. As a result, the actual financial condition, and results of operations of the combined company following the completion of the Merger may not be consistent with, or evident from, these pro forma financial statements. The assumptions used in preparing the pro forma financial information may prove to be inaccurate, and other factors may affect the combined company’s financial condition or results of operations following the Merger. Any decline or potential decline in the combined company’s financial condition or results of operations may cause significant variations in the market price of Company Common Stock.

The estimates and assumptions Nutex Health Holdco is required to make in connection with the preparation of its financial statements may prove to be inaccurate

The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amount of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period.

Nutex applies ASC 606 – Revenue from Contracts with Customers in making estimates of its earned revenue and accounts receivable at each reporting date. This estimation process for variable consideration is highly subjective. The Company regularly conducts a comparative analysis of its actual results to its previously estimated results in order to evaluate whether changes to its estimation process are required. The estimation of variable consideration is particularly complex at Nutex Health Holdco in particular and within the healthcare industry generally because of the broad range of services provided, the range of reimbursements by patient insurance companies and collectability of patient responsible amounts. In addition, Nutex Health Holdco operates as an out-of-network provider and, as such, does not have negotiated reimbursement rates with any insurance companies, adding to the complexity and potential uncertainty of the estimation process.

Our estimates with respect to the claims processing by insurance companies and our resulting cash collections may differ from previous estimated results and we may be required to make periodic adjustments to our estimation process for new facts or circumstances. For example, with respect to the first quarter of 2022, Nutex Health Holdco revised its previous estimates in response to actual collections and industry trends.

Ultimate amounts collected may differ from anticipated collections, and, as a result, may impact our ability to generate revenue at expected levels

Reimbursement for medical services is subject to change, including that the reimbursement that Nutex Health Holdco receives for services could significantly decline.

Because Nutex Holdco provides emergency medicine services, it does not have extensive relationships with large commercial payors and is generally out-of-network. Although some licensed facilities are in-network with payors, the Company’s general payor contracting/government enrollment strategy is to remain out of network. Since we wo not have any contractual arrangements with insurance companies, we cannot predict the timing and amount of the payments we ultimately receive for our services and estimates and assumptions which are based on historical insurance payment amounts and timing.

Although this is not an uncommon strategy employed by emergency medicine providers, there is increased scrutiny on the billing practices of out-of-network providers in the current regulatory landscape. When an enrollee receives emergency care either at an out-of-network facility or from an out-of-network provider because an insurer does not have a contract with the out-of-network facility or provider, it may decide not the pay the entirety of the bill. In this case, the out-of-network facility or provider will bill the enrollee for the balance of the bill. While 33 states have enacted laws to protect enrollees from “balance billing” practices, the No Surprises Act enacted by Congress in 2020, and effective January 1, 2022, provides protections in all 50 states from the most common sources of balance billing. The federal law prohibits providers from balance billing for (i) emergency services and (ii) non-emergency services rendered by out of-network providers at certain designated in-network facilities. In these instances, consumers’ financial liability will be capped at in-network cost sharing amounts. Texas, where the Company’s business is concentrated, already has comprehensive balance billing protections. Texas law prohibits out-of-network providers from billing enrollees for any amount beyond in-network cost sharing. Even to the extent the Company’s billing and coding practices are in compliance with current state law, effective January 1, 2022, its out-of-network providers in all states is required to comply with certain new notice and disclosure requirements under the No Surprises Act. Further, it is not clear how federal and state balance billing laws will interact and which aspects of Texas law may be preempted.

Our management has limited experience in operating a public company and we may incur additional expenses to operate as a public company.

Our executive officers and certain directors have limited experience in the management of a publicly traded company. Our management team may not successfully or effectively manage the integration of Nutex Health Holdco into a public company subject to significant regulatory oversight and reporting obligations under federal securities laws. Their limited experience in dealing with the increasingly complex laws pertaining to public companies could be a significant disadvantage in that it is likely that an increasing amount of our management’s time may be devoted to these activities which will result in less time being devoted to the management and growth of the company. Further, we may incur significantly increased personnel costs to support our operations as a public company, which will increase our operating costs in future periods.

Our expenses may increase in connection with our growth strategy and Nutex Health Holdco’s integration into a public reporting company

We expect that our operating expenses will increase as we grow our business, build relationships with physician partners, and develop new services and comply with the requirements associated with being a public company.

If our internal control over financial reporting is not effective, we may not be able to accurately report our financial results or file our periodic reports in a timely manner, which may cause adverse effects on our business and may cause investors to lose confidence in our reported financial information and may lead to a decline in the price of our Common Stock.

Effective internal control over financial reporting is necessary for us to provide reliable financial reports in a timely manner. Way may conclude that there were material weaknesses in our internal control over financial reporting. A material weakness is a deficiency, or a combination of deficiencies, in internal control over financial reporting, such that there is a reasonable possibility that a material misstatement of the annual or interim financial statements will not be prevented or detected on a timely basis.

While we have focused on (i) hiring qualified accounting, financial reporting, IT, and other key management personnel with public company experience, (ii) [engaging an external advisor to assist with evaluating and documenting the design, structure and operating effectiveness of internal controls and assist with the training of personnel, as necessary, and design and establishment of a formal internal audit function] and (iii) enhancing policies and procedures documentation for key areas of accounting, our internal control over financial reporting may not be effective, and the accuracy and timing of our financial reporting may be adversely affected, a material misstatement in our financial statements could occur, and we may be unable to maintain compliance with securities law requirements regarding timely filing of periodic reports, which may adversely affect our business and the price of our Common Stock may decline as a result.

If our arrangements with our affiliated professional entities and other physician partners are found to constitute the improper rendering of medical services or fee splitting under applicable state laws, our business, financial condition and our ability to operate in those states could be adversely impacted.

Our contractual relationships with our affiliated professional entities and other physician partners may implicate certain state laws that generally prohibit non-professional entities from providing licensed medical services or exercising control over licensed physicians or other healthcare professionals (such activities generally referred to as the “corporate practice of medicine”) or engaging in certain practices such as fee-splitting with such licensed professionals. The interpretation and enforcement of these laws vary significantly from state to state. There can be no assurance that these laws will be interpreted in a manner consistent with our practices or that other laws or regulations will not be enacted in the future that could have a material and adverse effect on our business, financial condition and results of operations. Regulatory authorities, state boards of medicine, state attorneys general and other parties may assert that, despite the agreements through which we operate, we are engaged in the provision of medical services and/or that our arrangements with our affiliated professional entities and other physician partners constitute unlawful fee-splitting. If a jurisdiction’s prohibition on the corporate practice of medicine or fee-splitting is interpreted in a manner that is inconsistent with our practices, we would be required to restructure or terminate our arrangements with our affiliated professional entities and other physician partners to bring our activities into compliance with such laws. A determination of non-compliance, or the termination of or failure to successfully restructure these relationships could result in disciplinary action, penalties, damages, fines, and/or a loss of revenue, any of which could have a material and adverse effect on our business, financial condition and results of operations. State corporate practice and fee-splitting prohibitions also often impose penalties on healthcare professionals for aiding in the improper rendering of professional services, which could discourage physicians and other healthcare professionals from providing clinical services to members of the health plans with whom we contract.

The health care industry is heavily regulated. Nutex Holdco’s failure to comply with regulatory requirements could create liability for it, result in adverse publicity and otherwise negatively affect its business.

The health care industry is heavily regulated and is constantly evolving due to the changing political, legislative, and regulatory landscape and other factors. Many health care laws are complex, and their application to specific services and relationships may not be clear. Further, some health care laws differ from state to state, and it is difficult to ensure Nutex Holdco’s business complies with evolving laws in all states. Nutex Holdco’s operations may be adversely affected by enforcement initiatives. Nutex Holdco’s failure to accurately anticipate the application of these laws and regulations to its business, or any other failure to comply with regulatory requirements, could create liability, force it to change operations, result in adverse publicity and negatively affect the business. For example, failure to comply with these requirements could result in closure of one or more facilities, inability to obtain or recoupment of reimbursement for services, fines and/or penalties, or exclusion from governmental reimbursement programs. Federal and state legislatures and agencies periodically consider proposals to revise aspects of the legal rules applicable to the health care industry, or to revise or create additional statutory and regulatory requirements. Such proposals, if implemented, could impact Nutex Holdco operations or could create unexpected liabilities for Nutex Holdco. We cannot predict what changes to laws or regulations might be made in the future or how those changes could affect Nutex Holdco’s business or operating costs.

Evolving government regulations may require increased costs or adversely affect Nutex Holdco’s business, operating results, and financial condition.

In a regulatory climate that is uncertain and constantly changing, Nutex Holdco’s operations may be subject to direct and indirect adoption, expansion or reinterpretation of various laws and regulations. Compliance with these future laws and regulations may require Nutex Holdco to change its practices at an undeterminable and possibly significant initial monetary and annual expense. These additional monetary expenditures may increase future overhead, which could have a material adverse effect on Nutex Holdco’s business, operating results and financial condition.

We have identified what we believe are the areas of government regulation that, if changed, would be costly to us. These include: rules governing the practice of clinical professions by licensed professionals; licensure standards for clinicians; licensure standards for facilities; laws limiting the corporate practice of medicine; laws governing financial relationships with current and potential referral sources; cybersecurity and privacy laws; labor and employment laws; employee benefits laws; and laws governing reimbursement for clinical services. There could be laws and regulations applicable to Nutex Holdco’s business that we have not identified or that, if changed, may be costly to Nutex Holdco, and we cannot predict all the ways in which implementation of such laws and regulations may affect Nutex Holdco.

In the states in which Nutex Holdco operates, we believe it is in compliance with all applicable regulations, but, due to the uncertain regulatory environment, certain states may determine that it is in violation of their laws and regulations. In the event that Nutex Holdco must remedy such violations, it may be required to modify services in such states in a manner that undermines its business, it may become subject to fines or other penalties or, if Nutex Holdco determines that the requirements to operate in compliance in such states are overly burdensome, it may elect to terminate operations in such states. In each case, revenue may decline, and business, operating results and financial condition could be materially adversely affected.

The COVID-19 global pandemic could negatively affect Nutex Holdco operations, business and financial condition, and our liquidity could be negatively impacted if the U.S. economy remains unstable for a significant amount of time.

The COVID-19 crisis is still rapidly evolving and much of its impact remains unknown and difficult to predict. It could potentially negatively impact Nutex Holdco’s financial performance in 2022 and beyond.

We experienced, and in the future could experience, supply chain disruptions, including shortages and delays, and could experience significant price increases, in equipment and medical supplies, particularly personal protective equipment or PPE. Staffing, equipment, and medical supplies shortages may also impact our ability to serve patients at our centers.

In addition, Nutex Holdco’s results and financial condition may be further adversely affected by future federal or state laws, regulations, orders, or other governmental or regulatory actions addressing the current COVID-19 pandemic or the U.S. health care system, which, if adopted, could result in direct or indirect restrictions to its business, financial condition, results of operations and cash flow.

The foregoing and other continued disruptions to our business as a result of the COVID-19 pandemic (including the potential resurgences of COVID-19 in jurisdictions currently engaged in reopening) have had and are likely to continue to have a material adverse effect on our business and could have a material adverse effect on our results of operations, financial condition, cash flows and our ability to service our indebtedness.

Nutex Health Holdco facilities may be adversely impacted by weather and other factors beyond our control, and disruptions in our disaster recovery systems or management continuity planning could limit our ability to operate our business effectively.

The financial results of our facilities may be negatively impacted by adverse weather conditions, such as tornadoes, earthquakes and hurricanes, or other factors beyond our control, such as wildfires. These weather conditions or other factors could disrupt patient scheduling, displace our patients, employees and physician partners and force certain of our facilities to close temporarily or for an extended period of time. In certain markets, we have a large concentration of centers that may be simultaneously affected by adverse weather condition or events beyond our control.

While we have disaster recovery systems and business continuity plans in place, any disruptions in our disaster recovery systems or the failure of these systems to operate as expected could, depending on the magnitude of the problem, adversely affect our operating results by limiting our capacity to effectively monitor and control our operations. Despite our implementation of a variety of security measures, our technology systems could be subject to physical or electronic break-ins, and similar disruptions from unauthorized tampering or weather-related disruptions where our headquarters is located. In addition, in the event that a significant number of our management personnel were unavailable in the event of a disaster, our ability to effectively conduct business could be adversely affected.

Our internal computer systems, or those of any of our manufacturers, other contractors, consultants, or collaborators, or third-party service providers may fail or suffer security or data privacy breaches or other unauthorized or improper access to, use of, or destruction of our proprietary or confidential data, employee data, or personal data, which could result in additional costs, loss of revenue, significant liabilities, harm to our brand and material disruption of our operations.

We use information technology systems, infrastructure, and data in many aspects of our business operations, and our ability to effectively manage our business depends significantly on the reliability and capacity of these systems. We are critically dependent on the integrity, security, and consistent operations of these systems. We also collect, process and store numerous classes of sensitive, personally identifiable and/or confidential information and intellectual property, including patients’ information, private information about employees and financial and strategic information about us and our business partners. The secure processing, maintenance and transmission of this information is critical to our operations.

Our systems, (including those of our contractors, consultants, collaborators and third-party service providers) may be subject to damage or interruption from power outages or damages, telecommunications problems, data corruption, software errors, network failures, acts of war or terrorist attacks, fire, flood, global pandemics and natural disasters; our existing safety systems, data backup, access protection, user management and information technology emergency planning may not be sufficient to prevent data loss or long-term network outages. In addition, we and our contractors, consultants, collaborators, and third-party service providers may have to upgrade our existing information technology systems or choose to incorporate new technology systems from time to time in order for such systems to support the increasing needs of our expanding business. Costs and potential problems and interruptions associated with the implementation of new or upgraded systems and technology or with maintenance or adequate support of existing systems could disrupt our business and result in transaction errors, processing inefficiencies and loss of production or sales, causing our business and reputation to suffer.

Further, our systems and those of our contractors, consultants, collaborators, and third-party service providers may be vulnerable to security incidents, attacks by hackers, acts of vandalism, computer viruses, misplaced or lost data, human errors, or other similar events. If unauthorized parties gain access to our networks or databases, or those of our third-party vendors, business partners, they may be able to steal, publish, delete, use inappropriately, or modify our private and sensitive third-party information, including credit card information and personal identification information. In addition, employees may intentionally or inadvertently cause data or security incidents that result in unauthorized release of personal or confidential information. Because the techniques used to circumvent security systems can be highly sophisticated, change frequently, are often not recognized until launched against a target and may originate from less regulated and remote areas around the world, we may be unable to proactively address all possible techniques or implement adequate preventive measures for all situations.

Security incidents compromising the confidentiality, integrity, and availability of this information and our systems and those of our third party vendors and business partners could result from cyber-attacks, computer malware, viruses, social engineering (including spear phishing and ransomware attacks), supply chain attacks, efforts by individuals or groups of hackers and sophisticated organizations, including state-sponsored organizations, errors or malfeasance of our personnel, and security vulnerabilities in the software or systems on which we rely. We anticipate that these threats will continue to grow in scope and complexity over time and such incidents have occurred in the past, and may occur in the future, resulting in unauthorized, unlawful, or inappropriate access to, inability to access, disclosure of, or loss of the sensitive, proprietary, and confidential information that we handle. As we rely on our contractors, consultants, collaborators, and third-party service providers, we are exposed to security risks outside of our direct control, and our ability to monitor these third-party service providers and business partners’ data security is limited. Despite the implementation of security measures, our internal computer systems, and those of our current and any other contractors, consultants, collaborators and third-party service providers, such measures may not be effective in every instance.

Cybercrime and hacking techniques are constantly evolving, and we and/or our third-party service providers may be unable to anticipate or avoid attempted or actual security breaches, react in a timely manner, or implement adequate preventative measures, particularly given the increasing use of hacking techniques designed to circumvent controls, avoid detection, and remove or obfuscate forensic artifacts. While we have taken measures designed to protect the security of the confidential and personal information under our control, we cannot assure you that any security measures that we or our third-party service providers have implemented will be effective against current or future security threats.

If such an event were to occur and cause interruptions in our operations or result in the unauthorized acquisition of or access to personally identifiable information or individually identifiable health information (violating certain privacy laws, it could result in a material disruption of our business operations, whether due to a loss of our trade secrets or other similar disruptions.

Laws in all states and U.S. territories require businesses to notify affected individuals, governmental entities, and/or credit reporting agencies of certain security incidents affecting personal information. Such laws are inconsistent, and compliance in the event of a widespread security incident is complex and costly and may be difficult to implement. Additionally, our insurance policies covering cybersecurity and related matters may not adequately compensate us for the losses arising from any such disruption, failure or security breach, and, given the increasing prevalence of hacking and other cybersecurity related incidents, we may not be able to continue to obtain or maintain insurance policies on favorable or economically reasonable terms, or at all. Further, our insurance may not cover all claims made against us and could have high deductibles in any event, and defending a suit, regardless of its merit, could be costly and divert management attention.

The cost of investigating, mitigating and responding to potential security breaches and complying with applicable breach notification obligations to individuals, regulators, partners and others can be significant. Security breaches can also give rise to claims, and the risk of such claims is increasing. For example, as discussed below, the CCPA creates a private right of action for certain data breaches. Further, defending a suit, regardless of its merit, could be costly, divert management attention and harm our reputation. The successful assertion of one or more large claims against us could adversely affect our reputation, business, financial condition, revenues, results of operations or cash flows. Any material disruption or slowdown of our systems or those of our third-party service providers and business partners, could have a material adverse effect on our business, financial condition, and results of operations.

Nutex Holdco has, and may in the future become, subject to medical liability claims, which could cause significant expenses and may require Nutex Holdco to pay significant damages if not covered by insurance, and could harm its business, operating results, and financial condition.

Nutex Holdco’s business entails the risk of medical liability claims, including class actions, against the clinicians employed by the physician practice entity (an “Affiliated Practice Entity”), and the Nutex facilities. Although Nutex Holdco and the Affiliated Practice Entities carry insurance covering medical malpractice claims in amounts that we believe are appropriate in light of the risks attendant to our and their respective businesses, successful medical liability claims could result in substantial damage awards that exceed the limits of our and the Affiliated Practice Entities’ insurance coverage. Professional liability insurance is expensive and insurance premiums may increase significantly in the future.

Any claims made against Nutex Holdco that are not fully covered by insurance could be costly to defend against, result in substantial damage awards against and divert the attention of management from operations, which could have a material adverse effect on the business, operating results, and financial condition. In addition, any claims may adversely affect Nutex Holdco’s business and reputation.