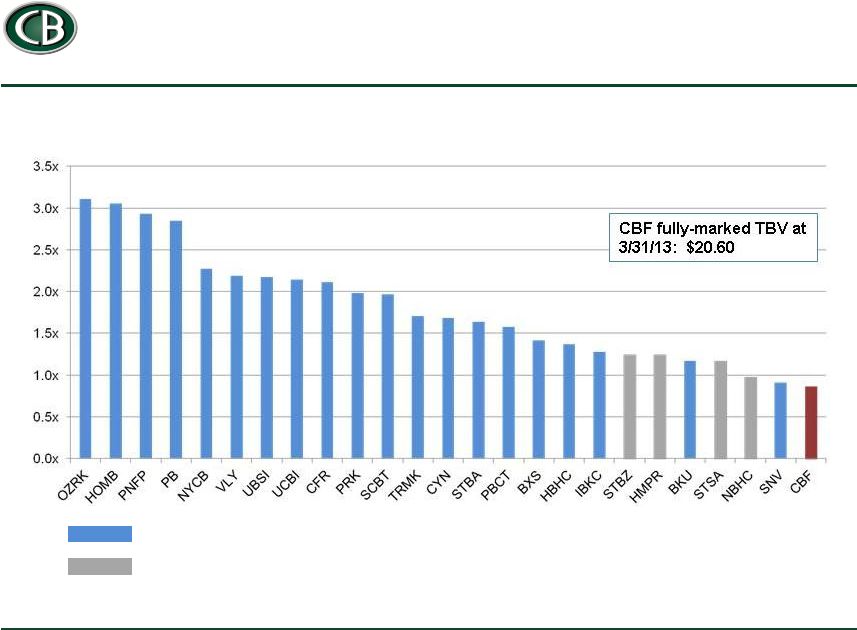

Tangible and Fully-marked Tangible Book Value 21 The methods and assumptions used to estimate fair value of financial instruments are described as follows: Carrying amount is the estimated fair value for cash and cash equivalents, receivable from FDIC, derivatives, noncontractual demand deposits and certain short-term borrowings. As it is not practicable to determine the fair value of Federal Reserve, Federal Home Loan Bank stock, indemnification asset and other bankers’ bank stock due to restrictions placed on transferability, the estimated fair value is equal to their carrying amount. Security fair values are based on market prices or dealer quotes, and if no such information is available, on the rate and term of the security and information about the issuer including estimates of discounted cash flows when necessary. For fixed rate loans or contractual deposits and for variable rate loans or deposits with infrequent repricing or repricing limits, fair value is based on discounted cash flows using current market rates applied to the estimated life, adjusted for expected credit risk. Fair values for impaired loans are estimated using discounted cash flow analysis or underlying collateral values. Fair value of long-term debt is based on current rates for similar financing. The fair value of off-balance sheet items that includes commitments to extend credit to fund commercial, consumer, real estate construction and real estate- mortgage loans and to fund standby letters of credit is considered nominal. The most significant difference between carrying value and estimated fair value of financial instruments is the differential between the carrying value and estimated fair value of our loan portfolio. As described in Note 14 to the Company’s Consolidated Financial Statements, the estimated fair value of loans exceeded their carrying value by approximately $256.8 million. This difference arises as acquired loans were initially recorded at acquisition date fair values which incorporated management’s expectation of lifetime credit losses. As our loan cash flow expectations and experience has generally improved from our original expectations and the market interest rates for similar instruments have generally declined, our estimates of fair value have increased. These estimates utilize discounted cash flows as a primary valuation approach incorporating collateral value, prepayment and credit risk (including consumer credit scores where applicable) along with the LIBOR/Swap curve for market interest rates. For loans with higher credit risk ratings, incremental spreads were added for credit and liquidity factors. Estimated fair values for commercial loans were determined using syndicated loan prices and spreads, survey data from the Federal Reserve e2 release, and rated corporate bonds. The Company’s internal risk ratings were mapped to the Federal Reserve e2 and Moody’s rating categories. Estimated fair values for commercial real estate loans also incorporated commercial mortgage backed security securitization prices and spreads. Estimated fair values for consumer loans were determined using product-specific survey rate data from a leading provider of financial information. Estimated fair values for residential mortgage loans were determined using mortgage backed security option-adjusted spreads, with incremental spreads added credit and liquidity. Credit spreads were sourced from third party survey data of mortgage banking activities from a leading provider of financial information. |