The mobile entertainment industry is still in its very early stages, with many

competitors offering unique services and a variety of business models. Intake's

competition includes companies offering video, audio, interactive programming,

telephony, data and other entertainment services, including cable television,

wireless companies, direct-to-home companies, Regional Bell Operating Companies

(RBOCs) and companies developing similar technologies and platforms.

Currently, Intake's service component is not subject to any governmental

regulation. However, in the future these services may be subject to U.S.

government regulation, mainly by the FCC or possibly by Congress, other federal

agencies, state and local authorities or the International Telecommunications

Union (ITU).

Intake's business is characterized by the following product offerings: Mobile

Video Hosting Services, ConcertView and Mobile Media Solutions. Intake provides

video streaming services to the corporate, educational, and government sectors

using its proprietary technology. Intake's products include: mobile video

hosting services, mobile marketing solutions, social networking and mobile media

solutions.

With its Mobile Video Hosting Services Intake plans to operate a mobile content

delivery network (CDN) in the digital media delivery services space. These

services are used by mobile content aggregators, developers and content

providers, media and entertainment companies, broadcasters and video

infrastructure providers, wireless carriers and MVNOS, advertisers, marketers,

ad agencies and corporate brands.

These mobile hosting and streaming solutions enable content owners to publish

their content to mobile users on all major carrier networks. Through its planned

proprietary video streaming process, Intake will extend programming via wireless

IP broadcast to data-enabled cell phones using the wireless operator networks.

Intake's audio and video content will be distributed across the wireless

networks of twelve U.S. carriers today, including the four largest operators:

AT&T Wireless, Verizon Wireless, Sprint-Nextel and T-Mobile. Other operators

include Alltel, Virgin Wireless, MetroPCS, Midwest Wireless, Cricket, nTelos,

U.S. Cellular, Centennial, Cellular South, and others.

Intake believes its mobile distribution relationships will expand, particularly

with its Mobile Video Hosting Services and ConcertView applications.

Additionally Intake will offer value-added services such as multiple billing

options including: credit card, carrier direct billing, carrier SMS and third

party billing capabilities. With its mobile marketing solutions Intake will

provide a wide range services including SMS campaigns and mobile marketing.

Intake will provide short code procurement through the cross-carrier short code

administration, campaign support for all tier one and two US carriers,

application design, password-protected real-time reporting, sweepstakes design

and campaign execution.

Intake's planned unique Mobile Media Solutions will provide a wide choice of

turnkey applications for delivering client and browser-based applications across

all mobile platforms including J2ME, BREW, Windows Mobile, Palm and WAP/xHTML.

Intake's applications will integrate the feature sets of all multimedia content

including: photos, music, movies, interactive text messaging, e-Commerce

functions such as mobile shopping, location based services, social networking,

cross-promotional marketing and communications including mobile IM and email.

28

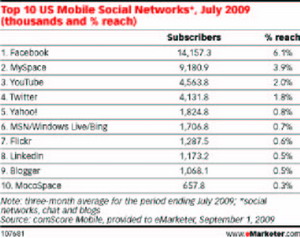

Intake's planned unique platforms will be well-positioned to capture a leading

share of emerging user-generated content segment of the mobile market. Intake

plans to develop an application that enables users to upload photos, videos,

music and blogs via PCs, handsets and set-top boxes (STBs). Customers will

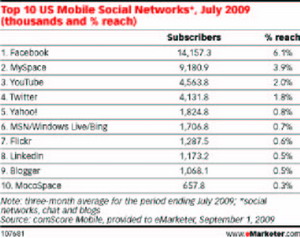

interact with social networking applications like MySpace and Facebook through

the Intake Mobile Media Solutions platform.

THE MARKET

The music industry is extremely broad and diverse and is a global business. With

the exception of sports, very few things stir the emotions and passions like

music. Music is also one of the only things that can be traced back to the

beginning of time. Throughout the centuries music has brought us joy, made us to

cry, filled us with national pride and caused us to sing out loud when we

thought no one was listening.

Music is a multi-billion dollar industry and is extremely diverse. The worldwide

music industry is expected to generate $66.4 billion in 2010 and $67.6 billion

in 2011. Live music concerts represent approximately $20.8 billion of the

industry's total revenue and are estimated to grow to $23.5 billion in 2011. Of

these estimates, streaming audio will account for worldwide mobile music

revenues of nearly $562 million with music downloads contribution approximately

$1.6 billion.

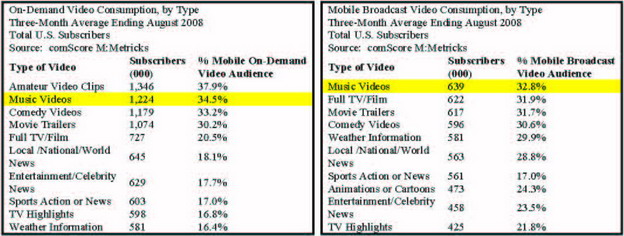

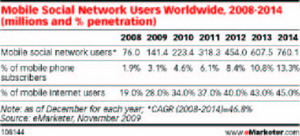

ComScore, Inc., a leader in measuring the digital world, reported that 6.5

million Americans tuned into mobile video in August 2008. According to the

study, on-demand video was the most popular format, with 3.6 million viewers.

With 1.3 million viewers, amateur videos, such as those on YouTube, represent

the most popular type of content, followed by music video and comedy videos.

Music videos are the top choice for programmed mobile broadcast video users,

followed closely by full television shows or films and movie trailers.

The music industry is diverse and complex incorporating ticket sales, live

concerts, recorded music, digital music, ringtones, ringback tones, music

downloads, music videos, music broadcast, publishing, CD sales, licensed

produces, music related advertising, collectables, streaming audio, etc. Because

of this diversity, it is difficult to put an all-encompassing figure on annual

revenue.

29

However, the media used to deliver music and its related market segments is

evolving quickly. Music related genres are one of the most widely view

categories online. At the same time, digital downloads are enabling consumers to

view and or listen to music and videos at their leisure. Finally, the rapid

emergence of music and video delivered via the state-of-the-art cell phone is

having a major impact on the industry.

Monetizing digital music assets will come in a variety of ways. One of the most

promising ways to monetize digital music is the use of advertising which

accounted for approximately $285.1 billion in the U.S. last year.

Among the best growth areas in advertising in recent years has been advertising

on mobile devices, advertising on movie screens and advertising online.

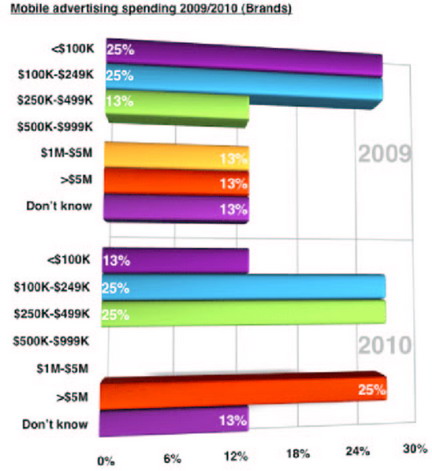

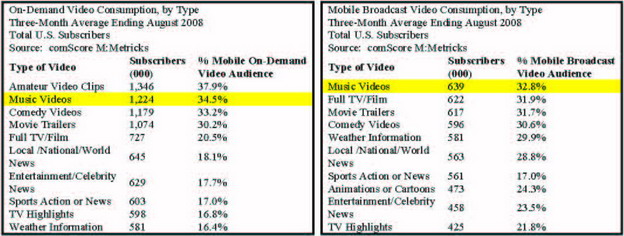

Ad agencies said that they will spend more money on mobile advertising in 2010

than they did in 2009, with strong increases on big ad spends (>$1 million),

based on the "State of the Industry Mobile Advertising" report jointly published

by Millennial Media, the largest and fastest growing mobile advertising network

in the U.S. and DM2PRO.COM, a knowledge base for digital media and marketing

professionals.

Source: Fierce Mobile

Source: Fierce Mobile

30

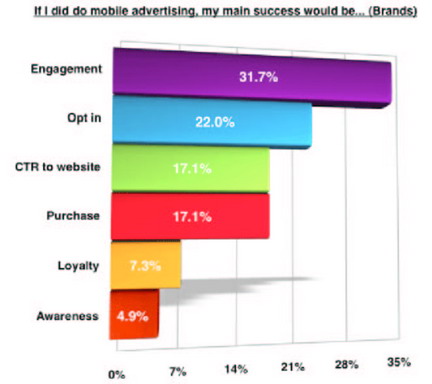

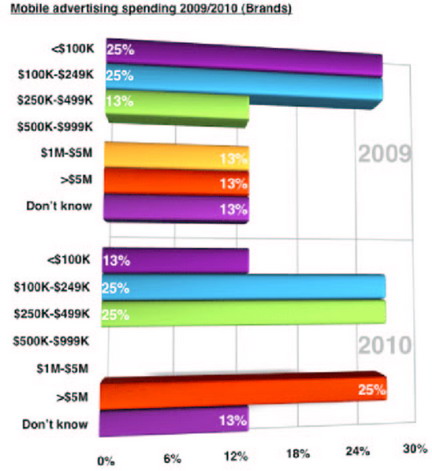

Their finding also concluded that the CPG, Retail, Entertainment, Travel and

Restaurant categories are expected to lead mobile spending; which is somewhat

consistent with who is spending the most in mobile advertising today. Engagement

leads the number one sought return for an investment in mobile marketing, though

"opt-in", or list building, was cited as the most likely goal for Q4 campaigns.

Source: Fierce Mobile

Source: Fierce Mobile

The largest cohorts replied that they will spend less than $100K in mobile

advertising in 2009; however, that number jumps significantly in 2010. With 60%

of non-mobile marketers planning to employ mobile advertising in 2010, the

increase in mobile spend is among the leading highlights:

o Mobile spending is expected to increase next year, with 31% of agency

respondents stating that they will invest between $100K and $249K.

o More than 15% plan to invest more than $1M and 2.6% projected spending of

greater than $5M.

o More than 1/2 of Q4 mobile campaigns will represent between 1% and 10% of

their clients' total spending, but, for a few, that number will be

40%-50%.

o Nearly 75% of the 100 leading agency respondents stated that they have

developed mobile campaigns for themselves or a client.

o As an average value, brand respondents forecasted at least a 15% increase

in spend in 2010.

31

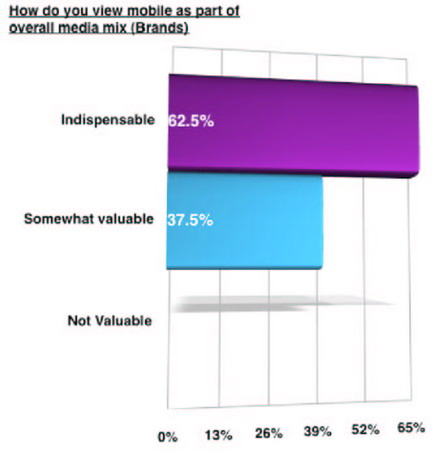

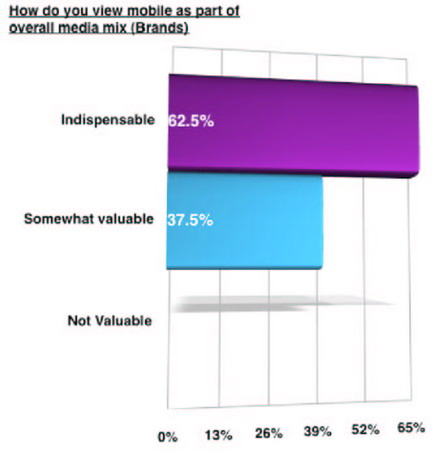

Mobile advertising performance meets expectations and remains valuable. Among

those who have executed mobile campaigns:

o 78% of respondents said the medium met their campaign goals, and an

additional 9% said mobile performed "beyond our wildest expectations."

o For 89% of agencies, the mobile facet of a campaign is just one portion of

a multi-platform buy.

o Nearly a third (30%) of agency respondents said mobile has become an

"indispensable" part of the media mix. Another 67% ranked mobile as

"somewhat valuable" and only 2% said it was not valuable in their overall

media mix.

Source: Fierce Mobile

Source: Fierce Mobile

More than 80% of agencies who have participated in mobile campaigns have hired

or developed internal resources to support them. Nearly 90% stated they are

typically the ones to suggest that a client employ mobile as part of their

campaign strategy. Still, it often involves multiple partners to expertly

execute on the promise of mobile media. Partners include technology, metrics,

mobile ad network, and app developer resources, among others. Approximately 80%

of mobile campaigns employed a mobile ad network of some kind, and about half of

those have a single favorite provider.

32

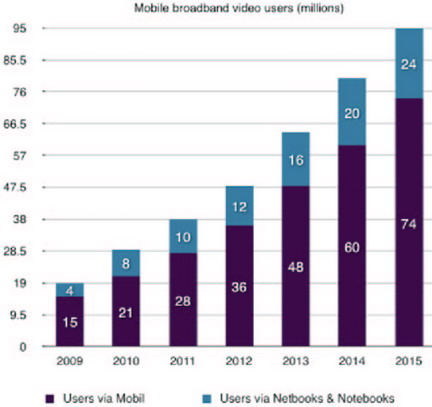

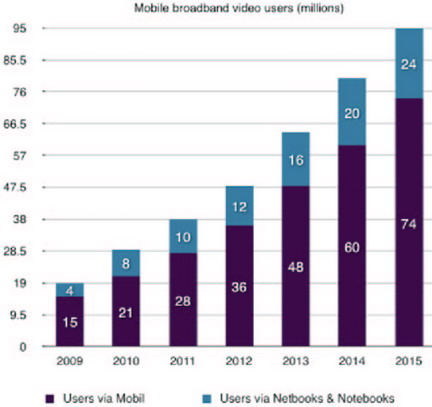

To help fuel the growth in mobile advertising the Coda Research Consultancy

forecasts that mobile broadband video users will grow from just 15 million in

2009 to more than 74 million by 2015. Mobile video use via netbooks and

notebooks also will see growth from a current 4 million users to more than 24

million users in 2015.

Source: Fierce Mobile

Source: Fierce Mobile

For advertisers willing to adapt to today's rapidly evolving environment, there

is good news. Effective advertising targets consumers based on their passions

rather than simply their age or socio-economic demographic. That is, the

increasing range of niche media now available enables carefully crafted messages

to be designed for and delivered to specific consumer "passionate interest

groups." Blogs, podcasting, cable TV programming, on-demand, mobile phone-based

news and entertainment programming, satellite radio and online social media

networks are booming. Never in history have there been so many unique

opportunities for targeted marketing based on consumer's tastes, interests,

special needs and passions.

33

According to Screen Digest, revenues from digital music downloads to mobile

phones are expected to double in terms of revenue over the next five years.

Revenue generated by content programming for so-called "smart" mobile phones

will increase 17% in 2009 as companies such as Walt Disney's ESPN and MobiTV

make more mobile videos available, according to one report released late last

week.

U.S. mobile-video revenue will grow to about $350 million this year, up from

$300 million in 2008, and will likely accelerate to a 25% annual growth rate

over the next few years as more people buy Apple's iPhones, Palm's Pre and

updated versions of Research In Motion's BlackBerry, research firm SNL Kagan

said.

Such spending growth would build on recent mobile-video trends, as about 50

million Americans used the Internet through their mobile devices in February, up

from about 29 million two years earlier, Nielsen said in a report released last

month.

With more people using the Internet from their cell phones, mobile-video viewing

has surged, prompting companies such as AT&T and Verizon Communications to

invest more in mobile applications. The number of people who watched mobile

video in the fourth quarter jumped 9% from the third quarter, to about 11

million, Nielsen said in February.

SNL Kagan said that such revenue will increase as more people subscribe to

mobile-video services. Smart phone subscribers will more than double to 114

million, or about 40% of all mobile-phone customers, in 2010, from 50 million,

or 19% in 2008. By the end of 2014, 60% of mobile-phone customers will be

smartphone subscribers, according to SNL Kagan.

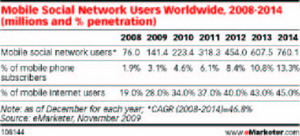

Data recently issued by Pyramid Research, estimates that the number of users

paying for mobile video services subscriptions directly delivered to their

handsets will grow five-fold by 2014, surpassing 534 million subscribers at the

end of the period. That is equivalent to 8.5% of all mobile subscriptions, up

from the current 2.5% level.

34

STRATEGY & POSITIONING

Business Model:

Intake Communications' business model is based on the market advantages its

planned delivery platform will incorporate. The platform's intelligence will

dynamically identify the network, the type of cell phone and the best format for

delivery to that phone. Given the sheer number and vast complexity of carrier

networks, given the number and complexity of the multiple handsets designed to

operate on each network and given the number of media players, the Company will

be a one-stop-shop solutions provider for content. Furthermore, the platform

will deliver content through the carrier networks as well as independently of

the carrier networks. Those competitive advantages form the foundation of our

business plan.

Advertising:

Intake believes that cell phones currently lend themselves best to multimedia

"snacks" - short, snippets of targeted entertainment and information. Management

further believes that this new medium is unlikely to be full-length television

programming on a small screen. Rather it will lend itself to special content to

targeted interest groups in "bite size" (1 to 5 minute video clips) - which

appeal mostly to a younger demographic. Further, the cell phone lends itself

extremely well to sponsored content and the Company believes that this will be

the most important segment of this new industry.

The power behind the Company's business model is that customers drive the

advertising. They market and sell the advertising across various mediums

including TV, print, radio, and now they have the ability to offer broadband and

mobile. This will increase revenue for the Company and more importantly allow it

to focus on technology and the execution vs. advertising which is not its core

competency.

Subscriptions:

The Company believes that there are substantial revenue growth opportunities in

mobile video subscriptions with the adoption of mobile video services, which

include paid video clips, music videos, live streaming concerts, encore

performances, music videos, TV episodes, TV programming, and movies.

Developments related to 3G and 4G networks, mobile TV broadcasting, downloading,

streaming, side-loading, content, data usage, smartphones, and other devices are

opportunities for The Company to capitalize on the continued adoption by

consumers in the mobile space across developed and emerging markets. The

availability of improved devices and networks are contributing to a higher level

of adoption and spending on mobile video services.

Partnerships:

The ability to simultaneously deliver multimedia content independent of and in

conjunction with the carriers is another important cornerstone of the Company's

business model. This will be done via the Partner's and Company's WAP site

initially and ultimately through the carrier's deck or when the content is

sponsored it will be given away free directly to the end-user.

35

Monetizing the Mobile Users:

On-Demand Clips

o Pre Roll and Post-Roll Sponsorship of Video

o Dynamic Ad Serving

o Target Ads/Sponsorships (via opt-in database)

o Links to Merchandise

o Links to pay-per-view, special events, social media sites

MANAGEMENT

We intend to employ and use consultants to build the corporate infrastructure in

FINANCE, ACCOUNTING, MARKETING, SALES, SOFTWARE, PURCHASING and other

administrative functions.

SALES AND MARKETING

InTake Communications intends to use the proceeds from this offering to develop

a detailed marketing plan. At the present time, we anticipate creating a limited

direct sales force dedicated to marketing and selling services to clients

seeking music and entertainment oriented mobile transactional solutions. These

clients are broad and diverse. Since the Company has limited financial

resources, the Company will not use traditional marketing efforts like TV,

radio, and other printing media. Instead, the Company will focus its efforts by

identifying and working with industry experts to develop the marketing plan.

InTake Communications expects to build a limited sale force in the south east.

With the variety of music and entertainment companies, the sales team will

identify and work closely with the top prospects, develop opportunities, close

sales, and manage those one-on-one client relationships.

In conjunction with the direct sales efforts, the Company intends to leverage

the indirect sales channel by identifying and working with other companies (ex.

channel partners) that service the music and entertainment industry that are

complementary to InTake Communications' efforts. The Company will identify these

other channel partners and develop marketing plans that are mutually beneficial

both on the business and financial side. At this time, these companies have not

been identified.

InTake Communications' strategy is to quickly establish relationships with the

market leaders in the music and entertainment industry as they position

themselves to respond to their customer's mobile and wireless needs.

STAFFING

As of December 31, 2009, InTake Communications has no permanent staff other than

its sole officer and director, Ron Warren, who is the President and Chairman of

the company. Ron Warren has the flexibility to work on InTake Communications up

to 20 to 25 hours per week. He is prepared to devote more time to our operations

as may be required. He is not being paid at present.

36

EMPLOYEES AND EMPLOYMENT AGREEMENTS

At present, InTake Communications has no employees other than its current sole

officer and director, Ron Warren, who has not been compensated. There are no

employment agreements in existence. The company presently does not have any

pension, health, annuity, insurance, stock options, profit sharing, or similar

benefit plans; however, the company may adopt plans in the future. There are

presently no personal benefits available to the company's director.

During the initial implementation of our development strategy, the company

intends to hire independent consultants, and contractors to develop, prototype,

various components of technology platform. The Company will need to raise

additional capital over the next twelve (12) months to hire and/or retain these

resources.

MANAGEMENT'S DISCUSSION AND ANALYSIS OR PLAN OF OPERATION

This section of the prospectus includes a number of forward-looking statements

that reflect our current views with respect to future events and financial

performance. Forward-looking statements are often identified by words like:

"believe", "expect", "estimate", "anticipate", "intend", "project" and similar

expressions, or words which, by their nature, refer to future events. You should

not place undue certainty on these forward-looking statements, which apply only

as of the date of this prospectus. These forward-looking statements are subject

to certain risks and uncertainties that could cause actual results to differ

materially from historical results or our predictions.

WE ARE A DEVELOPMENT STAGE COMPANY ORGANIZED TO DEVELOP

We have not yet generated or realized any revenues from business operations. Our

auditors have issued a going concern opinion. This means there is substantial

doubt that we can continue as an on-going business for the next twelve (12)

months unless we obtain additional capital to pay our bills. This is because we

have not generated any revenues and no revenues are anticipated until we begin

marketing our service to customers. Accordingly, we must raise cash from sources

other than revenues generated from the proceeds of loans we undertake.

From inception to December 31, 2009, the company's business operations have

primarily been focused on developing our business plan and market research.

LIMITED OPERATING HISTORY; NEED FOR ADDITIONAL CAPITAL

THERE IS NO HISTORICAL FINANCIAL INFORMATION ABOUT US UPON WHICH TO BASE AN

EVALUATION OF OUR PERFORMANCE. INTAKE COMMUNICATIONS, INC. WAS INCORPORATED IN

THE STATE OF FLORIDA ON December 24, 2009; WE ARE A DEVELOPMENT STAGE COMPANY

ATTEMPTING TO ENTER INTO THE ADVERTISING AND SUBSCRIPTION SUPPORTED CONTENT

MANAGEMENT SOLUTIONS TO DELIVER VIDEO, AUDIO AND RELATED ADVANCED MULTIMEDIA

PROGRAMMING TO BROADBAND, IPTV AND A WIDE VARIETY OF WIRELESS MOBILE DEVICES.

OUR INTENDED PRIMARY MARKETING BUSINESS APPROACH SHOULD BE TO PARTNER WITH

ESTABLISHED MUSIC AND ENTERTAINMENT CONTENT PROVIDERS TO MARKET AND SUPPORT THE

PRODUCT OFFERING. WE HAVE NOT GENERATED ANY REVENUES FROM OUR OPERATIONS. WE

CANNOT GUARANTEE WE WILL BE SUCCESSFUL IN OUR BUSINESS OPERATIONS. OUR BUSINESS

IS SUBJECT TO RISKS INHERENT IN THE ESTABLISHMENT OF A NEW BUSINESS ENTERPRISE,

INCLUDING THE FINANCIAL RISKS ASSOCIATED WITH THE LIMITED CAPITAL RESOURCES

CURRENTLY AVAILABLE TO US FOR THE IMPLEMENTATION OF OUR BUSINESS STRATEGIES (SEE

"RISK FACTORS"). TO BECOME PROFITABLE AND COMPETITIVE, WE MUST DEVELOP THE

BUSINESS AND MARKETING PLAN, EXECUTE THE PLAN AND ESTABLISH SALES AND

CO-DEVELOPMENT RELATIONSHIPS WITH CUSTOMERS AND PARTNERS.

37

Our sole officer and director undertakes to provide us with initial operating

and loan capital to sustain our business plan over the next twelve (12) month

period partially through this offering and will seek alternative financing

through means such as borrowings from institutions or private individuals.

PLAN OF OPERATION

Over the 12 month period starting upon the effective date of this registration

statement, the Company must raise capital in order to complete the Business and

Marketing Plan and to commence its execution. The Company anticipates that the

business and marketing plan will be completed within 180 days after the offering

is completed. After the business and marketing plan are completed, the company

plans on using consultants and contractors to commence the product development

strategy. During the initial implementation of our development strategy, the

Company intends to hire independent consultants, and contractors to develop,

prototype, various components of product. The Company expects product

development to last between eighteen (18) and twenty four (24) months.

Since inception to December 24, 2009, InTake Communications has spent a total of

$3,579 on start-up costs. The Company has not generated any revenue from

business operations. All proceeds currently held by the company are the result

of the sale of common stock to its officers. The Company does not have any

contractual arrangement with our CEO, Ron Warren to fund the Company on an

on-going basis for either operating capital or a loan. The CEO may elect to fund

the Company as he did initially, however there are no assurances that he will in

the future.

The Company incurred expenditures of $3,500 for audit services. The Company also

had expenditures of $79 for general administrative costs. Since inception, the

majority of the company's time has been spent refining its business plan and

conducting industry research, and preparing for a primary financial offering.

LIQUIDITY AND CAPITAL RESOURCES

As of the date of this registration statement, we have yet to generate any

revenues from our business operations. For the period ended December 31, 2009,

InTake Communications, Inc. issued 9,000,000 shares of common stock to our sole

officer and director for cash proceeds of $9,000 at $0.001 per share.

We anticipate needing a $175,000 in order to execute our business plan over the

next twelve (12) months, which includes completing the business plan, completing

the prototype plans, and identifying the necessary resources to implement our

plan. We anticipate the work will require three part time resources for

technical work that will cost approximately $35,000 each. In addition, we will

require one marketing resource that will require $40,000 and the balance of

$30,000 for general working capital purposes. However, the available cash is not

sufficient to allow us to commence full execution of our business plan. Based on

our success of raising additional capital over the next twelve (12) months, we

anticipate employing various consultants and contractors to commence the

development strategy for the product prototypes. Until the Business and

Marketing plan are completed, we are not able to quantify with any certainty any

planned capital expenditures including the hiring of consultants and

contractors. The only planned capital expenditure is the public company costs.

As of December 31, 2009, the Company has no firm commitments for any capital

expenditures.

38

Our business expansion will require significant capital resources that may be

funded through the issuance of common stock or of notes payable or other debt

arrangements that may affect our debt structure. Despite our current financial

status we believe that we may be able to issue notes payable or debt instruments

in order to start executing our Business and Marketing Plan. We anticipate that

receipt of such financing may require granting a security interest in the

service offering, and are willing to grant such interest to secure the necessary

funding.

Through December 31, 2009, we have spent a total of $3,579. $79 in General &

Administration expenses and $3,500 in professional fees.

To date, we have managed to keep our monthly cash flow requirement low for two

reasons. First, our sole officer has agreed not to draw a salary until a minimum

of $250,000 in funding is obtained or until we have achieved $500,000 in gross

revenues. Second, we have been able to keep our operating expenses to a minimum

by operating in space owned by our sole officer and are only paying the direct

expenses associated with our business operations.

In the early stages of our company, we will need cash for completing the

business and marketing plan. We anticipate that during the first year, in order

to execute our business plan to any meaningful degree, we would need to spend a

minimum of $175,000 on such endeavors. If we are unable to raise the funds

partially through this offering we will seek alternative financing through means

such as borrowings from institutions or private individuals. There can be no

assurance that we will be able to keep costs from being more than these

estimated amounts or that we will be able to raise such funds. Even if we sell

all shares offered through this registration statement, we expect that we will

seek additional financing in the future. However, we may not be able to obtain

additional capital or generate sufficient revenues to fund our operations. If we

are unsuccessful at raising sufficient funds, for whatever reason, to fund our

operations, we may be forced to seek a buyer for our business or another entity

with which we could create a joint venture. If all of these alternatives fail,

we expect that we will be required to seek protection from creditors under

applicable bankruptcy laws.

Our independent auditor has expressed substantial doubt about our ability to

continue as a going concern and believes that our ability is dependent on our

ability to implement our business plan, raise capital and generate revenues. See

Note 6 of our financial statements.

MANAGEMENT

OFFICERS AND DIRECTORS

Our sole officer and director will serve until his successor is elected and

qualified. Our officers will be elected by the board of directors to a term of

one (1) year and serve until their successor is duly elected and qualified, or

until they are removed from office. The board of directors has no nominating,

auditing or compensation committees.

39

The name, address, age and position of our president, secretary/treasurer, and

director and vice president is set forth below:

Name and Address Age Position(s)

- ---------------- --- -----------

Ron Warren 55 President, Secretary/Treasurer, Principal

Executive Officer Principal Financial Officer,

and sole member of the Board of Directors

The person named above has held his offices/positions since the inception of our

company and is expected to hold his offices/positions until the next annual

meeting of our stockholders.

COMMITTEES OF THE BOARD OF DIRECTORS

Our Board of Directors has not established any committees, including an Audit

Committee, a Compensation Committee, a Nominating Committee or any committee

performing a similar function. The functions of those committees are being

undertaken by the entire board as a whole. Because we do not have any

independent directors, our Board of Directors believes that the establishment of

committees of the Board would not provide any benefits to our company and could

be considered more form than substance.

We do not have a policy regarding the consideration of any director candidates

which may be recommended by our stockholders, including the minimum

qualifications for director candidates, nor has our Board of Directors

established a process for identifying and evaluating director nominees. We have

not adopted a policy regarding the handling of any potential recommendation of

director candidates by our stockholders, including the procedures to be

followed. Our Board has not considered or adopted any of these policies as we

have never received a recommendation from any stockholder for any candidate to

serve on our Board of Directors. Given our relative size and lack of directors

and officers insurance coverage, we do not anticipate that any of our

stockholders will make such a recommendation in the near future. While there

have been no nominations of additional directors proposed, in the event such a

proposal is made, all members of our Board will participate in the consideration

of director nominees. Our director is not an "audit committee financial expert"

within the meaning of Item 401(e) of Regulation S-K. In general, an "audit

committee financial expert" is an individual member of the audit committee or

Board of Directors who:

o understands generally accepted accounting principles and financial

statements,

o is able to assess the general application of such principles in connection

with accounting for estimates, accruals and reserves,

o has experience preparing, auditing, analyzing or evaluating financial

statements comparable to the breadth and complexity to our financial

statements,

o understands internal controls over financial reporting, and

o understands audit committee functions.

Our Board of Directors is comprised of an individual who was integral to our

formation and who is involved in our day to day operations. While we would

prefer our director be an audit committee financial expert, the individual who

has been key to our development has professional background in finance or

accounting. As with most small, early stage companies, until such time as our

40

company further develops its business, achieves a stronger revenue base and has

sufficient working capital to purchase directors and officers insurance, we do

not have any immediate prospects to attract independent directors. When we are

able to expand our Board of Directors to include one or more independent

directors, we intend to establish an Audit Committee of our Board of Directors.

It is our intention that one or more of these independent directors will also

qualify as an audit committee financial expert. Our securities are not quoted on

an exchange that has requirements that a majority of our Board members be

independent and we are not currently otherwise subject to any law, rule or

regulation requiring that all or any portion of our Board of Directors include

"independent" directors, nor are we required to establish or maintain an Audit

Committee or other committee of our Board of Directors.

WE DO NOT HAVE ANY INDEPENDENT DIRECTORS AND WE HAVE NOT VOLUNTARILY IMPLEMENTED

VARIOUS CORPORATE GOVERNANCE MEASURES, IN THE ABSENCE OF WHICH, STOCKHOLDERS MAY

HAVE MORE LIMITED PROTECTIONS AGAINST INTERESTED DIRECTOR TRANSACTIONS,

CONFLICTS OF INTEREST AND SIMILAR MATTERS.

Recent Federal legislation, including the Sarbanes-Oxley Act of 2002, has

resulted in the adoption of various corporate governance measures designed to

promote the integrity of the corporate management and the securities markets.

Some of these measures have been adopted in response to legal requirements.

Others have been adopted by companies in response to the requirements of

national securities exchanges, such as the NYSE or The NASDAQ Stock Market, on

which their securities are listed. Among the corporate governance measures that

are required under the rules of national securities exchanges are those that

address board of directors' independence, audit committee oversight, and the

adoption of a code of ethics. Our Board of Directors is comprised of one

individual who is also our executive officer. Our executive officer makes

decisions on all significant corporate matters such as the approval of terms of

the compensation of our executive officer and the oversight of the accounting

functions.

Although we have adopted a Code of Ethics and Business Conduct, we have not yet

adopted any of these other corporate governance measures and, since our

securities are not yet listed on a national securities exchange, we are not

required to do so. We have not adopted corporate governance measures such as an

audit or other independent committees of our board of directors as we presently

do not have any independent directors. If we expand our board membership in

future periods to include additional independent directors, we may seek to

establish an audit and other committees of our board of directors. It is

possible that if our Board of Directors included independent directors and if we

were to adopt some or all of these corporate governance measures, stockholders

would benefit from somewhat greater assurances that internal corporate decisions

were being made by disinterested directors and that policies had been

implemented to define responsible conduct. For example, in the absence of audit,

nominating and compensation committees comprised of at least a majority of

independent directors, decisions concerning matters such as compensation

packages to our senior officers and recommendations for director nominees may be

made by a majority of directors who have an interest in the outcome of the

matters being decided. Prospective investors should bear in mind our current

lack of corporate governance measures in formulating their investment decisions.

CODE OF BUSINESS CONDUCT AND ETHICS

In December 2009 we adopted a Code of Ethics and Business Conduct which is

applicable to our future employees and which also includes a Code of Ethics for

our CEO and principal financial officers and persons performing similar

functions. A code of ethics is a written standard designed to deter wrongdoing

and to promote

41

o honest and ethical conduct,

o full, fair, accurate, timely and understandable disclosure in regulatory

filings and public statements,

o compliance with applicable laws, rules and regulations,

o the prompt reporting violation of the code, and

o accountability for adherence to the code.

A copy of our Code of Business Conduct and Ethics has been filed with the

Securities and Exchange Commission as an exhibit to our S-1 filing. Any person

desiring a copy of the Code of Business Conduct and Ethics, can obtain one by

going to Edgar and looking at the attachments to our S-1.

BACKGROUND OF OFFICERS AND DIRECTORS

Ron Warren, President, CEO, Director, Secretary/treasurer

RESUME

Ron Warren has over 20 years of experience in senior level positions with

publicly traded companies listed on the NYSE, Nasdaq and OTCBB. Prior to joining

Intake Communications, Mr. Warren was Vice President of Investor Relations,

Corporate Communications and Secretary of uVuMobile, Inc. in starting in

December 2003. In May 2008, Warren was appointed Chief Financial Officer of the

uVuMobile. Mr. Warren is a senior level communications professional with a broad

background in financial, technical and regulatory issues. His experience

includes communications for high growth publicly held companies, national and

multicultural audiences. Prior to joining uVuMobile, Mr. Warren held various

Investor Relations and Corporate Communications positions at Beazer Homes,

Theragenics Corp., Rollins, Inc., and Advanced Telecommunications. Mr. Warren is

an active member of the National Investor Relations Institute (NIRI) and served

as the Atlanta Chapter President from 2002 to 2003.

CONFLICTS OF INTEREST

At the present time, we do not foresee a direct conflict of interest with our

sole officer and director. The only conflict that we foresee is Ron Warren's

devotion of time to projects that do not involve us. Currently, Mr. Warren is

working as a consultant with one other wireless company providing technical

support. In the event that Ron Warren ceases devoting time to our operations, he

has agreed to resign as an officer and director.

EXECUTIVE COMPENSATION

Ron Warren will not be taking any compensation until the Company has raised

$250,000 in working capital or has sales in excess of $500,000.

SUMMARY OF COMPENSATION

We did not pay any salaries in 2009. We do not anticipate beginning to pay

salaries until we have adequate funds to do so. There are no stock option plans,

retirement, pension, or profit sharing plans for the benefit of our officers and

director other than as described herein.

42

SUMMARY COMPENSATION TABLE

The following table provides certain summary information concerning cash and

certain other compensation we paid to our Chief Executive Officer for the fiscal

year ending December 31, 2009.

Non-Equity Non-

Incentive Qualified

Stock Option Plan Deferred All Other

Name & Fiscal Salary Bonus Award(s) Award(s) Compensation Compensation Compensation Total

Principal Position Year ($) ($) ($) ($) ($) Earnings ($) ($) ($)

- ------------------ ------ ------ ----- -------- -------- ------------ ------------ ------------ -----

Ron Warren 2009 $0 - - - - - - 0

Chief Executive Officer

Number of Percentage

Title of Class Name Shares Owned of Shares(1)

- -------------- ---- ------------ ------------

Shares of Common Stock Ron Warren (2) 9,000,000 100%

4655 Gran River Glen

Duluth, GA 30096

__________________

(1) Based on 9,000,000 shares outstanding as of December 31, 2009.

(2) The person named above may be deemed to be a "parent" and "promoter" of our

company, within the meaning of such terms under the Securities Act of 1933, as

amended, by virtue of his direct and indirect stock holdings. Ron Warren is the

only "promoter" of our company.

We have no employment agreements with our sole Executive Officer and Director.

DIRECTOR COMPENSATION

Mr. Ron Warren a member of our Board of Directors is also our executive officer.

We do not pay fees to directors for attendance at meetings of the Board of

Directors or of committees; however, we may adopt a policy of making such

payments in the future. We will reimburse out-of-pocket expenses incurred by

directors in attending board and committee meetings.

LONG-TERM INCENTIVE PLAN AWARDS

We do not have any long-term incentive plans including options and SARs that

provide compensation intended to serve as incentive for performance.

EMPLOYMENT AGREEMENTS

At this time, InTake Communications has not entered into any employment

agreements with our sole officer and director. If there is sufficient cash flow

available from our future operations, the Company may in the future enter into

employment agreements with our sole officer and director, or future key staff

members.

43

INDEMNIFICATION

Under our Articles of Incorporation and Bylaws of the corporation, we may

indemnify an officer or director who is made a party to any proceeding,

including a lawsuit, because of his position, if he acted in good faith and in a

manner he reasonably believed to be in our best interest. We may advance

expenses incurred in defending a proceeding. To the extent that the officer or

director is successful on the merits in a proceeding as to which he is to be

indemnified, we must indemnify him against all expenses incurred, including

attorney's fees. With respect to a derivative action, indemnity may be made only

for expenses actually and reasonably incurred in defending the proceeding, and

if the officer or director is judged liable, only by a court order. The

indemnification is intended to be to the fullest extent permitted by the laws of

the State of Florida

Regarding indemnification for liabilities arising under the Securities Act of

1933, which may be permitted to directors or officers under Florida law, we are

informed that, in the opinion of the Securities and Exchange Commission,

indemnification is against public policy, as expressed in the Act and is,

therefore, unenforceable.

PRINCIPAL STOCKHOLDERS

The following table sets forth, as of the date of this prospectus, the total

number of shares owned beneficially by our sole officer and director, and key

employees, individually and as a group, and the present owners of 5% or more of

our total outstanding shares. The stockholder listed below has direct ownership

of his shares and possesses sole voting and dispositive power with respect to

the shares.

Number of Percentage

Title of Class Name Shares Owned of Shares(1)

- -------------- ---- ------------ ------------

Shares of Common Stock Ron Warren (2) 9,000,000 100%

4655 Gran River Glen

Duluth, GA 30096

__________________

(1) Based on 9,000,000 shares outstanding as of December 31, 2009.

(2) The person named above may be deemed to be a "parent" and "promoter" of our

company, within the meaning of such terms under the Securities Act of 1933, Ron

Warren is the only "promoter" of our company.

For the period ended December 31, 2009, a total of 9,000,000 shares of common

stock were issued to our sole officer and director, all of which are restricted

securities, as defined in Rule 144 of the Rules and Regulations of the SEC

promulgated under the Securities Act. Under Rule 144, the shares can be publicly

sold, subject to volume restrictions and restrictions on the manner of sale,

commencing one year after their acquisition. Under Rule 144, a shareholder can

sell up to 1% of total outstanding shares every three months in brokers'

transactions. Shares purchased in this offering, which will be immediately

resalable, and sales of all of our other shares after applicable restrictions

expire, could have a depressive effect on the market price, if any, of our

common stock and the shares we are offering.

44

Our sole officer and director will continue to own the majority of our common

stock after the offering, regardless of the number of shares sold. Since he will

continue control our company after the offering, investors in this offering will

be unable to change the course of our operations. Thus, the shares we are

offering lack the value normally attributable to voting rights. This could

result in a reduction in value of the shares you own because of their

ineffective voting power. None of our common stock is subject to outstanding

options, warrants, or securities convertible into common stock.

The company is hereby registering 3,000,000 of its common shares, in addition to

the 9,000,000 shares currently issued and outstanding. The price per share is

$0.01 (please see "Plan of Distribution" below).

The 9,000,000 shares currently issued and outstanding were acquired by our sole

officer and director for the period ended, December 31, 2009. We issued a total

of 9,000,000 common shares for consideration of $9,000, which was accounted for

as a purchase of common stock. The Company received $6,000 cash and a $3,000

subscription receivable. The Company received the cash from the subscription

receivable on January 4th, 2010.

DESCRIPTION OF SECURITIES

In the event the company receives payment for the sale of their shares, InTake

Communications will receive all of the proceeds from such sales. InTake

Communications is bearing all expenses in connection with the registration of

the shares of the Company.

COMMON STOCK

The authorized common stock is two hundred and fifty million (250,000,000)

shares with a par value of $.0001 for an aggregate par value of twenty five

thousand dollars ($25,000).

* have equal ratable rights to dividends from funds legally available if and

when declared by our Board of Directors;

* are entitled to share ratably in all of our assets available for

distribution to holders of common stock upon liquidation, dissolution or winding

up of our affairs;

* do not have preemptive, subscription or conversion rights and there are no

redemption or sinking fund provisions or rights;

* and are entitled to one non-cumulative vote per share on all matters on

which stockholders may vote.

We refer you to the Bylaws of our Articles of Incorporation and the applicable

statutes of the State of Florida for a more complete description of the rights

and liabilities of holders of our securities.

NON-CUMULATIVE VOTING

Holders of shares of our common stock do not have cumulative voting rights,

which means that the holders of more than 50% of the outstanding shares, voting

for the election of directors, can elect all of the directors to be elected, if

they so choose, and, in that event, the holders of the remaining shares will not

be able to elect any of our directors. After this offering is completed, present

stockholders will own approximately 75% of our outstanding shares.

45

CASH DIVIDENDS

As of the date of this prospectus, we have not declared or paid any cash

dividends to stockholders. The declaration of any future cash dividend will be

at the discretion of our Board of Directors and will depend upon our earnings,

if any, our capital requirements and financial position, our general economic

conditions, and other pertinent conditions. It is our present intention not to

pay any cash dividends in the foreseeable future, but rather to reinvest

earnings, if any, in our business operations.

REPORTING

After we complete this offering, we will not be required to furnish you with an

annual report. Further, we will not voluntarily send you an annual report. We

will be required to file reports with the SEC under section 15(d) of the

Securities Act. The reports will be filed electronically. The reports we will be

required to file are Forms 10-K, 10-Q, and 8-K. You may read copies of any

materials we file with the SEC at the SEC's Public Reference Room at 100 F

Street, N.E., Washington, D.C. 20549. You may obtain information on the

operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. The

SEC also maintains an Internet site that will contain copies of the reports we

file electronically. The address for the Internet site is www.sec.gov.

STOCK TRANSFER AGENT

We have not engaged the services of a transfer agent at this time. However,

within the next twelve months we anticipate doing so. Until such a time a

transfer agent is retained, InTake Communications will act as its own transfer

agent.

STOCK OPTION PLAN

The Board of Directors of InTake Communications has not adopted a stock option

plan ("Stock Option Plan"). The company has no plans to adopt a stock option

plan but may choose to do so in the future. If such a plan is adopted, this plan

may be administered by the board or a committee appointed by the board (the

"Committee"). The committee would have the power to modify, extend or renew

outstanding options and to authorize the grant of new options in substitution

therefore, provided that any such action may not, without the written consent of

the optionee, impair any rights under any option previously granted. InTake

Communications may develop an incentive based stock option plan for its officers

and directors and may reserve up to 10% of its outstanding shares of common

stock for that purpose.

LITIGATION

We are not a party to any pending litigation and none is contemplated or

threatened.

LEGAL MATTERS

The validity of the securities offered by this prospectus will be passed upon

for us by Schneider Weinberger & Beilly LLP.

EXPERTS

Our financial statements have been audited for the period ending December 31,

2009 by Seale and Beers, as set forth in their report included in this

prospectus. Their report is given upon their authority as experts in accounting

and auditing.

46

FINANCIAL STATEMENTS

FINANCIAL STATEMENTS December 31, 2009

Auditors' Report .......................................................... F-2

Balance Sheet ............................................................. F-3

Statement of Operations ................................................... F-4

Statement of Stockholders' Equity (Deficit) ............................... F-5

Statement of Cash Flows ................................................... F-6

Notes to the Financial Statements ......................................... F-7

F-1

SEALE AND BEERS, CPAs

PCAOB & CPAB REGISTERED AUDITORS

- --------------------------------

www.sealebeers.com

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

-------------------------------------------------------

TO THE BOARD OF DIRECTORS

INTAKE COMMUNICATIONS, INC.

(A DEVELOPMENT STAGE COMPANY)

We have audited the accompanying balance sheets of InTake Communications, Inc.

(A Development Stage Company) as of December 31, 2009, and the related

statements of operations, stockholders' equity (deficit) and cash flows for the

period from inception on December 24, 2009 through December 31, 2009. These

financial statements are the responsibility of the Company's management. Our

responsibility is to express an opinion on these financial statements based on

our audits.

We conduct our audits in accordance with standards of the Public Company

Accounting Oversight Board (United States). Those standards require that we plan

and perform the audits to obtain reasonable assurance about whether the

financial statements are free of material misstatement. An audit includes

examining, on a test basis, evidence supporting the amounts and disclosures in

the financial statements. An audit also includes assessing the accounting

principles used and significant estimates made by management, as well as

evaluating the overall financial statement presentation. We believe that our

audits provide a reasonable basis for our opinion.

In our opinion, the financial statements referred to above present fairly, in

all material respects, the financial position of InTake Communications, Inc. (A

Development Stage Company) as of December 31, 2009, and the related statements

of operations, stockholders' equity (deficit) and cash flows for the period from

inception on December 24, 2009 through December 31, 2009, in conformity with

accounting principles generally accepted in the United States of America.

The accompanying financial statements have been prepared assuming that the

Company will continue as a going concern. As discussed in Note 6 to the

financial statements, the Company has an accumulated deficit of $3,579, which

raises substantial doubt about its ability to continue as a going concern.

Management's plans concerning these matters are also described in Note 6. The

financial statements do not include any adjustments that might result from the

outcome of this uncertainty.

/S/ SEALE AND BEERS, CPAS

Seale and Beers, CPAs

Las Vegas, Nevada

January 14, 2010

50 S. Jones Blvd. Ste 202 Las Vegas, NV 89107 (888) 727-8251 Fax: (888) 782-2351

- --------------------------------------------------------------------------------

F-2

InTake Communications, Inc.

(A Development Stage Company)

Balance Sheet

ASSETS

------

AS OF

DECEMBER 31,

2009

------------

CURRENT ASSETS

Cash and cash equivalents ..................................... $ 6,000

-----------

Total current assets ........................................ 6,000

-----------

-----------

TOTAL ASSETS .................................................... $ 6,000

===========

LIABILITIES AND STOCKHOLDERS' EQUITY (DEFICIENCY)

-------------------------------------------------

CURRENT LIABILITIES

Accounts Payable & Accrued Liabilities ........................ 3,579

-----------

Total liabilities ........................................... 3,579

===========

STOCKHOLDERS' EQUITY (DEFICIENCY)

Capital Stock (Note 4)

Authorized:

250,000,000 common shares, $0.0001 par value

Issued and outstanding shares:

9,000,000 ................................................. $ 900

Additional paid-in capital .................................. 8,100

Stock subscriptions receivable .............................. (3,000)

Deficit accumulated during the development stage ............ (3,579)

-----------

Total Stockholders' Equity (Deficiency) ..................... 2,421

-----------

TOTAL LIABILITIES AND STOCKHOLDERS' EQUITY ...................... $ 6,000

===========

The accompanying notes are an integral part of these financial statements.

F-3

InTake Communications, Inc.

(A Development Stage Company)

Statement of Operations

FOR THE PERIOD

FROM INCEPTION

DECEMBER 24,

2009 TO

DECEMBER 31,

2009

--------------

REVENUES ..................................................... $ 0

--------------

EXPENSES

General & Administrative ................................... $ 79

Professional Fees .......................................... $ 3,500

--------------

Loss Before Income Taxes ..................................... $ (3,579)

--------------

Provision for Income Taxes ................................... -

--------------

Net Loss ..................................................... $ (3,579)

==============

PER SHARE DATA:

Basic and diluted loss per common share .................... $ -

==============

Basic and diluted weighted average common shares outstanding 9,000,000

==============

The accompanying notes are an integral part of these financial statements.

F-4

InTake Communications, Inc.

(A Development Stage Company)

Statement of Stockholders' Equity (Deficiency)

Deficit

Accumulated

Common Stock Additional Stock During the

------------------ Paid-in Subscriptions Development

Shares Amount Capital Receivable Stage Total

--------- ------ ---------- ------------- ----------- -------

Inception - December 24, 2009 - $ - $ - $ - $ - $ -

Common shares issued to

Founder for cash at

$0.001 per share

(par value $0.0001) on

December 24, 2009 ........ 9,000,000 900 8,100 (3,000) - 6,000

Loss for the period

from inception on

December 24, 2009 to

December 31, 2009 ........ - - - - (3,579) (3,579)

--------- ------ ---------- ---------- ----------- -------

Balance - December 31, 2009 . 9,000,000 900 8,100 3,000 (3,579) 2,421

========= ====== ========== ========== =========== =======

The accompanying notes are an integral part of these financial statements.

F-5

InTake Communications, Inc.

(A Development Stage Company)

Statement of Cash Flows

FOR THE PERIOD

FROM INCEPTION

DECEMBER 24,

2009 TO

DECEMBER 31,

2009

--------------

OPERATING ACTIVITIES

Loss for the period ........................................ $ (3,579)

-------------

Changes in Operating Assets and Liabilities:

(Increase) decrease in prepaid expenses .................. -

Increase (decrease) in accounts payable .................. 3,579

Increase (decrease) in accrued liabilities ............... -

-------------

Net cash used in operating activities ...................... -

-------------

INVESTING ACTIVITIES

-------------

Net cash provide by Investing activities ................... -

-------------

FINANCING ACTIVITIES

Common stock issued for cash ............................... 6,000

-------------

Net cash provided by financing activities .................. 6,000

-------------

INCREASE IN CASH AND CASH EQUIVALENTS ........................ 6,000

CASH AND CASH EQUIVALENTS AT BEGINNING OF PERIOD ............. 0

-------------

CASH AND CASH EQUIVALENTS AT END OF PERIOD ................... $ 6,000

=============

Supplemental Cash Flow Disclosures:

Cash paid for:

Interest expense ......................................... $ -

=============

Income taxes ............................................. $ -

=============

The accompanying notes are an integral part of these financial statements.

F-6

INTAKE COMMUNICATIONS, INC.

(A Development Stage Company)

NOTES TO FINANCIAL STATEMENTS

(DECEMBER 31, 2009)

NOTE 1. GENERAL ORGANIZATION AND BUSINESS

Intake Communications, Inc. ("Intake Communications, Inc.") is a development

stage company, incorporated in the State of Florida on December 24, 2009 to

provide software to companies to help them market and sell their music and

entertainment content to consumers. The music and entertainment content is audio

and video clips of concerts, artist interviews, and highlights. Based on the

customer request, the software will extract the music and entertainment content

from the customer's music and entertainment library and stream that content to

the customer. This content is referred to as "digital assets". The customer can

request the content from any internet device such as a computer, laptop or

mobile device.

NOTE 2. SUMMARY OF SIGNIFICANT ACCOUNTING PRACTICES

Accounting Basis

- ----------------

The Company is currently a development stage enterprise reporting under the

provisions of FASB ASC 915, Development Stage Entity. These financial statements

are prepared on the accrual basis of accounting in conformity with accounting

principles generally accepted in the United States of America.

Cash and Cash Equivalents

- -------------------------

Cash and cash equivalents are reported in the balance sheet at cost, which

approximates fair value. For the purpose of the financial statements cash

equivalents include all highly liquid investments with an original maturity of

three months or less when purchased.

Earnings (Loss) per Share

- -------------------------

The Company adopted FASB ASC 260, Earnings per Share. Basic earnings (loss) per

share is calculated by dividing the Company's net income available to common

shareholders by the weighted average number of common shares outstanding during

the year. Diluted earnings (loss) per share is calculated by dividing the

Company's net income (loss) available to common shareholders by the diluted

weighted average number of shares outstanding during the year. The diluted

weighted average number of shares outstanding is the basic weighted number of

shares adjusted as of the first of the year for any potentially dilutive debt or

equity. There were no diluted or potentially diluted shares outstanding for all

periods presented.

Dividends

- ---------

The Company has not adopted any policy regarding payment of dividends. No

dividends have been paid during the period shown, and none are contemplated in

the near future.

F-7

INTAKE COMMUNICATIONS, INC.

(A Development Stage Company)

NOTES TO FINANCIAL STATEMENTS

(DECEMBER 31, 2009)

Income Taxes

- ------------

The Company adopted FASB ASC 740, Income Taxes, at its inception. Deferred tax

assets and liabilities are recognized for the future tax consequences

attributable to differences between the financial statement carrying amounts of

existing assets and liabilities and their respective tax bases. Deferred tax

assets, including tax loss and credit carry forwards, and liabilities are

measured using enacted tax rates expected to apply to taxable income in the

years in which those temporary differences are expected to be recovered or

settled. The effect on deferred tax assets and liabilities of a change in tax

rates is recognized in income in the period that includes the enactment date.

Deferred income tax expense represents the change during the period in the

deferred tax assets and deferred tax liabilities. The components of the deferred

tax assets and liabilities are individually classified as current and

non-current based on their characteristics. Deferred tax assets are reduced by a

valuation allowance when, in the opinion of management, it is more likely than

not that some portion or all of the deferred tax assets will not be realized. No

deferred tax assets or liabilities were recognized as of December 31, 2009.

Advertising

- -----------

The Company will expense advertising as incurred. Since inception, the

advertising dollars spent have been $0.00.

Use of Estimates

- ----------------

The preparation of financial statements in conformity with accounting principles

generally accepted in the United States of America requires management to make

estimates and assumptions that affect the reported amounts of assets and

liabilities and disclosure of contingent assets and liabilities at the date of

the financial statements and the reported amounts of revenue and expenses during

the reporting period. Actual results could differ from those estimates.

Revenue and Cost Recognition

- ----------------------------

The Company has no current source of revenue; therefore the Company has not yet

adopted any policy regarding the recognition of revenue or cost.

Property

- --------

The Company does not own any real estate or other properties. The Company's

office is located 4655 Gran River Glen, Duluth GA 30096. Our contact number is

678.516.5910. The business office is located at the home of Ron Warren, the CEO

of the Company, at no charge to the Company.

F-8

INTAKE COMMUNICATIONS, INC.

(A Development Stage Company)

NOTES TO FINANCIAL STATEMENTS

(DECEMBER 31, 2009)

NOTE 3. INCOME TAXES:

The Company provides for income taxes under the provisions of FASB ASC 740,

Income Taxes. FASB ASC Topic 740 requires the use of an asset and liability

approach in accounting for income taxes. Deferred tax assets and liabilities are

recorded based on the differences between the financial statement and tax bases

of assets and liabilities and the tax rates in effect currently.

ASC Topic 718 requires the reduction of deferred tax assets by a valuation

allowance if, based on the weight of available evidence, it is more likely than

not that some or all of the deferred tax assets will not be realized. In the

Company's opinion, it is uncertain whether they will generate sufficient taxable

income in the future to fully utilize the net deferred tax asset.

The components of the Company's income tax expenses at December 31, 2009 are as

follows:

Year Ended December 31, 2009

----------------------------

Deferred Tax Asset ............... $ -

Valuation Allowance .............. -

Current Taxes Payable ............ -

Income Tax Expense ............... -

------

The Company has filed no income tax returns since inception.

At December 31, 2009, the Company had estimated net loss carry forwards of

approximately $3,000 which expires through its tax year ending 2029. Utilization

of these net operating loss card forwards may be limited in accordance with IRCD

Section 3.82 in the event of certain shifts in ownership.

NOTE 4. STOCKHOLDERS' EQUITY

Common Stock

- ------------

On December 24, 2009, the Company issued 9,000,000 of its $0.0001 par value

common stock at $0.001 per share for $6,000 cash and $3,000 in a subscription

receivable to the founder of the Company. The issuance of the shares was made to

the sole officer and director of the Company and an individual who is a

sophisticated and accredited investor, therefore, the issuance was exempt from

registration of the Securities Act of 1933 by reason of Section 4 (2) of that

Act.

There are 250,000,000 Common Shares at $0.0001 par value authorized with

9,000,000 shares issued and outstanding at December 31, 2009.

F-9

INTAKE COMMUNICATIONS, INC.

(A Development Stage Company)

NOTES TO FINANCIAL STATEMENTS

(DECEMBER 31, 2009)

NOTE 5. RELATED PARTY TRANSACTIONS

An officer and director of the Company are involved in business activities

outside of the company and may, in the future, become involved in other business

opportunities that become available. They may face a conflict in selecting

between the Company and other business interests. The Company has not formulated

a policy for the resolution of such conflicts.

NOTE 6. GOING CONCERN

The accompanying financial statements have been prepared assuming that the

Company will continue as a going concern. For the period December 24, 2009 (date

of inception) through December 31, 2009 the Company has had a net loss of

$3,579. As of December 31, 2009, the Company has not emerged from the

development stage. In view of these matters, recoverability of any asset amounts

shown in the accompanying financial statements is dependent upon the Company's

ability to begin operations and to achieve a level of profitability. Since

inception, the Company has financed its activities from the sale of equity

securities. The Company intends on financing its future development activities

and its working capital needs largely from loans and the sale of public equity

securities with some additional funding from other traditional financing

sources, including term notes, until such time that funds provided by

operations, if ever, are sufficient to fund working capital requirements.

NOTE 7. THE EFFECT OF RECENTLY ISSUED ACCOUNTING STANDARDS

Below is a listing of the most recent accounting standards and their effect on

the Company.

Recent Accounting Pronouncements

- --------------------------------

In January 2010, the FASB issued Accounting Standards Update 2010-02,

Consolidation (Topic 810): Accounting and Reporting for Decreases in Ownership

of a Subsidiary. This amendment to Topic 810 clarifies, but does not change, the

scope of current US GAAP. It clarifies the decrease in ownership provisions of

Subtopic 810-10 and removes the potential conflict between guidance in that

Subtopic and asset derecognition and gain or loss recognition guidance that may

exist in other US GAAP. An entity will be required to follow the amended

guidance beginning in the period that it first adopts FAS 160 (now included in

Subtopic 810-10). For those entities that have already adopted FAS 160, the

amendments are effective at the beginning of the first interim or annual

reporting period ending on or after December 15, 2009. The amendments should be

applied retrospectively to the first period that an entity adopted FAS 160. The

Company does not expect the provisions of ASU 2010-02 to have a material effect

on the financial position, results of operations or cash flows of the Company.

F-10

INTAKE COMMUNICATIONS, INC.

(A Development Stage Company)

NOTES TO FINANCIAL STATEMENTS

(DECEMBER 31, 2009)

In January 2010, the FASB issued Accounting Standards Update 2010-01, Equity

(Topic 505): Accounting for Distributions to Shareholders with Components of

Stock and Cash (A Consensus of the FASB Emerging Issues Task Force). This

amendment to Topic 505 clarifies the stock portion of a distribution to

shareholders that allows them to elect to receive cash or stock with a limit on

the amount of cash that will be distributed is not a stock dividend for purposes

of applying Topics 505 and 260. Effective for interim and annual periods ending

on or after December 15, 2009, and would be applied on a retrospective basis.

The Company does not expect the provisions of ASU 2010-01 to have a material

effect on the financial position, results of operations or cash flows of the

Company.

In December 2009, the FASB issued Accounting Standards Update 2009-17,

Consolidations (Topic 810): Improvements to Financial Reporting by Enterprises

Involved with Variable Interest Entities. This Accounting Standards Update

amends the FASB Accounting Standards Codification for Statement 167. (See FAS

167 effective date below)

In December 2009, the FASB issued Accounting Standards Update 2009-16, Transfers

and Servicing (Topic 860): Accounting for Transfers of Financial Assets. This

Accounting Standards Update amends the FASB Accounting Standards Codification

for Statement 166. (See FAS 166 effective date below)

In October 2009, the FASB issued Accounting Standards Update 2009-15, Accounting

for Own-Share Lending Arrangements in Contemplation of Convertible Debt Issuance

or Other Financing. This Accounting Standards Update amends the FASB Accounting

Standard Codification for EITF 09-1. (See EITF 09-1 effective date below) In

October 2009, the FASB issued Accounting Standards Update 2009-14, Software

(Topic 985): Certain Revenue Arrangements That Include Software Elements. This

update changed the accounting model for revenue arrangements that include both

tangible products and software elements. Effective prospectively for revenue

arrangements entered into or materially modified in fiscal years beginning on or

after June 15, 2010. Early adoption is permitted. The Company does not expect

the provisions of ASU 2009-14 to have a material effect on the financial

position, results of operations or cash flows of the Company.

In October 2009, the FASB issued Accounting Standards Update 2009-13, Revenue

Recognition (Topic 605): Multiple-Deliverable Revenue Arrangements. This update

addressed the accounting for multiple-deliverable arrangements to enable vendors

to account for products or services (deliverables) separately rather than a

combined unit and will be separated in more circumstances that under existing US

GAAP. This amendment has eliminated that residual method of allocation.

Effective prospectively for revenue arrangements entered into or materially

modified in fiscal years beginning on or after June 15, 2010. Early adoption is

permitted. The Company does not expect the provisions of ASU 2009-13 to have a

material effect on the financial position, results of operations or cash flows

of the Company.

F-11

INTAKE COMMUNICATIONS, INC.

(A Development Stage Company)

NOTES TO FINANCIAL STATEMENTS

(DECEMBER 31, 2009)

In September 2009, the FASB issued Accounting Standards Update 2009-12, Fair

Value Measurements and Disclosures (Topic 820): Investments in Certain Entities

That Calculate Net Asset Value per Share (or Its Equivalent). This update

provides amendments to Topic 820 for the fair value measurement of investments

in certain entities that calculate net asset value per share (or its

equivalent). It is effective for interim and annual periods ending after

December 15, 2009. Early application is permitted in financial statements for

earlier interim and annual periods that have not been issued. The Company does

not expect the provisions of ASU 2009-12 to have a material effect on the

financial position, results of operations or cash flows of the Company.

In June 2009, the FASB issued SFAS No. 168 (ASC Topic 105), "The FASB Accounting

Standards Codification and the Hierarchy of Generally Accepted Accounting

Principles - a replacement of FASB Statement No. 162" ("SFAS No. 168"). Under

SFAS No. 168 the "FASB Accounting Standards Codification" ("Codification")

became the source of authoritative US GAAP to be applied by nongovernmental

entities. Rules and interpretive releases of the Securities and Exchange

Commission ("SEC") under authority of federal securities laws are also sources

of authoritative GAAP for SEC registrants. SFAS No. 168 was effective for

financial statements issued for interim and annual periods ending after

September 15, 2009. On the effective date, the Codification superseded all

then-existing non-SEC accounting and reporting standards. All other

non-grandfathered non-SEC accounting literature not included in the Codification

became non-authoritative. SFAS No. 168 was effective for the Company's interim

quarterly period beginning July 1, 2009. The Company does not expect the

adoption of SFAS No. 168 to have an impact on the financial statements other

than current references to BAAP.

In June 2009, the FASB issued SFAS No. 167 (ASC Topic 810), "Amendments to FASB

Interpretation No. 46(R) ("SFAS 167"). SFAS 167 amends the consolidation

guidance applicable to variable interest entities. The provisions of SFAS 167

significantly affect the overall consolidation analysis under FASB

Interpretation No. 46(R). SFAS 167 is effective as of the beginning of the first

fiscal year that begins after November 15, 2009. SFAS 167 was effective for the

Company beginning in 2010. The Company does not expect the provisions of SFAS

167 to have a material effect on the financial position, results of operations

or cash flows of the Company.

In June 2009, the FASB issued SFAS No. 166, (ASC Topic 860) "Accounting for