[Company Letterhead]

December 22, 2010

VIA EDGAR AND TELEFAX (703-813-6967)

Ms. Linda Cvrkel

Senior Assistant Chief Accountant

Division of Corporation Finance

Securities and Exchange Commission

100 F Street, N.E.

Washington, D.C. 20549-5546

Re: | TBS International Limited Annual Report on Form 10-K for the Fiscal Year Ended December 31, 2009, filed March 16, 2010 Quarterly Report on Form 10-Q for the Fiscal Quarter ended September 30, 2010 filed November 9, 2010 - File No. 001-34599 |

Dear Ms. Cvrkel:

On behalf of TBS International Limited (the “Company”), we are writing in response to your letter dated November 23, 2010, regarding the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2009, which the Company filed with the Securities and Exchange Commission (the “commission”) on March 16, 2010 and its Quarterly Report on Form 10-Q for the quarter ended September 30, 2010, which the Company filed with the Commission on November 9, 2010 (File No. 000-34599). Your comments are set forth below, followed by our corresponding response.

Form 10-K for the year ended December 31, 2009

Comment 1

Consolidated Statement of Changes in Shareholders’ Equity

We note from the Company’s consolidated statement of changes in stockholders’ equity that during 2008, the Company’s outstanding warrants increased by 23,050 due to anti-dilution provisions of the warrants. Please tell us and explain in the notes to the Company’s financial statements the specific terms of the warrants that require such anti-dilution adjustments, the nature and time of the events or circumstances that resulted in the issuance of additional warrants as a result of the anti-dilution adjustments and the Company’s accounting treatment for the warrants issued as a result of the anti-dilution provisions of the warrants. We may have further comment upon review of your response.

Response

The Company issued warrants in connection with its emergence from bankruptcy in 2001, and the warrants became exercisable when the first Preferred Ship Mortgage Notes were not paid on June 29, 2005. The warrant agreement contains an anti-dilution provision that adjusts the number of shares issuable upon exercise of the warrants whenever the Company issues additional common shares. In 2008, the Company issued additional shares in a registered public offering and in connection with equity grants issued under its Equity Incentive Plan. These events caused the number of shares issuable upon exercise of the outstanding warrants to increase by 7,845 Class A and 15,205 Class B common shares. The dollar amount of warrants recorded by the Company did not change because only the shares exercisable pursuant to the outstanding warrants increased. The 2008 Annual Report on Form 10-K disclosed the 2008 transactions; however, this language was excluded from the 2009 Annual Report on Form 10-K. We will include the following paragraph in our 2010 Annual Report:

“The warrant agreement includes an anti-dilution provision that adjusts the number of shares issuable upon exercise of the warrants whenever the Company issues additional common shares or engages in similar transactions. In 2008, additional shares were issued in connection with our secondary public offering and through our Equity Incentive Plan, shares. Consequently, shares exercisable under outstanding warrants increased by 7,845 Class A and 15,205 Class B ordinary common shares, or 23,050 total ordinary shares. “

We will include similar language in our future periodic filings whenever the number of shares exercisable pursuant to the outstanding warrants is adjusted due to anti-dilution provisions.

Comment 2

Note 2. Summary of Significant Accounting Policies and Basis of Presentation

Revenue Recognition -Related Expenses, page F-8

We note your disclosure that a voyage is deemed to commence upon the completion of discharge of the vessel’s previous cargo. Please note that recognition of voyage revenue commencing upon the completion of discharge of the vessel’s previous cargo is not considered to be in accordance with GAAP because revenue is recognized in advance of performance. Please revise your policy to recognize revenue under ASC 605-20-25 and restate your financial statements accordingly, if material.

Response

We respectfully submit that revenue is not recognized in advance of performance. The disclosure in our accounting policies states that “For voyages in progress at December 31, 2009 and 2008, we recognized voyage expenses as incurred and recognized voyage revenue ratably over the length of the voyage.” As disclosed, the Company measures the length of a voyage from completion of discharge of the vessel’s previous cargo to the completion of discharge of the current cargo. Our revenue recognition policy for voyages beginning and ending in two different accounting periods reflects the time at which a customer’s obligation to pay is established. Our Bill of Lading states “Should the Merchant fail to deliver the Goods booked, either in part or in full, for loading the Merchant shall pay deadfeight.” Deadfreight is an industry term that means the amount of money payable by the shipper to a shipowner for failing to load the quantity of cargo stipulated in the contract of carriage. A customer obligation is created when the customer is notified of the scheduled arrival of the vessel at the load port.

Consequently, treating a voyage as beginning when the vessel begins its transit to the load port after completion of discharge of the vessel’s previous cargo is in accordance with ASC 605-20-25 (EITF Issue 91-9, method 5), because method 5 specifically states that “revenue between reporting periods should be allocated based on the relative transit time in each reporting period.” The transit time to a load port is a necessary part of fulfilling our contractual obligation to our customers. Accordingly, revenue between reporting periods should be allocated from the time after completion of discharge of the vessel’s previous cargo. This is standard practice in the industry, is in compliance with generally accepted accounting principles as it relates to the revenue recognition laid out in SAB 104 and satisfies all 4 recognition criteria required to be met before revenue can be recognized. These criteria are: 1) persuasive evidence of an arrangement exists (wherein “arrangement” refers to the final understanding between the parties as to the specific nature and terms of the agreed-upon transaction), 2) services have been rendered or are being rendered, 3) the seller’s price (charter rate) to the buyer is fixed or determinable, and 4) collectability is reasonably assured.

On occasion, a vessel will wait for a short period after discharging the previous voyage’s cargo before steaming to the current voyage’s load port. The number of waiting days for the nine months ended September 30, 2010 was not significant, accounting for approximately 1% of total voyage days during the period. The change in revenue that would occur if waiting days were excluded from the calculation of 2010 quarterly revenue for voyages in progress between reporting periods is not material as shown below:

2

(In thousands) | | Impact

on voyage

revenue

due to

inclusion

of waiting

days | | Voyage

revenue

reported for

Quarter /

Year | | Percentage

of effect of

including

waiting

days to

voyage

revenue | | Impact

on net

income

(loss) due

to

inclusion

of waiting

days | | Net

Income

(Loss)

reported for

quarter /

year | | Percentage

effect of

including

waiting

days to

revenue | |

| | | | | | | | | | | | | |

Q1 2010 | | — | | 74,358 | | 0.000 | % | 4 | | (7,843 | ) | (0.051 | )% |

Q2 2010 | | 135 | | 70,640 | | 0.191 | % | (3 | ) | (9,677 | ) | 0.031 | % |

Q3 2010 | | (31 | ) | 75,196 | | (0.041 | )% | 7 | | (10,355 | ) | (0.068 | )% |

| | $104 | | $220,194 | | 0.047 | % | $8 | | $(27,875 | ) | (0.029 | )% |

| | | | | | | | | | | | | |

2009 | | $(758 | ) | $247,980 | | (0.306 | )% | $(39 | ) | $(67,040 | ) | 0.058 | % |

| | | | | | | | | | | | | |

2008 | | $820 | | $371,706 | | 0.221 | % | $37 | | $371,706 | | 0.010 | % |

| | | | | | | | | | | | | |

2007 | | $(85 | ) | $686,249 | | (0.012 | )% | $(28 | ) | $293,966 | | (0.010 | )% |

Time charter revenue is recognized only from the date of delivery of the vessel to the charter, and consequently waiting time is not a factor.

Comment 3

Deferred Dry Docking Costs, Page F-9

We believe that the note disclosure in this accounting policy should be expanded to also include the information contained in the last two sentences in the last paragraph under section D — Classification & Inspection in Item 1 (Business section), which is also the third full paragraph on page 10. Please revise accordingly.

Response

In future filings, we will expand the disclosure in Financial Statement, Note 2 — Summary of Significant Accounting Policies, Deferred Dry Docking. We will include the following sentences suggested by the SEC staff, which currently that is included in our disclosures under section D — Classification & Inspection in Item 1 (Business section), and in note titled Summary of Significant Accounting Policies — Deferred Dry Docking Costs:

“Deferred drydocking costs that are incurred to meet regulatory requirements, or are expenditures that add economic life to the vessel, increase the vessel’s earning capacity or improve the vessel’s efficiency. Normal repairs and maintenance, whether incurred as part of the drydocking or not are expensed as incurred.”

3

Comment 4

Valuation of Long-Lived Assets and Goodwill, page F-9

We note your disclosure that you believe the assumptions used in the December 31, 2008 impairment analysis are still applicable and there have not been any significant changes in events or circumstances, so you have concluded that there are no new triggering events requiring an additional impairment analysis during 2009 and there is no impairment to your fleet at December 31, 2009. However, in light of your disclosures in MD&A that one of the significant effects of the current global financial downturn has been a reduction in vessel values (page 42) and that through the first three quarters of 2009 you continued to experience lower freight rates (page 60), it appears there may have been changes in your economic situation during fiscal 2009 and the first nine months of fiscal 2010, that would be indicative that an interim impairment analysis is required. Please provide us with additional details as to why you do not believe it was appropriate to perform an impairment analysis on your vessels subsequent to the analysis performed for the year ended December 31, 2008. Include in your response how your failure to meet certain debt covenants in 2009, such as the collateral coverage requirements, and the sale of the Savannah Belle for a loss in July 2010, were considered in your conclusions.

Response

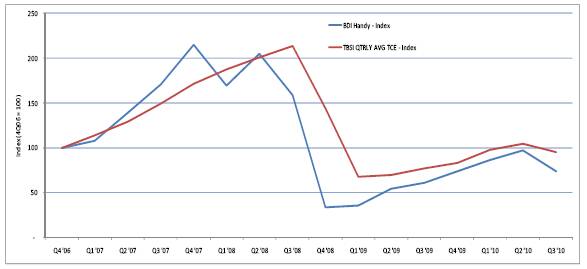

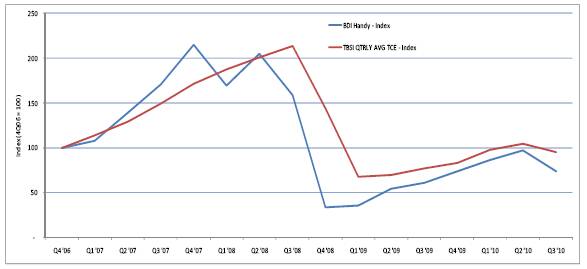

Our disclosures in MD&A about the reduction in vessel values and lower freight rates in 2009 are made relative to the historically high vessel values and freight rates reached in 2007 and 2008. Freight rates, as reflected in the Baltic Handy-size Index (“Index”), decreased 84% between the highs in the second quarter of 2008 and the fourth quarter of 2008. This significant change in freight rates was also confirmed by a dramatic drop in our average daily time charter equivalent rates (“TCE”), which decreased 68% from the highs in the third quarter of 2008 to historical lows in the first quarter of 2009.

As communicated in our Form 10-K filing for the year ended December 31, 2008 and in our correspondence with your office on August 7, 2009, concerning the SEC review of the 2008 Form 10-K filing, we concluded, based on our analysis, that further testing for recoverability should be performed due to the then-deteriorating market conditions. We performed our impairment analysis in February 2009 using information from our 2009 budget and three-year projection (2009 through 2011). For the purposes of ASC Topic 360, we perform our testing on the entire fleet taken as a whole (the asset group), and not on an individual vessel basis in accordance with ASC topics 280-10-50-11 and 360-10-20. At December 31, 2008, the undiscounted future cash flows exceeded the net carrying amount of long-lived assets and, consequently, we determined that there was no impairment and no impairment adjustment was deemed necessary.

We monitor changes in the shipping market as well as movements in our TCEs and compare them to our expectations as part of our qualitative analysis of events or changes in circumstance within the meaning of ASC 360-10-35-21. We reviewed the prevailing freight and charter rates as well as vessel values for possible indications that further impairment analysis was required. Freight and charter rates, as well as vessel values, continued to remain higher during the remainder of 2009 and in the nine months of 2010 than in December 2008 and early 2009. In addition, vessel valuations for our vessels, as indicated by independent ship valuation reports and second hand vessel market prices, were steadily improving indicating that no additional testing was warranted. Based on this analysis, during 2009 and during the nine months ended 2010, we determined that there were no new triggering events requiring additional impairment analysis. For these reasons, we concluded that there was no impairment to our fleet at any reporting period in 2009 or during the nine months ended 2010.

The chart below shows the Baltic Handy-size Index and our quarterly average daily TCE rates, beginning with the fourth quarter of 2006 as a base level:

4

At the end of 2009, the index and our TCEs, while still below the 2008 highs, were 118% and 23%, respectively, higher than their respective lows.

During 2010, the index and our TCEs remained flat with averages in the third quarter of 2010 being 117% and 41% higher than their respective lows.

Our September 30, 2010 qualitative analysis of other events and changes in circumstance indicated that there were no triggering events that would require additional impairment analysis. Consequently, we concluded that there was no impairment to our fleet at September 30, 2010. While we note that we did not believe a triggering event occurred, we updated our undiscounted cash flow model at September 30, 2010. Our analysis at September 30, 2010 indicated that future undiscounted cash flows on a fleet basis exceeded the carrying value of the vessels and related long-lived assets.

Collateral coverage requirements differ from an impairment analysis under ASC 360 because collateral coverage requirements reflect the ratio of the market value for a ship or group of ships, as determined by an independent appraiser, to the outstanding balance of the loan collateralized by such ships. In contrast, impairment under ASC 360 occurs only when the expected future undiscounted cash flows are less than the carrying value of the related long-lived assets. Our analysis at December 31, 2008 indicated that future undiscounted cash flows on a fleet basis exceeded the carrying value of the vessels and related long-lived assets and, consequently, there was no impairment.

The Savannah Belle, which was sold in July 2010, was one of the smallest and oldest vessels in our fleet, and the vessel was scheduled for a substantial period of dry docking. Because management expected the costs of this dry docking to be substantial, management decided to sell the vessel. Because our impairment analysis is performed at a fleet level, rather than a vessel level, the relationship between the sale price for a single vessel and its carrying value is not by itself a key factor in our impairment analysis. We respectfully submit that the sale price of Savannah Belle had no immediate bearing on our analysis of impairment.

Comment 5

Note 11. Financing, page F-18

We note from your disclosures that during 2009 you modified several credit facilities to waive financial covenants, introduce new covenants, and impose minimum cash balances. In addition, the amount available under certain credit facilities was reduced. Please explain to us how you accounted for these loan modifications

5

in accordance with ASC 470-50-40, including how you accounted for any unamortized deferred costs relating to the old arrangements.

Response

We modified our credit facilities in March 2009 and obtained an extension of waivers. Included below is a summary of the impact of the modification and the accounting treatment thereof:

March 2009 amendments: During March 2009, we modified the terms of almost all our credit facilities and incurred additional deferred financing costs (“DFC”) of approximately $4.4 million. These modifications related to both revolving and non-revolving credit facilities.

Revolving Credit Facility: The Bank of America (BOA) Credit Facility includes a revolving credit facility. Prior to the modification, the revolving credit facility, which is structured as a four-year term loan with a balloon payment of the outstanding balance due March 2012, allowed borrowings of up to $125.0 million based on a collateral formula. The modifications did not change the loan maturity or the members of the syndicated loan. As part of the loan modification, the borrowing ceiling was reduced from $125.0 to $85.0 million. This resulted in a 32% decrease in borrowing capacity defined as the product of the remaining term and the maximum available credit. Per ASC 470-50-40-21, $0.4 million or 32% of the $1.3 million unamortized finance costs allocated to the revolver was written off. This amount is included in “Interest Expense” in the Consolidated Statement of Operations for the three months ended March 31, 2009.

Non-Revolving Credit Facility: Applying the guidance in ASC 470-50 we considered the quantitative and qualitative factors to determine if the modification of debt would be considered substantial. The modifications did not change the quarterly principal amounts or loan maturity, nor were there any changes in the members of the syndicated loans. We also considered whether any of the credit facilities had changes in recourse or nonrecourse features, priority of the obligations, changes in collateral or debt covenants and/or waivers.

Aside from the increase in interest rate, the additional lenders’ costs paid for the modifications, and a slight change in the collateral on two of the credit facilities, there were no other changes as outlined in ASC 470-50. The change in the collateral involved adding three vessels to the Bank of America Credit Facility collateral pool, thereby bringing the total to 30 ships, and adding one vessel to the AIG Credit Facility collateral pool, thereby bringing the total to four ships. These changes were not considered substantial and did not cause the modification of debt to be considered substantial. The existing and amended credit facilities do not contain a conversion option, and consequently this was not a factor in our analysis

Applying the guidance in ASC 470-50-40, we compared the present value of the discounted cash flows under the March 2009 amended debt, including fees paid, to the present value of the discounted remaining cash flows under the original terms and determined that the 10% Cash Flow threshold had not been met. Consequently, existing unamortized DFC was not written off and we continued to amortize existing DFC as before. We also deferred the lenders’ costs incurred in connection with the March 2009 amendments and began to amortize the costs over the remaining term of the respective credit facilities.

Comment 6

Form 10-Q for the Quarter ended March 31, 2009

Note 10. Investment in Joint Ventures

We note your disclosure that the financial statements include a $2.5 million receivable that the Company expects to collect from Log-In for the costs incurred however it is not clear whether the Company will be reimbursed for these costs. Please explain to us why you have not recorded an allowance for bad debts for this amount, either in whole or for a portion of the receivable, if you are unsure whether you will collect the amount. As part of your response, please tell us the nature and the terms of the agreement that relates to reimbursement

6

or the specific costs incurred. If no such agreement exists, please explain in detail why you believe recognition of receivable is appropriate.

Response

We respectfully submit that it is our management’s judgement that Log.Star (a consolidated subsidiary of TBS) will be able to collect the $2.5 million receivable that it recorded as being owed by Log.In as of September 30, 2010.

Log.Star Navegacao S.A.(“Log.Star”) is a Brazilian joint-venture that was incorporated in January 2010 and is 70% owned by the Company and 30% owned by Logistica Intermodal S.A.(“Log.In”). Simultaneously with the formation of Log.Star, Log.In agreed to sublease three vessels to Log-Star for a period of three years under a bareboat charter agreement. The relevant agreements required that the vessels be delivered to Log.Star in operational, sea-worthy condition, and in compliance with all class requirements. After delivery of the vessels, Log.Star incurred costs to make the vessels operational, sea-worthy, and compliant with class requirements and incurred vessel costs such as charter hire and crew costs while the vessels were being made operational.

These costs are deemed the responsibility of Log.In under the relevant agreements, but it is management’s judgement that only $2.5 million, or 35%, of the costs (consisting of both capital and operational expenditures) identified as being the obligation of Log.In will be recovered by the Company.

Comment 7

Management’s Discussion and Analysis

Non-GAAP Financial Measures

We note your disclosure that MD&A includes a discussion of EBITDA, a non-GAAP financial measure. Please tell us, and revise your disclosure in future filings to explain whether the Company uses this measure as an operating performance measure or a liquidity measure and to include the reasons why management believes that presentation of the non-GAAP financial measure provides useful information to investors regarding your financial condition and results of operations. See Item 10(e) of Regulation S-K.

Response

We use EBITDA as a liquidity measure. We are in a capital-intensive business where debt is an important funding source. EBITDA is one of many non-GAAP financial measures that can help investors compare companies across industries because it levels the playing field by stripping out interest (which is higher for us than for other companies) and depreciation (which is higher than other companies because of our substantial fixed asset base). We believe that the presentation of EBITDA is useful to investors in evaluating our liquidity position. Additionally, EBITDA, is used in the calculation of several financial covenants such as the Consolidated Interest Charge Ratio and the Consolidated Leverage Ratio, which are present in most of credit facility agreements. We refer to these covenants in our quarterly and annual filings and consider it appropriate to include EBITDA with our financial results.

In future filings we will include the following statement explaining why management believes that presentation of EBITDA provides useful information to investors:

“We believe that EBITDA is useful to investors because our industry is capital intensive and this measure serves as an alternative indicator of our ability to satisfy our debt obligations and meet our covenant requirements.”

7

Comment 8

Liquidity and Capital Resources

We note your disclosure that you incurred financial costs in connection with the January 2010 waiver extensions and the May 2010 amendments and these costs are being amortized over the remaining terms of the respective credit facilities. In light of the fact that interest rates on the loan agreements appear to also have been modified during this time, please tell us how you analyzed the modifications under ASC 470-50-40 in accounting for both the new financing costs as well as any costs that had been previously deferred and revise future filings to explain the treatment used.

Response

In January 2010, we obtained an extension of waivers initially to April 1, 2010 and later to May 14, 2010. These events only extended covenant waivers and did not change any of the terms of the credit facilities. In May 2010, we finalized modifications to our credit facilities, which increase interest rates, modified financial covenant levels, and decreased the BOA Revolving Credit Facility from $85.0 million to $75.0 million. The May 2010 amendments, however, did not change the quarterly principal amounts, loan maturity or syndicate membership of the syndicated loans. The modifications of the credit facilities also did not change the recourse or nonrecourse features, priority of the obligations or collateral. The existing and amended credit facilities do not contain a conversion option, and consequently this was not a factor in our analysis.

January 2010 Extensions: In January 2010 our lending institutions extended the covenant waivers obtained in March 2009. These events did not change any of the terms of the credit facilities, such as the amount or timing of principal payments, repayment terms or interest rate margins. We considered the quantitative and qualitative factors outlined in ASC 470-50 to determine if the debt modifications would be considered substantial, and we concluded that the debt modifications were not substantial as defined by ASC 470-50. Consequently, the $1.7 million in additional financing costs incurred in January 2010 were deferred and are being amortized over the remaining term of the respective debt instruments.

May 2010 Amendments:

Revolving Credit Facility: Prior to the May 2010 modification, the BOA Revolving Credit Facility which was structured as a four-year term loan with a balloon payment of the outstanding balance due March 2012, was reduced to $85.0 million with the March 2009 Amendment. As part of the May 2010 amendment, the borrowing ceiling was further reduced from $85.0 million to $75.0 million. This resulted in a 12% decrease in borrowing capacity. Per ASC 470-50-40-21, $0.2 million, or 12%, of the $1.7 million unamortized finance costs allocated to the BOA Revolving Credit Facility was written off. Since this amendment was completed This amount was included in the Consolidated Statement of Operations and reported as “Loss on extinguishment of debt” for the three months ended March 31, 2010.

Non-Revolving Credit Facility: Applying the guidance in ASC 470-50, we considered quantitative and qualitative factors to determine if the modification of debt would be considered substantial. The modifications did not change the quarterly principal amounts, loan maturity, or syndicate membership of the syndicated loans. We also considered if any of the credit facilities had any changes in recourse or nonrecourse features, priority of the obligations, changes in collateral or debt covenants and/or waivers. The existing and amended credit facilities do not contain a conversion option, and consequently this was not a factor in our analysis.

Applying the guidance in ASC 470-50-40, we compared the present value of the discounted cash flows under the May 2010 amended debt, including fees paid, to the present value of the discounted remaining cash flows under the original terms prior to the March 2009 amendments. The analysis was done using terms that existed prior to the March 2009 amendments because the March 2009 modifications were not deemed to be substantial

8

and the May 2010 amendments, which although beyond the 12 month requirement to look back were being negotiated in March, were deemed, for the purpose of our analysis, to have taken place within one year of the March 2009 amendments. We determined that the 10% Cash Flow threshold had not been met. Consequently, existing unamortized DFC was not written off, and we continued to amortize the existing DFC as before. We also deferred the lenders’ costs incurred in connection with the May 2010 amendments and began to amortize the costs over the remaining term of the respective loan.

***

The Company hereby acknowledges that:

(i) | the Company is responsible for the adequacy and accuracy of the disclosures in the filings; |

(ii) | Staff comments or changes to disclosures in response to Staff comments in the filings reviewed by the Staff do not foreclose the SEC from taking any action with respect to the filing; and |

(iii) | the Company may not assert Staff comments as a defense in any proceedings initiated by the SEC or any person under the federal securities laws of the United States. |

We believe that the foregoing is responsive to your comments. If you have any additional comments or questions, please contact the undersigned at (914) 233-1123.

Very truly yours,

Ferdinand V. Lepere

Chief Financial Officer

cc: | Claire Erlanger, SEC Staff |

| Jonathan Sackstein, PricewaterhouseCoopers LLP |

| Steven Finley, Gibson Dunn & Crutcher LLP |

9