UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

(Mark One)

x Annual Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

For the fiscal year ended December 31, 2009

or

o Transition Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

For the transition period from to

Commission File Number 000-34599

TBS INTERNATIONAL PLC

(Exact name of registrant as specified in its charter)

| Ireland | 98-0646151 |

(State or other jurisdiction of incorporation or organization) | (IRS Employer Identification No.) |

Arthur Cox Building Earlsfort Terrace Dublin 2, Ireland |

| (Address of principal executive offices) |

| |

(Registrant's telephone number, including area code) 1 353(0) 1 618 0000 |

| Securities registered pursuant to section 12(b) of the Act: |

Title of each class | | Name of each exchange on which registered | |

| | | | |

| Class A ordinary shares, par value $0.01 | | The NASDAQ Global Select Market | |

Securities registered pursuant to section 12(g) of the Act: None

| Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. | Yes o No x |

| | |

| Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. | |

| | |

| Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. | |

| | |

| Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). | Yes o No o |

| | |

| Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. | o |

| | |

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company . See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act check one): | |

Large Accelerated Filer ¨ Accelerated Filer x Non-accelerated Filer ¨ (Do not check if a small reporting company) Smaller Reporting Filer ¨ |

| | |

| Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). | |

| | |

| The aggregate market value of voting and non-voting common equity held by non-affiliates was $133.3 million on June 30, 2009, based upon the last reported sales price of such stock on the NASDAQ Global Select Market on that date. |

As of February 26, 2010, the registrant had outstanding 17,503,102 Class A ordinary shares, par value $0.01 per share, and 12,390,461 Class B ordinary shares, par value $0.01 per share. |

| |

| |

| DOCUMENTS INCORPORATED BY REFERENCE |

| Portions of the proxy statement for the 2010 Annual Meeting of Stockholders, to be filed within 120 days of the end of the fiscal year ended December 31, 2009, are incorporated in Part III to the extent described herein. |

TBS International plc

| | | | | Page |

| | | | Part I | |

| Item 1 | | |

| | | A | | 4 |

| | | B | | 7 |

| | | C | | 8 |

| | | D | | 9 |

| | | E | | 10 |

| | | F | | 11 |

| | | G | | 11 |

| | | H | | 12 |

| | | I | | 13 |

| | | J | | 14 |

| | | K | | 15 |

| | | L | | 16 |

| | | M | | 17 |

| | | | | |

| Item 1A | | 17 |

| Item 1B | | 34 |

| Item 2 | | 34 |

| Item 3 | | 34 |

| Item 4 | Reserved | |

| | | | | |

| | | | Part II | |

| Item 5 | | 35 |

| Item 6 | | 38 |

| Item 7 | | 41 |

| Item 7A | | 72 |

| Item 8 | | 73 |

| Item 9 | | 73 |

| Item 9A | | 73 |

| Item 9B | | 73 |

| | | | | |

| | | | Part III | |

| Item 10 | | 74 |

| Item 11 | | 76 |

| Item 12 | | 76 |

| Item 13 | | 76 |

| Item 14 | | 76 |

| | | | | |

| | | | Part IV | |

| Item 15 | | 77 |

| | Signatures | |

As used in this Annual Report on Form 10-K, the terms "we," "our," and "us," "TBS" and "the Company" refer to TBS International plc, as successor to TBS International Limited, and its consolidated subsidiaries. We use the term "International," and "TBSI" when we wish to refer only to TBS International plc, the holding company that is the issuer of our ordinary shares and International Limited, the former holding company and issuer of our ordinary shares, and not to TBS International plc and its consolidated subsidiaries.

Forward-Looking Statements

Our filings with the Securities and Exchange Commission or the SEC, including this Annual Report on Form 10-K for the fiscal year ended December 31, 2009, our Annual Report to Shareholders, any quarterly report on Form 10-Q or any current report on Form 8-K (along with any exhibits or amendments to such reports), our press releases, or any other written or oral statements made by or on our behalf, may include or incorporate by reference forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements may include, among other things, the information concerning our possible or assumed future results of operations, our newbuilding plan, our drydocking program, business strategies, financing plans, competitive position, potential growth opportunities, customer demand and the effects of future regulation and competition.

Generally, one can identify these forward-looking statements because they use words like "anticipates," "believes," "estimates," "expects," "future," "intends," "plans," "targets," "projects," "seeks", "will," "should," "likely" and similar expressions. These statements appear throughout this Annual Report on Form 10-K including in the sections entitled "Item 1 - Business" and "Item 7 - Management's Discussion and Analysis of Financial Condition and Results of Operations." These statements are only our current expectations. They are based on our management's beliefs and assumptions and on information currently available to our management. The matters discussed in these forward-looking statements involve risks, uncertainties and assumptions. Although we do not make forward-looking statements unless we believe we have a reasonable basis for doing so, we cannot assure you of their accuracy. Actual results may differ materially from those expressed, implied or projected in or by these forward-looking statements due to a number of uncertainties, risks, and other factors. These uncertainties, risks and other factors, among other unforeseen risks, include, but are not limited to:

| ● | changes in demand for our services, which are increasingly difficult to predict due to current economic conditions and uncertainty; |

| ● | the effect of a decline in vessel valuations; |

| ● | our ability to maintain financial ratios and satisfy financial covenants required by our credit facilities; |

| ● | our ability to finance our operations and raise additional capital on commercially reasonable terms or at all; |

| ● | changes in rules and regulations applicable to the shipping industry, including legislation adopted by international organizations such as the International Maritime Organization and the European Union or by individual countries; |

| ● | actions taken by regulatory authorities; |

| ● | changes in trading patterns, which may significantly affect overall vessel tonnage requirements; |

| ● | changes in the typical seasonal variations in charter rates; |

| ● | volatility in costs, including changes in production of or demand for oil and petroleum products, crew wages, insurance, provisions, repairs and maintenance, generally or in particular regions; |

| ● | the risk that financial counterparties will default; |

| ● | a material decline or weakness in shipping rates, which may occur if the economic recovery is not sustainable; |

| ● | changes in general domestic and international political conditions; |

| ● | changes in the condition of our vessels or applicable maintenance or regulatory standards which may affect, among other things, our anticipated drydocking or maintenance and repair costs; |

| ● | increases in the cost of our drydocking program or delays in our anticipated drydocking schedule; |

| ● | China Communications Construction Company Ltd./Nantong Yahua Shipbuilding Group Co., Ltd.’s ability to complete and deliver the remaining vessels on the anticipated schedule and the ability of the parties to satisfy the conditions in the shipbuilding agreements; |

| ● | the possible effects of pending and future legislation in the United States that may limit or eliminate potential U.S. tax benefits resulting from our jurisdiction of incorporation; |

| ● | Irish corporate governance and regulatory requirements which could prove different or more challenging than currently expected; and |

| ● | other factors listed from time to time in our filings with the Securities and Exchange Commission, including, without limitation, our Annual Report on Form 10-K for the period ended December 31, 2009 and our subsequent reports on Form 10- Q and Form 8-K. |

You should not rely on any forward-looking statements. We undertake no obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events or otherwise, except to the extent required under applicable law.

PART I

We are an ocean transportation services company, originating in 1993, that offers worldwide shipping solutions to a diverse client base of industrial shippers. We offer liner, parcel and bulk services supported by a fleet of multipurpose tweendeckers and handysize and handymax bulk carriers. The flexibility of our fleet allows us to carry a wide range of cargo, including industrial goods, project cargo, steel products, metal concentrates, fertilizer, salt, sugar, grain, aggregates and general cargo, that cannot be carried efficiently by container or large dry bulk carriers. In December 2009, shareholders voted in favor of a reorganization proposal pursuant to which TBS International Ltd. common shares would be cancelled and holders of such shares would receive ordinary shares of TBS International plc, an Irish company, on a one-to-one basis. The reorganization transaction was completed on January 6, 2010, at which time TBS International plc replaced TBS International Ltd. as the ultimate parent company for our operations. Shares of TBS International plc began trading on the NASDAQ Global Select Market on January 7, 2010 under the symbol "TBSI," the same symbol under which TBS International Ltd. shares were previously traded.

Over the past 17 years, we have developed our business model around key trade routes between Latin America and Japan, South Korea and China, as well as ports in North America, Africa, the Caribbean, and the Middle East. We differentiate ourselves from our competitors by offering a fully integrated shipping solution to our customers, which we refer to as our Five Star Service. As part of our Five Star Service, we offer total project coordination, door-to-door supply chain management including port services, terminal operations, trucking, barging, warehousing, distribution, inland pick-up and delivery, and documentation. We also provide frequent, regularly scheduled voyages within our shipping network and offer additional services such as strategic planning, cargo scheduling, loading and discharge.

As of December 31, 2009, our controlled fleet totaled 48 vessels, including 46 ships that we own and two that we charter-in with an option to purchase. On March 29, 2007, we entered into a contract for six "Roymar Class" 34,000 deadweight ton, or dwt, multipurpose vessels with retractable tweendecks, designed to our specifications. We took delivery of the first vessel the Rockaway Belle on September 23, 2009 in China from Nantong Yahua Shipbuilding Group Co., Ltd. Three of the vessels are scheduled for delivery in 2010 and the remaining two in 2011. The three newbuildings, which are expected to be delivered in the first, second and fourth quarter of 2010, have been named Dakota Princess, Montauk Maiden and Omaha Belle, respectively.

Financial data including revenues from external customers, at and for the years ended December 31, 2009, 2008 and 2007: (in millions except for Number of Voyages)

| Year ended December 31, | | Total Assets | | Total Revenue | | Net Income/ (Loss) | | Total revenue tons (RT) carried | | Number of Voyages | |

| | | | | | | | | | | | |

| 2009 | | $ | 953.6 | | $ | 302.5 | | $ | (70.0 | ) | 8.8 RT | | 424 | |

| | | | | | | | | | | | | | | |

| 2008 | | $ | 1,041.7 | | $ | 611.6 | | $ | 191.8 | | 9.3 RT | | 380 | |

| | | | | | | | | | | | | | | |

| 2007 | | $ | 559.1 | | $ | 352.9 | | $ | 98.2 | | 6.6 RT | | 276 | |

We target niche markets, which include trade routes, ports and cargoes not efficiently served by container and large dry bulk vessel operators. In order to effectively serve these markets, we offer regularly scheduled voyages using our fleet of multipurpose tweendeckers and handysize and handymax dry bulk carriers. Tweendeck vessels are differentiated by their retractable decks that can create separate holds, facilitating the transportation of non-containerized cargoes. Our vessels are able to navigate and service many ports with restrictions on vessel size and transport many types of cargo that cannot be carried efficiently by container or large dry bulk carriers.

As part of our comprehensive transportation service offering, we provide portside and inland logistics, related support services and solutions for challenging cargoes. To provide these services, we employ a professional staff of approximately 170 employees at December 31, 2009, with extensive experience and diverse backgrounds. In addition, our affiliate, TBS Commercial Group Ltd. has fully-staffed agencies and representative offices on five continents, with local teams of commercial agents and port captains who meet regularly with customers to tailor solutions to their logistics needs. We believe this full-service approach to shipping provides a superior level of service that has resulted in the development of long-term relationships with our customers.

Our customers rely on our regular service as an integral part of their supply chain, and many of these relationships have been established for over 16 years. We serve approximately 300 customers in more than 20 countries. We have developed long-term relationships with established and well-respected industrial shippers in diverse markets including mining, steel manufacturing, trading, heavy industry, industrial equipment and construction. We believe our business model allows us to respond rapidly to our customers’ changing demands and short delivery windows, increasing the value of our services to them as we enable them to schedule production and distribution.

Shipping freight rates declined during the first three quarters of 2009; however, beginning in the fourth quarter of 2009 rates began to increase slightly. This increase has continued into the first quarter of 2010.

Our Competitive Strengths

Trade Routes and Ports of Call

We provide ocean transportation services over eight routes, focusing primarily on Asia and Latin America, with additional operations in North America, the Middle East and Africa. We began operations in 1993, sailing between East Asia and the West Coast of South America. In 1995, we expanded our routes by adding sailings between the East and West Coasts of South America. In 2002, we began offering cargo service between North America and the East and West Coasts of South America and expanded our routes by offering service from Brazil to West Africa and within the Middle East. We continued to expand our service in the Middle East and North Africa during 2005 and 2006.

During 2009 we operated our vessels in five liner, parcel and bulk services. We have taken a conservative approach to building our service network. The initial sailings on each route are typically based on the requirements of a major customer. After regular sailings are established, we notify other potential customers of the service so their cargoes may be transported as well. As demand increases, we evaluate committing additional resources to serve the route, either by purchasing or chartering-in additional vessels. We plan the loading and stowage of cargo on each sailing to maximize our ability to add cargo as vessels call in selected ports to discharge cargo, increasing our utilization rate and maximizing revenue per sailing. A summary of our services and routes operated during 2009 is as follows:

| | | | |

| TBS Pacific Service | | Eastbound: | | |

| | | Japan, South Korea and | | Steel products, project cargo |

| | | China to the West, North and East Coasts of South America | | and general cargo |

| | | Westbound: | | |

| | | Peru, Ecuador and Chile to East Asia | | Minerals, metals, metal concentrates and fishmeal |

| TBS Latin America Service | | Northbound: | | |

| | | Brazil to the Caribbean basin | | Steel products, project cargo |

| | | and the West Coast of South America | | and general cargo |

| | | Southbound: | | |

| | | Colombia to Brazil and Argentina | | Coal and petroleum coke |

| TBS North America Service | | Southbound: | | |

| | | North America to the Caribbean | | Fertilizer, agricultural products |

| | | basin, South America and West Africa | | and steel products |

| | | Northbound: | | |

| | | Caribbean to North America | | Limestone and aggregates |

| TBS Middle East Carriers | | Middle East region, including ports in the United Arab Emirates, to Qatar and Kuwait | | Bulk aggregates |

| TBS Ocean Carriers | | Brazil to the West Coast of Africa | | Bulk sugar and salt |

Our liner, parcel and bulk services primarily carry steel products, salt, sugar, grain, fertilizers, chemicals, metal concentrates and aggregates plus general and project cargoes.

| · | Steel products include specialty and carbon steel coils, steel pipe and structural steel used in infrastructure development, construction, oil and gas transmission and automotive and appliance manufacturing industries. |

| · | Fertilizers include ammonium sulfate shipped in bulk for use in commercial agriculture. |

| · | Metal concentrates include copper, zinc, silver and other metals generally shipped in small break-bulk lots from 1,000 to 10,000 metric ton parcels that are processed at their destinations by smelters into purer forms. |

| · | General and project cargoes includes industrial machinery, spare parts, oil well supplies, trailers, industrial tanks and other commercial goods used in industrial applications. |

In addition to our liner, parcel and bulk services on the trade routes described above, we time charter-out vessels on an individual customer basis through TBS Ocean Carriers. However, any of our services may time charter-out a vessel to meet our customers' needs. Generally, we time charter-out vessels on a long-term basis to customers seeking vessel tonnage and on a short-term basis to reposition a vessel.

A time charter is a contractual arrangement under which a shipowner is paid for the use of a vessel at a daily rate for a fixed period of time. The shipowner is responsible for providing the crew and paying vessel operating expenses while the charterer is responsible for paying the voyage expenses. At December 31, 2009, 16 vessels of our controlled and owned fleet were time chartered-out with an average remaining duration of 30 days.

The following table shows the annual number of time charters-out, related duration and gross charter revenue since 2005.

| Year | | Number of Charters | | Duration (Days) | | Gross Revenue (in thousands) | |

| 2009 | | 132 | | 4,733 | | $ | 51,201 | |

| 2008 | | 74 | | 3,004 | | | 83,883 | |

| 2007 | | 67 | | 3,659 | | | 88,365 | |

| 2006 | | 57 | | 4,301 | | | 63,114 | |

| 2005 | | 55 | | 4,257 | | | 71,456 | |

Our business strategy consists of providing reliable transportation services to leading industrial shippers over key ocean trade routes. The key elements of our business strategy are:

Focus on Increasing Cargo Volumes on Our Key Routes.We intend to increase cargo volumes on our key Pacific and Latin American trade routes, as well as our third sailing from China and Korea which carries steel parcels to Mexico, Central and South America. By adding additional vessels and sailings to the markets we already serve, we believe we will be able to provide more regular service to our clients, which we expect will allow us to capture a larger share of their shipping needs, and win new clients.

Develop New Trade Routes. We intend to continue developing new trade routes, such as adding sailings from Asia to Africa to our TBS Pacific Service. Our agents and port captains work closely with our clients, as well as potential clients, to identify additional services that we can provide. We target routes that share the characteristics of our established routes and appear suited to our fleet and our full service approach. When developing new trade routes, we initially utilize chartered-in vessels and commit resources to acquire vessels for operation on those routes once we have determined that the economics of the route are favorable and sustainable.

Develop Our Logistics Support. We intend to further develop our logistics support through our Five Star Service. The goal of our Five Star Service is to provide a complete transportation solution to our global customers by providing a fully-integrated cargo and transport management system. We offer total project coordination, door-to-door supply chain management including port services, terminal operations, trucking, barging, warehousing, distribution, inland pick-up and delivery, and documentation. The Five Star Service differentiates us from traditional dry bulk ship owners by adding strategic planning and logistics support to our customers. Additionally, we intend to expand our port warehouse network to support our logistics services.

Expand Our Fleet of Focused Vessel Types. We are expanding our fleet of multipurpose retractable tweendeckers through our newbuilding program. In 2007, we contracted a Chinese shipyard to build six newly designed vessels named the "Roymar Class". These 34,000 dwt vessels are a larger vessel class and their addition to our fleet will be a significant milestone in the implementation of our business plan to modernize and expand our fleet. While we remain committed to expanding our fleet, pending a significant change in global economic conditions, we are temporarily suspending any further acquisitions of secondhand vessels. Our current business strategy includes growing through newbuildings of multipurpose tweendeckers and chartering-in vessels as needed.

In September 2009, we took delivery of the first of six newbuildings, the Rockaway Belle. Three newbuildings are scheduled for delivery in 2010, and the last two newbuild vessels are scheduled for delivery in 2011. At December 31, 2009, the milestones met and the expected delivery dates for the remaining vessels are noted below:

| | | Caton | | Dorchester | | Longwoods | | McHenry | | Sunswyck |

| Maritime Corp. | Maritime Corp. | Maritime Corp. | Maritime Corp. | Maritime Corp. |

| Milestone | | Hull No NYHS200721 | | Hull No NYHS200722 | | Hull No NYHS200723 | | Hull No NYHS200724 | | Hull No NYHS200725 |

| Dakota Princess | Montauk Maiden | To be Named | Omaha Belle | To be Named |

| Contract Signing | | Met | | Met | | Met | | Met | | Met |

| Steel Cutting | | Met | | Met | | Met | | Met | | Met |

| Keel Laying | | Met | | Met | | Met | | Met | | 2nd Qtr 2010 |

| Launching | | Met | | Met | | 3rd Qtr 2010 | | 2nd Qtr 2010 | | 4th Qtr 2010 |

| Anticipated Delivery | | 1st Qtr 2010 | | 3rd Qtr 2010 | | 1st Qtr 2011 | | 4th Qtr 2010 | | 3rd Qtr 2011 |

Our current controlled fleet consists of a total of 48 vessels, aggregating approximately 1.4 million dwt. The fleet consists of 25 multipurpose tweendeckers (8,000–34,000 dwt) and 23 dry bulk carriers, including 18 Handymax (35,000–46,000 dwt) and five Handysize (22,000–29,000 dwt) vessels. All vessels are dual flagged in either Panama or Liberia and the Philippines. In addition to the newbuild vessel that we placed into operation in the third quarter of 2009, we have committed to acquire five additional newbuild 34,000 dwt multipurpose tweendeckers for a total purchase price of $214.3 million. We expect three vessels to be delivered in 2010 and the last two vessels in 2011.

The following table provides information regarding the 48 vessels in our controlled fleet at December 31, 2009, which excludes vessels chartered-in under short-term charter.

| | | | | Year | | Deadweight |

| Vessel Name | | Vessel Type | | Built | | Weight Tons |

| Zia Belle | | Multipurpose Tweendecker | | 1997 | | 8,492 |

| Tamoyo Maiden | | Multipurpose Tweendecker | | 1986 | | 17,235 |

| Ainu Princess | | Multipurpose Tweendecker | | 1987 | | 17,324 |

| Siboney Belle | | Multipurpose Tweendecker | | 1987 | | 17,324 |

| Kiowa Princess | | Multipurpose Tweendecker | | 1986 | | 19,762 |

| Seneca Maiden | | Multipurpose Tweendecker | | 1986 | | 19,764 |

| Aztec Maiden | | Multipurpose Tweendecker | | 1984 | | 19,777 |

| Hopi Princess | | Multipurpose Tweendecker | | 1984 | | 20,401 |

| Navajo Princess | | Multipurpose Tweendecker (1) | | 1987 | | 21,902 |

| Inca Maiden | | Multipurpose Tweendecker (1) | | 1986 | | 22,133 |

| Shawnee Princess | | Multipurpose Tweendecker | | 1984 | | 22,323 |

| Caribe Maiden | | Multipurpose Tweendecker | | 1987 | | 22,800 |

| Ottawa Princess | | Multipurpose Tweendecker | | 1987 | | 22,800 |

| Taino Maiden | | Multipurpose Tweendecker | | 1985 | | 23,278 |

| Tuckahoe Maiden | | Multipurpose Tweendecker | | 1985 | | 23,278 |

| Cherokee Princess | | Multipurpose Tweendecker | | 1990 | | 23,286 |

| Kickapoo Belle | | Multipurpose Tweendecker | | 1987 | | 23,319 |

| Apache Maiden | | Multipurpose Tweendecker | | 1987 | | 23,325 |

| Mohegan Princess | | Multipurpose Tweendecker | | 1983 | | 26,276 |

| Tayrona Princess | | Multipurpose Tweendecker | | 1983 | | 26,320 |

| Laguna Belle (2) | | Multipurpose Tweendecker | | 1996 | | 28,503 |

| Seminole Princess (2) | | Multipurpose Tweendecker | | 1997 | | 28,503 |

| Nanticoke Belle | | Multipurpose Tweendecker | | 1989 | | 28,835 |

| Wichita Belle | | Multipurpose Tweendecker | | 1991 | | 28,843 |

| Rockaway Belle (3) | | Multipurpose Tweendecker | | 2009 | | 34,005 |

| Savannah Belle | | Handysize Bulk Carrier | | 1982 | | 22,558 |

| Arapaho Belle | | Handysize Bulk Carrier | | 1998 | | 24,021 |

| Oneida Princess | | Handysize Bulk Carrier | | 1998 | | 24,247 |

| Mohave Maiden | | Handysize Bulk Carrier | | 1984 | | 28,074 |

| Zuni Princess | | Handysize Bulk Carrier | | 1984 | | 28,166 |

| La Jolla Belle (3) | | Handymax Bulk Carrier | | 1982 | | 35,025 |

| Shinnecock Belle | | Handymax Bulk Carrier | | 1985 | | 37,451 |

| Maori Maiden | | Handymax Bulk Carrier | | 1984 | | 37,734 |

| Tupi Maiden | | Handymax Bulk Carrier | | 1992 | | 38,852 |

| Nyack Princess | | Handymax Bulk Carrier | | 1984 | | 38,885 |

| Biloxi Belle | | Handymax Bulk Carrier | | 1984 | | 39,225 |

| Miami Maiden | | Handymax Bulk Carrier | | 1984 | | 39,333 |

| Iroquois Maiden | | Handymax Bulk Carrier | | 1983 | | 40,876 |

| Fox Maiden | | Handymax Bulk Carrier | | 1985 | | 40,902 |

| Alabama Belle | | Handymax Bulk Carrier | | 1986 | | 41,808 |

| Houma Belle | | Handymax Bulk Carrier | | 1985 | | 42,219 |

| Sioux Maiden | | Handymax Bulk Carrier | | 1989 | | 42,248 |

| Mohawk Princess | | Handymax Bulk Carrier | | 1982 | | 42,360 |

| Yakima Princess | | Handymax Bulk Carrier | | 1990 | | 42,475 |

| Canarsie Princess | | Handymax Bulk Carrier | | 1985 | | 42,842 |

| Chesapeake Belle | | Handymax Bulk Carrier | | 1984 | | 44,146 |

| Tuscarora Belle | | Handymax Bulk Carrier | | 1984 | | 44,189 |

| Manhattan Princess | | Handymax Bulk Carrier | | 1982 | | 45,526 |

| | | Total DWT | | | | 1,432,970 |

| (1) | These vessels are multipurpose tweendeckers with the ability to carry wheeled cargo such as automobiles, tractors or trailers. The vessels allow cargo to be "rolled on" and "rolled off" in addition to allowing cargo to be "lifted-on" and "lifted-off". |

| (2) | These vessels are leased and operated by us under a sale-leaseback arrangement that expires in 2014. The agreements allow for the purchase of the respective vessel at the end of 2012 and each year thereafter until the end of the charter period. |

| (3) | On September 23, 2009 we took delivery of the newly-constructed vessel Rockaway Belle from Nantong Yahua Shipbuilding Group Co., Ltd. La Jolla Belle was previously named Rockaway Belle and was part of our existing fleet. |

Multipurpose Tweendeckers

Our multipurpose tweendecker vessels have retractable tweendecks that can convert a multipurpose tweendecker to a bulk carrier, and back again. Unlike container ships, which can carry only cargo that can be or has been pre-packaged into standard 20-foot or 40-foot containers, or bulk carriers that limit the ability to mix different cargoes in any one hold, multipurpose tweendeckers can be divided into multiple cargo compartments by a mezzanine deck, or tweendeck. The tweendeck permits the carriage of cargoes of differing sizes and shapes in the same or separate holds and permits greater flexibility in the stowage and carriage of cargo. Many of our vessels sailing eastbound from Asia will call at multiple Latin American ports to discharge cargo and load additional cargo for shipment to other ports. Cargoes are stowed in a manner that facilitates efficient loading and discharging.

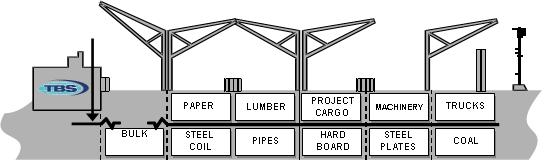

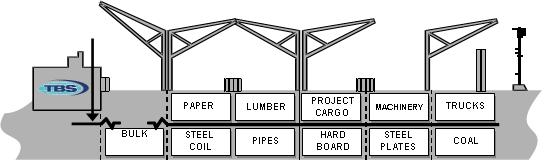

The following diagram shows a typical multipurpose tweendeck ship fitted for different types of cargo.

Bulk Carriers

Our bulk carriers range in size from 22,558 dwt to 45,526 dwt. Several of the vessels have equipment that enables self-loading and discharging in an effort to enhance our ability to serve a broad range of ports.

The hull and machinery of every commercial vessel must be "classed" by a classification society authorized by its country of registry. Our vessels currently are enrolled with Lloyds Register of Shipping, or LR, Nippon Kaiji Kyokai, or NKK, American Bureau of Shipping, or ABS, Det Norske Veritas, or DNV, and Bureau Veritas, or BV. The classification society certifies that a vessel is safe and seaworthy in accordance with the applicable rules and regulations of the country of registry of the vessel and international conventions promulgated by the International Maritime Organization, or IMO. These include the Convention on Maritime Pollution Prevention, the International Safety Management Code, or ISM Code, and International Convention for the Safety of Life at Sea, or SOLAS. All of our vessels have been certified as being "in class" by their respective classification societies.

A vessel must undergo annual surveys, intermediate surveys and special surveys. In lieu of a special survey, a vessel's machinery may be on a continuous survey cycle, under which the machinery would be surveyed periodically over a five-year period. All of our controlled vessels are on special survey cycles for hull inspection and continuous survey cycles for machinery inspection. Every vessel is required to be drydocked twice in every five-year period, with no interval greater than three years. Vessels less than 15 years of age may be underwater inspected instead of drydocked, at the intermediate period. Our fleet of 48 vessels will require approximately 96 drydockings over a five-year period. We anticipate drydocking approximately 19 vessels per year. We had 23 vessels in drydock during 2009, including one vessel that entered into drydock during December 2008. During 2010, we anticipate having 18 vessels in drydock, including two vessels that entered into drydock in late 2009.

| | | For the Year Ended December 31, | |

| | | 2009 | | 2008 | | 2007 | |

| Vessels Entering Drydock | | 22 | | 16 | | 21 | |

In 2009, our drydocking program focused on capital expenditures that were necessary or otherwise recommended by classification surveyors. In the two years prior to 2009, we used vessel drydocking to perform steel renewal and reinforcements that might have been required in the next five to ten years to reduce the cost of subsequent vessel drydockings.

Our drydocking expenditures and surveys are being accounted for using the deferral method. Under the deferral method of accounting for drydocking, the costs incurred are deferred and amortized on a straight-line basis over the period through the date of the next drydocking, which is typically 30 months. We only include in deferred drydocking costs those costs that are incurred to meet regulatory requirements, or are expenditures that add economic life to the vessel, increase the vessel’s earnings capacity or improve the vessel’s efficiency. Normal repairs and maintenance, whether incurred as part of the drydocking or not, are expensed as incurred.

Substantially all of the operations, ship maintenance, supervision of crewing, technical support, purchasing, insurance, financial management services and network of commercial agents necessary to support our fleet and operate our business are supervised by four service companies.

Two of these service companies, TBS Shipping Services Inc. and Roymar Ship Management Inc., are our wholly-owned subsidiaries that manage the accounts of our other subsidiaries and, on their behalf, make payments and advances for costs associated with the operation of our business. The other service companies, TBS Commercial Group Ltd. and Beacon Holdings Ltd., are controlled by certain of our key executive officers. Together these four companies employ approximately 340 experienced professionals who meet regularly with shippers and consignees to market our services in more than 20 countries and address the needs and concerns of our customers.

Operations management

TBS Shipping Services coordinates services to customers, integrates the activities of our commercial agency network, oversees charter activities, administers voyages and provides accounting services, including the preparation of our account ledgers and financial statements.

Ship management

Roymar manages our controlled fleet providing an experienced technical management staff and a full range of vessel maintenance capabilities to ensure that we maintain a high-level of ship performance. The services provided by Roymar include:

| ● | supervising the recruiting of crew; |

| ● | obtaining spares, stores and provisions necessary on board the vessels; |

| ● | implementing our maintenance program; |

| ● | arranging for and supervising all drydocking procedures; |

| ● | arranging for surveys and inspections according to requirements of classification society, flag state and port state rules and regulations; |

| ● | maintaining high safety and environmental protection standards in compliance with the ISM Code and SOLAS; |

| ● | arranging for insurance of the vessels; and |

| ● | identifying vessels to acquire and negotiating purchase options on vessels that we charter. |

We are fully responsible for the maintenance of our controlled fleet. We make every effort to prevent delays at sea or in port caused by malfunctions or breakdowns. Roymar deploys superintendents, including master mariners and engineers, to supervise the maintenance of our controlled fleet. We minimize operation costs through continuous onboard supervision of our vessels and use of the vessels' crews for ship maintenance. We believe that our preventive maintenance practice has extended the lives of the vessels in our controlled fleet, minimized drydocking expenses and nearly eliminated downtimes and off-hire periods resulting from speed deficiencies, stoppages at sea and vessel breakdowns.

Commercial agents

We have established a network of long-term commercial and operational relationships with affiliated commercial agency service companies. The majority of these service companies are wholly or partly-owned by TBS Commercial Group. These service companies employ locally-based sales and customer service professionals who personally meet with shippers and consignees on a regular basis. These professionals provide a competitive advantage by addressing our customers' concerns and anticipating their future needs through their personal contact with our customers. We believe that personal attention to customers has played a critical role in our growth and success. Our method of operation focuses on sales and service for long-term sustained expansion. The agreements with TBS Commercial Group are subject to the approval of the Compensation Committee of our Board of Directors. We paid TBS Commercial Group approximately $7.8 million, $16.8 million and $8.0 million in 2009, 2008, and 2007, respectively. See "Note 14 — Related Party Transactions" to our consolidated financial statements.

As of December 31, 2009, we had approximately 170 office employees located in Yonkers and Scarsdale, New York. At December 31, 2009, we had contracts with three unaffiliated manning agents, to provide approximately 1,150 crew for our vessels. We are not a party to the contracts with the seagoing personnel, all of whom are required to have appropriate maritime licenses. Historically our labor relations have been good.

We believe we distinguish ourselves from our competition by offering proven reliability, frequent and on-time service, flexible cargo management, expert loading and stowage and close client coordination in the ports and on the vessels. This customer focus has enabled us, through our affiliated agents, to develop long-term relationships with established and well-respected industrial shippers in diverse markets including mining companies, steel manufacturers, trading companies, heavy industry, industrial equipment enterprises and construction companies. Our business model is designed to enable us to respond rapidly to our customers' changing demands and short delivery windows, increasing the value of our services to them as we enable them to schedule production and distribution.

A substantial majority of our repeat business is based on our relationships and reputation with our customers, and is not governed by long-term contracts. We depend upon a limited number of customers for a large part of our revenue. Our top ten customers by revenue, accounted for, in the aggregate, 40.5% of our total consolidated revenue for 2009. We have affreightment contracts with several of these customers.

As noted in the table below, only one of our customers accounted for more than 10% of revenue. The loss of this customer could have a material adverse effect on our results of operations. The percentages of consolidated revenues from our major customers for each of the last three fiscal years are as follows:

| | | Year Ended December 31, | |

| Customer | | 2009 | | | 2008 | | | 2007 | |

| Dangote Industry Limited | | | 13.5 | % | | | 13.0 | % | | | 13.4 | % |

We transport cargo throughout the world, including the United States. The amount of voyage revenue generated by country for each of the last three fiscal years is as follows (in thousands):

| | | Year Ended December 31, | |

| Country | | 2009 | | | 2008 | | | 2007 | |

| | | | | | | | | | |

| Brazil | | $ | 53,192 | | | $ | 127,360 | | | $ | 72,053 | |

| Japan | | | 35,914 | | | | 79,812 | | | | 40,592 | |

| United Arab Emirates | | | 32,387 | | | | 69,714 | | | | 24,406 | |

| USA | | | 28,137 | | | | 33,702 | | | | 19,785 | |

| Peru | | | 26,870 | | | | 48,707 | | | | 31,728 | |

| Chile | | | 16,564 | | | | 46,923 | | | | 11,219 | |

| China | | | 12,944 | | | | 42,319 | | | | 21,624 | |

| Argentina | | | 8,021 | | | | 8,312 | | | | 15,059 | |

| Korea | | | 6,744 | | | | 15,699 | | | | 5,775 | |

| Venezuela | | | 5,063 | | | | 9,903 | | | | 4,579 | |

| Others | | | 22,144 | | | | 36,456 | | | | 14,689 | |

| | | $ | 247,980 | | | $ | 518,907 | | | $ | 261,509 | |

| | | | | | | | | | | | | |

Revenue attributed to these countries is based on the location where the cargo is loaded. Time charter revenue by country cannot be allocated because we do not control the itinerary of the vessel.

The cargo markets we serve are highly competitive. Our competition on the routes we serve consists primarily of regional shipping companies focused on the breakbulk market, international bulk shipping companies competing in the large lot segment of the bulk metal concentrates market and larger shipping concerns that compete in diverse shipping segments in addition to the breakbulk market. We compete on the basis of targeting niche markets that include trade routes, ports and cargoes not efficiently served by many container and large dry bulk vessel operators. We focus on smaller lots of 1,000 to 10,000 metric tons in the bulk metal concentrates market in Chile and Peru, whereas other bulk shipping companies focus on shipments of 20,000 to 45,000 metric tons of bulk metal concentrates. Additionally, we compete with other regional shipping companies in providing logistics, operations, port services and strategic planning.

Vessel Environmental Regulations

Ocean shipping and related operations are affected by extensive and changing environmental protection and other laws and regulations. These laws and regulations take the form of international conventions and agreements, including those administered by the IMO, and SOLAS, with which all internationally trading vessels must comply, and national, state and local laws and regulations, all of which are amended frequently. Compliance with these laws and regulations may entail significant expenses at any time, including expenses for ship modifications and changes in operating procedures, which could have an adverse effect on our results of operations. Subject to the discussion below and to the fact that the kinds of permits, licenses and certificates required for the operation of the owned vessels will depend upon a number of factors, we believe that we have and will be able to obtain all permits, licenses and certificates material to the conduct of our operations.

In the United States, we are subject to various federal, state and local environmental laws, ordinances and regulations requiring the cleanup of environmental contamination resulting from a discharge of oil or other regulated material, and may be held liable to a governmental entity or to third parties for remediation costs and related damages in connection with environmental contamination. These laws typically impose cleanup responsibility, and liability, which under these laws, has been interpreted to be strict and under certain circumstances, joint and several, and subject to very limited statutory defenses. The costs of investigation, remediation or removal of such regulated materials and damages resulting from their release may be substantial.

Although we do not transport petroleum products, we are subject to the U.S. Oil Pollution Act of 1990 (“OPA 90”), because we use petroleum products for fuel and because the possibility of accidents involving oil tankers presents an exposure to our vessels. Under OPA 90, vessel owners, operators and bareboat charterers are responsible parties and are jointly, severally and strictly liable, unless the spill results solely from the act or omission of a third party, an act of God or an act of war, for containment and cleanup costs and other damages resulting from the discharge or threatened discharge of oil into the navigable waters, adjoining shorelines or the 200 nautical mile exclusive economic zone of the United States. OPA 90 limits the liability of responsible parties for such costs and damages to the greater of $1,000 per gross ton of the vessel or $854,400 per non-oil tanker vessel that is over 300 gross tons, subject to possible adjustment for inflation. The Federal Water Pollution Control Act (“FWPCA”) imposes significant civil penalties as well as strict, joint and several liability on responsible parties for removal costs and imposes liability for natural resource damages arising from the discharge of oil or other hazardous substances into U.S. navigable waters, adjoining shorelines, waters of the contiguous zone and areas of the outer continental shelf and deepwater ports. The Comprehensive Environmental Response, Compensation & Liability Act of 1980, (“CERCLA”), imposes strict, and under certain circumstances, joint and several liability on responsible parties for releases and threatened releases of hazardous substances (other than oil) whether on land or at sea, subject to limits depending on the nature of the vessel and its cargo. Liability under CERCLA is limited to the greater of $300 per gross ton or $5 million for vessels over 300 gross tons carrying hazardous substances as cargo. The limits on liability under OPA 90, FWPCA and CERCLA do not apply if the discharge is caused by gross negligence, willful misconduct, or in the cases of OPA 90 and CERCLA, the violation by a responsible party or its agent of any applicable safety, construction or operating regulation. The statutory limits on liability may not apply in certain other instances, including if the responsible parties fail or refuse to report the incident or refuse to cooperate and assist in connection with oil removal activities. In addition, OPA 90, FWPCA and CERCLA specifically permit individual states to impose their own liability regimes with regard to oil and hazardous waste releases occurring within their boundaries, and many states have enacted legislation providing for unlimited liability for oil spills. In some cases, states that have enacted such legislation have not yet issued implementing regulations under these laws. We intend to comply with all applicable state regulations in ports where we call.

Pursuant to regulations promulgated by the U.S. Coast Guard, responsible parties (as defined in such regulations) must establish and maintain evidence of financial responsibility in the amount of $1,000 per gross ton, for a non-tank vessel. The Protection & Indemnity (“P&I”) Associations, which historically provided shipowners and operators financial assurance, have refused to furnish evidence of insurance to responsible parties, and therefore responsible parties have obtained financial assurance from other sources at additional cost, including evidence of surety bond, guaranty or by self-insurance. In addition, in recent years the U.S. Coast Guard has increased its inspection of vessels entering the United States to ensure they comply with applicable environmental regulations, including regulations related to the discharge of oil.

Port state authorities in general and in certain jurisdictions in particular have become more active in inspecting older vessels visiting their ports and, in certain instances, demanding that repairs be made before allowing a vessel to sail, even though that vessel may be fully insured, in class and in compliance with all relevant maritime conventions including SOLAS.

The IMO has adopted regulations that are designed to reduce oil pollution in international waters. In complying with OPA 90, IMO and other regulations that may be adopted, shipowners and operators may be forced to meet new maintenance and inspection requirements, develop contingency arrangements for potential spills and obtain additional insurance coverage.

The technical manager of our vessels, Roymar, is ISO 14001:2004 certified. Roymar has developed and implemented environmental practices and monitoring thereof, which protect and preserve the marine environment in which our managed vessels operate. We have high standards in our fleet for pollution prevention, regulatory compliance and continual improvement of our environmental management activities.

Other Regulations

Operation of our vessels also is affected by the requirements of the ISM Code. The ISM Code mandates an extensive “Safety Management System” that includes, among other things, the adoption of a safety and environmental protection policy setting forth instructions and procedures for operating vessels safely and describing procedures for dealing with emergencies. Our owned vessels and Roymar, the technical manager of our vessels, are currently ISM Code certified.

We also are required by various governmental and quasi-governmental agencies and other regulatory authorities to obtain permits, licenses and certificates in connection with our operations. Some countries in which we operate have laws that restrict the carriage of cargoes depending on the registry of a vessel, the nationality of its crew and prior and future ports of call, as well as other considerations relating to particular national interest.

We are subject to a variety of initiatives intended to enhance vessel security, including the Maritime Transportation Security Act of 2002, or MTSA. U.S. Coast Guard regulations require that vessels operating in waters subject to the jurisdiction of the United States implement a number of security measures. Similarly, a new chapter of SOLAS, dealing specifically with maritime security, which came into effect in July 2004, imposes various detailed security obligations on vessels and port authorities, most of which are contained in the International Ship and Port Facilities Security Code, or ISPS Code. The ISPS Code is designed to protect ports and international shipping against terrorism. Since July 1, 2004, to engage in international trade, a vessel must have an International Ship Security Certificate, or ISSC, which attests to the vessel’s compliance with SOLAS security requirements and the ISPS Code, from a recognized security organization approved by the vessel’s flag state. ISPS Code requirements include:

| · | on-board installation of automatic identification systems to provide a means for the automatic transmission of safety-related information among similarly equipped ships and shore stations, including information on a ship's identity, position, course, speed and navigational status; |

| · | on-board installation of ship security alert systems that do not sound on the vessel but instead alert the onshore authorities; |

| · | development of vessel security plans; |

| · | permanent marking of a ship's identification number on its hull; |

| · | maintenance of a continuous synopsis record on-board showing a vessel's history, including the name of the vessel and of the state whose flag the ship is entitled to fly, the date on which the ship was registered with that state, the ship's identification number, the port at which the ship is registered and the name of the registered owners and their registered address; and |

| · | compliance with flag state security certification requirements. |

Coast Guard regulations, intended to align with international maritime security standards, exempt non-U.S. vessels from MTSA vessel security measures, provided they have a valid ISSC on board. Our vessels comply with all MTSA, SOLAS and ISPS Code requirements and vessel certifications, which are kept current by Roymar.

Acts of piracy have historically affected ocean-going vessels trading in regions of the world such as the South China Sea and in the Gulf of Aden off the coast of Somalia. Throughout 2009 piracy incidents have continued in the Gulf of Aden, with dry bulk vessels and tankers particularly vulnerable to such attacks. We have implemented a corporate and vessel anti-piracy plan on all vessels transiting high risk areas. These plans incorporate best prevention and proactive practices in training, procedures and equipment recommended by security consultants and industry panels. These protective measures are being carried out for every transit in high risk areas, but do not ensure that an attack will be repulsed.

Our business is subject to normal hazards associated with owning and operating vessels in international trade. The operation of ocean-going vessels carries an inherent risk of catastrophic marine disaster, including oil spills and other environmental accidents, as well as property losses caused by adverse weather conditions, cargo loss or damage, mechanical failures, human error, war, terrorism and business interruption due to political circumstances in foreign countries, hostilities, piracy and labor action. Not all risk can be insured against and the policies have certain deductibles and other limits on coverage for which we are responsible. We believe that our current insurance coverage is adequate to protect us against normal accident-related risk involved in the conduct of our business. Our principal insurance policies include:

Hull and machinery and war risks insurance includes coverage for damages to a vessel’s hull and machinery in a collision, as well as basic perils of the sea and contributions for general average and salvage charges. This coverage includes the risk of actual or constructive total loss for our controlled fleet. Each vessel is insured for at least its fair market value, with a deductible of $75,000 per vessel per incident under the hull and machinery coverage and no deductible under the war risk coverage. The respective owners of the other vessels that we charter-in maintain insurance on those vessels, and we maintain time charter liability insurance to a limit of $500 million per incident.

Protection and Indemnity, or P&I, Insurance includes coverage for oil pollution, damage to docks and other installations and coverage against third-party liabilities including collision liabilities encountered in our commercial operations. It also includes coverage for the death, injury or illness of our crew. Our P&I insurance is provided by mutual marine insurance associations or P&I Clubs. P&I Clubs are formed by shipowners to provide protection from large financial losses to one member by contribution towards the loss by all members. We are subject to potential additional premiums for prior years due to funding requirements and coverage shortfalls of the clubs in the event claims exceed available funds and reserves. We also are subject to future premium increases based on prior year underwriting loss experience. We have an overall coverage limit of approximately $5.0 billion for damage to cargo and third party liabilities and a sublimit for oil pollution of $1.0 billion per vessel for each accident or occurrence. Deductibles range from $5,000 to $50,000 depending on the nature of the claim.

Other Insurance is maintained for legal expenses with respect to freight, demurrage and defense claims. We also carry limited insurance covering the loss of revenue resulting from extended vessel off-hire periods.

U.S. Taxation of Shipping Income

Unless exempt from U.S. federal income taxation under the rules discussed below, a foreign corporation generally is subject to U.S. federal income tax in respect of shipping income derived from sources within the United States. For these purposes, 50% of shipping income that is attributable to transportation that begins or ends, but that does not both begin and end, in the United States constitutes income from sources within the United States ("U.S. source shipping income"). Shipping income attributable to transportation exclusively between non-U.S. ports will be considered to be 100% derived from sources outside the United States. Accordingly, in the absence of an exemption from tax under Section 883 of the U.S. Internal Revenue Code, as amended (the "Code") our gross U.S. source shipping income would be subject to either a 4% tax imposed without allowance for deductions or to a net basis tax.

The net tax regime is applicable if we are considered to have a fixed place of business in the United States that is involved in the earning of U.S. source shipping income and substantially all of such shipping income is attributable to regularly scheduled transportation. The U.S. source shipping income to which the net tax regime is applicable, net of applicable deductions, would be subject to an effective tax rate of up to 54.5% and certain interest paid would be subject to a 30% branch interest tax, or such lesser percentage as may be available under an applicable treaty. Any gain derived from the sale of a vessel, if considered to be from U.S. sources, also would be partly or wholly subject to the net tax regime. If the net tax regime does not apply, the gross tax regime will apply. Under the gross tax regime, our U.S. source shipping income, which, by operation of the source rule, cannot be more than 50% of our total shipping income, would be subject to a 4% tax imposed on a gross basis, without allowance for deductions.

U.S. source shipping income of a foreign corporation will qualify for exemption from U.S. federal income tax under Section 883 of the Code if (i) the corporation is organized in a foreign country that grants an equivalent exemption to U.S. corporations (the "country of organization requirement"), (ii) the stock of the corporation, or the direct or indirect corporate parent thereof (provided the parent is organized in a country that satisfies the country of organization requirement) is "primarily and regularly traded on an established securities market" in such country, in another country that grants the equivalent exemption from tax to U.S. corporations or in the United States, and (iii) certain other requirements are met, including that non-qualified shareholders, each holding 5% or more of a class of stock of the corporation, do not own 50% or more of the total value of such class of stock for more than one-half the days of taxable year (together, the "publicly traded test"). This exemption is available whether or not the corporation has or is considered to have a fixed place of business in the United States that is involved in the earning of U.S. source shipping income. Regardless of whether our U.S. source shipping income qualifies for exemption under Section 883 of the Code, gain realized on a sale of a vessel generally will not be subject to U.S. federal income tax, provided the sale is considered to occur outside of the United States for U.S. federal income tax purposes.

We currently qualify for exemption under Section 883 of the Code, because International and its subsidiaries currently are incorporated in jurisdictions that satisfy the country of organization requirement and we satisfy the publicly traded test by virtue of International’s Class A ordinary shares being primarily traded on the NASDAQ Global Select Market. Further, the aggregate ownership of all non-qualified 5% shareholders is less than 50% of the total value of the Class A ordinary shares. If at any time we fail to satisfy the publicly traded test and we are unable to qualify for another applicable exemption, our U.S. source shipping income would be subject to U.S. federal income tax, either under the gross tax or under net tax regime, each of which is described above.

Federal and State Taxation of TBS International plc’s U.S. Subsidiaries

Our U.S. subsidiaries, Roymar and TBS Shipping Services and its subsidiaries, are subject to U.S. federal and state income taxes on the income earned by the respective subsidiary.

Ireland Taxation of TBS International plc

TBS International plc, the successor issuer to TBS International Limited, is incorporated in Ireland. TBS International plc as a separate entity is subject to tax in Ireland on its worldwide income and gains at 25% with the exception of dividend income received from its subsidiaries that are sourced from active trading profits, which is subject to tax in Ireland at 12.5%. TBS International plc should be considered an investment company for Irish tax purposes and should be allowed to deduct expenses of management against its income and gains. However, as it is not anticipated that TBS International plc will receive any significant dividends from its subsidiaries in the foreseeable future it is not expected that TBS International plc will have any material income subject to Irish taxation.

Bermuda Taxation of Our Subsidiary, TBS International Limited

There currently is no Bermuda income or profits tax, withholding tax, capital gains tax, capital transfer tax, estate duty or inheritance tax payable by our subsidiary TBS International Limited. We have obtained an assurance from the Minister of Finance of Bermuda under the Exempted Undertakings Tax Protection Act 1966 that, in the event that any legislation is enacted in Bermuda imposing any tax computed on profits or income, or computed on any capital asset, gain or appreciation or any tax in the nature of estate duty or inheritance tax, such tax shall not, until March 28, 2016, be applicable to TBS International Limited or any of its operations, debentures or other obligations except insofar as such tax applies to persons ordinarily resident in Bermuda or to any taxes payable by TBS International Limited in respect of real property owned or leased by us in Bermuda.

Marshall Islands Taxation of TBS International plc

Pursuant to the Marshall Islands Revised Code (the Association Law), a Marshall Islands non-resident corporation is exempt from any corporate profit tax, income tax, withholding tax on revenues of the entity, asset tax, tax reporting requirement on revenues of the entity, stamp duty, exchange controls or other fees. There is an agreement between the Marshall Islands and the United States for the exchange of information with respect to taxes.

We make all of our filings with the SEC, including this annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and all related amendments, available free of charge on our website at www.tbsship.com, under the Investor Relations tab, "SEC Filings" section. These reports are available soon after they are filed electronically with the SEC. Our SEC filings are also available at the SEC’s Public Reference Room at 100 F Street, N.E., Washington, DC 20549. Investors may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. In addition, the SEC maintains an Internet site at http://www.sec.gov that contains reports, proxy and information statements and other information regarding issuers that file electronically with the SEC, from which investors can electronically access our SEC filings.

Additionally, our corporate governance materials, including the charters of the Audit, Compensation, and Nominating and Corporate Governance Committees, the Corporate Governance Guidelines, and the Code of Business Conduct and Ethics may also be found under the "Governance" section of our website at www.tbsship.com. A copy of the foregoing corporate governance materials is available free of charge upon written request. In addition, we intend to post on our website at www.tbsship.com any amendment to, or waiver from, a provision of our Code of Business Conduct and Ethics that applies to our principal executive officer, principal financial officer, corporate controller and other employees performing similar functions within four business days following the date of such amendment or waiver.

The following risk factors and other information included in or incorporated by reference into this report should be carefully considered. Additional risks and uncertainties not presently known to us may also impair our business operations. If any of the following risks occur, our business, financial condition, operating results and cash flows could be materially adversely affected and the trading price of our Class A ordinary shares could decline.

Risk Factors Relating to the Shipping Industry and Current Economic Conditions

The global financial crisis has had, and may continue to have, an impact on our business and financial condition. Additionally, protracted economic weakness could have a material adverse effect on our operating income, cash flows and ability to service our debt obligations.

The dry bulk shipping industry is volatile and unpredictable. In 2009, we experienced added pressure on freight rates directly correlating to the global financial crisis. The global financial crisis reduced the availability of liquidity and credit to borrowers, which further pressured shipping rates. Many lenders and institutional investors reduced and, in some cases, ceased to provide funding and letters of credit necessary to finance purchases of steel products, agricultural commodities, metal concentrates and aggregates. As a result, corresponding with a decline in freight rates there was a reduced demand for steel products, agricultural commodities, metal concentrates and aggregates.

Shipping rates and the demand for shipping services correspond directly with the demand and price for commodities. Global economic conditions adversely affected the demand for commodities and in conjunction with the volatile prices for steel products, agricultural commodities, metal concentrates and aggregates, the demand for shipping services had moderated. The market turmoil and tightening of credit led to a widespread reduction of business activity, in general, which adversely affected demand for our services. These conditions are continuing into early 2010.

There continues to be uncertainty as to the long-term success of international efforts to address the global economic crisis. We cannot predict the timing and severity of future global economic or shipping downturns. However, a protracted economic slowdown, including recessions in major geographic regions, could reduce the demand for shipping services while decreasing freight rates and increasing our costs, which could have a material adverse effect on our results of operations and financial condition, including causing asset impairments, as well as a material adverse affect on our operating income, cash flows and the trading price of our stock.

Moreover, our business is exposed to risks associated with the creditworthiness and stability of our suppliers, customers and business partners. The consequences of such adverse effects could include interruptions or delays in performance of our contracts, reductions, renegotiations and interruptions in customer contracts, delays in or the inability of customers to obtain financing or letters of credit to finance shipping, and bankruptcy of customers or other creditors. Any of these events may adversely affect our cash flow, profitability and financial condition. Further, a continued downturn in the economy and our revenues could adversely affect our ability to maintain specified financial ratios and satisfy financial covenants required by our credit facilities.

The current worldwide financial crisis has reduced the availability of liquidity and credit to fund or support the continuation and expansion of business operations worldwide. Continued disruption of the credit markets has affected and could continue to adversely affect our suppliers’ and customers’ access to credit, which supports the continuation and expansion of their businesses worldwide and could result in disruptions in our business operations, contract cancellations or suspensions and payment delays or defaults by our customers. If current market conditions continue for a protracted period, our ability to access credit on favorable terms, or at all, may be adversely affected, which may limit our ability to finance future operations or capital needs, acquire vessels or pursue business opportunities.

The global financial crisis has had an adverse impact on our vessel values and cash flows, which in turn has adversely affected our ability to comply with certain financial covenants in our credit facilities.

One of the significant effects of the current global financial downturn has been a reduction in vessel values, which directly affected our ability to comply with certain financial covenants in our credit facilities. The financial covenants require that we maintain certain fixed charge and leverage ratios, as well as maintain tangible net worth within defined limits. We are also required to maintain minimum cash and cash equivalent balances and collateral coverage and to prepay principal or deliver additional security in the event that the fair market value of the vessels falls below limits specified in the loan agreement.. We concluded in early 2009, that due to the downturn in the shipping market and based on third-party vessel valuations, we did not meet our collateral coverage requirements. Consequently, we obtained waivers from all of our lenders to the collateral coverage ratio and financial covenants through January 1, 2010. As a result of the loan modification two additional covenants were introduced that require us to have a minimum end of month cash balance and a minimum EBITDA to interest expense ratio.

We met each of the additional covenants in 2009. In late December 2009, while economic conditions continued to improve, we concluded that based upon internal projections and the four quarter look-back methodology used in computing the ratios, it was probable that we would be in violation of the leverage and fixed charge coverage ratios on January 1, 2010 after the waivers expire. Accordingly, we obtained from all of our lenders, an extension of the waivers until April 1, 2010. The additional covenants are applicable through the extended waiver period.

Based on current internal projections, however, we anticipate that we will not meet certain of the reinstated covenant requirements during the next 12 months. Generally accepted accounting principles require that long-term loans be classified as a current liability when either a covenant violation that gives the lender the right to call the debt has occurred at the balance sheet date, or such a covenant violation would have occurred absent a waiver of those covenants, and in either case it is probable that the covenant violation will not be cured within the next 12 months. Accordingly, long-term loans are classified as a current liability in our consolidated balance sheet at December 31, 2009.

We are in the process of discussing permanent modifications to our credit facilities with our lenders. Additionally, we are seeking alternative financing sources to repay our credit facilities. We cannot give any assurance that we will be able to obtain the permanent covenant modifications and /or other financing. The failure to obtain the permanent covenant modifications or other financing would have a material adverse effect on our business, operations, financial condition and liquidity and would raise substantial doubt about our ability to continue as a going concern.

Costs and revenues in the shipping industry are volatile.

The shipping industry historically has experienced volatility in freight rates, the cost of fuel oil, the cost and availability of crew, port charges and currency exchange rates, as well as in vessel charter rates and vessel values due to changes in the level and pattern of global economic activity and the highly competitive nature of the world shipping industry. In addition, an increasing number of countries are regulating the sulfur content of fuel oil, which may increase the cost of such fuel. Changes to marine regulatory regimes in the ports at which our vessels call also may increase our costs.

Our revenue is influenced by a number of factors that are difficult to predict with certainty, including global and regional economic conditions, developments in international trade, changes in seaborne and other transportation patterns, the effects of global climate change on developing economies and agricultural production, weather patterns, port congestion, canal closures, political developments, armed conflicts, acts of terrorism, embargoes and strikes. Demand for our transportation services is influenced by the demand for the goods we ship, including steel products, agricultural commodities, metal concentrates and aggregates, which in turn is affected by general economic conditions, commodity prices and competition. Steel products, agricultural commodities, metal concentrates and aggregates accounted for approximately 24.2%, 20.7%, 15.1%, and 13.5%, respectively, of our total voyage revenues in 2009. Beginning in the fourth quarter of 2008 and continuing through most of 2009 the worldwide economy experienced a sluggish demand for steel products, metal concentrates, agricultural commodities, and aggregates. The softened demand for products and commodities translated into a decreased demand for shipping. However, a future worsening of worldwide economic conditions could result in a decrease in demand for steel products, metal concentrates, agricultural commodities, and aggregates, which could adversely affect our results of operations.

Our business depends to a significant degree on the stability and growth of the Asian and Latin American economies.

Freight rates for dry bulk transport, whether computed on a spot or period basis, were at or near all-time highs in 2008 as compared to prior years, as were prices for both new and secondhand vessels. The strength of the shipping industry in the past several years has been attributable, to a significant degree, to the rapid growth of the Chinese economy. Economic growth in China caused unprecedented demand for raw materials from Latin America, including iron ore, bauxite, soybeans, timber, zinc, manganese and copper. These raw materials generally are transported by ocean freight.

The growth of the Chinese economy stimulated growth in other Asian economies as well. Any pronounced slowdown or decline in the Chinese economy could be expected to have significant adverse effects on the economies of Latin American and Asian countries and on the demand for our services and could be expected to result in declines in freight rates and the value of our vessels. We expect that a significant decline in the Asian and Latin American economies would have a materially adverse effect on our results of operations.

High or volatile oil prices could adversely affect the global economy and our results of operations.

As oil prices continue to fluctuate, and experience periods of prolonged volatility, the global economy could weaken significantly. A global recession would significantly reduce the demand for ocean freight while our fuel costs could increase. A significant reduction in the demand for ocean freight combined with increased fuel costs would have a material and adverse impact on our results of operations and financial condition.

Acts of piracy on ocean-going vessels have increased recently in frequency and magnitude, which could

adversely affect our business.

Beginning in 2008, acts of piracy have risen steeply. While international efforts have been and continue to be made to prevent them, acts of piracy continue to occur, particularly off the coast of Somalia in the Gulf of Aden and in the South China Sea. If piracy attacks occur in regions in which our vessels are deployed, that are characterized by insurers as ‘‘war risk’’ zones or ‘‘war and strikes’’ listed areas, premiums payable for such insurance coverage could increase significantly and such insurance coverage may be more difficult to obtain. Crew costs, including those due to employing on-board security guards, could increase in such circumstances. In addition, while we believe the time charterer remains liable for charter payments when a vessel is seized by pirates for the period specified in the charter agreement, the charterer may dispute this and withhold charter fees until the vessel is released. A charterer may also claim that a vessel seized by pirates was not "on-hire" for a certain number of days and it is therefore entitled to cancel the charter, a claim that we would dispute. The detention of any of our vessels hijacked as a result of an act of piracy and any unrecoverable costs, increases in insurance premiums payable, or losses due to the unavailability of insurance coverage, could have a material adverse impact on our business, financial condition, results of operations and cash flows.

In the highly competitive international shipping market, we may not be able to compete with new entrants or established companies with greater resources.

We employ our vessels in highly competitive markets that are capital-intensive and highly fragmented. Competition arises primarily from other vessel owners, many of whom have substantially greater resources than we have. Competition for the transportation of cargo by sea is intense and depends on price, location, size, age, condition and the acceptability of the vessel and its operators. Due in part to the highly fragmented market, competitors with greater resources could enter our market and operate larger fleets through consolidation or acquisitions and may be able to offer lower rates and higher quality vessels than we are able to offer.

Worldwide increases in shipping capacity may further reduce shipping rates, which could adversely affect our results of operations.