UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-22378

DoubleLine Funds Trust

(Exact name of Registrant as specified in charter)

2002 North Tampa Street, Suite 200

Tampa, FL 33602

(Address of principal executive offices) (Zip code)

Ronald R. Redell

President

DoubleLine Funds Trust

2002 North Tampa Street, Suite 200

Tampa, FL 33602

(Name and address of agent for service)

(813) 791-7333

Registrant’s telephone number, including area code

Date of fiscal year end: March 31

Date of reporting period: March 31, 2024

Item 1. Reports to Stockholders.

(a)

| | |

| |

| | Annual Report March 31, 2024 |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Class | | | | Class | | | | Class |

| | | | | I | | | | | | | | N | | | | | | | | R6 | | | | |

| | | Shares | | | | Shares | | | | Shares |

| | | | | |

DoubleLine Total Return Bond Fund | | DBLTX | | | | DLTNX | | | | DDTRX |

| | | | | |

DoubleLine Core Fixed Income Fund | | DBLFX | | | | DLFNX | | | | DDCFX |

| | | | | |

DoubleLine Emerging Markets Fixed Income Fund | | DBLEX | | | | DLENX | | | | – |

| | | | | |

DoubleLine Low Duration Bond Fund | | DBLSX | | | | DLSNX | | | | DDLDX |

| | | | | |

DoubleLine Floating Rate Fund | | DBFRX | | | | DLFRX | | | | – |

| | | | | |

DoubleLine Shiller Enhanced CAPE® | | DSEEX | | | | DSENX | | | | DDCPX |

| | | | | |

DoubleLine Flexible Income Fund | | DFLEX | | | | DLINX | | | | DFFLX |

| | | | | |

DoubleLine Low Duration Emerging Markets Fixed Income Fund | | DBLLX | | | | DELNX | | | | – |

| | | | | |

DoubleLine Long Duration Total Return Bond Fund | | DBLDX | | | | DLLDX | | | | – |

| | | | | |

DoubleLine Strategic Commodity Fund | | DBCMX | | | | DLCMX | | | | – |

| | | | | |

DoubleLine Global Bond Fund | | DBLGX | | | | DLGBX | | | | – |

| | | | | |

DoubleLine Infrastructure Income Fund | | BILDX | | | | BILTX | | | | – |

| | | | | |

DoubleLine Shiller Enhanced International CAPE® | | DSEUX | | | | DLEUX | | | | – |

| | | | | |

DoubleLine Emerging Markets Local Currency Bond Fund | | DBELX | | | | DLELX | | | | – |

| | | | | |

DoubleLine Income Fund | | DBLIX | | | | DBLNX | | | | – |

| | | | | |

DoubleLine Multi-Asset Trend Fund | | DBMOX | | | | DLMOX | | | | – |

DoubleLine || 2002 North Tampa Street, Suite 200 || Tampa, FL 33602 || (813) 791-7333

fundinfo@doubleline.com || www.doubleline.com

| | | | | | | | | | |

| | | | Annual Report | | | | | March 31, 2024 | | 3 |

| | |

President’s Letter | | (Unaudited) March 31, 2024 |

Dear Shareholder,

On behalf of the DoubleLine Funds, I am pleased to deliver the Annual Report for the 12-month period ended March 31, 2024. On the following pages, you will find specific information regarding each Fund’s operation and holdings. In addition, we discuss each Fund’s investment performance and main drivers of that performance during the reporting period.

Over the 12-month period, financial markets, including many of the asset classes and sectors in which the DoubleLine Funds invest, experienced strong returns amid improved risk sentiment. Stocks rallied while bond returns were muted, as represented respectively by the S&P 500® Index’s 29.88% return and Bloomberg US Aggregate Bond Index’s 1.70% return. A broad trend in fixed income was lower-rated credit and floating-rate sectors outperforming traditional sectors, driven primarily by high interest income and lower interest-rate sensitivity, with large return dispersion across subsectors.

The Federal Reserve continued to tighten monetary policy at the beginning of the period, including what appears to have been the last increase in this hiking cycle in July, which raised the federal funds rate to a range of 5.25% to 5.50%. At the start of the period, market participants’ expectations for the path of monetary policy, as tracked by the Bloomberg World Interest Rate Probability function, were largely at odds with the Fed’s forecast published in its quarterly Summary of Economic Projections (SEP). However, by the close of the period, market expectations ultimately converged with those of the SEP, in which the median projection for the federal funds rate was for three cuts of 25 basis points (bps) each by year-end 2024.

Broadly speaking, economic fundamentals were largely resilient during the reporting period. U.S. gross domestic product (GDP) was positive on a year-over-year (YoY) and quarter-over-quarter (QoQ) basis across the final three quarters of 2023, with the strongest YoY print at a 3.1% seasonally adjusted annualized rate for the fourth quarter. Domestic growth was buoyed by a robust labor

market across the 12-month period, as the U-3 unemployment rate finished the period at 3.8%, just 0.4% above the measure’s lowest reading in over 50 years. The labor market still appeared tight by historical standards, as Job Openings and Labor Turnover Survey data for February showed the ratio of vacancies per unemployed jobseeker to be 1.45. A strong labor market and relatedly strong consumer have contributed to higher growth estimates, with first quarter real GDP forecast to grow at a seasonally adjusted annualized rate of 2.0% QoQ. Survey-based measures of economic activity similarly show resilience, with the ISM Services PMI and ISM Manufacturing PMI registering in expansionary territory as of March. One outlier is the Conference Board Leading Economic Index, which has been negative for some time and at a level historically associated with recession.

Over the 12-month period, the two-year U.S. Treasury yield rose 59 bps, the five-year yield rose 64 bps, the 10-year yield rose 73 bps, and the 30-year yield rose 69 bps. Traditional fixed-income sectors, including Treasuries and Agency mortgage-backed securities (MBS) were impacted by rising interest rates across the Treasury curve. Disparate returns throughout the fixed income universe were largely attributable to duration risk, as Treasuries and Agency MBS experienced muted positive returns while corporate bonds outperformed, driven by spread tightening amid strong corporate earnings. Sovereign bonds from developed markets (DMs) posted negative returns while sovereign bonds from emerging markets (EMs) were among the best-performing sectors in the global fixed-income landscape.

The European Central Bank hiked its deposit facility rate 100 bps over the period, with the most recent hike in September pushing the rate to 4.00% from 3.75%. Most of the DM countries, absent Japan, followed similar tightening paths during the period. Monetary policy and inflation differentiation between EM and DM countries became an increasingly relevant theme. EM central banks broadly moved earlier and more aggressively in raising rates in response to inflationary pressure.

| | |

| | | (Unaudited) March 31, 2024 |

Disinflation subsequently allowed EM central banks to ease rates, which should bode well for EM growth. While geopolitical tensions remained a risk across the period, any threat of escalation seemed to be brushed off by markets generally.

In China, weak consumer demand and a prolonged slowdown in the property sector continued to hamper confidence during the period in the world’s second largest economy despite piecemeal stimulus measures from policymakers in the second half of 2023 and first quarter of 2024. In March, the People’s Bank of China announced an ambitious economic growth target of 5%, citing further stimulus measures in monetary, fiscal and regulatory policy. The Bank of Japan at its March meeting delivered on a well-telegraphed message and removed its negative interest-rate policy and ended its yield curve control.

As we look toward the remainder of 2024 and beyond, we believe the Fed and other DM central banks will eye the second half of the year for an opening to relax monetary policy. The conditions that could permit the start of a cutting cycle still seem tied to the degree of confidence the Fed, and other central banks, will have that inflation will not reaccelerate.

The DoubleLine investment team strives to deliver attractive risk-adjusted returns to our investors through full economic cycles and variable interest-rate

environments using a time-tested process. We are confident in our ability to take advantage of future opportunities by drawing upon the extensive experience of our team.

If you have any questions regarding the DoubleLine Funds, please don’t hesitate to call us at 1 (877) DLINE 11 / 1 (877) 354-6311 or visit our website www.doubleline.com, where our investment management team offers deeper insights and analysis on relevant capital market activity impacting investors today.

Thank you for your continued support and entrusting DoubleLine with your investments. We deeply value your trust, and we will continue to work diligently to meet your broad investment needs.

Sincerely,

Ronald R. Redell, CFA

President

DoubleLine Funds Trust

May 1, 2024

| | | | | | | | | | |

| | | | Annual Report | | | | | March 31, 2024 | | 5 |

| | |

Management’s Discussion of Fund Performance | | (Unaudited) March 31, 2024 |

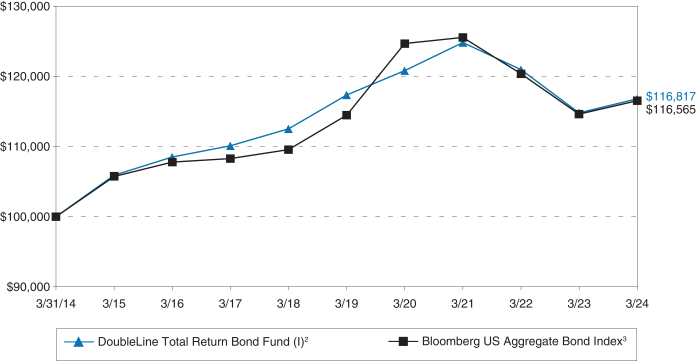

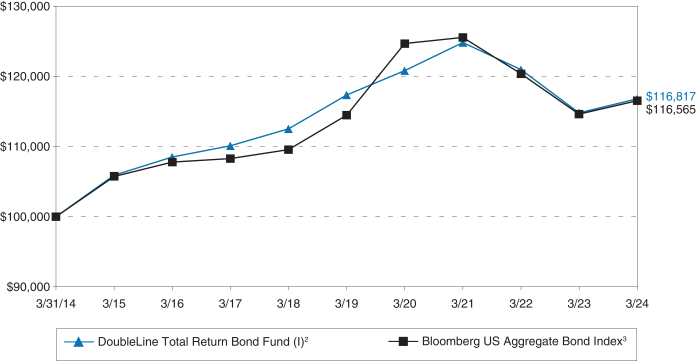

DoubleLine Total Return Bond Fund

For the 12-month period ended March 31, 2024, the DoubleLine Total Return Bond Fund’s Class I shares outperformed the benchmark Bloomberg US Aggregate Bond Index return of 1.70%. The biggest contributor to Fund performance was the Fund’s overweight relative to the index to securitized credit, including non-Agency residential mortgage-backed securities (MBS), non-Agency commercial MBS, asset-backed securities and collateralized loan obligations, all of which outperformed investment grade corporate bonds in the index. The Fund’s government-backed exposure, including U.S. Treasuries and Agency MBS, which generally exhibited longer durations than the Treasuries and Agency MBS in the index, detracted from performance, as Treasury rates rose in the period.

| | | | | | | | |

| | |

| 12-Month Period Ended 3-31-24 | | | | | 12-months | |

| | |

I Share | | | | | | | 1.75% | |

| | |

N Share | | | | | | | 1.50% | |

| | |

R6 Share | | | | | | | 1.81% | |

| | |

Bloomberg US Aggregate Bond Index* | | | | | | | 1.70% | |

| * | Reflects no deduction for fees, expenses, or taxes. |

For additional performance information, please refer to the “Standardized Performance Summary.”

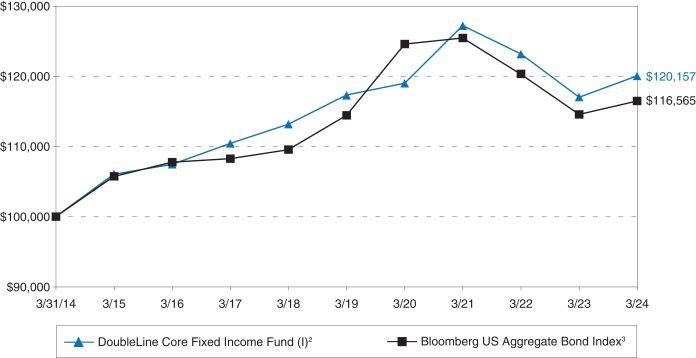

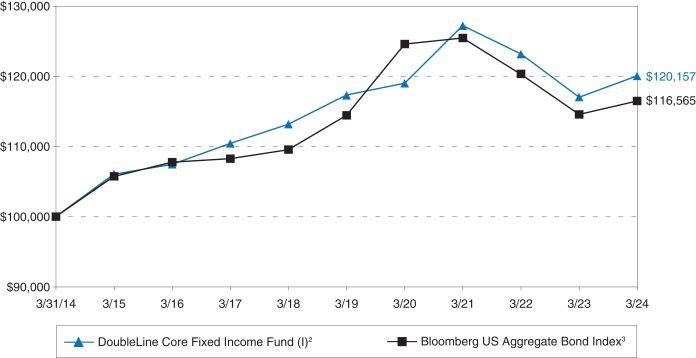

DoubleLine Core Fixed Income Fund

For the 12-month period ended March 31, 2024, the DoubleLine Core Fixed Income Fund outperformed the benchmark Bloomberg US Aggregate Bond Index return of 1.70%. The biggest contributor to Fund performance was its overweight relative to the index to credit-sensitive debt. Non-Agency residential mortgage-backed securities (MBS), non-Agency commercial MBS, asset-backed securities, collateralized loan obligations, bank loans, high yield and investment grade (IG) corporate bonds, and emerging markets debt all outperformed IG corporate bonds within the index. The Fund’s average duration in the period was slightly shorter than the index’s, which contributed to the Fund’s relative outperformance. During the period, U.S. Treasury rates rose in the period, which resulted in Treasuries and Agency MBS in the Fund detracting from performance.

| | | | | | | | |

| | |

| 12-Month Period Ended 3-31-24 | | | | | 12 months | |

| | |

I Share | | | | | | | 2.60% | |

| | |

N Share | | | | | | | 2.46% | |

| | |

R6 Share | | | | | | | 2.74% | |

| | |

Bloomberg US Aggregate Bond Index* | | | | | | | 1.70% | |

| * | Reflects no deduction for fees, expenses, or taxes. |

For additional performance information, please refer to the “Standardized Performance Summary.”

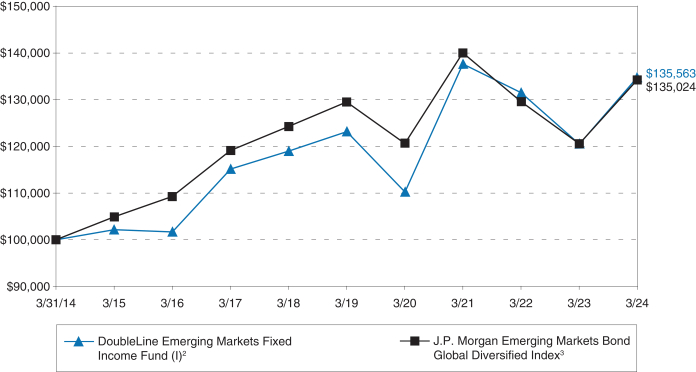

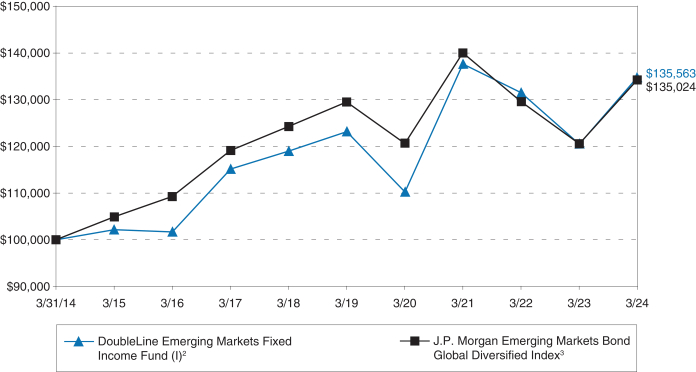

DoubleLine Emerging Markets Fixed Income Fund

For the 12-month period ended March 31, 2024, the DoubleLine Emerging Markets Fixed Income Fund outperformed the benchmark J.P. Morgan Emerging Markets Bond Global Diversified Index return of 11.28%. The strong index performance was primarily driven by spread tightening, particularly within the high yield subsector as default risk in several frontier market economies subsided after policymakers undertook significant policy adjustments. The biggest contributor to Fund performance was the Fund’s overweight relative to the index to India, Brazil and Colombia. The biggest detractor was the Fund’s underweight to Argentina and the region of Africa, the best-performing region in the index.

| | | | | | | | |

| | |

| 12-Month Period Ended 3-31-24 | | | | | 12 months | |

| | |

I Share | | | | | | | 11.78% | |

| | |

N Share | | | | | | | 11.37% | |

| | |

J.P. Morgan Emerging Markets Bond Global Diversified Index* | | | | | | | 11.28% | |

| * | Reflects no deduction for fees, expenses, or taxes. |

For additional performance information, please refer to the “Standardized Performance Summary.”

| | |

| | | (Unaudited) March 31, 2024 |

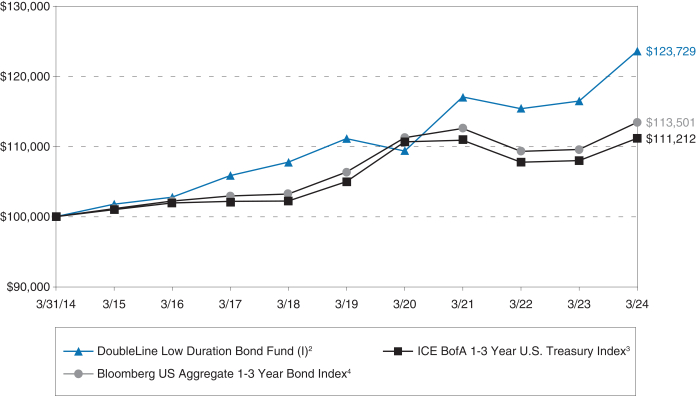

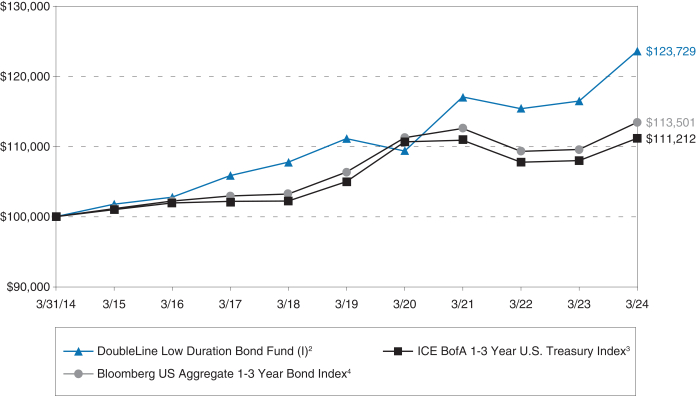

DoubleLine Low Duration Bond Fund

For the 12-month period ended March 31, 2024, the DoubleLine Low Duration Bond Fund outperformed the benchmark ICE BofA 1-3 Year U.S. Treasury Index return of 2.97% as all holdings within the Fund contributed to performance. The biggest contributor was the Fund’s overweight relative to the index to nontraditional credit sectors, which outperformed U.S. Treasuries in the index. Those nontraditional sectors included non-Agency residential mortgage-backed securities (MBS), non-Agency commercial MBS, asset-backed securities, collateralized loan obligations, bank loans and emerging markets debt. The Fund’s allocations to Treasuries and Agency MBS were the laggards to performance, but they outperformed Treasuries in the index. Treasury rates rose across the yield curve in the period, benefiting relative performance of the Fund, as the Fund’s average duration was less than the index’s average duration.

| | | | | | | | |

| | |

| 12-Month Period Ended 3-31-24 | | | | | 12 months | |

| | |

I Share | | | | | | | 6.16% | |

| | |

N Share | | | | | | | 5.90% | |

| | |

R6 Share | | | | | | | 6.20% | |

| | |

ICE BofA 1-3 Year U.S. Treasury Index*, ** | | | | | | | 2.97% | |

| | |

Bloomberg US Aggregate 1-3 Year Bond Index** | | | | | | | 3.56% | |

| * | Beginning in July 2022, transaction costs were incorporated into the calculation of total return for ICE fixed income indices. |

| ** | Reflects no deduction for fees, expenses, or taxes. |

For additional performance information, please refer to the “Standardized Performance Summary.”

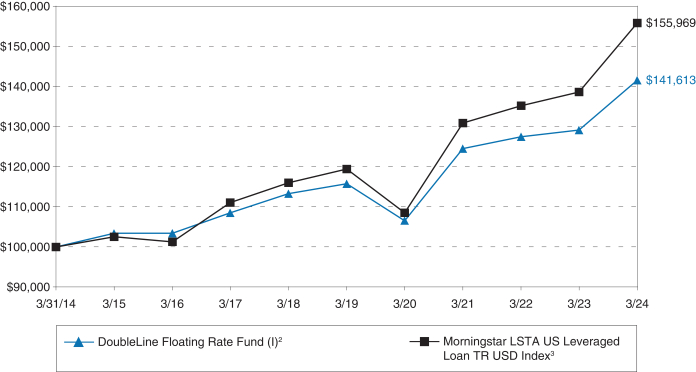

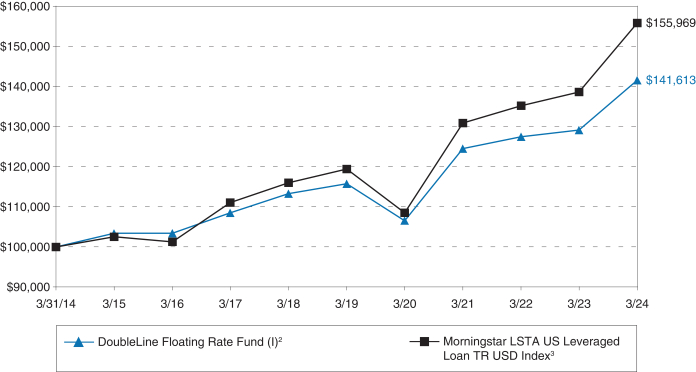

DoubleLine Floating Rate Fund

For the 12-month period ended March 31, 2024, the DoubleLine Floating Rate Fund posted positive performance but underperformed the benchmark Morningstar LSTA US Leveraged Loan TR USD Index return of 12.47%. Risk markets rebounded from depressed levels in the period as economic growth indicators remained resilient and the Federal Reserve ended its hiking campaign. Accordingly, the riskiest segments of the markets rebounded the most. The biggest contributor to Fund performance was its underweight relative to the index to the telecommunication services and media and entertainment sectors. Among the biggest detractors to Fund performance was the Fund’s underweight to bank loans rated CCC, which returned 18.97% in the period. Also detracting was the Fund’s exposure to certain software names that experienced competitive pressure and certain healthcare providers that struggled with inflationary costs.

| | | | | | | | |

| | |

| 12-Month Period Ended 3-31-24 | | | | | 12 months | |

| | |

I Share* | | | | | | | 9.61% | |

| | |

N Share* | | | | | | | 9.43% | |

| | |

Morningstar LSTA US Leveraged Loan TR USD Index** | | | | | | | 12.47% | |

| * | The Floating Rate Fund imposes a 1.00% redemption fee on all share classes if shares are sold within 90 days of purchase. Performance data does not reflect the redemption fee. If it had, returns would be reduced. |

| ** | Reflects no deduction for fees, expenses, or taxes. |

For additional performance information, please refer to the “Standardized Performance Summary.”

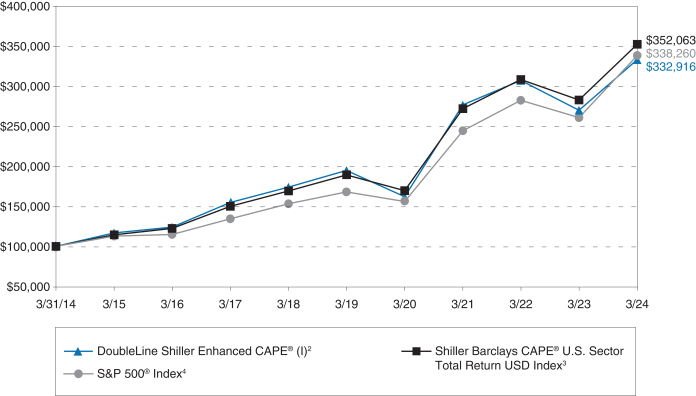

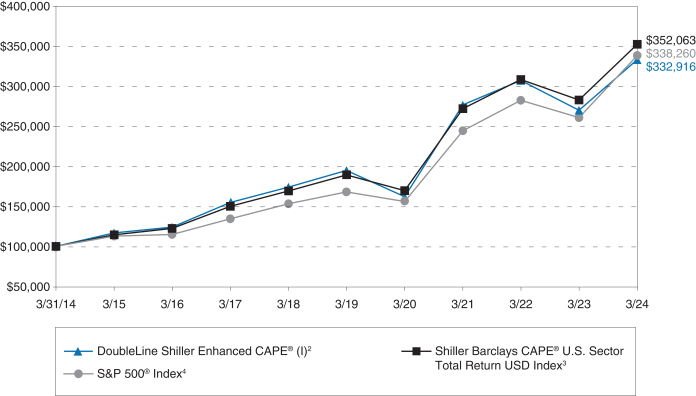

DoubleLine Shiller Enhanced CAPE®

For the 12-month period ended March 31, 2024, the DoubleLine Shiller Enhanced CAPE® posted positive performance but underperformed the benchmark S&P 500® Index return of 29.88%. During the period, the Shiller Barclays CAPE® U.S. Sector Total Return USD Index, to which the Fund gained exposure through the use of swap contracts, was allocated to seven sectors: communication services, consumer discretionary, consumer staples, financials, healthcare, materials and real estate. The communication services and financials allocations were the biggest contributors to Fund performance while real estate and consumer staples were the biggest detractors. The Fund’s fixed income portfolio increased in value during the period, with all holdings contributing to Fund performance. The biggest

| | | | | | | | | | |

| | | | Annual Report | | | | | March 31, 2024 | | 7 |

| | |

Management’s Discussion of Fund Performance (Cont.) | | |

contributor by sector to portfolio performance was collateralized loan obligations; the biggest laggard was commercial mortgage-backed securities.

| | | | | | | | |

| | |

| 12-Month Period Ended 3-31-24 | | | | | 12 months | |

| | |

I Share | | | | | | | 23.36% | |

| | |

N Share | | | | | | | 23.07% | |

| | |

R6 Share | | | | | | | 23.41% | |

| | |

S&P 500® Index* | | | | | | | 29.88% | |

| | |

Shiller Barclays CAPE® U.S. Sector Total Return USD Index* | | | | | | | 24.68% | |

| * | Reflects no deduction for fees, expenses, or taxes. |

For additional performance information, please refer to the “Standardized Performance Summary.”

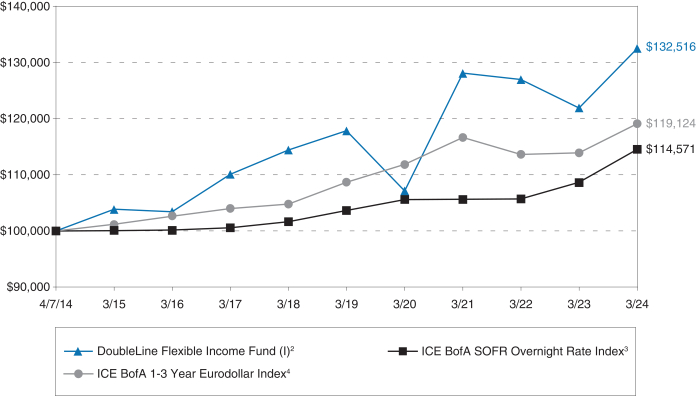

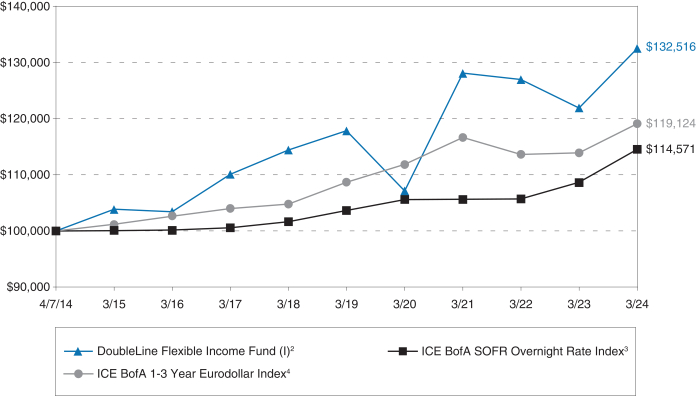

DoubleLine Flexible Income Fund

For the 12-month period ended March 31, 2024, the DoubleLine Flexible Income Fund outperformed the benchmark ICE BofA 1-3 Year Eurodollar Index return of 4.56%. Overall risk-on sentiment in the markets benefited credit-sensitive debt in the form of credit spread compression. All sectors of the Fund contributed to performance. U.S. Treasury yields increased across the curve in the period, which benefited the two floating-rate security types in the Fund, bank loans and collateralized loan obligations. Non-Agency residential mortgage-backed securities, in conjunction with the floating-rate sectors, were the biggest contributors by sector to Fund performance. Non-Agency commercial mortgage-backed securities provided positive returns over the period but contributed the least to Fund performance.

| | | | | | | | |

| | |

| 12-Month Period Ended 3-31-24 | | | | | 12 months | |

| | |

I Share | | | | | | | 8.69% | |

| | |

N Share | | | | | | | 8.42% | |

| | |

R6 Share | | | | | | | 8.73% | |

| | |

ICE BofA 1-3 Year Eurodollar Index* | | | | | | | 4.56% | |

| | |

ICE BofA SOFR Overnight Rate Index* | | | | | | | 5.44% | |

| * | Reflects no deduction for fees or taxes. Beginning in July 2022, transaction costs were incorporated into the calculation of total return for ICE fixed income indexes. |

For additional performance information, please refer to the “Standardized Performance Summary.”

DoubleLine Low Duration Emerging Markets Fixed Income Fund

For the 12-month period ended March 31, 2024, the DoubleLine Low Duration Emerging Markets Fixed Income Fund posted positive performance but underperformed the benchmark J.P. Morgan Corporate Emerging Markets Bond Index Broad Diversified 1-3 Year Index return of 8.45%. The strong performance of the index was driven by spread tightening. The biggest contributor to Fund performance was its overweight relative to the index to Latin America, which was among the best-performing regions in the index, and underweight to the Middle East, a laggard among its regional peers. The biggest detractors to Fund performance, relative to the index, were its longer duration and overweight to investment grade credits, which significantly underperformed their high yield counterparts in a period of risk-on sentiment.

| | | | | | | | |

| | |

| 12-Month Period Ended 3-31-24 | | | | | 12 months | |

| | |

I Share | | | | | | | 8.23% | |

| | |

N Share | | | | | | | 8.07% | |

| | |

J.P. Morgan CEMBI Broad Diversified 1-3 Year Index * | | | | | | | 8.45% | |

| * | Reflects no deduction for fees, expenses, or taxes. |

For additional performance information, please refer to the “Standardized Performance Summary.”

| | |

| | | (Unaudited) March 31, 2024 |

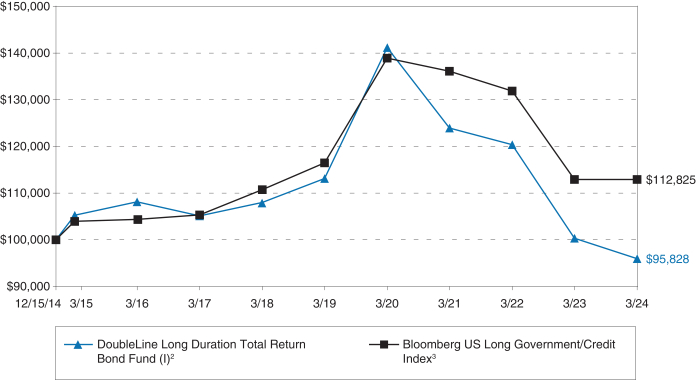

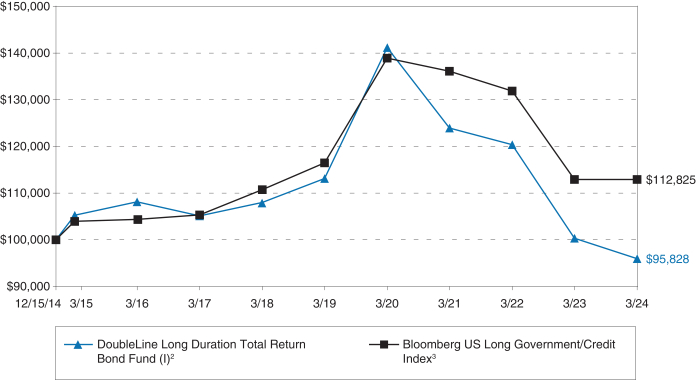

DoubleLine Long Duration Total Return Bond Fund

For the 12-month period ended March 31, 2024, the DoubleLine Long Duration Total Return Bond Fund underperformed the benchmark Bloomberg US Long Government/Credit Index return of negative 1.15%. The best-performing sector in the index was long-duration corporate bonds, which the Fund did not own, as it utilizes long-duration Agency mortgage-backed securities in lieu of corporate bonds. The biggest contributor by sector to Fund performance was Agency mortgage-backed securities, which generated a modest positive return. The biggest detractors were its allocation to U.S. Treasuries that were longer in duration than those in the index and lack of exposure to corporate bonds. The Fund’s average duration was 14.2 years for the period, slightly shorter than the index’s 14.4 years, which benefited Fund performance in a period of rising interest rates.

| | | | | | | | |

| | |

| 12-Month Period Ended 3-31-24 | | | | | 12 months | |

| | |

I Share | | | | | | | -4.39% | |

| | |

N Share | | | | | | | -4.63% | |

| | |

Bloomberg US Long Government/Credit Index* | | | | | | | -1.15% | |

| * | Reflects no deduction for fees, expenses, or taxes. |

For additional performance information, please refer to the “Standardized Performance Summary.”

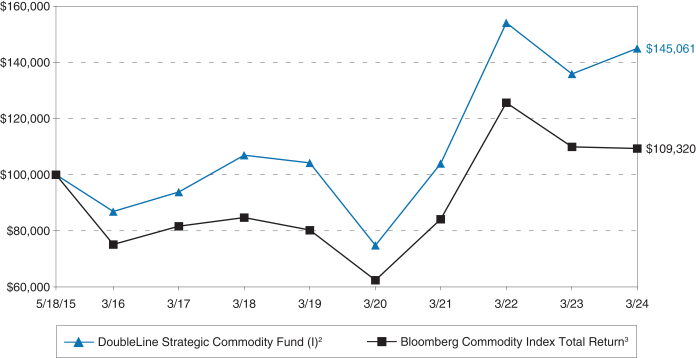

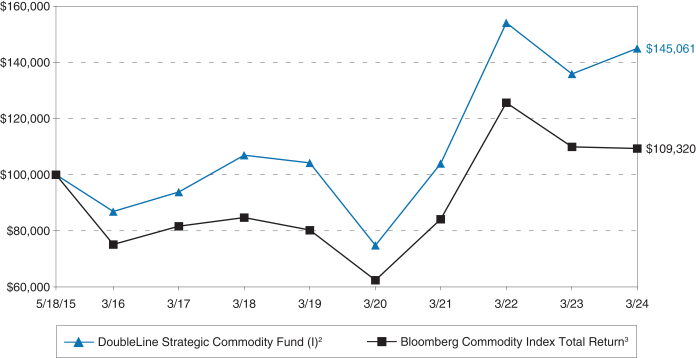

DoubleLine Strategic Commodity Fund

For the 12-month period ended March 31, 2024, the DoubleLine Strategic Commodity Fund posted positive performance and outperformed the benchmark Bloomberg Commodity (BCOM) Index Total Return return of negative 0.56%. During the period, the Fund was allocated to the Morgan Stanley Backwardation Focused Multi-Commodity Index (MSBFMCI beta exposure) and the DoubleLine Commodity Long Short Strategy (DCLSS alpha exposure), which the Fund gained exposure to through the use of swap contracts. The Fund’s MSBFMCI exposure decreased in value during the period, detracting from Fund performance. The DCLSS increased in value, contributing to Fund performance. The Fund’s outperformance relative to the BCOM Index Total Return was driven by the positive return of the DCLSS and the less-negative performance of the MSBFMCI relative to the BCOM Index Total Return. The Fund’s use of derivative instruments to gain exposure to commodities facilitated investment of the Fund’s remaining assets in U.S. Treasuries, which increased in value during the period.

| | | | | | | | |

| | |

| 12-Month Period Ended 3-31-24 | | | | | 12 months | |

| | |

I Share | | | | | | | 6.72% | |

| | |

N Share | | | | | | | 6.50% | |

| | |

Bloomberg Commodity Index Total Return* | | | | | | | -0.56% | |

| * | Reflects no deduction for fees, expenses, or taxes. |

For additional performance information, please refer to the “Standardized Performance Summary.”

DoubleLine Global Bond Fund

For the 12-month period ended March 31, 2024, the DoubleLine Global Bond Fund’s Class I shares performed in line with the benchmark FTSE World Government Bond Index return of negative 0.83%. The negative performance of the Fund and index was driven by a continued rise in global bond yields and foreign exchange market depreciation against the U.S. dollar, as measured by the U.S. Dollar Index. The dollar strengthened in the period against its G-10 peers as upside surprises in U.S. economic data led investors to curb bets for when the Federal Reserve might begin easing monetary policy. The biggest contributors to Fund performance were its shorter duration and overweight to Mexico relative to the index, and its cash balance. The biggest detractor was the Fund’s underweight to developed Europe, in particular a lack of exposure to Italy.

| | | | | | | | |

| | |

| 12-Month Period Ended 3-31-24 | | | | | 12 months | |

| | |

I Share | | | | | | | -0.83% | |

| | |

N Share | | | | | | | -1.19% | |

| | |

FTSE World Government Bond Index* | | | | | | | -0.83% | |

| * | Reflects no deduction for fees, expenses, or taxes. |

For additional performance information, please refer to the “Standardized Performance Summary.”

| | | | | | | | | | |

| | | | Annual Report | | | | | March 31, 2024 | | 9 |

| | |

Management’s Discussion of Fund Performance (Cont.) | | |

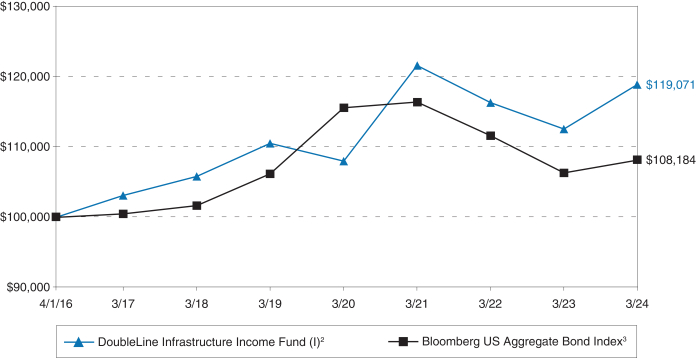

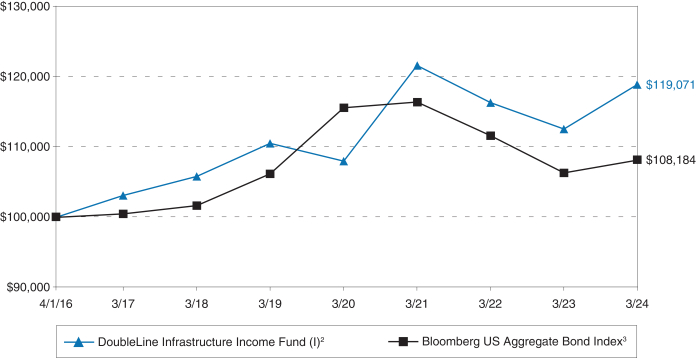

DoubleLine Infrastructure Income Fund

For the 12-month period ended March 31, 2024, the DoubleLine Infrastructure Income Fund outperformed the Bloomberg US Aggregate Bond Index return of 1.70%. The biggest contributor to Fund performance was duration positioning, as the Fund tactically maintained a lower duration than the index in a period of rising interest rates. The biggest contributors to Fund performance by sector were securitized infrastructure exposures, including senior aviation securitizations. Despite contributing positively to Fund performance, corporate infrastructure exposures lagged their securitized counterparts. However, income and spread return on these holdings overcame the adverse duration impacts of rising interest rates, generating strong relative and absolute performance.

| | | | | | | | |

| | |

| 12-Month Period Ended 3-31-24 | | | | | 12 months | |

| | |

I Share | | | | | | | 5.68% | |

| | |

N Share | | | | | | | 5.42% | |

| | |

Bloomberg US Aggregate Bond Index* | | | | | | | 1.70% | |

| * | Reflects no deduction for fees, expenses, or taxes. |

For additional performance information, please refer to the “Standardized Performance Summary.”

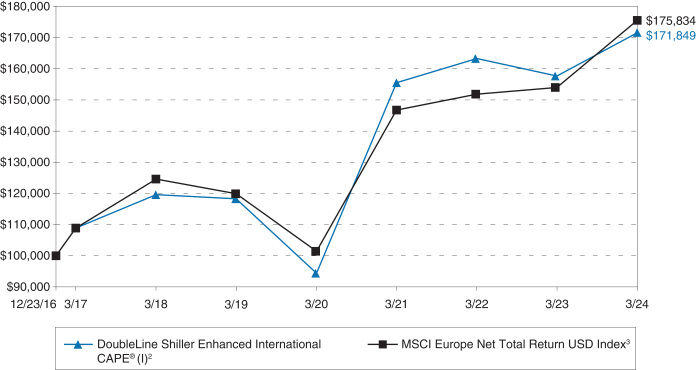

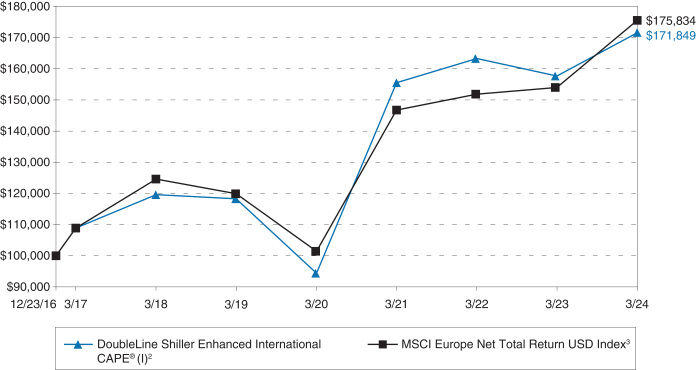

DoubleLine Shiller Enhanced International CAPE®

For the 12-month period ended March 31, 2024, DoubleLine Shiller Enhanced International CAPE® posted positive performance but underperformed the broad European equity market as measured by the benchmark MSCI Europe Net Total Return USD Index return of 14.11%. During the period, the Shiller Barclays CAPE® Europe Sector Net TR NoC USD Index, which the Fund gained exposure to through the use of swap contracts, was allocated to eight sectors: consumer discretionary, consumer staples, financials and real estate, healthcare, information technology, materials, communication services and utilities. Healthcare was the biggest contributor to Fund performance while communication services was the biggest detractor. The Fund’s fixed income portfolio increased in value during the period, contributing to Fund performance. The biggest contributor by sector to portfolio performance was collateralized loan obligations while the biggest laggard was U.S. government securities, but both contributed to portfolio performance.

| | | | | | | | |

| | |

| 12-Month Period Ended 3-31-24 | | | | | 12 months | |

| | |

I Share | | | | | | | 8.88% | |

| | |

N Share | | | | | | | 8.59% | |

| | |

MSCI Europe Net Total Return USD Index* | | | | | | | 14.11% | |

| * | Reflects no deduction for fees, expenses, or taxes. |

For additional performance information, please refer to the “Standardized Performance Summary.”

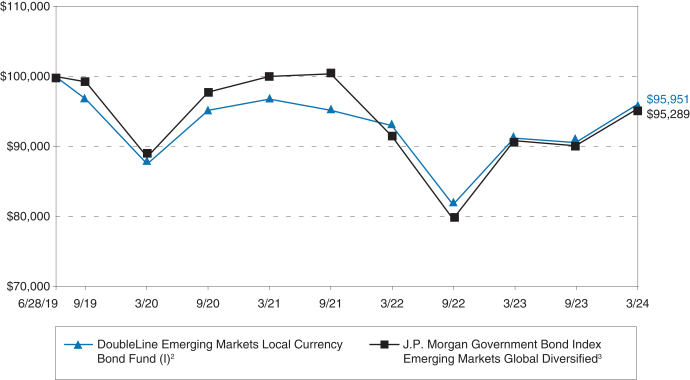

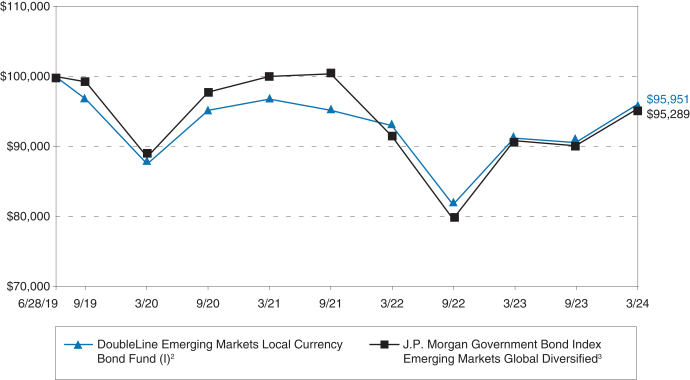

DoubleLine Emerging Markets Local Currency Bond Fund

For the 12-month period ended March 31, 2024, the DoubleLine Emerging Markets Local Currency Bond Fund outperformed the benchmark J.P. Morgan Government Bond Index Emerging Markets Global Diversified return of 4.91%. The performance of the index was driven primarily by its Latin America exposure. Among the biggest contributors to Fund performance was its shorter duration relative to the index in a period of rising interest rates. Also contributing was the Fund’s underweight relative to the index to emerging Asia, and security selection in Central and Eastern Europe, in particular, its lack of exposure to Turkey. The biggest detractor was the Fund’s underweight relative to the index to Colombia.

| | | | | | | | |

| | |

| 12-Month Period Ended 3-31-24 | | | | | 12 months | |

| | |

I Share | | | | | | | 5.21% | |

| | |

N Share | | | | | | | 5.10% | |

| | |

J.P. Morgan GBI-EM GD* | | | | | | | 4.91% | |

| * | Reflects no deduction for fees, expenses, or taxes. |

For additional performance information, please refer to the “Standardized Performance Summary.”

| | | | | | | | | | |

| 10 | | DoubleLine Funds Trust | | | | | | | | |

| | |

| | | (Unaudited) March 31, 2024 |

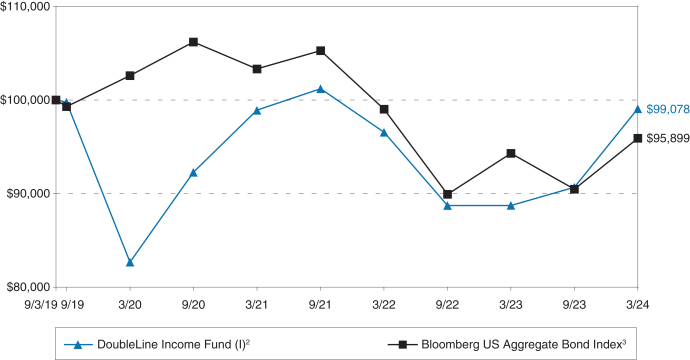

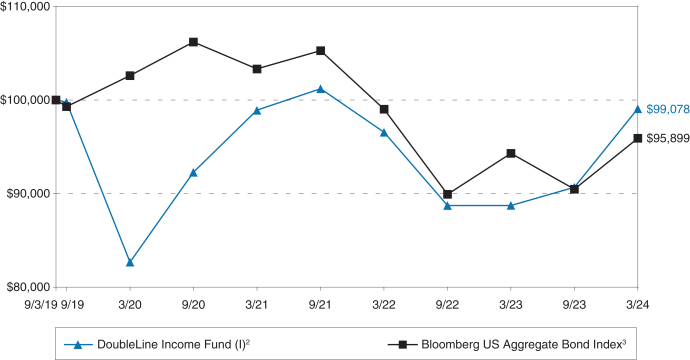

DoubleLine Income Fund

For the 12-month period ended March 31, 2024, the DoubleLine Income Fund outperformed the Bloomberg US Aggregate Bond Index return of 1.70%. The biggest contributors to Fund performance were asset allocation and duration positioning. The Fund’s diversified mix of subordinated, short-duration securitized credit outperformed the various components of the index. The biggest contributor to Fund performance by sector was collateralized loan obligations, as the asset class experienced spread compression and high interest income due to its coupons that reference short-term interest rates. The biggest laggard was Agency mortgage-backed securities, which generated a positive return but was the only Fund asset class to underperform the index.

| | | | | | | | |

| | |

| 12-Month Period Ended 3-31-24 | | | | | 12 months | |

| | |

I Share | | | | | | | 11.67% | |

| | |

N Share | | | | | | | 11.38% | |

| | |

Bloomberg US Aggregate Bond Index* | | | | | | | 1.70% | |

| * | Reflects no deduction for fees, expenses, or taxes. |

For additional performance information, please refer to the “Standardized Performance Summary.”

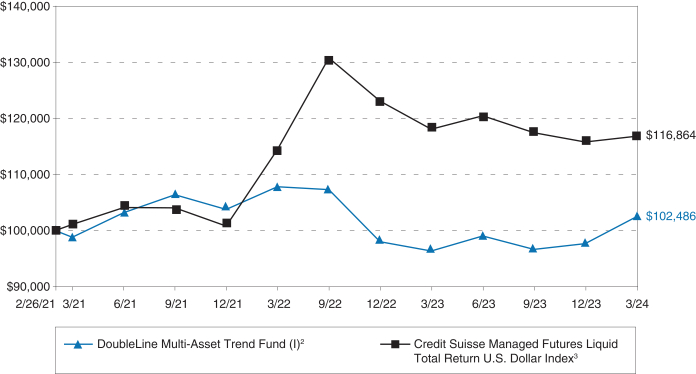

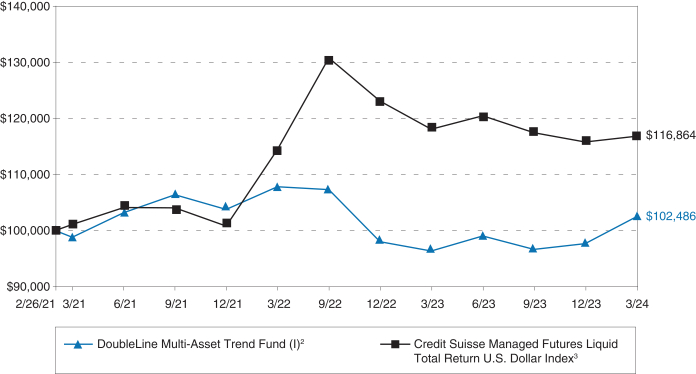

DoubleLine Multi-Asset Trend Fund

For the 12-month period ended March 31, 2024, the DoubleLine Multi-Asset Trend Fund posted positive performance and outperformed the benchmark Credit Suisse Managed Futures Liquid Total Return U.S. Dollar Index return of negative 1.07%. During the period, the Fund’s exposure to trend-following investments was obtained through the use of swap contracts referencing the BNP Paribas Multi-Asset Trend Index, which returned negative 0.08%. The biggest contributors to index performance were its equity exposures; the biggest detractors were commodity exposures. The Fund’s fixed income portfolio was the main contributor to Fund performance. The biggest contributor by sector to portfolio performance was bank loans while the biggest laggard was U.S. government securities, but both contributed to portfolio performance.

| | | | | | | | |

| | |

| 12-Month Period Ended 3-31-24 | | | | | 12 months | |

| | |

I Share | | | | | | | 6.37% | |

| | |

N Share | | | | | | | 5.97% | |

| | |

Credit Suisse Managed Futures Liquid Total Return USD Index* | | | | | | | -1.07% | |

| * | Reflects no deduction for fees, expenses, or taxes. |

For additional performance information, please refer to the “Standardized Performance Summary.”

Past Performance is not a guarantee of future results.

Opinions expressed herein are as of March 31, 2024, and are subject to change at any time, are not guaranteed and should not be considered investment advice. This report is for the information of shareholders of the Funds. It may also be used as sales literature when preceded or accompanied by the current prospectus.

A Fund’s investment objectives, risks, charges and expenses must be considered carefully before investing. You can obtain a Fund’s current prospectus and certain other regulatory filings by calling 1 (877) DLINE 11 / 1 (877) 354-6311, or visiting www.doubleline.com. You should read the prospectus and other filings carefully before investing.

The performance information shown assumes the reinvestment of all dividends and distributions. Investment performance reflects management fees and other fund expenses, including any applicable fee waivers that are in effect with respect to a particular Fund. In the absence of such waivers, total return would be reduced. Returns over 1 year are average annual returns. Performance data quoted represents past performance; past performance does not guarantee future results and does not reflect the deduction of any taxes a shareholder would pay on fund distributions or the sale of fund shares. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. Current performance of the Fund may be lower or higher than the performance quoted. The Funds’ gross and net expense ratios shown are from the most recent prospectus and may change over time. See the financial highlights section of the financial statements for more recent expense ratios. The Funds’ gross and net expense ratios also include “acquired fund fees and expenses,” which are expenses incurred indirectly as a result of a Fund’s investments in one or more underlying funds, including ETFs and money market funds. Because these costs are indirect, the expense ratios will not correlate to the expense ratios in the Funds’ financial statements, since financial statements only include direct costs of the Funds and not indirect costs of investing in the underlying funds. Performance data current to the most recent month-end may be obtained by calling 1 (877) DLINE 11 / 1 (877) 354-6311 or by visiting www.doubleline.com.

Fund holdings and sector allocations are subject to change at any time and are not recommendations to buy or sell any security. Please refer to the Schedules of Investments for a complete list of Fund holdings as of period end.

Mutual fund investing involves risk. Principal loss is possible.

Investments in securities related to real estate may decline in value as a result of factors affecting the real estate industry. Investments in debt securities typically decline in value when interest rates rise. This risk is usually greater for longer-term debt securities. Investments in asset-backed and mortgage-backed securities include additional risks that investors should be aware of including credit risk, prepayment risk, possible illiquidity and default, as well as increased susceptibility to

| | | | | | | | | | |

| | | | Annual Report | | | | | March 31, 2024 | | 11 |

| | |

Management’s Discussion of Fund Performance (Cont.) | | |

adverse economic developments. The Funds may invest in foreign securities (or derivatives which give exposure to foreign securities) which involve greater volatility and political, economic and currency risks and differences in accounting methods. These risks are greater for investments in emerging markets. Investments in lower rated and non-rated securities present a greater risk of loss to principal and interest than higher rated securities. Commodity-linked derivative instruments may involve additional costs and risks such as changes in commodity index volatility or factors affecting a particular industry or commodity, such as drought, floods, weather, livestock disease, embargoes, tariffs and international economic, political and regulatory developments. Investing in derivatives could result in losing more than the amount invested. Derivatives involve risks different from, and in certain cases, greater than the risks presented by more traditional investments. Derivatives may involve certain costs and risks such as liquidity, interest rate, market, credit, management and the risk that a position could not be closed when most advantageous. Investing in derivatives could lose more than the amount invested. Equities may decline in value due to both real and perceived general market, economic, and industry conditions. Exchange-traded fund investments involve additional risks such as the market price trading at a discount to its net asset value, an active secondary trading market may not develop or be maintained, or trading may be halted by the exchange in which they trade, which may impact a fund’s ability to sell its shares. Floating rate loans and other floating rate investments are subject to credit risk, interest rate risk, counterparty risk and financial services risks, among others. In addition, the Funds may invest in other asset classes and investments such as, among others, REITs, credit default swaps, short sales, derivatives and smaller companies which include additional risks. Investment strategies may not achieve the desired results due to implementation lag, other timing factors, portfolio management decision-making, economic or market conditions or other unanticipated factors. Additional principal risks for the Funds can be found in the prospectus.

Diversification does not assure a profit or protect against loss in a declining market.

Earnings growth is not representative of a fund’s future performance.

Credit ratings from Moody’s Investor Services, Inc. (“Moody’s”) range from the highest rating of Aaa for bonds of the highest quality that offer the lowest degree of investment risk to the lowest rating of C for the lowest rated class of bonds. Credit ratings from S&P Global Ratings (“S&P”) range from the highest rating of AAA for bonds of the highest quality that offer the lowest degree of investment risk to the lowest rating of D for bonds that are in default. In limited situations when the rating agency has not issued a formal rating, the rating agency will classify the security as nonrated.

Credit ratings are determined from the highest available credit rating from any Nationally Recognized Statistical Rating Organization (“NRSRO”, generally S&P, Moody’s and Fitch Ratings, Inc.). DoubleLine chooses to display credit ratings using S&P’s rating convention, although the rating itself might be sourced from another NRSRO.

The reference and link to any websites in this Annual Report have been provided as a convenience, and the information contained on such websites is not incorporated by reference into this Annual Report.

Index Disclaimers

Shiller Barclays CAPE® Index Disclaimers

Barclays Capital Inc. and its affiliates (“Barclays”) is not the issuer, sponsor or promoter of DoubleLine Shiller Enhanced CAPE® or DoubleLine Shiller Enhanced International CAPE® (together, in this paragraph, the “Funds”) and Barclays has no responsibilities, obligations or duties to investors in the Funds. The Shiller Barclays CAPE® US Sector TR USD Index and Shiller Barclays CAPE® Europe Sector Net TR NoC USD Index (each an “Index” and together the “Indices”) consist of the respective trademarks of Barclays Bank PLC and trademarks owned by or licensed to RSBB-I, LLC and Barclays Bank PLC and that are licensed for use by DoubleLine Funds Trust as the issuer of the Funds (the “Issuer”). Barclays’ only relationship with the Issuer in respect of the Indices is the licensing of these trademarks and the Indices which are determined, composed and calculated by Barclays without regard to the Issuer or the Funds or the owners of the Funds. Additionally, DoubleLine Capital LP may for the Funds execute transaction(s) with Barclays in or relating to the Funds’ respective Index; Fund investors acquire interests solely in the respective Fund; Fund investors neither acquire any interest in that Fund’s respective Index nor enter into any relationship of any kind whatsoever with Barclays upon making an investment in that Fund. The Funds are not sponsored, endorsed, sold or promoted by Barclays. Barclays does not make any representation or warranty, express or implied regarding the advisability of investing in the Funds or the advisability of investing in securities generally or the ability of the Indices to track corresponding or relative market performance. Barclays has not passed on the legality or suitability of the Funds’ names or the Indices with respect to any person or entity. Barclays is not responsible for and has not participated in the determination of the timing of, prices of, or quantities of the shares of the Funds to be issued. Barclays has no obligation to take the needs of the Issuer or the owners of the Funds or any other third party into consideration in determining, composing or calculating the Indices. Barclays has no obligation or liability in connection with administration, marketing or trading of the Funds. The licensing agreement between DoubleLine Funds Trust and Barclays is solely for the benefit of the Funds and Barclays and not for the benefit of the owners of the Funds, investors or other third parties.

BARCLAYS SHALL HAVE NO LIABILITY TO THE ISSUER, INVESTORS OR TO OTHER THIRD PARTIES FOR THE USE OF THE DOUBLELINE SHILLER ENHANCED CAPE® AND DOUBLELINE SHILLER ENHANCED INTERNATIONAL CAPE® NAMES, OR THE QUALITY, ACCURACY AND/OR COMPLETENESS OF THE SHILLER BARCLAYS CAPE® US SECTOR TR USD INDEX OR SHILLER BARCLAYS CAPE® EUROPE SECTOR NET TR NOC USD INDEX OR ANY DATA INCLUDED THEREIN OR FOR INTERRUPTIONS IN THE DELIVERY OF THE SHILLER BARCLAYS CAPE® US SECTOR TR USD INDEX OR SHILLER BARCLAYS CAPE® EUROPE SECTOR NET TR NOC USD INDEX. BARCLAYS MAKES NO WARRANTY, EXPRESS OR IMPLIED, AS TO RESULTS TO BE OBTAINED BY THE ISSUER, THE INVESTORS OR ANY OTHER PERSON OR ENTITY FROM THE USE OF THE SHILLER BARCLAYS CAPE® US SECTOR TR USD INDEX OR SHILLER BARCLAYS CAPE® EUROPE SECTOR NET TR NOC USD INDEX OR ANY DATA INCLUDED THEREIN. BARCLAYS MAKES NO EXPRESS OR IMPLIED WARRANTIES, AND HEREBY EXPRESSLY DISCLAIMS ALL WARRANTIES OF MERCHANTABILITY OR FITNESS FOR A PARTICULAR PURPOSE OR USE WITH RESPECT TO DOUBLELINE SHILLER ENHANCED CAPE® AND DOUBLELINE SHILLER ENHANCED INTERNATIONAL CAPE® NAMES, THE SHILLER BARCLAYS CAPE® US SECTOR TR USD INDEX OR SHILLER BARCLAYS CAPE® EUROPE SECTOR NET TR NOC USD INDEX OR ANY DATA INCLUDED THEREIN. BARCLAYS RESERVES THE RIGHT TO CHANGE THE METHODS OF CALCULATION OR PUBLICATION, OR TO CEASE THE CALCULATION OR PUBLICATION OF THE SHILLER BARCLAYS CAPE® US SECTOR TR USD INDEX AND SHILLER BARCLAYS CAPE® EUROPE SECTOR NET TR NOC USD INDEX, AND BARCLAYS SHALL NOT BE LIABLE FOR ANY MISCALCULATION OF OR ANY INCORRECT, DELAYED OR INTERRUPTED PUBLICATION WITH RESPECT TO ANY OF THE SHILLER BARCLAYS CAPE® US SECTOR TR USD INDEX AND SHILLER BARCLAYS CAPE® EUROPE SECTOR NET TR NOC USD INDEX. BARCLAYS SHALL NOT BE LIABLE FOR ANY DAMAGES, INCLUDING, WITHOUT LIMITATION, ANY SPECIAL, INDIRECT OR CONSEQUENTIAL DAMAGES, OR ANY LOST PROFITS AND EVEN IF ADVISED OF THE POSSIBILITY OF SUCH, RESULTING FROM THE USE OF THE SHILLER BARCLAYS CAPE® US SECTOR TR USD INDEX OR SHILLER BARCLAYS CAPE® EUROPE SECTOR NET TR NOC USD INDEX OR ANY DATA INCLUDED THEREIN OR WITH RESPECT TO THE DOUBLELINE SHILLER ENHANCED CAPE® OR DOUBLELINE SHILLER ENHANCED INTERNATIONAL CAPE®.

None of the information supplied by Barclays Bank PLC and used in this publication may be reproduced in any manner without the prior written permission of Barclays Capital, the investment banking division of Barclays Bank PLC. Barclays Bank PLC is registered in England No. 1026167. Registered office 1 Churchill Place London E14 5HP.

THE SHILLER BARCLAYS INDICES HAVE BEEN DEVELOPED IN PART BY RSBB-I, LLC, THE RESEARCH PRINCIPAL OF WHICH IS ROBERT J. SHILLER. RSBB-I, LLC IS NOT AN INVESTMENT ADVISOR, AND DOES NOT GUARANTEE THE ACCURACY OR COMPLETENESS OF THE SHILLER BARCLAYS INDICES OR ANY DATA OR METHODOLOGY EITHER INCLUDED THEREIN OR UPON WHICH IT IS BASED. NEITHER RSBB-I, LLC NOR ROBERT J. SHILLER OR ANY OF THEIR RESPECTIVE PARTNERS, EMPLOYEES, SUBCONTRACTORS, AGENTS, SUPPLIERS AND VENDORS (COLLECTIVELY, THE “PROTECTED PARTIES”), SHALL HAVE ANY LIABILITY, WHETHER CAUSED BY THE NEGLIGENCE OF A PROTECTED PARTY OR OTHERWISE, FOR ANY ERRORS, OMISSIONS, OR INTERRUPTIONS THEREIN, AND MAKE NO WARRANTIES, EXPRESS OR IMPLIED, AS TO PERFORMANCE OR RESULTS EXPERIENCED BY ANY PARTY FROM THE USE OF ANY INFORMATION INCLUDED THEREIN OR UPON WHICH IT IS BASED, AND EXPRESSLY DISCLAIM ALL WARRANTIES OF MERCHANTABILITY OR FITNESS FOR A PARTICULAR PURPOSE WITH RESPECT THERETO, AND SHALL NOT BE LIABLE FOR ANY CLAIMS OR LOSSES OF ANY NATURE IN CONNECTION WITH THE USE OF SUCH INFORMATION, INCLUDING BUT NOT LIMITED TO, LOST PROFITS OR PUNITIVE OR CONSEQUENTIAL DAMAGES, EVEN IF RSBB-I, LLC, ROBERT J. SHILLER OR ANY PROTECTED PARTY IS ADVISED OF THE POSSIBILITY OF SAME.

| | | | | | | | | | |

| 12 | | DoubleLine Funds Trust | | | | | | | | |

| | |

| | | (Unaudited) March 31, 2024 |

LSTA Morningstar Disclaimer

The DoubleLine Floating Rate Fund is not sponsored, endorsed, sold or promoted by Morningstar, Inc., or any of its affiliated companies (all such entities, collectively, “Morningstar Entities”) or the Loan Syndications and Trading Association (“LSTA”). The Morningstar Entities and LSTA make no representation or warranty, express or implied, to the owners of the DoubleLine Floating Rate Fund or any member of the public regarding the advisability of investing in leveraged loans generally or in the DoubleLine Floating Rate Fund in particular or the ability of the LSTA/Morningstar Leveraged Loan Index to track general leveraged loan market performance. The Morningstar Entities’ only relationship to the DoubleLine Floating Rate Fund is the licensing of certain service marks and service names of Morningstar and of the LSTA/Morningstar Leveraged Loan Index which is determined, composed and calculated by the Morningstar Entities without regard to DoubleLine or the DoubleLine Floating Rate Fund. The Morningstar Entities have no obligation to take the needs of DoubleLine or the owners of the DoubleLine Floating Rate Fund into consideration in determining, composing or calculating the LSTA/Morningstar Leveraged Loan Index. The Morningstar Entities and LSTA are not responsible for and have not participated in the determination of the prices and amount of the DoubleLine Floating Rate Fund or the timing of the issuance or sale of the DoubleLine Floating Rate Fund or in the determination or calculation of the equation by which the DoubleLine Floating Rate Fund is converted into cash. The Morningstar Entities and LSTA have no obligation or liability in connection with the administration, marketing or trading of the DoubleLine Floating Rate Fund.

THE MORNINGSTAR ENTITIES AND LSTA DO NOT GUARANTEE THE ACCURACY AND/OR THE COMPLETENESS OF THE LSTA/MORNINGSTAR LEVERAGED LOAN INDEX OR ANY DATA INCLUDED THEREIN AND HAVE NO LIABILITY FOR ANY ERRORS, OMISSIONS, OR INTERRUPTIONS THEREIN. THE MORNINGSTAR ENTITIES AND LSTA MAKE NO WARRANTY, EXPRESS OR IMPLIED, AS TO RESULTS TO BE OBTAINED BY DOUBLELINE, OWNERS OR USERS OF THE DOUBLELINE FLOATING RATE FUND, OR ANY OTHER PERSON OR ENTITY FROM THE USE OF THE LSTA/ MORNINGSTAR LEVERAGED LOAN INDEX OR ANY DATA INCLUDED THEREIN. THE MORNINGSTAR ENTITIES AND LSTA MAKE NO EXPRESS OR IMPLIED WARRANTIES, AND EXPRESSLY DISCLAIM ALL WARRANTIES OF MERCHANTABILITY OR FITNESS FOR A PARTICULAR PURPOSE OR USE WITH RESPECT TO THE LSTA/MORNINGSTAR LEVERAGED LOAN INDEX OR ANY DATA INCLUDED THEREIN. WITHOUT LIMITING ANY OF THE FOREGOING, IN NO EVENT SHALL THE MORNINGSTAR ENTITIES OR LSTA HAVE ANY LIABILITY FOR ANY SPECIAL, PUNITIVE, INDIRECT, OR CONSEQUENTIAL DAMAGES (INCLUDING LOST PROFITS), EVEN IF NOTIFIED OF THE POSSIBILITY OF SUCH DAMAGES.

Morgan Stanley Index Disclaimers

NOTHING IN THE FOLLOWING DISCLAIMER IS INTENDED TO MODIFY THE OBLIGATIONS OF ANY MORGAN STANLEY AFFILIATE, INCLUDING WITHOUT LIMITATION, MORGAN STANLEY SMITH BARNEY LLC (“MSSB”), UNDER ANY APPLICABLE AGREEMENT BETWEEN ANY SUCH AFFILIATE AND ITS RESPECTIVE CLIENTS WHO PURCHASE FUND SHARES THROUGH SUCH AFFILIATE.

THIS FUND IS NOT SPONSORED, ENDORSED, SOLD OR PROMOTED BY MORGAN STANLEY CAPITAL GROUP INC. (“MORGAN STANLEY”). NEITHER MORGAN STANLEY NOR ANY OF ITS OR ITS AFFILIATES’ AGENTS (INCLUDING CALCULATION AGENTS), DATA PROVIDERS (WHICH FOR PURPOSES OF THIS DISCLAIMER INCLUDES WITHOUT LIMITATION ICE DATA, LLP, CHICAGO MERCANTILE EXCHANGE INC., AND THE LONDON METAL EXCHANGE) OR ANY THIRD PARTY PROVIDING SERVICES IN CONNECTION WITH THE INDEX MAKES ANY REPRESENTATION OR WARRANTY, EXPRESS OR IMPLIED, REGARDING THE ADVISABILITY OF INVESTING IN THIS FUND OR THE ABILITY OF THE MORGAN STANLEY BFMCISM (THE “INDEX”) TO TRACK MARKET PERFORMANCE. THE INDEX IS THE EXCLUSIVE PROPERTY OF MORGAN STANLEY. MORGAN STANLEY AND THE INDEX ARE SERVICE MARKS OF MORGAN STANLEY AND/OR A MORGAN STANLEY AFFILIATE AND HAVE BEEN LICENSED TO DOUBLELINE ALTERNATIVES LP FOR USE FOR CERTAIN PURPOSES BY DOUBLELINE ALTERNATIVES LP (“LICENSEE”). MORGAN STANLEY HAS NO OBLIGATION TO TAKE THE NEEDS OF THE LICENSEE, ISSUER OR OWNERS OF THIS FUND INTO CONSIDERATION IN DETERMINING, COMPOSING OR CALCULATING THE INDEX. NEITHER MORGAN STANLEY NOR ANY OF ITS OR ITS AFFILIATES’ AGENTS (INCLUDING CALCULATION AGENTS), DATA PROVIDERS OR ANY THIRD PARTY PROVIDING SERVICES IN CONNECTION WITH THE INDEX IS RESPONSIBLE FOR AND HAS NOT PARTICIPATED IN THE DETERMINATION OF THE TIMING OF, PRICES AT, OR QUANTITIES OF THIS FUND OR ITS ASSETS OR IN THE DETERMINATION OR CALCULATION OF THE EQUATION BY WHICH THIS FUND IS REDEEMABLE. NEITHER MORGAN STANLEY NOR ANY OF ITS OR ITS AFFILIATES’ AGENTS (INCLUDING CALCULATION AGENTS), DATA PROVIDERS OR ANY THIRD PARTY PROVIDING SERVICES IN CONNECTION WITH THE INDEX HAS OR WILL HAVE ANY OBLIGATION OR LIABILITY TO OWNERS OF THIS FUND IN CONNECTION WITH THE ADMINISTRATION, MARKETING OR TRADING OF THIS FUND.

ALTHOUGH MORGAN STANLEY OR ITS AGENTS OR SERVICE PROVIDERS SHALL OBTAIN INFORMATION FOR INCLUSION IN OR FOR USE IN THE CALCULATION OF THE INDEX FROM SOURCES WHICH MORGAN STANLEY CONSIDERS RELIABLE, NEITHER MORGAN STANLEY NOR ANY OF ITS OR ITS AFFILIATES’ AGENTS (INCLUDING CALCULATION AGENTS), DATA PROVIDERS OR ANY THIRD PARTY PROVIDING SERVICES IN CONNECTION WITH THE INDEX GUARANTEES THE ACCURACY AND/OR THE COMPLETENESS OF THE INDEX OR ANY DATA INCLUDED THEREIN. NEITHER MORGAN STANLEY NOR ANY OF ITS OR ITS AFFILIATES’ AGENTS (INCLUDING CALCULATION AGENTS), DATA PROVIDERS OR ANY THIRD PARTY PROVIDING SERVICES IN CONNECTION WITH THE INDEX MAKES ANY WARRANTY, EXPRESS OR IMPLIED, AS TO RESULTS TO BE OBTAINED BY LICENSEE, LICENSEE’S CUSTOMERS AND COUNTERPARTIES, OWNERS OF OR INVESTORS IN THE FUND, OR ANY OTHER PERSON OR ENTITY FROM THE USE OF THE INDEX OR ANY DATA INCLUDED THEREIN IN CONNECTION WITH THE RIGHTS LICENSED HEREUNDER OR FOR ANY OTHER USE. NEITHER MORGAN STANLEY NOR ANY OF ITS OR ITS AFFILIATES’ AGENTS (INCLUDING CALCULATION AGENTS), DATA PROVIDERS OR ANY THIRD PARTY PROVIDING SERVICES IN CONNECTION WITH THE INDEX MAKES ANY EXPRESS OR IMPLIED WARRANTIES, AND DO HEREBY EXPRESSLY DISCLAIM ALL WARRANTIES OF MERCHANTABILITY OR FITNESS FOR A PARTICULAR PURPOSE WITH RESPECT TO THE INDEX OR ANY DATA INCLUDED THEREIN. WITHOUT LIMITING ANY OF THE FOREGOING, IN NO EVENT SHALL MORGAN STANLEY OR ANY AGENT OF MORGAN STANLEY OR ANY MORGAN STANLEY AFFILIATE (INCLUDING CALCULATION AGENTS), DATA PROVIDERS OR ANY THIRD PARTY PROVIDING SERVICES IN CONNECTION WITH THE INDEX HAVE ANY LIABILITY FOR ANY DIRECT, INDIRECT, SPECIAL, PUNITIVE, CONSEQUENTIAL OR ANY OTHER DAMAGES (INCLUDING LOST PROFITS) EVEN IF NOTIFIED OF THE POSSIBILITY OF SUCH DAMAGES.

NO PURCHASER, SELLER OR HOLDER OF THIS SECURITY, OR ANY OTHER PERSON OR ENTITY, SHOULD USE OR REFER TO ANY MORGAN STANLEY TRADE NAME, TRADEMARK OR SERVICE MARK TO SPONSOR, ENDORSE, MARKET OR PROMOTE THIS PRODUCT WITHOUT FIRST CONTACTING MORGAN STANLEY TO DETERMINE WHETHER MORGAN STANLEY’S PERMISSION IS REQUIRED. UNDER NO CIRCUMSTANCES MAY ANY PERSON OR ENTITY CLAIM ANY AFFILIATION WITH MORGAN STANLEY WITHOUT THE PRIOR WRITTEN PERMISSION OF MORGAN STANLEY.

BNP Paribas Multi-Asset Trend Index Disclaimers

This material is confidential and distributed to intended recipients only and may not be reproduced (in whole or in part) or transmitted to any other person. The information contained in this material is for general reference purposes only and should not be construed or used as an offer, solicitation or recommendation to buy or sell any securities or investment.

The BNP Paribas Multi-Asset Trend Index (the “Index”) is the exclusive property of BNP Paribas, the Index sponsor and Index calculation agent (the “Index Sponsor” and the “Index Calculation Agent”). The Index Sponsor does not guarantee the accuracy and/or completeness of the composition, calculation, publication and adjustment of the Index, any data included therein, or any data on which it is based, and the Index Sponsor shall have no liability for any errors, omissions, or interruptions therein. The Index Sponsor makes no warranty, express or implied, as to results to be obtained from the use of the Index. The Index Sponsor makes no express or implied warranties, and expressly disclaims all warranties of merchantability or fitness for a particular purpose or use with respect to the Index or any data included therein. Without limiting any of the foregoing, in no event shall the Index Sponsor have any liability for any special, punitive, indirect, or consequential damages (including lost profits), even if notified of the possibility of such damages.

For the avoidance of doubt the Index and/or any account, transaction or product using the information relating to the Index, is not sponsored, endorsed, sold, or promoted by any provider of the underlying data (the “Reference Assets”) comprised in the Index (each a “Reference Asset Sponsor”) and no Reference Asset Sponsor makes any representation whatsoever, whether express or implied, either as to the results to be obtained from the use of the relevant Reference Asset or the index and/or the levels at which the relevant Reference Asset or the Index stands at any particular time on any particular date or otherwise. No Reference Asset Sponsor shall be liable (whether in negligence or otherwise) to any person for any error in a Reference Asset and/or in the Index and a Reference Asset Sponsor is under no

| | | | | | | | | | |

| | | | Annual Report | | | | | March 31, 2024 | | 13 |

| | |

Management’s Discussion of Fund Performance (Cont.) | | |

obligation to advise any person of any error therein. No Reference Asset Sponsor is making any representation whatsoever, whether express or implied, as to the advisability of purchasing or assuming any risk in connection with the DoubleLine Multi-Asset Trend Fund managed by DoubleLine; or any product or investment strategy referencing the DoubleLine Multi-Asset Trend Fund managed by DoubleLine. No Reference Asset Sponsor shall have any liability for any act or failure to act by the Index Sponsor in connection with the calculation, adjustment or maintenance of the Index. None of the Reference Asset Sponsors or their affiliates have any affiliation with or control over the Index or the Index Sponsor or any control over the computation, composition or dissemination of the Index.

The Index Sponsor and the Index Calculation Agent shall not be held liable for any modification or change in the methodology used in calculating the index or any index components thereof (the “BNP Paribas Indices”). The Index Sponsor and the Index Calculation Agent are under no obligation to continue the calculation, publication or dissemination of the BNP Paribas Indices and shall not be held liable for any suspension or interruption in the calculation of any BNP Paribas Indices. The Index Sponsor and the Index Calculation Agent decline any liability in connection with the level of any BNP Paribas Index at any given time. None of BNP Paribas, the Index Sponsor, the Index Calculation Agent nor any of their affiliates shall be held liable for any loss whatsoever, directly or indirectly related to any BNP Paribas Index.

BNP Paribas, the Index Sponsor and the Index Calculation Agent do not guarantee the accuracy or completeness of the methodology or rules of the BNP Paribas Indices (the “BNP Paribas Index Rules”) or the calculation methods, any errors or omissions in computing or disseminating the BNP Paribas Indices, or for any use thereof, and the Index Sponsor and the Index Calculation Agent shall have no liability for any errors or omissions therein.

The BNP Paribas Index Rules are based on certain assumptions, certain pricing models and calculation methods adopted by the Index Sponsor and have certain inherent limitations. Information prepared on the basis of different models, calculation methods or assumptions may yield different results. Numerous factors may affect the analysis, which may or may not be taken into account. Therefore, the analysis of information may vary significantly from analysis obtained from other sources or market participants.

BNP Paribas, the Index Sponsor and Index Calculation Agent do not make any representation whatsoever, either as to the results to be obtained from the use of the BNP Paribas Indices, the levels of any BNP Paribas Index at any time or any use of any Index Component or the price, level or rate of any Index Component at any time.

The market data used to calculate the level of any BNP Paribas Index may be furnished by third party sources and is believed to be reliable; however, BNP Paribas, the Index Sponsor and the Index Calculation Agent make no representation or guarantee with respect to, and are under no obligation to verify, the accuracy and completeness thereof.

Index Descriptions and Other Definitions

An investment cannot be made directly in an index. The performance of any index mentioned in this commentary has not been adjusted for ongoing management, distribution and operating expenses applicable to mutual fund investments.

The index descriptions provided herein are based on information provided on the respective index provider’s website or from other third-party sources. The Funds and DoubleLine have not verified these index descriptions and disclaim responsibility for their accuracy and completeness.

Agency—Refers to mortgage-backed securities (MBS) whose principal and interest are guaranteed by a U.S. government agency such as Fannie Mae (FNMA) or Freddie Mac (FHLMC).

Alpha—Term used in investing to describe a strategy’s ability to beat the market, or its “edge.” Alpha is thus also often referred to as “excess return” or “abnormal rate of return,” which refers to the idea that markets are efficient, and so there is no way to systematically earn returns that exceed the broad market as a whole.

Asset-Backed Securities (ABS)—Investment securities, such as bond or notes, that are collateralized by a pool of assets, such as loans, leases, credit card debt, royalties or receivables.

Basis Points (bps)—Basis points (or basis point (bp)) refer to a common unit of measure for interest rates and other percentages in finance. One basis point is equal to 1/100th of 1%, or 0.01% or 0.0001, and is used to denote the percentage change in a financial instrument. The relationship between percentage changes and basis points can be summarized as: 1% change = 100 basis points; 0.01% = 1 basis point.

Beta Exposure—Beta is the return generated from a portfolio that can be attributed to overall market returns. Beta exposure is equivalent to exposure to systematic risk.

Bloomberg Commodity (BCOM) Index Total Return—The BCOM Index Total Return tracks the performance of the BCOM on a total return basis. The BCOM is calculated on an excess return basis and reflects the price movements of commodity futures. It rebalances annually, weighted two-thirds by trading volume and one-third by world production, and weight caps are applied at the commodity, sector and group levels for diversification. The roll period typically occurs from the sixth to 10th business day based on the roll schedule.

Bloomberg US Aggregate Bond Index—This index (the “Agg”) represents securities that are SEC registered, taxable and U.S. dollar denominated. It covers the U.S. investment grade, fixed-rate bond market, with components for government and corporate securities, mortgage pass-through securities and asset-backed securities. These major sectors are subdivided into more specific indices that are calculated and reported on a regular basis.

Bloomberg US Aggregate 1-3 Year Bond Index—This index tracks the one- to three-year component of the Bloomberg US Aggregate Bond Index, which represents securities that are SEC registered, taxable and dollar denominated in the U.S. investment grade, fixed-rate bond market.

Bloomberg US Long Government/Credit Index—This index tracks the market for investment grade, U.S. dollar-denominated, fixed-rate U.S. Treasuries, and government-related and corporate securities.

Bloomberg World Interest Rate Probability (WIRP) Function—Statistical function developed by Bloomberg that uses fed funds futures and options to assess the probability of future Federal Open Market Committee (FOMC) decisions. It seeks to calculate the chances of a rate hike at each of the FOMC meetings using futures trading data.

BNP Paribas Multi-Asset Trend Index—This index has been designed to seek investment exposure to trends in price movements of a broad universe of assets across different markets, including domestic, foreign and emerging markets equities; sovereign bonds and other debt securities; interest rates; currencies; and commodities (e.g., energy and metals). The index was selected, in significant part, because it reflects trend-following strategies using a broadly diversified set of investments.

Collateralized Loan Obligation (CLO)—Single security backed by a pool of debt.

Conference Board Leading Economic Index (LEI)—This index tracks a group of composite indexes (manufacturers’ orders, initial unemployment insurance claims, et al.) as a means of gauging the strength of a particular industry or the economy.

Credit Suisse Managed Futures Liquid Total Return U.S. Dollar Index—This index measures on a total return, U.S. dollar-denominated basis the performance of the Credit Suisse Managed Futures Liquid Index, which is designed to provide exposure to both up and down price trends in four broad asset classes: equities, fixed income, commodities and currencies.

Duration—Measure of the sensitivity of the price of a bond or other debt instrument to a change in interest rates.

Federal Funds Rate—Target interest rate, set by the Federal Reserve at its Federal Open Market Committee (FOMC) meetings, at which commercial banks borrow and lend their excess reserves to each other overnight. The Fed sets a target federal funds rate eight times a year, based on prevailing economic conditions.

| | | | | | | | | | |

| 14 | | DoubleLine Funds Trust | | | | | | | | |

| | |

| | | (Unaudited) March 31, 2024 |

FTSE World Government Bond Index (FTSE WGBI)—This broad index measures the performance of fixed-rate, local currency, investment grade sovereign bonds. It is a widely used benchmark comprising sovereign debt from more than 20 countries that is denominated in a variety of currencies.

G-10 (Group of Ten)—The G-10 comprises 11 industrialized nations that meet on an annual basis, or more frequently as needed, to consult each other, debate and cooperate on international financial matters. The member countries are: Belgium, Canada, France, Germany, Italy, Japan, the Netherlands, Sweden, Switzerland, the United Kingdom and the United States.

High Yield (HY)—Bonds that pay higher interest rates because they have lower credit ratings than investment grade (IG) bonds. HY bonds are more likely to default, so they must pay a higher yield than IG bonds to compensate investors.

ICE BofA 1-3 Year Eurodollar Index—This index includes all securities with a remaining term to final maturity of three years or less on the ICE BofA Eurodollar Index, which tracks the performance of U.S. dollar-denominated, investment grade, quasi-government, corporate, securitized and collateralized debt publicly issued in the eurobond markets.

ICE BofA 1-3 Year U.S. Treasury Index—An unmanaged index that tracks the performance of the direct sovereign debt of the U.S. government having a maturity of at least one year and less than three years.

ICE BofA SOFR Overnight Rate Index—This index tracks the performance of a synthetic asset paying the Secured Overnight Financing Rate (SOFR) to a stated maturity. The index is based on the assumed purchase at par of a synthetic instrument having exactly its stated maturity and with a coupon equal to that day’s fixing rate. That issue is assumed to be sold the following business day (priced at a yield equal to the current-day fixing rate) and rolled into a new instrument.

Investment Grade (IG)—Rating that signifies a municipal or corporate bond presents a relatively low risk of default. Bonds below this designation are considered to have a high risk of default and are commonly referred to as high yield (HY) or “junk bonds.” The higher the bond rating the more likely the bond will return 100 cents on the U.S. dollar.

ISM Manufacturing PMI—This index (which used to be called the ISM Manufacturing Purchasing Managers Index) is compiled by the Institute for Supply Management and tracks the economic health of the manufacturing sector. The index is based on five major indicators: new orders, inventory levels, production, supplier deliveries and employment environment. A number below 50 is considered a contractionary signal for the economy; a number above 50 is considered expansionary.

ISM Services PMI—This index (which used to be called the ISM Non-Manufacturing Purchasing Managers Index) is compiled by the Institute for Supply Management and tracks the economic health of the services (formerly nonmanufacturing) sector. A number below 50 is considered a contractionary signal for the economy; a number above 50 is considered expansionary.

Job Openings and Labor Turnover Survey (JOLTS)—Conducted by the U.S. Bureau of Labor Statistics, JOLTS involves the monthly collection, processing and dissemination of job openings and labor turnover data. The data, collected from sampled establishments on a voluntary basis, includes employment, job openings, hires, quits, layoffs, discharges and other separations. The number of unfilled jobs—used to calculate the job openings rate—is an important measure of the unmet demand for labor, providing a more complete picture of the U.S. labor market than by looking solely at the unemployment rate.

J.P. Morgan Corporate Emerging Markets Bond Index Broad Diversified (CEMBI BD) 1-3 Year Index—This index tracks corporate bonds with a maturity of one to three years and includes smaller issues and a wider array of bonds than the CEMBI, which is a market capitalization-weighted index consisting of U.S. dollar-denominated corporate bonds from emerging markets. The CEMBI is a liquid global corporate benchmark representing Asia, Latin America, Europe and the Middle East/Africa.

J.P. Morgan Emerging Markets Bond Global Diversified Index (EMBI GD)—This index is a uniquely weighted version of the EMBI. The EMBI tracks bonds from emerging markets (EM), and comprises sovereign debt and EM corporate bonds. The EMBI GD limits the weights of index countries with larger debt stocks by only including specified portions of those countries’ eligible current face amounts of debt outstanding.

J.P. Morgan Government Bond Index Emerging Markets Global Diversified (GBI-EM GD)—This custom-weighted index tracks local currency bonds issued by emerging market governments, excluding China and India, and has a broader roster of countries than the base GBI-EM, which limits inclusion to countries that are readily accessible and where no impediments exist for foreign investors.

Morgan Stanley Backwardation Focused Multi-Commodity Index (MSBFMCI)—This index comprises futures contracts selected based on the contracts’ historical backwardation relative to other commodity-related futures contracts and the contracts’ historical liquidity. The sectors represented in the index (industrial metals, energy and agricultural/livestock) have been selected to provide diversified exposure. The index is typically rebalanced annually in January.

Morningstar LSTA US Leveraged Loan TR USD Index—This index tracks the market-weighted performance of institutional weighted loans based on market weightings, spreads and interest payments.

Mortgage-Backed Securities (MBS)—Investment similar to a bond that is made up of a bundle of home loans bought from the banks that issued them. Investors in MBS receive periodic payments similar to bond coupon payments.

MSCI Europe Index—This index is U.S. dollar denominated and represents the performance of large- and mid-cap equities across 15 developed countries in Europe. It covers approximately 85% of the free float-adjusted market capitalization in each country.

MSCI Europe Net Total Return USD Index—This index is a component of the MSCI Europe Index and measures performance on a net total return basis.

S&P 500® Index—This unmanaged capitalization-weighted index of the stocks of the 500 largest publicly traded U.S. companies is designed to measure performance of the broad domestic economy through changes in the aggregate market value of the 500 stocks, which represent all major industries.

Shiller Barclays CAPE® Europe Sector Net TR NoC USD Index (European CAPE Index)—This index incorporates the principles of long-term investing distilled by Dr. Robert Shiller and expressed through the CAPE® (Cyclically Adjusted Price Earnings) Ratio (the “CAPE® Ratio”). The classic CAPE® Ratio assesses equity market valuations and averages 10 years of inflation-adjusted earnings to account for earnings and market cycles.

Shiller Barclays CAPE® U.S. Sector Total Return USD Index—This index incorporates the principles of long-term investing distilled by Dr. Robert Shiller and expressed through the CAPE® (Cyclically Adjusted Price Earnings) Ratio (the “CAPE® Ratio”). It aims to identify undervalued sectors based on a modified CAPE® Ratio, and then uses a momentum factor to seek to mitigate the effects of potential value traps.

Spread—Difference between yields on differing debt instruments, calculated by deducting the yield of one instrument from another. The higher the yield spread, the greater the difference between the yields offered by each instrument. The spread can be measured between debt instruments of differing maturities, credit ratings or risk.

U-3 Unemployment Rate—Officially recognized rate of unemployment, compiled and released monthly by the U.S. Bureau of Labor Statistics, measuring the number of unemployed people as a percentage of the labor force.

U.S. Dollar Index (DXY)—A weighted geometric mean of the U.S. dollar’s value relative to a basket of six major foreign currencies: the euro, Japanese yen, British pound, Canadian dollar, Swedish krona and Swiss franc.

| | | | | | | | | | |

| | | | Annual Report | | | | | March 31, 2024 | | 15 |

| | |

Management’s Discussion of Fund Performance (Cont.) | | |

This commentary may include statements that constitute “forward-looking statements” under the U.S. securities laws. Forward-looking statements include, among other things, projections, estimates, and information about possible or future results related to a Fund and market or regulatory developments. The views expressed above are not guarantees of future performance or economic results and involve certain risks, uncertainties and assumptions that could cause actual outcomes and results to differ materially from the views expressed herein.

DoubleLine has no obligation to provide revised assessments in the event of changed circumstances. While we have gathered this information from sources believed to be reliable, DoubleLine cannot guarantee the accuracy of the information provided. Securities discussed are not recommendations and are presented as examples of issue selection or portfolio management processes. They have been picked for comparison or illustration purposes only. No security presented within is either offered for sale or purchase. DoubleLine reserves the right to change its investment perspective and outlook without notice as market conditions dictate or as additional information becomes available.

Investment strategies may not achieve the desired results due to implementation lag, other timing factors, portfolio management decision making, economic or market conditions or other unanticipated factors. The views and forecasts expressed in this material are as of the date indicated, are subject to change without notice, may not come to pass and do not represent a recommendation or offer of any particular security, strategy, or investment. Past performance is no guarantee of future results.

The DoubleLine Funds are distributed by Quasar Distributors, LLC.

DoubleLine® is a registered trademark of DoubleLine Capital LP.

| | | | | | | | | | |

| 16 | | DoubleLine Funds Trust | | | | | | | | |

| | |

Standardized Performance Summary | | (Unaudited) March 31, 2024 |

The performance information shown assumes the reinvestment of all dividends and distributions. Returns over 1 year are average annual returns. Performance data quoted represents past performance; past performance does not guarantee future results and does not reflect the deduction of any taxes a shareholder would pay on fund distributions or the sale of fund shares. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. Current performance of the Fund may be lower or higher than the performance quoted. The Funds’ gross and net expense ratios shown are from the most recent prospectus and may change over time. See the financial highlights section of the financial statements for more recent expense ratios. The Funds’ gross and net expense ratios also include “acquired fund fees and expenses,” which are expenses incurred indirectly as a result of a Fund’s investments in one or more underlying funds, including ETFs and money market funds. Because these costs are indirect, the expense ratios will not correlate to the expense ratios in the Funds’ financial statements, since financial statements only include direct costs of the Funds and not indirect costs of investing in the underlying funds. Performance data current to the most recent month-end may be obtained by calling (877) 354-6311 or by visiting www.doubleline.com.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| DBLTX/DLTNX/DDTRX | | | | | | | | | | | | | | |

DoubleLine Total Return Bond Fund

Returns as of March 31, 2024 | | 1-Year | | 3-Years

Annualized | | 5-Years

Annualized | | 10-Years

Annualized | | Since Inception

Annualized

(4-6-10 to 3-31-24) | | Expense Ratio |

| | | | | | |

I Share (DBLTX) | | | | 1.75% | | | | | -2.20% | | | | | -0.09% | | | | | 1.57% | | | | | 3.72% | | | 0.49% |

| | | | | | |

N Share (DLTNX) | | | | 1.50% | | | | | -2.44% | | | | | -0.34% | | | | | 1.32% | | | | | 3.47% | | | 0.74% |

| | | | | | |

R6 Share (DDTRX)1 | | | | 1.81% | | | | | -2.11% | | | | | -0.02% | | | | | 1.60% | | | | | 3.75% | | | 0.44% |

| | | | | | |

Bloomberg US Aggregate Bond Index2 | | | | 1.70% | | | | | -2.46% | | | | | 0.36% | | | | | 1.54% | | | | | 2.31% | | | |

| DBLFX/DLFNX/DDCFX | | | | | | | | | | | | | | |

DoubleLine Core Fixed Income Fund

Returns as of March 31, 2024 | | 1-Year | | 3-Years

Annualized | | 5-Years

Annualized | | 10-Years

Annualized | | Since Inception

Annualized

(6-1-10 to 3-31-24) | | Gross

Expense

Ratio | | Net

Expense

Ratio3 |

| | | | | | | |

I Share (DBLFX) | | | | 2.60% | | | | | -1.92% | | | | | 0.46% | | | | | 1.85% | | | | | 3.36% | | | 0.51% | | 0.48% |

| | | | | | | |

N Share (DLFNX) | | | | 2.46% | | | | | -2.14% | | | | | 0.23% | | | | | 1.61% | | | | | 3.11% | | | 0.76% | | 0.73% |

| | | | | | | |

R6 Share (DDCFX)4 | | | | 2.74% | | | | | -1.89% | | | | | 0.51% | | | | | 1.88% | | | | | 3.38% | | | 0.48% | | 0.45% |

| | | | | | | |

Bloomberg US Aggregate Bond Index2 | | | | 1.70% | | | | | -2.46% | | | | | 0.36% | | | | | 1.54% | | | | | 2.15% | | | | | |

| DBLEX/DLENX | | | | | | | | | | | | | | |

DoubleLine Emerging Markets Fixed Income

Fund

Returns as of March 31, 2024 | | 1-Year | | 3-Years

Annualized | | 5-Years

Annualized | | 10-Years

Annualized | | Since Inception

Annualized

(4-6-10 to 3-31-24) | | Expense Ratio |

| | | | | | |

I Share (DBLEX) | | | | 11.78% | 11 | | | | -0.70% | | | | | 1.81% | | | | | 3.09% | | | | | 4.21% | | | 0.90% |

| | | | | | |

N Share (DLENX) | | | | 11.37% | 11 | | | | -0.96% | | | | | 1.54% | | | | | 2.83% | | | | | 3.95% | | | 1.15% |

| | | | | | | |

J.P. Morgan Emerging Markets Bond Global Diversified Index2 | | | | 11.28% | | | | | -1.40% | | | | | 0.71% | | | | | 3.05% | | | | | 4.28% | | | | | |

| DBLSX/DLSNX/DDLDX | | | | | | | | | | | | | | |

DoubleLine Low Duration Bond Fund

Returns as of March 31, 2024 | | 1-Year | | 3-Years

Annualized | | 5-Years

Annualized | | 10-Years

Annualized | | Since Inception

Annualized

(9-30-11 to 3-31-24) | | Expense Ratio |

| | | | | | |

I Share (DBLSX) | | | | 6.16% | | | | | 1.84% | | | | | 2.17% | | | | | 2.15% | | | | | 2.27% | | | 0.43% |

| | | | | | |

N Share (DLSNX) | | | | 5.90% | | | | | 1.59% | | | | | 1.91% | | | | | 1.90% | | | | | 2.01% | | | 0.67% |

| | | | | | |

R6 Share (DDLDX)5 | | | | 6.20% | | | | | 1.88% | | | | | 2.20% | | | | | 2.17% | | | | | 2.28% | | | 0.39% |

| | | | | | | |