This Article sets forth the creation of the Plan's Trust (or, in the case of an amendment of the Plan, the amended terms of the Trust) and the duties and responsibilities of the Trustee under the Plan. By executing the Trustee Declaration under the Agreement, the Trustee agrees to be bound by the duties, responsibilities and liabilities imposed on the Trustee under the Plan and to act in accordance with the terms of this Plan. The Employer may act as Trustee under the Plan by executing the Trustee Declaration.

The Trustee shall be advised in writing regarding the retention of investment powers by the Employer or the appointment of an Investment Manager or other Named Fiduciary with power to direct the investment of Plan assets. Any such delegation of investment powers will remain in force until such delegation is revoked or amended in writing. The Employer is deemed to have retained investment powers under this subsection to the extent the Employer directs the investment of Participant Accounts for which affirmative investment direction has not been received pursuant to Section 13.5(c).

The Employer is a Named Fiduciary for investment purposes if the Employer directs investments pursuant to this subsection. Any investment direction shall be made in writing by the Employer, Investment Manager, or Named Fiduciary, as applicable. A Directed Trustee must act solely in accordance with the direction of the Plan Administrator, the Employer, any employees or agents of the Employer, a properly appointed Investment Manager or other fiduciary of the Plan, a Named Fiduciary, or Plan Participants. (See Section 13.5(c) for a discussion of the Trustee's responsibilities with regard to Participant directed investments.)

The Employer may direct the Trustee to invest in any media in which the Trustee may invest, as described in Section 12.4. However, the Employer may not borrow from the Trust or pledge any of the assets of the Trust as security for a loan to itself; buy property or assets from or sell property or assets to the Trust; charge any fee for services rendered to the Trust; or receive any services from the Trust on a preferential basis.

The Trustee will receive all contributions made under the terms of the Plan. The Trustee is not obligated in any manner to ensure that such contributions are correct in amount or that such

contributions comply with the terms of the Plan, the Code or ERISA. In addition, the Trustee is under no obligation to request that the Employer make contributions to the Plan. The Trustee is not liable for the manner in which such amounts are deposited or the allocation between Participant's Accounts, to the extent the Trustee follows the written direction of the Plan Administrator or Employer.

(b)

The Trustee will make distributions from the Trust in accordance with the written directions of the Plan Administrator or other authorized representative. To the extent the Trustee follows such written direction, the Trustee is not obligated in any manner to ensure a distribution complies with the terms of the Plan, that a Participant or Beneficiary is entitled to such a distribution, or that the amount distributed is proper under the terms of the Plan. If there is a dispute as to a payment from the Trust, the Trustee may decline to make payment of such amounts until the proper payment of such amounts is determined by a court of competent jurisdiction, or the Trustee has been indemnified to its satisfaction.

(c)

The Trustee may employ agents, attorneys, accountants and other third parties to provide counsel on behalf of the Plan, where the Trustee deems advisable. The Trustee may reimburse such persons from the Trust for reasonable expenses and compensation incurred as a result of such employment. The Trustee shall not be liable for the actions of such persons, provided the Trustee acted prudently in the employment and retention of such persons. In addition, the Trustee will not be liable for any actions taken as a result of good faith reliance on the advice of such persons.

12.4

Trustee's Responsibility Regarding Investment of Plan Assets.

In addition to the powers, rights and duties enumerated under this Section, the Trustee has whatever powers are necessary to carry out its duties in a prudent manner. The Trustee's powers, rights and duties may be supplemented or limited by a separate trust agreement, investment policy, funding agreement, or other binding document entered into between the Trustee and the Plan Administrator which designates the Trustee's responsibilities with respect to the Plan. A separate trust agreement must be consistent with the terms of this Plan and must comply with all qualification requirements under the Code and regulations. To the extent the exercise of any power, right or duty is subject to discretion, such exercise by a Directed Trustee must be made at the direction of the Plan Administrator, the Employer, an Investment Manager, a Named Fiduciary, or Plan Participant.

(a)

The Trustee shall be responsible for the safekeeping of the assets of the Trust in accordance with the provisions of this Plan.

(b)

The Trustee may invest, manage and control the Plan assets in a manner that is consistent with the Plan's funding policy and investment objectives. The Trustee may invest in any investment, as authorized under Section 13.5, which the Trustee deems advisable and prudent, subject to the proper written direction of the Plan Administrator, the Employer, a properly appointed Investment Manager, a Named Fiduciary or a Plan Participant. The Trustee is not liable for the investment of Plan assets to the extent the Trustee is following the proper direction of the Plan Administrator, the Employer, a Participant, an Investment Manager, or other person or persons duly appointed by the Employer to provide investment direction. In addition, the Trustee does not guarantee the Trust in any manner against investment loss or depreciation in asset value, or guarantee the adequacy of the Trust to meet and discharge any or all liabilities of the Plan.

(c)

The Trustee may retain such portion of the Plan assets in cash or cash balances as the Trustee may, from time to time, deem to be in the best interests of the Plan, without liability for interest thereon.

(d)

The Trustee may collect and receive any and all moneys and other property due the Plan and to settle, compromise, or submit to arbitration any claims, debts, or damages with respect to the Plan, and to commence or defend on behalf of the Plan any lawsuit, or other legal or administrative proceedings.

(e)

The Trustee may hold any securities or other property in the name of the Trustee or in the name of the Trustee's nominee, and may hold any investments in bearer form, provided the books and records of the Trustee at all times show such investment to be part of the Trust.

(f)

The Trustee may exercise any of the powers of an individual owner with respect to stocks, bonds, securities or other property, including the right to vote upon such stocks, bonds or securities; to give general or special proxies or powers of attorney; to exercise or sell any conversion privileges, subscription rights, or other options; to participate in corporate reorganizations, mergers, consolidations, or other changes affecting corporate securities (including those in which it or its affiliates are interested as Trustee); and to make any incidental payments in connection with such

| © Copyright 2001 Pension Specialists, Inc. | | Profit Sharing/401(k) BPD | |

73

stocks, bonds, securities or other property. Unless specifically agreed upon in writing between the Trustee and the Employer, the Trustee shall not have the power or responsibility to vote proxies with respect to any securities of the Employer or a Related Employer or a Participating Employer or with respect to any Plan assets that are subject to the investment direction of the Employer or for which the power to manage, acquire, or dispose of such Plan assets has been delegated by the Employer to one or more Investment Managers or Named Fiduciaries in accordance with ERISA §403. With respect to the voting of Employer securities, or in the event of any tender or other offer with respect to shares of Employer securities held in the Trust, the Trustee will follow the direction of the Employer or other responsible fiduciary or, to the extent voting and similar rights have been passed through to Participants, of each Participant with respect to shares allocated to his/her Account.

(g)

The Trustee may borrow or raise money on behalf of the Plan in such amount, and upon such terms and conditions, as the Trustee deems advisable. The Trustee may issue a promissory note as Trustee to secure the repayment of such amounts and may pledge all, or any part, of the Trust as security.

(h)

The Trustee, upon the written direction of the Plan Administrator, is authorized to enter into a transfer agreement with the Trustee of another qualified retirement plan and to accept a transfer of assets from such retirement plan on behalf of any Employee of the Employer. The Trustee is also authorized, upon the written direction of the Plan Administrator, to transfer some or all of a Participant's vested Account Balance to another qualified retirement plan on behalf of such Participant.

(i)

The Trustee is authorized to execute, acknowledge and deliver all documents of transfer and conveyance, receipts, releases, and any other instruments that the Trustee deems necessary or appropriate to carry out its powers, rights and duties hereunder.

(j)

If the Employer maintains more than one Plan, the assets of such Plans may be commingled for investment purposes. The Trustee must separately account for the assets of each Plan. A commingling of assets, as described in this paragraph, does not cause the Trusts maintained with respect to the Employer's Plans to be treated as a single Trust, except as provided in a separate document authorized in the first paragraph of this Section 12.4.

(k)

The Trustee is authorized to invest Plan assets in a common/collective trust fund, or in a group trust fund that satisfies the requirements of IRS Revenue Ruling 81-100. All of the terms and provisions of any such common/collective trust fund or group trust into which Plan assets are invested are incorporated by reference into the provisions of the Trust for this Plan.

(l)

If the Trustee is a bank or similar financial institution, the Trustee is authorized to invest in any type of deposit of the Trustee (including its own money market fund) at a reasonable rate of interest.

(m)

The Trustee must be bonded as required by applicable law. The bonding requirements shall not apply to a bank, insurance company, or similar financial institution that satisfies the requirements of §412(a)(2) of ERISA.

12.5

More than One Person as Trustee. If the Plan has more than one person acting as Trustee, the Trustees may allocate the Trustee responsibilities by mutual agreement and Trustee decisions will be made by a majority vote (unless otherwise agreed to by the Trustees) or as otherwise provided in a separate trust agreement or other binding document.

12.6

Annual Valuation. The Plan assets will be valued at least on an annual basis. The Employer may designate more frequent valuation dates under Part 12, #45.b.(2) of the Agreement [Part 12, #63.b.(2) of the Profit Sharing/401(k) Agreement]. Notwithstanding any election under Part 12, #45.b.(2) of the Agreement [Part 12, #63.b.(2) of the Profit Sharing/401(k) Agreement], the Trustee and Plan Administrator may agree to value the Trust on a more frequent basis, and/or to perform an interim valuation of the Trust pursuant to Section 13.2(a).

12.7

Reporting to Plan Administrator and Employer.Within ninety (90) days following the end of each Plan Year, and within ninety (90) days following its removal or resignation, the Trustee will file with the Employer an accounting of its administration of the Trust from the date of its last accounting. The accounting will include a statement of cash receipts, disbursements and other transactions effected by the Trustee since the date of its last accounting, and such further information as the Trustee and/or Employer deems appropriate. Upon receipt of such information, the Employer must promptly notify the Trustee of its approval or disapproval of the information. If the Employer does not provide a written disapproval within ninety (90) days following the receipt of the information, including a written description of the items in question, the Trustee is forever released and discharged from any liability with respect to all matters reflected in such information.

| | | |

|---|

| Profit Sharing/401(k) BPD | | © Copyright 2001 Pension Specialists, Inc. | |

74

The Trustee shall have sixty (60) days following its receipt of a written disapproval from the Employer to provide the Employer with a written explanation of the terms in question. If the Employer again disapproves of the accounting, the Trustee may file its accounting with a court of competent jurisdiction for audit and adjudication.

All assets contained in the Trust accounting will be shown at their fair market value as of the end of the Plan Year or as of the date of resignation or removal. The value of marketable investments shall be determined using the most recent price quoted on a national securities exchange or over-the-counter market. The value of non-marketable securities shall, except as provided otherwise herein, be determined in the sole judgment of the Trustee, which determination shall be binding and conclusive. The value of investments in securities or obligations of the Employer in which there is no market will be determined by an independent appraiser at least once annually and the Trustee shall have no responsibility with respect to the valuation of such assets.

12.8

Reasonable Compensation.The Trustee shall be paid reasonable compensation in an amount agreed upon by the Plan Administrator and Trustee. The Trustee also will be reimbursed for any reasonable expenses or fees incurred in its function as Trustee. An individual Trustee who is already receiving full-time pay as an Employee of the Employer may not receive any additional compensation for services as Trustee. The Plan will pay the reasonable compensation and expenses incurred by the Trustee, pursuant to Section 11.4, unless the Employer pays such compensation and expenses. Any compensation or expense paid directly by the Employer to the Trustee is not an Employer Contribution to the Plan.

12.9

Resignation and Removal of Trustee.The Trustee may resign at any time by delivering to the Employer a written notice of resignation at least thirty (30) days prior to the effective date of such resignation, unless the Employer consents in writing to a shorter notice period. The Employer may remove the Trustee at any time, with or without cause, by delivering written notice to the Trustee at least 30 days prior to the effective date of such removal. The Employer may remove the Trustee upon a shorter written notice period if the Employer reasonably determines such shorter period is necessary to protect Plan assets. Upon the resignation, removal, death or incapacity of a Trustee, the Employer may appoint a successor Trustee which, upon accepting such appointment, will have all the powers, rights and duties conferred upon the preceding Trustee. In the event there is a period of time following the effective date of a Trustee's removal or resignation before a successor Trustee is appointed, the Employer is deemed to be the Trustee. During such period, the Trust continues to be in existence and legally enforceable, and the assets of the Plan shall continue to be protected by the provisions of the Trust.

12.10

Indemnification of Trustee.Except to the extent that it is judicially determined that the Trustee has acted with gross negligence or willful misconduct, the Employer shall indemnify the Trustee (whether or not the Trustee has resigned or been removed) against any liabilities, losses, damages, and expenses, including attorney, accountant, and other advisory fees, incurred as a result of:

(a)

any action of the Trustee taken in good faith in accordance with any information, instruction, direction, or opinion given to the Trustee by the Employer, the Plan Administrator, Investment Manager, Named Fiduciary or legal counsel of the Employer, or any person or entity appointed by any of them and authorized to give any information, instruction, direction, or opinion to the Trustee;

(b)

the failure of the Employer, the Plan Administrator, Investment Manager, Named Fiduciary or any person or entity appointed by any of them to make timely disclosure to the Trustee of information which any of them or any appointee knows or should know if it acted in a reasonably prudent manner; or

(c)

any breach of fiduciary duty by the Employer, the Plan Administrator, Investment Manager, Named Fiduciary or any person or entity appointed by any of them, other than such a breach which is caused by any failure of the Trustee to perform its duties under this Trust.

The duties and obligations of the Trustee shall be limited to those expressly imposed upon it by this instrument or subsequently agreed upon by the parties. Responsibility for administrative duties required under the Plan or applicable law not expressly imposed upon or agreed to by the Trustee shall rest solely with the Employer.

The Employer agrees that the Trustee shall have no liability with regard to the investment or management of illiquid Plan assets transferred from a prior Trustee, and shall have no responsibility for investments made before the transfer of Plan assets to it, or for the viability or prudence of any investment made by a prior Trustee, including those represented by assets now transferred to the custody of the Trustee, or for any dealings whatsoever with respect to Plan assets before the transfer of such assets to the Trustee. The Employer shall indemnify and hold the Trustee harmless for any and all claims, actions or causes of action for loss or damage, or any liability whatsoever relating to the assets of the Plan transferred to the Trustee by any prior Trustee of the Plan, including any liability arising out of or related to any act or event, including prohibited transactions, occurring prior to the date the Trustee accepts such assets, including all claims,

| © Copyright 2001 Pension Specialists, Inc. | | Profit Sharing/401(k) BPD | |

75

actions, causes of action, loss, damage, or any liability whatsoever arising out of or related to that act or event, although that claim, action, cause of action, loss, damage, or liability may not be asserted, may not have accrued, or may not have been made known until after the date the Trustee accepts the Plan assets. Such indemnification shall extend to all applicable periods, including periods for which the Plan is retroactively restated to comply with any tax law or regulation.

12.11

Appointment of Custodian.The Plan Administrator may appoint a Custodian to hold all or any portion of the Plan assets. A Custodian has the same powers, rights and duties as a Directed Trustee. The Custodian will be protected from any liability with respect to actions taken pursuant to the direction of the Trustee, Plan Administrator, the Employer, an Investment Manager, a Named Fiduciary or other third party with authority to provide direction to the Custodian.

| | | |

|---|

| Profit Sharing/401(k) BPD | | © Copyright 2001 Pension Specialists, Inc. | |

76

ARTICLE 13

PLAN ACCOUNTING AND INVESTMENTS

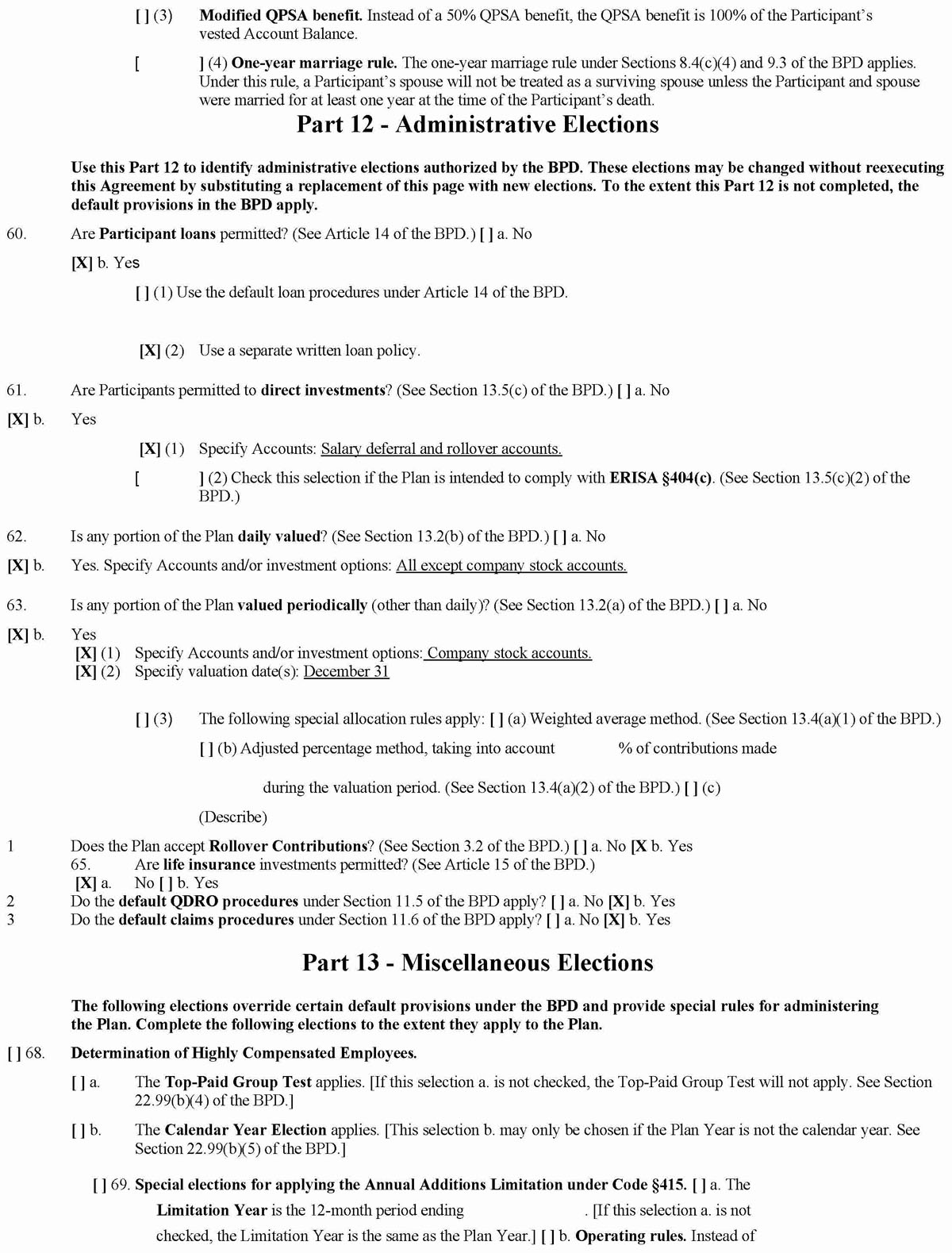

This Article contains the procedures for valuing Participant Accounts and allocating net income and loss to such Accounts. Part 12 of the Agreement permits the Employer to document its administrative procedures with respect to the valuation of Participant Accounts. Alternatively, the Plan Administrator may adopt separate investment procedures regarding the valuation and investment of Participant Accounts.

13.1

Participant Accounts. The Plan Administrator will establish and maintain a separate Account for each Participant to reflect the Participant's entire interest under the Plan. To the extent applicable, the Plan Administrator may establish and maintain for a Participant any (or all) of the following separate sub-Accounts: Employer Contribution Account, Section 401(k) Deferral Account, Employer Matching Contribution Account, QMAC Account, QNEC Account, Employee After-Tax Contribution Account, Safe Harbor Matching Contribution Account, Safe Harbor Nonelective Contribution Account, Rollover Contribution Account, and Transfer Account. The Plan Administrator also may establish and maintain other sub-Accounts as it deems appropriate.

13.2

Value of Participant Accounts. The value of a Participant's Account consists of the fair market value of the Participant's share of the Trust assets. A Participant's share of the Trust assets is determined as of each Valuation Date under the Plan.

(a)

Periodic valuation. The Trustee must value Plan assets at least annually. The Employer may elect under Part 12, #45.b.(2) of the Agreement [Part 12, #63.b.(2) of the Profit Sharing/401(k) Agreement] or may elect operationally to value assets more frequently than annually. The Plan Administrator may request the Trustee to perform interim valuations, provided such valuations do not result in discrimination in favor of Highly Compensated Employees.

(b)

Daily valuation. If the Employer elects daily valuation under Part 12, #44 of the Agreement [Part 12, #62 of the Profit Sharing/401(k) Agreement] or, if in operation, the Employer elects to have the Plan daily valued, the Plan Administrator may adopt reasonable procedures for performing such valuations. Unless otherwise set forth in the written procedures, a daily valued Plan will have its assets valued at the end of each business day during which the New York Stock Exchange is open. The Plan Administrator has authority to interpret the provisions of this Plan in the context of a daily valuation procedure. This includes, but is not limited to, the determination of the value of the Participant's Account for purposes of Participant loans, distribution and consent rights, and corrective distributions under Article 17.

13.3

Adjustments to Participant Accounts. As of each Valuation Date under the Plan, each Participant's Account is adjusted in the following manner.

(a)

Distributions and forfeitures from a Participant's Account. A Participant's Account will be reduced by any distributions and forfeitures from the Account since the previous Valuation Date.

(b)

Life insurance premiums and dividends. A Participant's Account will be reduced by the amount of any life insurance premium payments made for the benefit of the Participant since the previous Valuation Date. The Account will be credited with any dividends or credits paid on any life insurance policy held by the Trust for the benefit of the Participant.

(c)

Contributions and forfeitures allocated to a Participant's Account. A Participant's Account will be credited with any contribution or forfeiture allocated to the Participant since the previous Valuation Date.

(d)

Net income or loss.A Participant's Account will be adjusted for any net income or loss in accordance with the provisions under Section 13.4.

13.4

Procedures for Determining Net Income or Loss. The Plan Administrator may establish any reasonable procedures for determining net income or loss under Section 13.3(d). Such procedures may be reflected in a funding agreement governing the applicable investments under the Plan.

(a)

Net income or loss attributable to General Trust Account. To the extent a Participant's Account is invested as part of a General Trust Account, such Account is adjusted for its allocable share of net income or loss experienced by the General Trust Account using the Balance Forward Method. Under the Balance Forward Method, the net income or loss of the General Trust Account is allocated to the Participant Accounts that are invested in the General Trust Account, in the ratio that each Participant's Account bears to all Accounts, based on the value of each Participant's

| © Copyright 2001 Pension Specialists, Inc. | | Profit Sharing/401(k) BPD | |

77

Account as of the prior Valuation Date, reduced for the adjustments described in Section 13.3(a) and 13.3(b) above.

(1)

Inclusion of certain contributions.In applying the Balance Forward Method for allocating net income or loss, the Employer may elect under Part 12, #45.b.(3) of the Agreement [Part 12, #63.b.(3) of the Profit Sharing/401(k) Agreement] or under separate administrative procedures to adjust each Participant's Account Balance (as of the prior Valuation Date) for the following contributions made since the prior Valuation Date (the "valuation period") which were not reflected in the Participant's Account on such prior Valuation Date: (1) Section 401(k) Deferrals and Employee After-Tax Contributions that are contributed during the valuation period pursuant to the Participant's contribution election, (2) Employer Contributions (including Employer Matching Contributions) that are contributed during the valuation period and allocated to a Participant's Account during the valuation period, and (3) Rollover Contributions.

(2)

Methods of valuing contributions made during valuation period.In determining Participants' Account Balances as of the prior Valuation Date, the Employer may elect to apply a weighted average method that credits each Participant's Account with a portion of the contributions based on the portion of the valuation period for which such contributions were invested, or an adjusted percentage method, that increases each Participant's Account by a specified percentage of such contributions. The Employer may designate under Part 12, #45.b.(3)(c) of the Agreement [Part 12, #63.b.(3)(c) of the Profit Sharing/401(k) Agreement] to apply the special allocation rules to only particular types of contributions or may designate any other reasonable method for allocating net income and loss under the Plan.

(i)

Weighted average method.The Employer may elect under Part 12, #45.b.(3)(a) of the Agreement [Part 12, #63.b.(3)(a) of the Profit Sharing/401(k) Agreement] or under separate administrative procedures to apply a weighted average method in determining net income or loss. Under the weighted average method, a Participant's Account Balance as of the prior Valuation Date is adjusted to take into account a portion of the contributions made during the valuation period so that the Participant may receive an allocation of net income or loss for the portion of the valuation period during which such contributions were invested under the Plan. The amount of the adjustment to a Participant's Account Balance is determined by multiplying the contributions made to the Participant's Account during the valuation period by a fraction, the numerator of which is the number of months during the valuation period that such contributions were invested under the Plan and the denominator is the total number of months in the valuation period. The Plan's investment procedures may designate the specific type(s) of contributions eligible for a weighted allocation of net income or loss and may designate alternative methods for determining the weighted allocation, including the use of a uniform weighting period other than months.

(ii)

Adjusted percentage method.The Employer may elect under Part 12, #45.b.(3)(b) of the Agreement [Part 12, #63.b.(3)(b) of the Profit Sharing/401(k) Agreement] or under separate investment procedures to apply an adjusted percentage method of allocating net income or loss. Under the adjusted percentage method, a Participant's Account Balance as of the prior Valuation Date is increased by a percentage of the contributions made to the Participant's Account during the valuation period. The Plan's investment procedures may designate the specific type(s) of contributions eligible for an adjusted percentage allocation and may designate alternative procedures for determining the amount of the adjusted percentage allocation.

(b)

Net income or loss attributable to a Directed Account. If the Participant (or Beneficiary) is entitled to direct the investment of all or part of his/her Account (see Section 13.5(c)), the Account (or the portion of the Account which is subject to such direction) will be maintained as a Directed Account, which reflects the value of the directed investments as of any Valuation Date. The assets held in a Directed Account may be (but are not required to be) segregated from the other investments held in the Trust. Net income or loss attributable to the investments made by a Directed Account is allocated to such Account in a manner that reasonably reflects the investment experience of such Directed Account. Where a Directed Account reflects segregated investments, the manner of allocating net income or loss shall not result in a Participant (or Beneficiary) being entitled to distribution from the Directed Account that exceeds the value of such Account as of the date of distribution.

| | | |

|---|

| Profit Sharing/401(k) BPD | | © Copyright 2001 Pension Specialists, Inc. | |

78

(c)

Share or unit accounting. The Plan's investment procedures may provide for share or unit accounting to reflect the value of Accounts, if such method is appropriate for the investments allocable to such Accounts.

(d)

Suspense accounts. The Plan's investment procedures also may provide for special valuation procedures for suspense accounts that are properly established under the Plan.

13.5

Investments under the Plan.

(a)

Investment options. The Trustee or other person(s) responsible for the investment of Plan assets is authorized to invest Plan assets in any prudent investment consistent with the funding policy of the Plan and the requirements of ERISA. Investment options include, but are not limited to, the following: common and preferred stock or other equity securities (including stock bought and sold on margin); Qualifying Employer Securities and Qualifying Employer Real Property (to the extent permitted under subsection (b) below), corporate bonds; open-end or closed-end mutual funds (including funds for which the Volume Submitter Practitioner, if any, Trustee, or their affiliates serve as investment advisor or in any other capacity); money market accounts; certificates of deposit; debentures; commercial paper; put and call options; limited partnerships; mortgages; U.S. Government obligations, including U.S. Treasury notes and bonds; real and personal property having a ready market; life insurance or annuity policies; commodities; savings accounts; notes; and securities issued by the Trustee and/or its affiliates, as permitted by law. Plan assets may also be invested in a common/collective trust fund, or in a group trust fund that satisfies the requirements of IRS Revenue Ruling 81-100. All of the terms and provisions of any such common/collective trust fund or group trust into which Plan assets are invested are incorporated by reference into the provisions of the Trust for this Plan. No portion of any voluntary, tax deductible Employee contributions being held under the Plan (or any earnings thereon) may be invested in life insurance contracts or, as with any Participant-directed investment, in tangible personal property characterized by the IRS as a collectible.

(b)

Limitations on the investment in Qualifying Employer Securities and Qualifying EmployerReal Property. The Trustee may invest in Qualifying Employer Securities and Qualifying Employer Real Property up to certain limits. Any such investment shall only be made upon written direction of the Employer who shall be solely responsible for the propriety of such investment. Additional directives regarding the purchase, sale, retention or valuing of such securities may be addressed in a funding policy, statement of investment policy, or other separate procedures or documents governing the investment of Plan assets. In any conflicts between the Plan document and a separate investment trust agreement, the Plan document shall prevail.

(1)

Reserved.

(2)

Profit sharing plan other than a 401(k) plan.In the case of a profit sharing plan other than a 401(k) plan, no limit applies to the percentage of Plan assets invested in Qualifying Employer Securities and Qualifying Employer Real Property, except as provided in a funding policy, statement of investment policy, or other separate procedures or documents governing the investment of Plan assets.

(3)

401(k) plan. For Plan Years beginning after December 31, 1998, with respect to the portion of the Plan consisting of amounts attributable to Section 401(k) Deferrals, no more than 10% of the fair market value of Plan assets attributable to Section 401(k) Deferrals may be invested in Qualifying Employer Securities and Qualifying Employer Real Property if the Employer, the Trustee, or a person other than the Participant requires any portion of the Section 401(k) Deferrals and attributable earnings to be invested in Qualifying Employer Securities or Qualifying Employer Real Property.

(i)

Exceptions to Limitation.The limitation in this subsection (3) shall not apply if any one of the conditions in subsections (A), (B) or (C) applies.

(A)

Investment of Section 401(k) Deferrals in Qualifying Employer Securities or Qualifying Real Property is solely at the discretion of the Participant.

(B)

As of the last day of the preceding Plan Year, the fair market value of assets of all profit sharing plans and 401(k) plans of the Employer was not more than 10% of the fair market value of all assets under plans maintained by the Employer.

| © Copyright 2001 Pension Specialists, Inc. | | Profit Sharing/401(k) BPD | |

79

(C)

The portion of a Participant's Section 401(k) Deferrals required to be invested in Qualifying Employer Securities and Qualifying Employer Real Property for the Plan Year does not exceed 1% of such Participant's Included Compensation.

(ii)

Plan Years Beginning Prior to January 1, 1999. For Plan Years beginning before January 1, 1999, the limitations in this subsection (3) do not apply and a 401(k) plan is treated like any other profit sharing plan.

(iii)

No application to other contributions.The limitation in this subsection (3) has no application to Employer Matching Contributions or Employer Nonelective Contributions. Instead, the rules under subsection (2) above apply for such contributions.

(c)

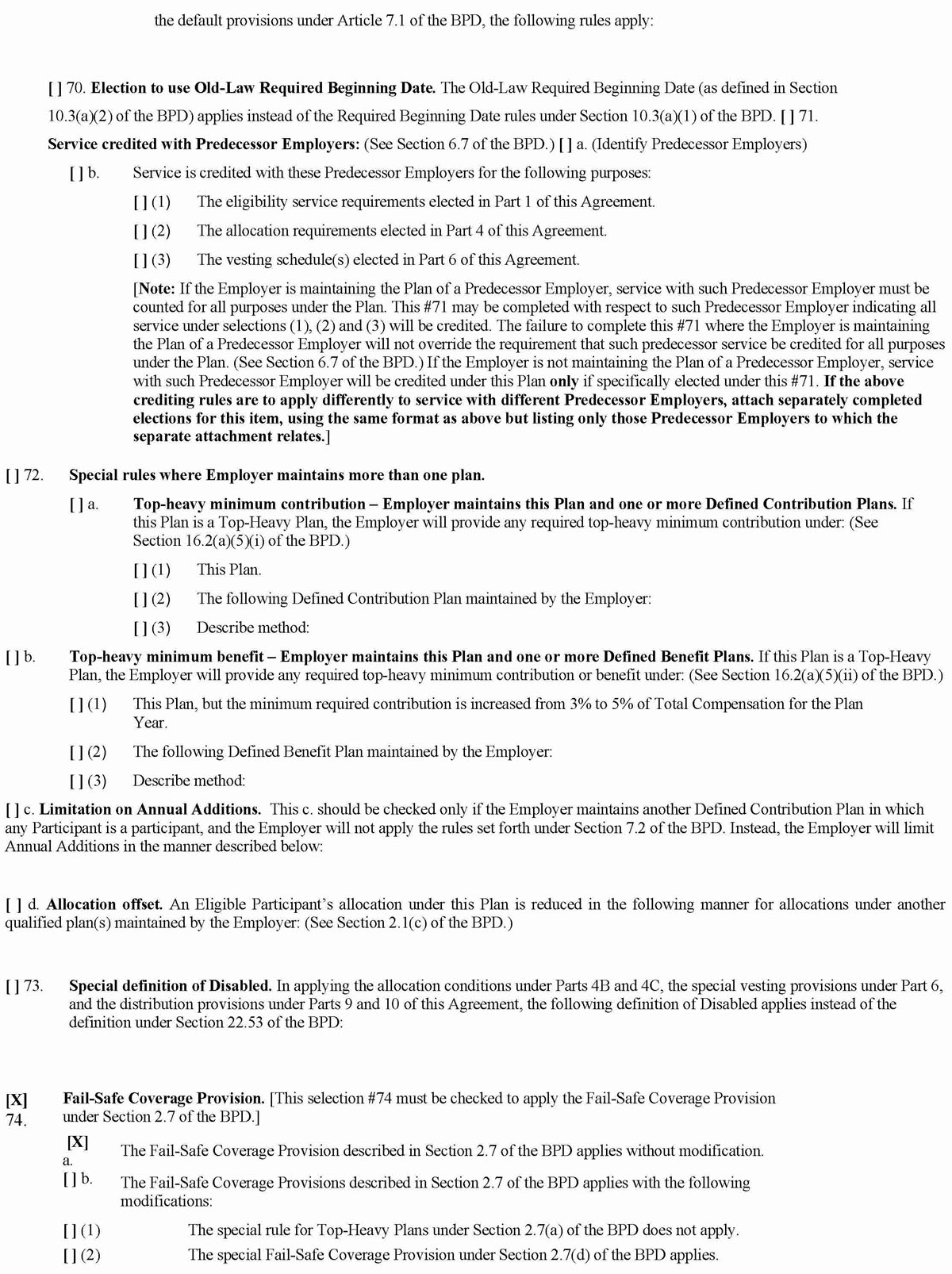

Participant direction of investments. If the Plan (by election in Part 12, #43 of the Agreement [Part 12, #61 of the Profit Sharing/401(k) Agreement] or by the Plan Administrator's administrative election) permits Participant direction of investments, the Plan Administrator must adopt investment procedures for such direction. The investment procedures should set forth the permissible investment options available for Participant direction, the timing and frequency of investment changes, and any other procedures or limitations applicable to Participant direction of investment. In no case may Participants direct that investments be made in collectibles, other than U.S. Government or State issued gold and silver coins. The investment procedures adopted by the Plan Administrator are incorporated by reference into the Plan. If Participant investment direction is limited to specific investment options (such as designated mutual funds or common or collective trust funds), it shall be the sole and exclusive responsibility of the Employer or Plan Administrator to select the investment options, and the Trustee shall not be responsible for selecting or monitoring such investment options, unless the Trustee has otherwise agreed in writing.

The Employer may elect under Part 12, #43.b.(1) of the Agreement [Part 12, #61.b.(1) of the Profit Sharing/401(k) Agreement] or under the separate investment procedures to limit Participant direction of investment to specific types of contributions. The investment procedures adopted by the Plan Administrator may (but need not) allow Beneficiaries under the Plan to direct investments. (See Section 13.4(b) for rules regarding allocation of net income or loss to a Directed Account.)

If Participant direction of investments is permitted, the Employer will designate how accounts will be invested in the absence of proper affirmative direction from the Participant. Except as otherwise provided in this Plan, neither the Trustee, the Employer, nor any other fiduciary of the Plan will be liable to the Participant or Beneficiary for any loss resulting from action taken at the direction of the Participant.

(1)

Trustee to follow Participant direction.To the extent the Plan allows Participant direction of investment, the Trustee is authorized to follow the Participant's written direction (or other form of direction deemed acceptable by the Trustee). A Directed Account will be established for the portion of the Participant's Account that is subject to Participant direction of investment. The Trustee may decline to follow a Participant's investment direction to the extent such direction would: (i) result in a prohibited transaction; (ii) cause the assets of the Plan to be maintained outside the jurisdiction of the U.S. courts; (iii) jeopardize the Plan's tax qualification; (iv) be contrary to the Plan's governing documents; (v) cause the assets to be invested in collectibles within the meaning of Code §408(m); (vi) generate unrelated business taxable income; or (vii) result (or could result) in a loss exceeding the value of the Participant's Account. The Trustee will not be responsible for any loss or expense resulting from a failure to follow a Participant's direction in accordance with the requirements of this paragraph.

Participant directions will be processed as soon as administratively practicable following receipt of such directions by the Trustee. The Trustee, Plan Administrator, or Employer will not be liable for a delay in the processing of a Participant direction that is caused by a legitimate business reason (including, but not limited to, a failure of computer systems or programs, failure in the means of data transmission, the failure to timely receive values or prices, or other unforeseen problems outside of the control of the Trustee, Plan Administrator, or Employer).

(2)

ERISA §404(c) protection.If the Plan (by Employer election under Part 12, #43.b.(2) of the Agreement [Part 12, #61.b.(2) of the Profit Sharing/401(k) Agreement] or pursuant to the Plan's investment procedures) is intended to comply with ERISA §404(c), the Participant investment direction program adopted by the Plan Administrator should comply with applicable Department of Labor regulations. Compliance with ERISA §404(c) is not

| | | |

|---|

| Profit Sharing/401(k) BPD | | © Copyright 2001 Pension Specialists, Inc. | |

80

required for plan qualification purposes. The following information is provided solely as guidance to assist the Plan Administrator in meeting the requirements of ERISA §404(c). Failure to meet any of the following safe harbor requirements does not impose any liability on the Plan Administrator (or any other fiduciary under the Plan) for investment decisions made by Participants, nor does it mean that the Plan does not comply with ERISA §404(c). Nothing in this Plan shall impose any greater duties upon the Trustee with respect to the implementation of ERISA §404(c) than those duties expressly provided for in procedures adopted by the Employer and agreed to by the Trustee.

(i)

Disclosure requirements.The Plan Administrator (or other Plan fiduciary who has agreed to perform this activity) shall provide, or shall cause a person designated to act on his behalf to provide, the following information to Participants:

(A)

Mandatory disclosures.To satisfy the requirements of ERISA §404(c), the Participants must receive certain mandatory disclosures, including

(I) an explanation that the Plan is intended to be an ERISA §404(c) plan; (II) a description of the investment options under the Plan; (III) the identity of any designated Investment Managers that may be selected by the Participant; (IV) any restrictions on investment selection or transfers among investment vehicles; (V) an explanation of the fees and expenses that may be charged in connection with the investment transactions; (VI) the materials relating to voting rights or other rights incidental to the holding of an investment; (VII) the most recent prospectus for an investment option which is subject to the Securities Act of 1933.

(B)

Disclosures upon request.In addition, a Participant must be able to receive upon request (I) the current value of the Participant's interest in an investment option; (II) the value and investment performance of investment alternatives available under the Plan; (III) the annual operating expenses of a designated investment alternative; and (IV) copies of any prospectuses, or other material, relating to available investment options.

(ii)

Diversified investment options. The investment procedure must provide at least three diversified investment options that offer a broad range of investment opportunity. Each of the investment opportunities must have materially different risk and return characteristics. The procedure may allow investment under a segregated brokerage account.

(iii)

Frequency of investment instructions. The investment procedure must provide the Participant with the opportunity to give investment instructions as frequently as is appropriate to the volatility of the investment. For each investment option, the frequency can be no less than quarterly.

| © Copyright 2001 Pension Specialists, Inc. | | Profit Sharing/401(k) BPD | |

81

ARTICLE 14

PARTICIPANT LOANS

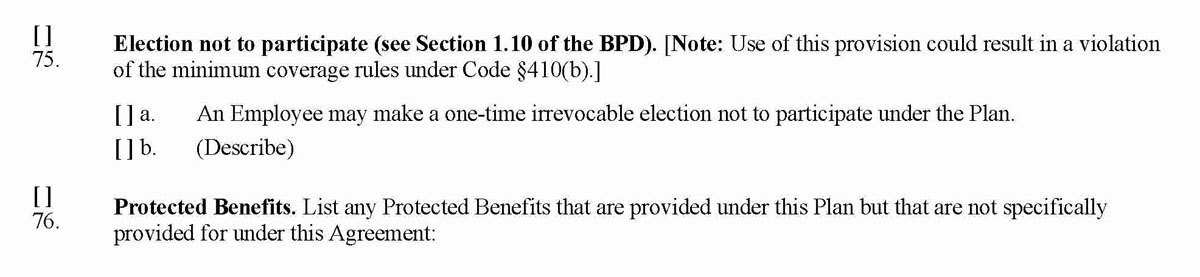

This Article contains rules for providing loans to Participants under the Plan. This Article applies if: (1) the Employer elects under Part 12 of the Agreement to provide loans to Participants or (2) if Part 12 does not specify whether Participant loans are available, the Plan Administrator decides to implement a Participant loan program. Any Participant loans will be made pursuant to the default loan policy prescribed by this Article 14 unless the Plan Administrator adopts a separate written loan policy or modifies the default loan policy in this Article 14 by adopting modified loan provisions. If the Employer adopts a separate written loan policy or written modifications to the default loan program in this Article, the terms of such loan policy or written modifications will control over the terms of this Plan with respect to the administration of any Participant loans.

14.1

Default Loan Policy.Loans are available under this Article only if such loans:

(a)

are available to Participants on a reasonably equivalent basis (see Section 14.3);

(b)

are not available to Highly Compensated Employees in an amount greater than the amount that is available to other Participants;

(c)

bear a reasonable rate of interest (as determined under Section 14.4) and are adequately secured (as determined under Section 14.5);

(d)

provide for periodic repayment within a specified period of time (as determined under Section 14.6); and

(e)

do not exceed, for any Participant, the amount designated under Section 14.7.

A separate written loan policy may not modify the requirements under subsections (a) through (e) above, except as permitted in the referenced Sections of this Article.

14.2

Administration of Loan Program.A Participant loan is available under this Article only if the Participant makes a request for such a loan in accordance with the provisions of this Article or in accordance with a separate written loan policy. To receive a Participant loan, a Participant must sign a promissory note along with a pledge or assignment of the portion of the Account Balance used for security on the loan. Except as provided in a separate loan policy or in a written modification to the default loan policy in this Article, any reference under this Article 14 to a Participant means a Participant or Beneficiary who is a party in interest (as defined in ERISA §3(14)).

In the case of a restated Plan, if any provision of this Article 14 is more restrictive than the terms of the Plan (or a separate written loan policy) in effect prior to the adoption of this Plan, such provision shall apply only to loans finalized after the adoption of this Plan, even if the restated Effective Date indicated in the Agreement predates the adoption of the Plan.

14.3

Availability of Participant Loans.Participant loans must be made available to Participants in a reasonably equivalent manner. The Plan Administrator may refuse to make a loan to any Participant who is determined to be not creditworthy. For this purpose, a Participant is not creditworthy if, based on the facts and circumstances, it is reasonable to believe that the Participant will not repay the loan. A Participant who has defaulted on a previous loan from the Plan and has not repaid such loan (with accrued interest) at the time of any subsequent loan will not be treated as creditworthy until such time as the Participant repays the defaulted loan (with accrued interest). A separate written loan policy or written modification to this loan policy may prescribe different rules for determining creditworthiness and to what extent creditworthiness must be determined.

No Participant loan will be made to any Shareholder-Employee or Owner-Employee unless a prohibited transaction exemption for such loan is obtained from the Department of Labor or the prohibition against loans to such individuals is formally withdrawn by statute or by action of the Treasury or the Department of Labor. The prohibition against loans to Shareholder-Employees and Owner-Employees outlined in this paragraph may not be modified by a separate written loan policy.

14.4

Reasonable Interest Rate.A Participant must be charged a reasonable rate of interest for any loan he/she receives. For this purpose, the interest rate charged on a Participant loan must be commensurate with the interest rates charged by persons in the business of lending money for loans under similar circumstances. The Plan Administrator will determine a reasonable rate of interest by reviewing the interest rates charged by a sample of third party lenders in the same geographical region as the Employer. The Plan Administrator must periodically review its interest rate assumptions to ensure the interest rate charged on Participant loans

| | | |

|---|

| Profit Sharing/401(k) BPD | | © Copyright 2001 Pension Specialists, Inc. | |

82

is reasonable. A separate written loan policy or written modifications to this loan policy may prescribe an alternative means of establishing a reasonable interest rate.

14.5

Adequate Security.All Participant loans must be adequately secured. The Participant's vested Account Balance shall be used as security for a Participant loan provided the outstanding balance of all Participant loans made to such Participant does not exceed 50% of the Participant's vested Account Balance, determined immediately after the origination of each loan, and if applicable, the spousal consent requirements described in Section 14.9 have been satisfied. The Plan Administrator (with the consent of the Trustee) may require a Participant to provide additional collateral to receive a Participant loan if the Plan Administrator determines such additional collateral is required to protect the interests of Plan Participants. A separate loan policy or written modifications to this loan policy may prescribe alternative rules for obtaining adequate security. However, the 50% rule in this paragraph may not be replaced with a greater percentage.

14.6

Periodic Repayment.A Participant loan must provide for level amortization with payments to be made not less frequently than quarterly. A Participant loan must be payable within a period not exceeding five (5) years from the date the Participant receives the loan from the Plan, unless the loan is for the purchase of the Participant's principal residence, in which case the loan must be payable within a reasonable time commensurate with the repayment period permitted by commercial lenders for similar loans. Loan repayments must be made through payroll withholding, except to the extent the Plan Administrator determines payroll withholding is not practical given the level of a Participant's wages, the frequency with which the Participant is paid, or other circumstances.

(a)

Unpaid leave of absence.A Participant with an outstanding Participant loan may suspend loan payments to the Plan for up to 12 months for any period during which the Participant is on an unpaid leave of absence. Upon the Participant's return to employment (or after the end of the 12month period, if earlier), the Participant's outstanding loan will be reamortized over the remaining period of such loan to make up for the missed payments. The reamortized loan may extend beyond the original loan term so long as the loan is paid in full by whichever of the following dates comes first: (1) the date which is five (5) years from the original date of the loan (or the end of the suspension, if sooner), or (2) the original loan repayment deadline (or the end of the suspension period, if later) plus the length of the suspension period.

(b)

Military leave.A Participant with an outstanding Participant loan also may suspend loan payments for any period such Participant is on military leave, in accordance with Code §414(u)(4). Upon the Participant's return from military leave (or the expiration of five years from the date the Participant began his/her military leave, if earlier), loan payments will recommence under the amortization schedule in effect prior to the Participant's military leave, without regard to the five-year maximum loan repayment period. Alternatively, the loan may be reamortized to require a different level of loan payment, as long as the amount and frequency of such payments are not less than the amount and frequency under the amortization schedule in effect prior to the Participant's military leave.

A separate loan policy or written modification to this loan policy may (1) modify the time period for repaying Participant loans, provided Participant loans are required to be repaid over a period that is not longer than the periods described in this Section; (2) specify the frequency of Participant loan repayments, provided the payments are required at least quarterly; (3) modify the requirement that loans be repaid through payroll withholding; or (4) modify or eliminate the leave of absence and/or military leave rules under this Section.

14.7

Loan Limitations.A Participant loan may not be made to the extent such loan (when added to the outstanding balance of all other loans made to the Participant) exceeds the lesser of:

(a)

$50,000 (reduced by the excess, if any, of the Participant's highest outstanding balance of loans from the Plan during the one-year period ending on the day before the date on which such loan is made, over the Participant's outstanding balance of loans from the Plan as of the date such loan is made) or

(b)

one-half (½) of the Participant's vested Account Balance, determined as of the Valuation Date coinciding with or immediately preceding such loan, adjusted for any contributions or distributions made since such Valuation Date.

A Participant may not receive a Participant loan of less than $1,000 nor may a Participant have more than one Participant loan outstanding at any time. A Participant may renegotiate a loan without violating the one outstanding loan requirement to the extent such renegotiated loan is a new loan (i.e., the renegotiated loan separately satisfies the reasonable interest rate requirement under Section 14.4, the adequate security requirement under Section 14.5, and the periodic repayment requirement under Section 14.6). and the renegotiated loan does not exceed the limitations under (a) or (b) above, treating both the replaced loan and the renegotiated loan as outstanding at the same time. However, if the term of the renegotiated loan does

| © Copyright 2001 Pension Specialists, Inc. | | Profit Sharing/401(k) BPD | |

83

not end later than the original term of the replaced loan, the replaced loan may be ignored in applying the limitations under (a) and (b) above.

In applying the limitations under this Section, all plans maintained by the Employer are aggregated and treated as a single plan. In addition, any assignment or pledge of any portion of the Participant's interest in the Plan and any loan, pledge, or assignment with respect to any insurance contract purchased under the Plan will be treated as loan under this Section.

A separate written loan policy or written modifications to this loan policy may (1) modify the limitations on the amount of a Participant loan; (2) modify or eliminate the minimum loan amount requirement; (3) permit a Participant to have more than one loan outstanding at a time; (4) prescribe limitations on the purposes for which loans may be required; or (5) prescribe rules for reamortization, consolidation, renegotiation, or refinancing of loans.

14.8

Segregated Investment.A Participant loan is treated as a segregated investment on behalf of the individual Participant for whom the loan is made. The Plan Administrator may adopt separate administrative procedures for determining which type or types of contributions (and the amount of each type of contribution) may be used to provide the Participant loan. If the Plan Administrator does not adopt procedures designating the type of contributions from which the Participant loan will be made, such loan is deemed to be made on a proportionate basis from each type of contribution.

Unless requested otherwise on the Participant's loan application, a Participant loan will be made equally from all investment funds in which the applicable contributions are held. A Participant or Beneficiary may direct the Trustee, on his/her loan application, to withdraw the Participant loan amounts from a specific investment fund or funds. A Participant loan will not violate the requirements of this default loan policy merely because the Plan Administrator does not permit the Participant to designate the contributions or funds from which the Participant loan will be made. Each payment of principal and interest paid by a Participant on his/her Participant loan shall be credited proportionately to such Participant's Account(s) and to the investment funds within such Account(s).

A separate loan policy or written modifications to this loan policy may modify the rules of this Section without limitation, including prescribing different rules for determining the source of a loan with respect to contribution types and investment funds.

14.9

Spousal Consent.If this Plan is subject to the Joint and Survivor Annuity requirements under Article 9, a Participant may not use his/her Account Balance as security for a Participant loan unless the Participant's spouse, if any, consents to the use of such Account Balance as security for the loan. The spousal consent must be made within the 90-day period ending on the date the Participant's Account Balance is to be used as security for the loan. Spousal consent is not required, however, if the value of the Participant's total vested Account Balance (as determined under Section 8.3(e)) does not exceed $5,000 ($3,500 for loans made before the time the $5,000 rules becomes effective under Section 8.3). If the Plan is not subject to the Joint and Survivor Annuity requirements under Article 9, a spouse's consent is not required to use a Participant's Account Balance as security for a Participant loan, regardless of the value of the Participant's Account Balance.

Any spousal consent required under this Section must be in writing, must acknowledge the effect of the loan, and must be witnessed by a plan representative or notary public. Any such consent to use the Participant's Account Balance as security for a Participant loan is binding with respect to the consenting spouse and with respect to any subsequent spouse as it applies to such loan. A new spousal consent will be required if the Account Balance is subsequently used as security for a renegotiation, extension, renewal, or other revision of the loan. A new spousal consent also will be required only if any portion of the Participant's Account Balance will be used as security for a subsequent Participant loan.

A separate loan policy or written modifications to this loan policy may not eliminate the spousal consent requirement where it would be required under this Section, but may impose spousal consent requirements that are not prescribed by this Section.

14.10

Procedures for Loan Default.A Participant will be considered to be in default with respect to a loan if any scheduled repayment with respect to such loan is not made by the end of the calendar quarter following the calendar quarter in which the missed payment was due.

If a Participant defaults on a Participant loan, the Plan may not offset the Participant's Account Balance until the Participant is otherwise entitled to an immediate distribution of the portion of the Account Balance which will be offset and such amount being offset is available as security on the loan, pursuant to Section 14.5. For this purpose, a loan default is treated as an immediate distribution event to the extent the law does not prohibit an actual distribution of the type of contributions which would be offset as a result of the loan default (determined without regard to the consent requirements under Articles 8 and 9, so long as spousal consent

| | | |

|---|

| Profit Sharing/401(k) BPD | | © Copyright 2001 Pension Specialists, Inc. | |

84

was properly obtained at the time of the loan, if required under Section 14.9). The Participant may repay the outstanding balance of a defaulted loan (including accrued interest through the date of repayment) at any time.

Pending the offset of a Participant's Account Balance following a defaulted loan, the following rules apply to the amount in default.

(a)

Interest continues to accrue on the amount in default until the time of the loan offset or, if earlier, the date the loan repayments are made current or the amount is satisfied with other collateral.

(b)

A subsequent offset of the amount in default is not reported as a taxable distribution, except to the extent the taxable portion of the default amount was not previously reported by the Plan as a taxable distribution.

(c)

The post-default accrued interest included in the loan offset is not reported as a taxable distribution at the time of the offset.

A separate loan policy or written modifications to this loan policy may modify the procedures for determining a loan default.

14.11

Termination of Employment.

(a)

Offset of outstanding loan.A Participant loan becomes due and payable in full immediately upon the Participant's termination of employment. Upon a Participant's termination, the Participant may repay the entire outstanding balance of the loan (including any accrued interest) within a reasonable period following termination of employment. If the Participant does not repay the entire outstanding loan balance, the Participant's vested Account Balance will be reduced by the remaining outstanding balance of the loan (without regard to the consent requirements under Articles 8 and 9, so long as spousal consent was properly obtained at the time of the loan, if required under Section 14.9), to the extent such Account Balance is available as security on the loan, pursuant to Section 14.5, and the remaining vested Account Balance will be distributed in accordance with the distribution provisions under Article 8. If the outstanding loan balance of a deceased Participant is not repaid, the outstanding loan balance shall be treated as a distribution to the Participant and shall reduce the death benefit amount payable to the Beneficiary under Section 8.4.

(b)

Direct Rollover.Upon termination of employment, a Participant may request a Direct Rollover of the loan note (provided the distribution is an Eligible Rollover Distribution as defined in Section 8.8(a)) to another qualified plan which agrees to accept a Direct Rollover of the loan note. A Participant may not engage in a Direct Rollover of a loan to the extent the Participant has already received a deemed distribution with respect to such loan. (See the rules regarding deemed distributions upon a loan default under Section 14.10.)

(c)

Modified loan policy.A separate loan policy or written modifications to this loan policy may modify this Section 14.11, including, but not limited to: (1) a provision to permit loan repayments to continue beyond termination of employment; (2) to prohibit the Direct Rollover of a loan note; and

(3) to provide for other events that may accelerate the Participant's repayment obligation under the loan.

| © Copyright 2001 Pension Specialists, Inc. | | Profit Sharing/401(k) BPD | |

85

ARTICLE 15

INVESTMENT IN LIFE INSURANCE

This Article provides special rules for Plans that permit investment in life insurance on the life of the Participant, the Participant's spouse, or other family members. The Employer may elect in Part 12 of the Agreement to permit life insurance investments in the Plan, or life insurance investments may be permitted, prohibited, or restricted under the Plan through separate investment procedures or a separate funding policy. If the Plan prohibits investments in life insurance, this Article does not apply.

15.1

Investment in Life Insurance.A group or individual life insurance policy purchased by the Plan may be issued on the life of a Participant, a Participant's spouse, a Participant's child or children, a family member of the Participant, or any other individual with an insurable interest. A life insurance policy includes any type of policy, including a second-to-die policy, provided that the holding of a particular type of policy is not prohibited under rules applicable to qualified plans.

Any premiums on life insurance held for the benefit of a Participant will be charged against such Participant's vested Account Balance. Unless directed otherwise, the Plan Administrator will reduce each of the Participant's Accounts under the Plan equally to pay premiums on life insurance held for such Participant's benefit. Any premiums paid for life insurance policies must satisfy the incidental life insurance rules under Section 15.2.

15.2

Incidental Life Insurance Rules.Any life insurance purchased under the Plan must meet the following requirements:

(a)

Ordinary life insurance policies.The aggregate premiums paid for ordinary life insurance policies (i.e., policies with both nondecreasing death benefits and nonincreasing premiums) for the benefit of a Participant shall not at any time exceed 49% of the aggregate amount of Employer Contributions (including Section 401(k) Deferrals) and forfeitures that have been allocated to the Account of such Participant.

(b)

Life insurance policies other than ordinary life.The aggregate premiums paid for term, universal or other life insurance policies (other than ordinary life insurance policies) for the benefit of a Participant shall not at any time exceed 25% of the aggregate amount of Employer Contributions (including Section 401(k) Deferrals) and forfeitures that have been allocated to the Account of such Participant.

(c)

Combination of ordinary and other life insurance policies.The sum of one-half (1/2) of the aggregate premiums paid for ordinary life insurance policies plus all the aggregate premiums paid for any other life insurance policies for the benefit of a Participant shall not at any time exceed 25% of the aggregate amount of Employer Contributions (including Section 401(k) Deferrals) and forfeitures which have been allocated to the Account of such Participant.

(d)

Exception for certain profit sharing and 401(k) plans.If the Plan is a profit sharing plan or a 401(k) plan, the limitations in this Section do not apply to the extent life insurance premiums are paid only with Employer Contributions and forfeitures that have been accumulated in the Participant's Account for at least two years or are paid with respect to a Participant who has been an Eligible Participant for at least five years. For purposes of applying this special limitation, Employer Contributions do not include any Section 401(k) Deferrals, QMACs, QNECs or Safe-Harbor Contributions under a 401(k) plan.

(e)

Exception for Employee After-Tax Contributions and Rollover Contributions. The Plan Administrator also may invest, with the Participant's consent, any portion of the Participant's Employee After-Tax Contribution Account or Rollover Contribution Account in a group or individual life insurance policy for the benefit of such Participant, without regard to the incidental life insurance rules under this Section.

15.3

Ownership of Life Insurance Policies.The Trustee is the owner of any life insurance policies purchased under the Plan in accordance with the provisions of this Article 15. Any life insurance policy purchased under the Plan must designate the Trustee as owner and beneficiary under the policy. The Trustee will pay all proceeds of any life insurance policies to the Beneficiary of the Participant for whom such policy is held in accordance with the distribution provisions under Article 8 and the Joint and Survivor Annuity requirements under Article 9. In no event shall the Trustee retain any part of the proceeds from any life insurance policies for the benefit of the Plan.

| | | |

|---|

| Profit Sharing/401(k) BPD | | © Copyright 2001 Pension Specialists, Inc. | |

86

15.4

Evidence of Insurability.Prior to purchasing a life insurance policy, the Plan Administrator may require the individual whose life is being insured to provide evidence of insurability, such as a physical examination, as may be required by the Insurer.

15.5

Distribution of Insurance Policies.Life insurance policies under the Plan which are held on behalf of a Participant must be distributed to the Participant or converted to cash upon the later of the Participant's Distribution Commencement Date (as defined in Section 22.56) or termination of employment. Any life insurance policies that are held on behalf of a terminated Participant must continue to satisfy the incidental life insurance rules under Section 15.2. If a life insurance policy is purchased on behalf of an individual other than the Participant, and such individual dies, the Participant may withdraw any or all life insurance proceeds from the Plan, to the extent such proceeds exceed the cash value of the life insurance policy determined immediately before the death of the insured individual.

15.6

Discontinuance of Insurance Policies.Investments in life insurance may be discontinued at any time, either at the direction of the Trustee or other fiduciary responsible for making investment decisions. If the Plan provides for Participant direction of investments, life insurance as an investment option may be eliminated at any time by the Plan Administrator. Where life insurance investment options are being discontinued, the Plan Administrator, in its sole discretion, may offer the sale of the insurance policies to the Participant, or to another person, provided that the prohibited transaction exemption requirements prescribed by the Department of Labor are satisfied.

15.7

Protection of Insurer.An Insurer that issues a life insurance policy under the terms of this Article, shall not be responsible for the validity of this Plan and shall be protected and held harmless for any actions taken or not taken by the Trustee or any actions taken in accordance with written directions from the Trustee or the Employer (or any duly authorized representatives of the Trustee or Employer). An Insurer shall have no obligation to determine the propriety of any premium payments or to guarantee the proper application of any payments made by the insurance company to the Trustee.

The Insurer is not and shall not be considered a party to this Agreement and is not a fiduciary with respect to the Plan solely as a result of the issuance of life insurance policies under this Article 15.

15.8

No Responsibility for Act of Insurer.Neither the Employer, the Plan Administrator nor the Trustee shall be responsible for the validity of the provisions under a life insurance policy issued under this Article 15 or for the failure or refusal by the Insurer to provide benefits under such policy. The Employer, the Plan Administrator and the Trustee are also not responsible for any action or failure to act by the Insurer or any other person which results in the delay of a payment under the life insurance policy or which renders the policy invalid or unenforceable in whole or in part.

| © Copyright 2001 Pension Specialists, Inc. | | Profit Sharing/401(k) BPD | |

87

ARTICLE 16

TOP-HEAVY PLAN REQUIREMENTS

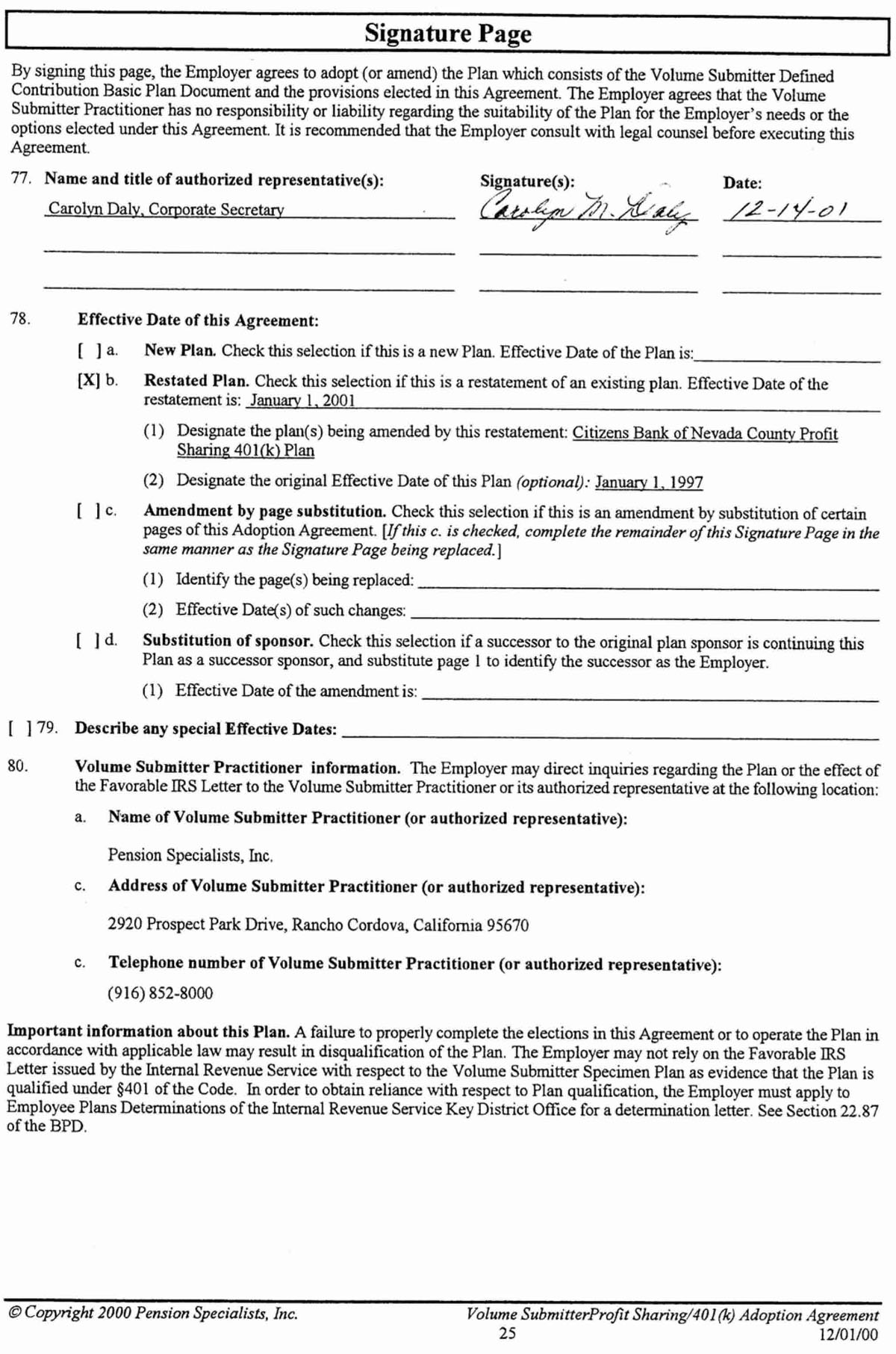

This Article contains the rules for determining whether the Plan is a Top-Heavy Plan and the consequences of having a Top-Heavy Plan. Part 6 of the Agreement provides for elections relating to the vesting schedule for a Top-Heavy Plan. Part 13 of the Agreement allows the Employer to elect to satisfy the Top-Heavy Plan allocation requirements under another plan.

16.1

In General. If the Plan is or becomes a Top-Heavy Plan in any Plan Year, the provisions of this Article 16 will supersede any conflicting provisions in the Plan or Agreement. However, this Article 16 will no longer apply if Code §416 is repealed.

16.2

Top-Heavy Plan Consequences.

(a)

Minimum allocation for Non-Key Employees. If the Plan is a Top-Heavy Plan for any Plan Year, except as otherwise provided in subsections (4) and (5) below, the Employer Contributions and forfeitures allocated for the Plan Year on behalf of any Eligible Participant who is a Non-Key Employee must not be less than a minimum percentage of the Participant's Total Compensation (as defined in Section 16.3(i)). If any Non-Key Employee who is entitled to receive a top-heavy minimum contribution pursuant to this Section 16.2(a) fails to receive an appropriate allocation, the Employer will make an additional contribution on behalf of such Non-Key Employee to satisfy the requirements of this Section. The Employer may elect under Part 4 of the Agreement [Part 4C of the Profit Sharing/401(k) Agreement] to make the top-heavy contribution to all Eligible Participants. If the Employer elects under the Agreement to provide the top-heavy minimum contribution to all Eligible Participants, the Employer also will make an additional contribution on behalf of any Key Employee who is an Eligible Participant and who did not receive an allocation equal to the top-heavy minimum contribution.

(1)

Determining the minimum percentage.The minimum percentage that must be allocated under subsection (a) above is the lesser of: (i) three (3) percent of Total Compensation for the Plan Year or (ii) the highest contribution rate for any Key Employee for the Plan Year. The highest contribution rate for a Key Employee is determined by taking into account the total Employer Contributions and forfeitures allocated to each Key Employee for the Plan Year, as a percentage of the Key Employee's Total Compensation. A Key Employee's contribution rate includes Section 401(k) Deferrals made by the Key Employee for the Plan Year (except as provided by regulation or statute). If this Plan is aggregated with a Defined Benefit Plan to satisfy the requirements of Code §401(a)(4) or Code §410(b), the minimum percentage is three (3) percent, without regard to the highest Key Employee contribution rate. See subsection (5) below if the Employer maintains more than one plan.

(2)

Determining whether the Non-Key Employee's allocation satisfies the minimum percentage. To determine if a Non-Key Employee's allocation of Employer Contributions and forfeitures is at least equal to the minimum percentage, the Employee's Section 401(k) Deferrals for the Plan Year are disregarded. In addition, Matching Contributions allocated to the Employee's Account for the Plan Year are disregarded, unless: (i) the Plan Administrator elects to take all or a portion of the Matching Contributions into account, or

(ii) Matching Contributions are taken into account by statute or regulation. The rule in (i) does not apply unless the Matching Contributions so taken into account could satisfy the nondiscrimination testing requirements under Code §401(a)(4) if tested separately. Any Employer Matching Contributions used to satisfy the Top-Heavy Plan minimum allocation may not be used in the ACP Test (as defined in Section 17.3), except to the extent permitted under statute, regulation or other guidance of general applicability.

(3)

Certain allocation conditions inapplicable. The Top-Heavy Plan minimum allocation shall be made even though, under other Plan provisions, the Non-Key Employee would not otherwise be entitled to receive an allocation, or would have received a lesser allocation for the Plan Year because of:

(i)

the Participant's failure to complete 1,000 Hours of Service (or any equivalent provided in the Plan),

(ii)

the Participant's failure to make Employee After-Tax Contributions to the Plan, or

(iii)

Total Compensation is less than a stated amount.

| | | |

|---|

| Profit Sharing/401(k) BPD | | © Copyright 2001 Pension Specialists, Inc. | |

88

The minimum allocation also is determined without regard to any Social Security contribution or whether an Eligible Participant fails to make Section 401(k) Deferrals for a Plan Year in which the Plan includes a 401(k) feature.

(4)

Participants not employed on the last day of the Plan Year. The minimum allocation requirement described in this subsection (a) does not apply to an Eligible Participant who was not employed by the Employer on the last day of the applicable Plan Year.

(5)

Participation in more than one Top-heavy Plan.The minimum allocation requirement described in this subsection (a) does not apply to an Eligible Participant who is covered under another plan maintained by the Employer if, pursuant to Part 13, #54 of the Agreement [Part 13, #72 of the Profit Sharing/401(k) Agreement], the other Plan will satisfy the minimum allocation requirement.

(i)

More than one Defined Contribution Plans.If the Employer maintains more than one top-heavy Defined Contribution Plan (including Paired Plans), the Employer may designate in Part 13, #54.a. of the Agreement [Part 13, #72.a. of the Profit Sharing/401(k) Agreement] which plan will provide the top-heavy minimum contribution to Non-Key Employees. Alternatively, under Part 13, #54.a.(3) of the Agreement [Part 13, #72.a.(3) of the Profit Sharing/401(k) Agreement], the Employer may designate another means of complying with the top-heavy requirements. If Part 13, #54 of the Agreement [Part 13, #72 of the Profit Sharing/401(k) Agreement] is not completed and the Employer maintains more than one Defined Contribution Plan, the Employer will be deemed to have selected this Plan under Part 13, #54.a. of the Agreement [Part 13, #72.a. of the Profit Sharing/401(k) Agreement] as the Plan under which the top-heavy minimum contribution will be provided.

If an Employee is entitled to a top-heavy minimum contribution but has not satisfied the minimum age and/or service requirements under the Plan designated to provide the top-heavy minimum contribution, the Employee may receive a top-heavy minimum contribution under the designated Plan. Thus, for example, if the Employer maintains both a 401(k) plan and a non-401(k) plan, a Non-Key Employee who has not satisfied the minimum age and service conditions under Part 1, #5 of the non-401(k) plan Agreement is eligible for a top-heavy minimum allocation under the non-401(k) plan (if so provided under Part 13, #54.a. of the Agreement [Part 13, #72.a. of the Profit Sharing/401(k) Agreement]) if such Employee has satisfied the eligibility conditions for making Section 401(k) Deferrals under the 401(k) plan. The provision of a top-heavy minimum contribution under this paragraph will not cause the Plan to fail the minimum coverage or nondiscrimination rules. The Employer may designate an alternative method of providing the top-heavy minimum contribution to such Employees under Part 13, #54.a.(3) of the Agreement [Part 13, #72.a.(3) of the Profit Sharing/401(k) Agreement].

(ii)