REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13A-16 OR 15D-16 OF THE SECURITIES EXCHANGE ACT OF 1934

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): [ ].

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): [ ].

Attached to this report on Form 6-K as Exhibit 99.1 is the Notice of Special Meeting of Shareholders and Proxy Statement of Diana Containerships Inc. ("the Company"), which was mailed to shareholders of the Company on or around October 6, 2017.

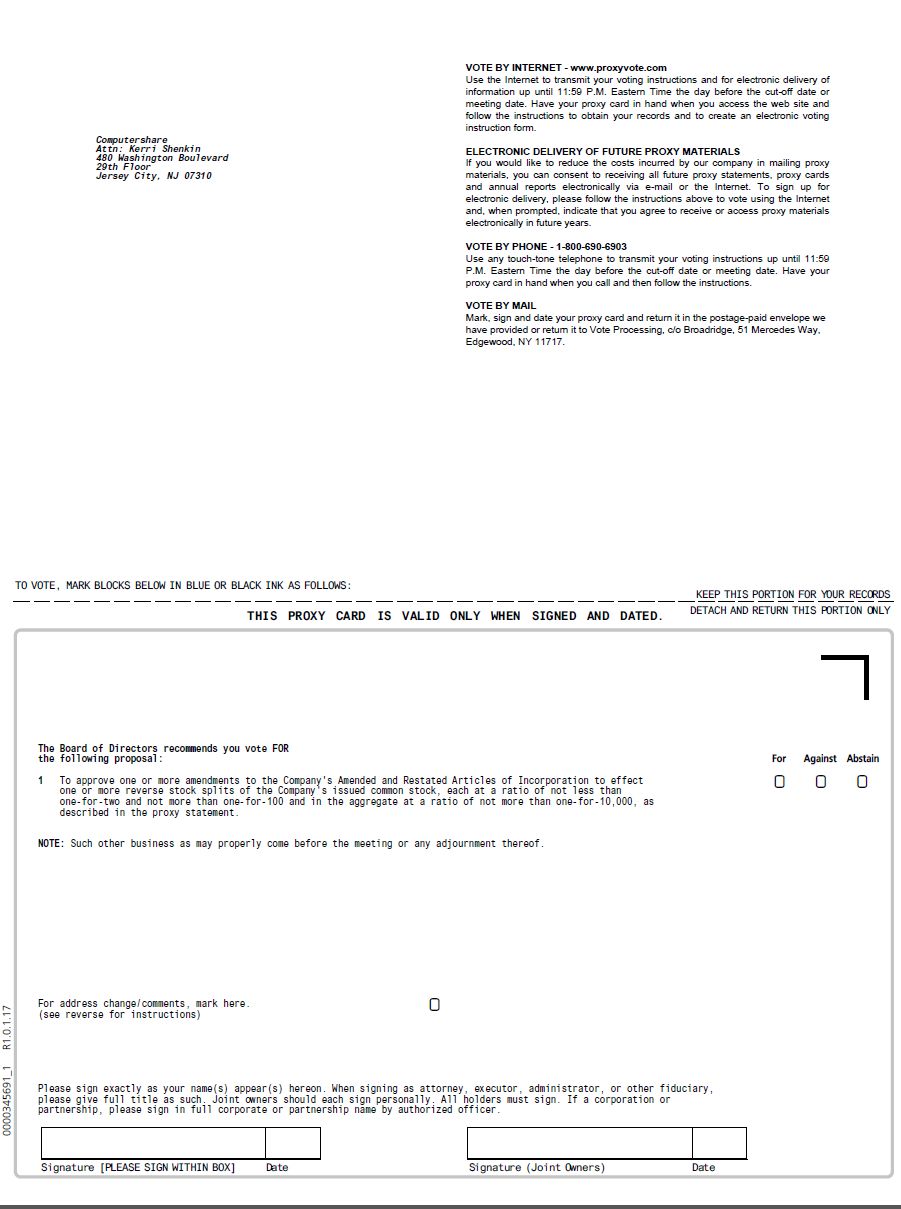

Attached to this report on Form 6-K as Exhibit 99.2 is the Proxy Card of the Company, which was mailed to shareholders of the Company on or around October 6, 2017.

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

DIANA CONTAINERSHIPS INC.

October 6, 2017

TO THE SHAREHOLDERS OF DIANA CONTAINERSHIPS INC.

Enclosed is a Notice of the Special Meeting of Shareholders (the "Meeting") of Diana Containerships Inc. (the "Company") which will be held at 21 Vasili Michailidi Street, 3026 Limassol, Cyprus on October 26, 2017 at 12:00 p.m. local time in Limassol.

At this Meeting, holders of shares of the Company's common stock and Series C preferred stock (together, the "Shares") will consider and vote upon the following proposal:

To approve one or more amendments to the Company's Amended and Restated Articles of Incorporation to effect one or more reverse stock splits of the Company's issued common stock, each at a ratio of not less than one-for-two and not more than one-for-100 and in the aggregate at a ratio of not more than one-for-10,000, with the exact ratio to be set at a whole number within this range to be determined by the Company's board of directors in its discretion, and to authorize the Company's board of directors to implement any such reverse stock split at any time prior to the date of the Company's 2020 Annual Meeting of Shareholders by filing an amendment to the Company's Amended and Restated Articles of Incorporation (the "Proposal").

Adoption of the Proposal requires the affirmative vote of a majority of all votes eligible to be cast by holders of Shares entitled to attend and vote at the Meeting.

You are cordially invited to attend the Meeting in person. If you attend the Meeting, you may revoke your proxy and vote your Shares in person.

WHETHER OR NOT YOU PLAN TO ATTEND THE MEETING, IT IS IMPORTANT THAT YOUR SHARES BE REPRESENTED AND VOTED AT THE MEETING. ACCORDINGLY, IF YOU HAVE ELECTED TO RECEIVE YOUR PROXY MATERIALS BY MAIL, PLEASE DATE, SIGN AND RETURN THE PROXY CARD TO BE MAILED TO YOU ON OR ABOUT OCTOBER 6, 2017, WHICH DOES NOT REQUIRE POSTAGE IF MAILED IN THE UNITED STATES. ANY SIGNED PROXY RETURNED AND NOT COMPLETED WILL BE VOTED IN FAVOR OF THE PROPOSAL PRESENTED IN THE PROXY STATEMENT. IF YOU RECEIVED YOUR PROXY MATERIALS OVER THE INTERNET, PLEASE VOTE BY INTERNET OR BY TELEPHONE IN ACCORDANCE WITH THE INSTRUCTIONS PROVIDED IN THE NOTICE OF INTERNET AVAILABILITY OF PROXY MATERIALS THAT YOU WILL RECEIVE IN THE MAIL. THE VOTE OF EVERY SHAREHOLDER IS IMPORTANT AND YOUR COOPERATION WILL BE APPRECIATED.

| | Very truly yours, |

| | |

| | Symeon P. Palios

Chief Executive Officer |

18 Pendelis Str., 175 64 Palaio Faliro, Athens, Greece

Tel: + (30) (216) 6002-400, Fax: + (30) (216) 6002-599

e-mail: ir@dcontainerships.com – www.dcontainerships.com

DIANA CONTAINERSHIPS INC.

NOTICE OF SPECIAL MEETING OF SHAREHOLDERS

October 26, 2017

NOTICE IS HEREBY given that the Special Meeting (the "Meeting") of the holders (the "Shareholders") of shares of the Company's common stock and Series C preferred stock (together, the "Shares") of Diana Containerships Inc. (the "Company") will be held on October 26, 2017 at 12:00 p.m. local time at 21 Vasili Michailidi Street, 3026 Limassol, Cyprus for the following purpose, which is more completely set forth in the accompanying Proxy Statement:

The consider and vote upon a proposal to approve one or more amendments to the Company's Amended and Restated Articles of Incorporation to effect one or more reverse stock splits of the Company's issued common stock, each at a ratio of not less than one-for-two and not more than one-for-100 and in the aggregate at a ratio of not more than one-for-10,000, with the exact ratio to be set at a whole number within this range to be determined by the Company's board of directors in its discretion, and to authorize the Company's board of directors to implement any such reverse stock split at any time prior to the date of the Company's 2020 Annual Meeting of Shareholders by filing an amendment to the Company's Amended and Restated Articles of Incorporation.

The board of directors has fixed the close of business on October 2, 2017 as the record date for the determination of the Shareholders entitled to receive notice and to vote at the Meeting or any adjournment thereof.

IT IS IMPORTANT TO VOTE. WHETHER OR NOT YOU PLAN TO ATTEND THE MEETING, PLEASE COMPLETE, DATE, SIGN AND RETURN THE ENCLOSED PROXY IN THE ENCLOSED ENVELOPE, WHICH DOES NOT REQUIRE POSTAGE IF MAILED IN THE UNITED STATES. THE VOTE OF EVERY SHAREHOLDER IS IMPORTANT AND YOUR COOPERATION IN RETURNING YOUR EXECUTED PROXY PROMPTLY WILL BE APPRECIATED. ANY SIGNED PROXY RETURNED AND NOT COMPLETED WILL BE VOTED IN FAVOR OF THE PROPOSAL PRESENTED IN THE PROXY STATEMENT.

All Shareholders must present a form of personal photo identification in order to be admitted to the Meeting. In addition, if your Shares are held in the name of your broker, bank or other nominee and you wish to attend the Meeting, you must bring an account statement or letter from the broker, bank or other nominee indicating that you were the owner of the Shares on October 2, 2017.

If you attend the Meeting, you may revoke your proxy and vote in person.

| | BY ORDER OF THE BOARD OF DIRECTORS |

| | |

| | Ioannis G. Zafirakis

Secretary |

October 6, 2017

Athens, Greece

DIANA CONTAINERSHIPS INC.

18 PENDELIS STR.

175 64 PALAIO FALIRO

ATHENS GREECE

______________________

PROXY STATEMENT FOR

SPECIAL MEETING OF SHAREHOLDERS

TO BE HELD ON OCTOBER 26, 2017

________________________

INFORMATION CONCERNING SOLICITATION AND VOTING

GENERAL

The enclosed proxy is solicited on behalf of the board of directors (the "Board") of Diana Containerships Inc., a Marshall Islands corporation (the "Company"), for use at the Special Meeting of holders of shares of common stock and Series C preferred stock of the Company (the "Shareholders") to be held at 21 Vasili Michailidi Street, 3026 Limassol, Cyprus on October 26, 2017 at 12:00 p.m. local time in Limassol, or at any adjournment or postponement thereof (the "Meeting"), for the purposes set forth herein and in the accompanying Notice of Special Meeting of Shareholders. This Proxy Statement and the accompanying form of proxy are expected to be mailed to the Shareholders of the Company entitled to vote at the Meeting on or about October 6, 2017.

VOTING RIGHTS AND OUTSTANDING SHARES

On October 2, 2017 (the "Record Date"), the Company had outstanding 2,668,363 shares of common stock, par value $0.01 per share (the "Common Shares") and 100 shares of Series C preferred stock, par value $0.01 per share (the "Series C Preferred Shares"). Each Shareholder of record at the close of business on the Record Date is entitled to one (1) vote for each Common Share then held and two hundred fifty thousand (250,000) votes for each Series C Preferred Share then held, provided however, that pursuant to the Statement of Designation of the Series C Preferred Stock, no holder of Series C Preferred Shares may exercise voting rights pursuant to any share of Series C Preferred Stock that would result in the total number of votes such holder, together with its affiliates, is entitled to vote (including any voting power derived from Series C Preferred Shares or Common Shares) to exceed 49.0% of the total number of votes eligible to be cast. One or more Shareholders representing at least one third of the total voting rights of the Company present in person or by proxy at the Meeting shall constitute a quorum for the purposes of the Meeting. The Shares represented by any proxy in the enclosed form will be voted in accordance with the instructions given on the proxy if the proxy is properly executed and is received by the Company prior to the close of voting at the Meeting or any adjournment or postponement thereof. Any proxies returned without instructions will be voted FOR the proposal set forth on the Notice of Special Meeting of Shareholders.

The Common Shares are listed on the NASDAQ Global Select Market under the symbol "DCIX."

REVOCABILITY OF PROXIES

A Shareholder giving a proxy may revoke it at any time before it is exercised. A proxy may be revoked by filing with the Secretary of the Company at the Company's corporate office, 18 Pendelis Str., 175 64 Palaio Faliro, Athens, Greece, a written notice of revocation by a duly executed proxy bearing a later date, or by attending the Meeting and voting in person.

PROPOSAL

APPROVAL OF ONE OR MORE AMENDMENTS TO THE AMENDED AND RESTATED ARTICLES OF INCORPORATION OF THE COMPANY TO EFFECT ONE OR MORE REVERSE STOCK SPLITS OF THE ISSUED COMMON SHARES, EACH AT A RATIO OF NOT LESS THAN ONE-FOR-TWO AND NOT MORE THAN ONE-FOR-100 AND IN THE AGGREGATE AT A RATIO OF NOT MORE THAN ONE-FOR-10,000

General

The Board has approved and is hereby soliciting shareholder approval of one or more amendments to Section D of the Company's Amended and Restated Articles of Incorporation to effect one or more reverse stock splits of the Company's issued Common Shares at a ratio of not less than one-for-two and not more than one-for-100 individually and of not more than one-for-10,000 in the aggregate (each, an "Amendment"). A vote FOR the Proposal will constitute approval of one or more Amendments providing for the combination of any number of the Company's issued Common Shares between and including two and 100 into one Common Share and will grant the Board the authority to select which of the approved exchange ratios within that range will be implemented. If the shareholders approve this proposal, the Board will have the authority, but not the obligation, in its sole discretion, and without further action on the part of the shareholders, to select, for each reverse stock split, one of the approved reverse stock split ratios and to effect one or more approved reverse stock splits by filing an Amendment with the Registrar of Corporations of the Republic of the Marshall Islands for each reverse stock split at any time after the approval of such Amendment. If an Amendment has not been filed with the Registrar of Corporations of the Republic of the Marshall Islands by the date of the Company's 2020 Annual Meeting of Shareholders, the Board will abandon the Amendment constituting the reverse stock split and shareholder approval would again be required prior to implementing any reverse stock split thereafter. If implemented, a reverse stock split will become effective as of the beginning of the business day after the filing of an Amendment with the Registrar of Corporations of the Republic of the Marshall Islands. An Amendment will not change the number of authorized shares or par value of the Company's Common Shares. After a reverse stock split, if implemented, the number of authorized Common Shares will remain at 500,000,000 Common Shares.

The Board believes that shareholder approval of an exchange ratio range (rather than an exact exchange ratio) provides the Board with maximum flexibility to achieve the purposes of one or more reverse stock splits. If shareholders approve the Proposal, a reverse stock split will be effected, if at all, only upon a determination by the Board that the reverse stock split is in the Company's and the shareholders' best interests at that time. In connection with any determination to effect a reverse stock split, the Board will set the time for such a split and select a specific exchange ratio within the range. These determinations will be made by the Board with the intention to create the greatest marketability of the Company's Common Shares based upon prevailing market conditions at that time.

The Board reserves its right to elect not to proceed, and abandon, a reverse stock split if it determines, in its sole discretion, that implementing this proposal is not in the best interests of the Company and its shareholders.

Purpose and Background of One or More Reverse Stock Splits

The purpose of a reverse stock split is to increase the per share trading value of the Company's Common Shares. The Board intends to effect one or more reverse stock splits only if it believes that a decrease in the number of Common Shares outstanding is likely to improve the trading price for the Company's Common Shares, and only if the implementation of a reverse stock split is determined by the Board to be in the best interests of the Company and its shareholders.

The NASDAQ Global Select Market has several listing criteria that companies must satisfy in order to maintain their listing, including that the Company's Common Shares maintain a minimum bid price that is greater than or equal to $1.00 per share. The Company believes that effecting one or more reverse stock splits will help it regain or maintain compliance with the minimum bid price per share listing requirement for listing its Common Shares on the NASDAQ Global Select Market.

The Company received a written notification from The Nasdaq Stock Market ("Nasdaq") dated May 22, 2017, indicating that the Company was not in compliance with this minimum $1.00 per share bid price requirement for continued listing on the NASDAQ Global Select Market. Pursuant to Nasdaq Listing Rules, the applicable grace period to regain compliance is 180 days, or until November 20, 2017. The Company has not yet regained compliance with this requirement.

There can be no assurance that a reverse stock split, if implemented, will achieve any of the desired results. There also can be no assurance that the price per share of the Company's Common Shares immediately after a reverse stock split, if implemented, will increase proportionately with the reverse stock split, or that any increase will be sustained for any period of time.

Procedure for Exchange of Stock Certificates

As soon as practicable after the effective date of a reverse stock split, shareholders holding Common Shares in physical certificate form will be sent a letter of transmittal from the Company notifying them that the reverse stock split has been effected. The letter of transmittal will contain instructions on how shareholders should surrender to the Company's exchange agent certificates representing pre-split shares in exchange for certificates representing post-split shares. The Company expects that its transfer agent will act as its exchange agent for purposes of implementing the exchange of share certificates. No new certificates will be issued to a shareholder until such shareholder has surrendered such shareholder's outstanding certificate(s) together with the properly completed and executed letter of transmittal to the exchange agent. Any pre-split shares submitted for transfer, whether pursuant to a sale or other disposition, or otherwise, will automatically be exchanged for post-split shares. SHAREHOLDERS SHOULD NOT DESTROY ANY SHARE CERTIFICATE(S) AND SHOULD NOT SUBMIT ANY CERTIFICATE(S) UNTIL REQUESTED TO DO SO.

Shareholders holding shares in book-entry form with the transfer agent need not take any action to receive post-split shares or cash payment in lieu of any fractional share interest, if applicable. If a shareholder is entitled to post-split shares, a transaction statement will automatically be sent to the shareholder's address of record indicating the number of shares of common stock held following the reverse stock split.

Upon a reverse stock split, the Company intends to treat shares held by shareholders in "street name" through a bank, broker or other nominee in the same manner as registered shareholders whose shares are registered in their names. Banks, brokers or other nominees will be instructed to effect the reverse stock split for their beneficial holders holding shares in "street name." However, these banks, brokers or other nominees may have different procedures than registered shareholders for processing the reverse stock split and making payment for fractional shares. If a shareholder holds shares with a bank, broker or other nominee and has any questions in this regard, shareholders are encouraged to contact their bank, broker or other nominee.

Fractional Shares

No fractional shares will be created or issued in connection with a reverse stock split. Shareholders of record who otherwise would be entitled to receive fractional shares because they hold a number of pre-split shares not evenly divisible by the number of pre-split shares for which each post-split share is to be exchanged, will be entitled, upon surrender to the exchange agent of certificates representing such shares or, in the case of non-certificated shares, such proof of ownership as required by the exchange agent, to a cash payment in lieu thereof at a price equal to the fraction to which the stockholder would otherwise be entitled multiplied by the closing price of the common stock on the NASDAQ Global Select Market on the last trading day prior to the effective date of the split as adjusted for the reverse stock split as appropriate or, if such price is not available, a price determined by the Board. The ownership of a fractional interest will not give the holder thereof any voting, dividend or other rights except to receive payment thereof as described herein.

Required Vote. Adoption of the Proposal requires the affirmative vote of a majority of all votes eligible to be cast by holders of Shares entitled to attend and vote at the Meeting.

Effect of abstentions. Abstentions will have the effect of voting AGAINST the Proposal.

SOLICITATION

The cost of preparing and soliciting proxies will be borne by the Company. Solicitation will be made primarily by mail, but Shareholders may be solicited by telephone, e-mail, or personal contact. The Board has retained Okapi Partners LLC as proxy solicitor in connection with the Meeting. If you have any questions or need assistance in voting your proxy, please contact Okapi Partners LLC at the toll-free number or email address listed below.

Okapi Partners LLC

437 Madison Avenue, 28th Floor

New York, New York 10022

+1 212 297-0720

Toll-free (888) 785-6709

info@okapipartners.com

OTHER MATTERS

No other matters are expected to be presented for action at the Meeting. Should any additional matter come before the Meeting, it is intended that proxies in the accompanying form will be voted in accordance with the judgment of the person or persons named in the proxy.

| | By Order of the Directors |

| | |

| | Ioannis G. Zafirakis

Secretary |

October 6, 2017

Athens, Greece