February 2019 2019 Global High Yield & Leveraged Finance Conference Exhibit 99.1

31 Important Information About Ryerson Holding Corporation These materials do not constitute an offer or solicitation to purchase or sell securities of Ryerson Holding Corporation (“Ryerson” or “the Company”) and no investment decision should be made based upon the information provided herein. Ryerson strongly urges you to review its filings with the Securities and Exchange Commission, which can be found at https://ir.ryerson.com/Docs. This site also provides additional information about Ryerson. Safe Harbor Provision Certain statements made in this presentation and other written or oral statements made by or on behalf of the Company constitute "forward-looking statements" within the meaning of the federal securities laws, including statements regarding our future performance, as well as management's expectations, beliefs, intentions, plans, estimates, objectives, or projections relating to the future. Such statements can be identified by the use of forward-looking terminology such as “objectives,” “goals,” "believes," "expects," "may," "estimates," "will," "should," "plans," or "anticipates" or the negative thereof or other variations thereon or comparable terminology, or by discussions of strategy. The Company cautions that any such forward-looking statements are not guarantees of future performance and may involve significant risks and uncertainties, and that actual results may vary materially from those in the forward-looking statements as a result of various factors. Among the factors that significantly impact the metals distribution industry and our business are: the cyclicality of our business; the highly competitive, volatile, and fragmented market in which we operate; fluctuating metal prices; our substantial indebtedness and the covenants in instruments governing such indebtedness; the integration of acquired operations; regulatory and other operational risks associated with our operations located inside and outside of the United States; work stoppages; obligations under certain employee retirement benefit plans; the ownership of a majority of our equity securities by a single investor group; currency fluctuations; and consolidation in the metals producer industry. Forward-looking statements should, therefore, be considered in light of various factors, including those set forth above and those set forth under "Risk Factors" in our annual report on Form 10-K for the year ended December 31, 2017, and in our other filings with the Securities and Exchange Commission. Moreover, we caution against placing undue reliance on these statements, which speak only as of the date they were made. The Company does not undertake any obligation to publicly update or revise any forward-looking statements to reflect future events or circumstances, new information or otherwise. Non-GAAP Measures Certain measures contained in these slides or the related presentation are not measures calculated in accordance with generally accepted accounting principles (“GAAP”). They should not be considered a replacement for GAAP results. Non-GAAP financial measures appearing in these slides are identified in the footnotes. A reconciliation of these non-GAAP measures to the most directly comparable GAAP financial measures is included in the Appendix.

Business Overview EDDIE LEHNER│ PRESIDENT & CHIEF EXECUTIVE OFFICER

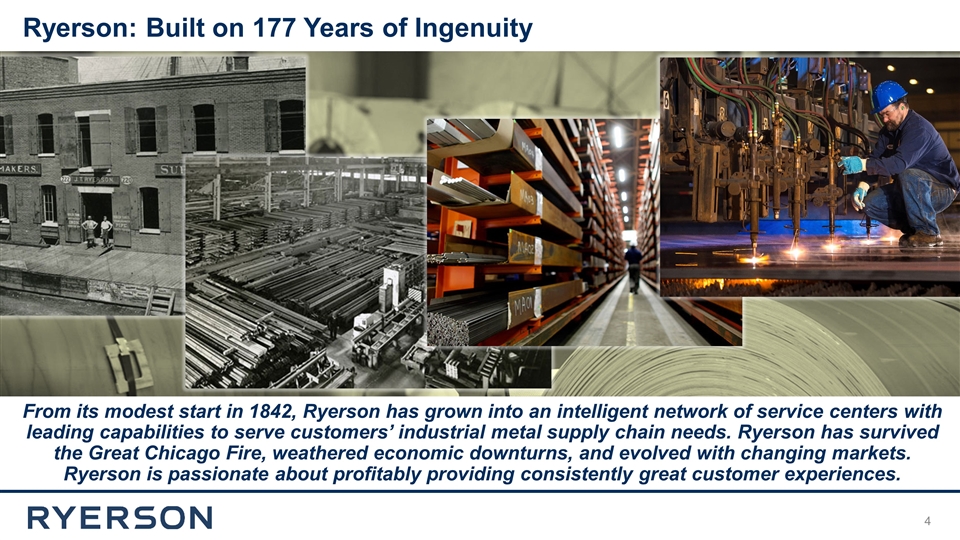

Ryerson: Built on 177 Years of Ingenuity From its modest start in 1842, Ryerson has grown into an intelligent network of service centers with leading capabilities to serve customers’ industrial metal supply chain needs. Ryerson has survived the Great Chicago Fire, weathered economic downturns, and evolved with changing markets. Ryerson is passionate about profitably providing consistently great customer experiences.

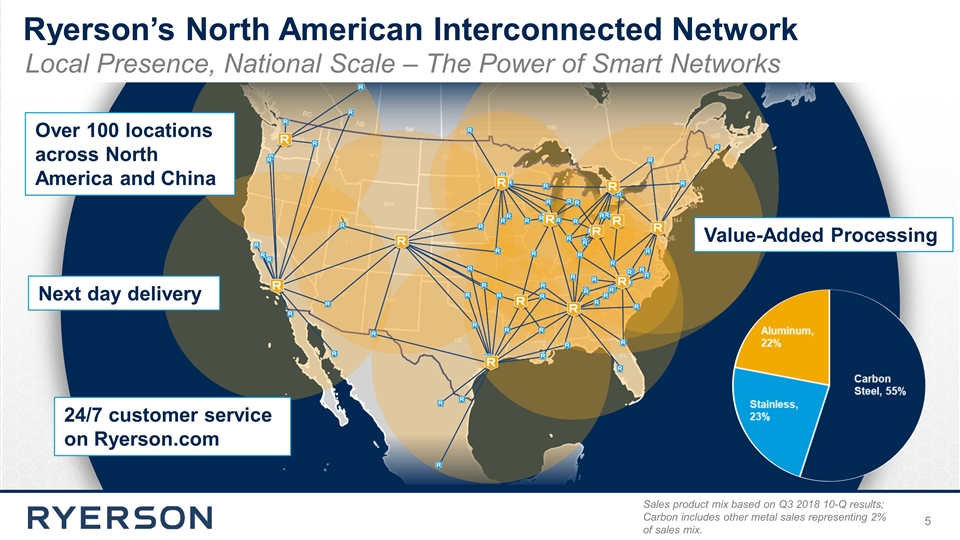

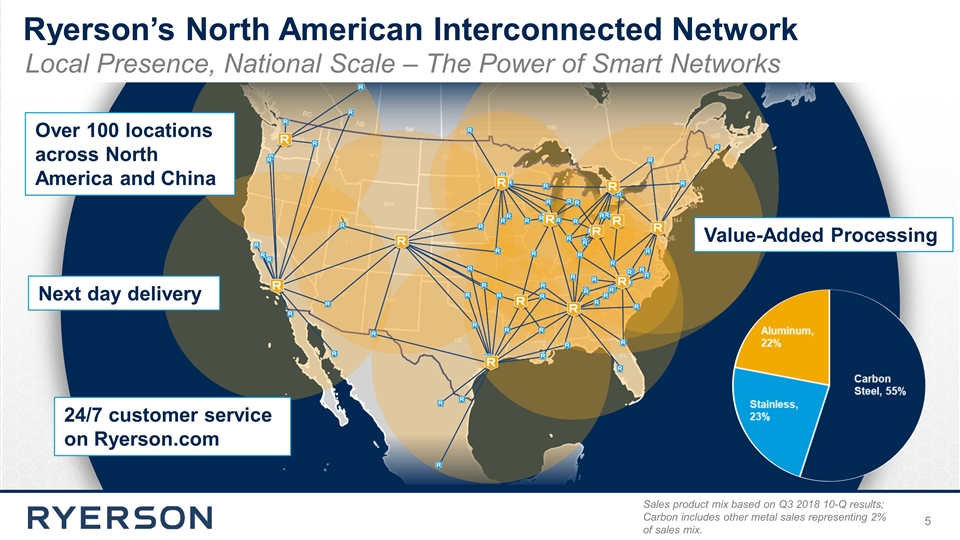

Ryerson’s North American Interconnected Network Local Presence, National Scale – The Power of Smart Networks Sales product mix based on Q3 2018 10-Q results; Carbon includes other metal sales representing 2% of sales mix. Over 100 locations across North America and China Next day delivery 24/7 customer service on Ryerson.com Value-Added Processing

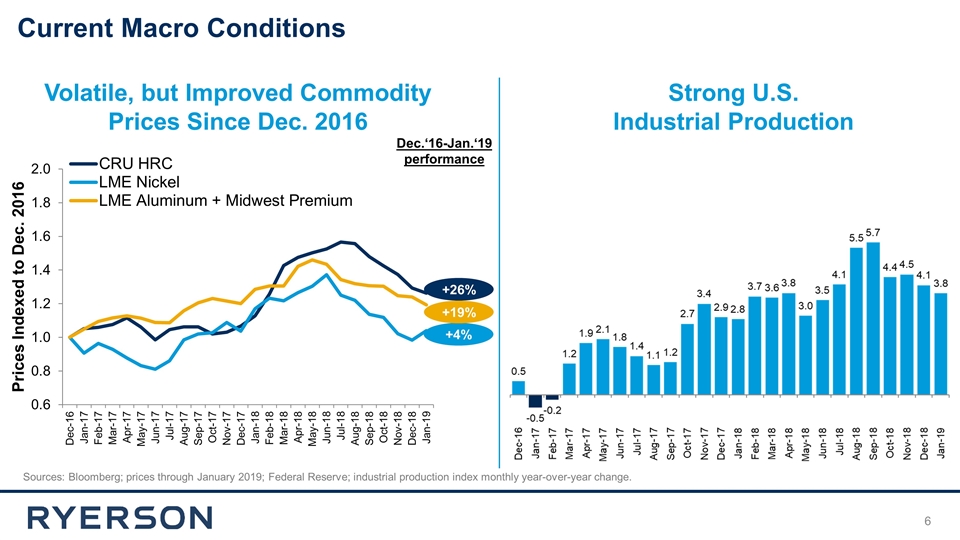

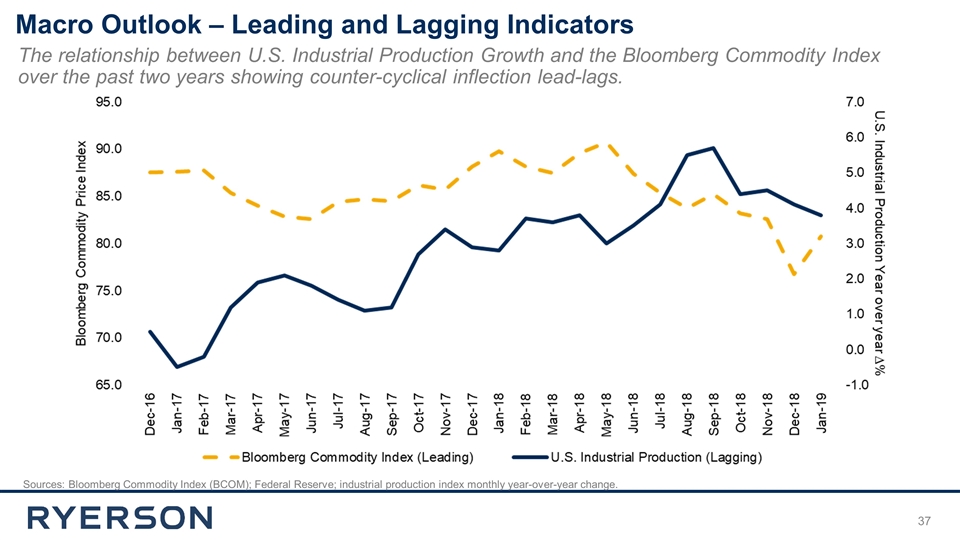

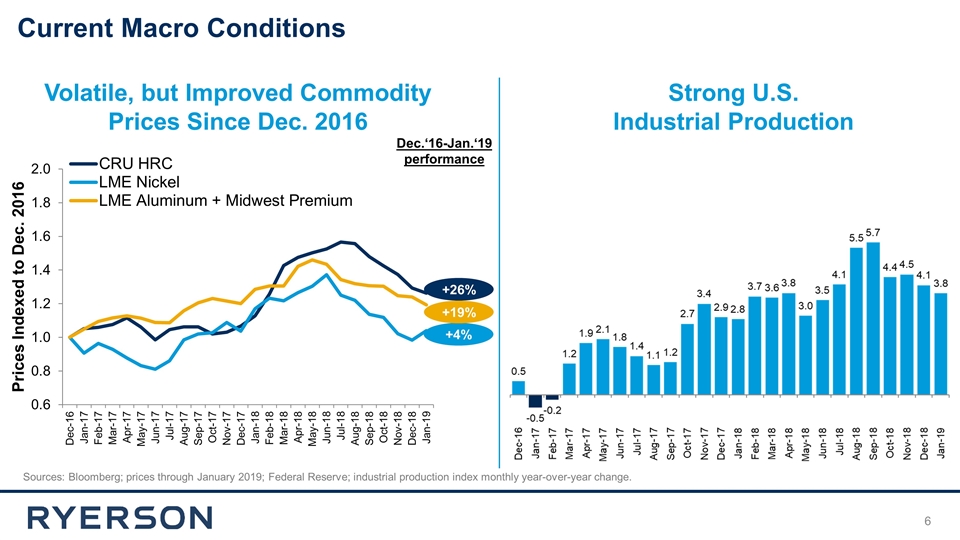

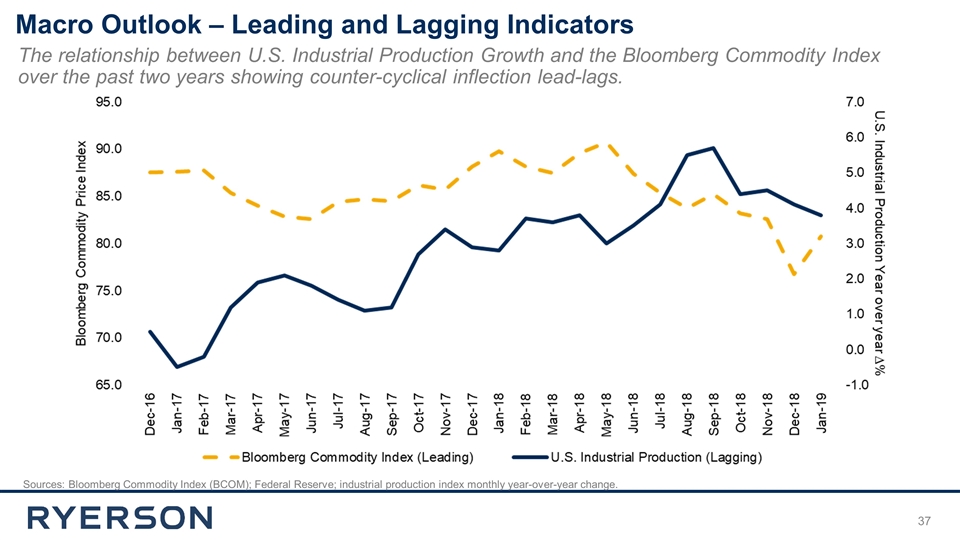

Current Macro Conditions Sources: Bloomberg; prices through January 2019; Federal Reserve; industrial production index monthly year-over-year change. Strong U.S. Industrial Production Dec.‘16-Jan.‘19 performance Volatile, but Improved Commodity Prices Since Dec. 2016 +4% +19% +26%

INDUSTRY-LEADING PERFORMANCE MARGIN EXPANSION OPERATIONAL EFFICIENCY Growing share by leveraging scale in highly fragmented market Multi-channel sales and distribution platform Investment in capabilities Strategic acquisitions Expanding use of analytics PROFITABLE GROWTH Optimize product and customer mix Value-added processing Value-driven pricing Supply chain innovation, architecture, and leadership Expense and working capital leadership Significant operating leverage Best practice talent management Speed Contributing to our customers’ success

2019 Ryerson Key Quantitative Performance Drivers Generate free cash flow from operations Gain profitable market share Explore opportunities to refinance 2022 Senior Secured Notes Reduce net leverage Realization of Central Steel & Wire synergies Grow value-added percentage of total revenue mix

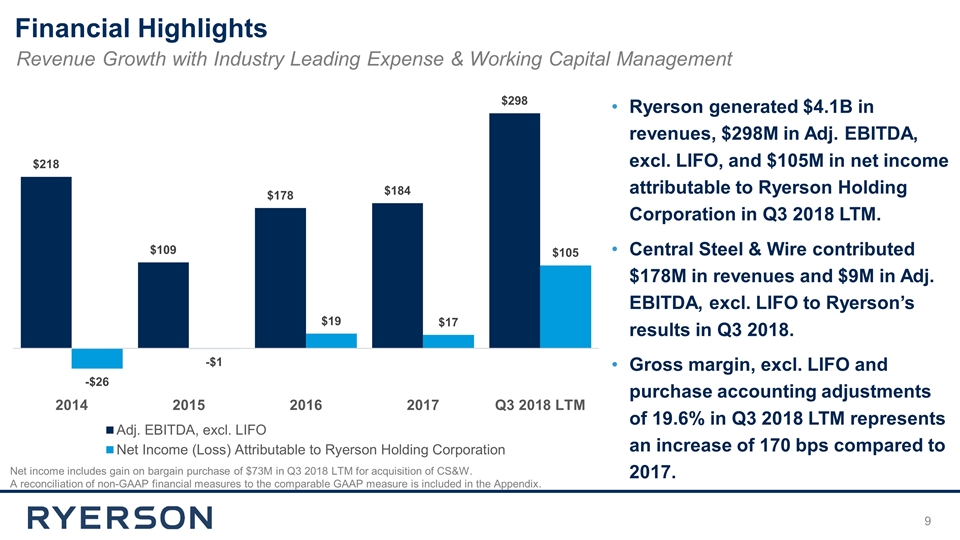

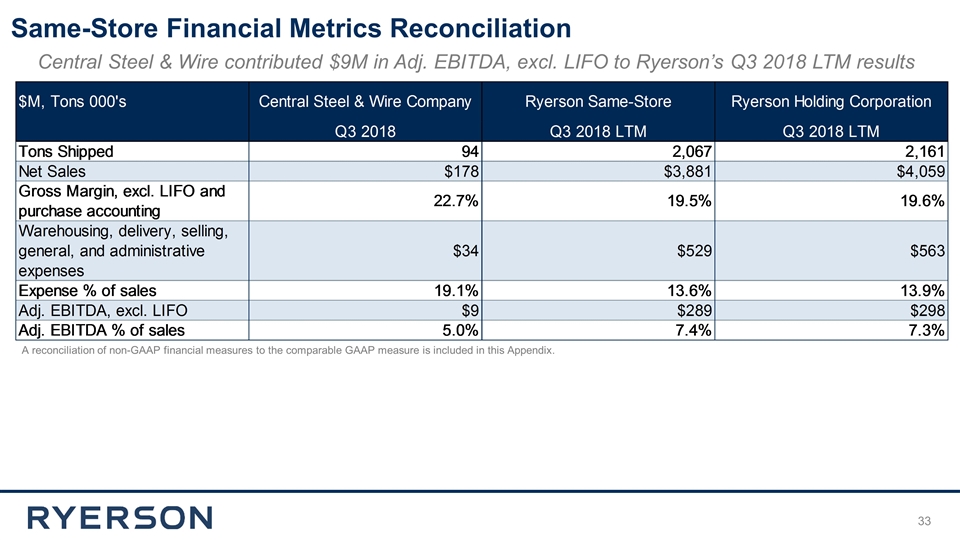

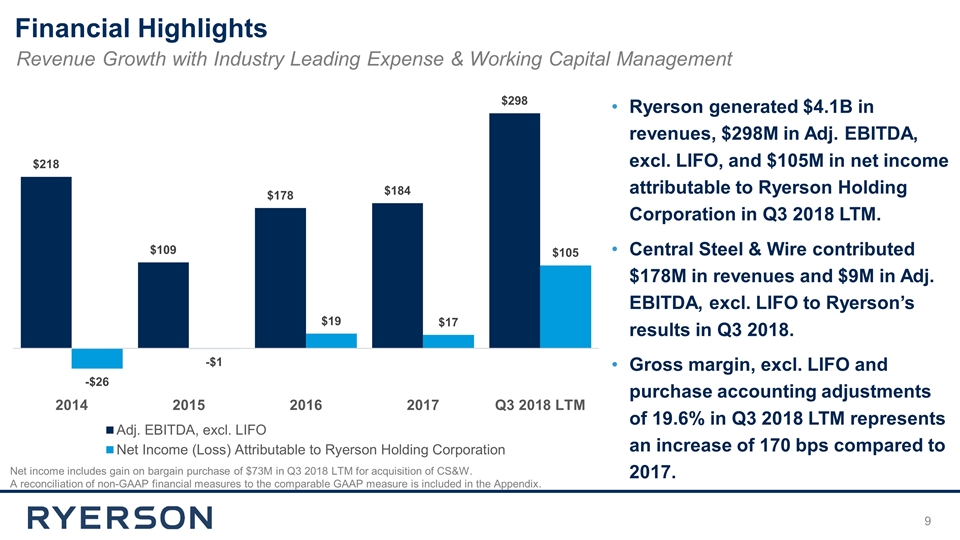

Financial Highlights Net income includes gain on bargain purchase of $73M in Q3 2018 LTM for acquisition of CS&W. A reconciliation of non-GAAP financial measures to the comparable GAAP measure is included in the Appendix. Revenue Growth with Industry Leading Expense & Working Capital Management Ryerson generated $4.1B in revenues, $298M in Adj. EBITDA, excl. LIFO, and $105M in net income attributable to Ryerson Holding Corporation in Q3 2018 LTM. Central Steel & Wire contributed $178M in revenues and $9M in Adj. EBITDA, excl. LIFO to Ryerson’s results in Q3 2018. Gross margin, excl. LIFO and purchase accounting adjustments of 19.6% in Q3 2018 LTM represents an increase of 170 bps compared to 2017.

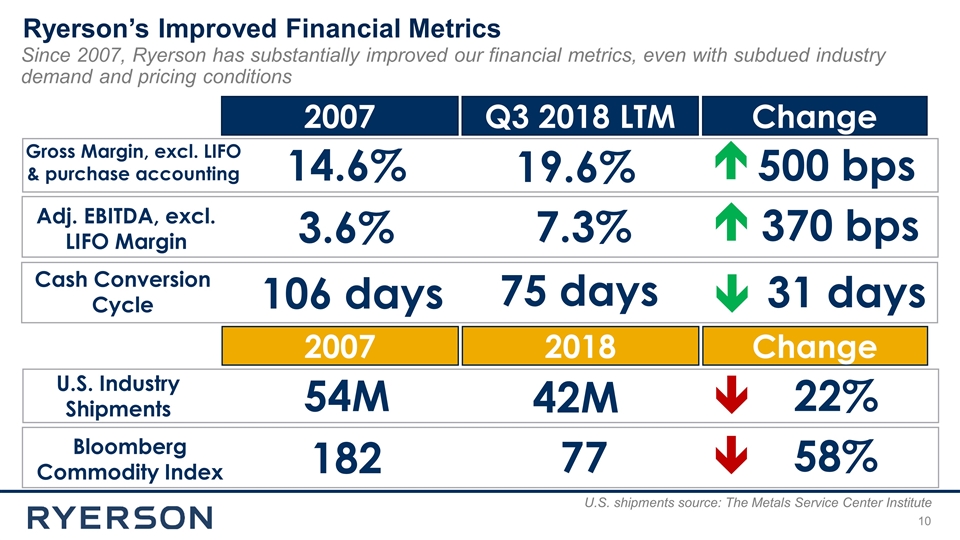

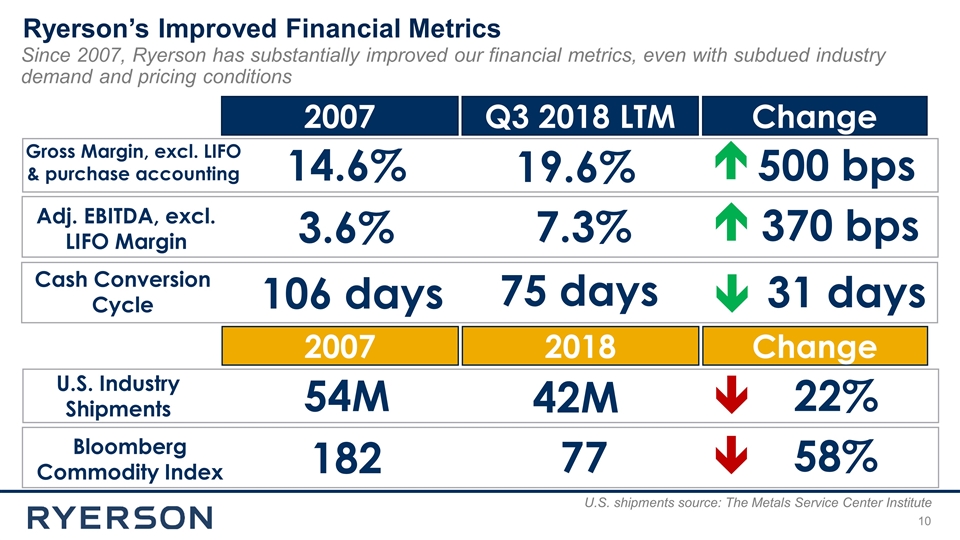

54M U.S. Industry Shipments 42M 22% é 2007 Change 14.6% Gross Margin, excl. LIFO & purchase accounting 19.6% 500 bps é 106 days Cash Conversion Cycle 75 days 31 days é 3.6% Adj. EBITDA, excl. LIFO Margin 7.3% 370 bps é Q3 2018 LTM Ryerson’s Improved Financial Metrics Since 2007, Ryerson has substantially improved our financial metrics, even with subdued industry demand and pricing conditions 2007 Change 182 Bloomberg Commodity Index 77 58% 2018 é U.S. shipments source: The Metals Service Center Institute

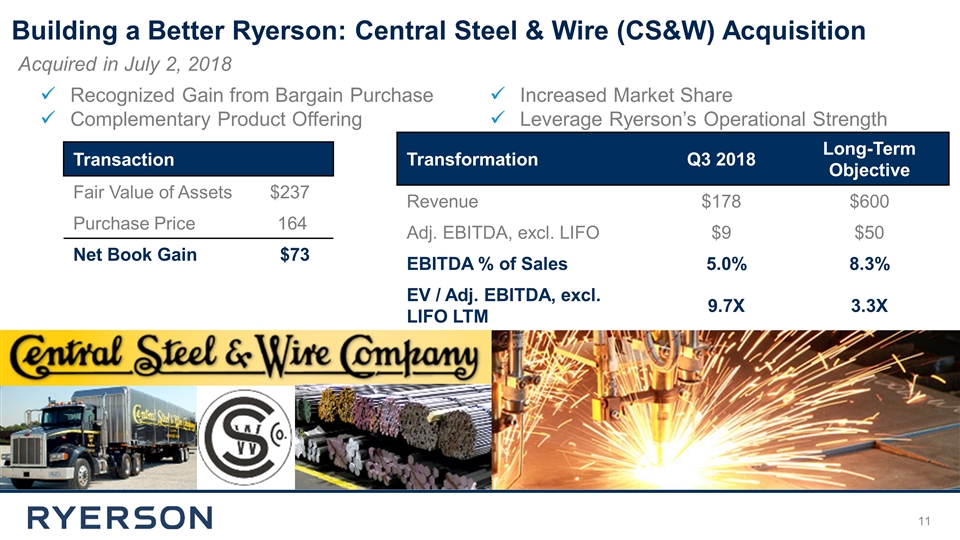

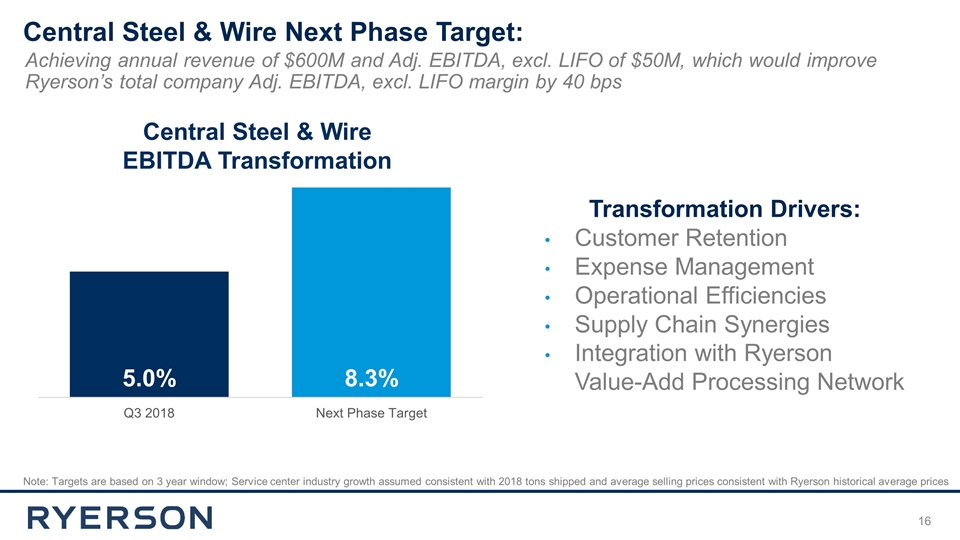

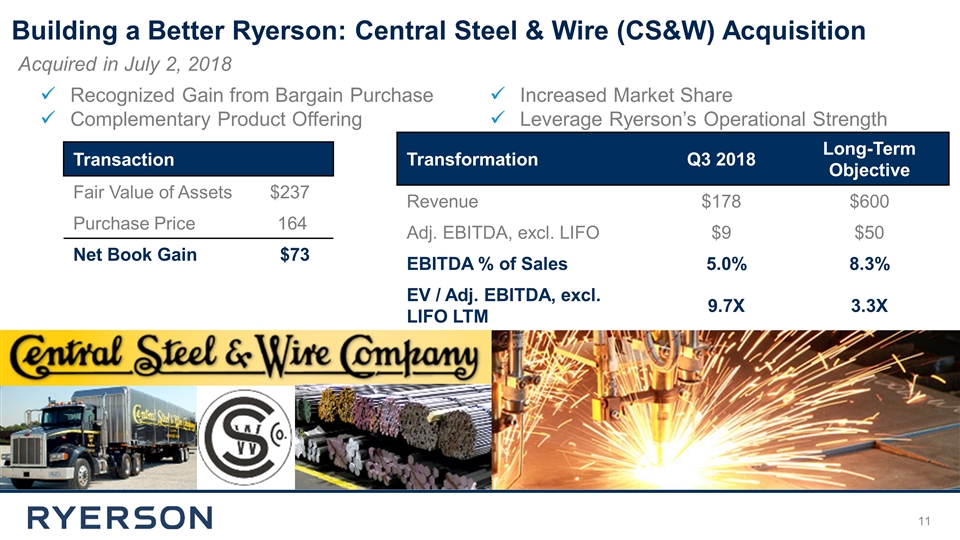

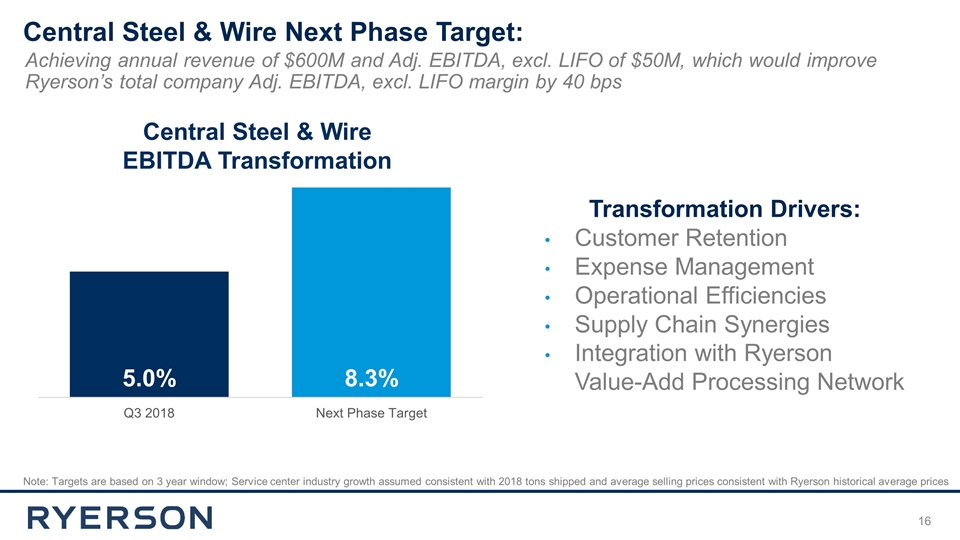

Building a Better Ryerson: Central Steel & Wire (CS&W) Acquisition Acquired in July 2, 2018 Recognized Gain from Bargain Purchase Complementary Product Offering Increased Market Share Leverage Ryerson’s Operational Strength Transaction Fair Value of Assets $237 Purchase Price 164 Net Book Gain $73 Transformation Q3 2018 Long-Term Objective Revenue $178 $600 Adj. EBITDA, excl. LIFO $9 $50 EBITDA % of Sales 5.0% 8.3% EV / Adj. EBITDA, excl. LIFO LTM 9.7X 3.3X

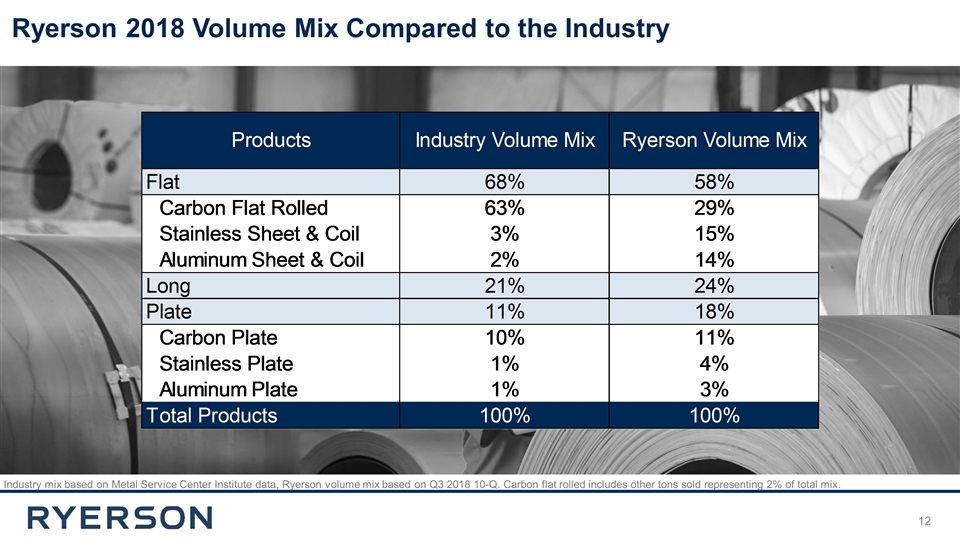

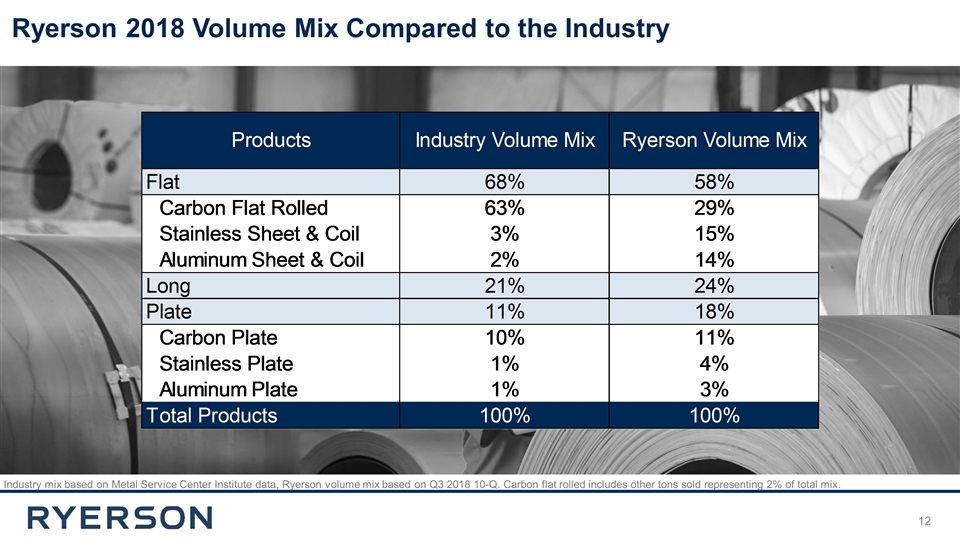

Ryerson 2018 Volume Mix Compared to the Industry Industry mix based on Metal Service Center Institute data, Ryerson volume mix based on Q3 2018 10-Q. Carbon flat rolled includes other tons sold representing 2% of total mix.

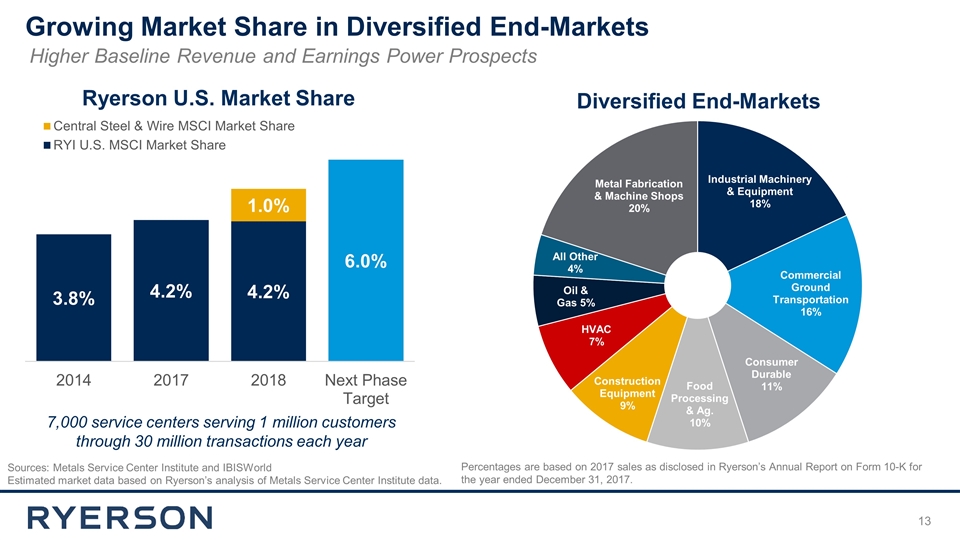

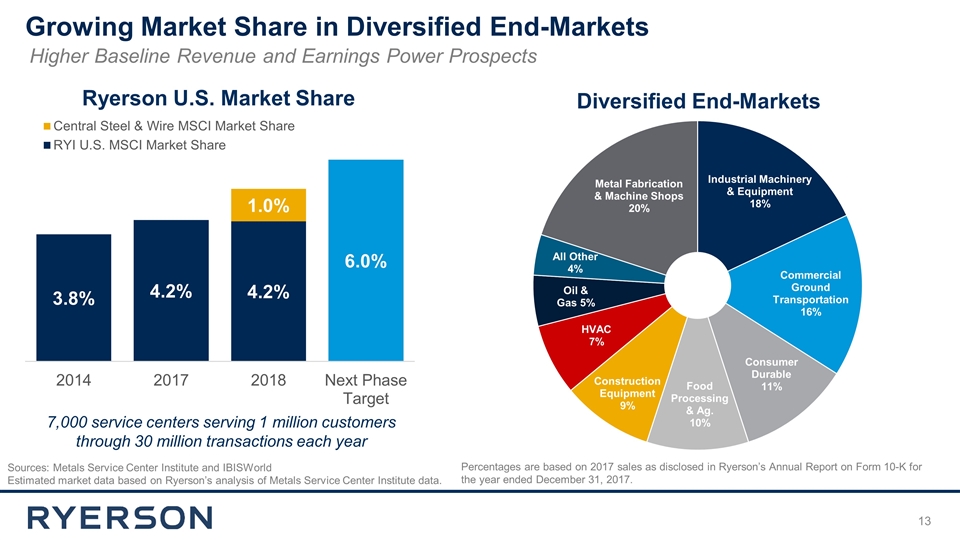

Growing Market Share in Diversified End-Markets Higher Baseline Revenue and Earnings Power Prospects Diversified End-Markets Ryerson U.S. Market Share 7,000 service centers serving 1 million customers through 30 million transactions each year Percentages are based on 2017 sales as disclosed in Ryerson’s Annual Report on Form 10-K for the year ended December 31, 2017. Sources: Metals Service Center Institute and IBISWorld Estimated market data based on Ryerson’s analysis of Metals Service Center Institute data.

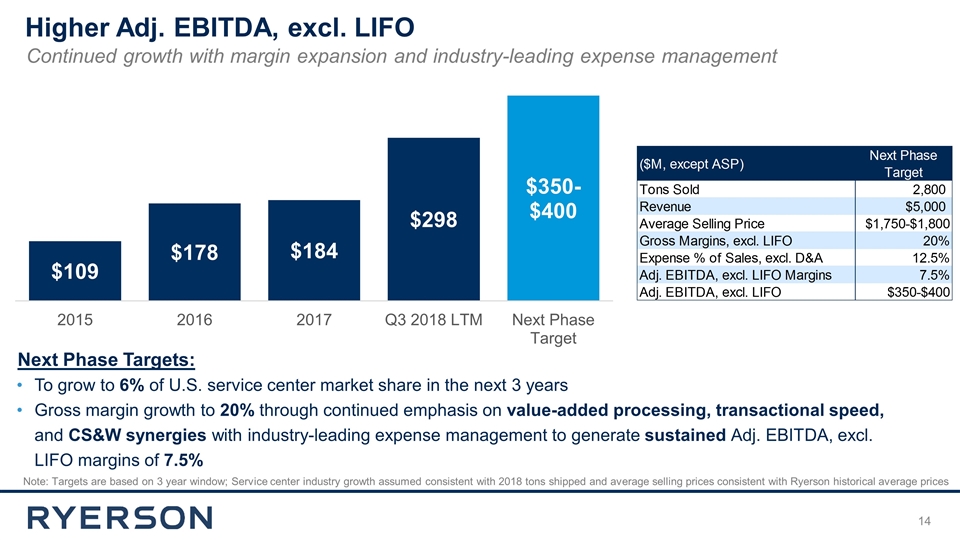

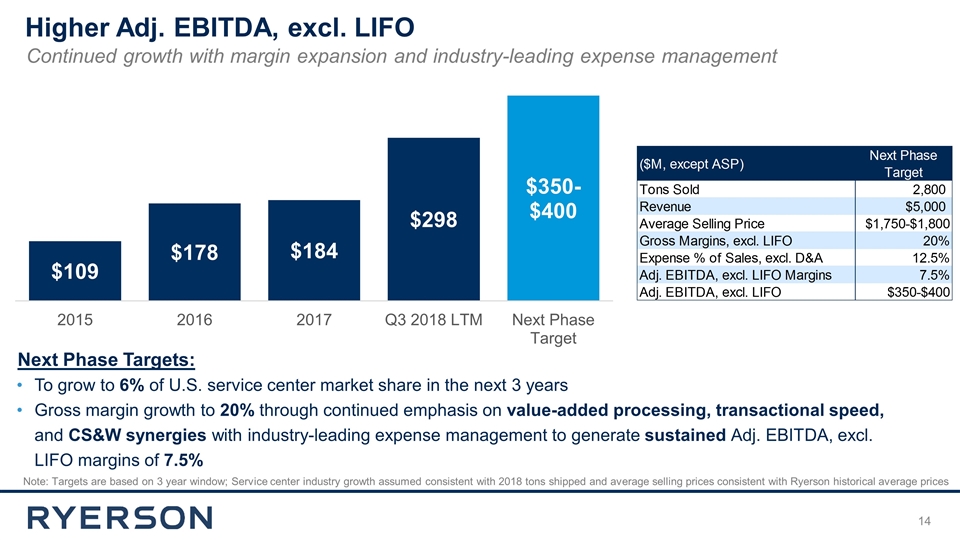

Continued growth with margin expansion and industry-leading expense management To grow to 6% of U.S. service center market share in the next 3 years Gross margin growth to 20% through continued emphasis on value-added processing, transactional speed, and CS&W synergies with industry-leading expense management to generate sustained Adj. EBITDA, excl. LIFO margins of 7.5% Next Phase Targets: Higher Adj. EBITDA, excl. LIFO Note: Targets are based on 3 year window; Service center industry growth assumed consistent with 2018 tons shipped and average selling prices consistent with Ryerson historical average prices

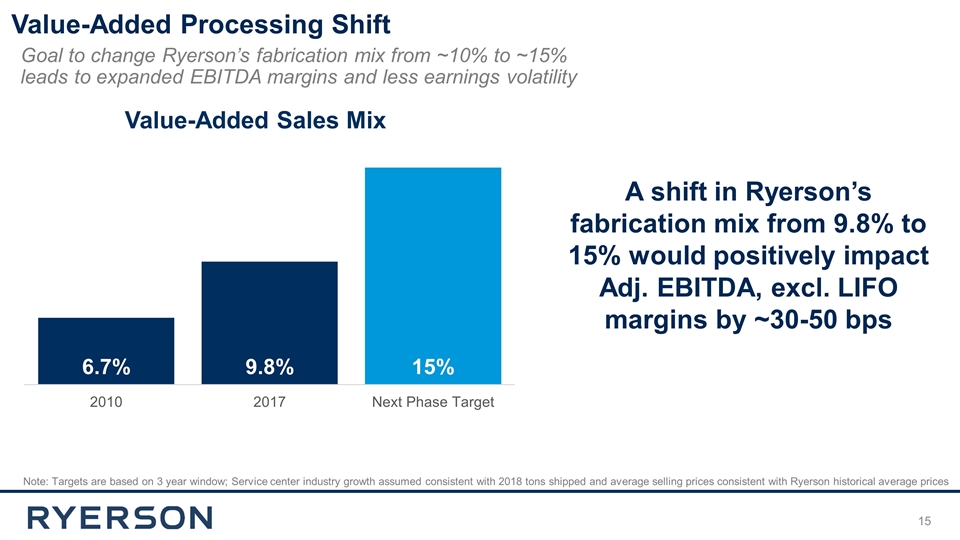

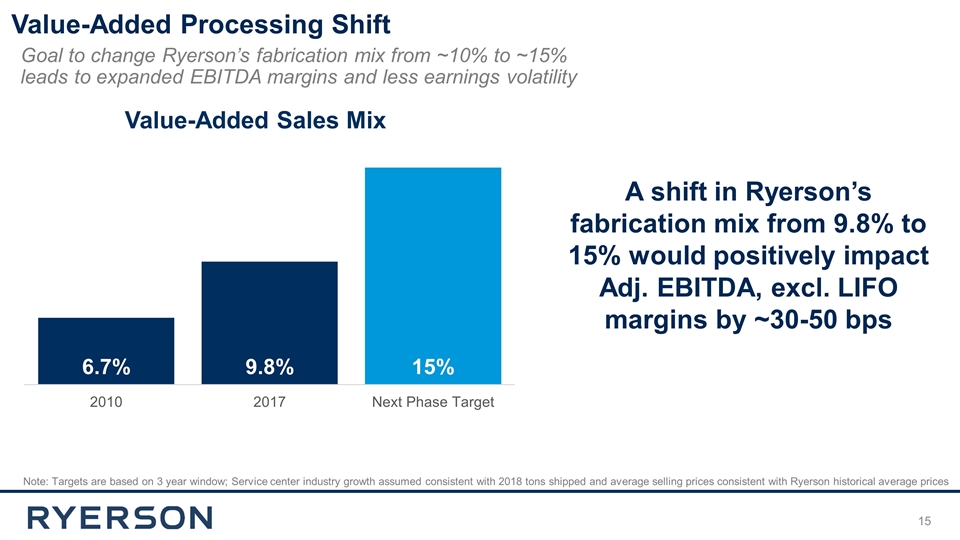

Value-Added Processing Shift Goal to change Ryerson’s fabrication mix from ~10% to ~15% leads to expanded EBITDA margins and less earnings volatility Value-Added Sales Mix Note: Targets are based on 3 year window; Service center industry growth assumed consistent with 2018 tons shipped and average selling prices consistent with Ryerson historical average prices A shift in Ryerson’s fabrication mix from 9.8% to 15% would positively impact Adj. EBITDA, excl. LIFO margins by ~30-50 bps

Central Steel & Wire Next Phase Target: Transformation Drivers: Customer Retention Expense Management Operational Efficiencies Supply Chain Synergies Integration with Ryerson Value-Add Processing Network Central Steel & Wire EBITDA Transformation Achieving annual revenue of $600M and Adj. EBITDA, excl. LIFO of $50M, which would improve Ryerson’s total company Adj. EBITDA, excl. LIFO margin by 40 bps Note: Targets are based on 3 year window; Service center industry growth assumed consistent with 2018 tons shipped and average selling prices consistent with Ryerson historical average prices

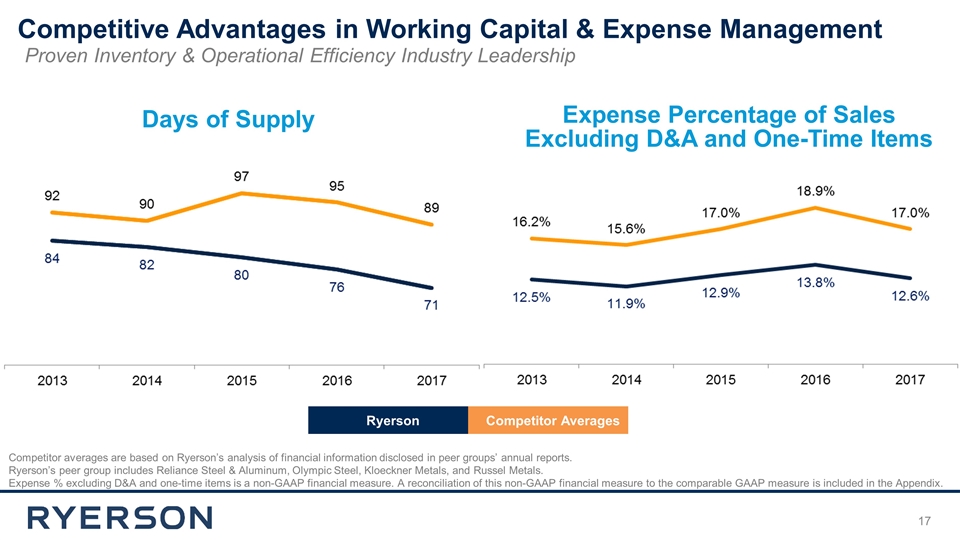

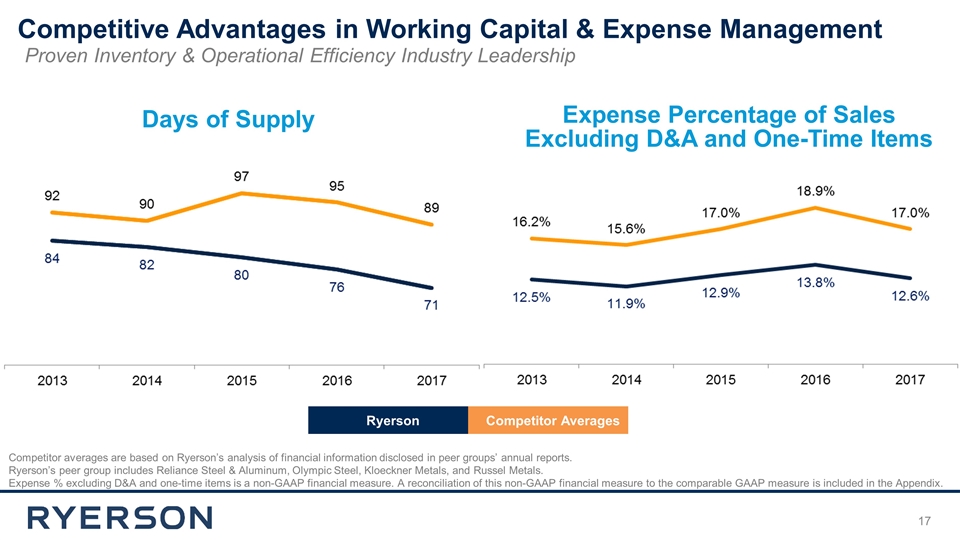

Competitive Advantages in Working Capital & Expense Management Proven Inventory & Operational Efficiency Industry Leadership Competitor averages are based on Ryerson’s analysis of financial information disclosed in peer groups’ annual reports. Ryerson’s peer group includes Reliance Steel & Aluminum, Olympic Steel, Kloeckner Metals, and Russel Metals. Expense % excluding D&A and one-time items is a non-GAAP financial measure. A reconciliation of this non-GAAP financial measure to the comparable GAAP measure is included in the Appendix. Ryerson Competitor Averages Expense Percentage of Sales Excluding D&A and One-Time Items Days of Supply

Improved Book Value of Equity Book Value of Equity ($M) Ryerson’s strong income generation and the net book gain on the acquisition of CS&W led to positive book value of equity of $102M as of Q3 ‘18. Despite our improved balance sheet, industry multiples are at cyclical troughs. EV / Adj. EBITDA, excl. LIFO Note: Q3 2018 LTM market capitalization determined based on November 1, 2018 stock price.

Financial Overview ERICH SCHNAUFER │ CHIEF FINANCIAL OFFICER

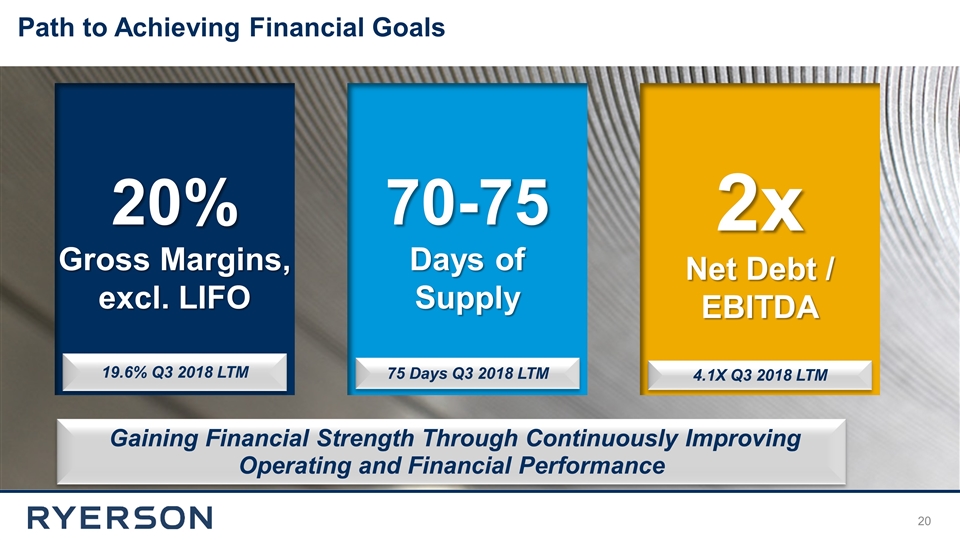

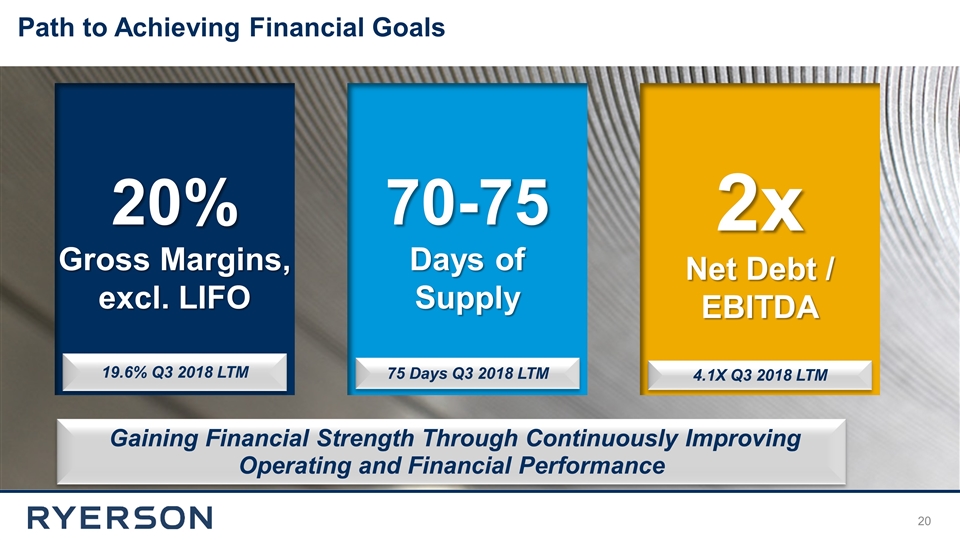

Path to Achieving Financial Goals Gaining Financial Strength Through Continuously Improving Operating and Financial Performance 70-75 Days of Supply 2x Net Debt / EBITDA 20% Gross Margins, excl. LIFO 19.6% Q3 2018 LTM 75 Days Q3 2018 LTM 4.1X Q3 2018 LTM

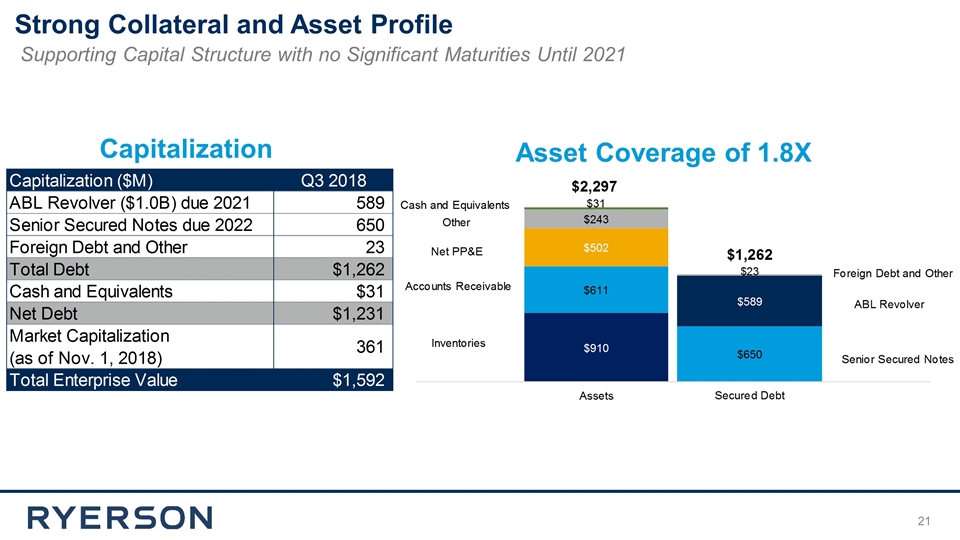

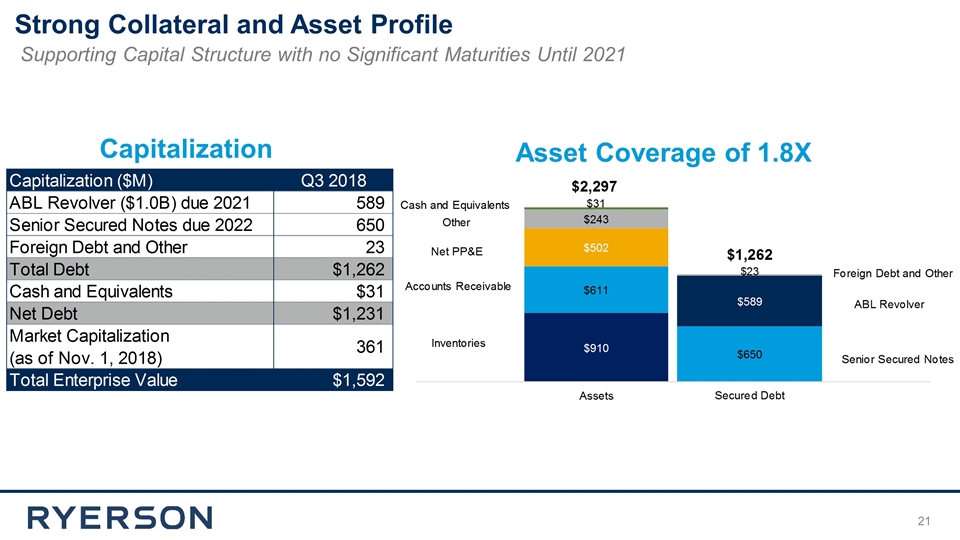

Strong Collateral and Asset Profile Capitalization Asset Coverage of 1.8X Supporting Capital Structure with no Significant Maturities Until 2021

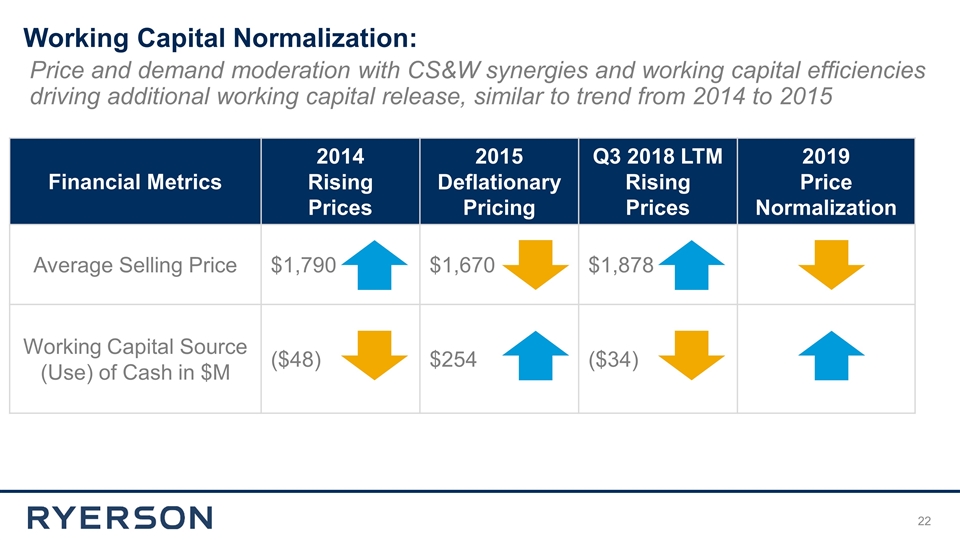

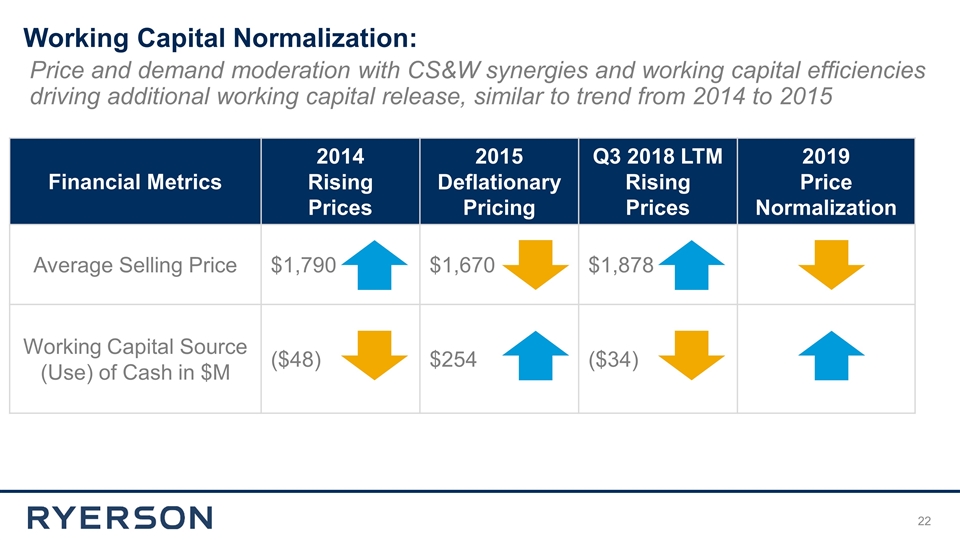

Working Capital Normalization: Price and demand moderation with CS&W synergies and working capital efficiencies driving additional working capital release, similar to trend from 2014 to 2015 Financial Metrics 2014 Rising Prices 2015 Deflationary Pricing Q3 2018 LTM Rising Prices 2019 Price Normalization Average Selling Price $1,790 $1,670 $1,878 Working Capital Source (Use) of Cash in $M ($48) $254 ($34)

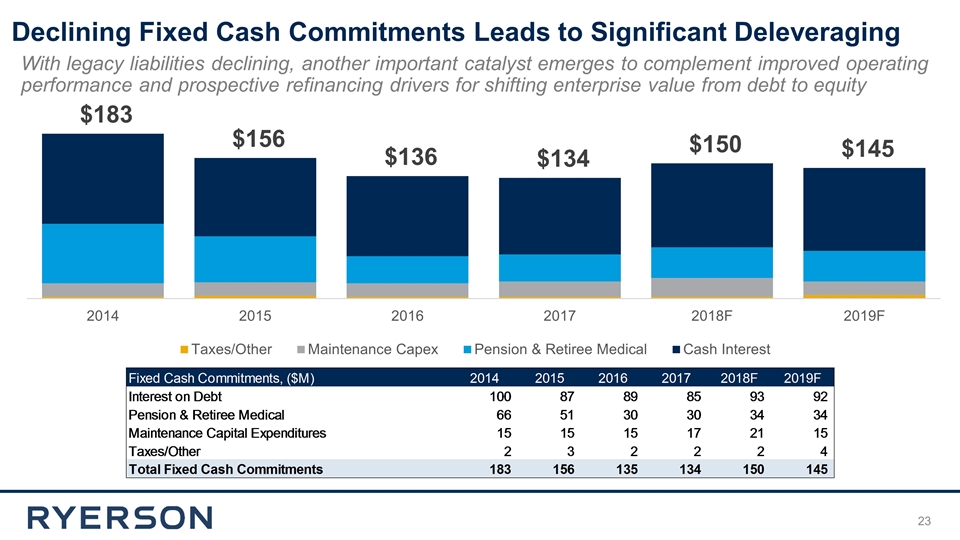

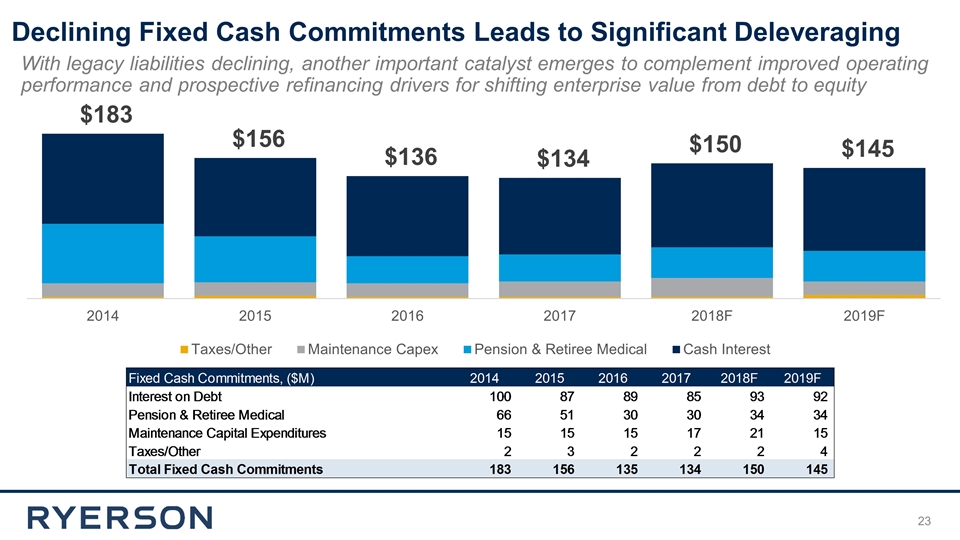

Declining Fixed Cash Commitments Leads to Significant Deleveraging With legacy liabilities declining, another important catalyst emerges to complement improved operating performance and prospective refinancing drivers for shifting enterprise value from debt to equity

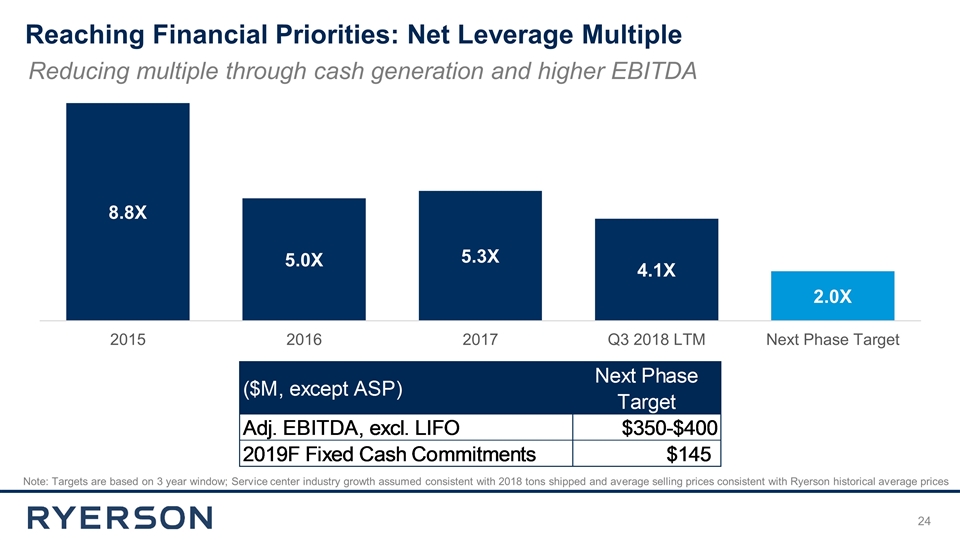

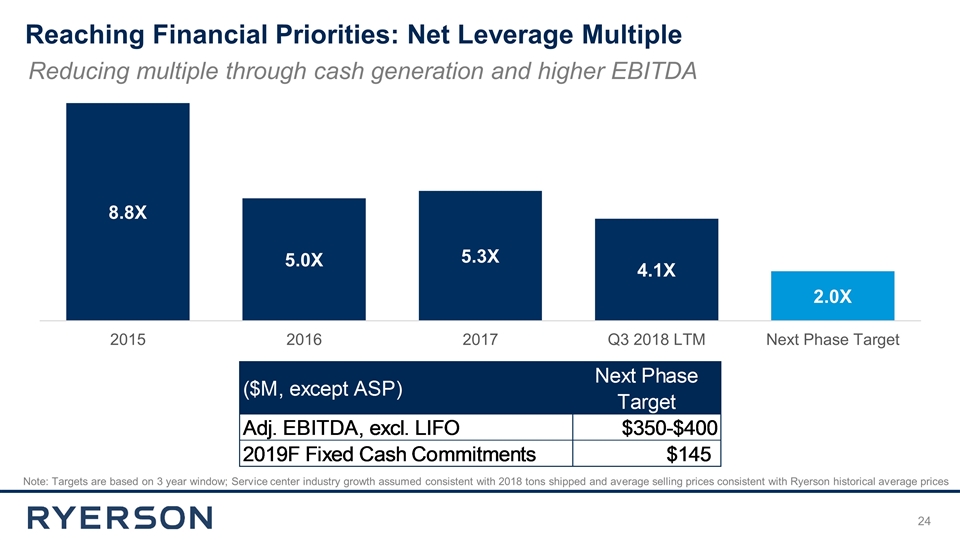

Reaching Financial Priorities: Net Leverage Multiple Reducing multiple through cash generation and higher EBITDA Note: Targets are based on 3 year window; Service center industry growth assumed consistent with 2018 tons shipped and average selling prices consistent with Ryerson historical average prices

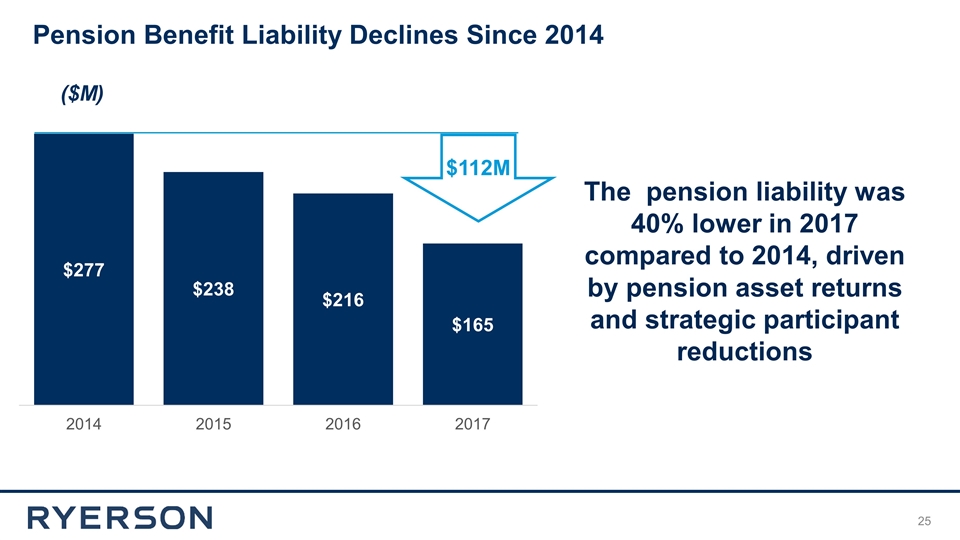

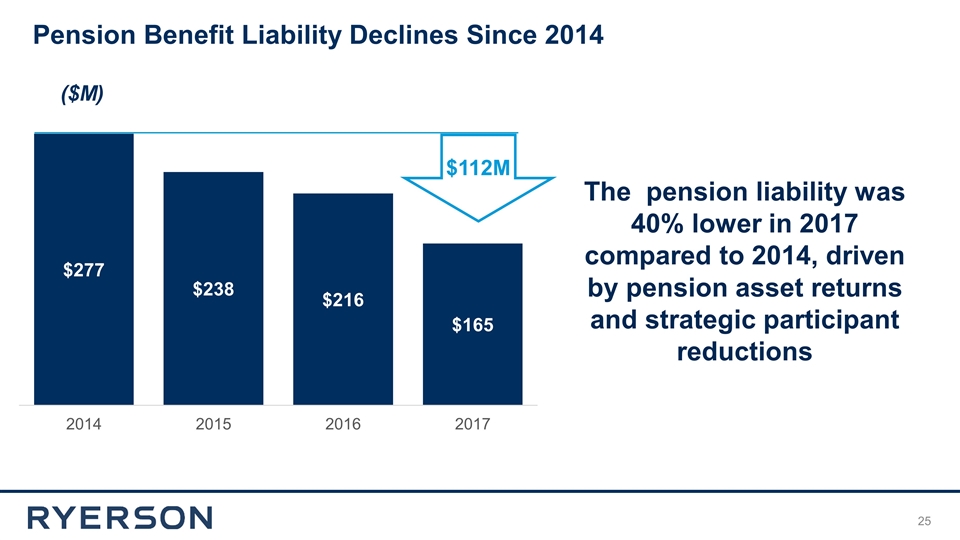

Pension Benefit Liability Declines Since 2014 The pension liability was 40% lower in 2017 compared to 2014, driven by pension asset returns and strategic participant reductions ($M) $112M

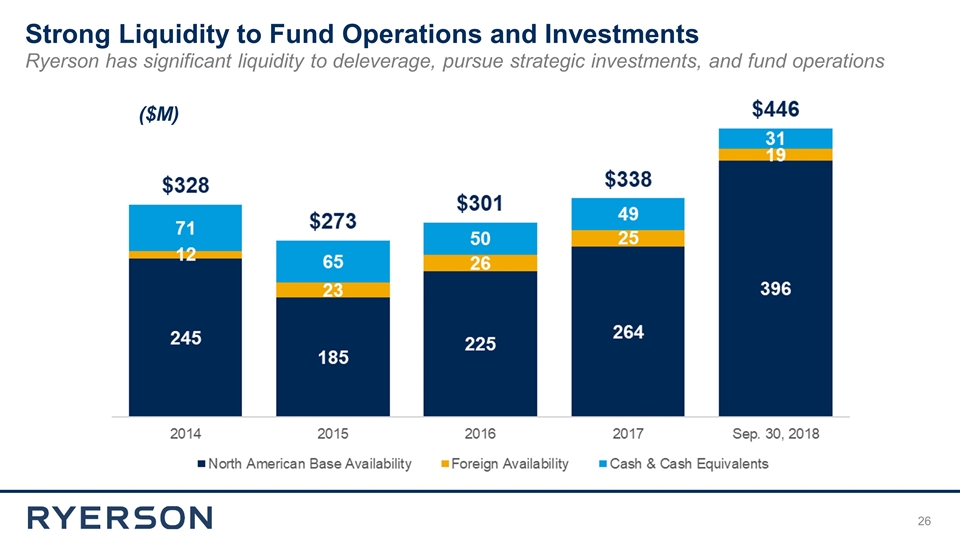

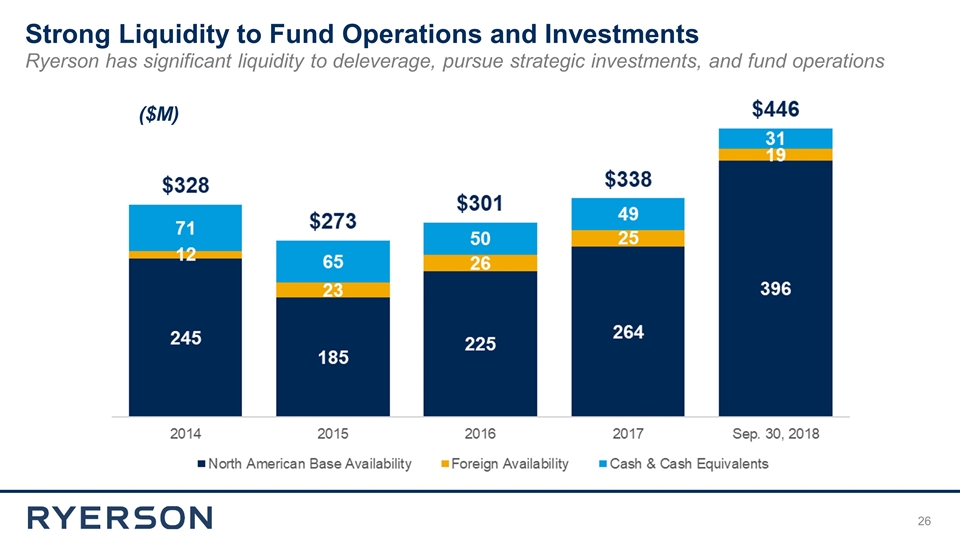

Strong Liquidity to Fund Operations and Investments Ryerson has significant liquidity to deleverage, pursue strategic investments, and fund operations ($M)

Conclusion EDDIE LEHNER│ PRESIDENT & CHIEF EXECUTIVE OFFICER

2019 Ryerson Key Quantitative Performance Drivers Generate free cash flow from operations Gain profitable market share Explore opportunities to refinance 2022 Senior Secured Notes Reduce net leverage Realization of Central Steel & Wire synergies Grow value-added percentage of total revenue mix

An Intelligent Network of Service Centers At Speed and Scale Profitably Delivering Consistently Great Customer Experiences Ryerson is positioned to generate free cash flow that affords us the opportunity to significant deleverage the balance sheet, thus effecting the enterprise value shift from debt to equity.

Appendix

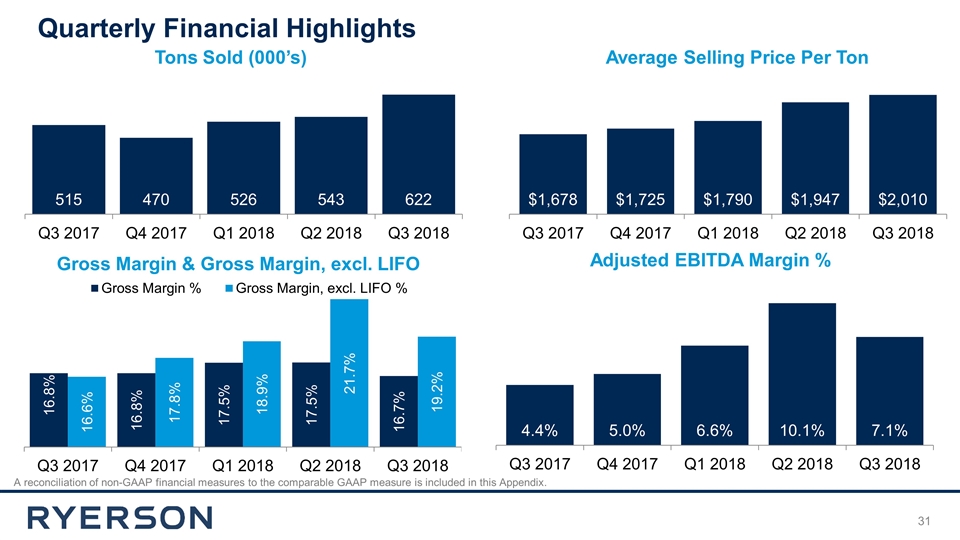

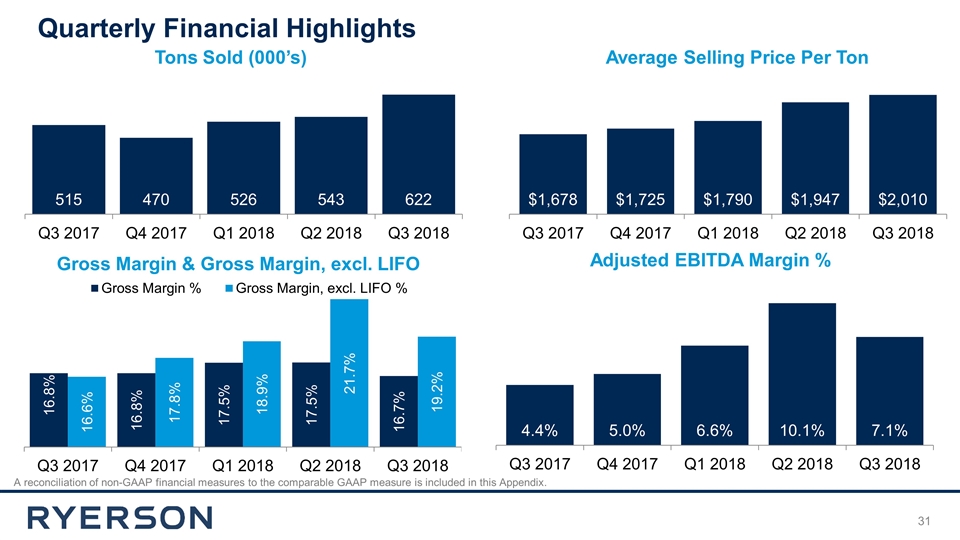

Quarterly Financial Highlights A reconciliation of non-GAAP financial measures to the comparable GAAP measure is included in this Appendix. Tons Sold (000’s) Average Selling Price Per Ton Gross Margin & Gross Margin, excl. LIFO Adjusted EBITDA Margin %

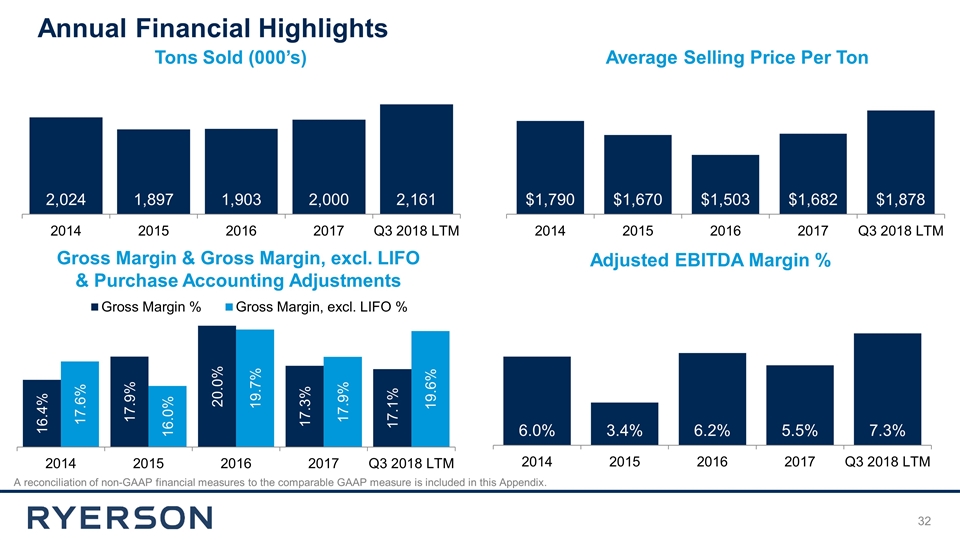

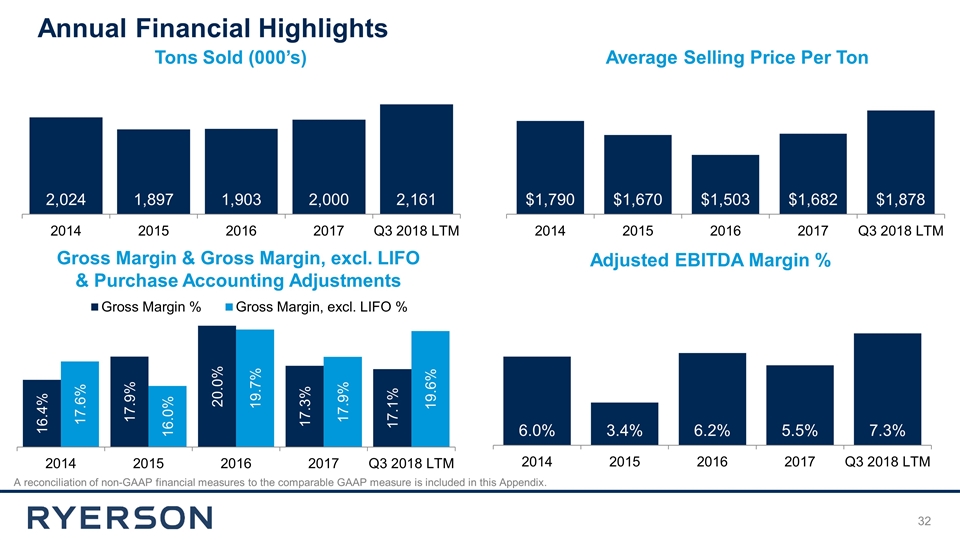

Annual Financial Highlights A reconciliation of non-GAAP financial measures to the comparable GAAP measure is included in this Appendix. Tons Sold (000’s) Average Selling Price Per Ton Gross Margin & Gross Margin, excl. LIFO & Purchase Accounting Adjustments Adjusted EBITDA Margin %

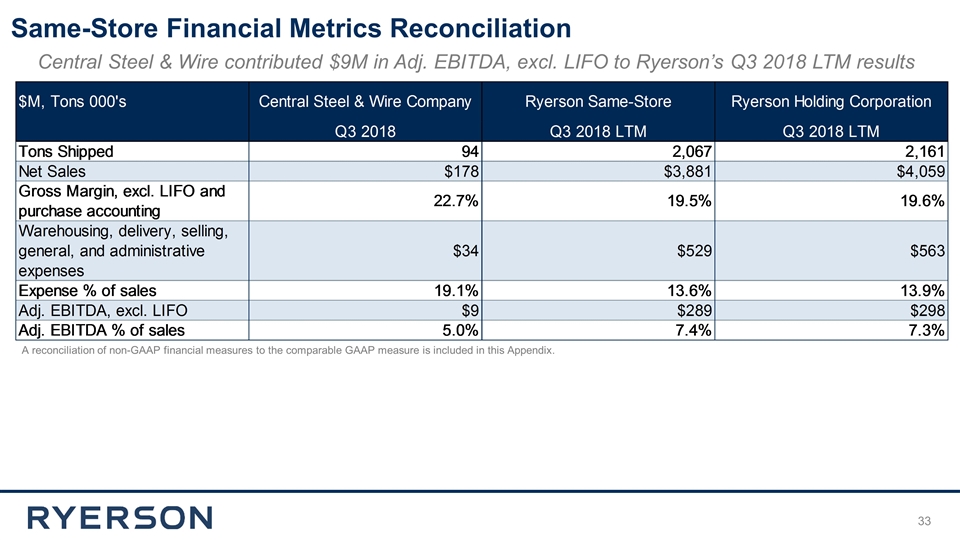

Same-Store Financial Metrics Reconciliation Central Steel & Wire contributed $9M in Adj. EBITDA, excl. LIFO to Ryerson’s Q3 2018 LTM results A reconciliation of non-GAAP financial measures to the comparable GAAP measure is included in this Appendix.

The DNA of Our Success SCALE VALUE-ADD SPEED CULTURE ANALYTICS

Ryerson’s Targeted Commercial Initiatives 8 Ryerson Virtual Warehouse – Mapped Supply Chains 7 Ryerson E-Commerce Build-Out & Scaling 5 Long Products Depots Centers of Excellence 6 Stainless Products Leadership 4 Develop & Diversify Vertical Markets Portfolio 3 Coil & Sheet Franchise Renewal 1 2 Ryerson Advanced Processing – Value-Add Amplifier & Accelerator Scale Prospecting & Call Centers Optimizing the Customer Experience Through Intelligently Networked Service Centers

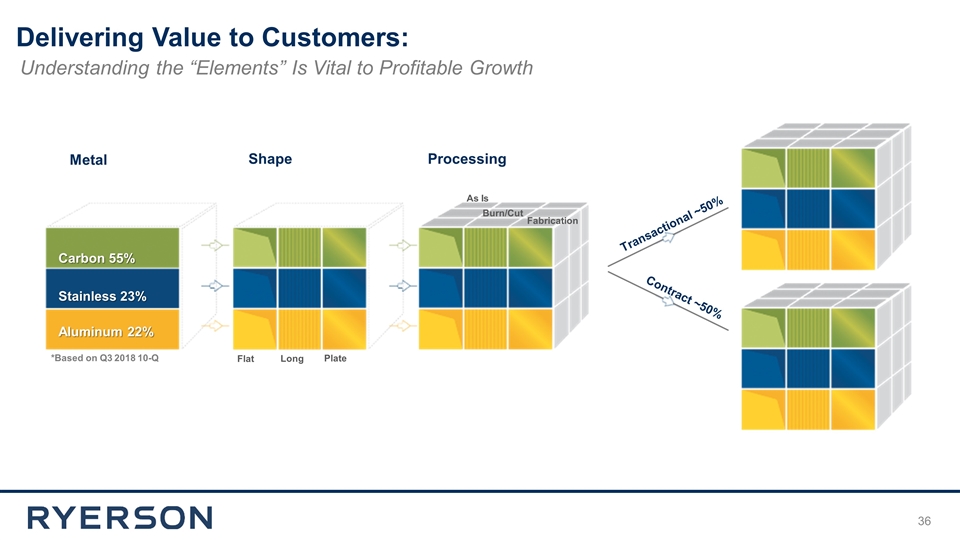

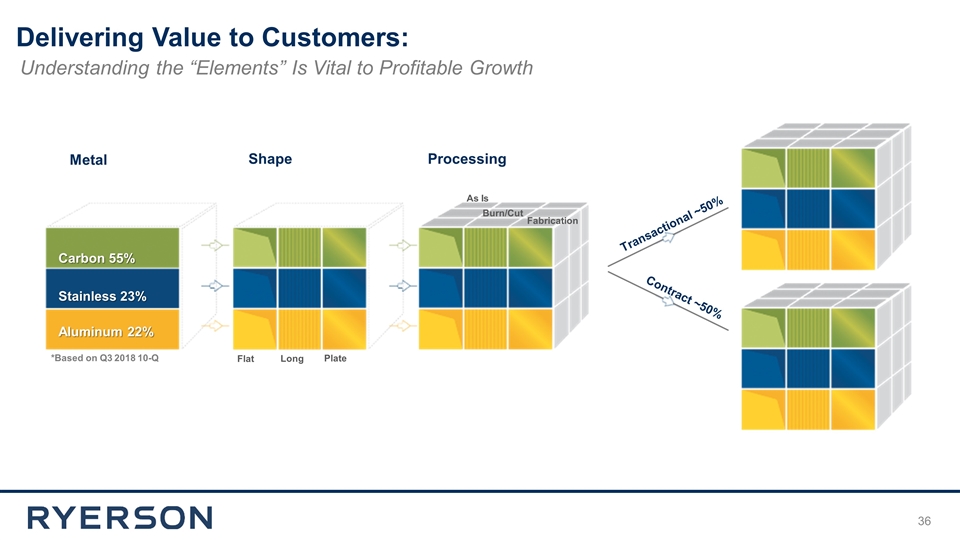

Delivering Value to Customers: Metal Shape Processing Carbon 55% Stainless 23% Aluminum 22% Fabrication Burn/Cut As Is Flat Long Plate Transactional ~50% Contract ~50% *Based on Q3 2018 10-Q Understanding the “Elements” Is Vital to Profitable Growth

Macro Outlook – Leading and Lagging Indicators Sources: Bloomberg Commodity Index (BCOM); Federal Reserve; industrial production index monthly year-over-year change. The relationship between U.S. Industrial Production Growth and the Bloomberg Commodity Index over the past two years showing counter-cyclical inflection lead-lags.

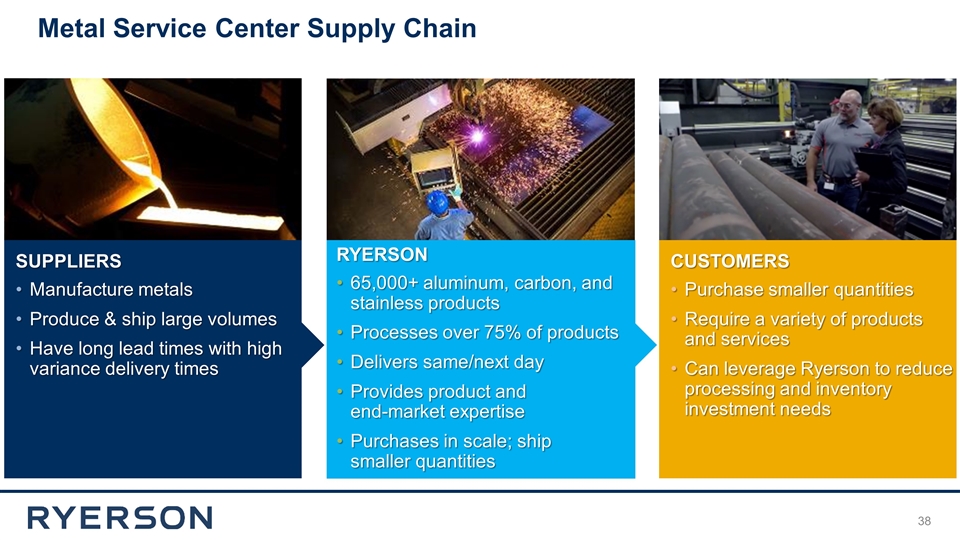

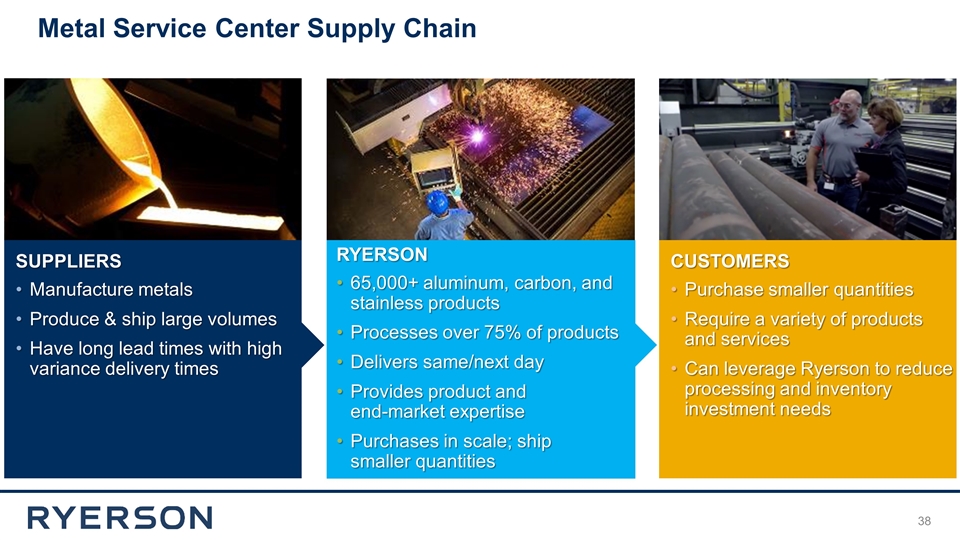

Metal Service Center Supply Chain CUSTOMERS Purchase smaller quantities Require a variety of products and services Can leverage Ryerson to reduce processing and inventory investment needs SUPPLIERS Manufacture metals Produce & ship large volumes Have long lead times with high variance delivery times RYERSON 65,000+ aluminum, carbon, and stainless products Processes over 75% of products Delivers same/next day Provides product and end-market expertise Purchases in scale; ship smaller quantities

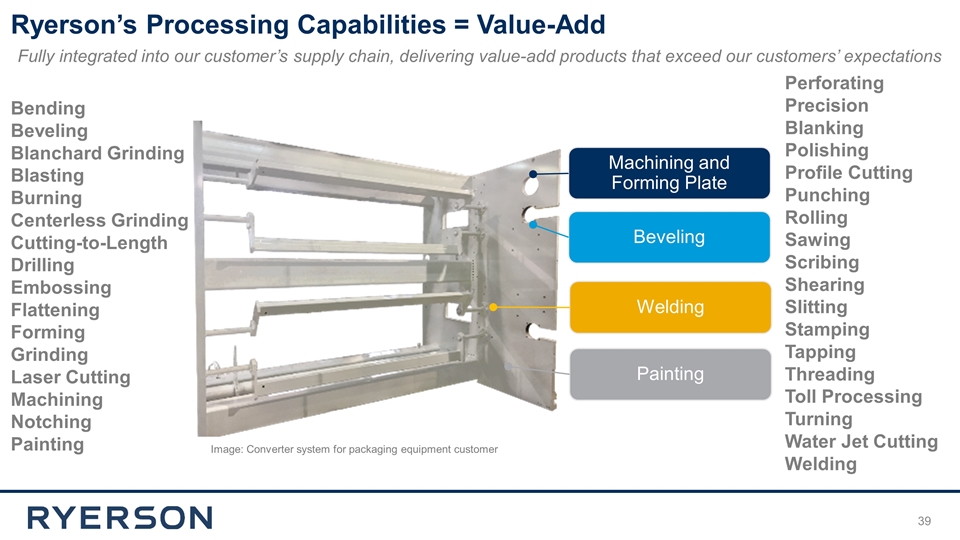

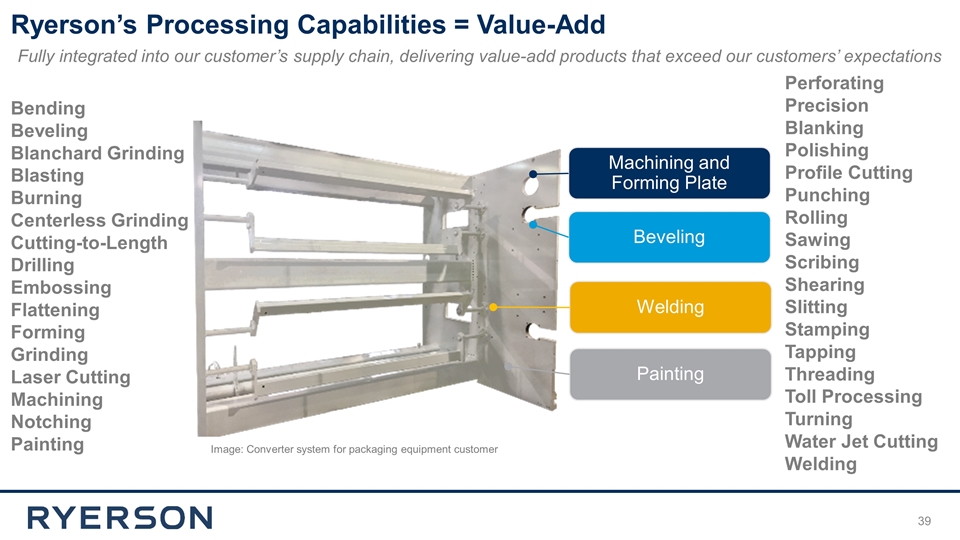

Perforating Precision Blanking Polishing Profile Cutting Punching Rolling Sawing Scribing Shearing Slitting Stamping Tapping Threading Toll Processing Turning Water Jet Cutting Welding 31 Machining and Forming Plate Painting Welding Beveling Ryerson’s Processing Capabilities = Value-Add Fully integrated into our customer’s supply chain, delivering value-add products that exceed our customers’ expectations Bending Beveling Blanchard Grinding Blasting Burning Centerless Grinding Cutting-to-Length Drilling Embossing Flattening Forming Grinding Laser Cutting Machining Notching Painting Image: Converter system for packaging equipment customer

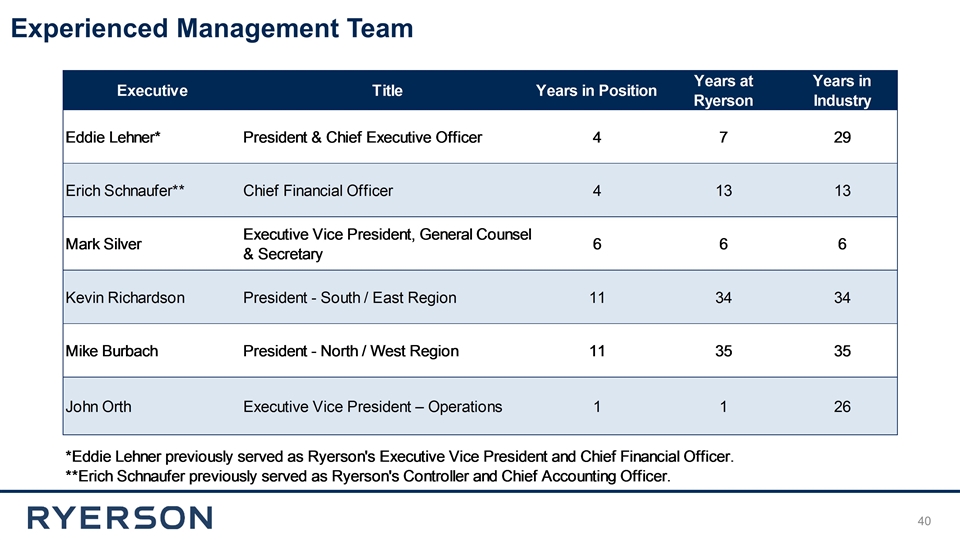

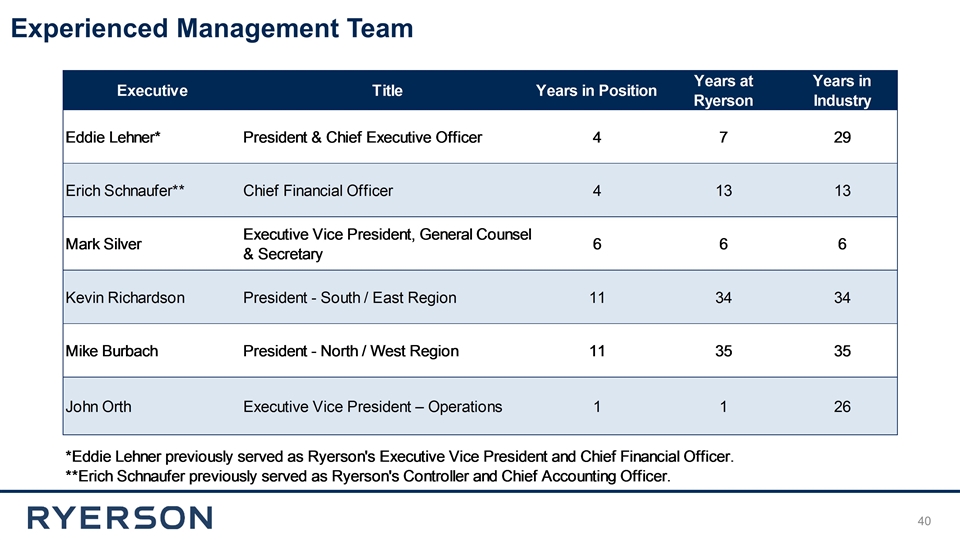

Experienced Management Team

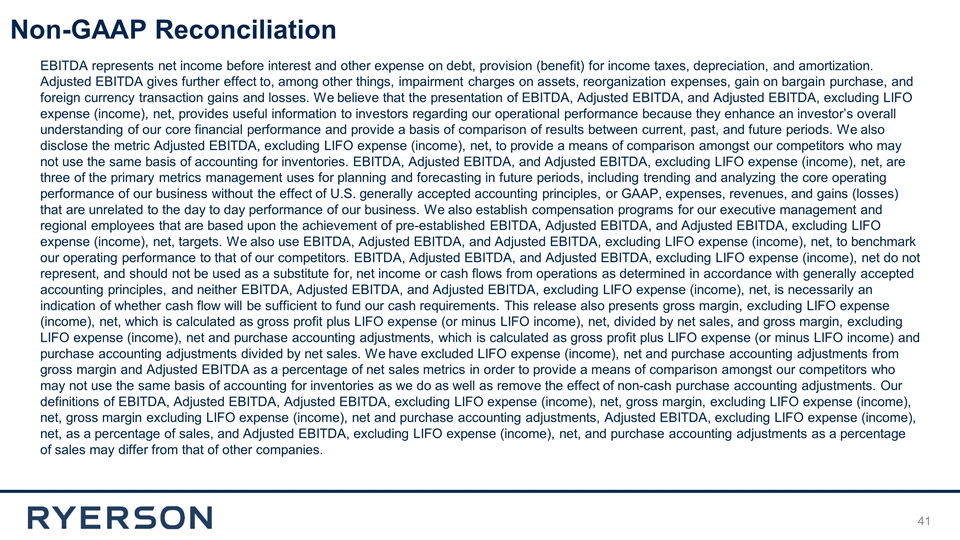

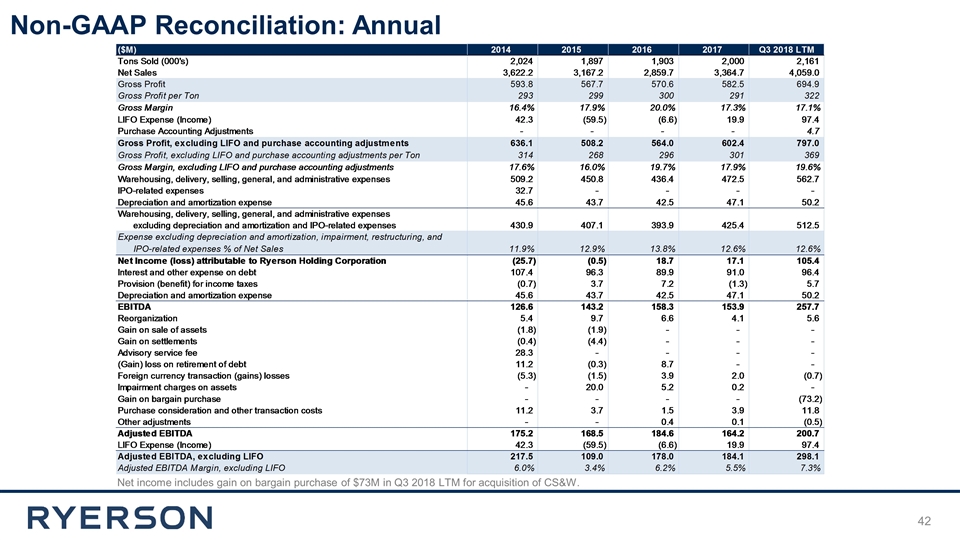

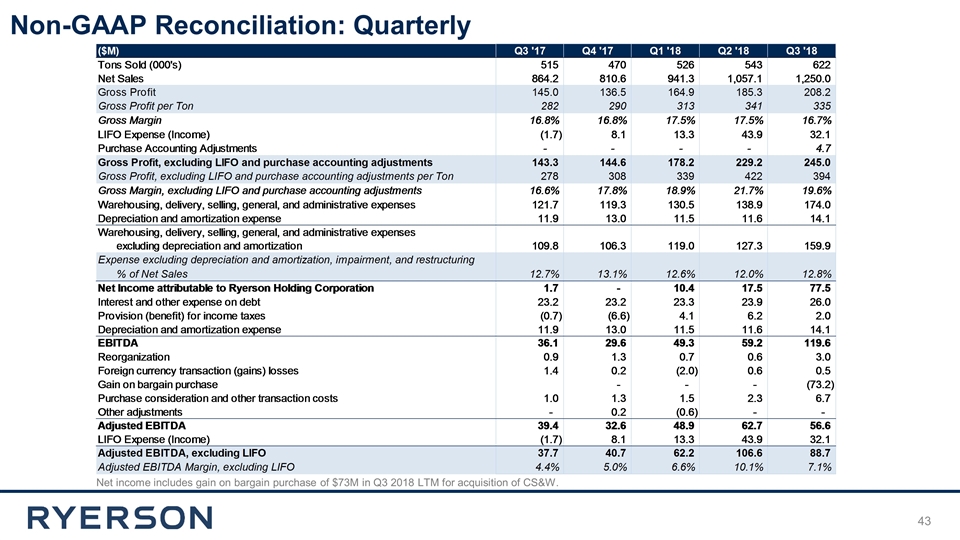

31 EBITDA represents net income before interest and other expense on debt, provision (benefit) for income taxes, depreciation, and amortization. Adjusted EBITDA gives further effect to, among other things, impairment charges on assets, reorganization expenses, gain on bargain purchase, and foreign currency transaction gains and losses. We believe that the presentation of EBITDA, Adjusted EBITDA, and Adjusted EBITDA, excluding LIFO expense (income), net, provides useful information to investors regarding our operational performance because they enhance an investor’s overall understanding of our core financial performance and provide a basis of comparison of results between current, past, and future periods. We also disclose the metric Adjusted EBITDA, excluding LIFO expense (income), net, to provide a means of comparison amongst our competitors who may not use the same basis of accounting for inventories. EBITDA, Adjusted EBITDA, and Adjusted EBITDA, excluding LIFO expense (income), net, are three of the primary metrics management uses for planning and forecasting in future periods, including trending and analyzing the core operating performance of our business without the effect of U.S. generally accepted accounting principles, or GAAP, expenses, revenues, and gains (losses) that are unrelated to the day to day performance of our business. We also establish compensation programs for our executive management and regional employees that are based upon the achievement of pre-established EBITDA, Adjusted EBITDA, and Adjusted EBITDA, excluding LIFO expense (income), net, targets. We also use EBITDA, Adjusted EBITDA, and Adjusted EBITDA, excluding LIFO expense (income), net, to benchmark our operating performance to that of our competitors. EBITDA, Adjusted EBITDA, and Adjusted EBITDA, excluding LIFO expense (income), net do not represent, and should not be used as a substitute for, net income or cash flows from operations as determined in accordance with generally accepted accounting principles, and neither EBITDA, Adjusted EBITDA, and Adjusted EBITDA, excluding LIFO expense (income), net, is necessarily an indication of whether cash flow will be sufficient to fund our cash requirements. This release also presents gross margin, excluding LIFO expense (income), net, which is calculated as gross profit plus LIFO expense (or minus LIFO income), net, divided by net sales, and gross margin, excluding LIFO expense (income), net and purchase accounting adjustments, which is calculated as gross profit plus LIFO expense (or minus LIFO income) and purchase accounting adjustments divided by net sales. We have excluded LIFO expense (income), net and purchase accounting adjustments from gross margin and Adjusted EBITDA as a percentage of net sales metrics in order to provide a means of comparison amongst our competitors who may not use the same basis of accounting for inventories as we do as well as remove the effect of non-cash purchase accounting adjustments. Our definitions of EBITDA, Adjusted EBITDA, Adjusted EBITDA, excluding LIFO expense (income), net, gross margin, excluding LIFO expense (income), net, gross margin excluding LIFO expense (income), net and purchase accounting adjustments, Adjusted EBITDA, excluding LIFO expense (income), net, as a percentage of sales, and Adjusted EBITDA, excluding LIFO expense (income), net, and purchase accounting adjustments as a percentage of sales may differ from that of other companies. Non-GAAP Reconciliation

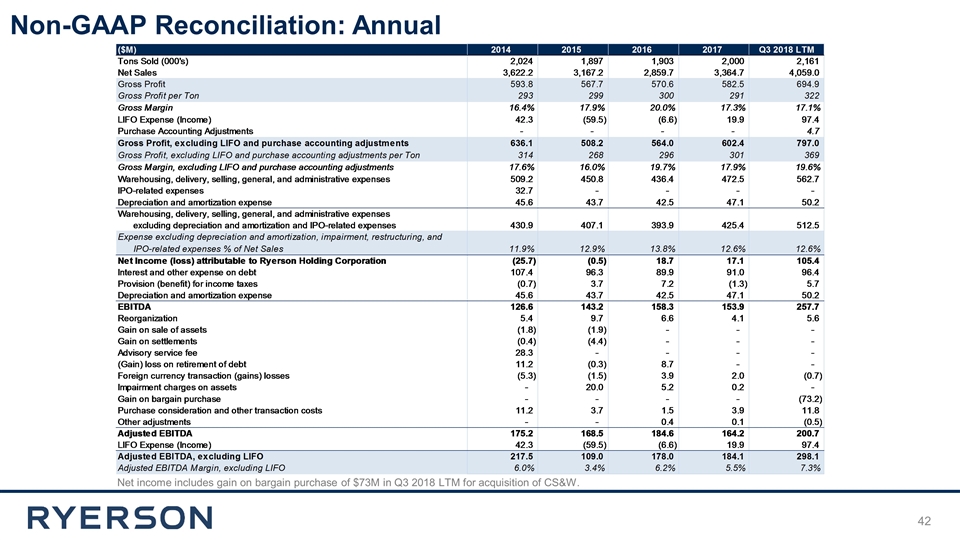

Non-GAAP Reconciliation: Annual Net income includes gain on bargain purchase of $73M in Q3 2018 LTM for acquisition of CS&W.

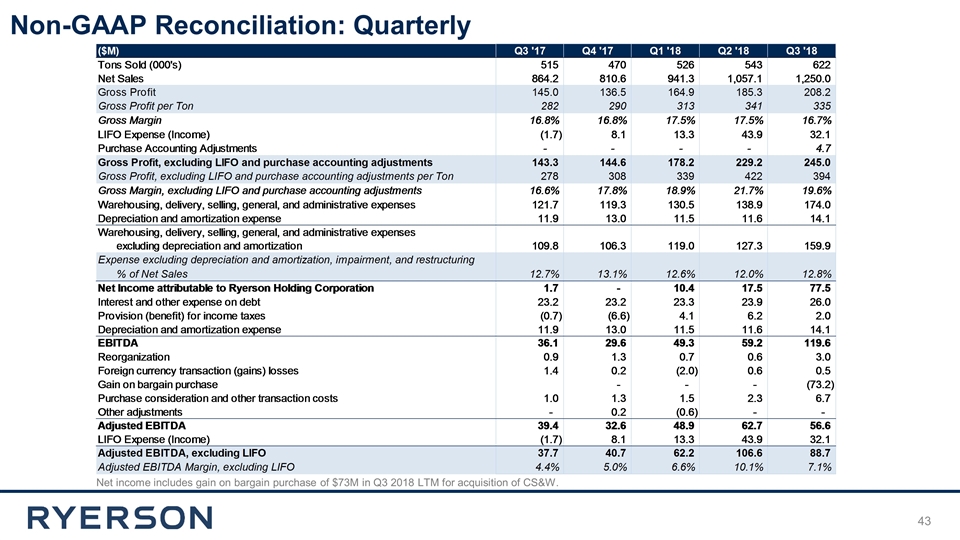

Non-GAAP Reconciliation: Quarterly Net income includes gain on bargain purchase of $73M in Q3 2018 LTM for acquisition of CS&W.