Jefferies Industrials Conference August 2020 Exhibit 99.1

31 Important Information About Ryerson Holding Corporation These materials do not constitute an offer or solicitation to purchase or sell securities of Ryerson Holding Corporation (“Ryerson” or “the Company”) or its subsidiaries and no investment decision should be made based upon the information provided herein. Ryerson strongly urges you to review its filings with the Securities and Exchange Commission, which can be found at https://ir.ryerson.com/financials/sec-filings/default.aspx. This site also provides additional information about Ryerson. Safe Harbor Provision Certain statements made in this presentation and other written or oral statements made by or on behalf of the Company constitute "forward-looking statements" within the meaning of the federal securities laws, including statements regarding our future performance, as well as management's expectations, beliefs, intentions, plans, estimates, objectives, or projections relating to the future. Such statements can be identified by the use of forward-looking terminology such as “objectives,” “goals,” “preliminary,” “range,” "believes," "expects," "may," "estimates," "will," "should," "plans," or "anticipates" or the negative thereof or other variations thereon or comparable terminology, or by discussions of strategy. The Company cautions that any such forward-looking statements are not guarantees of future performance and may involve significant risks and uncertainties, and that actual results may vary materially from those in the forward-looking statements as a result of various factors. Among the factors that significantly impact our business are: the cyclicality of our business; the highly competitive, volatile, and fragmented metals industry in which we operate; fluctuating metal prices; our substantial indebtedness and the covenants in instruments governing such indebtedness; the integration of acquired operations; regulatory and other operational risks associated with our operations located inside and outside of the United States; impacts and implications of adverse health events, including the COVID-19 pandemic; work stoppages; obligations under certain employee retirement benefit plans; the ownership of a majority of our equity securities by a single investor group; currency fluctuations; and consolidation in the metals industry. Forward-looking statements should, therefore, be considered in light of various factors, including those set forth above and those set forth under "Risk Factors" in our annual report on Form 10-K for the year ended December 31, 2019, and in our other filings with the Securities and Exchange Commission. Moreover, we caution against placing undue reliance on these statements, which speak only as of the date they were made. The Company does not undertake any obligation to publicly update or revise any forward-looking statements to reflect future events or circumstances, new information or otherwise. Non-GAAP Measures Certain measures contained in these slides or the related presentation are not measures calculated in accordance with generally accepted accounting principles (“GAAP”). They should not be considered a replacement for GAAP results. Non-GAAP financial measures appearing in these slides are identified in the footnotes. A reconciliation of these non-GAAP measures to the most directly comparable GAAP financial measures is included in the Appendix.

Business Overview Eddie Lehner President & Chief Executive Officer Molly Kannan Corporate Controller & Chief Accounting Officer

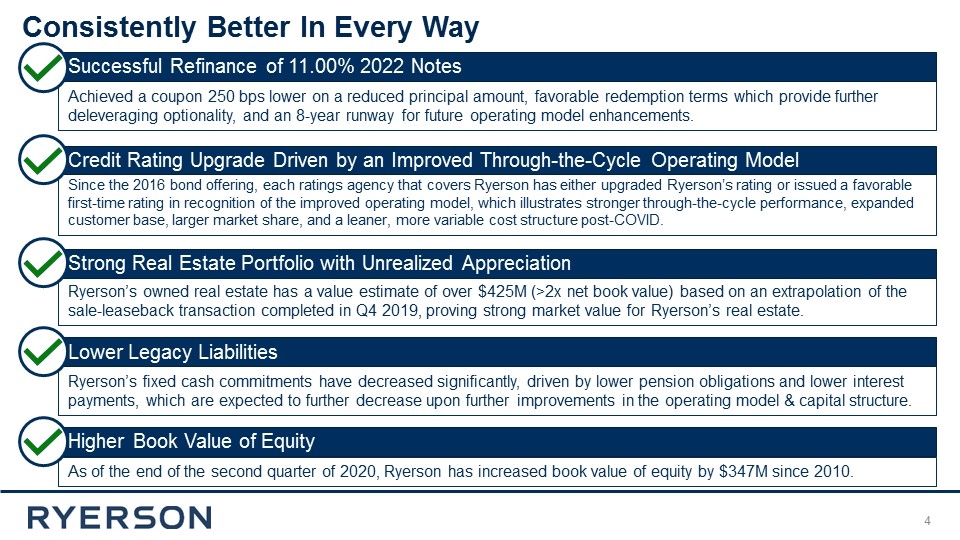

As of the end of the second quarter of 2020, Ryerson has increased book value of equity by $347M since 2010. Ryerson’s fixed cash commitments have decreased significantly, driven by lower pension obligations and lower interest payments, which are expected to further decrease upon further improvements in the operating model & capital structure. Ryerson’s owned real estate has a value estimate of over $425M (>2x net book value) based on an extrapolation of the sale-leaseback transaction completed in Q4 2019, proving strong market value for Ryerson’s real estate. Since the 2016 bond offering, each ratings agency that covers Ryerson has either upgraded Ryerson’s rating or issued a favorable first-time rating in recognition of the improved operating model, which illustrates stronger through-the-cycle performance, expanded customer base, larger market share, and a leaner, more variable cost structure post-COVID. Consistently Better In Every Way Credit Rating Upgrade Driven by an Improved Through-the-Cycle Operating Model Strong Real Estate Portfolio with Unrealized Appreciation Lower Legacy Liabilities Higher Book Value of Equity Achieved a coupon 250 bps lower on a reduced principal amount, favorable redemption terms which provide further deleveraging optionality, and an 8-year runway for future operating model enhancements. Successful Refinance of 11.00% 2022 Notes

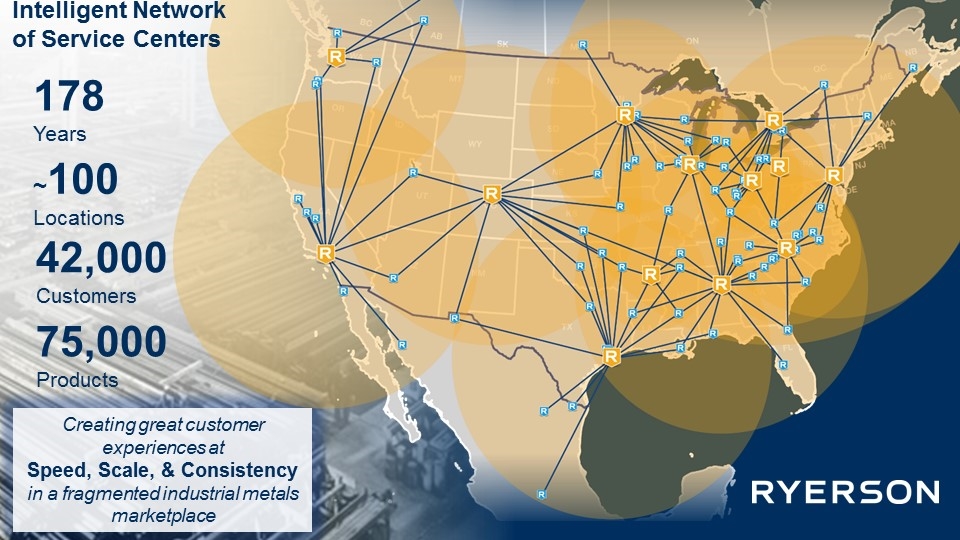

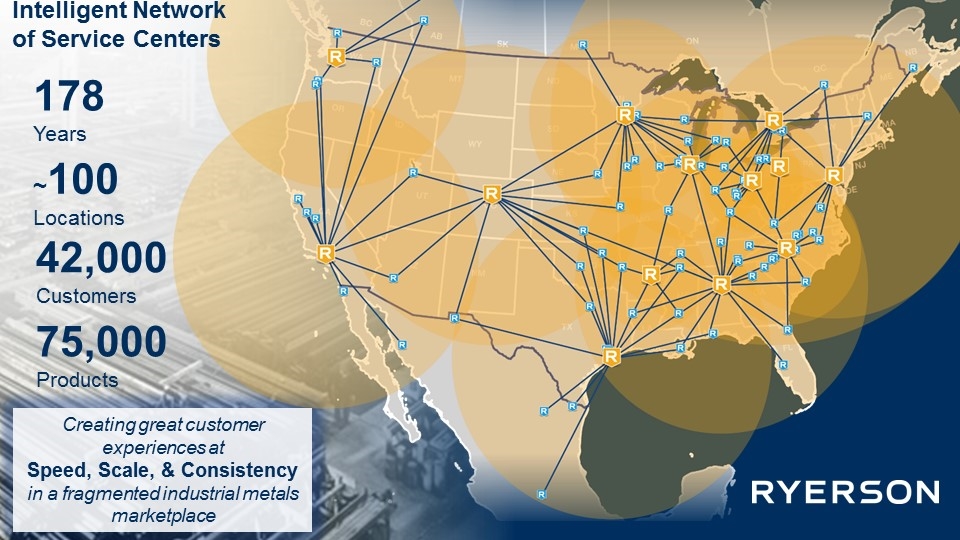

~100 Locations 178 Years 42,000Customers 75,000 Products Creating great customer experiences at Speed, Scale, & Consistency in a fragmented industrial metals marketplace Intelligent Network of Service Centers

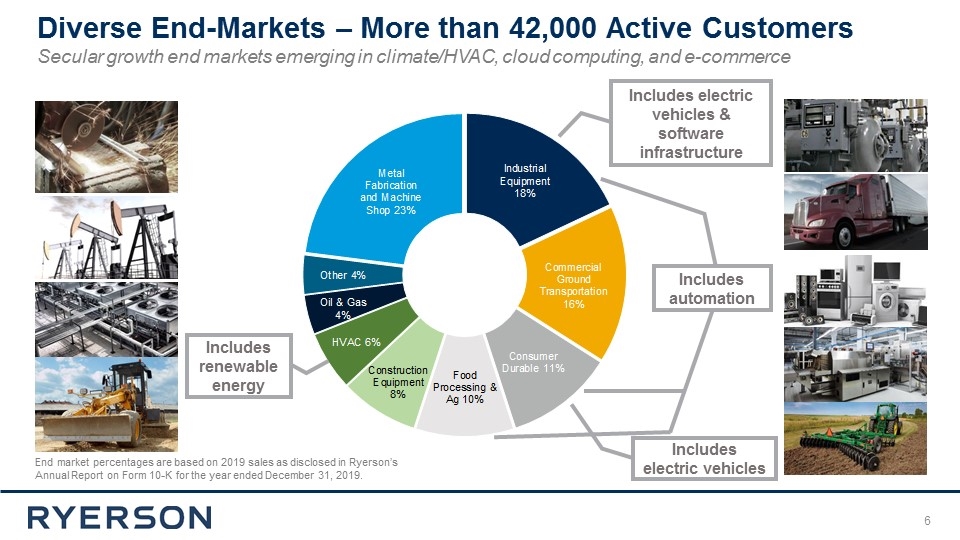

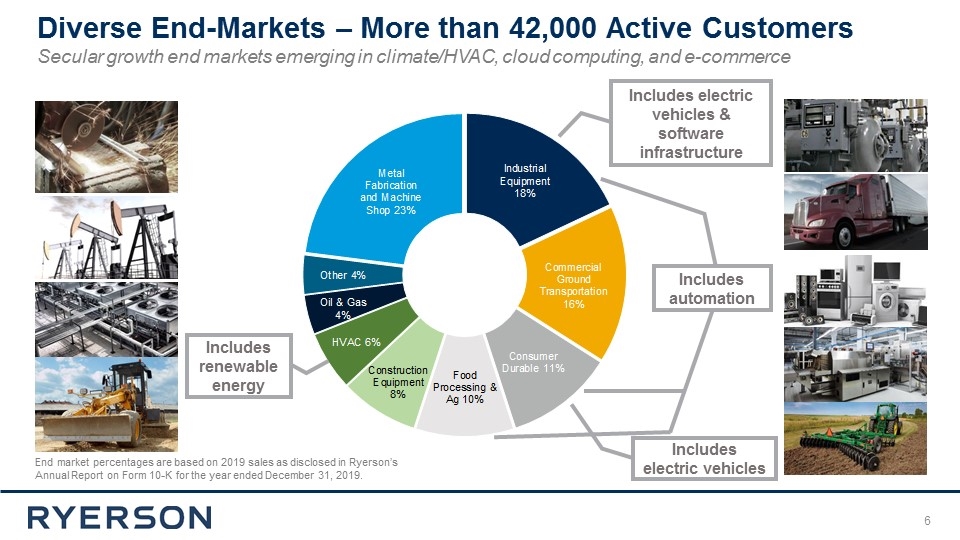

Diverse End-Markets – More than 42,000 Active Customers End market percentages are based on 2019 sales as disclosed in Ryerson’s Annual Report on Form 10-K for the year ended December 31, 2019. Secular growth end markets emerging in climate/HVAC, cloud computing, and e-commerce Includes renewable energy Includes automation Includes electric vehicles & software infrastructure Includes electric vehicles

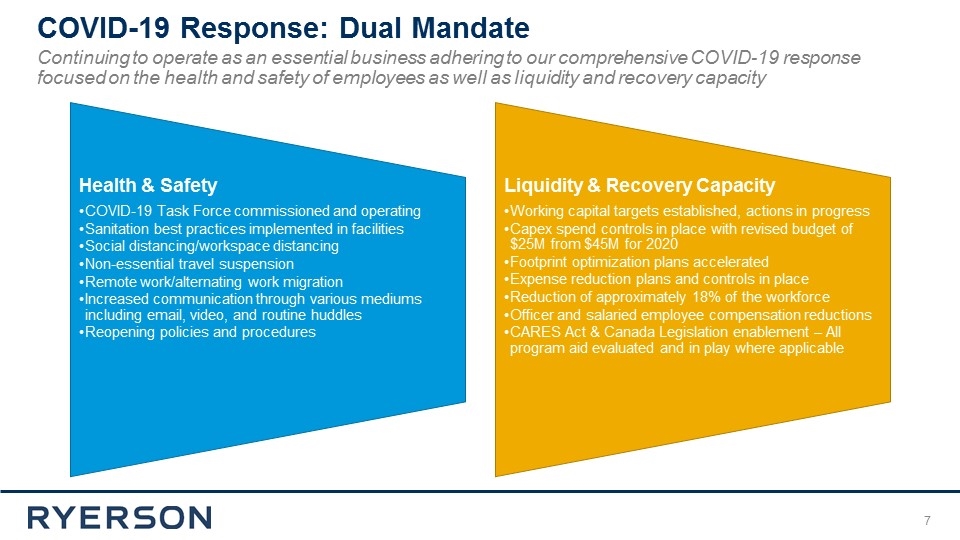

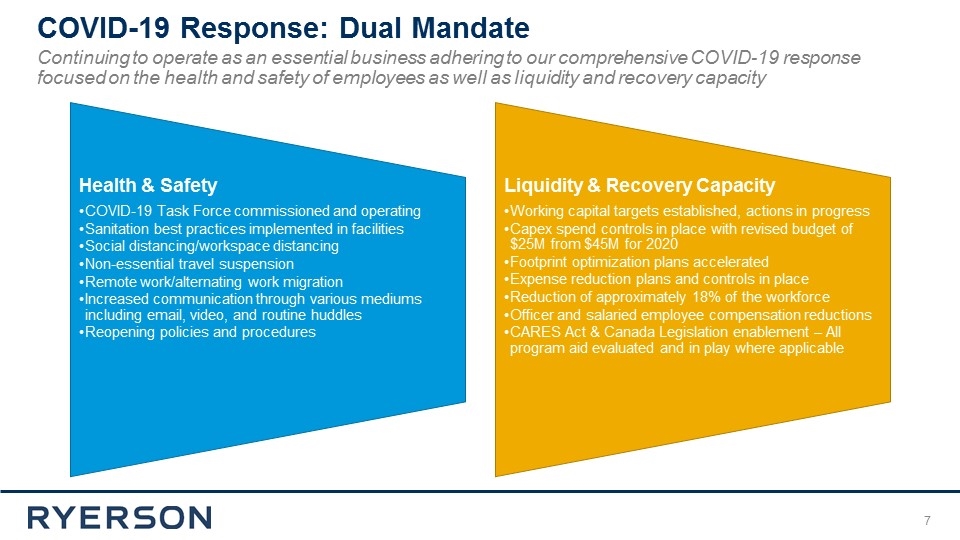

COVID-19 Response: Dual Mandate Continuing to operate as an essential business adhering to our comprehensive COVID-19 response focused on the health and safety of employees as well as liquidity and recovery capacity Health & Safety Sanitation best practices implemented in facilities Liquidity & Recovery Capacity Social distancing/workspace distancing Non-essential travel suspension Remote work/alternating work migration Increased communication through various mediums including email, video, and routine huddles Capex spend controls in place with revised budget of $25M from $45M for 2020 Expense reduction plans and controls in place Reduction of approximately 18% of the workforce CARES Act & Canada Legislation enablement – All program aid evaluated and in play where applicable Working capital targets established, actions in progress COVID-19 Task Force commissioned and operating Officer and salaried employee compensation reductions Reopening policies and procedures Footprint optimization plans accelerated

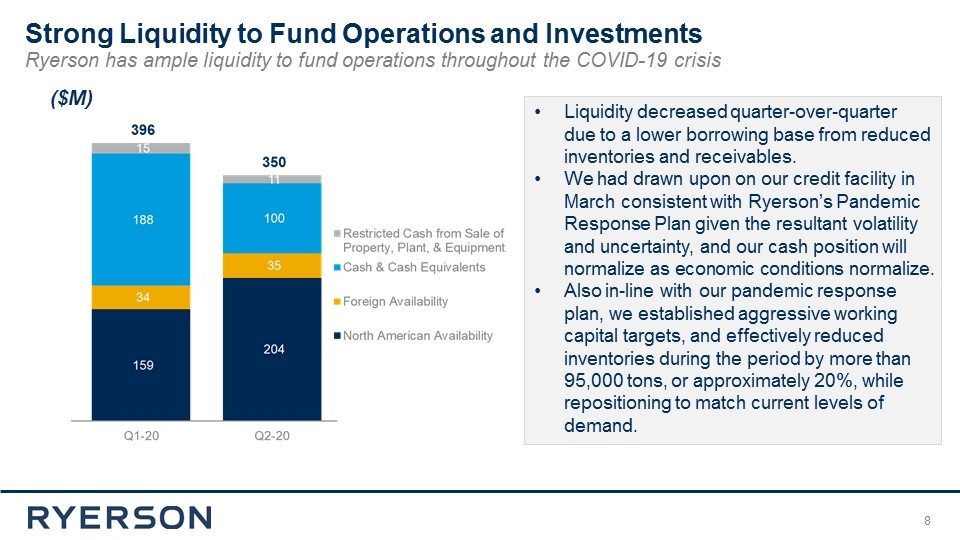

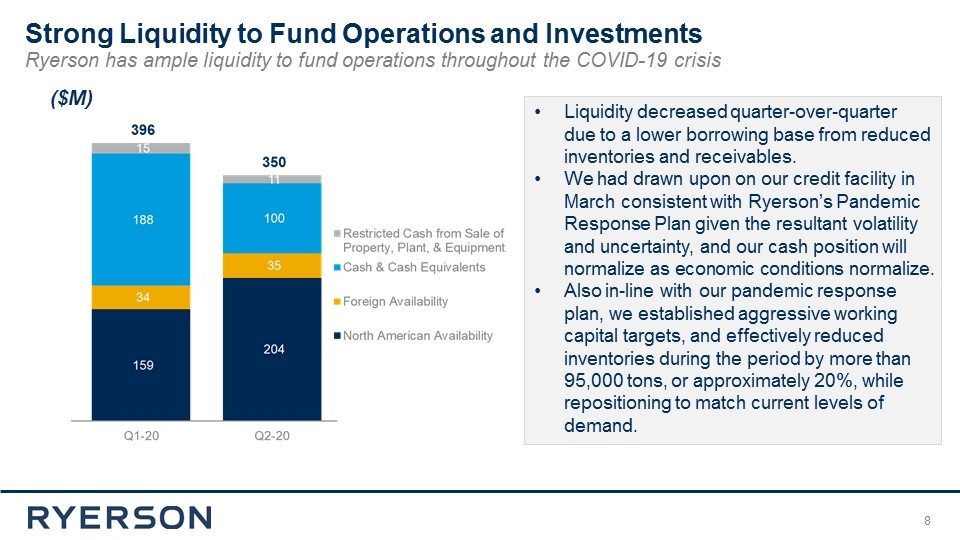

Strong Liquidity to Fund Operations and Investments Ryerson has ample liquidity to fund operations throughout the COVID-19 crisis ($M) Liquidity decreased quarter-over-quarter due to a lower borrowing base from reduced inventories and receivables. We had drawn upon on our credit facility in March consistent with Ryerson’s Pandemic Response Plan given the resultant volatility and uncertainty, and our cash position will normalize as economic conditions normalize. Also in-line with our pandemic response plan, we established aggressive working capital targets, and effectively reduced inventories during the period by more than 95,000 tons, or approximately 20%, while repositioning to match current levels of demand.

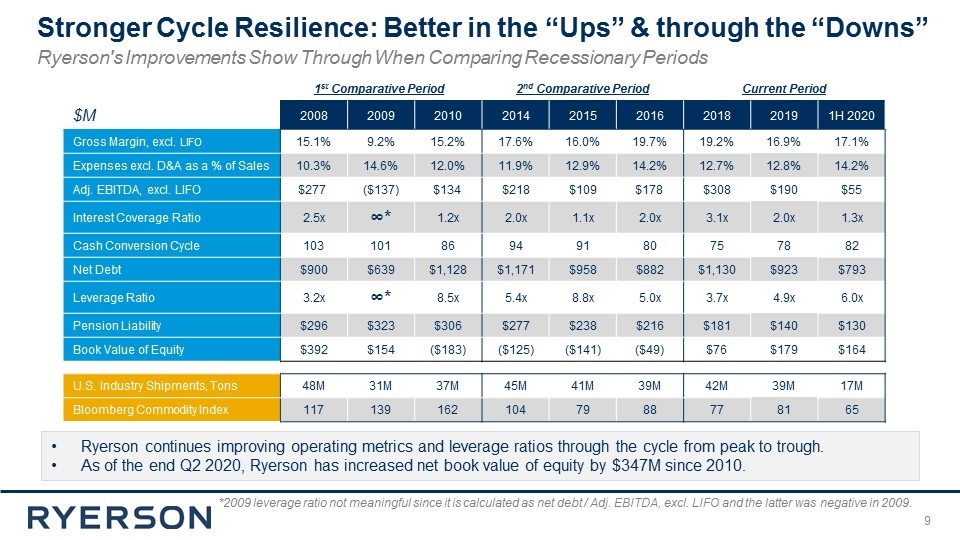

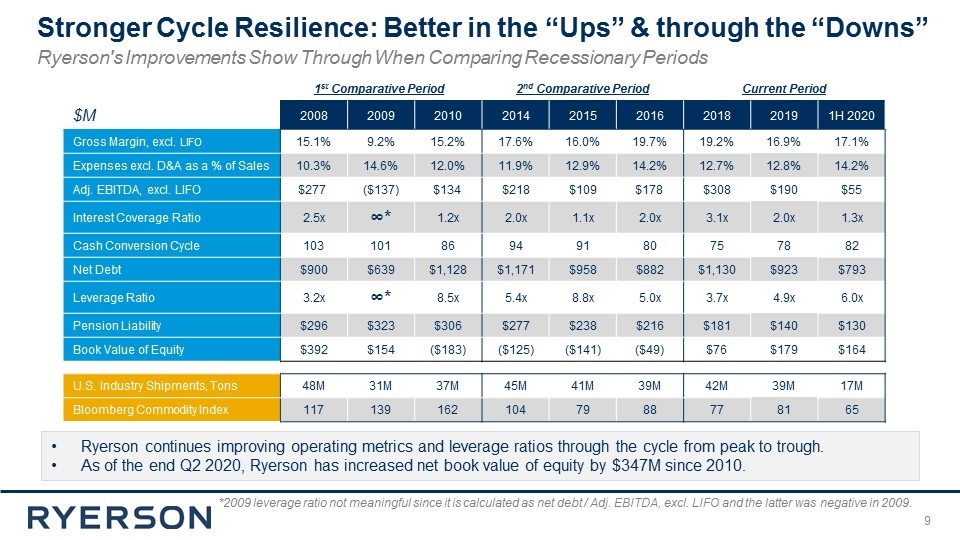

Ryerson continues improving operating metrics and leverage ratios through the cycle from peak to trough. As of the end Q2 2020, Ryerson has increased net book value of equity by $347M since 2010. *2009 leverage ratio not meaningful since it is calculated as net debt / Adj. EBITDA, excl. LIFO and the latter was negative in 2009. 1st Comparative Period 2nd Comparative Period Current Period $M 2008 2009 2010 2014 2015 2016 2018 2019 1H 2020 Gross Margin, excl. LIFO 15.1% 9.2% 15.2% 17.6% 16.0% 19.7% 19.2% 16.9% 17.1% Expenses excl. D&A as a % of Sales 10.3% 14.6% 12.0% 11.9% 12.9% 14.2% 12.7% 12.8% 14.2% Adj. EBITDA, excl. LIFO $277 ($137) $134 $218 $109 $178 $308 $190 $55 Interest Coverage Ratio 2.5x ∞* 1.2x 2.0x 1.1x 2.0x 3.1x 2.0x 1.3x Cash Conversion Cycle 103 101 86 94 91 80 75 78 82 Net Debt $900 $639 $1,128 $1,171 $958 $882 $1,130 $923 $793 Leverage Ratio 3.2x ∞* 8.5x 5.4x 8.8x 5.0x 3.7x 4.9x 6.0x Pension Liability $296 $323 $306 $277 $238 $216 $181 $140 $130 Book Value of Equity $392 $154 ($183) ($125) ($141) ($49) $76 $179 $164 U.S. Industry Shipments, Tons 48M 31M 37M 45M 41M 39M 42M 39M 17M Bloomberg Commodity Index 117 139 162 104 79 88 77 81 65 Stronger Cycle Resilience: Better in the “Ups” & through the “Downs” Ryerson's Improvements Show Through When Comparing Recessionary Periods

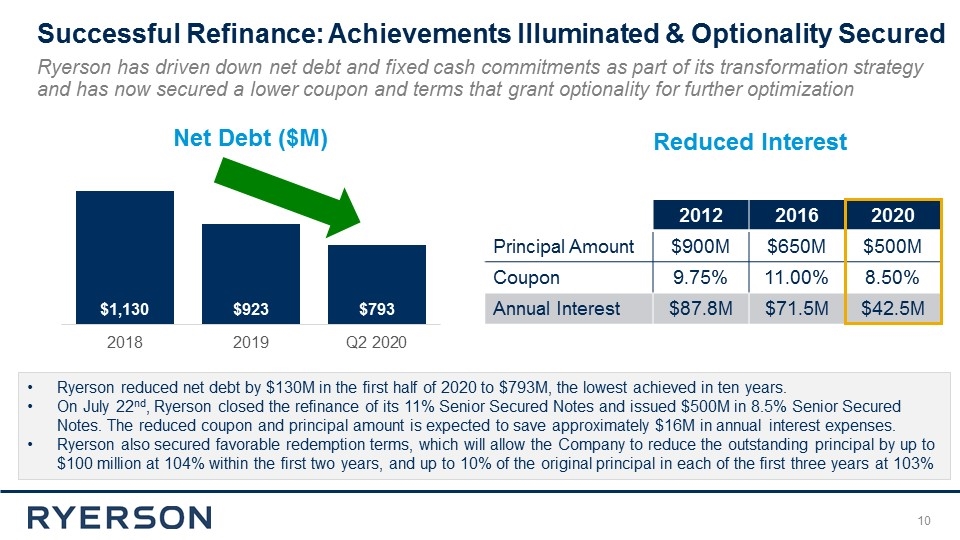

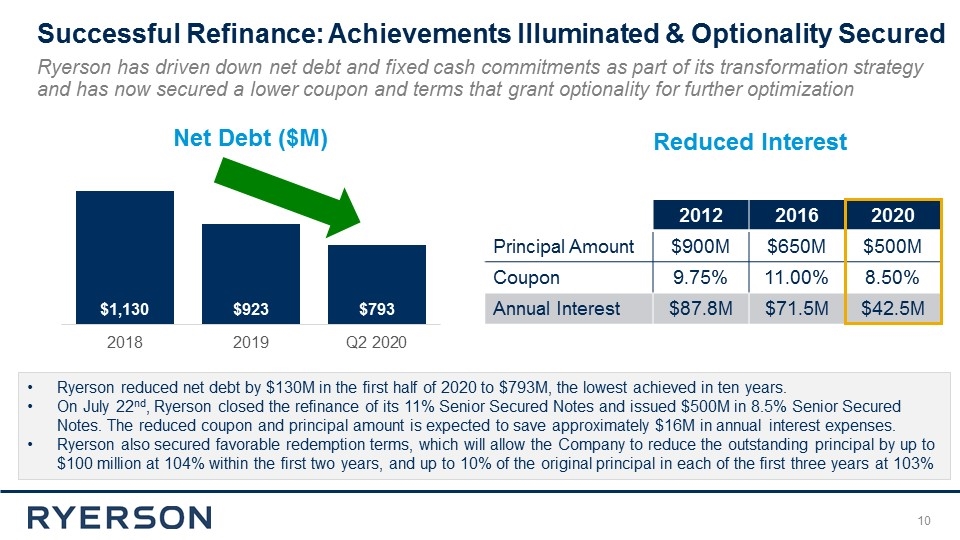

Successful Refinance: Achievements Illuminated & Optionality Secured Ryerson has driven down net debt and fixed cash commitments as part of its transformation strategy and has now secured a lower coupon and terms that grant optionality for further optimization 2012 2016 2020 Principal Amount $900M $650M $500M Coupon 9.75% 11.00% 8.50% Annual Interest $87.8M $71.5M $42.5M Ryerson reduced net debt by $130M in the first half of 2020 to $793M, the lowest achieved in ten years. On July 22nd, Ryerson closed the refinance of its 11% Senior Secured Notes and issued $500M in 8.5% Senior Secured Notes. The reduced coupon and principal amount is expected to save approximately $16M in annual interest expenses. Ryerson also secured favorable redemption terms, which will allow the Company to reduce the outstanding principal by up to $100 million at 104% within the first two years, and up to 10% of the original principal in each of the first three years at 103% Net Debt ($M) Reduced Interest

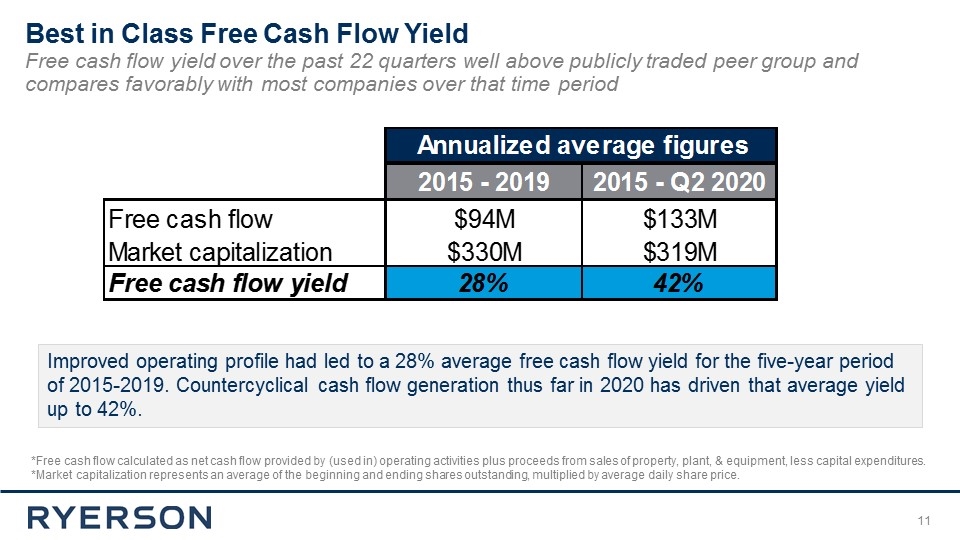

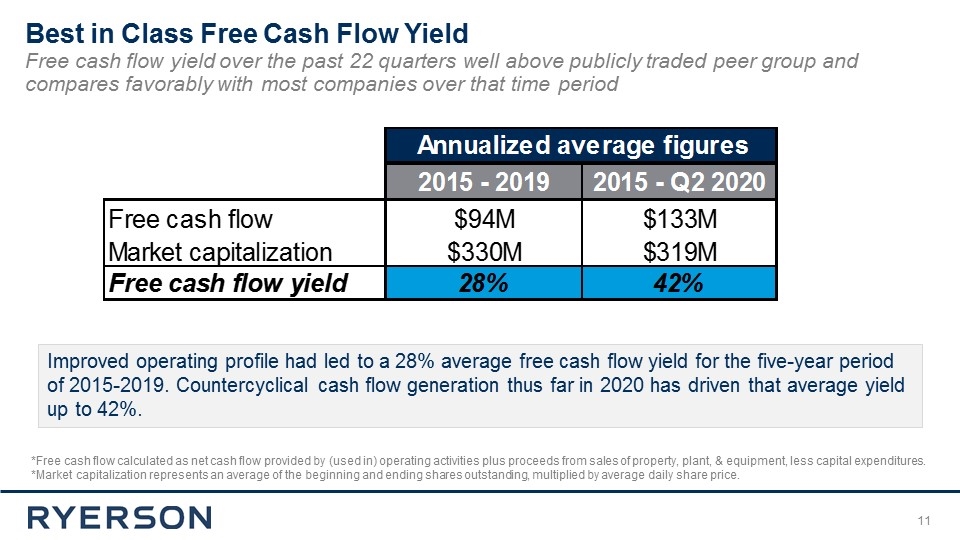

Best in Class Free Cash Flow Yield Free cash flow yield over the past 22 quarters well above publicly traded peer group and compares favorably with most companies over that time period Improved operating profile had led to a 28% average free cash flow yield for the five-year period of 2015-2019. Countercyclical cash flow generation thus far in 2020 has driven that average yield up to 42%. *Free cash flow calculated as net cash flow provided by (used in) operating activities plus proceeds from sales of property, plant, & equipment, less capital expenditures. *Market capitalization represents an average of the beginning and ending shares outstanding, multiplied by average daily share price.

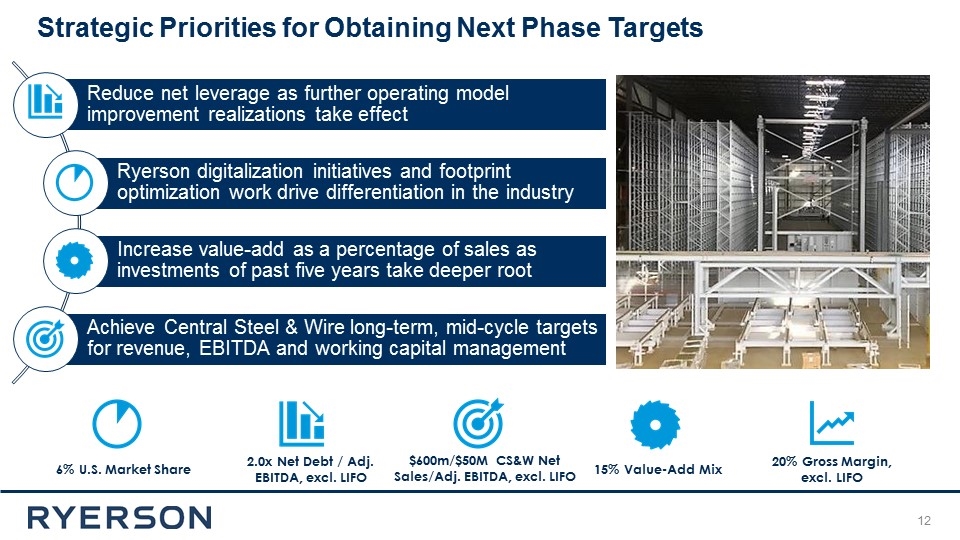

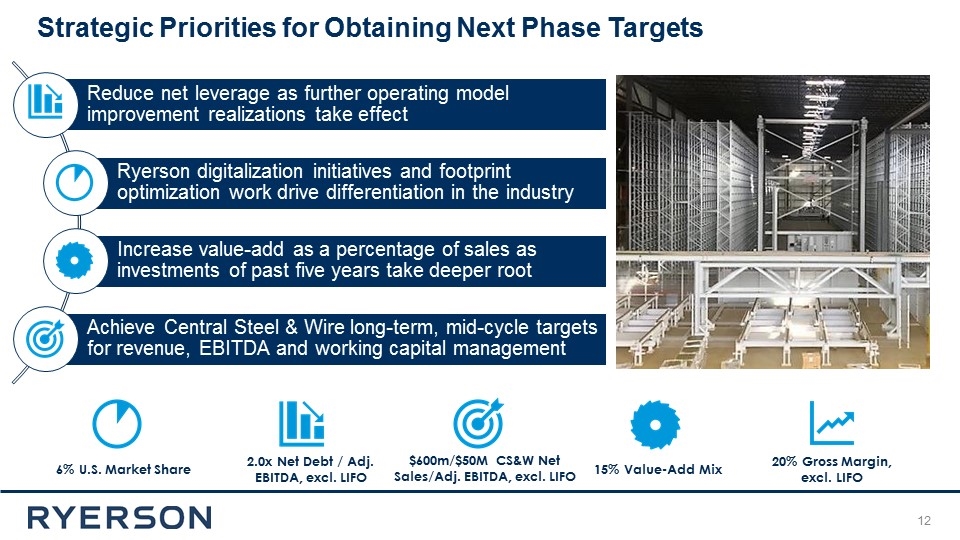

12 6% U.S. Market Share 15% Value-Add Mix 20% Gross Margin, excl. LIFO 2.0x Net Debt / Adj. EBITDA, excl. LIFO $600m/$50M CS&W Net Sales/Adj. EBITDA, excl. LIFO Strategic Priorities for Obtaining Next Phase Targets Increase value-add as a percentage of sales as investments of past five years take deeper root Achieve Central Steel & Wire long-term, mid-cycle targets for revenue, EBITDA and working capital management Ryerson digitalization initiatives and footprint optimization work drive differentiation in the industry Reduce net leverage as further operating model improvement realizations take effect

Navigating Through the Unprecedented 2020 Environment Growth Supportive Factors - Low Imports - Inventory Replenishment - Fiscal Stimulus - Supply Side Responses - Reshoring - YITTB- Yes, It’s Time to Build Movement Uncertainties - Asynchronous Virus Uncertainty - Continued Fiscal and Monetary Stimulus - Working Capital Flywheel RPM’s - Labor Market Dislocations/Unemployment - Business Investment Confidence - Consumer Confidence Risks - Political Risk - Debt Levels - Global Trade Tensions

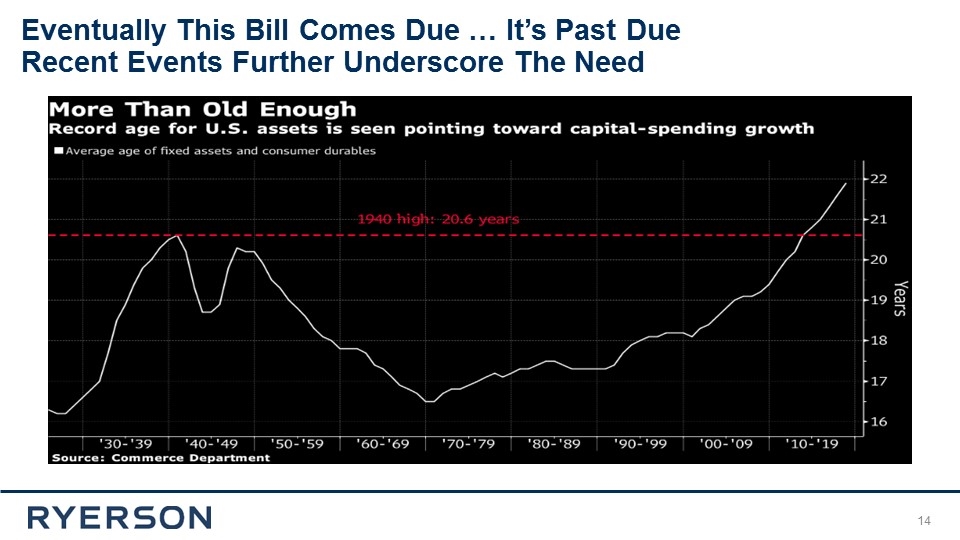

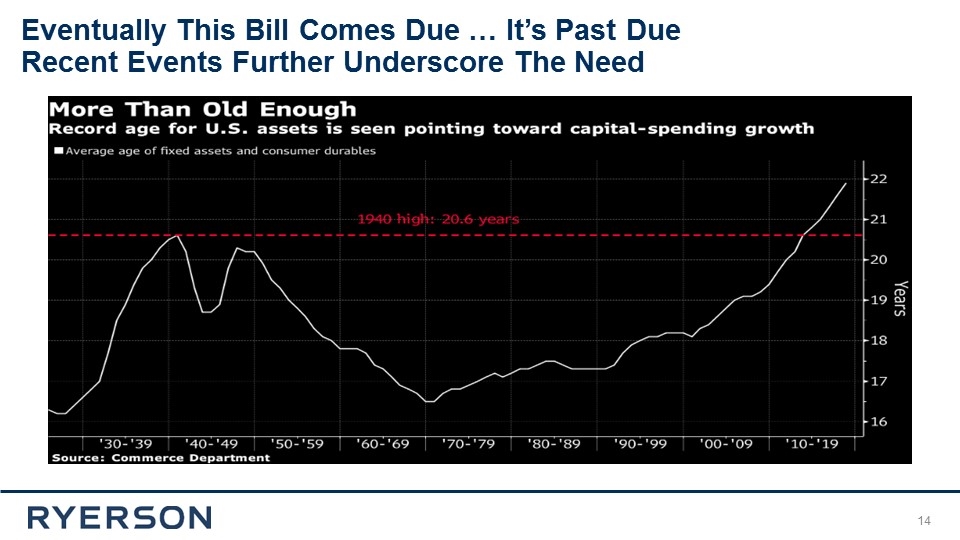

Eventually This Bill Comes Due … It’s Past Due Recent Events Further Underscore The Need 14

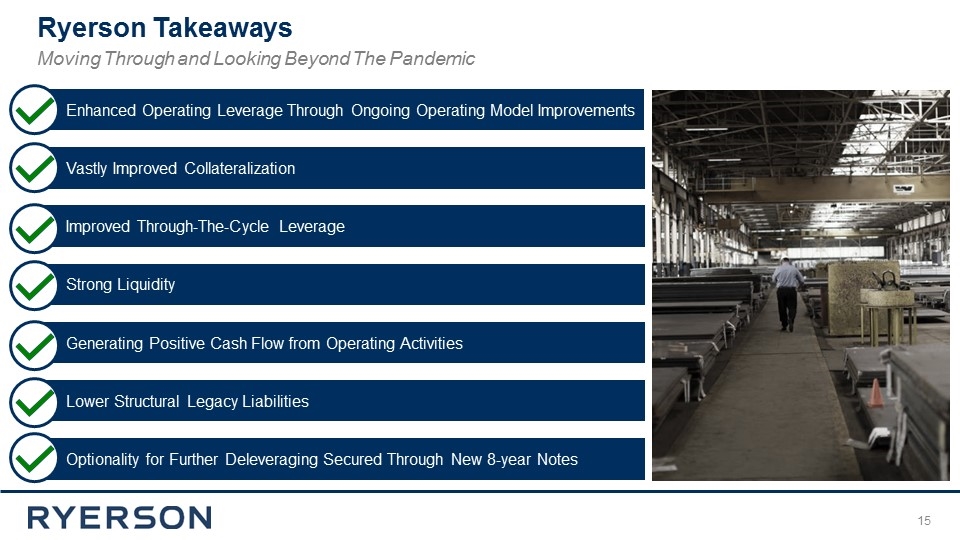

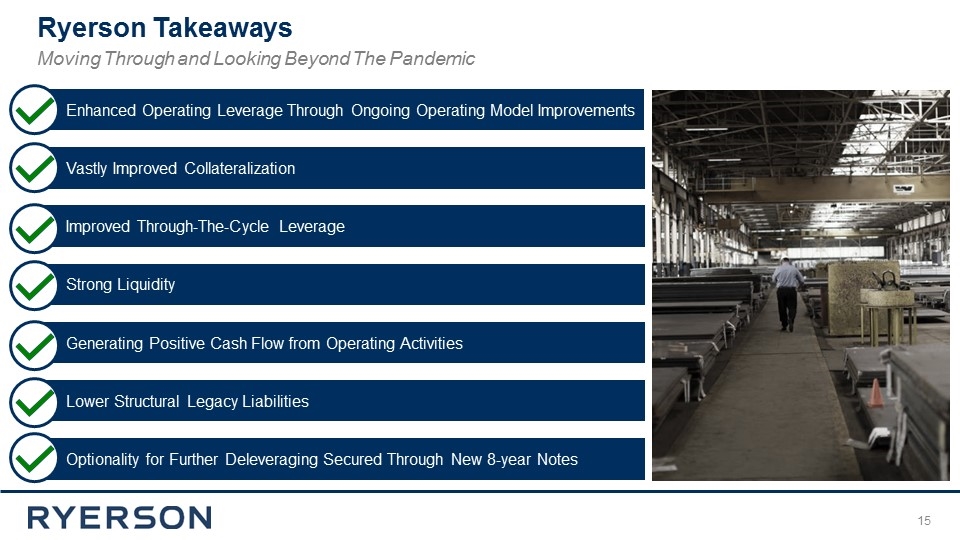

Ryerson Takeaways 15 Moving Through and Looking Beyond The Pandemic Enhanced Operating Leverage Through Ongoing Operating Model Improvements Vastly Improved Collateralization Improved Through-The-Cycle Leverage Strong Liquidity Generating Positive Cash Flow from Operating Activities Lower Structural Legacy Liabilities Optionality for Further Deleveraging Secured Through New 8-year Notes

YES, IT’S TIME TO BUILD #YITTB

Appendix

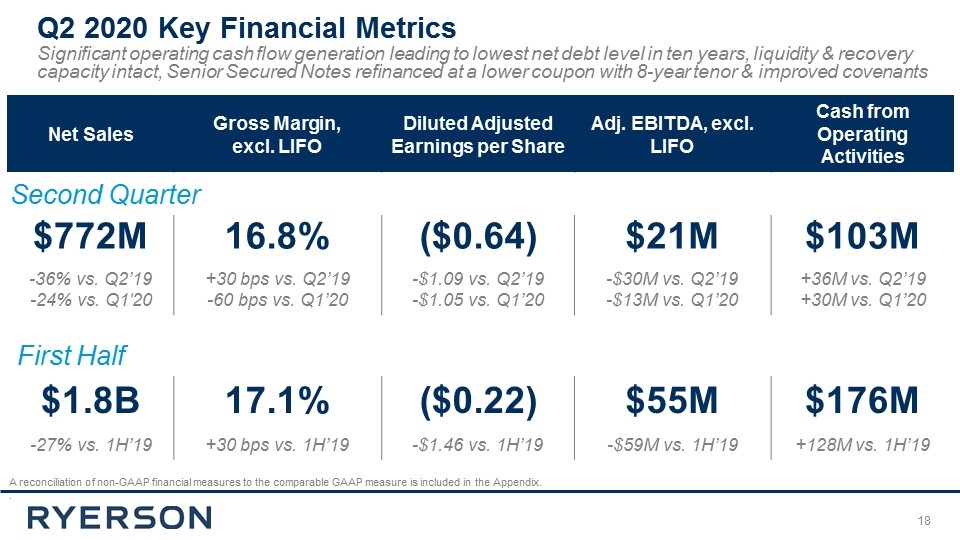

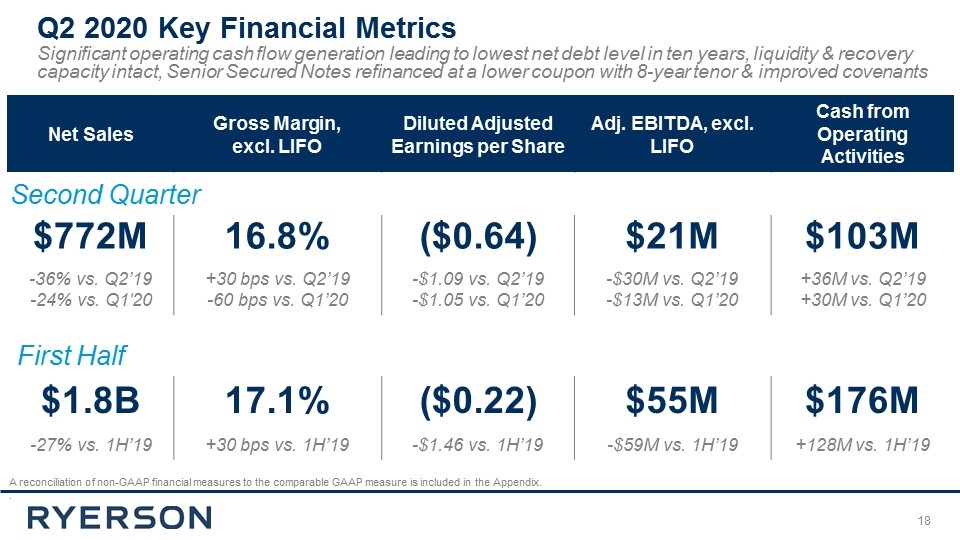

A reconciliation of non-GAAP financial measures to the comparable GAAP measure is included in the Appendix. . Net Sales Gross Margin, excl. LIFO Diluted Adjusted Earnings per Share Adj. EBITDA, excl. LIFO Cash from Operating Activities $772M 16.8% ($0.64) $21M $103M -36% vs. Q2’19 -24% vs. Q1'20 +30 bps vs. Q2’19 -60 bps vs. Q1’20 -$1.09 vs. Q2’19 -$1.05 vs. Q1’20 -$30M vs. Q2’19 -$13M vs. Q1’20 +36M vs. Q2’19 +30M vs. Q1’20 Second Quarter Q2 2020 Key Financial Metrics Significant operating cash flow generation leading to lowest net debt level in ten years, liquidity & recovery capacity intact, Senior Secured Notes refinanced at a lower coupon with 8-year tenor & improved covenants $1.8B 17.1% ($0.22) $55M $176M -27% vs. 1H’19 +30 bps vs. 1H’19 -$1.46 vs. 1H’19 -$59M vs. 1H’19 +128M vs. 1H’19 First Half

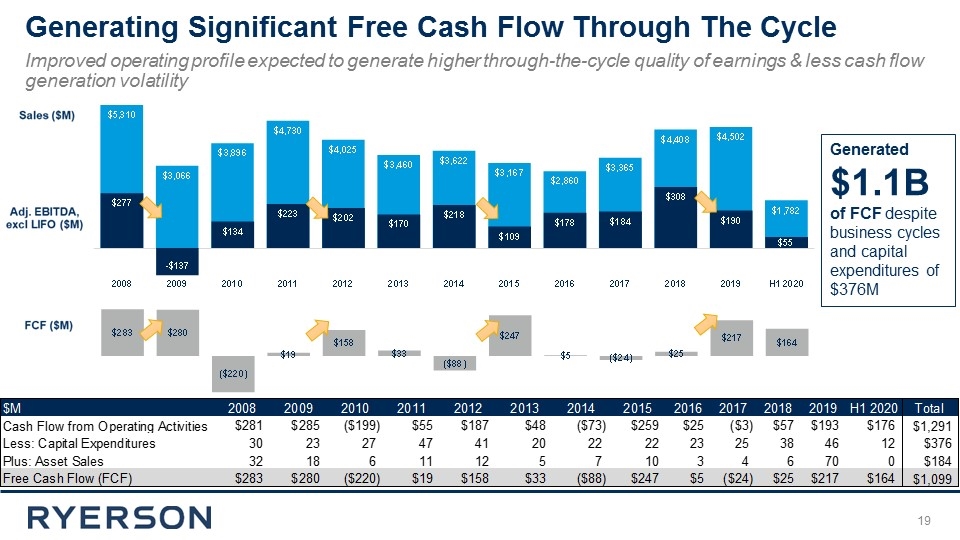

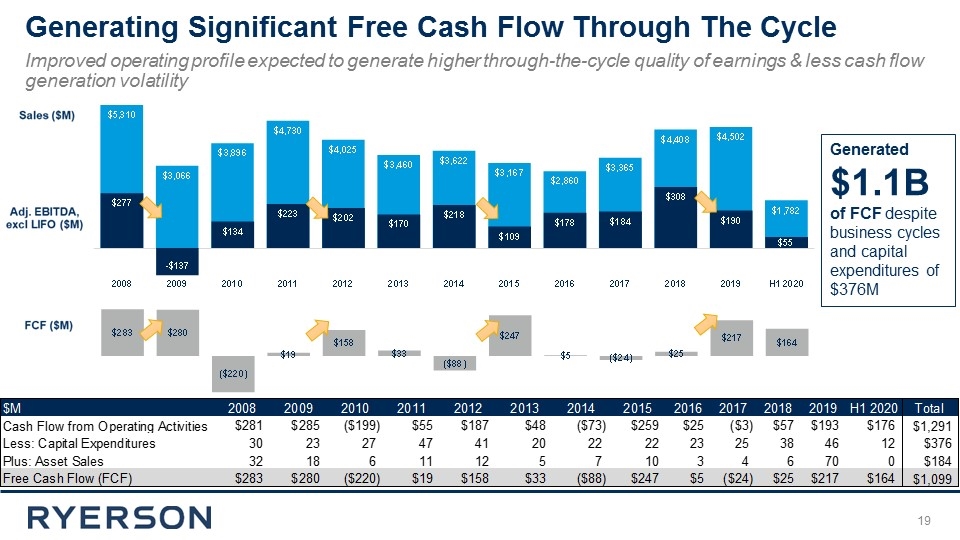

Generating Significant Free Cash Flow Through The Cycle Improved operating profile expected to generate higher through-the-cycle quality of earnings & less cash flow generation volatility 19 Generated $1.1B of FCF despite business cycles and capital expenditures of $376M

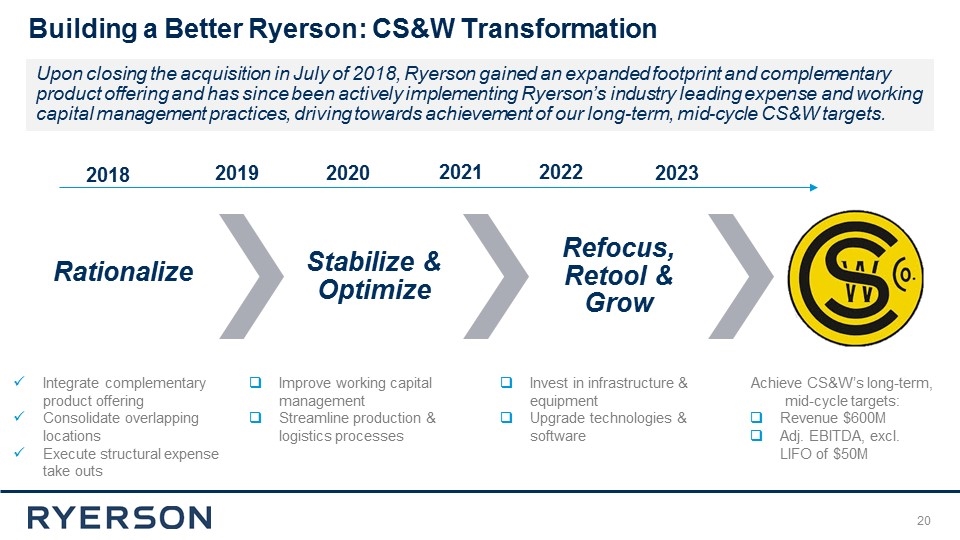

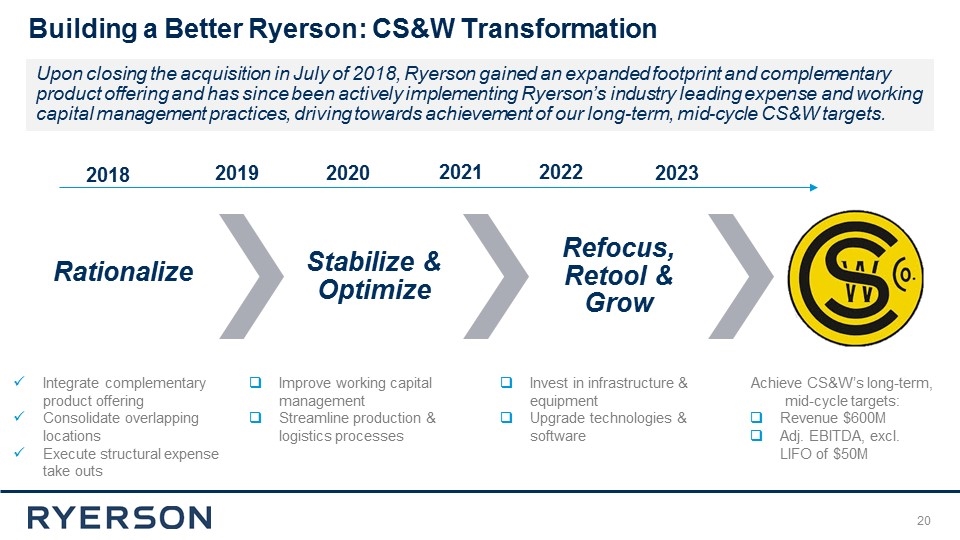

2019 2020 2021 2022 2023 2018 Building a Better Ryerson: CS&W Transformation Achieve CS&W’s long-term, mid-cycle targets: Revenue $600M Adj. EBITDA, excl. LIFO of $50M Integrate complementary product offering Consolidate overlapping locations Execute structural expense take outs Improve working capital management Streamline production & logistics processes Invest in infrastructure & equipment Upgrade technologies & software Upon closing the acquisition in July of 2018, Ryerson gained an expanded footprint and complementary product offering and has since been actively implementing Ryerson’s industry leading expense and working capital management practices, driving towards achievement of our long-term, mid-cycle CS&W targets. Rationalize Stabilize & Optimize Refocus, Retool & Grow

CS&W Transformation: Q2 2020 Results Two years since acquisition, CS&W has generated $146M in cash flows, or approximately 90% of its purchase price. While affected by the second quarter’s pandemic induced demand weakness, CS&W’s expense decrease outpaced the volume contraction and margins remained above 2019 levels. 20.4% Gross Margin, excl. LIFO, above 2019 levels despite pandemic environment 22.1% Decrease in Operating Expenses Q2 ’20 vs. Q1 ‘20 $146M Cash Flows since acquisition, ~90% of purchase price Tons Shipped & Gross Margin, excl. LIFO Operating Expenses *Operating expenses exclude restructuring charges

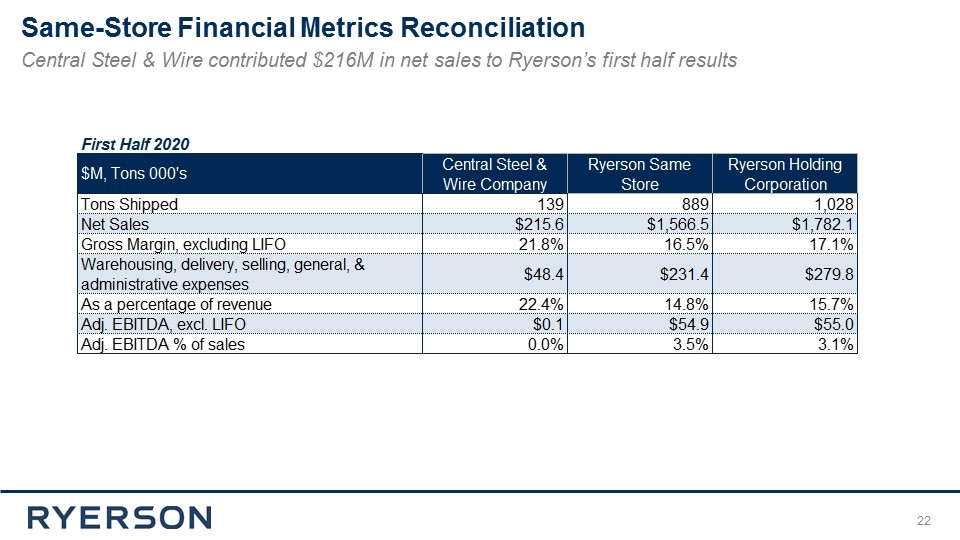

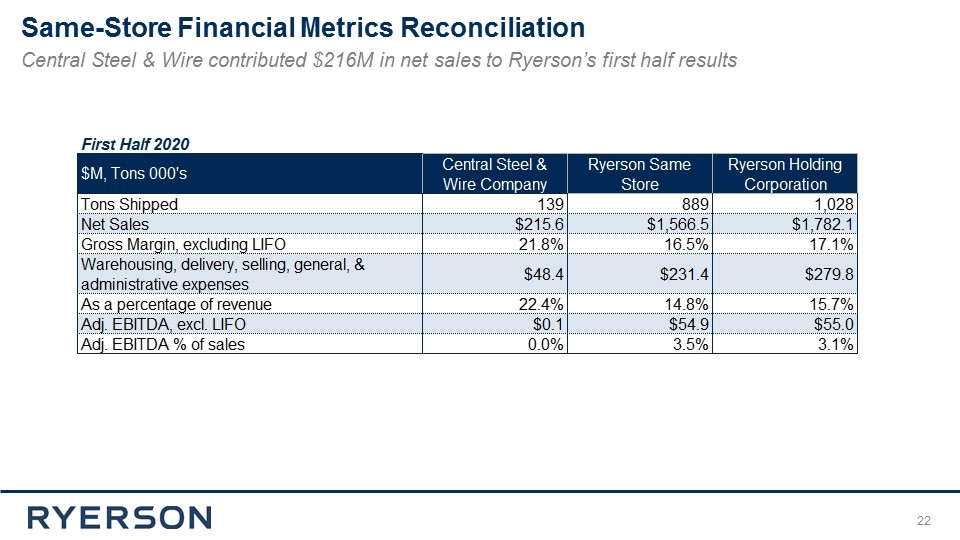

Same-Store Financial Metrics Reconciliation Central Steel & Wire contributed $216M in net sales to Ryerson’s first half results

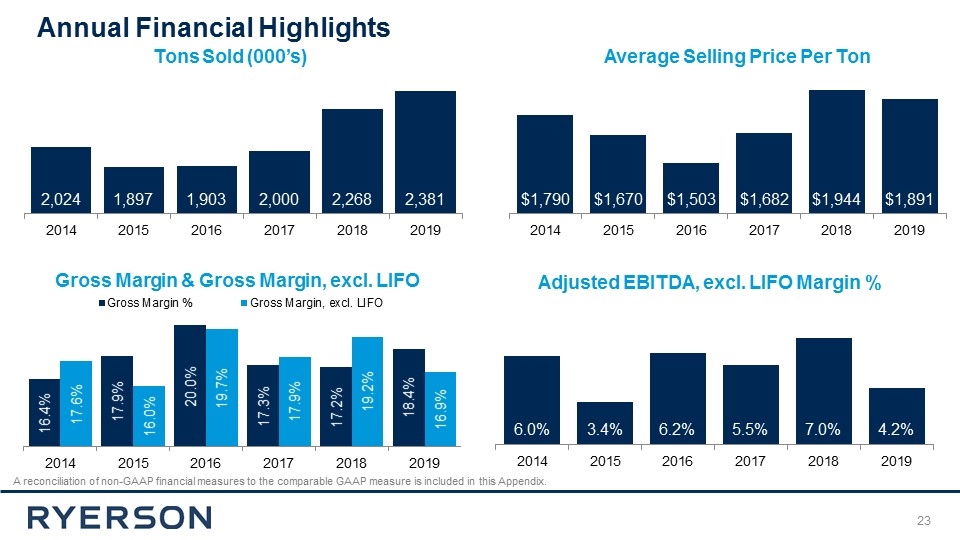

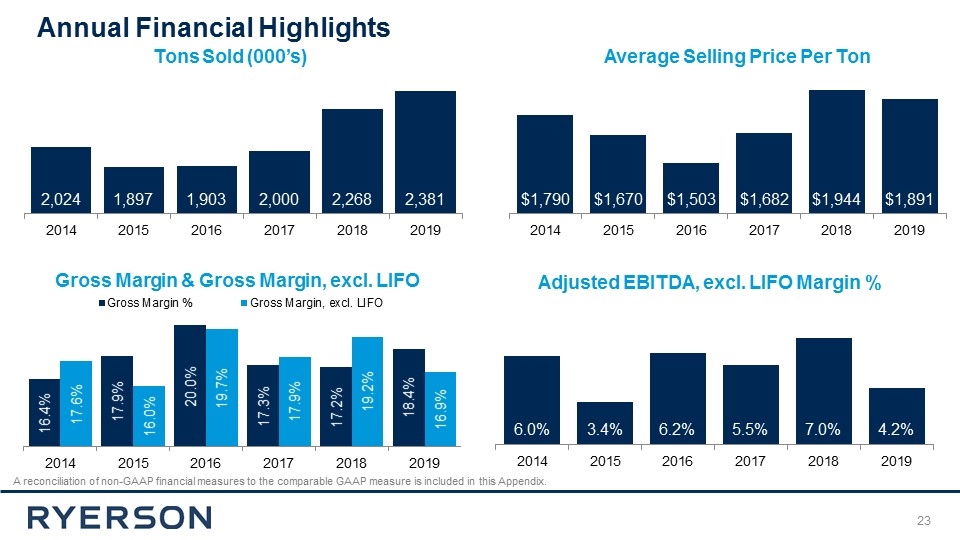

Annual Financial Highlights A reconciliation of non-GAAP financial measures to the comparable GAAP measure is included in this Appendix. Tons Sold (000’s) Average Selling Price Per Ton Gross Margin & Gross Margin, excl. LIFO Adjusted EBITDA, excl. LIFO Margin %

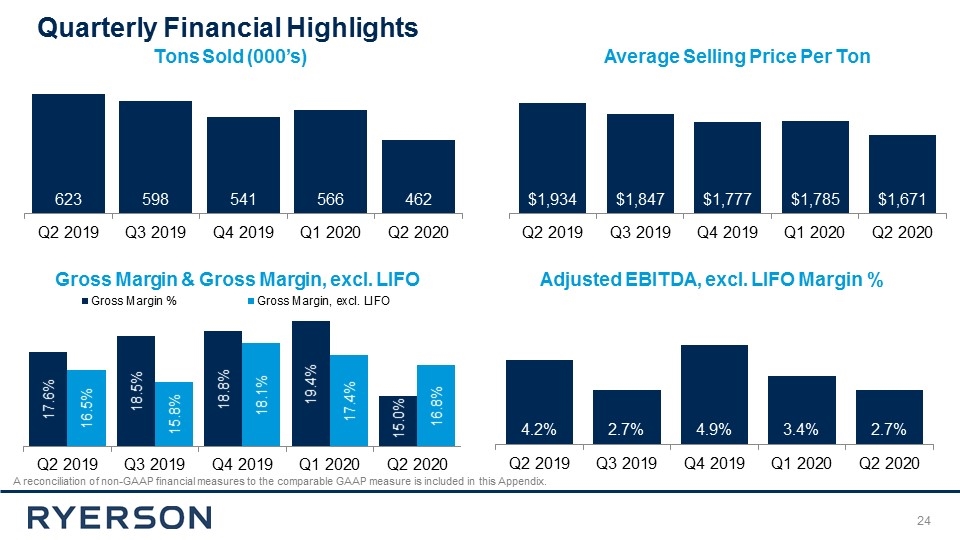

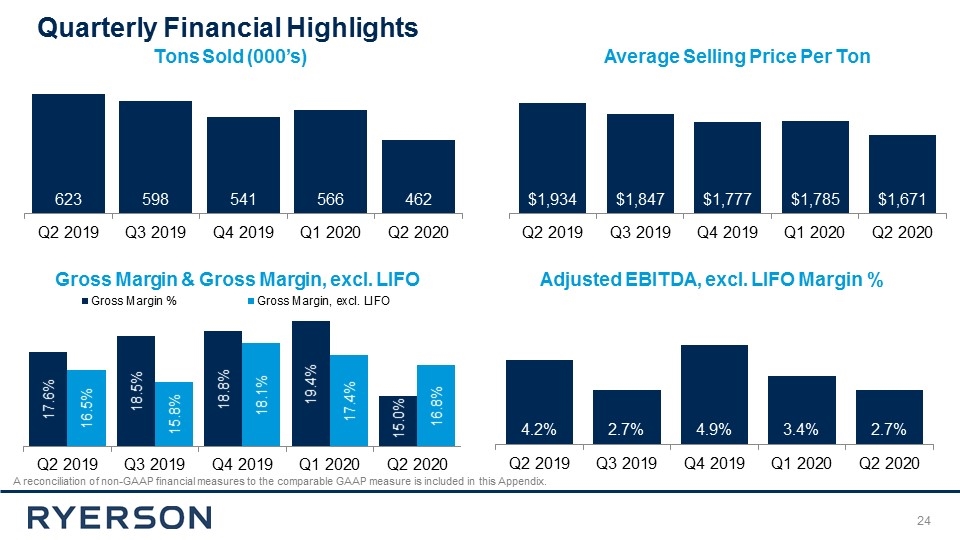

Quarterly Financial Highlights A reconciliation of non-GAAP financial measures to the comparable GAAP measure is included in this Appendix. Tons Sold (000’s) Average Selling Price Per Ton Adjusted EBITDA, excl. LIFO Margin % Gross Margin & Gross Margin, excl. LIFO

Although our operations by their nature do not have a significant impact on the environment, we continue to: Purchase metal produced using recycled materials or scrap melted in electric arc furnaces and sell scrap to recyclers Use propane fuel to operate forklifts Install energy efficient lighting Utilize energy efficient diesel tractors Ryerson’s Commitment to our Employees and Communities Safety Community Support Sustainability We consistently outperform the Bureau of Labor Statistics, and, in the first half of 2020, our safety record as measured by OSHA’s TRI metric of total recordable incidents declined to a five-year low, indicating that our workplace is becoming even safer and our culture of workplace safety is being internalized and embedded in our behaviors. The Ryerson Gives Back program supports active employee involvement in numerous local community volunteer activities, from serving in food kitchens to children’s causes and educational programs. Ryerson also awards college sponsorship and tuition reimbursement.

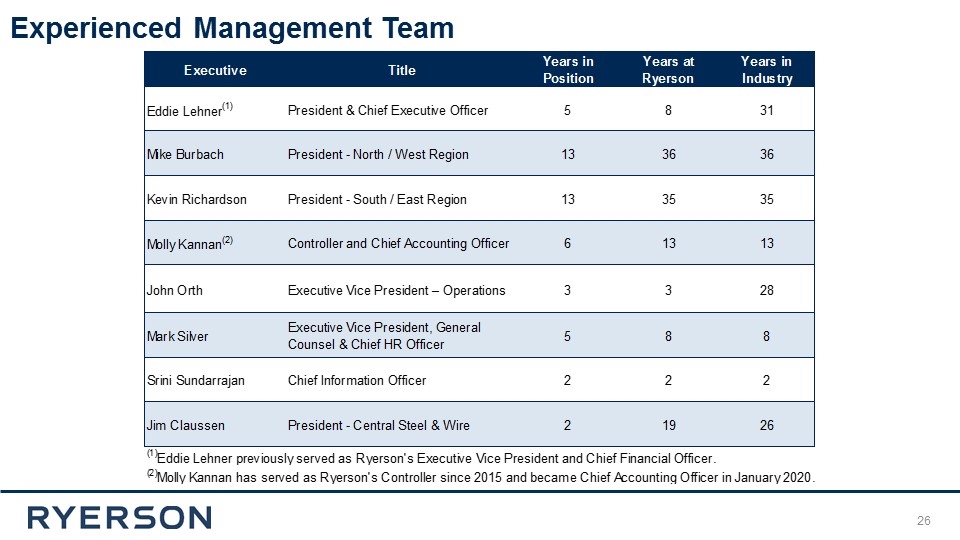

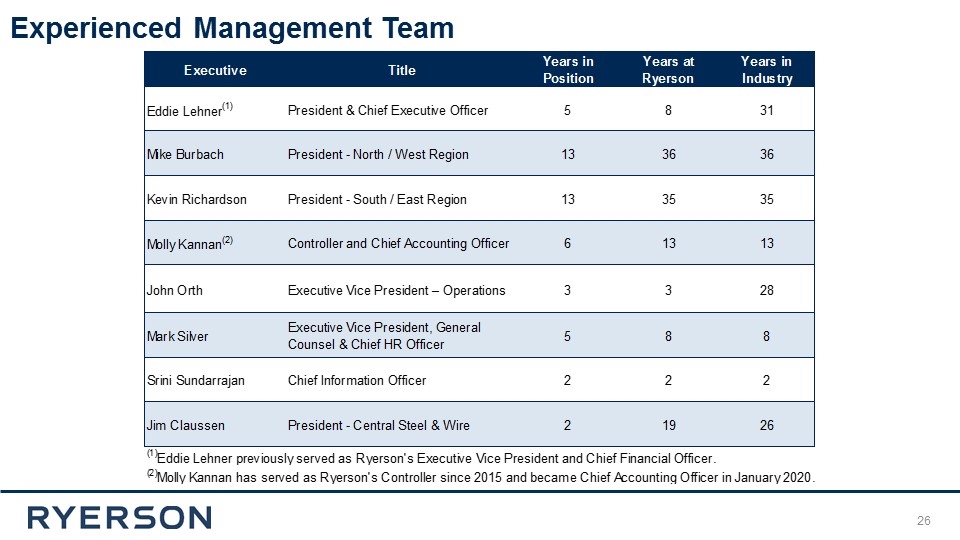

Experienced Management Team

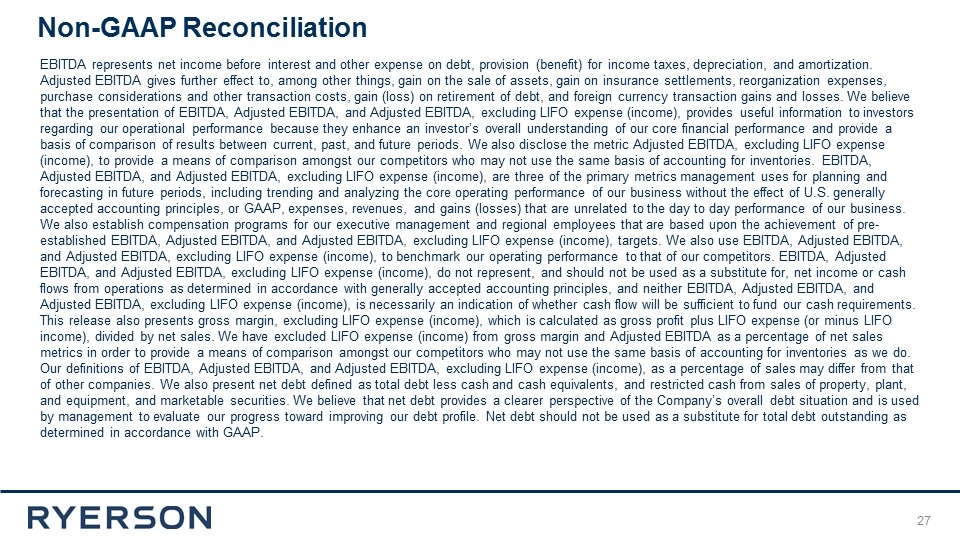

31 EBITDA represents net income before interest and other expense on debt, provision (benefit) for income taxes, depreciation, and amortization. Adjusted EBITDA gives further effect to, among other things, gain on the sale of assets, gain on insurance settlements, reorganization expenses, purchase considerations and other transaction costs, gain (loss) on retirement of debt, and foreign currency transaction gains and losses. We believe that the presentation of EBITDA, Adjusted EBITDA, and Adjusted EBITDA, excluding LIFO expense (income), provides useful information to investors regarding our operational performance because they enhance an investor’s overall understanding of our core financial performance and provide a basis of comparison of results between current, past, and future periods. We also disclose the metric Adjusted EBITDA, excluding LIFO expense (income), to provide a means of comparison amongst our competitors who may not use the same basis of accounting for inventories. EBITDA, Adjusted EBITDA, and Adjusted EBITDA, excluding LIFO expense (income), are three of the primary metrics management uses for planning and forecasting in future periods, including trending and analyzing the core operating performance of our business without the effect of U.S. generally accepted accounting principles, or GAAP, expenses, revenues, and gains (losses) that are unrelated to the day to day performance of our business. We also establish compensation programs for our executive management and regional employees that are based upon the achievement of pre-established EBITDA, Adjusted EBITDA, and Adjusted EBITDA, excluding LIFO expense (income), targets. We also use EBITDA, Adjusted EBITDA, and Adjusted EBITDA, excluding LIFO expense (income), to benchmark our operating performance to that of our competitors. EBITDA, Adjusted EBITDA, and Adjusted EBITDA, excluding LIFO expense (income), do not represent, and should not be used as a substitute for, net income or cash flows from operations as determined in accordance with generally accepted accounting principles, and neither EBITDA, Adjusted EBITDA, and Adjusted EBITDA, excluding LIFO expense (income), is necessarily an indication of whether cash flow will be sufficient to fund our cash requirements. This release also presents gross margin, excluding LIFO expense (income), which is calculated as gross profit plus LIFO expense (or minus LIFO income), divided by net sales. We have excluded LIFO expense (income) from gross margin and Adjusted EBITDA as a percentage of net sales metrics in order to provide a means of comparison amongst our competitors who may not use the same basis of accounting for inventories as we do. Our definitions of EBITDA, Adjusted EBITDA, and Adjusted EBITDA, excluding LIFO expense (income), as a percentage of sales may differ from that of other companies. We also present net debt defined as total debt less cash and cash equivalents, and restricted cash from sales of property, plant, and equipment, and marketable securities. We believe that net debt provides a clearer perspective of the Company’s overall debt situation and is used by management to evaluate our progress toward improving our debt profile. Net debt should not be used as a substitute for total debt outstanding as determined in accordance with GAAP. Non-GAAP Reconciliation

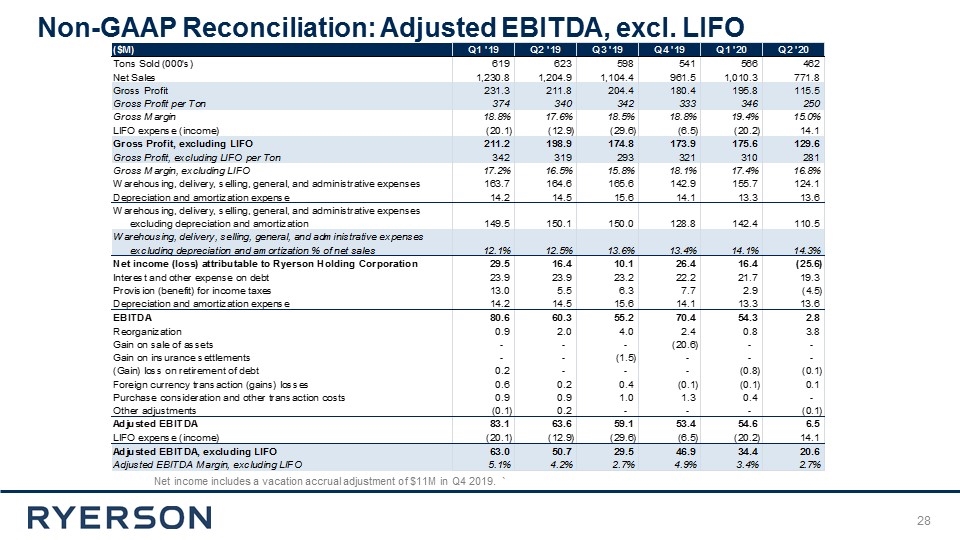

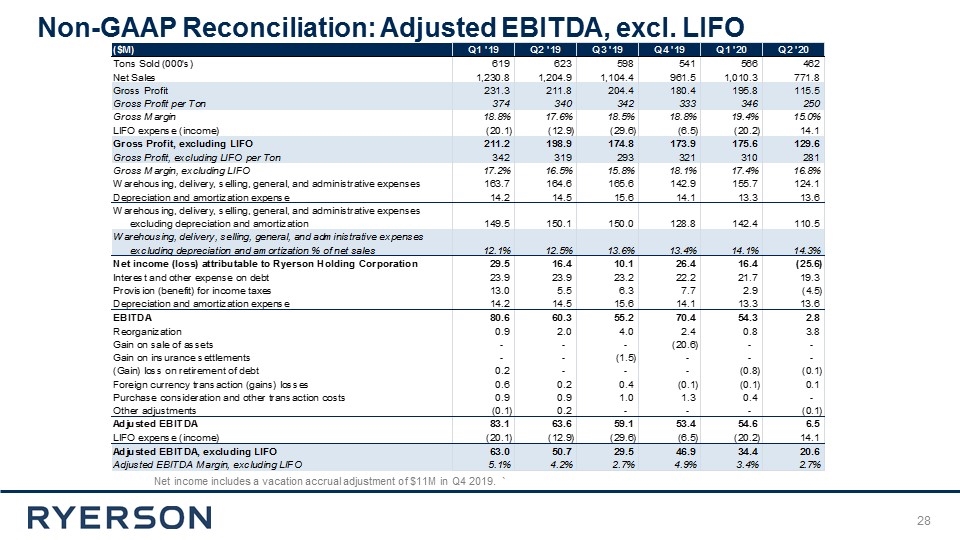

Net income includes a vacation accrual adjustment of $11M in Q4 2019. ` Non-GAAP Reconciliation: Adjusted EBITDA, excl. LIFO

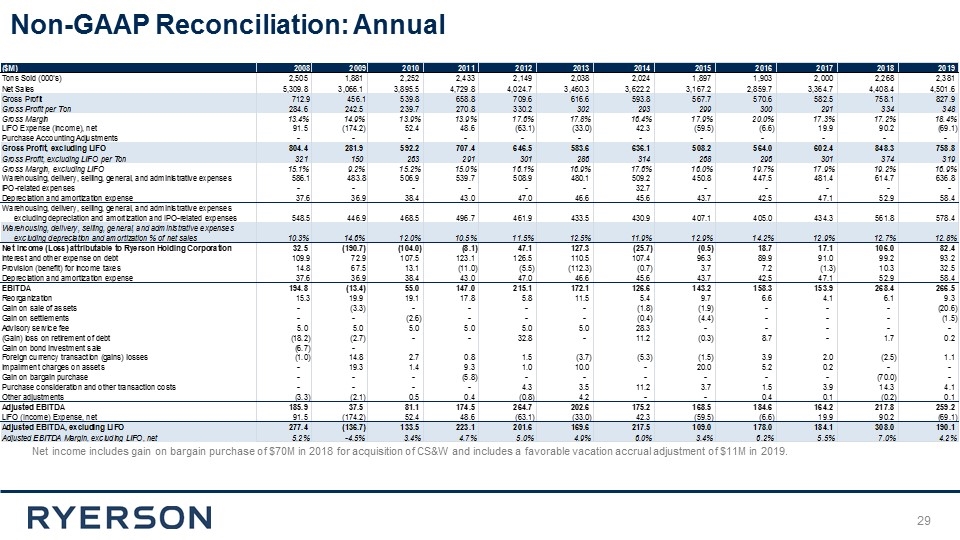

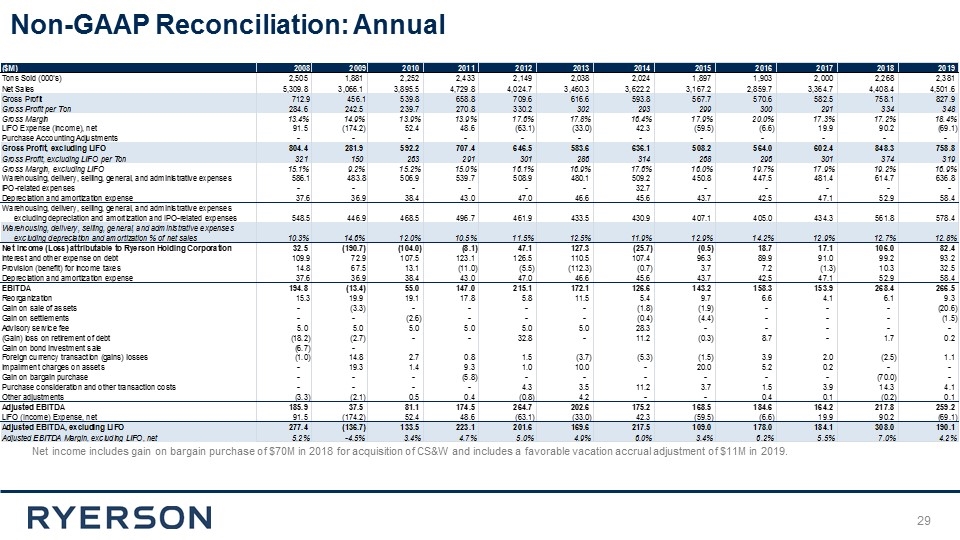

Non-GAAP Reconciliation: Annual Net income includes gain on bargain purchase of $70M in 2018 for acquisition of CS&W and includes a favorable vacation accrual adjustment of $11M in 2019.

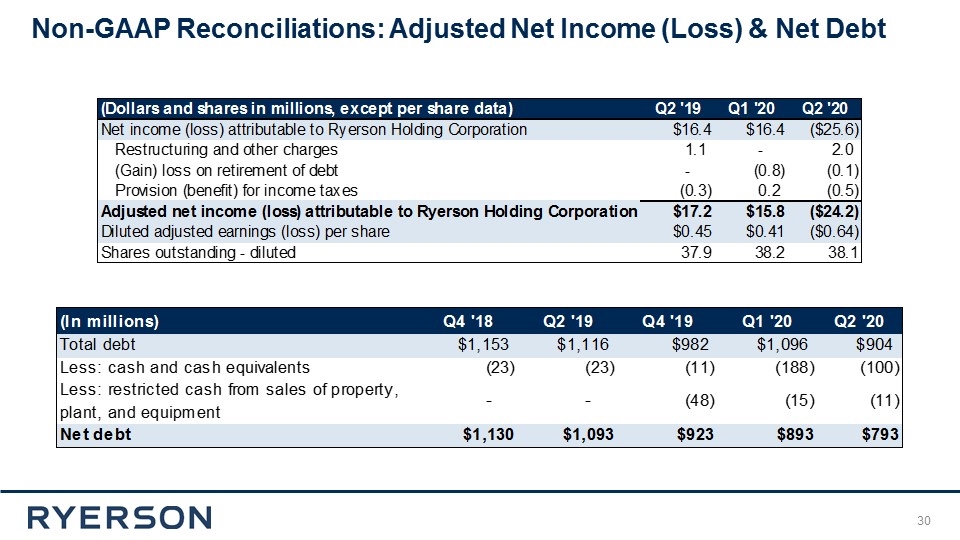

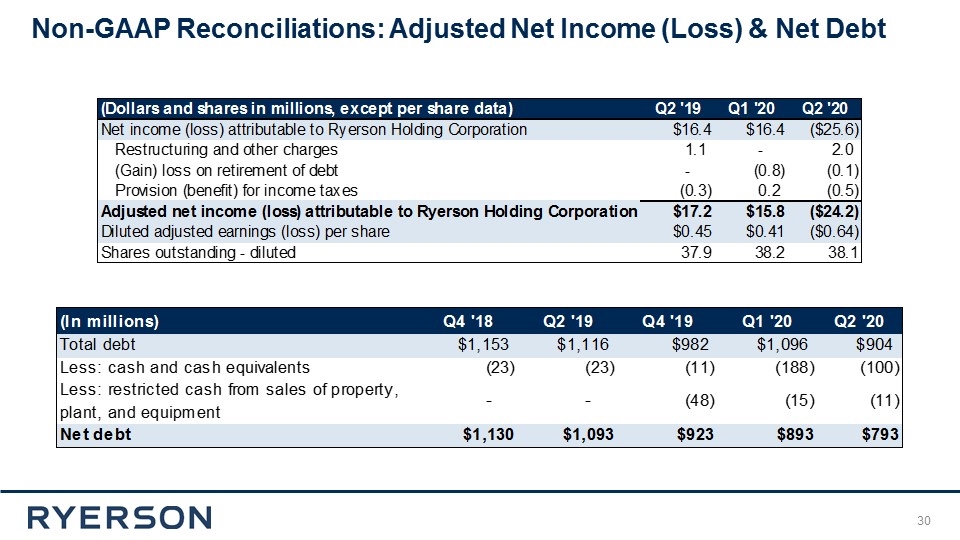

Non-GAAP Reconciliations: Adjusted Net Income (Loss) & Net Debt