Ryerson Quarterly Release Presentation Q3 2020 Exhibit 99.2

31 Important Information About Ryerson Holding Corporation These materials do not constitute an offer or solicitation to purchase or sell securities of Ryerson Holding Corporation (“Ryerson” or “the Company”) or its subsidiaries and no investment decision should be made based upon the information provided herein. Ryerson strongly urges you to review its filings with the Securities and Exchange Commission, which can be found at https://ir.ryerson.com/financials/sec-filings/default.aspx. This site also provides additional information about Ryerson. Safe Harbor Provision Certain statements made in this presentation and other written or oral statements made by or on behalf of the Company constitute "forward-looking statements" within the meaning of the federal securities laws, including statements regarding our future performance, as well as management's expectations, beliefs, intentions, plans, estimates, objectives, or projections relating to the future. Such statements can be identified by the use of forward-looking terminology such as “objectives,” “goals,” “preliminary,” “range,” "believes," "expects," "may," "estimates," "will," "should," "plans," or "anticipates" or the negative thereof or other variations thereon or comparable terminology, or by discussions of strategy. The Company cautions that any such forward-looking statements are not guarantees of future performance and may involve significant risks and uncertainties, and that actual results may vary materially from those in the forward-looking statements as a result of various factors. Among the factors that significantly impact our business are: the cyclicality of our business; the highly competitive, volatile, and fragmented metals industry in which we operate; fluctuating metal prices; our substantial indebtedness and the covenants in instruments governing such indebtedness; the integration of acquired operations; regulatory and other operational risks associated with our operations located inside and outside of the United States; impacts and implications of adverse health events, including the COVID-19 pandemic; work stoppages; obligations under certain employee retirement benefit plans; the ownership of a majority of our equity securities by a single investor group; currency fluctuations; and consolidation in the metals industry. Forward-looking statements should, therefore, be considered in light of various factors, including those set forth above and those set forth under "Risk Factors" in our annual report on Form 10-K for the year ended December 31, 2019, and in our other filings with the Securities and Exchange Commission. Moreover, we caution against placing undue reliance on these statements, which speak only as of the date they were made. The Company does not undertake any obligation to publicly update or revise any forward-looking statements to reflect future events or circumstances, new information or otherwise. Non-GAAP Measures Certain measures contained in these slides or the related presentation are not measures calculated in accordance with generally accepted accounting principles (“GAAP”). They should not be considered a replacement for GAAP results. Non-GAAP financial measures appearing in these slides are identified in the footnotes. A reconciliation of these non-GAAP measures to the most directly comparable GAAP financial measures is included in the Appendix.

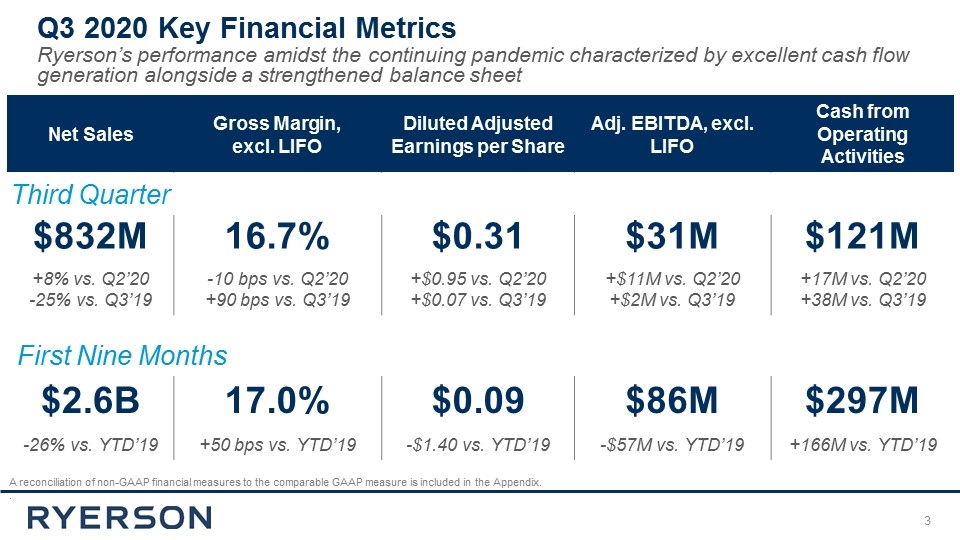

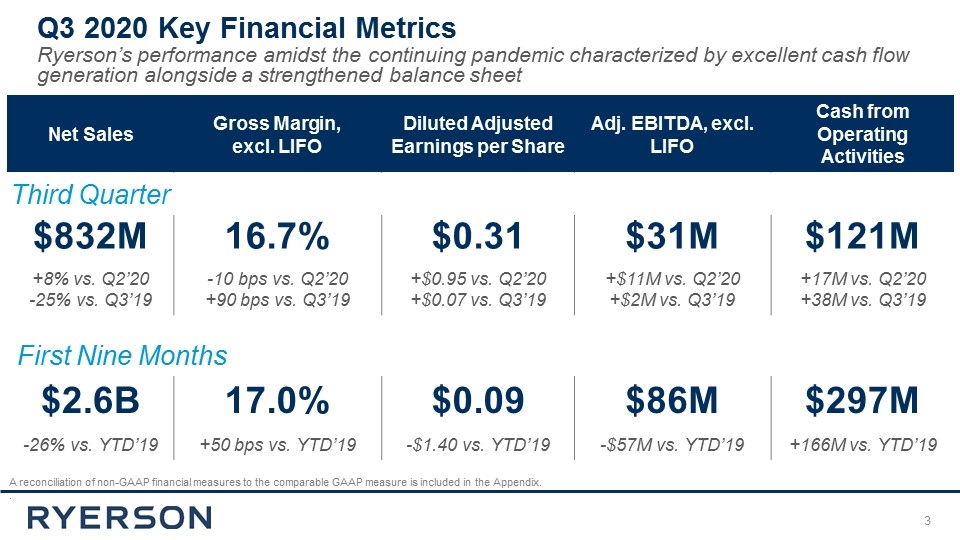

A reconciliation of non-GAAP financial measures to the comparable GAAP measure is included in the Appendix. . Net Sales Gross Margin, excl. LIFO Diluted Adjusted Earnings per Share Adj. EBITDA, excl. LIFO Cash from Operating Activities $832M 16.7% $0.31 $31M $121M +8% vs. Q2’20 -25% vs. Q3’19 -10 bps vs. Q2’20 +90 bps vs. Q3’19 +$0.95 vs. Q2’20 +$0.07 vs. Q3’19 +$11M vs. Q2’20 +$2M vs. Q3’19 +17M vs. Q2’20 +38M vs. Q3’19 Third Quarter Q3 2020 Key Financial Metrics Ryerson’s performance amidst the continuing pandemic characterized by excellent cash flow generation alongside a strengthened balance sheet $2.6B 17.0% $0.09 $86M $297M -26% vs. YTD’19 +50 bps vs. YTD’19 -$1.40 vs. YTD’19 -$57M vs. YTD’19 +166M vs. YTD’19 First Nine Months

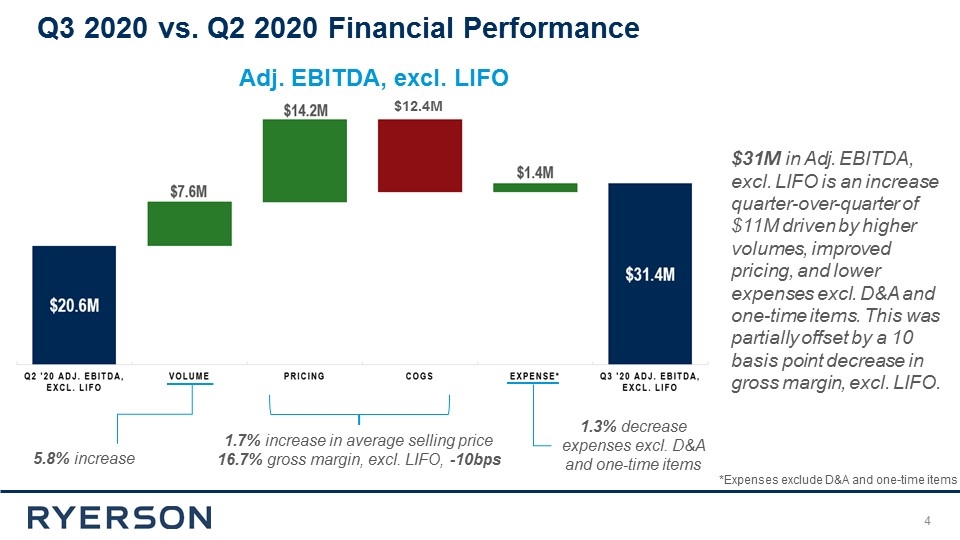

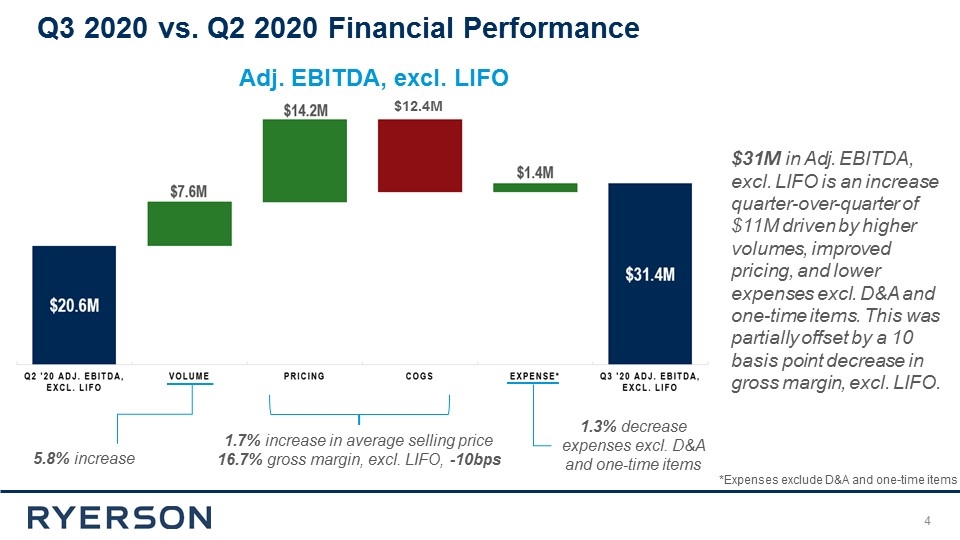

1.7% increase in average selling price 16.7% gross margin, excl. LIFO, -10bps Adj. EBITDA, excl. LIFO 5.8% increase 1.3% decrease expenses excl. D&A and one-time items $31M in Adj. EBITDA, excl. LIFO is an increase quarter-over-quarter of $11M driven by higher volumes, improved pricing, and lower expenses excl. D&A and one-time items. This was partially offset by a 10 basis point decrease in gross margin, excl. LIFO. Q3 2020 vs. Q2 2020 Financial Performance *Total Expense excl. D&A and ‘One-time’ Items *Total Expense excl. D&A and ‘One-time’ Items *Total Expense excl. D&A and ‘One-time’ Items *Total Expense excl. D&A and ‘One-time’ Items *Expenses exclude D&A and one-time items $12.4M

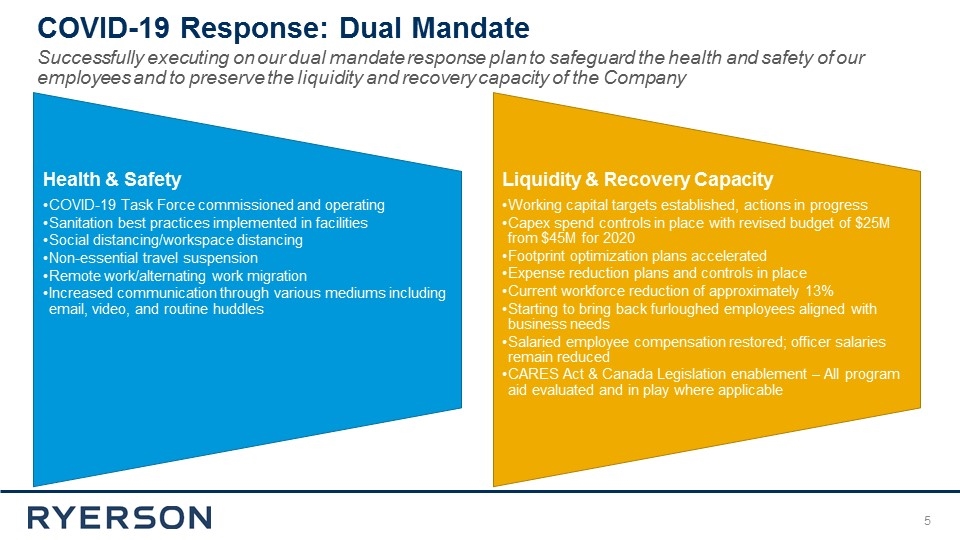

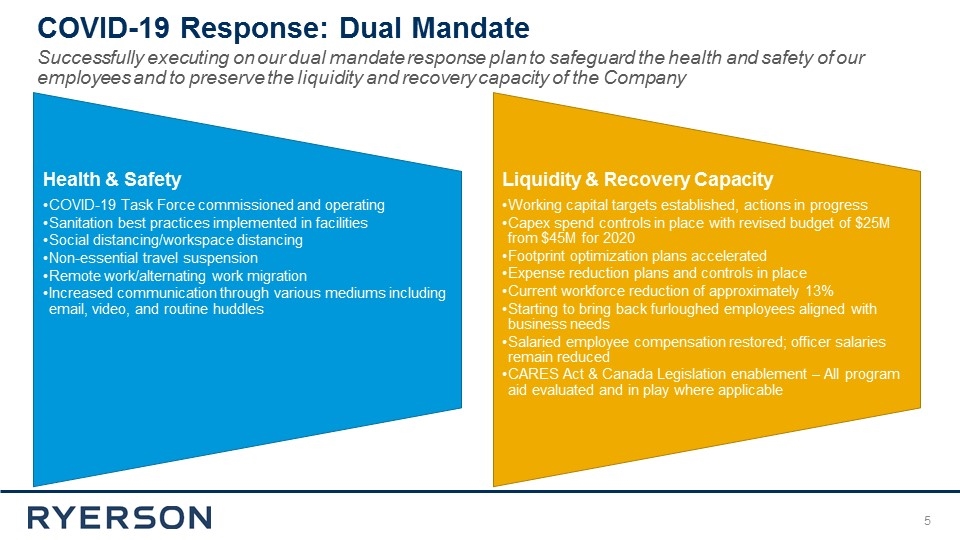

COVID-19 Response: Dual Mandate Successfully executing on our dual mandate response plan to safeguard the health and safety of our employees and to preserve the liquidity and recovery capacity of the Company Health & Safety Sanitation best practices implemented in facilities Liquidity & Recovery Capacity Social distancing/workspace distancing Non-essential travel suspension Remote work/alternating work migration Increased communication through various mediums including email, video, and routine huddles Capex spend controls in place with revised budget of $25M from $45M for 2020 Expense reduction plans and controls in place Current workforce reduction of approximately 13% Working capital targets established, actions in progress COVID-19 Task Force commissioned and operating Footprint optimization plans accelerated Starting to bring back furloughed employees aligned with business needs CARES Act & Canada Legislation enablement – All program aid evaluated and in play where applicable Salaried employee compensation restored; officer salaries remain reduced

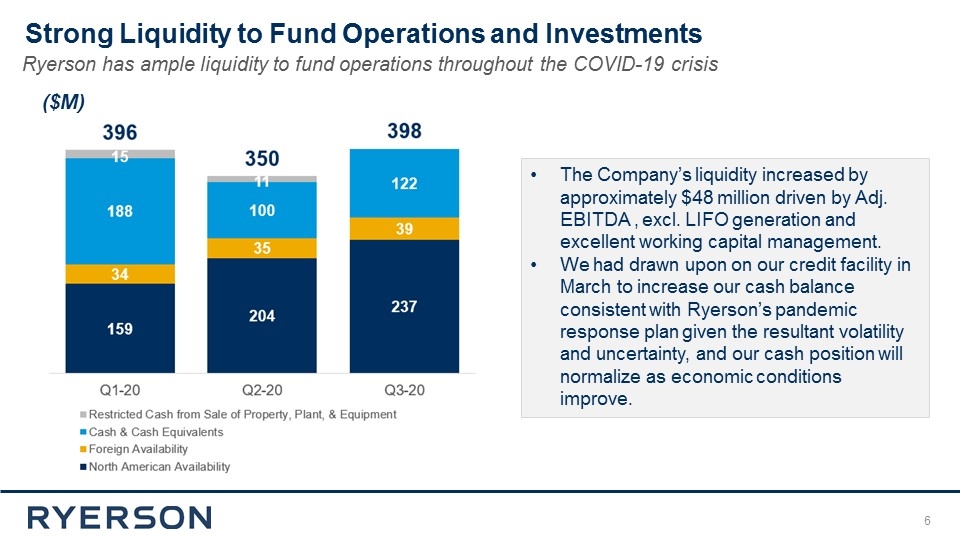

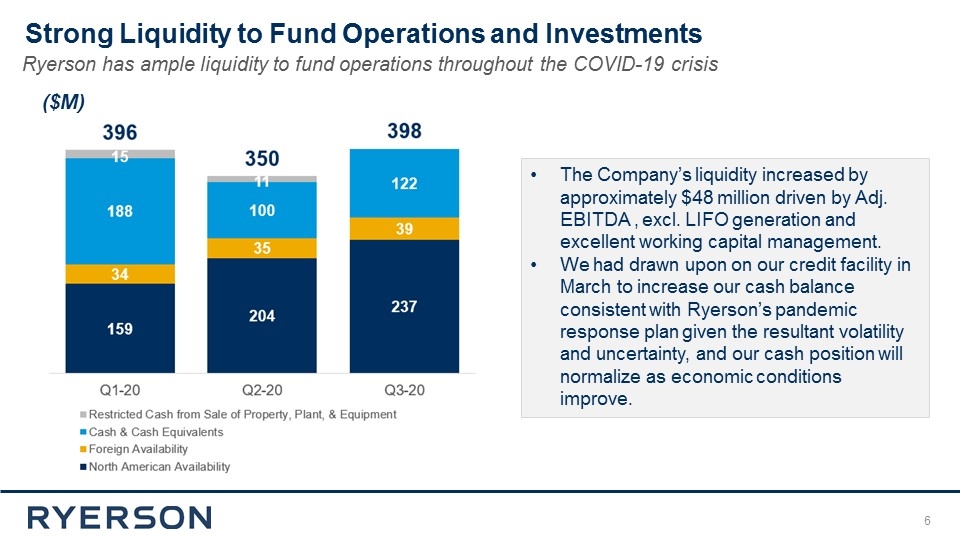

Strong Liquidity to Fund Operations and Investments Ryerson has ample liquidity to fund operations throughout the COVID-19 crisis The Company’s liquidity increased by approximately $48 million driven by Adj. EBITDA , excl. LIFO generation and excellent working capital management. We had drawn upon on our credit facility in March to increase our cash balance consistent with Ryerson’s pandemic response plan given the resultant volatility and uncertainty, and our cash position will normalize as economic conditions improve. ($M)

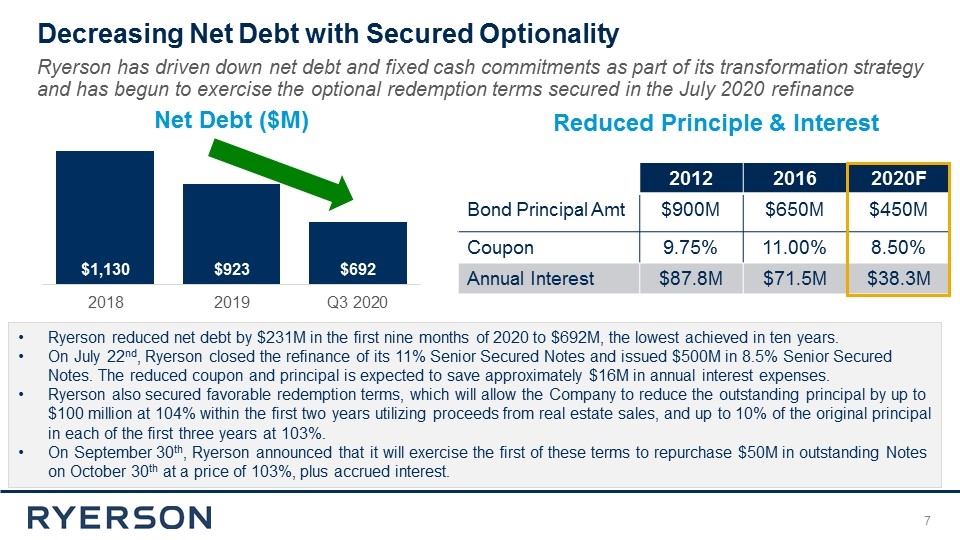

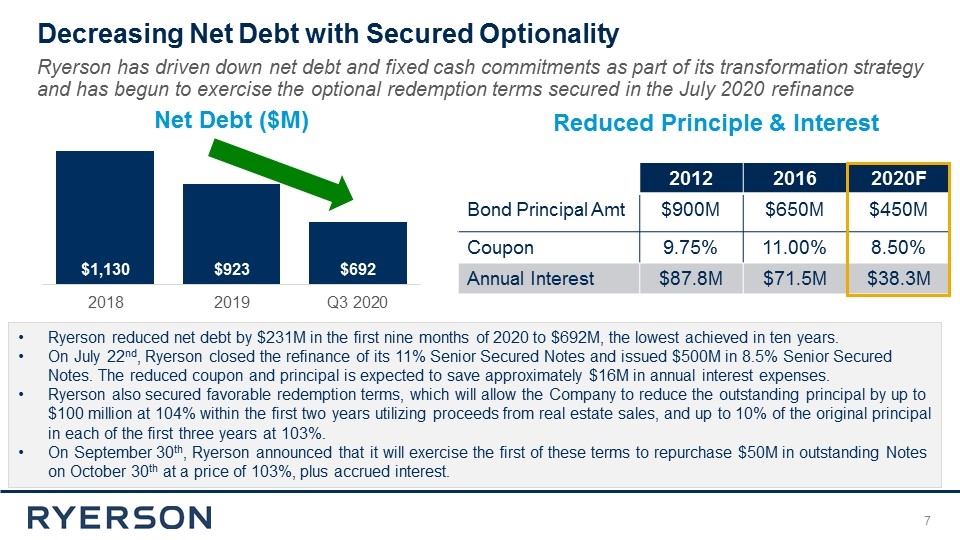

Decreasing Net Debt with Secured Optionality Ryerson has driven down net debt and fixed cash commitments as part of its transformation strategy and has begun to exercise the optional redemption terms secured in the July 2020 refinance 2012 2016 2020F Bond Principal Amt $900M $650M $450M Coupon 9.75% 11.00% 8.50% Annual Interest $87.8M $71.5M $38.3M Ryerson reduced net debt by $231M in the first nine months of 2020 to $692M, the lowest achieved in ten years. On July 22nd, Ryerson closed the refinance of its 11% Senior Secured Notes and issued $500M in 8.5% Senior Secured Notes. The reduced coupon and principal is expected to save approximately $16M in annual interest expenses. Ryerson also secured favorable redemption terms, which will allow the Company to reduce the outstanding principal by up to $100 million at 104% within the first two years utilizing proceeds from real estate sales, and up to 10% of the original principal in each of the first three years at 103%. On September 30th, Ryerson announced that it will exercise the first of these terms to repurchase $50M in outstanding Notes on October 30th at a price of 103%, plus accrued interest. Net Debt ($M) Reduced Principle & Interest

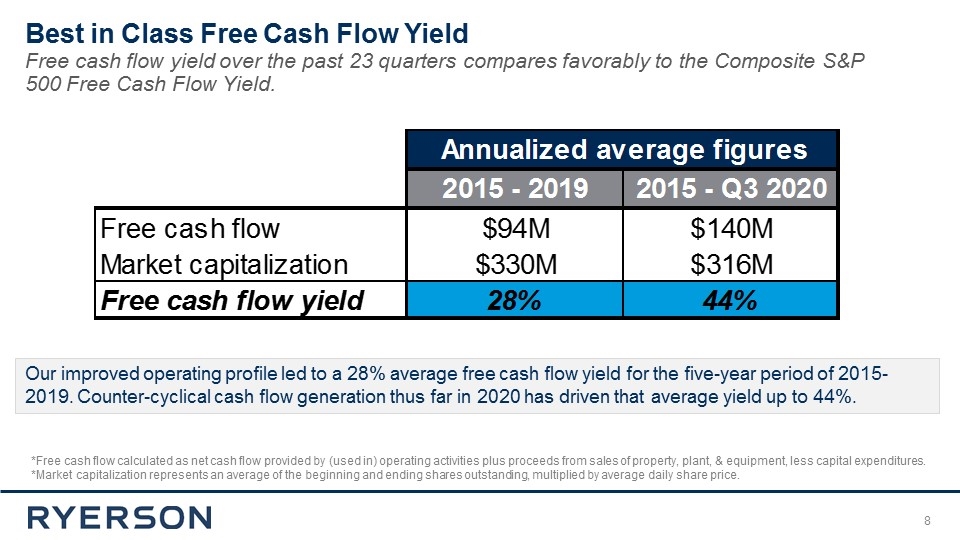

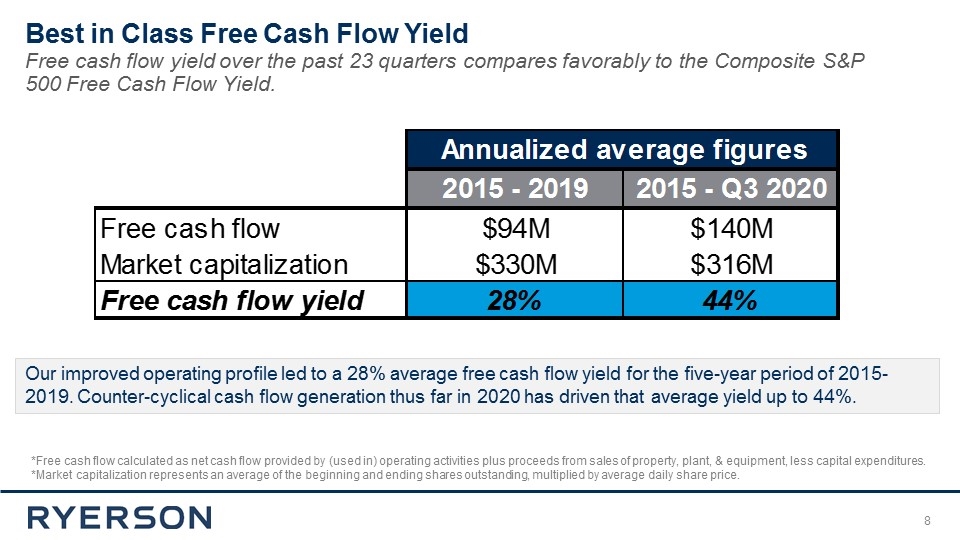

Best in Class Free Cash Flow Yield Free cash flow yield over the past 23 quarters compares favorably to the Composite S&P 500 Free Cash Flow Yield. Our improved operating profile led to a 28% average free cash flow yield for the five-year period of 2015-2019. Counter-cyclical cash flow generation thus far in 2020 has driven that average yield up to 44%. *Free cash flow calculated as net cash flow provided by (used in) operating activities plus proceeds from sales of property, plant, & equipment, less capital expenditures. *Market capitalization represents an average of the beginning and ending shares outstanding, multiplied by average daily share price.

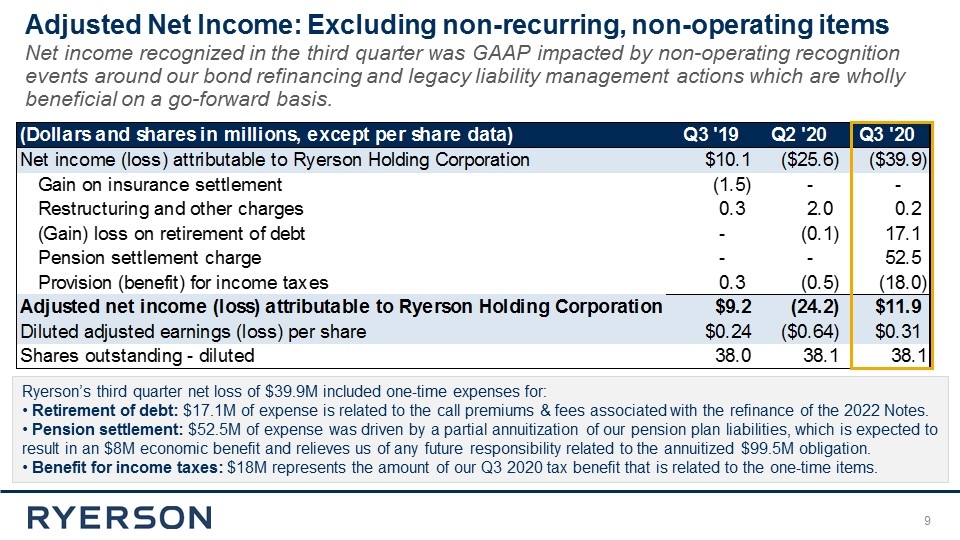

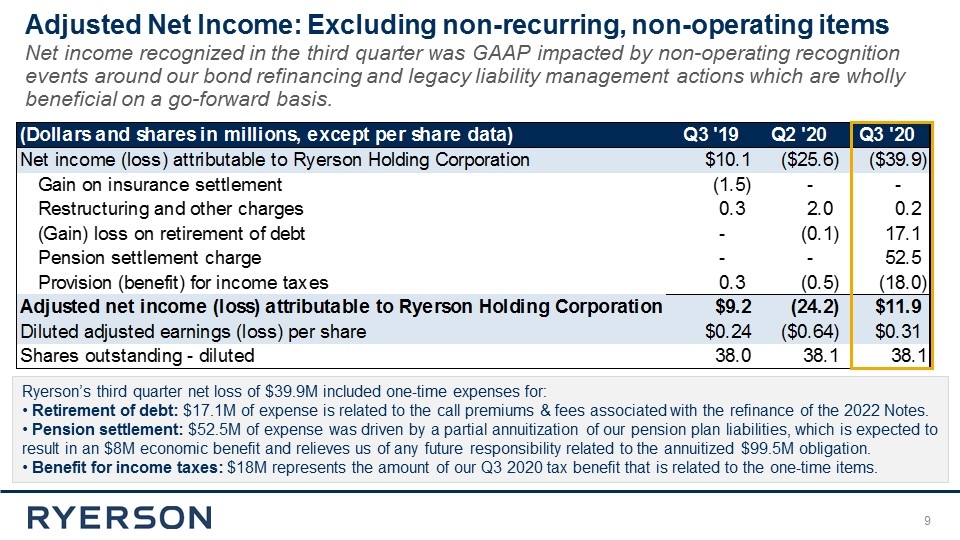

Adjusted Net Income: Excluding non-recurring, non-operating items Net income recognized in the third quarter was GAAP impacted by non-operating recognition events around our bond refinancing and legacy liability management actions which are wholly beneficial on a go-forward basis. Ryerson’s third quarter net loss of $39.9M included one-time expenses for: Retirement of debt: $17.1M of expense is related to the call premiums & fees associated with the refinance of the 2022 Notes. Pension settlement: $52.5M of expense was driven by a partial annuitization of our pension plan liabilities, which is expected to result in an $8M economic benefit and relieves us of any future responsibility related to the annuitized $99.5M obligation. Benefit for income taxes: $18M represents the amount of our Q3 2020 tax benefit that is related to the one-time items.

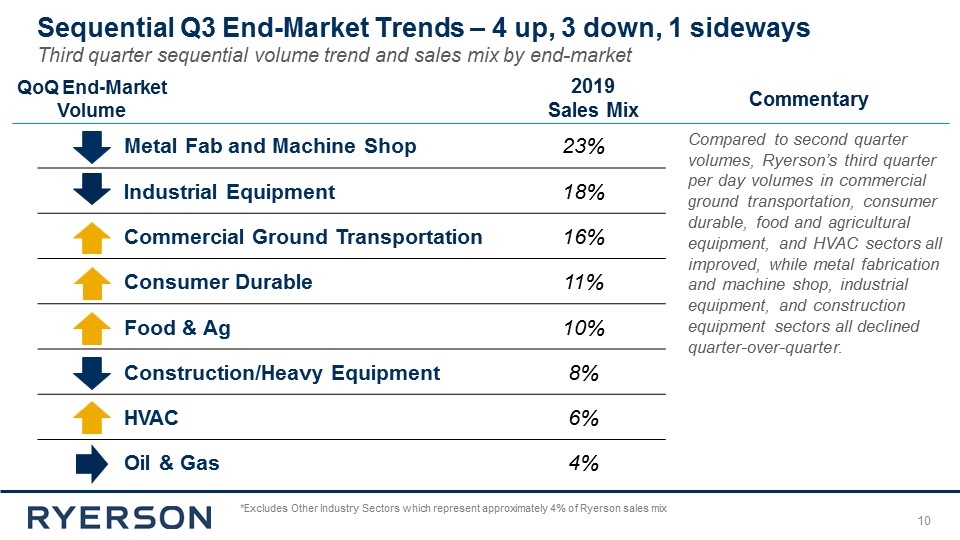

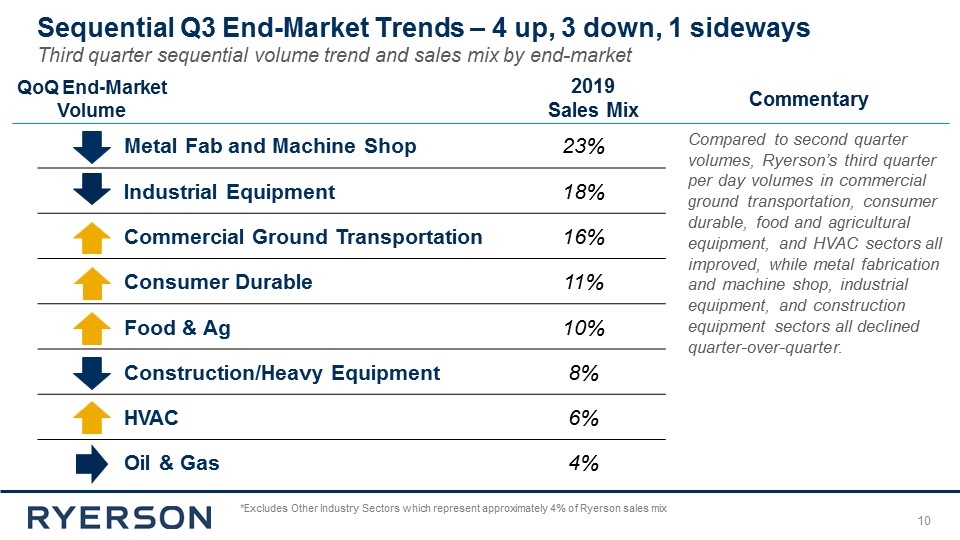

Third quarter sequential volume trend and sales mix by end-market Metal Fab and Machine Shop 23% Industrial Equipment 18% Commercial Ground Transportation 16% Consumer Durable 11% Food & Ag 10% Construction/Heavy Equipment 8% HVAC 6% Oil & Gas 4% *Excludes Other Industry Sectors which represent approximately 4% of Ryerson sales mix Compared to second quarter volumes, Ryerson’s third quarter per day volumes in commercial ground transportation, consumer durable, food and agricultural equipment, and HVAC sectors all improved, while metal fabrication and machine shop, industrial equipment, and construction equipment sectors all declined quarter-over-quarter. 2019 Sales Mix Commentary QoQ End-Market Volume Sequential Q3 End-Market Trends – 4 up, 3 down, 1 sideways

Appendix

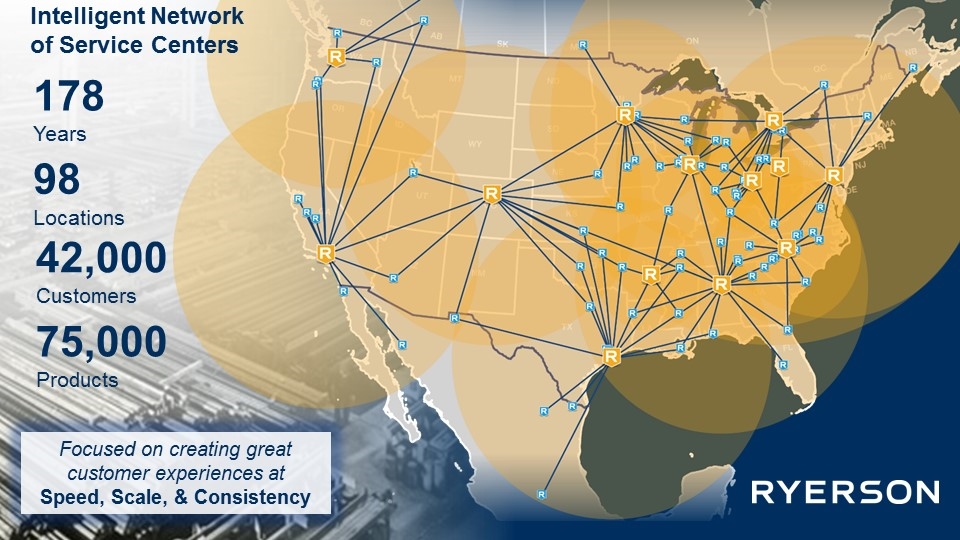

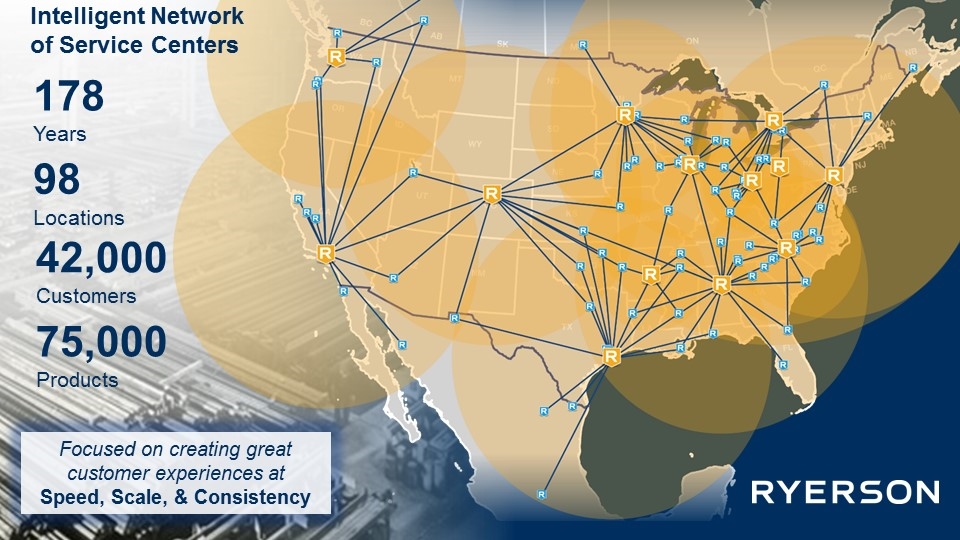

98 Locations 178 Years 42,000Customers 75,000 Products Focused on creating great customer experiences at Speed, Scale, & Consistency Intelligent Network of Service Centers

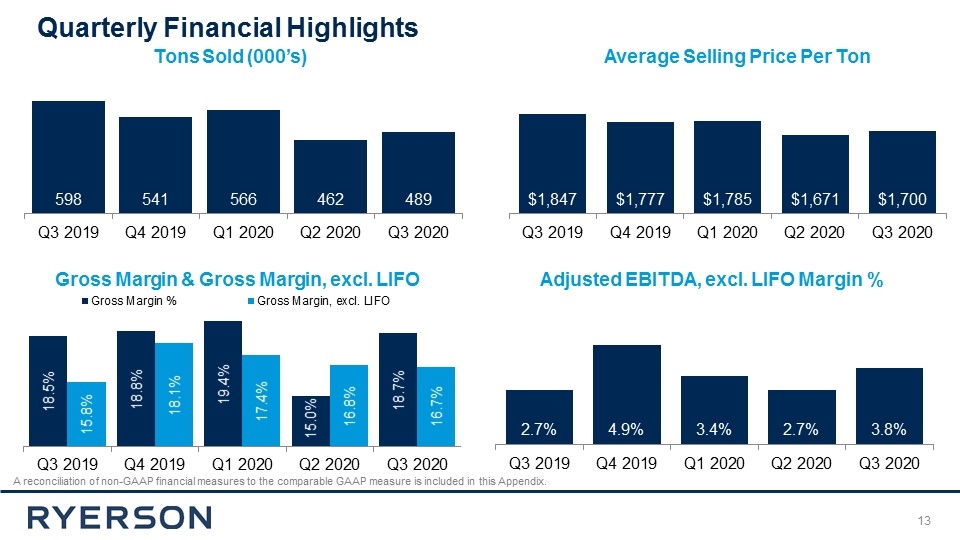

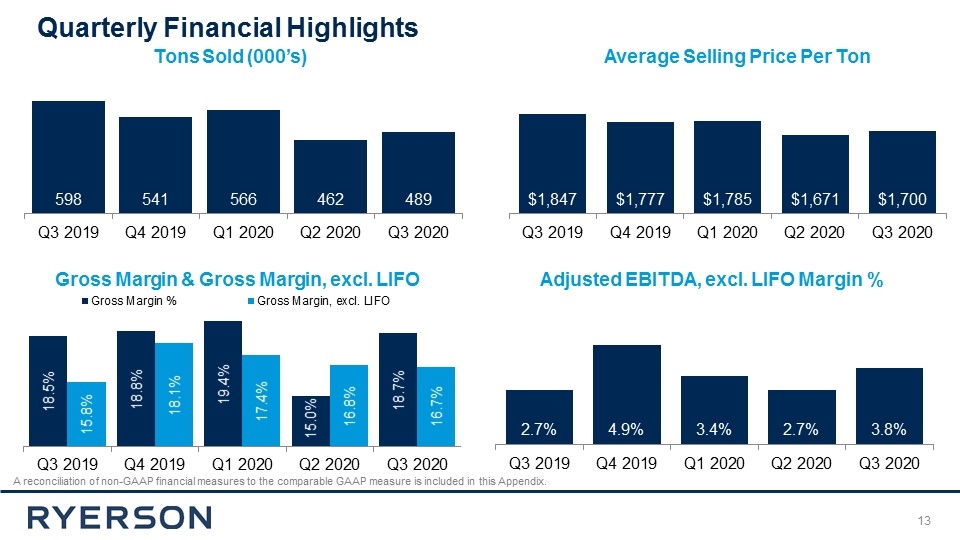

Quarterly Financial Highlights A reconciliation of non-GAAP financial measures to the comparable GAAP measure is included in this Appendix. Tons Sold (000’s) Average Selling Price Per Ton Adjusted EBITDA, excl. LIFO Margin % Gross Margin & Gross Margin, excl. LIFO

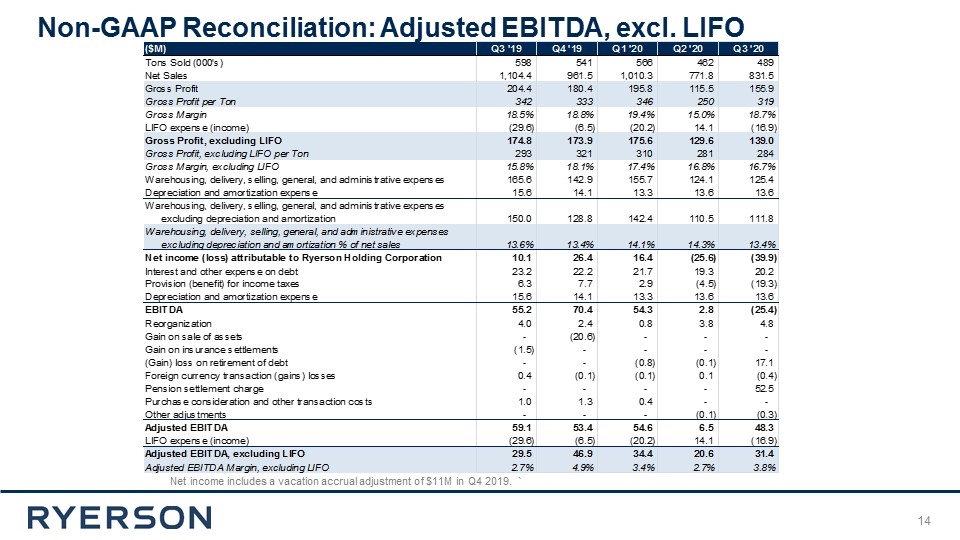

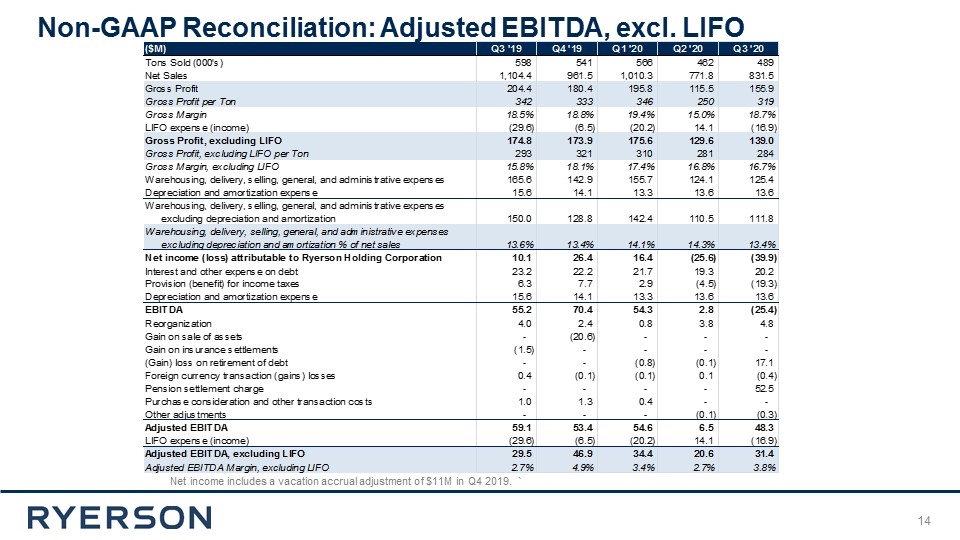

Net income includes a vacation accrual adjustment of $11M in Q4 2019. ` Non-GAAP Reconciliation: Adjusted EBITDA, excl. LIFO

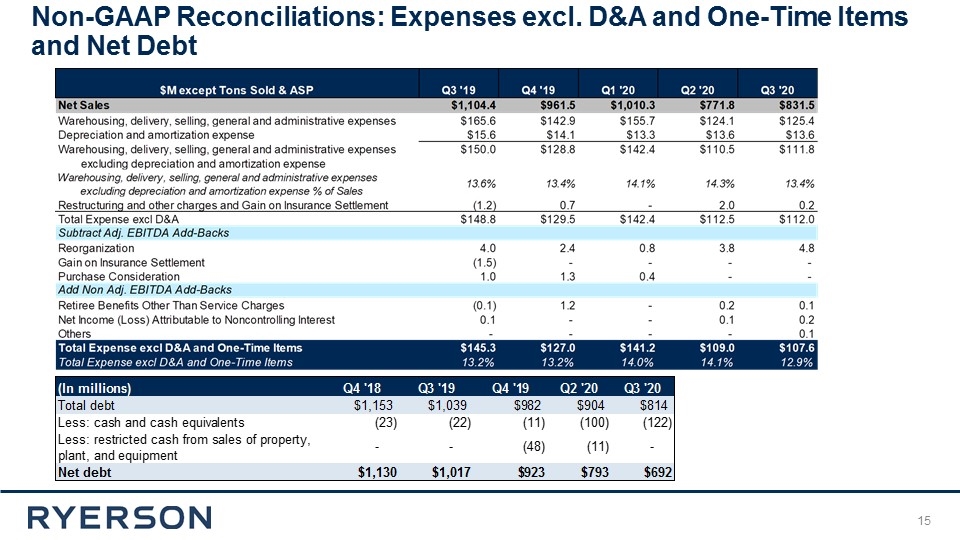

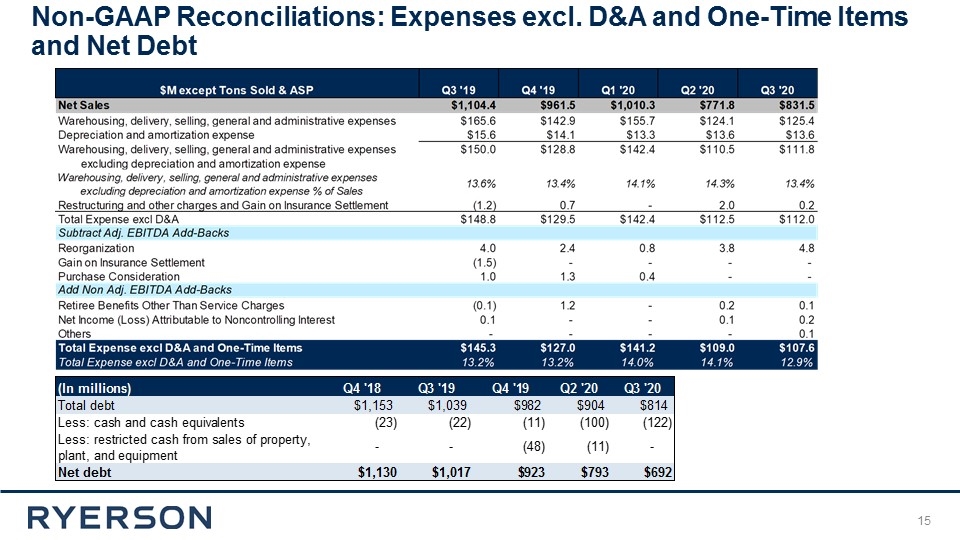

Non-GAAP Reconciliations: Expenses excl. D&A and One-Time Items and Net Debt

31 Note: EBITDA represents net income before interest and other expense on debt, provision for income taxes, depreciation, and amortization. Adjusted EBITDA gives further effect to, among other things, reorganization expenses, gain or loss on retirement of debt, loss on pension settlement, purchase consideration and other transaction costs, and foreign currency transaction gains and losses. We believe that the presentation of EBITDA, Adjusted EBITDA, and Adjusted EBITDA, excluding LIFO expense (income), provides useful information to investors regarding our operational performance because they enhance an investor’s overall understanding of our core financial performance and provide a basis of comparison of results between current, past, and future periods. We also disclose the metric Adjusted EBITDA, excluding LIFO expense (income), to provide a means of comparison amongst our competitors who may not use the same basis of accounting for inventories. EBITDA, Adjusted EBITDA, and Adjusted EBITDA, excluding LIFO expense (income), are three of the primary metrics management uses for planning and forecasting in future periods, including trending and analyzing the core operating performance of our business without the effect of U.S. generally accepted accounting principles, or GAAP, expenses, revenues, and gains (losses) that are unrelated to the day to day performance of our business. We also establish compensation programs for our executive management and regional employees that are based upon the achievement of pre-established EBITDA, Adjusted EBITDA, and Adjusted EBITDA, excluding LIFO expense (income), targets. We also use EBITDA, Adjusted EBITDA, and Adjusted EBITDA, excluding LIFO expense (income), to benchmark our operating performance to that of our competitors. EBITDA, Adjusted EBITDA, and Adjusted EBITDA, excluding LIFO expense (income), do not represent, and should not be used as a substitute for, net income or cash flows from operations as determined in accordance with generally accepted accounting principles, and neither EBITDA, Adjusted EBITDA, and Adjusted EBITDA, excluding LIFO expense (income), is necessarily an indication of whether cash flow will be sufficient to fund our cash requirements. This release also presents gross margin, excluding LIFO expense (income), which is calculated as gross profit minus LIFO expense (income), divided by net sales. We have excluded LIFO expense (income) from gross margin and Adjusted EBITDA as a percentage of net sales metrics in order to provide a means of comparison amongst our competitors who may not use the same basis of accounting for inventories as we do. Our definitions of EBITDA, Adjusted EBITDA, Adjusted EBITDA, excluding LIFO expense (income), gross margin, excluding LIFO expense (income), and Adjusted EBITDA, excluding LIFO expense (income), as a percentage of sales may differ from that of other companies. Adjusted Net income (loss) and Adjusted Earnings (loss) per share is presented to provide a means of comparison with periods that do not include similar adjustments. Non-GAAP Reconciliation