Exhibit 99.2

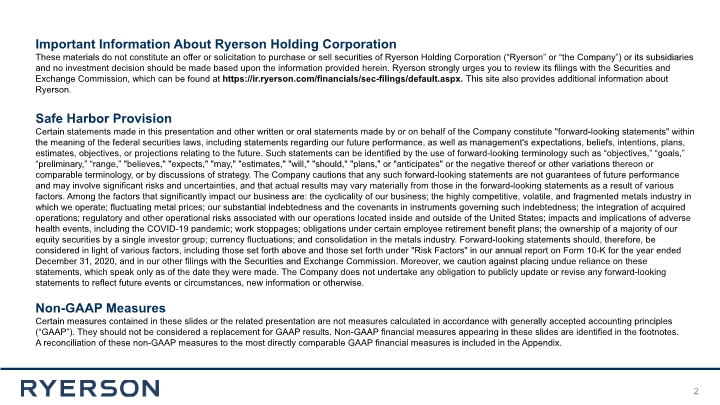

31 Important Information About Ryerson Holding Corporation These materials do not constitute an offer or solicitation to purchase or sell securities of Ryerson Holding Corporation (“Ryerson” or “the Company”) or its subsidiaries and no investment decision should be made based upon the information provided herein. Ryerson strongly urges you to review its filings with the Securities and Exchange Commission, which can be found at https://ir.ryerson.com/financials/sec-filings/default.aspx. This site also provides additional information about Ryerson. Safe Harbor Provision Certain statements made in this presentation and other written or oral statements made by or on behalf of the Company constitute "forward-looking statements" within the meaning of the federal securities laws, including statements regarding our future performance, as well as management's expectations, beliefs, intentions, plans, estimates, objectives, or projections relating to the future. Such statements can be identified by the use of forward-looking terminology such as “objectives,” “goals,” “preliminary,” “range,” "believes," "expects," "may," "estimates," "will," "should," "plans," or "anticipates" or the negative thereof or other variations thereon or comparable terminology, or by discussions of strategy. The Company cautions that any such forward-looking statements are not guarantees of future performance and may involve significant risks and uncertainties, and that actual results may vary materially from those in the forward-looking statements as a result of various factors. Among the factors that significantly impact our business are: the cyclicality of our business; the highly competitive, volatile, and fragmented metals industry in which we operate; fluctuating metal prices; our substantial indebtedness and the covenants in instruments governing such indebtedness; the integration of acquired operations; regulatory and other operational risks associated with our operations located inside and outside of the United States; impacts and implications of adverse health events, including the COVID-19 pandemic; work stoppages; obligations under certain employee retirement benefit plans; the ownership of a majority of our equity securities by a single investor group; currency fluctuations; and consolidation in the metals industry. Forward-looking statements should, therefore, be considered in light of various factors, including those set forth above and those set forth under "Risk Factors" in our annual report on Form 10-K for the year ended December 31, 2020, and in our other filings with the Securities and Exchange Commission. Moreover, we caution against placing undue reliance on these statements, which speak only as of the date they were made. The Company does not undertake any obligation to publicly update or revise any forward-looking statements to reflect future events or circumstances, new information or otherwise. Non-GAAP Measures Certain measures contained in these slides or the related presentation are not measures calculated in accordance with generally accepted accounting principles (“GAAP”). They should not be considered a replacement for GAAP results. Non-GAAP financial measures appearing in these slides are identified in the footnotes. A reconciliation of these non-GAAP measures to the most directly comparable GAAP financial measures is included in the Appendix. 2

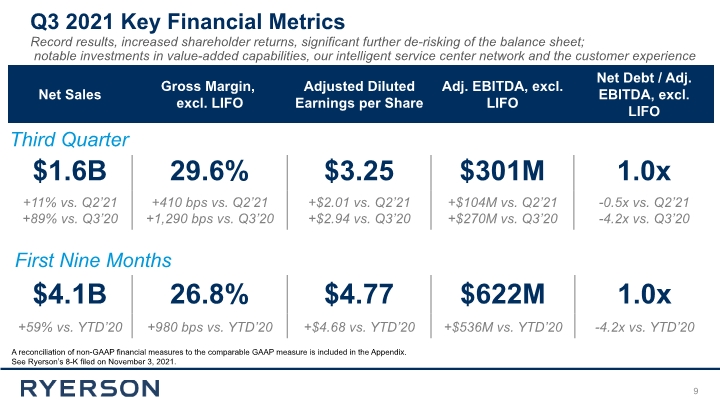

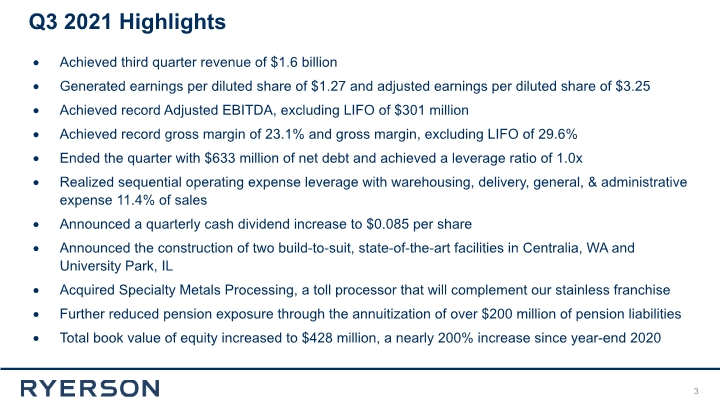

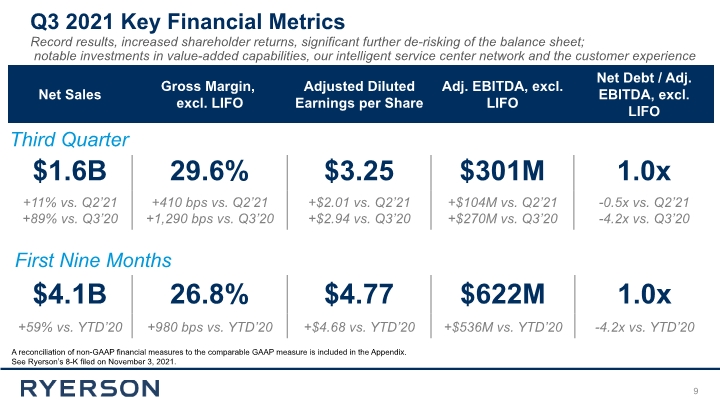

Q3 2021 Highlights Achieved third quarter revenue of $1.6 billion Generated earnings per diluted share of $1.27 and adjusted earnings per diluted share of $3.25 Achieved record Adjusted EBITDA, excluding LIFO of $301 million Achieved record gross margin of 23.1% and gross margin, excluding LIFO of 29.6% Ended the quarter with $633 million of net debt and achieved a leverage ratio of 1.0x Realized sequential operating expense leverage with warehousing, delivery, general, & administrative expense 11.4% of sales Announced a quarterly cash dividend increase to $0.085 per share Announced the construction of two build-to-suit, state-of-the-art facilities in Centralia, WA and University Park, IL Acquired Specialty Metals Processing, a toll processor that will complement our stainless franchise Further reduced pension exposure through the annuitization of over $200 million of pension liabilities Total book value of equity increased to $428 million, a nearly 200% increase since year-end 2020 3

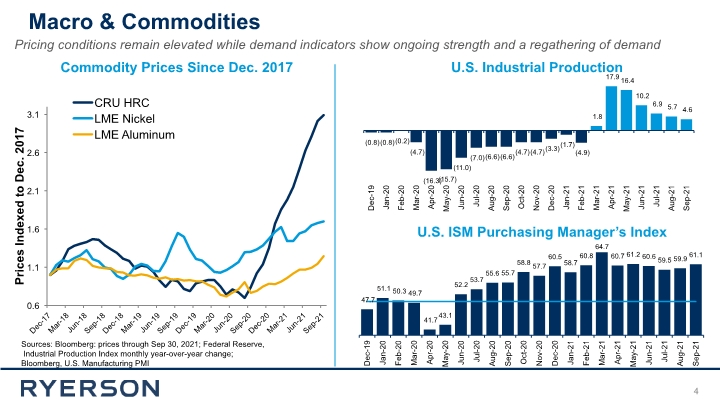

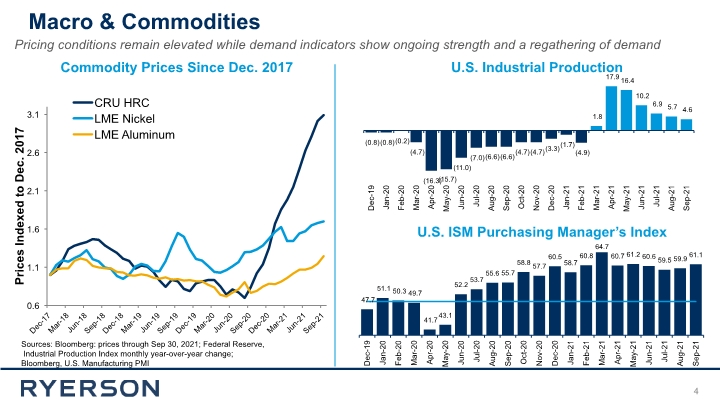

Macro & Commodities 4 Pricing conditions remain elevated while demand indicators show ongoing strength and a regathering of demand Sources: Bloomberg: prices through Sep 30, 2021; Federal Reserve, Industrial Production Index monthly year-over-year change; Bloomberg, U.S. Manufacturing PMI Commodity Prices Since Dec. 2017 U.S. Industrial Production U.S. ISM Purchasing Manager’s Index

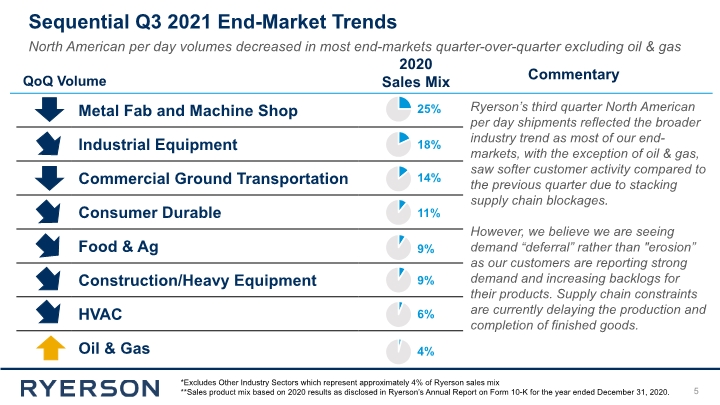

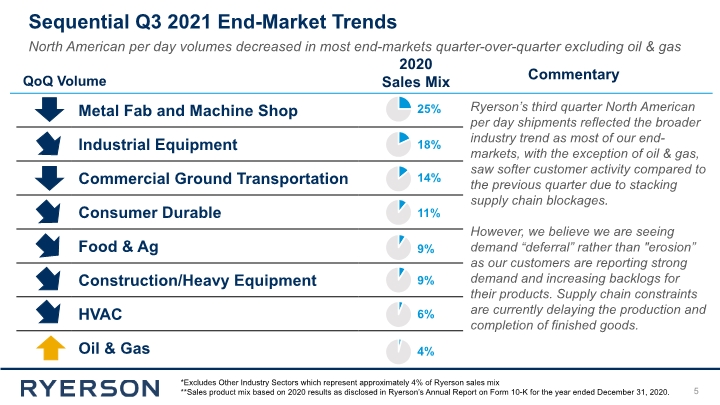

Sequential Q3 2021 End-Market Trends 5 North American per day volumes decreased in most end-markets quarter-over-quarter excluding oil & gas *Excludes Other Industry Sectors which represent approximately 4% of Ryerson sales mix **Sales product mix based on 2020 results as disclosed in Ryerson’s Annual Report on Form 10-K for the year ended December 31, 2020. Ryerson’s third quarter North American per day shipments reflected the broader industry trend as most of our end-markets, with the exception of oil & gas, saw softer customer activity compared to the previous quarter due to stacking supply chain blockages. However, we believe we are seeing demand “deferral” rather than "erosion” as our customers are reporting strong demand and increasing backlogs for their products. Supply chain constraints are currently delaying the production and completion of finished goods. 2020 Sales Mix Commentary QoQ Volume

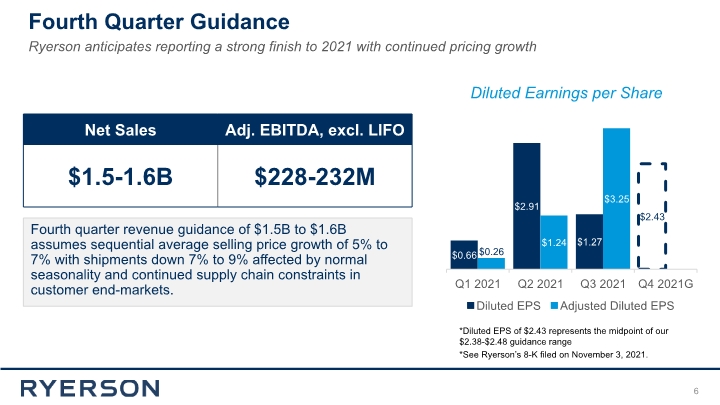

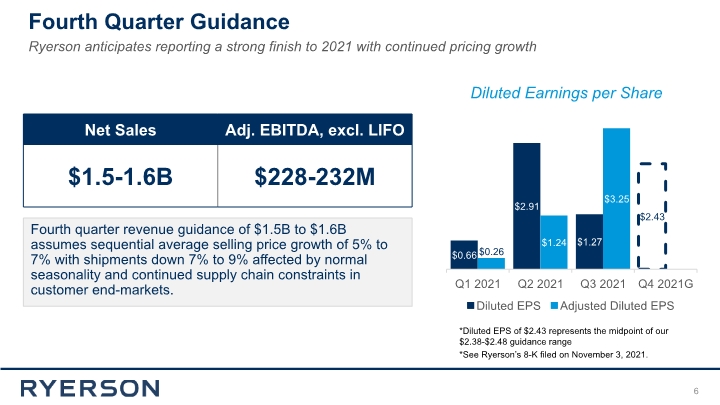

Fourth Quarter Guidance Fourth quarter revenue guidance of $1.5B to $1.6B assumes sequential average selling price growth of 5% to 7% with shipments down 7% to 9% affected by normal seasonality and continued supply chain constraints in customer end-markets. 6 Ryerson anticipates reporting a strong finish to 2021 with continued pricing growth Diluted Earnings per Share *Diluted EPS of $2.43 represents the midpoint of our $2.38-$2.48 guidance range *See Ryerson’s 8-K filed on November 3, 2021.

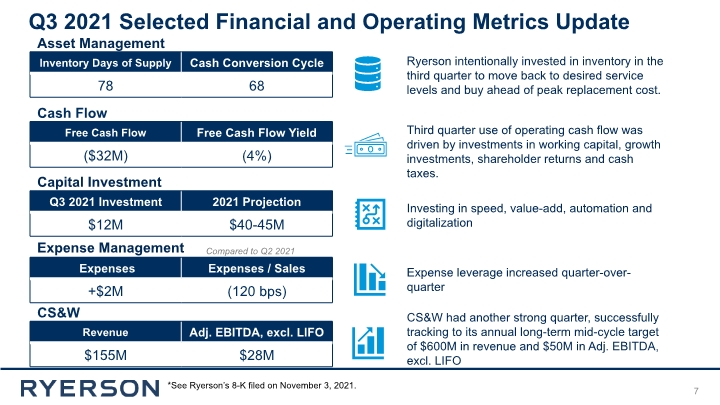

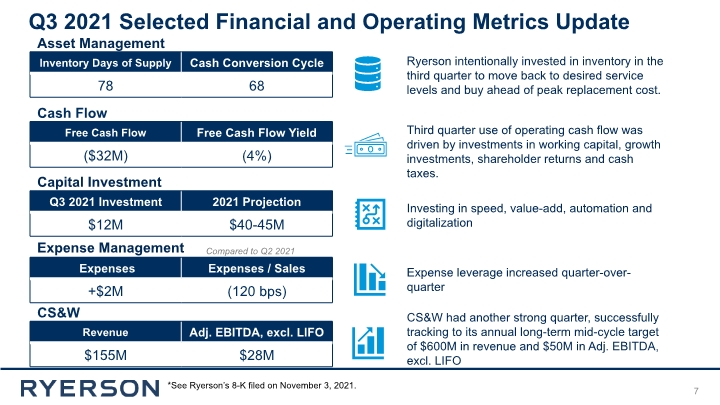

7 Q3 2021 Selected Financial and Operating Metrics Update Capital Investment Investing in speed, value-add, automation and digitalization Expense Management Compared to Q2 2021 Expense leverage increased quarter-over-quarter Asset Management Third quarter use of operating cash flow was driven by investments in working capital, growth investments, shareholder returns and cash taxes. Cash Flow CS&W Ryerson intentionally invested in inventory in the third quarter to move back to desired service levels and buy ahead of peak replacement cost. CS&W had another strong quarter, successfully tracking to its annual long-term mid-cycle target of $600M in revenue and $50M in Adj. EBITDA, excl. LIFO *See Ryerson’s 8-K filed on November 3, 2021.

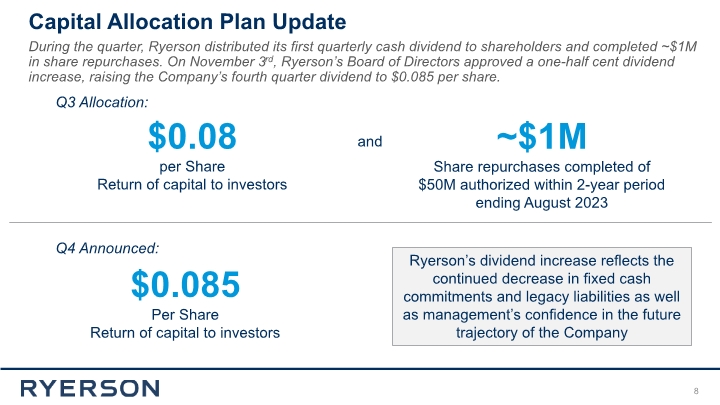

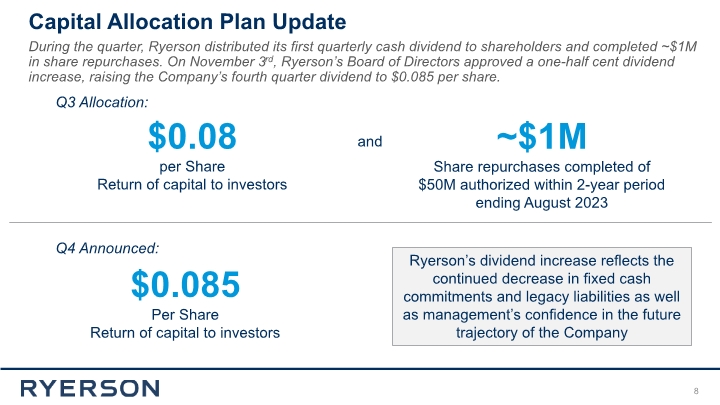

Capital Allocation Plan Update 8 During the quarter, Ryerson distributed its first quarterly cash dividend to shareholders and completed ~$1M in share repurchases. On November 3rd, Ryerson’s Board of Directors approved a one-half cent dividend increase, raising the Company’s fourth quarter dividend to $0.085 per share. $0.08 per Share Return of capital to investors and ~$1M Share repurchases completed of $50M authorized within 2-year period ending August 2023 Q3 Allocation: $0.085 Per Share Return of capital to investors Q4 Announced: Ryerson’s dividend increase reflects the continued decrease in fixed cash commitments and legacy liabilities as well as management’s confidence in the future trajectory of the Company

A reconciliation of non-GAAP financial measures to the comparable GAAP measure is included in the Appendix. See Ryerson’s 8-K filed on November 3, 2021. 9 Third Quarter Q3 2021 Key Financial Metrics Record results, increased shareholder returns, significant further de-risking of the balance sheet; notable investments in value-added capabilities, our intelligent service center network and the customer experience First Nine Months

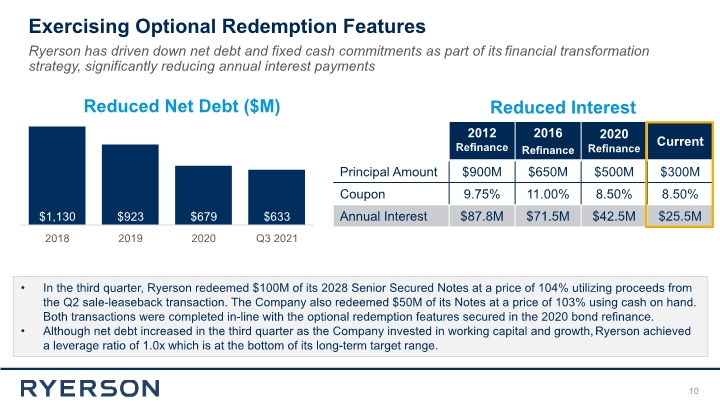

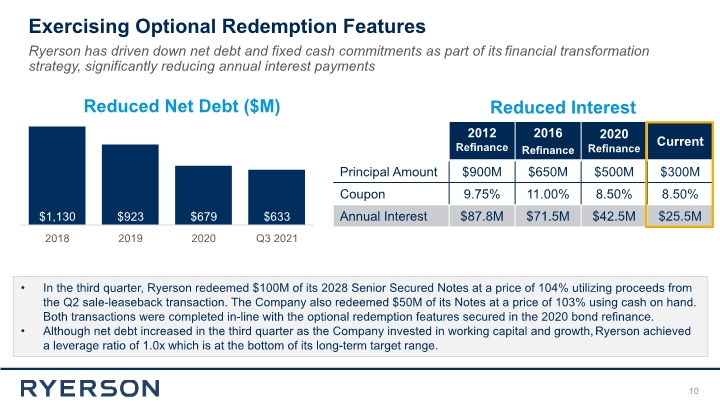

Exercising Optional Redemption Features 10 Ryerson has driven down net debt and fixed cash commitments as part of its financial transformation strategy, significantly reducing annual interest payments In the third quarter, Ryerson redeemed $100M of its 2028 Senior Secured Notes at a price of 104% utilizing proceeds from the Q2 sale-leaseback transaction. The Company also redeemed $50M of its Notes at a price of 103% using cash on hand. Both transactions were completed in-line with the optional redemption features secured in the 2020 bond refinance. Although net debt increased in the third quarter as the Company invested in working capital and growth, Ryerson achieved a leverage ratio of 1.0x which is at the bottom of its long-term target range. Reduced Net Debt ($M) Reduced Interest

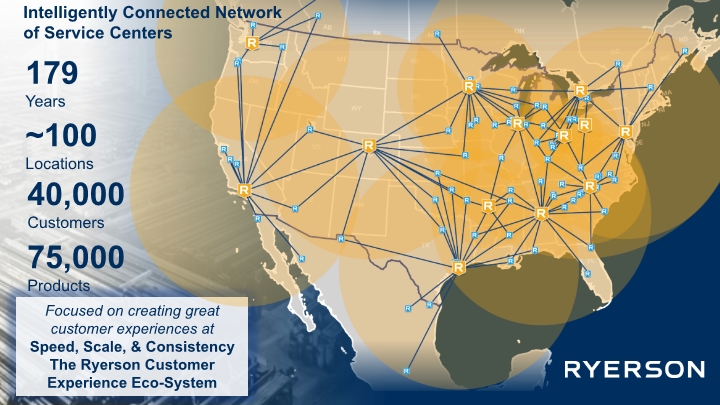

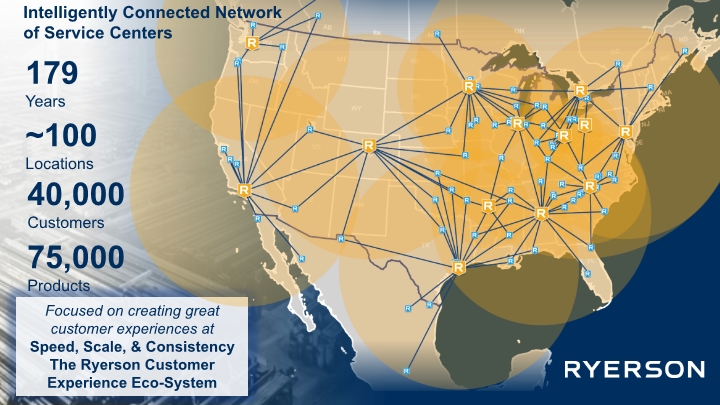

~100 Locations 179 Years 40,000Customers 75,000 Products Focused on creating great customer experiences at Speed, Scale, & Consistency The Ryerson Customer Experience Eco-System Intelligently Connected Network of Service Centers

Appendix

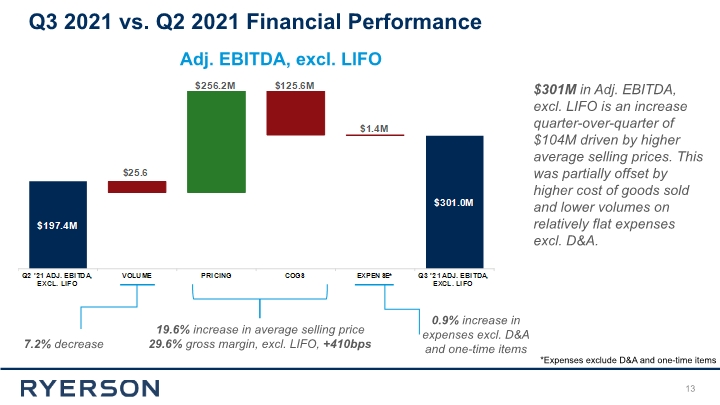

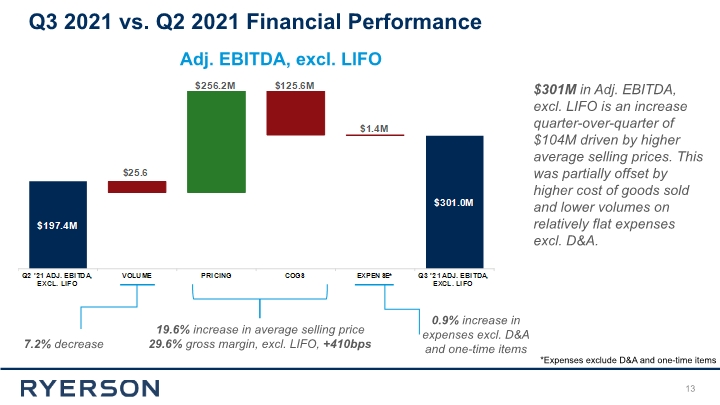

13 19.6% increase in average selling price 29.6% gross margin, excl. LIFO, +410bps Adj. EBITDA, excl. LIFO 7.2% decrease 0.9% increase in expenses excl. D&A and one-time items $301M in Adj. EBITDA, excl. LIFO is an increase quarter-over-quarter of $104M driven by higher average selling prices. This was partially offset by higher cost of goods sold and lower volumes on relatively flat expenses excl. D&A. Q3 2021 vs. Q2 2021 Financial Performance *Expenses exclude D&A and one-time items

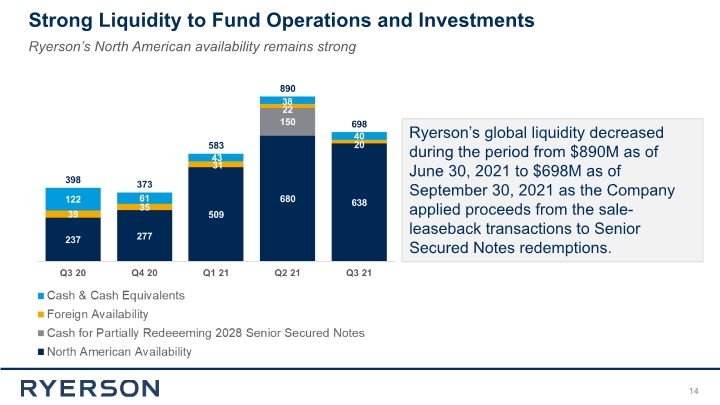

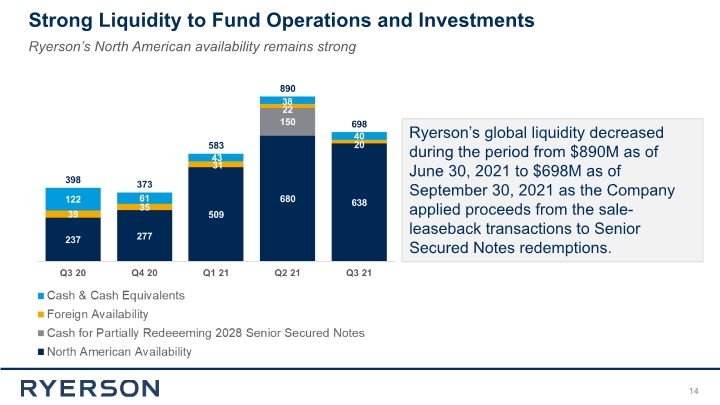

Strong Liquidity to Fund Operations and Investments 14 Ryerson’s North American availability remains strong Ryerson’s global liquidity decreased during the period from $890M as of June 30, 2021 to $698M as of September 30, 2021 as the Company applied proceeds from the sale-leaseback transactions to Senior Secured Notes redemptions.

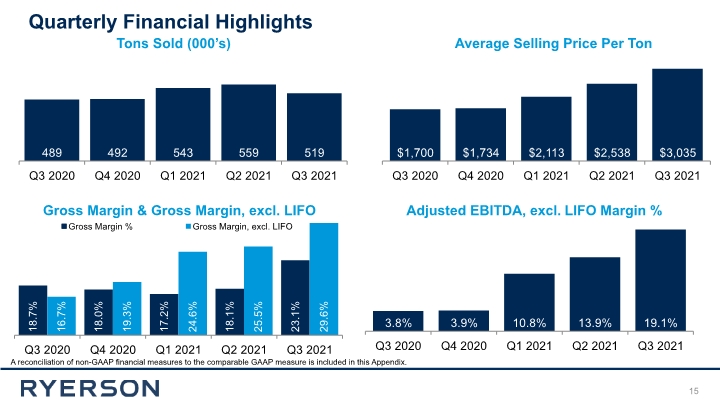

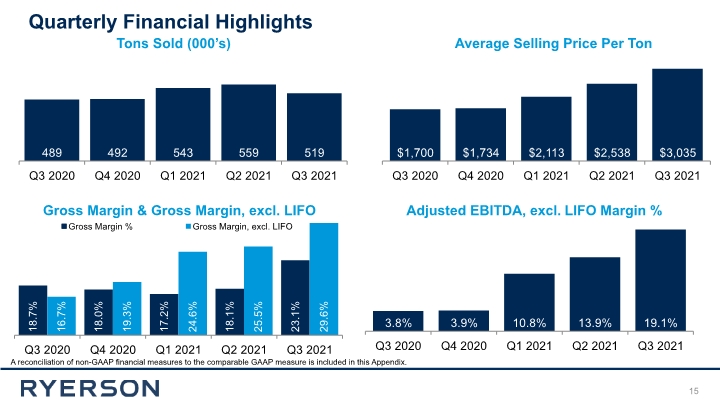

Quarterly Financial Highlights A reconciliation of non-GAAP financial measures to the comparable GAAP measure is included in this Appendix. Tons Sold (000’s) Average Selling Price Per Ton Adjusted EBITDA, excl. LIFO Margin % 15 Gross Margin & Gross Margin, excl. LIFO

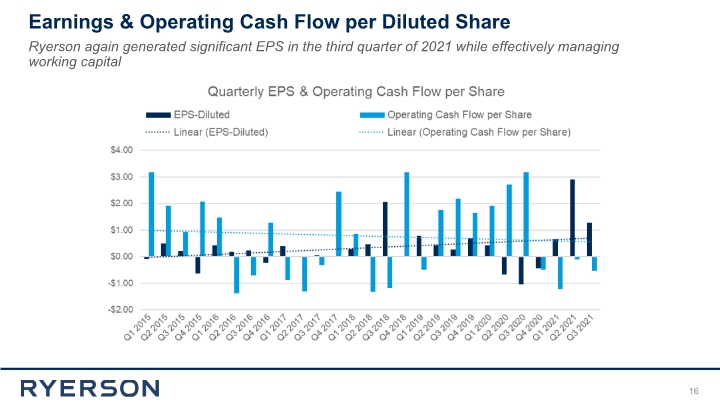

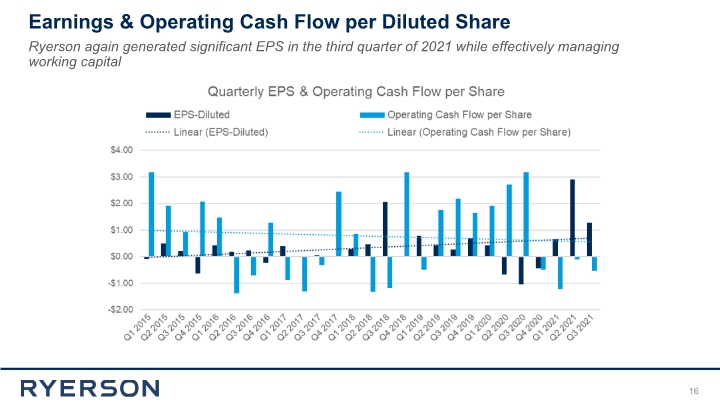

Earnings & Operating Cash Flow per Diluted Share 16 Ryerson again generated significant EPS in the third quarter of 2021 while effectively managing working capital

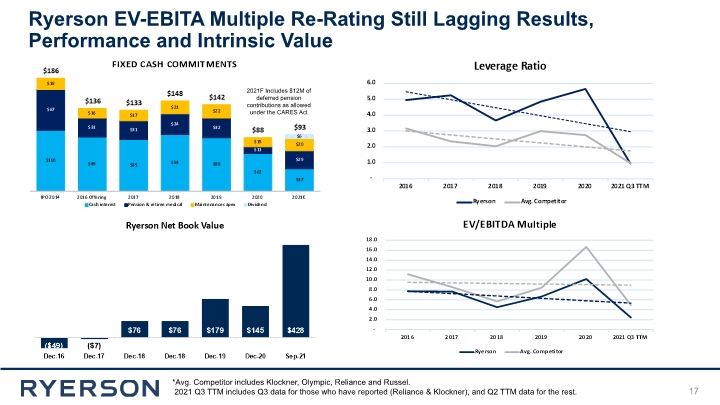

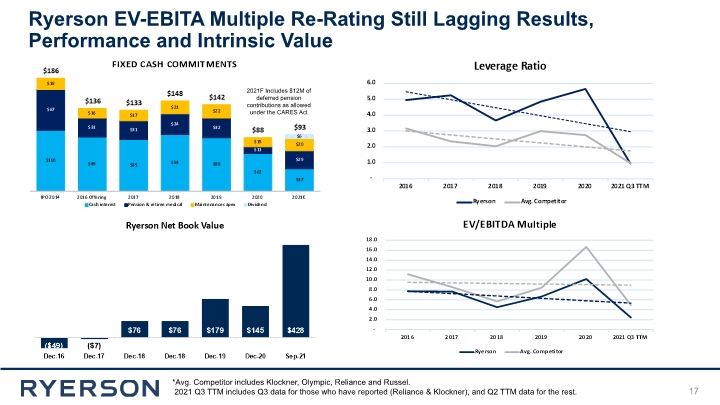

17 Ryerson EV-EBITA Multiple Re-Rating Still Lagging Results, Performance and Intrinsic Value *Avg. Competitor includes Klockner, Olympic, Reliance and Russel. 2021 Q3 TTM includes Q3 data for those who have reported (Reliance & Klockner), and Q2 TTM data for the rest. 2021F Includes $12M of deferred pension contributions as allowed under the CARES Act

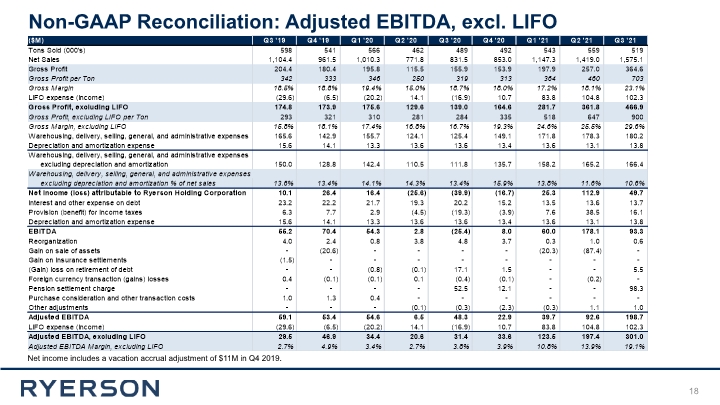

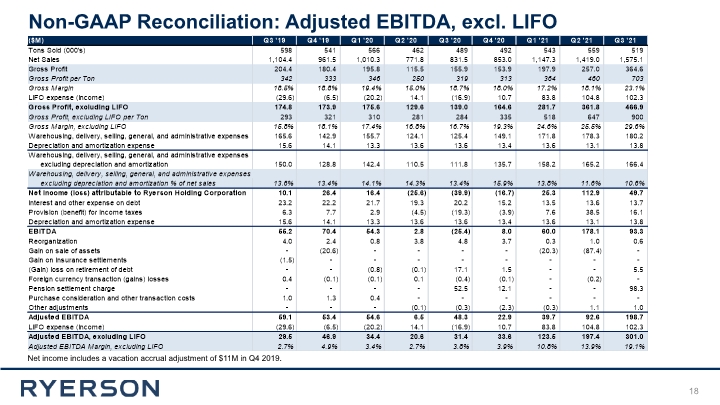

18 Non-GAAP Reconciliation: Adjusted EBITDA, excl. LIFO Net income includes a vacation accrual adjustment of $11M in Q4 2019.

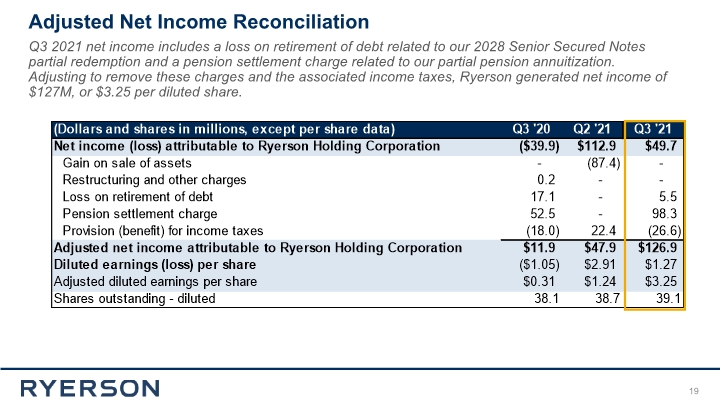

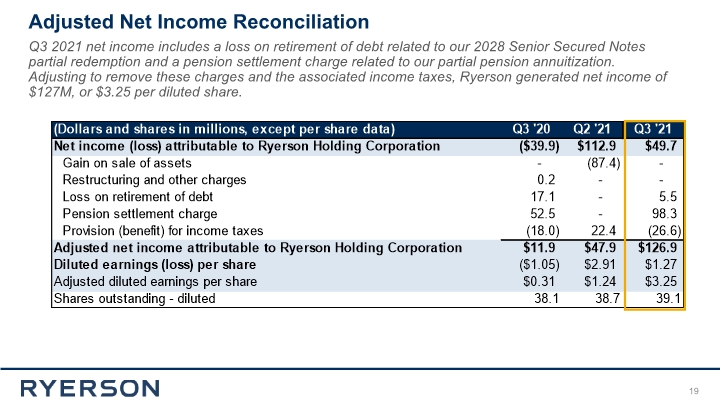

Adjusted Net Income Reconciliation 19 Q3 2021 net income includes a loss on retirement of debt related to our 2028 Senior Secured Notes partial redemption and a pension settlement charge related to our partial pension annuitization. Adjusting to remove these charges and the associated income taxes, Ryerson generated net income of $127M, or $3.25 per diluted share.

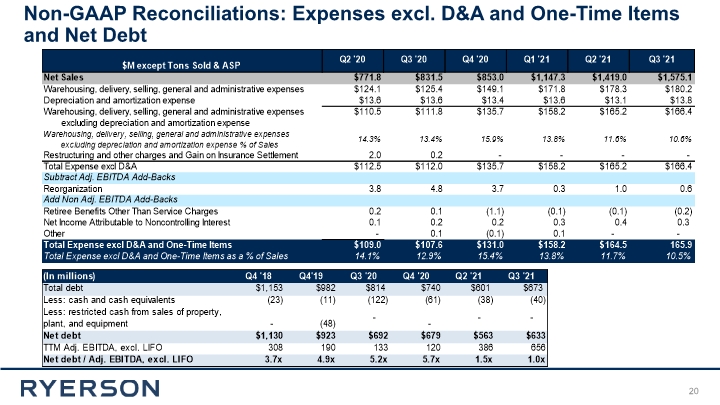

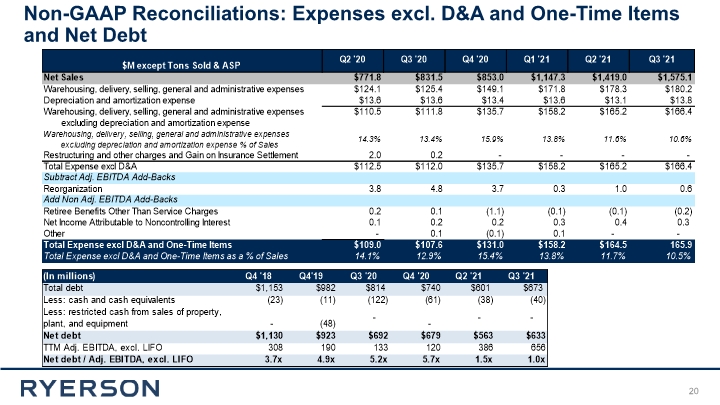

Non-GAAP Reconciliations: Expenses excl. D&A and One-Time Items and Net Debt 20

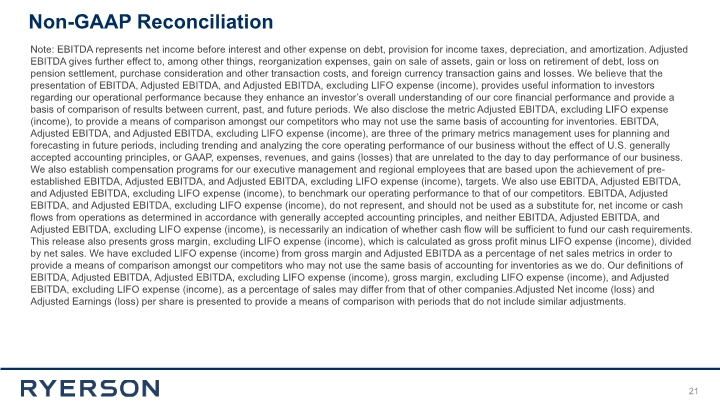

31 Note: EBITDA represents net income before interest and other expense on debt, provision for income taxes, depreciation, and amortization. Adjusted EBITDA gives further effect to, among other things, reorganization expenses, gain on sale of assets, gain or loss on retirement of debt, loss on pension settlement, purchase consideration and other transaction costs, and foreign currency transaction gains and losses. We believe that the presentation of EBITDA, Adjusted EBITDA, and Adjusted EBITDA, excluding LIFO expense (income), provides useful information to investors regarding our operational performance because they enhance an investor’s overall understanding of our core financial performance and provide a basis of comparison of results between current, past, and future periods. We also disclose the metric Adjusted EBITDA, excluding LIFO expense (income), to provide a means of comparison amongst our competitors who may not use the same basis of accounting for inventories. EBITDA, Adjusted EBITDA, and Adjusted EBITDA, excluding LIFO expense (income), are three of the primary metrics management uses for planning and forecasting in future periods, including trending and analyzing the core operating performance of our business without the effect of U.S. generally accepted accounting principles, or GAAP, expenses, revenues, and gains (losses) that are unrelated to the day to day performance of our business. We also establish compensation programs for our executive management and regional employees that are based upon the achievement of pre-established EBITDA, Adjusted EBITDA, and Adjusted EBITDA, excluding LIFO expense (income), targets. We also use EBITDA, Adjusted EBITDA, and Adjusted EBITDA, excluding LIFO expense (income), to benchmark our operating performance to that of our competitors. EBITDA, Adjusted EBITDA, and Adjusted EBITDA, excluding LIFO expense (income), do not represent, and should not be used as a substitute for, net income or cash flows from operations as determined in accordance with generally accepted accounting principles, and neither EBITDA, Adjusted EBITDA, and Adjusted EBITDA, excluding LIFO expense (income), is necessarily an indication of whether cash flow will be sufficient to fund our cash requirements. This release also presents gross margin, excluding LIFO expense (income), which is calculated as gross profit minus LIFO expense (income), divided by net sales. We have excluded LIFO expense (income) from gross margin and Adjusted EBITDA as a percentage of net sales metrics in order to provide a means of comparison amongst our competitors who may not use the same basis of accounting for inventories as we do. Our definitions of EBITDA, Adjusted EBITDA, Adjusted EBITDA, excluding LIFO expense (income), gross margin, excluding LIFO expense (income), and Adjusted EBITDA, excluding LIFO expense (income), as a percentage of sales may differ from that of other companies. Adjusted Net income (loss) and Adjusted Earnings (loss) per share is presented to provide a means of comparison with periods that do not include similar adjustments. 21 Non-GAAP Reconciliation