Supplemental Financial Data FIRST QUARTER 2013 Supplemental Financial Data

First Quarter 2013 Supplemental Financial Data Table of Contents Company Profile 3 Highlights of the First Quarter 2013 and AFFO Guidance 4 Consolidated Statements of Operations 5 Reconciliation of Funds From Operations Attributable to Common Stockholders and Unitholders and Adjusted Funds From Operations Attributable to Common Stockholders and Unitholders to Net Loss Attributable to Common Stockholders 6 Notes to Consolidated Statements of Operations and Reconciliation of Funds From Operations Attributable to Common Stockholders and Unitholders and Adjusted Funds From Operations Attributable to Common Stockholders and Unitholders to Net Loss Attributable to Common Stockholders 7 Consolidated Balance Sheets 8 Consolidated Statements of Cash Flows 9 Real Estate Loans, Capital Expenditures and Physical and Average Economic Occupancy 10 Same Store Financial Data 11 Definitions of Non-GAAP Measures 12

First Quarter 2013 Supplemental Financial Data Page 3 Preferred Apartment Communities, Inc. Preferred Apartment Communities, Inc. (NYSE MKT: APTS), or the Company, is a Maryland corporation formed primarily to acquire and operate multifamily properties in select targeted markets throughout the United States. As part of our business strategy, we may enter into forward purchase contracts or purchase options for to-be-built multifamily communities and we may make mezzanine loans, provide deposit arrangements, or provide performance assurances, as may be necessary or appropriate, in connection with the construction of multifamily communities and other properties. As a secondary strategy, we also may acquire or originate senior mortgage loans, subordinate loans or mezzanine debt secured by interests in multifamily properties, membership or partnership interests in multifamily properties and other multifamily related assets and invest not more than 10% of our total assets in other real estate related investments, as determined by our manager as appropriate for us. We have elected to be taxed as a REIT for U.S. federal income tax purposes, commencing with our tax year ended December 31, 2011. Forward-Looking Statements "Safe Harbor" Statement under the Private Securities Litigation Reform Act of 1995: Estimates of future earnings and performance are, by definition, and certain other statements in this Supplemental Financial Data Report may constitute, "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995 and involve known and unknown risks, uncertainties and other factors that may cause our actual results, performance, achievements or transactions to be materially different from the results, performance, achievements or transactions expressed or implied by the forward looking statements. Factors that impact such forward looking statements include, among others, our business and investment strategy; legislative or regulatory actions; the state of the U.S. economy generally or in specific geographic areas; economic trends and economic recoveries; our ability to obtain and maintain debt or equity financing; financing and advance rates for our target assets; our leverage level; changes in the values of our assets; availability of attractive investment opportunities in our target markets; our ability to maintain our qualification as a real estate investment trust, or REIT, for U.S. federal income tax purposes; our ability to maintain our exemption from registration under the Investment Company Act of 1940, as amended; availability of quality personnel; our understanding of our competition; and market trends in our industry, interest rates, real estate values, the debt securities markets and the general economy. Except as otherwise required by the federal securities laws, we assume no liability to update the information in this Supplemental Financial Data Report. We refer you to the sections entitled "Risk Factors" and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in our Annual Report on Form 10-K for the twelve months ended December 31, 2012 that was filed with the Securities and Exchange Commission, or SEC, on March 15, 2013, which discusses various factors that could adversely affect our financial results. Such risk factors and information may be updated or supplemented by our subsequent Form 10-Q and Form 8-K filings and other documents filed from time to time with the SEC.

First Quarter 2013 Supplemental Financial Data Page 4 Highlights of the first quarter 2013: Net cash provided by operating activities for the first quarter 2013, excluding the effect of approximately $1.1 million of acquisition costs related to the three communities acquired in January 2013, was $1,863,401. This represents an increase of approximately $935,000, or 101% over net cash provided by operating activities for the first quarter 2012, excluding the effect of $912 of miscellaneous acquisition costs related to prior period acquisitions, of $928,306. (1) Adjusted Funds From Operations Attributable to Common Stockholders and Unitholders, or AFFO, was $897,917 for the first quarter of 2013, an increase of 16.8% from our AFFO result of $768,941 for the first quarter of 2012. On January 17, 2013, we closed on a private placement transaction in which we issued 40,000 shares of Series B Mandatorily Convertible Cumulative Perpetual Preferred Stock (“Series B Preferred Stock”) for a purchase price of $1,000 per share, and received proceeds of approximately $37.6 million, net of commissions. On January 23, 2013, we acquired three multifamily communities: McNeil Ranch, a 192 unit community in Austin, Texas, for approximately $21.0 million; Lake Cameron, a 328 unit community in Raleigh, North Carolina, for approximately $30.4 million; and Ashford Park, a 408 unit community in Atlanta, Georgia for approximately $39.4 million. These three additional properties added 928 units to our portfolio, which now total 1,693 units. We financed these acquisitions utilizing proceeds from the Series B Preferred Stock transaction described above. On January 24, 2013, we refinanced our three newly-acquired properties with seven-year, nonrecourse mortgage financing, which totaled approximately $59.0 million. Fixed rate, interest-only payments of 3.13% per annum are due monthly through February 28, 2018. On March 28, 2013, we closed on and partially funded a mezzanine construction loan totaling a maximum aggregate amount of approximately $12.7 million, to partially finance the construction of a multifamily community in Naples, Florida. At March 31, 2013, the aggregate funded amount was approximately $2.2 million. The loan includes an option to purchase the property once developed and stabilized. On April 4, 2013, we increased the aggregate borrowing limit on our revolving credit facility from $15.0 million to $30.0 million. Other than with regard to this instrument, we continue to hold no debt at the Company or operating partnership levels, have no cross-collateralization of our real estate assets, and have no contingent liabilities at the Company or operating partnership levels with regard to our secured mortgage debt on our communities. As of March 31, 2013, and through the month of April 2013, we had no borrowings outstanding against the revolving credit facility. We declared a quarterly dividend on our Common Stock of $0.145 per share, which was paid on April 22, 2013 to all common stockholders of record as of March 28, 2013. Our aggregate dividend declarations during the three-month period ended March 31, 2013 were: Common Series A Series B Total 771,923$ 360,039$ 690,476$ 1,822,438$ Preferred AFFO guidance: We currently project AFFO to be in the range of $1,750,000 - $2,050,000 for the second quarter of 2013. This guidance assumes our Series B Preferred Stock is converted to Common Stock on May 16, 2013. (2) (1) See Reconciliation of Funds From Operations Attributable to Common Stockholders and Unitholders and Adjusted Funds From Operations Attributable to Common Stockholders and Unitholders to Net Loss Attributable to Common Stockholders and Definitions of Non-GAAP Measures on pages 6 and 12. (2) Guidance on projected AFFO for the second quarter of 2013 excludes any proceeds from any additional shares of our Series A Redeemable Preferred Stock or other securities that we may issue and potential dividends to be paid on those securities.

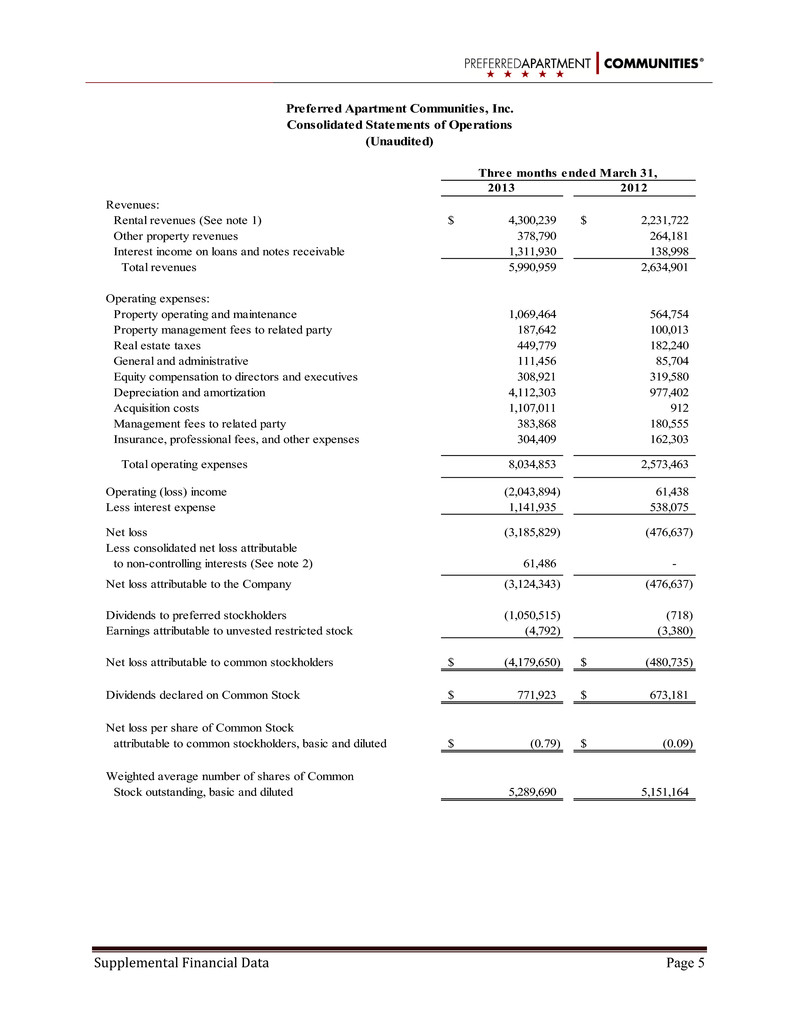

First Quarter 2013 Supplemental Financial Data Page 5 2013 2012 Revenues: Rental revenues (See note 1) 4,300,239$ 2,231,722$ Other property revenues 378,790 264,181 Interest income on loans and notes receivable 1,311,930 138,998 Total revenues 5,990,959 2,634,901 Operating expenses: Property operating and maintenance 1,069,464 564,754 Property management fees to related party 187,642 100,013 Real estate taxes 449,779 182,240 General and administrative 111,456 85,704 308,921 319,580 Depreciation and amortization 4,112,303 977,402 Acquisition costs 1,107,011 912 Management fees to related party 383,868 180,555 Insurance, professional fees, and other expenses 304,409 162,303 Total operating expenses 8,034,853 2,573,463 Operating (loss) income (2,043,894) 61,438 Less interest expense 1,141,935 538,075 Net loss (3,185,829) (476,637) Less consolidated net loss attributable to non-controlling interests (See note 2) 61,486 - Net loss attributable to the Company (3,124,343) (476,637) Dividends to preferred stockholders (1,050,515) (718) Earnings attributable to unvested restricted stock (4,792) (3,380) Net loss attributable to common stockholders (4,179,650)$ (480,735)$ Dividends declared on Common Stock 771,923$ 673,181$ Net loss per share of Common Stock attributable to common stockholders, basic and diluted (0.79)$ (0.09)$ Weighted average number of shares of Common Stock outstanding, basic and diluted 5,289,690 5,151,164 Equity compensation to directors and executives Three months ended March 31, Preferred Apartment Communities, Inc. Consolidated Statements of Operations (Unaudited)

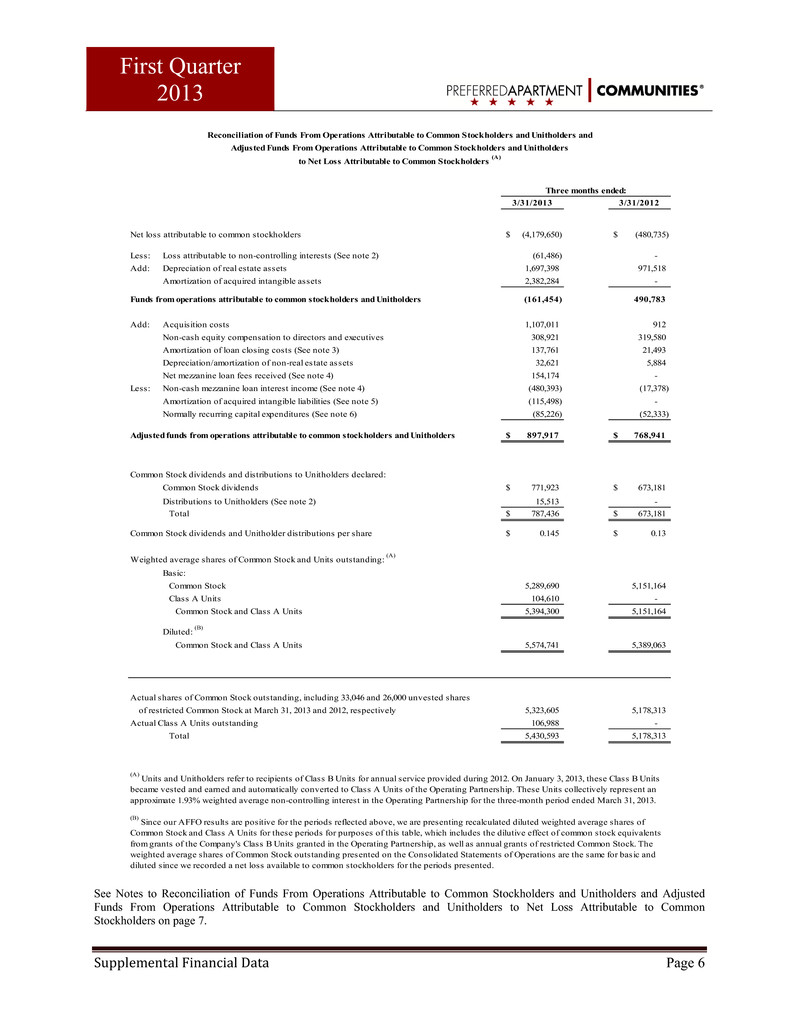

First Quarter 2013 Supplemental Financial Data Page 6 3/31/2013 3/31/2012 Net loss attributable to common stockholders (4,179,650)$ (480,735)$ Less: Loss attributable to non-controlling interests (See note 2) (61,486) - Add: Depreciation of real estate assets 1,697,398 971,518 Amortization of acquired intangible assets 2,382,284 - Funds from operations attributable to common stockholders and Unitholders (161,454) 490,783 Add: Acquisition costs 1,107,011 912 Non-cash equity compensation to directors and executives 308,921 319,580 Amortization of loan closing costs (See note 3) 137,761 21,493 Depreciation/amortization of non-real estate assets 32,621 5,884 Net mezzanine loan fees received (See note 4) 154,174 - Less: Non-cash mezzanine loan interest income (See note 4) (480,393) (17,378) Amortization of acquired intangible liabilities (See note 5) (115,498) - Normally recurring capital expenditures (See note 6) (85,226) (52,333) Adjusted funds from operations attributable to common stockholders and Unitholders 897,917$ 768,941$ Common Stock dividends and distributions to Unitholders declared: Common Stock dividends 771,923$ 673,181$ Distributions to Unitholders (See note 2) 15,513 - Total 787,436$ 673,181$ Common Stock dividends and Unitholder distributions per share 0.145$ 0.13$ Weighted average shares of Common Stock and Units outstanding: (A) Basic: Common Stock 5,289,690 5,151,164 Class A Units 104,610 - Common Stock and Class A Units 5,394,300 5,151,164 Diluted: (B) Common Stock and Class A Units 5,574,741 5,389,063 Actual shares of Common Stock outstanding, including 33,046 and 26,000 unvested shares of restricted Common Stock at March 31, 2013 and 2012, respectively 5,323,605 5,178,313 Actual Class A Units outstanding 106,988 - Total 5,430,593 5,178,313 Reconciliation of Funds From Operations Attributable to Common Stockholders and Unitholders and Adjusted Funds From Operations Attributable to Common Stockholders and Unitholders to Net Loss Attributable to Common Stockholders (A) Three months ended: (B) Since our AFFO results are positive for the periods reflected above, we are presenting recalculated diluted weighted average shares of Common Stock and Class A Units for these periods for purposes of this table, which includes the dilutive effect of common stock equivalents from grants of the Company's Class B Units granted in the Operating Partnership, as well as annual grants of restricted Common Stock. The weighted average shares of Common Stock outstanding presented on the Consolidated Statements of Operations are the same for basic and diluted since we recorded a net loss available to common stockholders for the periods presented. (A) Units and Unitholders refer to recipients of Class B Units for annual service provided during 2012. On January 3, 2013, these Class B Units became vested and earned and automatically converted to Class A Units of the Operating Partnership. These Units collectively represent an approximate 1.93% weighted average non-controlling interest in the Operating Partnership for the three-month period ended March 31, 2013. See Notes to Reconciliation of Funds From Operations Attributable to Common Stockholders and Unitholders and Adjusted Funds From Operations Attributable to Common Stockholders and Unitholders to Net Loss Attributable to Common Stockholders on page 7.

First Quarter 2013 Supplemental Financial Data Page 7 Notes to Consolidated Statements of Operations and Reconciliation of Funds From Operations Attributable to Common Stockholders and Unitholders and Adjusted Funds From Operations Attributable to Common Stockholders and Unitholders to Net Loss Attributable to Common Stockholders 1) Rental and other property revenues and expenses for the three-month period ended March 31, 2013 include activity for the McNeil Ranch, Lake Cameron, and Ashford Park properties from January 23, 2013 (the acquisition date) through the reporting date and so are not representative of a full quarter of results for those properties. 2) As of March 31, 2013, the 106,988 Class B Units of the Preferred Apartment Communities Operating Partnership, L.P., or our Operating Partnership, awarded to our key executive officers for service performed during 2012, became vested and earned on January 3, 2013. These Class B Units automatically converted to Class A Units of the Operating Partnership, and as such are apportioned a percentage of the Company’s financial results as non-controlling interests. The weighted average ownership percentage of these Class A Unitholders for the first quarter of 2013 was calculated to be 1.93%. 3) We incurred aggregate loan closing costs of approximately $1.5 million on our mortgage loans, which are secured on a property-by-property basis by each of our six acquired multifamily communities. In addition, we paid a total of $323,918 in loan closing costs to secure our $15.0 million revolving line of credit, which was increased to $30.0 million in April 2013. These loan costs are being amortized over the lives of the respective loans, and the non-cash amortization expense is an addition to FFO in the calculation of AFFO. Neither we nor the Operating Partnership have any recourse liability in connection with any of the mortgage loans, nor do we have any cross-collateralization arrangements with respect to these assets, other than in connection with our revolving line of credit. 4) We receive loan fees and loan commitment fees in conjunction with the origination of certain real estate loans. These fees are then recognized as revenue over the lives of the applicable loans as adjustments of yield using the effective interest method. The total fees received, after the payment of acquisition fees to Preferred Apartment Advisors, LLC, our Manager, are additive adjustments in the calculation of AFFO. Correspondingly, the non-cash income recognized under the effective interest method is a deduction in the calculation of AFFO. 5) This adjustment is the reversal of the non-cash amortization of below-market lease intangibles, which were recognized in conjunction with the acquisition of the Ashford Park and McNeil Ranch multifamily communities. These intangibles, totaling approximately $277,000, are to be amortized over the estimated average remaining lease term of approximately six months. 6) We deduct from FFO normally recurring capital expenditures that are necessary to maintain the communities’ revenue streams in the calculation of AFFO. No adjustment is made in the calculation of AFFO for non-recurring capital expenditures, which totaled $3,600 and $170,333 for the three-month periods ended March 31, 2013 and 2012, respectively. See Definitions of Non-GAAP Measures on page 12.

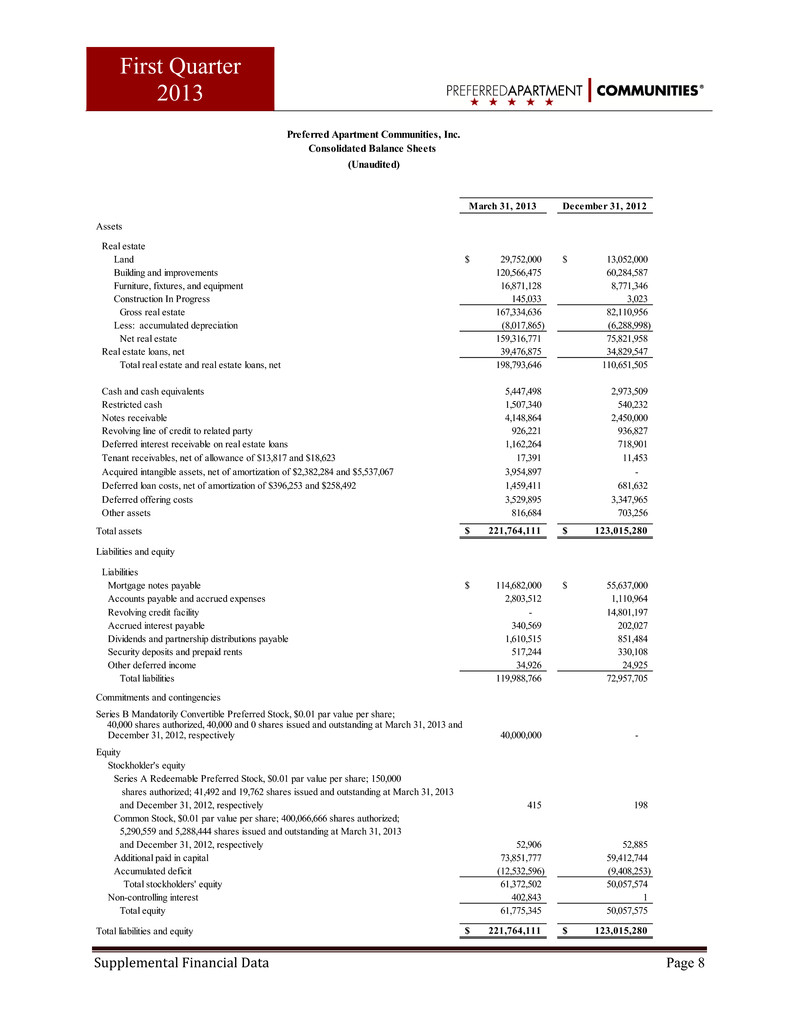

First Quarter 2013 Supplemental Financial Data Page 8 March 31, 2013 December 31, 2012 Assets Real estate Land 29,752,000$ 13,052,000$ Building and improvements 120,566,475 60,284,587 Furniture, fixtures, and equipment 16,871,128 8,771,346 Construction In Progress 145,033 3,023 Gross real estate 167,334,636 82,110,956 Less: accumulated depreciation (8,017,865) (6,288,998) Net real estate 159,316,771 75,821,958 Real estate loans, net 39,476,875 34,829,547 Total real estate and real estate loans, net 198,793,646 110,651,505 Cash and cash equivalents 5,447,498 2,973,509 Restricted cash 1,507,340 540,232 Notes receivable 4,148,864 2,450,000 Revolving line of credit to related party 926,221 936,827 Deferred interest receivable on real estate loans 1,162,264 718,901 Tenant receivables, net of allowance of $13,817 and $18,623 17,391 11,453 Acquired intangible assets, net of amortization of $2,382,284 and $5,537,067 3,954,897 - Deferred loan costs, net of amortization of $396,253 and $258,492 1,459,411 681,632 Deferred offering costs 3,529,895 3,347,965 Other assets 816,684 703,256 Total assets 221,764,111$ 123,015,280$ Liabilities and equity Liabilities Mortgage notes payable 114,682,000$ 55,637,000$ Accounts payable and accrued expenses 2,803,512 1,110,964 Revolving credit facility - 14,801,197 Accrued interest payable 340,569 202,027 Dividends and partnership distributions payable 1,610,515 851,484 Security deposits and prepaid rents 517,244 330,108 Other deferred income 34,926 24,925 Total liabilities 119,988,766 72,957,705 Commitments and contingencies Series B Mandatorily Convertible Preferred Stock, $0.01 par value per share; 40,000 shares authorized, 40,000 and 0 shares issued and outstanding at March 31, 2013 and 40,000,000 - Equity Stockholder's equity Series A Redeemable Preferred Stock, $0.01 par value per share; 150,000 shares authorized; 41,492 and 19,762 shares issued and outstanding at March 31, 2013 and December 31, 2012, respectively 415 198 Common Stock, $0.01 par value per share; 400,066,666 shares authorized; 5,290,559 and 5,288,444 shares issued and outstanding at March 31, 2013 and December 31, 2012, respectively 52,906 52,885 Additional paid in capital 73,851,777 59,412,744 Accumulated deficit (12,532,596) (9,408,253) Total stockholders' equity 61,372,502 50,057,574 Non-controlling interest 402,843 1 Total equity 61,775,345 50,057,575 Total liabilities and equity 221,764,111$ 123,015,280$ December 31, 2012, respectively Preferred Apartment Communities, Inc. Consolidated Balance Sheets (Unaudited)

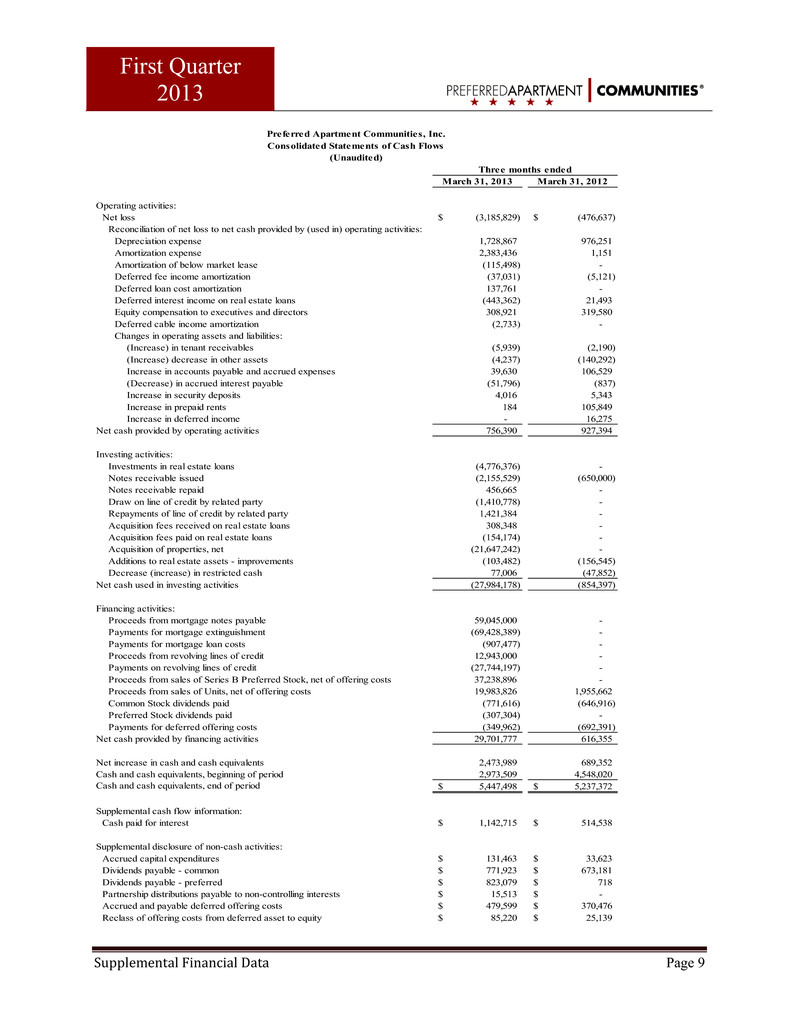

First Quarter 2013 Supplemental Financial Data Page 9 March 31, 2013 March 31, 2012 Operating activities: Net loss (3,185,829)$ (476,637)$ Reconciliation of net loss to net cash provided by (used in) operating activities: Depreciation expense 1,728,867 976,251 Amortization expense 2,383,436 1,151 Amortization of below market lease (115,498) - Deferred fee income amortization (37,031) (5,121) Deferred loan cost amortization 137,761 - Deferred interest income on real estate loans (443,362) 21,493 Equity compensation to executives and directors 308,921 319,580 Deferred cable income amortization (2,733) - Changes in operating assets and liabilities: (Increase) in tenant receivables (5,939) (2,190) (Increase) decrease in other assets (4,237) (140,292) Increase in accounts payable and accrued expenses 39,630 106,529 (Decrease) in accrued interest payable (51,796) (837) Increase in security deposits 4,016 5,343 Increase in prepaid rents 184 105,849 Increase in deferred income - 16,275 Net cash provided by operating activities 756,390 927,394 Investing activities: Investments in real estate loans (4,776,376) - Notes receivable issued (2,155,529) (650,000) Notes receivable repaid 456,665 - Draw on line of credit by related party (1,410,778) - Repayments of line of credit by related party 1,421,384 - Acquisition fees received on real estate loans 308,348 - Acquisition fees paid on real estate loans (154,174) - Acquisition of properties, net (21,647,242) - Additions to real estate assets - improvements (103,482) (156,545) Decrease (increase) in restricted cash 77,006 (47,852) Net cash used in investing activities (27,984,178) (854,397) Financing activities: Proceeds from mortgage notes payable 59,045,000 - Payments for mortgage extinguishment (69,428,389) - Payments for mortgage loan costs (907,477) - Proceeds from revolving lines of credit 12,943,000 - Payments on revolving lines of credit (27,744,197) - Proceeds from sales of Series B Preferred Stock, net of offering costs 37,238,896 - Proceeds from sales of Units, net of offering costs 19,983,826 1,955,662 Common Stock dividends paid (771,616) (646,916) Preferred Stock dividends paid (307,304) - Payments for deferred offering costs (349,962) (692,391) Net cash provided by financing activities 29,701,777 616,355 Net increase in cash and cash equivalents 2,473,989 689,352 Cash and cash equivalents, beginning of period 2,973,509 4,548,020 Cash and cash equivalents, end of period 5,447,498$ 5,237,372$ Supplemental cash flow information: Cash paid for interest 1,142,715$ 514,538$ Supplemental disclosure of non-cash activities: Accrued capital expenditures 131,463$ 33,623$ Dividends payable - common 771,923$ 673,181$ Dividends payable - preferred 823,079$ 718$ Partnership distributions payable to non-controlling interests 15,513$ -$ Accrued and payable deferred offering costs 479,599$ 370,476$ Reclass of offering costs from deferred asset to equity 85,220$ 25,139$ Preferred Apartment Communities, Inc. Consolidated Statements of Cash Flows (Unaudited) Three months ended

First Quarter 2013 Supplemental Financial Data Page 10 Real Estate Loans The following table presents details of our real estate loan portfolio as of March 31, 2013: Total units upon Loan balance at March Total loan Purchase Project/Property (1) Location completion 31, 2013 (4) commitments Begin End option price Trail II Hampton, VA 96 5,955,231$ 6,000,000$ 4/1/2014 6/30/2014 17,825,600$ Summit II Suburban Atlanta, GA 140 6,056,417 6,103,027 10/1/2014 2/28/2015 19,254,155$ Crosstown Walk (2) Suburban Tampa, FL N/A (2) 4,680,439 4,685,000 N/A N/A N/A City Park Charlotte, NC 284 7,490,276 10,000,000 11/1/2015 3/31/2016 30,945,845$ City Vista Pittsburgh, PA 272 8,129,326 12,153,000 2/1/2016 5/31/2016 43,560,271$ Madison - Rome (3) Rome, GA - 5,119,584 5,360,042 N/A N/A N/A Lely Naples, FL 308 2,045,602 12,713,242 4/1/2016 8/30/2016 43,500,000$ 1,100 (2) 39,476,875$ 57,014,311$ (1) All loans are mezzanine loans pertaining to developments of multifamily communities, except as otherwise indicated. (2) (3) Madison-Rome is a mezzanine loan for a planned 88,351 square foot retail development project. (4) Loan balances are presented net of any associated deferred revenue related to loan fees. Purchase option window Crosstown Walk was a land acquisition bridge loan that was converted to a mezzanine loan in April 2013; the planned 342 units in the project bring our total additional units upon completion to 1,442. Capital Expenditures We regularly incur capital expenditures related to our owned properties. Capital expenditures may be nonrecurring and discretionary, as part of a strategic plan intended to increase a property’s value and corresponding revenue-generating ability, or may be normally recurring and necessary to maintain the income streams and present value of a property. Certain capital expenditures may be budgeted and reserved for upon acquiring a property as initial expenditures necessary to bring a property up to our standards or to add features or amenities that we believe make the property a compelling value to prospective residents in its individual market. These budgeted nonrecurring capital expenditures in connection with an acquisition are funded from the capital source(s) for the acquisition and are not dependent upon subsequent property operational cash flows for funding. For the three-month period ended March 31, 2013, our capital expenditures were: Summit Crossing Trail Creek Stone Rise Ashford Park McNeil Ranch Lake Cameron Total Nonrecurring capital expenditures: Budgeted at property acquisition -$ -$ -$ 3,600$ -$ -$ 3,600$ Other nonrecurring capital expenditures - - - - - - - Total nonrecurring capital expenditures - - - 3,600 - - 3,600 Normally recurring capital expenditures 15,929 14,803 12,224 19,405 11,685 11,180 85,226 Total capital expenditures 15,929$ 14,803$ 12,224$ 23,005$ 11,685$ 11,180$ 88,826$ Physical and Average Economic Occupancy As of March 31, 2013, our aggregate physical occupancy was 93.0%. For the three-month period ended March 31, 2013, our average monthly economic occupancy was 91.6% and our average physical occupancy was 93.8%. We define physical occupancy as the number of units occupied divided by total apartment units. We calculate average economic occupancy by dividing gross potential rent less vacancy losses, model expenses, bad debt expenses and concessions by gross potential rent.

First Quarter 2013 Supplemental Financial Data Page 11 Same Store Financial Data The following chart presents same store operating results for the Company’s multifamily communities which have been owned for at least 15 full months, enabling comparisons of the current reporting period to the prior year comparative period. Same store net operating income is a non-GAAP measure that is most directly comparable to net income/loss, with a reconciliation following below. $ inc % inc 3/31/2013 3/31/2012 (dec) (dec) Revenues: Rental revenues 2,313,518$ 2,231,722$ 81,796$ 3.7% Other property revenues 260,764 264,181 (3,417) (1.3)% Total revenues 2,574,282 2,495,903 78,379 3.1% Operating expenses: Property operating and maintenance 541,044 564,754 (23,710) (4.2)% Property management fees 104,590 100,019 4,571 4.6% Real estate taxes 190,443 182,240 8,203 4.5% Other 82,881 88,272 (5,391) (6.1)% Total operating expenses 918,957 935,285 (16,328) (1.7)% Same store net operating income 1,655,325$ 1,560,618$ 94,707$ 6.1% 3/31/2013 3/31/2012 Same store net operating income 1,655,325$ 1,560,618$ Add: Non-same-store property revenues 2,108,746 - Less: Non-same-store property operating expenses 967,347 - Property net operating income 2,796,724 1,560,618 Add: Interest revenue 1,311,930 138,998 Less: Depreciation and amortization 4,112,303 977,402 Interest expense 1,141,935 538,075 Acquisition costs 1,107,011 912 Other corporate expenses 933,234 659,865 Net loss (3,185,829)$ (476,637)$ Three months ended: Reconciliation of Same Store Net Operating Income (NOI) to Net Loss Same Store Net Operating Income Trail Creek, Summit Crossing, and Stone Rise Multifamily Communities Three months ended:

First Quarter 2013 Supplemental Financial Data Page 12 Definitions of Non-GAAP Measures Funds From Operations Attributable to Common Stockholders and Unitholders (“FFO”) Analysts, managers, and investors have, since the first real estate investment trusts were created, made certain adjustments to reported net income amounts under U.S. GAAP in order to better assess these vehicles’ liquidity and cash flows. FFO is one of the most commonly utilized Non-GAAP measures currently in practice. In its 2002 “White Paper on Funds From Operations”, which was most recently revised in 2012, the National Association of Real Estate Investment Trusts, or NAREIT, standardized the definition of how Net income/loss should be adjusted to arrive at FFO, in the interests of uniformity and comparability. The NAREIT definition of FFO (and the one reported by the Company) is: Net income/loss: Excluding impairment charges on and gains/losses from sales of depreciable property; Plus depreciation and amortization of real estate assets; and After adjustments for unconsolidated partnerships and joint ventures. Not all companies necessarily utilize the standardized NAREIT definition of FFO, so caution should be taken in comparing the Company’s reported FFO results to those of other companies. The Company’s FFO results are comparable to the FFO results of other companies that follow the NAREIT definition of FFO and report these figures on that basis. We believe FFO is useful to investors as a supplemental gauge of our operating results. FFO is a non-GAAP measure that is reconciled to its most comparable GAAP measure, which the Company believes to be net income/loss available to common stockholders. Adjusted Funds From Operations Attributable to Common Stockholders and Unitholders (“AFFO”) AFFO makes further adjustments to FFO results in order to arrive at a more refined measure of operating and financial performance. There is no industry standard definition of AFFO and practice is divergent across the industry. The Company calculates AFFO as: FFO, plus: Acquisition costs; Organization costs; Non-cash equity compensation to directors and executives; Amortization of loan closing costs; REIT establishment costs; Depreciation and amortization of non-real estate assets; and Net mezzanine loan fees received; Less: Non-cash mezzanine loan interest income; Amortization of acquired intangible liabilities; and Normally recurring capital expenditures. AFFO figures reported by us may not be comparable to those reported by other companies. Investors are cautioned that AFFO excludes acquisition costs which are generally recorded in the periods in which the properties are acquired (and often preceding periods). We utilize AFFO to measure the liquidity generated by our portfolio of real estate assets. We believe AFFO is useful to investors as a supplemental

First Quarter 2013 Supplemental Financial Data Page 13 gauge of our operating performance and is useful in comparing our operating performance with other real estate companies that are not as involved in ongoing acquisition activities. AFFO is a useful supplement to, but not a substitute for, its closest GAAP-compliant measure, which we believe to be net income/loss available to common stockholders. Same Store Net Operating Income “NOI” The Company uses same store net operating income as an operational metric for properties the Company has owned for at least 15 full months, enabling comparisons of those properties’ operating results between the current reporting period and the prior year comparative period. The Company defines net operating income as rental and other property revenues, less total property and maintenance expenses, property management fees, real estate taxes, general and administrative expenses, and property insurance. The Company believes that net operating income is an important supplemental measure of operating performance for a REIT’s operating real estate because it provides a measure of the core operations, rather than factoring in depreciation and amortization, financing costs, acquisition costs, and other corporate expenses. Net operating income is a widely utilized measure of comparative operating performance in the REIT industry, but is not a substitute for its closest GAAP-compliant measure, which we believe to be net income/loss. For further information: Leonard A. Silverstein President and Chief Operating Officer Preferred Apartment Communities, Inc. lsilverstein@pacapts.com +1-770-818-4147