Registration No. 333-_________

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

MASCOT VENTURES INC

(Exact name of registrant as specified in its charter)

| Nevada | | 1000 | | None |

| (State or Other Jurisdiction of | | (Primary Standard Industrial | | (IRS Employer |

| Incorporation or Organization) | | Classification Number) | | Identification Number) |

1802 North Carson Street, Suite 212

Carson City, Nevada 89701

(646) 520-7426

(Address, including zip code, and telephone number, including area code,

of registrant’s principal executive offices)

Wendy Wildmen

President and Chief Executive Officer

Mascot Ventures Inc.

1802 North Carson Street, Suite 212

Carson City, Nevada 89701

(646) 520-7426

(Address, including zip code, and telephone number,

including area code, of agent for service)

Copies to:

Thomas E. Puzzo, Esq.

Law Offices of Thomas E. Puzzo, PLLC

4216 NE 70th Street

Seattle, Washington 98115

Telephone No.: (206) 522-2256

Facsimile No.: (206) 260-0111

Approximate date of proposed sale to the public: As soon as practicable and from time to time after the effective date of this Registration Statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. x

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer ¨ | Accelerated filer ¨ |

Non-accelerated filer ¨ | Smaller reporting company x |

| (Do not check if a smaller reporting company) | |

CALCULATION OF REGISTRATION FEE

| Title of Each Class | | | | | Proposed Maximum | | | Proposed Maximum | | | | |

| of Securities | | Amount to Be | | | Offering Price | | | Aggregate | | | Amount of | |

| to be Registered | | Registered(1) | | | per Share | | | Offering Price | | | Registration Fee | |

| Common Stock, $0.001 per share | | | 1,860,000 | (2) | | $ | 0.10 | (3) | | $ | 186,000 | | | $ | 13.26 | |

| TOTAL | | | 1,860,000 | | | $ | - | | | $ | 186,000 | | | | 13.26 | |

(1) In the event of a stock split, stock dividend or similar transaction involving our common stock, the number of shares registered shall automatically be increased to cover the additional shares of common stock issuable pursuant to Rule 416 under the Securities Act of 1933, as amended.

(2) Represents the number of shares of common stock currently outstanding to be sold by the selling security holders.

(3) Estimated solely for the purpose of calculating the registration fee pursuant to Rule 457(a) and (o) of the Securities Act.

THE REGISTRANT HEREBY AMENDS THIS REGISTRATION STATEMENT ON SUCH DATE OR DATES AS MAY BE NECESSARY TO DELAY ITS EFFECTIVE DATE UNTIL THE REGISTRANT SHALL FILE A FURTHER AMENDMENT WHICH SPECIFICALLY STATES THAT THIS REGISTRATION STATEMENT SHALL THEREAFTER BECOME EFFECTIVE IN ACCORDANCE WITH SECTION 8(A) OF THE SECURITIES ACT OF 1933, OR UNTIL THE REGISTRATION STATEMENT SHALL BECOME EFFECTIVE ON SUCH DATE AS THE COMMISSION, ACTING PURSUANT TO SECTION 8(A), MAY DETERMINE.

PRELIMINARY PROSPECTUS SUBJECT TO COMPLETION DATED APRIL 9, 2010

MASCOT VENTURES INC

1,860,000 SHARES OF COMMON STOCK

This prospectus relates to the resale by certain selling security holders of Mascot Ventures Inc of up to 1,860,000 shares of common stock held by selling security holders of Mascot Ventures Inc. We will not receive any of the proceeds from the sale of the shares by the selling stockholders.

The selling security holders will be offering our shares of common stock at a fixed price of $0.10 per share until our shares are quoted on the OTC Bulletin Board and thereafter at prevailing market prices or privately negotiated prices. Each of the selling stockholders may be deemed to be an “underwriter” as such term is defined in the Securities Act of 1933, as amended (the “Securities Act”).

There has been no market for our securities and a public market may never develop, or, if any market does develop, it may not be sustained. Our common stock is not traded on any exchange or on the over-the-counter market. After the effective date of the registration statement relating to this prospectus, we hope to have a market maker file an application with the Financial Industry Regulatory Authority for our common stock to be eligible for trading on the Over-the-Counter Bulletin Board. We do not yet have a market maker who has agreed to file such application. There can be no assurance that our common stock will ever be quoted on a stock exchange or a quotation service or that any market for our stock will develop.

OUR BUSINESS IS SUBJECT TO MANY RISKS AND AN INVESTMENT IN OUR SHARES OF COMMON STOCK WILL ALSO INVOLVE A HIGH DEGREE OF RISK. YOU SHOULD CAREFULLY CONSIDER THE FACTORS DESCRIBED UNDER THE HEADING “RISK FACTORS” BEGINNING ON PAGE 5 BEFORE INVESTING IN OUR SHARES OF COMMON STOCK.

NEITHER THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THESE SECURITIES OR DETERMINED IF THIS PROSPECTUS IS TRUTHFUL OR COMPLETE. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

The information in this prospectus is not complete and may be changed. This prospectus is included in the registration statement that was filed by us with the Securities and Exchange Commission. The selling security holders may not sell these securities until the registration statement becomes effective. This prospectus is not an offer to sell these securities and is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

The date of this prospectus is _______________, 2010.

The following table of contents has been designed to help you find information contained in this prospectus. We encourage you to read the entire prospectus.

TABLE OF CONTENTS

| | | Page |

| | | |

| Prospectus Summary | | 4 |

| Risk Factors | | 6 |

| Risk Factors Relating to Our Company | | 6 |

| Risk Factors Relating to Our Common Stock | | 9 |

| Use of Proceeds | | 12 |

| Determination of Offering Price | | 12 |

| Selling Security Holders | | 12 |

| Plan of Distribution | | 13 |

| Description of Business | | 18 |

| Our Executive Offices | | 25 |

| Legal Proceedings | | 25 |

| Market for Common Equity and Related Stockholder Matters | | 25 |

| Management’s Discussion and Analysis of Financial Condition and Results of Operations | | 26 |

| Directors, Executive Officers, Promoters and Control Persons | | 29 |

| Executive Compensation | | 31 |

| Security Ownership of Certain Beneficial Owners and Management | | 31 |

| Certain Relationships and Related Transactions | | 32 |

| Disclosure of Commission Position on Indemnification for Securities Act Liabilities | | 32 |

| Where You Can Find More Information | | 32 |

| Changes In and Disagreements with Accountants on Accounting and Financial Disclosure | | 33 |

| Financial Statements | | F-1 |

Until ___ ______, 2010 (90 business days after the effective date of this prospectus) all dealers that effect transactions in these securities whether or not participating in this offering, may be required to deliver a prospectus. This is in addition to the dealer’s obligation to deliver a prospectus when acting as underwriters and with respect to their unsold allotments or subscriptions.

A CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus contains forward-looking statements which relate to future events or our future financial performance. In some cases, you can identify forward-looking statements by terminology such as “may”, “should”, “expects”, “plans”, “anticipates”, “believes”, “estimates”, “predicts”, “potential” or “continue” or the negative of these terms or other comparable terminology. These statements are only predictions and involve known and unknown risks, uncertainties and other factors, including the risks in the section entitled “Risk Factors,” that may cause our or our industry’s actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by these forward-looking statements.

While these forward-looking statements, and any assumptions upon which they are based, are made in good faith and reflect our current judgment regarding the direction of our business, actual results will almost always vary, sometimes materially, from any estimates, predictions, projections, assumptions or other future performance suggested herein. Except as required by applicable law, including the securities laws of the United States, we do not intend to update any of the forward-looking statements to conform these statements to actual results.

PROSPECTUS SUMMARY

As used in this prospectus, references to the “Company,” “we,” “our”, “us” or “Mascot” refer to Mascot Ventures Inc. unless the context otherwise indicates.

The following summary highlights selected information contained in this prospectus. Before making an investment decision, you should read the entire prospectus carefully, including the “Risk Factors” section, the financial statements, and the notes to the financial statements.

OUR COMPANY

Mascot Ventures Inc. was incorporated on September 25, 2007, under the laws of the State of Nevada, for the purpose of conducting mineral exploration activities.

We are an exploration stage company formed for the purposes of acquiring, exploring, and if warranted and feasible, developing natural resource property. We raised an aggregate of $40,500 through private placements of our securities. Proceeds from these placements were used to acquire a mineral property and for working capital.

The Monty Lode Claim, comprising 20 acres, was located on November 26, 2007 and was filed in the Clark County recorder’s office in Las Vegas, Nevada, on November 30, 2007. We had a qualified consulting geologist prepare a geological evaluation report on the claim. We intend to conduct exploratory activities on the claim and if feasible, develop the claim.

The Company’s principal offices are located at 1802 North Carson Street, Suite 212, Carson City, Nevada 89701 and our telephone number is (646) 520-7426.

THE OFFERING

| Securities offered: | | The selling stockholders are offering hereby up to 1,860,000 shares of common stock. |

| | | |

| Offering price: | | The selling stockholders will offer and sell their shares of common stock at a fixed price of $0.10 per share until our shares are quoted on the OTC Bulletin Board, if our shares of common stock are ever quoted on the OTC Bulletin Board, and thereafter at prevailing market prices or privately negotiated prices. |

| | | |

| Shares outstanding prior to offering: | | 11,860,000 |

| | | |

| Shares outstanding after offering: | | 11,860,000 |

| | | |

| Market for the common shares: | | There is no public market for our shares. Our common stock is not traded on any exchange or on the over-the-counter market. After the effective date of the registration statement relating to this prospectus, we hope to have a market maker file an application with the Financial Industry Regulatory Authority (“FINRA”) for our common stock to eligible for trading on the Over The Counter Bulletin Board. We do not yet have a market maker who has agreed to file such application. There is no assurance that a trading market will develop, or, if developed, that it will be sustained. Consequently, a purchaser of our common stock may find it difficult to resell the securities offered herein should the purchaser desire to do so when eligible for public resale. |

| | | |

| Use of proceeds: | | We will not receive any proceeds from the sale of shares by the selling security holders |

SUMMARY FINANCIAL INFORMATION

The tables and information below are derived from our audited financial statements for the period from September 25, 2007 (Inception) to October 31, 2009. Our working capital as at October 31, 2009 was $42,850.

| | | October 31, 2009 ($) | |

| Financial Summary | | | |

| Cash and Deposits | | | 42,850 | |

| Total Assets | | | 49,350 | |

| Total Liabilities | | | — | |

| Total Stockholder’s Equity | | | 49,350 | |

| | | Accumulated From September 25, 2007 | |

| | | (Inception) to October 31, 2009 ($) | |

| | | | |

| Statement of Operations | | | |

| Total Expenses | | | 39,562 | |

| Net Loss for the Period | | | 38,650 | |

| Net Loss per Share | | | (0.00 | ) |

RISK FACTORS

An investment in our common stock involves a number of very significant risks. You should carefully consider the following known material risks and uncertainties in addition to other information in this prospectus in evaluating our company and its business before purchasing shares of our company’s common stock. You could lose all or part of your investment due to any of these risks.

RISKS RELATING TO OUR COMPANY

OUR AUDITORS HAVE EXPRESSED SUBSTANTIAL DOUBT ABOUT OUR ABILITY TO CONTINUE AS A GOING CONCERN.

Our financial statements for the year ended October 31, 2009 were prepared assuming that we will continue our operations as a going concern. We were incorporated on September 25, 2007 and do not have a history of earnings. As a result, our independent accountants in their audit report have expressed substantial doubt about our ability to continue as a going concern. Continued operations are dependent on our ability to complete equity or debt financings or generate profitable operations. Such financings may not be available or may not be available on reasonable terms. Our financial statements do not include any adjustments that may result from the outcome of this uncertainty.

WE MAY REQUIRE ADDITIONAL FUNDS WHICH WE PLAN TO RAISE THROUGH THE SALE OF OUR COMMON STOCK, WHICH REQUIRES FAVORABLE MARKET CONDITIONS AND INTEREST IN OUR ACTIVITIES BY INVESTORS. IF WE ARE NOT BE ABLE TO SELL OUR COMMON STOCK, FUNDING WILL NOT BE AVAILABLE FOR CONTINUED OPERATIONS, AND OUR BUSINESS WILL FAIL.

We anticipate that our current cash of $42,850 will be sufficient to complete the first phase of our planned exploration program on the Monty Lode mining claim. Subsequent exploration activities will require additional funding. Our only present means of funding is through the sale of our common stock. The sale of common stock requires favorable market conditions for exploration companies like ours, as well as specific interest in our stock, neither of which may exist if and when additional funding is required by us. If we are unable to raise additional funds in the future, our business will fail.

WE HAVE A VERY LIMITED HISTORY OF OPERATIONS AND ACCORDINGLY THERE IS NO TRACK RECORD THAT WOULD PROVIDE A BASIS FOR ASSESSING OUR ABILITY TO CONDUCT SUCCESSFUL MINERAL EXPLORATION ACTIVITIES. WE MAY NOT BE SUCCESSFUL IN CARRYING OUT OUR BUSINESS OBJECTIVES.

We were incorporated on September 25, 2007 and to date, have been involved primarily in organizational activities, obtaining financing and acquiring an interest in the claims. Accordingly we have no track record of successful exploration activities, strategic decision making by management, fund-raising ability, and other factors that would allow an investor to assess the likelihood that we will be successful as a junior resource exploration company. Junior exploration companies often fail to achieve or maintain successful operations, even in favorable market conditions. There is a substantial risk that we will not be successful in our exploration activities, or if initially successful, in thereafter generating any operating revenues or in achieving profitable operations.

The Monty Lode mining claim has an expiration date of September 1, 2010. In order to maintain the tenure of our ownership of the claim in good standing, it will be necessary for us to pay an annual maintenance fee of $125 to the Bureau of Land Management before the expiration date.

DUE TO THE SPECULATIVE NATURE OF MINERAL PROPERTY EXPLORATION, THERE IS SUBSTANTIAL RISK THAT NO COMMERCIALLY VIABLE MINERAL DEPOSITS WILL BE FOUND ON OUR MONTY LODE CLAIM OR OTHER MINERAL PROPERTIES THAT WE ACQUIRE.

In order for us to even commence mining operations we face a number of challenges which include finding qualified professionals to conduct our exploration program, obtaining adequate financing to continue our exploration program, locating a viable mineral body, partnering with a senior mining company, obtaining mining permits, and ultimately selling minerals in order to generate revenue. Moreover, exploration for commercially viable mineral deposits is highly speculative in nature and involves substantial risk that no viable mineral deposits will be located on any of our present or future mineral properties. There is a substantial risk that the exploration program that we will conduct on the Claim may not result in the discovery of any significant mineralization, and therefore no commercial viable mineral deposit. There are numerous geological features that we may encounter that would limit our ability to locate mineralization or that could interfere with our exploration programs as planned, resulting in unsuccessful exploration efforts. In such a case, we may incur significant costs associated with an exploration program, without any benefit. This would likely result in a decrease in the value of our common stock.

DUE TO THE INHERENT DANGERS INVOLVED IN MINERAL EXPLORATION, THERE IS A RISK THAT WE MAY INCUR LIABILITY OR DAMAGES AS WE CONDUCT OUR BUSINESS.

The search for minerals involves numerous hazards. As a result, we may become subject to liability for such hazards, including pollution, cave-ins and other hazards against which we cannot insure or may elect not to insure. We currently have no such insurance nor do we expect to obtain such insurance for the foreseeable future. If a hazard were to occur, the costs of rectifying the hazard may exceed our asset value and cause us to liquidate all our assets and cease operations, resulting in the loss of your entire investment.

OUR ACTIVITIES ARE SUBJECT TO GOVERNMENTAL REGULATIONS WHICH MAY SUBJECT US TO PENALTIES FOR FAILURE TO COMPLY, MAY LIMIT OUR ABILITY TO CONDUCT EXPLORATION ACTIVITIES AND COULD CAUSE US TO DELAY OR ABANDON OUR PROJECT.

Various regulatory requirements affect the current and future activities of the Company, including exploration activities on our lode claim. Exploration activities require permits from various federal, state and local governmental authorities and are subject to laws and regulations governing, among other things, prospecting, exports, taxes, labor standards, occupational health, waste disposal, toxic substances, land use, environmental protection, mine safety, and others which currently or in the future may have a substantial adverse impact on the Company. Exploration activities are also subject to substantial regulation under these laws by governmental agencies and may require that the Company obtain permits from various governmental agencies.

Licensing and permitting requirements are subject to changes in laws and regulations and in various operating circumstances. There can be no assurance that the Company will be able to obtain or maintain all necessary licenses and/or permits it may require for its activities or that such permits will be will be obtainable on reasonable terms or on a timely basis or that such laws and regulations will not have an adverse effect on any project which we might undertake. If the Company is unable to obtain the necessary licenses or permits for our exploration activities, we might have to change or abandon our planned exploration for such non-permitted properties and/or to seek other joint venture arrangements. In such event, the Company might be forced to sell or abandon its property interests.

Failure to comply with applicable laws, regulations, and permitting requirements may result in enforcement actions, including orders issued by regulatory or judicial authorities causing exploration activities to cease or be curtailed, and may include corrective measures requiring capital expenditures, installation of additional equipment, or remedial actions. Parties engaged in mining activities may be required to compensate those suffering loss or damage by reason of the mining activities and may have civil or criminal fines or penalties imposed for violations of applicable laws or regulations and, in particular, environmental laws.

Any change in or amendments to current laws, regulations and permits governing activities of mineral exploration companies, or more stringent implementation thereof, could require increases in exploration expenditures, or require delays in exploration or abandonment of new mineral properties. The cost of compliance with changes in governmental regulations has a potential to increase the Company’s expenses.

BECAUSE THE COMPANY IS SUBJECT TO COMPLIANCE WITH ENVIRONMENTAL REGULATION, THE COST OF OUR EXPLORATION PROGRAM MAY INCREASE.

Our operations may be subject to environmental regulations promulgated by government agencies from time to time. Environmental legislation provides for restrictions and prohibitions on spills, releases or emissions of various substances produced in association with certain exploration and mining industry operations, such as seepage from tailings disposal areas, which would result in environmental pollution. A breach of such legislation may result in the imposition of fines and penalties. In addition, certain types of operations require the submission and approval of environmental impact assessments. Environmental legislation is evolving in a manner which means stricter standards, and enforcement, fines and penalties for non-compliance are more stringent. Environmental assessments of proposed projects carry a heightened degree of responsibility for companies and directors, officers and employees. The cost of compliance with changes in governmental regulations has a potential to reduce the profitability of operations.

THE MARKET PRICE FOR PRECIOUS METALS IS BASED ON NUMEROUS FACTORS OUTSIDE OF OUR CONTROL. THERE IS A RISK THAT THE MARKET PRICE FOR PRECIOUS METALS WILL SIGNIFICANTLY DECREASE, WHICH WILL MAKE IT DIFFICULT FOR US TO FUND FURTHER MINERAL EXPLORATION ACTIVITIES, AND WOULD DECREASE THE PROBABILITY THAT ANY SIGNIFICANT MINERALIZATION THAT WE LOCATE CAN BE ECONOMICALLY EXTRACTED.

Numerous factors beyond our control may affect the marketability of minerals. These factors include market fluctuations, the proximity and capacity of natural resource markets and processing equipment, government regulations, including regulations relating to prices, taxes, royalties, land tenure, land use, importing and exporting of minerals and environmental protection. The exact effect of these factors cannot be accurately predicted, but the combination of these factors may result in our not receiving an adequate return on invested capital and you may lose your entire investment in this offering.

OUR OFFICERS AND DIRECTORS MAY HAVE A CONFLICT OF INTEREST WITH THE MINORITY SHAREHOLDERS AT SOME TIME IN THE FUTURE. SINCE THE MAJORITY OF OUR SHARES OF COMMON STOCK ARE OWNED BY OUR PRESIDENT, CHIEF EXECUTIVE OFFICER AND DIRECTORS, OUR OTHER STOCKHOLDERS MAY NOT BE ABLE TO INFLUENCE CONTROL OF THE COMPANY OR DECISION MAKING BY MANAGEMENT OF THE COMPANY.

Our directors beneficially own 84.2% of our outstanding common stock. The interests of our directors may not be, at all times, the same as that of our other shareholders. Our directors are not simply passive investors but are also executive officers of the Company, their interests as executives may, at times be adverse to those of passive investors. Where those conflicts exist, our shareholders will be dependent upon our directors exercising, in a manner fair to all of our shareholders, their fiduciary duties as officers or as members of the Company’s Board of Directors. Also, our directors will have the ability to control the outcome of most corporate actions requiring shareholder approval, including the sale of all or substantially all of our assets and amendments to our articles of incorporation. This concentration of ownership may also have the effect of delaying, deferring or preventing a change of control of us, which may be disadvantageous to minority shareholders.

SINCE OUR OFFICERS AND DIRECTORS HAVE THE ABILITY TO BE EMPLOYED BY OR CONSULT FOR OTHER COMPANIES, THEIR OTHER ACTIVITIES COULD SLOW DOWN OUR OPERATIONS.

Our officers and directors are not required to work exclusively for us and do not devote all of their time to our operations. Therefore, it is possible that a conflict of interest with regard to their time may arise based on their employment by other companies. Their other activities may prevent them from devoting full-time to our operations which could slow our operations and may reduce our financial results because of the slowdown in operations. It is expected that each of our officers and directors will devote between 5 and 10 hours per week to our operations on an ongoing basis, and when required will devote whole days and even multiple days at a stretch when property visits are required or when extensive analysis of information is needed. We do not have any written procedures in place to address conflicts of interest that may arise between our business and the business activities of our directors.

CURRENT MANAGEMENT’S LACK OF EXPERIENCE IN AND/OR WITH MINING AND, IN PARTICULAR, MINERAL EXPLORATION ACTIVITY, MEANS THAT IT IS DIFFICULT TO ASSESS, OR MAKE JUDGMENTS ABOUT, OUR POTENTIAL SUCCESS.

None of our officers or directors has any prior experience with or ever been employed in the mining industry. Additionally, none of our officer or directors has a college or university degree, or other educational background, in mining or geology or in a field related to mining. More specifically, each of our officers and directors lack technical training and experience with exploring for, starting, and/or operating a mine. With no direct training or experience in these areas, each of our officers and directors may not be fully aware of many of the specific requirements related to mineral exploration, let alone the overall mining industry as a whole. For example, each of our officer’s and director’s decisions and choices may fail to take into account standard engineering and other managerial approaches mineral exploration companies commonly use. Consequently, our operations, earnings, and ultimate financial success could suffer irreparable harm due to our officers’ and directors’ future possible mistakes, lack of sophistication, judgment or experience in this particular industry. As a result, if we do obtain the funding or other means to implement a bona fide mineral exploration program, such program will likely have to be implemented and carried out by joint venturers, partners or independent contractors who would have the requisite mineral exploration experience and know-how that we currently lack.

IF THE SELLING SHAREHOLDERS SELL A LARGE NUMBER OF SHARES ALL AT ONCE OR IN BLOCKS, THE MARKET PRICE OF OUR SHARES WOULD MOST LIKELY DECLINE.

The selling shareholders are offering up to 1,860,000 shares of our common stock through this prospectus. Our common stock is presently not traded or quoted on any market or securities exchange, but should a market develop, shares sold at a price below the current market price at which the common stock is quoted will cause that market price to decline. Moreover, the offer or sale of a large number of shares at any price may cause the market price to fall. The outstanding shares of common stock covered by this prospectus represent 15.8% of the common shares outstanding as of the date of this prospectus.

RISKS RELATING TO OUR COMMON STOCK

THERE IS NO LIQUIDITY AND NO ESTABLISHED PUBLIC MARKET FOR OUR COMMON STOCK AND WE MAY NOT BE SUCCESSFUL AT OBTAINING A QUOTATION ON A RECOGNIZED QUOTATION SERVICE. IN SUCH EVENT IT MAY BE DIFFICULT TO SELL YOUR SHARES.

There is presently no public market in our shares. There can be no assurance that we will be successful at developing a public market or in having our common stock quoted on a quotation facility such as the OTC Bulletin Board. There are risks associated with obtaining a quotation, including that broker dealers will not be willing to make a market in our shares, or to request that our shares be quoted on a quotation service. In addition, even if a quotation is obtained, the OTC Bulletin Board and similar quotation services are often characterized by low trading volumes, and price volatility, which may make it difficult for an investor to sell our common stock on acceptable terms. If trades in our common stock are not quoted on a quotation facility, it may be very difficult for an investor to find a buyer for their shares in our Company.

Under U.S. federal securities legislation, our common stock will constitute “penny stock”. Penny stock is any equity security that has a market price of less than $5.00 per share, subject to certain exceptions. For any transaction involving a penny stock, unless exempt, the rules require that a broker or dealer approve a potential investor’s account for transactions in penny stocks, and the broker or dealer receive from the investor a written agreement to the transaction, setting forth the identity and quantity of the penny stock to be purchased. In order to approve an investor’s account for transactions in penny stocks, the broker or dealer must obtain financial information and investment experience objectives of the person, and make a reasonable determination that the transactions in penny stocks are suitable for that person and the person has sufficient knowledge and experience in financial matters to be capable of evaluating the risks of transactions in penny stocks. The broker or dealer must also deliver, prior to any transaction in a penny stock, a disclosure schedule prepared by the Commission relating to the penny stock market, which, in highlight form sets forth the basis on which the broker or dealer made the suitability determination. Brokers may be less willing to execute transactions in securities subject to the “penny stock” rules. This may make it more difficult for investors to dispose of our common stock and cause a decline in the market value of our stock. Disclosure also has to be made about the risks of investing in penny stocks in both public offerings and in secondary trading and about the commissions payable to both the broker-dealer and the registered representative, current quotations for the securities and the rights and remedies available to an investor in cases of fraud in penny stock transactions. Finally, monthly statements have to be sent disclosing recent price information for the penny stock held in the account and information on the limited market in penny stocks.

WE MAY, IN THE FUTURE, ISSUE ADDITIONAL COMMON SHARES, WHICH WOULD REDUCE INVESTORS’ PERCENT OF OWNERSHIP AND MAY DILUTE OUR SHARE VALUE.

Our Articles of Incorporation authorize the issuance of 75,000,000 shares of common stock. As of April 9, 2010, the Company had 11,860,000 shares of common stock outstanding. Accordingly, we may issue up to an additional 63,140,000 shares of common stock. The future issuance of common stock may result in substantial dilution in the percentage of our common stock held by our then existing shareholders. We may value any common stock issued in the future on an arbitrary basis. The issuance of common stock for future services or acquisitions or other corporate actions may have the effect of diluting the value of the shares held by our investors, and might have an adverse effect on any trading market for our common stock.

THERE IS NO CURRENT TRADING MARKET FOR OUR SECURITIES AND IF A TRADING MARKET DOES NOT DEVELOP, PURCHASERS OF OUR SECURITIES MAY HAVE DIFFICULTY SELLING THEIR SHARES.

There is currently no established public trading market for our securities and an active trading market in our securities may not develop or, if developed, may not be sustained. We intend to have an application filed for admission to quotation of our securities on the OTC Bulletin Board after this prospectus is declared effective by the SEC. If for any reason our common stock is not quoted on the OTC Bulletin Board or a public trading market does not otherwise develop, purchasers of the shares may have difficulty selling their common stock should they desire to do so. No market makers have committed to becoming market makers for our common stock and none may do so.

Secondary trading in common stock sold in this offering will not be possible in any state until the common stock is qualified for sale under the applicable securities laws of the state or there is confirmation that an exemption, such as listing in certain recognized securities manuals, is available for secondary trading in the state. If we fail to register or qualify, or to obtain or verify an exemption for the secondary trading of, the common stock in any particular state, the common stock could not be offered or sold to, or purchased by, a resident of that state. In the event that a significant number of states refuse to permit secondary trading in our common stock, the liquidity for the common stock could be significantly impacted thus causing you to realize a loss on your investment.

Upon effectiveness of this Prospectus, the Company intends to become a “reporting issuer” under Section 12(g) of the U.S. Securities Exchange Act of 1934, as amended, by way of filing a Form 8-A with the Securities and Exchange Commission (“SEC”). A Form 8-A is a “short form” of registration whereby information about the Company will be incorporated by reference to the Registration Statement on Form S-1, under which this Prospectus became effective. Upon filing of the Form 8-A, the Company’s shares of common stock will become “covered securities,” or “federally covered securities” as described in some states’ laws, which means that unless you are an “underwriter” or “dealer,” you will have a “secondary trading” exemption under the laws of most states (and the District of Columbia, Guam, the Virgin Islands and Puerto Rico) to resell the shares of common stock you purchase in this offering. However, four states do impose filing requirements on the Company: Michigan, New Hampshire, Texas and Vermont. The Company intends, at its own cost, to make the required notice filings in Michigan, New Hampshire, Texas and Vermont immediately after filings its Form 8-A with the SEC.

The Company does not intend to seek registration or qualification of its shares of common stock the subject of this offering in any State or territory of the United States. Aside from a “secondary trading” exemption, other exemptions under state law and the laws of US territories may be available to purchasers of the shares of common stock sold in this offering,

ANTI-TAKEOVER EFFECTS OF CERTAIN PROVISIONS OF NEVADA STATE LAW HINDER A POTENTIAL TAKEOVER OF MASCOT VENTURES.

Though not now, we may be or in the future we may become subject to Nevada’s control share law. A corporation is subject to Nevada’s control share law if it has more than 200 stockholders, at least 100 of whom are stockholders of record and residents of Nevada, and it does business in Nevada or through an affiliated corporation. The law focuses on the acquisition of a “controlling interest” which means the ownership of outstanding voting shares sufficient, but for the control share law, to enable the acquiring person to exercise the following proportions of the voting power of the corporation in the election of directors:

(i) one-fifth or more but less than one-third, (ii) one-third or more but less than a majority, or (iii) a majority or more. The ability to exercise such voting power may be direct or indirect, as well as individual or in association with others.

The effect of the control share law is that the acquiring person, and those acting in association with it, obtains only such voting rights in the control shares as are conferred by a resolution of the stockholders of the corporation, approved at a special or annual meeting of stockholders. The control share law contemplates that voting rights will be considered only once by the other stockholders. Thus, there is no authority to strip voting rights from the control shares of an acquiring person once those rights have been approved. If the stockholders do not grant voting rights to the control shares acquired by an acquiring person, those shares do not become permanent non-voting shares. The acquiring person is free to sell its shares to others. If the buyers of those shares themselves do not acquire a controlling interest, their shares do not become governed by the control share law.

If control shares are accorded full voting rights and the acquiring person has acquired control shares with a majority or more of the voting power, any stockholder of record, other than an acquiring person, who has not voted in favor of approval of voting rights is entitled to demand fair value for such stockholder’s shares.

Nevada’s control share law may have the effect of discouraging takeovers of the corporation.

The effect of Nevada’s business combination law is to potentially discourage parties interested in taking control of Mascot Ventures from doing so if it cannot obtain the approval of our board of directors.

BECAUSE WE DO NOT INTEND TO PAY ANY CASH DIVIDENDS ON OUR COMMON STOCK, OUR STOCKHOLDERS WILL NOT BE ABLE TO RECEIVE A RETURN ON THEIR SHARES UNLESS THEY SELL THEM.

We intend to retain any future earnings to finance the development and expansion of our business. We do not anticipate paying any cash dividends on our common stock in the foreseeable future. Unless we pay dividends, our stockholders will not be able to receive a return on their shares unless they sell them. There is no assurance that stockholders will be able to sell shares when desired.

USE OF PROCEEDS

This prospectus relates to shares of our common stock that may be offered and sold from time to time by the selling stockholders. We will not receive any of the proceeds from the sale of the common shares being offered for sale by the selling security holders.

DETERMINATION OF THE OFFERING PRICE

The selling shareholders will sell our shares at $0.10 per share until our shares are quoted on the OTCBB, and thereafter at prevailing market prices or privately negotiated prices. This price was arbitrarily determined by us.

SELLING SECURITY HOLDERS

The following table sets forth the shares beneficially owned, as of April 9, 2010, by the selling security holders prior to the offering contemplated by this prospectus, the number of shares each selling security holder is offering by this prospectus and the number of shares which each would own beneficially if all such offered shares are sold.

Beneficial ownership is determined in accordance with Securities and Exchange Commission rules. Under these rules, a person is deemed to be a beneficial owner of a security if that person has or shares voting power, which includes the power to vote or direct the voting of the security, or investment power, which includes the power to vote or direct the voting of the security. The person is also deemed to be a beneficial owner of any security of which that person has a right to acquire beneficial ownership within 60 days. Under the Securities and Exchange Commission rules, more than one person may be deemed to be a beneficial owner of the same securities, and a person may be deemed to be a beneficial owner of securities as to which he or she may not have any pecuniary beneficial interest. Except as noted below, each person has sole voting and investment power.

The percentages below are calculated based on 11,860,000 shares of our common stock issued and outstanding as of April 9, 2010. We do not have any outstanding options, warrants or other securities exercisable for or convertible into shares of our common stock.

| | | | | | Total Number of | | | | | | | |

| | | | | | Shares to be Offered for | | | Total Shares | | | Percentage of | |

| | | Shares Owned | | | the Security | | | Owned After the | | | Shares owned After | |

| Name of | | Before | | | Holder’s | | | Offering is | | | the Offering is | |

| Selling Shareholder | | the Offering | | | Account | | | Complete | | | Complete | |

| Lisa Steele | | | 100,000 | | | | 100,000 | | | | 0 | | | | 0 | |

| Doug Walman | | | 100,000 | | | | 100,000 | | | | 0 | | | | 0 | |

| David Bromley | | | 100,000 | | | | 100,000 | | | | 0 | | | | 0 | |

| Justin Berridge | | | 100,000 | | | | 100,000 | | | | 0 | | | | 0 | |

| Doug Waldie | | | 100,000 | | | | 100,000 | | | | 0 | | | | 0 | |

| Kevin Woods | | | 100,000 | | | | 100,000 | | | | 0 | | | | 0 | |

| Chad Smith | | | 100,000 | | | | 100,000 | | | | 0 | | | | 0 | |

| George Clark | | | 100,000 | | | | 100,000 | | | | 0 | | | | 0 | |

| Stan Ker | | | 100,000 | | | | 100,000 | | | | 0 | | | | 0 | |

| Peter Dillon | | | 100,000 | | | | 100,000 | | | | 0 | | | | 0 | |

| Philip Argue | | | 100,000 | | | | 100,000 | | | | 0 | | | | 0 | |

| Jennifer Cano | | | 100,000 | | | | 100,000 | | | | 0 | | | | 0 | |

| Ruth Lawless | | | 100,000 | | | | 100,000 | | | | 0 | | | | 0 | |

| Al Haines | | | 100,000 | | | | 100,000 | | | | 0 | | | | 0 | |

| Tony Cairns | | | 100,000 | | | | 100,000 | | | | 0 | | | | 0 | |

| Kelly Short | | | 10,000 | | | | 10,000 | | | | 0 | | | | 0 | |

| Jan Young | | | 10,000 | | | | 10,000 | | | | 0 | | | | 0 | |

| Murray Mason | | | 10,000 | | | | 10,000 | | | | 0 | | | | 0 | |

| Harold Cole | | | 10,000 | | | | 10,000 | | | | 0 | | | | 0 | |

| Jim Parton | | | 10,000 | | | | 10,000 | | | | 0 | | | | 0 | |

| Ron White | | | 10,000 | | | | 10,000 | | | | 0 | | | | 0 | |

| Bob West | | | 10,000 | | | | 10,000 | | | | 0 | | | | 0 | |

| Bob David | | | 10,000 | | | | 10,000 | | | | 0 | | | | 0 | |

| Andrew Wagner | | | 10,000 | | | | 10,000 | | | | 0 | | | | 0 | |

| Bob Jones | | | 10,000 | | | | 10,000 | | | | 0 | | | | 0 | |

| Mark Eli | | | 10,000 | | | | 10,000 | | | | 0 | | | | 0 | |

| Kelly Price | | | 10,000 | | | | 10,000 | | | | 0 | | | | 0 | |

| Anne Clarke | | | 10,000 | | | | 10,000 | | | | 0 | | | | 0 | |

| Mark Crain | | | 10,000 | | | | 10,000 | | | | 0 | | | | 0 | |

| Bill Hay | | | 10,000 | | | | 10,000 | | | | 0 | | | | 0 | |

| Alex French | | | 10,000 | | | | 10,000 | | | | 0 | | | | 0 | |

| Karen Kelly | | | 10,000 | | | | 10,000 | | | | 0 | | | | 0 | |

| Dan Bissett | | | 10,000 | | | | 10,000 | | | | 0 | | | | 0 | |

| Bob Legh | | | 10,000 | | | | 10,000 | | | | 0 | | | | 0 | |

| Daniel Long | | | 10,000 | | | | 10,000 | | | | 0 | | | | 0 | |

| Bill Lyons | | | 10,000 | | | | 10,000 | | | | 0 | | | | 0 | |

| Peter Levy | | | 50,000 | | | | 50,000 | | | | 0 | | | | 0 | |

| Ed Hunter | | | 50,000 | | | | 50,000 | | | | 0 | | | | 0 | |

| Ben Lund | | | 50,000 | | | | 50,000 | | | | 0 | | | | 0 | |

| | | | | | | | | | | | | | | | | |

| Total | | | 1,860,000 | | | | 1,860,000 | | | | 0 | | | | 0 | |

We may require the selling stockholders to suspend the sales of the securities offered by this prospectus upon the occurrence of any event that makes any statement in this prospectus, or the related registration statement, untrue in any material respect, or that requires the changing of the statements in these documents in order to make statements in those documents not misleading. We will file a post-effective amendment to the registration statement to reflect any such material changes to this prospectus.

PLAN OF DISTRIBUTION

As of the date of this prospectus, there is no market for our securities. After the date of this prospectus, we expect to have an application filed with the Financial Industry Regulatory Authority for our common stock to be eligible for trading on the OTC Bulletin Board. Until our common stock becomes eligible for trading on the OTC Bulletin Board, the selling security holders will be offering our shares of common stock at a fixed price of $0.10 per common share. After our common stock becomes eligible for trading on the OTC Bulletin Board, the selling security holders may, from time to time, sell all or a portion of the shares of common stock on OTC Bulletin Board, in privately negotiated transactions or otherwise. After our common stock becomes eligible for trading on the OTC Bulletin Board, such sales may be at fixed prices prevailing at the time of sale, at prices related to the market prices or at negotiated prices.

After our common stock becomes eligible for trading on the OTC Bulletin Board, the shares of common stock being offered for resale by this prospectus may be sold by the selling security holders by one or more of the following methods, without limitation:

* ordinary brokerage transactions and transactions in which the broker solicits purchasers;

* privately negotiated transactions;

* market sales (both long and short to the extent permitted under the federal securities laws);

* at the market to or through market makers or into an existing market for the shares;

* through transactions in options, swaps or other derivatives (whether exchange listed or otherwise); and

* a combination of any of the aforementioned methods of sale.

In the event of the transfer by any of the selling security holders of its shares of common stock to any pledgee, donee or other transferee, we will amend this prospectus and the registration statement of which this prospectus forms a part by the filing of a post-effective amendment in order to have the pledgee, donee or other transferee in place of the selling security holder who has transferred his, her or its shares.

The selling security holders and any broker-dealers or agents that participate with the selling security holders in the sale of the shares of common stock may be deemed to be “underwriters” within the meaning of the Securities Act in connection with these sales. In that event, any commissions received by the broker-dealers or agents and any profit on the resale of the shares of common stock purchased by them may be deemed to be underwriting commissions or discounts under the Securities Act.

From time to time, any of the selling security holders may pledge shares of common stock pursuant to the margin provisions of customer agreements with brokers. Upon a default by a selling security holder, their broker may offer and sell the pledged shares of common stock from time to time. After our common stock becomes eligible for trading on the OTC Bulletin Board, upon a sale of the shares of common stock, the selling security holders intend to comply with the prospectus delivery requirements under the Securities Act by delivering a prospectus to each purchaser in the transaction. We intend to file any amendments or other necessary documents in compliance with the Securities Act that may be required in the event any of the selling security holders defaults under any customer agreement with brokers.

To the extent required under the Securities Act, a post effective amendment to this registration statement will be filed disclosing the name of any broker-dealers, the number of shares of common stock involved, the price at which the shares of common stock is to be sold, the commissions paid or discounts or concessions allowed to such broker-dealers, where applicable, that such broker-dealers did not conduct any investigation to verify the information set out or incorporated by reference in this prospectus and other facts material to the transaction.

We and the selling security holders will be subject to applicable provisions of the Exchange Act and the rules and regulations under it, including, without limitation, Rule 10b-5 and, insofar as a selling security holder is a distribution participant and we, under certain circumstances, may be a distribution participant, under Regulation M. All of the foregoing may affect the marketability of the shares of common stock.

Any shares of common stock covered by this prospectus which qualify for sale pursuant to Rule 144 under the Securities Act, as amended, may be sold under Rule 144 rather than pursuant to this prospectus.

PENNY STOCK RULES

The Securities Exchange Commission has also adopted rules that regulate broker-dealer practices in connection with transactions in “penny stocks” as such term is defined by Rule 15g-9. Penny stocks are generally equity securities with a price of less than $5.00 (other than securities registered on certain national securities exchanges or quoted on the NASDAQ system provided that current price and volume information with respect to transactions in such securities is provided by the exchange or system).

The shares offered by this prospectus constitute penny stock under the Securities and Exchange Act. The shares will remain penny stock for the foreseeable future. The classification of penny stock makes it more difficult for a broker-dealer to sell the stock into a secondary market, which makes it more difficult for a purchaser to liquidate his or her investment. Any broker-dealer engaged by the purchaser for the purpose of selling his or her shares in our company will be subject to the penny stock rules.

The penny stock rules require a broker-dealer, prior to a transaction in a penny stock not otherwise exempt from those rules, deliver a standardized risk disclosure document prepared by the Commission, which: (i) contains a description of the nature and level of risk in the market for penny stocks in both public offerings and secondary trading; (ii) contains a description of the broker’s or dealer’s duties to the customer and of the rights and remedies available to the customer with respect to a violation to such duties or other requirements of Securities’ laws; (iii) contains a brief, clear, narrative description of a dealer market, including bid and ask prices for penny stocks and significance of the spread between the bid and ask price; (iv) contains a toll-free telephone number for inquiries on disciplinary actions; (v) defines significant terms in the disclosure document or in the conduct of trading in penny stocks; and (vi) contains such other information and is in such form as the Commission shall require by rule or regulation. The broker-dealer also must provide to the customer, prior to effecting any transaction in a penny stock, (i) bid and offer quotations for the penny stock; (ii) the compensation of the broker-dealer and its salesperson in the transaction; (iii) the number of shares to which such bid and ask prices apply, or other comparable information relating to the depth and liquidity of the market for such stock; and (iv) monthly account statements showing the market value of each penny stock held in the customer’s account.

In addition, the penny stock rules require that prior to a transaction in a penny stock not otherwise exempt from those rules; the broker-dealer must make a special written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser’s written acknowledgment of the receipt of a risk disclosure statement, a written agreement to transactions involving penny stocks, and a signed and dated copy of a written suitability statement. These disclosure requirements will have the effect of reducing the trading activity in the secondary market for our stock because it will be subject to these penny stock rules. Therefore, stockholders may have difficulty selling those securities.

REGULATION M

During such time as we may be engaged in a distribution of any of the shares we are registering by this registration statement, we are required to comply with Regulation M. In general, Regulation M precludes any selling security holder, any affiliated purchasers and any broker-dealer or other person who participates in a distribution from bidding for or purchasing, or attempting to induce any person to bid for or purchase, any security which is the subject of the distribution until the entire distribution is complete. Regulation M defines a “distribution” as an offering of securities that is distinguished from ordinary trading activities by the magnitude of the offering and the presence of special selling efforts and selling methods. Regulation M also defines a “distribution participant” as an underwriter, prospective underwriter, broker, dealer, or other person who has agreed to participate or who is participating in a distribution.

Regulation M under the Exchange Act prohibits, with certain exceptions, participants in a distribution from bidding for or purchasing, for an account in which the participant has a beneficial interest, any of the securities that are the subject of the distribution. Regulation M also governs bids and purchases made in order to stabilize the price of a security in connection with a distribution of the security. We have informed the selling shareholders that the anti-manipulation provisions of Regulation M may apply to the sales of their shares offered by this prospectus, and we have also advised the selling shareholders of the requirements for delivery of this prospectus in connection with any sales of the common stock offered by this prospectus.

CANADIAN SECURITIES LAW

Selling shareholders who are residents of a province of Canada must comply with applicable provincial securities laws to resell their securities. To the extent required by such provincial securities laws, selling shareholders will have to rely on available prospectus and registration exemptions to resell their securities. To the extent such an exemption is not available such residents may be subject to an indefinite hold period with respect to their securities of the Company. All Canadian shareholders should consult independent legal counsel with respect to ascertaining any available prospectus exemptions for reselling their securities of the Company.

GLOSSARY OF TECHNICAL TERMS

The following are definitions of certain technical terms used in this prospectus.

Bedding: A layer of sedimentary deposit.

Brecca: Rock composed of angular fragments of older rocks melded together.

Bullion: Gold or silver considered in mass rather than in value.

Conformity: Contact relationship between adjacent layers of the sedimentary rock, which are undisturbed and parallel to one and another. The thickness of each layer is uniform.

Cyanidation (MacArthur-Forrest Process): The method in which copper, silver, and gold are extracted from their ores.

Deposit: When mineralized material has been systematically drilled and explored so that a reasonable estimate of tonnage and economic grade can be made.

Development – Preparation of a mineral deposit for commercial production, including installation of plant and machinery.

Exploration Stage: A mining prospect which is not in either the development or production stage.

Fault: A planar feature produced by breaking of the Earth’s crust with movement on one, or both, sides of the plane.

Fold: A portion of strata that is folded or bent, as an anticline or syncline, or that connects two horizontal or parallel portions of strata of different levels (as a monocline).

Geophysical: Surveys that are conducted to measure the Earth’s physical properties as a means of identify areas where anomalous features may exist.

Igneous rocks - One of three types of rocks. It was formed from the congealing of molten rock fluids.

Intercalated: Interpolated; interposed.

Mine: An opening or excavation in the ground for the purpose of extracting minerals; a pit or excavation from which ores or other mineral substances are taken by digging; an opening in the ground made for the purpose of taking out minerals; an excavation properly underground for digging out some usable product, such as ore, including any deposit of any material suitable for excavation and working as a placer mine; collectively, the underground passage and workings and the minerals themselves.

Mineralized: Material added by hydrothermal solutions, principally in the formation of ore deposits. Often refers to the presence of a mineral of economic interest in a rock.

Mineralized Material: The term “mineralized material” refers to material that is not included in the reserve as it does not meet all of the criteria for adequate demonstration for economic or legal extraction.

Oxide: A mineral compound characterized by the linkage of oxygen with one or more metallic elements. Sulfide minerals typically convert to oxides on exposure to oxygen. Oxides are more amenable to heap leach techniques than are sulfides.

Porphyry: An igneous rock containing conspicuous crystals or phenocysts in a fine-grained groundmass; type of mineral deposit in which ore minerals are widely disseminated, generally of a low grade by large tonnage.

Sediments: Material that has been deposited on the surface of the Earth through geologic means, usually transported and deposited by water. This material may eventually be cemented into rock.

Silica: The dioxide form of silicon, SiO 2 , occurring especially as quartz sand, flint, and agate: used usually in the form of its prepared white powder chiefly in the manufacture of glass, water glass, ceramics, and abrasives. Also called silicon dioxide.

Siliceous: Adjective form of the noun silica; containing, consisting of, or resembling silica.

Sulfide: A mineral compound characterized by the linkage of sulphur with a metal.

Strata: Rock layers and their places in succession can be identified at a specific position in the sequence and do not recur. These rock layers are called strata.

Stratigraphy: a branch of geology dealing with the classification, nomenclature, correlation, and interpretation of stratified rocks.

Strike: The course or bearing of the outcrop of an inclined bed, vein, or fault plane on a level surface; the direction of a horizontal line perpendicular to the direction of the dip.

Tons: A unit of weight measurement. In this prospectus it means dry short tons (2,000 pounds).

Quartz: A mineral of silicon dioxide.

Sulfide: a compound of sulfur with a more electropositive element or, less often, a group.

Time Periods:

| Name of Era | | Name of Period | | Number of Years Before Present | |

| | | | | | |

| Quaternary | | Holocene | | 0 to 400,000 | |

| | | Pleistocene | | 400,000 to 1,800,000 | |

| Tertiary | | Pliocene | | 1,800,000 to 5,000,000 | |

| | | Miocene | | 5,000,000 to 24,000,000 | |

| | | Oligocene | | 24,000,000 to 36,500,000 | |

| | | Eocene | | 36,500,000 to 56,000,000 | |

| | | Paleocene | | 56,000,000 to 66,000,000 | |

| Mesozoic | | Cretaceous | | 66,000,000 to 140,000,000 | |

| | | Jurassic | | 140,000,000 to 200,000,000 | |

| | | Triassic | | 200,000,000 to 250,000,000 | |

| Paleozoic | | Permian | | 250,000,000 to 290,00,000 | |

| | | Carboniferous | | 290,000,000 to 365,000,000 | |

| | | Devonian | | 365,000,000 to 405,000,000 | |

| | | Silurian | | 405,000,000 to 425,000,000 | |

| | | Ordivician | | 425,000,000 to 500,000,000 | |

DESCRIPTION OF BUSINESS

ORGANIZATION WITHIN THE LAST FIVE YEARS

On September 25, 2007, the Company was incorporated under the laws of the State of Nevada. We are engaged in the business of acquisition, exploration and development of natural resource properties.

Wendy Wildmen has served as our President and Chief Executive Officer, and Treasurer, from October 3, 2007, until the current date. Clive Hope has served as our Secretary since October 3, 2007, until the current date. Our board of directors is comprised of two persons: Ms. Wildmen and Clive Hope.

We are authorized to issue 75,000,000 shares of common stock, par value $.001 per share. In October 2007 we issued 5,000,000 shares of common stock to each of our two directors, for an aggregate issuance of 10,000,000 shares. Said issuances were paid at a purchase price of the par value per share or a total of $10,000.

IN GENERAL

We are an exploration stage company engaged in the acquisition and exploration of mineral properties. We currently own a 100% undivided interest in the Monty Lode Claim located in Clark County, State of Nevada, that we call the “Monty Lode Property.” We are currently conducting mineral exploration activities on the Monty Lode Property in order to assess whether it contains any commercially exploitable mineral reserves. Currently there are no known mineral reserves on the Monty Lode Property.

We have not earned any revenues to date. Our independent auditor has issued an audit opinion which includes a statement expressing substantial doubt as to our ability to continue as a going concern. The source of information contained in this discussion is our geology report prepared by Laurence Sookochoff, P. Eng., dated September 23, 2009.

There is the likelihood of our mineral claim containing little or no economic mineralization or reserves of silver and other minerals. We are presently in the exploration stage of our business and we can provide no assurance that any commercially viable mineral deposits exist on our mineral claims, that we will discover commercially exploitable levels of mineral resources on our property, or, if such deposits are discovered, that we will enter into further substantial exploration programs. Further exploration is required before a final determination can be made as to whether our mineral claims possess commercially exploitable mineral deposits. If our claim does not contain any reserves all funds that we spend on exploration will be lost.

On September 23, 2009, we purchased a 100% undivided interest in a mineral claim known as the Monty Lode Claim for a price of $6,500. The claims are in good standing until September 1, 2010.

We engaged Laurence Sookochoff, P. Eng., to prepare a geological evaluation report on the Monty Lode Property. Mr. Sookochoff is a consulting professional geologist in the Geological Section of the Association of Professional Engineers and Geoscientists of British Columbia. Mr. Sookochoff attended the University of British Columbia and holds a Bachelor of Science degree in geology.

The work completed by Mr. Sookochoff in preparing the geological report consisted of a review of geological data from previous exploration within the region. The acquisition of this data involved the research and investigation of historical files to locate and retrieve data information acquired by previous exploration companies in the area of the mineral claims.

We received the geological evaluation report on the Monty Lode Property entitled “Geological Evaluation Report on the Monty Lode Mining Claim, Yellow Pine Mining District, Clark County, Nevada, USA” prepared by Mr. Sookochoff on September 23, 2009. The geological report summarizes the results of the history of the exploration of the mineral claims, the regional and local geology of the mineral claims and the mineralization and the geological formations identified as a result of the prior exploration. The geological report also gives conclusions regarding potential mineralization of the mineral claims and recommends a further geological exploration program on the mineral claims. The description of the Monty Lode Property provided below is based on Mr. Sookochoff’s report.

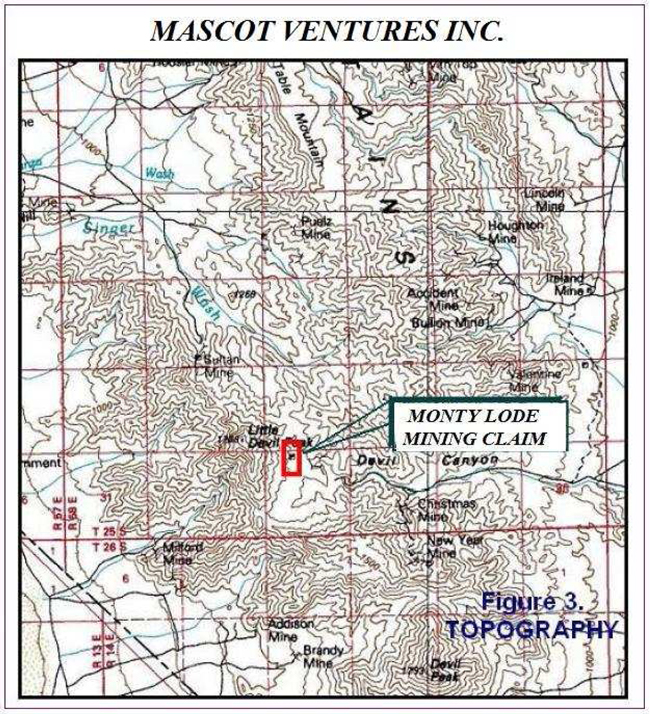

DESCRIPTION OF PROPERTY

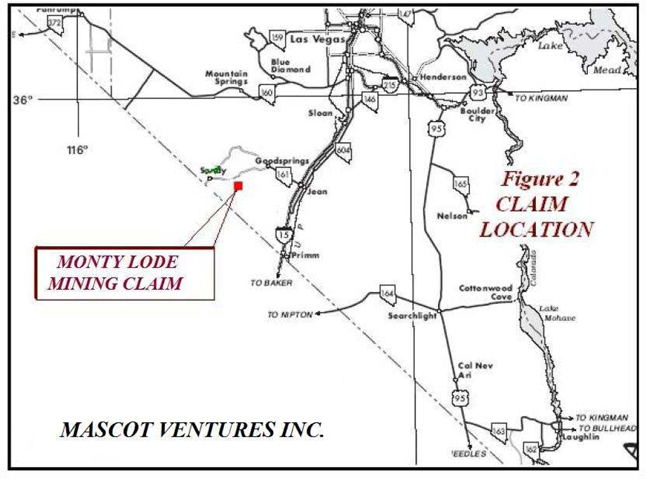

The property owned by Mascot Ventures is the Monty Lode Claim which is comprised of one located mineral claim. The Monty Lode Claim is located within Township 25S, Range 58E, Sections 28 & 33 in the Yellow Pine Mining District of Clark County Nevada. Access from Las Vegas, Nevada to the Monty Lode Claim is southward via Interstate Highway 15 for approximately 31 miles, to within five miles past Jean, Nevada, and then westerly for seven miles to the Monty Lode Claim. The entire distance from Las Vegas to the Monty Lode Claim is approximately 39 miles.

The claim was recorded with the Recorder’s Office in Clark County, NV and the Bureau of Land Management.

PHYSIOGRAPHY, CLIMATE, VEGETATION & WATER

The Monty Lode Property is situated in Nevada, at the southern end of the Sheep Mountain Range, a north-south trending range of mountains with peaks reaching an elevation of 4,184 feet. The western portion of the claim covers a plateau-like area at an elevation of 1,300 feet with a range of elevation on the property of a maximum of 100 feet.

The area is of a typically desert climate and relatively high temperature and low precipitation. Vegetation consists mainly of desert shrubs and cactus. Sources of water would be available from valley wells.

PROPERTY HISTORY

The Monty Lode Property is situated in the Yellow Pine Mining District, which stems from 1856, when Mormon missionaries reported ore in the area. In 1857, the smelting of ore produced approximately 9,000 pounds of lead, and in 1898, a mill was built south of Goodsprings, near the Monty Lode Property. As a result of the mill availability, exploration activity led to the discovery of many of the mines in the area. The completion of the San Pedro, Los Angeles and Salt Lake railroads in 1905 and recognition of oxidized zinc minerals in the ore in 1906 stimulated development of the mines and the region has been subject to intermittent activity up to 1964, particularly during the World War I and II years.

Production from the mines of the Yellow Pine Mining District from 1902 to 1929 was 477,717 tons. Bullion recovery from 7,656 tons of this ore by amalgamation and cyanidation was 9,497 ounces of gold and 2,445 ounces of silver. The concentrator treated 230,452 tons of ore which yielded 58,641 tons of lead-zinc concentrate and 32,742 tons of lead concentrate. Crude ore shipped to 1929 was 227,952 tons from which recovery amounted to 3,196 ounces gold, 422,379 ounces silver, 3,085,675 pounds copper, 34,655,460 pounds lead and 110,833,051 pounds zinc.

Reported production from the Monty Lode Property workings is included in production from the mines within the immediate area of the Monty Lode Claim including Reported production from the Monty Lode Property workings is included in production from the mines within the immediate area of the Monty Lode Claim including production from the Christmas Mine and the Eureka Mine. The three mines reported production of 532,505 lb lead, 449,886 lb zinc, 16,635 oz silver, 2 oz gold and 195 lb copper.

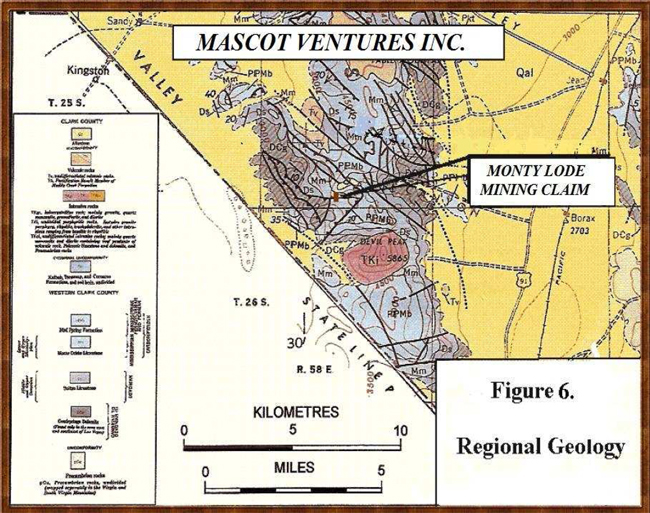

REGIONAL GEOLOGY

In the Yellow Pine district, the Spring Mountain Range in the west, and the Sheep Mountain Range in the east consist maily of Paleozoic sediments which have undergone intense folding accompanied by faulting. A series of Carnoniferous sediments consist largely of siliceous limestones and include strata of pure crystalline limestone and dolomite with occasional intercalated beds of fine grained sandstone. These strata have a general west to southwest dip of from 15 to 45 degrees which is occasionally disturbed by local folds. Igneous rocks are scarce and are represented chiefly by quartz-monzonite porphyry dikes and sills. The quartz-monzonite porphyry is intruded into these strata and is of post-Jurassic age, perhaps Tertiary.

STRATIGRAPHY

The sedimentary rocks in the district range in age from Upper Cambrian to Recent. The Paleozoic section includes the Cambrian Bonanza King and Nopah Formations, the Devonian Sultan, Mississippian Monte Cristo Limestone, Pennsylvanian/Mississippian Bird Spring Formation and Permina Kaibab Limestone (Carr, 1987).

Only two varieties of intrusive rocks are known in the district. The most abundant is granite porphyry which forms three large sill-like masses (Hewett, 1931). The sills generally lie near major thrust faults and are thought to have been emplaced along breccia zones at the base of the upper plate of the thrust fault. Locally, small dikes of basaltic composition and uncertain age have been encountered in some of the mine workings.

STRUCTURE

The region reveals an amazing record of folding, thrust faulting and normal faultings. Folding began in the early Jurassic, resulting in broad flexures in the more massive units and tight folds in the thinly bedded rocks. The thrust faults in the district are part of a belt of thrust faulted rocks, the Foreland Fold and Thrust Belt that stretches from southern Canada to southern California. Deformation within this belt began in the Jurassic and continued until Cretaceous time. Within the Goodsprings District thrust faulting appears to post-date much of the folding, but despite intensive study the actual age of thrusting continues to be the subject of contentious debate. Three major thrusts have been mapped; from west to east, the Green Monster, Keystone and Contact thrusts.

Of these, the Keystone is the most persistent along strike having been mapped for a distance of over 50 kilometers. The stratigraphic relationships along the Keystone fault are similar to those for all the major thrusts in the area. The Cambrian Bonanza King Formation has been thrust eastward over younter Paleozoic rocks.

PROPERTY GEOLOGY

The Monty Lode Claim covers some former exploratory workings which explored mineralization hosted by a breccia zone parallel to bedding in the Bird Spring Formation.

REGIONAL MINERALIZATION

ORE MINERALOGY AND ALTERATION

It is reported (Albritton, 1954) that ore deposits in the Goodsprings (Yellow Pine) district can at best be characterized as enigmatic. They appear to fall into two distinct types, which may or may not be related, gold-copper deposits and lead-zinc deposits. Gold-copper deposits are clearly related to sill-like masses of granite porphyry. All existing mines worked the contact between the intrusive and surrounding sedimentary rock. Gold occurred in both the instrusive and the carbonate wall rocks. It appears any carbonate unit was a suitable host.

The lead-zinc deposits are often distant from the intrusives and occur as veins or replacements of brecciated rocks along fault zones, either thrust faults or normal faults. Unlike the gold deposits, the productive lead-zinc deposits are restricted to the Monte Cristo Formation.

Mineralogy of gold-copper deposits consists of native gold, pyrite, limonite, cinnabar, malachite, azurite and chrysocolla. Lead-zinc deposits are comprised of hydrozincite, calamine, smithsonite, cerrusite, anglesite, galena and iron oxides. The rather unusual mineralogy of the district is due to the great depth of surface oxidation; exceeding 600 feet.

ORE MINERALOGY AND ALTERATION

Typical sulfides such as chalcopyrite, sphalerite and pyrite have been partially or completely altered to more stable hydrated carbonates and sulfates. Only the highly insoluble lead sulfide, galena has successfully resisted surface oxidation.

Primary alteration is difficult to characterize due to the supergene overprint, but again appears to differ for gold-copper deposits and lead-zinc deposits. Gold-copper ores have been extensively sericitized and kaolinized, alterning the host pluton to a rock that can be mined through simple excavation with little or no blasting. The rock is so thoroughly altered it decrepitates on exposure to the atmosphere. On the other hand, lead-zinc deposits appear to be characterized by dolomization and minor silicification.

PROPERTY MINERALIZATION

The workings on the Monty Lode Claim reveal silver/lead/zinc mineralization with vanadinite and cuprodescloizite in a limesone breccia zone parallel to bedding in the Bird Spring Formation. Gold is also reported.

PRESENT PROPERTY CONDITION AND PERMITTING REQUIREMENTS

The Monty Lode Property has no plant and equipment, infrastructure or other facilities, and there is currently no exploration of the Monty Lode Property. We have incurred $39,562 in operating costs, which sum includes $3,620 of exploration expenditures, as at October 31, 2009. We expect to incur $94,000 of exploration costs to complete Phases 1, 2 and 3 of our Plan of Operation, with Phase 3 being Positive areas of the Monty Lode Property being diamond drill tested. There is no source of power or water on the Monty Lode Property that can be utilized.

A yearly maintenance fee of $125.00 is required to be paid to the Bureau of Land Management prior to the expiry date to keep the claim in good standing for an additional year. No other permits are required for us to perform the exploration activities on the Monty Lode Property.

CONDITIONS TO RETAIN TITLE TO THE CLAIM

State and Federal regulations require a yearly maintenance fee to keep the claim in good standing. In accordance with Federal regulations, the Monty Lode Claim is in good standing to September 1, 2010. A yearly maintenance fee of $125.00 is required to be paid to the Bureau of Land Management prior to the expiry date to keep the claim in good standing for an additional year.

COMPETITIVE CONDITIONS

The mineral exploration business is an extremely competitive industry. We are competing with many other exploration companies looking for minerals. We are a very early stage mineral exploration company and a very small participant in the mineral exploration business. Being a junior mineral exploration company, we compete with other companies like ours for financing and joint venture partners. Additionally, we compete for resources such as professional geologists, camp staff, helicopters and mineral exploration supplies.

GOVERNMENT APPROVALS AND RECOMMENDATIONS

We will be required to comply with all regulations, rules and directives of governmental authorities and agencies applicable to the exploration of minerals in USA generally, and in Nevada specifically.

COSTS AND EFFECTS OF COMPLIANCE WITH ENVIRONMENTAL LAWS

We currently have no costs to comply with environmental laws concerning our exploration program. We will also have to sustain the cost of reclamation and environmental remediation for all work undertaken which causes sufficient surface disturbance to necessitate reclamation work. Both reclamation and environmental remediation refer to putting disturbed ground back as close to its original state as possible. Other potential pollution or damage must be cleaned-up and renewed along standard guidelines outlined in the usual permits. Reclamation is the process of bringing the land back to a natural state after completion of exploration activities. Environmental remediation refers to the physical activity of taking steps to remediate, or remedy, any environmental damage caused, i.e. refilling trenches after sampling or cleaning up fuel spills. Our initial programs do not require any reclamation or remediation other than minor clean up and removal of supplies because of minimal disturbance to the ground. The amount of these costs is not known at this time as we do not know the extent of the exploration program we will undertake, beyond completion of the recommended three phases described above. Because there is presently no information on the size, tenor, or quality of any resource or reserve at this time, it is impossible to assess the impact of any capital expenditures on our earnings or competitive position in the event a potentially economic deposit is discovered.

EMPLOYEES

We currently have no employees other than our directors. We intend to retain the services of geologists, prospectors and consultants on a contract basis to conduct the exploration programs on our mineral claims and to assist with regulatory compliance and preparation of financial statements.

OUR EXECUTIVE OFFICES

Our executive offices are located at 1802 North Carson Street, Suite 212, Carson City, Nevada 89701

LEGAL PROCEEDINGS

There are no pending legal proceedings to which the Company is a party or in which any director, officer or affiliate of the Company, any owner of record or beneficially of more than 5% of any class of voting securities of the Company, or security holder is a party adverse to the Company or has a material interest adverse to the Company. The Company’s mineral claim is not the subject of any pending legal proceedings.

MARKET FOR COMMON EQUITY AND RELATED STOCKHOLDER MATTERS

MARKET INFORMATION

ADMISSION TO QUOTATION ON THE OTC BULLETIN BOARD

We intend to have our common stock be quoted on the OTC Bulletin Board. If our securities are not quoted on the OTC Bulletin Board, a security holder may find it more difficult to dispose of, or to obtain accurate quotations as to the market value of our securities. The OTC Bulletin Board differs from national and regional stock exchanges in that it:

(1) is not situated in a single location but operates through communication of bids, offers and confirmations between broker-dealers, and

(2) securities admitted to quotation are offered by one or more Broker-dealers rather than the “specialist” common to stock exchanges.