| | | | | | | | | | | | | | | | | | | | |

2025 | | | 55 | | | | 17,525 | | | | 7.4% | | | | 455,473 | | | | 6.6% | |

2026 | | | 41 | | | | 18,989 | | | | 8.1% | | | | 497,460 | | | | 7.3% | |

2027 | | | 41 | | | | 15,351 | | | | 6.5% | | | | 529,339 | | | | 7.7% | |

2028 | | | 19 | | | | 9,474 | | | | 4.0% | | | | 293,196 | | | | 4.3% | |

2029 | | | 11 | | | | 19,878 | | | | 8.4% | | | | 394,430 | | | | 5.8% | |

Thereafter | | | 29 | | | | 36,930 | | | | 15.7% | | | | 974,353 | | | | 14.2% | |

| | | | | | | | | | | | | | | | | | | | |

Total | | | 662 | | | $ | 235,595 | | | | 100.0% | | | | 6,859,596 | | | | 100.0% | |

| | | | | | | | | | | | | | | | | | | | |

(1) Annualized base rent represents annualized contractual base rental income as of September 30, 2020, adjusted to straight-line any contractual tenant concessions (including free rent), rent increases and rent decreases from the lease’s inception through the balance of the lease term.

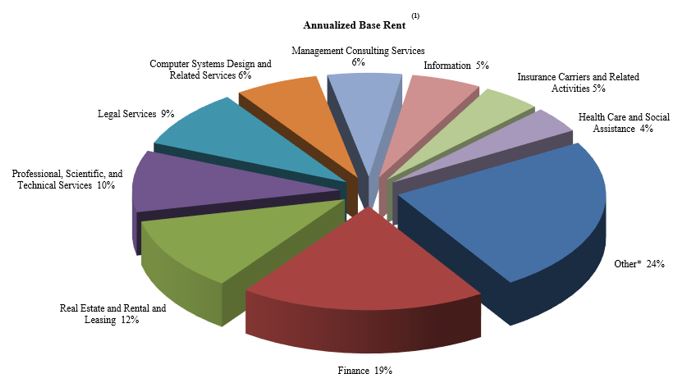

Significant Tenants and Industry Concentrations

As of September 30, 2020, our portfolio’s highest tenant industry concentrations (greater than 10% of annualized base rent) were as follows:

| | | | | | | | | | |

Industry | | Number of

Tenants | | Annualized Base Rent(1)

(in thousands) | | | Percentage of

Annualized Base Rent | |

Finance | | 125 | | $ | 44,816 | | | | 19.0% | |

Real Estate | | 60 | | | 27,101 | | | | 11.5% | |

(1) Annualized base rent represents annualized contractual base rental income as of September 30, 2020, adjusted to straight-line any contractual tenant concessions (including free rent), rent increases and rent decreases from the lease’s inception through the balance of the lease term.

As of September 30, 2020, no other tenant industries accounted for more than 10% of annualized base rent and no tenant accounted for more than 10% of the annualized base rent.

Real Estate-Related Investments

As of September 30, 2020, we, through an indirect wholly owned subsidiary, had originated one real estate loan receivable as follows (dollars in thousands):

| | | | | | | | | | | | | | | | | | | | | | |

Loan Name/Location of Related Property

or Collateral | | Date

Acquired /

Originated

| | Property

Type | | Loan

Type | | Payment

Type | | Outstanding

Principal

Balance

as of

September 30,

2020 (1) | | Purchase /

Origination

Price (2) | | Book Value

as of

September 30,

2020 (3) | | Loan-to-

Value | | Contractual

Interest

Rate (4) | | Annualized

Effective

Interest

Rate (4) | | Maturity

Date |

Hardware Village First Mortgage/ Salt Lake City, Utah | | 05/07/2020 | | Apartment | | Mortgage | | Interest

Only (5) | | $150,213 | | $150,213 | | $148,290 | | 84%(6) | | Higher of

3.95% or

one-month

LIBOR

+3.50% | | 5.34% | | 05/06/2021 |

(1) Outstanding principal balance as of September 30, 2020 represents original principal balance outstanding under the loan and does not include origination costs.

(2) Purchase/origination price represents the amount funded by us to acquire or originate the loan and does not include origination costs.

(3) Book value represents outstanding principal balance, adjusted for unamortized origination discounts and origination costs and net of an allowance for credit losses. During the nine months ended September 30, 2020, we recorded a provision for credit loss of $0.7 million, applying a probability-of-default method to measure the allowance for credit losses.

(4) Contractual interest rate is the stated interest rate on the face of the loan. Annualized effective interest rate is calculated as the actual interest income recognized in 2020, using the interest method, annualized and divided by the average amortized cost basis of the investment during 2020. The annualized effective interest rate and contractual interest rate presented are as of September 30, 2020.

(5) Monthly payments are interest only, with the outstanding principal due and payable at maturity on May 6, 2021; however, the buyer/borrower can prepay the outstanding principal and any unpaid accrued interest at any time without fee, premium or penalty.

(6) At origination, the loan-to-value ratio was 84%, based upon the amount funded at origination (excluding origination costs) and the “as-is” appraised value of the building securing the loan. Appraisals are based on numerous estimates, judgments and assumptions that significantly affect the appraised value of the underlying property. In addition, the value of the property will change over time.

On December 11, 2020, the borrower on the Hardware Village First Mortgage exercised its prepayment option available under the promissory note, pursuant to which the borrower paid off the entire outstanding principal balance and accrued interest in the amount of $150.4 million, without fee, premium or penalty. See below, “—Payoff of the Hardware Village First Mortgage”

In addition, as of September 30, 2020, we owned an investment in the equity securities of Prime US REIT. For purposes of the December 7, 2020 estimated value per share, we valued our investment in units of Prime US REIT at $203.5 million, based on the closing trading price of the units of Prime US REIT on the SGX-ST as of December 1, 2020 less a discount for blockage due to the quantity of units held by us relative to the normal level of trading volume in Prime US REIT units. As of December 7, 2020, we owned 289,561,899 units of Prime US REIT, which represented 27.4% of the outstanding units of Prime US REIT.

Financings

As of September 30, 2020 and December 31, 2019, our notes payable consisted of the following (dollars in thousands):

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Book Value as of

September 30,

2020 | | | Book Value as of

December 31,

2019 | | | Contractual

Interest Rate as of

September 30,

2020(1) | | | Effective

Interest Rate as of

September 30,

2020(1) | | | Payment Type | | | Maturity Date(2) | |

Anchor Centre Mortgage Loan(3) | | $ | 48,590 | | | $ | 49,043 | | |

| One-month

LIBOR + 1.50 |

% | | | 1.65 | % | | | Principal & Interest | | | | 12/1/2020 | |

201 17th Street Mortgage Loan(4) | | | — | | | | 64,750 | | | | (4) | | | | (4) | | | | (4) | | | | (4) | |

The Almaden Mortgage Loan | | | 93,000 | | | | 93,000 | | | | 4.20 | % | | | 4.20 | % | | | Interest Only | | | | 01/01/2022 | |

201 Spear Street Mortgage Loan | | | 125,000 | | | | 125,000 | | |

| One-month

LIBOR + 1.45 |

% | | | 1.60 | % | | | Interest Only | | | | 01/05/2024 | |

Carillon Mortgage Loan | | | 111,000 | | | | 111,000 | | |

| One-month

LIBOR +1.40 |

% | | | 1.55 | % | | | Interest Only | | | | 04/11/2024 | |

Portfolio Loan Facility(5) | | | 683,225 | | | | 684,225 | | |

| One-month

LIBOR + 1.80 |

% | | | 1.95 | % | | | Interest Only | | | | 11/03/2020 | |

Modified Portfolio Revolving Loan Facility(6) | | | 292,622 | | | | 196,113 | | |

| One-month

LIBOR + 1.50 |

% | | | 1.65 | % | | | Interest Only | | | | 03/01/2023 | |

3001 & 3003 Washington Mortgage Loan | | | 143,245 | | | | 143,245 | | |

| One-month

LIBOR + 1.45 |

% | | | 1.60 | % | | | Interest Only(7) | | | | 06/01/2024 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total notes payable principal outstanding | | $ | 1,496,682 | | | $ | 1,466,376 | | | | | | | | | | | | | | | | | |

Deferred financing costs, net | | | (4,557 | ) | | | (6,497 | ) | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total Notes Payable, net | | $ | 1,492,125 | | | $ | 1,459,879 | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

(1) Contractual interest rate represents the interest rate in effect under the loan as of September 30, 2020. Effective interest rate is calculated as the actual interest rate in effect as of September 30, 2020, consisting of the contractual interest rate and using interest rate indices as of September 30, 2020, where applicable.

(2) Represents the maturity date as of September 30, 2020; subject to certain conditions, the maturity dates of certain loans may be extended beyond the dates shown.

(3) As of September 30, 2020, the Anchor Centre Mortgage Loan has one six-month extension option to June 1, 2021, subject to conditions contained in the loan modification agreement.

(4) On January 23, 2020, the 201 17th Street Mortgage Loan was paid off and the 201 17th Street property was added to the collateral of the Modified Portfolio Revolving Loan Facility.

(5) As of September 30, 2020, the Portfolio Loan Facility was secured by RBC Plaza, Preston Commons, Sterling Plaza, Towers at Emeryville, Ten Almaden, Town Center and Accenture Tower. As of September 30, 2020, the face amount of the Portfolio Loan Facility was $911.0 million, of which $683.2 million was term debt and $227.8 million was revolving debt. As of September 30, 2020, the outstanding balance under the loan consisted of $683.2 million of term debt. As of September 30, 2020, an additional $227.8 million of revolving debt remained available for immediate future disbursements, subject to certain conditions set forth in the loan agreement. Subsequent to September 30, 2020, we released Accenture Tower as security from the Portfolio Loan Facility and exercised a one-year extension option to extend the maturity date to November 3, 2021. There is an additional one-year extension option remaining on the Portfolio Loan Facility.

(6) As of September 30, 2020, the Modified Portfolio Revolving Loan Facility was secured by 515 Congress, Domain Gateway, the McEwen Building, Gateway Tech Center and 201 17th Street. As of September 30, 2020, the face amount of the Modified Portfolio Revolving Loan Facility was $325.0 million, of which $162.5 million was term debt and $162.5 million was revolving debt. As of September 30, 2020, a total of $292.6 million was funded under the Modified Portfolio Revolving Loan Facility, of which $162.5 million was term debt and $130.1 million was revolving debt. As of September 30, 2020, an additional $32.4 million of revolving debt was available upon satisfaction of certain conditions set forth in the loan documents. During the term of the Modified Portfolio Revolving Loan Facility, we have an option to increase the committed amount of the Modified Portfolio Revolving Loan Facility up to four times with each increase of the committed amount to be at least $15.0 million but no greater than, in the aggregate, an additional $325.0 million so that the committed amount will not exceed $650.0 million, of which 50% would be term debt and 50% would be revolving debt, with the addition of one or more properties to secure the loan, subject to certain terms and conditions contained in the loan documents. The Modified Portfolio Revolving Loan Facility has two 12-month extension options, subject to certain terms, conditions and fees as described in the loan documents.

(7) Represents the payment type required as of September 30, 2020. Certain future monthly payments due under the loan also include amortizing principal payments.

As of September 30, 2020, we had debt obligations in the aggregate principal amount of $1.5 billion, with a weighted-average remaining term of 1.5 years. The maturity dates of certain loans may be extended beyond their current maturity date, subject to certain terms and conditions contained in the loan documents. Assuming our notes payable are fully extended under the terms of the respective loan agreements and other loan documents, we have $48.6 million of notes payable maturing or amortization payments due during the 12 months ending September 30, 2021. We plan to exercise our extension options available under our loan agreements or pay down or refinance the related notes payable prior to their maturity dates. As of September 30, 2020, we had a total of $93.0 million of fixed rate notes payable and $1.4 billion of variable rate notes payable. As of September 30, 2020, the interest rates on $1.1 billion of our variable rate notes payable were effectively fixed through interest rate swap agreements (including one forward interest rate swap in the amount of $65.0 million, which became effective in November 2020). The weighted-average interest rates of our fixed rate debt and variable rate debt as of September 30, 2020 were 4.2% and 3.1%, respectively. The weighted-average interest rate represents the actual interest rate in effect as of September 30, 2020 (consisting of the contractual interest rate and the effect of interest rate swaps, if applicable), using interest rate indices as of September 30, 2020, where applicable. As of September 30, 2020, we had $260.2 million of revolving debt available for immediate future disbursement under various loans, subject to certain conditions set forth in the loan agreements.

We have tried to spread the maturity dates of our debt to minimize maturity and refinance risk in our portfolio. In addition, a majority of our debt allows us to extend the maturity dates, subject to certain conditions contained in the applicable loan documents. Although we believe we will satisfy the conditions to extend the maturity of our debt obligations, we can give no assurance in this regard. The following table shows the current maturities, including principal amortization payments, of our debt obligations as of September 30, 2020 (in thousands):

| | | | |

October 1, 2020 through December 31, 2020 | | $ | 731,815 | |

2021 | | | — | |

2022 | | | 93,000 | |

2023 | | | 292,622 | |

2024 | | | 379,245 | |

| | | | |

| | $ | 1,496,682 | |

| | | | |

Financings Subsequent to September 30, 2020

Accenture Tower Revolving Loan

On November 2, 2020, we, through an indirect wholly owned subsidiary (the “Accenture Tower Borrower”), entered into a three-year loan facility for a committed amount of up to $375.0 million (the “Accenture Tower Revolving Loan”), of which $281.3 million is term debt and $93.7 million is revolving debt. At closing, $281.3 million was funded, of which approximately $210.3 million was used to pay down the Portfolio Loan Facility. Also, at closing, the revolving portion of $93.7 million remained available for future disbursements, subject to certain terms and conditions contained in the loan documents. Subject to certain terms and conditions contained in the loan documents, the Accenture Tower Revolving Loan may be used for working capital, capital expenditures, real property acquisitions and other corporate purposes, provided that $30.0 million of the revolving debt is to be used for tenant improvements and lease commissions related to the Accenture lease although this restriction is released as we complete such projects.

The Accenture Tower Revolving Loan matures on November 2, 2023, with two 12-month extension options, subject to certain terms and conditions contained in the loan documents. The Accenture Tower Revolving Loan bears interest at a floating rate of 225 basis points over one-month LIBOR so long as the loan is subject to a lender provided swap. The Accenture Tower Revolving Loan includes provisions for a “LIBOR Successor Rate” in the event LIBOR is unascertainable or ceases to be available. Monthly payments are interest only with the entire balance and all outstanding interest and fees due at maturity. We will have the right to repay the loan in part and in whole subject to certain conditions contained in the loan documents.

Modified Portfolio Loan Facility

On November 3, 2017, we, through indirectly wholly owned subsidiaries, entered into a three-year loan facility for an amount of up to $1.01 billion (the “Portfolio Loan Facility”), of which $757.5 million is term debt and $252.5 million is revolving debt. The Portfolio Loan Facility had an initial maturity date of November 3, 2020, with two 12-month extension options, subject to certain terms and conditions contained in the loan documents.

On November 3, 2020, we, through indirect wholly owned subsidiaries, entered into a loan extension and modification agreement (the “Modified Portfolio Loan Facility”) to (i) extend the maturity date of the Modified Portfolio Loan Facility to November 3, 2021 and (ii) modify the loan documents to include provisions for a “LIBOR Successor Rate” in the event LIBOR is unascertainable or ceases to be available. As of November 3, 2020, the face amount of the Portfolio Loan Facility was $630.6 million, of which $472.9 million was term debt and $157.7 million was revolving debt. As of November 3, 2020, the outstanding balance under the Portfolio Loan Facility consisted of $472.9 million of term debt. The entire revolving portion of the Portfolio Loan Facility remains available for future disbursements, subject to certain terms and conditions contained in the loan documents. The Modified Portfolio Loan Facility has one additional 12-month extension option, subject to certain terms and conditions as described in the loan documents. The Modified Portfolio Loan Facility is secured by RBC Plaza, Preston Commons, Sterling Plaza, Towers at Emeryville, Ten Almaden and Town Center. Accenture Tower was released as security from the loan in connection with the entry into the Accenture Tower Revolving Loan.

Refinancing of The Almaden Mortgage Loan

On November 18, 2020, we, through an indirect wholly owned subsidiary (“The Almaden Borrower”), entered into a three-year mortgage loan with a lender unaffiliated with us or our advisor (“The Almaden Lender”) for $123.0 million (the “Refinancing”). The Refinancing is secured by The Almaden building. At closing, $123.0 million of the Refinancing was funded, of which $93.3 million was used to pay off the outstanding principal balance and accrued interest under The Almaden Mortgage Loan. The Refinancing matures on December 1, 2023 with two 12-month extension options, subject to certain terms, conditions and fees as described in the loan documents. The Refinancing bears interest at a fixed rate of 3.65% for the initial term of the loan and a floating rate of 350 basis points over one-month LIBOR during the extension options, subject to a minimum interest rate of 3.65%. The Refinancing includes provisions for a LIBOR successor rate in the event LIBOR is unascertainable or ceases to be available. Monthly payments are interest only with the entire balance and all outstanding interest and fees due at maturity. During the initial term of the Refinancing, we will have the right to repay the Refinancing in full, but not in part, on or after December 1, 2021, subject to certain conditions and prepayment fees contained in the loan documents.

Anchor Centre Mortgage Loan Extension

On May 22, 2014, in connection with the acquisition of Anchor Centre, we, through an indirectly wholly owned subsidiary, entered into a three-year secured mortgage loan with an unaffiliated lender for borrowings of up to $53.2 million secured by Anchor Centre (the “Anchor Centre Mortgage Loan”). The Anchor Centre Mortgage Loan had an initial maturity date of June 1, 2017, with three one-year extension options, subject to certain terms and conditions contained in the loan documents.

On May 1, 2020, we, through an indirect wholly owned subsidiary, entered into a loan modification agreement to extend the maturity date of the Anchor Centre Mortgage Loan to December 1, 2020 with one six-month extension option to June 1, 2021, subject to conditions contained in the loan modification agreement. On December 1, 2020, we exercised the extension option available under the loan modification agreement and extended the maturity date of the Anchor Centre Mortgage Loan to June 1, 2021.

Payoff of the Hardware Village First Mortgage

On May 7, 2020, we, through a consolidated joint venture (the “Hardware Village Joint Venture”) sold a multi-family apartment project (“Hardware Village”) to a buyer unaffiliated with the Hardware Village Joint Venture, us or our advisor, for a purchase price of $178.0 million, before third-party closing costs, credits and the disposition fee payable to our advisor. The cost basis of our investment in Hardware Village, including the cost for us to buyout the joint venture partner’s interest in the Hardware Village Joint Venture as of May 7, 2020, was $134.7 million. The buyer of Hardware Village paid the purchase price in a combination of approximately $27.8 million in cash and approximately $150.2 million in seller financing provided by one of our indirect wholly owned subsidiaries (the “Lender”). In connection with the sale and seller financing, on May 7, 2020, the buyer entered into a promissory note with the Lender for $150.2 million. The promissory note was secured by a first mortgage on Hardware Village (the “Hardware Village First Mortgage”).

On December 11, 2020, the buyer/borrower on the Hardware Village First Mortgage exercised its prepayment option available under the promissory note, pursuant to which the buyer/borrower paid off the entire outstanding principal balance and accrued interest in the amount of $150.4 million, without fee, premium or penalty. The Hardware Village First Mortgage had an original maturity date of May 6, 2021.

79