The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the SEC and various states is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

SUBJECT TO COMPLETION

PRELIMINARY PROSPECTUS DATED OCTOBER 29, 2021

Maximum Offering of $2,000,000,000

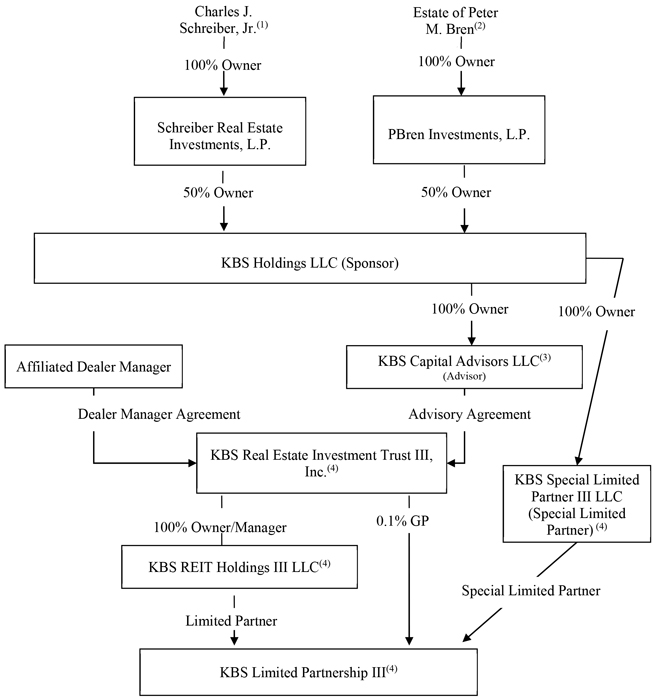

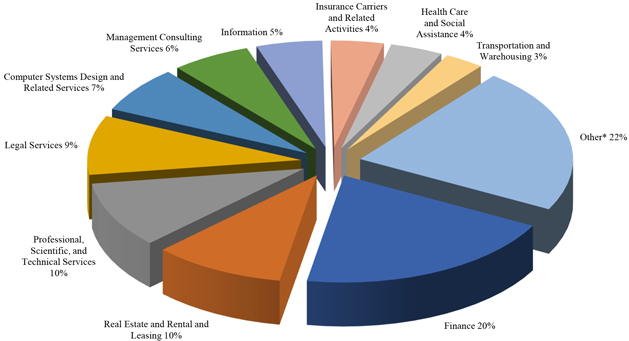

KBS Real Estate Investment Trust III, Inc. is a net asset value (“NAV”) based perpetual life real estate investment trust (“REIT”) that is primarily focused on investing in and operating a diverse portfolio of core real estate properties throughout the U.S. We are externally managed by our advisor, KBS Capital Advisors, LLC. We conduct our operations as a REIT for U.S. federal income tax purposes. We are not a mutual fund and do not intend to register as an investment company under the Investment Company Act of 1940, as amended.

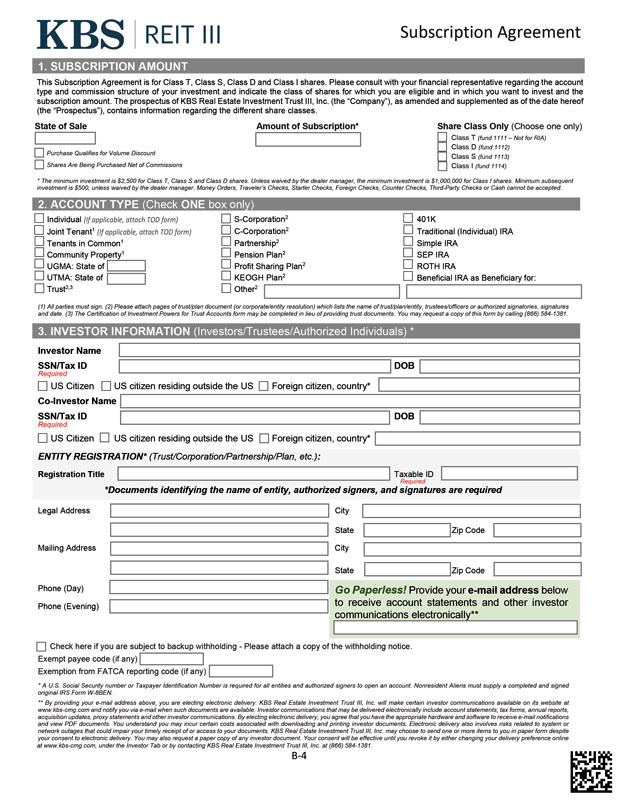

We are offering on a continuous basis up to $2,000,000,000 of shares of common stock, consisting of up to $1,700,000,000 in shares in our primary offering and up to $300,000,000 in shares pursuant to our dividend reinvestment plan. We are offering to sell any combination of four classes of shares of our common stock, Class T shares, Class S shares, Class D shares and Class I shares, with a dollar value up to the maximum offering amount. The share classes have different upfront selling commissions and dealer manager fees, and different ongoing distribution fees. The purchase price per share for each class of common stock will vary and will generally equal our prior month’s NAV per share (which will be our most recently disclosed NAV per share at such time), plus applicable upfront selling commissions and dealer manager fees. In cases where we believe there has been a material change (positive or negative) to our NAV per share since the end of the prior month, we may offer shares at a price that we believe reflects the NAV per share of such stock more appropriately than the prior month’s NAV per share. This is a “best efforts” offering, which means that [•], the dealer manager for this offering and our affiliate, will use its best efforts to sell shares, but is not obligated to purchase or sell any specific amount of shares in this offering. Subject to certain exceptions, you must initially invest at least $2,500 in shares of our Class T, Class S and Class D common stock and $1,000,000 in shares of our Class I common stock in this offering.

This investment involves a high degree of risk. You should purchase these securities only if you can afford the complete loss of your investment. See “Risk Factors” beginning on page 31 for risks to consider before buying our shares, including:

| • | | There is no public trading market for our common stock and the redemption of shares by us will likely be the only way to dispose of your shares. We are not obligated to redeem any shares under our share redemption program and may choose to redeem only some, or even none, of the shares that have been requested to be redeemed. Redemptions will be subject to available liquidity and other significant restrictions. Our board of directors may modify or suspend our share redemption program at any time. Our shares should be considered as having only limited liquidity and at times may be illiquid. |

| • | | We cannot guarantee that we will pay distributions. We have and may in the future fund distributions from sources other than cash flow from operations, including the sale of assets, borrowings, return of capital or offering proceeds. We have no limits on the amounts we may pay from such sources. |

| • | | The offering price and redemption price for shares of our common stock are generally based on our prior month’s NAV (as described above) plus, in the case of our offering price, applicable upfront selling commissions and dealer manager fees, and are not based on any public trading market. While there will be independent annual appraisals of our properties, the appraisal of properties is inherently subjective. Our NAV may not reflect the prices at which our assets could be liquidated on any given day. |

| • | | We have no employees and are dependent on our advisor and its affiliates to conduct our operations. |

| • | | All of our officers, our affiliated director and other key professionals of our advisor are also officers, directors, managers, key professionals and/or holders of interests in our advisor and/or other affiliated entities. They face conflicts of interest, including conflicts from time constraints, allocation of investments and the fact that the fees our advisor and its affiliates will receive for services are based on our NAV, which our advisor is responsible for determining. |

| • | | There are limits on the ownership and transferability of our shares. See “Description of Capital Stock—Restrictions on Ownership of Shares.” |

| • | | If we fail to qualify as a REIT and no relief provisions apply, our NAV and cash available for distribution to our stockholders could materially decrease. |

| • | | A portion of the proceeds received in this offering is expected to be used for redemption requests, including requests from our existing stockholders which may be significant. This will reduce the proceeds available for new acquisitions, which may result in reduced liquidity, profitability or growth. |

Neither the Securities and Exchange Commission, the Attorney General of the State of New York nor any other state securities regulator has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Securities regulators have not passed upon whether this offering can be sold in compliance with existing or future suitability or conduct standards, including the ‘Regulation Best Interest’ standard, to any or all purchasers. Any representation to the contrary is a criminal offense.

The use of forecasts in this offering is prohibited. Any oral or written predictions about the amount or certainty of any cash benefits or tax consequences that may result from an investment in our common stock is prohibited. No one is authorized to make any statements about this offering inconsistent with those that appear in this prospectus.

| | | | | | | | | | | | | | | | |

| | | Price to the

Public(1) | | | Upfront Selling

Commissions(2) | | | Dealer

Manager Fees(2) | | | Proceeds to

Us, Before

Expenses(3) | |

Maximum Offering(4) | | $ | 1,700,000,000 | | | $ | 41,087,076 | | | $ | 410,628 | | | $ | 1,658,502,296 | |

Class T Shares, per Share | | $ | | | | $ | | | | $ | | | | $ | | |

Class S Shares, per Share | | $ | | | | $ | | | | $ | — | | | $ | | |

Class D Shares, per Share | | $ | | | | $ | | | | $ | — | | | $ | | |

Class I Shares, per Share | | $ | | | | $ | — | | | $ | — | | | $ | | |

Maximum Dividend Reinvestment Plan | | $ | 300,000,000 | | | $ | — | | | $ | — | | | $ | 300,000,000 | |

(1) The price per share shown for each of our classes of shares is the [•], 2021 transaction price, which is equal to such class’s NAV as of [•], 2021, plus applicable upfront selling commissions and dealer manager fees. Shares of each class will be issued on a monthly basis at a price per share generally equal to the prior month’s NAV per share for such class (which will be our most recently disclosed NAV per share at such time), plus applicable upfront selling commissions and dealer manager fees. The transaction price is the then-current offering price per share before applicable selling commissions and dealer manager fees and is generally the prior month’s NAV per share for such class.

(2) The table assumes that all $1,700,000,000 of shares are sold in the primary offering, with 5% of the primary offering proceeds from the sale of Class T shares, 65% of the primary offering proceeds from the sale of Class S shares, 5% of the primary offering proceeds from the sale of Class D shares and 25% of the primary offering proceeds from the sale of Class I shares. The number of shares of each class sold and the relative proportions in which the classes of shares are sold are uncertain and may differ significantly from this assumption. For Class T shares sold in the primary offering, investors will pay upfront selling commissions of up to 3.0% of the transaction price and upfront dealer manager fees of 0.5% of the transaction price; however, such amounts may vary at certain participating broker-dealers, provided that the sum will not exceed 3.5% of the transaction price. For Class S shares sold in the primary offering, investors will pay upfront selling commissions of up to 3.5% of the transaction price. For Class D shares sold in the primary offering, investors may pay upfront selling commissions of up to 1.5% of the transaction price. We will also pay on a monthly basis the following selling commissions as distribution fees to the dealer manager, subject to Financial Industry Regulatory Authority, Inc. (“FINRA”) limitations on underwriting compensation: (a) for Class T shares only, an advisor distribution fee of 0.65% per annum and a dealer distribution fee of 0.20% per annum of the aggregate NAV for the Class T shares, however, with respect to Class T shares sold through certain participating broker-dealers, the advisor distribution fee and the dealer distribution fee may be other amounts, provided that the sum of such fees will always equal 0.85% per annum of the NAV of such shares, (b) for Class S shares only, a distribution fee equal to 0.85% per annum of the aggregate NAV for the Class S shares and (c) for Class D shares only, a distribution fee equal to 0.25% per annum of the aggregate NAV for the Class D shares. No distribution fees will be paid with respect to the Class I shares. The total amount that will be paid over time for distribution fees depends on the average length of time for which the shares remain outstanding, the term over which such amount is measured and the performance of our investments. We will also pay or reimburse certain other items of underwriting compensation and other organization and offering expenses, subject to FINRA limitations on underwriting compensation. See “Plan of Distribution,” “Estimated Use of Proceeds” and “Compensation.”

(3) Proceeds are calculated before deducting distribution fees, certain other items of underwriting compensation and other organization and offering expenses payable by us, which are paid over time.

(4) We reserve the right to reallocate shares of common stock between our dividend reinvestment plan and our primary offering.

The date of this prospectus is [•], 2021