1 3003 Washington Arlington, VA February 2025 Portfolio Update Exhibit 99.1

KBS-CMG.COM 2 The information contained herein should be read in conjunction with, and is qualified by, the information in KBS Real Estate Investment Trust III, Inc.’s (the “Company”, “KBS REIT III”, ”we” or “our”) Annual Report on Form 10-K (the “Annual Report”), and in the Company’s Quarterly Report on Form 10-Q for the period ended September 30, 2024 (the “Quarterly Report”), including the “Risk Factors” contained therein. For a full description of the limitations, methodologies and assumptions used to value the Company’s assets and liabilities in connection with the calculation of the Company’s estimated value per share, see the Company’s Current Report on Form 8-K, filed with the SEC on December 20, 2024 (the “Valuation 8-K”). Important Disclosures Certain statements contained herein may be deemed to be forward-looking statements within the meaning of the Federal Private Securities Litigation Reform Act of 1995. The Company intends that such forward-looking statements be subject to the safe harbor created by Section 21E of the Securities Exchange Act of 1934, as amended. These statements include statements regarding the intent, belief or current expectations of the Company and members of its management team, as well as the assumptions on which such statements are based, and generally are identified by the use of words such as ”could”, “may,” “will,” “seeks,” “anticipates,” “believes,” “estimates,” “expects,” “plans,” “intends,” “should” or similar expressions. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date they are made. The Company undertakes no obligation to update or revise forward-looking statements to reflect changed assumptions, the occurrence of unanticipated events or changes to future operating results over time, unless required by law. Such statements are subject to known and unknown risks and uncertainties which could cause actual results to differ materially from those contemplated by such forward -looking statements. The Company makes no representation or warranty (express or implied) about the accuracy of any such forward-looking statements. These statements are based on a number of assumptions involving the judgment of management. You should interpret many of the risks identified in this presentation and in the Company’s Annual Report and Quarterly Repor t as being heightened as a result of the continued disruptions in the financial markets impacting the U.S. commercial real estate industry, especially as it pertains to commercial office buildings, the challenging commercia l real estate lending environment, the current interest rate environment, leasing challenges in certain markets where KBS REIT III owns properties and the lack of transaction volume in the U.S. office market as well as general market instability. There can be no assurance as to when the markets will stabilize. Though the appraisals of the appraised properties and the valuation of the Company’s investment in units of Prime US REIT, wi th respect to Kroll, and the valuation estimates used in calculating the estimated value per share, with respect to Kroll, the Advisor and the Company, are the respective party’s best estimates as o f the dates of the respective valuations, the Company can give no assurance in this regard. Even small changes to these assumptions could result in significant differences in the appraisal values of the appraised properties, the valuation of the Company’s investment in the units of Prime US REIT and the estimated value per share. The Company can give no assurances with respect to the ultimate return to investors. Valuations for U.S. office properties continue to fluctuate due to weakness in the current real estate capital markets and the lack of transaction volume for U.S. office properties, increasing the uncertainty of valuations in the current market environment. Our significant investment in the equity securities of Prime US REIT (the “SREIT”), a traded Singapore real estate investment trust, is subject to the risks associated with real estate investments as well as the risks inherent in investing in traded securities, including, in this instance, risks related to the quantity of units held by us relative to the trading volume of the units. Due to the disruptions in the financial markets, the trading price of the common units of the SREIT has experienced substantial volatility and has been significantly impacted by the market sentiment for stock with significant investment in U.S. office buildings. Forward-Looking Statements

KBS-CMG.COM 3 In order to refinance, restructure or extend maturing debt obligations, KBS REIT III has been required to reduce the loan commitments and/or make paydowns on certain loans, and KBS REIT III has agreed to satisfy certain conditions that are not in its sole control, including making principal paydowns durin g the terms of the loans, selling assets and taking identified actions relating to its portfolio. Selling real estate assets in the current market may result in a lower sale price than KBS REIT III would otherwise obtain. KBS REIT III will be adversely affected if it is unable to satisfy the terms and conditions contained in its loan agreements. There is no assurance that KBS REIT III will be able to satisfy the terms and conditions of its existing loan agreements or the terms and conditions of any future extension or refinancing agreements that are entered into. If KBS REIT III is unable to make required principal paydowns under certain loans, sell assets or satisfy certain covenants and conditions in its loan agreements, the lenders may seek to foreclose on the underlying collateral. KBS REIT III’s loan agreements contain cross default provisions whereby the occurrence of (or a demand following) an “event of default ” under one or more of its debt facilities may trigger a default under certain other debt facilities and the guaranty obligations in respect thereof, thereby giving lenders a right to accelerate the relevant debt obligations and exercise their enforcement rights with respect thereto. KBS REIT III has pledged the equity of certain of its subsidiaries (and all proceeds therefrom) in connection with the restructuring of certain debt facilities. If an event of default occurs under such debt facilities and the lenders party thereto elect to exercise their en forcement rights thereunder, one of the remedies available to them is to take possession of the relevant pledged equity. If KBS REIT III is unable to satisfy the terms and conditions contained in its loan agreements or successfully refinance or restructure certain of its debt instruments, KBS REIT III may seek the protection of the bankruptcy court to implement a restructuring plan. As a result of KBS REIT III’s upcoming loan maturities, the challenging commercial real estate lending environment, the current interest rate environment, leasing challenges in certain markets where KBS REIT III owns properties and the lack of transaction volume in the U.S. office market as well as general market instability, there may continue to be substant ial doubt about KBS REIT III’s ability to continue as a going concern, though such risk has been reduced substantially as a result of the refinancing activity completed in the last 12 mon ths. Stockholders may have to hold their shares for an indefinite period of time. Due to certain restrictions and covenants included in KBS REIT III’s loan agreements as a result of refinancing certain of its debt facilities, KBS REIT III does not expect to pay any dividends or distributions or redeem any shares of common stock until certain loans are repaid or refinanced. One of the loans with these restrictions has a current maturity of January 2027 but may be extended subject to the terms and conditions of the loan agreement. KBS REIT III can provide no assurance that it will be able to provide additional liquidity to stockholders. The statements herein also depend on factors such as: future economic, competitive and market conditions; the Company’s abili ty to maintain and/or improve occupancy levels and rental rates at its real estate properties; and other risks identified in Part I, Item 1A of the Company’s most recent Annual Report. Forward-Looking StatementsImportant Disclosures

4 Park Place Village Leawood, KS Section 01 Real Estate Update KBS-CMG.COM

KBS-CMG.COM 5 2024 Fund Transaction Recap through February 2025 Sold the McEwen building in February 2024 for $49M. Refinanced or extended the following loans1: • Amended and Restated Portfolio Loan Facility - $466M • Accenture Tower Loan - $306M • Modified Portfolio Revolving Loan Facility – $203M • 3003/3001 Washington Loan - $139M • Carillon - $88M • Credit Facility - $63M Sold the Preston Commons building in November 2024 for $151M, one of the few office sale transactions in 2024 in excess of $150M. Accenture Tower Chicago, IL Section 01 | Real Estate Update 1 Principal balance as of loan extension or modification closing.

KBS-CMG.COM 6 Return to Office Dynamics Shift Among the greatest impacts to the Company’s assets has been the ongoing effects of the pandemic as those relate to office attendance and overall demand for office space. Fortunately, there has been substantial momentum in return to office policies among some of the largest U.S. employers including, among many others, the United States Federal Government largely due to last month’s turnover of Presidential administrations. Additionally, many of the largest technology companies in the world have more recently made significant movement toward greater in-office expectations. This is a notable change from sentiment and policies surrounding in-office attendance over the last several years. This trend is extremely beneficial to the basic supply and demand fundamentals around office space, particularly as technology companies have generally been laggards in post-pandemic return to office landscape. Market Outlook 2025 Section 01 | Real Estate Update Notable Companies Significantly Advancing Return to Office Mandates

KBS-CMG.COM 7 According to CBRE, the U.S. enters 2025 with positive momentum in terms of economic growth, potentially setting up the U.S office market for a pivotal switch in 2025, with stabilization paving the way for a new cycle. With that in mind, we highlight the following significant trends impacting the office market that we see continuing throughout 2025. Section 01 | Real Estate Update Flight to Quality According to a recent CBRE Occupier Sentiment Survey, more than one-third of respondents plan to increase their portfolio requirements over the next two years. Tenants that relocate will prioritize buildings in prime locations with first-class amenities, and as these spaces become more scarce, demand will spill over to the next tier of buildings. The Wall Street Journal recently reported on the same phenomenon in metropolitan areas across the U.S. The Company’s portfolio of assets is comprised entirely of Class A buildings and is well situated to benefit from the continued flight to quality trend. Lack of New Supply According to JLL, groundbreakings for the past six quarters have averaged 10% lower than the previous historical low. Additionally, record volume of inventory continues to be removed for conversion and redevelopment. Per CBRE, the office construction pipeline is notably thin, with new supply expected to fall to 17 million square feet in 2025, well below the 10-year average of 44 million square feet. We believe this steep drop in supply may further facilitate a recovery in overall office market conditions. Improved Debt Markets Since early 2022, debt for office buildings has been nearly unattainable. More recently, CMBS/SASB have been leading the market in year over year increases, replacing some of the declining liquidity from Banks, Life Insurance Companies, and Debt Fund sectors at competitive pricing relative to other asset classes. Life Insurance Companies and Banks are also beginning to express interest in providing liquidity to Tier I assets in target markets. This improved availability of debt capital is helping to provide much needed relief for existing lenders to be repaid, which should allow them to re-lend those dollars, and eventually enable the lending cycle to continue and increase overall participation on the equity side of the capital markets. Uncertainties It remains to be seen what develops, if anything, on a potential “trade war” between the U.S. and its largest trading partners, particularly Canada, Mexico, and China. Specific to our industry, this could lead to increased costs on raw materials in construction activities, or separately, could hit the bottom lines of our existing tenants and/or new prospects and potentially impact their growth plans and overall space needs. Additionally, uncertainties remain with regards to future interest rate policy as impacted by inflation continuing to be “sticky” and running at levels above the Federal Reserves 2% target and also uncertainties related to current trade policy. An increased shift in the current forecasted path of future rates could negatively impact a real estate recovery. Separately, the speed of the trickle-down impact on return to office among the largest employers remains to be seen, though we are encouraged by the improved trajectory which received a boost, in part, due to the recent election results and return to office mandate by the new administration. Market Outlook 2025 (continued) Improving Statistics According to a recent study by JLL, for three consecutive quarters, office leasing volume has a established post-pandemic high. Additionally, Q4 2024 leasing volume reflected over 92% of typical pre-pandemic averages. The market experienced its first quarter of positive net absorption since Q4 2021, just the second time since the pandemic began. Availability has declined for two consecutive quarters, pointing towards notable declines in vacancy in 2025.

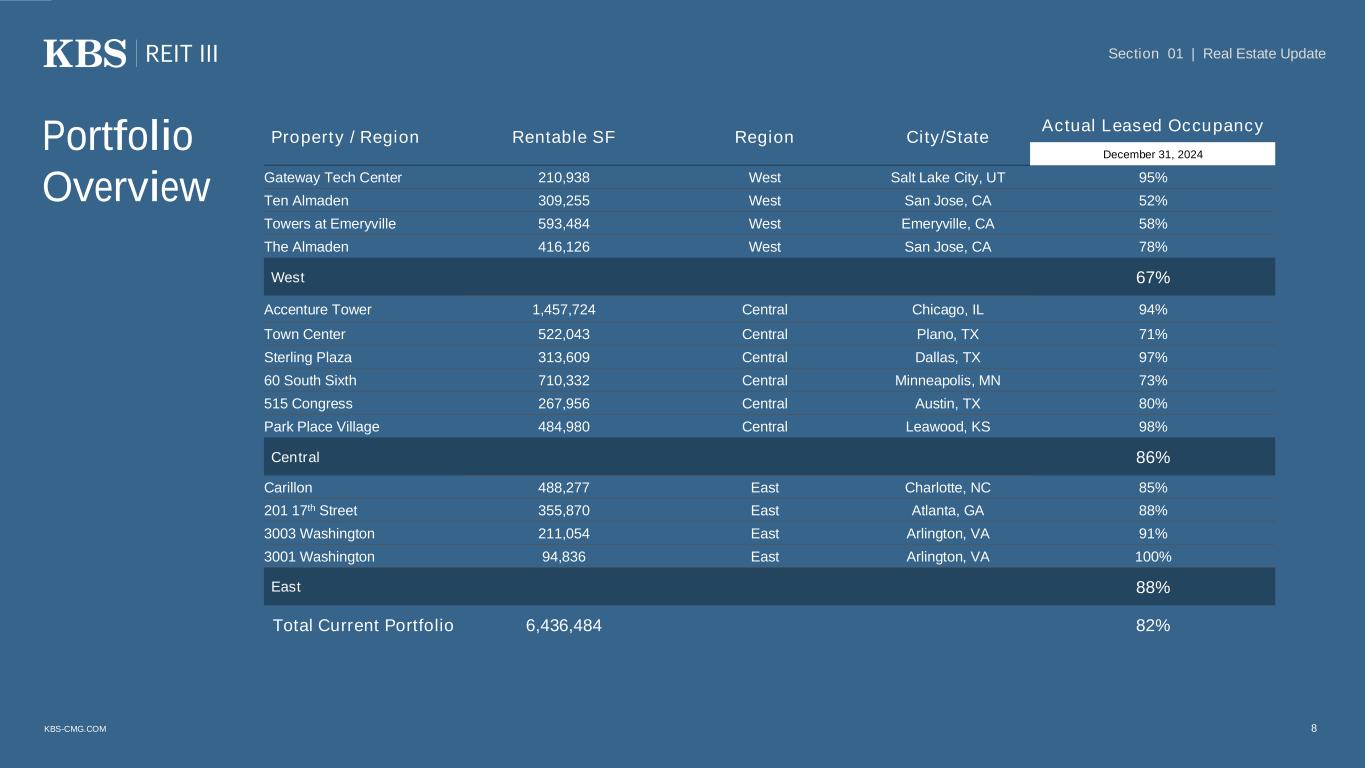

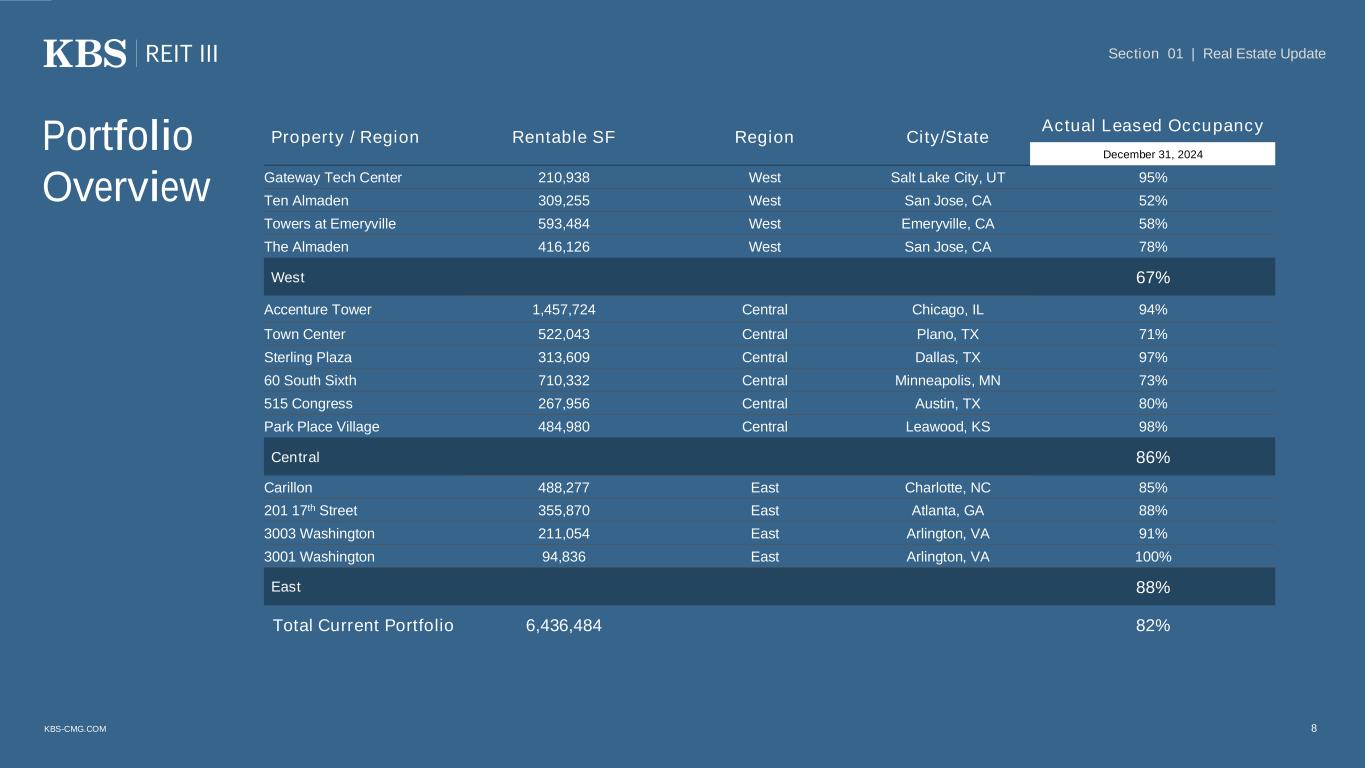

KBS-CMG.COM 8 Property / Region Rentable SF Region City/State Actual Leased Occupancy December 31, 2024 Gateway Tech Center 210,938 West Salt Lake City, UT 95% Ten Almaden 309,255 West San Jose, CA 52% Towers at Emeryville 593,484 West Emeryville, CA 58% The Almaden 416,126 West San Jose, CA 78% West 67% Accenture Tower 1,457,724 Central Chicago, IL 94% Town Center 522,043 Central Plano, TX 71% Sterling Plaza 313,609 Central Dallas, TX 97% 60 South Sixth 710,332 Central Minneapolis, MN 73% 515 Congress 267,956 Central Austin, TX 80% Park Place Village 484,980 Central Leawood, KS 98% Central 86% Carillon 488,277 East Charlotte, NC 85% 201 17th Street 355,870 East Atlanta, GA 88% 3003 Washington 211,054 East Arlington, VA 91% 3001 Washington 94,836 East Arlington, VA 100% East 88% Total Current Portfolio 6,436,484 82% Portfolio Overview Section 01 | Real Estate Update

KBS-CMG.COM Towers at Emeryville, Emeryville, CA • Tenant demand remains significantly down from pre-pandemic levels. • In 2024, the market only recorded eight lease transactions over 20,000 SF and eight lease transactions between 10,000-20,000 SF (including renewals) in Oakland Metro’s 27.8M SF office market. This is compared to 31 deals over 20,000 SF and 33 deals between 10,000-20,000 SF in 2019. • Per CoStar, vacancy in the submarket among Class A buildings remains stubbornly high at 32.1%. This is up from a pre-pandemic average of approximately 15%. • A pickup in life science/biotech funding would drive demand because Emeryville is a major life science hub and even though the Towers is not lab space, these firms require traditional office space as well. • A recent announcement by Sutter Health, our largest tenant, to invest more than $1 billion across the East Bay, including a new 1.3 million square foot medical campus in the heart of Emeryville has taken significant amounts of office availability off the market and has the potential to boost our leasing demand via adjacency requirements by office users needing to be in close proximity to the medical campus. Market and Leasing Challenges Section 01 | Real Estate Update 9 San Francisco Bay Area Markets within the San Francisco Bay Area like Silicon Valley and San Francisco have experienced among the lowest return-to-office rates of any market in the country. However, we have seen a market-wide uptick in touring activity, largely due to more employees being asked to come back to office locations and many companies not having enough physical space to accommodate that influx of staff.

KBS-CMG.COM Ten Almaden and The Almaden, San Jose, CA • The Silicon Valley multi-tenant office market experienced some stabilization in 2024, ending the year with a slight reduction in total available space. • However, vacancy rates across Silicon Valley, as is the case with other Bay Area markets, are very high relative to pre-pandemic averages. • Class A vacancy in downtown San Jose is approximately 35%--up from an average of 14% in the 3 years pre-pandemic. • By way of example, pre-pandemic, the typical number of full floors available in downtown San Jose was approximately 15. For each of the last three years, that number has hovered around 68. • Remote work policies, among other factors, have contributed to these stubbornly high amounts of availability. • We are encouraged by positive movement in return-to-office policies by large downtown users, including Zoom, but the market will require a sharp correction in office demand and physical space utilization to see a meaningful recovery. Market and Leasing Challenges (continued) Section 01 | Real Estate Update 10

KBS-CMG.COM 60th South Sixth Street, Minneapolis, MN • In 2018, our former anchor tenant at 60 South Sixth, RBC Wealth Management, announced it would be leaving 280,000 SF for build-to- suit new construction. Another tenant occupying 43,000 SF also left for that new construction in late 2022. Those advanced-scheduled departures in 2022 proved to be especially adverse given the pandemic and social unrest that occurred in 2020 that largely led to a still unrecovered CBD office market. • We were fortunate to secure a new lease with Fredrikson & Byron, spanning 160,000 SF, which helped fill roughly half of the vacant space left by the two tenants noted above. The lease commenced in June 2023, marking a positive development for our occupancy and cash flows. • Without the Fredrikson lease and a handful of other smaller new leases, the building would be approximately 40% leased. • While we’ve made significant progress, the building is only 73% leased as of January 2025, leaving considerable additional leasing to do in a submarket that, similar to the San Francisco Bay Area markets, remains quiet from a leasing perspective. Market and Leasing Challenges (continued) Section 01 | Real Estate Update 11 Minneapolis Downtown Minneapolis has struggled considerably due to a lack of return-to-office by the many large employers (Target HQ, US Bank HQ, Thrivent HQ, numerous large law firms, Ameriprise HQ, Wells Fargo’s sizable presence, etc.) that occupy a majority of the central business district (CBD) and whose workforce has not yet returned to the office in a meaningful way.

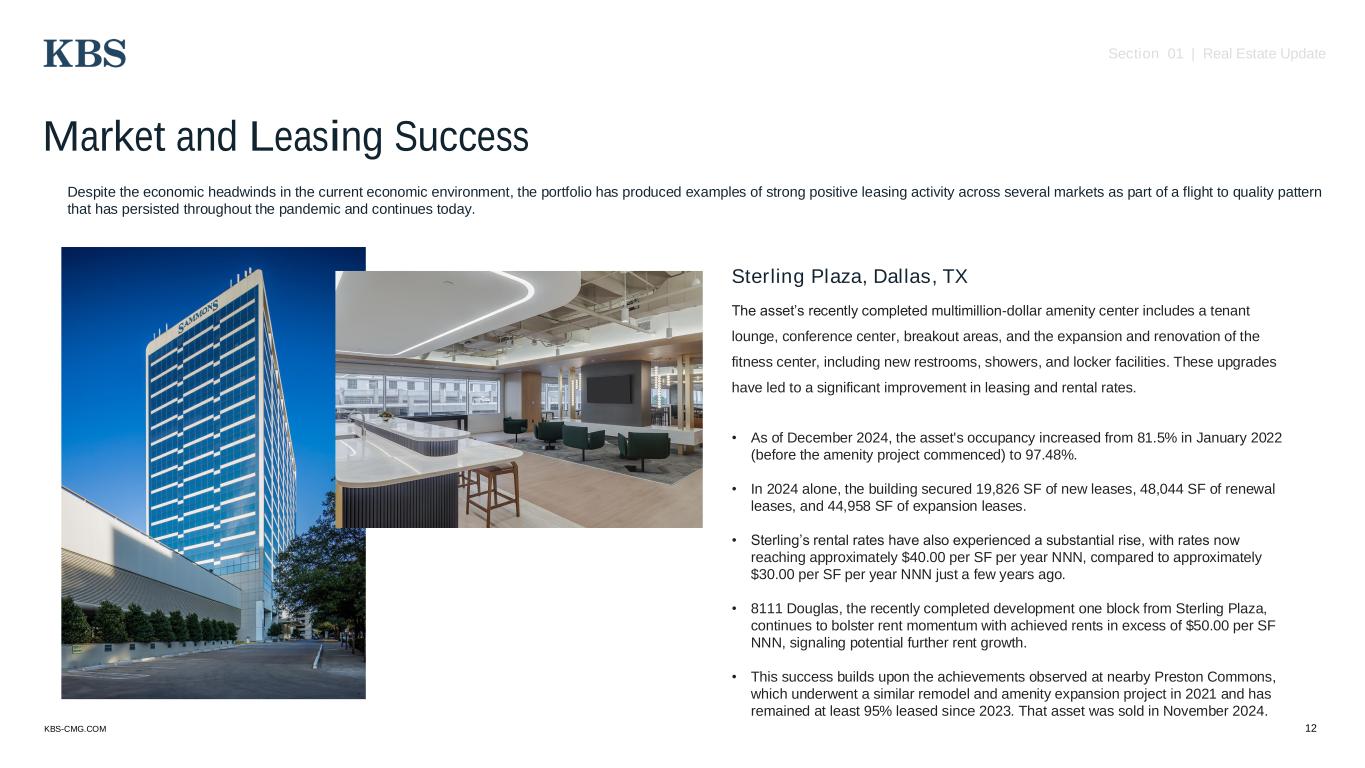

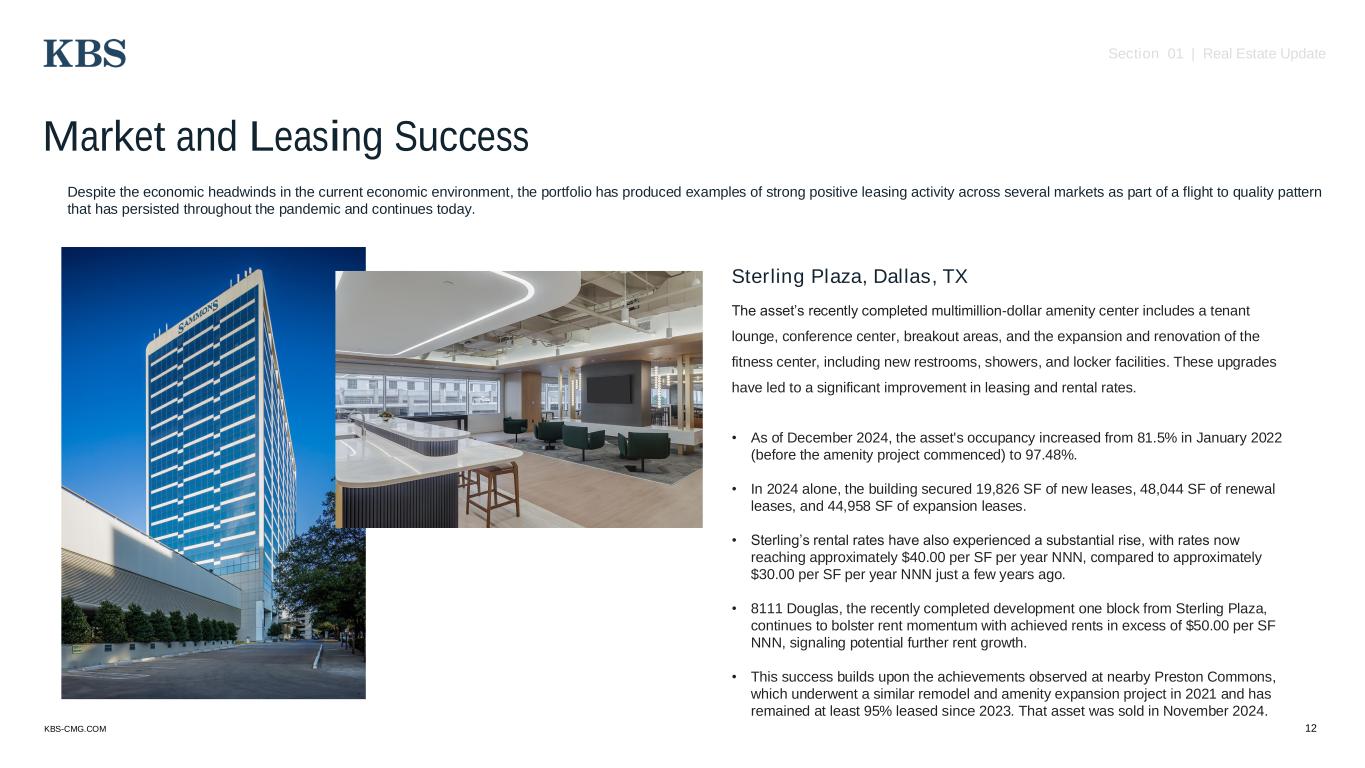

KBS-CMG.COM Sterling Plaza, Dallas, TX The asset’s recently completed multimillion-dollar amenity center includes a tenant lounge, conference center, breakout areas, and the expansion and renovation of the fitness center, including new restrooms, showers, and locker facilities. These upgrades have led to a significant improvement in leasing and rental rates. • As of December 2024, the asset's occupancy increased from 81.5% in January 2022 (before the amenity project commenced) to 97.48%. • In 2024 alone, the building secured 19,826 SF of new leases, 48,044 SF of renewal leases, and 44,958 SF of expansion leases. • Sterling’s rental rates have also experienced a substantial rise, with rates now reaching approximately $40.00 per SF per year NNN, compared to approximately $30.00 per SF per year NNN just a few years ago. • 8111 Douglas, the recently completed development one block from Sterling Plaza, continues to bolster rent momentum with achieved rents in excess of $50.00 per SF NNN, signaling potential further rent growth. • This success builds upon the achievements observed at nearby Preston Commons, which underwent a similar remodel and amenity expansion project in 2021 and has remained at least 95% leased since 2023. That asset was sold in November 2024. Market and Leasing Success Despite the economic headwinds in the current economic environment, the portfolio has produced examples of strong positive leasing activity across several markets as part of a flight to quality pattern that has persisted throughout the pandemic and continues today. Section 01 | Real Estate Update 12

KBS-CMG.COM Market and Leasing Success (continued) Section 01 | Real Estate Update 13 Accenture Tower, Chicago, IL Through its programmatic repositioning of the building lobby, amenities, and construction of nearly 200,000 SF of spec suites post-COVID, the building has maintained a 94% average occupancy since Q222. In comparison, the West Loop and Chicago CBD submarkets sat at 17.8% and 19.1% vacancy respectively, during the same period. This has also led to double digit rent growth at the asset compared to pre-renovation. Supported by its superior location sitting atop Ogilvie Transportation Center, the 6th busiest rail station in North America, the asset blends best-in-class amenities with its one-of-a-kind location. This has continued to be a driver as employers look to make lease decisions that provide convenience and experience for their employees. Period End Economic Occ. % Leased Occ. % Q222 72% 87% Q322 85% 91% Q422 87% 95% Q123 88% 96% Q223 90% 98% Q323 93% 98% Q423 94% 98% Q124 94% 96% Q224 90% 92% Q324 90% 92% Q424 93% 94% *Leasing Activity from April 1, 2022 through December 31, 2024 Leasing Activity* 2025 Recipient of the BOMA Chicago Toby Award

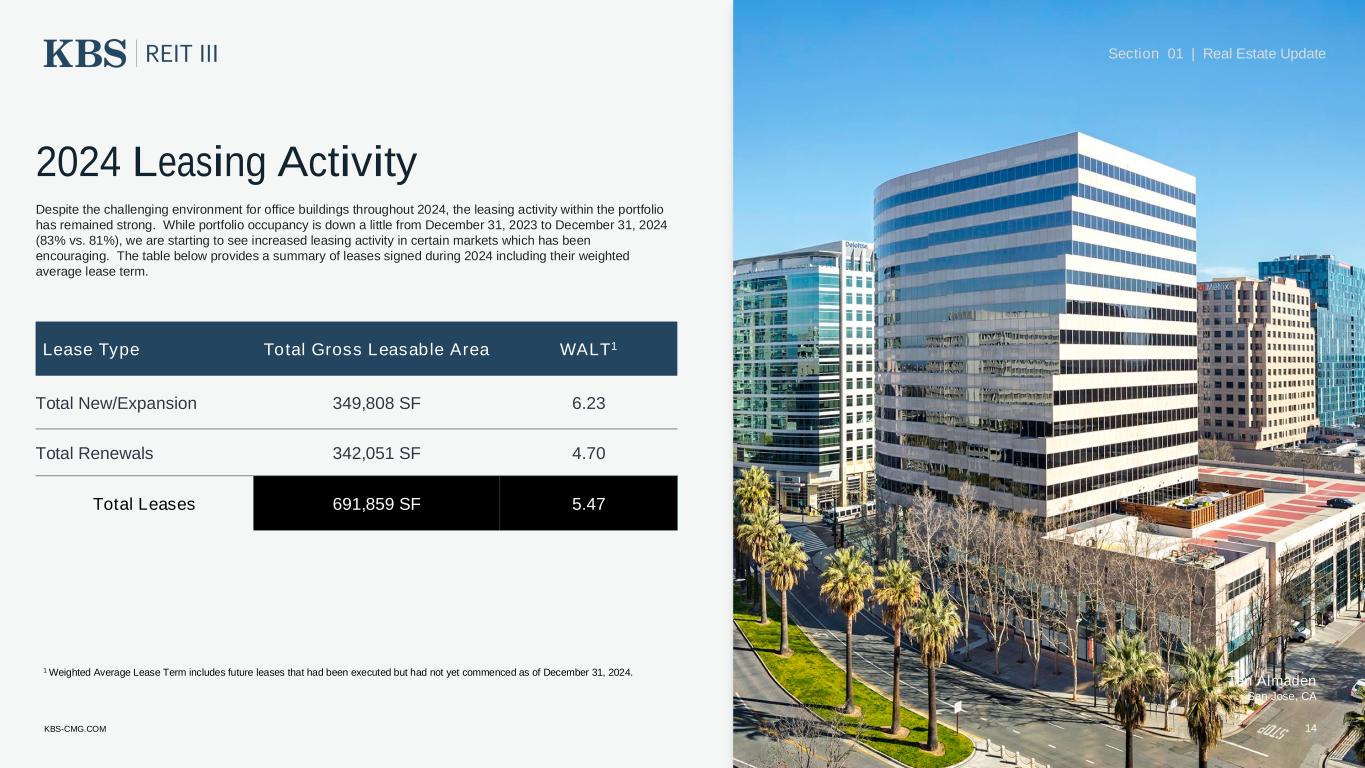

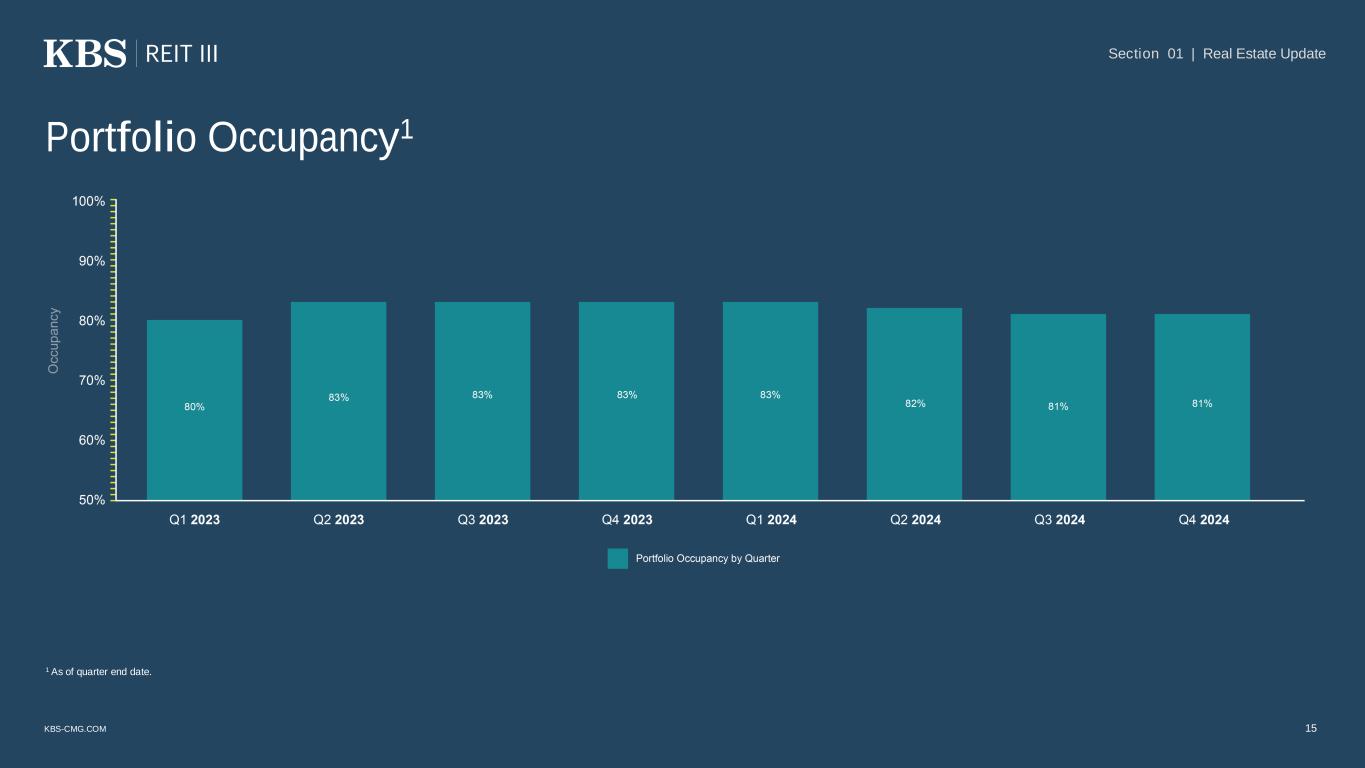

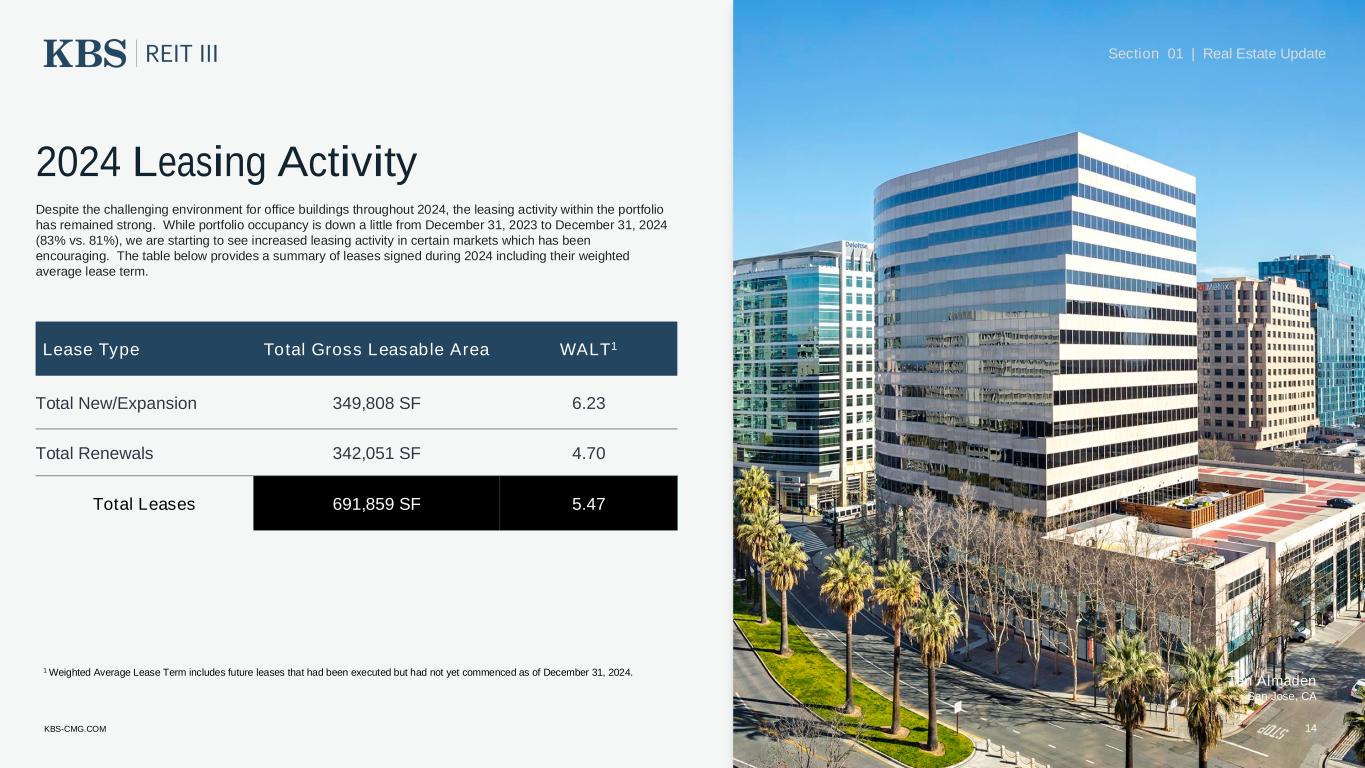

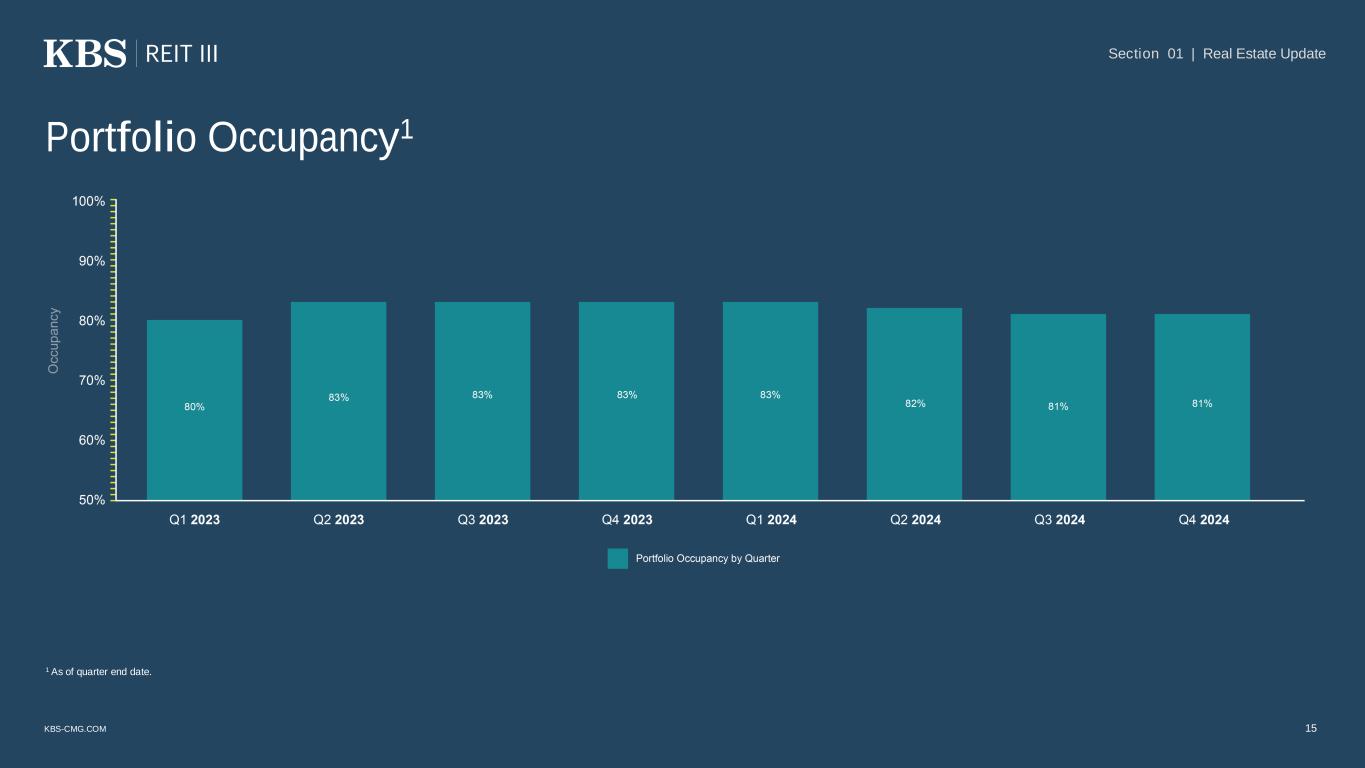

KBS-CMG.COM Ten Almaden San Jose, CA 2024 Leasing Activity Lease Type Total Gross Leasable Area WALT1 Total New/Expansion 349,808 SF 6.23 Total Renewals 342,051 SF 4.70 Total Leases 691,859 SF 5.47 Section 01 | Real Estate Update 14 1 Weighted Average Lease Term includes future leases that had been executed but had not yet commenced as of December 31, 2024. Despite the challenging environment for office buildings throughout 2024, the leasing activity within the portfolio has remained strong. While portfolio occupancy is down a little from December 31, 2023 to December 31, 2024 (83% vs. 81%), we are starting to see increased leasing activity in certain markets which has been encouraging. The table below provides a summary of leases signed during 2024 including their weighted average lease term.

KBS-CMG.COM 15 Portfolio Occupancy1 Section 01 | Real Estate Update 1 As of quarter end date.

16 The Almaden San Jose, CA Section 02 Debt Update KBS-CMG.COM

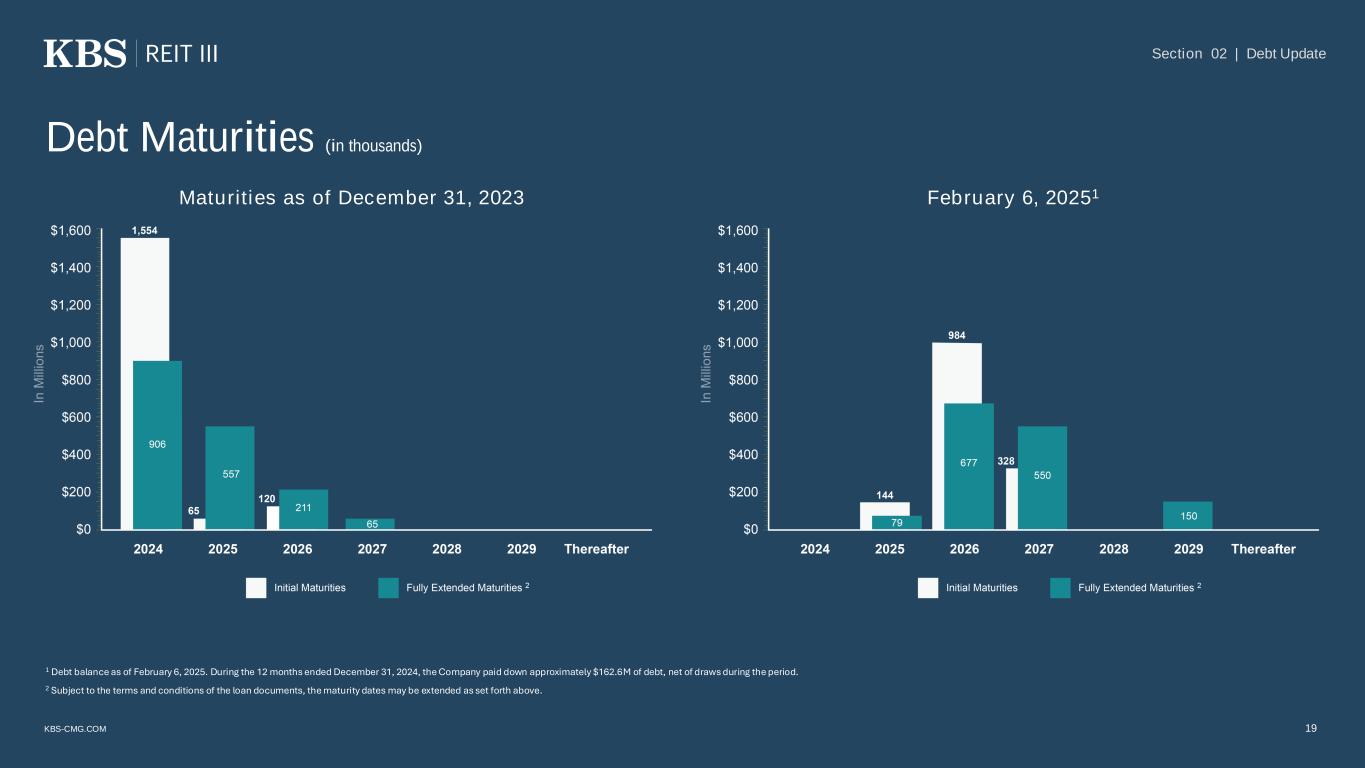

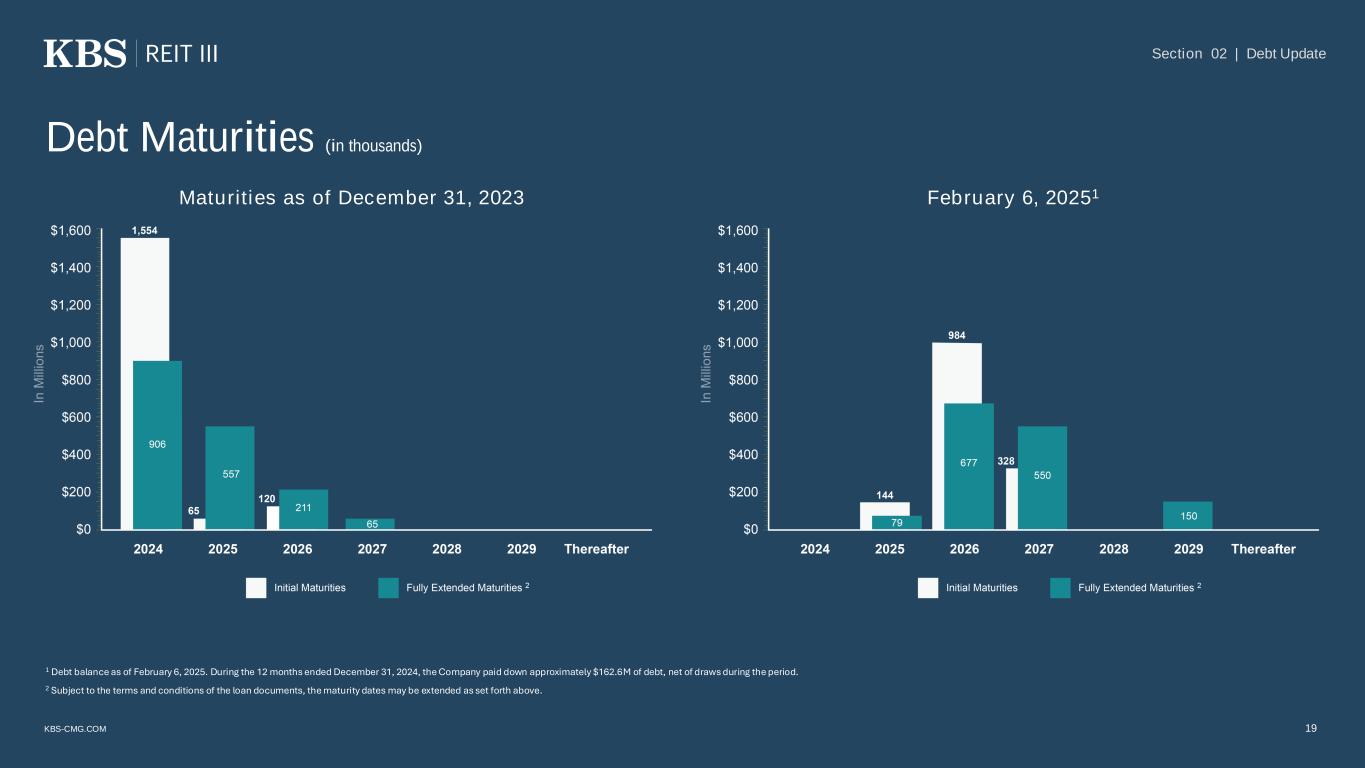

KBS-CMG.COM Recent Loan Refinancing During the 12 months ending February 6, 2025, KBS REIT III refinanced or extended a significant amount of maturing debt across six different loans (in excess of $1.3 billion). The refinancing activity provided much needed liquidity relief to the portfolio and provides near term loan availability of almost $50 million as of the closing of the loans (subject to the terms of loan documents) as well as allowing for an additional amount of proceeds from the sales of assets securing certain loans to be used to fund capital needs of other assets (otherwise such proceeds would have been required to paydown the debt the asset was securing). However, some of the loans refinanced require principal paydowns throughout the terms of the loans and also require a number of asset sales beginning in 2025. Additionally, KBS REIT III’s loan agreements contain cross default provisions and KBS REIT III has pledged the equity of certain of its subsidiaries (and all proceeds therefrom) in connection with the restructuring of certain debt facilities. The Amended and Restated Portfolio Loan facility (with a principal balance of $466 million at the time of refinancing) was extended to January 2027 with two additional one year extension options. This is the largest of KBS REIT III’s loan facilities and is secured by assets in some of the more challenged markets such as the Bay Area and Minneapolis. This extension provides a critical amount of additional time for these struggling markets to begin to stabilize. We continue to work on a potential loan modification with regard to the Carillon loan to provide some enhanced loan term and additional loan proceeds needed to complete the capital and releasing plan for the project. The Carillon asset is well located and has had substantial leasing activity over the last 12 months . The following slides show the details of each of the current outstanding loans, including the current outstanding balance, initial and extended maturity dates, and also includes a comparison to the loan maturity schedule as of December 31, 2023. Section 02 | Debt Update 17

KBS-CMG.COM Debt Maturities1. 2 Borrower Outstanding Balance (in thousands) Additional Liquidity (in thousands) Total Commitment (in thousands) Initial Maturity Extended Maturity4 Accenture Tower Loan $307,000 $15,000 $322,000 11/2/26 11/2/27 The Almaden Mortgage Loan $118,000 - $118,000 2/1/26 2/1/26 Carillon Mortgage Loan $88,000 - $88,000 4/11/26 4/11/26 Amended and Restated Portfolio Loan Facility2 $466,000 $15,000 $481,000 1/22/27 1/23/29 Modified Portfolio Revolving Loan Facility $210,000 $9,145 $219,145 3/1/26 3/1/26 3001 & 3003 Washington Mortgage Loan $139,000 - $139,000 5/6/26 5/6/26 Park Place Village Mortgage Loan $65,000 - $65,000 8/31/25 8/31/27 Credit Facility3 $63,000 - $63,000 9/30/27 9/30/27 Total $1,456,000 $39,145 $1,495,145 Section 02 | Debt Update 18 1 All debt balance information is as of February 6, 2025. 2 In connection with the recent refinancing, the loan agreement requires principal paydowns throughout the term of the loan so that the total commitment amount does not exceed $420M, $300M and $150M by December 31, 2025, December 31, 2026 and December 31, 2027, respectively. 3 In connection with the recent refinancing, the loan agreement requires principal paydowns throughout the term of the loan so that the total commitment amount does not exceed $37.5M and $27.5M by December 31, 2025 and September 30, 2026, respectively. 4 Subject to the terms and conditions of the loan documents, the maturity dates may be extended as set forth above.

KBS-CMG.COM 19 Debt Maturities (in thousands) Section 02 | Debt Update Maturities as of December 31, 2023 February 6, 20251 1 Debt balance as of February 6, 2025. During the 12 months ended December 31, 2024, the Company paid down approximately $162.6M of debt, net of draws during the period. 2 Subject to the terms and conditions of the loan documents, the maturity dates may be extended as set forth above.

20 515 Congress Austin, TX Section 03 December 2024 Estimated Value KBS-CMG.COM

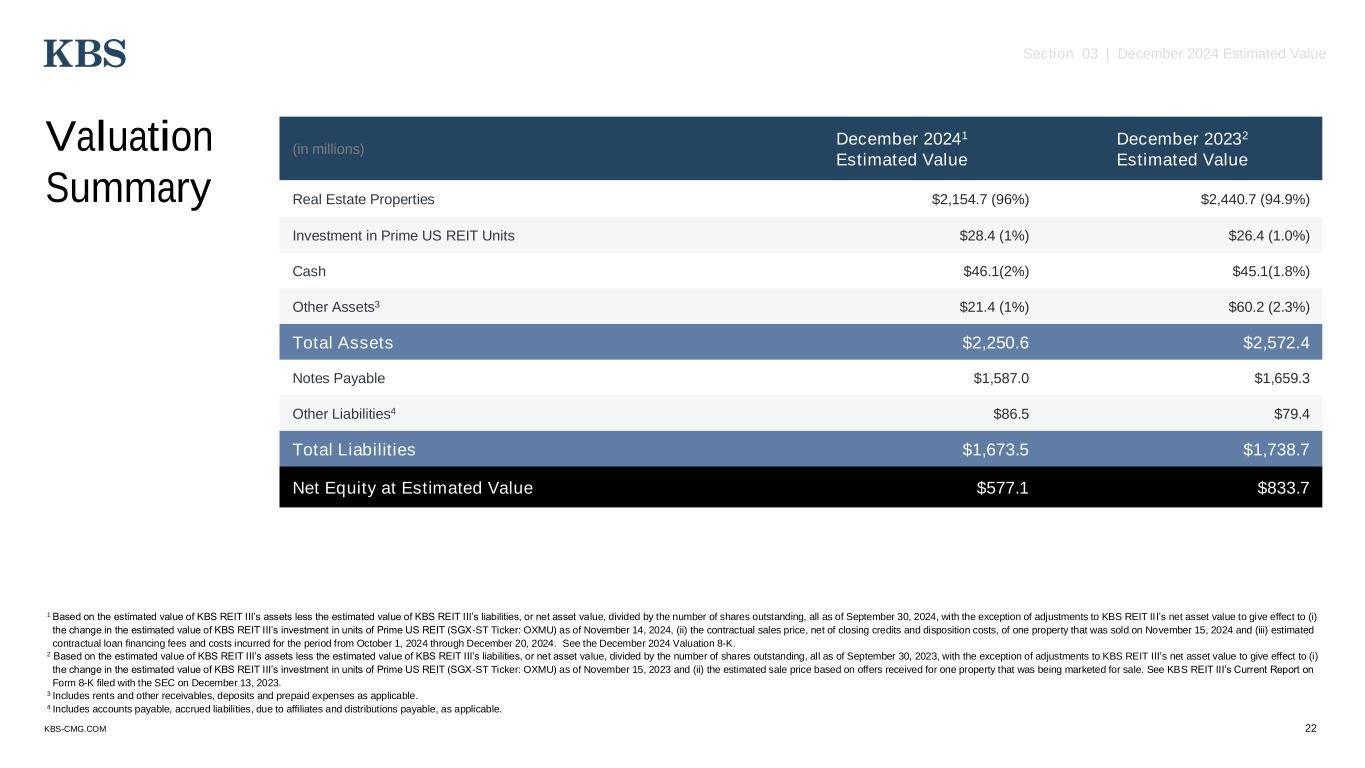

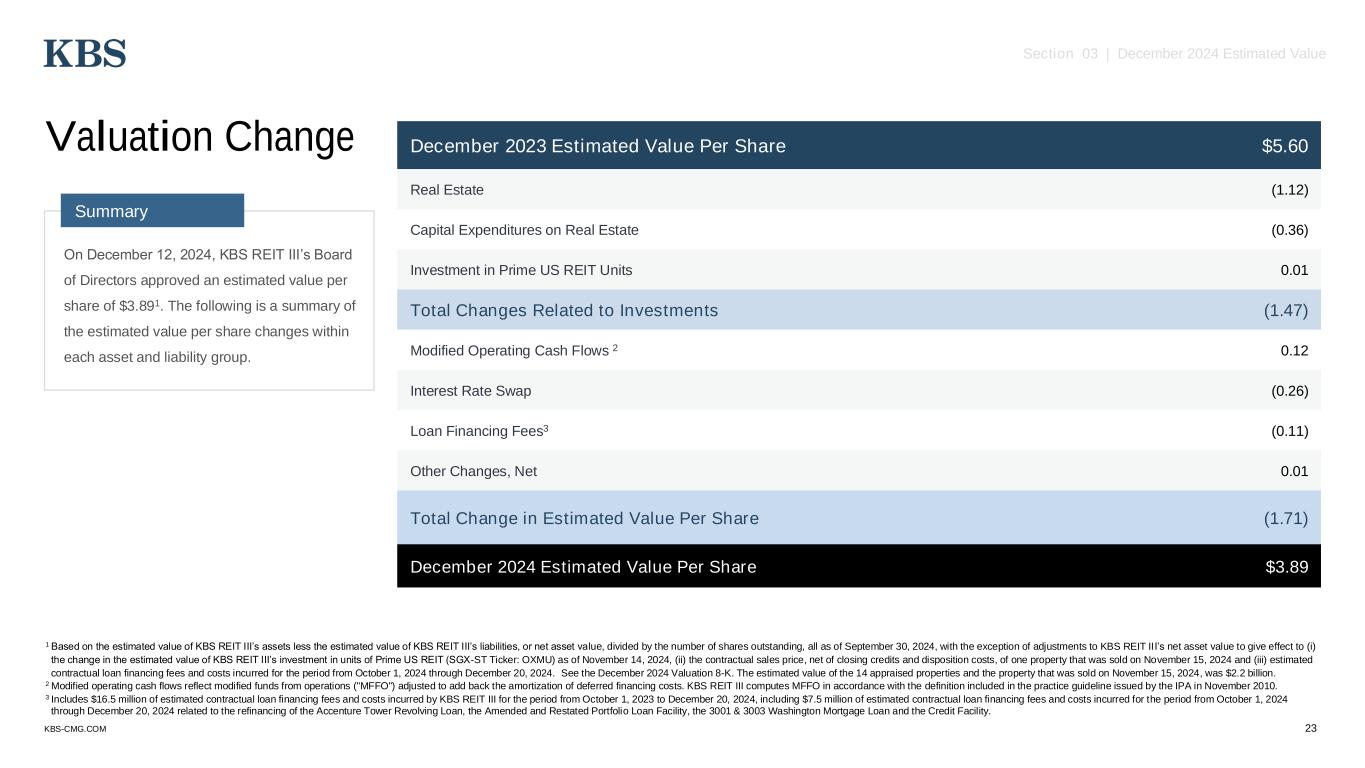

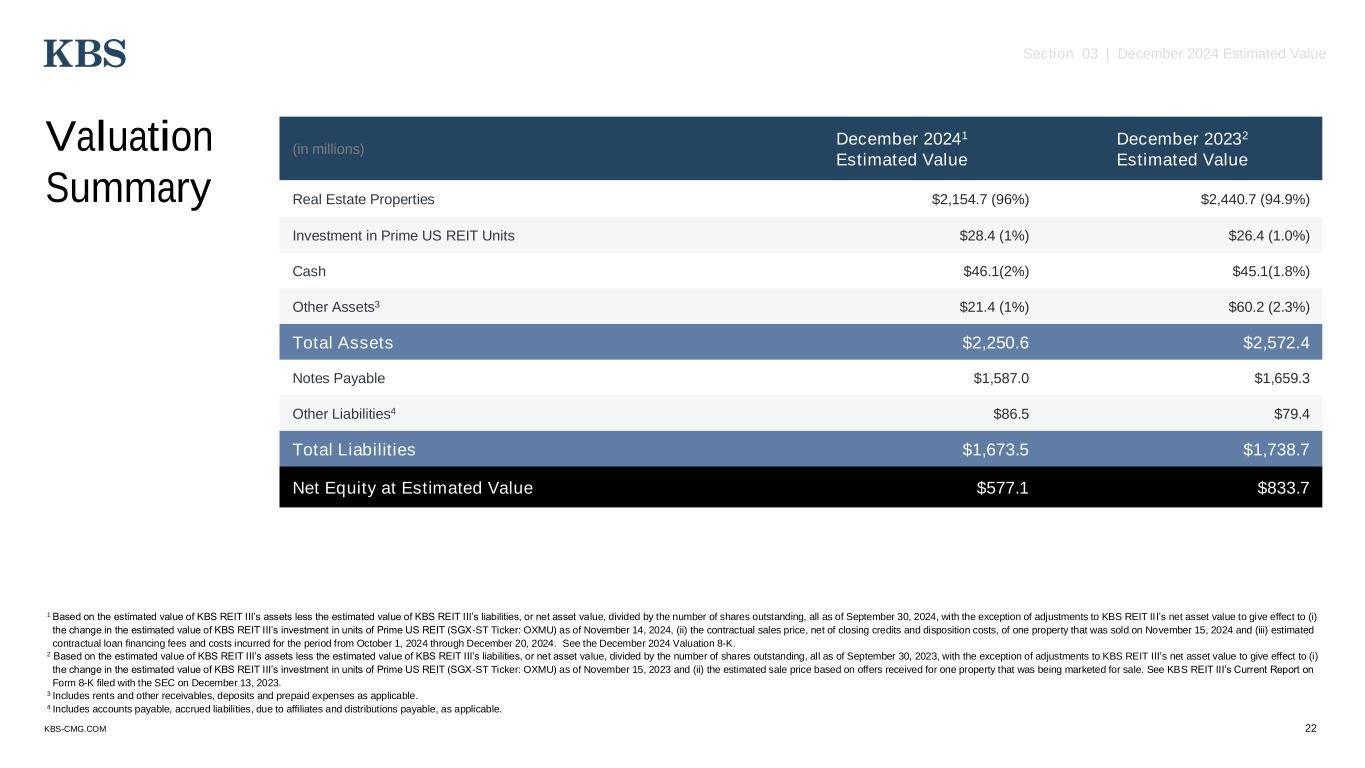

KBS-CMG.COM Value Information • KBS REIT III’s estimated value per share was determined in accordance with the Institute for Portfolio Alternatives’ Practice Guideline 2013-01, Valuations of Publicly Registered Non-Listed REITs. • Kroll, an independent, third-party real estate valuation firm, was engaged to provide a calculation of the range in estimated value per share of common stock. Kroll based the range in estimated value per share upon: o Appraisals of 14 of KBS REIT III’s real estate properties as of September 30, 2024and an estimated value for the investment in units of PRIME US REIT (SGX-ST Ticker: OXMU) as of November 14, 2024, all performed by Kroll. o The estimated value of Preston Commons, which was based on the contractual sales price, net of closing credits and disposition costs. Preston Commons was sold on November 15, 2024. o Estimated contractual loan financing fees and costs incurred for the period from October 1, 2024 through December 20, 2024. o Valuations performed by the Advisor of KBS REIT III’s other assets and liabilities as of September 30, 2024. The estimated value of KBS REIT III’s notes payable is equal to the GAAP fair value as of September 30, 2024. The estimated values of cash and a majority of the other assets and other liabilities are equal to their carrying values. o The estimated value per share did not include an enterprise (portfolio) premium or discount. Consideration was given to any potential subordinated participation in cash flows that would be due to the Advisor in a hypothetical liquidation if the required stockholder return thresholds are met. On December 12, 2024, KBS REIT III’s board of directors approved $3.89 as the estimated value per share of KBS REIT III’s common stock, which approximates the mid-range value of the range in estimated value per share calculated by Kroll, and which estimated value per share was recommended by the Advisor and KBS REIT III’s conflicts committee. Both the range in estimated value per share and the estimated value per share were based on Kroll appraisals, Kroll’s valuation of KBS REIT III’s investment in units of Prime US REIT, the Advisor’s valuations and the adjustments described above. Section 03 | December 2024 Estimated Value 21

KBS-CMG.COM Valuation Summary (in millions) December 20241 Estimated Value December 20232 Estimated Value Real Estate Properties $2,154.7 (96%) $2,440.7 (94.9%) Investment in Prime US REIT Units $28.4 (1%) $26.4 (1.0%) Cash $46.1(2%) $45.1(1.8%) Other Assets3 $21.4 (1%) $60.2 (2.3%) Total Assets $2,250.6 $2,572.4 Notes Payable $1,587.0 $1,659.3 Other Liabilities4 $86.5 $79.4 Total Liabilities $1,673.5 $1,738.7 Net Equity at Estimated Value $577.1 $833.7 1 Based on the estimated value of KBS REIT III’s assets less the estimated value of KBS REIT III’s liabilities, or net asset value, divided by the number of shares outstanding, all as of September 30, 2024, with the exception of adjustments to KBS REIT III’s net asset value to give effect to (i) the change in the estimated value of KBS REIT III’s investment in units of Prime US REIT (SGX-ST Ticker: OXMU) as of November 14, 2024, (ii) the contractual sales price, net of closing credits and disposition costs, of one property that was sold on November 15, 2024 and (iii) estimated contractual loan financing fees and costs incurred for the period from October 1, 2024 through December 20, 2024. See the December 2024 Valuation 8-K. 2 Based on the estimated value of KBS REIT III’s assets less the estimated value of KBS REIT III’s liabilities, or net asset value, divided by the number of shares outstanding, all as of September 30, 2023, with the exception of adjustments to KBS REIT III’s net asset value to give effect to (i) the change in the estimated value of KBS REIT III’s investment in units of Prime US REIT (SGX-ST Ticker: OXMU) as of November 15, 2023 and (ii) the estimated sale price based on offers received for one property that was being marketed for sale. See KBS REIT III’s Current Report on Form 8-K filed with the SEC on December 13, 2023. 3 Includes rents and other receivables, deposits and prepaid expenses as applicable. 4 Includes accounts payable, accrued liabilities, due to affiliates and distributions payable, as applicable. Section 03 | December 2024 Estimated Value 22

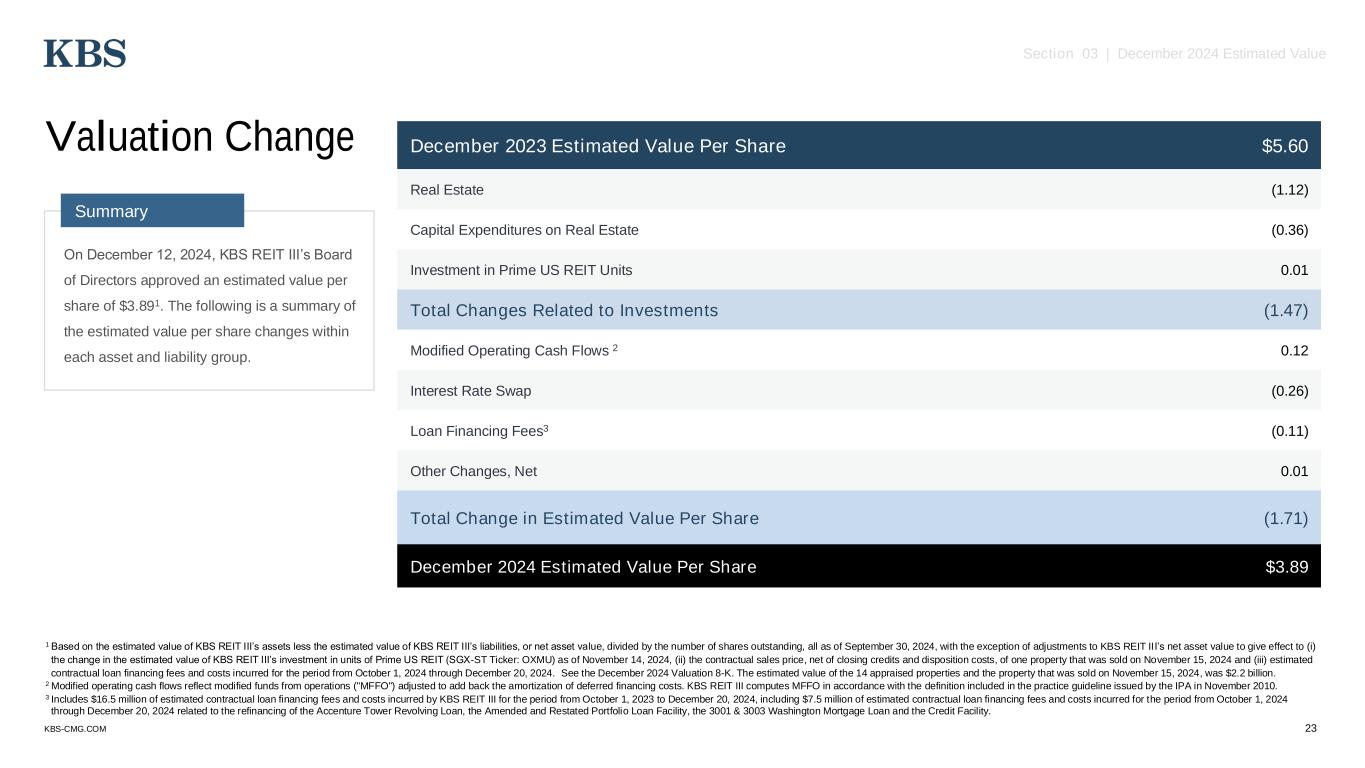

KBS-CMG.COM Valuation Change December 2023 Estimated Value Per Share $5.60 Real Estate (1.12) Capital Expenditures on Real Estate (0.36) Investment in Prime US REIT Units 0.01 Total Changes Related to Investments (1.47) Modified Operating Cash Flows 2 0.12 Interest Rate Swap (0.26) Loan Financing Fees3 (0.11) Other Changes, Net 0.01 Total Change in Estimated Value Per Share (1.71) December 2024 Estimated Value Per Share $3.89 1 Based on the estimated value of KBS REIT III’s assets less the estimated value of KBS REIT III’s liabilities, or net asset value, divided by the number of shares outstanding, all as of September 30, 2024, with the exception of adjustments to KBS REIT III’s net asset value to give effect to (i) the change in the estimated value of KBS REIT III’s investment in units of Prime US REIT (SGX-ST Ticker: OXMU) as of November 14, 2024, (ii) the contractual sales price, net of closing credits and disposition costs, of one property that was sold on November 15, 2024 and (iii) estimated contractual loan financing fees and costs incurred for the period from October 1, 2024 through December 20, 2024. See the December 2024 Valuation 8-K. The estimated value of the 14 appraised properties and the property that was sold on November 15, 2024, was $2.2 billion. 2 Modified operating cash flows reflect modified funds from operations ("MFFO") adjusted to add back the amortization of deferred financing costs. KBS REIT III computes MFFO in accordance with the definition included in the practice guideline issued by the IPA in November 2010. 3 Includes $16.5 million of estimated contractual loan financing fees and costs incurred by KBS REIT III for the period from October 1, 2023 to December 20, 2024, including $7.5 million of estimated contractual loan financing fees and costs incurred for the period from October 1, 2024 through December 20, 2024 related to the refinancing of the Accenture Tower Revolving Loan, the Amended and Restated Portfolio Loan Facility, the 3001 & 3003 Washington Mortgage Loan and the Credit Facility. Section 03 | December 2024 Estimated Value Summary On December 12, 2024, KBS REIT III’s Board of Directors approved an estimated value per share of $3.891. The following is a summary of the estimated value per share changes within each asset and liability group. 23

KBS-CMG.COM West Region Valuation Change in Value $507,500,000 -16.7% Avg. Change in Discount Rate Avg. Change in Terminal Cap 50 bps 50 bps Central Region Valuation Change in Value $1,050,600,000 -1.5% Avg. Change in Discount Rate Avg. Change in Terminal Cap 13 bps 12 bps East Region Valuation Change in Value $452,480,000 -4.7% Avg. Change in Discount Rate Avg. Change in Terminal Cap 25 bps 37 bps West Central East 1 For the December 2024 valuation, discount rates and terminal capitalization rates are based on the estimated value of the 14 Appraised Properties. 2 The changes in valuation discount and terminal capitalization rates are based on the 14 Appraised Properties. Section 03 | December 2024 Estimated Value Valuation Change Summary (December 2024 vs. December 2023)1 Overview The challenging interest rate environment coupled with uncertainty in the market leads to more conservative underwriting assumptions by investors, lenders, appraisers, and the like. This impact was seen across the board during the current NAV process—on average, discount rates and terminal capitalization rates utilized by Kroll[2] were 25 and 27 basis points higher, respectively, than those utilized in the previous valuation. The change in discount rates and terminal capitalization rates were the main drivers of the change in real estate values. 24

KBS-CMG.COM • a stockholder would be able to resell his or her shares at KBS REIT III’s estimated value per share; • a stockholder would ultimately realize distributions per share equal to KBS REIT III’s estimated value per share upon liquidation of KBS REIT III’s assets and settlement of its liabilities or a sale of KBS REIT III; • KBS REIT III’s shares of common stock would trade at the estimated value per share on a national securities exchange; • another independent third-party appraiser or third-party valuation firm would agree with KBS REIT III’s estimated value per share; or • the methodology used to determine KBS REIT III’s estimated value per share would be acceptable to FINRA or for compliance with ERISA reporting requirements. The December 2024 estimated value per share was performed in accordance with the provisions of and also to comply with the IPA Valuation Guidelines. As with any valuation methodology, the methodologies used are based upon a number of estimates and assumptions that may not be accurate or complete. Different parties with different assumptions and estimates could derive a different estimated value per share of KBS REIT III’s common stock, and this difference could be significant. The estimated value per share is not audited and does not represent the fair value of KBS REIT III’s assets less the fair value of KBS REIT III’s liabilities according to GAAP. KBS REIT III can give no assurance that: Stockholder Valuation Information KBS REIT III provides its estimated value per share to assist broker dealers that participated in KBS REIT III’s now-terminated initial public offering in meeting their customer account statement reporting obligations. Valuations for U.S. office properties continue to fluctuate due to weakness in the current real estate capital markets and the lack of transaction volume for U.S. office properties, increasing the uncertainty of valuations in the current market environment. The valuation of KBS REIT III’s investment in Prime US REIT is also subject to increased uncertainty. Due to the disruptions in the financial markets, the trading price of the common units of Prime US REIT has experienced substantial volatility and has been significantly impacted by the market sentiment for stock with significant investment in U.S. office buildings. KBS REIT III’s estimated value per share does not reflect a discount for the fact that KBS REIT III is externally managed, nor does it reflect a real estate portfolio premium/discount versus the sum of the individual property values. KBS REIT III’s estimated value per share does not take into account estimated disposition costs and fees for real estate properties that are not under contract to sell, debt prepayment penalties that could apply upon the prepayment of certain of KBS REIT III’s debt obligations, the impact of restrictions on the assumption of debt or swap breakage fees that may be incurred upon the termination of certain of KBS REIT III’s swaps prior to expiration. KBS REIT III has generally incurred disposition costs and fees related to the sale of each real estate property since inception of 0.8% to 2.9% of the gross sales price less concessions and credits, with the weighted average being approximately 1.5%. The estimated value per share does not take into consideration any financing and refinancing costs subsequent to December 20, 2024. KBS REIT III currently expects to utilize an independent valuation firm to update its estimated value per share no later than December 2025. Section 03 | December 2024 Estimated Value 25

KBS-CMG.COM Stockholder Valuation Information (continued) • As discussed, KBS REIT III has refinanced or extended over $1.3 billion of maturing loans during the 12 months ending February 6, 2025. • As of February 28, 2025, KBS REIT III has approximately $390 million of debt maturing in the next 12 months and also has approximately $80 million of required loan paydowns. • Only one of the loans maturing in the next 12 months, with a $65 million current outstanding balance, has additional extension options available and these options are subject to certain terms and conditions contained in the loan documents, some of which are not required as part of the current loan compliance tests. • KBS REIT III will likely seek to refinance or restructure its near-term maturing debt, and in order to do so, may need to make further paydowns on the maturing loan amounts. • In order to fund paydowns of its debt, KBS REIT III may need to evaluate selling equity securities and/or certain assets into a challenged real estate market in an effort to create liquidity for such paydowns and to fund potential capital needs of the portfolio. Additionally, KBS REIT III is required to sell assets in 2025, 2026 and 2027 as a result of its current loan agreements. Sales of assets for either purpose in the current real estate market may result in a lower sale price than KBS REIT III would otherwise obtain. • As a result of KBS REIT III’s upcoming loan maturities, the challenging commercial real estate lending environment, the current interest rate environment, leasing challenges in certain markets where KBS REIT III owns properties and the lack of transaction volume in the U.S. office market as well as general market instability, there may continue to be substantial doubt about KBS REIT III’s ability to continue as a going concern, though such risk has been reduced substantially as a result of the refinancing activity completed in the last 12 months. • KBS REIT III is completing its going concern analysis in connection with preparing its Annual Report on Form 10-K. The Annual Report on Form 10-K will be filed with the SEC in March 2025 and will be available on the SEC’s website at www.sec.gov. • These risks are not priced into the December 2024 estimated value per share. Potential Going Concern Risk Related to Estimated Value Per Share Section 03 | December 2024 Estimated Value 26

27 Legacy Town Center Plano, TX Section 04 Liquidity Update KBS-CMG.COM

KBS-CMG.COM Share Redemption Plan and Distributions Prior to the most recent real estate downturn and credit crunch that occurred subsequent to the COVID-19 pandemic and the aggressive interest rate hiking cycle by the federal reserve, we consistently focused on providing liquidity to shareholders. From the inception of KBS REIT III beginning in mid 2011, we consistently paid monthly distributions to shareholders at an annualized rate of 6.5% of the initial investor basis less any special distribution through the December 2022 record date and then at a slightly reduced annualized rate of 5.0% beginning with the January 2023 record date through the June 2023 record date, at which time we ceased monthly distributions to preserve liquidity given the state of the market. The total inception-to-date distributions per share to the first and last investors are $8.40 and $5.74, respectively1. Additionally, with regards to our share redemption program, we consistently provided liquidity through August 2022 (subject to the limitations on redemptions under our share redemption plan and suspensions of ordinary redemptions from December 2019 through the June 2021, as we planned for a tender offer). Since inception, we have redeemed $788.7 million of redemption requests or a total of approximately 74,646,957 shares. This includes a tender offer in Q2 2021 in which we offered to redeem $350.0 million of shares and only received redemption requests of approximately $272.7 million when finalized in early Q3 2021. As a result of the most recent real estate market downturn and credit crunch, and in order to preserve liquidity needed within the REIT, we ceased declaring distributions in June 2023. Due to certain restrictions and covenants included in our loan agreements as a result of refinancing certain of our debt facilities, we do not expect to pay any dividends or distributions or redeem any shares of common stock until certain loans are repaid or refinanced. One of the loans with these restrictions has a current maturity of January 2027 but may be extended subject to the terms and conditions of the loan agreement. As a result, we are unable to predict when we will be in a position to pay distributions to or provide liquidity to stockholders. Section 04 | Liquidity Update 28 1 Total inception-to-date distributions assumes all distributions received in cash other than special dividend shares and no share redemptions. For first investors, reflects all distributions per share paid since inception for a hypothetical investor who invested on escrow break (March 24, 2011). For last investors, reflects all distributions per share since investment for a hypothetical investor who invested on July 28, 2015.

29 Salt Lake Hardware Building Salt Lake City, UT Section 05 Future Strategy KBS-CMG.COM

KBS-CMG.COM Future Strategy In the current market environment with real estate valuations at a significant discount to previous market values, a strategic transaction involving a portfolio that is nearly 100% office is very difficult if not impossible to achieve. Additionally, with debt and equity capital for office buildings on the sidelines over the last couple of years, selling office buildings of significant size is very difficult due to the lack of available financing. KBS REIT III’s conflicts committee and our board of directors believe the best course of action is to carefully manage the portfolio through the current challenging market environment in order to be ready to complete a liquidation or strategic transaction once the markets have improved. Even for U.S. office properties, it does appear that the market is stabilizing, as additional debt and equity capital is beginning to be deployed into certain markets, especially for smaller well-located office properties. The conflicts committee and board of directors are focused on getting to a place in the real estate cycle where the debt and equity markets would support a larger pool of institutional buyers who would be able to purchase larger assets similar to those the REIT owns. We remain focused on returning funds to shareholders and providing liquidity as soon as market conditions are receptive. In order to make distributions to shareholders, we will need to pay down certain loan facilities as required by our loan agreements. We will continue to evaluate targeted sales of real estate assets in order to manage loan maturities, make required paydowns and eventually create liquidity for all shareholders. Section 05 | Future Strategy 30 Carillon Charlotte, NC

KBS-CMG.COM 31 KBS REIT III 2025 Goals & Objectives Deploy capital for value enhancing lease opportunities Efficiently manage the current real estate portfolio throughout the uncertain economic environment Finalize Carillon loan modification and manage required loan paydowns and other loan requirements throughout the portfolio Continue to execute strategic asset sales as markets stabilize and debt/equity capital return to the market 201 17th Street Atlanta, GA Section 05 | Future Strategy

KBS-CMG.COM 32 Section 05 | Future Strategy Carillon Charlotte, NC For questions, please contact Investor/Advisor Relations toll free at: (866) 527-4264 32