Lucky Express (China) Limited

Consolidated Balance Sheets (Stated in US dollars)

| | | | September 30, 2010 | | | June 30, 2010 | |

| | | | (Unaudited) | | | | |

| ASSETS | | | | | | | |

| Current assets | | | | | | | |

| Cash and cash equivalents | | | $ | 793,654 | | | $ | 136,742 | |

| Accounts receivable | | | | 1,909,099 | | | | 5,003,961 | |

| Advances for inventory purchase | | | | 606,187 | | | | 1,412,365 | |

| Advances for services | | | | 161,967 | | | | - | |

| Other receivables | | | | 149,404 | | | | 301,113 | |

| Deferred Tax Asset - Current | | | | 104,989 | | | | - | |

| Inventory, net | | | | 2,739,896 | | | | 3,308,935 | |

| Notes receivable | | | | 46,261 | | | | 214,738 | |

| Total Current Assets | | | | 6,511,457 | | | | 10,377,854 | |

| Prepayments for office building | | | | 1,295,905 | | | | 1,278,768 | |

| Property, plant and equipment, net | | | | 4,501,545 | | | | 4,207,210 | |

| Other assets | | | | 273,374 | | | | 269,759 | |

| TOTAL ASSETS | | | $ | 12,582,281 | | | $ | 16,133,591 | |

| LIABILITIES & SHAREHOLDERS’ EQUITY | |

| Current Liabilities | |

| Accounts payable | | | $ | 364,789 | | | $ | 356,216 | |

| Customer deposits | | | | 151,873 | | | | - | |

| Accrued expenses and other liabilities | | | | 14,000 | | | | 99,966 | |

| Taxes payable | | | | 14,087 | | | | 62,015 | |

| Due to related parties | | | | 3,625,664 | | | | 8,059,244 | |

| Total Current Liabilities | | | | 4,170,413 | | | | 8,577,441 | |

| TOTAL LIABILITIES | | | $ | 4,170,413 | | | $ | 8,577,441 | |

| | | | | | | | | | |

| SHAREHOLDERS’ EQUITY | | | | | | | | | |

| Common Stock (par value $0.1287 per share; 10,000,000 shares authorized; 10,000 shares issued and outstanding as of September 30, 2010 and June 30, 2010) | | | $ | 1,287 | | | $ | 1,287 | |

| Additional paid in capital | | | | 7,841,197 | | | | 7,796,200 | |

| Retained earnings /(deficits) | | | | 161,767 | | | | (386,518 | ) |

| Accumulated other comprehensive income | | | | 407,617 | | | | 145,181 | |

| TOTAL SHAREHOLDERS’ EQUITY | | | | 8,411,868 | | | | 7,556,150 | |

| | | | | | | | | | |

| TOTAL LIABILITIES AND SHAREHOLDERS’ EQUITY | | | $ | 2,582,281 | | | $ | 16,133,591 | |

The accompanying notes are an integrated part of these consolidated financial statements

Lucky Express (China) Limited

Consolidated Statements of Operations and Comprehensive Income

(Stated in US dollars)

| | | Three Months Ended | |

| | | September 30, 2010 | | | September 30, 2009 | |

| | | (Unaudited) | | | (Unaudited) | |

| Sales revenue | | $ | 17,024,602 | | | $ | 6,876,769 | |

| Cost of goods sold | | | 16,517,173 | | | | 7,117,684 | |

| Gross Profit | | | 507,429 | | | | (240,915 | ) |

| | | | | | | | | |

| Operating expenses | | | | | | | | |

| Selling expenses | | | 34,018 | | | | 101,077 | |

| General and administrative expenses | | | 56,476 | | | | 72,814 | |

Total operating expenses | | | 90,494 | | | | 173,891 | |

| | | | | | | | | |

| Income (loss) from operations | | | 416,935 | | | | (414,806 | ) |

| Interest income | | | 297 | | | | 256 | |

| Bank Charge | | | (1,128 | ) | | | (270 | ) |

| | | | | | | | | |

| Income (loss) before income tax | | | 416,104 | | | | (414,820 | ) |

| | | | | | | | | |

| Income Tax provision | | | - | | | | - | |

| | | | | | | | | |

| Net Income (Loss) | | $ | 416,104 | | | $ | (414,820 | ) |

| | | | | | | | | |

| Other comprehensive income | | | | | | | | |

| Foreign currency translation adjustments | | | 262,436 | | | | 261,103 | |

| Total Comprehensive Income (Loss) | | $ | 678,540 | | | $ | (153,717 | ) |

The accompanying notes are an integrated part of these consolidated financial statements

Lucky Express (China) Limited

Consolidated Statements of Cash Flows

(Stated in US dollars)

| | | Three Months Ended | |

| | | September 30, 2010 | | | September 30, 2009 | |

| | | (Unaudited) | | | (Unaudited) | |

| CASH FLOWS FROM OPERATING ACTIVITIES | | | | | | |

| Net income (loss) | | $ | 416,104 | | | $ | (414,820 | ) |

| Adjustments to reconcile net income (loss) to net cash provided by operating activities: | | | | | | | | |

| Depreciation expense | | | 61,551 | | | | 83,874 | |

| Changes in operating assets and liabilities: | | | | | | | | |

| Accounts receivable | | | 3,161,919 | | | | (296,142 | ) |

| Note receivable | | | 171,355 | | | | (21,497 | ) |

| Advances to suppliers | | | 664,216 | | | | (72,389 | ) |

| Other receivables | | | 155,744 | | | | (227,282 | ) |

| Inventories | | | 613,381 | | | | (531,303 | ) |

| Deferred tax asset | | | (104,989 | ) | | | - | |

| Accounts payable | | | 3,799 | | | | 258,359 | |

| Customer deposits | | | 151,873 | | | | 169,966 | |

| Other payables | | | (87,306 | ) | | | (7,600 | ) |

| Taxes payable | | | (48,759 | ) | | | (4,941 | ) |

| Due to/from related party | | | (4,541,580 | ) | | | 1,202,407 | |

| CASH USED IN OPERATING ACTIVITIES | | | 617,308 | | | | 138,632 | |

| | | | | | | | | |

| CASH FLOWS FROM INVESTING ACTIVITIES | | | | | | | | |

| Purchase of property, plant and equipment | | | (9,707 | ) | | | (142,946 | ) |

| Prepayments for office building | | | - | | | | (18,497 | ) |

| CASH USED IN INVESTING ACTIVITIES | | | (9,707 | ) | | | (161,443 | ) |

| | | | | | | | | |

| Effect of exchange rate changes on cash and cash equivalents | | | 49,311 | | | | 18,296 | |

| NET INCREASE (DECREASE) IN CASH | | | 656,912 | | | | (4,515 | ) |

| CASH AND CASH EQUIVALENTS AT BEGINNING OF YEAR | | $ | 136,742 | | | $ | 111,725 | |

| CASH AND CASH EQUIVALENTS AT END OF YEAR | | $ | 793,654 | | | $ | 107,210 | |

| | | | | | | | | |

| Supplementary Disclosures for Cash Flow Information: | | | | | | | | |

| Income taxes paid | | $ | 138,798 | | | $ | - | |

| NON-CASH INVESTING AND FINANCING ACTIVITIES | | | | | | | | |

| Imputed interest to the related party | | $ | 59,478 | | | $ | 18,300 | |

The accompanying notes are an integrated part of these consolidated financial statements

Lucky Express (China) Limited

Notes to Consolidated Financial Statements

(Stated in US dollars)

NOTE 1 - ORGANIZATION AND BUSINESS OPERATIONS

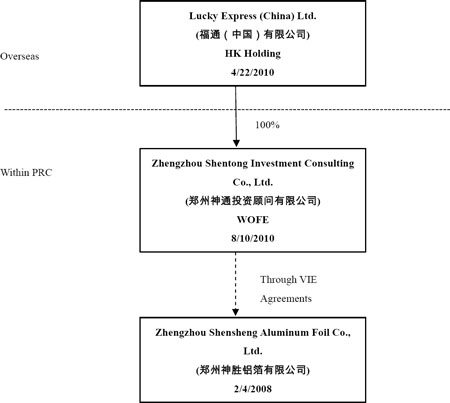

Zhengzhou Shensheng Aluminum Foil Co., Ltd. (“Shensheng”) was incorporated on February 4, 2008 in Zhengzhou City, Henan Province, People’s Republic of China (the“PRC”) with registered capital of RMB 60 million ($8,342,255). Mr. Congfu Li is the controlling shareholder of Zhengzhou Aluminum Co., Ltd., (“Zhengzhou Aluminum”) and 100% of equity interest of Shensheng is held by Zhengzhou Aluminum. Shensheng is primarily engaged in manufacturing and sales of aluminum foils products in China.

Prior to the incorporation on February 4, 2008, Shensheng was a division of Zhengzhou Aluminum. On January 22, 2008, the shareholders of Zhengzhou Aluminum consented to separate the division from the Group and incorporate into a new company. Zhengzhou Aluminum transferred its equipments to Shensheng and the assets transferred were recorded at historical cost as it was a transfer between entities under common control.

Lucky Express (China) Limited (the “Company” or “Lucky”) was incorporated under laws of Hong Kong, PRC, on April 22, 2010 to serve as the intermediate holding company. Mr. Congfu Li, the controlling interest holder of Shensheng acquired 100% of outstanding shares of this Company on September 20, 2010. As of June 30, 2010, the Company has 10,000,000 common shares authorized with HKD 1 par value ($0.1287) each and 10,000 shares are issued and outstanding.

Zhengzhou Shentong Investment Consulting Co., Ltd. (“Shentong”) was incorporated on August 10, 2010 in Zhengzhou City, Henan Province, PRC, and is a wholly owned foreign enterprise (“WOFE”) of the Company.

As part of the restructuring, on August 12, 2010, Shentong entered into a series of agreements with Zhengzhou Aluminum and Shensheng, including Consulting Agreement and Operating Agreement, which entitled Shentong to have substantially all of the economic benefits of Shensheng in consideration for consulting services provided by Shentong to Shensheng. An Option Agreement allows Shentong to acquire the shares of Shensheng when permitted by the PRC laws. And, Powers of Attorney that provides Shentong with the voting rights of Shensheng’s shareholder and Equity Interest Pledge Agreement that pledges the shares in Shensheng to Shentong without transferring legal ownership in Shensheng to Shentong. As the result of restructuring, Shensheng became a variable interest entity (“VIE”) and is included in the consolida ted group.

The corporate structure of the Company is as follows:

Since the Company and Shensheng are under common control for accounting purposes, the acquisition of Shensheng’s controlling interest has been treated as a recapitalization with no adjustment to the historical basis of their assets and liabilities. The restructuring has been accounted for using the “as if” pooling method of accounting and the operations were consolidated as if the restructuring had occurred as of the beginning of the earliest period presented in our consolidated financial statements and the current corporate structure had been in existence throughout the periods covered by our consolidated financial statements.

Basis of Presentation

The accompanying unaudited interim consolidated financial statements as of September 30, 2010 and 2009 and for the three months ended September 30, 2010 and 2009 have been prepared in accordance with accounting principles generally accepted in the United States of America (“U.S. GAAP”) and pursuant to the rules and regulations of the Securities and Exchange Commission. Certain information and footnote disclosures normally included in financial statements prepared in accordance with U.S. GAAP have been condensed or omitted pursuant to such rules and regulations. The consolidated financial statements in this report should be read in conjunction with the June 30, 2010 and 2009 audited financial statements of the Company and the notes thereto included in the Company’s Form 8-K filed on November 10, 2010.

In the opinion of management, the unaudited interim consolidated financial statements for the three months ended September 30, 2010 and 2009 have been prepared on the same basis as the audited consolidated statements as of June 30, 2010 and 2009 and reflect all adjustments, consisting of normal recurring adjustments, necessary for fair presentation of financial position and results of operations for the interim periods presented have been reflected herein. The results of operations for the three months ended September 30, 2010 and 2009 are not necessarily indicative of the operating results for any subsequent quarter, for the full fiscal year or any future periods.

NOTE 2 – ADVANCE FOR SERVICES

As of September 30, 2010, the Company prepaid approximately $160,000 for consulting services provided for assisting the Company listed on US stock market.

NOTE 3 – INCOME TAXES

The Company’s PRC subsidiary Shentong and VIE Shensheng were incorporated in the PRC and are governed by the Enterprise Income Tax Law of the PRC (“EIT Law”). The Company is subject to tax at a statutory rate of 25% on income reported in the statutory financial statements after tax adjustments for three month periods ended September 30, 2009 and 2008 respectively. The effective tax rates for the Company are as follows:

| | | Three Month Periods Ended, | |

| | | September 30, 2010 | | | September 30, 2009 | |

| | | | | | | |

| U.S Federal income tax statutory rate | | | 35 | % | | | 35 | % |

| PRC statutory income tax rate (25%) difference | | | (10 | )% | | | (10 | )% |

| Changes in valuation allowance of deferred tax assets | | | (25 | )% | | | (25 | )% |

| Effective tax rate | | | - | | | | - | |

NOTE 4 –SUBSEQUENT EVENTS

On October 29, 2010, the Company completed a private placement transaction (the “Private Placement”) pursuant to which the Company sold an aggregate of 990,000 shares of common stock at $0.1515 per share. As a result, the Company received gross proceeds in the amount of $150,000.

On November 1, 2010, Lucky Express (China) Limited (the “Company”) completed a reverse acquisition with through a share exchange with China Aluminum Foil, Inc. (“China Aluminum Foil”, previously AJ Acquisition Corp V, Inc.), whereby China Aluminum Foil acquired 100% of the issued and outstanding common stock of the Company in exchange for 99,000 shares of China Aluminum Foil. As a result of the reverse acquisition, the Company became China Aluminum Foil’s wholly-owned subsidiary and the former shareholders of the Company became controlling stockholders of China Aluminum Foil. The share exchange transaction with China Aluminum Foil was treated as a reverse acquisition, with the Company as the accounting acquirer and China Aluminum Foil as the acquired party.