Exhibit 99.1

DEFINITIONS

The following is a listing of certain abbreviations, acronyms and other industry terminology used throughout this Exhibit 99.1.

Measurements:

Barrel: One barrel of petroleum products that equals 42 U.S. gallons

BPD: Barrels per day

Bcf : One billion cubic feet of natural gas

Bcf/d: One billion cubic feet of natural gas per day

British Thermal Unit (Btu): A unit of energy needed to raise the temperature of one pound of water by one degree

Fahrenheit

Dekatherms (Dth): A unit of energy equal to one million British thermal units

Mbbls/d: One thousand barrels per day

Mdth/d: One thousand dekatherms per day

MMcf/d: One million cubic feet per day

MMdth: One million dekatherms or approximately one trillion British thermal units

MMdth/d: One million dekatherms per day

TBtu: One trillion British thermal units

Consolidated Entities:

Cardinal: Cardinal Gas Services, L.L.C.

Constitution: Constitution Pipeline Company, LLC

Gulfstar One: Gulfstar One LLC

Northwest Pipeline: Northwest Pipeline, LLC

Transco: Transcontinental Gas Pipe Line Company, LLC

Partially Owned Entities: Entities in which we do not own a 100 percent ownership interest and, as of December 31, 2014, which we account for as an equity investment, including principally the following:

Aux Sable: Aux Sable Liquid Products LP

Caiman II: Caiman Energy II, LLC

Discovery: Discovery Producer Services LLC

Gulfstream: Gulfstream Natural Gas System, L.L.C.

Laurel Mountain: Laurel Mountain Midstream, LLC

OPPL: Overland Pass Pipeline Company LLC

UEOM: Utica East Ohio Midstream LLC

Government and Regulatory:

EPA: Environmental Protection Agency

FERC: Federal Energy Regulatory Commission

IRS: Internal Revenue Service

SEC: Securities and Exchange Commission

Other:

ACMP: Access Midstream Partners, L.P.

B/B Splitter: Butylene/Butane splitter

Caiman Acquisition: Our April 2012 purchase of 100 percent of Caiman Eastern Midstream, LLC located in the

Ohio River Valley area of the Marcellus Shale region

DAC: Debutanized aromatic concentrate

Fractionation: The process by which a mixed stream of natural gas liquids is separated into its constituent products,

such as ethane, propane, and butane

IDR: Incentive distribution right

Laser Acquisition: Our February 2012 purchase from Delphi Midstream Partners, LLC of 100 percent of certain

entities that operate in Susquehanna County, PA and southern New York

LNG: Liquefied natural gas; natural gas which has been liquefied at cryogenic temperatures

MVC: Minimum volume commitment

NGLs: Natural gas liquids; natural gas liquids result from natural gas processing and crude oil refining and are

used as petrochemical feedstocks, heating fuels, and gasoline additives, among other applications

NGL margins: NGL revenues less Btu replacement cost, plant fuel, transportation, and fractionation

NYSE: New York Stock Exchange

RGP Splitter: Refinery grade propylene splitter

Throughput: The volume of product transported or passing through a pipeline, plant, terminal, or other facility

Williams: The Williams Companies, Inc. and, unless the context otherwise indicates, its subsidiaries (other than Williams Partners L.P. and its subsidiaries)

PART II

Item 6. Selected Financial Data

The following financial data at December 31, 2014 and 2013 and for each of the three years in the period ended December 31, 2014, should be read in conjunction with Item 7, Management’s Discussion and Analysis of Financial Condition and Results of Operations and Item 8, Financial Statements and Supplementary Data of this Exhibit 99.1. All other financial data has been prepared from our accounting records.

|

| | | | | | | | | | | | | | | | | | | | |

| | | 2014 | | 2013 | | 2012 | | 2011 | | 2010 |

| | | (Millions, except per-unit amounts) |

| Revenues (1) | | $ | 7,409 |

| | $ | 6,835 |

| | $ | 7,471 |

| | $ | 7,916 |

| | $ | 6,625 |

|

| Net income (1) | | 1,284 |

| | 1,119 |

| | 1,291 |

| | 1,604 |

| | 1,234 |

|

| Net income attributable to controlling interests (1) | | 1,188 |

| | 1,116 |

| | 1,291 |

| | 1,604 |

| | 1,218 |

|

| Net income per common unit (1) | | .99 |

| | 1.76 |

| | 2.30 |

| | 4.51 |

| | 3.26 |

|

| Total assets at December 31 (1) (3) | | 49,322 |

| | 23,571 |

| | 20,678 |

| | 15,486 |

| | 14,295 |

|

| Commercial paper and long-term debt due within one year at December 31 (2) | | 802 |

| | 225 |

| | — |

| | 324 |

| | 458 |

|

| Long-term debt at December 31 (1) (3) | | 16,326 |

| | 9,057 |

| | 8,437 |

| | 6,913 |

| | 6,365 |

|

| Total equity at December 31 (1) (3) | | 28,685 |

| | 11,567 |

| | 9,691 |

| | 6,122 |

| | 5,826 |

|

| Cash distributions declared per common unit | | 3.642 |

| | 3.415 |

| | 3.140 |

| | 2.900 |

| | 2.653 |

|

____________

| |

| (1) | 2014 is impacted by the merger with ACMP. Because ACMP was under the common control of Williams effective July 1, 2014, the merger was accounted for as a common control transaction, whereby ACMP’s assets and liabilities were combined with ours at Williams’ historical carrying values and the historical results of ACMP’s operations were combined with ours beginning with the date (July 1, 2014) Williams obtained control of ACMP. Net income per common unit was recast for years prior to 2014 to reflect the surviving entity’s equity structure. The 2014 increase in Long-term debt reflects $2.8 billion in issuances as well as $4.1 billion in debt assumed as the result of the merger with ACMP. |

| |

| (2) | The increase in 2014 and 2013 reflects borrowings under our commercial paper program, which was initiated in 2013. |

| |

| (3) | The change in 2012 reflects assets acquired, as well as debt and equity issuances related to the Caiman and Laser Acquisitions. |

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations

General

We are an energy infrastructure master limited partnership focused on connecting North America’s significant hydrocarbon resource plays to growing markets for natural gas, NGLs, and olefins through our gas pipeline and midstream businesses. WPZ GP LLC, a Delaware limited liability company wholly owned by Williams, is our general partner.

Our interstate natural gas pipeline strategy is to create value by maximizing the utilization of our pipeline capacity by providing high quality, low cost transportation of natural gas to large and growing markets. Our gas pipeline businesses’ interstate transmission and storage activities are subject to regulation by the FERC and as such, our rates and charges for the transportation of natural gas in interstate commerce, and the extension, expansion or abandonment of jurisdictional facilities and accounting, among other things, are subject to regulation. The rates are established through the FERC’s ratemaking process. Changes in commodity prices and volumes transported have limited near-term impact on revenues because the majority of cost of service is recovered through firm capacity reservation charges in transportation rates.

The ongoing strategy of our midstream operations is to safely and reliably operate large-scale midstream infrastructure where our assets can be fully utilized and drive low per-unit costs. We focus on consistently attracting new business by providing highly reliable service to our customers. These services include natural gas gathering, processing and treating, NGL fractionation and transportation, crude oil production handling and transportation, olefin production, marketing services for NGL, oil and natural gas, as well as storage facilities.

Our reportable segments are Access Midstream, Northeast G&P, Atlantic-Gulf, West, and NGL & Petchem Services which are comprised of the following businesses as of December 31, 2014:

| |

| • | Access Midstream provides domestic gathering, treating, and compression services to producers under long-term, fixed fee contracts. Its primary operating areas are in the Barnett Shale region of north-central Texas, the Eagle Ford Shale region of south Texas, the Haynesville Shale region of northwest Louisiana; the Marcellus Shale region primarily in Pennsylvania and West Virginia, the Niobrara Shale region of eastern Wyoming, the Utica Shale region of eastern Ohio, and the Mid-Continent region which includes the Anadarko, Arkoma, Delaware and Permian Basins. Access Midstream also includes a 49 percent equity-method investment in UEOM, a 50 percent equity-method investment interest in the Delaware Basin gas gathering system in the Mid-Continent region, and Appalachia Midstream Services, LLC, which owns an approximate average 45 percent interest in 11 gas gathering systems in the Marcellus Shale (Appalachia Midstream Investments). |

| |

| • | Northeast G&P is comprised of midstream gathering and processing businesses in the Marcellus and Utica shale regions, as well as a 69 percent equity investment in Laurel Mountain and a 58 percent equity investment in Caiman II. |

| |

| • | Atlantic-Gulf is comprised of our interstate natural gas pipeline, Transco, and significant natural gas gathering and processing and crude oil production handling and transportation in the Gulf Coast region, as well as a 50 percent equity investment in Gulfstream, a 60 percent equity investment in Discovery, and a 41 percent interest in Constitution (a consolidated entity). |

| |

| • | West is comprised of our gathering, processing and treating operations in New Mexico, Colorado, and Wyoming and our interstate natural gas pipeline, Northwest Pipeline. |

| |

| • | NGL & Petchem Services is comprised of our 83.3 percent interest in an olefins production facility in Geismar, Louisiana, along with a refinery grade propylene splitter and various petrochemical and feedstock pipelines in the Gulf Coast region, an oil sands offgas processing plant near Fort McMurray, Alberta, and an NGL/olefin fractionation facility and B/B splitter facility at Redwater, Alberta. This segment also includes an NGL and natural gas marketing business, storage facilities and an undivided 50 percent interest in an NGL fractionator near Conway, Kansas, and a 50 percent equity investment in OPPL. |

Unless indicated otherwise, the following discussion and analysis of critical accounting estimates, results of operations, and financial condition and liquidity should be read in conjunction with the consolidated financial statements and notes thereto included in Part II, Item 8 of this document.

Merger

Pursuant to an Agreement and Plan of Merger dated as of October 24, 2014, the general partners of Williams Partners L.P. and Access Midstream Partners, L.P. agreed to combine those businesses and their general partners, with Williams Partners L.P. merging with and into Access Midstream Partners, L.P. and the Access Midstream Partners, L.P. general partner being the surviving general partner (the Merger). Following the completion of the Merger on February 2, 2015, as further described below, the surviving Access Midstream Partners, L.P. changed its name to Williams Partners L.P., and the surviving general partner changed its name to WPZ GP LLC. For the purpose of this discussion, Williams Partners L.P. (WPZ) refers to the renamed merged partnership, while Pre-merger Access Midstream Partners, L.P. (Pre-merger ACMP) and Pre-merger Williams Partners L.P. (Pre-merger WPZ) refer to the separate partnerships prior to the consummation of the Merger and subsequent name change.

In accordance with the terms of the Merger, each Pre-merger ACMP unitholder received 1.06152 Pre-merger ACMP units for each Pre-merger ACMP unit owned immediately prior to the Merger. In conjunction with the Merger, each Pre-merger WPZ common unit held by the public was exchanged for 0.86672 common units of Pre-merger ACMP. Each Pre-merger WPZ common unit held by Williams was exchanged for 0.80036 common units of Pre-merger ACMP. Prior to the closing of the Merger, the Class D limited partner units of Pre-merger WPZ, all of which were held by Williams, were converted into Pre-merger WPZ common units on a one-for-one basis pursuant to the terms of the partnership agreement of Pre-merger WPZ. All of the general partner interests of Pre-merger WPZ were converted into general partner interests of Pre-merger ACMP such that the general partner interest of Pre-merger ACMP represents 2 percent of the outstanding partnership interest. Following the Merger, Williams owns approximately 60 percent of the merged partnership, including the general partner interest and IDRs.

Because the Merger was between entities under common control, Pre-merger ACMP’s historical financial position, results of operations, and cash flows were combined with those of Pre-merger WPZ for periods during which Pre-merger ACMP was under common control of Williams (periods subsequent to July 1, 2014). Both Pre-merger WPZ and Pre-merger ACMP are reflected at Williams’ historical basis in both partnerships.

Distributions

In January 2015, our general partner’s Board of Directors approved a quarterly distribution to unitholders of $0.85 per unit.

Overview

Net income attributable to controlling interests for the year ended December 31, 2014, improved compared to the prior year. The current year improvement includes contributions from Access Midstream since July 1, 2014. Other significant fluctuations include lower NGL margins driven by lower volumes and lower olefin margins associated with the absence of volumes from our Geismar plant partially offset by related insurance recoveries. Interest expense increased due to higher debt levels, partially offset by higher fee-based revenues. See additional discussion in Results of Operations.

Abundant and low-cost natural gas reserves in the United States continue to drive demand for midstream and pipeline infrastructure. We believe that we have successfully positioned our energy infrastructure businesses for future growth.

Canada Acquisition

On February 28, 2014, we acquired certain of Williams’ Canadian operations for total consideration valued at approximately $1.2 billion. The operations included an oil sands offgas processing plant near Fort McMurray, Alberta, an NGL/olefin fractionation facility and B/B Splitter facility at Redwater, Alberta. We funded the transaction with $56 million of cash including $31 million that was paid in the second quarter, the issuance of 25,577,521 Pre-merger WPZ Class D limited-partner units, and an increase in the capital account of our general partner to allow it to maintain its 2

percent general partner interest. In lieu of cash distributions, the Class D units received quarterly distributions of additional paid-in-kind Class D units. This common control acquisition was treated similar to a pooling of interests whereby the historical results of operations were combined with ours for all periods presented.

In October 2014, a purchase price adjustment was finalized whereby we received $56 million in cash from Williams in the fourth quarter 2014 and Williams waived $2 million in payments on its IDRs with respect to Pre-merger WPZ’s November 2014 distribution.

Geismar Incident

On June 13, 2013, an explosion and fire occurred at our Geismar olefins plant. The incident (Geismar Incident) rendered the facility temporarily inoperable and resulted in significant human, financial, and operational effects. This facility is part of our NGL & Petchem Services segment.

At the time of the incident, we had insurance coverage for repair and replacement costs, lost production and additional expenses related to the incident as follows:

| |

| • | Property damage and business interruption coverage with a combined per-occurrence limit of $500 million and retentions (deductibles) of $10 million per occurrence for property damage and a 60-day waiting period per occurrence for business interruption; |

| |

| • | General liability coverage with per-occurrence and aggregate annual limits of $610 million and retentions (deductibles) of $2 million per occurrence; |

| |

| • | Workers’ compensation coverage with statutory limits and retentions (deductibles) of $1 million total per occurrence. |

During the year ended December 31, 2014, we received $246 million of insurance recoveries related to the Geismar Incident and incurred $14 million of related covered insurable expenses in excess of our retentions (deductibles). These amounts are reflected as a net gain in Net insurance recoveries- Geismar Incident within Costs and expenses in our Consolidated Statement of Comprehensive Income.

We expect our total loss to exceed our $500 million policy limit, which would result in a total claim of approximately $72 million related to the repair of the plant and the remainder related to business interruption. Through December 31, 2014, we have received a total of $296 million from insurers. We continue to work with insurers in support of all claims, as submitted, and are vigorously pursuing collection of the remaining $200 million insurance limits.

Further, we are impacted by certain uninsured losses, including amounts associated with the 60-day waiting period for business interruption, as well as other deductibles, policy limits, and uninsured expenses. Our assumptions and estimates including repair cost estimates and insurance proceeds associated with our property damage and business interruption coverage, are subject to various risks and uncertainties that could cause the actual results to be materially different.

Our Geismar plant, which restarted in February 2015, is expected to continue to ramp up to expanded capacity through March. Production during February and March is expected to be intermittent, resulting in limited financial contribution for the first quarter.

Northeast G&P

Marcellus Shale

In the first half of 2014, we added: (1) fractionation capacity at our Moundsville fractionator facility bringing the NGL handling capacity to approximately 42.5 Mbbls/d, (2) the associated 50-mile ethane pipeline to Houston, Pennsylvania, and (3) the first phase to the condensate stabilization project in the Marcellus Shale. In the third quarter of 2014, we completed the construction of our first deethanizer with a capacity of 40 Mbbls/d; and in the fourth quarter of 2014, we completed our first turbo-expander at our Oak Grove facility to add 200 MMcf/d of processing capacity and the last phase of the condensate stabilization project.

Caiman II

As a result of contributions made in the first quarter of 2014, our ownership in the Caiman II joint project increased to 58 percent. These contributions are used to fund Caiman II’s 50 percent investment in Blue Racer Midstream LLC (Blue Racer Midstream).

Through capital invested within our Caiman II equity investment, we began construction of the Blue Racer Midstream joint project in 2014. Blue Racer Midstream is an expansion of the gathering and processing and the associated liquids infrastructure serving oil and gas producers in the Utica Shale, primarily in Ohio and Northwest Pennsylvania. Expansion plans included the addition of Natrium II, a second 200 MMcf/d processing plant at Natrium, West Virginia, which was completed in April 2014. Construction of an additional 200 MMcf/d processing plant is underway at the Berne complex in Monroe County, Ohio. Berne I was placed into service in January 2015.

Atlantic-Gulf

Gulfstar One

During the fourth quarter of 2014, we completed the Gulfstar FPS™, which is a proprietary floating production system that had been under construction since late 2011. It is supported by multiple agreements with two major producers to provide production handling, oil and gas gathering and gas processing services for the Tubular Bells field development located in the eastern deepwater Gulf of Mexico. The Gulfstar FPS™ ties into our wholly owned oil and gas gathering and gas processing systems in the eastern Gulf of Mexico. Gulfstar FPS™ has an initial capacity of 60 Mbbls/d, up to 200 MMcf/d of natural gas and the capability to provide seawater injection services. We expect Gulfstar FPS™ to be capable of serving as a central host facility for other deepwater prospects in the area. We own a 51 percent interest in Gulfstar One. In December 2013, Gulfstar One agreed to host the Gunflint development, which will result in an expansion of the Gulfstar One system to provide production handling capacity of 20 Mbbls/d and 40 MMcf/d for Gunflint. The project has a first oil target of the first quarter of 2016, dependent on the producer’s development activities.

New Transco rates effective

On August 31, 2012, Transco submitted to the FERC a general rate filing principally designed to recover increased costs and to comply with the terms of the settlement in its prior rate proceeding. The new rates became effective March 1, 2013, subject to refund and the outcome of a hearing. On August 27, 2013, Transco filed a stipulation and agreement with the FERC proposing to resolve all issues in this proceeding without the need for a hearing (Agreement). On December 6, 2013, the FERC issued an order approving the Agreement without modifications. Pursuant to its terms, the Agreement became effective March 1, 2014. We paid $118 million of rate refunds on April 18, 2014.

Keathley Canyon Connector™

Discovery constructed a 215-mile, 20-inch deepwater lateral pipeline in the central deepwater Gulf of Mexico that it owns and operates. Discovery has signed long-term agreements with anchor customers for natural gas gathering and processing services for production from the Keathley Canyon and Green Canyon areas. The Keathley Canyon Connector™ lateral originates from a third-party floating production facility in the southeast portion of the Keathley Canyon area and connects to Discovery’s existing 30-inch offshore natural gas transmission system. The gas is processed at Discovery’s Larose Plant and the NGLs are fractionated at Discovery’s Paradis Fractionator. The lateral pipeline is estimated to have the capacity to flow more than 400 MMcf/d and will accommodate the tie-in of other deepwater prospects. The pipeline was put into service in the first quarter 2015.

NGL & Petchem Services

Williams has announced that it plans to drop-down its remaining NGL & Petchem Services assets. This transaction is expected to take place in the future. The transaction is subject to execution of an agreement, review, and recommendation by the Conflicts Committee of our general partner, and approval of both Williams’ and our Board of Directors.

Volatile Commodity Prices

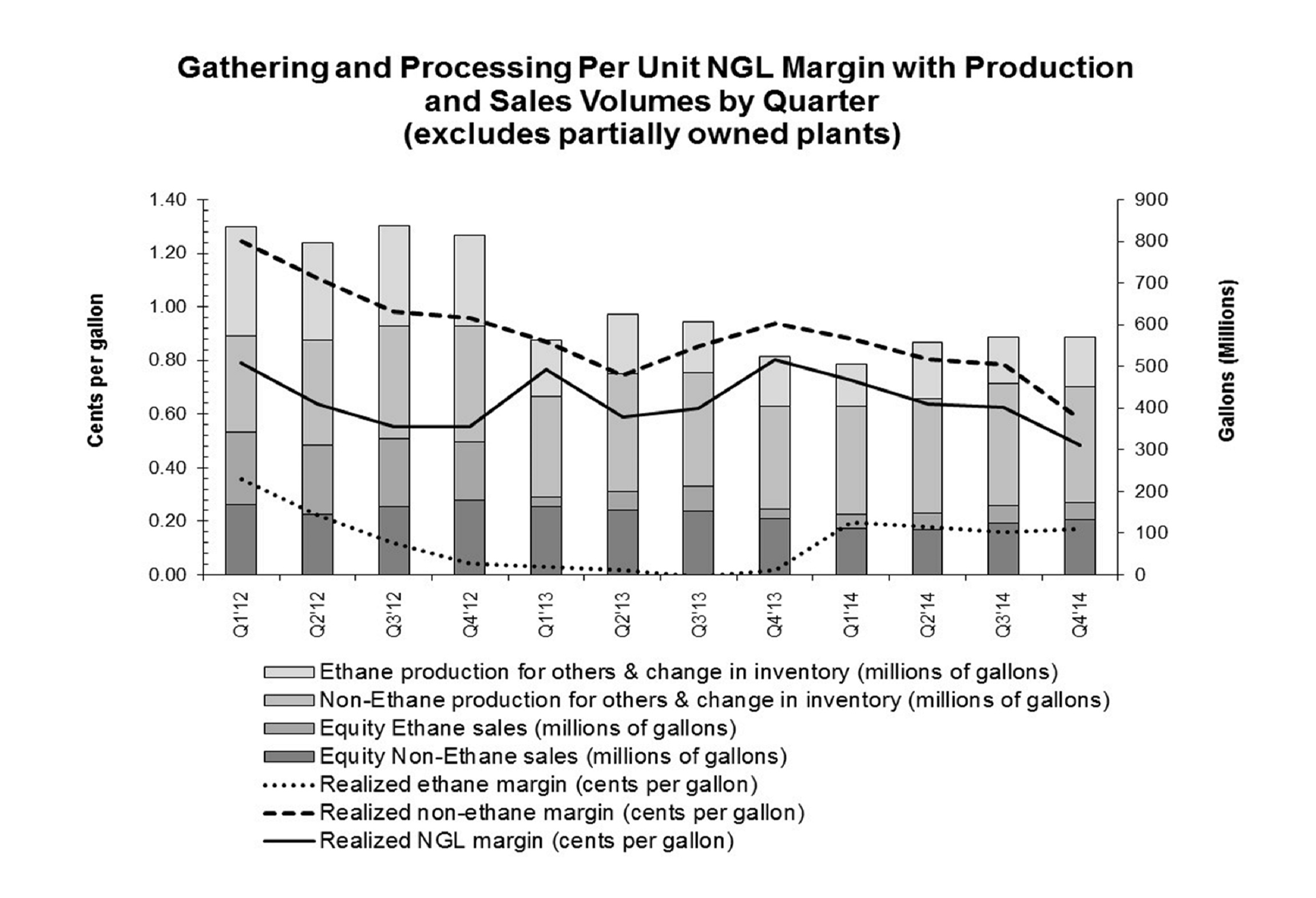

NGL margins were approximately 25 percent lower in 2014 compared to 2013, driven primarily by lower volumes and higher natural gas prices. Volumes declined primarily due to a customer contract in the West that expired in September 2013. Due to unfavorable ethane economics, we further reduced our recoveries of ethane in our domestic plants in 2014 compared to 2013. These reductions are substantially offset by new volumes generated by our Canadian ethane recovery facility which was placed into service in December 2013. Despite the sharp decline in NGL prices during the fourth quarter of 2014, NGL prices on average, were higher in 2014 compared to 2013.

NGL margins are defined as NGL revenues less any applicable Btu replacement cost, plant fuel, and third-party transportation and fractionation. Per-unit NGL margins are calculated based on sales of our own equity volumes at the processing plants. Our equity volumes include NGLs where we own the rights to the value from NGLs recovered at our plants under both “keep-whole” processing agreements, where we have the obligation to replace the lost heating value with natural gas, and “percent-of-liquids” agreements whereby we receive a portion of the extracted liquids with no obligation to replace the lost heating value.

The following graph illustrates the effects of this margin volatility, notably the decline in equity ethane sales driven by reduced recoveries, as well as the margin differential between ethane and non-ethane products and the relative mix of those products.

Company Outlook

Our strategy is to provide large-scale energy infrastructure designed to maximize the opportunities created by the vast supply of natural gas, natural gas products, and crude oil that exists in North America. We seek to accomplish this through further developing our scale positions in current key markets and basins and entering new growth markets and basins where we can become the large-scale service provider. We will maintain a strong commitment to safety, environmental stewardship, operational excellence, and customer satisfaction. We believe that accomplishing these goals will position us to deliver an attractive return to our unitholders.

Following the sharp decline in energy commodity prices in fourth quarter 2014, we expect crude oil, NGLs, and olefins prices to remain at lower levels throughout 2015 as compared to 2014, which will have an adverse effect on our operating results and cash flows. Fee-based businesses are a significant component of our portfolio and have further increased as a result of the Merger. This serves to somewhat reduce the influence of commodity price fluctuations on our operating results and cash flows. However, due in part to lower natural gas prices, we anticipate that overall producer drilling economics will decrease slightly. This may reduce our gathering volumes available for both fee-based and keep-whole processing.

Our business plan for 2015 continues to reflect both significant capital investment and growth in distributions as compared to 2014. We continue to manage expenditures as appropriate without compromising safety and compliance. Our planned capital investments for 2015 total between $3.68 billion and $4.23 billion. We expect to maintain an attractive cost of capital and reliable access to capital markets, both of which will allow us to pursue development projects and acquisitions.

Potential risks and obstacles that could impact the execution of our plan include:

| |

| • | General economic, financial markets, or industry downturn; |

| |

| • | Lower than anticipated energy commodity prices and margins; |

| |

| • | Decreased volumes from third parties served by our midstream business; |

| |

| • | Unexpected significant increases in capital expenditures or delays in capital project execution; |

| |

| • | Lower than anticipated or delay in receiving insurance recoveries associated with the Geismar Incident; |

| |

| • | Limited availability of capital due to a change in our financial condition, interest rates, market or industry conditions; |

| |

| • | Lower than expected levels of cash flow from operations; |

| |

| • | Downgrade of our investment grade credit rating and associated increase in cost of borrowings; |

| |

| • | Counterparty credit and performance risk; |

| |

| • | Changes in the political and regulatory environments; |

| |

| • | Physical damages to facilities, including damage to offshore facilities by named windstorms; |

| |

| • | Reduced availability of insurance coverage. |

We continue to address these risks through maintaining a strong financial position and ample liquidity, as well as through managing a diversified portfolio of energy infrastructure assets.

In 2015, we anticipate an overall improvement in operating results compared to 2014 primarily due to increases in olefins volumes associated with the repair and expansion of the Geismar plant and our fee-based businesses primarily a result of the Merger, partially offset by lower NGL margins and higher operating expenses associated with the growth of our business.

The following factors, among others, could impact our businesses in 2015.

Commodity price changes

NGL and olefin price changes have historically correlated somewhat with changes in the price of crude oil, although NGL, olefin, crude, and natural gas prices are highly volatile and difficult to predict. Commodity margins are highly dependent upon regional supply/demand balances of natural gas as they relate to NGL margins, while olefins are

impacted by global supply and demand fundamentals. NGL products are currently the preferred feedstock for ethylene and propylene production, and are expected to remain advantaged over crude-based feedstocks into the foreseeable future. We continue to benefit from our strategic feedstock cost advantage in propylene production from Canadian oil sands offgas.

Following the sharp decline in the fourth quarter of 2014, we anticipate the following trends in overall energy commodity prices in 2015, compared to 2014:

| |

| • | Natural gas and ethane prices are expected to be at or below 2014 levels primarily due to higher inventory levels. |

| |

| • | Non-ethane prices, including propane, are expected to be lower primarily due to oversupply and the sharp decline in crude oil prices. |

| |

| • | Olefins prices, including propylene, ethylene, and the overall ethylene crack spread, are expected to be lower than 2014 levels due to the volatility in the price of crude oil and correlated products. |

Gathering, transportation, processing, and NGL sales volumes

The growth of natural gas production supporting our gathering and processing volumes is impacted by producer drilling activities, which are influenced by commodity prices, including natural gas, ethane, and propane prices. In addition, the natural decline in production rates in producing areas impact the amount of gas available for gathering and processing.

| |

| • | Following the Merger, Pre-merger ACMP’s results of operations were combined with those of Pre-merger WPZ for periods under common control (periods subsequent to July 1, 2014). As such, we expect an increase in overall results for the Access Midstream segment in 2015 compared to 2014 associated with a full year of results. |

| |

| • | In our Atlantic-Gulf segment, we expect higher production handling volumes compared to 2014, following the completion of Gulfstar FPS™ in the fourth quarter of 2014. We also anticipate higher natural gas transportation revenues compared to 2014, as a result of expansion projects placed into service at Transco in 2014 and anticipated to be placed in service in 2015. |

| |

| • | In our Northeast G&P segment, we anticipate growth in our natural gas gathering volumes compared to the prior year as our infrastructure grows to support drilling activities in the region. |

| |

| • | In our Access Midstream segment, we expect an increase in volumes in 2015 as compared to 2014 in the Haynesville area primarily due to an increase in customer rig counts. We also expect an increase in volumes in the Utica area primarily due to the build out of the Cardinal system, relieving compression constraints and adding new well connections. |

| |

| • | Our West segment expects an unfavorable impact in equity NGL volumes in 2015 compared to 2014, primarily due to the sharp decline in NGL prices. |

| |

| • | In 2015, we anticipate a continuation of periods when it will not be economical to recover ethane in our domestic businesses. |

Olefin production volumes

| |

| • | Our NGL & Petchem Services segment anticipates higher ethylene volumes in 2015 compared to 2014 substantially due to the repair and expansion of the Geismar plant, which restarted in February of 2015. |

Other

| |

| • | In our Atlantic-Gulf segment, we expect higher equity earnings compared to 2014 following the completion of Discovery’s Keathley Canyon Connector™ lateral in the first quarter of 2015. |

| |

| • | In our Access Midstream segment, we anticipate an increase in amounts recognized under minimum volume commitments in 2015 compared to 2014 in the Barnett area. |

| |

| • | We anticipate higher operating expenses in 2015 compared to 2014, including depreciation expense related to our growing operations in our Northeast G&P segment and expansion projects in our Atlantic-Gulf segment. |

Expansion Projects

We expect to invest between $3.25 billion and $3.8 billion of capital among our business segments in 2015. Our ongoing major expansion projects include the following:

Northeast G&P

| |

| • | We plan to expand our processing capacity at our Oak Grove facility by adding a second 200MMcf/d cryogenic natural gas processing plant, which is expected to be placed into service at the end of 2015. |

| |

| • | We will continue to expand the gathering system in the Susquehanna Supply Hub in northeastern Pennsylvania that is needed to meet our customer’s production plans. The expansion of the gathering infrastructure includes additional compression and gathering pipeline to the existing system. |

Atlantic-Gulf

| |

| • | The Atlantic Sunrise Expansion Project involves an expansion of Transco’s existing natural gas transmission system along with greenfield facilities to provide firm transportation from the northeastern Marcellus producing area to markets along Transco’s mainline as far south as Station 85 in Alabama. We plan to file an application with the FERC in the second quarter of 2015 for approval of the project. We plan to place the project into service during the second half of 2017, assuming timely receipt of all necessary regulatory approvals, and it is expected to increase capacity by 1,700 Mdth/d. |

| |

| • | In December 2014, we received approval from the FERC for Transco’s Leidy Southeast Expansion project to expand our existing natural gas transmission system from the Marcellus Shale production region on Transco’s Leidy Line in Pennsylvania to delivery points along its mainline as far south as Station 85 in Alabama. We plan to place a portion of the project into service in March 2015, which will enable us to begin providing firm transportation service through the mainline portion of the project on an interim basis, until the in-service date of the project as a whole. We plan to place the remainder of the project into service during the fourth quarter of 2015 and expect it to increase capacity by 525 Mdth/d. |

| |

| • | In April 2014, we received approval from the FERC to construct and operate an expansion of Transco’s Mobile Bay line south from Station 85 in west central Alabama to delivery points along the line. We plan to place the project into service during the second quarter of 2015, and it is expected to increase capacity on the line by 225 Mdth/d. |

| |

| • | In December 2014, we received approval from the FERC to construct and operate the jointly owned Constitution pipeline. We also received a Notice of Complete Application from the New York Department of Environmental Conservation in December 2014. We currently own 41 percent of Constitution with three other parties holding 25 percent, 24 percent, and 10 percent, respectively. We will be the operator of Constitution. The 124-mile Constitution pipeline will connect our gathering system in Susquehanna County, Pennsylvania, to the Iroquois Gas Transmission and Tennessee Gas Pipeline systems in New York. We plan to place the project into service in the second half of 2016, assuming timely receipt of all necessary regulatory approvals, with an expected capacity of 650 Mdth/d. The pipeline is fully subscribed with two shippers. |

| |

| • | In May 2014, we received FERC approval for Transco’s Northeast Connector project to expand our existing natural gas transmission system from southeastern Pennsylvania to the proposed Rockaway Delivery Lateral. In December 2014, we placed a portion of the project into service, which enabled us to begin providing 65 Mdth/d of firm transportation from Station 195 to the Rockaway Delivery Lateral junction. We plan to place the remainder of the project into service during the second quarter of 2015. In total, the project is expected to increase capacity by 100 Mdth/d. |

| |

| • | In May 2014, we received FERC approval for Transco’s Rockaway Delivery Lateral project to construct a three-mile offshore lateral to a distribution system in New York. We plan to place the project into service during the second quarter of 2015, and the capacity of the lateral is expected to be 647 Mdth/d. |

| |

| • | In November 2013, we received approval from the FERC for Transco’s Virginia Southside project to expand our existing natural gas transmission system from New Jersey to a proposed power station in Virginia and delivery points in North Carolina. In December 2014, we placed a portion of the project into service, which enabled us to begin providing 250 Mdth/d of firm transportation capacity through the mainline portion of the project on an interim basis, until the in-service date of the project as a whole. We plan to place the remainder of the project into service during the third quarter of 2015. In total, the project is expected to increase capacity by 270 Mdth/d. |

| |

| • | In June 2014, we filed an application with the FERC for Transco’s Rock Springs Expansion project to expand our existing natural gas transmission system from New Jersey to a proposed generation facility in Maryland. The project is planned to be placed into service in third quarter 2016, assuming timely receipt of all necessary regulatory approvals, and is expected to increase capacity by 192 Mdth/d. |

| |

| • | In November 2014, we filed an application with the FERC for approval of the initial phases of Transco’s Hillabee Expansion project, which involves an expansion of our existing natural gas transmission system from our Station 85 in Alabama to a proposed new interconnection with Sabal Trail Transmission's system in Alabama. The project will be constructed in phases, and all of the project expansion capacity will be leased to Sabal Trail Transmission. We plan to place the initial phases of the project into service during the second quarter of 2017, assuming timely receipt of all necessary regulatory approvals, and together they are expected to increase capacity by 1,025 Mdth/d. |

| |

| • | In December 2014, we filed an application with the FERC for Transco’s Gulf Trace Expansion Project to expand our existing natural gas transmission system together with greenfield facilities to provide firm transportation from Station 65 in St. Helena Parish, Louisiana westward to a new interconnection with Sabine Pass Liquefaction in Cameron Parish, Louisiana. We plan to place the project into service during the second half of 2017, assuming timely receipt of all necessary regulatory approvals, and it is expected to increase capacity by 1,200 Mdth/d. |

West

| |

| • | Due to a reduction in drilling in the Piceance basin during 2012 and early 2013, we delayed the in-service date of our 350 MMcf/d cryogenic natural gas processing plant in Parachute that was planned for service in 2014. We are currently planning an in-service date in mid-2018. We will continue to monitor the situation to determine whether a different in-service date is warranted. |

NGL & Petchem Services

| |

| • | In association with Williams’ long-term agreement to provide gas processing to a second bitumen upgrader in Canada’s oil sands near Fort McMurray, Alberta, we have a long-term agreement with Williams to provide NGL transportation and fractionation services and are increasing the capacity of the Redwater facilities where NGL/olefins mixtures will be fractionated into an ethane/ethylene mix, propane, polymer grade propylene, normal butane, an alkylation feed and condensate. This capacity increase at Redwater is expected to be placed into service during the fourth quarter of 2015. We will receive a fee-based payment from Williams for the fractionation service we provide to it. |

Critical Accounting Estimates

The preparation of financial statements in conformity with generally accepted accounting principles requires management to make estimates and assumptions. We have reviewed the selection, application, and disclosure of these critical accounting estimates with our general partner’s Audit Committee. We believe that the nature of these estimates and assumptions is material due to the subjectivity and judgment necessary, or the susceptibility of such matters to change, and the impact of these on our financial condition or results of operations.

Goodwill

At December 31, 2014, our Consolidated Balance Sheet includes $1.1 billion of goodwill, of which $474 million is associated with the reporting units representing the northeast, central, and west regions within our Access Midstream segment and $646 million is associated with our Northeast G&P segment. The goodwill within the Access Midstream segment was recorded in the third quarter of 2014 in conjunction with Williams’ acquisition of Pre-merger ACMP completed on July 1, 2014. (See Note 2 of Notes to Consolidated Financial Statements.) We performed our annual assessment of goodwill for impairment as of October 1 and no impairments were identified or recognized.

Following a significant decline in energy commodity prices in the fourth quarter of 2014, we performed an additional review of our Northeast G&P segment. In our evaluation of our Northeast G&P segment, our estimate of the fair value of the reporting unit exceeded its carrying value by 30 percent, including goodwill, and thus, no impairment was recognized in 2014. The fair value of our Northeast G&P segment was estimated by an income approach utilizing discounted cash flows and corroborated with a market capitalization analysis.

As a result of the decline in energy commodity prices and a decline in the trading price of ACMP's publicly-traded limited partner units, both in the fourth quarter of 2014, we performed an additional impairment evaluation as of December 31, 2014, of the goodwill allocated to the reporting units within the Access Midstream segment. We estimated the fair value of each reporting unit identified above based on an income approach that utilized a discount rate of 7.25 percent, as well as a market approach that considered appropriate peer transactions and companies, all of which was corroborated with a market capitalization analysis. In this evaluation, our estimate of the fair value of each reporting unit exceeded the related carrying value, and thus, no impairment losses were recognized in 2014. We estimate that a 75 basis point increase in the discount rate utilized could result in a partial impairment of this goodwill.

Judgments and assumptions are inherent in our estimates of future cash flows, discount rates, and market measures used to evaluate these assets. The use of alternate judgments and assumptions could result in a different calculation of fair value, which could ultimately result in the recognition of an impairment charge in the consolidated financial statements.

Equity-method Investments

At December 31, 2014, our Consolidated Balance Sheet includes approximately $8.4 billion of investments that are accounted for under the equity-method of accounting. We evaluate these investments for impairment when events or changes in circumstances indicate, in our management’s judgment, that the carrying value of such investments may have experienced an other-than-temporary decline in value. When evidence of loss in value has occurred, we compare our estimate of fair value of the investment to the carrying value of the investment to determine whether an impairment has occurred. We generally estimate the fair value of our investments using an income approach where significant judgments and assumptions include expected future cash flows and the appropriate discount rate. In some cases, we may utilize a form of market approach to estimate the fair value of our investments.

If the estimated fair value is less than the carrying value and we consider the decline in value to be other-than-temporary, the excess of the carrying value over the fair value is recognized in the consolidated financial statements as an impairment charge. Events or changes in circumstances that may be indicative of an other-than-temporary decline in value will vary by investment, but may include:

| |

| • | Lower than expected cash distributions from investees; |

| |

| • | Significant asset impairments or operating losses recognized by investees; |

| |

| • | Significant delays in or lack of producer development or significant declines in producer volumes in markets served by investees; |

| |

| • | Significant delays in or failure to complete significant growth projects of investees. |

No impairments of investments accounted for under the equity-method have been recorded for the year ended December 31, 2014.

Impairment of Long-lived Assets

We evaluate our long lived assets for impairment when events or changes in circumstances indicate, in our management's judgment, that the carrying value of such assets may not be recoverable. When an indicator of a potential impairment has occurred, we compare our management's estimate of undiscounted future cash flows attributable to the assets to the carrying value of the assets to determine whether an impairment has occurred.

In December 2010 we detected a leak in one of the seven underground natural gas storage caverns at our Eminence Storage Field in Covington County, Mississippi. Due to the leak at this cavern, damage to the well at an adjacent cavern, and operating problems at two other caverns constructed at about the same time, we determined that the four caverns should be retired, which was completed in 2014. In addition, further studies have indicated the need for capital improvements over the next several years of the remaining three caverns. As a result, we performed an assessment of our Eminence storage field for impairment as of December 31, 2014. The carrying value at that date was $78 million. These events have not affected the performance of our obligations under our service agreements with our customers. However, judgments and assumptions are inherent in our estimate of future cash flows used to evaluate Eminence. In our evaluation, our estimate of the undiscounted cash flows of Eminence exceeded its carrying value, and thus no impairment loss was recognized in 2014. If our estimates of revenues were to significantly decrease, it could result in a write down of this asset to fair value.

Results of Operations

Consolidated Overview

The following table and discussion is a summary of our consolidated results of operations for the three years ended December 31, 2014. The results of operations by segment are discussed in further detail following this consolidated overview discussion.

|

| | | | | | | | | | | | | | | | | | | | | | | |

| | Years Ended December 31, |

| | 2014 | | $ Change from 2013* | | % Change from 2013* | | 2013 | | $ Change from 2012* | | % Change from 2012* | | 2012 |

| | (Millions) |

| Revenues: | | | | | | | | | | | | | |

| Service revenues | $ | 3,888 |

| | +974 |

| | +33 | % | | $ | 2,914 |

| | +200 |

| | +7 | % | | $ | 2,714 |

|

| Product sales | 3,521 |

| | -400 |

| | -10 | % | | 3,921 |

| | -836 |

| | -18 | % | | 4,757 |

|

| Total revenues | 7,409 |

| | | | | | 6,835 |

| | | | | | 7,471 |

|

| Costs and expenses: | | | | | | | | | | | | | |

| Product costs | 3,016 |

| | +11 |

| | — | % | | 3,027 |

| | +474 |

| | +14 | % | | 3,501 |

|

| Operating and maintenance expenses | 1,277 |

| | -197 |

| | -18 | % | | 1,080 |

| | -61 |

| | -6 | % | | 1,019 |

|

| Depreciation and amortization expenses | 1,151 |

| | -360 |

| | -46 | % | | 791 |

| | -57 |

| | -8 | % | | 734 |

|

| Selling, general, and administrative expenses | 633 |

| | -114 |

| | -22 | % | | 519 |

| | +64 |

| | +11 | % | | 583 |

|

| Net insurance recoveries – Geismar Incident | (232 | ) | | +192 |

| | NM |

| | (40 | ) | | +40 |

| | NM |

| | — |

|

| Other (income) expense – net | (45 | ) | | +96 |

| | NM |

| | 51 |

| | -27 |

| | -113 | % | | 24 |

|

| Total costs and expenses | 5,800 |

| | | | | | 5,428 |

| | | | | | 5,861 |

|

| Operating income | 1,609 |

| | | | | | 1,407 |

| | | | | | 1,610 |

|

| Equity earnings (losses) | 228 |

| | +124 |

| | +119 | % | | 104 |

| | -7 |

| | -6 | % | | 111 |

|

| Interest expense | (562 | ) | | -175 |

| | -45 | % | | (387 | ) | | +17 |

| | +4 | % | | (404 | ) |

| Other income (expense) – net | 38 |

| | +13 |

| | +52 | % | | 25 |

| | +9 |

| | +56 | % | | 16 |

|

| Income before income taxes | 1,313 |

| | | | | | 1,149 |

| | | | | | 1,333 |

|

| Provision (benefit) for income taxes | 29 |

| | +1 |

| | +3 | % | | 30 |

| | +12 |

| | +29 | % | | 42 |

|

| Net income | 1,284 |

| | | | | | 1,119 |

| | | | | | 1,291 |

|

| Less: Net income attributable to noncontrolling interests | 96 |

| | -93 |

| | NM |

| | 3 |

| | -3 |

| | NM |

| | — |

|

| Net income attributable to controlling interests | $ | 1,188 |

| | | | | | $ | 1,116 |

| | | | | | $ | 1,291 |

|

| |

| * | + = Favorable change; - = Unfavorable change; NM = A percentage calculation is not meaningful due to a change in signs, a zero-value denominator, or a percentage change greater than 200. |

2014 vs. 2013

Service revenues increased primarily due to contributions from Access Midstream beginning in third quarter 2014, including $167 million of minimum volume commitment fees. Gathering fees increased driven by higher volumes and a net increase in gathering rates primarily in the Susquehanna Supply Hub. Natural gas transportation fee revenues increased primarily associated with expansion projects placed in service at Transco in 2013. In addition, Service revenues increased related to new processing, fractionation, and transportation fees from Ohio Valley Midstream facilities that were placed in service in 2013 and 2014.

Product sales decreased primarily due to lower olefin sales volumes associated with the lack of production in 2014 as a result of the Geismar Incident, partially offset by an increase in olefin sales on the RGP splitter primarily associated with higher volumes. In addition, equity NGL sales decreased primarily reflecting lower non-ethane volumes, partially offset by higher average ethane per-unit sales prices. Crude oil, natural gas, and other marketing revenues decreased

primarily related to lower volumes, while NGL marketing revenues increased primarily related to higher volumes partially offset by lower NGL prices.

Product costs decreased primarily due to lower olefin feedstock purchases related to the lack of production in 2014 as a result of the Geismar Incident. In addition, natural gas purchases associated with the production of equity NGLs decreased slightly reflecting lower volumes, which were substantially offset by higher natural gas prices. These decreases were partially offset by an increase in lower-of-cost-or-market adjustments due to significant declines in NGL prices during the fourth quarter of 2014 and lower crude oil, natural gas and olefin volumes, partially offset by higher NGL volumes.

Operating and maintenance expenses increased primarily due to expenses associated with Access Midstream beginning in third quarter 2014, including $15 million of transition-related costs, expenses incurred in 2014 associated with the installation of certain safety equipment at the Geismar plant, and higher maintenance and growth in our Northeast G&P operations. These increases were partially offset due primarily to a net increase in system gains, and reduced gathering fuel expense in the West operations.

Depreciation and amortization expenses increased primarily due to expenses associated with Access Midstream beginning in third quarter 2014 and due to depreciation on new projects placed in service.

Selling, general, and administrative expenses (SG&A) increased primarily due to expenses associated with Access Midstream beginning in third quarter 2014, including $42 million of acquisition, merger, and transition-related costs recognized in 2014. In addition, SG&A increased related to operational growth in our Northeast G&P operations.

The favorable change in Net insurance recoveries — Geismar Incident is primarily due to the receipt of $246 million of insurance recoveries in 2014, compared to the receipt of $50 million of insurance recoveries in 2013. (See Note 7 – Other Income and Expenses of Notes to Consolidated Financial Statements.)

Other (income) expense – net within Operating income includes the following increases to net income:

| |

| • | $154 million of cash proceeds received in 2014 related to a contingency settlement gain; |

| |

| • | The absence of a $25 million accrued loss recognized in 2013 associated with a producer claim against us; |

| |

| • | The absence of $12 million of expense recognized in 2013 and $3 million of expense reversal in 2014, related to the portion of the Eminence abandonment regulatory asset that will not be recovered in rates; |

| |

| • | A $12 million net gain recognized in 2014 related to the settlement of a partial acreage dedication release. |

Other (income) expense – net within Operating income includes the following decreases to net income:

| |

| • | $52 million of impairment charges recognized in 2014 related to certain materials and equipment; |

| |

| • | The absence of $16 million of income from insurance recoveries in 2013 related to the abandonment of certain Eminence storage assets; |

| |

| • | A $10 million loss on the sale of certain assets in 2014; |

| |

| • | $9 million of expenses in excess of the insurable limit associated with the Geismar Incident; |

| |

| • | A $9 million increase in expenses associated with a regulatory liability for certain employee costs; |

| |

| • | The absence of a $9 million involuntary conversion gain recognized in 2013 related to a 2012 furnace fire at our Geismar olefins plant. |

Operating income changed favorably primarily due to increased service revenues of $193 million related to our pre-merger operations, a $192 million increase in net insurance recoveries related to the Geismar Incident, $167 million

of minimum volume commitment fee revenue at Access Partners, and $154 million of cash proceeds in 2014 related to a contingency gain settlement. These increases are partially offset by $192 million lower olefin margins, $130 million lower NGL margins and $59 million lower marketing margins, as well as higher operating costs and higher impairment charges recognized in 2014.

Equity earnings (losses) changed favorably primarily due to the recognition of $96 million of equity earnings in the second half of 2014 related to equity investments held by Access Midstream, and higher equity earnings from Caiman II and Laurel Mountain.

Interest expense increased due to a $206 million increase in Interest incurred primarily due to new debt issuances in the fourth quarter of 2013 and the first half of 2014, as well as expense associated with Access Midstream’s debt beginning in the third quarter of 2014, and $9 million of Access Midstream acquisition-related financing costs incurred in 2014. The increase in Interest incurred is partially offset by an increase of $31 million in Interest capitalized related to construction projects in progress. (See Note 2 – Acquisitions and Note 13 – Debt, Banking Arrangements, and Leases of Notes to Consolidated Financial Statements.)

Other income (expense) – net changed favorably primarily due to the benefit from the allowance for equity funds used for construction associated with ongoing capital projects within our regulated operations.

Provision (benefit) for income taxes changed favorably primarily due to the absence of Texas franchise tax incurred related to a second-quarter 2013 tax law change, partially offset by an unfavorable increase due to higher foreign pre-tax income associated with our Canadian operations.

Net income attributable to noncontrolling interests changed unfavorably due to income allocated to Pre-merger ACMP interests held by the public that is presented within noncontrolling interests for periods prior to consummation of the Merger.

2013 vs. 2012

The increase in Service revenues is primarily due to higher fee revenues associated with the growth in the businesses acquired in the 2012 Caiman and Laser Acquisitions, as well as contributions from the processing and fractionation facilities placed in service in the latter half of 2012 and in 2013. Additionally, natural gas transportation fee revenues increased from expansion projects placed into service in 2012 and 2013 and new rates effective during first-quarter 2013. Partially offsetting these increases are decreased gathering and processing fee revenues driven by lower volumes in the Piceance, Four Corners and eastern Gulf Coast areas.

The decrease in Product sales is primarily due to lower NGL production revenues driven by reduced ethane recoveries and decreases in average realized NGL per-unit sales prices, as well as a decrease in olefin production revenues primarily from the loss of production as a result of the Geismar Incident, partially offset by higher olefin per-unit sales prices. Additionally, marketing revenues decreased resulting from lower NGL per-unit prices and lower crude oil and ethane volumes, partially offset by higher non-ethane volumes. The changes in marketing revenues are more than offset by similar changes in marketing purchases, reflected above as Product costs.

The decrease in Product costs is primarily due to a decrease in NGL marketing purchases resulting from lower NGL prices and lower crude oil volumes, partially offset by higher non-ethane volumes. The changes in marketing purchases are substantially offset by similar changes in marketing revenues. In addition, olefin feedstock purchases decreased reflecting lower volumes and lower average per-unit feedstock costs. Costs associated with the production of NGLs also decreased primarily resulting from lower ethane recoveries, partially offset by an increase in average natural gas prices.

The increase in Operating and maintenance expenses is primarily associated with the subsequent growth in the operations of the businesses acquired in the Caiman and Laser Acquisitions, scheduled maintenance expenses incurred at our Canadian olefins facility, and $13 million of costs incurred under our insurance deductibles resulting from the Geismar Incident. These increases are partially offset by lower compressor and natural gas pipeline maintenance and repair expenses primarily due to the absence of expenses related to the substantial completion of our natural gas pipeline

integrity management plan during 2012, and lower operating costs in our Four Corners area, which experienced lower volumes.

The increase in Depreciation and amortization expenses reflects a full year of depreciation and amortization expense in 2013 associated with the businesses acquired in 2012 and depreciation on subsequent infrastructure additions, increased depreciation of certain assets that were decommissioned in the third quarter of 2013 in preparation of the completion of the ethane recovery system, as well as higher depreciation related to the Boreal Pipeline, which was placed into service in 2012. These increases are partially offset by the absence of increased depreciation in 2012 on certain assets in the Gulf Coast region resulting from a change in the estimated useful lives.

The decrease in SG&A is primarily due to a reduction in allocated administrative expenses from Williams reflecting the absence of reorganization related costs incurred in 2012 (see Note 5 – Related Party Transactions of Notes to Consolidated Financial Statements) and the absence of acquisition and transition costs incurred in 2012 (see Note 2 – Acquisitions of Notes to Consolidated Financial Statements).

The favorable change in Net insurance recoveries — Geismar Incident is primarily due to the receipt of $50 million of insurance recoveries in 2013 (see Note 7 – Other Income and Expenses of Notes to Consolidated Financial Statements.)

Other (income) expense – net within Operating income includes the following increases to net expense:

| |

| • | $25 million accrued loss for a settlement in principle of a producer claim against us; |

| |

| • | $23 million increase in amortization expense related to our regulatory asset associated with asset retirement obligations; |

| |

| • | $12 million expense recognized in 2013 related to the portion of the Eminence abandonment regulatory asset that will not be recovered in rates. |

Other (income) expense – net within Operating income includes the following decreases to net expense:

| |

| • | $16 million of income from insurance recoveries related to the abandonment of certain of Eminence storage assets in 2013; |

| |

| • | $9 million involuntary conversion gain recognized in 2013 related to a 2012 furnace fire for our Geismar olefins plant; |

| |

| • | $5 million favorable change in net foreign currency exchange gains. |

The decrease in Operating income generally reflects lower NGL production margins, lower olefin production margins, higher operating costs, and the net unfavorable changes in Other (income) expense – net as described above, partially offset by increased fee revenues, higher marketing margins, higher Geismar Incident insurance recoveries, and lower SG&A expenses.

The unfavorable change in Equity earnings (losses) is primarily due to lower equity earnings from Discovery, partially offset by improved equity earnings from Laurel Mountain.

Interest expense decreased due to a $36 million increase in Interest capitalized related to construction projects, partially offset by a $19 million increase in Interest incurred primarily due to an increase in borrowings. (See Note 13 – Debt, Banking Arrangements, and Leases of Notes to Consolidated Financial Statements.)

Provision (benefit) for income taxes changed favorably primarily due to lower foreign pre-tax income associated with our Canadian operations, partially offset by Texas franchise tax incurred related to the impact of a second-quarter 2013 tax law change.

Year-Over-Year Operating Results – Segments

Access Midstream

|

| | | |

| | Year Ended December 31, 2014 |

| | (Millions) |

| Service revenues | $ | 781 |

|

| Segment revenues | 781 |

|

| | |

| Depreciation and amortization expenses | 296 |

|

| Other segment costs and expenses | 316 |

|

| Equity (earnings) losses | (96 | ) |

| Segment profit | $ | 265 |

|

The results of operations for the Access Midstream segment are only presented for periods under common control (periods subsequent to July 1, 2014) and are reflected at Williams’ historical basis in the underlying operations (see Note 2 – Acquisitions).

Segment revenues are supported by minimum volume commitments associated with gas gathering agreements with certain producers in the Barnett Shale and Haynesville Shale areas. In 2014, we recognized $167 million related to these minimum volume commitment contracts.

Northeast G&P

|

| | | | | | | | | | | |

| | Years Ended December 31, |

| | 2014 | | 2013 | | 2012 |

| | (Millions) |

| Service revenues | $ | 451 |

| | $ | 335 |

| | $ | 168 |

|

| Product sales | 230 |

| | 166 |

| | 2 |

|

| Segment revenues | 681 |

| | 501 |

| | 170 |

|

| | | | | | |

| Product costs | 221 |

| | 160 |

| | 4 |

|

| Depreciation and amortization expenses | 170 |

| | 132 |

| | 76 |

|

| Other segment costs and expenses | 97 |

| | 226 |

| | 104 |

|

| Equity (earnings) losses | (19 | ) | | 7 |

| | 23 |

|

| Segment profit (loss) | $ | 212 |

| | $ | (24 | ) | | $ | (37 | ) |

2014 vs. 2013

Service revenues increased primarily due to $88 million higher gathering fees associated with 30 percent higher volumes driven by new well connections and the completion of various compression projects, and a net increase in gathering rates associated with customer contract modifications, primarily in the Susquehanna Supply Hub. Service revenues also increased $22 million due to contributions from our Ohio Valley Midstream business resulting from the addition of processing, fractionation, and transportation facilities placed in service in 2013 and 2014.

Product sales increased due primarily to growth in the NGL marketing activities attributable to the Ohio Valley Midstream business. The changes in marketing revenues are partially offset by similar changes in marketing purchases, reflected above as Product costs.

Depreciation and amortization expenses increased due to new projects placed in service.

Other segment costs and expenses decreased primarily due to $154 million of cash received in the fourth quarter of 2014 associated with the resolution of a contingent gain related to claims arising from the purchase of a business in a prior period (see Note 7 – Other Income and Expenses of Notes to Consolidated Financial Statements), the absence

of a $25 million accrued loss incurred in 2013 associated with a producer claim against us, and a $12 million net gain in 2014 related to a partial acreage dedication release. These decreases are partially offset by $30 million of impairment charges related to certain materials and equipment, $6 million of costs resulting from fire damages at a compressor station in the Susquehanna Supply Hub, and higher expenses associated with maintenance and growth in these operations.

Equity (earnings) losses changed favorably due primarily to $14 million higher equity earnings from Caiman II resulting primarily from business interruption insurance proceeds received in 2014 and higher volumes due to assets placed into service in 2014. In addition, Laurel Mountain equity earnings increased $12 million primarily due to 20 percent higher gathering volumes, an 18 percent increased ownership percentage beginning in fourth quarter 2014, and the absence of certain write-offs in 2013.

The favorable change in Segment profit (loss) is primarily due to the cash received from the fourth quarter 2014 settlement discussed previously and an increase in service revenues, partially offset by higher depreciation and higher expenses associated with growth in these operations.

2013 vs. 2012

Service revenues increased due primarily to $129 million in higher gathering fees associated with 78 percent higher volumes driven by new well connections related to infrastructure additions placed into service in 2012 and 2013, a full year of operations associated with the gathering systems included in the 2012 acquisitions, and increased gathering rates associated with customer contract modifications primarily in the Susquehanna Supply Hub. Service revenues also reflect contributions from the processing and fractionation facilities placed in service in the latter half of 2012 and in 2013 in our Ohio Valley Midstream business.

Product sales in 2013 primarily represent new NGL marketing revenues attributable to the Ohio Valley Midstream business. The changes in marketing revenues are offset by similar changes in marketing purchases, reflected above as Product costs.

Depreciation and amortization expenses reflect a full year of expenses in 2013 associated with the acquired businesses and depreciation on subsequent infrastructure additions.

Other segment costs and expenses increased primarily due to higher expenses associated with the acquired businesses and the subsequent growth in these operations. This increase includes approximately $26 million in higher employee-related costs and $19 million in higher outside service operating expenses including $15 million related to pipeline maintenance and repair costs. In addition, 2013 reflects a $25 million loss for a producer claim against us and higher allocated support costs due to the relative growth in the businesses. These increases are partially offset by the absence of $23 million related to acquisition and transition costs incurred in 2012.

Equity (earnings) losses changed favorably primarily due to $15 million improved Laurel Mountain equity earnings driven primarily by 55 percent higher gathering volumes, the receipt of an annual minimum volume commitment fee in 2013, and lower leased compression expenses.

The favorable change in Segment profit (loss) is primarily due to an increase in fee revenues in the Susquehanna Supply Hub and Ohio Valley Midstream businesses, improved Laurel Mountain equity earnings and the absence of acquisition and transition costs incurred in 2012. These increases are partially offset by higher costs primarily in our Ohio Valley Midstream business and a $25 million loss for a producer claim against us.

Atlantic-Gulf

|

| | | | | | | | | | | |

| Years Ended December 31, |

| 2014 |

| 2013 | | 2012 |

| (Millions) |

| Service revenues | $ | 1,501 |

| | $ | 1,424 |

| | $ | 1,383 |

|

| Product sales | 853 |

| | 925 |

| | 1,072 |

|

| Segment revenues | 2,354 |

| | 2,349 |

| | 2,455 |

|

| | | | | | |

| Product costs | 791 |

| | 843 |

| | 956 |

|

| Depreciation and amortization expenses | 379 |

| | 363 |

| | 381 |

|

| Other segment costs and expenses | 625 |

| | 601 |

| | 636 |

|

| Equity (earnings) losses | (76 | ) | | (72 | ) | | (92 | ) |

| Segment profit | $ | 635 |

| | $ | 614 |

| | $ | 574 |

|

| | | | | | |

| NGL margin | $ | 57 |

| | $ | 79 |

| | $ | 113 |

|

2014 vs. 2013

Service revenues increased primarily due to a $71 million increase in Transco’s natural gas transportation fee revenues primarily associated with expansion projects placed in service and new rates effective in 2013. Additionally, Gulfstar One fees were $19 million in 2014 due to the start-up of operations. Western Gulf Coast fees increased $8 million associated with increased production and a short-term increase in volumes. These increases are partially offset by lower production handling and crude oil transportation fee revenues in the eastern Gulf Coast primarily driven by lower Bass Lite production area volumes, natural declines of other fields, and producers’ operational issues.

Product sales decreased primarily due to:

| |

| • | A $61 million decrease in marketing revenues reflecting a decrease in crude oil marketing sales, partially offset by an increase in NGL marketing sales. Crude oil marketing sales decreased primarily due to lower crude oil volumes related to natural declines in production areas served by our Mountaineer crude oil pipeline. NGL marketing sales increased primarily due to higher NGL volumes associated with a short-term increase in production in the western Gulf Coast. These changes in marketing revenues are offset by similar changes in marketing purchases; |

| |

| • | A $25 million decrease in revenues from our equity NGLs reflecting lower equity NGL sales volumes. Equity NGL sales volumes are 28 percent lower driven by 25 percent lower non-ethane volumes as a result of customer contract changes and producers’ operational issues; |

| |

| • | An $8 million increase in system management gas sales from Transco. System management gas sales are offset in Product costs and, therefore, have no impact on Segment profit. |

Product costs decreased primarily due to:

| |

| • | A $60 million decrease in marketing purchases (offset in Product sales); |

| |

| • | An $8 million increase in system management gas costs (offset in Product sales). |

Depreciation and amortization expenses increased primarily due to the Gulfstar FPS™ and associated pipelines, which were placed in service in the fourth quarter of 2014.

Other segment costs and expenses increased due to an increase in other materials and supplies cost, miscellaneous contractual services costs primarily due to various repairs and maintenance projects, and impairment charges recognized in 2014 related to certain materials and equipment.

Segment profit increased primarily due to higher service revenues, partially offset by $22 million lower NGL margins reflecting lower volumes, and higher Other segment costs and expenses and depreciation, as previously discussed.

2013 vs. 2012

Service revenues increased primarily due to a $72 million increase in natural gas transportation fee revenues primarily associated with expansion projects placed in service in 2012 and 2013 and to the implementation of new rates for Transco in March 2013. These increases are partially offset by $34 million lower fee revenues in the eastern Gulf Coast primarily driven by natural declines in Bass Lite and Blind Faith production area volumes.

Product sales decreased primarily due to:

| |

| • | A $158 million decrease in marketing revenues reflecting a $120 million decrease in crude oil marketing sales and a $38 million decrease in NGL marketing sales. Crude oil marketing sales decreased primarily due to 25 percent lower crude oil volumes related to natural declines in production areas served by our Mountaineer crude oil pipeline. NGL marketing sales decreased primarily due to lower NGL prices. These changes in marketing revenues are offset by similar changes in marketing purchases. |

| |

| • | A $39 million decrease in revenues from our equity NGLs reflecting a decrease of $21 million associated with lower equity NGL sales volumes and a decrease of $18 million associated with lower average realized NGL per-unit sales prices. Equity NGL sales volumes are 29 percent lower driven by 56 percent lower ethane volumes due primarily to unfavorable ethane economics, as previously mentioned, and 7 percent lower non-ethane volumes. Average realized ethane and non-ethane per-unit sales prices decreased by 54 percent and 11 percent, respectively. |

| |

| • | A $48 million increase in other product sales primarily due to higher system management gas sales from Transco. System management gas sales are offset in Product costs and, therefore, have no impact on Segment profit. |

Product costs decreased primarily due to:

| |

| • | A $158 million decrease in crude oil and NGL marketing purchases (offset in Product sales). |

| |

| • | A $5 million decrease in costs associated with our equity NGLs primarily due to an $11 million decrease associated with lower natural gas volumes, partially offset by a $6 million increase related to higher per-unit natural gas prices. |

| |

| • | A $48 million increase in other product costs primarily due to higher system management gas costs (offset in Product sales). |

Depreciation and amortization expenses decreased primarily reflecting the absence of increased depreciation in 2012 on certain assets in the Gulf Coast region resulting from a change in the estimated useful lives.

Other segment costs and expenses decreased primarily due to lower operating costs, including compressor and pipeline maintenance and repair expenses resulting from the absence of expenses relating to the substantial completion of a natural gas pipeline integrity management plan during 2012, lower project development costs, and insurance recoveries recognized by Transco in 2013 related to the abandonment of certain of its Eminence storage assets. These decreases are partially offset by increased amortization of regulatory assets associated with asset retirement obligations, a decrease in reversals of project feasibility costs from expense to capital associated with expansion projects, and expense recognized in 2013 related to the portion of the Eminence abandonment regulatory asset that is not expected to be recovered in rates.

Equity earnings decreased primarily due to lower equity earnings from Discovery driven by lower NGL margins reflecting lower volumes including reduced ethane recoveries and natural declines, as well as lower NGL prices.

Additionally, charges to write-down two lateral pipelines and electrical equipment in 2013, and the absence of a favorable customer settlement in 2012 decreased our equity earnings from Discovery.

Segment profit increased primarily due to higher service revenues and lower operating and depreciation expenses, partially offset by $34 million lower NGL margins reflecting commodity price changes including lower NGL sales prices coupled with higher per-unit natural gas costs and lower volumes, increased amortization of regulatory assets associated with asset retirement obligations, and lower equity earnings, as previously discussed.

West

|

| | | | | | | | | | | |

| | Years Ended December 31, |

| | 2014 | | 2013 | | 2012 |

| | (Millions) |

| Service revenues | $ | 1,034 |

| | $ | 1,054 |

| | $ | 1,072 |

|

| Product sales | 546 |

| | 772 |

| | 1,129 |

|

| Segment revenues | 1,580 |

| | 1,826 |

| | 2,201 |

|

| | | | | | |

| Product costs | 270 |

| | 380 |

| | 472 |

|

| Depreciation and amortization expenses | 239 |

| | 236 |