SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

(Mark One)

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| | |

| For the fiscal year ended May 31, 2013 |

| | |

| o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from _______________ to _______________

Commission File Number 000-54444

RED MOUNTAIN RESOURCES, INC.

(Exact Name of Registrant as Specified in Its Charter)

| Florida | | 27-1739487 |

| (State or Other Jurisdiction of Incorporation or Organization) | | (I.R.S. Employer Identification Number) |

2515 McKinney Avenue, Suite 900 Dallas, TX | | 75201 |

| (Address of Principal Executive Offices) | | (Zip Code) |

(214) 871-0400

(Registrant's Telephone Number, Including Area Code)

Securities registered pursuant to Section 12(b) of the Act: None

Securities registered pursuant to Section 12(g) of the Act:

Common Stock, par value $0.00001 per share

10.0% Series A Cumulative Redeemable Preferred Stock, par value $0.0001 per share

Warrants to purchase common stock

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Exchange Act. Yes o No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the past 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirement for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No o

Indicate by check mark if disclosure of delinquent filers in response to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of the registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See definition of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act.

| Large accelerated filer o | | Accelerated filer o |

| | | |

| Non-accelerated filer x (Do not check if a smaller reporting company) | | Smaller reporting company o |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes o No x

As of November 30, 2012 (the last business day of the registrant's most recently completed second fiscal quarter), the aggregate market value of the registrant's common stock (based on a reported closing market price of $0.90 per share on the OTCQB) held by non-affiliates of the registrant was approximately $71.4 million. For purposes of this computation, all officers, directors and 10% beneficial owners of the registrant are deemed to be affiliates. Such determination should not be deemed to be an admission that such officers, directors or 10% beneficial owners are, in fact, affiliates of the registrant.

As of September 12, 2013, there were 133,140,303 shares of common stock, $0.00001 par value per share, outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant's proxy statement to be furnished to shareholders in connection with its 2013 Annual Meeting of Stockholders are incorporated by reference in Part III, Items 10-14 of this Annual Report on Form 10-K.

RED MOUNTAIN RESOURCES, INC.

FORM 10-K

TABLE OF CONTENTS

Forward-Looking Statements

This Annual Report on Form 10-K contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended (the "Exchange Act"). Statements that are not historical facts, including statements about our beliefs and expectations, are forward-looking statements. Forward-looking statements include statements preceded by, followed by or that include the words "may," "could," "would," "should," "believe," "expect," "anticipate," "plan," "estimate," "target," "project," "intend," "understand," or similar expressions and the negative of such words and expressions, although not all forward-looking statements contain such words or expressions.

Forward-looking statements are only predictions and are not guarantees of performance. These statements generally relate to our plans, objectives and expectations for future operations and are based on management's current beliefs and assumptions, which in turn are based on its experience and its perception of historical trends, current conditions and expected future developments as well as other factors it believes are appropriate under the circumstances. Although we believe that the plans, objectives and expectations reflected in or suggested by the forward-looking statements are reasonable, there can be no assurance that actual results will not differ materially from those expressed or implied in such forward-looking statements. Forward-looking statements also involve risks and uncertainties. Many of these risks and uncertainties are beyond our ability to control or predict and could cause results to differ materially from the results discussed in such forward-looking statements. Such risks and uncertainties include, but are not limited to, the following:

| | ● | our ability to generate sufficient cash flow from operations, borrowings or other sources to enable us to fully develop and produce our oil and natural gas properties; |

| | | |

| | ● | declines or volatility in the prices we receive for our oil and natural gas; |

| | | |

| | ● | general economic conditions, whether internationally, nationally or in the regional and local market areas in which we do business; |

| | | |

| | ● | risks associated with drilling, including completion risks, cost overruns and the drilling of non-economic wells or dry holes; |

| | | |

| | ● | uncertainties associated with estimates of proved oil and natural gas reserves; |

| | | |

| | ● | the presence or recoverability of estimated oil and natural gas reserves and the actual future production rates and associated costs; |

| | | |

| | ● | risks and liabilities associated with acquired companies and properties; |

| | | |

| | ● | risks related to integration of acquired companies and properties; |

| | | |

| | ● | potential defects in title to our properties; |

| | | |

| | ● | cost and availability of drilling rigs, equipment, supplies, personnel and oilfield services; |

| | | |

| | ● | geological concentration of our reserves; |

| | | |

| | ● | environmental or other governmental regulations, including legislation of hydraulic fracture stimulation; |

| | | |

| | ● | our ability to secure firm transportation for oil and natural gas we produce and to sell the oil and natural gas at market prices; |

| | | |

| | ● | exploration and development risks; |

| | ● | management's ability to execute our plans to meet our goals; |

| | | |

| | ● | our ability to retain key members of our management team; |

| | | |

| | ● | weather conditions; |

| | | |

| | ● | actions or inactions of third-party operators of our properties; |

| | | |

| | ● | costs and liabilities associated with environmental, health and safety laws; |

| | | |

| | ● | our ability to find and retain highly skilled personnel; |

| | | |

| | ● | operating hazards attendant to the oil and natural gas business; |

| | | |

| | ● | competition in the oil and natural gas industry; and |

| | | |

| | ● | the other factors discussed under Item 1A. "Risk Factors" in this report. |

Forward-looking statements speak only as of the date hereof. All such forward-looking statements and any subsequent written and oral forward-looking statements attributable to us or any person acting on our behalf are expressly qualified in their entirety by the cautionary statements contained or referred to in this section and any other cautionary statements that may accompany such forward-looking statements. Except as otherwise required by applicable law, we disclaim any duty to update any forward-looking statements.

Glossary of Oil and Natural Gas Terms

The following are abbreviations and definitions of terms commonly used in the oil and natural gas industry and this Annual Report on Form 10-K.

"Bbl" One stock tank barrel or 42 U.S. gallons liquid volume of oil or other liquid hydrocarbons.

"Boe" One barrel of oil equivalent, determined using the ratio of six Mcf of natural gas to one Bbl of oil and 42 gallons of natural gas liquids to one Bbl of oil.

"Boe/d" Boe per day.

"Btu" A British thermal unit is a measurement of the heat generating capacity of natural gas. One Btu is the heat required to raise the temperature of a one-pound mass of pure liquid water one degree Fahrenheit at the temperature at which water has its greatest density (39 degrees Fahrenheit).

"completion" The process of treating a drilled well followed by the installation of permanent equipment for the production of oil or natural gas, or in the case of a dry well, the reporting of abandonment to the appropriate agency.

"condensate" A mixture of hydrocarbons that exists in the gaseous phase at original reservoir temperature and pressure, but that, when produced, is in the liquid phase at surface pressure and temperature.

"developed acreage" The number of acres that are allocated or assignable to productive wells or wells capable of production.

"development costs" Costs incurred to obtain access to proved reserves and to provide facilities for extracting, treating, gathering and storing the oil and natural gas. More specifically, development costs, including depreciation and applicable operating costs of support equipment and facilities and other costs of development activities, are costs incurred to:

| | ● | gain access to and prepare well locations for drilling, including surveying well locations for the purpose of determining specific development drilling sites, clearing ground, draining, road building, and relocating public roads, natural gas lines, and power lines, to the extent necessary in developing the proved reserves; |

| | | |

| | ● | drill and equip development wells, development-type stratigraphic test wells, and service wells, including the costs of platforms and of well equipment such as casing, tubing, pumping equipment, and the wellhead assembly; |

| | | |

| | ● | acquire, construct, and install production facilities such as lease flow lines, separators, treaters, heaters, manifolds, measuring devices, and production storage tanks, natural gas cycling and processing plants, and central utility and waste disposal systems; and |

| | | |

| | ● | provide improved recovery systems. |

"development well" A well drilled within the proved area of an oil or natural gas reservoir to the depth of a stratigraphic horizon known to be productive.

"dry well" A well found to be incapable of producing hydrocarbons in sufficient quantities such that proceeds from the sale of such production exceed production expenses and taxes.

"exploration costs" Costs incurred in identifying areas that may warrant examination and in examining specific areas that are considered to have prospects of containing oil and natural gas reserves, including costs of drilling exploratory wells and exploratory-type stratigraphic test wells.

"exploratory well" A well drilled for the purpose of discovering new reserves in unproven areas.

"field" An area consisting of a single reservoir or multiple reservoirs all grouped on, or related to, the same individual geological structural feature or stratigraphic condition. The field name refers to the surface area, although it may refer to both the surface and the underground productive formations.

"formation" A layer of rock which has distinct characteristics that differ from nearby rock.

"gross acres" The total acres in which a working interest is owned.

"Henry Hub" The pricing point for natural gas futures contracts traded on the NYMEX.

"horizontal well" A well that is drilled vertically to a certain depth and then drilled at a right angle within a specific interval.

"hydraulic fracturing" or "fracing" A process involving the injection of fluids, usually consisting mostly of water, but typically including small amounts of sand and other chemicals, in order to create fractures extending from the wellbore through the rock formation to enable oil or natural gas to move more easily through the rock pores to a production well.

"lease operating expenses" The expenses, usually recurring, which pay for operating the wells and equipment on a producing lease.

"MBbl" One thousand barrels of oil or other liquid hydrocarbons.

"MBoe" One thousand barrels of oil equivalent.

"Mcf" One thousand cubic feet of natural gas.

"Mcf/d" One thousand cubic feet of natural gas per day.

"MMBoe" One million barrels of oil equivalent.

"MMBtu" One million British thermal units.

"MMcf" One million cubic feet of natural gas.

"natural gas" Natural gas and natural gas liquids.

"net acres" The sum of the fractional working interests owned in gross acres.

"NYMEX" The New York Mercantile Exchange.

"oil" Oil and condensate.

"overriding royalty interest" An interest in an oil and/or natural gas property entitling the owner to a share of oil and natural gas production free of costs of production.

"PDP" Proved developed producing reserves.

"PDNP" Proved developed non-producing reserves.

"play" A term applied to a portion of the exploration and production cycle following the identification by geologists and geophysicists of areas with potential natural gas and oil reserves.

"plugging and abandonment" Refers to the sealing off of fluids in the strata penetrated by a well so that the fluids from one stratum will not escape into another or to the surface. Regulations of many states require plugging of abandoned wells.

"producing well" A well found to be capable of producing either oil or natural gas in sufficient quantities to justify completion as an oil or natural gas well.

"production costs" Costs incurred to operate and maintain wells and related equipment and facilities, including depreciation and applicable operating costs of support equipment and facilities and other costs of operating and maintaining those wells and related equipment and facilities. They become part of the cost of oil and natural gas produced. Examples of production costs (sometimes called lifting costs) are:

| | ● | costs of labor to operate the wells and related equipment and facilities; |

| | | |

| | ● | repairs and maintenance; |

| | | |

| | ● | materials, supplies, and fuel consumed and supplies utilized in operating the wells and related equipment and facilities; |

| | | |

| | ● | property taxes and insurance applicable to proved properties and wells and related equipment and facilities; and |

| | | |

| | ● | severance taxes. |

"productive well" A well that is found to be capable of producing hydrocarbons in sufficient quantities such that proceeds from the sale of the production exceed production expenses and taxes.

"proved developed reserves" Reserves that can be expected to be recovered through existing wells with existing equipment and operating methods.

"proved properties" Properties with proved reserves.

"proved reserves" Those quantities of oil and natural gas, which, by analysis of geoscience and engineering data, can be estimated with reasonable certainty to be economically producible — from a given date forward, from known reservoirs, and under existing economic conditions, operating methods, and government regulations — prior to the time at which contracts providing the right to operate expire, unless evidence indicates that renewal is reasonably certain, regardless of whether deterministic or probabilistic methods are used for the estimation. The project to extract the hydrocarbons must have commenced or the operator must be reasonably certain that it will commence the project within a reasonable time. The area of the reservoir considered as proved includes (i) the area identified by drilling and limited by fluid contacts, if any, and (ii) adjacent undrilled portions of the reservoir that can, with reasonable certainty, be judged to be continuous with it and to contain economically producible oil or natural gas on the basis of available geoscience and engineering data. In the absence of data on fluid contacts, proved quantities in a reservoir are limited by the lowest known hydrocarbons, or LKH, as seen in a well penetration unless geoscience, engineering, or performance data and reliable technology establishes a lower contact with reasonable certainty. Where direct observation from well penetrations has defined a highest known oil, or HKO, elevation and the potential exists for an associated gas cap, proved oil reserves may be assigned in the structurally higher portions of the reservoir only if geoscience, engineering, or performance data and reliable technology establish the higher contact with reasonable certainty. Reserves which can be produced economically through application of improved recovery techniques (including, but not limited to, fluid injection) are included in the proved classification when (i) successful testing by a pilot project in an area of the reservoir with properties no more favorable than in the reservoir as a whole, the operation of an installed program in the reservoir or an analogous reservoir, or other evidence using reliable technology establishes the reasonable certainty of the engineering analysis on which the project or program was based, and (ii) the project has been approved for development by all necessary parties and entities, including governmental entities. Existing economic conditions include prices and costs at which economic producibility from a reservoir is to be determined. The price shall be the average price during the 12-month period prior to the ending date of the period covered by the report, determined as an unweighted arithmetic average of the first-day-of-the-month price for each month within such period, unless prices are defined by contractual arrangements, excluding escalations based upon future conditions.

"proved undeveloped reserves" Reserves that are expected to be recovered from new wells on undrilled acreage or from existing wells where a relatively major expenditure is required.

"PUD" Proved undeveloped reserves.

"PV-10" When used with respect to oil and natural gas reserves, PV-10 means the estimated future gross revenue to be generated from the production of proved reserves, net of estimated production and future development and abandonment costs, using prices and costs in effect at the determination date, before income taxes, and without giving effect to non-property-related expenses, discounted to a present value using an annual discount rate of 10% in accordance with the guidelines of the SEC.

"reasonable certainty" If deterministic methods are used, reasonable certainty means a high degree of confidence that the quantities will be recovered. If probabilistic methods are used, there should be at least a 90% probability that the quantities actually recovered will equal or exceed the estimate. A high degree of confidence exists if the quantity is much more likely to be achieved than not, and, as changes due to increased availability of geoscience (geological, geophysical, and geochemical), engineering, and economic data are made to estimated ultimate recovery, or EUR, with time, reasonably certain EUR is much more likely to increase or remain constant than to decrease.

"recompletion" The process of re-entering an existing wellbore that is either producing or not producing and completing new reservoirs in an attempt to establish or increase existing production.

"reserves" Estimated remaining quantities of oil and natural gas and related substances anticipated to be economically producible as of a given date by application of development prospects to known accumulations. In addition, there must exist, or there must be a reasonable expectation that there will exist, the legal right to produce or a revenue interest in the production, installed means of delivering oil and natural gas or related substances to market, and all permits and financing required to implement the project.

"reservoir" A porous and permeable underground formation containing a natural accumulation of producible natural gas and/or oil that is confined by impermeable rock or water barriers and is separate from other reservoirs.

"sand" A geological term for a formation beneath the surface of the Earth from which hydrocarbons are produced. Its make-up is sufficiently homogenous to differentiate it from other formations.

"shale" Fine-grained sedimentary rock composed mostly of consolidated clay or mud. Shale is the most frequently occurring sedimentary rock.

"spacing" The distance between wells producing from the same reservoir. Spacing is often expressed in terms of acres, e.g., 40-acre spacing, and is often established by regulatory agencies.

"standardized measure" The present value of estimated future cash inflows from proved oil and natural gas reserves, less future development, abandonment, production and income tax expenses, discounted at 10% per annum to reflect the timing of future cash flows and using the same pricing assumptions as were used to calculate PV-10. Standardized measure differs from PV-10 because standardized measure includes the effect of future income taxes.

"stratigraphic test well" A drilling effort, geologically directed, to obtain information pertaining to a specific geologic condition. Such wells customarily are drilled without the intention of being completed for hydrocarbon production.

"undeveloped acreage" Lease acreage on which wells have not been drilled or completed to a point that would permit the production of commercial quantities of oil and natural gas regardless of whether such acreage contains proved reserves.

"vertical well" An oil or natural gas wellbore that is drilled from the surface to the depth of interest without directional deviation.

"wellbore" The hole drilled by the bit that is equipped for oil or natural gas production on a completed well. Also called well or borehole.

"working interest" The right granted to the lessee of a property to explore for and to produce and own oil, natural gas, or other minerals. The working interest owners bear the exploitation, development, and operating costs on either a cash, penalty, or carried basis.

Unless the context otherwise requires, all references to "Red Mountain," the "Company," "we," "our" and "us" refer to (i) Red Mountain Resources, Inc., (ii) Red Mountain's wholly owned subsidiaries, including Black Rock Capital, Inc. ("Black Rock") and RMR Operating, LLC ("RMR Operating"), and (iii) subsequent to January 28, 2013, Cross Border Resources, Inc. ("Cross Border"). Pro forma production and related data for 2013 reflects the acquisition of Cross Border as if it occurred on June 1, 2012. As of May 31, 2013, we owned 83% of the outstanding common stock of Cross Border. Acreage, reserves and production information presented subsequent to January 28, 2013 includes acreage, reserves and production represented by the 17% of Cross Border's common stock not owned by us.

Our Company

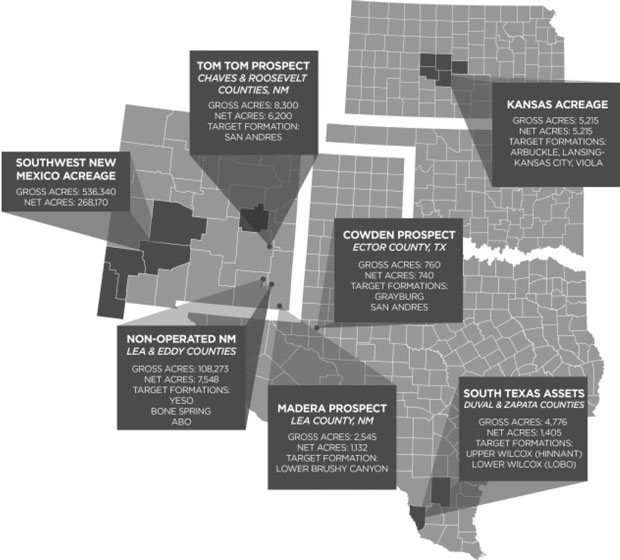

We are a Dallas-based growth-oriented energy company engaged in the acquisition, development and exploration of oil and natural gas properties in established basins with demonstrable prolific producing zones. Currently, we have established acreage positions and production in the Permian Basin of West Texas and Southeast New Mexico and the onshore Gulf Coast of Texas. Additionally, we have an established and growing acreage position in Kansas.

We plan to grow production and reserves by acquiring, exploring and developing an inventory of long-life, low risk drilling opportunities with attractive rates of return. Our focus is on opportunities in and around producing oil and natural gas properties where we can enhance production and reserves through application of newer drilling and completion techniques, infill drilling, targeting untapped but known productive hydrocarbon strata, and enhanced oil recovery applications.

As of May 31, 2013, we had proved reserves of approximately 3.5 MMBoe. For the fiscal year ended May 31, 2013, on a pro forma basis, we produced 172.2 MBbls of oil and 966.9 MMcf of natural gas, resulting in average net daily production of 913 Boe/d. In June 2013, we produced 981 Boe/d, of which 56% was oil.

As of May 31, 2013, we owned interests in 883,226 gross (305,845 net) mineral and lease acres in New Mexico, Texas and Kansas, of which 336,851 gross (31,011 net) acres are within the Permian Basin. We have successfully leased over 5,200 net acres in Kansas located on the Central Kansas Uplift, and we also owned interests in over 1,400 net acres located on the Villarreal, Frost Bank, Resendez, Peal Ranch and La Duquesa Prospects in the Gulf Coast of Texas.

History

Red Mountain was originally formed in January 2010 as Teaching Time, Inc. in order to design, develop, and market instructional products and services for the corporate, education, government, and healthcare e-learning industries. In March 2011, Teaching Time, Inc. determined to enter into oil and natural gas exploration, development and production and changed its name to Red Mountain Resources, Inc. to better reflect that plan. On March 22, 2011, we entered into a Plan of Reorganization and Share Exchange Agreement, as amended on June 17, 2011 and June 20, 2011 (the "Share Exchange Agreement"), with Black Rock Capital, LLC and The StoneStreet Group, Inc. ("StoneStreet"), the sole shareholder of Black Rock Capital, LLC. Alan W. Barksdale, our current president, chief executive officer and chairman of the board, was the president and the sole member of Black Rock Capital, LLC and the sole owner and the president of StoneStreet. On June 22, 2011, we completed a reverse merger pursuant to the Share Exchange Agreement in which we issued 27,000,000 shares of common stock to StoneStreet in exchange for 100% of the interests in Black Rock Capital, LLC. Concurrently with the closing, we retired 225,000,000 shares of common stock for no additional consideration. In connection with the reverse merger, the management of Black Rock Capital, LLC became our management.

While we were the legal acquirer in the reverse merger, Black Rock Capital, LLC was treated as the accounting acquirer and the transaction was treated as a recapitalization. As a result, at the closing, the historical financial statements of Black Rock became those of the Company. The description of our business presented below is that of our current business and all discussions of periods prior to the reverse merger describe the business of Black Rock.

Black Rock was originally formed on October 28, 2005 as an Arkansas limited liability company under the name "Black Rock Capital, LLC." From inception through May 2010, Black Rock had no operations. Effective June 1, 2010, Black Rock purchased two separate oil and natural gas fields out of the bankruptcy estate of MSB Energy, Inc. located in Zapata County and Duval County in the onshore Gulf Coast of Texas. Effective May 31, 2011, Black Rock acquired our current interests in the Madera Prospect. In June 2011, Black Rock Capital, LLC filed Articles of Conversion with the Secretary of State for the State of Arkansas to convert Black Rock Capital, LLC into a corporation. The conversion became effective July 1, 2011 and, accordingly, Black Rock Capital, LLC was converted to Black Rock Capital, Inc. As a result of the conversion, our 100% membership interest in Black Rock Capital, LLC became an interest in all of the outstanding common stock of Black Rock.

Recent Developments

Bamco Asset Purchase Agreement. On December 10, 2012, we entered into an Asset Purchase Agreement (the "Asset Purchase Agreement") with Bamco Gas, LLC ("Bamco"). Mr. Barksdale was the receiver for the receivership estate of Bamco. Pursuant to the Asset Purchase Agreement, we agreed to acquire working interests and claims and causes of action in or relating to certain oil and gas exploration projects in Duval, Johnson and Zapata Counties in Texas (the "Bamco Properties"). On December 10, 2012, pursuant to the Asset Purchase Agreement, we issued 2,375,000 shares of our common stock to the indenture trustee of certain debentures of Bamco, and we executed a waiver and release of a claim against the receivership estate of Bamco for a $2.7 million note receivable that we deemed uncollectible in 2011.

Acquisition of Cross Border. On January 28, 2013, pursuant to privately negotiated transactions, we acquired 5,091,210 shares of common stock of Cross Border from a limited number of stockholders in exchange for the issuance of 10,182,420 shares of our common stock, bringing our total ownership to approximately 78% of Cross Border's outstanding common stock (the "Acquisition"). Prior to the Acquisition, we owned 47% of Cross Border's outstanding common stock, and the investment was accounted for under the equity method of accounting. Subsequent to the Acquisition, we account for Cross Border as a consolidated subsidiary. As of May 31, 2013, we owned of record 14,327,767 shares of Cross Border common stock, representing 83% of Cross Border's outstanding common stock. In addition, as of May 31, 2013, we owned warrants to acquire an additional 2,502,831 shares of Cross Border common stock. The warrants have an exercise price of $2.25 per share and are exercisable until May 26, 2016.

As of May 31, 2013, Cross Border owned over 865,893 gross (293,843 net) mineral and lease acres in New Mexico and Texas, of which approximately 25,000 net acres were located in the Permian Basin. A significant majority of Cross Border's acreage consists of either owned mineral rights or leases held by production, allowing it to hold lease rental payments to under $5,000 annually.

Senior Credit Facility. On February 5, 2013, we entered into a Senior First Lien Secured Credit Agreement (as amended, the "Credit Agreement") with Cross Border, Black Rock and RMR Operating (collectively with the Company, the "Borrowers") and Independent Bank, as Lender (the "Lender").The Credit Agreement provides for an up to $100.0 million revolving credit facility (the "Credit Facility") with an initial commitment of $20.0 million and a maturity date of February 5, 2016.

Simultaneously with entering into the Credit Agreement, we borrowed $7.6 million under the Credit Facility and used a portion of the proceeds to repay outstanding indebtedness, and Cross Border borrowed $8.9 million and used a portion of the proceeds to repay in full its existing credit facility. As of May 31, 2013, the Borrowers had collectively borrowed $19.8 million and had availability of $0.2 million under the Credit Facility. On February 21, 2013, pursuant to the terms of the Credit Agreement, we entered into a hedge agreement with BP Energy Company, LP ("BP Energy") to hedge a portion of the future oil production of the Borrowers.

On July 19, 2013, we entered into an amendment to the Credit Agreement to permit the payment of cash dividends on our 10.0% Series A Cumulative Redeemable Preferred Stock (the "Series A Preferred Stock") so long as we are not otherwise in default under the Credit Agreement and payment of such cash dividends would not cause us to be in default under the Credit Agreement.

We were not in compliance with the current ratio covenant in the Credit Agreement as of May 31, 2013. We entered into an amendment and waiver to the Credit Agreement effective September 12, 2013, which waived the non-compliance at May 31, 2013. In addition, the amendment increased the borrowing base under the Credit Agreement from $20.0 million to $30.0 million.

Private Placements. On February 5, 2013, we closed a private placement for 7,058,823 shares of common stock at a purchase price of $0.85 per share, raising gross proceeds of $6.0 million, from certain of the initial investors in our company. We used the proceeds for drilling expenses, repayment of debt and general working capital. On May 3, 2013, we closed a private placement for 3,529,412 shares of common stock at a purchase price of $0.85 per share, raising gross proceeds of $3.0 million, from certain of the initial investors in our company. We used the proceeds for general working capital.

Madera 24 Federal 3H Well. During the three months ended February 28, 2013, we commenced drilling the Madera 24 Federal 3H well, which is located in the Madera prospect just to the west of the Madera 24 Federal 2H well. We are the operator of the well and own a 33% working interest. The well was spudded on February 6, 2013 and, on May 10, 2013, we finished drilling and completing the well. The initial production rate from the Madera 24 Federal 3H well was 1,491 Boe (81% oil). The well has a total measured depth of 13,570 feet, including a true vertical depth of 9,062 feet and a lateral length of 4,508 feet. At May 31, 2013, the well was still producing and permanent production facilities were under construction.

Reverse Stock Split. On April 22, 2013, our Board of Directors approved a reverse stock split. The Board authorized management to effectuate the reserve stock split in its discretion within a range of 1 for 5 to 1 for 10. We intend to consummate the reverse stock split during the first six months of fiscal 2014.

Change of Fiscal Year End. On July 17, 2013, we changed our fiscal year end from May 31 to June 30, effective June 30, 2013.

Closing of Units Offerings. In August 2013, we closed public offerings of 476,687 Units (the "Units"), including 100,002 Units sold in cancellation of $2.3 million in debt, raising gross cash proceeds of $8.5 million. Each Unit consisted of one share of our Series A Preferred Stock and one warrant to purchase up to 25 shares of common stock. We intend to use the proceeds for general corporate purposes, including to fund a portion of our fiscal 2014 drilling and development expenditures and the payment of accrued interest and fees on indebtedness that was cancelled.

Closing of Common Stock Offering. In August 2013, we closed a public offering of 6,428,572 shares of common stock, raising gross cash proceeds of $4.5 million. We intend to use the proceeds for general corporate purposes, including to fund a portion of our fiscal 2014 drilling and development expenditures and the repayment of indebtedness.

Our Business Strategies

Key elements of our business strategy include:

Increase Reserves and Production Through Low-Risk Drilling Program. We intend to achieve reserves and production growth over the next few years through our drilling program, which will focus on low risk opportunities with attractive rates of return. In addition to our proved reserve base of 3.5 MMBoe at May 31, 2013, we believe we have significant upside potential to convert our current probable and possible reserves into proved reserves. We plan to drill and complete, workover or recomplete 55 gross wells (38.1 net) through fiscal 2014 to develop our current properties.

Maintain a Conventional Balance Sheet and Capital Structure. We take a conventional approach to our drilling program and seek to find and develop geologically defined conventional prospects. Similarly, we intend to maintain a conventional balance sheet minimizing our risk and allowing us to maintain strong credit metrics. Further, we plan to use derivatives to hedge against falling commodity prices to ensure adequate cash flows to meet our corporate and drilling objectives.

Pursue Growth through Acquisitions that Leverage Our Expertise. Our primary acquisition strategy is to identify and acquire geologically defined, undercapitalized plays with development potential. At the same time, we continually review opportunities to acquire producing properties, undeveloped acreage and drilling prospects. We focus particularly on opportunities where we believe our operational efficiency, reservoir management and geological expertise will enhance value and performance.

Retain Operational Control. We intend to retain a high degree of operational control over our interests, through a high average working interest or acting as the operator in areas of significant exploration and development activity. This strategy is intended to provide us with controlling interests in a multi-year inventory of drilling locations, positioning us for reserve and production growth through drilling. We plan to control the timing, level and allocation of our drilling capital expenditures and the technology and methods utilized in the planning, drilling and completion process on related targets. We believe this flexibility to opportunistically pursue development on properties provides us with a meaningful competitive advantage.

Mitigate Operational and Financial Risk. Our goal is to generate attractive rates of return on every dollar invested. Concurrently, our goal is to manage risk by spreading our capital dollars over a significant number of wells to mitigate capital, geologic and mechanical concentration risk to any one project. The combination may prevent us from aggressively and continuously drilling in any one area but the participation in more projects allows us to better manage our production growth, effectively procure services, and provides ample time necessary to evaluate results in order to attempt to improve future wells.

Our Competitive Strengths

We believe that the following competitive strengths will help us successfully execute our business strategies and create substantial value:

Large Acreage Position Consisting of Mineral Ownership and Leases Held by Production. As of May 31, 2013, we controlled 305,845 net acres, 98% of which was in Texas and New Mexico. Included in this acreage position were approximately 275,000 net mineral acres within Southwest New Mexico and the Permian Basin region of Southeast New Mexico. This net mineral acreage carries no drilling commitments or leasehold obligations. Furthermore, 93% of our leasehold acreage in the Permian Basin is currently held by existing production. The combination of perpetual mineral ownership and leases held by production provides us with ample time to exploit our drilling inventory in the Permian Basin.

Long-Life Reserves and Multi-Horizon Drilling Opportunities. One of the great attributes of the Permian Basin is that there are dozens of productive formations that lie deep into the Earth. Enhancements in drilling and completion technology have improved the economics of drilling and producing various hydrocarbon bearing strata that previously were uneconomic. We believe that much of our productive acreage has drilling opportunities into multiple hydrocarbon bearing zones that we have yet to evaluate which could provide substantial upside to our reserve base. Many of these zones are productive on nearby leases owned by other operators. Cash flow from our longer life reserve base combined with existing infrastructure should allow us to opportunistically test numerous potentially productive zones in the San Andres, Bone Spring, Brushy Canyon and other known horizons providing us with a multi-year drilling inventory.

Strong Management and Operations Team. Our team of managers, employees, consultants and directors combine to represent over 300 years of experience in the oil and natural gas industry as owners, investors, company builders, financiers, operators, geologists, service providers and petroleum engineers. In these various capacities, the Red Mountain team has participated in more than 10,000 wells in 20 states and 22 countries. We intend to utilize sophisticated geologic and 3-D seismic models to enhance the predictability and reproducibility of our operations. We also intend to utilize multi-zone, multi-stage hydraulic fracturing technology in completing wells to substantially increase near-term production, resulting in faster payback periods and higher rates of return and present values. Our team has applied these techniques to improve initial and ultimate production and returns for other organizations. We believe that the depth and breadth of our operations team coupled with a proven team in the areas of accounting, finance and capital markets, positions us well to take advantage of our large inventory of acreage and drilling opportunities.

Management with Meaningful Equity Ownership. As of September 13, 2013, our chairman of the board, chief executive officer and president, Alan Barksdale, owned 8.3% of our outstanding shares of common stock, and other members of our management and board of directors owned 1.1% of our outstanding shares of common stock. As a result of their equity investment in us, we believe our management's interests are highly aligned with our stockholders' interests in stock price appreciation and profitable growth.

Existing Infrastructure. All of our properties are located within established oil and natural gas producing areas or existing fields. We seek to enhance existing production in these properties by using our engineering and geological expertise. These areas also have a fully developed transportation infrastructure, which allows us to transport our oil and natural gas to market without long-term delay or significant investment.

Our Properties

Currently, our oil and natural gas properties are concentrated in the Permian Basin, the onshore Gulf Coast of Texas, Southwest New Mexico and Kansas. The Permian Basin covers an area approximately 250 miles wide and 300 miles long in West Texas and Southeast New Mexico. The Permian Basin is one of the most prolific onshore oil and natural gas producing regions in the United States. It is characterized by an extensive production history, mature infrastructure, long reserve life and hydrocarbon potential in multiple producing formations. Our primary operations in the onshore Gulf Coast are in conventional fields that produce primarily from the Wilcox formation in Zapata and Duval counties of Texas.

Permian Basin. As of May 31, 2013, we had interests in 336,851 gross (31,011 net) acres in the Permian Basin, including of the Madera Prospect, Pawnee Prospect, Cowden Lease, Shafter Lake Lease, Martin Lease, Jackson Bough C Prospect, East Ranch Prospect and West Ranch Prospect. We are the operator of each of these properties. These interests include the oil and natural gas interests of Cross Border in the Permian Basin, a large portion of which is non-operated acreage located in the heart of the Bone Spring play in central Lea and Eddy counties of New Mexico. Cross Border also has non-operated acreage in the Yeso and Abo trends along the Northwest Shelf and in areas targeting the Queen, Grayburg, and San Andres reservoirs. Cross Border also holds acreage in the Tom Tom area, where it is the operator.

In the aggregate, as of May 31, 2013, these properties had 209 gross (92.4 net) producing wells and, during the month of May 2013, had daily average net production of 636 Boe/d, 73% of which was oil. As of May 31, 2013, our Permian Basin properties had approximately 3,147 MBoe of proved reserves, of which 74% was oil. Of our proved reserves in the Permian Basin, 32% are from the Madera Prospect, 22% are from the Lusk Prospect and 17% are from the Tom Tom Prospect. During the fiscal year ended May 31, 2013, we derived approximately 79% of our revenue from the Permian Basin.

Onshore Gulf Coast. As of May 31, 2013, we had interests in 4,776 gross (1,405 net) acres in the onshore Gulf Coast of Texas, consisting of the Villarreal Prospect, Frost Bank Prospect, Peal Ranch Prospect, Resendez Prospect and La Duquesa Prospect. We are the operator of each of these properties, other than the Villarreal Prospect, which is operated by ConocoPhillips Company, and the Peal Ranch Prospect, which is operated by White Oak Energy.

In the aggregate, as of May 31, 2013, these properties had 39 gross (13.0 net) wells and, during the month of May 2013, had daily average net production of 244 Boe/d, substantially all of which was natural gas. As of May 31, 2013, our onshore Gulf Coast properties had approximately 401 MBoe of proved reserves, substantially all of which was natural gas. Of our proved reserves in the onshore Gulf Coast, 74% are from the Villarreal Prospect and 16% are from the Peal Ranch Prospect. During the fiscal year ended May 31, 2013, we derived approximately 21% of our revenue from the onshore Gulf Coast.

Southwest New Mexico. As of May 31, 2013, we owned 536,340 gross (268,170 net) mineral acres in Hidalgo, Grant, Sierra, and Socorro Counties, New Mexico. This mineral ownership carries no drilling commitments or leasehold obligations. As of May 31, 2013, this acreage had no proved reserves or production.

Kansas. As of May 31, 2013, we owned oil and natural gas interests in 5,215 gross and net acres in central Kansas. There are multiple target horizons in this prospect including the Arbuckle and the Lansing Kansas City formations. We own a 100% working interest and an average net revenue interest of 80%. RMR Operating is the operator. As of May 31, 2013, the Kansas acreage had no proved reserves or production.

For more detailed information on our properties, see "Item 2. Properties."

Planned Operations

During fiscal year 2014, we plan to spend approximately $39.5 million for drilling, completion, workovers, and recompletion on our properties including Madera, Tom Tom, Cowden and Shafter Lake and on properties in Cross Border's non-operated acreage. See "Management's Discussion and Analysis of Financial Condition and Results of Operations—Planned Operations."

Marketing and Customers

During the fiscal year ended May 31, 2013, we sold $5.6 million of oil to High Sierra Crude Oil & Marketing, LLC ("High Sierra"), representing 63% of our total revenues, and $2.0 million of oil to Phillips 66 Company, representing 22% of our total revenues . We sell our oil to High Sierra from our Good Chief State #1, Big Brave State #1 and Madera 24 Federal 2H and 3H wells pursuant to crude oil purchase contracts. The price of the oil delivered is based on the West Texas Intermediate price, subject to certain price adjustments. The purchase agreements continue until terminated by either party upon thirty days prior written notice. We believe that the loss of either customer would not have a material adverse effect on us because alternative purchasers are readily available.

Competition

The oil and natural gas industry is highly competitive and we compete with a substantial number of other companies that have greater resources than we do. The largest of these companies explore for, produce and market oil and natural gas, carry on refining operations and market the resultant products on a worldwide basis. The primary areas in which we encounter substantial competition are in our drilling and development operations, locating and acquiring prospective oil and natural gas properties and reserves and attracting and retaining highly skilled personnel. There is also competition between producers of oil and natural gas and other industries producing alternative energy and fuel. Furthermore, competitive conditions may be substantially affected by various forms of energy legislation and/or regulation considered from time to time by the United States government; however, it is not possible to predict the nature of any such legislation or regulation that may ultimately be adopted or its effects upon our future operations. Such laws and regulations may, however, substantially increase the costs of exploring for, developing or producing oil and natural gas and may prevent or delay the commencement or continuation of a given operation. The effect of these risks cannot be accurately predicted.

Insurance

We currently maintain oil and natural gas commercial general liability protection relating to all of our oil and natural gas operations (including environmental and pollution claims) with a total limit of coverage in the amount of $2.0 million (with no deductible) and excess liability protection with a total limit of $3.0 million (with a deductible of $10,000).

As is common in the oil and natural gas industry, we will not insure fully against all risks associated with our business either because such insurance is not available or because premium costs are considered prohibitive. In addition, pollution and environmental risks generally are not fully insurable. A loss not fully covered by insurance could have a material adverse effect on our business, financial condition and results of operations.

Legal Proceedings

On May 4, 2011, Clifton M. (Marty) Bloodworth filed a lawsuit in the State District Court of Midland County, Texas, against Doral West Corp. d/b/a Doral Energy Corp. and Everett Willard Gray II. Mr. Bloodworth alleges that Mr. Gray, as CEO of Cross Border, made false representations which induced Mr. Bloodworth to enter into an employment contract that was subsequently breached by Cross Border. The claims that Mr. Bloodworth has alleged are: breach of his employment agreement with Doral West Corp, common law fraud, civil conspiracy breach of fiduciary duty, and violation of the Texas Deceptive Trade Practices-Consumer Protection Act. Mr. Bloodworth is seeking damages of approximately $280,000. Mr. Gray and Cross Border deny that Mr. Bloodworth's claims have any merit.

Cross Border was previously party to an engagement letter, dated February 7, 2012 (the "Engagement Letter"), with KeyBanc Capital Markets Inc. ("KeyBanc") pursuant to which KeyBanc was to act as exclusive financial advisor to Cross Border's Board of Directors in connection with a possible "Transaction" (as defined in the Engagement Letter). The Engagement Letter was formally terminated by Cross Border on August 21, 2012. The Engagement Letter provided that KeyBanc would be entitled to a fee upon consummation of a Transaction within a certain period of time following termination of the Engagement Letter. On May 16, 2013, KeyBanc delivered an invoice to Cross Border in the amount of $751,334, representing amounts purportedly owed by Cross Border to KeyBanc as a result of the consummation of a purported Transaction that KeyBanc asserts had been consummated within the required time period and its out-of-pocket expenses in connection therewith. Cross Border disputes that any Transaction was consummated and that KeyBanc is entitled to any out-of-pocket expenses. The matter was originally filed in the 44th-B Judicial District Court for the State of Texas, Dallas County but was subsequently removed to the United States District Court for the Northern District of Texas, Dallas Division. Cross Border intends to vigorously defend the action.

Employees

As of May 31, 2013, we had 27 full-time employees. We are not a party to any collective bargaining agreements and have not experienced any strikes or work stoppages. We believe our relationships with our employees are good.

Hydraulic Fracturing Policies and Procedures

We contract with third parties to conduct hydraulic fracturing as a means to maximize the productivity of our oil and natural gas wells in almost all of our wells. Hydraulic fracturing involves the injection of water, sand, gel and chemicals under pressure into formations to fracture the surrounding rock and stimulate production. All of our proved non-producing and proved undeveloped reserves associated with future drilling, completion and recompletion projects will require hydraulic fracturing.

Although average drilling and completion costs for each area will vary, as will the cost of each well within a given area, on average approximately 40% of the drilling and completion costs for our wells are associated with hydraulic fracturing activities. These costs are treated in the same way that all other costs of drilling and completing our wells are treated and are built into and funded through our normal capital expenditures budget. A change to any federal and state laws and regulations governing hydraulic fracturing could impact these costs and adversely affect our business and financial results. See "Risk Factors—Federal and state legislative and regulatory initiatives as well as governmental reviews relating to hydraulic fracturing could result in increased costs and additional operating restrictions or delays as well as adversely affect our level of production."

The protection of groundwater quality is important to us. Our policy and practice is to ensure our service providers follow all applicable guidelines and regulations in the areas where we have hydraulic fracturing operations. In addition, we send at least one of our own engineers or an experienced consultant to the well site to personally supervise each hydraulic fracture treatment.

We believe that the hydraulic fracturing operations on our properties are conducted in compliance with all state and federal regulations and in accordance with industry standard practices for groundwater protection. These protective measures include setting surface casing at a depth sufficient to protect fresh water zones as determined by applicable state regulatory agencies, and cementing the casing to create a permanent isolating barrier between the casing pipe and surrounding geological formations. The casing plus the cement are intended to prevent contact between the fracturing fluid and any aquifers during the hydraulic fracturing or other well operations. For recompletions of existing wells, the production casing is pressure tested prior to perforating the new completion interval. Injection rates and pressures are monitored at the surface during our hydraulic fracturing operations. Pressure is monitored on both the injection string and the immediate annulus to the injection string.

The vast majority of hydraulic fracturing treatments are made up of water and sand or other kinds of man-made propping agents. Our service providers track and report chemical additives that are used in the fracturing operation as required by the applicable governmental agencies.

Hydraulic fracturing requires the use of a significant amount of water. All produced water, including fracture stimulation water, is disposed of in a way that does not impact surface waters. All produced water is disposed of in permitted and regulated disposal facilities.

Environmental Matters and Regulation

Our exploration, development and production operations are subject to various federal, state and local laws and regulations governing health and safety, the discharge of materials into the environment or otherwise relating to environmental protection. These laws and regulations may, among other things: require the acquisition of permits to conduct exploration, drilling and production operations; govern the amounts and types of substances that may be released into the environment in connection with oil and natural gas drilling and production; restrict the way we handle or dispose of our wastes or of naturally occurring radioactive materials generated by our operations; cause us to incur significant capital expenditures to install pollution control or safety related equipment operating at our facilities; limit or prohibit construction or drilling activities in sensitive areas such as wetlands, wilderness areas or areas inhabited by endangered or threatened species; impose specific health and safety criteria addressing worker protection; require investigatory and remedial actions to mitigate pollution conditions caused by our operations or attributable to former operations; impose obligations to reclaim and abandon well sites and pits and impose substantial liabilities on us for pollution resulting from our operations. Failure to comply with these laws and regulations may result in the assessment of administrative, civil and criminal penalties, the imposition of remedial obligations and the issuance of orders enjoining some or all of our operations in affected areas.

Additionally, the United States Congress and federal and state agencies frequently revise environmental, health and safety laws and regulations, and their interpretations thereof, and any changes that result in more stringent and costly operational requirements or waste handling, disposal, cleanup and remediation requirements for the oil and natural gas industry could have a significant impact on our operating costs. The trend in environmental regulation is to place more restrictions and limitations on activities that may affect the environment, and thus, any changes in environmental laws and regulations or new interpretations of enforcement policies that result in more stringent and costly waste handling, storage, transport, disposal or remediation requirements could have a material adverse effect on our financial condition and results of operations. We may be unable to pass on such increased compliance costs to our customers.

We believe that we are in substantial compliance with all existing environmental laws and regulations applicable to our current operations and that our continued compliance with existing requirements will not have a material adverse impact on our financial condition and results of operations. We have not incurred any material capital expenditures for remediation or pollution control activities during fiscal 2013, and we are not aware of any environmental issues or claims that will require material capital expenditures during fiscal 2014, other than the remediation plan for Cross Border's Tom Tom and Tomahawk fields, or that will otherwise have a material impact on our financial condition and results of operations in the future. However, we cannot assure you that the passage of more stringent laws and regulations in the future will not have a negative impact on our business, financial condition or results of operations.

The following is a summary of the more significant existing environmental, health and safety laws and regulations to which our business is subject and for which compliance may have a material adverse impact on our capital expenditures, financial condition or results of operations.

Comprehensive Environmental Response, Compensation and Liability Act. Comprehensive Environmental Response, Compensation and Liability Act ("CERCLA"), also known as the "Superfund" law, and comparable state statutes impose strict and joint and several liability for costs of investigation and removal and remediation of previously disposed wastes (including wastes disposed of or released by prior owners or operators) or property contamination (including groundwater contamination), for natural resource damages and the cost of certain health studies without regard to fault or legality of the original conduct, on certain classes of persons with respect to the release into the environment of substances designated under CERCLA as hazardous substances. These classes of persons, or so-called potentially responsible parties ("PRPs") include the current and past owners or operators of a site where the release occurred and anyone who transported or disposed or arranged for the transport or disposal of a hazardous substance found at the site. CERCLA also authorizes the Environmental Protection Agency (the "EPA") and, in some instances, third parties to take actions in response to threats to public health or the environment and to seek to recover from the PRPs the costs of such action. Additionally, it is not uncommon for neighboring landowners and other third parties to file claims for personal injury and property damage allegedly caused by the hazardous substances released into the environment. Many states have adopted comparable or more stringent state statutes.

Although CERCLA generally exempts "petroleum" from the definition of hazardous substance, in the course of our operations, we will generate, transport and dispose or arrange for the disposal of wastes that may fall within CERCLA's definition of hazardous substances. Comparable state statutes may not contain a similar exemption for petroleum. We may also be the owner or operator of sites on which hazardous substances have been released.

Solid and Hazardous Waste Handling. The Resource Conservation and Recovery Act ("RCRA") and comparable state statutes and regulations promulgated thereunder regulate the generation, transportation, treatment, storage, disposal and cleanup of solid and hazardous waste. With federal approval, the individual states administer some or all of the provisions of RCRA, sometimes in conjunction with their own, more stringent regulations. Although oil and natural gas waste generally is exempt from regulations as hazardous waste under RCRA, such wastes may constitute "solid wastes" that are subject to the less stringent requirements of non-hazardous waste provisions. Additionally, we will generate waste as a routine part of our operations that may be subject to RCRA and not all state and local laws contain a comparable exemption. Further, there is no guarantee that the Environmental Protection Agency ("EPA") or individual states or local governments will not adopt more stringent requirements for the handling of non-hazardous waste or categorize some non-hazardous waste as hazardous in the future. Indeed, legislation has been proposed from time to time in Congress to re-categorize certain oil and natural gas exploration, development and production wastes as "hazardous wastes." Any such change could result in an increase in our costs to manage and dispose of waste, which could have a material adverse effect on our financial condition and results of operations.

It is also possible that our oil and natural gas operations may require us to manage naturally occurring radioactive materials, or NORM. NORM is present in varying concentrations in sub-surface formations, including hydrocarbon reservoirs, and may become concentrated in scale, film and sludge in equipment that comes in contract with crude oil and natural gas production and processing streams. Some states have enacted regulations governing the handling, treatment, storage and disposal of NORM.

Administrative, civil and criminal penalties can be imposed for failure to comply with waste handling requirements. We believe that we are in substantial compliance with applicable requirements related to waste handling, and that we hold all necessary and up-to-date permits, registrations and other authorizations to the extent that our operations require them under such laws and regulations. Although we do not believe the current costs of managing our wastes, as presently classified, to be significant, any legislative or regulatory reclassification of oil and natural gas exploration and production wastes could increase our costs to manage and dispose of such wastes.

Water Discharges. The Federal Water Pollution Control Act of 1972, as amended, also known as the Clean Water Act (the "CWA"), the Safe Drinking Water Act (the "SDWA"), the Oil Pollution Act (the "OPA") and analogous state laws and regulations promulgated thereunder impose restrictions and strict controls regarding the unauthorized discharge of pollutants, including produced waters and other gas and oil wastes, into navigable waters of the United States, as well as state waters. The discharge of pollutants into regulated waters is prohibited, except in accordance with the terms of certain permits issued by the EPA or an analogous state agency. Spill prevention, control and countermeasure ("SPCC") requirements under federal law require appropriate containment berms and similar structures to help prevent the contamination of navigable waters in the event of a petroleum hydrocarbon tank spill, rupture or leak. In addition, the Clean Water Act and analogous state laws require individual permits or coverage under general permits for discharges of storm water runoff from certain types of facilities. The Clean Water Act also prohibits the discharge of dredge and fill material in regulated waters, including wetlands, unless authorized by a permit issued by the United States Army Corps of Engineers. In addition, on October 20, 2011, the EPA announced a schedule to develop pre-treatment standards for wastewater discharges produced by natural gas extraction from underground coalbed and shale formations. The EPA stated that it will gather data, consult with stakeholders, including ongoing consultation with industry, and solicit public comment on a proposed rule for coalbed methane in 2013 and a proposed rule for shale gas in 2014. Costs may be associated with the treatment of wastewater or developing and implementing storm water pollution prevention plans, as well as for monitoring and sampling the storm water runoff from certain of our facilities. Some states also maintain groundwater protection programs that require permits for discharges or operations that may impact groundwater conditions.

Federal and state regulatory agencies can impose administrative, civil and criminal penalties, as well as require remedial or mitigation measures, for non–compliance with discharge permits or other requirements of the Clean Water Act and analogous state laws and regulations. In the event of an unauthorized discharge of wastes, we may be liable for penalties and costs of remediation. The Oil Pollution Act of 1990 ("OPA") is the primary federal law for oil spill liability. The OPA imposes requirements on "responsible parties" related to the prevention of oil spills and liability for damages resulting from oil spills into or upon navigable waters, adjoining shorelines or in the exclusive economic zone of the United States. A "responsible party" under the OPA may include the owner or operator of an onshore facility. The OPA subjects responsible parties to strict, joint and several financial liability for removal costs and other damages, including natural resource damages, caused by an oil spill that is covered by the statute. It also imposes other requirements on responsible parties, such as the preparation of an oil spill contingency plan and maintaining certain significant levels of financial assurance to cover potential environmental cleanup and restoration costs. Failure to comply with the OPA may subject a responsible party to civil or criminal enforcement action. We may conduct operations on acreage located near, or that affects, navigable waters subject to the OPA. We believe that compliance with applicable requirements under the OPA will not have a material and adverse effect on us.

Hydraulic fracturing is a practice that is used to stimulate production of hydrocarbons, particularly natural gas, from tight formations. The process involves the injection of water, sand and chemicals under pressure into the formation to fracture the surrounding rock and stimulate production. Although hydraulic fracturing has historically been regulated by state oil and gas commissions the EPA recently asserted federal regulatory authority over the process under the SDWA's Underground Injection Control ("UIC") Program. Under this assertion of authority, the EPA requires facilities to obtain permits to use diesel fuel in hydraulic fracturing operations, specifically in Class II wells, which are those wells injecting fluids associated with oil and natural gas production activities. The U.S. Energy Policy Act of 2005, which exempts hydraulic fracturing from regulation under the SDWA, prohibits the use of diesel fuel in the fracturing process without a UIC permit. On May 4, 2012, the EPA published a draft UIC Program permitting guidance for oil and natural gas hydraulic fracturing activities using diesel fuel. The guidance document is designed for use by EPA UIC permit writers, and describes how Class II regulations may be tailored to address the purported unique risks of diesel fuel injection during the hydraulic fracturing process. Although EPA has delegated UIC permitting authority to many states, it is encouraging those states to review and consider use of this permit guidance. The draft guidance document underwent an extended public comment process, which concluded on August 23, 2012. The EPA is presently evaluating the public comments and will likely issue a final guidance document at a later date. On November 3, 2011, the EPA released its Plan to Study the Potential Impacts of Hydraulic Fracturing on Drinking Water Resources. The study will include both analysis of existing data and investigative activities designed to generate future data. The EPA issued a progress report in December 2012, and expects to release a final report for public comment and peer review in 2014. In addition, legislation is pending in Congress to repeal the hydraulic fracturing exemption from the SDWA, provide for federal regulation of hydraulic fracturing, and require public disclosure of the chemicals used in the fracturing process, and such legislation could be introduced in the current session of Congress. The agency also announced that one of its enforcement initiatives for 2011 to 2013 would be to focus on environmental compliance by the energy extraction sector. This additional regulatory scrutiny could make it difficult to perform hydraulic fracturing and increase our costs of compliance and doing business.

Many states have adopted, and other states are considering adopting, legislation or regulations requiring the disclosure of the chemicals used in hydraulic fracturing or otherwise restrict hydraulic fracturing in certain circumstances. For example, pursuant to legislation adopted by the State of Texas in June 2011, beginning February 1, 2012, companies were required to disclose to the Railroad Commission of Texas (the "RRC") and the public the chemical components used in the hydraulic fracturing process, as well as the volume of water used. Furthermore, on May 23, 2013, the RRC issued the "well integrity rule," which updates the RRC's Rule 13 requirements for drilling, putting pipe down, and cementing wells. The rule also includes new testing and reporting requirements, such as (i) the requirement to submit to the RRC cementing reports after well completion or after cessation of drilling, whichever is later, and (ii) the imposition of additional testing on wells less than 1,000 feet below usable groundwater. The "well integrity rule" takes effect in January 2014. The Wyoming Oil and Gas Conservation Commission also passed a rule requiring disclosure of hydraulic fracturing fluid. In addition, a number of states in which we plan to conduct, are currently conducting, or may in the future conduct, hydraulic fracturing operations regularly review hydraulic fracturing and new regulations from such reviews could restrict or limit our access to shale formations or could delay our operations or make them more costly. In addition to state law, local land use restrictions, such as city ordinances, may restrict or prohibit the performance of well drilling in general and/or hydraulic fracturing in particular.

Finally, with respect to our operations that occur on federally managed public lands, on May 16, 2013, the U.S. Department of Interior ("DOI") issued a proposed rule that seeks to require companies operating on federal and Indian lands to (i) publicly disclose the chemicals used in the hydraulic fracturing process, (ii) confirm their wells meet certain construction standards and (iii) establish site plans to manage flowback water. The revised proposed rule is presently subject to an extended 90-day public comment period, which ends on August 23, 2013.

Air Emissions. Our operations are subject to federal regulations for the control of emissions from sources of air pollution under the Clean Air Act ("CAA"), as amended, and analogous state and local regulations. Federal and state laws require new and modified sources of air pollutants to obtain permits prior to commencing construction and also impose various monitoring and reporting requirements. Major sources of air pollutants are subject to more stringent, federally imposed requirements including additional permits. Federal and state laws designed to control hazardous or toxic air pollutants may require installation of additional controls. Administrative enforcement actions for failure to comply strictly with air pollution regulations or permits are generally resolved by payment of monetary fines and correction of any identified deficiencies. Alternatively, regulatory agencies could bring lawsuits for civil penalties or require us to forego construction, modification or operation of certain air emission sources.

In August 2012, the EPA adopted rules that subject oil and natural gas production, processing, transmission, and storage operations to regulation under the New Source Performance Standards, or NSPS, and National Emission Standards for Hazardous Air Pollutants, or NESHAP, programs. The rule includes NSPS standards for completions of hydraulically fractured gas wells and establishes specific new requirements for emissions from compressors, controllers, dehydrators, storage vessels, natural gas processing plants and certain other equipment. The final rule became effective October 15, 2012; however, a number of the requirements did not take immediate effect. The final rule establishes a phase-in period to allow for the manufacture and distribution of required emissions reduction technology. During the first phase, ending December 31, 2014, owners and operators of gas wells must either flare their emissions or use emissions reduction technology called "green completions" technologies already deployed at wells. On or after January 1, 2015, all newly fractured gas wells will be required to use green completions. Controls for certain storage vessels and pneumatic controllers may phase-in over one year beginning on the date the final rule is published in the Federal Register, while certain compressors, dehydrators and other equipment must comply with the final rule immediately or up to three years and 60 days after publication of the final rule, depending on the construction date and/or nature of the unit. We continue to evaluate the EPA's final rule, as it may require changes to our operations, including the installation of new emissions control equipment. These standards, as well as any future laws and their implementing regulations, may require us to obtain pre-approval for the expansion or modification of existing facilities or the construction of new facilities expected to produce air emissions, impose stringent air permit requirements, or utilize specific equipment or technologies to control emissions. Our failure to comply with these requirements could subject us to monetary penalties, injunctions, conditions or restrictions on operations and, potentially, criminal enforcement actions.

We have incurred additional capital expenditures to insure compliance with these new regulations as they come into effect. We may also be required to incur additional capital expenditures in the next few years for air pollution control equipment in connection with maintaining or obtaining operating permits addressing other air emission related issues, which may have a material adverse effect on our operations. Obtaining permits also has the potential to delay the development of oil and natural gas projects. We believe that we currently are in substantial compliance with all air emissions regulations and that we hold all necessary and valid construction and operating permits for our current operations.

Climate Change Legislation. In response to certain scientific studies suggesting that emissions of carbon dioxide, methane and other greenhouse gases ("GHGs") are contributing to the warming of the Earth's atmosphere and other climatic changes, the United States Congress has considered legislation to reduce such emissions. To date, the United States Congress has failed to enact a comprehensive GHG program. Some states, either individually or on a regional level, have considered or enacted legal measures to reduce GHG emissions. Although most of the state-level initiatives have to date focused on large sources of GHG emissions, it is possible that smaller sources of emissions could become subject to GHG emission limitations. The cost of complying with these programs could be significant.